Gold World News Flash |

- Gold In Sterling 2.2% Higher After Bank Of England Cuts To 0.25% and Expands QE

- Australia Customs Department Confirms BullionStar’s Analysis on Gold Export to China

- The World in 2017: These Events Prove Something is Going On!

- Best Cash ISA for Crash / Collapse in UK Savings Interest Rates

- Investing in Gold in 2016: Global Paradigm Shifts in Politics and Markets

- False Flags and the Gladio Agenda - Richard Dolan

- This Is a Powerful Bull Market in Gold

- Are we living in a Simulated Reality? The Game of Life and How to Play It!

- Only In China: Companies Become Banks To 'Solve' Financial Difficulties

- Paul Craig Roberts Warns US is Completely Busted, Non Delivery of Gold Crash the System 2016

- "Jobs Data Nowhere As Strong As Headline" - Analysts Throw Up On Today's Seasonal Adjustment

- Carl Icahn Has Never Been More Short The Market, Is Pressing For A Crash

- Gold Price Closed at $1336.40 Down $22.40 or -1.6% and Down $12.60 or -0.9% for the Week

- Harry Dent Global Economic Collapse is Near 2016-2017 Crash Report

- Gold Daily and Silver Weekly Charts - Where the Elite Meet To Cheat

- Janet Yellen: 21st-Century Houdini

- Gold and Gold Stocks Bull Analogs

- Gold Stocks Autumn Rally

- Gold In Sterling 2.2% Higher After Bank Of England Cuts To 0.25% and Expands QE

- Hacked bitcoin exchange says users may share $68 million loss

- DEUTSCHE BANK COLLAPSE EXPLAINED BY HARRY DENT

- China Gold Leasing Boosts Imports, Masks 20% Demand Drop

- Does Gold Continue Its Bull Market Towards $1500 or Crash?

- Breaking News And Best Of The Web

- Stock Market, Gold Update

| Gold In Sterling 2.2% Higher After Bank Of England Cuts To 0.25% and Expands QE Posted: 06 Aug 2016 01:00 AM PDT by Mark O'Byrne, GoldCore:

Sterling fell sharply on markets and gold rose from £1,014/oz to over £1,036/oz where it remains this morning. Ultra loose monetary policies are now even looser after the BOE cut interest rates for the first time in more than seven years and launched a bigger-than-expected package of monetary measures. The Bank cut official interest rates to a new record low of 0.25% from 0.5% and signalled they would be reduced further in the coming months. The deepening of ultra loose monetary policies is bullish for gold, especially in sterling terms. Sterling gold is 38.4% higher in 2016 year to date. This means that gold is now just 14% below the all time record nominal high of £1,179/oz reached on the 5th of September 2011. Gold remains one of the best performing assets in all currencies over a 10, 15 and 20 year period. Governor Carney also aggressively renewed and expanded its QE and launched a new £100bn funding scheme for banks. The BoE also launched a new £70 billion a month bond-buying programme which was quickly termed a 'sledgehammer stimulus' by analysts. This will include £10 billion of sterling denominated investment grade corporate bonds, from companies the BOE judges make a "material contribution" to the UK economy. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Australia Customs Department Confirms BullionStar’s Analysis on Gold Export to China Posted: 06 Aug 2016 12:00 AM PDT by Koos Jansen, Bullion Star:

Obviously, what we're after is exactly how much (non-monetary) gold China is importing from all countries around the world. As China doesn't disclose its cross-border trade statistics for gold, the only way to reach our objective is by establishing net gold export from all countries around the world to China, subsequently to aggregate these numbers and come to an estimate of total Chinese gold import. One of the largest exporters of gold to China is Australia, but calculating Australia's gold export to China is complicated, as we need to be cautious to avoid double counting in computing China's total net gold import. The thing is, ABS bluntly alters any "export to Hong Kong" into "export to China" when they suspect the gold is shipped to Hong Kong but will reach the mainland as its final destination – this is what ABS confirmed to me. Therefor, from using Australia's "export to China" double counting can arise when any gold flowing from Australia via Hong Kong to China would then be declared as "export to China" by Australia and "export to China" by Hong Kong. Let us clarify this subject. Have a look at the chart below. If we focus on the period from January 2013 until December 2014 we can observe that Australia's "export to China" (purple bars, data sourced via ABS/COMTRADE) roughly matches Hong Kong's "import from Australia" (turquoise bars, data sourced from the Hong Kong Census and Statistics Department). We must conclude that over this period roughly all gold Australia exported to China was transferred via Hong Kong. If we then would sum up Australia's gold "export to China" to Hong Kong's gold "export to China" this would result in double counting. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The World in 2017: These Events Prove Something is Going On! Posted: 05 Aug 2016 11:00 PM PDT Shocking Worldwide Events: prophetic events from around the world the past week or so end times signs of the times current world news strange events mystery booms strange sounds bible prophecy last days proof The Financial Armageddon Economic Collapse Blog tracks trends and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Best Cash ISA for Crash / Collapse in UK Savings Interest Rates Posted: 05 Aug 2016 10:19 PM PDT The Bank of England slashing UK interest rate from 0.5% to 0.25% in a panic to save its always teetering on the edge of bankruptcy bankster brethren from going bust again and to monetize government debt by means of quantitative easing, the smoke and mirrors phrase used for the Bank of England to print another £170 billion mostly for its banking sector friends to gorge themselves on, to generate additional artificial profits. The net effect of this 'THEFT' of purchasing power is that the price savers and workers have already been paying for 8 years has just gotten a lot worse! | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investing in Gold in 2016: Global Paradigm Shifts in Politics and Markets Posted: 05 Aug 2016 10:00 PM PDT by Claudio Grass, Acting Man:

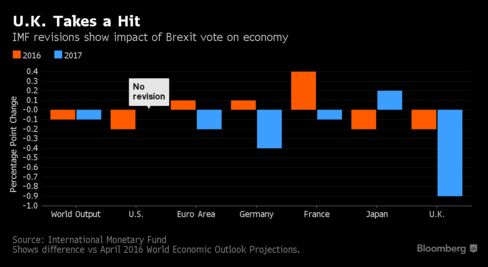

In the past few months, we have witnessed a series of defining events in modern political history, with Britain's vote to exit the EU, (several) terror attacks in France and Germany, as well as the recent attempted military coup in Europe's backyard, Turkey. Uncertainty over Europe's political stability and the future of the EU keeps growing. These worries are quite valid, as geopolitical developments have the potential to shake markets to the core. The current high-risk environment makes it especially important to take prudent investment decisions in order to protect one's wealth. Helicopter Hopes Markets have greeted the rumors of helicopter money with intense enthusiasm, beginning with Ben Bernanke's visit to Japan. This is a symptom of the economy's addiction to loose monetary policy and "something for nothing" fiscal remedies. Helicopter money, the next evolutionary stage of QE, is the manifestation of the failing, yet persistent, monetary policies adopted and enforced by modern-day central bankers. This time, their proposed solution for rescuing an economy that flatly refuses to get back on a growth track (despite a long series of aggressive interventions), is a direct and permanent injection of newly printed money into the economy, by circumventing the banking system completely. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| False Flags and the Gladio Agenda - Richard Dolan Posted: 05 Aug 2016 09:00 PM PDT Richard Dolan tells the history of false flags since the 1930s, likening them to massive mind control ops. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This Is a Powerful Bull Market in Gold Posted: 05 Aug 2016 07:00 PM PDT from KitcoNews: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Are we living in a Simulated Reality? The Game of Life and How to Play It! Posted: 05 Aug 2016 07:00 PM PDT Are we living in a Simulated Reality? The Game of Life and How to Play It! by Nanice Ellis August 5, 2016 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Only In China: Companies Become Banks To 'Solve' Financial Difficulties Posted: 05 Aug 2016 06:30 PM PDT Submitted by Valentin Schmid via The Epoch Times, China is desperate to solve several problems it has due to its debt to GDP ratio being north of 300 percent. It may have found a pretty unconventional one by letting companies become banks, according to a report by the Wall Street Journal.

Sany already operates an insurance and finance division with the goal of internal financing and insurance services for clients.  Sany Heavy Industries already operates a Finance and Insurance arm, although it’s unclear what gold has to do with it. (Company Website) Debt ProblemOne problem is that companies are defaulting on bond payments and there is no adequate resolution mechanism for bad debts, at least according to Goldman Sachs.

By becoming or owning banks, the companies can just shift debt around different balance sheets to avoid a default, although this is probably not the resolution that Goldman Sachs had in mind when talking about structural reforms. Another problem is that the regime has more and more difficulties pushing more debt into the economy to grease the wheels and keep GDP growth from collapsing entirely. China needs 11.9 units of new debt to create one unit of GDP growth. At the same time, the velocity of money or the measure of how often one unit of money changes hands during a year has fallen to below 0.5, another measure of how saturated the economy is with uneconomical credit. If the velocity of money goes down, the economy needs a higher stock of money to keep the same level of activity. So if companies can’t pay back loans, old banks don’t want to give out loans, and consumers don’t want to circulate the money, you can just let some companies become banks to prevent them from defaulting and maybe even issue new loans to themselves. It would not be the first time China has tried a circular financial arrangement to solve some structural issues. Sany Not AloneAccording to the Wall Street Journal report, the Sany Heavy Industries case is only one of a few. Other companies in the tobacco and travel sectors, for example, have taken over banks or formed new ones. ChinaTopix reports that the China Banking Regulatory Commission (CBRC) has already awarded five licenses for private banks and received another 12 applications during the past year. It also mentions that industrial firms are behind this move:

We don’t know if the regulator had this in mind when they launched the initiative to boost private banks in China in 2014 in order to improve lending to the technology sector, but it did explicitly mention that private companies should form banks. “Qualified private enterprises shall be encouraged to set up private banks. The innovation of products, services, management, and technology by private banks will inject new vitality into the sustainable and innovative development of the banking sector,” the CBRC states in an undated report. * * * It remains to be seen whether this is a long-term sustainable solution. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Paul Craig Roberts Warns US is Completely Busted, Non Delivery of Gold Crash the System 2016 Posted: 05 Aug 2016 04:50 PM PDT Dr. Paul Craig Roberts Assistant Secretary of the US Treasury Dr. ... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| "Jobs Data Nowhere As Strong As Headline" - Analysts Throw Up On Today's Seasonal Adjustment Posted: 05 Aug 2016 04:47 PM PDT One week ago, the BEA admitted that it had "found a problem" when it comes to calculating GDP numbers. Specifically it blamed "residual seasonality" adjustments for giving historical GDP numbers a persistent optimistic bias. This came in the aftermath of last week's shocking Q2 GDP report which printed at 1.2%, less than half of Wall Street's consensus. Today, seasonality made another appearance, this time however in the much anticipated July jobs number, which unlike the woeful Q2 GDP number, was the opposite, coming in far higher than expected. In fact it was higher than the top Wall Street estimate.

And, just like in the case of GDP, it appears that seasonal adjustments were the culprit for today's blowout headline print which excluding the Arima X 13 contribution to the headline number, would have been notably weaker. As Mitsubishi UFJ strategist John Herrmann wrote in a note shortly after the report, the "jobs headline overstates" strength of payrolls. He adds that the unadjusted data show a "middling report" that's "nowhere as strong as the headline" and adds that private payrolls unadjusted +85k in July vs seasonally adjusted +217k. In Herrmann's view, the government applied a "very benign seasonal adjustment factor upon private payrolls to transform a soft private payroll gain into a strong gain." He did not provide a reason why the government would do that. Courtesy of Southbay Research, which also blasted today's seasonal adjustment factor, this is how the seasonal adjustments look like relative to history. We leave it up to readers to decide just why the government may want to represent what would otherwise have been a far weaker than expected report, into a blowout number, one which merely adds to the economic "recovery" narrative, which incidentally will come in very useful to Hillary's presidential campaign. Yet even assuming the market has no doubts about the seasonally adjusted headline number, as appears to be the case, the other problem that has emerged for the Fed is how to ignore this strong number. As Bank of Tokyo's Chris Rupkey writes, "Let's see Yellen get out of this one and find something in the data to once again not raise rates in September." (We assume he did not see the unadujsted numbers.) As he adds, slowing 2Q GDP growth of 1.2% took Sept. rate hike "off the table" and now "the million dollar question" is whether 255k payroll jobs in July, 292k in June put it back on. As a reminder, Yellen speaks exactly in three weeks time at Jackson Hole on Aug. 26; "let's see if she provides some guidance." But while rate hike odds may have spiked after today's report, it is almost certain that, as we said last night, the Fed will not dare to hike the rate in September and potentially unleash market turmoil in the most sensitive part of the presidential race. As for a December rate hike, there are 4 months until then, and much can happen: who knows, maybe the BLS will even undo the significant seasonal adjustment boost that send July jobs soaring. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Carl Icahn Has Never Been More Short The Market, Is Pressing For A Crash Posted: 05 Aug 2016 04:24 PM PDT Three months ago, when looking at the 10-Q of Carl Icahn's hedge fund vehicle, Icahn Enterprises, L.P. (IEP) we found something striking: Carl Icahn had put his money where his mouth was. Recall that over the past year, Carl Icahn had become one of the most vocal market bears with a series of increasingly escalating forecasts. At first, he was mostly pessimistic about junk bonds, saying last May that "what's even more dangerous than the actual stock market is the high yield market." As the year progressed his pessimism become more acute and in December he said that the "meltdown in high yield is just beginning." It culminated in February when he said on CNBC that a "day of reckoning is coming." Some skeptics thought that Icahn was simply trying to scare investors into selling so he could load up on risk assets at cheaper prices, however that turned out to be wrong when IEP revealed that as of March 31 it had taken its net short position from a modestly bearish 25% net short to an unprecedented for Icahn 149% short position, a six-fold increase in bearish bets. However, even as other prominent billionaires piled onto the bearish side, the market soared. And then, after Q1, it soared some more to the point where as of the end of June, following the brief Brexit dump, it was just shy of all time highs (where it is now). So there was renewed speculation if Icahn had given up on his record bearish bet. So when overnight IEP released its latest 10-Q, we were eager to find out if Carl had unwound his record short, or perhaps, added more to it. What we found is that one quarter after having a net short position of -149%, as of June 30, Icahn's net position was once again -149%, or in other words, he has once again never been shorter the market.

This is the result of a relatively flat long gross exposure of 174% (up 10% from the previous quarter) resulting from a 166% equity and 8% credit long, and another surge soaring short book which has grown even more from -313% as of March 31, 2016 to a gargantuan 323% as of the last quarter, on the back of 301% in gross short equity exposure and 22% short credit. This is what IEP added as detail:

There was little incremental detail. One quarter ago, when asked about this unprecedented bearish position, Icahn Enterprises CEO Cozza said during the earnings call that "Carl has been very vocal in recent weeks in the media about his negative views" adding that "we're much more concerned about the market going down 20% than we are it going up 20%. And so the significant weighting to the short side reflects that." Considering that since then the market has soared higher on wave after wave of central bank intervention, which has brought the monthly total amount of global QE to just shy of $200 billion, after the latest QE increase by the BOE...

... perhaps Icahn's directional fears were displaced. On the other hand, since Icahn has shown no interest in unwinding his bearish position, and has kept it identical to a quarter ago, one can conclude that the financier-rapidly-turning-politician, has merely delayed his bet for a day of reckoning for the S&P500. Perhaps this time he will be right. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1336.40 Down $22.40 or -1.6% and Down $12.60 or -0.9% for the Week Posted: 05 Aug 2016 04:21 PM PDT

Until today, stocks were below water for the week, as was the US dollar, & silver & gold were higher. Then the lying government jobs report came out & restored the majick spell that deceiveth the investor world. Just for a moment, let's pretend y'all are locked up in a lunatic asylum. Surrounded by crazy people. Imagine that some of 'em run naked all the time, some of 'em wrap up in sheets and call themselves Julius Caesar, some of 'em squat on all fours and bray like a donkey, & others claim they are pigs and pour their food on the floor and eat it. You, the lone sane person, watch all this. Would there be any reason for YOU to imitate their loony behavior? Would you go naked, or wrap up in bed sheets, or bray like a jackass, or eat off the floor? Of course you wouldn't. Today we live in a monetary & financial lunatic asylum, run by lunatics (central bankers). But as a sane person, you know that humans are not donkeys or pigs and that you must keep your clothes on in public, so you don't participate in their loony behavior. Mostly this consists of PRETENDING that the economy is booming and that stocks OUGHT to be rising and that lying government reports really are true, and that any word that falls of Janet Yellen's fat, curled lip is important. Any sane person knows that all this is lunatic behavior & following it will land you penniless in the funny farm. None of this is real, or important, or productive, or valid. It's all silly, insane pretense. Thus I just sit back and shake my head on days like today. First of all, I have figured out how to tell when government officials are lying: their lips are moving. Thus I will not be sucked in by LYING government jobs reports that miraculously double the number of jobs reported in May, or report huge jumps in July. Ain't none of it so, ain't none of it real, even if every jack leg smart guy on Wall Street believes it AND buys stocks because of it. I ain't loony yet, and I ain't tearing my clothes off or eating off the floor, I don't give two hoots and a holler how many people do, I ain't never gonna do it. That is part of why I am so opposed to investing in stocks, because the whole market is an illusion created by Fed money-printing & corporate debt for buybacks. Ain't the first durned thing productive about that, so no future to it. Other part is seen in the Dow in Gold & Dow in Silver charts. Both of those show a PRIMARY DOWNTREND that will last another 6-8 years. The first leg of that, 1999 - 2011 shaved 85% of the value off stocks. Correction 2011 - 2015 was nothing, peanuts, sawdust. From the December high stocks will lose ANOTHER 85% of their value against metals. I don't have to worry, I ain't fretted, I can patiently wait for the trend to unroll, WITHOUT the risk of depending on the criminals at the Fed to keep on pumping imaginary money into an imaginary market to raise imaginary prices. Have I made myself clear? Or am I so mealy mouthed y'all missed my point? TODAY stocks rose based on the LYING government jobs report. Dow rose 191.48 (1.04%) to 18,543.53. S&P500 rose 18.62 (0.86%) to a new high at 2,182.87. The US Dollar Index rose 45 basis points to 96.17 on the LYING government jobs report, from speculators begging that the Fed might just raise interest rates in September. That, of course, won't happen, BUT EVEN IF IT DOES it won't make as much difference as freezing to death at 10 degrees or 5 degrees. (Before I forget it, if y'all watched that Dollar Index as much as I do, y'all, too would notice that week to week it doesn't change much. That would reinforce my well-founded belief that in manipulating rates, central bankers MAINLY want stability. The less change, the better.) Higher dollar drove silver & gold to break support levels, & that took the Dow in Gold & Dow in Silver down. Charts are here, http://schrts.co/ohwLZP and here, http://schrts.co/8Sv0tc Y'all ought to be used to these silly sudden moves by now. Dow in Silver went back to its last low then bounced up through its 20 day moving average. Pray, mark that this occurs AFTER the June breakdown that shattered support from the lows that had held since February, and also completed a descending triangle by breaking down from it. All this is occurring miles below the 200 day moving average, so momentum is downward with the same intensity that pulls down a corpse weighted by concrete overshoes and chains. Yet deal we must with the appearance of a double bottom. Yea, it might well be, but if so 'twill make itself known by piercing the 50 DMA above and that old support line. Don't bet on that, don't draw to inside straights. Dow in gold has not fallen as enthusiastically as the Dow in silver since this began in December. However, it's fallen enough. Today carried it back up to the 20 DMA, which is hardly a turnaround but may signal some sideways movement for a while. Of course, all this upward enthusiasm could vanish Monday like mist in July sun, as it so many times has already. Gold tumbled $22.40 (1.6%) to $1,336.40 on Comex. Silver fell 3.1% or 62.6¢ to 1978¢. Repeat after me, "Silver is always more volatile than gold, both upside AND downside." Gold fell back through the upper boundary of its channel (pink line) & toward the 20 DMA and the uptrend line (blue), but fell not through them. So far so good, but volume shot up, confirming the move's direction, and MACD almost turned down. If it breaks that support line, it could trade back to the 50 DMA (now $1,308), about the neighborhood of the last low at $1,310.70. Monday will tell. Silver poked through the 20 DMA (2013¢) and sliced through the blue uptrend line to close slightly below it. Bad juju. Most likely target is 1927¢, scene of the last two lows. MACD has turned down. For those of y'all chafin' at what appears to be my 180 degree turnaround, stop. I didn't plan on, & the metals only partly hinted at, a lying government jobs report. However, the influence of that won't last any longer than a half-pint among professional drinkers. Y'all relax and go enjoy supper with your spouses tonight. The silver & gold uptrend that began in December remains safe. Besides, the yankee government and criminal central banks around the world are every one working, night and day, to drive silver & gold up. I believe in 'em. Yankee government on 5 August 1861 levied the first income tax, a tax on individuals then, as now, one cannot find in the constitution. Thus began the Riddle of the Income Tax. Don't ask me how they do it or who it applies to. Y'all know already I'm jes' a nat'ral born durned fool from Tennessee. Y'all enjoy your weekend. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Harry Dent Global Economic Collapse is Near 2016-2017 Crash Report Posted: 05 Aug 2016 04:20 PM PDT Harry S. Dent Harry S. Dent Jr. The Great Depression Ahead Harry S. Dent, Jr. is the Founder and President of the H. S. Dent Foundation, whose mission is "Helping People Understand Change". Using exciting new research developed from years of hands-on business experience, Mr. Dent offers a... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Where the Elite Meet To Cheat Posted: 05 Aug 2016 01:28 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Janet Yellen: 21st-Century Houdini Posted: 05 Aug 2016 01:03 PM PDT This post Janet Yellen: 21st-Century Houdini appeared first on Daily Reckoning. Harry Houdini was the greatest escape artist of the 20th century. He escaped from specially made handcuffs, underwater trunks and once escaped from being buried alive. Now Janet Yellen will try to become the greatest escape artist of the 21st century. Yellen is handcuffed by weak growth, persistent deflationary trends, political gridlock and eight years of market manipulation from which there appears to be no escape. Yet there is one way for Yellen and the Fed to break free of their economic handcuffs, at least in the short run. Yellen's only escape is to trash the dollar. Investors who see this coming stand to make spectacular gains. Yellen and the Fed face as many constraints as Harry Houdini in trying to escape a potential collapse of confidence in the U.S. dollar and a possible sovereign debt crisis for the United States. Let's look at some of the constraints on Yellen — and the possible "tricks" she might use to escape. The first and most important constraint on Fed policy is that the U.S. economy is dead in the water. Quarterly GDP figures have been volatile over the past three years, with annualized real growth as high as 5% in the third quarter of 2014 and as low as minus 1.2% in the first quarter of 2014. We have not seen persistent growth or a definite trend — until now. Finally, there is a trend, and it's not a good one. Annualized real growth for the past four quarters has been 2.0%, 0.9%, 0.8% and 1.2%, for average growth of 1.23%. That's a trend that will drive the U.S. into a sovereign debt crisis. Deficits are still running over 3% per year and set to skyrocket as baby boomers retire and claim Social Security and Medicare benefits. In effect, the U.S. economy has flat-lined at a level that cannot sustain our deficit spending. Take a look at the chart below…

The second constraint on the Fed is a persistent deflationary tendency. The U.S. economy is not yet in outright deflation. But there are powerful deflationary forces arising from demographics, debt, deleveraging and technology. That's important because the Fed's government debt problems could be solved with some inflation. (Inflation is not a good deal for you, but the Fed doesn't care about you. They care about the banks.) Inflation would help to solve the U.S. debt problem because it would lower the real cost of the debt. Making the debt burden sustainable is not about real growth; it's about nominal growth. Nominal growth is what you get when you add inflation to real growth. For example, if real growth is 2% and inflation is 2%, then nominal growth is 4%. Since debt is repaid with nominal, not real, dollars, then 4% nominal growth is enough to make debt sustainable even if deficits are 3% per year. The problem is that inflation is not 2% (what the Fed wants). Right now, inflation is closer to 1.5%. With 1.5% inflation and 1.23% real growth, nominal growth is still only 2.73%. That's not enough to sustain deficits of over 3%. The third constraint on the Fed is political gridlock. The Fed might be able to cause some inflation if they could employ "helicopter money." The use of helicopter money requires cooperation among the White House, Congress and the Fed. Basically, the White House and Congress would agree on massive spending programs and larger deficits. The Treasury would finance the deficits by issuing more bonds. Then the Fed would buy the bonds with printed money and promise never to sell the bonds. The debt would stay buried on the Fed's balance sheet possibly forever if "perpetual" bonds were used. Unfortunately for the Fed, there's almost no possibility of helicopter money this year. The U.S. has to get past the presidential election. They need to see which parties control the House and Senate and then try to achieve some consensus on a new spending program. That won't happen until February 2017 at the earliest. That's too late to get the U.S. out of its flat-line growth trend this year. The fourth constraint on the Fed is their desperate race against time. The Fed needs to raise interest rates so they can cut them when recession hits. The problem is that U.S. economy may be in recession before the Fed can normalize interest rates. If the Fed cannot cut rates enough to get the economy out of recession, it could become a permanent depression, as happened in Japan. My own view is that the U.S. has been in a depression since 2007 (defined as persistent below-trend growth). Japan has been in depression for over 25 years; the U.S. has been in depression for nine years. The entire world seems headed in the same direction. Here's the math. Economists estimate that the Fed has to cut interest rates about 350 basis points (3.5%) to offset the effects of a recession and stimulate a return to growth. Today, the Fed funds rate is 0.25%. The Fed would have to raise rates 3.25% before the next recession in order to cut them 3.5% to fight that recession. The problem is that the average U.S. economic expansion since 1980 lasted 79 months. The current expansion has already lasted 85 months. In other words, the next recession is already overdue. If the Fed rushes to raise rates now, they will cause the recession they are trying to avoid. The Fed's actual policy has been to do nothing and hope for the best, but that strategy is running out of time. Those are the Fed's handcuffs — weak growth, persistent deflation, no helicopter money and no ability to cut rates to avoid recession. How can the Fed escape these constraints? How can the Fed get the inflation it needs both to sustain the debt and facilitate rate hikes? At Currency Wars Alert we use the IMPACT system to forecast changes in exchange rates based on inflation, deflation, interest rates and other central bank policies. The IMPACT system uses intelligence techniques I learned at the CIA for predicting terrorist attacks and other geopolitical shocks. The IMPACT system looks for what intelligence analysts call "indications and warnings" that are unique to a particular course of events. Once these indications and warnings are spotted, the analyst has a good idea of what path is being taken and what the final destination will be. The Fed's final destination is inflation — the Fed needs inflation to escape its handcuffs. What are the indications and warnings of inflation from a policy perspective? There are four ways to get inflation when rate cuts are off the table. These four ways are helicopter money, world money, higher gold prices and currency wars. As mentioned, we may see helicopter money in 2017 if there's political will in Congress and the White House. But helicopter money does not guarantee inflation. People and companies on the receiving end of government deficit spending may just save the money or pay down debt instead of spending more themselves. This behavior negates the "multiplier effect." But that doesn't mean it won't be used anyway. The Fed never lets reality get in the way of trying out a bad idea. The second way to get inflation is for the IMF to issue world money in the form of special drawing rights, SDRs. This may happen in the next global financial crisis, but it won't happen in the short run. The IMF moves even more slowly than the Fed. SDRs may be issued in sufficient size to cause inflation in 2018. But it's unlikely to happen before then. The third way to get inflation is for governments to dictate a higher price for gold, perhaps $3,000 per ounce or higher. The idea is not to reward gold investors. The idea is to devalue the dollar relative to gold so the dollar price of everything else goes up. The U.S. government did this with some success in 1933 when it raised the price of gold by 70% in the middle of the Great Depression. However, this method is so extreme from a central banker's perspective that I don't expect it except in the most desperate circumstances. We may see this in 2019, but it's unlikely to happen sooner. That doesn't mean gold won't go up on its own — it will. It's just that investors should not expect the government to force the price higher by official action anytime soon. If we can potentially expect helicopter money in 2017, SDRs in 2018 and a high official gold price in 2019, what can we expect here and now? How can the Fed cause inflation in 2016? There's only one way to escape the room right now — currency wars. The Fed can trash the dollar and import inflation in the form of higher import prices. You can bet a cheap dollar will be on the agenda Sept. 4, 2016, when the G-20 Leaders meet in Hangzhou, China. A cheaper dollar is a complicated play, because it involves other currencies. If the dollar goes down, something else has to go up. It won't be the Chinese yuan or pounds sterling. China and the U.K. have serious growth problems of their own and need a cheap currency too. If the dollar goes down, then the three forms of money that have to go up are the yen, the euro and gold. Regards, Jim Rickards Ed. Note: Sign up for your FREE subscription to The Daily Reckoning, and you'll start receiving regular offers for specific profit opportunities. By taking advantage now, your ensuring that you'll be financially secure later. Best to start right away.

The post Janet Yellen: 21st-Century Houdini appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold and Gold Stocks Bull Analogs Posted: 05 Aug 2016 10:50 AM PDT Over the past two weeks the precious metals complex has retested its Brexit breakout and rebounded back to the July highs. Today’s jobs report has pushed the complex lower but has delivered an opportunity to cash heavy portfolios which have missed the bulk of the move. With that said, we wanted to share our current analog charts for Gold, gold stocks and junior gold stocks which suggest continued upside potential in the sector. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 05 Aug 2016 10:46 AM PDT The gold miners’ stocks have already enjoyed a phenomenal year, blasting higher with gold’s new bull market. This sector’s market-dominating performance has been amazing. Yet incredibly, the gold stocks are only now entering their strongest time of the year seasonally. Historically during bull-market years the gold stocks have enjoyed massive autumn rallies on average, starting right about now which is very bullish. Gold-stock performance is highly seasonal, which certainly sounds odd. The gold miners produce and sell their metal at relatively-constant rates year-round, so the temporal journey through calendar months should be irrelevant. Based on these miners’ revenues, there’s no reason investors should favor them more at certain times of the year than others. Yet history proves that’s exactly what happens in this sector. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold In Sterling 2.2% Higher After Bank Of England Cuts To 0.25% and Expands QE Posted: 05 Aug 2016 09:24 AM PDT Gold in sterling was 2.2% higher yesterday and was marginally higher in dollar terms after the Bank of England cut interest rates to all time, 322 year record low at 0.25% and surprised markets by renewing and aggressively expanding quantitative easing or QE. Sterling fell sharply on markets and gold rose from £1,014/oz to over £1,036/oz where it remains this morning. Ultra loose monetary policies are now even looser after the BOE cut interest rates for the first time in more than seven years and launched a bigger-than-expected package of monetary measures. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hacked bitcoin exchange says users may share $68 million loss Posted: 05 Aug 2016 08:37 AM PDT By Lulu Yilun Chen and Yuji Nakamura After suffering a crippling hack earlier this week, Hong Kong-based bitcoin exchange Bitfinex said it may spread the loss among its users, including ones not directly impacted by the hack. "We are leaning toward a socialized loss scenario among bitcoin balances and active loans to BTC-USD positions," the exchange wrote in a blog post Friday. Bitfinex is still "settling positions and balances," and will provide more details soon, it said. This week's attack is potentially the second-largest on an exchange since Japan's Mt. Gox, and could further erode confidence in the virtual currency. Bitfinex was the largest exchange for U.S. dollar-denominated transactions over the past month, according to bitcoincharts.com, and the attack sent bitcoin's price plunging more than 20 percent. Efforts to contact Bitfinex were not immediately successful. A representative of the exchange, verified by Bloomberg, wrote on Reddit that users who either had bitcoin deposited at the exchange or who were in the process of lending U.S. dollars for margin trading would be affected. ... ... For the remainder of the report: http://www.bloomberg.com/news/articles/2016-08-05/hacked-bitcoin-exchang... ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| DEUTSCHE BANK COLLAPSE EXPLAINED BY HARRY DENT Posted: 05 Aug 2016 05:45 AM PDT DEUTSCHE BANK COLLAPSE - WHAT YOU NEED TO KNOW - HARRY DENT Deutsche Bank shares are already down by more than half over the past 12 months, and the financial sharks can smell blood in the water.According to some reports, the bank could cut up to 35,000 jobs by the year 2020. Why is... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China Gold Leasing Boosts Imports, Masks 20% Demand Drop Posted: 05 Aug 2016 04:22 AM PDT Bullion Vault | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Does Gold Continue Its Bull Market Towards $1500 or Crash? Posted: 05 Aug 2016 03:15 AM PDT Gold has a “clear presence” to play in a world dominated with ‘global economic uncertainty” My analysis shows that gold will be implemented to protect ‘global purchasing power’ and minimize losses during our upcoming periods of ‘market shock’. It serves as a high-quality, liquid asset to be used when selling other assets would cause losses. Central Banks of the world’s largest long-term investment portfolios use gold to mitigate portfolio risk in this manner and have been net buyers of gold since 2010. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 04 Aug 2016 06:44 PM PDT Good US jobs report. Gold plunges, stocks jump. Oil hovers around $40. BoE cutes rates, UK bond yields plunge. European banks have investors running scared. Japan begins new round of stimulus. The Trump campaign may be collapsing. Best Of The Web Michael Belkin interview – King World News What happens when rampant asset inflation […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 04 Aug 2016 10:36 AM PDT It looks as though the stock market is waiting for the malefic Saturn Stationary/Direct in Sagittarius around August 13th before any serious damage might occur. The 7- week cycle low is due August 16 +/- and may coincide with the August 19th projected GDX low where there is a bisecting of the January 20 to August 2 .618 retrace and Mar '09 to January '16 rising bottoms line near 1952/53. GDX: July 6-25 (wave X) added to the August 2 top (Wave Y) = August 19 (which is also a TLC low, wave Z). |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Gold in sterling was 2.2% higher yesterday and was marginally higher in dollar terms after the Bank of England cut interest rates to all time, 322 year record low at 0.25% and surprised markets by renewing and aggressively expanding quantitative easing or QE.

Gold in sterling was 2.2% higher yesterday and was marginally higher in dollar terms after the Bank of England cut interest rates to all time, 322 year record low at 0.25% and surprised markets by renewing and aggressively expanding quantitative easing or QE. Since 2015 I've stated the raw data published by the

Since 2015 I've stated the raw data published by the  Crumbling Stability

Crumbling Stability

No comments:

Post a Comment