Gold World News Flash |

- The End Of A Trend: Oil Prices And Economic Growth

- How Europe Is Getting Rich by Fueling Its Own Terror Epidemic

- Monetary Madness, Political Madness, Debt Madness

- PLANETARY PONZI IMPLODING — Mitchell Feierstein

- It’s Time To Prepare For Hyperinflationary Collapse — James Wesley Rawles

- SILVER: The Bankers Achilles’ Heel… and TOP Performing Asset of 2016 YTD

- THE TIDE HAS TURNED: Large Silver Miner Reports First Profit In 3 Years

- Gold Price Closed at $1358.80 up $2.70 or 0.20%

- Musical Chairs

- War Or Peace: The Essential Question Before American Voters On November 8th

- Legendary executive Rob McEwen talks about gold mining in golden times

- The Bank of England Just Provided Us With More Reasons to Own Gold and Silver

- Alasdair Macleod: Saving the system

- Maybe Indians buy so much gold because their currency is so crappy

- Previewing Tomorrow's Payrolls: Watch Out For Short-End Fireworks

- Doomsday Approaching - Gov. Spending is Signaling Preparation!

- Doomsday Approaching - Gov. Spending is Signaling Preparation!

- Galactic Council of Light, Moving beyond Limitations

- David Duke - Media Propaganda Against Trump Out of Control

- Stock Market, Gold Update

- Gold Daily and Silver Weekly Charts - Respect

- The Dollar Will Be Removed From Int'l Trade,Which Will Send Shock Waves Throughout The US:Jim Willie

- What’s Coming Is Going to Be a Mess

- Jim’s Mailbox

- The Coming Economic Collapse Of America 2016 2017

- How Israel Created ISIS Explained by Ken O'Keefe

- Be Careful Before US Dollar Collapse

- Gold Bullion – The Ultimate Monetary Solution

- Buy Gold and “Real Assets†Says the ‘Bond King’

- Royalty Deal with Waterton Should Bolster Terraco Gold

- Seabridge Is Turning Cash into Gold

- Gold Prices Jump on $220bn of New UK QE and Record-Low Rates

| The End Of A Trend: Oil Prices And Economic Growth Posted: 05 Aug 2016 01:00 AM PDT Submitted by Kurt Cobb via OilPrice.com, It used to be that when it came to the world economy, oil prices and economic growth were more like distant cousins who disliked each other rather than a happily married couple always seen nuzzling together in public. The received wisdom was that low oil prices are good for the overall economy even if they are bad for the oil industry and for countries that are heavily dependent on oil for their revenues. That's what many believed when suggesting that even though high oil prices and an attendant oil boom had underpinned economic recovery in the United States after the 2008 financial crash, low oil prices would now somehow on balance deliver even more recovery. And, low prices would also benefit the rest of the world as well. Nowadays, as the oil price dips into the low $40 range again and economic growth weakens simultaneously, we must re-evaluate. U.S. economic growth declined significantly after oil prices began to fall in 2014. Only last week, U.S. growth for the second quarter of 2016 came in at 1.2 percent (annualized), less than half the forecast of 2.5 percent. First quarter growth was revised down to 0.8 percent from a previous estimate of 1.1 percent. That's down significantly from a peak of 5 percent growth for the third quarter of 2014, the last quarter during which the price of oil was over $100 per barrel. World economic growth instead of speeding up, slowed down slightly from 2.6 percent in 2014 to 2.5 percent in 2015 according to the World Bank. There are many reasons for the subpar growth of the world economy since the Great Recession. Record average daily prices for oil four years running from 2011 through 2014 helped sap the world economy of its strength by siphoning funds from the non-energy economy. Of the other causes, chief of among them is the heavy buildup of private and public debt which may be hindering growth by siphoning funds from consumption and investment into debt service. In the first quarter of this year, U.S. credit growth was $644.9 billion. U.S. gross domestic product growth was $64.7 billion. It took $10 of credit growth for every $1 of GDP growth. There was a time long, long ago when the ratio was 1 to 1. China's credit growth had been running twice its GDP growth through the end of last year. (I don't have dollar or yuan amounts.) Debt isn't necessarily a bad thing if one uses it to invest in something that will produce goods or services rather than merely to consume. But much of our debt creation has been exactly for consumption. That isn't particularly bad either if we as individuals, nations or a world society can afford to service that debt. But there is a level we cannot afford and it stunts growth. To get a better understanding of how too much debt is affecting economic growth around the world, listen to economist Steve Keen explain why debt matters and how the rate of credit creation affects growth. You may need to watch it twice before you get the "aha" moment. But let's look further now into the relationship between debt and energy to find out more about why oil prices seem much more correlated to the health of the overall economy than they used to be. First, oil remains the central energy source for the world economy, especially critical as transportation fuel. It provides 33 percent of total energy according to the BP Statistical Review of World Energy. Second, our desperation for additional sources of oil led to a debt-fueled boom in the United States, debt used by drilling companies to reach deep shale deposits and release oil found in them through a new version of hydraulic fracturing called high-volume slickwater hydraulic fracturing. It turns out that the low oil prices of today make these deposits largely unprofitable and production has been falling. Many of the high-flying drillers during the boom are now in or headed for bankruptcy. Debt, it must be remembered, is simply a way to bring what would be future consumption into the present. We have brought energy consumption from the future into the present with debt through the fracking boom in the United States and to a certain extent the boom in oil sands in Canada. And, we've shifted consumption of so many other natural resources and finished goods from the future to the present through the vast expansion of private and public debt. Still, we are faced with slower world economic growth than in the past despite our herculean financial efforts. The simple explanation is that cheap energy was the cornerstone of growth of the industrial economy. As long as that energy was cheap, we could grow at a relatively rapid pace. Once it becomes expensive, growth must decline for most sectors of the economy as more and more resources are sent to the energy sector. By this logic then, today's low prices should be providing substantial stimulus to the global economy. Why are we not feeling it? The short answer would be that the debt we built up procuring expensive energy during a period of high and rising energy prices over the last 15 years is holding back economic growth. We are experiencing the hangover. The hangover manifests itself as slow growth which is a reflection of the difficulty consumers are having maintaining their growth in spending in a high-debt world. That means everything is less affordable at the margin, and this has led to a creeping slowdown in the world economy. Now, here's the kicker. If we as a global society can no longer afford high-priced oil--and that's what's left to get out of the ground--then as long as oil remains the central energy component of our economy, we will be trapped in a low- or no-growth economy where oil prices can't rise high enough to make new drilling in high-cost deposits profitable; and, when prices do rise, they simply squeeze the life out of economic growth and send the economy back into a stall or near stall. (Gail Tverberg has explained this phenomenon in detail on her blog, Our Finite World.) Far from a sign of good things for the economy as whole, recently declining oil prices now tend to indicate a weakening economy that was already in a weak state. It turns out that the oil price and the economy are now in a very tight relationship, and we are going to be seeing them together a lot for a long time to come. But I don't think their marriage will be the happy one I alluded to at the beginning of this piece. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| How Europe Is Getting Rich by Fueling Its Own Terror Epidemic Posted: 04 Aug 2016 11:00 PM PDT Submitted by Darius Shahtahmasebi via TheAntiMedia.org, Though Europe does not have the rates of gun violence the United States continues to grapple with, European governments have made over a billion euros by fueling gun violence in the Middle East and North Africa. A report conducted by a team of reporters from the Balkan Investigative Reporting Network (BIRN) and the Organized Crime and Corruption Reporting Project (OCCRP) found a group of European nations has been funneling arms into the Middle East region since 2012, making at least 1.2 billion euros in the process. According to the report, 68 flights that took place within 13 months transported weapons and ammunition to the Middle East, including to NATO member Turkey, which in turn “funnelled arms into brutal civil wars in Syria and Yemen.” The report also notes that these flights make up only a small portion of the 1.2 billion euros in arms deals between Europe and the Middle East since 2012. The report’s conclusions are horrifying, to say the least. The report states:

Considering Europe is battling a continually rising terrorist threat, they seem to be going about tackling this issue the wrong way. Surely the best way to counter terrorism is to cease funding it in the first place. One astounding aspect of the report is that the lucrative war-profiteering business involves nations the world would not usually regard as overly-interested in war. The countries contributing to the rising terror threat, as identified by the report, are Bosnia and Herzegovina, Bulgaria, Croatia, the Czech Republic, and Romania, among others. This report adds to the already glaring problem of European countries making billions of dollars off the death and destruction of Middle Eastern civilian life. The Stockholm International Peace Research Institute (SIPRI) found the United Kingdom was second only to the United States in arms sales, making up 10.4 percent of the total $401 billion worth of arms sold around the world for the 2014 period. Although these figures refer directly to companies selling arms, the fact remains that European governments do nothing to deter this. In fact, former U.K. Prime Minister David Cameron insists the U.K. has “one of the strictest regimes anywhere in the world for sales of defence equipment but we do believe that countries have a right to self-defence.” Shamefully, the United Kingdom’s billion dollar arms sales have been fueling the conflict in Yemen — the poorest and most disadvantaged country in the Arab region — by arming the aggressive Saudi Arabian regime. Saudi Arabia’s ongoing intervention in Yemen merely benefits al-Qaeda. Arms sales from Britain to human rights abusers are only increasing. The idea that European governments want to prevent terrorist attacks on the European mainland is ludicrous given the fact European governments continue to directly arm terrorist groups and brutal regimes that export jihadist philosophies. But hey, at least they made a billion dollars, right? | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Monetary Madness, Political Madness, Debt Madness Posted: 04 Aug 2016 09:30 PM PDT by Gary Christenson, Deviant Investor:

Many people watched the most recent circus – the DNC: A few comments:

The RNC and DNC were not the only circus acts in town. Less entertaining versions emanated from the Eccles building in D.C. and from other central banks.

Michael Pento explained it eloquently in his article, "Four Stages of Monetary Madness."

"There are four stages of fiat money printing that have been used by central banks throughout their horrific history of usurping the market-based value of money and borrowing costs. It is a destructive path that began with going off the gold standard and historically ends in hyperinflation and economic chaos. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| PLANETARY PONZI IMPLODING — Mitchell Feierstein Posted: 04 Aug 2016 09:02 PM PDT by SGT, SGT Report.com: Mitchell Feierstein, author of Planet Ponzi returns to SGT Report to dissect the global economic meltdown and implosion of the planetary fiat Ponzi scheme. From $13 Trillion in bonds yielding negative interest rates to the ever-expanding criminal reach of Goldman Sachs, it’s everything for the international banking cartel and nothing but un-repayable debt for the people. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| It’s Time To Prepare For Hyperinflationary Collapse — James Wesley Rawles Posted: 04 Aug 2016 09:01 PM PDT by SGT, SGT Report.com: Author, Patriot and Founder of SurvivalBlog.com James Wesley Rawles returns to SGT Report to discuss current events, including the Clinton crime family, the fragile state of the global economy and the coming hyperinflationary collapse of fiat currencies around the world. James says, it’s time to prepare with “tangibles, tangibles, tangibles.” | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| SILVER: The Bankers Achilles’ Heel… and TOP Performing Asset of 2016 YTD Posted: 04 Aug 2016 08:59 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| THE TIDE HAS TURNED: Large Silver Miner Reports First Profit In 3 Years Posted: 04 Aug 2016 08:41 PM PDT by Steve St. Angelo, SRS Rocco:

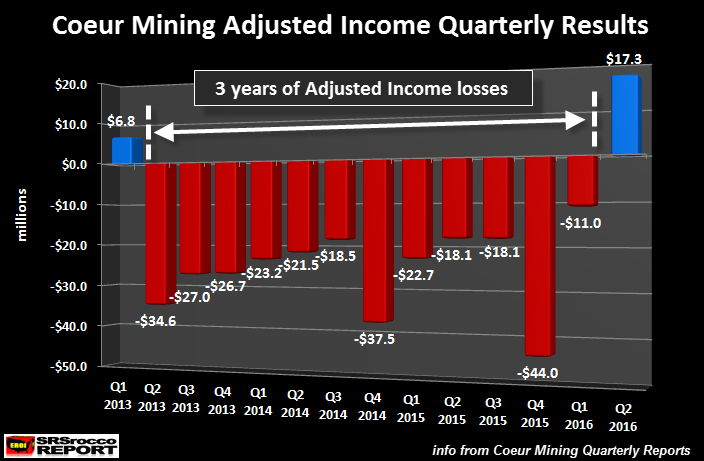

It looks as if the TIDE HAS TURNED as one of the industry's large silver producers finally reported its first profit after three long years. Coeur Mining reported a $17.3 million adjusted income profit in Q2 2016 compared to an $11 million adjusted loss in the previous quarter. This is truly a significant trend change as Coeur Mining has suffered 12 consecutive quarters of adjusted income losses. The last time Coeur stated a profit, was in the first quarter of 2013 when it reported an adjusted income gain of $6.8 million:

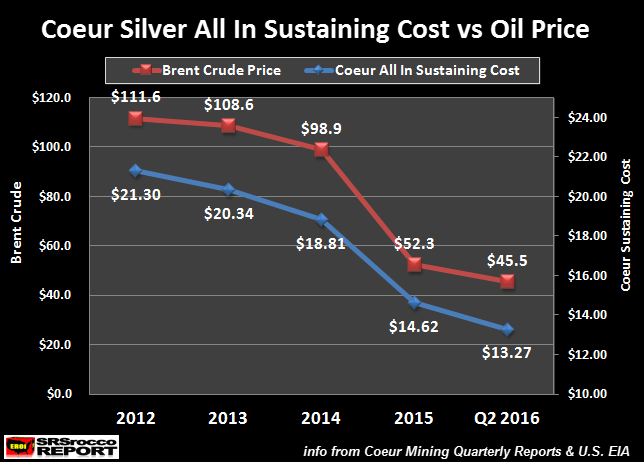

The reason I use "Adjusted income" rather than "Net Income" because it removes any impairments, right-offs or various items that aren't directly associated with the day-to-day costs of mining silver. That being said, Coeur Mining lost a total of $303 million in adjusted income from Q2 2013 to Q1 2016. That is one hell of a lot money to lose or silver to give away as the Fed and Central banks print money and digital currency at will. During the three years from 2013 to 2015, Coeur produced 50 million oz (Moz) of silver. If we divide their total adjusted losses of $303 million by their total production, this is the result: Coeur Total Adjusted Income Losses = $303 million / 50 Moz Coeur Total Adjusted Income Loss Per Oz = $6.06 So, as the Fed and Central Banks continued to print money, loot third world countries and funnel liquidity into stocks, bonds and real estate, Coeur lost an average of $6 for each ounce of silver it produced in that three-year time frame. WHAT A FRICKEN DEAL…. AYE? Coeur's Silver All In Sustaining Cost Is Based On The Oil PriceTo understand Coeur's cost to produce silver, we have to compare it to the price of oil. While Coeur's "All In Sustaining Cost" for producing silver is a good guideline, it does not include all costs. Also, they use what is known as "Silver Equivalent" accounting. This means, they take all their gold and base metal by-product sales and convert it to silver equivalent ounces. For example, Coeur produced 4 Moz of silver, but when we add in their gold and base metal production, they report a total of 9.6 Moz of silver equivalent production. This may be a convenient way for the company to report costs, but to me… it confuses inexperienced investors. Regardless, if we look at Coeur's All In Sustaining Cost (per silver equivalent oz) and compare it to the price of oil, we see a similar downward trend:

Even though the Brent Crude oil price has fallen more in percentage terms than Coeur's All In Costs, the trend is quite similar. We also must consider that inflationary costs in labor, equipment and other materials aren't falling (some likely rising) as much as the oil price. Thus, Coeur's All-In Costs are only down 38% since 2012 versus 59% for oil. As the price of Brent Crude continued to fall to $45 a barrel in the second quarter of 2016 while the price of silver increased, Coeur made a $17.3 million adjusted income profit. According to my "Estimated Breakeven Analysis", Coeur's total cost to produce silver was $15.52. Coeur received a realized price of $17.38 in Q2 2016… thus their estimated profit per ounce was $1.86. Let me break this down more simply: Coeur's Q2 2016 Realized Silver price = $17.38 Coeur's Q2 2016 All-In-Sustaining Cost = $13.27 SRSrocco Coeur's Estimated Break-Even = $15.52 The reason my Estimated Break-even cost is higher than Coeur's All-In Sustaining Cost is because they are using silver equivalent accounting. Coeur's revenues were 43% silver and 57% gold & base metal. Coeur made profits on their gold and base metal sales that are separate from silver. Actually, Coeur made more profits on their gold than silver. Coeur's net gold revenue (not including smelting costs) was $111 million versus $70 million for silver. So, we must remove gold revenue and costs to get a more realistic estimated silver cost per oz. Coeur sold 88,543 oz of gold and 4 Moz of silver in Q2 2016. Coeur cannot sell 9.3 Moz of silver equivalent metal into the market. There is no such thing. No smelter or refiner will take silver equivalent metal. They will take silver, gold, lead, zinc and copper. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1358.80 up $2.70 or 0.20% Posted: 04 Aug 2016 08:15 PM PDT

Until today I have been fretting at the lack of retail buying and size of retail selling. They selling confirms we saw a bottom in December, but the want of buying might threaten the rally. Then I saw this article today, "Investing in gold: Big players put money into the precious metals" at http://cnb.cx/2aLP98Y Naturally I ain't taking CNBC's word for anything, so I called up the biggest gold & silver wholesaler I know who turns over more than $5 billion yearly. I asked him if he had seen those large sales. He confirmed they are seeing lots of retail sellers and few retail buyers, but also confirmed they are seeing lots of big money business. That takes the edge off my fear that futures market buying alone is driving this rally. That won't work, long term. As they say in the futures business, "Sooner or later, everything comes back to physicals." Futures can rise for a while in the absence of demand for physical, but not for long. And proving once again that the Bib Banks in the US & around the world are all criminal enterprises, the Fed fined Goldman Sachs $36.3 million for fencing and using confidential Fed supervisory information. All the banks are the same: they shrug these wrist slaps off as a "cost of doing business." What's that you say? Did any bankers go to jail? Never. Don't y'all know that bankers are ABOVE the law? The law only applies to us unwashed hoi polloi. Anybody want to begin laying bets that interest rates have seen their low? That's another way of asking, Have bonds peaked? Looky here, http://schrts.co/d3HP1X That's a 4-2/3 year chart of the US 30 year Treasury bond. Made an all-time, all-time high on 8 January 2016. Now meditate on this until your joints turn to water: what will happen when markets wrest interest rate control out of Janet Yellen's cold, uncalloused hands? How far will the havoc reach? What will the stampede out of bonds look like? Not saying it has started yet, but a throwover of a 30 year channel with a 4+ year rising wedge, well, it's sure enough a candidate for reversal. Let's talk about the scrofulous, scurvy, boil-covered fiat currencies first. The least rotten of the whole rotten lot, the US dollar index, rose 0.2% to 95.72. However, it's looking at that 95.90 level like it was the gallows and the dollar index a condemned criminal. Must climb over that 95.90 level or fall further. Closed above the 50 DMA and 95.50 support, but still weak as a day old kitten. Euro sank 0.19% to $1.1130. Criminal central bankers must sit up nights chain smoking & drinking bad coffee, trying to figure out how to manipulate the euro up. Yen was flat at 98.82. Stocks today were confused, contradicting each other. Dow fell 2.95 (0.02%) while the S&P500 rose 0.46 (get out your microscope, 0.02%). They're broke and need a couple of zillion more dollars of Fed stimulus to get unbroke. It's not like silver & gold had a banner day either. On Comex silver mislaid 3¢ somewhere for a 2040.6¢ close. Gold rose $2.70 to $1,358.80. Not much going on. Gold chart appeareth here, http://schrts.co/Eyyuq1 Only thing that transpired was gold touched back to the upper channel boundary after breaking out through it a few days ago. Today it confirmed that breakout by going back to that line for one last Good-Bye Kiss. First indication you would have that my interpretation is incorrect would be a close below that blue uptrend line, tomorrow about $1,341. Silver, remember, is always more volatile than gold, both upside & downside. Today silver bumped into its 20 DMA, but remaineth safely distant from the blue uptrend line about 2000¢. Any close below that would signal trouble. Don't borrow trouble before it signals. US$5 gold commemoratives minted 1986-2008. Best buy on the market in a fractional-ounce coin, about 3.5% over melt. Cheaper than most one ounce coins, like American Eagles, Krugerrands, Maple Leaves, etc. US$5 Commems contain 0.241875 troy ounce of pure gold, about a quarter-ounce. Considering that most coins that size cost 6.5% to 14% over their gold content, this can't last long. Call us at (888) 218-9226 or (931) 766-6066 for a quotation. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 04 Aug 2016 08:00 PM PDT

Musical Chairs | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| War Or Peace: The Essential Question Before American Voters On November 8th Posted: 04 Aug 2016 07:55 PM PDT Submitted by Gilbert Doctorow via Russia-Insider.com, In the 1992 presidential election, the campaign team of Bill Clinton had the remarkable insight to simplify the choice before the American electorate in November, encapsulating the whole thought process in the phrase “it’s the economy, stupid.” Following this advice, voters ignored the foreign policy triumphs of President George W. Bush’s administration, including the recently won war against Iraq to liberate occupied Kuwait, and the slightly more remote “victory” in the Cold War, which Bush recalled to the nation in the forlorn hope of eliciting gratitude. Indeed, going into the elections, the economy was anemic, for cyclical reasons, and it was not to the incumbent’s advantage that this fact be highlighted. Today, as another Clinton faces off with an unconventional and widely demonized Republican candidate, the economy is once again anemic, though this time under the stewardship of a Democratic administration, and again for cyclical reasons, but the economy and the domestic welfare programs that are so dependent on vibrant performance are not what the election is all about. Voters will not confront a typical Right-Left choice, although supporters of Hillary Clinton would like to play it that way. It will not be about who gets more of the economic pie and who gets less, who is more equal than others and who is less equal. Charges that Hillary is in the pocket of Wall Street and big business, who have generously financed her campaign, were first brought against her very effectively and persistently by her opponent in the Democratic primaries, Bernie Sanders, who embodied the Left by his persona and points in his platform. He lost to Hillary, the Centrist. Meanwhile, across the court, notwithstanding the support he has consistently received from Tea Party Republicans for his anti-establishment rhetoric, Trump is in many ways more of a Nelson Rockefeller Republican on domestic economic issues, that is to say a Centrist, who, unlike that quintessential Tea Party campaigner, Ron Paul, has no desire to tear down the Federal Reserve and deconstruct the federal government. In matters of substance as opposed to character assassination that both parties’ candidates have engaged in freely, what separates the candidates and makes it worthwhile to register and vote on November 8th is the domain of international relations. This, as a general rule, is the only area where a president has free hands anyway, whatever position his party holds in the Congress. Here the choice facing voters is stark, I would say existential: do we want War or Peace? Do we want to pursue our path of global hegemony, which is bringing us into growing confrontation with Russia, meaning a high probability of war, (the policy of Hillary Clinton), or do we want a harmonious international order in which the U.S. plays its role at the board of governors, just like other major world powers (the policy of Donald Trump). Let me go one step further and explain what “war” means, since it is not something that gets much attention in our media, whereas it is at the top of the news each day in Russia. “War” does not mean Cold War-II, a kind of scab you can pick to indulge a pleasure in pain that is not life threatening. War means what our military like to call “kinetics” to mask the horror of it all. It means live ammunition, ranging from conventional to thermonuclear devices that can devastate large swathes of the United States if we play our hand badly, as would likely be the case for reasons I explain below should Hillary and her flock of Neocon armchair strategists take the reins of power in January 2017. Let us consider the following: 1. Where we are presently in relations with the world’s only other nuclear superpower, Russia, which, I remind you, together with the United States, has 50:50 ownership of 95% of all nuclear warheads on earth. Briefly, we are in an escalating confrontation with the Russians, who have said openly and clearly that they view our ongoing build-up of NATO forces at their borders in the Baltics and Poland as posing an unacceptable threat to their security. They have also said openly and clearly that our completion this spring of what is called an anti-missile defense base in Romania and construction of a similar base in Poland, due for completion in 2017, threatens to upset the strategic nuclear balance by giving the United States a first strike capability. Whether they are right or wrong in their assessment of our words and deeds is beside the point. They are laying down their response based on their view of us, not our view of us. For the past year or more, the Kremlin has said vaguely that host countries of the missile defense bases would be in their “crosshairs.” Russian positions have become more specific and more threatening following the NATO summit in Warsaw in early July that approved an American led program of provocative military exercises near Russia’s borders and stationing in the Baltic States of 4 brigades with mixed NATO Member State contingents. This has forced the Russian military to move to the previously ‘safe’ and undefended Western frontier region near St Petersburg large masses of troops and equipment from the center of their country, east of Moscow. By their public statements, the Russians have made no secret of their intention to act preemptively, as necessary, to wipe out the US bases in Romania and Poland and restore what they see as strategic parity. Just a couple of weeks ago, on a widely watched Russian state television run political talk show, Duma deputy and leader of the nationalist LDPR party Vladimir Zhirinovsky said that Germans risked utter destruction if they continued on their present track of operating Bundeswehr forces in the Baltics. Zhirinovsky would never make such threats without tacit Kremlin backing. Vladimir Zhirinovsky explaining that NATO's current course will result in war For his part, in a recent press conference, President Vladimir Putin asked rhetorically why Western leaders “don’t get it” – why they are not heeding Russia’s warnings on its determination to protect vital security interests, including by means of preemptive strikes. In this press conference from June 2016, Putin explains in detail why Russia sees NATO's behavior as threatening, and why Russia will be forced to react unless NATO changes course. Strongly recommended! Indeed, why are we tone deaf when our very survival is at risk? 2. Why is it that the American political Establishment, of which Hillary Clinton is the standard bearer in this presidential election, does not take the Russians seriously? Back in the 1960s and 70s, when the bard Tom Lehrer was touring college campuses with his irreverent song devoted to the nuclear Armageddon “We’ll all go together when we go,” Americans feared and even respected the USSR for what its military arsenal signified. Our sense that we had “won” the Cold War when the USSR collapsed in 1992 was followed by our witnessing the economic collapse of Russia as it struggled to make a transition from directed to market economy in the 1990s. Meanwhile Russia’s national wealth was siphoned off by newly emerged “oligarchs.” The vast majority of the population was pauperized in that period, as we plainly understood when our religious communities sent assistance packages to the Russian people. And Russia’s political infrastructure fell apart, replaced by regional satrapies and would- be successor states from among minority nationalities. The net result is that the United States Establishment’s respect for Russia degraded into open mockery. The fact that Russia was led in the 1990s by a confirmed alcoholic with multiple health problems that took him away from his desk for weeks at a time, only contributed to the sense that Russia had become the “Sick Man of Europe” both literally and figuratively. This image of Russia has persisted in the thinking of our Establishment, when it is not jostled by images of a tin-pot dictator named Vladimir Putin who holds onto power by making frightening poses against foreign powers, in particular, against the United States. For our establishment, Russia remains, as Barack Obama said a couple of years ago, “just a regional power,” “ a bully” in its neighborhood who has to be put in his place, and also a country that produces nothing that anyone wants, to which no one willingly emigrates (all patently false statements). In sharing all of these views, Hillary is no different from the rest of our political Establishment. It is Donald Trump and his questioning the wisdom of poking the Russian bear in the eye who is the odd man out. What makes Hillary different from her Establishment peers is the opportunity she has had in the Obama administration to act on her beliefs with all the powers of Secretary of State. We should have given our view of Russian capabilities a serious rethink following their military action in Crimea in March 2014, when they engineered a bloodless takeover of the peninsula notwithstanding the local presence of nearly the same number of Ukrainian armed forces (20,000) as their own. Another jolt back to present reality could have emerged from Russian military action in Syria as from October 2015, which they used as a proving ground for their most up-to-date military gear and troops. However, the U.S. response, with Hillary as cheerleader, has been to double down, ignore the potential risks of conflict, and continue to drive the Russians to the wall, so as to “negotiate from a position of strength” if indeed we have any intention of negotiating with the Russians at all. 3. Why do I say that Hillary Clinton is the War Party candidate? The record of Hillary Clinton on foreign policy issues has been very well documented in a recent article that appeared in Consortium News, entitled, The Fear Of Hillary's Foreign Policy, and was republished in Russia Insider. The author, James Carden, is a former State Department employee with concentration in Russia who left the service in the George Bush Jr. years to become a journalist and now is a regular contributor to The Nation. I will not repeat blow for blow Carden’s chronology of Hillary's terrible foreign policy baggage, going back to the decisions taken in Bill's second term that brought us more US military interventions abroad than any other similar period in the country's history while also setting up the dangerous confrontation with Russia, the New Cold War, that dominates headlines today. As James Carden shows, the baggage carries through to Hillary's consistent behavior as Secretary of State in the Obama Administration, where she was always among the most hawkish, pro-military action voices, working hard to overcome the passive resistance of Obama to anything resembling policy decisions. Here I will focus on one non-Russian issue, for the sake of simplification and clarification: Libya. No, not the Libya of the Benghazi catastrophe and the killing of our US consul. That has been discussed endlessly in our media, but misses the point entirely regarding Hillary's culpability and why she will be a disastrous president. The Libyan intervention to remove Colonel Gaddafi had the full support of Hillary within the Administration. She was a cheerleader in this exercise of American global (mis)management and regime change leading to chaos. It was fully in line with her basic instincts, call it all-American hubris or arrogance. And the most revealing proof of her unfitness to be Commander in Chief is the now widely publicized video sequence of Hillary, face distorted in glee, celebrating (!) the savage murder of Gaddafi following his being sodomized and grievously wounded: "we came, we saw, he died." It is not for nothing that the Neocon vultures that took control of US foreign and military policy under Bush-Cheney are now avid supporters of Hillary's candidacy. As regards Russia, Hillary has been pouring oil on the flames of potential conflict for years now. She has publicly likened Vladimir Putin to Adolf Hitler, an insult that no one dared to apply to Russian (Soviet) leaders during the 50 years of the Cold War. That coming from our nation’s senior diplomat virtually closes the door on diplomacy and reason, leaving us with brute force to settle our differences. She has called repeatedly for providing lethal weapons to Ukraine, which, if implemented would put us on a direct collision course with Russia. She has called for establishing a no-flight zone in Syria well after the Russians introduced their air force assets, including a highly advanced air defense system covering all of Syrian air space/ The result of implementing her recommendations in Syria would be direct armed conflict with the Russian forces in the region if we attempted to enforce an interdiction. And de jure, we would be in the wrong, because Russian presence has the express support of the Syrian government, whereas ours does not. Hillary’s public statements on Russia are highly irresponsible and make sense only if we were prepared to launch a war on that country here and now. I doubt that is the case. Meanwhile, the asymmetrical structures of political decision making in the USA and Russia, whereby the Russian President can act with full authority far more quickly than his American counterpart, render this kind of US bluffing and posturing extremely dangerous. Russia is not Iraq. Russia is not Libya. The Russian leadership is tough, experienced and…brave. For reasons of Hillary’s past record of ill-considered adventurism abroad and for reasons of the mad advisers from the Neocon camp whom she has in her inner circle today, it could be a fatal mistake to vote Hillary Clinton on November 8th. About Trump’s past record in power, there is not much to say. About his present promises on foreign policy, one may have doubts. However, the bad blood between him and the Neocons ensures us that a Trump presidency would finally put them out on the curb, where they belong. And if we step back from our present policies on Russia, Moscow will surely reciprocate and seek accommodation. After all, even as late as 2008 Vladimir Putin harbored hopes of his country joining NATO. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Legendary executive Rob McEwen talks about gold mining in golden times Posted: 04 Aug 2016 07:35 PM PDT ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata By Derrick Penner Vancouver Sun, Vancouver, British Columbia, Canada Thursday, August 4, 2016 Legendary mining executive Rob McEwen knows a thing or two about gold-mining companies, having built Goldcorp Inc. into a powerhouse producer before stepping down as chairman and CEO in 2005. Now he's working on building up his next venture, McEwen Mining Inc., with mines in Mexico and Argentina, just as gold has hit a rebound. The Vancouver Sun caught up with him at the recent Sprott Natural Resources Symposium to talk about his views on where the rally is going: Q: With your firm, you take the title chief owner. Why is it important for you to spell that out? A: I think it's very important that people running companies have skin in the game, they have something at risk. They don't just get a big salary with lots of options and have no investment in the company. It makes you focus on what's the most important thing a company should be doing, that is building the value for every other share owner of that company. ... ... For the remainder of the interview: http://vancouversun.com/business/local-business/qa-legendary-executive-r... Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Bank of England Just Provided Us With More Reasons to Own Gold and Silver Posted: 04 Aug 2016 07:33 PM PDT Yesterday the Bank of England cut its main interest rate from 0.5% to 0.25% for the first time, marking its first interest rate change since March 2009, and provided all of us with more reasons to keep converting fiat currencies into physical gold and physical silver. In addition the BOE announced an increase in its QE bond-buying program of £60bn to £435bn. And in response, the British pound immediately fell by 1% to the USD and traders added to their British pound longs, exceeding previous record net long positions in the pound recorded three years ago. I understand that traders are seeking a stronger rebound in the British pound after its plunge post-Brexit, and since the process for the UK to exit the EU has not even begun since the yes referendum vote, traders may be right to assume that the British pound will eventually rebound significantly in strength following this rate cut after people realize that a Brexit yes referendum vote may translate into an indefinite stay of limbo for the UK within the EU.

However, believing that any strengthening of any global fiat currency will be sustained over time is folly as all Central Bankers have aptly illustrated for years that they have already moved beyond the point of no return from their indefinitely low-interest rate, weak currency purchasing power policy years ago and can not raise interest rates to anything close to a free market interest rate. Thus, even if the British pound rebounds much more significantly from its post Brexit and post BOE interest rate cut, and it should, the spiraling weakening of its purchasing power will resume long-term without a doubt. The same knee-jerk trader reaction happened in response to the US Federal Reserve raising their Fed Funds interest rate by a paltry amount from a 0.00% to 0.25% range to a 0.25% to 0.50% range on 16 December 2015. The very next day, traders responding by dumping precious metals due to the silly Central Banker Janet Yellen's talk of a strengthening economy spurring their interest rate raise. When she publicly announced this interest rate hike decision, Yellen stated that their decision was based upon "the committee's confidence that the economy will continue to strengthen. The economic recovery has clearly come a long way, though it is not yet complete…but with the economy performing well and expected to do so, the committee judged that modest increase in the Federal Funds rate is now appropriate." In response, gold and silver both dumped in price, with silver suffering an especially hard fall of more than 3.5% the next trading day. This undeserved weakness in gold and silver prices persisted for a couple of weeks in gold and for an entire month in silver, even though this paltry raise in the Fed Funds interest rate was the first hike in over 9 ½ years since 29 June, 2006, simply because this interest rate "hike" (if one can call a measly ¼ of 1% increase a hike) was accompanied by silly claims of a strengthening, robust US economy made by Fed Reserve Chairman Janet Yellen. I, for one, have never understood why traders lose their minds over such policy announcements, instigating sharp asset price spikes and falls depending upon the announcement, that are often very sharply reversed in the near future. Certainly the gold and silver price dumps that occurred in reaction to Yellen's announcement of a 0.25% raise in the Fed Funds rate has been sharply reversed through all of 2016. Of course, I understand that traders don't care about fundamentals and only care about profiting from any strong movement in asset price, even if the price move is very short-lived and counterintuitive.

However, does a 0.25% Fed Funds rate increase really change the Central Banker fiat currency destruction policy adopted for decades, and provide an impetus to sell one's gold and silver in exchange for devaluing paper and digital fiat currencies? We've all seen massive spikes and falls in crude oil spikes happen within a span of days in recent years. Is it really possible for a trader to be on the right side of every unexpected intraday spike higher and lower, especially when sharp movements higher are often reversed just days later and vice versa? Why not just understand the long-term picture, and position yourself to be on the right side of this equation? I guess that may be too much to ask of a trader, however, and it may be tantamount to asking a newborn duckling not to take to water. In other words, during that press conference, Yellen stated the same bunk that Federal Reserve bankers had stated in their minutes eight times a year, for 7 years in a row in which they implied an interest rate hike could be coming, only to never raise interest rates. And after 7 years of deception in which they finally made good on their threat to raise interest rates, the interest rate "hike" turned out to be a measly 0.25% raise, because that's all they could afford to raise it without risking greater ripples and sell-offs in the financial markets. In other words, bankers released somewhere around 55 statements in a row about possibilities of raising interest rates without actually raising interest rates, before executing what amounted to the lowest possible "hike" they could possibly execute. And today, analysts incredibly still wait upon the public statements of Central Bankers with unbridled anticipation, and still incredibly use their statements to guide their investment strategies.

For example, I randomly pulled a FOMC minutes statement from January 2011, more than five years ago, and that statement contained Central Banker affirmations of "strong" consumer spending, "improvements in household and business confidence and in labor market conditions [that] "would likely reinforce the rise in domestic demand", talk of "gains" in employment and anticipation of "stronger growth" in the US economy for FY2011, with "gradual acceleration" of US economic growth in 2012 and 2013. In fact, one can pull any Federal Reserve FOMC statement from their archives over the past 5-½ years and you will find the same bunk and nonsense that they used to further inflate the US stock market bubble and to control gold and silver prices time after time after time. As I review the content of these statements every year, if one could go back and review years prior to 2011, though the Feds do not keep statements archived prior to 2011, one would discover that the Feds were using this same deceitful language since 2009. I, for one, at a complete loss for why big bank analysts still talk about "normalization" of interest rates and parrot Janet Yellen's frequent press statements in regard to this topic as if this were even a remote, much less, a realistic possibility. If we stop and think about the definition of "normalized" interest rates, how high of a level should normalized rates be when Bank of Japan bankers adopted ZIRP (Zero Interest Rate Policy) for 16 years before deciding ZIRP was inadequate enough to stimulate their economy and plunged interest rates into negative territory this year, and US Federal Reserve bankers maintained ZIRP for 7 years before finally "raising" interest rates for the first time in nearly 10 years on 16 December 2015?

Thus, we've had 16 consecutive years of zero interest rate policy (and now negative interest rate policy) in Japan and 7 years of ZIRP (and now a paltry 0.25% to 0.50% Fed Funds rate) in the US to understand that normalization of interest rates is never happening, yet analysts from JP Morgan, Goldman Sachs, Citibank, etc. still frequently discuss the timeline for "normalized" interest rates in the mass media as if they will happen. That's a whole lot of exhibited foolishness in not being able to read between the lines, especially when the lines are so clearly demarcated for all to see. Furthermore, my definition of "normalized" interest rates is the reinstatement of free market interest rates, which we all know will never happen during any of our lifetimes without Central Bankers being expelled out of nations. But what if we consider the Central Bankers' definition of "normalized" interest rates, likely within a 0.50% to 1.00% interest rate range? Given the fact that the Fed Funds interest rates was as high as 20% in the early 1980s and consistently around 5% throughout most of the 1990s, a "normalized" 050% to 1.00% interest rate is not normal at all. Furthermore, if we understand how a rate hike today to 1.00% might cause a meltdown in the BIS last-reported figure of $493 trillion of global derivatives contracts and cause TPTB banks to fail, then we know that even an abnormally-low "normalized" interest rate is likely never to happen (furthermore, the amount of global derivatives contracts still outstanding in the world today, is in reality, still close to a quadrillion dollars and not the misleading figure reported by the BIS. Years ago, to arrive at their current figure of $493 trillion, the BIS cut the existing figure in half overnight by changing the metric to measure notional derivative contract valuations, which was tantamount to an Enron-like cooking of the books simply to significantly lessen the appearance of risk inherent in the global financial system.)

In the end, there is no end in sight to the fiat currency purchasing power devaluation objectives of Central Bankers, and for this reason, we should stop taking our cues from traders that try to profit on every single short-term move in asset prices. Rather, we need to understand that the global currency wars still firmly remains a race to the bottom in purchasing power, and that converting fiat currencies into wealth preserving physical gold and physical silver still makes a whole lot of sense.

To receive news about SmartKnowledgeU articles when we first release them, please subscribe to our article rss feed here. Click here for more information on the best junior gold and silver mining stocks and wealth preservation strategies. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alasdair Macleod: Saving the system Posted: 04 Aug 2016 07:19 PM PDT By Alasdair Macleod Monetary policy, we are told, is all about staving off recession and stimulating economic growth. However, not only is monetary debasement in any form counterproductive and destroys the personal wealth of the masses, but the economists who devised today's monetarism have completely lost their way. This article addresses the confusion surrounding this subject, and concludes that the real reason for today's global monetary policies is an ultimately futile attempt to prevent a systemic and economic crisis. ... ... For the remainder of the commentary: https://wealth.goldmoney.com/research/goldmoney-insights/saving-the-syst... ADVERTISEMENT We Are Amid the Biggest Financial Bubble in History; With GoldCore you can own allocated -- and most importantly -- segregated coins and bars in Switzerland, Singapore, and Hong Kong. Switzerland, Singapore, and Hong Kong remain extremely safe jurisdictions for storing bullion. Avoid exchange-traded funds and digital gold providers where you are a price taker. Ensure that you are outright legal owner of your bullion. If you do not own segregated bullion that you can visit, inspect, and take delivery of, you are exposed. Crucial guides to storage in Singapore and Switzerland can be read here: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland GoldCore does not report transactions to any authority. Safety, privacy, and confidentiality are paramount when we are entrusted with storage of our clients' precious metals. Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44(0)203-086-9200. U.S.: +1-302-635-1160. International: +353(0)1-632-5010. Visit us at: http://www.goldcore.com Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Maybe Indians buy so much gold because their currency is so crappy Posted: 04 Aug 2016 07:06 PM PDT Why Do Indians Spend So Much on Gold? RBI to Study By the Press Trust of India http://timesofindia.indiatimes.com/business/india-business/Why-Indians-s... MUMBAI -- The Reserve Bank of India has set up a committee to study Indian household financing patterns and why Indians spend large sums on gold. The panel will look at various facets of household finance in India and to benchmark India's position vis-a-vis both peer and advanced countries, the RBI said in a statement on Thursday. The panel, headed by Tarun Ramadorai, professor of financial economics at the University of Oxford, will have representation from financial sector regulators SEBI, IRDAI, and PFRDA apart from the RBI. ... Dispatch continues below ... ADVERTISEMENT Free Storage with BullionStar in Singapore Until 2016 Bullion Star is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. Bullion Star's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in Bullion Star's bullion vault, which is integrated with Bullion Star's shop and showroom, making it a convenient one-stop-shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage is FREE until 2016 and will have the most competitive rates in the industry thereafter. For more information, please visit Bullion Star here: It will consider "whether, how, and why the financial allocations of Indian households deviate from desirable financial allocation and behaviour (for example, the large household allocation to gold)." The committee has also been asked to benchmark the current depth of household financial markets in India vis-a-vis those in other major world markets and to identify areas of priority for growth and change. To characterize and evaluate households' demands in formal financial markets (for assets such as pensions as well as liabilities such as home loans) over the coming decade is another key term of reference given to it. The RBI further said that the panel will evaluate the "design of new systems and the redesign of existing systems" of incentives and regulations to encourage and enable better participation by households in formal financial markets. The terms of reference also include assessing the role of new financial technologies and products (robo-advising, automatically refinancing mortgages) in the cost-effective provision of high-quality and suitable financial products to Indian households while containing risks. The committee is expected to submit its report by the end of July 2017. The demand for formal financial market investment product like pensions as well as liability products like home loans from the Indian household was discussed during the meeting of the Subcommittee of Financial Stability and Development Council held in April. It was decided that a committee should be set up to look at various facets of household finance in India and submit a report, the RBI said. Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Previewing Tomorrow's Payrolls: Watch Out For Short-End Fireworks Posted: 04 Aug 2016 06:40 PM PDT As the world awaits the next in the series of "most important jobs numbers ever," which has now been shown as only relevant to the degree by which it moves the S&P 500 higher (or god forbid lower), consensus expectations are for a goldilocks 180k gain in jobs and flat 4.9% unemployment rate. The market will be looking to see if the Fed's recent optimism surrounding labor market conditions (despite a collapse in their own LMCI) are justified and if the employment figures of July and August demonstrate a new trend in conjunction with June ahead of the September meeting... and of course the 'election adjustment'. Consensus Expectations:

So just ignore this... It's probably nothing...

Goldman expects a 190k increase in nonfarm payroll employment in July, slightly above consensus expectations for a 180k gain. Most labor market indicators were roughly in line with their recent trends, though a couple of key indicators were somewhat stronger in July. Arguing for a stronger report:

Neutral factors:

We expect the unemployment rate to remain at 4.9% in July from an unrounded 4.899% in June, but see the risks as tilted to the downside. The headline U3 rate rose 0.2pp in June, while the broader U6 underemployment rate fell 0.1pp to 9.6% as a result of a very large drop in involuntary part-time employment. In our recent labor market status report, we estimated that there is about 0.5pp of broad slack remaining in full-time equivalent terms. With trend employment growth still running at roughly double our 85k estimate of the breakeven rate, we expect the labor market to reach full employment by early 2017 and to surpass it thereafter. Average hourly earnings for all workers are likely to rise 0.3% in July, in part reflecting favorable calendar effects. This should leave the year-on-year rate unchanged at 2.6%, though we see the risks as tilted to the upside. Our wage tracker—which aggregates four measures of wage growth—has accelerated to 2.8% year-on-year in our preliminary Q2 estimate, a sign that diminishing slack is boosting wage growth. Market ReactionAs ever with the NFP release, the headline is likely to garner much of the initial focus with algorithms and fast money moves jumping on any large discrepancies. Participants are likely to view the jobs report with a wide context, as recent months have seen two extreme numbers on either side of the spectrum, and any substantial revision to last month's large beat could weigh on the USD. However, how the report is received will ultimately be decided on whether it can justify more of the few calling for a September hike and to do so a very strong report must be seen. And BNP's strategists Timothy High and Daniel Tangho warn risks to short-end yields appear underpriced...

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Doomsday Approaching - Gov. Spending is Signaling Preparation! Posted: 04 Aug 2016 05:22 PM PDT Hillary Clinton is trying desperately to sell herself to the American public while her own party protested her at the DNC. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Doomsday Approaching - Gov. Spending is Signaling Preparation! Posted: 04 Aug 2016 05:08 PM PDT Does the Government know they will never have to pay the bill? Is global catastrophe make all debt irrelevant? Banking exec thinks there is something coming. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Galactic Council of Light, Moving beyond Limitations Posted: 04 Aug 2016 04:58 PM PDT Galactic Council of Light, Moving beyond Limitations by Jenny Schiltz August 3, 2016 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| David Duke - Media Propaganda Against Trump Out of Control Posted: 04 Aug 2016 04:00 PM PDT Jeff Rense & David Duke - Media Propaganda Against Trump Out of Control Clip from August 03, 2016 - guest David Duke on the Jeff Rense Program. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 04 Aug 2016 02:36 PM PDT It looks as though the stock market is waiting for the malefic Saturn Stationary/Direct in Sagittarius around August 13th before any serious damage might occur. The 7- week cycle low is due August 16 +/- and may coincide with the August 19th projected GDX low where there is a bisecting of the January 20 to August 2 .618 retrace and Mar '09 to January '16 rising bottoms line near 1952/53. GDX: July 6-25 (wave X) added to the August 2 top (Wave Y) = August 19 (which is also a TLC low, wave Z). | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Respect Posted: 04 Aug 2016 01:41 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Dollar Will Be Removed From Int'l Trade,Which Will Send Shock Waves Throughout The US:Jim Willie Posted: 04 Aug 2016 01:34 PM PDT Jim Willie CB Proprietor, GoldenJackass.com Editor, Hat Trick Letter The man behind the name Jim Willie has experience in three important fields of statistical practice in the 23 years following completion of a PhD in Statistics at Carnegie Mellon University. He spent time since 2001 in a private... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| What’s Coming Is Going to Be a Mess Posted: 04 Aug 2016 01:33 PM PDT This post What's Coming Is Going to Be a Mess appeared first on Daily Reckoning. The last two months alone have seen Britain leaving the European Union, terror attacks, cop killings, Deutsche Bank nearly collapsing, the German long term interest rates set at negative, to name a few. But over the next couple of years, it’s going to get a whole lot worse. As economies worsen, there will be more social unrest, more angry people, and crazier politicians. Somebody will try to come along on a white horse to save us all, but she usually makes it worse. Are we at a point right now where it feels like it's accelerating. People all over are very unhappy about what’s going on. If you read history, there are a lot of similarities between now and the 1920s and ’30s. That's when fascism and communism broke out in much of the world. And a lot of the same issues are popping up again. Brexit could be a triggering moment. This is another step in an ongoing deterioration of events. It’s also an important turning point because it now means the central banks are going to print even more money. That may prop the markets up in the short term. We have a strange economy. Markets look like they’re fine. But underneath the surface, most stocks are not doing well. Most stocks around the world are down. Most stocks in the United States are down. In 2015, when the market averages were flat, twice as many stocks were down on the New York stock exchange as were up. And in the last nine months, earnings are down in the United States. A recession is starting, it is already in place. But if you look at the averages and the bond market, they still go up. That’s because all the central banks are running their printing presses as fast as they can, and Brexit means they'll run them even faster. Except for the central banks printing a lot of money, the entire market would have tanked by now. We had a problem in 2008 because of too much debt, domestically and worldwide. Now the debt levels are staggering compared to 2008. Some countries have up to five times as much debt as they had eight years ago. And the dangers now are even larger than 2008. If you look at the last few bubbles, the Federal Reserve at least had the ability to drop rates from 6% or 5% down to zero. Now it has virtually no room left to maneuver. The Fed doesn't know what it's doing. This is all an experiment with them. They just decided to print more money, drive interest rates to zero, and see what happens. There are going to be profound consequences of this giant delusional experiment. Ironically, with negative interest rates in so many places around the world, investors are putting their money in the U.S. because they think the dollar’s a safe haven and at least there’s still yield in the U.S. But history shows it’s not sustainable. In the 1920s, America had to raise interest rates because of the debt situation in Europe after WWI. The U.S. stock market went through the roof because all the money going from Europe to the U.S. Stocks became so overpriced because all that money kept flowing in one direction. Then all of a sudden… the bubble burst. The Great Depression, fascism and communism came next. Every situation is different, and you can't draw exact parallels between different eras. But history rhymes if it doesn't necessarily repeat, as Mark Twain said. I'm very worried because what we're facing now can get worse than anything most of us have seen in our lifetimes. The world may be overdue for a crisis of that magnitude. Throughout history, we’ve had periods of severe crisis. I don’t mean 1968 or 2008, for instance. I mean a serious crisis with widespread bankruptcies, massive unemployment, the emergence of dictators, and war. America’s the largest debtor nation in the history of the world. And the debts are getting higher and higher. The U.K. has huge government debts, huge balance trade imbalances, and now they’ve voted for Brexit. That’s going to cause many problems within the U.K. because of all the tensions that are building up. Spain has problems. Italy has major problems now with its banks. Germany has problems. China has a massive debt problem. Japan looks like it could resort to helicopter money as a way out. There are few bright spots. Societies around the world are already falling apart, or nearly so. Look at all the recent terrorist attacks and mass shooting incidents in America and Europe. And look at what's happening in Venezuela right now. People are literally starving. Even the most basic necessities of life are impossible to find in stores. Hundreds of thousands of people are trying to get into Colombia to buy food. The government just makes it worse because it doesn’t know what it's doing. What we're seeing in Venezuela has happened in many countries throughout history. It’s happened to many countries in the last century — this isn't something that happened 500 years ago. It hasn't happened in the U.S. yet, of course. But don't think it can't if the circumstances are right. The European Union as we know it is not going to survive. Not as we know it. Britain voted to leave, and France could very well be next. Why France? One of the main reasons is because the French economy is softer than the German economy. At least in Germany people are still earning money and making a living, despite all the recent turmoil. In France, the same malaise that's settling over the U.S. and other places is settling in. And it’s going to spread. There is no place to hide with what’s coming. I'm not saying it’s coming this year, or even the next. I can't give a specific date. But imbalances are building up to such a degree, they just can’t continue much longer. We’ve had two 50% market drops in the last 15 years. Why can’t we have a third? And if it can drop 50%, why can’t it drop 75%? It can and it will ultimately. But in the meantime, all that money printing could still drive stocks higher. And central banks might take even more desperate measures to keep the game going. The Japanese central bank is already buying stocks. It's already bought all the government bonds. The European Central Bank is running out of bonds and government bonds to buy. Now it's starting to buy corporate bonds. Why can’t that happen in America? Why can’t the Federal Reserve buy these assets? When Bernanke was head of the Fed he said, “If we have to, we’ll buy anything. We’ll buy shares of gold mines.” If the Central Banks all over the world buy stocks, there’s really no top. It's hard to say when the music will end. But it will end, and that's when we can see a 75-80% drop in stocks. The biggest lesson of history is people don’t learn from history. And history shows us that even the people that know history, don’t learn from history. At the beginning of 2008, the head economist at the Federal Reserve in Washington, DC published a paper that mocked all the people out there who warned about a housing crisis. He said they have 1,000 of the smartest and best educated economists in the world working at the central bank of the United States. Those fools don’t know what they’re talking about. We do. Except they didn't. And that’s the problem. Too many people believe 1,000 of the smartest economists in the world who don’t know what they’re talking about. That’s why they get blindsided. I urge everybody I meet to learn history. Once you become knowledgeable, you’re going to be worried. Once you’re worried, you might be prepared. If you’re prepared, you will be one of those who survives whatever happens. Because what’s coming is going to be a mess. Regards, Jim Rogers Ed. Note: Sign up for your FREE subscription to The Daily Reckoning, and you'll start receiving regular offers for specific profit opportunities. By taking advantage now, your ensuring that you'll be financially secure later. Best to start right away. The post What's Coming Is Going to Be a Mess appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 04 Aug 2016 12:35 PM PDT "Aeroplane money" versus "Helicopter money" used by the combined central banks of Europe and the USA would give you $40,000 Dow easily, with the gold to Dow ratio (with gold more than 50% higher than the Dow). Aeroplane money is different than Helicopter money and cannot be camouflaged as to being sterilized. Best Regards,Jim Hi... Read more » The post Jim’s Mailbox appeared first on Jim Sinclair's Mineset. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Coming Economic Collapse Of America 2016 2017 Posted: 04 Aug 2016 10:24 AM PDT Real estate deals are collapsing in Vancouver, as more people back out of deals. ADP job reports shows construction jobs have declined. Office Depot, Kate Spade and others are reporting losses during this incredible recovery. Auto sales decline for the month of July, the only reason auto sales had... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| How Israel Created ISIS Explained by Ken O'Keefe Posted: 04 Aug 2016 10:00 AM PDT mossad king of false flag operations Zionist Author Reveals ISIS is Israeli Secret Intelligence Service Thank you to Zinoist watch for producing and uploading this video, I encourage all such productions for all serious truth tellers. The Financial Armageddon Economic Collapse Blog... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Be Careful Before US Dollar Collapse Posted: 04 Aug 2016 08:50 AM PDT Economic collapse and financial crisis is rising any moment. Getting informed about collapse and crisis may earn you, or prevent to lose money. Do you want to be informed with Max Keiser, Alex Jones, Gerald Celente, Peter Schiff, Marc Faber, Ron Paul,Jim Willie, V Economist, and many... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Bullion – The Ultimate Monetary Solution Posted: 04 Aug 2016 06:00 AM PDT gold.ie | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Buy Gold and “Real Assets†Says the ‘Bond King’ Posted: 04 Aug 2016 05:28 AM PDT Buy gold and “real assets” and not bonds is the financial advice of the “Bond King”, Bill Gross in his latest must read newsletter which covers everything from his favoured assets to sex. Gross, the founder of and ex boss of the largest bond fund in the world PIMCO, now manager of the Janus Global Unconstrained Bond Fund, says buy gold and warns of the risks in the bond market. He favours allocating funds to physical assets such as gold and real estate and he explained why in interviews on CNBC and Bloomberg yesterday. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Royalty Deal with Waterton Should Bolster Terraco Gold Posted: 04 Aug 2016 01:00 AM PDT Terraco Gold's recent Spring Valley royalty deal with a private Waterton investment fund has primed the company and its investors for growth. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Seabridge Is Turning Cash into Gold Posted: 04 Aug 2016 01:00 AM PDT Seabridge Gold hosts one of the world's largest gold resources, offering shareholders exceptional leverage to a rising gold price. Chairman and CEO Rudi Fronk explains his company's value-enhancing strategy of obtaining resources at low cost and spinning them into gold. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Prices Jump on $220bn of New UK QE and Record-Low Rates Posted: 03 Aug 2016 05:00 PM PDT |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment