saveyourassetsfirst3 |

- Banksters Silver Narrative Exposed

- How Much Will Silver’s Value Increase Compared To Gold During The Next Financial Crash? Check Out These Charts

- Economist Warns: “Physical Precious Metals Markets May Freeze Up- In A Buying Frenzy, $5,000 Gold Is A Conservative Estimate”

- Central Banks Are Losing Control

- India’s Golden Monsoon

- This Is “Why Case Against Gold Is Wrong” – James Rickards

- Eric Sprott Calls the Bottom on Gold and Silver, “Let’s See How Far We Can Rip Here…”

- Here’s What the Doomers Forget to Mention About What Happens After Society Collapses

- Heaps Of Lies

- Hoarding Cash: Prelude to the CRASH & BURN

- Breaking News And Best Of The Web

- Where does the term ‘Dollar’ originate?

- Gold Price Supports from Former Highs are between 1263 and 1304

- AEP: Dollar hegemony endures as share of global transactions keeps rising

- Putting Gold Miners into Proper Perspective

- Gold against Foreign Currencies Update

| Banksters Silver Narrative Exposed Posted: 02 Sep 2016 01:00 PM PDT There is a problem with the accepted narrative that industry uses 70% of the global physical silver. NOTHING could be further from the truth… By Rory Hall, The Daily Coin: Can we trust what the mainstream media to report the truth or should we trust our own lying eyes? I will never claim to be […] The post Banksters Silver Narrative Exposed appeared first on Silver Doctors. |

| Posted: 02 Sep 2016 12:00 PM PDT Many investors believe the value of silver will surge much higher in percentage terms compared to gold during the next financial and economic crash. I happen to belong to that savvy group of silver investors, and for good reason. If we look at the charts below, the data proves that silver bullion is certainly the […] The post How Much Will Silver's Value Increase Compared To Gold During The Next Financial Crash? Check Out These Charts appeared first on Silver Doctors. |

| Posted: 02 Sep 2016 11:00 AM PDT Wait until the physical market freezes up. I saw it once (1980)…I saw what happened with gold and silver when it was a panic buy… Submitted by Mac Slavo, SHTFPlan: Economist David Morgan of The Morgan Report is one of the world's best known silver investors. In the following interview with Future Money Trends Morgan […] The post Economist Warns: "Physical Precious Metals Markets May Freeze Up- In A Buying Frenzy, $5,000 Gold Is A Conservative Estimate" appeared first on Silver Doctors. |

| Central Banks Are Losing Control Posted: 02 Sep 2016 10:00 AM PDT It may not be obvious to the casual observer just yet, but the Central Banks are beginning to Lose Control… Buy 100 oz Silver Bars at SD Bullion As Low As 39 Cents/oz Over Spot! The post Central Banks Are Losing Control appeared first on Silver Doctors. |

| Posted: 02 Sep 2016 10:00 AM PDT The all too crucial monsoon season in India is on pace for a record year. The crops that need the rain will now be overflowing in the coming months. Translation – higher yielding crops for Indian farmers means higher physical gold demand in the market… By Rory Hall, The Daily Coin: India's love of gold is […] The post India's Golden Monsoon appeared first on Silver Doctors. |

| This Is “Why Case Against Gold Is Wrong” – James Rickards Posted: 02 Sep 2016 09:00 AM PDT Jim Rickards debunks the most commonly held arguments against gold in best selling UK financial publication Money Week: From Mark Obyrne: James Rickards, geopolitical and monetary expert and best selling author of the 'The New Case for Gold' considered today 'the case against gold' in best selling UK financial publication Money Week. Rickards debunks the most […] The post This Is "Why Case Against Gold Is Wrong" – James Rickards appeared first on Silver Doctors. |

| Eric Sprott Calls the Bottom on Gold and Silver, “Let’s See How Far We Can Rip Here…” Posted: 02 Sep 2016 08:07 AM PDT With gold and silver surging higher on Friday’s weak jobs report, Eric Sprott believes the 2 month correction in precious metals is OVER: Buy 10 oz Silver Bars Online As Low As 65 Cents/oz Over Spot! The post Eric Sprott Calls the Bottom on Gold and Silver, “Let’s See How Far We Can Rip Here…” appeared first on Silver Doctors. |

| Here’s What the Doomers Forget to Mention About What Happens After Society Collapses Posted: 02 Sep 2016 08:00 AM PDT A short list of some of the unexpected disasters that will be waiting for us if society collapses… By Joshua Krause: Post-apocalyptic movies are popular for a reason. We live in a world that is brimming with long lines, bills, traffic jams, bureaucracy, and stressful jobs. So even though we intuitively understand that living […] The post Here's What the Doomers Forget to Mention About What Happens After Society Collapses appeared first on Silver Doctors. |

| Posted: 02 Sep 2016 07:30 AM PDT Since truth hardly matters anymore, we all get numb to the day-to-day barrage of falsities and outright lies that come at us every day. But something clicked today and caused me to simply stop and take it all in… Submitted by Craig Hemke, TFMetals: And even “take it all in” is an exaggeration on my […] The post Heaps Of Lies appeared first on Silver Doctors. |

| Hoarding Cash: Prelude to the CRASH & BURN Posted: 02 Sep 2016 07:00 AM PDT Everything is going as our model has projected. The peak in trusting banks and government is in place. From here on out, all we have is the collapse in public confidence and the 2016 elections bring that home. All we are waiting for now is simply the Crash & Burn… From Martin Armstrong, […] The post Hoarding Cash: Prelude to the CRASH & BURN appeared first on Silver Doctors. |

| Breaking News And Best Of The Web Posted: 01 Sep 2016 05:37 PM PDT US jobs, factory orders disappoints, lowering odds of September rate hike and sending stocks, oil, gold higher. Japan preparing major new stimulus, Europe considering it. Central bankers losing credibility while buying equities. Major shipping company collapses. Trump visits Mexico, confusing everyone. Clinton emails remain major problem. Best Of The Web We pulled the ripcord […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| Where does the term ‘Dollar’ originate? Posted: 01 Sep 2016 03:00 PM PDT Perth Mint Blog |

| Gold Price Supports from Former Highs are between 1263 and 1304 Posted: 01 Sep 2016 02:40 PM PDT |

| AEP: Dollar hegemony endures as share of global transactions keeps rising Posted: 01 Sep 2016 11:11 AM PDT This posting includes an audio/video/photo media file: Download Now |

| Putting Gold Miners into Proper Perspective Posted: 15 Aug 2016 01:00 AM PDT |

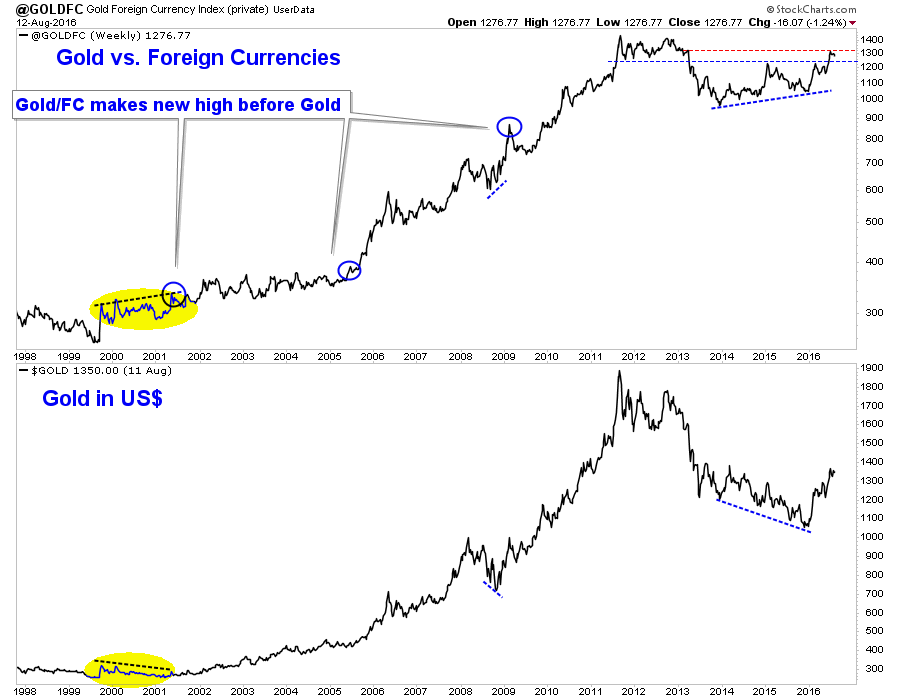

| Gold against Foreign Currencies Update Posted: 12 Aug 2016 06:40 PM PDT It is the dog days of summer. The metals are trading below their recent highs while the miners continue to be on the cusp of their next leg higher. In any event we remain bullish as we expect the next big move to be higher not lower. One reason, among many is Gold remains strong against foreign currencies and that often is a leading indicator for the sector at large. This is something we track often and we wanted to provide an update during the slowest period of the year. In the chart below we plot Gold against foreign currencies and Gold in normal, US$ terms. To be clear Gold against foreign currencies (Gold/FC) is Gold against the currency basket that comprises the US$ index. Since the new millennium Gold/FC has been an excellent leading indicator for the sector. Note that Gold/FC has made new highs ahead of Gold and made positive divergences before the three most important lows of the past 16 years (2016, 2008, 2001). In fact, the action from 2014-2015 shows strong similarities to 1999-2000. Moreover, note that at its peak a few weeks ago, Gold/FC was within 8% of its all time high. That is the equivalent of nearly $1750/oz in US$ terms.  Gold, Gold vs. Foreign Currencies

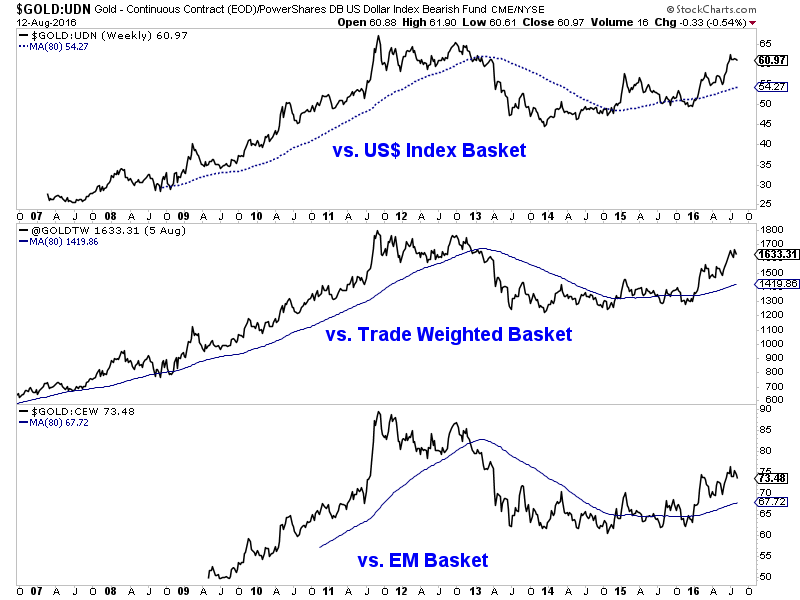

In the next chart we look at different iterations of Gold against foreign currencies. The top plot is the same version shown above while the middle plot shows Gold against the US$ trade weighted basket. The bottom plot shows Gold against emerging market currencies. In every case Gold remains firmly in bull market territory and stronger than Gold in US$'s.  Gold vs. Foreign Currencies

Tracking Gold's performance against foreign currencies is essential as we can glean quite a bit more information about what is really going on in the market. Many newsletters purporting to be analysts fear monger over the stability of the US$ as a reason for people to buy Gold. However, note that the US$ index is essentially flat compared to 10 and 20 years ago while Gold denominated in any and every currency is much higher. In other words, if Gold is going up only because of a falling US$, that is a US$ bear market, not a Gold bull market. A Gold bull market is Gold rising against the majority of currencies. In the same vein, a Gold bear market is Gold falling against the majority of currencies. The charts show that actually ended well before the final low at the end of 2015. On the mining side, most Gold and Silver comes from outside of the USA and many (but not all) companies are exposed to foreign or local currencies and not the US Dollar. Many companies in Canada and Australia bottomed a full year ahead of the sector because the Gold price in those currencies was very strong (even though Gold in US$ had yet to bottom). Summing it up, Gold's strength in foreign currencies confirms its global bull market status and provides a hint that more gains for Gold in US$ terms are likely ahead. We view any weakness in the weeks ahead as a buying opportunity. For professional guidance in riding the uptrend in Gold, consider learning more about our premium service including our favorite junior miners which we expect to outperform in the second half of 2016.

Jordan Roy-Byrne, CMT, MFTA

|

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment