saveyourassetsfirst3 |

- Tesla's Spectacular International Sales Collapse

- Who Exactly is the Enemy?

- “We’ll Let the Boyz Knock it Down a Little”: Eric Sprott On Gold and Silver Price Smash

- Gold and Gold Stocks Bull Analogs

- Venezuela’s Economic Collapse Is So Bad That People Are Slaughtering And Eating Zoo Animals

- Gold Notes: Is the New US Treasury Currency Hiding in Plain Sight?

- Hyperinflation Defined, Explained, and Proven

- Gerald Celente Warns The Fundamentals Are Imploding, World Crash Looms

- Killing The Reserve Currency

- Bank of England’s Rate Cut and Gold

- You Can’t Eat Gold

- Silver Smashed Under $20 On Bogus Jobs Report

- Mixed Seed: US Gov to Lift Ban on Part-Human, Part-Animal Embryos

- The Dollar Is Going to 1/10,000 Ounce, Report 31 July, 2016

- Breaking News And Best Of The Web

- The U.S. Has Lost 195,000 Good Paying Energy Industry Jobs

| Tesla's Spectacular International Sales Collapse Posted: 05 Aug 2016 02:01 PM PDT |

| Posted: 05 Aug 2016 01:00 PM PDT The only other time I can remember when everything ceased was after 9/11.. Theodore Roosevelt 5 oz Silver ATB Intro Pricing: As Low As $2.49/oz Over Spot at SD Bullion! Submitted by Tim Price, Sovereign Man: "..I sat at my desk wringing my hands, transfixed by the tragic slapstick of British politics.. "We are in […] The post Who Exactly is the Enemy? appeared first on Silver Doctors. |

| “We’ll Let the Boyz Knock it Down a Little”: Eric Sprott On Gold and Silver Price Smash Posted: 05 Aug 2016 12:08 PM PDT With Precious Metals Hammered Friday, Eric Sprott discusses today’s jobs report and its impact on gold and silver prices. I wouldn’t worry about the jobs numbers at all. We’ll let the boyz knock it down a little for awhile. We’ll see what happens when the people in China, India, and Turkey all figure out they […] The post “We’ll Let the Boyz Knock it Down a Little”: Eric Sprott On Gold and Silver Price Smash appeared first on Silver Doctors. |

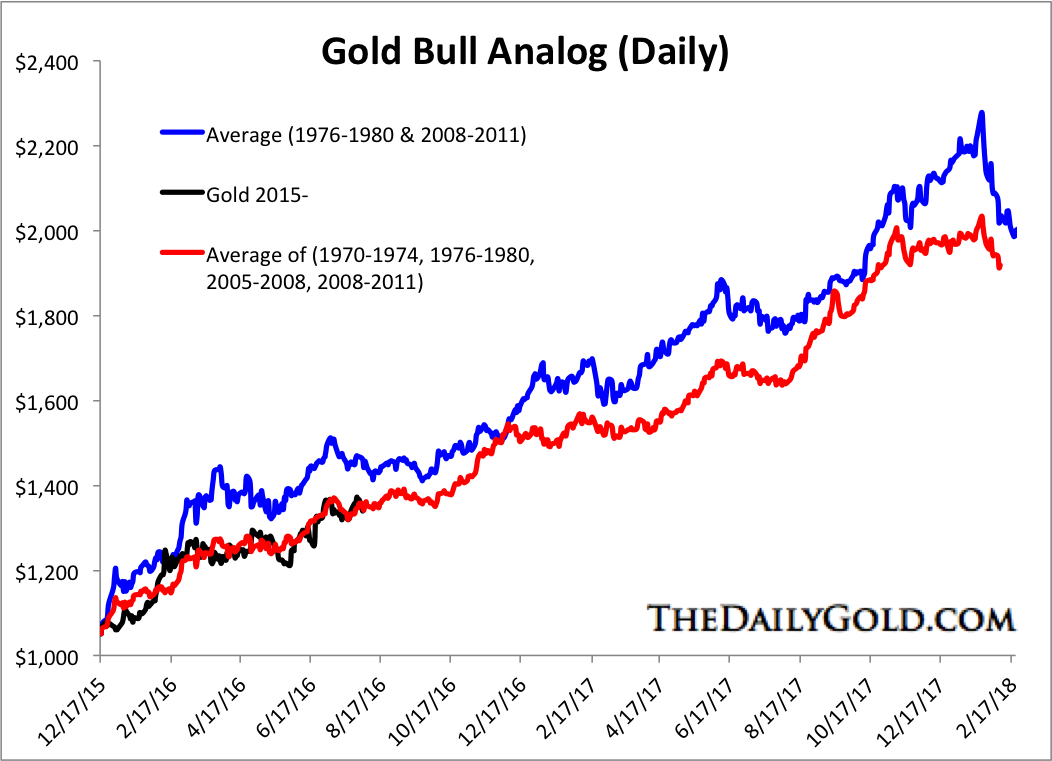

| Gold and Gold Stocks Bull Analogs Posted: 05 Aug 2016 12:07 PM PDT Over the past two weeks the precious metals complex has retested its Brexit breakout and rebounded back to the July highs. Today's jobs report has pushed the complex lower but has delivered an opportunity to cash heavy portfolios which have missed the bulk of the move. With that said, we wanted to share our current analog charts for Gold, gold stocks and junior gold stocks which suggest continued upside potential in the sector. The first chart plots the current rebound in Gold compared to the average of its two strongest cyclical rebounds (1976 and 2008) and the average of four rebounds (including 1976 and 2008) within its secular bull markets. As we can see, the current rebound is closely following the average of the four rebounds. If Gold continues to follow that path then it could reach $1500/oz before the end of the year and retest its all time high of $1900/oz by the end of next year.  Gold Bull Analog

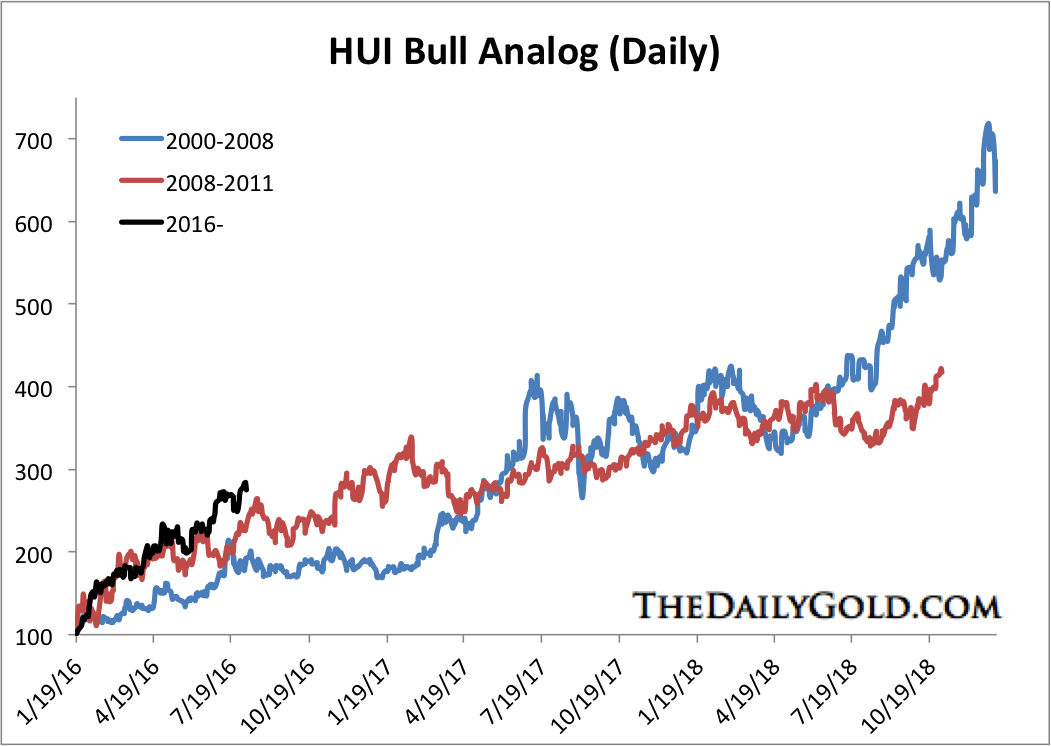

Turning to the stocks we find that the large miners are fairly extended at present. The HUI is currently above the other two rebounds. If the HUI continues to follow the path of the last cyclical bull market (2008-2011) then it has somewhat limited upside. However, considering my research and analysis, the recent low in gold stocks figures to be quite a bit more like the 2000 low. By following that path the miners could triple over the next two and a half years.  HUI Bull Analog

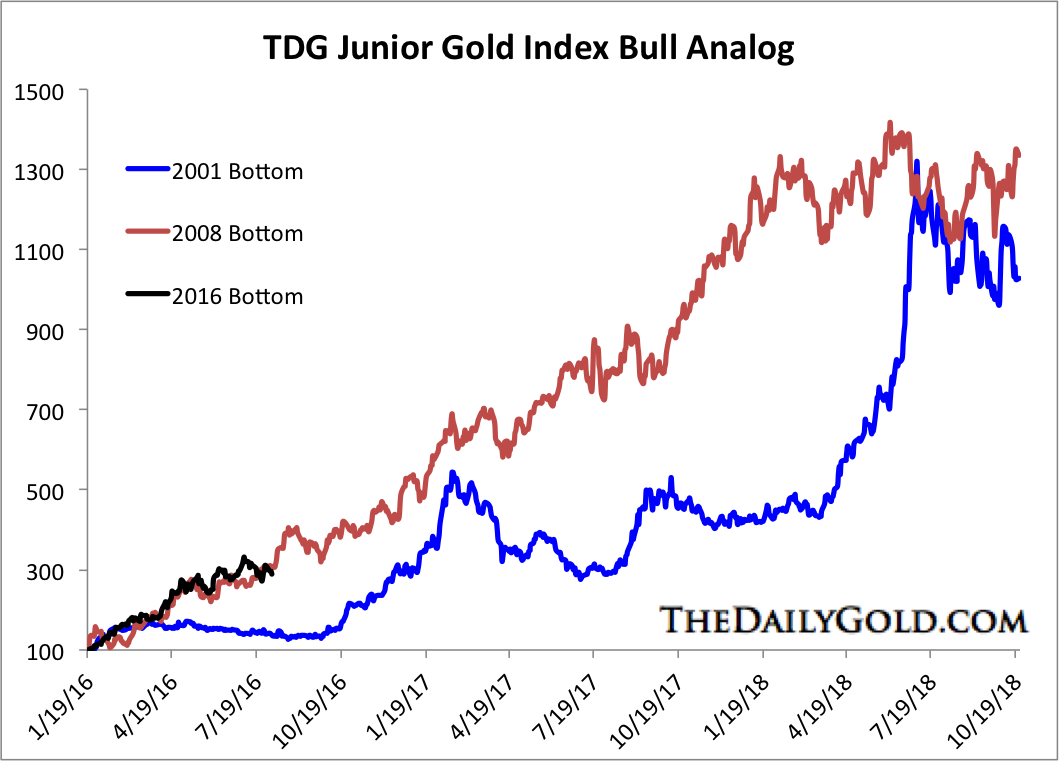

My own research and discussions with industry sources (folks with more experience and knowledge than me) leads me to believe the best value is currently in the juniors and the smallest juniors. My junior index bull analog chart shown below confirms that view. My index has already tripled but has plenty of upside potential over the next six months and two years.  TheDailyGold Junior Bull Analog

Thus far Gold and gold stocks appear to be tracking history quite well. If the bull market continues then these charts should continue to provide some context as to where things could go. History is a very good guide but it is not perfect. No indicator by itself is infallible. In addition to historical analogs we also employ technical analysis, intermarket analysis and various sentiment indicators. We reiterate our view that precious metals are in the early stages of a cyclical bull market that has a chance to turn into a full blown mania. Our views are always subject to change but we remain bullish over the near term. For professional guidance in riding the uptrend in Gold, consider learning more about our premium service including our favorite junior miners which we expect to outperform in the second half of 2016.

Jordan Roy-Byrne, CMT, MFTA

|

| Venezuela’s Economic Collapse Is So Bad That People Are Slaughtering And Eating Zoo Animals Posted: 05 Aug 2016 12:00 PM PDT The situation in Venezuela is becoming desperate… Teddy Roosevelt 5 oz Silver ATB Intro Pricing: As Low As $2.49/oz Over Spot at SD Bullion! From Michael Snyder, The Economic Collapse Blog: If you were hungry enough, would you kill and eat zoo animals? To most of us such a notion sounds absolutely insane, but this […] The post Venezuela’s Economic Collapse Is So Bad That People Are Slaughtering And Eating Zoo Animals appeared first on Silver Doctors. |

| Gold Notes: Is the New US Treasury Currency Hiding in Plain Sight? Posted: 05 Aug 2016 11:00 AM PDT Is the US Treasury preparing to axe the Federal Reserve via gold-backed US Treasury notes? The answer may be hiding in plain sight… Lowest Priced US Mint Silver Eagles Theodore Roosevelt 5 oz Silver ATB Intro Pricing: As Low As $2.49/oz Over Spot at SD Bullion! The post Gold Notes: Is the New US Treasury Currency Hiding in Plain Sight? appeared first on Silver Doctors. |

| Hyperinflation Defined, Explained, and Proven Posted: 05 Aug 2016 10:00 AM PDT Hyperinflation is not merely an economic "threat" looming in our near future, it is a certainty… Theodore Roosevelt 5 oz Silver ATB Intro Pricing: As Low As $2.49/oz Over Spot at SD Bullion! By Jeff Nielson, Sprott: Regular readers already know that hyperinflation is not merely an economic "threat" looming in our near future, […] The post Hyperinflation Defined, Explained, and Proven appeared first on Silver Doctors. |

| Gerald Celente Warns The Fundamentals Are Imploding, World Crash Looms Posted: 05 Aug 2016 09:00 AM PDT Trends Forecaster Gerald Celente warns the Fundamentals are IMPLODING… Buy 90% Junk Silver Bags at SD Bullion As Low As $1.49/oz Over Spot! View Today's Data: 2 oz Silver Queen's Beasts Just $2.89 Over Spot, ANY QTY At SD Bullion! The post Gerald Celente Warns The Fundamentals Are Imploding, World Crash Looms appeared first on Silver Doctors. |

| Posted: 05 Aug 2016 08:00 AM PDT It appears September 4 and 5, 2016 will be milestones in monetary history… Lowest Priced US Mint Silver Eagles Submitted by Rory Hall, The Daily Coin: This is the second and final piece for this series. It is very clear the IMF is moving towards the replacement of the reserve currency system. As Mike Maloney stated […] The post Killing The Reserve Currency appeared first on Silver Doctors. |

| Bank of England’s Rate Cut and Gold Posted: 05 Aug 2016 07:21 AM PDT SunshineProfits |

| Posted: 05 Aug 2016 07:00 AM PDT I read that I can't eat gold as I munched on my 401(k) sandwich and guzzled my IRA wine, which tastes like a cheap Chardonnay. For a side dish I ate blanched twenty dollar bills and consumed a chocolate money market for dessert… Buy Gold Bars at SD Bullion Most Trusted Bullion Dealer is Now […] The post You Can’t Eat Gold appeared first on Silver Doctors. |

| Silver Smashed Under $20 On Bogus Jobs Report Posted: 05 Aug 2016 06:12 AM PDT The algos have just INSTANTLY repriced a Fed rate hike into the market, today’s BLS(BS) numbers came in at a literally unbelievable +255k for July smashing expectations, sending silver prices down the proverbial mine-shaft nearly .50, and under the psychologically significant $20: Gold smashed below $1350: Silver smashed through $20, with a last of […] The post Silver Smashed Under $20 On Bogus Jobs Report appeared first on Silver Doctors. |

| Mixed Seed: US Gov to Lift Ban on Part-Human, Part-Animal Embryos Posted: 05 Aug 2016 05:30 AM PDT “For the coming of the Son of Man will be just like the days of Noah…” From Michael Krieger, Liberty Blitzkrieg: Here's your feel good story of the day… From an NPR article published this morning: The federal government announced plans Thursday to lift a moratorium on funding of controversial experiments that use human stem […] The post Mixed Seed: US Gov to Lift Ban on Part-Human, Part-Animal Embryos appeared first on Silver Doctors. |

| The Dollar Is Going to 1/10,000 Ounce, Report 31 July, 2016 Posted: 05 Aug 2016 02:11 AM PDT Monetary Metals |

| Breaking News And Best Of The Web Posted: 04 Aug 2016 06:44 PM PDT Good US jobs report. Gold plunges, stocks jump. Oil hovers around $40. BoE cutes rates, UK bond yields plunge. European banks have investors running scared. Japan begins new round of stimulus. The Trump campaign may be collapsing. Best Of The Web Michael Belkin interview – King World News What happens when rampant asset inflation […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| The U.S. Has Lost 195,000 Good Paying Energy Industry Jobs Posted: 04 Aug 2016 05:28 PM PDT

Just today we got some more disturbing news. According to Challenger, Gray & Christmas, the U.S. has lost 195,000 good paying energy jobs since the middle of 2014…

Those are good paying jobs that are not easy to replace, and unfortunately the jobs losses appear to be accelerating. In their new report, Challenger, Gray & Christmas went on to say that 95,000 of those job cuts have come in 2016, and 17,725 of them were in July alone. We also got some other bad news for the U.S. economy on Thursday. Factory orders are down again, and at this point U.S. factory orders have now been down on a year over year basis for 20 months in a row. That is the longest streak in all of U.S. history. Needless to say, we have never seen such a thing happen outside of a recession. In addition, it is being reported that U.S. banks have been tightening lending standards for four quarters in a row. Once again, this is something that has never happened outside of a recession. On top of all that, tax receipts continue to plummet. This is a very bad sign for the economy, because falling tax receipts are usually a sign that we are headed into a recession. The following comes from Zero Hedge…

Are you starting to see a pattern here? And let’s review what else we have learned over the past couple of weeks… -U.S. GDP growth came in at an extremely disappointing 1.2 percent for the second quarter of 2016, and the first quarter was revised down to 0.8 percent. -The rate of homeownership in the United States has fallen to the lowest level ever. -The Wall Street Journal says that this is the weakest “economic recovery” since 1949. -Barack Obama is on track to be the only president in U.S. history to never have a single year of 3 percent GDP growth. Meanwhile, things continue to get worse around the rest of the planet as well. For example, the economic depression in Brazil continues to deepen and it is being reported that the Brazilian economy has now been shrinking for five quarters in a row…

And of course Brazil is hosting the Olympics this summer, and that is turning out to be a major debacle. Many of the international athletes will actually be rowing, sailing and swimming in open waters that are highly contaminated by raw sewage, and Brazilian police have been welcoming tourists to Rio with a big sign that says “Welcome To Hell“. And let us not forget that right next door in Venezuela the economic collapse has gotten so bad that people are killing and eating zoo animals. As the global economy continues to deteriorate, what should we do? Legendary investor Bill Gross shared some of his thoughts on the matter in his latest Investment Outlook…

I tend to agree with Gross. Bonds are in a tremendous bubble right now, and the stock market bubble has grown to ridiculous proportions. In the end, the only wealth that you are going to be able to fully rely on is wealth that you can physically have in your possession. As you have seen in this article, signs of economic decline are all around us. And yet, many people out there are still convinced that good times are right around the corner. What is it going to take to convince them that they are wrong? |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment