saveyourassetsfirst3 |

- Monthly Charts Argue for Lower Prices in Precious Metals Complex

- BlackStone Group Says The Market Is The Most Treacherous They Have Seen

- Dollar Looks Vulnerable To Start Q4

- Breaking News And Best Of The Web

- The Midas Touch Consulting Report

- Deutsche Bank Collapse: The Most Important Bank In Europe Is Facing A Major ‘Liquidity Event’

- Deutsche Bank – On the Brink of Global Financial Collapse? 2 Experts Who Aren’t Buying A Meltdown This Weekend

- Deutsche Bank To Trigger Global Financial Collapse THIS Weekend? Eric Sprott Warns “This Is EXACTLY How Things Go Down!”

- PANIC As Margin Calls Begin: Deutsche Bank Has Financial System On The Cusp Of Collapse

- Jim Willie: If Deutsche Bank Goes Under It Will be Lehman TIMES FIVE!

- Oathkeeper Chapter 4

- This Is How A Bank Run Starts – Bill Holter

- Germany Faces Banking Collapse; Orders Citizens to “Prepare for National Emergency”

- DEUTSCHE BANK & $100 TRILLION IN DERIVATIVES HANG BY A THREAD ON EVE OF JUBILEE

- Deutsche Bank Will “Create A Widespread Global Panic Just Like Lehman” – MSM Suddenly Panicking

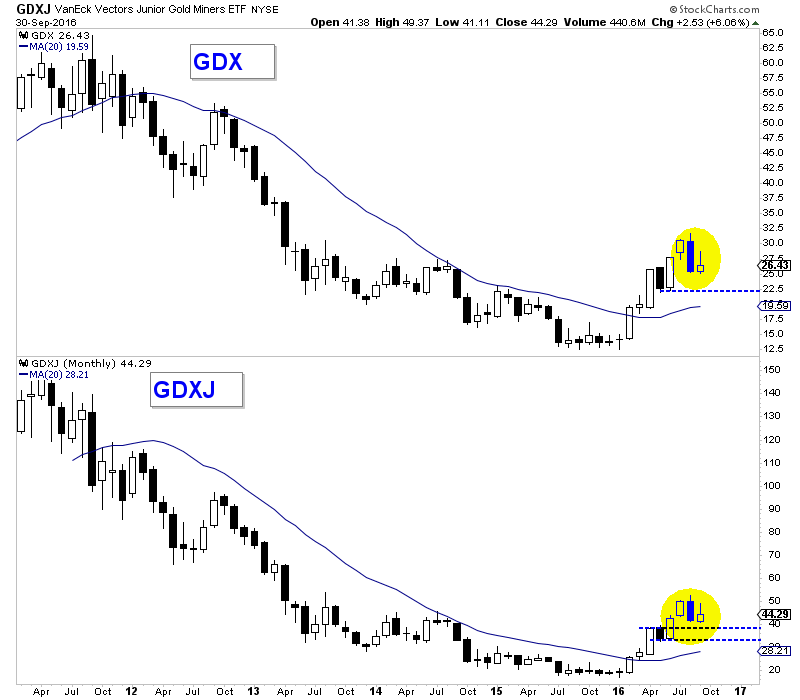

| Monthly Charts Argue for Lower Prices in Precious Metals Complex Posted: 01 Oct 2016 01:14 PM PDT The trading month doesn't always end on a Friday but when it does we like to take a look at the monthly charts. Generally, I prefer daily and weekly charts because they have more data points. However, monthly charts carry more significance than weekly charts which carry more significance than daily charts. You get the point. One reason and a good reason we expect the current correction to continue is the sector monthly charts. The chart below plots the monthly candle charts of GDX and GDXJ. Earlier this year the miners exploded above their 20-month moving averages and into a new bull market. They were trading at three year highs before a bearish reversal in August that reversed the entire gains from July. September saw a recovery but failure to hold most of those gains. This tells us that selling pressure remains present and miners will likely see lower prices in October.  GDX, GDXJ Monthly

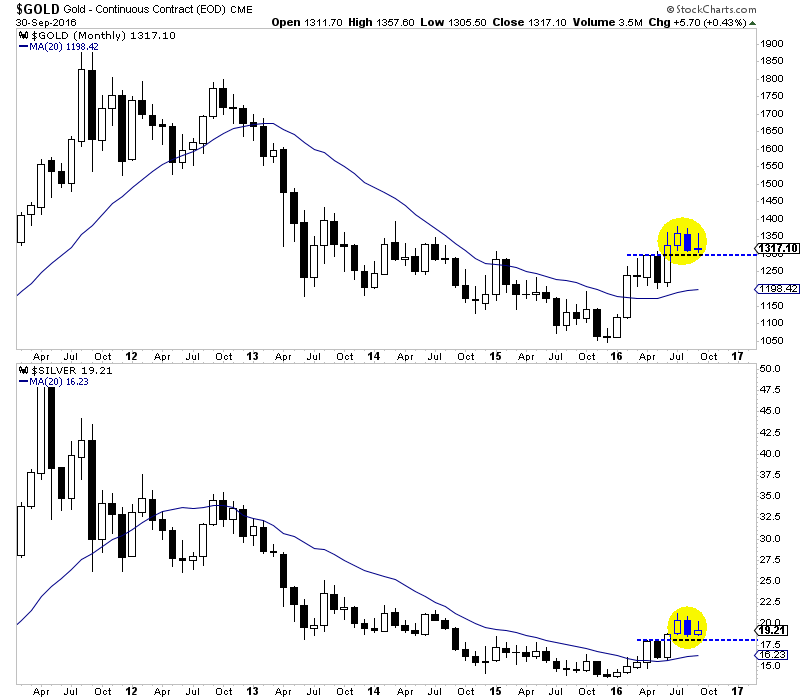

The metals show a similar picture. Markets moved well above their 20-month moving averages but the August candle engulfed July's candle while September recovered only to a small degree. That implies lower prices in October. Gold has support around $1290 while Silver has support near $18. Like the miners, the metals remain a healthy distance above their rising long-term moving averages.  Gold, Silver Monthly

The monthly charts and in particular the action of the past two months leads us to believe lower prices in October are more likely than not. The monthly charts obviously take more time to develop (we have to wait an entire month) but they are the most significant. Time will tell but we see the potential for an important low in October. Traders and investors are advised to wait for lower prices and an oversold condition. We will focus on opportunities scattered amongst individual companies. For professional guidance in riding the uptrend in Gold, consider learning more about our premium service including our favorite junior miners which we expect to outperform into 2017.

Jordan Roy-Byrne, CMT, MFTA

The post Monthly Charts Argue for Lower Prices in Precious Metals Complex appeared first on The Daily Gold. |

| BlackStone Group Says The Market Is The Most Treacherous They Have Seen Posted: 01 Oct 2016 10:00 AM PDT There has rarely ever been another time like this. Not since 1999 and not since 1929 before that, have so many billionaires, central banksters, financial elites and fund managers, warned that we are on the verge of a catastrophic bust: Buy 90% Silver Half Dollars at SD Bullion As Low As $1.99/oz Over Spot! […] The post BlackStone Group Says The Market Is The Most Treacherous They Have Seen appeared first on Silver Doctors. |

| Dollar Looks Vulnerable To Start Q4 Posted: 01 Oct 2016 07:54 AM PDT |

| Breaking News And Best Of The Web Posted: 30 Sep 2016 05:37 PM PDT US GDP revised slightly higher, consumer spending softens. OPEC agrees to output cut, oil price jumps. US stocks recover on calming words from Deutsche CEO. Commerzbank to cut 9,600 jobs, suspend dividend. Wells Fargo draws abuse for consumer fraud. China’s debt crisis has gone from inevitable to imminent — but Japan is even scarier. Gold […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| The Midas Touch Consulting Report Posted: 30 Sep 2016 05:19 PM PDT The Silver GoldSpot |

| Deutsche Bank Collapse: The Most Important Bank In Europe Is Facing A Major ‘Liquidity Event’ Posted: 30 Sep 2016 04:42 PM PDT

At one point on Friday, Deutsche Bank stock fell below the 10 euro mark for the first time ever before bouncing back a bit. A completely unverified rumor that was spreading on Twitter that claimed that Deutsche Bank would settle with the Department of Justice for only 5.4 billion dollars was the reason for the bounce. But the size of the fine is not really the issue now. Shares of Deutsche Bank have fallen by more than half so far in 2016, and this latest episode seems to have been the final straw for the deeply troubled financial institution. Old sources of liquidity are being cut off, and nobody wants to be the idiot that offers Deutsche Bank a new source of liquidity at this point. As a result, Deutsche Bank is potentially facing a “liquidity event” on a scale that we have not seen since the financial crisis of 2008. The following comes from Zero Hedge…

The more the stock price drops, the faster other financial institutions, investors and regular banking clients are going to want to pull their money out of Deutsche Bank. And every time there is news about people pulling money out of the bank, that is just going to drive the stock price even lower. In other words, Deutsche Bank may be entering a death spiral that may be impossible to stop without a government bailout, and the German government has already stated that there will be no bailout for Deutsche Bank. Banking customers have a total of approximately 566 billion euros deposited with the bank, and even if a small fraction of those clients start demanding their money back it is going to cause a major, major crunch. Deutsche Bank CEO John Cryan attempted to calm nerves on Friday by releasing a memo to employees that blamed “speculators” for the decline in the stock price…

If you would like to ready the full memo, you can do so right here. One of the reasons why Deutsche Bank is considered to be so systemically “dangerous” is because it has 42 trillion euros worth of exposure to derivatives. That is an amount of money that is 14 times larger than the GDP of the entire nation of Germany. Some firms that were derivatives clients of the bank have already gotten spooked and have moved their business to other institutions. It was this report from Bloomberg that really helped drive down the stock price of Deutsche Bank earlier this week…

So what comes next? Monday is a banking holiday for Germany, so we may not see anything major happen until Tuesday. An announcement of a major reduction in the Department of Justice fine may buy Deutsche Bank some time, but any reprieve would likely only be temporary. What appears to be more likely is the scenario that Jeffrey Gundlach is suggesting…

It will be very interesting to see how desperate things become before the German government finally gives in to the pressure. The complete and total collapse of Deutsche Bank would be an event many times more significant for the global financial system than the collapse of Lehman Brothers was. Global leaders simply cannot afford for such a thing to happen, but without serious intervention it appears that is precisely where we are heading. Personally, I don’t know exactly what will happen next, but it will be fascinating to watch. |

| Posted: 30 Sep 2016 03:30 PM PDT Deutsche Bank On the Brink: Could We See A Systemic Financial Collapse Sunday Night? As Much As Part Of Us Would Love To See Deutsche Bank to Blow A $100 Trillion Hole In the Global Financial System This Weekend, We Suspect It Won’t Happen. Here’s Why: Eric’s thoughts on the possibility of […] The post Deutsche Bank – On the Brink of Global Financial Collapse? 2 Experts Who Aren’t Buying A Meltdown This Weekend appeared first on Silver Doctors. This posting includes an audio/video/photo media file: Download Now |

| Posted: 30 Sep 2016 02:15 PM PDT “Shades of Lehman All Over Again…Except Deutsche Bank Is A MUCH Bigger Entity- Probably 50 TIMES Bigger Than Lehman!… Keep Your Eyes On the Banking Sector Here, THIS Is When You Want to Own Gold and Silver! The Rats Are Deserting the Ship, This Is EXACTLY HOW THINGS GO DOWN!” From SprottMoney: Related: Deutsche Bank […] The post Deutsche Bank To Trigger Global Financial Collapse THIS Weekend? Eric Sprott Warns “This Is EXACTLY How Things Go Down!” appeared first on Silver Doctors. |

| PANIC As Margin Calls Begin: Deutsche Bank Has Financial System On The Cusp Of Collapse Posted: 30 Sep 2016 02:01 PM PDT THIS is how the run begins… From PM Fund Manager Dave Kranzler: DB stock is now in a full panic sell-off as I write this. It just hit another new all-time NYSE low on by the heaviest volume ever in the stock since its 2001 NYSE listing. It's currently down almost 10%. No […] The post PANIC As Margin Calls Begin: Deutsche Bank Has Financial System On The Cusp Of Collapse appeared first on Silver Doctors. |

| Jim Willie: If Deutsche Bank Goes Under It Will be Lehman TIMES FIVE! Posted: 30 Sep 2016 02:00 PM PDT A bank failure contagion, that’s whats going to push the price of gold WAY over $2,000/oz again. The Price of Silver is going to be moving over $100 and the price of gold is going over $5,000… A failure of Deutsche Bank would trigger a systemic banking contagion the likes of which the Western world has never […] The post Jim Willie: If Deutsche Bank Goes Under It Will be Lehman TIMES FIVE! appeared first on Silver Doctors. |

| Posted: 30 Sep 2016 02:00 PM PDT A peaceful valley in the mountains of Colorado becomes a battleground pitting the federal government against a rural sheriff's department. Sheriff Bear Ellison finds himself increasingly isolated as he is forced to decide between risking his life protecting a local hero, or reneging on his oath and handing him over to federal prosecutors… […] The post Oathkeeper Chapter 4 appeared first on Silver Doctors. |

| This Is How A Bank Run Starts – Bill Holter Posted: 30 Sep 2016 01:59 PM PDT The take-down of the Western standard of living is happening in real time, RIGHT NOW… From Bill Holter, JSMineset: I did not intend to write today but 3 events warrant a heads up. 1. Deutsche Bank may be having their "Lehman moment" as 10 hedge funds have withdrawn funds and are cutting exposure […] The post This Is How A Bank Run Starts – Bill Holter appeared first on Silver Doctors. |

| Germany Faces Banking Collapse; Orders Citizens to “Prepare for National Emergency” Posted: 30 Sep 2016 01:44 PM PDT Only weeks ago, the German government recommended that citizens prepare for a survival emergency. Was an impending economic collapse triggered by Deutsche Bank and $100 Trillion in derivatives the reason why? From Daisy Luther, The Organic Prepper: Hot on the heels of the Deutsche Bank debacle comes the next nail in Germany's economic coffin. Germany's […] The post Germany Faces Banking Collapse; Orders Citizens to "Prepare for National Emergency" appeared first on Silver Doctors. |

| DEUTSCHE BANK & $100 TRILLION IN DERIVATIVES HANG BY A THREAD ON EVE OF JUBILEE Posted: 30 Sep 2016 01:35 PM PDT Will Deutsche Bank implode today, two days before the end of the Jubilee Year? Submitted by Jeff Berwick, The Dollar Vigilante: Nearly a year ago to the day, on September 28th, we wrote "Will Deutsche Bank Be This Cycle's Lehman Brothers?" In it we asked, "In 2008, the financial crisis was set-off by the […] The post DEUTSCHE BANK & $100 TRILLION IN DERIVATIVES HANG BY A THREAD ON EVE OF JUBILEE appeared first on Silver Doctors. |

| Deutsche Bank Will “Create A Widespread Global Panic Just Like Lehman” – MSM Suddenly Panicking Posted: 30 Sep 2016 01:22 PM PDT “You’re Going to Create a Widespread Global Panic, Just Like Lehman”… From CNBC: Related: Deutsche Bank To Trigger Global Economic Collapse This Weekend? Eric Sprott Issues Warning: Deutsche Bank & $100 Trillion In Derivatives Hang By A Thread On Eve Of Jubilee! PANIC As Margin Calls Begin: Deutsche Bank Has Financial System On Cusp […] The post Deutsche Bank Will “Create A Widespread Global Panic Just Like Lehman” – MSM Suddenly Panicking appeared first on Silver Doctors. |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment