Gold World News Flash |

- The Secret Global Court: Why Corporate Criminals & Corrupt Politicians Desperately Want TPP

- Small Business Defaults Rise, Borrowing Drops: "What Scares Us Is The Rise In Delinquencies"

- When Will Helicopter Money Take Off? Consequences For Markets?

- Germany’s Largest Bank Refuses “Deliveries of Physical Gold” After Customer Request

- The War on Cash Continues

- Deutsche Boerse Responds To Deutsche Bank’s Failure To Deliver Physical Gold

- Obamacare About to Implode Like the Subprime Mortgage Scheme of 2007

- ARE YOU READY FOR THE END GAME? […It’s Coming] — Andy Hoffman

- Can The “RIG” Survive an Economic War?

- Ultra-Violent Venezuelan Gangs Ignore Maduro Crackdown: "Better To Fight Police, Than Each Other"

- Albert Edwards Sees Shades Of 2007 In The Biggest Risk Facing The US Consumer

- Gold Demand vs Prices: Who Buys, Not How Much

- Deutsche Bank Denies Clients Their Gold

- The Coming Gold Super-Spike

- End Times Headline News - September 1st, 2016

- Why the Big Silver Short?

- China’s Monetary Ascension Is Paved with Gold

- Why the Big Silver Short?

- Gold Daily and Silver Weekly Charts - A Nation of Servants

- Dollar hegemony endures as share of global transactions keeps rising

- In The News Today

- Asia loosens London’s grip on FX trading

- 2 Can’t-Miss Charts for “Scary September” Trading

- Ted Butler: How prices get set

- How Governments Can Kill Cash

- The Big Banks Hiding Money For Elites

- BrExit Economic Collapse Evaporates into Boom as PMI Soars

- Gold, Silver, Mining Shares Bottom Evident

- Rye Patch Jump-Starts Florida Canyon Mine Production with New Heap Leach Facility

- US Dollar Hegemony Questioned as World Bank Sells SDR Bond Using Chinese Yuan

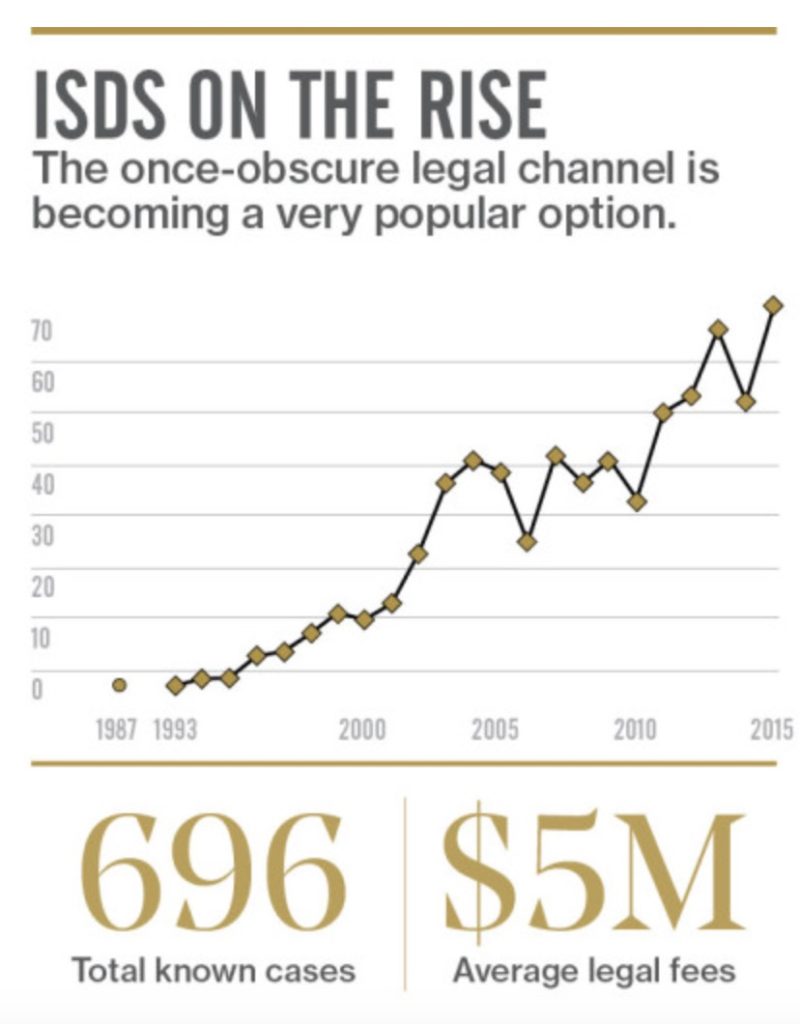

| The Secret Global Court: Why Corporate Criminals & Corrupt Politicians Desperately Want TPP Posted: 02 Sep 2016 12:30 AM PDT Submitted by Mike Krieger via Liberty Blitzkrieg blog, Obama needs to ensure he gets well compensated after leaving office for a job well done protecting, defending and further enriching the global oligarch class. This is precisely why he’s so adamant about passing the TPP during the upcoming lame duck session of Congress, when he knows “representatives” who no longer face reelection can be coerced or bribed into voting for this monumental public betrayal. The Trans-Pacific Partnership (TPP) ins’t really a free trade deal, it’s a way for global oligarchs to consolidate, grow and protect their enormous wealth. The investor-state dispute settlement system (ISDS) is perhaps the most nefarious and objectionable aspect of the deal, with this shadowy court system being used to accomplish the following for the super rich and powerful:

The whole thing is absolutely disgusting and epitomizes all that is wrong and unethical about the world today. As such, stopping the TPP from passage is probably the most important near-term challenge ahead for all of us who want to make the world a better place (or at least prevent it from getting much, much worse). Before getting into today’s article, I want to commend Chris Hamby and BuzzFeed for publishing this extremely timely and important work. We can only hope that it will inform millions of Americans sufficiently to create the needed pushback to prevent the TPP from ever becoming law. So without further ado, let’s get on with it. What follows are excerpts from Part 1 of a four part investigative series. My snippets don’t do this work the justice it deserves; as such, I strongly encourage you to read the entire piece and share it with everyone you know. Now, from the blockbuster piece, The Court That Rules the World:

I wonder why they failed. Perhaps the following will provide some insight: New Report from Princeton and Northwestern Proves It: The U.S. is an Oligarchy

I mean, it takes some nerve to make a statement like that.

Bull market in oligarch thievery continues unabated:

Can you believe this? Outside of technology, pretty much all the big money being made these days is from purely parasitic, extractive activities.

This is why Obama will try to pass it when the fewest members of government can be held accountable.

Now here’s an example of ISDS abuse from Egypt.

Here’s an example from El Salvador.

|

| Small Business Defaults Rise, Borrowing Drops: "What Scares Us Is The Rise In Delinquencies" Posted: 01 Sep 2016 11:43 PM PDT Yesterday, we pointed out something disturbing when we looked at the latest NACM Credit Manager Index report: over the past year it had declined steadily, hitting the lowest print since 2009, or as the National Asscoiation of Credit Managers' economist Chris Kuehl said "Overall, it was fun while it lasted - the trends had been up and now they aren't" adding that "the best that can be said about the decline is that it was bad and hasn't gotten much worse.... The sales collapse is consistent with what has been appearing in the Purchasing Managers' Index and other statistics, so it is unlikely to be an anomaly, not good timing as far as the retail community is concerned."

Today, we got a validating, and equally concerning, perspective on how small businesses are doing, courtesy of the latest Thomson Reuters/PayNet Small Business Lending Index, which fell to 121.5 in July, the lowest level since January and down from an upwardly revised 139.2 in June. But while the headline decline was mildly troubling, the details within the report were worse: according to PayNet, borrowing by U.S. small businesses sank in July, with more firms late on repaying existing loans, trends which according to Reuters "point to softer economic growth ahead." More troubling is that companies are increasingly struggling to pay back existing debts. Loans more than 30 days past due rose in July to 1.63%, the fourth straight monthly increase and the highest delinquency rate since December 2012, separate data from PayNet showed. "The thing that scares us is the rise in delinquencies," said Bill Phelan, PayNet's president. "Every one of these months where investment is down and delinquencies are up is one step more toward contraction." Here is why the PayNet data matters: the index typically corresponds to U.S. gross domestic product growth one or two quarters ahead. With the U.S. economy growing a paltry 1.1% in Q2, many economists have staked their reputation on the belief that growth will rebound in the third quarter. According to this data, not only will there be no rebound, but growth will deteriorate further. Small business borrowing is a key barometer of growth because small companies tend to do much of the hiring that drives economic gains. Just as importantly, the figures come as the Federal Reserve mulls the timing of its next rate hike, which may take place in just three weeks. With demand for debt sliding, and delinquencies steadily on the rise, the one thing that will happen if the Fed raises rates again, is accelerate these already adverse trends, leading to even less borrowing, and even more delinquencies and defaults. PayNet collects real-time loan information such as originations and delinquencies from more than 325 leading U.S. lenders. |

| When Will Helicopter Money Take Off? Consequences For Markets? Posted: 01 Sep 2016 11:30 PM PDT by Robert F. Kennedy Jr., GoldAndLiberty:

The quarterly Advisory Board organized by Incrementum Liechtenstein took place recently, and, as usual, the discussion was focused on challenging the consensus view. Part of the discussion was centered around helicopter money which is one of the anticipated scenarios that central banks around the world will launch shortly, meant as a monetary tool to 'stimulate' the economy. We believe the discussion about helicopter money was particularly interesting, and, in this article, we picked out some key thoughts on that topic. We recommend readers to read the whole document (i.e., transcript of the meeting), in order to get valuable thoughts on the consequences of helicopter money on financial markets and inflation. Besides helicopter money, some trading ideas were discussed, as well as the consequences of the Brexit, gold and mining stocks, inflation expectations and the outlook for the US dollar. Read the full document (pdf). James Rickards discusses different forms of helicopter money as well its economic consequences : I don't think we'll see it in 2016, but I'd say it'll definitely be on the agenda in 2017. It makes sense to start with a definition of what helicopter money actually is, because a lot of people are going to the cameras and to the news without actually having understood what it is. One thing that it's not: It's not dropping money out of helicopters. But what it means: It is money printing, but a different kind of money printing than we had so far. The big question is: How can you print money such that it's certain to be spent? It's a problem if people don't spend because they're fearful, too concerned, they want to save or want to do leverage – and it's the same thing in the corporations. If the economy is in a liquidity trap, you turn to government, because the government is really good in spending money. |

| Germany’s Largest Bank Refuses “Deliveries of Physical Gold” After Customer Request Posted: 01 Sep 2016 10:00 PM PDT ShtfPlan |

| Posted: 01 Sep 2016 09:45 PM PDT by Brad Sebion, Moneyandtrading.com via SGT Report.com:

The Harvard professor and ex chief economist at the International Monetary Fund is now calling for the ban on $20, $50, and $100 bills. He explained cash fuels crime, leads to tax evasion, and terrorism.

This echoes the remarks made by the European Central Bank President, Mario Draghi to get rid of the $500 euro in February. Two weeks later, Larry Summers made a statement implying the United States should ban the $100 dollar bill. These economists and bankers realize that printing money and reducing interest rates is not going to work forever. The only way to keep the system going is to make all currencies go digital. The cover to use digital money will be all the reasons Ken Rogoff listed. The real push for block chain currencies have mostly to do with the leverage in the banking system and unfunded liabilities that governments can't deliver on. The FDIC only has 25 billion dollars to cover trillions of liabilities. In early 2015, Blyth Masters, the former head of commodities at JPMorgan Chase, went to work for Digital Asset Holdings. This company is using Bitcoin's technology for financial transactions. In April of 2016, Larry Summers became a senior advisor to Bitcoin. The big players in the financial community are making their moves. If you want no privacy, continued war, and a higher cost of living hop on the digital currency train. If you don't, educate yourself on the importance of sound money. Let's get back to a semblance of Capitalism instead of the Alice in Wonderland economy we are stuck in. Brad Sebion

|

| Deutsche Boerse Responds To Deutsche Bank’s Failure To Deliver Physical Gold Posted: 01 Sep 2016 09:13 PM PDT “the exchange was unable to name any bank which is in a position to deliver physical gold without problems.” from Zero Hedge:

In the latest stunning development involving a documented failure of a bank to deliver physical gold when demanded, yesterday we reported that according to German website godmode-trader.de, a client of the Xetra-Gold Exchange-Traded Commodity was told the fund’s designated sponsor, Deutsche Bank, would be unable to deliver the requested gold. This was contrary to the explict reps and warrantiesmade explicitly in the Xetra-Gold’s prospectus, which said that investors are entitled to the delivery of the certified amount of physical gold at any time, and proudly added that “since the introduction of Xetra-Gold in 2007, investors have exercised this right 900 times, with a total of 4.5 tons of gold delivered.”

As the German article concluded: anyone who wants to easily convert their Xetra-Gold holdings into physical gold – at least for clients of Deutsche Bank – can do so only by selling their shares, and then buying gold coins or bars directly elsewhere. Which leads the author to the logical question: what is the worth of the Xetra-Gold service, which certifies the right to redeem physical gold, if said delivery is no longer possible? In other words, what was supposedly an ETC which promised physical delivery upon demand, is nothing more than yet another “paper only” play. We asked another, more nuanced question: is the inability to deliver physical gold an issue with Xetra-Gold, or with the company’s “designated sponsor“, Deutsche Bank, and if the latter is suddenly unable to satisfy even the smallest of delivery requests by retail clients, just how pervasive is the global physical gold shortage? |

| Obamacare About to Implode Like the Subprime Mortgage Scheme of 2007 Posted: 01 Sep 2016 09:00 PM PDT by J. D. Heyes, Natural News:

As reported by Zero Hedge, the CEO of a major pharmaceutical firm was recently forced to defend her company’s major drug price increases from attacks by Congress and the campaign of Democratic presidential nominee Hillary Clinton, stating that the reasoning is clear: The U.S. healthcare system is in “crisis.” Big Pharma firm Mylan and its CEO, Heather Bresch, are being touted as “greedy” examples of pharmaceutical corporatism, though it is not the company’s fault it is a de facto monopoly and has limitless pricing ability. This week, however, the maker of the EpiPen announced plans to increase access to its EpiPen Auto-Injector through the expansion of an existing program for patients facing higher out-of-pocket costs (which is happening to more and more Americans with each passing year). Mylan will reduce EpiPen costs via use of a savings card that covers up to $300 for the EpiPen 2-Pak. “We recognize the significant burden on patients from continued, rising insurance premiums and being forced increasingly to pay the full list price for medicines at the pharmacy counter,” Bresch said in a statement, as Zero Hedge reported. “Patients deserve increased price transparency and affordable care, particularly as the system shifts significant costs to them.” ‘Only in healthcare’Bresch, whose compensation has risen some 671 percent since 2007 to $18.9 million annually, then appeared on CNBC to note that corporate profitability is an issue, and her company’s price hikes are not just limited to EpiPen. The price for Ursodiol, used to dissolve gallstones, rose 542 percent; Metoclopramide, used short-term for heartburn, 444 percent; and Dicyclomine, a treatment for irritable bowel syndrome, 400 percent. But she further noted that price was just one part of the equation Mylan must address. “All involved must also take steps to meaningfully address the U.S. healthcare crisis,” she said, adding that her company is more than willing to do its part to “drive change,” along with healthcare professionals, patients and lawmakers. |

| ARE YOU READY FOR THE END GAME? […It’s Coming] — Andy Hoffman Posted: 01 Sep 2016 07:42 PM PDT by SGT, SGT Report.com: Andy Hoffman is back to kick off September by helping us document the collapse. From 6.2 BILLION in PAPER Gold dumped on the futures market in just the past week to BREXIT 2 which Andy predicts is coming in November when Trump beats Hillary, the end game is coming into focus quickly. |

| Can The “RIG” Survive an Economic War? Posted: 01 Sep 2016 06:45 PM PDT by Bill Holter, JS Mineset, SGTreport.com:

Bill Gross formerly of PIMCO, at one point managed the largest pool of money on the planet, he is no fool. I would also believe because of his fame, tenure and reputation, he would not lightly claim that markets are “rigged”. Not only has he claimed this for several months, he now says THE FED “has mastered market manipulation”! Please understand this is a VERY BIG statement on his part as he is (was?) a member of a very exclusive club (and we ain’t in it).

Do you suppose he would risk his reputation and inclusion in “the club” lightly on just a suspicion? Or do you believe he is a man who firmly believes what he says and does so out of a steadfast conscience? Speaking of “rigged”, there are those out there who will agree that ALL markets are rigged …except of course for gold and silver because “they would never do this” or “central banks could care less” about gold. It was just last week where we saw $1.5 billion worth of gold sold in just seconds …today we witnessed another $4.7 billion dumped all at once. Someone Just Dumped Almost $5 Billion Notional Gold Into The Futures Market These two trades combined represent over 6% of global annual production or about 3 weeks worth. As I have said 20 times before, no one has this amount of gold to sell and no trader who wanted to keep his job would ever sell like this, period. You have again witnessed IN YOUR FACE MANIPULATION! The argument that all markets are rigged “except” gold and silver is hilarious. The rigging BEGAN in these markets for the simple reason they are the only credible threats and competition to fiat currency, namely the dollar. In order to keep the façade in place, the rigging has spread from market to market. If gold and silver were not suppressed, could we have zero percent interest rates …or the buying power that fiat currencies currently afford …or stocks at many multiples of book value and 20 times +++ earnings? No, we would already be living in a very different world …and one that will certainly arrive when the rigs finally fail! As for politics, do you truly believe the polls? Isn’t it odd that Donald Trump continues to hold standing room only/lines around the block to get in to rallies …while Hillary draws only a few hundred? Yet the polls do not reflect this dynamic at all? And of course we are being fed horse manure by the press, so stinky that they (the press) themselves are talking about it. Even if you are a far left liberal, doesn’t the “American” in you tell you “something” is wrong regarding the lack of investigation into the Clinton Foundation and the blatantly stupid (and dangerous) actions of conducting government business on unsecure servers? (As a side note, I wonder how the press will react to her hacked e-mails that will surely be dumped?). Before getting off of politics, I have been saying for quite some time, “if we have elections?” and recently said I believed it to be greater than a coin flip chance we do not have them. Lo and behold, this from a mainstream outlet! Crazy stuff huh? Even if you only get your news from facebook, you can sense the country is about to explode, left vs. right, racial strife, class strife, religious strife, even gender strife. Would we have an election if a major “terror” event occurred just before the election? Or I guess a better question would be, would a giant FALSE FLAG be enough to implement martial law …and postpone (cancel) the election? I find it hard to believe the mainstream press would ever ask if “the election could be delayed or eliminated”? Have they EVER asked this question publicly before? Are we being “prepped”??? Oh, and one more election related point. We are told that two states’ polling systems have been “hacked” …and that none other than Homeland Security (doesn’t the word “homeland” remind you of Germany a few years back?) will monitor the polls. Boy do I feel better! As soon as I read this one, my first thought was “it’s over”. They have shoved this down our throats, hook line and sinker! If this one flies, we can’t even blame Congress for “passing it so we can see what’s inside”…! As the title suggests, we are now on the verge of economic WW III. The EU is pressing Apple for back taxes of $14.5 billion. I don’t get it, why now? This has been known for at least 10 years. I can remember John McCain suggesting we lower corporate tax rates or create an amnesty program where U.S. corporations are allowed to bring untaxed revenue back to home at far reduced rates… and that was 8 years ago! Of course, the next question is “who is next”? We already have hints that McDonald’s and Amazon are in the crosshairs. Is this retribution for the U.S. fining BNP Paribas last year? Is this Europe’s plan to re liquefy their system? Can you imagine what this will do to our financial system should $100’s of billions be claimed and actually paid to the EU? WOW, what a wealth transfer. My next questions are, how will the U.S. react to this? Will this create an all out economic war? A hot war eventually? What will happen to the “rigs” in place on the markets? Will Europe attack our rigs and we attack theirs? Can the rigs survive an economic war? Lastly, China reportedly just issued the first “SDR bond” in many many years. In Historic Event, China Sells First World Bank SDR-Denominated Bonds In Decades | Zero Hedge If nothing else, this is another step away from the dollar. China will soon be included in the SDR basket, this move looks to me like they are “bringing forth” the SDR and back into the system. It is almost like China is creating a new market, maybe even underwriting it if you will. In no way shape or form can this move be seen as dollar friendly. In fact, I am sure the U.S. did not invite China into the SDR and neither did they give blessing to the SDR bond issuance. I guess a funny question related to the body of this writing would be, how will the U.S. rig the SDR market? Sadly, the U.S. has painted itself into a very ugly corner. The economic truth doesn’t work so the markets must be painted, bullied, and shackled. As our “rigs” have affected the rest of the world, they are pushing back. In some cases quietly and others quite publicly. The world sees us as “no more truth, no more justice and the American way has become lie, cheat and steal because you can get away with it.” The ugly truth provided from foreigners will expose our financially naked system and leave us as lonely pariahs stuck solo in a corner. Unfortunately, we as citizens will bear the brunt of all the lies piled up over the years as payment for a standard of living that never really was… This was a public article, if you would like to see all of aour work, please subscribe here. Post script: Story broke last night that Deutsche Bank failed to deliver gold, if this is true it is game over. We await clarification as to what really happened and will comment at that point. Standing watch, Bill Holter image credit: silverdoctors.com |

| Ultra-Violent Venezuelan Gangs Ignore Maduro Crackdown: "Better To Fight Police, Than Each Other" Posted: 01 Sep 2016 05:55 PM PDT Amid threats of violence, opponents of Venezuelan President Nicolas Maduro flooded the streets of Caracas today (2 million strong) in a major test of their strength and the government's ability to tolerate growing dissent. However, for a nation that is forced to slaughter stallions for meat, line up for toilet paper, and dying from lack of simple medicines, Reuters reports that there is another destabilizing factor - ultra-violent street gangs are thriving. As Fox News reports, the Thursday march called the "taking of Caracas" aimed to pressure electoral authorities to allow a recall referendum against Maduro this year.

Quite a crowd...Maduro claims *VENEZUELA OPPOSITION MARCH HAD 25K-30K PROTESTERS, MADURO SAYS... looks like a lot more than that!...

Maduro had expelled may foreign journalists hoping that would minimize coverage but 2 million people turned out in Caracas today - we don't think his plan is working. But as AP notes, the government plans a counter protest on Thursday, but Pantoulas said authorities will have a tougher time rallying supporters among the poor amid 700 percent inflation blamed for growing hunger and a collapse in wages.

But as police unleash tear gas to quell the protests...

Maduro faces more problems than just the average 'Juan' Venezuelan, as Reuters reports, Venezuela's socialist economy is suffering triple-digit inflation, severe shortages and a third year of recession, but ultra-violent street gangs have found strength and profit in the chaos.

However, unlike a growing array of other armed groups in Venezuela - which include pro-government gangs and some small rural guerrilla and right-wing paramilitary forces - the street gangs are largely apolitical.

Maduro says crime is part of a conspiracy by the opposition and the United States. His opponents blame his policies and armed pro-government "collectives," which have multiplied in the past 5 years.

At his safe house, one gang leader confirmed that.

But apart from that - socialist utopia!! |

| Albert Edwards Sees Shades Of 2007 In The Biggest Risk Facing The US Consumer Posted: 01 Sep 2016 05:03 PM PDT One month ago, when the first Q2 GDP estimate was released, we reported that if one strips away the consumer part of the economy, the US was already in a recession. Overnight, In his latest letter SocGen's Albert Edwards picks up on this topic, but first dispenses with the usual warning, saying that "the US economy is on crutches, and they are about to be kicked away" adding that "US economic growth is weak yet the labour market is tight. This juxtaposition is keeping the Fed in a quandary on whether to raise interest rates. As it stands it probably will, or will not, depending on which way the wind (data) is blowing that day!" After the requisite "flip-flop Fed watching", Albert then proceeds to agree with what we said recently, namely that "the only thing keeping the US out of recession is the US consumer (see chart below). It is difficult to say consumption is driving the economy forward - rather it is like a woodwormridden crutch creaking under the strain of holding up a deadweight economy. This recovery ? the fourth longest in history - is surely nearing its end." While so far the consumer remains resilient, and in fact in the second quarter, US personal spending unexpectedly soared to near cycle highs just as the rest of the economy dipped in a recession...

... this pace of consumption, of which Obamacare has been a significant recipient, will hardly sustain itself. According to Edwards, his "hypothesis that a US profits recession will lead to a collapse in business investment and take the economy into recession seems to be playing out. If consumption stalls then we really are in trouble, for the next devastating phase of the secular valuation bear market in equities will kick in ? much to the shock of both investors and the Fed." But before we drill down into the consumer part, first a quick look into why the SocGen strategist so confident that the non-consumer part of the economy is about to tap out. For that, he present the following historical parallel:

So going back to the consumer, what does Edwards believes will catalyze the next move in spending lower? Well, besides today's abysmal auto sales numbers

His conclusion:

To be sure, rising wages (something corporations have only granted to the lowest paid workers as shown earlier this week) may delay the day of reckoning, but it opens up a whole new can of worms, because as Fitch warned just today in a report titled "Sharp US Wage Shock Could Cause Global Tightening; Major Slowdown", a domestic US wage cost shock could lead to substantial financial tightening, which would result in a significant slowdown in the world economy. In the report Fitch economists explore the consequences of a much faster-than-expected pick-up in US wage growth and the impact on economic growth, Fed policy and bond yields as well as international macroeconomic spillovers.

As Fitch concludes:

Or, in other words, a recession is coming if wages remain low, but should wages rise too fast, the recession will come even faster. Pick your poison. |

| Gold Demand vs Prices: Who Buys, Not How Much Posted: 01 Sep 2016 05:00 PM PDT Bullion Vault |

| Deutsche Bank Denies Clients Their Gold Posted: 01 Sep 2016 03:28 PM PDT This post Deutsche Bank Denies Clients Their Gold appeared first on Daily Reckoning. The first signs of a global gold shortage? We learn today that one of the world's largest banks has broken its promise to offer its clients physical gold upon demand. Deutsche Bank is the principal bank and redemption agent behind an outfit called Xetra-Gold, a publicly traded exchange-traded commodity. It claims that "every gram of gold purchase electronically is backed by the same amount of physical gold.” It further swears that investors always enjoy "the right for physical delivery of gold." But apparently not… At least one German Xetra-Gold investor recently decided to exercise his "right for physical delivery of gold" — and was told to go jump in a lake. The account executive of Deutsche Bank informed him that they're no longer offering physical delivery for reasons of ahem… "business policy.” What reasons might those be we can only speculate. How about they don't have the goods? This fellow demanding his gold should have read Jim Rickards: [Financial institutions] have created enormous volumes of "gold products" that are not gold. These are paper contracts… There is some gold somewhere in the structure, but you don't own it — you own a share. Even the share is not physical; it's digital. And here's the kicker: If too many customers claimed physical gold at once, the bank can terminate the contract and simply provide the counterparty with cash at the closing price as of the date of termination. The customer would get a check at that closing price, but they're not going to get the actual gold. The sponsors or the exchanges or the banks, whoever is behind it, will exercise termination clauses and you won’t actually get your gold. These investors who want physical gold would have to cash in their shares and buy it elsewhere. And now that a large group like Deutsche Bank is refusing to satisfy its clients' fairly limited demands for physical gold… does it suggest a much larger gold shortage? According to Jim's top contact in the gold industry, "Goldfinger," gold shortages are already a reality. This fellow is head of the world's largest gold refinery in Switzerland. And he can't find the gold to keep up with demand. The cupboards are bare. He recently told Jim, “I’ve got a waiting list of people who want to buy my gold, but I can’t find the gold that I need to melt it down and refine it, whether it comes from miners or existing gold bars that aren’t quite the quality the buyers want to buy.” Maybe Deutsche Bank — and remember it's Xetra-Gold's redemption agent — suspended redemption because it's been deluged with paper gold investors wanting to cash out for the genuine article? We can't say. But it makes sense that private German demand for gold and hard currency would be on the upswing… The Wall Street Journal reported the other day that Germans are stocking up on home safes to hoard cash, rather than leaving it in the banks. That's because they're worried about being socked with negative interest rates. The Japanese have done the same thing. They've also been buying gold by the bushel. Negative interest rates just aren't following the script elites have written. People are hoarding cash and buying gold, not spending it on gewgaws to "stimulate the economy." The Journal reports that "Recent economic data show consumers are saving more in Germany and Japan, and in Denmark, Switzerland and Sweden, three noneurozone countries with negative rates." It adds that "savings are at their highest since 1995, the year the Organization for Economic Cooperation and Development started collecting data on those countries." And the Germans prefer cash, anyway. According to a 2014 Bundesbank survey, some 80% of German retail sales are transacted in cash. That's nearly double the U.S. rate of 46%. And therein lies a great lesson… Many Germans recall the Nazi and, later, East German totalitarian regimes that spied on every aspect of their lives. Cash — and hard money like physical gold and silver — have great appeal to them because it's anonymous. It leaves no footprint. As one German businesswoman said, "I don't want to become completely transparent. I don't want everyone to know whether I buy chocolate, strawberries or mangoes at the store." Despite the IRS, Americans have no experience with that level of government surveillance over their private finances. But if the elites have their way with negative interest rates and the banning of cash, they will soon… Below, Jim Rickards shows you why the gold shortages hinted at above are leading to a gold "super-spike." And how it can make savvy investors fortunes in the months and years ahead. Read on. Regards, Brian Maher Ed. note: "A charmingly mordant take on the stock news of the day, accentuated by philosophical maunderings…" That's how one leading financial magazine described the FREE daily email edition of The Daily Reckoning. You'll find cutting-edge analysis from the complex worlds of finance, politics and culture. Presented in an entertaining style few can match. Click here now to sign up for FREE. The post Deutsche Bank Denies Clients Their Gold appeared first on Daily Reckoning. |

| Posted: 01 Sep 2016 03:14 PM PDT This post The Coming Gold Super-Spike appeared first on Daily Reckoning. I consider gold a form of money. That means I investigate price movements in gold the same way I investigate moves in any other global currency — and find the best way for you to play it. Right now, if you understand physical gold flows, you could stand to make a fortune in the months and years ahead. Last June, I visited Zurich and was able to meet with some of the most knowledgeable experts and insiders in the physical gold industry. In March, I visited Lugano where I met with the top executive of the world's largest gold refinery. As a result of these visits to Switzerland, and other points of contact, I have been able to gather extensive information on the major buyers and sellers of gold bullion in the world and the exact flows of physical gold.  Your correspondent inside a secure vault near Zurich, Switzerland, with an array of 400 ounce gold bars. Each bar is individually stamped with the name of the refinery, a serial number, purity, name of the assayer, and the date it was refined. These bars are worth about $535,000 each at current market prices. This information about gold flows is critical to understanding what will happen next to the price of gold. The reason is that the price of gold is largely determined in "paper gold" markets, such as Comex gold futures and gold ETFs. These paper gold contracts represent 100 times (or more) the amount of physical gold available to settle those contracts. As long as paper gold contracts are rolled over or settled for paper money, then the system works fine. But, as soon as paper gold contract holders demand physical gold in settlement, they will be shocked to discover there's not nearly enough physical gold to go around. At that point, there will be panicked buying of gold. The price of gold will skyrocket by thousands of dollars per ounce. Gold mining stocks will increase in value by ten times or more. Paper gold sellers will move to shut down the futures exchange and terminate paper gold contacts because they cannot possibly honor their promises to deliver gold. The key to seeing this gold-buying panic in advance is to follow the flows of physical gold. Once the price of physical gold starts to move up on basic supply and demand fundamentals, the stage is set for corresponding increases in paper gold prices. As more and more paper gold holders turn from the paper market to obtain physical gold, which is already in short supply in the physical market, we'll see the beginning of a price super-spike. As long as supply and demand for physical gold are in rough equilibrium, there is no catalyst for a sudden spike in gold prices, apart from the usual geopolitical flight to quality demand. But, as soon as demand begins to overwhelm supply, then it's "game on" for significantly higher physical gold prices followed by the toppling of the inverted pyramid of paper gold contracts. What information do we have about the flows of physical gold that will help us to understand the supply/demand situation? That's a mixed bag. Some physical gold players are completely opaque and do not report their purchases or holdings transparently. The Chinese and Saudi Arabians are the least transparent when it comes to reporting their gold market activities. On the other hand, the Swiss are highly transparent. The Swiss report gold imports and exports by source and destination on a monthly basis. The Swiss information gives us a window on the world. That's because Swiss imports and exports are mostly about the Swiss refining business, which is the largest in the world. There are no major gold mines in Switzerland and Swiss citizens are not known as major buyers of gold (unlike, say, Chinese or Indian citizens). The Swiss watch industry does use a lot of gold, but imports are balanced out by exports; Switzerland itself is not a major destination for Swiss watches. In effect, Switzerland is a conduit for much of the gold in the world. Gold arrives in Switzerland as 400-ounce good delivery bars (the kind I'm holding in the photo above), doré bars (those are 80% pure ingots from gold miners), and "scrap" (that's the term for jewelry and other recycled gold objects). This gold is then melted down and refined mostly into 99.99% pure 1-kilo gold bars, worth about $45,000 each at current market prices. These 1-kilo "four nines" quality bars are the new global standard and are the ones most favored by the Chinese. By examining Swiss imports and exports, we can see where the supply and demand for physical gold is coming from and how close to balance (or imbalance) that supply and demand is. This information can help us to forecast the coming super-spike in gold prices. Importantly, Switzerland has been a net exporter of gold for the past four months. More gold is going out than is coming in. This means demand remains strong, but supplies are tight. Switzerland does not produce its own gold. Some refiners may have inventories and there are gold vaults in Switzerland that are a potential source of supply. But the high-net worth individuals who keep their gold in Switzerland are long-term buy-and-hold investors and tend not to sell. On balance, these net outflows are unsustainable. If the outlfows persist, the price of gold is likely to go up because that's the market's solution to excess demand. The "big five" destinations are China, Hong Kong, India, the U.K. and the United States. Those five destinations account for 91% of total Swiss gold exports. Hong Kong demand is mostly for re-export to China. This is revealed through separate Hong Kong import/export figures, which are also considered reliable by international standards. Using Hong Kong as a conduit for Chinese gold is just one more way China tries to hide its true activities in the physical gold market. Bear in mind that China is the largest gold producer in the world. There is an additional 450 tons per year of indigenous mining output available to satisfy China's voracious demand for official gold, held by its central bank and sovereign wealth funds. Chinese demand has been tempered by the recent strong dollar, which makes gold more expensive when purchased for yuan. That headwind may be about to dissipate if the Fed engineers a weaker dollar (which we expect) to deal with a slowing U.S. economy. Switzerland has exported 102 tons to the U.K. and U.S., almost all to satisfy demand from ETF investors. Will this strong demand persist? ETF demand runs in a feedback loop relative to gold prices. When gold is going up, ETF demand goes up also which puts more upward pressure on the price. This also works in reverse as we saw in 2013. When gold is going down, ETFs tend to disgorge gold, which puts further downward pressure on the gold price. Either way, ETF demand tends to be pro-cyclical and to amplify whatever gold is doing based on other factors. If we have reason to believe that gold prices are going up on their own, ETF demand will tend to drive the price even higher and faster. Supplies of gold in Switzerland are already tight (I heard this first-hand from my refinery and vault contacts there). If that shortage gets worse, as we expect it will, there's only one way to adjust the Swiss gold trade imbalance — higher prices. Once the higher prices kick in, the ETF demand will send it into overdrive. From there, it's just a matter of time before the whole paper gold pyramid comes crashing down. Gold prices are set to skyrocket based on a combination of supply and demand fundamentals and the ETF pro-cyclical feedback loop. If gold goes up, the prices of gold mining stocks go up even faster. In effect, buying gold mining stocks is a leveraged bet on the price of gold itself. Regards, Jim Rickards Ed. Note: Sign up for your FREE subscription to The Daily Reckoning, and you'll start receiving regular insights for specific profit opportunities. By taking advantage now, you're ensuring that you'll be financially secure for the future. Best to start right away – it's FREE. The post The Coming Gold Super-Spike appeared first on Daily Reckoning. |

| End Times Headline News - September 1st, 2016 Posted: 01 Sep 2016 03:01 PM PDT With a world spiraling into the new world order we are seeing how the world will look once the nwo has taken control. Another day of news of Biblical proportions. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Posted: 01 Sep 2016 03:00 PM PDT Jeffrey Lewis |

| China’s Monetary Ascension Is Paved with Gold Posted: 01 Sep 2016 02:23 PM PDT The world monetary order is changing. Slowly but steadily, global trade and currency markets are becoming less dollar-centric. Formerly marginal currencies such as the Chinese yuan now stand to become serious competitors to U.S. dollar dominance. Could gold also begin to emerge as a leading currency in world trade? Over time, it certainly could. But the more immediate implications for gold’s monetary role center on its increasing accumulation by central banks such as China’s. |

| Posted: 01 Sep 2016 02:16 PM PDT The key to understanding where silver prices come from is the COMEX futures market. It is undisputed that the 4 and 8 largest traders hold a massive paper silver short relative to all other commodities in it’s class. And it’s obvious that they are not legitimate producers or users… (It is also worth mentioning that despite some of these shorts being held on behalf of a diversity of clients, the fact remains that the positions they control (as a whole) are manipulative based on concentration alone). |

| Gold Daily and Silver Weekly Charts - A Nation of Servants Posted: 01 Sep 2016 01:27 PM PDT |

| Dollar hegemony endures as share of global transactions keeps rising Posted: 01 Sep 2016 11:11 AM PDT This posting includes an audio/video/photo media file: Download Now |

| Posted: 01 Sep 2016 10:55 AM PDT Jim Sinclair's Commentary This is the beginning of the end. Deutsche Bank Refuses Clients’ Demand For Physical GoldSeptember 1, 2016 Clients of Germany's biggest bank who have invested in the exchange-traded commodity Xetra-Gold are facing problems when they want to obtain physical gold, according to German analytic website Godmode-Trader.de. Xetra-Gold is a bond on the... Read more » The post In The News Today appeared first on Jim Sinclair's Mineset. |

| Asia loosens London’s grip on FX trading Posted: 01 Sep 2016 10:02 AM PDT By Katie Martin London is losing its grip on a global currencies-trading business that is tilting toward Asia, the latest benchmark survey of the industry from the Bank for International Settlements reveals. The UK capital's market share in this crucial but scandal-tinged business has dropped for the first time in more than a decade, reaching 37.1 percent from nearly 41 percent in the previous study in 2013. New York's slice grew slightly to 19 percent, while the combined heft of Tokyo, Hong Kong, and Singapore -- the other three large global trading hubs -- swelled to 21 percent from 15 per cent, underscoring the growing importance of the Asian region and of China in particular in global trade. The renminbi is now the world's most heavily traded emerging-market currency, doubling its share of the global market and knocking the Mexican peso off its perch. ... ... For the remainder of the report: http://www.ft.com/cms/s/0/f062b948-7020-11e6-9ac1-1055824ca907.html ADVERTISEMENT The Gold Mine Barrick Might Regret Having Sold K92 Mining is poised for production at its Papua New Guinea gold project and has just listed on the Toronto Venture exchange under the symbol KNT.V. The gold mining startup came together during one of the toughest periods in mining history. K92's main asset is the Kainantu project, a large high-grade gold resource with extensive infrastructure including underground mine development, a mill processing facility, a fully permitted tailings pond, and paved roads. The infrastructure means K92 can aim to restart mining in the near term with minimal capital costs and seek to grow through cash-flow funded exploration on the roughly 405-square kilometer property, considered prospective for additional discoveries. For more information, please visit: https://ceo.ca/@tommy/the-gold-mine-barrick-might-regret-selling Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| 2 Can’t-Miss Charts for “Scary September” Trading Posted: 01 Sep 2016 08:22 AM PDT This post 2 Can’t-Miss Charts for “Scary September” Trading appeared first on Daily Reckoning. Welcome to September—a horror show of losses for investors throughout recorded history. Statistically, we're entering the worst trading month of the year. Since the beginning days of the Dow, September is the only month that has averaged a loss. Over the past 120 years, September has posted an average drop of more than 1%. As summer draws to a close, stocks remain trapped in a tight range. The S&P 500 limped toward a small loss in August. The commodity rally is losing steam. Momentum is diverging. Yet the major averages remain just a breath from their all-time highs. Most market watchers don't know what to make of these conflicting developments. They're terrified of what the beast of September might bring. Analysts aren't any different. They're desperate to call for a pullback in stocks. But they're not sure where to begin. Just look at this headline:

That sounds about right. One of the ways you can weather a potential September storm is by keeping a close eye on the charts. The market is changing fast. Blink in September and you risk missing important developments that could make or break your 2016 returns. I've spotted 2 key charts you have to watch as we begin the new trading month. These trends will serve as important market barometers as we speed toward the fourth quarter. They also have the potential to turn into lucrative trades. First up is the death of the safety trade. We first alerted you to this phenomenon back in July. We noted that Investors have gobbled up anything and everything with a decent yield this year. They've bid up utilities and consumer staples stocks to prices not seen in decades. Utilities alone rose more than 21% during the first half of 2016. That's the sector's best performance in over 25 years. Consumer staples names jumped nearly 10% over the same timeframe. That's crazy—especially when you consider that the major averages barely squeezed out a gain over that 6-month period. But that all changed in just a few weeks. Since late July, The utilities sector has dropped 7%.

"The most popular trade of 2016 is showing more signs of unwinding," Bloomberg reports. "Shares in dividend-paying companies in defensive groups — utility, phone and consumer staples — are trailing the S&P 500 Index in the third quarter by at least 5 percentage points after outperforming by more than 6 points in the first half." Meanwhile, bank stocks are breaking out. Financials are ripping higher, indicating that we might be on track for a rate hike before the end of the year. Remember, this sector had lagged the major averages so far this year. It's also one of the few places on the market that has yet to top its 2007 highs. That could all change soon enough. A post-Brexit surge has financials up more than 4% year-to-date:

The big, bad banks are surging… "Shares of Morgan Stanley, the biggest beneficiary of the summer rally among the largest U.S. banks, rose by 12% in August," The Wall Street Journal reports. "Bank of America Corp. shares added 11% and Citigroup Inc. shares increased 9%. The financial sector also includes shares of insurers and other firms." With banks leaping higher and a resurgent U.S. Dollar emerging, the market is beginning to entertain the idea that higher rates are on the horizon. Adjust your portfolio accordingly. Sincerely, Greg Guenthner P.S. Make money in ANY market –sign up for my Rude Awakening e-letter, for FREE, right here. Never miss another buy signal. Click here now to sign up for FREE. The post 2 Can’t-Miss Charts for “Scary September” Trading appeared first on Daily Reckoning. |

| Ted Butler: How prices get set Posted: 01 Sep 2016 08:20 AM PDT 11:19a ET Thursday, September 1, 2016 Dear Friend of GATA and Gold: Silver market analyst Ted Butler writes today that the futures markets for commodities in the United States now are so much bigger than their corresponding physical markets that they are controlling prices without regard to supply and demand for the real stuff. The British economist Peter Warburton saw this coming back in 2001 with his prophetic essay, "The Debasement of World Currency: It's Inflation But Not as We Know It," which asserted that governments would use futures markets to destroy free markets and mask inflation: Butler's commentary is headlined "How Prices Get Set" and it's posted at GoldSeek's companion site, SilverSeek, here -- http://www.silverseek.com/commentary/how-prices-get-set-15897 -- and at 24hGold here: http://www.24hgold.com/english/news-gold-silver-how-prices-get-set.aspx?... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Posted: 01 Sep 2016 08:15 AM PDT This post How Governments Can Kill Cash appeared first on Daily Reckoning. It's almost as if someone hit the "start" button right around April 11 (the beginning of IMF Spring Meeting week), and the elites have been cranking out the inflation plans ever since. Of course, inflation is just one part of the global elite plan. There's a lot else going on that is aimed at destroying your wealth to solve the global debt problem. We write about these developments in issues of Strategic Intelligence. Here's a quick overview to give you the picture. The inflation plans described above may take a few years to implement. The elites are discussing them now to condition the intellectual environment for action later. Still, developments such as actual changes in fiscal deficits and issuance of more standard drawing rights (SDRs) will take time. In the meantime, the global elites are using negative interest rates to do the same thing as inflation — make your money disappear. One way to avoid negative interest rates is to go to physical cash. In order to prevent that option, the elites have launched a war on cash. The war on cash has two main thrusts. The first is to make it difficult to obtain cash in the first place. U.S. banks will report anyone taking more than $3,000 in cash as engaging in a "suspicious activity" using Treasury Form SAR (Suspicious Activity Report). The second thrust is to eliminate large-denomination banknotes. The U.S. got rid of its $500 note in 1969, and the $100 note has lost 85% of its purchasing power since then. With a little more inflation, the $100 bill will be reduced to chump change. The war on cash is old news, but there are new developments. On Wednesday, May 4, 2016, the European Central Bank announced that they were discontinuing the production of new 500 euro notes (worth about $575 at current exchange rates). Existing 500 euro notes will still be legal tender, but new ones will not be produced. This means that over time, the notes will be in short supply and individuals in need of large denominations may actually bid up the price above face value paying, say, 502 euros in smaller bills for a 500 euro note. The 2 euro premium in this example is like a negative interest rate on cash. The whole idea of the war on cash is to force savers into digital bank accounts so their money can be taken from them in the form of negative interest rates. An easy solution to this is to go to physical cash. Yet if physical cash becomes scarce (or nearly worthless due to inflation), savers may pay a slight premium for large-denomination notes. Your premium disappears because the note pays no interest. The elites have actually figured out a way to have negative interest rates follow you from digital accounts to paper money. Another solution to negative interest rates is to buy physical gold. But if the government has a war on cash, can the war on gold be far behind? Probably not. Governments always use money laundering, drug dealing and terrorism as an excuse to keep tabs on honest citizens and deprive them of the ability to use money alternatives such as physical cash and gold. When you start to see news articles about criminals using gold instead of cash, that's a stalking horse for government regulation of gold. Guess what? An article on the topic of criminals using gold just appeared on May 5, 2016, in Bloomberg. This is one more reason to get your physical gold now, while you still can. As if inflation, confiscation, and negative rates weren't enough, the global elites are coordinating a new plan for global taxation. As usual, there's a technical name for global taxation so nonelites won't understand the plan. It's called base erosion and profit shifting, or "BEPS." The BEPS project is being handled by the OECD and the G-20, with the IMF contributing technical support. If you're interested in BEPS, there's an entire website devoted to the global taxation plans and timetables. The website is worth a look. To paraphrase that famous line attributed to Trotsky, "You may not be interested in BEPS, but BEPS is interested in you." The global elite plan doesn't stop there. There's also the climate change agenda led by the United Nations. This agenda goes by the name United Nations Framework Convention on Climate Change (UNFCCC). The science of climate change is a sticky topic. It's enough to know that climate change is a convenient platform for world money and world taxation. That's because climate change does not respect national borders. If you have a global problem, then you can justify global solutions. A global tax plan to pay for global climate change infrastructure with world money is the end game. Don't think that climate change is unrelated to the international monetary system. Christine Lagarde almost never gives a speech on finance without mentioning climate change. The same is true for other monetary elites. They know that climate change is their path to global financial control. That's the global elite plan. World money, world inflation and world taxation, with the IMF as the central bank of the world, and the G-20 Leaders as the Board of Directors. None of this is secret. It's all hiding in plain sight. Regards, Ed. Note: Sign up for your FREE subscription to The Daily Reckoning, and you'll start receiving regular insights for specific profit opportunities. By taking advantage now, you're ensuring that you'll be financially secure for the future. Best to start right away – it's FREE. The post How Governments Can Kill Cash appeared first on Daily Reckoning. |

| The Big Banks Hiding Money For Elites Posted: 01 Sep 2016 07:04 AM PDT This post The Big Banks Hiding Money For Elites appeared first on Daily Reckoning. The U.S. Government talks tough about cracking down on money laundering and offshore tax havens. But the big banks involved effectively 'pay-to-play' with criminals and get relatively tiny fines for fraudulent and quasi-legal practices (like Goldman Sachs' most recent $5 billion settlement in April). Professional tax dodgers and money launderers set up shell companies to hide or move billions of dollars. Banks help them because it is profitable for them. Meanwhile, if you dare withdraw or transfer $10K from your account to take the family on a dream Cayman vacation, your bank files a report. In their global quest to recoup taxes from offshore havens, countries are collaborating to extract information from banks. At least, that's the reason the Obama administration has fed to us to collect banking information. Yet in practice, American retirees living abroad, like my Dad, have their social security and pension fund payments scoured for non-existent nefarious activity while drug cartel appointees pass cash through teller windows at global banks, unbothered. The Obama administration has lead other governments in requiring offshore banks to disclose information on hidden assets (big and small). The U.S. has won disclosure battles with Swiss banks over shielding client information. But the U.S. doesn't reciprocate. Last year, the U.S. leapt to third place as the top bank secrecy center in the world—above the Cayman Islands and Luxembourg, and just below Switzerland and Hong Kong. (According to the financial secrecy index, produced by the Tax Justice Network (TJN)). States like Delaware, Wyoming and Nevada have been onshore secrecy havens for years. Now they are increasingly establishing shell companies for foreign "secrecy-seekers." The U.S. is becoming a premier tax haven while cracking down on similar behavior abroad. The onshore locations in the U.S. might not boast the scenic Alps or white sands of the Cayman's, but money-hiders don't visit to ski or tan. Vegas is a brazen sprawl of humanity and gold-plated towers bearing the name Trump, and it's a growing U.S. tax haven. These shell organizations don't need glamor—they just need government negligence.

Nomi Prins sharing a panel with Jack Blum, Chair of the TJN. We spoke on money laundering, tax havens and financial corruption at the Mirage Hotel. Behind this façade of cooperation to locate "disappearing money", national governments let their banks duke it out to capitalize on the international tax haven space. Then, bankers make generous donations to politicians who enable them. (If you need proof that banks and governments are working together, read my book, All the Presidents' Bankers.) The result? Your account may be routinely monitored, but those of billionaires or international terrorist rings who launder funds through your bank are treated as VIPs, and ignored. Their money is hidden in a complex maze of shell companies, often created by big banks, utilizing a worldwide web of tax havens. Riddle This: What do HSBC, Mexican Drug Cartels, and Hillary Clinton Have in Common? |

| BrExit Economic Collapse Evaporates into Boom as PMI Soars Posted: 01 Sep 2016 02:08 AM PDT The latest news out for the UK economy is that the post BrExit economic collapse as illustrated by the Purchasing Managers Index that during July fell sharply to 48.3 (a reading below 50 implies economic contraction) which most academic economists that populate the mainstream press concluded heralded the start of a severe imminent economic downtrend, an recession early warning. |

| Gold, Silver, Mining Shares Bottom Evident Posted: 01 Sep 2016 01:52 AM PDT The chart below of GLD shows support on the long standing up trend line. GDX has sported a bullish “Morning Star” pattern. Normally, Mercury Retrograde ends an up movement, but in this case has ended a down movement. Expect some upside fireworks to begin tomorrow (Sept 1) and especially on the employment report Friday. The final “C” Wave of the sequence should commence. |

| Rye Patch Jump-Starts Florida Canyon Mine Production with New Heap Leach Facility Posted: 01 Sep 2016 01:00 AM PDT Construction has begin on a new heap leach facility at Rye Patch Gold Corp.'s Florida Canyon Mine in Nevada, a move that Dundee Capital Markets' analyst Ron Stewart believes could add value for investors over both the long and short terms. |

| US Dollar Hegemony Questioned as World Bank Sells SDR Bond Using Chinese Yuan Posted: 31 Aug 2016 05:00 PM PDT |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Last Week, in The Wall Street Journal, there was a picture of a man wearing a trench coat. He was holding the coat open and tucked inside was cash. Yes, US legal tender was the conspicuous item. Included with this image was an article by Ken Rogoff.

Last Week, in The Wall Street Journal, there was a picture of a man wearing a trench coat. He was holding the coat open and tucked inside was cash. Yes, US legal tender was the conspicuous item. Included with this image was an article by Ken Rogoff.

The longer Obamacare remains in effect, the more it fails, and a total meltdown of the law – and the healthcare system it seeks to “manage” – is inevitable. The only thing left to chance at this point is how many millions of Americans will be impacted when it does.

The longer Obamacare remains in effect, the more it fails, and a total meltdown of the law – and the healthcare system it seeks to “manage” – is inevitable. The only thing left to chance at this point is how many millions of Americans will be impacted when it does. I did not plan to write another public article so soon after the last one but today’s topic(s) are very important and very connected in my opinion. I apologize for the length but I can’t make this stuff up, I just try to tie it together . First, we have been hearing the word “rigged” on a daily basis and pertaining to many facets of our life. We hear the word regarding markets, politics (specifically elections), our rule of law and judicial system, and even when it comes to lawmakers and bribery.

I did not plan to write another public article so soon after the last one but today’s topic(s) are very important and very connected in my opinion. I apologize for the length but I can’t make this stuff up, I just try to tie it together . First, we have been hearing the word “rigged” on a daily basis and pertaining to many facets of our life. We hear the word regarding markets, politics (specifically elections), our rule of law and judicial system, and even when it comes to lawmakers and bribery.

No comments:

Post a Comment