Gold World News Flash |

- ‘Lucky’ Larry Silverstein Designed NEW WTC-7 in APRIL of 2000

- Deutsche Bank: The US May Now Be In A Recession

- Anonymous - The TRUTH about WW3

- Gold and Gold Stocks Correction Continues

- Global Economic Overview (Brexit, China, Screwflation, Humility, Patience... )

- Silver the antidote’s: GOLD & SILVER Update

- The Great 9/11 Coverup

- Why One Hedge Fund Is Once Again Preparing For The End Of The Euro

- The Disturbing Signs Of Global Conflict Continue To Gather Pace

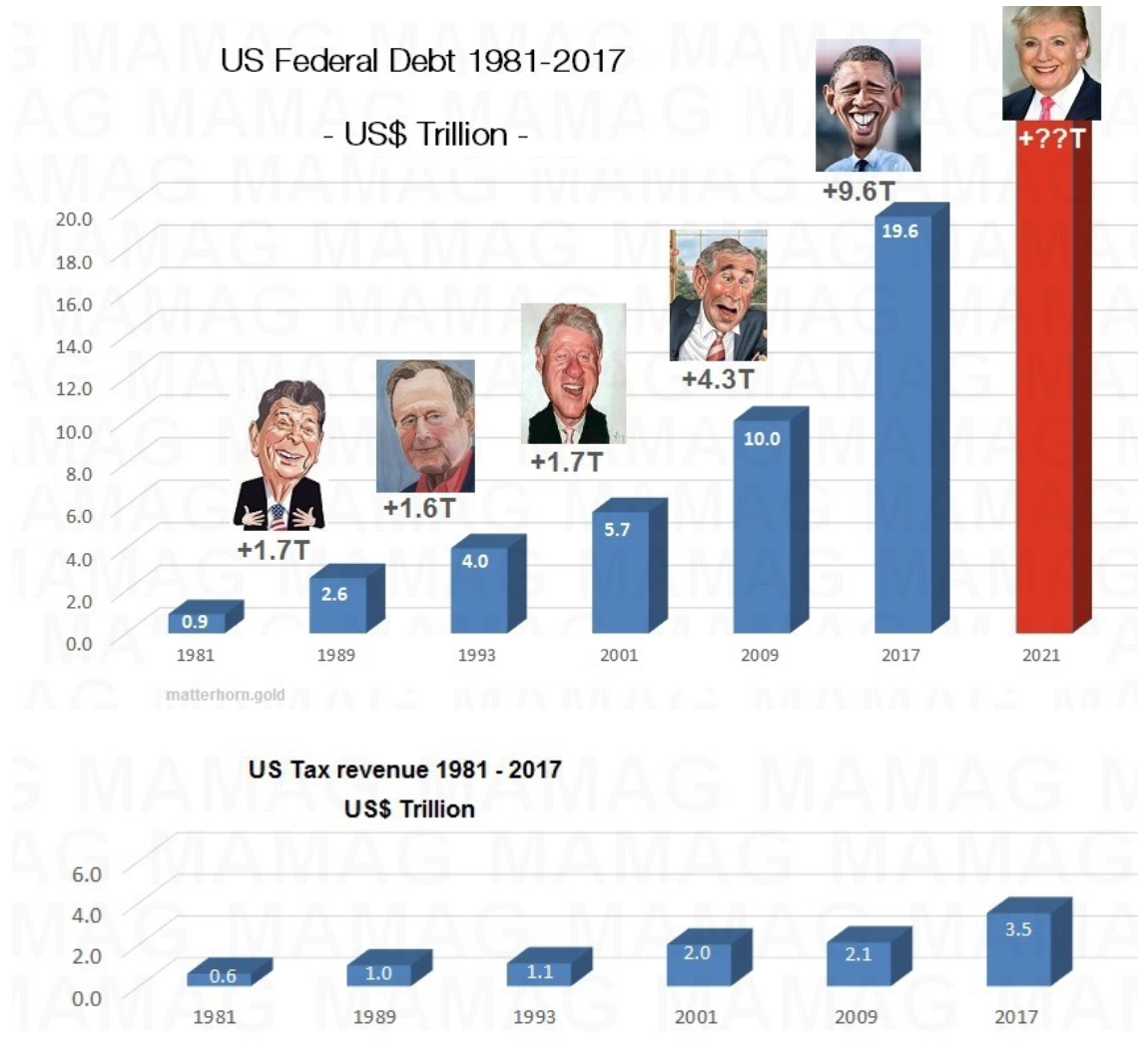

- The Six Presidents Causing US Bankruptcy

- Visualizing The (Massive) Size Of The US National Debt

- Physical Gold & Silver Demand Beginning to Stymie Government Intervention

- Jan Skoyles becomes research executive for GoldCore

- Ronan Manly: Chinese gold bar photos -- lost in translation

- GoldSeek Radio's Chris Waltzek interviews GATA Chairman Bill Murphy

- In The News Today

- Gold And Silver Are Money. Everything Else Is Debt. Globalist’s Biggest Scam

- Jubilee Jolt: Dow Down 400, Stocks Smashed In Biggest Drop Since Brexit

- High-Ranking North Korean Diplomat in London Defects to South Korea

- Breaking News And Best Of The Web

| ‘Lucky’ Larry Silverstein Designed NEW WTC-7 in APRIL of 2000 Posted: 10 Sep 2016 11:30 PM PDT “Lucky Larry” STILL bragging about his crimes of 9/11/2001 – shows no fear of impending arrest, execution by Kevin Barrett, Veterans Today:

He may just be a Silver-stein. But "Lucky Larry" sets the gold standard for chutzpah. Latest example: In the above video, Silverstein says of the new WTC-7, which replaced the one he famously confessed to demolishing on 9/11/01:

One slight problem: If he hadn't been planning the illegal, un-permitted, homicidal demolitions of WTC-7 and the entire World Trade Center complex that took place on September 11th, 2001, there would have been no point to any such design meeting back in April, 2000 … and no opportunity for beginning construction of a new WTC-7 in 2002.

With the supreme chutzpah that has become his trademark, Silverstein breezes over the demolitions of 9/11/2001 as if they were not even worth remarking on, instead going straight from his new-WTC-7 design meeting in April 2000 to the beginning of construction in 2002.

In 2001, "Lucky Larry," who had previously owned only WTC-7, orchestrated a deal with his fellow-ultra-Zionist Lewis Eisenberg, Chairman of the mobbed-up NY Port Authority, and another Zionist extremist billionaire, Frank Lowy, to sell the entire WTC complex to Silverstein and backers on a 100-year lease. The deal was finalized in July, 2001, and Larry took possession of the buildings … and security arrangements. But first, he hard-balled his insurers into doubling the terror insurance coverage and changing the terms to "instant cash payout." On September 11th, Larry hit the jackpot. The condemned-for-asbestos and largely vacant Twin Towers, with their obsolete communications infrastructure and money-hemorrhaging balance sheet, were both demolished for free – with 3,000 people inside. Larry should have been at the Windows on the World restaurant at the top of the North Tower, just like every other day. Fortunately, he tells us, his wife reminded him of a dermatologist appointment. His daughter, who always took breakfast with him, made a similarly lame excuse. Both survived … and prospered … while everyone above the 91st floor, including everyone who showed up to have breakfast at Windows on the World, died miserable deaths. Lucky Larry indeed. Larry's luck held out when he demanded double indemnity – on the basis that he had been "victimized" by two completely separate and unrelated terrorist attacks, namely the two planes – and got it, to the tune of 4. 5 billion dollars. That's a hefty cash-payout return on a relatively minor investment. (Silverstein put up less than 15 million of his own money to buy the WTC, and his backers had added a little over 100 million.) Even after video proof emerged that he had confessed to "pulling" (i.e. demolishing) WTC-7, he still somehow evaded the hangman's noose. Then he went back to court to ask for more than $10 billion more – this time not from his own insurers, but from those of the airlines he falsely blamed for the demolitions that he himself had conducted. But even the mobbed-up 9/11-complicit Zionist judge, Alvin Hellerstein, had had enough. For the full (satirical) story, check out my article: But that didn't stop not-quite-so-Lucky Larry from trying to steal another 500 million from the federal government through an EB-5 visa scam. Then last month, Larry's inimitable chutzpah resurfaced when he said that his first thought on looking at the plans for the new South Tower was "it looks like it's going to topple, it's going to fall over." At least if you "pull" on it hard enough, it might. Right, Larry? |

| Deutsche Bank: The US May Now Be In A Recession Posted: 10 Sep 2016 07:52 PM PDT Three months ago, we presented an analysis which showed something disturbing: according to Deutsche, the "current business cycle is already the fourth longest in the post- WWII period, and the corporate debt-to-GDP ratio suggests that imbalances are building", and that worse, as a result of soaring corporate debt and rolling-over profit margins, "a recession could hit as soon as the second half." Overnight, and three months since its last such analysis, Deutsche Bank has published an update. It shows that, as illustrated in the chart below, profits per worker have generally trended higher over time. This is a function of productivity gains and inflation. However, this has changed in recent years. "In the current business cycle, margins peaked at $18,752 per worker in Q4 2014. This compares to a ratio of $16,487 per worker as of Q2 2016. Margins have fallen because corporate profits have declined -6.3% annualized over the past six quarters, while private sector job growth over this period has been very steady at around 2.1%." And before we get the usual "but... but... you must exclude energy" complaints (we wonder why: it is becoming increasingly obvious that oil is not going back to $100 so the new normoil may well be crude at $50 or lower, which means including all energy-related data), here it the punchline: it's excluded. As of the latest sector-level data available through Q1 of this year, domestic profits excluding petroleum and coal products and Federal Reserve Banks were down -5.2% compared to a year ago. In fact, this series has been declining in year-over-year terms since Q2 2015. This means that recent overall margin compression has had less to do with the strengthening dollar and depressed energy prices, and more to do with weak domestic demand coupled with near-zero growth in nonfarm business productivity. From Q4 2014, when profit margins peaked, to Q2 2016, domestic profits have declined by a little less than $200 billion. As we can see in the charts below, this compares to a negligible $10 billion decline in profits from outside the US over the same period. Not surprisingly, the decline in profit growth has occurred alongside a deceleration in domestic demand. The year-over-year growth rate of real final sales to private domestic purchasers peaked at 3.9% in Q1 2015 and has since slowed to 2.3% as of last quarter.

So why are margins important? Because as we noted in our June note, margins always lead en economic contraction and always peak in advance of a recession: there has not been one business cycle in the post-WWII era where this has not been the case. The reason margins are a leading indicator is simple: When corporate profitability declines, a pullback in spending and hiring eventually ensues. Thus far, firms have reacted to declining profit growth by cutting back on capital spending and inventory accumulation and have kept layoffs to a minimum. For example, real non-residential fixed investment has declined -0.2% annualized over the last six quarters. However, this has done little to stem the tide of margin compression because unfortunately productivity growth has been just 0.1% annualized over the same period, while unit labor costs are up 2.4%. This highlights a major risk that we see to the labor market at present: Nominal income growth continues to outpace nominal GDP, a terrible situation for corporate profitability. In light of collapsing productivity, declining domestic demand, and sliding growth of real final sales, how has the US corporate sector avoided a full-blown recession so far? Simple: it has been loading up on debt to mask the income statement effects of declining demand. As DB calculates, the corporate sector has taken on a substantial amount of debt in the current business cycle. Nonfinancial corporate debt has increased by $4.5 trillion from its trough in Q4 2009 (the latest corporate debt data correspond to Q1 2016). As illustrated in the chart below, the ratio of nonfinancial corporate debt to nominal GDP is at its highest level since Q1 2009, when the economy was still in recession and nominal output was substantially depressed. Alongside tepid demand, the weakness in corporate balance sheets means that the Fed needs to be alert to any possible tightening in financial conditions, for one reason: based on nominal corporate balance sheets, the US is already effectively in a recession - the only thing preventing the hammer from falling are record low interest rates, keeping interest coverage ratios at all time lows. So if the corporate balance sheet screams recession, what does the corporate income statement say? Well, the average and median lead times between the peak in margins and the onset of recession are nine and eight quarters, respectively. This would imply... the second half of 2016. To be sure, as shown in the table below, the time period between the peak in profit margins and the beginning of recession varies substantially across business cycles. Margins can sometimes peak well in advance of the onset of recession, as they did in the 1960s and 1990s business cycles. In the former period, the peak in margins occurred 16 quarters before recession. In the latter episode, the peak occurred 15 quarters ahead of the economy's entering recession. Conceivably, such a scenario could unfold now. However, the current business cycle is already the fourth longest in the post-WWII period, and as we mentioned before, productivity growth has been abysmal. Hence, there is little cushion for the economy to absorb any negative endogenous shock. And, worse, as the chart above shows, with corporate debt-to-GDP ratio at recession highs, it suggests that imbalances have built up to the point where there is absolutely no capacity for tighter financial conditions. Summarizing all of the above: based on corporate balance sheets and income statements, the US economy may be in a recession as of this moment... and if it isn't, even just one rate hike by the Fed, either in the September 21 meeting or in December, will assure that the backbone of corporate America, already straining under record debt and tumbling profits, will finally snap. |

| Anonymous - The TRUTH about WW3 Posted: 10 Sep 2016 07:50 PM PDT Anonymous - The TRUTH about WW3 (Anonymous Message 2016) The Truth About WWIIIWe are Anonymous.We are Legion.We do not forgive.We do not forget.Expect us. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Gold and Gold Stocks Correction Continues Posted: 10 Sep 2016 07:35 PM PDT The failure of Gold and gold stocks to sustain recent gains coupled with a strong selloff to close the week dashes any hope that the correction ended last week. The charts and probabilities argue that the sector remains in a larger correction and perhaps has started the C portion of a typical A-B-C (down-up-down) correction. |

| Global Economic Overview (Brexit, China, Screwflation, Humility, Patience... ) Posted: 10 Sep 2016 07:14 PM PDT

In this letter we are taking up the ambitious goal of painting a picture of the global economic landscape as we see it, in order to walk you through the investment process that we been fine tuning for this less-than-exciting picture. The Answer Is Not in Your Econ Book The Great Recession may be over, but seven years later we can still see the deep scars and unhealed wounds it left on the global economy. In an attempt to prevent an unpleasant revisit to the Stone Age, global governments have bailed out banks and the private sector. These bailouts and subsequent stimuli resulted in swollen global government debt, which jumped 75% from $33 trillion in 2007 to $58 trillion in 2014. (These numbers come from a recent McKinsey study on global debt. They are the latest numbers we have, but we promise you they have not shrunk since.) A lot of things about today's environment don't fit into economic theory. Ballooning government debt should have brought higher – much higher – interest rates. But central banks bought the bonds of their respective governments and corporations, driving interest rates down to… well, today a quarter of global government debt "pays" negative interest. The concept of positive interest rates is straightforward. You take your savings, which you amass by foregoing current consumption – not buying a newer car or making fewer trips to fancy restaurants, and lend them to someone. In exchange for your sacrifice you receive interest payments. With negative interest rates something very different happens: You lend $100 to your neighbor. A year later, the neighbor knocks on your door and with a smile on his face repays that $100 loan in full by writing you a check for $95. You had to pay him $5 for foregoing your consumption of $100 for a year. This is what negative interest rates are! Try to explain this logic to your kids. We tried to explain it to ours and failed, miserably. The key takeaway is this: negative and near-zero interest rates show central banks' desperation to avoid deflation, and more importantly they highlight the bleak state of the global economy. In theory, low and negative interest rates were supposed reduce savings, get consumers off their butts, and stimulate spending. In practice the opposite has happened – the savings rate has gone up. As interest rate on their deposits declined, consumers felt that now they had to save more to earn the same income. Go figure. Some countries resort to negative interest rates because they want to devalue their currencies. This strategy suffers from what economists call the fallacy of composition – the mistaken assumption that what is true of one member of a group is true for the group as a whole. As a country goes to negative interest rates, its currency will decline against others – arguably stimulating its export sector (at the expense of other countries). But there is absolutely nothing proprietary about this strategy: other governments will do the same, and in the end all will experience lowered consumption and a higher savings rate. The following point is so important we want to repeat it, bold it, italicize it, and underline it: If our global economy was doing great, interest rates would not be where they are today! As We Zoom in Things Get Worse Let's start with Europe, the world's second largest economy. European political (EU) and monetary (EMU) unions were great experiments that made a lot of sense on paper. Europe, which had roughly the same size population and economy as the US, was at a competitive disadvantage, as dozens of currencies embedded extra transaction costs in cross-border trade, and each currency separately had little chance to compete with the US dollar for reserve currency status. There were also important noneconomic considerations. Germans were haunted by their past; they had started two world wars in the 20th century, and a united Europe was their way of lowering the chances of future European wars. EMU sounded like a very logical marriage of all the significant powers of post–World War II Europe. But the arrangement was never really a marriage; it was more like a civil union. EMU members combined their currencies into one, the euro. They agreed to use the same central bank and thus implicitly guaranteed one another's debts. Though treaties put limits on budget deficits (limits that, ironically, Germany was the first to exceed), each country went on spending its money as it wished. Some were relatively frugal (like Germany); others (Portugal, Ireland, Italy, Greece, and Spain) went on spending binges like newly hitched college students who had just gotten their first credit card, with an irresistibly low introductory rate and a free T-shirt. The European Union is a collection of states that are vastly different from each other. They are separated by culture, language (which impedes labor mobility resulting in semi-permanent labor productivity disparity between countries – think Greece and Germany), economic growth rate, total indebtness, and history. (Germany, for instance, suffered through hyperinflation in the early twentieth century and is thus paranoid about inflation.) Now let's turn to Brexit – the UK referendum on exiting the EU. Ironically, the UK doesn't have half the problems that most EU nations are going through. Since it is not part of the European Monetary Union, it has retained its currency and its central bank. The UK's main dissatisfaction with EU membership is due to the immigration issue. Since treaties have turned the EU into a borderless union, when Germany accepted refuges from Northern Africa it basically made a unilateral decision on behalf of all EU members to accept those refuges to all EU countries. High unemployment, wage stagnation, and Muslim terrorism are now endemic in the EU, and you can see how the UK citizenry might have a problem with this. After the Brexit vote, the financial media lit up with opinions on its consequences for the EU and global market economy. They've varied from "Brexit is a non-event" to "This is a Lehman moment for the global economy" (referring to Lehman Brothers going bankrupt and almost bringing the financial system to a halt in 2008). The arguments on both sides are quite convincing: The argument for Brexit being a non-event is simple and straightforward. The UK maintained its currency; thus dis-joining the EU will bring lower complexity. The UK and EU will forge new trade treaties. There is a fear that the EU may impose trade sanctions on UK, not so much to punish the UK as to threaten other EU members that exit will come at a stiff economic cost (effectively turning this voluntary club into a prison). However, the UK is a net importer of goods from the EU; thus any sanctions will hurt remaining EU members more than the UK. Of course, the UK may never exit the EU. The referendum was not binding; it was there to measure the temperature. The new prime minister may decide to ignore the will of the people and remain in the EU. The Lehman moment argument is less simple, but it is not unimaginable either. Brexit may provide a spark that will ignite already gasoline-soaked ground. Though the EU and EMU were supposed to unite Europeans, they may have had the opposite effect – they may have caused a groundswell of nationalism. In all honesty, we are concerned more about Italy than the UK. Italy is the third largest economy in the EU and the second most indebted one. Its debt to GDP stands at 132% (Greece is at 171%). Seventeen percent of Italian bank loans are non-current. In the depths of the financial crisis, that number was 5% in the US. Italian lenders account for nearly half of bad debt in the EU (source WSJ). If Italy was not part of the European Monetary Union (EMU), it would just print lira and bail out its banks. But it gave up that luxury when it joined the EMU. To make things worse, in 2014 the EU passed a law that prohibits governments from bailing out their banking systems; thus the shareholders, debtholders, and depositors may bear the brunt of the eventual bailout. Unless the EU passes a new law that bends the 2014 law – or the Italian government takes matters into its own hands, violating the EU charter – we may see Italian debtholders and depositors hit with the cost of bank bailouts take to the streets and demand "Italexit." Nationalism is a highly emotional, zero-sum, us-against-them sort of business. Add immigration concerns on top of economic ones and it's not hard to see how Europe has turned into a highly combustible mixture looking for a match. And since emotions are often anti-logical, future decisions by EU countries may not necessarily be beneficial to the European continent. Since the situation in Europe is so complex and combustible, we don't know whether Brexit will be just another match that simply burns out or the one that starts the fire. Will it trigger other exits? Will it slow down EU growth, thus straining an already leveraged system? We don't know, and nobody does. China is the third largest economy in the world and is living through the largest debt bubble we probably we'll ever see in our lifetime. From 2007 to 2014 its debt quadrupled from $7 to $28 trillion (according to McKinsey). Over the same time period its economy tripled, growing from $3.5 to $10.5 trillion. These numbers are staggering, and they point to one indisputable fact: all Chinese growth since 2007 came from borrowing. There was no miracle in it. But it gets worse, much worse. The numbers also show that every $1 of new debt brought only cents of GDP growth. In the absence of skyrocketing debt, the Chinese overcapacity bubble, which was already fully inflated pre-2007, would have burst years ago. As the government continues to engineer growth using debt, every yuan of debt will bring less growth. The laws of economics have not been suspended in China. American economist Herbert Stein's law states that things that cannot go on forever, won't. When its debt bubble bursts, China will turn from being a tailwind for global growth into a headwind. This brings us to the world's fifth largest economy, Japan. It is the most indebted developed nation in the world – its debt to GDP is over 230%. Japan is the proof of Herbert Stein's law – its economy is still suffering a hangover from what at the time seemed an endless real estate party (bubble) that lasted from the mid '80s into the early '90s. Japan has been on the QE and endless stimulus bandwagon longer than anyone else and has nothing (well, except a lot of debt) to show for it. Japan also has the oldest population in the world – 26% of its population is older than 65 (in contrast to the US, where the figure is only 15%). Rising debt and an aging population are a double negative for the economy, as debt per capita is rising at an even faster rate than total debt. And since the working population is declining at an even faster rate than the population, debt per working person is growing at an even faster rate. From what we just told you, you might think Japan is paying the highest interest rates in the world, somewhere in the high teens. Wrong! The Japanese ten-year bond yields negative interest. We just spilled a lot of digital ink to give you a brief overview of what we see around the world. We did not do it to increase your consumption of alcohol or anti-anxiety medicine. We did it for a few reasons. First, we wanted to show you that stock market performance has not been driven by the improving health of the global economy. Just as negative interest rates are not a positive for the continued health of the economy, nor does current stock market performance augur rosy future returns for stocks. In fact, the opposite is true. The bulk of the stock market gains are due to one variable: the expansion of the price-to-earnings ratio. S&P 500 earnings have stagnated since 2014. Stock prices have gone up because the Federal Reserve and other central banks have squeezed all investors to the right side of the risk curve. Stocks, and especially high-quality ones that pay dividends, are looked upon as bond substitutes. Investors now look at the dividends of those stocks and compare those yields to what they can earn in Treasuries. This strategy will end in tears, as these bond-substitute stocks are significantly overvalued (see Coke example further on). Secondly, we wanted to show you the headwinds we are facing and what we are doing to avoid having them deflate the sails of your portfolio. Summarizing, these headwinds are: The risk of lower or negative global economic growth. If we get higher economic growth, we'll treat that as a bonus. Something-flation. Inflation (high interest rates), deflation (low interest rates) or screwflation (higher interest rates and deflation). We don't know which of these extremes we'll see and in which order. Nobody does. Despite their eloquence and portrayed confidence, financial commentators arguing one or another extreme point of view on CNBC don't know, either. In fact, the more confident they are more dangerous they are. The difference between us and them is that we know we don't know and are therefore trying to construct an "I don't know" portfolio that can handle any extremes. And finally, stock valuations will decline. This is a time for humility and patience. Humility, because saying the words "I don't know" is difficult for us testosterone-laden alpha male money manager types. Patience, because most assets today are priced for perfection. They are priced for a confluence of two outcomes: low (or negative) interest rates continue to stay where they are (or decline further) and above-average global economic growth. Both happening at once in the future is extremely unlikely. Take one of them away (only one!) and stock market indices are overvalued somewhere between a lot and humongously (we don't even try to quantify superlatives). Take both away and… Vitaliy N. Katsenelson, CFA, is Chief Investment Officer at Investment Management Associates in Denver, Colo. He is the author of Active Value Investing (Wiley) and The Little Book of Sideways Markets (Wiley). |

| Silver the antidote’s: GOLD & SILVER Update Posted: 10 Sep 2016 07:00 PM PDT from Silver The Antidote: |

| Posted: 10 Sep 2016 06:50 PM PDT Authored by Eric Zuesse, originally posted at Off-Guardian.org, Did you happen to notice that after more than a decade of the ‘news’ media’s demanding publication of “the missing 28 pages” (which turned out actually to have been 29 pages) from the U.S. Congress’s investigation into 9/11, the document’s press-coverage, finally, on 15 July 2016, turned out to have been little-to-none? And did you notice that the little there was, said it contained nothing important? Perhaps you didn’t get to know even this much about the press-coverage of it, because the U.S. Congress, which had been hiding the document ever since 2003, dumped it on a Friday night, in order for it to receive as little press-coverage as possible. Well, what that document actually showed, and proved (and cited FBI investigators who could then have testified in public, if requested), was the opposite of unimportant: that the Saudi Ambassador to the United States, Prince Bandar bin Sultan al-Saud (who was known in Washington as “Bandar Bush,” because of his closeness to the Bush family), had secretly been paying the Saudi handlers of at least two of the 15 Saudis among the 19 9/11 hijackers, and that Bandar’s wife and other relatives were also paying those hijackers-to-be, and their families — thus enabling the future hijackers to obtain the necessary pilot-training etc., for the 9/11 attacks. How much news-coverage of this was there in the U.S.’democracy’ that is supposed to be informing the public about such things, instead of continuing the cover-ups of them? Why do U.S. ‘news’ media hide it — after having demanded for more than ten years that the ‘missing 28 pages’ become published? But that’s not all there is to the cover-up: As I mentioned and documented in my July 20th news-report on “9/11: Bush’s Guilt and the ’28 Pages’,” U.S. President George W. Bush was also involved in the 9/11 operation: He had instructed his National Security Advisor Condoleezza Rice to block his obtaining from U.S. government sources any specific information about what the attacks would entail, or about the date on which they would occur. (Presumably, he already knew, via his private communications with Prince Bandar or someone else who was in on the event’s planning, all that he had wanted to know about the coming event.) When CIA Director George Tenet, on 10 July 2001, was practically screaming to Rice to allow him into the Oval Office, to meet privately with the President to inform him of how urgent the situation had become to take action on it, she said: “We’re not quite ready to consider this. We don’t want the clock to start ticking.” Tenet was shocked, and dismayed. That encounter with Rice was intended to urge the President to establish a hit-team to take out bin Laden, so as to avert the operation — whatever it was, or would turn out to be. The way that Chris Whipple put this, in his terrific report in Politico magazine, on 12 November 2015, titled “The Attacks Will Be Spectacular”, was that, “they did not want a paper trail to show that they’d been warned.” Apparently, “Bandar Bush” knew the details, but his friend George W. Bush did not — Bush needed “deniability” — it’s not for nothing that he was able to say, after the event, as Condoleezza Rice was to put it when speaking to reporters on 16 May 2002, “This government did everything that it could in a period in which the information was very generalized, in which there was nothing specific to react to … Had this president known of something more specific, or known that a plane was going to be used as a missile, he would have acted on it.” How does she now square that statement with her having told Tenet, on 10 July 2001, “We’re not quite ready to consider this. We don’t want the clock to start ticking.”? What ‘clock’? Why not? No one asks her — especially not under oath. Is that the way things happen in a democracy, even 15 years after the event? On 10 September 2012, Kurt Eichenwald, who had reported for The New York Times, was then issuing his new book on the aftermath of the 9/11 attacks, 500 Days: Secrets and Lies in the Terror Wars, and he headlined an op-ed then in his former newspaper (which thus could hardly have declined to accept it), “The Deafness Before the Storm”, describing the most puzzling aspect of the lead-up to 9/11: It was perhaps the most famous presidential briefing in history. On Aug. 6, 2001, President George W. Bush received a classified review of the threats posed by Osama bin Laden and his terrorist network, Al Qaeda. That morning’s “presidential daily brief” — the top-secret document prepared by America’s intelligence agencies — featured the now-infamous heading: “Bin Laden Determined to Strike in U.S.” A few weeks later, on 9/11, Al Qaeda accomplished that goal. On April 10, 2004, the Bush White House declassified that daily brief — and only that daily brief — in response to pressure from the 9/11 Commission, which was investigating the events leading to the attack. Administration officials dismissed the document’s significance, saying that, despite the jaw-dropping headline, it was only an assessment of Al Qaeda’s history, not a warning of the impending attack. While some critics considered that claim absurd, a close reading of the brief showed that the argument had some validity. That is, unless it was read in conjunction with the daily briefs preceding Aug. 6, the ones the Bush administration would not release. While those documents are still not public, I have read excerpts from many of them, along with other recently declassified records, and come to an inescapable conclusion: the administration’s reaction to what Mr. Bush was told in the weeks before that infamous briefing reflected significantly more negligence than has been disclosed. In other words, the Aug. 6 document, for all of the controversy it provoked, is not nearly as shocking as the briefs that came before it. Those “briefs” still are not published. And now, after the revelation, by Chris Whipple, that Condoleezza Rice was under instruction from her boss not to allow him to be informed too early for “the clock to start ticking,” we can understand why there is still so much that hasn’t yet been released to the public, in our ‘democracy’, about who was really behind 9/11. On 17 April 2016, Paul Sperry in the New York Post headlined “How US covered up Saudi role in 9/11”, and he reported that his own investigation showed: “Actually, the kingdom’s involvement was deliberately covered up at the highest levels of our government. And the coverup goes beyond locking up 28 pages of the Saudi report in a vault in the US Capitol basement. Investigations were throttled. Co-conspirators were let off the hook.” But isn’t it time, now, to demand that Bush’s role also be explored — not only that the Saud family’s (especially Bandar’s) role in it be prosecuted? After all, Bush was the one who took a Presidential oath. Or: Is the U.S. not enough of a democracy, for that to happen — for the Constitution to be enforced, by the U.S. President after Bush (the President who will not prosecute his intended successor)? How total must the non-accountability at the top be, before we call the country a “dictatorship” — only a fake ‘democracy’? Regarding the actions that brought down the three World Trade Center Buildings, WTC1, WTC2, and WTC7, there also is good reason to distrust the official ‘history’. Witness accounts both by firefighters and by the general public were videoed at the time saying that they heard multiple explosions, which indicated controlled demolitions after the two plane-crashes into WTC1 and WTC2. Other witnesses of the WTC7 collapse also heard explosions. Regarding WTC7, there was testimony from the owner of the WTC, Larry Silverstein, saying that he instructed the Fire Department not to go into WTC7 but simply to “pull it.” (And his subsequent statement saying he didn’t really mean that and he meant only to “pull” the firefighters from that building, which actually had none, was debunked.) Even the government’s “Final Report on the Collapse of World Trade Center Building 7” acknowledged (p. 48) that there had been “(2) a freefall descent over approximately eight stories of gravitational acceleration for approximately 2.25 s[econds]” meaning that that 8-story segment had been blasted so that, throughout those 8 stories, there was zero resistance to the collapsed portion falling through it from above. This alone constitutes solid and conclusive physical proof of the official lie, though itself published in the official source. And yet on the very next page in that official document is stated, “Blast events did not play a role in the collapse of WTC 7. … There were no witness reports of such a loud noise.” But there were such witness reports; and, anyway, the very admission (on the prior page) that there was free-fall over an 8-story segment of the building, constitutes acknowledgement of physical proof that there had been controlled demolition on WTC7. Further, there has even been expert testimony that nano-thermite was used to bring down each of these buildings. But clearly, whatever the truth of the matter is, the U.S. Government has been lying, and continues to lie, about 9/11. For at least the past 16 years, we’ve been living in a dictatorship. And the evidence suggests that this has been the case ever since at least 1981. * * * |

| Why One Hedge Fund Is Once Again Preparing For The End Of The Euro Posted: 10 Sep 2016 06:20 PM PDT Our friends at Fasanara Capital have released a new report, which in keeping with the Mayfair fund's recent trend of gloomy predictions, has looked beyond the current set of adverse socioeconomic development jarring Europe, and looks forward to the "last act of the Euro", explaining why "whatever it takes" is now over, and why the time to panic about the future of the common currency is once again nigh. Here is their latest analysis: The last act begins for the EUR peg Why the EUR-peg is likely to break We have long been negative on the prospects for the EUR peg to survive the test of global structural deflation and local ineffective policymaking. Back in 2013, we wrote of the instability and unsustainability of a currency construct set for failure. At the time, we highlighted three big problems with it:

The implosion of the EUR may not be such an outlier in financial history: after all, each and every fixed exchange-rate regime in history was let go, sooner or later. However, there was reason for hope this last June. The Brexit referendum sent an unequivocal message in rejection of the current state of affairs of EU policymaking. In addition to issues with migrations flows and income inequality, the anti-elite stance taken against Brussels was hard to miss. The more so as it added to several other indicators of anti-elite discontent all over the world, from the rise of Trump in the US to support for extremists in Austria and Hungary, etc. Brexit was part of a trend, not an isolated data point. Sure thing, secular stagnation, technological disruption and globalization all conspire to feed on income inequality and stagnant real wages to a point where they can easily serve as scapegoats. But the EU crisis policymaking fell short (unable to avert deflation), if not backfired (new QE is disinflationary), while the EU red tape super-state exacerbated the crisis (further impediment to growth), leading to the political defeat of Brexit. First and foremost, it was a defeat for the EU. On grounds of logical thinking, it should have worked as the proverbial canary in the coal mine, the last minute wake-up call averting disaster. It did not. In the aftermath of the Brexit referendum, we thought Europe had the unmissable chance to seize the opportunity for building consensus for deep structural reforms of the EU, acknowledging defeat and learning from past mistakes. Yet, despite the second biggest GDP in the EU opting to drop out, the EU is very much business as usual, much as Brexit never happened. To this day, no grand action plan is in sight, no sense of urgency, except the idea of bullying the UK upon negotiations in an attempt to deter further uprising across Europe. The list of past mistakes is long and getting longer:

On the other hand, we believe only a dramatic shift in narrative at the EU level could derail the train before it hits the wall, with measures including:

The biggest threat to EU survival is then not so much Brexit but the lack of response that followed. The dramatic warning signal shot by Brexit fell on the deaf ears of inadequate EU policymaking. We doubt the UK will ever prove weak enough to help the case of the EU current policymaking. If anything, so far it seems like the UK is performing remarkably well, if one is to look at the business and consumer confidence surveys of late. The GBP is weaker than any QE by Mervyn King/Mark Carney could ever achieve/dream of. But is surely too early a time to draw conclusions, Article 50 has not even been triggered yet. Chances are, though, that the UK will do ok even after that, relative to the rest of Europe. We expect a mild recession, if any, and a rebound afterwards. And that is just more problem for Europe (see also Fasanara Interview at CNBC: Brexit: don't think UK is 'standing on the cliff of a disaster'). The UK doing well will send another unequivocal message to struggling EU countries: there is life after the EU. Professor Joseph Stiglitz has recently reaffirmed his view that the EUR will break, as 'the cost of keeping the Eurozone together probably exceeds the cost of breaking it up'. Earlier this year, former BoE's Governor Mervyn King predicted the collapse of the Eurozone. Russia's President Vladimir Putin recently said that Russia holds 40% of its FX reserves in EUR, while he thinks the Union may comprise fewer stronger countries in the future (see BBG interview), thus leading to an appreciating EUR. The time for treating the EUR-peg as a taboo may soon be past us, and an open discussion become the dominant narrative, in pursuit of a long-term durable solution to economic stagnation, in an attempt to save the European Union, so to orderly drive the process as opposed to end up being overwhelmed by the trending course of events. Timeline for a EUR de-peg In terms of timing the de-peg, other than saying that whatever is unstable and unsustainable will necessarily have to come to an end, that no fixed currency regime ever survived the test of time, the next obviousness is to say that it is impossible to know what precise trigger will precipitate events. However, one can look at the steady growth of EUR-sceptics across Europe, and interpolate from there to get some rough idea. At present, when looking through populist parties and EUR-sceptics, an estimated 30%-40% of the European electorate would stand to vote against staying in the Monetary Union (which does not necessarily mean leaving the EU). That number shrunk somehow after the Brexit vote, in fear of disaster hitting the shores of the UK. One year from now, it may be evident that the UK is doing just fine, while some parts of Europe further crumbled. At that point, the 30%-40% will have become 50%-60%, offering the political capital for a regime change. That may trigger the change in course for crisis policymaking that might have happened today if only the strong message of Brexit was not wasted. At that point then, the EUR-peg may be going, in one of two ways: orderly sacrificed in an attempt to preserve the EU, or disorderly as momentum/chaos takes the upper hand. So far QE provided the glues and tapes to stick the broken pieces together in Europe. Now though, it seems that QE may be running out of steam. * * * Tomorrow we will present the second part of Fasanara's analysis looking at why QE no longer works. |

| The Disturbing Signs Of Global Conflict Continue To Gather Pace Posted: 10 Sep 2016 05:50 PM PDT Submitted by Graham Vanbergen via Stratgic-Culture.org, The signs are ominous, the rhetoric constant. Whichever way you look at it, the world is slowly descending into an ever greater spiral of conflict. We all know that the current wars raging in the Middle East have the potential to go catastrophically wrong and pull the super-powers into something much bigger. You also know things are not good when the so-called ‘conspiracy theories’ from alternative media outlets eventually goes mainstream, and there’s no shortage:

To confirm the state of the world today, the Global Peace Index states, and I quote – “There are now only ten countries in the world that are free from conflict”. The Independent has a 40 second video (HERE) of these ten countries, it’s worth watching, you’ll be surprised... Some believe World War III has already started, most dispute that. It takes no more than a spark to light the fire and currently there are a lot of sparks flying around. Even political instability in the European Union as a result of a refugee crisis is a cause for concern. Pew Research, published just last month, confirmed that European’s fear a wave of refugees will mean more terrorism and fewer jobs. Violent protests have broken out, politician’s are worried. The VP of the International Relations Committee at Hungary’s parliament, Jobbik Member Marton Gyongyosi was supported by other EU leaders when he has suggested that “physical protection of our borders” is required. He went further –

In that context, a few EU leaders are calling for an EU wide army and its own intelligence service. It seems America and therefore NATO are not as trusted as they once were. The US/EU trade deal TTIP, the largest deal in the history of humanity, is reported as being over. Is this evidence of the widening gap of disagreement, maybe. The outcome is a changing political landscape. Before the European Union was created by the Maastricht Treaty on November 1st 1993 there were just 25 nationalist political parties. Since the birth of the formalised EU there has been a 150 per cent rise in political parties on the extremes of the political spectrum, now totalling 64. One of them was Ukip that focused on immigration and subsequently produced the ‘Brexit’ protest vote that now threatens to tear the EU project apart. North Korea is a wild card scenario – anything could happen, but if South Korea was attacked, America would have no option but to step in. And what would China do – it’s anyone’s guess. Tension has substantially risen around the world over USA and Russia/China relations, the South China Sea, Ukraine and Crimea, multiple Mid-East conflicts, north Africa and South America. One should not forget currency wars, economic and political sanctions adding to the global strain. John Pilger’s interview on the Threat of World War Three leaves the viewer in no doubt as to where he lays blame, and if anyone knows about war, he should, he’s covered most of them since Vietnam. Even basic resources are a cause for concern. Natural water for one, food scarcity, food security and environmental disasters all add to a backdrop where global terrorism is massively on the rise, global debt is now a third bigger than prior to 2007, mass protests due to political instability, such as South America (Brazil being a new hotspot) all adding to increasing tension. The geo-political situation is now characterised by ever-increasing militarism across the world, bringing the prospect of another world war closer than at any time since 1939. Scrutinising the underlying issues and causes for the devastating outbreak of World War I in 1914 which ended up killing 17 million, Leon Trotsky laid bare the startling similarities between the crisis of the world economy at the time and the turn to militarism. Historical records display a relevance for today that should serve as an advance warning of the horrors that extreme neoliberalism and globalisation offers up if we do not make efforts to pull back from the brink. From WSWS in an article entitled “Capitalist breakdown and the drive to war,” comparisons are made between the extreme economic conditions just prior to the first world war and today.

Corrupt bankers represent a threat not only to those they directly rip off but also potentially the entire global financial system, the Governor of the Bank of England has warned. The parallels are striking, particularly as the financial crisis forced upon us in 2007/8 by an out of control banking system, that benefited a tiny elite, caused wave after wave of economic turbulence, austerity and the dismantling of the social democratic movement that itself was born from the wreckage of World War Two. Peoples across the world are getting angry as inequality worsens. Mark Carney has written a very strongly worded letter, in his capacity as chair of the Financial Stability Board (FSB) to a global forum of national regulators, financial ministries and central banks – to the G20, which is currently meeting in China. “The incidence of financial sector misconduct has risen to a level that has the potential to create systemic risks” he says. The message is quite clear. Carney believes there is another systemic crisis centred around financial markets. Even he believes and openly stated that corrupt bankers now represent a threat not only to those they directly rip off but also to the entire global financial system. Last year, just four of Britain’s banks were fined well over £50billion ($67bn) for their egregious acts of criminality. Prison beckoned for no-one, whilst poverty soared. Don’t forget the London riots. Spreading like wildfire, the resulting chaos generated looting, arson, and mass deployment of police and resulted in the death of five people. In just three days, a dozens towns and cities were no-go areas of violence, 3,443 crimes reported, over a thousand arrests – from an unrelated spark. According to Jim Rickards, the CIA’s Asymmetric Warfare Advisor, the probability of a new global conflict is rising every day. In a startling interview from last year he reveals that all 16 U.S. Intelligence Agencies have begun to prepare for World War III. Richards is predicting the fall of the dollar with the result of “an extended period of global anarchy”. In the meantime, Russia is preparing to be attacked by NATO and America. Global Research reports that “Colonel General Leonid Ivashov, President of the International Centre of Geopolitical Analysis explained in an interview to KP, that ‘if data on Russia-NATO power balance at the Western direction is analyzed, as well as military activity build-up rate at our borders, scale of combat equipment deployment, if the grade of Russia’s demonization is estimated, one can say that preparation to a real war is taking place, as such acts are usually undertaken at the forefront of a war.’ Russia, so threatened by the West, it is now building huge nuclear bunkers around Moscow to protect itself at a time when financial resources are at best ‘stretched’. As TIME reports “The South China Sea has instantly become uncharted waters for the globe’s two most-powerful nations. The ruling from the Netherlands, while legally binding, has no mechanism for enforcement. That means negotiations will be required to ease the growing territorial tensions in and around the South China Sea. If talks don’t happen, or go nowhere—and China continues to refuse to back down—a military clash could occur.” Dr.Paul Craig Roberts quite firmly believes a Third World War is currently being fought. How long before it moves into its hot stage he asks.

“We have already seen what the New World Order has done with Islam” As Pope Francis says, “they have used it to foment a crisis, a clash of civilisations” Even The Pope believes the start of World War Three is underway – ““To be clear, when I speak about war, I speak about real war. Not a war of religion. There is a war of interests. There is a war for money. There is a war for natural resources. There is a war for domination of peoples” Pope Francis said, alluding to globalisation and the goals of the so-called New World Order of complete and total control over every human being on the planet. Already, the world has more displaced people than at any time during the course of either World War One or Two. The fight for resources as a direct result of globalism now threatens peace on every continent in the world. The Doomsday Clock is an internationally recognised design that conveys how close we are to destroying our civilisation with dangerous technologies of our own making, nuclear weaponry by far our most dangerous experiment, makes the clock tick each year. It puts the current time of war at 23.57 – just 120 seconds left. The current position of the Doomsday Clock is the closest it has been since 1984 and is actually a few clicks closer to reaching a global extinction event for humans than in 1962 when the Cuban missile crisis had twitchy American and Russian fingers on red buttons. What a cataclysmic ending for humanity, bombed back into the stone age. For what? |

| The Six Presidents Causing US Bankruptcy Posted: 10 Sep 2016 05:30 PM PDT by Egon Von Greyerz, Gold Switzerland:

After 55 years of US deficits debt has grown from $286Bn to $19.6T Reagan was hailed as a superb president primarily because he (like Thatcher in the UK) assumed power at the bottom of the economic and stock market cycles. So they were lucky to get in at the right time. But few people realise that Reagan achieved this by almost tripling debt from $0.9 trillion to $2,6T. So in eight years Reagan incurred $1.7T of debt which is almost twice what all the presidents before him had incurred since 1789. And from then on every single president continued on the neck braking deficit course. Most people believed that Clinton managed the US economy particularly well and created surpluses for the first time in 35 years. But what the Clinton administration succeeded particularly well with was to cook the books rather than to create surpluses. Because in every single year of the Clinton administration, federal debt increased in spite of the fact that budget surpluses were shown. And by the time Clinton left in 2001, he had managed to add another $1.6T debt to make the total $5.7T. Next record breaker was Bush Jr who increased debt by $4.3T from $5.7T to $10T. But Obama has been the most productive of all presidents so far. Remember that it took the US 219 years to go from zero debt to $10T. Then "Après nous le Deluge" (after us the deluge) Obama took over and before he has finished, US debt will be around $20T. That is the most astonishing increase in national debt in history excluding hyperinflationary economies. And remember that this figure does not include the Fed's money printing or unfunded liabilities nor personal or corporate debt which all have grown exponentially. With all of that we can add at least $250 trillion! US Debt will never be repaid

Thus in the last 36 years, US debt will have increased 22 times. It took 220 years to reach $10 trillion debt and Obama has achieved to double this in only 8 years. Having already received the Nobel peace prize, he should perhaps also be awarded the Noble Prize in Economics as the most productive president in world history. The second chart above shows US tax revenue from 1981 to date. Tax receipts have gone from $900 billion to $3.5 trillion, a 5.8 times increase. SINCE 1960 THE US HAS NOT PRODUCED A REAL BUDGET SURPLUS IN ANY SINGLE YEAR. WITH DEBT UP 22X SINCE 1981 AND TAX REVENUE UP ONLY 5.8X, IT IS TOTALLY CLEAR THAT THE US DEBT CAN NEVER BE REPAID WITH THE ONLY REALISTIC SOLUTION BEING DEFAULT AND BANKRUPTCY. Neither presidential candidate will solve the US debt catastrophe Even under normal circumstances and without major recessions, the US deficit is forecast to grow substantially in coming years. The promises of Clinton/Trump will also contribute to escalating deficits. Add to that a serious recession, increasing interest rates and a derivative debacle and we will see deficits not only in the dollar tens but in the hundreds of trillions. Thus Clinton/Trump are likely to preside over a US default. A country that for 55 years cannot manage its finances properly is on the road to perdition. It is only a matter of time before the US economy implodes. And as the country implodes, so will the US dollar. A currency that is just supported by worthless debt and by a weakening military power, does not qualify for the role as reserve currency. And that is why the hegemony of the US and the dollar is now coming to an end. The country will clearly not give up this role without putting up a massive fight. This could sadly involve starting major military conflicts even of nuclear proportions. It is also guaranteed to involve money printing of a magnitude never seen before in history. |

| Visualizing The (Massive) Size Of The US National Debt Posted: 10 Sep 2016 05:20 PM PDT When numbers get into the billions or trillions, they start to lose context. As Visual Capitalist's Jeff Desjardins notes, the U.S. national debt is one of those numbers. It currently sits at $19.5 trillion, which is actually such a large number that it is truly difficult for the average person to comprehend. How big is the U.S. National Debt?The best way to understand these large numbers? We believe it is to represent them visually, by plotting the data with comparable numbers that are easier to grasp. Courtesy of: The Money Project

Today’s data visualization plots the U.S. National Debt against everything from the assets managed by the world’s largest money managers, to the annual value of gold production.

* * * Source: The Money Project - an ongoing collaboration between Visual Capitalist and Texas Precious Metals that seeks to use intuitive visualizations to explore the origins, nature, and use of money. |

| Physical Gold & Silver Demand Beginning to Stymie Government Intervention Posted: 10 Sep 2016 03:00 PM PDT by Mike Gleason, Money Metals:

Precious metals markets surged Tuesday to open the holiday-shortened week. But they have given back some of those gains since Wednesday. Click HERE to Listen |

| Jan Skoyles becomes research executive for GoldCore Posted: 10 Sep 2016 12:47 PM PDT 3:47p ET Saturday, September 10, 2016 Dear Friend of GATA and Gold: Jan Skoyles, lately of The Real Asset Co. and Coinsilium Group in London, who often has appeared on financial news programs involving gold, has become research executive at bullion dealer GoldCore. GoldCore's announcement of Skoyles' appointment is here -- http://www.goldcore.com/us/gold-blog/jan-skoyles-appointed-research-exec... -- and her first commentary for the company, headlined "Gold, Silver, Blockchain, and Fintech -- Solutions to Negative Rates, Bail-ins, Cash Confiscations, and Cashless Society," is here: http://www.goldcore.com/us/gold-blog/jan-skoyles-appointed-research-exec... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT NewCastle Gold's New CEO, Gerald Panneton, Hits the Ground Running By Tommy Humphreys Mining entrepreneur Gerald Panneton took a few years off after building one of Canada's largest gold miners, Detour Gold. He raced performance cars in his down time, and conducted due diligence on various mining assets to potentially back. This summer, the geologist set his sights on NewCastle Gold (TSXV:NCA), owner of a past-producing gold mine in California with similarities to Detour Gold in its early days. ... ... For the remainder of the report: https://ceo.ca/@tommy/new-newcastle-gold-ceo-gerald-panneton-hits-the-gr... Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Ronan Manly: Chinese gold bar photos -- lost in translation Posted: 10 Sep 2016 12:33 PM PDT 3:32p ET Saturday, September 10, 2016 Dear Friend of GATA and Gold: China doesn't export gold, so few people in the West have seen gold bars made by Chinese refiners, but gold researcher Ronan Manly says there are many Chinese refiners and he has tracked down photographs of their products and hallmarks. His report is headlined "Chinese Gold Bar Photos -- Lost in Translation" and it's posted at Bullion Star here: https://www.bullionstar.com/blogs/ronan-manly/chinese-gold-bar-photos-lo... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sandspring Resources Commences 2016 Exploration Campaign Company Announcement Sandspring Resources Ltd. (TSX VENTURE:SSP, US OTC: SSPXF) is pleased to announce commencement of the 2016 exploration campaign at its Toroparu Gold Project in Guyana, South America. In 2015 the company completed a 3,700-meter diamond drilling program on the promising Sona Hill Prospect, located 5 kilometers southeast of the main Toroparu deposit. Sona Hill is the easternmost gold anomaly in a cluster of 10 gold features located within a 20-by-7-kilometer hydrothermal alteration halo around Toroparu. Drilling at Sona Hill in 2012 and in 2015 intercepted high-grade mineralization in both saprolite and bedrock, and confirmed the continuity and grade potential of the Sona Hill mineralization. For the remainder of the announcement and highlights of the 2015 drill program: https://finance.yahoo.com/news/sandspring-resources-commences-2016-explo... Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| GoldSeek Radio's Chris Waltzek interviews GATA Chairman Bill Murphy Posted: 10 Sep 2016 12:24 PM PDT 3:22p ET Saturday, September 10, 2016 Dear Friend of GATA and Gold: GoldSeek Radio's Chris Waltzek interviews GATA Chairman Bill Murphy about last week's action in the gold and silver markets, Resolute Mining's beginning to treat gold as money by offering metal in dividends, and the continuing efforts of the gold cartel to control the metal's price. The interview is seven minutes long and begins at the 6:23 mark here: CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT NewCastle Gold's New CEO, Gerald Panneton, Hits the Ground Running By Tommy Humphreys Mining entrepreneur Gerald Panneton took a few years off after building one of Canada's largest gold miners, Detour Gold. He raced performance cars in his down time, and conducted due diligence on various mining assets to potentially back. This summer, the geologist set his sights on NewCastle Gold (TSXV:NCA), owner of a past-producing gold mine in California with similarities to Detour Gold in its early days. ... ... For the remainder of the report: https://ceo.ca/@tommy/new-newcastle-gold-ceo-gerald-panneton-hits-the-gr... Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Posted: 10 Sep 2016 11:11 AM PDT Jim Sinclair's Commentary The latest from John Williams' www.shadowstats.com - Tough Week Ahead for Headline Economic Data - No Chance of a Near-Term Overheating of the Economy - Jawboning for an Imminent FOMC Rate Hike Hits Stocks, Boosts the Dollar, Hits Gold and Silver - Broad Outlook Unchanged “No. 831: General Outlook “http://www.shadowstats.com Hillary Calls... Read more » The post In The News Today appeared first on Jim Sinclair's Mineset. |

| Gold And Silver Are Money. Everything Else Is Debt. Globalist’s Biggest Scam Posted: 10 Sep 2016 09:39 AM PDT Last week, in “Fiat ‘Dollar’ Says Gold And Silver Will Struggle,” we said the following: [See 4th paragraph] Money does not exist in this country. In fact, money does not exist anywhere in the world. What is money? So few people know, and many who profess to know do not. Money is a commodity with a recognized value. Gold and silver remain the last known standard of real money. Remember J P Morgan’s famous words: “Gold is money. Everything else is credit.” The globalists, through their creation of the Federal Reserve, have sold the biggest lie ever to the world and continue to get away with it. People everywhere believe the fiat-created Federal Reserve Note, falsely called the “dollar,” is actually a monetary dollar. We have often stated how Federal Reserve Notes are evidences of debt issued by the Fed. We also always add that debt is not and can never be money, yet almost every American wrongly believes debt is money because they believe the Fed “dollar” is money. |

| Jubilee Jolt: Dow Down 400, Stocks Smashed In Biggest Drop Since Brexit Posted: 10 Sep 2016 09:33 AM PDT It was just two days ago that we wrote, “Gold Has Biggest One Day Rally Since Brexit as Elites Rush Into Gold”. Now, to end the week, US stocks had their biggest drop since Brexit on Friday. The Dow Jones Industrial Average fell 394.46 points, or 2.1%, to 18085.45, and the S&P 500 declined 2.45%, while the Nasdaq Composite lost 2.5%. |

| High-Ranking North Korean Diplomat in London Defects to South Korea Posted: 10 Sep 2016 05:31 AM PDT What Happens To North Korean Defectors? North Korea restricts citizens from leaving its borders. So what happens to those who manage to defect from the authoritarian government? The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Breaking News And Best Of The Web Posted: 09 Sep 2016 05:37 PM PDT Stocks plunge, gold drops on Fed rate hike speculation. ECB leaves rates unchanged. German industrial production falls. US jobs, service sector growth disappoint. Japan preparing major new stimulus. The war on cash heats up. North Korea tests a nuke. Trump and Clinton even in latest polls. More Clinton emails to be released soon. Best […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Since Reagan came to power in 1981, the US has had a total of five presidents who have spent ever increasing amounts of money to hang on to power and buy votes. This has resulted in the most extraordinary money printing venture in history. It is not just central banks that print money. Governments that borrow vast amounts of money are also performing a printing function since money is created out of thin air. And even worse than that, the US government neither has the intention, nor the ability to ever repay the debt with real money. Thus the US debt can only vaporise when the country defaults. Since there is no other way of eradicating this debt, a default by the US is guaranteed to take place in coming years. But before that the Fed and the US government will flood the market with jumbo jet money since helicopter money won't suffice. Jumbo jet money will create hyperinflation but it will never repay the debt since all it does is to increase the amount of debt outstanding from trillions of dollars to quadrillions.

Since Reagan came to power in 1981, the US has had a total of five presidents who have spent ever increasing amounts of money to hang on to power and buy votes. This has resulted in the most extraordinary money printing venture in history. It is not just central banks that print money. Governments that borrow vast amounts of money are also performing a printing function since money is created out of thin air. And even worse than that, the US government neither has the intention, nor the ability to ever repay the debt with real money. Thus the US debt can only vaporise when the country defaults. Since there is no other way of eradicating this debt, a default by the US is guaranteed to take place in coming years. But before that the Fed and the US government will flood the market with jumbo jet money since helicopter money won't suffice. Jumbo jet money will create hyperinflation but it will never repay the debt since all it does is to increase the amount of debt outstanding from trillions of dollars to quadrillions.

ater in the program, we'll hear a tremendous interview with Craig Hemke of the TF Metals Report. Craig discusses why he believes the bullion banks are finding it harder and harder to suppress the price of gold and silver so far in 2016, provides some great analysis on some of the key price levels he's watching for in the metals, and shares his outlook for the final four months of the year. So be sure to stick around for my conversation with Craig Hemke coming up after this week's market update.

ater in the program, we'll hear a tremendous interview with Craig Hemke of the TF Metals Report. Craig discusses why he believes the bullion banks are finding it harder and harder to suppress the price of gold and silver so far in 2016, provides some great analysis on some of the key price levels he's watching for in the metals, and shares his outlook for the final four months of the year. So be sure to stick around for my conversation with Craig Hemke coming up after this week's market update.

No comments:

Post a Comment