Gold World News Flash |

- Why is Gold NOT Above $2,000? — The Media Answer 5 hours 10 Minutes Ago

- Phony US Employment Numbers Combined With Toxic Fed Strategies Boost Gold and Silver

- Gold Price Closed at $1322.10 Up $9.90 or 0.8% Silver Price Closed at 19.28 Up $0.42 or 2.2%

- How Silicon Valley Follows The Money

- China's Monetary Ascension Is Paved With Gold

- Deutsche Bank Tries To Explain Why It Did Not Deliver Physical Gold, Fails

- An Old Friend Might Die This Weekend

- A Timetable for the Dollar’s Demise

- Gold Daily and Silver Weekly Charts - Out of Season

- Silver Miners’ Q2’16 Stocks Fundamentals

- URGENT: "Brazil Becomes A War Zone" Riots Over Impeachment Of Rousseff

- Zero Hedge: Deutsche Bank tries to explain why it failed to deliver gold as promised

- Hillary Threatens War With Russia

- The Fed Feedback Loop

- Is Janet Yellen in Bed With Hillary?

- Ronan Manly: With the IMF, 'transparency' about gold sales means 'secrecy'

- Physical Gold Delivery Failure By German Banks

- Gold Price and Political Business Cycle

- GATA board member Ed Steer interviewed about gold market manipulation

- Deutsche Bank Cannot Be Saved - Will Make Lehman Brothers Look Minor

- Gold Price Closed at $1312.20 up $5.30 or 0.41%

- Hillary Clinton Is EVIL!!! -(THE REMIX)-

- Breaking News And Best Of The Web

- AEP: Dollar hegemony endures as share of global transactions keeps rising

| Why is Gold NOT Above $2,000? — The Media Answer 5 hours 10 Minutes Ago Posted: 03 Sep 2016 12:32 AM PDT by Jeff Nielson, Bullion Bulls:

I debated whether or not to file this under Minor Gold Tid-Bits, since (once again) this is a topic which I also intend to flesh-out into a full commentary. But I also wanted to toss it out here on the Forum, so that it could be a discussion topic as well. As I will be noting in my commentary, the mainstream media is rarely foolish enough to frame their propaganda in this manner: why is the price of gold (or the price of silver) NOT closer to a realistic price level?

It’s foolish, because it is much easier to pick apart the lies when framed in the negative, as we will see: …They attributed gold's relative weakness to a stronger U.S. economy, in the form of a strong dollar and higher yields, as well as a lack of physical demand, among other factors. The “they” in this case is Macquarie Bank, but it could be coming from any corrupt Big Bank or charlatan economist, since these are the arguments that we alwayssee from the propaganda machine. Let’s pick apart the Big Three — one at a time. 1) “A stronger U.S. economy.” Right. It’s so “strong” that after “recovering” for nearly 8 years (lol), the Federal Reserve is still afraid to pull the trigger, and move the benchmark interest rate from an ultra-loose 0.25% to an ultra-loose 0.50%. Readers who live in the real world already know that there was never any U.S. recovery, and thus never any “strength” in the U.S. economy. 2) “A strong dollar.” This is especially hilarious, given that there has never been aWEAKER major currency in human history than the 2016 U.S. dollar. This is the Bernanke Helicopter Drop. It is a chart of dilution, the most-radical monetary dilution ever seen in a major currency. In the past, I have used the analogy of lemonade, since the concept of dilution applies in a virtually identical manner. Imagine that the chart above was not a chart showing how fast B.S. Bernankediluted the value of the U.S. dollar with the ultra-extreme printing of funny-money. Imagine instead that this chart shows the rate at which water is being added to a pitcher of lemonade — an exponentially increasing rate of lemonade dilution. By the time that one is finished adding all this water, do we end up with stronglemonade?

Of course not. Do we end up with weak lemonade? No, still not accurate. Add water to lemonade at a rate so that you end up with (literally) 5 times as much lemonade, and by the time you’re finished, all you have is WATER. [Remember: in the Fed’s 100-year history, the U.S. dollar had already lost 98% of its value before the Bernanke Helicopter drop. It was already virtually nothing but water.] The drinker can no longer even taste any lemonade because of the extreme dilution. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Phony US Employment Numbers Combined With Toxic Fed Strategies Boost Gold and Silver Posted: 02 Sep 2016 07:20 PM PDT from The Daily Bell:

What a mess. The latest jobs report shows lowered growth. That doesn't matter of course. The government will revise the numbers upward. And the Federal Reserve will do its part, ultimately, by continuing to print money at a rapid clip, even if it does manage to raise rates a quarter point. Surely that's won't happen before the presidential elections, will it? And ultimately, none of it matters. Fed monetary debasement cannot create a profitable economy. And lying about the economy doesn't make it any healthier. What can you do at this critical juncture? Prepare yourself as best you can for significant upcoming economic challenges. And maybe a war or two besides. Certainly you don't want to trust government numbers. And don't be fooled by Fed pronouncements. The Fed has been trying to goose the economy for eight years without much success. The numbers are always phony, whether they come from the government or the Fed. Price inflation, for instance, supposedly pushed upwards toward the magic 2% mark. But real price inflation is a good deal higher than that. When it comes to almost any kind of number fedgov figures can be disputed. This makes Federal Reserve decisions themselves suspect. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1322.10 Up $9.90 or 0.8% Silver Price Closed at 19.28 Up $0.42 or 2.2% Posted: 02 Sep 2016 05:17 PM PDT

Franklin Sanders Daily commentary is now only available via email. FREE!: Get Franklin Sanders Daily Gold Price Reports and Market Commentaries: If the form above does not display in your iPhone or android app, please use this link to visit the website signup form: http://goldprice.org/franklin-sanders | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| How Silicon Valley Follows The Money Posted: 02 Sep 2016 05:10 PM PDT Authored by Pepe Escobar via Strategic-Culture.org, There’s way more in common between Wall Street and Silicon Valley than meets the untrained eye Wall Street and Silicon Valley are two of the key strategic hubs of hyperpower global domination. The others are the industrial-military-surveillance-security complex – of which Hollywood and corporate media are the soft power extensions – and the petrodollar racket/tributary system. Silicon Valley has been relentlessly constructed and idolized as a benign myth; technology breaking the ultimate frontiers and reaching Utopia At Last. Not really. A joyride of a book - Chaos Monkeys: Inside the Silicon Valley Money Machine, by Antonio Garcia Martinez – argues it’s all about, what else, money. As in cold, hard cash, stock options and, just like in Wall Street, bonuses. Martinez tells it like an American Dream insider. He’s a son of Cuban exiles, born in Southern California, with an almost PhD in Physics at Stanford, and a detour across Goldman Sachs that taught him how the casino system works. Then, back in California, he built a start-up with two friends whose embryonic product was a code-grounded method to target and boost electronic advertising. Secret revealed; electronic ads happen to be the real Holy Grail of the much lauded IT Revolution. Academic Michael Brenner defined Chaos Monkeys as Divine Comedy as anthropology. Not quite. We’re not in the presence of Virgil guiding Dante here, more like a Benzedrine-boosted neo-Kerouac let loose on the (techno) road. Right on page 25 Martinez captures Silicon Valley’s business logic, something that I learned myself three decades ago when I was crisscrossing the Valley – with a later stint on MIT – doing a special report on the Brave New Digital World ahead. At the time, I heard from the late great Marvin Minsky that the future would be a cross between artificial intelligence (AI) and genetic engineering. We are almost there. Martinez notes that in the future, it’s all about «computers talking to one another, with humans involved only in the writing of the logic itself». Wall Street, of course, saw it before anyone else. Then came transportation (Uber), the hotel business (Airbnb), food delivery (Instacart), a massive array of services. We are smack on the road towards humans merely filling the gaps in a sanitized, non-stop computer workflow. The world all that fabulous concentration of engineers, code writers, product managers, venture capitalists, key word filters, metadata and algorithms Silicon Valley is shaping is for all practical purposes a Consumer Holy Grail. We are all «free», but essentially free as extremely, precisely defined targets with a ton of features and preferences supplied to the digital workflow every time we click for a post, a comment, a search. Then, in a few minutes of digital life, we will be hit by a pop-up offer to buy something, anything. Martinez also concisely explains the basics of search engine marketing. Marketers curate keyword lists «like a bonsai tree»; «If the revenue generated by postclick sales outpaces cost, up go the bid and the budget». This in a nutshell is how «Google makes more than some European countries produce in a year». Monetize those bits, babyWhat is a chaos monkey, really? That’s a software tool created and open-sourced by Netflix. One uses it to test a website’s resiliency against that proverbial nightmare; a server failure. That leads Martinez to conceptualize tech entrepreneurs as society’s chaos monkeys wreaking havoc on traditional industries; «One industry after another is simply knocked out via venture-backed entrepreneurial daring and hastily shipped software. Silicon Valley is a zoo where the chaos monkeys are kept, and their numbers only grow in time. With the explosion of venture capital, there is no shortage of bananas to feed them. The question for society is whether it can survive these entrepreneurial chaos monkeys intact, and at what human cost». The Silicon Valley zoo is predictably populated by hordes of talent –Ants? Bees? - all invariably fixated on monetizing their data brokerage skills, for their companies and especially for themselves. An extra cast of characters revolves around the geeks – from venture capitalists to an army of lawyers and the odd «angel investor» doubling as spiritual guide. For the geek hordes, the base salary may not be exceptional, but there is prestige, perks and in a few cases stock options involved. Hotel California this ain’t; you can’t check out any time you like, because then you will lose all those perks and the lifestyle associated with them. You can always leave (or get fired) – and in this case you will always miss what you will never have elsewhere. Very few – essentially founders and CEOs - touch serious «f**k you money» and enter the billion-dollar league. Startup life is usually hell; «backroom deals negotiated via phone calls to leave no legal trace, behind-the-back betrayals of investors or cofounders, seductive duping of credulous employees so they work for essentially nothing». It’s an extremely closed system, as I saw it for myself. In San Francisco, an extension of the Valley, everything is concentrated between First and Eight Streets, and between King and Market, in the SoMa (South of Market) district. That’s where you find, among others, Twitter, Airbnb and Uber, once startups, now enjoying Masters of the Universe status. The ecosystem is also an apotheosis of juvenilia – in thesis the best and the brightest from the US’s elite schools all striving purposely towards an open, transparent, hyper-connected Brave New World, a never-before-tested original human experience. Well, the goals are not that lofty. A telling episode is that when Facebook faced a mortal challenge from Google in the social network front, it was pure war, Rome against Carthage-style. The standard psychological profile across the Valley would reveal an empathy-deprived Narcissus Drowned. Mature adults are extremely hard to find. It’s quite telling that Martinez spends the last stretch of the book deconstructing his experience as a Facebook product manager, developing what would be the ineffable ad targeting mechanism. Silicon Valley after all is about how to monetize technology. Facebook is actually going one step beyond, exploring the monetization of users’ news feeds and expanding a dominant role in the news business itself. A June study by Oxford University determined that 44% of internet users already get their news through Facebook. There are no less than 1.7 billion Facebook users around the world – and counting. Its algorithms will progressively rule content published on news sites. Computers talking to computers – with humans just filling the gaps. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China's Monetary Ascension Is Paved With Gold Posted: 02 Sep 2016 03:55 PM PDT Submitted by Stefan Gleason via MoneyMetals.com, The world monetary order is changing. Slowly but steadily, global trade and currency markets are becoming less dollar-centric. Formerly marginal currencies such as the Chinese yuan now stand to become serious competitors to U.S. dollar dominance. Could gold also begin to emerge as a leading currency in world trade? Over time, it certainly could. But the more immediate implications for gold’s monetary role center on its increasing accumulation by central banks such as China’s. On October 1st, the Chinese yuan is slated to enter the International Monetary Fund’s Special Drawing Right (SDR) basket of top-tier currencies. It will share SDR status with the U.S. dollar, euro, British pound, and Japanese yen. Before the yuan officially becomes an SDR currency, the World Bank intends sell $2.8 billion in SDR bonds in Chinese markets. The rollout of SDR bonds in China began August 31st. According to Reuters, China’s promotion of SDR bonds “is part of a wider push in China to… boost demand for Chinese yuan and diminish reliance on the U.S. dollar in global reserves.” King Dollar won’t be dethroned overnight. But the place of prominence the U.S. dollar – more accurately called the Federal Reserve Note – enjoys as the world's reserve currency will indeed diminish over time. Yuan’s Inclusion in the SDR Currency Basket: Merely a Part of China’s De-Dollarization StrategyChina and Russia have mutual geostrategic interests in helping to promote de-dollarization. Toward that end, the two powers are engaging in bilateral trade deals that bypass the dollar. Annual bilateral trade between China and Russia has surged from $16 billion in 2003 to nearly $100 billion today. When China hosts the G20 summit in September, it will make Russian President Vladimir Putin its premier guest of honor. U.S. officials are none too pleased. They fear Putin aims to expand his global reach by forging stronger ties with China.

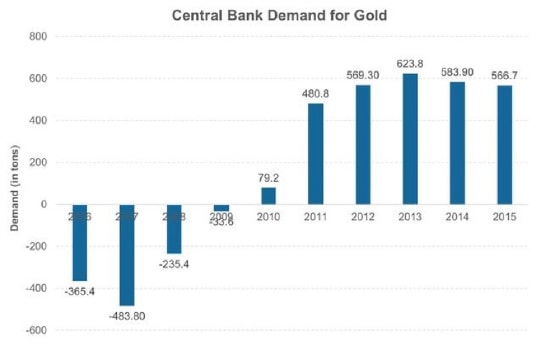

According to the South China Post, “Some Western analysts have viewed the recent, rapid enhancement of such collaboration as the beginning of a partnership set on destabilizing the U.S.-led world order and diminishing Washington’s capacity to influence strategic outcomes.” Some in the Hillary Clinton campaign even fear that Russia will interfere in the upcoming U.S. election to try to block Hillary’s path to the White House. Russian hackers have been implicated in a number of recent “leaks” that damaged the reputations of U.S. banks and the Obama administration. Wikileaks founder Julian Assange has hinted at further releases. Hillary’s allies openly speculate that these Wikileaks hacks are being sourced from Russia. But the Russians and the Chinese aren’t counting on cyber warfare to dethrone King Dollar. In addition to bilateral trade deals and strategic plays for regional economic dominance, the two powers are bulking up on gold. Over the past several years, Russia and China have each been adding massively to their gold holdings. World’s Central Banks Becoming Net Gold BuyersSince 2009, China’s officially reported gold holdings have jumped by 60%. The enlarged gold stockpiles held by the People’s Bank of China helped China win ascension into the IMF’s elite SDR currency basket. It’s part of a larger trend of world central banks becoming net gold buyers. They were net sellers throughout much of the 1990s and early 2000s. That helped keep gold prices suppressed. But since 2010, central banks have been net buyers of gold – to the tune of more than 500 tons per year.

Russia alone added 172 tons of gold in 2014 and 208 tons in 2015. By swapping some of its U.S. Treasury securities for bullion bars, the Russian central bank has become the world’s seventh largest gold holder. Yet gold makes up just 16.2% of Russia’s monetary reserves, which is a lower proportion held by its Eurozone neighbors. Russia likely isn’t done accumulating. As the world’s third largest gold producer, Russia can readily supply itself with more. A similar scenario figures to play out in China, perhaps even more dramatically so. China’s “official” gold hoard of 1,823 tons as of August 2016 gives it the world’s sixth biggest gold reserve. Yet relative to the size of China’s economy and currency supply, its gold stash doesn’t amount to much – just 2.3% of total monetary reserves. Unofficially, China likely has additional gold reserves that it doesn’t report. But even if China’s real gold stash is double or triple what it actually reports, as some analysts suggest, that still leaves the country of 1.3 billion people with far less gold backing than Russia, the United States, Europe, and some of its Asian rivals. China has a lot more gold accumulating to do in the years ahead.

Chinese leaders aim to be regionally dominant. In order to secure that position they are moving to own and control greater shares of the gold market. The recently opened Shanghai Gold Exchange gives China a direct mechanism for controlling the physical gold market in Asia. It’s a way for China to take at least some control away from Western governments and banks that have traditionally dominated the gold trade out of London and New York. When the Chinese yuan becomes an SDR currency this fall, that could be the inflection point for a new multi-polar currency regime that sees the Federal Reserve Note decline in stature as central banks scramble to stock up on the ultimate money: gold. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deutsche Bank Tries To Explain Why It Did Not Deliver Physical Gold, Fails Posted: 02 Sep 2016 03:27 PM PDT The unprecedented escalation involving Deutsche Bank's failure to deliver physical gold on demand continues. As we first reported two days ago, a client of Xetra-Gold, a German Exchange-Traded Commodity fund, tried to get access to the gold he had been promised under the Xetra-Gold prospectus, leading to much confusion about just where the failure to deliver had taken place, at Xetra or at the fund's designated sponsor, and the client's principal bank: Deutsche Bank. Then, overnight, we presented the just as odd response provided by Deutsche Boerse where the ETC is traded, which sounded as if it was trying to pass the buck onto Deutsche Bank. This is what it said:

As we said at the time, the response led to even more questions, and even more public outcry in Germany, which may explain why moments ago none other than the custodian bank, Deutsche Bank, joined the fray, by doing something it has never done before: provide a rationalization for why it failed to deliver gold on demand. Or at least try. Its response:

And so another non-response, because in the same press release Deutsche Bank both admits that it has an obligation to deliver the gold "as a matter of course", and then tacitly confirms that it failed to do so, by first saying that it evaluates the "economic efficiency of physical delivery", something it should have no right to do since the Xetra prospectus explicitly mandates that it should release gold on demand, and then adds that "should an investor's request for the handover of physical gold not have been complied with immediately in individual cases, this will be reviewed and an individual solution will be found with the client." As we already know, this handover of physical gold failed on at least one occasion, and while we are comforted that Deutche Bank is reviewing the situation and a "solution will be found with the client", it certainly does not even remotely explain why the situation should have arisen in the first place. However, what is most notable is how quickly every entity involved in this failure to deliver, from Xetra-Gold, to Deutsche Börse, and ultimately to Deutsche Bank, responded with an attempt to placate public concerns about the availability of physical gold with statements that may have, paradoxically, only raised concerns whether the gold is in fact still there. It remains to be seen if this one individual case spills over, and leads to more gold redemption requests, first at Xetra-Gold as well as at other similar "gold-backed" ETFs. We will promptly report any notable development in this fascinating escalation of a topic that has been near and dear to many gold bugs' hearts for years.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| An Old Friend Might Die This Weekend Posted: 02 Sep 2016 02:35 PM PDT This post An Old Friend Might Die This Weekend appeared first on Daily Reckoning. Huzzah and hooray. It's Labor Day weekend. When Americans will flock to the beach… to the lake… to the mountains. When the kids enjoy their last days of freedom… And when the dollar dies? The world's 20 leading economic powers will powwow this Labor Day weekend in the lovely lakeside city of Hangzhou, China. Few Americans will notice. Fewer will care. But they might wish they had one day… Jim Rickards says that in a few years, "People will look at [this weekend] and see it for what it is: the end of the dollar… That was the turning point for the dollar, and we didn't see it at the time." The IMF officially adds the Chinese yuan to its basket of currencies later this month, Sept. 30. Then it becomes part of the IMF's own currency, the special drawing right (SDR). You may prefer a more sinister term: world money. (See below for more on SDRs.) But Jim says this weekend's G-20 gabfest actually represents China's "coming out party." It's when China says, "We are an equal partner, maybe more than the equal partner of the United States of America and Europe. They will no longer dictate the world's financial system." And he's not alone in that view… The New York Times says that with this weekend's G-20 summit, China is "determined to show the world that it is an equal partner in one of the most exclusive clubs of wealthy nations… that the world's second-largest economy after the United States deserves a bigger role in global governance." Zhu Jiejin, associate professor of international relations at China's Fudan University, translates its real meaning: "Hosting the G-20 offers a significant opportunity for China to become a rule maker rather than a rule taker." Not for nothing does China call itself the "Middle Kingdom." Rule-taking never sat very well with China. Chinese traditionally refer to foreigners as "barbarians." No, the Middle Kingdom makes the rules. Others follow them. And Jim Rickards says the symbolism and the visuals this weekend will be spectacular: "Other world leaders will metaphorically kowtow to the new Chinese emperor and recognize China as the co-head of the global monetary system alongside the U.S." The new monetary machinery is already getting cranking… Just this Wednesday, the World Bank issued landmark bonds denominated in SDRs in the Chinese market. It was only the equivalent of $700 million. But China Daily says the World Bank is planning to issue a much larger wave of SDR bonds in China — up to $2 billion worth. Once they kick the tires a bit, more will certainly follow. And Bloomberg tells us this morning that the Chinese yuan has nearly doubled its share of the global currency trade over the past three years. It was $120 billion in 2013. Now it's $202 billion, making it the most actively traded emerging-market currency. Being the most actively traded emerging-market currency might sound like being the highest hill on the prairie. And the yuan remains a mound to the dollar's Matterhorn for now. But in 10 years? Below, Jim Rickards shows you why the next five weeks will mark one of the most significant transformations in the international monetary system in over 30 years. Read on. Regards, Brian Maher Ed. note: "A charmingly mordant take on the stock news of the day, accentuated by philosophical maunderings…" That's how one leading financial magazine described the FREE daily email edition of The Daily Reckoning. You'll find cutting-edge analysis from the complex worlds of finance, politics and culture. Presented in an entertaining style few can match. Click here now to sign up for FREE. The post An Old Friend Might Die This Weekend appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| A Timetable for the Dollar’s Demise Posted: 02 Sep 2016 02:11 PM PDT This post A Timetable for the Dollar's Demise appeared first on Daily Reckoning. The next five weeks will mark one of the most significant transformations in the international monetary system in over 30 years. Since the dollar is still the lynchpin of this system, the dollar itself will be affected. Whatever affects the dollar affects you, your portfolio and your personal financial security. It is vital to understand the changes underway in order to protect your net worth, and even prosper in the coming transition. Such radical transformations of the international monetary system have happened many times before, including the dual "accords" of the 1980s. These were the Plaza Accord in 1985, and the Louvre Accord in 1987 — named respectively after the Plaza Hotel in New York, and the Louvre Museum in Paris where the key meetings took place. At the Plaza Accord, the top financial officials from the U.S., U.K., West Germany, France and Japan agreed on Sept. 22, 1985, to devalue the dollar. The dollar plunged 30% in the next two years. The damage was so bad that a second meeting was called at the Louvre on Feb. 22, 1987. That meeting was attended by the top financial officials from the U.S., U.K., West Germany, France, Canada and Japan. Participants at that meeting agreed to halt the dollar's devaluation. The dollar was relatively stable in the years following. It's a mistake to believe the dollar's value is set by market forces. That may be true in the short run, but in the longer run, the dollar is worth whatever governments want it to be worth. The more powerful the government, the more they can call the shots. There's no doubt that the U.S. was the most powerful country in the world in the 1980–2000 period shown in the chart above. The Soviet Union was in terminal decline by 1987, and collapsed in 1991. China was still emerging and had a major setback with the Tiananmen Square uprising in 1989. Europe did not implement the euro until 1999. The U.S. was king of the hill. When the U.S. wanted a weaker dollar in 1985, we just dictated that result to the world in the Plaza Accord. When the U.S. wanted to lock in the cheap dollar in 1987, we dictated that result also in the Louvre Accord. Market forces had nothing to do with it. Whatever the U.S. wanted, the U.S. got. Investors were just along for the ride. Before the Plaza and Louvre Accords, there was the Smithsonian Agreement of December 1971. That was an agreement among the "Group of 10" (actually 11: U.S., U.K., Japan, Canada, France, West Germany, Belgium, Netherlands, Italy, Sweden and Switzerland) to devalue the dollar between 7% and 17% (depending on the currency pair in question). This happened shortly after President Nixon suspended the conversion of dollars for gold on Aug. 15, 1971. Nixon thought this would be a temporary suspension and that the gold standard could be resumed once the devaluation was agreed. The devaluation happened but the gold standard never returned. By January 1980, the dollar had devalued 95% when measured in the weight of gold. Even before the Smithsonian Agreement, there was Harold Wilson's 14% sterling devaluation (1967), the Bretton Woods Conference (1944), FDR's gold confiscation and 60% dollar devaluation (1933), U.K. abandoning the gold standard (1931), and the Genoa Conference and the Gold Exchange Standard (1922). The point is that monetary earthquakes happen from time to time. We just noted nine big ones in the past hundred years, but there were many others, including the sterling crisis of 1992 when George Soros broke the Bank of England, and the Tequila Crisis of 1994 when the Mexican peso devalued 50% in a matter of months. These monetary earthquakes move in both directions. Sometimes the dollar is a huge winner (1980–85), and sometimes it loses a large part of its value (1971–80 and 1985–87). The key for investors is to be alert to behind-the-scenes plans of the global monetary elite and anticipate the direction of the next big move. What will happen in the next five weeks is just as significant as any of the monetary earthquakes mentioned above. There are three major events happening in rapid sequence. Here's the list:

You might be tempted to dismiss this calendar as "business as usual." G20 leaders' meetings happen every year. The SDR basket has been changed many times in the past. The IMF has global meetings twice a year (spring and fall). But it's not business as usual. This time is different. The hidden agenda involves the formal transition from a dollar standard to an SDR standard in world monetary affairs. It won't happen overnight, but the elite decisions and seal of approval will take place at these meetings. The SDR is a source of potentially unlimited global liquidity. That's why SDRs were invented in 1969 (when the world was seeking alternatives to the dollar), and that's why they will be used in the imminent future. SDRs were issued in several tranches during the monetary turmoil between 1971 and 1981 before they were put back on the shelf. In 2009 (also in a time of financial crisis). A new issue of SDRs was distributed to IMF members to provide liquidity after the panic of 2008. The 2009 issuance was a case of the IMF "testing the plumbing" of the system to make sure it worked properly. With no issuance of SDRs for 28 years, from 1981–2009, the IMF wanted to rehearse the governance, computational and legal processes for issuing SDRs. The purpose was partly to alleviate liquidity concerns at the time, but also partly to make sure the system works in case a large new issuance was needed on short notice. The 2009 experience showed the system worked fine. Since 2009, the IMF has proceeded in slow steps to create a platform for massive new issuances of SDRs and the creation of a deep liquid pool of SDR-denominated assets. On Jan. 7, 2011, the IMF issued a master plan for replacing the dollar with SDRs. This included the creation of an SDR bond market, SDR dealers, and ancillary facilities such as repos, derivatives, settlement and clearance channels, and the entire apparatus of a liquid bond market. In November 2015, the Executive Committee of the IMF formally voted to admit the Chinese yuan into the basket of currencies into which an SDR is convertible. In July 2016, the IMF issued a paper calling for the creation of a private SDR bond market. These bonds are called "M-SDRs" (for market SDRs) in contrast to "O-SDRs" (for official SDRs). In August 2016, the World Bank announced that it would issue SDR-denominated bonds to private purchasers. Industrial and Commercial Bank of China (ICBC), the largest bank in China, will be the lead underwriter on the deal. Other private SDR bond issues are expected soon. On Sept. 4, 2016, the G20 leaders will meet in Hangzhou, China, under the leadership of G20 President Xi Jinping, who is also the general secretary of the Communist Party of China. In this meeting, other world leaders will metaphorically kowtow to the new Chinese emperor and recognize China as the co-head of the global monetary system alongside the U.S. On Sept. 30, 2016, at the close of business, the inclusion of the Chinese yuan in the SDR basket goes live. On Oct. 7, 2016, the IMF will hold its annual meeting in Washington, D.C., to consider additional steps to expand the role of SDRs and make China an integral part of the new world money order. Over the next several years, we will see the issuance of SDRs to transnational organizations, such as the U.N. and World Bank, to be spent on climate change infrastructure and other elite pet projects outside the supervision of any democratically elected bodies. (I call this the New Blueprint for Worldwide Inflation.) Thereafter, the international monetary elite will await the next global liquidity crisis. When that crisis arrives, there will be massive issuances of SDRs to return liquidity to the world and cause global inflation. The result will be the end of the dollar as the leading global reserve currency. Based on past practice, we can expect that the dollar will be devalued by 50–80% in the coming years. A devaluation of this magnitude will wipe out the value of your life's savings. You'll still have just as many dollars, but they won't be worth nearly as much. The time to start preparing is now. Regards, Jim Rickards Ed. Note: Sign up for your FREE subscription to The Daily Reckoning, and you'll receive regular insights for specific profit opportunities. By taking advantage now, you're ensuring that you'll be financially secure for the future. Best to start right away – it's FREE. The post A Timetable for the Dollar's Demise appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Out of Season Posted: 02 Sep 2016 01:07 PM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Miners’ Q2’16 Stocks Fundamentals Posted: 02 Sep 2016 11:36 AM PDT The silver miners’ stocks have enjoyed an epic year, skyrocketing higher with silver’s new bull market. At best since mid-January alone, some of these elite stocks had actually septupled! Naturally such extreme gains beg the question of whether they can possibly be fundamentally justified. The recently-released second-quarter financial and operational results of the top silver miners offer much insight on this. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| URGENT: "Brazil Becomes A War Zone" Riots Over Impeachment Of Rousseff Posted: 02 Sep 2016 11:04 AM PDT Sao Paulo Brazil has become a "War Zone" as people are in the streets riots and tear gas, and homemade bombs over the impeachment of President Rousseff The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Zero Hedge: Deutsche Bank tries to explain why it failed to deliver gold as promised Posted: 02 Sep 2016 10:15 AM PDT 1:15p ET Friday, September 2, 2016 Dear Friend of GATA and Gold: Zero Hedge today summarizes developments in what seems to be the default of a bank-backed commodity fund in Germany to deliver gold to investors as was promised. Zero Hedge's report is headlined "Deutsche Bank Tries to Explain Why It Did Not Deliver Physical Gold, Fails" and it's posted here: http://www.zerohedge.com/news/2016-09-02/deutsche-bank-explains-why-it-f... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver Coins and Rounds with Employee Pricing and Free Shipping Grab your Silver Starter Kit at cost from Money Metals Exchange, the company named "Precious Metals Dealer of the Year" by industry ratings group Bullion Directory. Simply go to MoneyMetals.com and type "GATA" in the radio box at the top of the page. This special silver offer contains 4 ounces of silver coins and rounds in the most popular 1-ounce, half-ounce, and 10th-ounce forms. Claim yours now, because GATA readers get employee pricing and free shipping. So go to -- -- and type "GATA" in the radio box at the top of the page. Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hillary Threatens War With Russia Posted: 02 Sep 2016 09:56 AM PDT Hillary Clinton just threatened to attack Russia and the media didn't even report on it. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

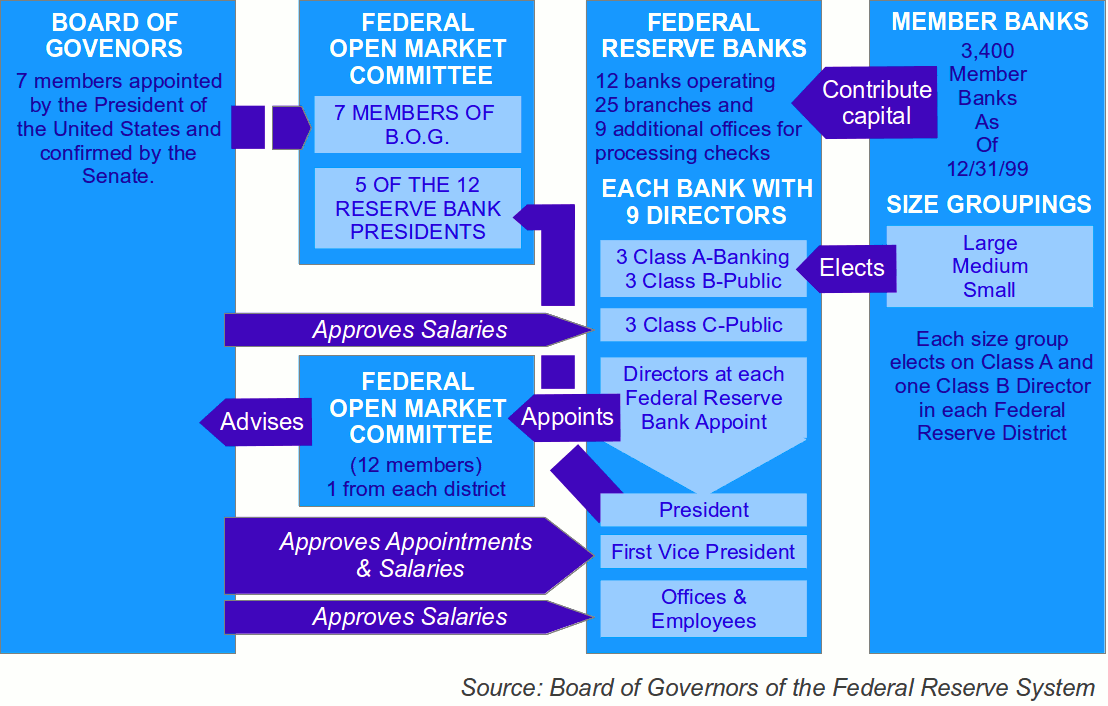

| Posted: 02 Sep 2016 09:48 AM PDT This post The Fed Feedback Loop appeared first on Daily Reckoning. In a word, the Fed has failed in its mission to restore robust growth to the U.S. economy. That failure has laid the foundation for the next global monetary crisis. This failure was inevitable. The reason is that the problems in the economy are structural. They have to do with taxation, regulation, demographics and other factors beyond the Fed's mandate. The Fed's solutions are monetary. A policymaker cannot solve structural problems with monetary tools. Since structural solutions are not on the horizon due to political gridlock, the U.S. economy will remain stuck in a low-growth, Japanese style pattern indefinitely. Without structural change, this pattern will persist for decades as it has in Japan already. This weak growth scenario will be punctuated with occasional technical recessions, and exhibit persistent deflationary tendencies. That's the best case, and not the most likely one. The likely outcome is a financial panic and global liquidity crisis caused by the Fed's failed monetary policies. To understand why, it is necessary to understand the futile feedback loop in which the Fed, and all major central banks now find themselves. The Federal Open Market Committee (FOMC) has gone down an unprecedented path with its quantitative easing programs, "QE." The FOMC consists of members from the Feds Washington board and the regional reserve banks. It was established to appropriately determine monetary policy.

The first program, QE1, started in late 2008. It was understood at the time as an appropriate response to the liquidity crisis stemming from the Lehman Brothers and AIG failures that fall. Providing cash during a liquidity crisis is exactly what central banks are supposed to do; it's why they were created. We'll give the Fed a pass on that. QE1 ended in June 2010. It may have saved the economy from a more severe recession in 2009, but it did nothing to stimulate long-term growth. No sooner had QE1 ended than U.S. growth stalled out. By late 2010, the Fed was ready to launch QE2. QE2 was different. It started in November 2010, at a time when there was no liquidity crisis. QE2 was an experiment dreamed up by Ben Bernanke. The Fed pledged to purchase $600 billion of intermediate-term Treasury securities before June 2011. The idea was to lower long-term interest rates so that investors would be forced into other assets such as stocks and real estate. The resulting asset price increases would create a wealth effect that would result in higher spending and higher collateral values for borrowing. This new lending and spending would stimulate the economy toward self-sustained trend growth. In fact, the wealth effect was always a mirage. QE did not create sustained trend growth. What it did create were asset bubbles that are still around and still waiting to pop. QE2 ended as planned in June 2011. Growth stalled again after the money printing ended. Already the Fed was finding itself trapped by the monster it had created. As long as the Fed was easing with QE, the economy muddled through. As soon as the easing ended, the economy stalled out. These experiments in 2010 and 2011 were the beginning of the "risk on," "risk off" see-saw mentality that trapped the FED and the markets. In September 2012, the Fed launched QE3. Unlike QE2, there were no time or quantity limits in QE3. The Fed would print as much money as they wanted for as long as they wanted in order to create the needed stimulus. The problem was that the Fed was now completely trapped with no way out. When they eased, the economy improved but did not boom. When they tightened, the economy stalled, even if it did not collapse. Policy flip-flopped. The Fed was stuck in a feedback loop. Boom Bust – Discussion with James Rickards on QE and the Fed. The term "feedback loop" is a popular expression for what physicists and complexity theorists also call recursive functions. In a recursive function, the output of one equation becomes the input for the next iteration of the same equation. The complex interaction of human behavior (setting policy rates) and the feedback loop (with a fixed point attractor) is a continual flip-flop in policy. First the Fed talks tough, then markets sink, then the Fed eases up, then markets rally, then the Fed talks tough again, and so on. This is the Fed circle game. Here's how this has played out since QE3 began in November 2012 under the direction of both Ben Bernanke and later current leader of the Fed, Janet Yellen. The initial state of the system as of April 2013 was one of ease because of QE3 itself: That's ten flip-flops in just over three years. This reveals that the Fed has no idea what it is doing and is trapped in the feedback loop. Regards, Ed. Note: Sign up for your FREE subscription to The Daily Reckoning, and you'll receive regular insights for specific profit opportunities. By taking advantage now, you're ensuring that you'll be financially secure for the future. Best to start right away – it's FREE. The post The Fed Feedback Loop appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Is Janet Yellen in Bed With Hillary? Posted: 02 Sep 2016 09:00 AM PDT This post Is Janet Yellen in Bed With Hillary? appeared first on Daily Reckoning. (Editor's note: In observance of Labor Day, we will not be publishing Covel Uncensored on Monday, September 5. We hope you enjoy the holiday!) Trump is staging a fierce comeback… Hillary Clinton's post-convention lead in the polls has nearly disappeared. Prominent pollster Rasmussen Reports now has Trump leading Clinton 40% to 39%. Trump also has a 45% to 42% lead in the Los Angeles Times poll. And Hillary's edge in the polls in which she's still leading has narrowed sharply. There'll be more back-and-forth momentum swings in the horse race to come, but these new polls show one thing: The odds of a Trump presidency shot higher this week. And that means the odds of a Fed interest-rate hike before Election Day got lower… The Fix Is InLook, Janet Yellen isn't going to do anything to jeopardize a Clinton presidency. They're both card-carrying Deep Staters. They're both liberals who served under Obama. They both dress the same: Mao chic. And most of all, Yellen wants to keep her job when her term expires in February 2018. She's a lock to stay on in a Clinton administration. But it won't happen in Trump's. He's already told the Wall Street Journal that he won't keep Yellen as Fed Chair. I don't see how Yellen can raise rates between now and Election Day… if Trump can win. If she did, it would tank the stock market, nail the economy and give Trump the White House. When the Fed raised rates in December 2015, the stock market plunged, with the Dow dropping more than 1,300 points in the month following. A plunging market would wipe out trillions in paper wealth and slam the economy into recession. But Yellen isn't going to let any normal course of events happen before Election Day, especially since a Trump presidency would be every central banker's worst freaking nightmare… Highly SuspiciousTrump is deeply suspicious of the Fed… as many of us are. He's rightfully and repeatedly said that Fed policies have created a stock market bubble that will burst. He's called the Fed's QE nonsense a bad economic idea that produced “phony numbers." He told GQ that he prefers the gold standard to a Fed-manipulated fiat currency: “Bringing back the gold standard would be very hard to do — but boy, would it be wonderful. We’d have a standard on which to base our money." And he also supports an extensive audit of the Fed to bring transparency and accountability to the secretive "central bank" that's brought devastating boom-and-bust cycles for decades. Of course, nobody knows if Trump will follow through on these promises if elected. Once in Washington, he could very well become just another lying politician. But right now, the last thing Yellen and her New World Order cronies want to do is take a chance on President Trump. They want to keep their unchecked power to create endless amounts of money out of thin air… their power to build and pop one financial bubble after another… all to redistribute from the little people to the elites… and destroy free market capitalism in the name of State-manipulated Ponzi finance. Look, we know that won't change under Clinton. And maybe it won't change under Trump. But you can bet central bankers don't trust that business as usual will continue with Trump. So come the next Fed meeting in September, expect a lot of sophisticated talk from Yellen about this or that economic data, assorted indecipherable mumblings, and an army of TV talking heads lapping it all up as if an economic god has spoken. Just don't hold your breath waiting for a rate hike… no matter what the economy's doing. Please send me your comments to coveluncensored@agorafinancial.com. Let me know what you think of today’s issue. Michael Covel The post Is Janet Yellen in Bed With Hillary? appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ronan Manly: With the IMF, 'transparency' about gold sales means 'secrecy' Posted: 02 Sep 2016 08:35 AM PDT 11:36a ET Friday, September 2, 2016 Dear Friend of GATA and Gold: Gold researcher Ronan Manly reports today that while the International Monetary Fund repeatedly has claimed to be "transparent" about its gold sales, the IMF actually has obscured and suppressed its records of the transactions and even admits that some records are being withheld indefinitely, against the agency's ordinary practice, because of their "sensitivity." It is plain from Manly's research today that the IMF has been working closely with the Bank for International Settlements, other central banks, and bullion banks to move gold around the world and apply it to the markets as necessary for price control. Even the IMF's duplicity about "transparency" cannot conceal the price control scheme, since it still permeates some of its records that remain in the public archive. Manly also acknowledges that the success of this scheme is largely a matter of the complicity of mainstream financial news organizations -- their refusal ever to put to any central banker any critical question about official involvement in the gold market. Manly's analysis is headlined "IMF Gold Sales -- Where 'Transparency' Means 'Secrecy'" and it's posted at Bullion Star here: https://www.bullionstar.com/blogs/ronan-manly/imf-gold-sales-transparenc... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers: To invest or learn more, please visit: Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Physical Gold Delivery Failure By German Banks Posted: 02 Sep 2016 07:33 AM PDT The physical gold delivery failure to clients of Deutsche Bank who own Xetra-Gold, the gold exchange traded commodity, was confirmed yesterday by Deutsche Bourse who said that the inability to deliver gold was not limited to Deutsche Bank and that other German banks were having “problems” delivering gold. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price and Political Business Cycle Posted: 02 Sep 2016 07:19 AM PDT Many economists ask why economic activity fluctuates. Among many theories of business cycles, there is the politicalbusiness cycle, formulated in the 1970s. According to it, incumbents try to juice up the economy during election years to improve their chances of re-election. They use fiscal or monetary policy to stimulate the economy just before an election to increase their odds of remaining in office. However, although expansionary monetary and fiscal policies are politically attractive in the short run (due to increased spending), they might lead to some unpleasant consequences in the long term (like high inflation or excessive budget deficits). Therefore, after the election is over and the next election is far away, politicians reverse the course and restrict the fiscal and monetary stimuli. Thus, major elections produce economic booms and busts, as politicians try to create an artificial boom before everyelection and take advantage of voters’ short-sightedness. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GATA board member Ed Steer interviewed about gold market manipulation Posted: 02 Sep 2016 05:41 AM PDT 8:41a ET Friday, September 2, 2016 Dear Friend of GATA and Gold: Financial letter writer Dennis Miller yesterday interviewed GATA board member Ed Steer, editor of Ed Steer's Gold and Silver Daily letter, about gold and silver market manipulation. The interview is headlined "Are the Central Banks Manipulating the Price of Gold?" and it's posted at Miller's Internet site, Miller on the Money, here: http://milleronthemoney.com/central-banks-manipulating-gold/ CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deutsche Bank Cannot Be Saved - Will Make Lehman Brothers Look Minor Posted: 02 Sep 2016 03:46 AM PDT Josh Sigurdson talks with author and economic analyst John Sneisen about the continued collapse of Deutsche Bank as central planning inflates the problem and bailouts bankrupt the people. John goes over all of the stats and the massive web that this problem creates as it effects banks like... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1312.20 up $5.30 or 0.41% Posted: 02 Sep 2016 03:08 AM PDT

Franklin Sanders Daily commentary is now only available via email. FREE!: Get Franklin Sanders Daily Gold Price Reports and Market Commentaries: If the form above does not display in your iPhone or android app, please use this link to visit the website signup form: http://goldprice.org/franklin-sander | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hillary Clinton Is EVIL!!! -(THE REMIX)- Posted: 02 Sep 2016 02:07 AM PDT Voting for hillary because she's a woman is as stupid as drinking anti-freeze because it looks like gatorade The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 01 Sep 2016 05:37 PM PDT US jobs, factory orders disappoints, lowering odds of September rate hike and sending stocks, oil, gold higher. Japan preparing major new stimulus, Europe considering it. Central bankers losing credibility while buying equities. Major shipping company collapses. Trump visits Mexico, confusing everyone. Clinton emails remain major problem. Best Of The Web We pulled the ripcord […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AEP: Dollar hegemony endures as share of global transactions keeps rising Posted: 01 Sep 2016 11:11 AM PDT This posting includes an audio/video/photo media file: Download Now |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

US created 151,000 jobs in August vs. 180,000 jobs expected … August traditionally has been a difficult month for jobs numbers, and 2016 proved no exception, likely putting the Federal Reserve on hold for a rate hike anytime soon. – CNBC

US created 151,000 jobs in August vs. 180,000 jobs expected … August traditionally has been a difficult month for jobs numbers, and 2016 proved no exception, likely putting the Federal Reserve on hold for a rate hike anytime soon. – CNBC

No comments:

Post a Comment