Gold World News Flash |

- Duestche Bank Systematic Breakdown Might Start A Chain Reaction Collapse

- Gold Price Closed at $1313.30 Down $8.40 or -$0.60

- Lessons From The Japanese Economic Meltdown

- Deutsche Bank Troubles Raise Fear of Global Shock

- The Complete A To Z Of Nations Destroyed By Hillary Clinton's "Hubris"

- This Is How A Bank Run Starts – Bill Holter

- Silver Way Undervalued

- Michael Savage radio broadcast which was banned by all his radio affiliates

- FBI USES IMMUNITY DEALS to COVER UP HILLARY CLINTON CORRUPTION -James Comey

- America's Last Day Of Freedom ?

- A “Lehman Moment on Steroids”

- Gold Price Closed at $1321.70 Up $2.30 or 0.17%

- Deutsche Bank Nears Collapse

- Gold Daily and Silver Weekly Charts - Non-Farm Payrolls Report Next Week - Zimbabwe Express

- Nomi Prins: Jail Wells Fargo CEO John Stumpf!

- SIGNS OF THE END PART 216 - LATEST EVENTS SEPTEMBER 2016

- China seeking to succeed where Japan failed in yuan's global push

- LIVE Stream: Donald Trump Rally in Novi, MI 9/30/16 (RSB CAMERAS)

- I Don’t See How Germany Can Contain the Deutsche Bank Collapse

- The Eyes At Ground Zero David Icke & Luke Rudkowski

- Donald Trump Post Debate Meltdown, Betfair Betting Market Points to Collapse in Odds of Winning

- Monarch averts collapse after securing last-minute licence

- Is This Crisis Like Lehman Brothers on Steroids?

- Secret Alpine gold vaults are the new Swiss bank accounts

- Ted Butler: The biggest scandal

- Silver Way Undervalued

- Why Krugman, Roubini, Rogoff And Buffett Dislike Gold

- ANONYMOUS - OBAMA and PUTIN sends signals for the NEW WORLD ORDER

- Deutsche Bank Hangs By A Thread On Eve Of Jubilee

- GOLD MARKET FLASH NOTE: Ending With a Bang, Not a Whimper

| Duestche Bank Systematic Breakdown Might Start A Chain Reaction Collapse Posted: 30 Sep 2016 09:00 PM PDT from X22 Report: Episode 1089a | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1313.30 Down $8.40 or -$0.60 Posted: 30 Sep 2016 07:51 PM PDT

FREE!: Get Franklin Sanders Daily Gold Price Reports and Market Commentaries: If the form above does not display in your iPhone or android app, please use this link to visit the website signup form: http://goldprice.org/franklin-sanders | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Lessons From The Japanese Economic Meltdown Posted: 30 Sep 2016 07:20 PM PDT from corbettreport: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deutsche Bank Troubles Raise Fear of Global Shock Posted: 30 Sep 2016 06:55 PM PDT by Peter S. Goodman, NY Times:

LONDON — Germany's largest bank appears in danger, sending stock markets worldwide on a wild ride. Yet the biggest source of worry is less about its finances than a vast tangle of unknowns — not least, whether Europe can muster the will to mount a rescue in the event of an emergency. In short, fears that Europe lacks the cohesion to avoid a financial crisis may be enhancing the threat of one. The immediate source of alarm is the health of Deutsche Bank, whose vast and sprawling operations are entangled with the fates of investment houses from Tokyo to London to New York.

Deutsche is staring at a multibillion-dollar fine from the Justice Department for its enthusiastic participation in Wall Street's festival of toxic mortgage products in the years leading up to financial crisis of 2008. Given Deutsche's myriad other troubles — a role in the manipulation of a financial benchmark, claims of trades that violated Russian sanctions and a generalized sense of confusion about its mission — the American pursuit of a stiff penalty comes at an inopportune time. It heightens the sense that Deutsche — whose shares have lost more than half their value this year — needs to secure additional investment, lest it leave itself vulnerable to some new crisis. The biggest worries center on what happens if Deutsche falls apart to the point that it threatens the globe with a financial shock — and whether new rules and buffers put in place since the last crisis will keep the pain from spreading. Regulations that took effect this year in the European Union standardize how member countries are supposed to handle the potential implosion of a large financial institution. Banks, too, have put aside more money to deal with potential losses. Deutsche could pose the first test of the new arrangement. Recent challenges have underscored concerns about the limits of solidarity in Europe. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Complete A To Z Of Nations Destroyed By Hillary Clinton's "Hubris" Posted: 30 Sep 2016 06:30 PM PDT Submitted by Wayne Madsen via infowars.com In an email sent to his business partner and Democratic fundraiser Jeffrey Leeds, former Secretary of State Colin Powell wrote of Hillary Clinton, “Everything HRC touches she kind of screws up with hubris.” Clinton’s tenure as Secretary of State during Barack Obama’s first term was an unmitigated disaster for many nations around the world. Neither the Donald Trump campaign nor the corporate media have adequately described how a number of countries around the world suffered horribly from Mrs. Clinton’s foreign policy decisions. Millions of people were adversely harmed by Clinton’s misguided policies and her “pay-to-play” operations involving favors in return for donations to the Clinton Foundation and Clinton Global Initiative. The following is a before and after recap, country by country, of the destabilizing effects of Clinton’s policies as Secretary of State: AbkhaziaBefore Hillary: In 2009, more and more nations began recognizing the independence of this nation that broke away from Georgia and successfully repelled a U.S.-supported Georgian invasion in 2008. After Hillary: Clinton pressured Vanuatu and Tuvalu to break off diplomatic relations with Abkhazia in 2011. The State Department pressured the governments of India, Germany, and Spain to refuse to recognize the validity of Abkhazian passports and, in violation of the US-UN Treaty, refused to permit Abkhazian diplomats to visit UN headquarters in New York. The Clinton State Department also threatened San Marino, Belarus, Ecuador, Bolivia, Cuba, Somalia, Uzbekistan, and Peru with recriminations if they recognized Abkhazia. Georgia was connected to Clinton through the representation of Georgia in Washington by the Podesta Group, headed by Tony Podesta, the brother of Mrs. Clinton’s close friend and current campaign chairman John Podesta. ArgentinaBefore Hillary: Under President Nestor Kirchner and his wife Cristina Fernandez de Kirchner, Argentina’s economy improved and the working class and students prospered. After Hillary: After former president Nestor Kirchner’s sudden death in 2010, the U.S. embassy in Buenos Aires became a nexus for anti-Kirchner activities, including the fomenting of political and labor protests against the government. Meanwhile, Clinton pressed Argentina hard on its debt obligations to the IMF, also crippling the economy. BoliviaBefore Hillary: Bolivia’s progressive president Evo Morales, the country’s first indigenous Aymara leader, provided government support to the country’s coca farmers and miners. Morales also committed his government to environmental protection. He kept his country out of the Free Trade Area of the Americas and helped start the Peoples’ Trade Agreement with Venezuela and Cuba. After Hillary: Clinton permitted the U.S. embassy in La Paz to stir up separatist revolts in four mostly European-descent Bolivian provinces, as well as foment labor strikes among miners and other workers in the same model used in Venezuela. BrazilBefore Hillary: Brazil’s progressive presidents, Luiz Inacio Lula da Silva and Dilma Rousseff, ushered in a new era for the country, with workers’ and students' rights at the forefront and environmental protection and economic development for the poor major priorities. After Hillary: Clinton’s authorization of massive electronic spying from the US embassy in Brasilia and consulate general in Rio de Janeiro resulted in a “constitutional coup” against Rousseff and the Workers’ Party government, ushering in a right-wing, CIA-supported corrupt government. Central African RepublicBefore Hillary: Under President Francois Bozize, the CAR remained relatively calm under a peace agreement hammered out under the auspices of Muammar Qaddafi’s Libya. After Hillary: In 2012, Islamist terrorists of the Seleka movement and supported by Saudi Arabia conducted an uprising, massacring Christians and riving Bozize’s government from power. The CAR became a failed state under Clinton’s State Department. EcuadorBefore Hillary: Ecuador began sharing its oil wealth with the people and the economy and the plight of the nation’s poor improved. After Hillary: Clinton authorized a 2010 National Police coup against President Rafael Correa. The economy soon plunged as labor disputes wracked the mining and oil sectors. EgyptBefore Hillary: Under Hosni Mubarak, Egypt was a stable secular nation that suppressed jihadist politics in the mosques. The jihadist-oriented Muslim Brotherhood was kept at bay. After Hillary: After Clinton’s 2011 “Arab Spring” and the toppling of Mubarak, Egypt saw Mohamed Morsi of the Muslim Brotherhood elected president. Immediately, the secular country began a process of Islamization with Christian Copts experiencing repression and violence, including massacres. Morsi’s rule resulted in a military coup, thus ending Egypt’s previous moves toward democracy. GermanyBefore Hillary: The nation was a peaceful country where German culture, as well as religious freedom and women’s rights were guaranteed. After Hillary: Clinton’s “Arab Spring” eventually resulted in a flood of mainly Muslim refugees being welcomed into Germany from the Middle East, Africa, and South Asia. Today, Germany is wracked by Muslim refugee street crime, unsanitary and harmful public health habits of migrants, sexual assaults by migrant men of women and children, increased acts of terrorism, and a diminution of German culture and religious practices. GreeceBefore Hillary: Greece was a nation that saw government safety net social services extended to all in need. It also remained a top tourist destination for northern Europeans. After Hillary: The 2010 debt crisis emaciated the Greek economy and Clinton remained adamant that Greece comply with draconian economic measures dictated by Germany, the European Union, and the IMF/World Bank. Making matters worse, Clinton’s “Arab Spring” eventually resulted in a flood of mainly Muslim refugees being welcomed into first, the Greek isles, and then mainland Greece, from the Middle East, Africa, and South Asia. Today, Greece, especially the islands of Lesbos, Chios, Samos, Symi, Rhodes, Leros, and Kos, are wracked by Muslim refugee crime, unsanitary public health habits of migrants, sexual assaults by migrant men of women and children, acts of arson and vandalism, and a diminution of Greek culture and religious practices. GuatemalaBefore Hillary: Under President Alvaro Colom, the nation’s first populist progressive president, the poor received access to health, education, and social security. After Hillary: Clinton authorized the U.S. embassy in Guatemala to work against the 2011 election of president Colom’s wife, Sandra Torres. Colom was succeeded by a right-wing corrupt president who resigned for corruption and then was arrested. HaitiBefore Hillary: Haiti was prepared in 2011 to re-elect Jean-Bertrand Aristide, forced out of office and into exile in a 2004 CIA coup. The prospects of Artistide’s return to power was a blessing for the slum dwellers of Haiti. After Hillary: Clinton refused to allow Aristide to return to Haiti from exile in South Africa until it was too late for him to run in the 2011 election. Under a series of U.S.-installed presidents, all approved by Bill and Hillary Clinton, Haiti is a virtual cash cow for the Clintons. The Clinton Foundation diverted for its own use, international aid to Haiti, and the Clintons ensured that their wealthy friends in the hotel, textile, and construction businesses landed lucrative contracts for Haitian projects, none of which have benefited the Haitian poor and many of which resulted in sweat shops and extremely low wage labor practices. HondurasBefore Hillary: Emergent multi-party democracy with a populist progressive president, Manuel Zelaya. Children received free education, poor children received free school meals, interest rates were reduced, and the poorest families were given free electricity. After Hillary: Clinton authorized a military coup d’etat against Zelaya in 2009. Clinton family “fix-it” man Lanny Davis became a public relations flack for the military dictatorship. A fascist dictatorship involved in extrajudicial death squad killings of journalists, politicians, and indigenous leaders followed the “constitutional coup” against Zelaya. During 2012, Clinton ordered U.S. embassy in Tegucigalpa to work against the 2013 election of Xiomara Castro de Zelaya as president. IraqBefore Hillary: Under Prime Minister Nouri al-Maliki, Iraq experienced small moves toward an accommodation with the Kurds of the north and Sunnis. Iran acted as a moderating political force in the country that deterred any attempts by Saudi-supported jihadis to disrupt the central government in Baghdad. After Hillary: Clinton’s Arab Spring resulted in the rise of the Sunni/Wahhabist Islamic State in northern and western Iraq and Iraq’s plunge into failed state status. Shi’as, Kurds, Yazidis, Assyrian Christians, and moderate Sunnis were massacred by the jihadis in northern, western, and central Iraq. The Iraqi cities of Mosul, Kirkuk, and Nineveh fell to ISIL forces with non-Muslims being raped, tortured, and executed and priceless antiquities being destroyed by the marauding jihadists. KosovoBefore Hillary: Kosovo, which became independent in 2008, initially granted its Serbian minority in northern Kosovo and Metohija some degree of self-government. After Hillary: In 2009, Kosovo increasingly became a state ruled by criminal syndicates and terrorists of the former Kosovo Liberation Army. The rights of Serbs were increasingly marginalized and Kosovo became a prime recruiting ground for jihadist guerrillas in Arab countries subjected to Clinton’s “Arab Spring” operations, including Libya and Syria. Clinton pressured states receiving U.S. aid and other U.S. allies to recognize Kosovo’s independence. These included Pakistan, Palau, Maldives, St. Kitts-Nevis, Dominica, Fiji, Papua New Guinea, Burundi, East Timor, Haiti, Chad, Gambia, Brunei, Ghana, Kuwait, Ivory Coast, Gabon, St. Lucia, Benin, Niger, Guinea, Central African Republic, Andorra, Oman, Guinea-Bissau, Qatar, Tuvalu, Kiribati, Honduras, Somalia, Djibouti, Vanuatu, Swaziland, Mauritania, Malawi, New Zealand, Dominican Republic, Jordan, Bahrain, and Comoros. In the Kosovo capital of Pristina, there is a 10-foot-high statue of Bill Clinton standing over Bill Clinton Boulevard. Not far away is a women’s clothing store called “Hillary.” LibyaBefore Hillary: Under Muammar Qaddafi, post-sanction Libya saw a boom in urban construction and a new major international airport to serve as a hub for Africa. Plans announced for an African dinar, supported by Libyan gold holdings, to serve the needs of Africa. All Libyans received free education and medical care. There was a program for revenue sharing of Libya’s oil wealth with the Libyan people. After Hillary: Clinton’s 2011 regime change operations against Qaddafi, which saw the Libyan leader sodomized, beaten, and shot in the head by U.S.-supervised jihadist rebels, resulted in Clinton laughing about the incident in the infamous, “We came, we saw, he died” comment. Libya became a failed state where Islamic jihadist terrorists vied for control of the country and Qaddafi’s arm caches were given or sold to jihadist terrorists in Syria, Iraq, Egypt, the pan-Sahel region, and sub-Saharan Africa. After Qaddafi’s ouster, black African guest workers and their families were massacred by jihadist forces. MalaysiaBefore Hillary: Malaysia, before 2009, was a religiously tolerant nation where Buddhists, Christians, and Hindus enjoyed freedom of religion. After Hillary: In 2009, Najib Razak became prime minister and he began accepting bribes from Saudi Arabia that totaled some $2.6 billion with additional Malaysian public money in Razak’s personal bank accounts plus the Saudi cash totaling some $3.5 billion. Razak began allowing Saudi-influenced clerics to push for sharia law throughout Malaysia and Christians in Sarawak, Sabah, and Penang began experiencing Wahhabist repression. Clinton was silent about Malaysian persecution of non-Muslims. The reason may have been a reported several hundred million donation from Razak’s slush fund into the Clinton Foundation’s coffers. PalestineBefore Hillary: In 2012, Palestine was granted non-member observer status in the United nations. The 2009 Goldstone Report of the UN found that Israel violated international humanitarian law in its war against Gaza in 2009. Palestine was gaining more support and sympathy internationally and was successfully putting to rest Israeli propaganda disinformation. After Hillary: Hillary Clinton rejected the Goldstone Report as “one-sided.” Clinton’s unbridled support for expanding Israeli settlements in the West Bank and east Jerusalem and its silence on the dehumanizing Israeli blockade of Gaza, emboldened Israel’s theocratic right-wing government to further encroach on Palestinian territories and cementing into place an apartheid-like series of Palestinian “Bantustans” in the West Bank and an open-air ghetto in Gaza. ParaguayBefore Hillary: The country under Fernando Lugo began lifting out of poverty the nation’s rural campesinos and urban workers. Paraguay also began a steady move toward democratization after years of military dictatorships. After Hillary: Clinton’s 2012 “constitutional coup” against Fernando Lugo brought back into power the military-industrial oligarchy with the nation’s campesinos being forced back into poverty and repressive rule. South SudanBefore Hillary: Prior to independence in 2011, South Sudan, while rife with intra-tribal feuding, was relatively calm. After Hillary: After being rushed into independence from Sudan in 2011, South Sudan, a special project of Clinton, George Soros, and actor George Clooney, descended into civil war and chaos. It beat all records in being transformed from a newly-independent state into a failed state. SyriaBefore Hillary: Syria was a multi-cultural and multi-religious secular state championing the concept of pan-Arab socialism and progressive policies advanced by Egypt’s Gamal Abdel Nasser. Syria was not a safe place for jihadism. After Hillary: After Clinton’s 2011 green light for the “Arab Spring,” Syria became a failed state where the Islamic State gained a firm foothold. Minority Alawites, Christians, Druze, and Kurds were massacred by jihadist groups aided and abetted by NGOs and other interests backed by Clinton. ThailandBefore Hillary: Thailand’s Red Shirt movement was a powerful force that demanded a return to democracy in Thailand and the restoration of former Prime Minister Thaksin Shinawatra, ousted in a 2006 military coup, to power. After Hillary: A Red Shirt protest in 2010 resulted in a bloody crackdown by the Thai military. Clinton remained silent about the Thai army’s killing of protesters and the mass arrests of Red Shirt leaders. U.S. military assistance to the Thai government was continued by Clinton. When Thaskin’s sister, Yingluck Shinawatra, became prime minister in 2011, Clinton began working to undermine her and her government in a manner not unlike Clinton’s subterfuge against Rousseff in Brazil and Cristina Kirchner in Argentina. When it comes to women leaders, Clinton only tolerates conservatives who kow-tow to the United States. The pressure against Yingluck eventually resulted in her ouster in 2014 and her being criminally charged in the same manner that saw Rousseff charged in Brazil. TunisiaBefore Hillary: Tunisia was one of the most secular nations in the Arab and Islamic world. A top destination for European tourists, the country was more European in its outlook than North African. After Hillary: After Clinton’s 2011 “Jasmine Revolution,” a textbook themed revolution crafted by Clinton’s friend George Soros, Tunisia descended into Islamist rule and violence. Today, Tunisia is the top country for recruits to the Islamic State. TurkeyBefore Hillary: Turkey was moving steadily closer to European standards on human rights and democracy. Even under the Islamist-oriented Prime Minister Recep Tayyip Erdogan, the country remained committed to pluralism. After Hillary: Clinton authorized the shipment of Libyan weapons captured from Qaddafi’s arms caches to Turkish middlemen in the employment of Erdogan’s government for transfer to the jihadist rebels in Syria. A complication in this arrangement resulted in the September 11, 2012 jihadist attack on the CIA warehouse facility in Benghazi, which killed U.S. envoy Chris Stevens and other State Department personnel. Turkey’s dalliance with jihadist rebels in Syria was mirrored by increasing Islamization of Turkey. The events of 2011 and 2012 resulted in Turkey today being ruled by an Islamist strongman, Erdogan, with open political opposition being stamped out. UkraineBefore Hillary: Ukraine was a stable and neutral country that neither aligned itself with the West and NATO nor with Russia under the presidency of Viktor Yanukovych, elected in 2009 and inaugurated in 2010. After Hillary: Clinton tried everything possible to ensure the 2009 defeat of Viktor Yanukovych. The State Department and its friends in the George Soros camp provided assistance to Clinton’s favorite candidate Yulia Tymoshenko to defeat Yanokovych. It was this early interference in the 2009 election that ultimately led to the “Euromaidan” themed revolution in 2014 against the government, resulting in civil war, the retrocession of Crimea back to Russia, and secessionist states in eastern Ukraine. Clinton’s policies directly led to a failed state in Europe. VenezuelaBefore Hillary: Under Hugo Chavez, the country provided basic social services to its poorest of citizens. Venezuela also provided discounted gasoline to several Caribbean and Central American countries through the PetroCaribe consortium. After Hillary: After Clinton allowed the U.S. embassy in Caracas to foment anti-Chavez labor and political protests, the country | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This Is How A Bank Run Starts – Bill Holter Posted: 30 Sep 2016 05:40 PM PDT by Bill Holter, via Silver Doctors:

1. Deutsche Bank may be having their "Lehman moment" as 10 hedge funds have withdrawn funds and are cutting exposure with DB. This is how a "bank run" starts folks! Quite convenient that this Monday I believe is a banking holiday in Germany. If this is truly a Lehman moment, we will have a far larger event in a very compressed timeframe than we had in 2008. 2. The veto of the Saudi 911 bill was overridden in the House and Senate. 3. It looks like John Kerry is threatening to cut off diplomatic ties with Russia. This is horrific on so many levels, particularly to the survival of the human race. Please understand the "timing" of this particular item. All three of these events are happening at one time, if you believe it's a "bad coincidence" you are wrong in my opinion. The take-down of the Western standard of living is happening in real time, right now. Ignore this at your own risk! Standing watch, Bill Holter | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 30 Sep 2016 05:16 PM PDT Zealllc | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Michael Savage radio broadcast which was banned by all his radio affiliates Posted: 30 Sep 2016 04:00 PM PDT Censorship in America. Watch this video get deleted and this account terminated for this video. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FBI USES IMMUNITY DEALS to COVER UP HILLARY CLINTON CORRUPTION -James Comey Posted: 30 Sep 2016 03:00 PM PDT FBI USES IMMUNITY DEALS to COVER UP HILLARY CLINTON CORRUPTION -James Comey The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| America's Last Day Of Freedom ? Posted: 30 Sep 2016 02:30 PM PDT John Kirby of the State Department said that about Isis blowing up Russian cities The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

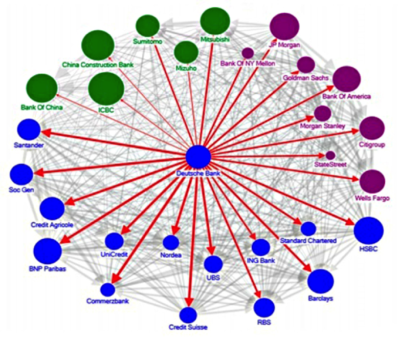

| Posted: 30 Sep 2016 02:13 PM PDT This post A "Lehman Moment on Steroids" appeared first on Daily Reckoning. "Ghost of Lehman Haunts Deutsche Bank," says The Wall Street Journal with a fright. Lehman got hauled off to the boneyard eight years ago this month. Cause of death: the subprime mortgage crisis. And its shade has been spooking the markets ever since. Lehman succumbed to a classic bank run. The Journal puts it thusly: "Lehman failed the way all banks fail: It ran out of cash and liquid assets it could quickly sell to pay clients and counterparties as they ran for the exit." Now Deutsche Bank is in a similar fix. Jim Rickards often speaks of the "snowflake" that can trigger an avalanche. Any individual snowflake is a nothing in itself. But when the snow builds high enough, it just takes that one last flake to bring down the mountain. Could Deutsche Bank be the snowflake that triggers another 2008-like avalanche? Lehman was leveraged 24:1 at time of death. But Deutsche Bank's leveraged more than 40:1 today. That's at least 40 claims on every buck in the vault. If everyone demands theirs at once, all but one go scratching. And the bank…rupts. Trouble started this summer when Deutsche Bank's U.S. subsidiary was one of two banks that failed the Fed's annual stress test. (Deutsche Bank flunked the same exam last year.) Investors sent Deutsche Bank shares to their lowest point in 30 years. Then two weeks ago, the U.S. Justice Department "proposed" the bank fork over $14 billion for its role in the 2008 mortgage crisis. That sparked fears it could clear the bank's thinly capitalized cupboards. And that's got lots of folks nervous. Bloomberg said 10 hedge funds have removed cash reserves from the bank. "Why would you keep collateral with Deutsche Bank right now?" asks Raoul Pal, independent researcher and harsh critic of the bank. "If you are a hedge fund right now, you start pulling lines and go somewhere else." "It is all about confidence now," adds Julian Brigden of Macro Intelligence 2 Partners, an independent research company dealing with hedge funds. "If a client has some derivatives at Deutsche Bank, he starts to think — will I get paid?" Then he puts the hammer on the nail: "Things can get out of hand quickly." The IMF let Deutsche Bank have it good and hard this June, saying it “appears to be the most important net contributor to systemic risks.” At one point, Deutsche was mixed up in $72 trillion of derivative financial instruments — about a quarter of total global exposure. That's what led precious metals analyst Jim Willie to wail "it will be Lehman TIMES FIVE" if Deutsche Bank sinks. Lehman nearly capsized the ship. And times five? "Unlike the collapse of Lehman Bros. in 2008, which the western central banks were able to contain thanks to $13 trillion in bailout funds," Willie goes on, "a failure of Deutsche Bank would trigger a systemic banking contagion the likes of which the Western world has never seen." (Emphasis ours.) And that's the risk in today's hyperconnected Rube Goldberg contraption of a banking system. Start some trouble somewhere and it's out of control in two seconds flat. A picture is worth 72 trillion words:

Jim Rickards has noted that Deutsche Bank's derivatives exposure is down from a comic-worthy $72 trillion to (only!) $42 trillion. Isn't that good? Less exposure, less counterparty risk? No, says Jim. It's actually not. It's a disguised bank run: "That means counterparties are already terminating and replacing contracts. There's a silent run on the bank already." Jim likens the situation at Deutsche Bank to a "Lehman moment on steroids." And here we note the great irony of zero interest rates and QE and all the acrobatics central banks used to keep the banks going… They've crippled the banks. Sure, they've gotten to borrow money for next to zilch. But the blade slices both ways. Ultralow interest rates have limited what they make on loans and earn on their other investments. That's cut into profits. And it's left them less cushion to meet a crisis. Banks with falling earnings also have gone further out on the risk branch in the search for yield. In short… Zero rates make the system less stable over time. Not more. Even that great monetary vandal Ben Bernanke admitted (don't laugh), "Very low interest rates, if maintained too long, could undermine financial stability." He said that in May 2013. It's now going on eight years that interest rates have been at or near zero. And a lot more snowflakes have piled atop the mountain… just waiting. Regards, Brian Maher Ed. Note: Sign up for your FREE subscription to The Daily Reckoning, and you'll receive regular insights for specific profit opportunities. By taking advantage now, you're ensuring that you'll be financially secure for the future. Best to start right away – it's FREE. The post A "Lehman Moment on Steroids" appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1321.70 Up $2.30 or 0.17% Posted: 30 Sep 2016 02:09 PM PDT

FREE!: Get Franklin Sanders Daily Gold Price Reports and Market Commentaries: If the form above does not display in your iPhone or android app, please use this link to visit the website signup form: http://goldprice.org/franklin-sanders | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 30 Sep 2016 02:09 PM PDT This post Deutsche Bank Nears Collapse appeared first on Daily Reckoning. One of the biggest banks in the world has come several steps closer to complete collapse. I rely on signals from around the world for our information. These signals are what the intelligence community calls "indications and warnings," and I use them to update my investment hypotheses. Sometimes the signal is weak. But sometimes the signal is flashing bright red. This is one of those times. The bank in question is Deutsche Bank. It's the largest bank in Germany, by far, and one of the twelve largest in the world. It is difficult to overstate the importance of Deutsche Bank not only to the global economy, but also in terms of its vast web of off-balance-sheet derivatives, guarantees, trade finance, and other financial obligations on five continents. Deutsche Bank's gross notional derivatives exposure is €42 trillion — over 25 times what the bank reveals on the size of its balance sheet. This figure has dropped recently from over 70 trillion, which means counterparties are already terminating and replacing contracts. There's a silent run on the bank already. As usual retail depositors are the last to know. The financial distress at Deutsche Bank is like a "Lehman Moment" on steroids. But Deutsche Bank is certainly in the "too big to fail" category. Therefore it won't be allowed to fail. Germany will intervene as needed to prop up the bank. First, let's examine Deutsche Bank itself. Then we'll look at the signal that tells us what's happening. That signal, incidentally, is being ignored by most Wall Street analysts. The problems at Deutsche Bank are well-known. They have suffered through bad debt write-offs and mark-to-market trading losses just like many of their big bank peers. But, the problems go deeper. Deutsche Bank's capital is barely adequate under generous ECB "stress tests," and is completely inadequate under real world scenarios involving a global liquidity crisis of the kind we saw in 2008. Recently, the U.S. Department of Justice announced that it was seeking $14 billion to settle charges that Deutsche Bank engaged in misleading sales practices with regard to residential mortgage backed securities between 2005 and 2007. Of course, that's just a claim. But, even if Deutsche Bank settles the case for a fraction of that amount, say $5 billion, it will significantly impair an already weak capital base. Not surprisingly, Deutsche Bank's stock has suffered enormously. From a pre-Lehman interim high of €104 per share, it fell to €34 per share by early 2015. That's a 68% decline, mostly driven by the global financial crisis of 2007-08 and the European sovereign debt crisis of 2011-2015. Just when investors thought things could not get worse, they did. From the €34 per share level in 2015, Deutsche Bank stock fell again to €10.25 per share in recent days. That's a massive decline off the lower 2015 base. This sequence makes an important point. When a stock falls 70% or more many investors assume the profit potential from a short position is gone. In effect, investors ask, "How much lower can it go?" The answer is that no matter how low a stock goes, it can always go lower until it hits zero. This is the financial equivalent of Zeno's Paradox. Zeno, a fifth century Stoic Greek philosopher, imagined an arrow shot across a room. He said that an arrow would first cross half the room. Then it would cross the remaining half. Then the remaining half, and so on in an infinite series of remaining half-rooms. Zeno said the arrow could never cross the room because of the infinite time needed to cross an infinite number of half rooms. (Newton's calculus resolved this paradox in the 17th century). Likewise, a stock can fall 90%, and then fall 90% again, and 90% again and so on until it hits zero. Deutsche Bank is not going to zero. But it could go to €2 per share before Germany steps in to truncate the collapse and stop the bleeding. A €2 per share end-point is down over 80% from current levels. The question is, what could take Deutsche Bank down from here despite the huge losses the stock has suffered already? This brings us to our market signal. At Intelligence Triggers, we use a method called causal inference to make forecasts about events arising in complex systems such as capital markets. Causal inference methodology is based on Bayes' Theorem, an early 19th century formula first discovered by Thomas Bayes. This is the same method we used to correctly forecast the outcome of the Brexit vote. Now we're using it to forecast the likelihood of a Deutsche Bank stock collapse in the next few months. What signals are we getting that indicate a collapse? The strongest signal is not coming from Germany — it's coming from Italy. While the world is waiting for the denouement of the Deutsche Bank drama, another bank fiasco is playing out in Italy. This involves the Banca Monte dei Paschi di Siena (BMP), the world's oldest bank still in operation, founded in 1472. BMP was the only top bank to fail the ECB's recent stress tests. It is required to raise capital and has announced plans to do so. The capital raise is being led by JP Morgan and a syndicate including Goldman Sachs and some of the largest banks in China. The syndicate was formed in July and was supposed to announce results by the end of September. We're almost there and the news is not good. Reuters recently reported that the capital raising effort is not going well, and the syndicate expects they will delay any announcement until after important Italian elections scheduled for November. What do the travails of BMP have to do with Deutsche Bank? Both banks are too-big-to-fail and are failing, but BMP is closer to the brink. It's the "canary in the coal mine" for Deutsche Bank. Italy wants to bail-out BMP with taxpayer money. That's the standard playbook that governments used in 2008. But the rules have changed. At the G20 Leaders' Summit in Brisbane in 2014, it was decided that bailouts would be replaced by "bail-ins." In a bail-in taxpayer money is not used to recapitalize the sick bank. Instead bondholders and depositors take haircuts and are involuntarily converted into equity holders. Imagine if you had $500,000 on deposit at the bank and you got a notice in the mail that said your deposit was now $250,000 (the insured amount) and the other $250,000 had been converted into stock in a "bad bank," which might or might not produce returns in the future. That's what happens in a bail-in. The German government under Angela Merkel is telling Italy that they cannot bail-out BMP; they have to use the new bail-in rules instead. But what's sauce for the goose is sauce for the gander. If Germany forces Italy to bail-in BMP, then Italy will insist that Germany also bail-in Deutsche Bank when the time comes. Germany won't like that, but if they don't bail-in Deutsche Bank, the European Union will come apart because of acrimony between Italy and Germany. Compared to this dispute, UK Brexit is a sideshow. Greece is a sideshow of a sideshow. Italy is the real deal. If Germany and Italy can't cooperate, then there is no European Union. This is why the BMP capital raise syndicate pushed their announcement out past November. They know that if they announced their failure today, the bail-in option would be required immediately and the government would lose the elections. If the government can get past the elections intact, the bail-in of BMP (or bail-out as the case may be) can come in December. Markets won't wait while German and Italian politicians tiptoe around the bail-in question. They will draw their own conclusions and start a run on Deutsche Bank. It's already happening. That will take the stock down another 90% on top of the multiple crashes that have already occurred. The German government will let Deutsche Bank stock fall to €2 before they intervene. That's how existing stockholders make their "contribution" to the bail-in. Deutsche Bank won't fail and the stock won't go to zero. But there's still plenty of room to fall, and this story is far from over. The eurozone is in trouble. Regards, Jim Rickards Ed. Note: Sign up for your FREE subscription to The Daily Reckoning, and you'll receive regular insights for specific profit opportunities. By taking advantage now, you're ensuring that you'll be financially secure for the future. Best to start right away – it's FREE. The post Deutsche Bank Nears Collapse appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Non-Farm Payrolls Report Next Week - Zimbabwe Express Posted: 30 Sep 2016 01:40 PM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Nomi Prins: Jail Wells Fargo CEO John Stumpf! Posted: 30 Sep 2016 01:37 PM PDT This post Nomi Prins: Jail Wells Fargo CEO John Stumpf! appeared first on Daily Reckoning. This piece originally appeared in Bill Moyers & Co. Consider this. You're a mob boss. You run a $1.8 trillion network of businesses across state lines and continents. Many of these are legit, but a select subset of them – not so much. Every so often the illegal components flare up; some Washington commission launches an investigation, someone blows a whistle, people lose their homes, a pack of investors sheds a ton of money and lawsuits fly. You get reprimanded and have to pay lawyers and accountants overtime to deal with the paperwork. You settle on fines with the government — $10 billion worth. Then you keep going with no one the wiser, no wings clipped, no hard time. After all of that — you say you're sorry, forfeit some money you didn't even make yet, and (maybe) resign with boatloads more of it. This is what we're dealing with regarding Wells Fargo CEO and Chairman John Stumpf. He could be a really nice guy and wears some lovely tailored attire. (Hell, even Al Capone cared about proper milk expiration date labels.) But he's also a crook, plain and simple. He's cheated shareholders and taxpayers and customers, and used a stockpile of FDIC-backed deposits as fodder for illicit activities that have been repeatedly investigated and fined. And he made hundreds of millions of dollars doing it. This is not conjecture, nor sour grapes from the nonmillionaire swath of the population. It's based on documented facts. But by no means is Wells the only guilty bank on the street, or Stumpf the only "apologetic" CEO. Apologies are cheap, and so is money when it's a small piece of a much larger pie. Somewhere, JPMorgan Chase Chairman and CEO Jamie Dimon and Goldman Sachs Chairman and CEO Lloyd Blankfein are sighing in relief that this time it was Stumpf and not one of them, the other two of the three (of the Big Six bank) CEOs left standing since the crisis. These are just some highlights of those nearly $10 billion in total fines Wells agreed to, rather than take matters to court, since 2009. The sheer sum of those fines reveal a recidivist attitude toward ethics, regulations and the law. The associated transgressions were all committed under Stumpf's leadership. There's no way a regular citizen committing a fraction of a fraction of anything like these wouldn't be in jail. Complexity is no excuse for criminal behavior. Nor is calling these practices "abuses" rather than felony fraud for misleading, at the very least, investors and shareholders in a publicly traded mega-company that violates securities laws. Note:

The list goes on. "Clawback"For this most recent discovery of fraudulent behavior, creating 2 million fake accounts for which real customers were bilked out of $2.4 million, and after a verbal spanking at the hands of Sen. Elizabeth Warren (D-MA), Stumpf resigned from his Fed advisory post. He has to fork over $41 million in stock awards, part of a "clawback" of the appreciation in the stock value due to manipulating information. The term "clawback" sounds dramatic, connoting an animal paw grabbing what's rightly ours, not theirs. It conveys the idea of forcibly parting a crooked CEO from his ill-gotten spoils. But Stumpf's $41 million "clawback" doesn't mean very much. Let me be clear. (Yes, I'm channeling Bernie Sanders.) It is money he hasn't made yet — not cash, or even cars or houses. The clawback refers to a portion of his stock awards that are not vested, meaning not his to liquidate now anyway. His total stock awards are worth $247 million. If Stumpf was a car thief, it'd be like he stole six cars and had to return one, but would still be allowed to profit from selling the other five. Not to mention that he's not behind bars, nor has he been indicted for theft. Part of the press and his supporters (yes, including you Warren Buffett) feel he's being unfairly chastised for a little crime that he might not have actually committed himself (don't most mobsters have hired guns, except when they're bored or really pissed off?) They cite the "little" fine of $185 million and the casualties of 5,300 low-level employees and the mere $2.4 million "fudge" as small in comparison to all the good Stumpf has done at the helm. But the directive of falsifying 2 million accounts to meet sales targets comes from the top. It filtered down from Stumpf as the leader and culture-bearer of the firm as a way for low-paid workers to keep their jobs. I worked in the lower and upper echelons of Wall Street and international banking for 15 years. Nothing — and I mean nothing — happened at the bottom that wasn't given a license from the top. The Big PictureEven if Stumpf resigns with a mighty cushy fallback, it would likely be with the understanding that criminal prosecution or associated punishment would be off the table. President Obama's Department of Justice has failed to indict a single Wall Street CEO, instead copping to nearly $150 billion in fines and settlements for crimes involving nearly every department of the major US banks that got bailed out, while those they screwed over seethed on the sidelines or lost their homes. Our Justice Department is so pathetic, so flippant about the reality of mega financial criminal behavior and suitable punishment that this CEO of the nation's second-largest bank can stand before the Senate on national television and the vastness of the internet and say he's sorry. He can use words to the effect of taking responsibility for the actual fraud that people under his supervision were directed to commit, and nothing happens. He gives back some money, and what — maybe — resigns? That's just the price of doing business — for a long time. He flat-out told the Senate commission, "I accept full responsibility for all unethical sales practices in our retail banking business, and I am fully committed to doing everything possible to fix this issue, strengthen our culture, and take the necessary actions to restore our customers' trust." What's unethical and unlawful is stealing money from other people. Saying you take full responsibility requires you to step down. It means a criminal confession, if a crime has been committed. But unethical? That's what he's going with. Not, say, criminal. The bank stole money from people. We're supposed to be okay with the fact that — this time — the collective heist was only a few million dollars. What about that car thief who stole a '98 Chevy from a nearby lot and is doing time? Why is that less okay? Even if he does resign, Stumpf's exit stash is secured. Even if he were found to have played a role in committing or directing the fraud to which he admitted responsibility before the Senate, he's coming out way ahead. Let's say Stumpf was fired. First, he wouldn't be, because he conveniently happens to be chairman of the board that would have to vote to fire him. But in that fantasy, he would still pocket around $102.7 million on his way out the door toward his gilded retirement. If he retired before the board of directors that he chairs told him to (or decided it was better for him financially to do so), he'd get to keep about another $25.2 million worth of unvested stock and options. On Thursday, he offered a better-crafted dodge before the House Financial Services Committee. Its chairman, Jeb Hensarling (R-TX), asked the first question. Just this year (2015-16), Hensarling's campaign took in $10,000 from Wells Fargo. As a concession between congressional investigation sessions, Wells Fargo decided to end its product sales goals for retail bank employees by Oct. 1, after previously saying it would make that change Jan. 1. That's not getting serious. That's camouflage. The Obama administration, which was supposed to be about change, has been anything but for the cronyism and banking mobsters. These individuals not only have broken the law, but they have left the majority of Americans in the fray of an unprecedented financial crisis. In our justice system, 1 in 5 people is incarcerated for drug offenses, whereas zero big bank CEOs have even been indicted. The majority of youth incarcerated are locked up for non-violent crimes, while their Wall Street counterparts commit multibillion-dollar fraud and walk the streets. The Word from Our CandidatesDonald Trump wants more deregulation and to bring back Glass-Steagall to break up such big banks, simultaneously, which doesn't even make any sense. He only mentioned Glass-Steagall once — around the Republican Convention — because someone probably told him it'd be a good way to siphon off a few votes from frustrated Bernie supporters. As for Hillary Clinton, all the bank CEOs are her friends. You don't indict your friends. Instead, you talk platitudes about how Wall Street should not be allowed to hurt Main Street and have some awesome plan to "fix" it. You change nothing. She won't bring back Glass-Steagall because her "people" supposedly have a better plan than reducing the size and power of big banks and their Teflon CEOs. Who won the first presidential debate? Well, I can tell you who lost: the American people. Neither candidate was asked what they would do to end the vicious cycle of fraudulent activity among the nation's largest banks. The candidates could not be more similar in their silence, negligence and complicity about demanding real jail time for crimes committed from atop these mega-banks over and over again. To say nothing is to be guilty in permitting Wall Street mobsters to fire thousands of employees, pocket millions of dollars and keep the economy at risk of further upheaval. Clinton and Trump could demand justice — or at least a modicum of similar treatment for bank CEOs as petty car thieves. Bernie Sanders did. But they didn't. Wells Fargo has donated to both of their campaigns. Whoever takes up residence at 1600 Pennsylvania Ave. will invite those people to extravagant dinners while someone in a sh***y jail in the worst corner of the capital eats the equivalent of rotting bread and tepid water. That's not justice. It's reprehensible. Regards, Nomi Prins Ed. Note: The most entertaining and informative 15-minute read of your day. That describes the free daily email edition of The Daily Reckoning. It breaks down the complex worlds of finance, politics and culture to bring you cutting-edge analysis of the day's most important events. In a way you're sure to find entertaining… even risqué at times. Click here now to sign up for FREE. The post Nomi Prins: Jail Wells Fargo CEO John Stumpf! appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SIGNS OF THE END PART 216 - LATEST EVENTS SEPTEMBER 2016 Posted: 30 Sep 2016 01:30 PM PDT end times, end times signs, end times news, end times events, bible prophecy, prophecy in the news, tornado, earthquake, strange weather, strange events, apocalyptic signs, apocalyptic events, strange weather phenomenon The Financial Armageddon Economic Collapse Blog tracks trends... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China seeking to succeed where Japan failed in yuan's global push Posted: 30 Sep 2016 01:17 PM PDT By Justina Lee and Enda Curran As China's yuan takes the first steps toward becoming a global reserve currency, Japan offers a lesson on how hard it is to rival the dollar's supremacy. The Japanese yen's share of global reserves reached a record 8.5 percent in 1991 as the nation's post-War industrial boom made its economy the world's second-largest. But its economic decline soon resulted in its clout shrinking as the euro gained ground and the greenback re-asserted its dominance. While the yen is still ranked third for trading and fourth for payments, it now accounts for just 4 percent of world reserves, compared with the dollar's 64 percent and the yuan's 1 percent. The yen's failure to dent the U.S. currency's primacy illustrates the precarious mix of policy, political will, and prosperity needed for the yuan to come even close to dislodging the dollar. Like China, Japan struggled with the degree of openness needed to promote global use of its currency. By the time its markets became more accessible to foreigners, the bursting of its asset bubbles and consequent "lost decade" -- coinciding with China's dizzying rise -- relegated the yen to its also-ran status as a reserve currency. "The main lesson is that it is impossible to have a major reserve currency like the dollar or euro unless you are willing to sustain a high degree of financial market openness over a very long period of time," said Arthur Kroeber, the Beijing-based founding partner and managing director at Gavekal Dragonomics, a research firm. ... ... For the remainder of the report: http://www.bloomberg.com/news/articles/2016-09-29/china-seeking-to-succe... ADVERTISEMENT NewCastle Gold's New CEO, Gerald Panneton, Hits the Ground Running By Tommy Humphreys Mining entrepreneur Gerald Panneton took a few years off after building one of Canada's largest gold miners, Detour Gold. He raced performance cars in his down time, and conducted due diligence on various mining assets to potentially back. This summer, the geologist set his sights on NewCastle Gold (TSXV:NCA), owner of a past-producing gold mine in California with similarities to Detour Gold in its early days. ... ... For the remainder of the report: https://ceo.ca/@tommy/new-newcastle-gold-ceo-gerald-panneton-hits-the-gr... Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| LIVE Stream: Donald Trump Rally in Novi, MI 9/30/16 (RSB CAMERAS) Posted: 30 Sep 2016 01:11 PM PDT Friday, September 30, 2016: Live streaming coverage of the Donald J. Trump for President rally in Novi, MI at Suburban Collection Showplace. Live coverage begins at 5:00 PM ET.LIVE Stream: Donald Trump Rally in Novi, MI 9/30/16 The Financial Armageddon Economic Collapse Blog tracks... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| I Don’t See How Germany Can Contain the Deutsche Bank Collapse Posted: 30 Sep 2016 12:43 PM PDT Let’s talk about Deutsche Bank (DB). Deutsche Bank is the 11th largest bank in the world. It has assets of $1.8 trillion and over ~$60 trillion in derivatives on its books. From a balance sheet perspective, DB’s balance sheet is 50% the size of Germany’s GDP. By way of comparison, imagine if JP Morgan was a $9 TRILLION bank. That’s effectively DB’s status in Germany. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Eyes At Ground Zero David Icke & Luke Rudkowski Posted: 30 Sep 2016 12:41 PM PDT The Eyes At Ground Zero David Icke & Luke Rudkowski The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Donald Trump Post Debate Meltdown, Betfair Betting Market Points to Collapse in Odds of Winning Posted: 30 Sep 2016 12:25 PM PDT According to the betting markets It appears Donald Trump's campaign is in full meltdown mode in the wake of Trumps loss to Hillary in the first debate following which instead of Trump's campaign trying to learn lessons from the defeat, instead has increasingly witnessed delusional Trump claiming victory and doubling down on by basically magnifying that which lost him the debate in the eyes of the voters as illustrated by calling into Fox and Friends that literally had the presenters grimacing in response to some of the statements that Trump was making such as being in the lead in fictitious opinion polls and then trying to defend the fat Miss Universe saga. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Monarch averts collapse after securing last-minute licence Posted: 30 Sep 2016 12:22 PM PDT This posting includes an audio/video/photo media file: Download Now | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Is This Crisis Like Lehman Brothers on Steroids? Posted: 30 Sep 2016 09:00 AM PDT This post Is This Crisis Like Lehman Brothers on Steroids? appeared first on Daily Reckoning. Deutsche Bank is blood in the water… and the sharks smell it. Yesterday, Bloomberg reported that major hedge funds were reducing their exposure to the German banking behemoth. The smart money is headed for the exits. That caused the bank's U.S.-listed shares to hit a new all-time low of $11.27 yesterday. The stock closed down nearly 7% for the day. And that's just the most recent bad news for Deutsche… Earlier this week, Chancellor Angela Merkel said that Germany wasn't going to bail it out. That's on top of $14 billion fine recently imposed by the U.S. Justice Department that the bank can't afford to pay. Its current market capitalization is just $16.8 billion. This torrent of negativity has the talking heads warning that Deutsche Bank is careening toward bankruptcy, bringing back memories of Lehman Bros. in 2008. But it's more than that… Leveraged to the HiltWhat investors are finally realizing is that Deutsche Bank is insolvent, something I told my Trend Following subscribers back in July. Deutsche has astounding leverage of 40 times. Leverage is the proportion of debts that a bank has compared with its equity/capital. That means Deutsche has 40 times more debt than equity/ capital. Remember, Lehman Bros. was only 31 times leveraged when it imploded in 2008. The huge concern for investors right now is whether the bank can make enough profit to start overcoming its liabilities. But it's trapped in a low-growth economic environment. And it's being choked to death by the European Central Bank's negative interest rate policy (NIRP). Because of NIRP, EU banks like Deutsche Bank effectively have to pay the central bank to hold cash on their balance sheets. At the same time, they can't charge high rates on the loans they make. As a result, they're getting squeezed on net interest margins, which decimates profits. Plus, Deutsche has more than $72 trillion of risky derivatives exposure. Derivatives are the complex financial instruments that cratered the global economy in 2008. Deutsche Bank's derivatives exposure is four times the size of the entire EU economy. And it acts as a counterparty to virtually every major bank in the world, across almost all asset classes. That means its interconnectedness with the rest of the financial system is a colossal problem. If Deutsche fails, it will bring many big international banks straight down the toilet with it. The Mother of All BailoutsThe bottom line is Germany and the EU aren't going to let Deutsche Bank go under no matter how much fear the media is sowing. It’s far too systematically critical. Its collapse would be like Lehman Bros. on steroids. The Eurocrats will soon float anti-bailout posturing like Merkel did earlier this week. That will give them political cover post-bailout when they tell their constituents they had no other choice. The situation was too dire in the end. And despite Merkel's protests, the rescue plan is already taking shape… German news weekly Die Zeit on Wednesday reported that German and EU officials were working on an emergency plan for Deutsche "if the worst comes to the worst." Change "if" to "when" in that quote for a more accurate assessment. Look, no one knows what shape the rescue will take. It may be hampered by the new EU rules passed in January that require shareholder bail-ins before any taxpayer money is used for bailouts. But make no mistake, the European Central Bank and/or the EU will step forward with a new Ponzi scheme to rescue Deutsche Bank. They can't afford not to. It's far too large and far too dangerous. That will prevent a major collapse in the short term and keep the stock market artificially levitated. And that's mission accomplished as far as the Eurocrats see it. Please send your comments to me at coveluncensored@agorafinancial.com. Let me know what you think of today's issue. Regards, Michael Covel Ed. Note: Sign up for your FREE subscription to The Daily Reckoning, and you'll receive regular insights for specific profit opportunities. By taking advantage now, you're ensuring that you'll be financially secure for the future. Best to start right away – it's FREE. The post Is This Crisis Like Lehman Brothers on Steroids? appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Secret Alpine gold vaults are the new Swiss bank accounts Posted: 30 Sep 2016 08:04 AM PDT By Hugo Miller and Stephanie Baker Deep in the Swiss Alps, next to an old airstrip suitable for landing Gulfstream and Falcon jets, is a vast bunker that holds what may be one of the world's largest stashes of gold. The entrance, protected by a guard in a bulletproof vest, is a small metal door set into a granite mountain face at the end of a narrow country lane. Behind two farther doors sits a 3.5-ton metal portal that opens only after a code is entered and an iris scan and a facial-recognition screen are performed. A maze of tunnels once used by Swiss armed forces lies within. The owner of this gold vault wants to remain anonymous for fear of compromising security, and he worries that even disclosing the name of his company might lead thieves his way. He's quick to dismiss questions about how carefully he vets clients but says many who come to him looking for a safe haven for their assets don't pass his sniff test. "For every client we take, we turn one or two away," he says. "We don't want problems." ... ... For the remainder of the report: http://www.bloomberg.com/news/articles/2016-09-30/secret-swiss-gold-vaul... ADVERTISEMENT Gold Standard Continues to Expand North Dark Star High-Grade Deposit Company Announcement VANCOUVER, British Columbia, Canada -- Gold Standard Ventures Corp. (TSXV: GSV; NYSE MKT:GSV) today announced assay results from two holes, DS16-21 and DS16-04, at the recently discovered North Dark Star oxide gold deposit on its fully-owned and controlled Railroad-Pinion Project in Nevada's Carlin Trend. Results from DS16-21 have increased the width of the deposit and, more importantly, have confirmed that higher-grade oxide mineralization projects up-dip to more shallow depths to the east of DS16-08. The primary objective of this year's drill program at North Dark Star was to expand the high-grade zone discovered in core hole DS15-13 (15.4 meters of 1.85 gold grams per tonne and 97 meters of 1.61 gold grams per tonne) at the end of last year's drill program. ... ...For the remainder of the announcement: https://goldstandardv.com/news/2016/expansion-gold-standards-north-dark-... Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ted Butler: The biggest scandal Posted: 30 Sep 2016 07:36 AM PDT 10:37a ET Friday, September 30, 2016 Dear Friend of GATA and Gold: Silver market rigging whistleblower Ted Butler writes today that the financial scandals highlighted by mainstream financial news organizations are small compared to the manipulation of commodity prices through the futures markets, manipulation that exacts a far higher cost from humanity. Butler's commentary is headlined "The Biggest Scandal" and it's posted at GoldSeek's companion site, SilverSeek, here: http://www.silverseek.com/commentary/biggest-scandal-15982 CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT K92 Mining Shows What 'Fast Track' Really Means Company Announcement "Fast-tracking" is an overused phrase in the mining sector. But K92 Mining Inc. (TSX.V: KNT) has demonstrated exactly what that concept means. Less than four months after going public on May 25, the company has completed additional financings totaling $18.5 million. It also refurbished the mill and mine facilities with enhanced processing capacity and has two drills turning onsite. With all this accomplished, production looks to be just days away. "The technical team on site has done an excellent job with the production restart, and we are on schedule and on budget," says Director and Chief Operating Officer John Lewins. "With that focus on track, and with the enhanced financial flexibility resulting from our recent financings, we are now looking to target a resource expansion that we believe exists." K92 has under-promised and over-delivered. ... ... For the remainder of the announcement: http://www.bnn.ca/k92-shows-what-fast-track-really-means-1.568196 Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 30 Sep 2016 06:08 AM PDT After rocketing higher mid-year, silver has spent most of the third quarter drifting sideways to lower. This has naturally weighed on sentiment, with investors and speculators alike growing more bearish during recent months. Yet silver remains way undervalued relative to its primary driver gold, so silver’s young bull market is far from over. This metal’s upside from here is still massive as it mean reverts higher with gold. Silver has always been exceptionally volatile, which is partially a function of this market’s relatively-small size. The world’s leading authority on global silver supply and demand is the venerable Silver Institute. It reported total worldwide silver demand of 1170.5m ounces in 2015. At last year’s average silver price of $15.68, that works out to an annual market value of $18.3b. That’s practically a rounding error! | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why Krugman, Roubini, Rogoff And Buffett Dislike Gold Posted: 30 Sep 2016 05:44 AM PDT By Jan Skoyles Edited by Mark O’Byrne : A couple of weeks ago an article appeared on Bitcoin Magazine entitled ‘Some economists really hate bitcoin’. I read it with a sigh of nostalgia. As someone who has been writing about gold for a few years, I am used to reading similar criticisms as those bitcoin receives from mainstream economists, about gold. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ANONYMOUS - OBAMA and PUTIN sends signals for the NEW WORLD ORDER Posted: 30 Sep 2016 04:36 AM PDT Anonymous presents to you the signals produced by Barack Obama and Putin for the new world order. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deutsche Bank Hangs By A Thread On Eve Of Jubilee Posted: 30 Sep 2016 04:18 AM PDT Nearly a year ago to the day, on September 28th, we wrote “Will Deutsche Bank Be This Cycle’s Lehman Brothers?” In it we asked, “In 2008, the financial crisis was set-off by the collapse of Lehman Brothers. Could this year’s crisis be caused by a collapse of Deutsche Bank?” | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GOLD MARKET FLASH NOTE: Ending With a Bang, Not a Whimper Posted: 29 Sep 2016 08:43 AM PDT Rudi Fronk and Jim Anthony, co-founders of Seabridge Gold, discuss how extreme monetary policy does not stimulate growth. As we have predicted for some time, central bankers are doubling down on the madness that has failed to achieve economic lift-off. It is no surprise to us that easy money has not stimulated growth. There was never any reason why it should. It reminds us of trying to force hay into the wrong end of an elephant. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

I did not intend to write today but 3 events warrant a heads up.

I did not intend to write today but 3 events warrant a heads up.

No comments:

Post a Comment