saveyourassetsfirst3 |

- Gold Is Still A Good Hedge When Volatility Rises

- Barrick Gold: Don't Miss The Buying Opportunity

- Gold and Gold Stocks Correction Continues

- Gold and Gold Stocks Correction Continues

- CEO’s Inside View: Big Institutions Are Using This Correction to Enter the Gold and Silver Bull Market

- Golden Nuggets of Truth: The Day The Truth Died

- “I’m All In!” Eric Sprott Explains DRAMATIC Sudden Sell Off In Long Bonds, Gold, & Silver

- They’re Trapped! We’re About to See T-Bond Managers RUNNING SCARED – Jim Willie

- Michael Ballanger’s Fall Outlook for Metals Investing – Back Up The Truck!

- RED ALERT: CDC Giving Itself Unconstitutional POWERS To Detain Citizens En Masse Anytime, Anywhere & Throw Away The Key

- THE FOUR HORSEMEN – Ready to Ride? – Bo Polny

- Photos Capture Wheelchair Lift On Hillary’s Special Van – Does Hillary Clinton Have End-Stage Parkinson’s Disease?

- Economist Warns: “Physical Precious Metals Markets May Freeze Up- In A Buying Frenzy, $5,000 Gold Is A Conservative Estimate”

- This One Chart Should Drive Investors Into Buying Gold & Silver

| Gold Is Still A Good Hedge When Volatility Rises Posted: 10 Sep 2016 01:14 PM PDT |

| Barrick Gold: Don't Miss The Buying Opportunity Posted: 10 Sep 2016 09:49 AM PDT |

| Gold and Gold Stocks Correction Continues Posted: 10 Sep 2016 07:11 AM PDT The Daily Gold |

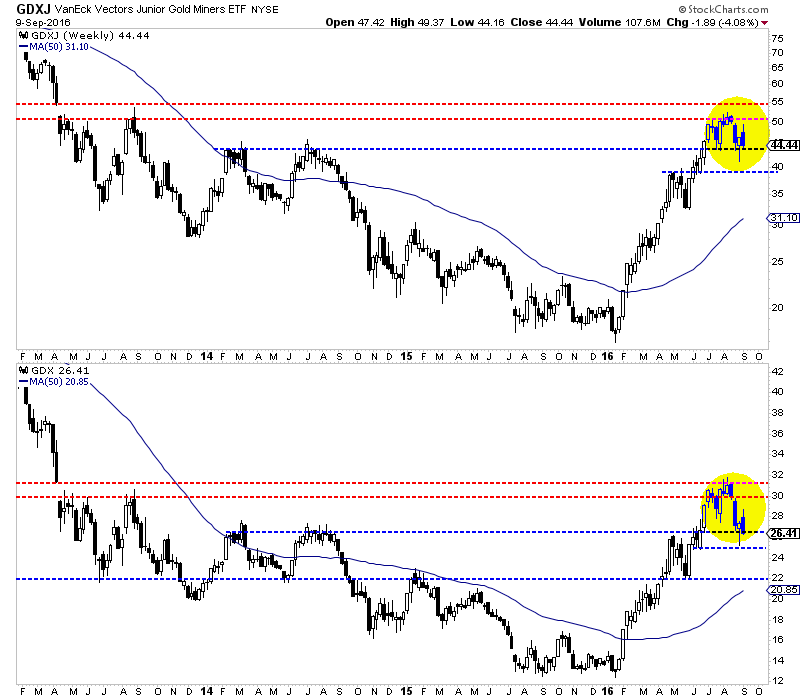

| Gold and Gold Stocks Correction Continues Posted: 09 Sep 2016 06:37 PM PDT The failure of Gold and gold stocks to sustain recent gains coupled with a strong selloff to close the week dashes any hope that the correction ended last week. The charts and probabilities argue that the sector remains in a larger correction and perhaps has started the C portion of a typical A-B-C (down-up-down) correction. This week started out strong for the miners but that strength faded and was completely reversed with Friday's selloff. GDX and GDXJ closed down 3%-4% for the week and left nasty bearish candles on the weekly charts. GDXJ, which made a low of $41 last week could test at least $39 while GDX, which tested a low of $25 last week has downside potential to $22.

GDX, GDXJ Weekly Candle

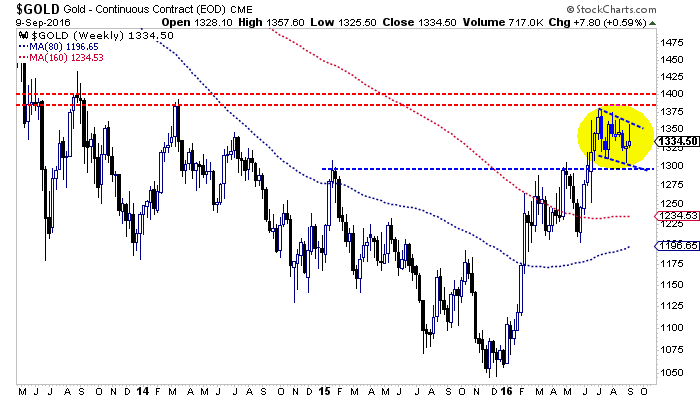

Before I get to Gold, here is an important note on GDX. During bull market corrections, GDM, the parent index of GDX often found support at its 400-day exponential moving average. This happened seven times during 2002-2003, 2006 and 2009-2010. The 400-day exponential moving average for GDX is currently at $22 and rising slowly. Hence, I consider $22-$23 as a potential bottom for GDX. Turning to Gold, we note that Gold failed at the $1355-$1360 resistance earlier in the week. That coupled with Friday's decline increases the odds that Gold will head lower to the bottom of its channel near $1300. Gold closed at $1334. It has support at $1300-$1310 and $1275-$1280.

Gold Weekly

The negative reversal in miners and metals at the end of this week (and their failure to hold the rebound) signals that a larger and longer correction is playing out and more downside potential is directly ahead. GDX closed at $26.41. It has a very strong confluence of support around $22 which includes its 200-day moving average, its 400-day exponential moving average (noted above) and the 50% retracement of the entire rebound. Do not be surprised if this target is reached quickly, such as in days and not weeks. Remember that fishing line type declines (think of the trajectory of a fishing line) are a buying opportunity. For professional guidance in riding the uptrend in Gold, consider learning more about our premium service including our favorite junior miners which we expect to outperform in the second half of 2016.

Jordan Roy-Byrne, CMT, MFTA

|

| Posted: 09 Sep 2016 05:10 PM PDT With Gold and Silver’s Correction Continuing, Top Mining CEO Keith Neumeyer Joined the Show For An Insider’s Perspective On the Early Stages of a Major Bull Market: “No One’s Ever Done This” Neumeyer Reveals How He Paid “Virtually Nothing” For Gold and Silver First Mining Finance – Keith Neumeyer is So Convinced Gold Prices Are […] The post CEO’s Inside View: Big Institutions Are Using This Correction to Enter the Gold and Silver Bull Market appeared first on Silver Doctors. This posting includes an audio/video/photo media file: Download Now |

| Golden Nuggets of Truth: The Day The Truth Died Posted: 09 Sep 2016 05:00 PM PDT We spend most of our time here at SD discussing topics related to Sound Money – physical gold and silver. In this new series, we’re going to delve into a commodity that is more valuable than even gold and silver – Truth… You shall know the Truth, and The Truth shall set you free… Your […] The post Golden Nuggets of Truth: The Day The Truth Died appeared first on Silver Doctors. |

| “I’m All In!” Eric Sprott Explains DRAMATIC Sudden Sell Off In Long Bonds, Gold, & Silver Posted: 09 Sep 2016 02:30 PM PDT In A Crucial Market Update, Eric Sprott Explains This Week’s STUNNING and DRAMATIC Global Sell-Off in Long Bonds, and what the implications are for gold and silver prices: On Sale At SD Bullion Last Chance… The post “I’m All In!” Eric Sprott Explains DRAMATIC Sudden Sell Off In Long Bonds, Gold, & Silver appeared first on Silver Doctors. |

| They’re Trapped! We’re About to See T-Bond Managers RUNNING SCARED – Jim Willie Posted: 09 Sep 2016 02:29 PM PDT In This Special Report, Jim Willie Joins Us For A Crucial Market Update, A Systemic Lehman Event is IN PROGRESS, the Chinese are Ready to Launch a Gold-Backed Yuan, and Warns We’re About to See A Run On Treasury Bonds… We’re About to See the Managers of Treasury Bonds Running Scared… From Craig Hemke, TFMetals: I […] The post They’re Trapped! We’re About to See T-Bond Managers RUNNING SCARED – Jim Willie appeared first on Silver Doctors. |

| Michael Ballanger’s Fall Outlook for Metals Investing – Back Up The Truck! Posted: 09 Sep 2016 02:25 PM PDT Submitted by Michael Ballanger, The AU Report: Precious metals expert Michael Ballanger explains his strategy for playing the gold-to-silver ratio and discusses the post-summer outlook for metals investment. The heat I took last week over my “Back up the Truck” call was somewhat comedic in that every guru out there was urging “extreme caution.” […] The post Michael Ballanger’s Fall Outlook for Metals Investing – Back Up The Truck! appeared first on Silver Doctors. |

| Posted: 09 Sep 2016 02:15 PM PDT The CDC is creating a police healthcare state… by Catherine J Frompovich, Natural Blaze via SHTFPlan: The U.S. Centers for Disease Control and Prevention literally has overstepped its authority in proposing to grant itself powers that obviously negate any rights U.S. citizens thought they had by issuing the Proposed Rule "Control of Communicable Diseases" on […] The post RED ALERT: CDC Giving Itself Unconstitutional POWERS To Detain Citizens En Masse Anytime, Anywhere & Throw Away The Key appeared first on Silver Doctors. |

| THE FOUR HORSEMEN – Ready to Ride? – Bo Polny Posted: 09 Sep 2016 02:00 PM PDT Are we about to enter Biblical times as foretold in the Book of Revelation? Are the Four Horsemen of the Apocalypse soon to ride? How could such terrible calamities begin as foretold within the Book, and WHAT could be the 'triggering event"? Looking at our world today, the best guess of WHAT the 'triggering event" could […] The post THE FOUR HORSEMEN – Ready to Ride? – Bo Polny appeared first on Silver Doctors. |

| Posted: 09 Sep 2016 01:56 PM PDT Is Hillary Clinton is covering up a MAJOR illness that would make her unfit to serve as president? Just today we learned that there is a wheelchair lift in her van. The only reason why Hillary Clinton would be riding around in a van with a wheelchair lift is because somebody needs it, and I will give […] The post Photos Capture Wheelchair Lift On Hillary’s Special Van – Does Hillary Clinton Have End-Stage Parkinson's Disease? appeared first on Silver Doctors. |

| Posted: 09 Sep 2016 01:45 PM PDT Wait until the physical market freezes up. I saw it once (1980)…I saw what happened with gold and silver when it was a panic buy… Submitted by Mac Slavo, SHTFPlan: Economist David Morgan of The Morgan Report is one of the world's best known silver investors. In the following interview with Future Money Trends Morgan […] The post Economist Warns: "Physical Precious Metals Markets May Freeze Up- In A Buying Frenzy, $5,000 Gold Is A Conservative Estimate" appeared first on Silver Doctors. |

| This One Chart Should Drive Investors Into Buying Gold & Silver Posted: 09 Sep 2016 01:30 PM PDT The chart below is VERY bad news for Americans rich and poor. This is the reason investors need to be holding onto LOTS of physical gold and silver bullion: From the SRSRocco Report: The U.S. financial system is in serious trouble and this one chart confirms it. Investors who understand the negative consequences of this […] The post This One Chart Should Drive Investors Into Buying Gold & Silver appeared first on Silver Doctors. |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment