saveyourassetsfirst3 |

- Daily Gold Update - No Respite In Sight

- Comments on Gold & Gold Stocks

- GOLD & DEBT: A Look at the Great Depression vs the Coming Financial Collapse

- System Again Bumping Up Against Debt Saturation Levels – Day of Reckoning Seems to Be in Sight -Bill Holter

- DHS Places MASSIVE Order For Radiation Detectors – Is A Nuclear Attack Imminent?

- Financial Analyst Warns Of Major September Market Event

- This Would Make George Orwell Blush: Facebook Just Got a Whole Lot Creepier

- Dutch Central Bank Refuses To Publish Gold Bar List For Dubious Reasons

- The US Government’s Biggest Gold Manipulation Mistake

- Two Days To Go So Let's Have A Hat Contest!

- Friday’s Jobs Report Could Trigger A Stock Market CRASH – Stewart Thomson

- Drudge: ‘HOMELAND SECURITY TO TAKE CHARGE OF ELECTIONS’

- US Financial Collapse: Now, Or Later?

- Redstar: High-Grade Gold in Alaska

- Top Ten Videos — August 31

- July U.S. Consumer Spending and Gold

- A Bit More Downside Potential in Gold Stocks

- Gold Stock Technicals During Dog Days of Summer

- Gold against Foreign Currencies Update

| Daily Gold Update - No Respite In Sight Posted: 31 Aug 2016 01:24 PM PDT |

| Comments on Gold & Gold Stocks Posted: 31 Aug 2016 12:25 PM PDT A flash update for subscribers was sent late last evening. We cover the current outlook for Gold and gold stocks. Learn more about our premium service here.

|

| GOLD & DEBT: A Look at the Great Depression vs the Coming Financial Collapse Posted: 31 Aug 2016 12:00 PM PDT Americans are in real trouble. While Americans have been suffering 45 years of Gold & Silver Monetary Amnesia, PRECIOUS METALS RELIGION will finally wake up the living dead... From SRSRocco: The situation Americans face in the future will be nothing like anything they have experienced in the past. While we have seen old footage […] The post GOLD & DEBT: A Look at the Great Depression vs the Coming Financial Collapse appeared first on Silver Doctors. |

| Posted: 31 Aug 2016 11:00 AM PDT The 2008 Great Financial Crisis came about because we began to hit “debt saturation” levels. The crisis was one of solvency but was attended to with added liquidity. Sovereign treasuries still had the ability to add debt to their balance sheets which was done in unprecedented amounts. Now, we are again bumping up against debt […] The post System Again Bumping Up Against Debt Saturation Levels – Day of Reckoning Seems to Be in Sight -Bill Holter appeared first on Silver Doctors. |

| DHS Places MASSIVE Order For Radiation Detectors – Is A Nuclear Attack Imminent? Posted: 31 Aug 2016 11:00 AM PDT There is a real possibility that one morning we'll wake up to a massive terror attack on the United States. Will you be ready for it? Submitted by Mac Slavo, SHTFPlan: Earlier this year we reported that Texas game wardens on the southern border have been issued radiation detectors due to concerns that […] The post DHS Places MASSIVE Order For Radiation Detectors – Is A Nuclear Attack Imminent? appeared first on Silver Doctors. |

| Financial Analyst Warns Of Major September Market Event Posted: 31 Aug 2016 10:00 AM PDT "There's A Lot Of Chatter Regarding A Market Crash…" Buy 1 oz Silver Bars at the Lowest Price Online From Mac Slavo, SHTFPlan: Gregory Mannarino of TradersChoice.net has previously warned that when the global debt bubble bursts it could lead to the deaths of millions upon millions of people on a worldwide scale. By all accounts, […] The post Financial Analyst Warns Of Major September Market Event appeared first on Silver Doctors. |

| This Would Make George Orwell Blush: Facebook Just Got a Whole Lot Creepier Posted: 31 Aug 2016 09:03 AM PDT I've been creeped out by Facebook for a long time now. The following story takes it to another level… From Michael Krieger, Liberty Blitzkrieg: From Fusion: While some of these incredibly accurate friend suggestions are amusing, others are alarming, such as this story from Lisa*, a psychiatrist who is an infrequent Facebook user, mostly […] The post This Would Make George Orwell Blush: Facebook Just Got a Whole Lot Creepier appeared first on Silver Doctors. |

| Dutch Central Bank Refuses To Publish Gold Bar List For Dubious Reasons Posted: 31 Aug 2016 09:00 AM PDT My hunt for the gold bar list of the Dutch official gold reserves started in 2015… Submitted by Koos Jansen: On September 26 of that year I visited a conference in Rotterdam, the Netherlands, called Reinvent Money. One of the speakers was Jacob De Haan from the Dutch central bank (DNB) Economics and Research Division – you can […] The post Dutch Central Bank Refuses To Publish Gold Bar List For Dubious Reasons appeared first on Silver Doctors. |

| The US Government’s Biggest Gold Manipulation Mistake Posted: 31 Aug 2016 08:00 AM PDT Alasdair Macleod explains the US government’s BIGGEST MISTAKE with gold… The post The US Government’s Biggest Gold Manipulation Mistake appeared first on Silver Doctors. |

| Two Days To Go So Let's Have A Hat Contest! Posted: 31 Aug 2016 07:49 AM PDT Maybe this will actually be "THE MOST IMPORTANT JOBS REPORT OF ALL TIME" this time around as gold, silver and their primary HFT inputs all sit perched upon key technical levels ahead of Friday's BLSBS. |

| Friday’s Jobs Report Could Trigger A Stock Market CRASH – Stewart Thomson Posted: 31 Aug 2016 07:35 AM PDT The September and October time-frame is what I call "US stock market crash season". The worst stock market crashes have historically occurred during these months, and Friday's jobs report has the potential to create another one. The PBOC could announce a major yuan devaluation if Janet hikes rates in September, and that could potentially unleash […] The post Friday’s Jobs Report Could Trigger A Stock Market CRASH – Stewart Thomson appeared first on Silver Doctors. |

| Drudge: ‘HOMELAND SECURITY TO TAKE CHARGE OF ELECTIONS’ Posted: 31 Aug 2016 07:28 AM PDT "HOMELAND SECURITY TO TAKE CHARGE OF ELECTIONS" From Michael Snyder: Why does the Department of Homeland Security all of a sudden want to oversee security for the election in November? Just a little while ago I checked the Drudge Report, and I was greeted by the following headline all in red: "HOMELAND SECURITY […] The post Drudge: 'HOMELAND SECURITY TO TAKE CHARGE OF ELECTIONS' appeared first on Silver Doctors. |

| US Financial Collapse: Now, Or Later? Posted: 31 Aug 2016 07:00 AM PDT The U.S. collapse will happen either now or later. For the latter outcome, at some point the Fed will need to print 10's of trillions of dollars to prevent that horizontal line on the graph above from turning into a downward-pointing near-vertical line. Of course, please review the history of Germany circa 1923 to see […] The post US Financial Collapse: Now, Or Later? appeared first on Silver Doctors. |

| Redstar: High-Grade Gold in Alaska Posted: 31 Aug 2016 01:00 AM PDT |

| Posted: 30 Aug 2016 05:01 PM PDT A new way to explore for gold. Max Keiser on gold, David Morgan on silver, Harry Dent on Depression. Lots of debate on negative interest rates. The post Top Ten Videos — August 31 appeared first on DollarCollapse.com. |

| July U.S. Consumer Spending and Gold Posted: 30 Aug 2016 02:40 AM PDT SunshineProfits |

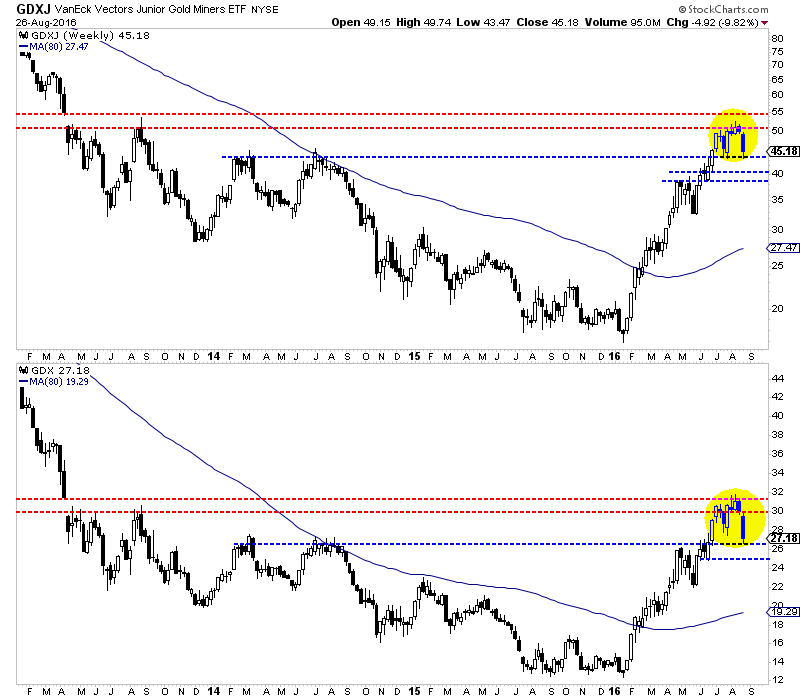

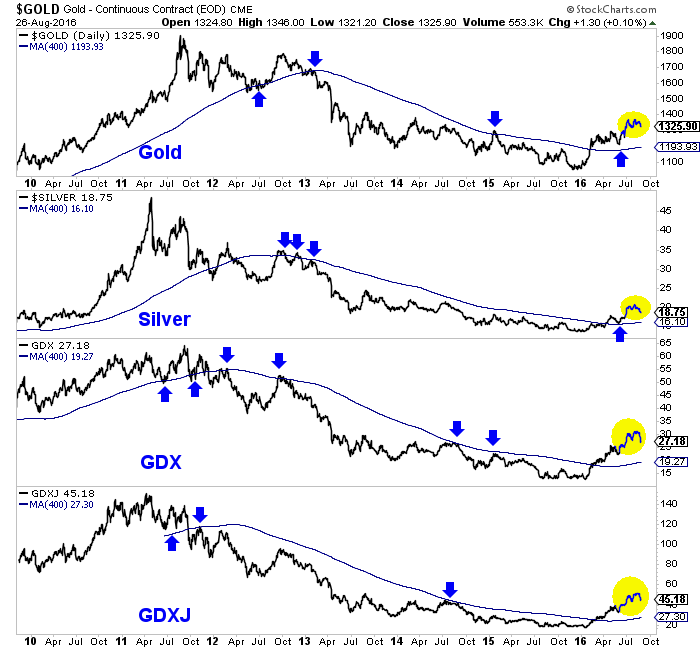

| A Bit More Downside Potential in Gold Stocks Posted: 26 Aug 2016 02:39 PM PDT Last week we projected 5% to 10% downside in the gold stocks. Well, not to butter my own bread but GDX and GDXJ both lost 9% on the week. That being said, I believed that the weakness would be limited and miners could rebound to new highs in September. While that possibility remains, there is a chance this correction could go a bit deeper and perhaps last longer. The weekly candle charts below show that the miners are correcting after failing to break into a "thin zone" of resistance. GDX has broken below its July lows and corrected as much as 16%. It has support at $25-$26 and that includes the Brexit gap. Also, the 38% retracement of its entire rebound is just below $25. Meanwhile, GDXJ has yet to break its July low in the $43s. It has corrected as much as 17% but could end up testing $39-$41. The 38% retracement of its entire rebound is a hair below $39.

GDXJ, GDX Weekly Candles

Whether the correction lasts longer or evolves into a long consolidation, precious metals will remain in a bull market. It is hard to argue against the chart below. We plot Gold, Silver, GDX and GDXJ along with the 400-day moving average which is an excellent indicator of the primary trend. The sector sits comfortably above the 400-day moving averages which are sloping upward for the first time in years.

While we expected this correction, we did not anticipate there would be a chance for a larger correction. If you believe we are in a new bull market, as I do, then the path to financial success is buying and holding and buying weakness. (Our guidance for selling, we'll get to another time). If I were holding too much cash or missed the epic rebound, I would be taking advantage of further weakness. Buying 20% to 25% weakness in a bull market (especially one that is only months old) will likely payoff in the long run. For professional guidance in riding the uptrend in Gold, consider learning more about our premium service including our favorite junior miners which we expect to outperform in the second half of 2016.

Jordan Roy-Byrne, CMT, MFTA

|

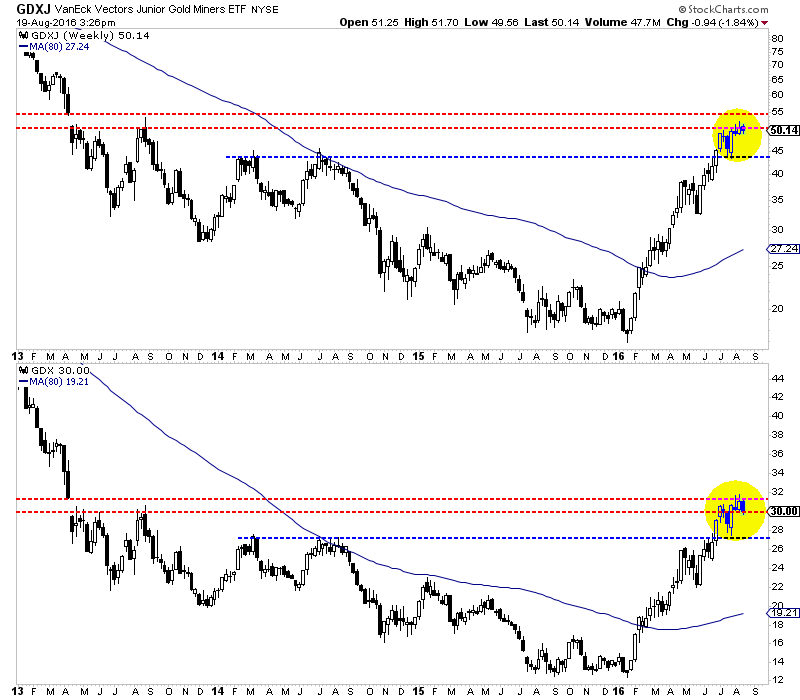

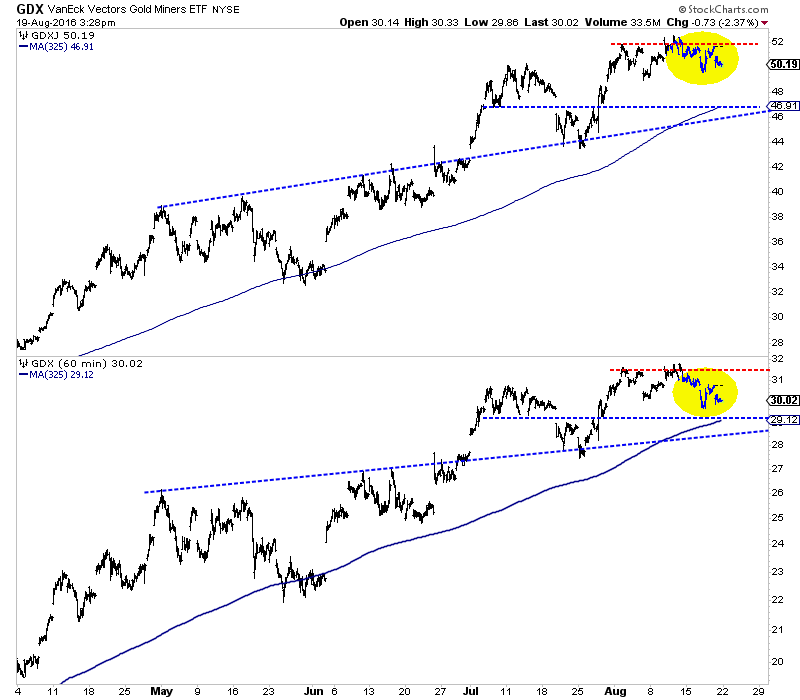

| Gold Stock Technicals During Dog Days of Summer Posted: 19 Aug 2016 01:11 PM PDT The gold stocks are trading around their highs but have failed to breakout this August. Is that due to the dog days of summer, the upcoming Fed conference or something else? We aren't sure and don't think it matters a great deal anyway. With that said, let's delve into the current technicals. The weekly candle charts of GDXJ (top) and GDX (below) are shown below. The miners have remained strong but are struggling to break higher here during the dog days of summer. GDXJ is set to close around $50 and GDX around $30. The weekly charts show strong support at GDXJ $44 and GDX $27. Call that about 10% lower.  GDXJ, GDX Weekly Candles

Let's turn to the hourly chart which gives us a look at what to expect in the days ahead. We see that GDX (bottom) and GDXJ (top) have failed to break to new highs in recent days. Today the miners traded lower, confirming the failed breakout. The miners remain in good shape overall but could trade to lower levels next week. GDXJ has a confluence of support around $47 while GDX has good support at $28-$29.  GDX, GDXJ Hourly

Overall, the current rebound in the miners remains well intact but susceptible to further short term weakness. It would not surprise me to see a 5% to 10% decline in the wake of the Fed conference. Judging from the broad strength in the charts and the litany of those looking for a correction (including those calling for one since February) my guess is the weakness will not last very long. For professional guidance in riding the uptrend in Gold, consider learning more about our premium service including our favorite junior miners which we expect to outperform in the second half of 2016.

Jordan Roy-Byrne, CMT, MFTA |

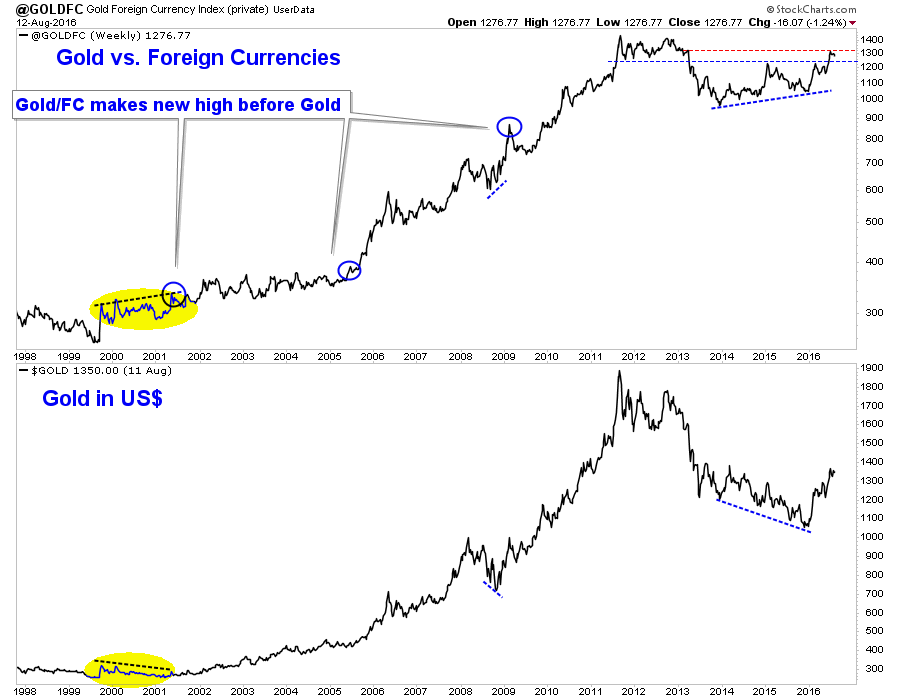

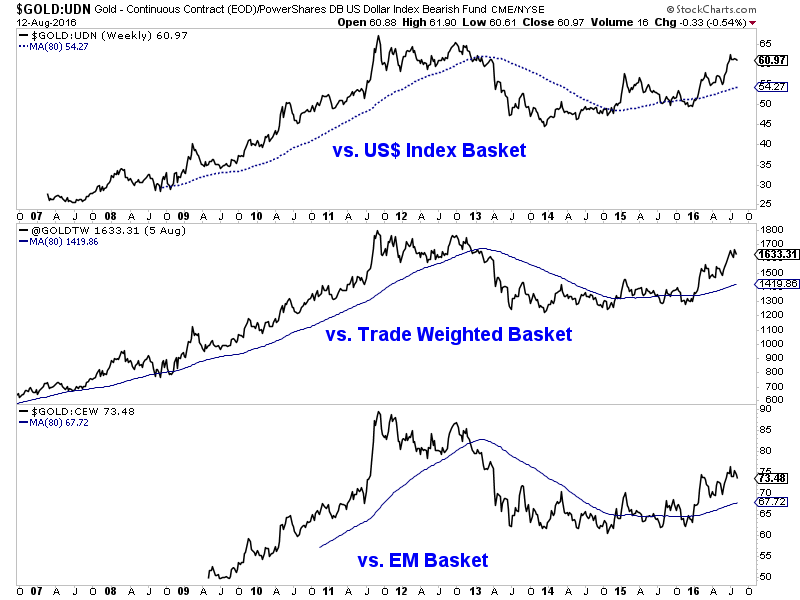

| Gold against Foreign Currencies Update Posted: 12 Aug 2016 06:40 PM PDT It is the dog days of summer. The metals are trading below their recent highs while the miners continue to be on the cusp of their next leg higher. In any event we remain bullish as we expect the next big move to be higher not lower. One reason, among many is Gold remains strong against foreign currencies and that often is a leading indicator for the sector at large. This is something we track often and we wanted to provide an update during the slowest period of the year. In the chart below we plot Gold against foreign currencies and Gold in normal, US$ terms. To be clear Gold against foreign currencies (Gold/FC) is Gold against the currency basket that comprises the US$ index. Since the new millennium Gold/FC has been an excellent leading indicator for the sector. Note that Gold/FC has made new highs ahead of Gold and made positive divergences before the three most important lows of the past 16 years (2016, 2008, 2001). In fact, the action from 2014-2015 shows strong similarities to 1999-2000. Moreover, note that at its peak a few weeks ago, Gold/FC was within 8% of its all time high. That is the equivalent of nearly $1750/oz in US$ terms.  Gold, Gold vs. Foreign Currencies

In the next chart we look at different iterations of Gold against foreign currencies. The top plot is the same version shown above while the middle plot shows Gold against the US$ trade weighted basket. The bottom plot shows Gold against emerging market currencies. In every case Gold remains firmly in bull market territory and stronger than Gold in US$'s.  Gold vs. Foreign Currencies

Tracking Gold's performance against foreign currencies is essential as we can glean quite a bit more information about what is really going on in the market. Many newsletters purporting to be analysts fear monger over the stability of the US$ as a reason for people to buy Gold. However, note that the US$ index is essentially flat compared to 10 and 20 years ago while Gold denominated in any and every currency is much higher. In other words, if Gold is going up only because of a falling US$, that is a US$ bear market, not a Gold bull market. A Gold bull market is Gold rising against the majority of currencies. In the same vein, a Gold bear market is Gold falling against the majority of currencies. The charts show that actually ended well before the final low at the end of 2015. On the mining side, most Gold and Silver comes from outside of the USA and many (but not all) companies are exposed to foreign or local currencies and not the US Dollar. Many companies in Canada and Australia bottomed a full year ahead of the sector because the Gold price in those currencies was very strong (even though Gold in US$ had yet to bottom). Summing it up, Gold's strength in foreign currencies confirms its global bull market status and provides a hint that more gains for Gold in US$ terms are likely ahead. We view any weakness in the weeks ahead as a buying opportunity. For professional guidance in riding the uptrend in Gold, consider learning more about our premium service including our favorite junior miners which we expect to outperform in the second half of 2016.

Jordan Roy-Byrne, CMT, MFTA

|

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment