Gold World News Flash |

- Gold and Bonds

- "It Was Fun While It Lasted" - Credit Manager 'Sales' Index Crashes To 7-Year Lows

- "All Eyes On Central Banks" In September, But "No Reason To Smile"

- Europe Reels As A New Wave Of Refugees Begins To Flood The Continent

- Don’t Be Fooled: The SDR Is Designed As A Rescue Operation For The US Dollar - Nico Simons

- WAKE UP CALL: Our Entire World is Going To Change — BILL HOLTER

- BOOM: Deutsche Bank Refuses Delivery Of Physical Gold Upon Demand

- Gold Rising & Germans Hoarde Cash At Home

- Half of Corporate America losing BILLIONS in Forex for no reason

- Debt Bubble in Ireland and Globally Sees Wealthy Diversify Into Gold

- Amazon, Wells Fargo Unexpectedly Terminate Student Loan Partnership Announced Just One Month Ago

- Top 7 Ways a Hospital Stay Can Go Downhill

- Prominent European Firm Issues A Nearly $60 Target For The Price Of Silver!

- Peter Schiff : The Fed Up Fix Is In

- History Says Crash Could Come in September

- The Upcoming Months Are Critical for China

- MORE EVIDENCE GERMANY is PREPARING for WAR

- Gold Daily and Silver Weekly Charts - Silence of the Scams

- LIVE: Donald Trump and Mexican President Nieto News Conference 8/31/16

- WARNING -- The European Refugee Crisis could spread to the U.S.

- Koos Jansen: Why are Chinese banks holding gold?

- China Enters World Money Machine

- Here’s What’s Wrong with Gold

- Zero Hedge: Someone just dumped $5 billion in notional gold into the futures market

- Bond king Gross says Fed has 'mastered market manipulation'

- Gold withdrawals from New York Fed are increasing

- Debt Bubble in Ireland and Globally

- Why Wall Street Is Throwing Billions At The Permian

- Gold’s strong summer may be harbinger of things to come

- GDX Gold Stocks Update…The First Consolidation Pattern

- Redstar: High-Grade Gold in Alaska

- Top Ten Videos — August 31

| Posted: 01 Sep 2016 01:06 AM PDT By Chris at www.CapitalistExploits.at Market dislocations occur when financial markets, operating under stressful conditions, experience large widespread asset mispricing. Welcome to this week's edition of "World Out Of Whack" where every Wednesday we take time out of our day to laugh, poke fun at and present to you absurdity in global financial markets in all it's glorious insanity.

While we enjoy a good laugh, the truth is that the first step to protecting ourselves from losses is to protect ourselves from ignorance. Think of the "World Out Of Whack" as your double thick armour plated side impact protection system in a financial world littered with drunk drivers. Selfishly we also know that the biggest (and often the fastest) returns come from asymmetric market moves. But, in order to identify these moves we must first identify where they live. Occasionally we find opportunities where we can buy (or sell) assets for mere cents on the dollar - because, after all, we are capitalists. In this week's edition of the WOW we're covering the relationship between Bonds and CommoditiesAs our monetary overlords swallow up more and more of the sovereign bond market, punching bonds higher, and kicking yields into negative territory, the inevitable consequences are showing themselves. Bonds are now being traded and priced in much the same way as commodities are. To be clear: this isn't "supposed" to happen. When traders buy a bushel of wheat they don't do so expecting to receive a yield on it. They buy it to sell it at a higher price to the next guy. Bonds, however, are completely different. Or at least they used to be. Investors buy bonds (i.e. they lend money) and are then paid a set percentage fee for the lifetime of the loan, and they're also paid the principal at the end of the loan term. The coupon or yield can be paid monthly, quarterly, annually, or capitalised and paid at maturity. That's entirely different to a commodity. Also, we know that bonds are typically secured against assets standing ahead of other creditors in the event of liquidation and as such they're more secure than equity. Now, I'm not telling you anything you didn't already know. My apologies for being really simplistic but I do it because when so little makes sense in markets, it's probably time for us all to go back to basics, bring out the crayons, and ensure that 1 and 1 really does equal 2. As I write to you today, bonds no longer trade on yield but on some future price. Let's for a minute revisit the 2008 global financial crisis. It's worth revisiting - for the purposes of understanding - how and why we humans do such stupid stupid things and do them repeatedly. It's as if we have marshmallows between our ears. If it was the case for central bankers, we'd all be better off as instead of inflicting such damage to the world economy, they'd instead be found slumped on the sofa, eyes glazed over, and drool running down their chests. Alas there are not enough marshmallows to go around and so instead we get what we get. As I discussed a couple of months ago, the GFC was birthed in the real estate market. Now real estate is a yield bearing investment, or at least it should be. So unless you're buying real estate for your personal use, it is essentially a bond. It has underlying collateral value, and it provides a quantifiable and consistent stream of cashflows. In a bull market capital chases yield first. It doesn't chase price appreciation. Price appreciation is simply the consequence of yield chasing since yields decline as more buyers dive in. In today's world of bond pricing 1 and 1 doesn't equal 2 or even 15. It is so far removed from reality that today 1 and 1 equals a chicken. Below is spot gold in red overlaid by the PIMCO 25-year zero coupon Treasury ETF in blue. They may as well be twins. I find this correlation fascinating but not unsurprising.

Spot gold (red) and Pimco 25-year zero coupon Treasury ETF (blue) When bonds are being bought for capital appreciation then of course they're going to trade like a commodity. Just as housing in the 2000's was increasingly bought not of yield but capital appreciation so too today we find ourselves facing the same set of circumstances. Ten years ago, heck even five years ago, if you'd told me that we'd have over US$13 trillion in negative yielding debt, underwritten by bankrupt governments, and at the tail end of a demographic boom in developed countries - with much of that debt in Europe which is also facing a collapsing banking sector, a fragmenting European Union, and the easiest short in recent history, I'd have suggested that you've been smoking crack. And yet here we are. Contributing Factors

Central banks completely and totally have your back when investing in government bonds. Why? Letting rates normalise by any meaningful amount would cause severe problems for governments to actually service debt payments. They would all suddenly look very Greek. And though the Greeks have a cool sounding accent, lovely beaches, and don't pay their taxes nobody really wants to be Greek. So even though core inflation seems to be rising in the US, it's completely meaningless. Because even if inflation was raging, the resulting real adjustment in debt and the serviceability of it due to inflation would take some time to reach anything resembling manageable before the Fed could conceivably hike rates by a meaningful amount. They simply can't afford to. -------------------------------------- -------------------------------------- So the central banks have your back on the long sovereign bond trade. That is obvious. I can see why owning bonds makes sense based on having a central bank "put". In fact, I've even suggested a few months ago that trading (not investing) by selling the Spanish ten year while going long the US ten year provided a great arbitrage as the inevitable discrepancy would get re-priced. To be clear, that's a short term opportunistic trade and I wouldn't want to put something like that on and go on holiday for 6 months. I'm not getting paid enough to take duration risk on something like that. What to Watch ForSo when bonds, which are traditionally bought for safety and yield, provide neither and trade just like gold is it maybe, just maybe time to buy the asset which is traditionally bought purely for safety and offers no yield? What I believe is a critical chart to watch is the chart I posted above. That of bonds and gold. When we see these diverging then the probability is higher that the belief in central banks is finally failing. Interestingly the only way for these two asset classes to move in tandem to the upside is if bonds continue to go into deeper negative yielding territory. If you think about that for a minute it means that the cost of owning bonds becomes increasingly more expensive, surpassing the cost of owning gold. On a relative basis gold becomes cheaper to own even while its rising in value. Something for you to ponder. And so... Something else? Share your thoughts in the comment box here. Know anyone that might enjoy this? Please share this with themInvesting and protecting our capital in a world which is enjoying the most severe distortions of any period in mans recorded history means that a different approach is required. And traditional portfolio management fails miserably to accomplish this. And so our goal here is simple: protecting the majority of our wealth from the inevitable consequences of absurdity, while finding the most asymmetric investment opportunities for our capital. Ironically, such opportunities are a result of the actions which have landed the world in such trouble to begin with. - Chris "Ten years ago, the notion that zero-coupon perpetual securities should make a comeback seemed like a good April Fools' joke. Now, it's no laughing matter." — Edward Chancellor -------------------------------------- Liked this article? Don't miss our future articles and podcasts, and get access to free subscriber-only content here. -------------------------------------- |

| "It Was Fun While It Lasted" - Credit Manager 'Sales' Index Crashes To 7-Year Lows Posted: 01 Sep 2016 12:30 AM PDT “Overall, it was fun while it lasted - the trends had been up and now they aren’t,” warns National Asscociation of Credit Managers' economist Chris Kuehl. This sentiment comes as NACM's Credit Manager Index plummetes to its lowest since 2009... The score reflects the deterioration in the combined favorable categories reading (56.4). In July, it was as high as it was in March (60.0). The categories in the favorable sector were lower than they had been last month, and some by quite a lot. The index of combined unfavorable factors also dropped (49.2 to 49.1), but not as dramatically. “The best that can be said about the decline is that it was bad and hasn’t gotten much worse,” Kuehl added. When looking at specifics in the favorable categories, there was not much to celebrate and some of these sectors are worrying. The sales category was riding a high at 60.0 last month and dropped to 53.7, marking the lowest point in seven years.

“The sales collapse is consistent with what has been appearing in the Purchasing Managers’ Index and other statistics, so it is unlikely to be an anomaly, not good timing as far as the retail community is concerned,” explained Kuehl. And finally, favorable and unfavorable aggregate indices have plunged...

We leave to Kuehl to sum up: “the most vexing part of the change is that it is happening at the start of the season that many in the economy count on for growth.” |

| "All Eyes On Central Banks" In September, But "No Reason To Smile" Posted: 31 Aug 2016 11:45 PM PDT Submitted by Saxo Bank Head of Macro Analysis, Christopher Dembik via TradingFloor.com,

The global economy is listing badly, and central banks' ability to right the ship is in question. September will be quite a busy month for investors since there are around 30 major central banks meetings scheduled. Since the Bank of England’s last policy announcement, the total monthly amount in global official quantitative easing has reached almost $200 billion, which corresponds, for the purpose of comparison, to Portugal’s annual GDP in 2015. Long-rumoured and oft-discussed, QE infinity is now a reality. Global credit conditions are the loosest they have ever been with the average yield on global government bonds (all maturities included) evolving to around 0.7%. The Federal Open Market Committee meeting on September 20-21 is the most crucial monetary policy event this month. There is clearly a case for an interest rate hike, but the final decision of the central bank will depend on the data for the month of August – especially the September 2 nonfarm payrolls report that could confirm the good momentum in the US labour market. According to Bloomberg, more than 50% of investors expect a rate hike will happen before the end of the year. In the wake of a Fed hike, monetary policy divergence would increase between the US and the euro area, which could further attract attention towards the US dollar. The European Central Bank will have fresh economic data this month that are likely to confirm downside risks are still present. These will encourage the central bank to adjust its asset purchase program at its September 8 meeting. Our baseline scenario is that the ECB will extend its asset purchase program by six to nine months and will increase the issuer limits to 50%. With the exception of the Russian central bank, the other central banks (Bank of Japan, Bank of England, Reserve Bank of Australia, etc.) should keep rates unchanged since they have already adjusted monetary policy in the past two months.

Global overview: Any reason to smile?Is there a light at the end of the tunnel for the global economy? Consensus expected that the global PMI would enter into contraction this summer, which would constitute an early sign of recession. Actually, however, it inched up to a three-month high in July at 51.4. This does not mean the global economy is getting better – far from it. The composite PMI output index for developed markets is still very sluggish. The stronger-than-forecasted emerging market growth (the composite PMI output index reached 51.7) is the main explanation behind the relatively solid global PMI performance in July. Downward risks are still present, and that’s why central banks remain on alert.

Source: Saxo Bank The numerous central bank meetings scheduled this month could push volatility higher. The rapid reaction of central banks in the wake of Brexit certainly averted a panic this summer. Over the past few weeks, the BoJ’s Kuroda and the ECB’s Coeure confirmed they won’t hesitate to act decisively again if needed, which is a clear signal that new measures are in the pipeline. However, one should not misinterpret their words. Global central banks acknowledge that monetary policy is not to remain the only game in town, thus they push more and more to hand the policy baton to the fiscal side of things.

Source: Saxo Bank

The case for a US hikeThe FOMC meeting on September 20-21 will be the key event this month for investors. There is clearly a case for higher interest rates. Here are six factors that could push the central bank to further normalise monetary policy:

The US remains a rare beacon in a world of ever-increasing easing. We think the possible rate hike in September should go very smoothly because it has already been priced in and, above all, it will not fundamentally change global credit conditions. After all, the scale of the rate increase will be quite low, and is expected to reach a maximum of 25 basis points.

Source: Saxo Bank

Western Europe: No time to rest on its laurelsThe other central bank at the top of the agenda in September is the ECB. Governor Mario Draghi has hinted that the ECB will conduct a review of the impact of monetary policy this month based on fresh economic data. This review will certainly focus on the effect of the corporate bond buying program (CSPP) that was launched last June and that has been pretty successful until now. The purchases reach €7 billion euros/month (mostly BBB1 and lower-rated companies), which is quite remarkable given the summer lull. However, risks on the downside remain thus we believe that there is a 100% chance that the review will open the door to further easing. The most likely scenario is that the ECB extends QE by March 2017 to six or nine months, which is almost a done deal, and that it sets the issuer limits at 50% instead of 33%. This could allow the ECB to buy more German bonds and it would be a coherent decision considering the likely extension of the asset purchases. We cannot rule out further deposit rate cuts but it is a risky monetary policy instrument (as outlined by the last International Monetary Fund staff report on the euro area) that can seriously hurt the profitability of the financial sector. Therefore, it is probable the ECB will restrain from using this tool again in the short term. In the long run, the most logical evolution of the ECB monetary policy would consist in increasing the monthly amount of the CSPP in order to lower further borrowing and investment costs for large companies. In this matter, the Bank of England showed the way one month ago by deciding to buy corporate bonds up to £10 billion/month.

Contrary to the ECB, the BoE will adopt a wait-and-see approach at its meeting on September 15. The central bank seems more and more sceptical about QE but it had to announce this sort of combination of measures last month, more for the sake of its own reputation than for that of economic benefits. The direct market impact is to lower government bond yields that are progressively heading towards zero. The UK 10-year government bond yield, for instance, fell to 0.55% versus 1.38% pre-Brexit. Two conclusions may be drawn from the BoE’s last monetary policy move:

For now, negative rates are not an option, thus we can expect the policy rate will fall to 0.10% or 0.05% in the coming months. This move is already priced in by the market. A lower GBP exchange rate is the main objective sought by the BoE in the short term in order to help the economy to overcome Brexit. However, what the UK really needs is a “Hammond moment”. The priority is to present a fiscal stimulus plan, which could be put forth by chancellor of the exchequer Phillip Hammond as soon as this autumn. This would mark a fundamental break with the past and the fiscal consolidation plans presented by his predecessor, George Osborne.

Asia–Pacific: More easing to come…but laterIn Asia-Pacific this month, the focus will be mainly on Japan and Australia. “Wait-and-pray” is the new mantra in Japan as the timid measures unveiled last July prove the central bank does not have much room left to act in the current monetary policy framework. Since January 1, 2015, the BoJ’s balance sheet has increased by a massive 58% and the yen by 14% versus the US dollar. It is increasingly clear that Japanese monetary policy has not had the desired effect: it has not pushed the country out of deflation (Japan's July CPI print posted its largest annual fall in three years) and it has not succeeded in devaluing the Japanese yen, which is the most direct and massive consequence of accommodative monetary policy. In this context, the next step for the BoJ will be when the report on the impact of the current monetary policy is submitted to the government, which should happen by the end of the month. Until then, no new measures are expected by the BoJ at its next meeting scheduled for September 20-21. The ball is in the government’s court, monetary policy cannot do much at this level.

Japan is home to perhaps the world's longest-running experiment in central bank-led stimulus, and its prospects appear to be dimming. The BoJ is not the first global central bank to recognise that current monetary policy is about to reach its limits. In its last quarterly bulletin, the BoE recognised that the “money multiplier” approach, commonly used by policymakers, does not work. Moreover, RBA governor Stevens, who is leaving office, recently declared that he has “serious reservations about the extent of reliance on monetary policy around the world," explaining that "it isn’t that the central banks were wrong to do what they could, it is that what they could do was not enough, and never could be enough, fully to restore demand after a period of recession associated with a very substantial debt build-up”. He has perfectly summarised in two sentences the main problem of the global economy: monetary policy has replaced fiscal policy since 2007 but it is not sufficient to boost nominal demand and growth. Fiscal policy is also required to stimulate the economy. This is exactly the message sent by the BoJ to the Japanese government one month ago.

In spite of his scepticism about the effect of monetary policy on the real economy, Stevens decided to cut the cash rate to all-time low of 1.5% last month. This is the end of an era; Australia was well-known for high interest rates which favored the use of the AUD in carry trade strategies. The economic outlook is getting quite gloomy. CPI fell to 1% annually in the second quarter, the weakest expansion in 17 years, and consumer inflation expectations weakened again in August. Moreover, growth is expected to decline in the coming quarters. Chinese GDP has increasingly become a key driver of the Australian nominal GDP and it indicates us that growth is decelerating. With inflation low and likely to remain low for a prolonged period of time, and considering the risk of economic slowdown, the new governor taking office this month will have to continue to drop rates again in an attempt to run the economy at a faster level. The RBA is heading to 1%, but not yet. The central bank will certainly wait to see the macroeconomic and AUD exchange rate impacts from the last rate cut.

CEE–Russia: Waiting for the storm to passIn the CEE-Russia area, unchanged policy rates are widely forecasted by the market, except for Russia. The last economic figures could push the Russian central bank to lower interest rates by at least 25 basis points to 10.25% at its meeting on September 16. Headline inflation was a bit lower than expected in July, at 7.2% year-over-year versus 7.5% y/y in June, which is the lowest level since March 2014. Moreover, preliminary data point out that Russia just saw its smallest economic contraction since 2014 (minus 0.6% on the second quarter y/y). The primary force driving improvement was the industrial sector that benefited from a lower rouble but there are also early signs of recovery regarding consumer confidence and vehicle sales. In this context, the central bank could be encouraged to lower rates in order to put the economy on the comeback trail. If it does not stimulate growth, the risk is quite high that the recovery will quickly falter and the economy will decline again, following what happened at the end of 2015. Therefore, there is a strong probability the central bank will began a new cycle of rate cuts in September.

Most of the countries in CEE are likely to adopt a wait-and-see position, like Poland whose central bank will meet on September 7. The NBP has closed the door to monetary policy easing for now. Therefore, the benchmark rate should stay at a record-low 1.5% until the end of the year. However, we don’t share the optimism of the central bank regarding the capacity of escaping deflation. It forecasts that price growth will accelerate to 1.3% next year versus 0.8% in June but the main CPI components point out that downside risks are increasing.

Is the Polish central bank more bullish than circumstances warrant? Compared with the beginning of 2015, only food – which is therefore the primary support for headline inflation – is in positive territory. Energy (electricity and gas) has been heading into negative territory since the end of last year. From what we can see, the inflation outlook is worsening and not improving as expected by the NBP.

In Serbia, the upcoming meeting of the central bank on September 8 should not surprise. The main policy rate is expected to be maintained at 4.25%. As indicated in its last statement, the central bank will wait to have more visibility on the evolution of commodity prices and financial markets before taking a decision on the next step for monetary policy. However, a further rate cut of 25 basis points is a done deal by the end of the year. The sharply downward trend seen in the Serbian CPI (which reached 0.3% in June, far below the targets of between 2.5% and 5.5%) and the need to offset the fiscal consolidation pushed by the new government will force the central bank to step in again.

Finally, the central bank of Hungary will keep rates unchanged at a record-low 0.9%. This summer, it confirmed that it was done cutting and that rates will stay at its current level for an “extended period”. Therefore, there is no surprise to wait for. The poor economic performance seen in the first quarter was certainly temporary. Growth is expected to rebound in the coming quarters, driven by strong private consumption growth, improving economic sentiment, and the fiscal stimulus package that will be presented this autumn. One of the main black spots of the economy is construction output. The free fall in the sector that has started at the beginning of the year (minus 26.6% y/y in May) could last at least until the end of 2016. However, this very negative trend, mostly linked to the phasing out of EU funding, does not represent a real concern for the country for the moment.

Nordic: Things are getting very messy for NorwayIn the Nordic area, the focus will be on Norway. The consensus expected a new rate cut by the Norges Bank on September 22 but this option is less and less likely due to soaring inflation. For quite a while, the Norges Bank had chosen not to pay too much attention to the evol |

| Europe Reels As A New Wave Of Refugees Begins To Flood The Continent Posted: 31 Aug 2016 11:01 PM PDT Angela Merkel, and Europe in general, had hoped they had managed to move beyond the unprecedented wave of refugees unleashed on the content in 2015 courtesy of the German Chancellor's open door policy, with the fragile March 2016 refugee deal signed with Turkey. Sadly - for both Europeans who have suffered a surge in terrorist attacks as a result and for Merkel, whose approval rating has subsequently plunged - Europe is once buckling under the weight of a new wave of migrants. According to Reuters, some 3000 migrants were saved in the Strait of Sicily in 30 separate rescue missions just on Tuesday, the Italian coastguard said, bringing the total to almost 10,000 in two days and marking a sharp acceleration in refugee arrivals in Italy. The migrants were packed on board dozens of boats, many of them rubber dinghies that become dangerously unstable in high seas. No details were immediately available on their nationalities. Data from the International Organization for Migration released on Friday said around 105,000 migrants had reached Italy by boat in 2016, many of them setting sail from Libya. An estimated 2,726 men, women and children have died over the same period trying to make the journey.

The reason for the surge are favorable weather conditions, which this week have seen an increase in boats setting sail. Some 1,100 migrants were picked up on Sunday and 6,500 on Monday, in one of the largest influxes of refugees in a single day so far this year. Italy has been on the front line of Europe's migrant crisis for three years, and more than 400,000 have successfully made the voyage to Italy from North Africa since the beginning of 2014, fleeing violence and poverty. So far this year, some 116,000 migrants—many of them from sub-Saharan Africa—have arrived in Italy. That compares with 154,000 for all of 2015, a phenomenon overshadowed by the surge of migrants arriving in Greece via Turkey. The closing of European borders to the migrants means that, unlike, in previous years, the vast majority are stuck in Italy, unable to reach Europe's north as they had hoped. Italian reception centers now host 145,000 migrants, according to the interior ministry in Rome. And while North African refugees are fleeing the chaos in their native lands by boat, hoping to reach Italy in a perilous voyage across the Mediterranean, Greece is once again the target of those refugees from Syria who find themselves in Turkey as an intermediate step. According to the WSJ, the number of people landing on Greek islands has risen to about 100 a day in August, up from fewer than 50 a day in May and June. About 460 people landed on Greek islands on Monday, a number Greece hasn't experienced since early April. The traffic is still far below daily peaks of 6,800 in October last year. But the rising numbers are making Greek and EU officials worried that the fragile deal with Turkey—aimed at returning almost all who land on Greek shores—could break down. It could get much worse: as we have reported over the past few months, as Turkish officials, angered by what they see as a lack of European support for Turkish democracy as Ankara roots out alleged supporters of July's failed coup, have threatened to scuttle the migration deal if the EU doesn't grant Turkish citizens visa-free travel to the bloc by October. Turkey says it was promised the concession. "We cannot independently verify an uptick, but even if it were true it is related to the increasingly popular view among illegal immigrants that the Turkey-EU agreement is on the brink of collapse and that there will be no legal mechanism to return them to Turkey once they cross the Aegean Sea," a senior Turkish official said. "If the European Union fails to honor its agreement with Turkey, no matter how strong the enforcement, there will be greater incentives for more migrants to risk their lives at sea." As we have further said, Turkey continues to have most of the leverage, something the WSJ confirms: "The tough talk from Turkey has alarmed Athens, which knows that any sharp increase in migration would mainly affect Greece. "We will be tested very hard if the agreement with Turkey collapses," Greek Migration Minister Yiannis Mouzalas said this month."

Unlike in Italy, in smaller, poorer Greece, the numbers arriving on Aegean islands don't need to reach 2015's high levels to cause problems. The five islands that receive most of the newcomers—Lesbos, Leros, Chios, Kos and Samos—are already struggling. Chios is currently sheltering about 3,300 migrants and refugees, three times its camp's capacity. In the camp, built around an abandoned aluminum factory, migrants live in overcrowded containers with unsanitary conditions. Six to eight people, often from two different families, typically share a room designed for four. "We live like animals here," says Wassim Omar, a 34-year-old English teacher from Syria, as he waits in the line for his family's dinner of potatoes, olives and bread. Many complain there isn't enough food or access to doctors. Women say they and their children are afraid to leave their rooms after dark, as fights often break out among migrants of different nationalities.

Vournous, the mayor, says he fears tensions between locals and migrants could easily escalate. What is probably most vexing for the Greeks and the Italians, is that the influx of refugees was unleashed as a result of German, and specifically Angela Merkel, policies. However, as a result of border closures, Germany has largely succeeded in isolating itself from the refugee flow. The losers, once again, Europe's poorest, peripheral nations. |

| Don’t Be Fooled: The SDR Is Designed As A Rescue Operation For The US Dollar - Nico Simons Posted: 31 Aug 2016 11:00 PM PDT Sprott Money |

| WAKE UP CALL: Our Entire World is Going To Change — BILL HOLTER Posted: 31 Aug 2016 10:25 PM PDT by SGT, SGT Report.com: The cartel hit gold hard again on Wednesday selling $1.5 BILLION is paper gold into the market in ONE MINUTE and as JS Mineset’s Bill Holter notes, “$1.5 Billion of gold is close to 2% of global production and to see that sold in one minute is laughable.” Bill asks, “Who has that amount of gold to sell? And the answer of course is almost no one. And what trader would ever sell in that fashion? And the answer is no one wo would want to keep a job if they were selling for profit. So the sell was obviously to create price, a lower one.” But as the bond market and rising LIBOR rates are telling us, the system is coming apart at the seams and the coming collapse will cause “our entire world to change.” |

| BOOM: Deutsche Bank Refuses Delivery Of Physical Gold Upon Demand Posted: 31 Aug 2016 10:05 PM PDT [Ed. Note: Friends, when we say “If you don’t hold it you don’t own it,” we are being literal.] Xetra-Gold is an Exchange-Traded Commodity which differentiates itself by “representing that every gram of gold purchase electronically is backed by the same amount of physical gold” and its principal bank is none other than Deutsche Bank. from Zero Hedge:

While the trading world was focused on the latest news involving Deutsche Bank, namely that the troubled German bank had been contemplating a merger with Germany’s other mega-bank, Commerzbank as part of a strategy to sell all or part of a key business to speed up its flagging overhaul, a more troubling report emerged in a German gold analysis website, according to which Deutsche Bank was unable to satisfy a gold delivery request when asked to do so by a client of Germany’s Xetra-Gold service. But first, what is Xetra-Gold?

According to its website, the publicly traded company “provides investors with an efficient instrument to participate in the performance of the gold market. Xetra-Gold's combination of features – cost-efficient trading and the right for physical delivery of gold – makes it an attractive product.” Among its highlights, Xetra-Gold lists the following: Cost-efficient trading: No mark-up fee, no transportation or insurance costs such as those incurred when purchasing physical gold. Only the standard transaction fees that are charged for on-exchange securities trading are payable at the time of acquisition. The spreads that apply to purchase and sale correspond to the standard conditions on the global market and are considerably lower than those for traditional gold-based financial products. Furthermore, management or administration fees relating to Xetra-Gold are not incurred. The investor pays the amount of custody fees which he/she has agreed upon with the depository bank. Physically backed: The issuer uses the proceeds from the issue of Xetra-Gold to purchase gold. The physical gold is held in custody for the issuer in the Frankfurt vaults of Clearstream Banking AG, a wholly-owned subsidiary of Deutsche Börse AG. In order to facilitate the delivery of physical gold, the issuer holds a further limited amount of gold on an unallocated weight account with Umicore AG & Co. KG. Transparent: Xetra-Gold tracks the price of gold on a virtually 1:1 basis, and is always up to date. Tradeable in euros per gram: While in the past, gold was mainly denominated in US dollars per troy ounce, you trade Xetra-Gold in euros per gram. Stable/Constant holdings: The investor's right to receive delivery of the certificated amount of gold is not reduced by management costs or other fees, unlike other investments in gold. 1,000 units of Xetra-Gold will still represent a kilogram of gold in 30 years’ time. Delivery of gold: If an investor asserts his/her right to the delivery of the certificated volume of gold from the issuer, the gold will be transported to the respective point of delivery by Umicore AG & Co. KG, which is responsible for all physical delivery processes. The issuer will also have delivery rights of gold from Umicore AG & Co. KG, as the gold leaf debtor. Investors can find information on delivery and the alternative payment claims that are relevant for investment and insurance companies in the PDF document entitled ‘Information on the process for exercising Xetra-Gold’. In other words, Xetra-Gold is an Exchange-Traded Commodity which differentiates itself by “representing that every gram of gold purchase electronically is backed by the same amount of physical gold” and its principal bank is none other than Deutsche Bank. And with Germans recently rushing to buy safes or find sound money alternatives in a country where the interest rate is negative, the ETC, it is not surprising that the population has flocked to its offering. According to recent report by LeapRate, the gold held in custody by Deutsche Borse Commodities for the purpose of physically backing the Xetra-Gold bond has risen to a new record high of 90.67 tons, an increase of more than 50% since the beginning of the year. “For each Xetra-Gold bond, exactly one gram of gold is deposited in the central vaults for German securities in Frankfurt” the report parrots the company’s website. |

| Gold Rising & Germans Hoarde Cash At Home Posted: 31 Aug 2016 10:00 PM PDT from Junius Maltby: |

| Half of Corporate America losing BILLIONS in Forex for no reason Posted: 31 Aug 2016 08:19 PM PDT Here's the big irony for the markets. As we explain in Splitting Pennies book, Forex is the largest market in the world and the least understood. Corporate America certainly doesn't understand Forex. Well, according to this report, about 50% do:

So what does this data mean? It means that half of Corporate America is speculating BIG in Forex. Not hedging, when you have FX positions, is speculating. For example, imagine you're a big US multinational like McDonalds (MCD). McDonalds (MCD) is a great example because they are one of the companies that lives off their FX hedges. Without FX hedging, it's questionable if MCD could survive, because more than 60% of their revenue comes from non-US Dollar (USD). That means their revenue, without FX hedging, would be nearly an exact function of the FX markets (which is the case for these companies that don't hedge). Companies that lose billions of dollars due to 'currency headwinds' - they are losing huge in Forex. Here's the irony. Pension Funds and many institutions are reluctant to invest in Forex strategies because they are 'risky'. But they invest in the stock of companies that lose billions in Forex! And that's OK. Well, everyone is losing, so why not us too. Heck, I don't want to be singled out as the one state pension fund that's actually MAKING money for our retirees, that might cause me to get promoted, or lose my job. Why don't these companies hedge you ask? Isn't it their fiduciary duty to their shareholders? Here's one perspective from PWC:

So you see, according to this perspective, CFOs understand Forex, but they understand that others such as analysts don't understand, and think that there's a negative perception problem, to closing a big gaping hole in their FX exposure. One year in the 90's, Intel Corporation made more money on their FX positions than they did selling processors. Not all of Corporate America is completely stupid. There are some savvy FX managers out there, that do a great job. But for the other half, one has to wonder if FX volatility will finally drive these unhedged companies out of business. Here's what you see on every street corner in Russia:

At least, some humans are prepared for potential financial catastrophe, even if it's as simple as FX volatility. To learn more about Forex Hedging, checkout Splitting Pennies - your pocket guide designed to make you an instant Forex Genius! Or checkout Fortress Capital Forex Hedging.  |

| Debt Bubble in Ireland and Globally Sees Wealthy Diversify Into Gold Posted: 31 Aug 2016 08:00 PM PDT by Mark O'Byrne, GoldCore:

Key points in the interview are: – Groupthink in Ireland and internationally with few questioning the "recovery narrative" – Irish government, like the U.S. and most western countries, is technically insolvent but this is masked by "statistical manipulation"

– Ireland 's national debt is €185 billion – down to 91% of GNP – this sounds good but totally bogus as excludes all future pensions liabilities – state and private – Irish state pensions not included and they alone add another €100 billion – pushes debt to GNP ratio over 150% – Non state, private pension liabilities in Ireland are estimated to be roughly another €80 billion – Irish banks weakest in EU as seen in stress tests. Therefore real risk of deposit bail-ins – Real risk of another global financial crisis given "astronomical" debt levels throughout the western world – Wealthiest investors and largest institutions in the world, including Lord Rothchilds and insurance company Munich Re, are diversifying into gold |

| Amazon, Wells Fargo Unexpectedly Terminate Student Loan Partnership Announced Just One Month Ago Posted: 31 Aug 2016 07:28 PM PDT Just over a month ago, on July 21, we reported that Amazon and Wells Fargo had launched a partnership which they dubbed at the time a "tremendous opportunity", to offer college students an even greater incentive to get buried under student loans when Wells Fargo announced it would offer a discount on private student loans to members of Amazon's "Prime Student" program. "We are focused on innovation and meeting our customers where they are—and increasingly that is in the digital space," John Rasmussen, a Wells Fargo executive, said in a July 21 news release. "This is a tremendous opportunity to bring together two great brands."

As we said then, "in Amazon's latest attempt to entice shoppers into its premium Prime program, Wells Fargo will cut half a percentage point from its interest rate on student loans to Amazon customers who pay for a "Prime Student" subscription, which provides the traditional Prime benefits such as free two-day shipping and access to movies, television shows and photo storage. The subscription-based service will cost $49 a year, half the regular Amazon Prime fee." Meanwhile, Wells Fargo, Buffet's favorite US bank, would benefit by expanding the size of its student loan portfolio. The third largest U.S. bank by assets and the second-largest private student lender by origination volume, is interested in "meeting our customers where they are – and increasingly that is in the digital space," John Rasmussen, head of Wells Fargo's Personal Lending Group, said in a news release. The bank had $12.2 billion in student loans outstanding at the end of 2015, compared with $11.9 billion at the end of 2014. Apparently, Wells was not interested enough, because just six weeks after revealing said "tremendous opportunity", the two companies unexpectedly ended their partnership. As Bloomberg recaps our previous thoughts, "the deal between the giant online retailer and the nation's third-largest bank by assets represented Amazon's first foray into the competitive market of lending to college students. For Wells Fargo, which has aggressively tried to build up its student loan business, the partnership was meant to help the bank reach millions of potential customers who shop on Amazon and might be enticed by the bank's half-percentage point discount on its higher-education loans." There was little justification for the abrupt deal failure: Catherine B. Pulley, a Wells Fargo spokeswoman, said Wednesday that the "promotion for Prime Student members has ended." She didn't immediately respond to messages seeking further details. Deborah Bass of Amazon e-mailed the same statement in response to questions but did not immediately respond to a message seeking additional information. As Bloomberg adds, as of today, Amazon no longer features Wells Fargo on its student-focused website, and the bank's Amazon-focused site now redirects visitors to Wells Fargo's general student loan section. The two companies had been talking about the partnership for more than a year, according to a July report in the Wall Street Journal. While there is no information at all on what causedthe abrupt end in the relationship, consumer advocates should be delighted: they quickly assailed the partnership between the two companies after it was announced in July. Pauline Abernathy, a former official in Bill Clinton's White House who now works for the Institute for College Access & Success, described the arrangement as "the kind of misleading private loan marketing that was rampant before the financial crisis."She said both companies buried the otherwise high costs and inflexible repayment terms that she said are standard in private student loans and that the deal was a "cynical attempt to dupe current students." "We congratulate Amazon for deciding to stop promoting Wells Fargo's costly private education loans. Private loans are one of the riskiest ways to pay for college," Abernathy said Wednesday. Come to think of it, she is not wrong. Undergraduate students can borrow from the feds at a 3.76% interest rate, a loan that effectively acts as an entitlement thanks to virtually no underwriting requirements. But the government caps student borrowing, leaving many to rely on private student loans to fill the gap between college costs and federal loan limits. A review of Wells Fargo's website shows student loans that carry interest rates as high as 10.93%. Which explains why both Amazon and Wells Fargo had so much to gain, and nothing to lose form their partnership, and which makes the sudden, unexplained collapse of this arrangement all the more curious and surprising. |

| Top 7 Ways a Hospital Stay Can Go Downhill Posted: 31 Aug 2016 07:20 PM PDT by S.D. Wells, Natural News:

Welcome to America, where people think medical insurance is the best thing since sliced bread, but many find out the hard way that the slippery slope of medical care can rapidly decline, sending them tumbling down, down, down, into the abyss of the chronic sick-care nightmare that’s sadly become commonplace.

Here they come: The top 7 ways a hospital stay can go downhill – and fast!1. Superbugs: Hospitals across America are well aware that the MRSA (methicillin-resistant staphylococcus aureus) superbug bacterium causes potentially deadly staph infections and is completely immune to antibiotics. The biggest irony is that MRSA can be killed by natural medicines like colloidal silver, garlic and aloe vera, but hospitals refuse to use any natural medicines since doctors can’t prescribe them, and they can’t be patented by Big Pharma. MRSA can enter the body through the skin, mouth or nasal passages, then travel to the bloodstream, urinary tract, lungs or other organs, leading to sepsis, severe inflammation, pneumonia and other potentially fatal complications. Watch out for electronic thermometers, the doctor and nurses’ laboratory coats, soiled gowns, endoscopes, food and flies! |

| Prominent European Firm Issues A Nearly $60 Target For The Price Of Silver! Posted: 31 Aug 2016 07:08 PM PDT As we come to the end of what has been a wild summer, this firm has issued a nearly $60 target for the price of silver. By Ronald-Peter Stoeferle, Incrementum AG Liechtenstein |

| Peter Schiff : The Fed Up Fix Is In Posted: 31 Aug 2016 02:57 PM PDT The Peter Schiff Show Podcast - Episode 190 Peter Schiff is a well-known commentator appearing regularly on CNBC, TechTicker and FoxNews. He is often referred to as "Doctor Doom" because of his bearish outlook on the economy and the U.S. Dollar in particular. Peter was one of the first... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

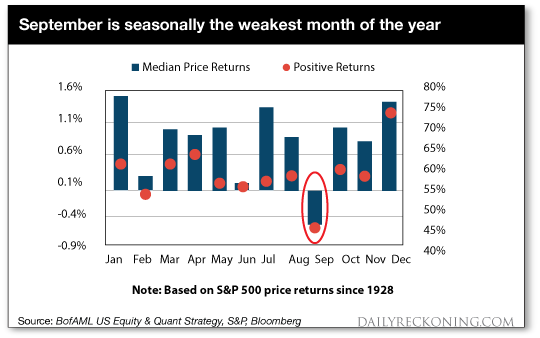

| History Says Crash Could Come in September Posted: 31 Aug 2016 02:41 PM PDT This post History Says Crash Could Come in September appeared first on Daily Reckoning. This year — like every year — gloom-and-doomers of every make and model will yell about October. There was the Crash of 1929… "Black Monday" of 1987… the Panic of 1907. All took place in October, they warn. There's even a term for it — the "October effect." But are they right? Is October really the bogeyman it's cracked up to be? If history is any guide, no. If anything, October has spelled the end of more bear markets than the beginning, according to Investopedia. Downturns in 1987, 1990, 2001 and 2002 all turned around in October, it reminds us. If not October, then what month is the great menace for markets? September… History shows September, not October, is the month to circle. "Since the Dow Jones industrial average was created in the late 1890s," financial columnist Mark Hulbert notes, "September has produced an average loss of 1.1%. The 11 other months of the calendar, in contrast, have produced an average gain of 0.8%." Nor, Hulbert adds, can September's black record be traced to one or two dismal years: "On the contrary, the month has an impressively consistent record at or near the bottom of the rankings." Same with the S&P 500. The median September return for the index has been negative stretching all the way back to 1928, according to Bank of America Merrill Lynch strategist Savita Subramanian. That's 88 years running. The prosecution presents the following as proof thereof:

Pictures don't lie. It's been a quiet, quiet August. Volatility is currently near its lowest level in 26 years. And the skies are deep azure to the horizon. Now that the calendar's about to flip to September, we pose a question we admit we shouldn't ask… a question that could tempt fate even on its busiest day… What could possibly go wrong? Turns out the 30 days ahead are peppered with land mines that could go off with… detonative effects on the market. One of them is Sept. 21. That's when the Fed meets to decide interest rates. It'll be taking a hard look at August’s jobs report, due out this Friday. If it's good it could put the Fed in a real bind. Here's David Stockman: After what will be 93 months crouched on the zero bound, it will have no excuse not to raise rates by 25 basis points. Especially if it continues to be deluded by the false and lagging indicators of the BLS jobs report. But the market has most definitely not "priced in" a rate hike. It will sell off violently if the Fed goes ahead and raises rates. This has been recently suggested by its key rate strategist and Goldman man on the case, Bill Dudley, president of the New York Fed. And if the Fed stays pat on the 21st? On the other hand, if it punts until another time, that decision will come with new concerns. Concerns that continuing head winds from China, Europe and the rest of the world have the potential to seriously harm the struggling domestic recovery. Then there's the upcoming election. Markets have baked a Hillary victory into the cake. But David says not so fast. He says volatility can return tout-suite after their Sept. 26 debate. If Trump puts on a show or Hillary makes a hash of it, watch out: Another September event could trigger volatility as well. On Sept. 26, Trump and Hillary will have their first presidential debate. The results of this debate could also blindside the market because at the moment Hillary Clinton is considered to be a shoo-in… There is no telling what Donald Trump will do, but at this stage of the game there is absolutely no reason to think that the market has it right and that Hillary has it in the bag. David saw it happen in 1980 when Carter was ahead late in the game. Then Reagan thumped him in their second debate and took the lead heading into the election. Two monetary events in September could also trip a mine — a big one. And the dollar would suffer the blast. The first is when the G-20 meets Sept. 4 in Hangzhou, China. The second happens on Sept. 30, when the IMF officially accepts the Chinese yuan into its basket of currencies making up its special drawing right (SDR). Throw in the IMF meeting in Washington on Oct. 7 and the market could soon be in for quite a shake, according to Jim Rickards: The next five weeks will mark one of the most significant transformations in the international monetary system in over 30 years. Since the dollar is still the lynchpin of this system, the dollar itself will be affected… Such radical transformations of the international monetary system have happened many times before… What will happen in the next five weeks is just as significant as any of the previous monetary earthquakes… The hidden agenda involves the formal transition from a dollar standard to an SDR standard in world monetary affairs. Fed meetings that could raise rates, presidential debates that could rattle markets, monetary meetings that could hammer the dollar. Add it together and September has a lot of mines to tiptoe around. Maybe it'll make it through. Then again, maybe it won't… T.S. Eliot once said April is the cruelest month. But for markets, history says September's the cruelest month. Proceed with caution. Regards, Brian Maher Ed. Note: Sign up for your FREE subscription to The Daily Reckoning, and you'll start receiving regular offers for specific profit opportunities. By taking advantage now, your ensuring that you'll be financially secure later. Best to start right away. The post History Says Crash Could Come in September appeared first on Daily Reckoning. |

| The Upcoming Months Are Critical for China Posted: 31 Aug 2016 02:22 PM PDT This post The Upcoming Months Are Critical for China appeared first on Daily Reckoning. The ongoing power struggle between the U.S. and China is entering an acceleration phase right now. China has two big moves lined up, and the first one is happening at the G20 meeting on Sept. 4. Jim Rickards has said that this will be the day the dollar dies. This will also be the day China shows that it is an equal to the U.S. and any other country vying for world supremacy. But there are two other dates that intensify the upcoming shift in global superpower position. On September 30, the IMF will officially add the Chinese yuan to the currencies in the SDR basket. And on November 8, the U.S. will (finally!) elect a new president. These events will hasten the decline of the dollar. But we're going to look at the flip side of that coin: These events place China's influence as an economic and political force on a rapid ascent. As a result of the yuan being included in the SDR basket and the announcement of an SDR bond market, we can expect more bonds to be issued with yuan and SDRs components — and better opportunities to invest in in the Chinese market growth that will follow. The non-U.S. International Elites (with China leading the charge) have been pushing to get the yuan addition to the SDR in place as scheduled, before the U.S. election. This is no accident. China has been keenly monitoring the events leading up to Nov. 8. and is eager to insulate the Chinese economy from the U.S. dollar, and its new president. As I learned when I was on the ground there last month, China believes that next U.S. presidential administration will provide it with more impetus to compete with the U.S. for global power. It is watching for any signs of political paralysis that occur during the ongoing campaigns and election. Any perceived weakness in the U.S. will be used to strengthen China's position in the global community. China views its position as the rising superpower not just from an economic standpoint, but from a diplomatic one, too. It stepped into that role in the wake of Brexit at the Mongolia summit. Both nations focused on expanding Chinese-European alliances. This is important because, even if the U.S. maintains an anti-China stance, China is forging stronger alliances globally. And it has used each such opportunity to insert itself as a world influence. The larger the leadership vacuum left by the U.S. in the world, the more China will occupy the void. The SDR is one area of economic and financial influence, but China will also be watching our election very closely in terms of assessing future trade agreements, economic stability and political influence, poised to take advantage of any weakness. The arrogance of both candidates in brushing off China's seriousness in this regard is a weakness. Both candidates represent different paths for China's future relationship with the U.S. But China is intent on playing the long game. It is determined to become the dominant global superpower. This is the same determination that built The Great Wall — it's not going to fade out any time soon.  Your correspondent at the Great Wall of China. The Wall is over 5,500 miles long was built over a period of 17 centuries. First, let's examine China's views on the U.S. presidential contenders and how that informs their immediate foreign and domestic policy plans… When considering investments outside of the U.S., it is absolutely imperative to understand the perspective of the press beyond the U.S. Don't take the U.S. media as gospel. I do not mean to tell you that foreign news is propaganda free. After all, most mainstream presses (including in the U.S.) are fed information from the very elite government and business officials on which they are reporting. China is no different in that respect. But without analyzing China's media, you only get half the story and half the information you need to make informed investment decisions. That's why I go to China and why I peruse China's main English-translated paper, China Daily. This expands my understanding of the unfolding financial climate and relationship between U.S. and China. Commentary on the U.S. and its elections in Chinese papers has been known to foreshadow the policy decisions of the Chinese government. According to China Daily, blaming other nations for U.S. problems has been a strategy for both candidates. It was a strategy the Obama administration used throughout the post-financial crisis period, rather than accepting responsibility for flaws in the banking system and economy. That tact works with the American public. But it is misleading, and intentional. There are many examples of Hillary Clinton using this approach. She has been a thorn in China's side for decades, going all the way back to 1993. Recall her "human rights are women's rights" moment as First Lady. It was a valid yet public slap in the face to China — but then she changed her stance in 2009 and implied human rights are secondary to economic issues. This combative relationship continued as she ran for President in the 2008 election, during her time as the Secretary of State, and into the present. =In her recent DNC acceptance speech, Clinton said, "If you believe we should say 'no' to unfair trade deals, that we should stand up to China, that we should support our steelworkers and autoworkers and homegrown manufacturers, join us." To say that Hillary has a tradition of frustrating the Chinese is an understatement. Trump has been outspoken about China stealing U.S. jobs and has made loud claims that China is manipulating its currency to thwart our trading capacity (something the Obama administration emphasized repeatedly). In his RNC acceptance speech on July 21, Trump vowed to stop "China's outrageous theft of intellectual property, along with their illegal product dumping, and their devastating currency manipulation," adding that "our horrible trade agreements with China and many others will be totally renegotiated." Of course trade deals should be fair to all sides and worker levels. That's why China has been making better ones with its new allies, as should the U.S. But playing the blame and tariff game, as both Trump and Clinton want, is not a recipe for trade success, but delusion and exclusion. Additionally, Trump unnerves China, mostly because of his erratic posturing. Trump also enthused in Denver in July, "China is great. I love China. I do business with China," noting a Chinese bank was his tenant in Manhattan and other partnerships. "We can do great with China. But we have stupid people representing us, stupid, stupid people." China does not know which Trump it would receive. When I met with Dr. Lam at the IMF last month in Beijing, our conversation about the economic future of China was somber. Dr. Lam maintained an impassive expression throughout our talk. The only time he cracked a smile — and it was a nervous smile — was when I mentioned Trump. This was something I experienced in Mexico too, nerves born of incredulity and unclear expectations. But perhaps unclear expectations are preferred to negative expectations. "While Trump's campaign seemed a joke six months ago to many Chinese (just as to many Americans)," said a recent China Daily op-ed, many Chinese now prefer Trump over Clinton in their pick of the lesser of two evils. "Trump's less interventionist foreign policy resonates with Chinese," added the paper. Now that's not something you'll hear about in the American media. Regards, Nomi Prins Ed. note: "A charmingly mordant take on the stock news of the day, accentuated by philosophical maunderings…" That's how one leading financial magazine described the FREE daily email edition of The Daily Reckoning. You'll find cutting-edge analysis from the complex worlds of finance, politics and culture. Presented in an entertaining style few can match. Click here now to sign up for FREE. The post The Upcoming Months Are Critical for China appeared first on Daily Reckoning. |

| MORE EVIDENCE GERMANY is PREPARING for WAR Posted: 31 Aug 2016 01:20 PM PDT EVIDENCE GERMANY is PREPARING for WAR: DOCTORS ARE BEING DRAFTED Catastrophe expected in European countries. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Gold Daily and Silver Weekly Charts - Silence of the Scams Posted: 31 Aug 2016 01:20 PM PDT |

| LIVE: Donald Trump and Mexican President Nieto News Conference 8/31/16 Posted: 31 Aug 2016 12:46 PM PDT LIVE: Donald Trump and Mexican President Nieto News Conference 8/31/16 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| WARNING -- The European Refugee Crisis could spread to the U.S. Posted: 31 Aug 2016 12:37 PM PDT Europe's refugee influx could spill over to the U.S.Former aide to Margaret Thatcher Nile Gardiner on how the European refugee crisis could spread to the U.S. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Koos Jansen: Why are Chinese banks holding gold? Posted: 31 Aug 2016 12:21 PM PDT 3:20p ET Wednesday, August 31, 2016 Dear Friend of GATA and Gold: Gold researcher Koos Jansen today sorts through the possibilities to determine the nature of the gold reported held by Chinese banks -- gold owned by bank customers, inventory for the gold business of the banks themselves, gold for leasing, and gold for hedging. Jansen's analysis is headlined "What Are These Huge Tonnages in 'Precious Metals' On Chinese Commercial Bank Balance Sheets?" and it's posted at Bullion Star here: https://www.bullionstar.com/blogs/koos-jansen/what-are-these-huge-tonnag... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| China Enters World Money Machine Posted: 31 Aug 2016 11:10 AM PDT This post China Enters World Money Machine appeared first on Daily Reckoning. Why the political urgency to include the yuan in the special drawing rights (SDR) if China does not meet the usual requirements? The answer is that a new global financial panic comes closer by the day. These panics happen every five–eight years almost like clockwork. Look at the financial panics in Mexico (1994), Russia/LTCM (1998), Lehman/AIG (2008) and you get the idea. Another panic in 2018, if not sooner, is a near certainty. The next panic will be bigger than the central banks' ability to put out the fire. The only source of bailout cash will be the SDR. But a massive issuance of SDRs will require cooperation by China. This is not because of International Monetary Fund (IMF) voting (China's vote is not that large). It's because SDRs are useful only if they can be swapped for other reserve currencies to prop up banks and liquidate panicked sellers of stocks. (The IMF runs a secret trading desk where these SDR swaps are conducted.) When your neighbors are in full panic mode, they won't want SDRs from Citibank; they'll want dollars. But who will swap dollars for the SDRs printed by the IMF? The answer is China. The PBOC and SAFE would love to dump dollar assets in exchange for SDRs. But there's a catch. China will only engage in SDR/Dollar swaps if the yuan is included in the SDR. China does not want to pay club dues unless it's a member of the club. The rush to include China in the SDR should be seen as global monetary elites getting their ducks in a row before the next panic comes to destroy your portfolio. In the 1960s, hippies had an expression to describe membership in a small group. They said, "You're either on the bus or off the bus." Well, the IMF wants China on the bus before the next panic hits. When trillions of SDRs are issued in the next panic, China will dump its dollars for SDRs (with the yuan inside). The U.S. dollar will be reduced to the status of a local currency. The dollar will still be used for local transactions inside the U.S. (the same way the Mexican peso is used inside Mexico), but it will no longer be the benchmark for sound reserve management. The impact on the dollar from the issuance of SDRs will be highly inflationary. After more than 10 years of trying and failing, the Federal Reserve will finally have the inflation it wants. But they will rue the day. Instead of the 2% annual inflation the Fed is targeting (really slow-motion theft), inflation of 10% or more can be expected. From there, it will spin even further out of control. With trillions in SDRs and thousands of tonnes of gold, China will call the shots the same way the U.S. called the shots at Bretton Woods in 1944. The slow death of the dollar, which began in 2009 with the issue of over $250 billion in SDRs, will be complete. How can you hedge your exposure to a dollar collapse and also profit from the rise of the SDR? There's that old saying: If you can't beat 'em, join 'em! The solution to the fall of the dollar and rise of SDRs is to invest in SDRs. That's a neat solution, but not as easy as it sounds. SDRs are for countries only; they are not walking-around money for you and me. There are almost no bonds denominated in SDRs, and no stocks at all. The IMF has borrowed billions of SDRs from its members to fund its lending operations, but those SDR notes are held in reserve positions and not freely traded. Eventually, a deep liquid pool of SDR-denominated assets will be created, but we're not there yet. In January 2010, the IMF released a paper with a long-term plan to support the rise of the SDR. It included specific instructions for the issuance of SDR notes by multinational corporations such as IBM and Siemens of Germany. The paper also outlined the purchase of those notes by multilateral institutions such as the Asian Development Bank. It also suggested the formation of a dealer network led by Goldman Sachs and the creation of clearance and settlement procedures (the so-called "plumbing" of a bond market). All this will take years to develop. Meanwhile, the largest, most sophisticated investors in the world (such as the $1 trillion sovereign wealth funds of Norway and Abu Dhabi) have found a way to synthesize SDRs. They are building portfolios denominated in currencies that match the official SDR weights. For example, if you select fundamentally strong European companies in your portfolio, but the euro crashes against the dollar, you will suffer dollar-denominated losses even if your stock picks were strong. Likewise, a portfolio of U.S. stocks may be strong on fundamentals. But if the dollar suffers a 1970s-style inflationary episode, your purchasing power is eroded relative to European and Asian investors. This phenomenon of exchange rates dominating fundamental analysis is especially true during currency wars. The reason the IMF has created a six-month delay between the announcement date and the effective date of the new SDR basket is to give the big guys like Norway time to "rebalance" their portfolios toward the new SDR basket. When you have $1 trillion to rebalance, you can't do things overnight without adverse market impact that hurts your own position. A six-month window lets you move daily in small increments so that you hit the target date without too much disruption. This rebalancing will give a lift to the yuan as mega-investors reach to acquire high-quality yuan-denominated assets to conform to the new SDR basket weights. Membership in the exclusive SDR currency club has changed only once in the past 30 years. The SDR has been dominated by the "Big Four" (U.S., U.K., Japan and Europe) since the IMF abandoned the gold SDR in 1973. This is why inclusion of the Chinese yuan is so momentous. Regards, Ed. Note: Sign up for your FREE subscription to The Daily Reckoning, and you'll start receiving regular insights for specific profit opportunities. By taking advantage now, you're ensuring that you'll be financially secure for the future. Best to start right away – it's FREE. The post China Enters World Money Machine appeared first on Daily Reckoning. |

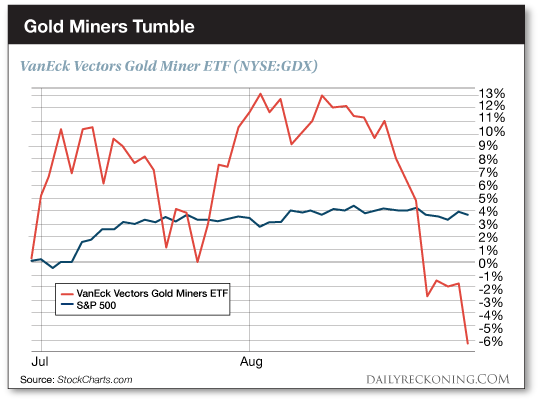

| Posted: 31 Aug 2016 10:18 AM PDT This post Here’s What’s Wrong with Gold appeared first on Daily Reckoning. Gold hasn't tripped down the stairs today… yet. Bu the yellow metal hasn't acted healthy lately. Gold futures dropped 1% on Tuesday, settling at the lowest levels we've seen since June. What gives? So far this year, we've revealed more than a handful of ways to play gold's rebound. And for the first six months of 2016, gold plays were our most profitable trades of the year. But markets move fast. After a rip-roaring first half, gold is stalling out. Just two months ago, we were watching precious metals and miners vault to two-year highs as the Fed backed off on a summer rate hike and world markets shook in fear of the Brexit vote. Fast forward two months and gold's outlook is drastically different. The major averages survived the Brexit shock, defied the pundits and marched higher. On the other hand, the once-unstoppable gold and gold miners trade started to stall out. Then it fell off a cliff…

Since July 1st, the S&P 500 has gained nearly 3.7%. Over that same timeframe, the VanEck Vectors Gold Miner ETF (NYSE:GDX) has lost more than 6.5%. That's a major change in character from the start of summer when gold was leaping higher every single week. Yesterday's punch in the golden gut came courtesy of the U.S. Dollar. A resurgent dollar is inflicting some serious damage on the commodities market this week. Of course, the formerly red-hot gold miners are feeling the heat while this story unfolds. The fast money is moving on to newer and better trades, and precious metals and miners continue to retreat from their July highs. A lot of folks will try to hang onto these mining stocks as they stumble toward Labor Day. The market might eventually reward them for doing so. But we can't ignore what price is telling us right now…

As gold miners have weakened this month, the group has dropped below a critical near-term support level near $27. This move snaps the uptrend that has powered miner shares higher all year. The next support level in sight is between $21-$22, which would lead GDX to a test of its 200-day moving average. The market has spoken—it's time to sell. I'll keep an eye on gold and the mining sector as it fights this bout of volatility. If gold miners reverse course, find support, and blast higher, I'll gladly get us back into some potentially profitable trades. But for now, the right move with gold and gold miners is to wait on the sidelines. Of course, other outside forces are also pulling at gold. We could spend all day speculating about whether or not the Fed will raise rates in September and how this will impact gold over the next one, three or five years. But even if rates remain the same for now (which the smart money favors), gold could continue to break down. We can't sit around waiting for the Fed to act. Price leads the news. Right now, price says sell. It's that simple… Sincerely, Greg Guenthner P.S. Make money in ANY market –sign up for my Rude Awakening e-letter, for FREE, right here. Never miss another buy signal. Click here now to sign up for FREE. The post Here’s What’s Wrong with Gold appeared first on Daily Reckoning. |

| Zero Hedge: Someone just dumped $5 billion in notional gold into the futures market Posted: 31 Aug 2016 08:37 AM PDT From Zero Hedge Gold futures are near the psychologically important $1,300 once again as someone decided that this morning was the perfect time to dump $4.7 billion in notional gold into the futures markets. ... ... For the remainder of the report: http://www.zerohedge.com/news/2016-08-31/someone-just-dumped-almost-5-bi... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Bond king Gross says Fed has 'mastered market manipulation' Posted: 31 Aug 2016 07:08 AM PDT Where has he been all this time? And he doesn't know the half of it. But better late than never. * * * By Jeff Cox The Federal Reserve, with its bargain-basement interest rates and money printer always on standby, is manipulating financial markets and crushing capitalism, bond king Bill Gross said in his latest broadside against the U.S. central bank. In a letter to clients, Gross addresses Fed Chair Janet Yellen directly, saying the policies she has pushed "have deferred long-term pain for the benefit of short-term gain." The criticisms come as the Fed is weighing whether to raise interest rates after years of keeping them anchored in efforts to stimulate the economy and create inflation. Instead, Gross said, the Fed has merely inflated asset prices while actually harming the economy. Yellen and other global central bankers "all have mastered the art of market manipulation and no -- that's not an unkind accusation -- it's one in fact that Ms. Yellen and other central bankers would plead guilty to over a cocktail at Jackson Hole or any other get together of PhD economists who have lost their way," Gross wrote. Directing his comments to Yellen specifically, he said, "Capitalism, almost commonsensically, cannot function well at the zero bound or with a minus sign as a yield. Eleven trillion dollars of negative-yielding bonds are not assets -- they are liabilities. Factor that, Ms. Yellen into your asset price objective." ... ... For the remainder of the report: http://www.cnbc.com/2016/08/31/bill-gross-the-fed-and-janet-yellen-have-... ADVERTISEMENT We Are Amid the Biggest Financial Bubble in History; With GoldCore you can own allocated -- and most importantly -- segregated coins and bars in Switzerland, Singapore, and Hong Kong. Switzerland, Singapore, and Hong Kong remain extremely safe jurisdictions for storing bullion. Avoid exchange-traded funds and digital gold providers where you are a price taker. Ensure that you are outright legal owner of your bullion. If you do not own segregated bullion that you can visit, inspect, and take delivery of, you are exposed. Crucial guides to storage in Singapore and Switzerland can be read here: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland GoldCore does not report transactions to any authority. Safety, privacy, and confidentiality are paramount when we are entrusted with storage of our clients' precious metals. Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44(0)203-086-9200. U.S.: +1-302-635-1160. International: +353(0)1-632-5010. Visit us at: http://www.goldcore.com Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |