Gold World News Flash |

- BOOK REVIEW: ATOMIC BOMB SECRETS by DAVID J. DIONISI

- Fiction, Fairy Tales, Fiat & Hyperinflationary Collapse

- If hardly anyone cares about gold, why are central banks all over its market?

- The (160 to 1) Gold-Silver Ratio Every Investor Needs To Know About

- A Word of Caution to President Rodrigo Duterte & the Philippines – Warning, You’re Dealing With the NWO!

- IMF Gold Sales – Where ‘Transparency’ means ‘Secrecy

- "Anything & Everything Goes" - The Corrupt & Deranged Governance Of America

- Gold Daily and Silver Weekly Charts - Restless

- If 'hardly anyone' cares about gold, why are central banks all over its market?

- Four September Indicators that Could Spell Disaster

- SIGNS OF THE END PART 205 - LATEST EVENTS SEPTEMBER 2016

- Gold Stocks Massive Price Correction

- Deranged Lunatics Have Taken Over the World

- USD/JPY Could Be Supported by BOJ Policy Stance

- Gold, Silver, Blockchain and Fintech – Solutions To Negative Rates, Bail-ins, Cash Confiscations and Cashless Society

- Gold During Presidential Election Cycle

- 2017 Will Be a Good Year for the US Dollar

- Gold Bull Market Assurances from Michael Oliver

- Explaining the moves in the gold price

- Breaking News And Best Of The Web

| BOOK REVIEW: ATOMIC BOMB SECRETS by DAVID J. DIONISI Posted: 10 Sep 2016 12:00 AM PDT by James Perloff, James Perloff.com:

The U.S. government long claimed it dropped A-bombs on Hiroshima and Nagasaki because only this would convince Japan to end the Second World War, and that it "spared millions of lives" which allegedly would have been lost had America been forced to invade the islands.

I've known this was a lie ever since reading Dr. Anthony Kubek's 1963 classic How the Far East Was Lost. Japan had, in fact, already offered to surrender on virtually the same terms we approved at war's end.1 America demanded "unconditional surrender." The Japanese were willing to accept this, but wanted to salvage onecondition—to retain their emperor. Since we wound up granting that condition anyway, the dropping of A-bombs does not square with the public justification at all. Establishment historians have tried offering an alternative explanation: President Harry Truman, aware of an impending cold war with Russia, wanted to demonstrate the A-bomb's power in order to frighten Stalin. However, this is equally bogus. In 1952, Major George Racey Jordan, a Lend-Lease expediter during the war, revealed that the Roosevelt-Truman administration had shipped the Soviet Union both the blueprints and materials for making the atomic bomb. This high-level treason, done on express orders from Harry Hopkins (White House front man for Zionist bankster Bernard Baruch), was detailed in Jordan's bookFrom Major Jordan's Diaries.

It made no sense that these people, who were gifting Stalin the A-bomb on a silver platter, would also try to "frighten" him with it. Establishment media's image of Truman as "Cold War warrior" is myth. As documented in Kubek's book noted above, the Truman State Department went into overdrive helping put Mao Tse-tung and the communists into power in China, so much so that even Capitol Hill Democrats condemned the President for it, including young Congressman John F. Kennedy.2Truman did not send over 30,000 American soldiers to their deaths in the Korean War in order to "fight Communism," but to validate the UN as a "peacekeeper" and to set a permanent precedent for by-passing Congress's Constitutional authority to declare war. A 33rd degree Freemason who was the 33rd U.S. President, Truman also served Zionism with servility, recognizing Israel within minutes of its declaration of statehood, after AIPAC founder Abraham Feinberg gave him $2 million in a suitcase, discussed in another post on this site. So why did Truman's controllers order Japan's nuclear bombing? As I have grown increasingly aware of the ruthless Talmudic psychopathology of the Powers that Be, I cynically confided to friends, "I think they enjoyed it." But after discovering David Dionisi's Atomic Bomb Secrets, we can be much more specific. This well-written, 217-page gem, documented with 496 end-notes, blows the lid off the sordid episode. A ground-breaking detail I learned from Dionisi is the A-bomb's role in Korea's division into North and South. I've discussed the artificial justification for this division elsewhere, but Dionisi elaborates that Japanese scientists were developing their own atomic bomb. After initial research in Japan, the project was transferred to the Konan region of northern Korea (then a Japanese protectorate). This area was selected for multiple reasons: availability of uranium, the power the Chosin dams could generate, and (perhaps most importantly) keeping away from American bombers. Giving the Soviet Union postwar control of North Korea (allegedly its reward for a mere five-days' participation in the Pacific War) now makes far more sense. Not only was the cabal handing Stalin the plans and materials for the atomic bomb, they were giving him Japan's installations for making one. But Dionisi solves much more, especially the mystery of why Nagasaki was targeted. |

| Fiction, Fairy Tales, Fiat & Hyperinflationary Collapse Posted: 09 Sep 2016 10:01 PM PDT by Guy Christopher, Money Metals Exchange, Deviant Investor:

The fantasy ignores sound money and belittles those who separate fact from fiction. This fable teaches the more unpayable the debt, the merrier.

Do young Americans today know anything about economics? No, they don't, according to a study during the 2016 presidential primary season, which says lots of other Americans don't either. The survey found 58% of millennials favor government-run socialism (statistically 6 out of 10), while a nearly identical number (64%) don't want government interference in free markets. The incompatible findings make no sense, unless… Americans aged 18-24 simply don't understand the real meanings of either concept. Sadly, the study says that's true of one-third of all Americans. Not a clue. The evidence is the large following behind avowed socialist Bernie Sanders during his presidential campaign. This lack of understanding is concerning, as the implications for individual lives and the nation's future are significant. Witness the latest failure of socialism in Venezuela, where millions are rebelling against the government-controlled economy driving their lives into the dirt. We know one answer. The thrust of government influenced, politically correct education for many decades has been to rewrite history and literature, aimed at growing government power while diminishing individual liberties. It starts with childhood. The first global macro-economics lesson ever taught to children was The Legend of Robin HoodAsk anyone, and you'll hear Robin Hood was the guy who robbed the rich to give to the poor. The ingrained implication is clear – sharing the wealth through class conflict is the way to go. Balladeers passed along this folk tale beginning 600 years ago. Since silent movie days, Robin Hood has been played as champion of the oppressed by every major entertainer from Errol Flynn to Kermit The Frog. Even Bill Clinton marketed the popular view in recent days. "I was sorta Robin Hood," he said, defending the millions he's raked in selling influence around the globe. We're sorry to bring this up now, but we've all been living a lie.The "rich" in Robin Hood's days were primarily government bureaucratic officials, bestowed with royal titles, and beholden to the king. Robin's constant nemesis was the Sheriff of Nottingham, the onerous, tyrannical tax collector. The Merry Men of Sherwood Forest were in reality anti-government, anti-tax activists! Robin Hood was busyhijacking the IRS! But that's certainly not a plot line government's compliant educators wanted planted in young, inquiring minds. Over the years they pushed a wholly incorrect socialist view of Robin Hood, burying the anti-tax storyline. A few weeks after you elect a new president, win or lose, you'll want time to enjoy the holidays. MGM's The Wizard of Oz will air often between Thanksgiving and Christmas, a screen classic now for 77 years. What you're getting is another rewrite.You'll see Judy Garland as Dorothy, ripped from her home by a tornado, off to discover the truth of courage, intelligence, and heartfelt compassion. That 1939 film became instantly, universally loved. In 1941, two brigades of burly Australian troops marched across North Africa against Nazi tanks singing "The Wonderful Wizard of Oz." Then, in 1963, a New York high school teacher was preparing a lesson plan on the history of sound money. Before he knew it, Henry Littlefield had written a scholarly study, the first to recognize author Lyman Frank Baum's fantasy classic as historical satire of the bimetallism political fight of the 1890's. |

| If hardly anyone cares about gold, why are central banks all over its market? Posted: 09 Sep 2016 08:37 PM PDT GATA |

| The (160 to 1) Gold-Silver Ratio Every Investor Needs To Know About Posted: 09 Sep 2016 08:35 PM PDT by Steve St. Angelo, SRSRocco Report:

Before I get into this important Gold-Silver ratio, let's quickly examine some of the historic ratios listed above. The Historic Gold-Silver Price Ratio Briefly Explained The Gold-Silver price ratio remained 15/1 (thereabouts) for centuries until it started to rise in 1874, due to the Coinage Act of 1873 that stated:

By removing silver as legal tender in 1873, this impacted the value of silver. There have been many conspiracy theories stating that the Coinage Act of 1873, which ended the bimetallism standard (gold & silver), destroyed the value of silver as money. However, congress passed a law called the Bland-Allison Act in 1878 that required the U.S. Treasury to purchase silver every month to make Silver Dollars:

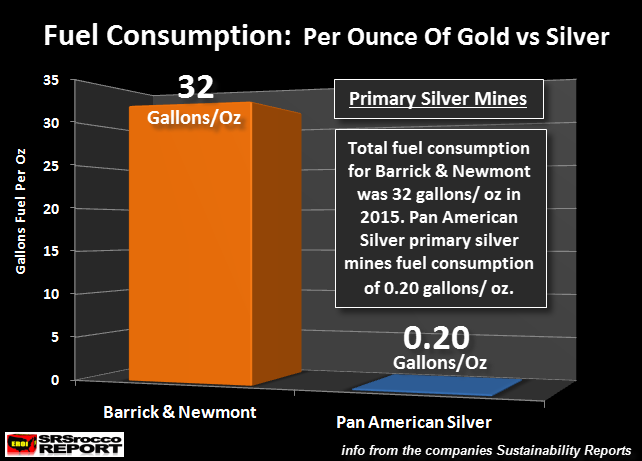

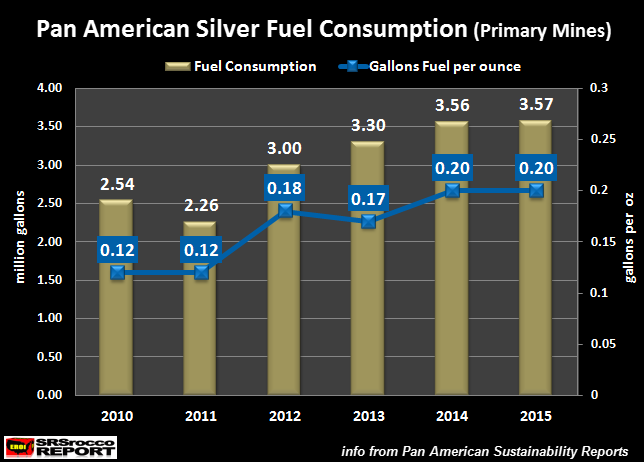

Here we can see that Congress actually overrode President Rutherford Hayes veto of this bill. At that point in time in the history of the United States, Congress was not totally corrupted by the elite or corporations as they are today. Again, there's been a lot of conspiracy theories on the Crime of 1873 that I won't get into. My opinion on the matter is still not decided, but the Gold-Silver price ratio continued to increase even after silver was reintroduced by the U.S. Treasury to coin Silver Dollars after 1878 and various denominations until 1965. For example, the Gold-Silver price ratio continued to increase from 15/1 in 1873 to a high of 71/1 in 1931 (Source: U.S. Bureau of Mines 1932 Gold & Silver Yearbook). The rapidly increasing Gold-Silver ratio from 39/1 in 1929 to 71/1 in 1931 was due to the U.S. Great Depression. Many precious metals investor believe the value of gold and silver should be tied to the actual Silver-Gold production ratio. While this made sense in the past, the current Gold-Silver price ratio is based on their COST of primary production rather than RATIO of production. The Historic Silver-Gold Production Ratio Briefly Explained According to the data put out by the U.S. Bureau of Mines in 1930 for world gold and silver production from 1493-1927, the average annual silver production in the 1700's was roughly 18.3 million oz (Moz) versus 612,000 oz of gold. This was a Silver-Gold production ratio of 30/1. Basically, the world was producing 30 times more silver in the 1700's than gold. However, the Gold-Silver price ratio remained at 15/1 for that century. Now, in 1927 (the last year this report provided data), the world produced 251 Moz of silver and 19.4 Moz of gold. This turned out to be a Silver-Gold production ratio of 13/1 in 1927. However, the Gold-Silver price ratio had risen to 33/1 in 1927. Even though the world was producing more gold in respect to silver in 1927, the value of silver had declined from $1.29 an ounce in the 1700's to $0.58 in 1927. While there is evidence that the elite were manipulating the value of silver for centuries by the excellent work of Charles Savoie on his site, SilverStealers.net, another reason for the decline in value of silver versus gold was due to the falling cost to produce silver as coal and oil were substituted as the main energy sources compared to human and animal labor for the past 2,000+ years. Currently, the world produced 887 Moz of silver and 101.5 Moz of gold in 2015. The Silver-Gold production ratio is now lower at 8.7/1 while the Gold-Silver price ratio of 74.1 was much higher in 2015 (the price of gold was $1,160 and silver $15.68 in 2015). Again, the value of gold and silver have been valued based on a "Commodity Pricing Mechanism" (their cost of production), rather than their superior "Store of Wealth" properties. More on this in future articles. The Important Gold-Silver Fuel Consumption Ratio Is Unknown By Most Investors Because the quality of gold ore has declined over the century, the amount of energy consumed in its extraction has increased substantially. I have been documenting this in past articles on the rising fuel consumption by the top primary gold miners. However, I have not written many articles on how fuel consumption in the gold mining industry compares to the primary silver mining industry. Well, here it is. According to the data put out by Barrick, Newmont and Pan American Silver in their Sustainability Reports, it took 32 gallons of fuel to produce an ounce of gold versus 0.20 gallons of fuel to produce an ounce of silver:

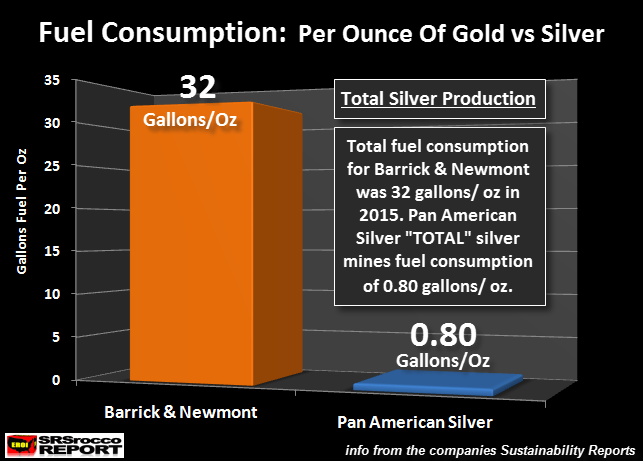

Thus, the Gold-Silver fuel consumption ratio shown in the chart above is 160/1. I arrived at that ratio by dividing Barrick and Newmont's 32 gallons of fuel per oz of gold by Pan American Silver's 0.20 gallons of fuel per oz of silver to get that 160/1 ratio, This is a very important ratio to understand due to the upcoming collapse of U.S. and Global oil production. Basically, the mining of gold will be impacted much greater than silver due the massive amount of fuel that is needed to produce gold compared to silver. I decided to use Pan American Silver as an example for the primary silver mining industry because Pan American Silver is one of the few companies that reports data in a Sustainability Report. That being said, I would imagine fuel consumption results would be similar in the overall primary silver mining industry. This would also be true for the gold mining industry as well. Now, let me clarify that chart above. It only includes Pan American Silver's primary silver producing mines. Even though Pan American Silver produced a total of 26 Moz in 2015, I only used their primary silver mines that produced 18.3 Moz that year. If I was to include their other lower grade silver and gold mines, this would be the result:

If we include ALL of Pan American Silver mines, the total fuel consumption would increase to 0.80 gallons per oz of silver produced. This would change the Gold-Silver fuel consumption ratio to 40/1… still high though. For example, Pan American Silver's Dolores Mine is an open-pit mine with low gold and silver ore grades. Of the total 11 million tonnes of ore Pan American Silver processed from its mines in 2015, the Dolores Mine accounted for 6.1 million tonnes, or 55% of the total. This is why I removed the Dolores Mine from the calculation, because it is behaving more like a gold mine with by-product silver. I wanted to get a more representative figure for the primary silver mining industry. Pan American Silver's primary silver mines produced 18.3 Moz while consuming 3.5 million gallons of fuel in 2015, for a fuel consumption of 0.20 gallons per ounce. Here is the breakdown of Pan American Silver's primary silver mines fuel consumption per ounce since 2010:

|

| Posted: 09 Sep 2016 08:00 PM PDT My Message to President Rodrigo Duterte & the Philippines from Silver The Antidote: |

| IMF Gold Sales – Where ‘Transparency’ means ‘Secrecy Posted: 09 Sep 2016 07:30 PM PDT by Ronan Manly, Bullion Star:

Off and On Market: Between October 2009 and December 2010, the International Monetary Fund (IMF) claims to have sold a total of 403.3 tonnes of gold at market prices using a combination of 'off-market' sales and 'on-market' sales. 'Off-market' gold sales are gold sales to either central banks or other official sector gold holders that are executed directly between the parties, facilitated by an intermediary.

For now, we will park the definition of 'on-market' gold sales, since as you will see below, IMF 'on-market' gold sales in reality are nothing like the wording used to describe them. In total, this 403.3 tonnes of gold was purportedly sold so as to boost IMF financing arrangements as well as to facilitate IMF concessional lending to the world's poorest countries. As per its Articles of Agreement, IMF gold sales have to be executed at market prices. Critically, the IMF claimed on numerous occasions before, during and after this 15-month sales period that its gold sales process would be 'Transparent'. In fact, the concept of transparency was wheeled out by the IMF so often in reference to these gold sales, that it became something of a mantra. As we will see below, there was and is nothing transparent about the IMF's gold sales process, but most importantly, the IMF blocked and continues to block access to crucial IMF board documents and papers that would provide some level of transparency about these gold sales. Strauss-Kahn – Yes, that guyOn 18 September 2009, the IMF announced that its Executive Board had approved the sale of 403.3 metric tonnes of gold. Prior to these sales, the IMF officially claimed to hold 3217.3 tonnes of gold. Commenting on the gold sales announcement, notable party attendee and then IMF Managing Director Dominique Strauss-Kahn stated: "These sales will be conducted in a responsible and transparent manner that avoids disruption of the gold market." The same IMF announcement on 18 September 2009 also stated that: "As one of the elements of transparency, the Fund will inform markets before any on-market sales commence. In addition, the Fund will report regularly to the public on the progress with the gold sales."  On 2 November 2009, the IMF announced the first transaction in its gold sales process, claiming that it had sold 200 tonnes of gold to the Reserve Bank of India (RBI) in what it called an 'off-market' transaction. This transaction was said to have been executed over 10 trading days between Monday 19 November to Friday 30 November with sales transactions priced each day at market prices prevailing on that day. On average, the 200 tonne sales transaction would amount to 20 tonnes per day over a 10 day trading period. Note that the Reserve Bank of India revealed in 2013 that this 200 tonne gold purchase had merely been a book entry transfer, and that the purchased gold was accessible for use in a US Dollar – Gold swap, thereby suggesting that the IMF-RBI transaction was executed for gold held at the Bank of England in London, which is the only major trading center for gold-USD swaps. As a Hindu Business Line article stated in August 2013: "According to RBI sources, the gold that India bought never came into the country as the transaction was only a book entry. The gold was purchased for $6.7 billion, in cash." "The Reserve Bank of India bought 200 tonnes of gold for $1,045 an ounce from the IMF four years ago. The Government can swap it for US dollars," said [LBMA Chairman David] Gornall." Two weeks after the Indian purchase announcement in November 2009, another but far smaller off-market sale wasannounced by the IMF on 16 November 2009, this time a sale of 2 tonnes of gold to the Bank of Mauritius (the Mauritian central bank), said to have been executed on 11 November 2009. Another two weeks after this, on 25 November 2009, the IMF announced a third official sector sales transaction, this time a sale of 10 tonnes of gold to the Central Bank of Sri Lanka. |

| "Anything & Everything Goes" - The Corrupt & Deranged Governance Of America Posted: 09 Sep 2016 07:00 PM PDT Authored by Robert Gore via Straight Line Logic,

Contemporary governance embodies corruption within deranged systems resting on foundations of theft and fraud. Corruption makes reform impossible; derangement assures eventual collapse. “Defense” spending is a misnomer. The US could defend itself at a small fraction of what it spends on its military and intelligence. The US government’s foreign intervention and maintenance of a confederated empire are actually a welfare and transfer payment program. Spending has become the point: maximizing the payoff to military and intelligence contractors, their think tanks and lobbying arms, captured politicians, and the vast bureaucracies. Winning wars doesn’t serve the interests of those beneficiaries, lengthy and inconclusive engagements do. The war on terrorism is a mother lode. The enemy is whomever the government deems it to be, wherever the government chooses to fight it. The war itself creates more terrorism. Victory cannot be defined; the war will go on as long as the current ideology remains in place. It enriches the military-intelligence-industrial complex, but a war-without-end welfare program is clearly deranged, a fitting target of satire. It will continue indefinitely because its beneficiaries have far more incentive and resources to promote their interests than the rest of us have in promoting peace. Politicians use other people’s money to line their own pockets and buy votes; recipients accept the largess and become dependent on it. There is no limit to demands that the government fund “needs,” and no limit on the political willingness to meet those demands. It is testament to this lack of limits that the world’s richest countries cannot fund the demand for redistributive largess from their countries’ own resources. Aggregated, they have accumulated the largest debt load in history, far beyond their ability to repay it. Mounting debt generates its own limit: insolvency. Demographics shaped by the transfer state compound the problem. Stealing the fruits of labor penalizes honest productivity and constricts opportunity. Faced with bleak prospects, many of the young opt out of the financial obligations of starting families, rearing children, or even supporting themselves. Birthrates have dropped far below replacement in most developed countries: fewer people to fund taxes and debt just as the number of putative beneficiaries skyrocket. Pension shortfalls around the world are the canary in this coal mine. The mathematics are inescapable. Present arrangements are unsustainable, but will continue until debt markets and taxpayers rebel. They will face a counter-rebellion by dependency-warped recipients deprived of that which was never really theirs. Those who can but don’t honestly produce are both dishonest and unproductive. Faced with a cut-off, expect chaos and violence. Debt and taxes fund governments and enslaves their constituents. They’re the foundation for the second most insidious racket: the banking complex. The Federal Reserve Act of 1913 began the shift from real money (gold) to debt, enshrined the banking cartel, and was, through the establishment of the lender of last resort function, the first major step towards making taxpayers the guarantors of bank liabilities. Later, deposit insurance and Too Big To Fail (TBTF) sealed that guaranty. Bankers have found heaven on earth, but their paradise has destroyed the economy. TBTF has removed capitalism’s most potent corrective: failure. Government debt issuance, central bank monetization, interest rate suppression, and random, whimsical, and absurd policies provide banks with middleman’s profits, inside information, access to cheap funding for speculation, and, as a particularly vicious policy—the war on cash—gathers steam, captive deposits. They destroy honest saving and investment and burden the economy with an increasingly onerous load of debt and taxes. Even governments and central banks, entities that can conjure their own debt and mandate its acceptance, will for all intents and purposes go broke if spending outruns revenues long enough. The most insidious racket? While the banking camarilla is nothing to sneeze at, lawyers writing laws and regulations must be reckoned the Mt. Everest of rackets. They write, implement, interpret, and enforce the laws, augmenting their wealth and power every step of the way. Even the bankers ostensibly kowtow to the government (what happens behind the scenes is another matter). The repository of lawful coercive force, government inevitable becomes organized crime and the law nothing more than the means to corrupt ends. Write the law and write your own ticket. Standards of honesty and integrity crumble in societies based on theft and fraud, replaced by a new standard. Coercive, redistributive “altruism” excuses all manner of corruption among the powerful and the servitude of those who either choose or are forced to produce. Bread, circuses, and moral degeneracy entertain and placate the masses. The bizarre becomes commonplace, but the populace grows sated with each new manifestation, always more “transgressive” (of standards that no longer exist) than the previous one, in progressively shorter spans of time. Anything and everything goes. Only one standard remains that rouses virtually everyone—rich and poor, powerful and powerless—to righteous indignation: the more pervasive the corrupt derangement, the less acceptable it is to talk about it. In our own time, the obvious conclusion that the warfare and welfare states are morally and fiscally bankrupt, doomed to collapse, remains confined to the fringe. Here’s a rewrite of the “Emperor’s New Clothes” in light of modern realities.

Hillary Clinton wins support not despite her corruption and derangement, but because of it, especially among the establishment. Their rackets need a participant and patron. Donald Trump is hardly a naively honest child, but he has had the temerity to question a few rackets, notably immigration, trade, and the warfare state’s global empire. Questioning that last one—because it’s the largest and most lucrative—has provoked copious quantities of vehement vitriol. Truth can awaken minds and rouse people to action, posing an obvious threat to the corrupt and deranged. Should Trump win the election, he will assuredly be presented with the same choice as the child in the story: get with the program or die. Odds are he folds, in which case those of us rooting for meaningful change will be left with the hope that the inevitable collapse occurs before we die. |

| Gold Daily and Silver Weekly Charts - Restless Posted: 09 Sep 2016 02:07 PM PDT |

| If 'hardly anyone' cares about gold, why are central banks all over its market? Posted: 09 Sep 2016 01:35 PM PDT 4:40p ET Friday, September 9, 2016 Dear Friend of GATA and Gold: In commentary posted today at GoldSeek headlined "Explaining the Moves in the Gold Price" -- http://news.goldseek.com/SpeculativeInvestor/1473429960.php -- financial letter writer and technical analyst Steve Saville again cites some charts to claim that gold is performing just as expected in relation to other markets without regard to any "whims/abilities of evil manipulators." There are only two explanations for this correlation, Saville writes. "One is that the currency and bond markets, both of which are orders of magnitude bigger than the gold market, are being manipulated in a way that is designed to conceal the manipulation of a market that hardly anyone cares about. The other is that the gold price generally does what it should do given the performances of other financial markets. Only one of these explanations makes sense." ... Dispatch continues below ... ADVERTISEMENT Silver Coins and Rounds with Employee Pricing and Free Shipping Grab your Silver Starter Kit at cost from Money Metals Exchange, the company named "Precious Metals Dealer of the Year" by industry ratings group Bullion Directory. Simply go to MoneyMetals.com and type "GATA" in the radio box at the top of the page. This special silver offer contains 4 ounces of silver coins and rounds in the most popular 1-ounce, half-ounce, and 10th-ounce forms. Claim yours now, because GATA readers get employee pricing and free shipping. So go to -- -- and type "GATA" in the radio box at the top of the page. Actually, there's a third possible explanation for the seeming consistency of Saville's charts: that governments are meddling in all these markets because they are connected and because a disparity in one might expose and upset the manipulation of the others. As for Saville's assertion that gold is "a market that hardly anyone cares about," it can be questioned in many ways. For example: Why has the Bank for International Settlements just returned to the gold swap business? http://www.gata.org/node/16704 Why has the director of market operations of the Banque de France admitted that his bank is trading gold for its own account and the accounts of other central banks "nearly on a daily basis," that central banks lately are managing their gold reserves "more actively," and that they won't explain their activity in the gold market? http://www.gata.org/node/13373 http://www.gata.org/node/14716 http://www.gata.org/node/14954 Why is the International Monetary Fund refusing to disclose its gold records, citing their "sensitivity"? http://www.gata.org/node/16722 Why did former Secretary of State Hillary Clinton's close adviser Sidney Blumenthal tell her by e-mail her that NATO overthrew the regime of Muammar Gaddafi in Libya to prevent him from starting a North African currency backed by gold? http://www.gata.org/node/16074 Why at a public forum in Virginia in March did the president of the Federal Reserve Bank of New York, William Dudley, clumsily refuse to answer a question about the Fed's own gold swaps? http://www.gata.org/node/16341 This largely surreptitious involvement of governments with gold goes on and on, if largely unreported by the mainstream financial news media and supposed savants like Saville: http://www.gata.org/node/14839 Is such involvement really consistent with "a market that hardly anyone cares about"? Or is it consistent with a market that central banks care very much about and that Saville and other technical analysts know very little about and want to know very little about, lest it undermine their technical analysis business? CHRIS POWELL, Secretary/Treasurer Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Four September Indicators that Could Spell Disaster Posted: 09 Sep 2016 01:21 PM PDT This post Four September Indicators that Could Spell Disaster appeared first on Daily Reckoning. September could prove to be a catalyst for a major market shock. The trigger signs are there and the economic climate is ripe for a major shake up. As early as April 2016 GOP presidential candidate Donald Trump was belting out that the country is headed for "a very massive recession." While Trump is known for the extremes, even some bankers are keeping a nervous eye on the possibility of a recession in the future. Deutsche Bank officials point toward a yield curve that identifies a 60% chance of recession in the coming months. Even a Wall Street Journal survey of economists put the probability at 21% (double from last year). We are in the midst of a historically critical month for markets. As Brian Maher has already noted, "history shows September, not October, is the month to circle." The apex of the 2008 financial crisis hit its darkest month in September. That was when the major home mortgage lenders began to tank and the top Wall Street banks ran to the government for bailouts. History has a funny way of shining light on where we have been, and guiding where we are headed. For the market, this is especially true. Here are four indicators to watch on the economic horizon: The Fed.With discussion swirling over interest rate hikes in December, something more damming has been let out. In August, 2016 a report was distributed that noted the Fed's (FOMC) ability to respond in the event of future recessions that the U.S might face. The paper was set to be a reassurance of the world's most powerful bank… It triggered quite the opposite. The author was David Reifschneider. David is deputy director of research and statistics at the Board of Governors of the Federal Reserve System. As someone who has worked at the Board since in 1982, he has seen his share of bubbles, booms and busts. Within his pressing analysis the Director wrote, “One cannot rule out the possibility that there could be circumstances in the future in which the ability of the FOMC to provide the desired degree of accommodation using these tools would be strained.” Translation: They are running out of bullets. If a rate hike by the Fed is showing confidence in the economy, consider the trigger warning we saw today as an immediate indicator. A Fed official hinted today in language showing preference toward raising interest rates this month. The market immediately went into panic mode. The Dow Jones fell more than 250 points and the Nasdaq dropped about 1.5 percent. Regardless of whether the Fed or the economy is set for an interest rate change, this shows that markets are still on edge. While interest rates might not change the state of the market, they could prove to be an impetus marker. As one chief market analyst noted on CNBC, “Voting member Eric Rosengren, historically a dove, repeated his desire (was hawkish two weeks ago) for a rate hike notwithstanding the soft data over the past week.” He expanded that, “Bottom line, this is important because here we have is a voting member, a dove and someone that is calling for a rate hike even after the recent string of weak economic data.” Blood is in the water… Too Big To Fail.Political voices from both the left and right in U.S politics identified that the "too big to fail" structure was a major threat to our economic system. In 2013, Senators Elizabeth Warren and John McCain were making strides for a bill to break up these colossal banking institutions. Instead of fixing the problem, as is so often the case in Congress, the bill went nowhere. Since then, the size of these banking institutions has only increased concentration of risk. Before the 2008 crisis, the five largest banks held 35 percent of all bank assets. As of now, that figure has jumped in size to 44 percent. It's all time high. This is concerning in 2016, and in particular September, because over the past year the US commercial bankruptcy filings jumped from 3% last year to 29%. This according to the American Bankruptcy Institute, in partnership with Eqip systems. Source: WolfStreet September is also a vital month for Wall Street because it is historically slow month for markets. Europe.It’s not any better across the pond. Europe is quite literally paying investors to lend their money to companies on behalf of European Central Bank (ECB) monetary policy. Coupling this ECB free money system, the Greek tragedy continues to unfold. Today, September 9, the Eurogroup (Eurozone finance ministers) assembled in Brussels to discuss the governing of bailouts, financial "haircuts" and deadline criteria that the Greek government must continue to meet. If this goes par for the course, expect theatrics. While Greece has conditionally met its prior agreements, the country is in a continued recession. The unemployment rate in Greece is officially on record at 23.5% as of May – more than double the average in Europe. With its GDP growth faltering, the Greek government is facing a steep challenge in paying its debts, its European creditors and the range of pensioners on payroll. Though it is easy to point out Greece as a government that had flawed policy in place, it is not the act of one single country that has put a black cloud over Europe. The structure of the Eurozone experiment itself was, and continues to be, the core problem. Europe was once the darling economic and social project of the world. Now, even the likes of Nobel Prize winning economist Joseph Stiglitz is calling it a failure. While at the London School of Economics in September 2016 he concluded that ""The cost of keeping the Eurozone together probably exceeds the cost of breaking it up." At some point, it all will come to an end. As the meetings by the Eurozone continue this September, any sense of quarrel amongst the European leaders could show cracks in the system. Keeping a firm eye on Greece could give way to what direction the region, collectively, will go. The Election.In presidential election years, the term "October surprise" has been colloquially tossed around. It references events that are the "silver bullet" in making one campaign and breaking another. This election, the October surprise might come early. Say hello to September… David Stockman notes, "September 26th could be a major turning point in this shock. That date is important because it is the first presidential debate. While I don't know how the debate will turn out, I do think that the outcome could be surprisingly favorable to Trump. If this is the result, the polls could tighten dramatically." The markets appear to have bet the house on a Clinton victory in November. If the first debate receives as many viewers as expected and things veer away from market expectations, expect a negative reaction. There is one thing markets dislike above all else and that is being wrong. "If the election gets close and uncertainty is high, the path over the last 30 years in policy could comes into question," says Stockman. This debate could send triggers to not only the U.S economy, but the global one as well. The economy could be pushed toward a crisis by a combination of these factors, or by something else all together. The future is not unknown, but unknowable — But it is clear this is no typical September. This is no average market. This is not a usual election. Regards, Ed. Note: Sign up for a FREE subscription to The Daily Reckoning, and you'll receive regular insights for specific profit opportunities. By taking advantage now, you're ensuring that you'll be set up for updates and issues in the future. It's FREE. The post Four September Indicators that Could Spell Disaster appeared first on Daily Reckoning. |

| SIGNS OF THE END PART 205 - LATEST EVENTS SEPTEMBER 2016 Posted: 09 Sep 2016 10:36 AM PDT end times, end times signs, end times news, end times events, bible prophecy, prophecy in the news, tornado, earthquake, strange weather, strange events, apocalyptic signs, apocalyptic events, strange weather phenomenon The Financial Armageddon Economic Collapse Blog tracks trends and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Gold Stocks Massive Price Correction Posted: 09 Sep 2016 08:19 AM PDT Gold stocks have suffered a terrible month, plunging in a serious selloff. The resulting carnage has left investors and speculators shaken, wondering if this red-hot sector’s blistering new bull this year has already run out of steam. These fears are misplaced, as massive corrections are common in major gold-stock bulls. They create bulls’ best buying opportunities in sentimental, technical, and fundamental terms. It’s easy to understand why gold-stock sentiment is so bearish today, as this sector has been trashed since early August. In less than a month the gold miners went from 2016’s overwhelmingly-dominant top-performing sector to bear-market-grade losses! Falling from heroes to zeroes in such a short span of time is enough to test the resolve of even the most-hardened contrarians. It’s a tough turn of events to weather. |

| Deranged Lunatics Have Taken Over the World Posted: 09 Sep 2016 08:15 AM PDT This post Deranged Lunatics Have Taken Over the World appeared first on Daily Reckoning. Is the Fed out of ammunition? That’s the legitimate fear when the next crisis rolls in. Basically, the answer is a resounding yes. There’s no magic bullet in the Fed’s six-shooter that will fix their ineptitude when the next meltdown arrives. The problem is that Yellen and Co. don’t believe that analysis. Neither do the inept academics running the other major central banks. They’re all too “smart.” You see, they’re already planning the next great monetary experiment for the next rescue. And it just may blow the global economy to smithereens. Stop the Insanity!To get a sense of how unhinged and reckless central banking has become, consider what the Bank of Japan (BoJ) has launched … After two decades of sluggish growth, the BoJ started its monetary manipulation bender by introducing zero interest rate policy (ZIRP) in 1999 — supposedly to fight deflation and promote economic growth. It didn’t work. So while keeping ZIRP in place, they continued Dr. Frankensteining the Japanese economy… How? The BOJ “invented” quantitative easing (QE) programs in 2001, through purchases of government bonds, asset-backed securities and commercial paper. That sad-sack effort came to an end in March 2006, as deflation and stagnant growth remained a nightmare for average Japanese investors and savers. Normal people learn lessons from abject failure, but central bankers are an arrogant, incestuous breed. They kept plowing ahead, certain of their rectitude, in the face of their own incompetence. So yet another BoJ QE program was implemented in October 2010, and that morphed into an even more aggressive QE in April 2013. Those all bombed. More failure, of course, led to more experiments. So the BoJ went all in… In April 2014, it launched the single largest QE program in history, with a program to buy roughly $730 billion in government bonds each year. That failed spectacularly too. So did the adoption of negative interest rates in January 2016 — perhaps its most perverse move of all. The result? Inflation in the Japanese economy is still non-existent. In fact, it’s declined from roughly 2.5% in late 2014 to -0.19% year-to-date. And Japanese GDP for the second quarter of 2016 came in at a measly 0.7%. All the while, the Bank of Japan has been buying $70bn of bonds each month, essentially monetizing Japan’s entire budget deficit. It now owns 33% of Japan’s $9.3 trillion public debt. And now, since it’s running out of government bonds to buy, the BoJ has turned to buying stock ETFs and other equities in what will be a futile bid to defibrillate the Japanese economy. According to Bloomberg: “Already a top-five owner of 81 companies in Japan’s Nikkei 225 Stock Average, the BOJ is on course to become the No. 1 shareholder in 55 of those firms by the end of next year, according to estimates compiled by Bloomberg from the central bank’s exchange-traded fund holdings. Where does this insanity end? When the BoJ buys up all stocks and bonds in Japan? It sounds certifiably crazy. But that’s the trajectory in which they’re headed. And if you think this type of monetary madness will never happen with the Fed, you should take the straightjacket off and stop licking lollipops. Yellen’s ShockerSince the start of the 2008-9 financial crisis, the Fed has followed the BoJ’s lead with their own zero interest rates and quantitative easing. And numerous Fed members, including Chair Janet Yellen, have admitted that negative interest rates are on the table, ready for deployment. But that’s just the beginning of “fun with your money”… On Wednesday, I told you about the little-known mathematical formula tucked away in a footnote of Yellen’s recent Jackson Hole speech. Many believe this “magic formula” is what the Fed will eventually use to automatically determine future interest rates. And, of course, Yellen cited the formula lovingly in the small print. Here’s why that should scare the hell out of you… If the Fed had been following this formula during the last meltdown, they would have dropped rates to -9%. That’s -9%! Consider that negative rates of just -0.4% in Europe are destroying the big banks and causing the Swiss and Germans to make a run on safes to hoard their cash. Just imagine what –9% rates will do. That’s the level of psychopathy we’re dealing with here. The bottom line is that we have unconstrained and unelected central bankers fundamentally rewriting economics, finance and basic human liberty — with zero oversight. These insane asset purchases can go on forever. They can drop rates way lower than anyone ever imagined possible. And nobody will stop them. The real problem isn’t that central bankers are out of ammunition. The problem is they have the patient tied to the operating table, with zero anesthesia, using Civil War-era surgery techniques — knowing full well that the odds of the patient surviving suck. Never, ever, underestimate how crazy things will get. Why do I worry about such projections? Just trade the trend, right? Ignore the fundamentals and ride the winners, right? You bet. That’s the plan for investing. But I also care about seeing the right thing done. Not everyone will be a trend following trader in time. Many good and hardworking people will be burned… never to recover. Please send your comments to me at coveluncensored@agorafinancial.com. Let me know what you think of the Fed’s latest scheme.

Michael Covel The post Deranged Lunatics Have Taken Over the World appeared first on Daily Reckoning. |

| USD/JPY Could Be Supported by BOJ Policy Stance Posted: 09 Sep 2016 08:09 AM PDT easyMarkets writes: When the Bank of Japan released its last monetary policy statement, many analysts expected that they would follow suit with Japanese Prime Minister Shinzo Abe and the rest of the Japanese government by releasing a large stimulus plan. Prime Minister Abe’s plan gave a 28 trillion yen stimulus plan to bolster the economy. However, the Bank of Japan did not follow suit. Instead, they decided on increasing dollar-lending and exchange traded fund purchases. Despite negative interest rates, no changes were made to the base interest rate or to the current bond-purchase program. |

| Posted: 09 Sep 2016 06:19 AM PDT gold.ie |

| Gold During Presidential Election Cycle Posted: 09 Sep 2016 04:48 AM PDT Let’s analyze the chart below which shows how gold performed each year of the presidential election cycle. The first year of a presidency is a post-election year, the second is called the midterm election year, the third is the pre-election year, and the last year is an election year. For the yellow metal, the post-election year is the worst, as it gains only 2.27 percent, on average. On the contrary, the second year of the presidency is the best for the price of gold, as the shiny metal rallies 12.82 percent, on average. The pre-election (11.21 percent) and election (8.99 percent) years are between, but gold’s highest performance is evidently closer to the midterm year. |

| 2017 Will Be a Good Year for the US Dollar Posted: 09 Sep 2016 03:37 AM PDT BY JARED DILLIAN : If you go back to the 1990s, during the Clinton years, the US followed an explicit strong dollar policy. Every time you got Treasury Secretary Robert Rubin in front of a microphone, he said the US had a strong dollar policy. And guess what? The dollar was strong. What are the benefits of a strong dollar? |

| Gold Bull Market Assurances from Michael Oliver Posted: 09 Sep 2016 01:30 AM PDT Kitco |

| Explaining the moves in the gold price Posted: 08 Sep 2016 07:00 PM PDT Speculative Investor |

| Breaking News And Best Of The Web Posted: 08 Sep 2016 05:37 PM PDT Stocks, gold down on Fed rate hike speculation. ECB leaves rates unchanged. German industrial production falls. US jobs, service sector growth disappoint. Japan preparing major new stimulus. The war on cash heats up. North Korea tests a nuke. Trump and Clinton even in latest polls. More Clinton emails to be released soon. Best Of […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Books are periodically sent to me, or recommended by readers—more, unfortunately, than I've been able to keep up with. I just finished one, however, that cried "book review".

Books are periodically sent to me, or recommended by readers—more, unfortunately, than I've been able to keep up with. I just finished one, however, that cried "book review".

Today's best-selling government fairy tale is that debt is actually wealth, that countless trillions in paper and digital currency can be spread around the world without catastrophic societal upheaval.

Today's best-selling government fairy tale is that debt is actually wealth, that countless trillions in paper and digital currency can be spread around the world without catastrophic societal upheaval. According to my new research, there is a very important Gold-Silver ratio that every precious metals investor needs to know about. While most precious metals investors are familiar with the Gold-Silver price ratio of 68/1 (presently) as well as the Silver-Gold production ratio of nearly 9/1 (2015), they have no idea about an even more important ratio that I will explain below.

According to my new research, there is a very important Gold-Silver ratio that every precious metals investor needs to know about. While most precious metals investors are familiar with the Gold-Silver price ratio of 68/1 (presently) as well as the Silver-Gold production ratio of nearly 9/1 (2015), they have no idea about an even more important ratio that I will explain below.

Welcome to the twilight zone of IMF gold sales, where transparency really means secrecy, where on-market is off-market, and where IMF gold sales documents remain indefinitely "classified" and out of public view due to the "sensitivity of the subject matter".

Welcome to the twilight zone of IMF gold sales, where transparency really means secrecy, where on-market is off-market, and where IMF gold sales documents remain indefinitely "classified" and out of public view due to the "sensitivity of the subject matter".

No comments:

Post a Comment