Gold World News Flash |

- FOMC Vice Chair Stan Fischer Endorses Negative Rates

- Your Retirement Income is at Risk! (part two)

- The Day The Lights Go Out And The Trucks Stop Running

- Gold: Double Your Money – Mining Stocks: 20X Your Money

- At a Time of Political Darkness in America, Our Whistleblowers and Activists Give Us Reason to Hope

- Do Newly Built Skyscrapers Signal The Top Of The Stock Market?

- Gold Price Closed $1311.70 Down $11.00 or -0.83%

- Gold’s strong summer may be harbinger of things to come

- The Darwin Awards For Nations

- Mike Kosares: Gold's strong summer may be harbinger of things to come

- Major Banks Launch Plot Against Dollar

- Crypto-currencies and the Fate of the Dollar

- Gold Daily and Silver Weekly Charts - Stanley Steamer

- RON PAUL - Economic Collapse is Happening Now! Protect Yourself

- Four Horses Of The U.S. Debt Apocalypse

- Trade wars: Why the central pillar of global order is in danger of collapse as TTIP disintegrates

- New World Money

- M&A Signaling Market Bottom in Agriculture and Fertilizer Stocks?

- END TIMES SIGNS: LATEST EVENTS (AUGUST 30, 2016)

- Bron Suchecki: Dutch central bank hides gold bar list to conceal leasing

- Bix Weir 2016 MUST WATCH Economıc Collapse in Aug Sept

- No one can ask why gold isn't keeping up with central bank balance sheets

- Resolute Mining to pay dividends in gold bullion

- Central bankers get tired of gold as lower exports cut cash

- Stagflation to Force People into Gold

- Late-August Calm a Breeding Ground for Gold Bullion Bank Shenanigans

- Correction in Gold and Silver Price Underway

- Big Gold Rally This Week, Stocks Down?

- Gold Bars Near 5-Week Dollar Low as Fed's 'Full Employment' Rate-Rise Hints Meet 'Falling Inflation'

- The Power of Price Spikes On Intraday Charts

- The Right Lessons from Obamacare's Meltdown

- Canada Housing Market in Extreme Bubble Territory - Here’s How to Profit

| FOMC Vice Chair Stan Fischer Endorses Negative Rates Posted: 31 Aug 2016 01:00 AM PDT Gold Stock Bull | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Your Retirement Income is at Risk! (part two) Posted: 30 Aug 2016 11:01 PM PDT Part one is available here. Discussed in Part One: Richard Russell on "The Big Lie." "Central banks create fiat money, denigrate gold, and try to convince the people that the money they print is... {This is a content summary only. Click on the blog title to continue reading this post, share your comments, browse the website, and more!} | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Day The Lights Go Out And The Trucks Stop Running Posted: 30 Aug 2016 11:00 PM PDT Submitted by Michael Snyder via The Economic Collapse blog, What would happen if some sort of major national emergency caused a massive transportation disruption that stopped trucks from running? The next time you talk to a trucker, please thank them for their service, because without their hard work none of our lives would be possible. In America today, very few of us live a truly independent lifestyle, and that means that we rely on the system to provide what we need. Most of us take for granted that there will always be plenty of goods at Wal-Mart and at the grocery store whenever we need more “stuff”, and most of us never give a second thought to how all of that “stuff” gets there. Well, the truth is that most of it is brought in by trucks, and if the trucks stopped running for some reason the entire country would devolve into chaos very rapidly. Earlier today, I came across a quote from Alice Friedemann that detailed what we would be facing during a major national transportation disruption very nicely…

There is so much infrastructure that we take for granted that would suddenly become very vulnerable in this type of scenario. There are countless numbers of workers out there that never get any glory that do the hard work of maintaining our nuclear power plants, our natural gas pipelines, our electrical grid, etc. If they suddenly were not able to do their jobs, the consequences would be absolutely catastrophic. The following comes from Tess Pennington…

For most Americans, a major national emergency of this magnitude may seem unimaginable right now. But the truth is that it isn’t difficult to see how this kind of scenario could happen. The Yellowstone supervolcano is becoming increasingly active, a single large asteroid could change all of our lives in a single moment, a crippling pandemic could bring normal life in America to a complete standstill, a terror attack involving weapons of mass destruction would spread panic and fear like wildfire, and a historic earthquake along the New Madrid fault, the Cascadia Subduction zone or any of the major faults in California could literally change the geography of our entire continent. In addition, a massive EMP burst from a nuclear weapon or from the sun could fry our power grid and send us back into the stone age in a single moment. This is something that I have written about extensively, and those that want to minimize this threat simply don’t know what they are talking about. And an electromagnetic pulse is not even required to cause very serious problems with our electrical grid. For instance, just consider what happened in Ukraine toward the end of last year…

The truth is that we are far more vulnerable than most of us would like to admit. So what would you do if “normal life” suddenly came to an end and you no longer had access to food, water or power? How would you and your family respond? Hopefully you would continue to act in a civilized manner, but history has shown that many people would not. Desperate people do desperate things, and it would only take a matter of days for some people to become violent…

And even though things may seem relatively stable for the moment, concern about what is coming is one of the factors that has led an increasing number of Americans to arm themselves. According to a brand new study from the Pew Research Center, 44 percent of all American homes now have a gun. Just two years ago, a different study found that number was sitting at just 31 percent. The way that we are living our lives right now will not last indefinitely. At some point a major national emergency will strike, and when that day arrives we could suddenly be facing major power grid and transportation disruptions. Are you prepared for that? | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold: Double Your Money – Mining Stocks: 20X Your Money Posted: 30 Aug 2016 10:30 PM PDT from CrushTheStreet: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| At a Time of Political Darkness in America, Our Whistleblowers and Activists Give Us Reason to Hope Posted: 30 Aug 2016 10:00 PM PDT by Pam Martens and Russ Martens, Wall Street On Parade:

The smooth functioning of the U.S. economy is based on citizens having confidence in the country's leaders. Over two-thirds of the U.S. economy stems from consumer spending. When consumers lack confidence, they scale back spending. When businesses lack confidence, they lay off workers or stop hiring. When new home buyers lack confidence, they postpone signing a contract. Last Friday, Bloomberg News reported that the CEO of Signet Jewelers Ltd., Mark Light, was blaming a slowdown in diamond wedding ring sales on "a presidential campaign season that has scared couples into closing their checkbooks."

No Federal agency has done more to drain investor and consumer confidence than the crony Securities and Exchange Commission. Public revulsion of the SEC has now reached such epic proportions that a whistleblower, Eric Ben-Artzi, has turned down his half of a $16.5 million whistleblower award from the SEC for alerting the agency that his former employer, Deutsche Bank, had been inflating the value of its credit derivatives to avoid taking losses. The SEC imposed a $55 million fine on the bank but took no further actions against the employees who were responsible for misspricing the derivatives and hiding the losses. In an OpEd in the Financial Times earlier this month, Ben-Artzi explained his digust with how the SEC went about its enforcement in the case as follows: "…top executives retired with multimillion-dollar bonuses based on the misrepresentation of the bank's balance sheet. It is therefore especially disappointing that in 2015, after a lengthy investigation helped by multiple whistleblowers, the SEC imposed a fine on Deutsche's shareholders instead of the managers responsible." Ben-Artzi saw a link to this lapdog enforcement action and the revolving door between the SEC and Deutsche Bank, writing: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Do Newly Built Skyscrapers Signal The Top Of The Stock Market? Posted: 30 Aug 2016 06:55 PM PDT Have you heard of the Burj Khalifa in Dubai? It’s the tallest skyscraper in the world at 828m (2,717 ft), and it was completed in 2009. The price tag was a whopping $1.5 billion, making it one of the most expensive buildings of all time. As Visual Capitalist's Jeff Desjardin explains, for these bold projects to get the go ahead, global financial conditions have to be just right. Record-breaking skyscrapers can take multiple years to build, and things can change drastically from start to finish. In this case, construction of the Burj Khalifa started in 2004. By the time it was completed, however, the financial markets were in ruins. Lehman had collapsed, and rescue efforts such as TARP and QE were in full force to try and stop the bleeding. Between October 2007 and March 2009, the Dow Jones Industrial Average lost 55% of value. The crisis didn’t only bankrupt financial markets – it also took its toll on competing projects that aimed to unseat the Burj Khalifa as the world’s height record-holder. For example, One Dubai Tower A was supposed to be a whopping 1,008m (3,307 ft) tall – but it was shelved in March 2009 once it was clear that global financial conditions would not be improving any time soon. DO NEWLY BUILT SKYSCRAPERS SIGNAL THE TOP OF THE STOCK MARKET? Could record-setting skyscrapers signal economic over-expansion and a misallocation of capital? EWN Interactive, a subscription service focused on technical analysis, thinks so. The following infographic follows the “Skyscraper Curse” through six different market tops and subsequent crashes over the past century. It is gigantic in size, so please click here or the below image to access the legible version: Courtesy of: Visual Capitalist EWM Interactive sums up the infographic with these words:

That said, there are counter-examples that show the “skyscraper theory” is not perfect. The recession after World War I, the recession of 1937, and the recession in the early 1980s were not correlated with any record-breaking skyscraper projects. An empirical test in 2015 that looked at the theory found that record-setting skyscrapers did not correspond directly with the business cycle. Let’s hope that they are right, since the Jeddah Tower – a 1,008m (3,307 ft) monster in Saudi Arabia – is expected to unseat the Burj Khalifa as the world’s tallest building by the year 2019. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed $1311.70 Down $11.00 or -0.83% Posted: 30 Aug 2016 06:39 PM PDT

Franklin Sanders Daily commentary is now only available via email. FREE!: Get Franklin Sanders Daily Gold Price Reports and Market Commentaries: If the form above does not display in your iPhone or android app, please use this link to visit the website signup form: http://goldprice.org/franklin-sanders | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold’s strong summer may be harbinger of things to come Posted: 30 Aug 2016 06:02 PM PDT USA Gold | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 30 Aug 2016 05:40 PM PDT Submitted by Jeff Thomas via InterntionalMan.com, The fellow in the photo above is taking a bit of a risk. If all does not go well for him, he may become a candidate for the annual Darwin Awards – an award given to those who have inadvertently taken themselves out of the gene pool. Of course, Darwin’s premise was that, through natural selection, those who are born weaker, deformed, or otherwise less capable of survival are less likely to live long enough to procreate, thus assuring an ever-stronger, more adaptable species. This same premise can be applied to banks that follow unsound business practices. They’re more likely to go under as a result. This invariably causes suffering for those individuals who chose to do business with the irresponsible bank, but it can also be argued that those who believe empty promises by an irresponsible bank need to learn the lesson of economic prudence. Winnowing out those banks and their clients results in the responsible banks being stronger. Of course, when we declare any bank to be “too big to fail,” we assure that the bank in question (and other banks) will behave irresponsibly, as they are assured that they will be bailed out by the taxpayer. And the premise applies also to governments. Any government that behaves irresponsibly (promising entitlements to the populace, waging war and increasing the size of the government itself, without any plan as to how it will all be paid for) can be expected to exit the gene pool of nations. The problem is that, unlike the personal Darwin Awards, in which the imbecile in question is likely to meet his end soon after his error, nations tend to suffer for an extended period from poor economic and militaristic steps taken by governments before they collapse. Worse, they take their people down with them when they go. As an example, in the twentieth century, the UK poured money into two world wars, ultimately impoverishing the country and ending their dominance as the world’s foremost empire. The UK still limps along as a nation, but is greatly diminished from what it was in the nineteenth century. Across the pond in the U.S., the Federal Reserve was created in 1913, in part, to rob the American people, through regular inflation over an extended period of time. It worked well. Not understanding what inflation means, the American people have lost over 97% of the value of their dollar over the last one hundred years. At around the same time, the U.S. instituted income tax. It started out small (as income taxes always do), then, like Topsy, it just grew. As a result, people who receive lower wages in a no-tax jurisdiction are likely to have a far better standard of living than those in the U.S. (and other countries that have income tax). And that’s not to say that the UK and U.S. are unique. Quite the opposite. In fact, it’s the norm for any country’s politicians to make promises of largesse to their people just prior to an election. And with each election, the promises need to become larger, to inspire the people to vote for the promisers. Along the way, politicians use warfare as a tool to both distract the voters from political misdeeds and to convince them to give up their rights in times of war. Today, the concept of perpetual war allows a more frequent removal of rights. Each of the above works to the advantage of the political class (regardless of whether they claim to be Tory or Labour, Democrat or Republican.) It does however mean that, at some point, economic, social and political collapse will take place when the abnormalities become so excessive that the system can no longer bear their weight. We’re passing through an unprecedented period in history, in which quite a few of those nations that were once the most prosperous; the most free; the most forward-thinking, are all headed downward at the same time, and for the same reasons. Hence, we shall in the near future be observing the removal from the gene pool of nations many of the most powerful (and formerly most desirable) countries. It should be stressed that this does not necessarily mean that these countries will come to an end. Their geography will remain, but they may be crisscrossed with new boundary lines, should any of them be cut up. For others, it will mean retaining the name of the country, but they will be “under new management.” However, existence within these geographical locations will be changed dramatically. Once a country collapses economically/socially/politically, it’s likely to take a long time to recover. That means that those who are getting by in those jurisdictions (or may even be doing well) may find their well-being curtailed – possibly dramatically. Japan is overdue for a Darwin Award, as are the countries of the EU. They represent a buffer for countries such as the U.S. and Canada. Once the first dominoes topple, the others will soon fall. We’re taught to believe that we’re married to the country of our birth and would be “deserters” if we were to leave. But, if our country of birth doesn’t represent how we wish to live, we’re living in the wrong neighbourhood. Most people understand that, if they don’t like their neighbourhood, they’d be stupid not to leave for a better neighbourhood. But what if that “neighbourhood” is the country of your birth? Is the concept not the same? If someone we know foolishly tempts fate by putting his head in a crocodile’s mouth, very few of us would follow his lead. Yet, people in their millions have, throughout history, watched their countries reach the point of self-destruction and have simply gone along – accepting their fate as the failing country carries them over the cliff. Darwin was correct. Those who represent the future of the species are those who are the strongest and choose their own survival in times of crisis. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mike Kosares: Gold's strong summer may be harbinger of things to come Posted: 30 Aug 2016 03:27 PM PDT By Michael J. Kosares We are now wrapping up one of the stronger summers in memory at USAGold and heading into the strongest time of year seasonally for gold and silver -- September through February. Normally the summer months are the quiet part of the year, but 2016 has been an exception. The price of gold is up 9 percent since the beginning of June and silver over 18 percent. ETF gold inventories reached highs in July and August not seen since 2009, the year after the collapse of Lehman Brothers and the launch of the so-called credit crisis. Some see the stronger than usual summer showing for the precious metals markets as a harbinger of things to come. ... ... For the remainder of the commentary: http://www.usagold.com/cpmforum/2016/08/30/golds-strong-summer-may-be-ha... ADVERTISEMENT Silver Coins and Rounds with Employee Pricing and Free Shipping Grab your Silver Starter Kit at cost from Money Metals Exchange, the company named "Precious Metals Dealer of the Year" by industry ratings group Bullion Directory. Simply go to MoneyMetals.com and type "GATA" in the radio box at the top of the page. This special silver offer contains 4 ounces of silver coins and rounds in the most popular 1-ounce, half-ounce, and 10th-ounce forms. Claim yours now, because GATA readers get employee pricing and free shipping. So go to -- -- and type "GATA" in the radio box at the top of the page. Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Major Banks Launch Plot Against Dollar Posted: 30 Aug 2016 02:45 PM PDT This post Major Banks Launch Plot Against Dollar appeared first on Daily Reckoning. The most interesting news is often buried in the back pages. Few see it. Even fewer grasp it… CNBC yawned the other day that four of the world’s largest banks — the Swiss bank UBS, Deutsche Bank, Spanish Santander Bank and BNY Mellon — have teamed up to create something they call the "Utility Settlement Coin (USC)." What in bloody blue blazes is that? A new way to pay the water bill? No. It's a new form of digital money, like Bitcoin. But for banks. These banks believe it will "become an industry standard to clear and settle financial trades over blockchain, the technology underpinning Bitcoin." The USC would be the first Bitcoin-like currency used officially between major financial institutions. Why are these banks doing it? The USC would let financial institutions pay for securities like stocks and bonds without the delays associated with traditional money transfers. These can take days. And these delays cost money. According to a report by a consulting firm Oliver Wyman, the world spends up to $80 billion every year to clear and settle trades. USC would change that, says the Financial Times: "They would use digital coins that are directly convertible into cash at central banks, cutting the time and cost of post-trade settlement and clearing." Granted, not quite Page 1 stuff. The obituaries are thrillers beside it. But this obscure story contains a library of information to the practiced eye… Over 80% of all global financial transactions are conducted in dollars. So every major financial institution, corporation, central bank and foreign government needs piles of greenbacks to transact business. That creates an almost unlimited global demand for the things. As "Sovereign Man" and Daily Reckoning contributor Simon Black explains, The way the international trade system is set up right now, most international financial transactions must pass through the U.S. banking system's network of correspondent accounts. This gives the U.S. government an incredible amount of power… As long as the U.S. dollar remains the world's dominant reserve currency, major banks must able to clear and settle U.S. dollar transactions if they expect to remain in business, making the U.S. banking system the gatekeeper of the U.S. dollar. This new digital payment system lets banks bypass the swamps of the U.S. banking system. They can instead send real-time payments directly to one another using their own version of digital cash, saving time and money. Seems harmless enough, really. Nothing wrong with saving time and money. So… what's the big deal? The big deal, says Black, is that this thing could mean the dollar's no longer the center of the financial solar system: "If foreign banks are able to transact directly with one another without having to go through the U.S. banking system, then why would they need to park trillions of dollars in the United States?" His answer: "They wouldn't." Then it's every man for himself: Adoption of this technology could cause a gigantic vacuum of deposits out of the U.S. banking system. U.S. banks would take a big hit. And the U.S. government would have far fewer foreign buyers to sell its ever-expanding piles of debt to. Make no mistake, the adoption of this technology is a game-changing development with far-reaching implications. And it's happening very quickly. Or as globalintelhub puts it in Zero Hedge: What makes this week’s announcement unique is that for the first time, the banks publicly announced they are making a new digital ‘cryptocurrency’ that isn’t issued by a central bank, that can be implemented by them and across borders, which is a perfect fit for a replacement of the U.S. dollar and other fiat currencies when they completely run out of QE steam. A lot of people think the central banks are running out of QE steam as it is. How much do they have left? The Utility Settlement Coin is expected to launch in 18 months. It could be years before it gains traction, of course. But the direction is clear: the world wants alternatives to the dollar. The real question: Can the Utility Settlement Coin and other cryptocurrencies like Bitcoin replace the dollar when the next crisis strikes? Below, Jim Rickards provides the answer. And it might surprise you. Read on. Regards, Brian Maher Ed. Note: Sign up for your FREE subscription to The Daily Reckoning, and you'll start receiving regular offers for specific profit opportunities. By taking advantage now, your ensuring that you'll be financially secure later. Best to start right away. The post Major Banks Launch Plot Against Dollar appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Crypto-currencies and the Fate of the Dollar Posted: 30 Aug 2016 02:37 PM PDT This post Crypto-currencies and the Fate of the Dollar appeared first on Daily Reckoning. At various times in history, feathers have been money, shells have been money, dollars and euros are money. Gold and silver are certainly money. Bitcoin and other crypto-currencies can also be money. People say some forms of money, such as Bitcoin or U.S. dollars, are not backed by anything. But that’s not true. They are backed by one thing: confidence. If you and I have confidence that something is money and we agree that it’s money, then it's money. I can call something money, but if nobody else in the world wants it, then it’s not money. The same applies to gold, dollars and crypto-currencies. Governments have an edge here because they make you pay taxes in their money. Put another way, governments essentially create an artificial use case for their own forms of paper money by threatening people with punishment if they do not pay taxes denominated in the government’s own fiat currency. The dollar has a monopoly as legal tender for the payment of U.S. taxes. According to John Maynard Keynes and many other economists, it is that ability of state power to coerce tax payments in a specified currency that gives a currency its intrinsic value. This theory of money boils down to saying we value dollars only because we must use them to pay our taxes — otherwise we go to jail. So-called crypto-currencies such as Bitcoin have two main features in common. The first is that they are not issued or regulated by any central bank or single regulatory authority. They are created in accordance with certain computer algorithms and are issued and transferred through a distributed processing network using open source code. Any particular computer server hosting a crypto-currency ledger or register could be destroyed, but the existence of the currency would continue to reside on other servers all over the world and could quickly be replicated. It is impossible to destroy a crypto-currency by attacking any single node or group of nodes. The second feature in common is encryption, which gives rise to the "crypto" part of the name. It is possible to observe transactions taking place in the so-called block chain, which is a master register of all currency units and transactions. But, the identity of the transacting parties is hidden behind what is believed to be an unbreakable code. Only the transacting parties have the keys needed to decode the information in the block chain in such a way as to obtain use and possession of the currency. This does not mean that crypto-currencies are fail-safe. Large amounts of crypto-currency units have been lost by those who entrusted them to certain unregulated Bitcoin "banks" and "exchanges." Others have been lost to old-fashioned fraud. Some units have been lost because personal hardware holding encryption keys or "digital wallets" has been destroyed. But on the whole, the system works reasonably well and is growing rapidly for both legitimate and illegitimate transactions. It's worth pointing out that the U.S. dollar is also a digital crypto-currency for all intents and purposes. It's just that dollars are issued by a central bank, the Federal Reserve, while Bitcoin is issued privately. While we may keep a few paper dollars in our wallets from time to time, the vast majority of dollar denominated transactions, whether in currency or securities form, are conducted digitally. We pay bills online, pay for purchases via credit card, and receive direct deposits to our bank accounts all digitally. These transactions are all encrypted using the same coding techniques as Bitcoin. The difference is that ownership of our digital dollars is known to certain trusted counterparties such as our banks, brokers and credit card companies, whereas ownership of Bitcoin is known only to the user and is hidden behind the block chain code. Bitcoin and other crypto-currencies present certain challenges to the existing system. One problem is that the value of a Bitcoin is not constant in terms of U.S. dollars. In fact, that value has been quite volatile, fluctuating between $100 and $1,100 over the past few years. It's currently around $575. It's true that dollars fluctuate in value relative to other currencies such as the euro. But those changes are typically measured in fractions of pennies, not jumps of $100 per day. This gives rise to tax problems. For example, if you acquire a Bitcoin for $200 and later exchange it for $1000 of good or serveries, you have an $800 gain on the purchase and sale of the Bitcoin itself. From the perspective of the IRS, this gain is no different than if you had purchased a share of stock for $200 and later sold it for $1000. You have to report the $800 as a capital gain. It seems unlikely that most Bitcoin users have been reporting these gains. Those who do not may be involved in tax evasion. The IRS has broad powers to investigate evasion, and may require counterparties to reveal information, including computer keys, which can lead to discovery of the transacting parties. Given the fact that the IRS has engaged in selective enforcement against Tea Party activists and other political opponents in recent years, this is a serious potential problem for libertarian users of Bitcoin. One potential solution to the Bitcoin volatility problem I find interesting is to link bitcoin to gold at a fixed rate. This would require consensus in the bitcoin community and a sponsor willing to make a market in physical gold at the agreed value in bitcoin. This kind of gold-backed bitcoin might even give the dollar a run for its money as a reserve currency, especially if it were supported by gold powers such as Russia and China who are looking for ways out of the current system of dollar hegemony. Another problem is that Bitcoin and the other crypto-currencies have not survived a complete business and credit cycle yet. Bitcoin, the first crypto-currency, was invented in 2009. The global economy has been in a weak expansion since then, but has not experienced a financial panic or technical recession. Investors have some experience with how stocks, bonds, gold and other asset classes might perform in a downturn, but we have no experience with Bitcoin. Will liquidity dry up and prices plunge? Or will investors consider it a safe harbor, which will lead to price increases? We don't know the answer. I believe Bitcoin and its crypto cousins represent an opportunity. It is still too early for investors to hold in their portfolios due to excessive volatility and unresolved tax issues. But the time may come, sooner than later, when some Bitcoin technology companies might warrant investor interest based on their possible role in the future of payments and in other forms of wealth transfer. Companies such as Western Union and PayPal dominate the private payments systems space today. They may have company from crypto-currency start-ups soon. One of the things I like about gold is it's not digital, it doesn't depend on the internet, it doesn't depend on the power grid. It has intrinsic value independent of those things. Bitcoin does not. If the power grid goes down, your Bitcoins are worthless. I’m not anti-Bitcoin, but physical gold does not have the disabilities of Bitcoin and digital currencies like the U.S. dollar. Regards, Jim Rickards Ed. Note: Sign up for your FREE subscription to The Daily Reckoning, and you'll start receiving regular insights for specific profit opportunities. By taking advantage now, you're ensuring that you'll be financially secure for the future. Best to start right away – it's FREE. The post Crypto-currencies and the Fate of the Dollar appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Stanley Steamer Posted: 30 Aug 2016 01:38 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| RON PAUL - Economic Collapse is Happening Now! Protect Yourself Posted: 30 Aug 2016 12:19 PM PDT Economic collapse and financial crisis is rising any moment. Getting informed about collapse and crisis may earn you, or prevent to lose money. Do you want to be informed with Max Keiser, Alex Jones, Gerald Celente, Peter Schiff, Marc Faber, Ron Paul,Jim Willie, V Economist, and many... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Four Horses Of The U.S. Debt Apocalypse Posted: 30 Aug 2016 11:41 AM PDT This post Four Horses Of The U.S. Debt Apocalypse appeared first on Daily Reckoning. Crises are based on compound bets (or debts) gone awry. As with lightning, though, crises don't usually strike the same place twice, not consecutively, anyway. Over the past two decades, we've seen the emerging-market collapse in the late 1990s, the Enron-led crime spree in 2001–02 and the housing-spawned financial crisis of 2008. Since that last crisis, the Fed's cheap money policy has helped big banks and corporate customers, but most regular people have not fully recovered. Regardless of whether the Fed raises rates or keeps recklessly bating business media about the possibility, these connected debt pockets can crush the economy again. Here, I'll lay out how they can push us over the edge. Understanding these connected debt bubbles means that you can not only survive the looming implosion but also come out ahead.

Because of that law, private banks piled into the lending business (although they have since backtracked). This, in turn, stoked college tuition, which necessitated more student debt. Current numbers are epic. Americans owe about $1.3 trillion in student loan debt across 43 million borrowers. This a HUGE increase from $260 billion in 2004. The average class of 2016 graduate has $37,172 in student loan debt, up 6% from 2015 and 12% from 2014. The student loan delinquency rate has reached a peak of 11.6% and is rising. The impact of this condition is vast — felt in fewer students purchasing homes, starting businesses, investing and consuming. All of this hurts the future economy. And the overhang hinders more people as they go through life. The share of student debt for people over 60 has skyrocketed from $8 billion to $43 billion, with 5% deducting loan payments from Social Security checks. Two: Subprime Auto Loans — You may have heard about the record amount of auto sales recently — over $1 trillion. More Americans bought new cars in 2015 than ever. Fitch Ratings blamed this boom in auto sales on laxer borrowing standards, especially for subprime borrowers. Indeed, the rate of delinquent subprime car loans soared above 5% in February — the highest level in 20 years. The fall in oil prices is a main factor in rising defaults. Companies in the oil and gas sector are getting hit hard. As a result, they cut staff, which means people can't afford to pay bills. But falling oil prices aren't the only factor in increased defaults. Banks aren't fashioning as many mortgage-backed securities (MBS) and related complex derivatives as in the last crisis. Instead, they have found new products — like auto loans — to game markets. With rates at zero and investors seeking yield from anywhere possible, banks have stoked a car loan bubble by concocting subprime auto ABS. Repo men may see some boom times soon. Some lessons are never learned.

According to Equifax, in May "lenders issued 10.6 million new credit cards to subprime borrowers in 2015, a 25% increase compared to 2014." Thus, the least well-positioned people are gaining the most debt. The fallout won't be contained to just those people, however. It will impact credit availability for everyone. Yet banks are still pushing plastic. Card issuers are raising customers' credit limits, doling out more cards and pumping up perks. In the first quarter of 2016, Citigroup credit card balances posted their first year-over-year increase since 2008. Balances also grew at Discover Financial Services and J.P. Morgan Chase, the nation's largest lender, and elsewhere. Four: 99% of Corporates' Cash/Debt Ratios Are Poor — If liquidity problems just plagued consumers, it'd be one thing. That's not the case. The top 25 U.S. nonfinancial companies, or top 1%, control 51% of the total cash held by all nonfinancial U.S. corporations, according to S&P Global Ratings. That's up from 38% five years ago. Meanwhile, the bottom 99% of these companies are adding debt. Their cash-to-debt ratios dropped to 15%, the lowest level of the past decade. This means that they have 15 cents in cash on average for each dollar they owe. That's a decline from a comparable peak of 23% in 2010 and below the 16% ratio in 2008. This phenomenon reflects the appetites yield-starved investors have for corporate debt. Companies use this debt to pursue acquisitions or return cash to shareholders via dividends or stock buybacks. But these are temporary measures of stability and strategies with diminishing returns. The top 1% of companies has $945 billion of cash piled up, more than enough to repay their outstanding debts of $620 billion. They have a cash-to-debt ratio of 153%, a figure 10 times that of the bottom 99%. That's a disparity eclipsing the one from the recent financial crisis. If the Fed raises rates, these companies face the likelihood of taking out more debt at a higher cost. Even if the Fed doesn't raise rates, the clock is still ticking down. Companies that don't have enough money to meet their debts will be in trouble. These four horses of debt, galloping toward us simultaneously from different sectors, don't show any sign of slowing. They will trigger the U.S. Debt Apocalypse, bringing more defaults, vast job cuts and economic fallout than even the Great Recession. Regards, Ed. note: "A charmingly mordant take on the stock news of the day, accentuated by philosophical maunderings…" That's how one leading financial magazine described the FREE daily email edition of The Daily Reckoning. You'll find cutting-edge analysis from the complex worlds of finance, politics and culture. Presented in an entertaining style few can match. Click here now to sign up for FREE. The post Four Horses Of The U.S. Debt Apocalypse appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Trade wars: Why the central pillar of global order is in danger of collapse as TTIP disintegrates Posted: 30 Aug 2016 10:37 AM PDT This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 30 Aug 2016 09:03 AM PDT This post New World Money appeared first on Daily Reckoning. The construction of the IMF’s special drawing rights (SDRs) valuation basket is reviewed every five years by the IMF Executive Board. But it can be changed more or less frequently at the Executive Board's discretion. The new effective date for the revised basket is midnight on Sept. 30, 2016. China is its newest addition. Membership in the exclusive SDR currency club has changed only once in the past 30 years. That change took place in 1999, and was purely technical due to the fact that the German mark and French franc were being replaced by the euro. Leaving aside this technical change, the SDR has been dominated by the "Big Four" (U.S., U.K., Japan and Europe) since the IMF abandoned the gold SDR in 1973. This is why inclusion of the Chinese yuan is so momentous. Including the yuan is a "seal of approval" by the world's major financial powers, led by the United States. It means China is a financial superpower and deserves a seat at the table when the international monetary system is reset. The decision to now include the yuan in the SDR basket is part of a larger power play between China and the U.S. Since 2009, China has been one of the biggest lenders to the IMF. You can think of this as a four-person poker game where a fifth player just sat down at the table with a large pile of chips. The poker game will now take on a new dynamic.

China does not strictly meet all the IMF criteria for inclusion in the SDR club. But use of the Chinese yuan in global trade does satisfy the test. The yuan's share of global payments has been steadily rising, from less than 1% in 2013 to about 2% in 2014. Yuan use is currently approaching 3% as shown in the charts below. Use of Chinese yuan surpassed Australian, Canadian, Singapore and Hong Kong dollars, as well as Swiss francs, by 2014. It also recently passed the Japanese yen. This makes the yuan the fourth most used currency in the world after U.S. dollars, euros and sterling. Where the Chinese yuan doesn't meet IMF standards is in having an open capital account. China has also not always been transparent in their reporting of reserve positions. Market confusion and turmoil have been caused lately by China's efforts to move in the direction required by the IMF. For two years prior to August 2015, China informally pegged the yuan to the U.S. dollar at a rate of about 6.2-to-1. Maintaining the peg requires continuous market intervention by the People's Bank of China, or PBOC (the central bank). Market forces tried to drive the yuan lower. This forced the PBOC to sell dollars and buy yuan to maintain the peg. This operation drained about $500 billion from China's $4 trillion in reserve assets in a matter of months. It is inconsistent with an open capital account in which market forces, not PBOC intervention, determine the value of the yuan. But suddenly, in August 2015, China devalued the yuan in two steps, to a level of about 6.4-to-1. This was a shot heard round the world. Epoch Times interview March 2016 The devaluation led directly to meltdowns in U.S. equity markets as the resulting strong dollar threatened to hurt U.S. exports and jobs. A stronger dollar also hurts earnings of U.S. companies with overseas operations. This damage has since become apparent in third-quarter corporate earnings reports. From China's perspective, the devaluation was a step in the direction of an open capital account. But from the world's perspective, it was a continuation of the currency wars. Investors saw more devaluations coming and more damage to U.S. corporate earnings. For now, China is defending the new peg with more intervention. You should expect further devaluations. You should also expect more market shocks in the near future as China stumbles its way to a freely traded yuan. China has also improved the transparency of its reserve reporting, especially with regard to gold. From 2009–2015, China reported no increases in its gold reserves. Yet the evidence (from mining statistics and Hong Kong imports) was conclusive that China was, in fact, acquiring thousands of tonnes of gold. In mid-2015, China suddenly announced that its gold reserves had increased by 604 tonnes. The total rose from 1,054 tonnes to 1,658 tonnes. Since then, China has updated its gold reserve position monthly (in keeping with IMF criteria). All of these figures are misleading because China keeps several thousand tonnes of gold "off the books" in a separate entity called the State Administration for Foreign Exchange (SAFE). Small amounts are transferred from SAFE to PBOC monthly, and that becomes the basis for the official reserve reports. The truth about China's gold is hidden for now. It will be revealed later in the poker game when China needs to increase its pile of chips. China's case for admission into the SDR club is a mixed bag. The yuan meets the use criteria and is close on the reserve criteria. China does not meet the criteria for an open capital account and transparent reporting. Still, they are moving in the right direction. In fact, none of this matters. The IMF's decision to include the yuan in the SDR is a political decision, not an economic one. The green light to proceed has already been given by the IMF Executive Board. The story of New World Money continues. Regards, Ed. Note: Sign up for your FREE subscription to The Daily Reckoning, and you'll start receiving regular insights for specific profit opportunities. By taking advantage now, you're ensuring that you'll be financially secure for the future. Best to start right away – it's FREE. The post New World Money appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

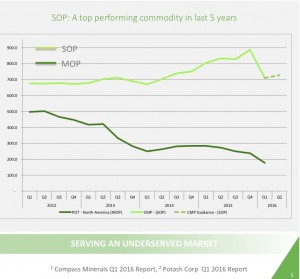

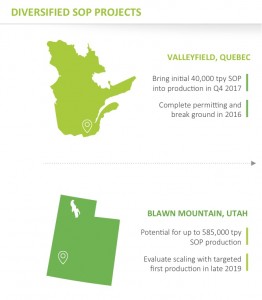

| M&A Signaling Market Bottom in Agriculture and Fertilizer Stocks? Posted: 30 Aug 2016 08:43 AM PDT Big news hits the fertilizer sector as Bloomberg reports that Potash Corp (POT) and Agrium (AGU) are in advance M&A discussions. If Bloomberg is true then this could be a major catalyst for the sector. Potash Corp is the world’s second largest producer and a merger with Agrium could mark a bottom in the agricultural sectors which has been declining for years. Both companies are struggling cutting dividends and taking losses as emerging economies such as India and China have been waiting on the sidelines to sign contracts. Today’s action may be signalling the end of this downtrend. For a couple of months now I have been looking into the agriculture and food sector as it has become so cheap. As inflation rears its ugly head high quality agriculture stocks could soar as food prices rise. Witness the recent move in gold stocks, six months ago no one touched them now investors can’t get enough of it as the gold price has jumped a couple of hundred dollars. Similarly, the agricultural market may be in the early stages of a major turnaround not seen in many years. However, that may be changing as Belarus may once again work with the Russians to set a floor to pricing. Fertilizer stocks may be bottoming such as Potash Corp, Agrium and Mosaic. These developments must be monitored in Belarus as this could set a floor to the global agricultural market which has been in decline since the Credit Crisis. Also a merger with Potash Corp and Agrium could signal a bottom for the potash sector. Emerging economies such as China and India are the largest consumers and these deals could be the sign of a turning point in the recent downturn in global food prices. Enter center stage a junior developer in North America. Potash Ridge (PRK.TO or POTRF) has a goal to become the largest producer of sulfate of Potash (SOP) in North America. Don't confuse SOP with Regular Potash. Sulfate of Potash is a premium product to regular potash costing triple the amount as it is requited for higher end vegetables, nuts and fruits which can't handle the chlorine from regular potash. While the Russian have crashed the regular potash market over the past 3 years, SOP is one of the better performing commodities outperforming many other commodities. Potash Ridge has two major SOP properties, Valleyfield in Quebec and Blawn Mountain in Utah. The company's goal is to get Valleyfield into production by the 4th quarter of 2017. Potash Ridge is currently permitting and exploring financing options. Once these areas are de-risked I expect a major re-rating. Potash Ridge is working with SNC Lavalin (SNC.TO) on environmental studies needed to apply to the Quebec Government to certify the Valleyfield processing facility using In addition to Valleyfield in Quebec, Blawn Mountain in Utah is where I see the huge leverage to the SOP market. This could produce more than 10x that of Valleyfield annually and change the US from an importer to exporter of this critical fertilizer which is critical for places like Africa where there are current food shortages. Blawn Mountain could come into production by the end of this decade. Potash Ridge is led by management who worked for a major producing nickel mining company called Sherritt (S.TO). Recently, Potash Ridge announced a Memo of Understanding with SNC Lavalin to develop Blawn Mountain in Utah. SNC is looking to scale down the 2013 prefeasibility study so that it could help production be more attainable in a timely manner. Within the next five years, Potash Ridge (PRK.TO or POTRF) could be the largest producer of SOP in North America. This may be attracting smart money as the company has been able to raise several equity financings this year with some smart mining investors. The current market cap is small relative to their asset base and what it could possibly be valued at if they get into production and are able to execute on the construction financing. See my recent interview with Potash Ridge COO Ross Phillips by clicking here… https://www.youtube.com/watch?v=uAGjVrcXgSw Disclosure: http://goldstocktrades.com/blog/featured-companies-on-gold-stock-trades/ Section 17(b) provides that: _______________________________________________________ Sign up for my free newsletter by clicking here… Order premium service by clicking here… Please see my disclaimer and full list of sponsor companies by clicking here… To send feedback or to contact me click here… Tell your friends! Please forward this article to a friend or share the link on Facebook, Twitter or Linkedin. For informational purposes only. This is not investment advice. May contain forward looking statements. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| END TIMES SIGNS: LATEST EVENTS (AUGUST 30, 2016) Posted: 30 Aug 2016 08:04 AM PDT end times, end times signs, end times news, end times events, bible prophecy, prophecy in the news, tornado, earthquake, strange weather, strange events, apocalyptic signs, apocalyptic events, strange weather phenomenon, wars and rumors of wars The Financial Armageddon Economic Collapse... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bron Suchecki: Dutch central bank hides gold bar list to conceal leasing Posted: 30 Aug 2016 07:41 AM PDT 10:40a ET Tuesday, August 30, 2016 Dear Friend of GATA and Gold: Bron Suchecki, formerly an executive at the Perth Mint and now vice president for operations at Monetary Metals LLC, speculates today that the Netherlands central bank has refused to make public a list of its gold reserve bars because changes in the list would indicate how much gold leasing the bank has been doing. Such an explanation would fit exactly with the secret March 1999 staff report of the International Monetary Fund, which acknowledged that central banks conceal their gold leases and swaps to facilitate their surreptitious intervention in the gold and currency markets: http://www.gata.org/node/12016 Suchecki's commentary is headlined "Central Bank Non-Transparency" and it's posted at his blog, Gold Chat, here: http://goldchat.blogspot.com/2016/08/central-bank-non-transparency.html CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers: To invest or learn more, please visit: Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bix Weir 2016 MUST WATCH Economıc Collapse in Aug Sept Posted: 30 Aug 2016 05:25 AM PDT IN THIS INTERVIEW:- Will America unify behind one presidential ticket? ►0:54- Collapse coming in August, September time-frame ►2:30- There is no chance of unifying the country ►4:39- Why is the economy so fragile right now? ►6:03- Gold and silver market rigging ►8:24- Will gold and silver supply... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| No one can ask why gold isn't keeping up with central bank balance sheets Posted: 30 Aug 2016 05:21 AM PDT 8:20p ET Tuesday, August 30, 3016 Dear Friend of GATA and Gold: A market note by two market analysts for Deutsche Bank, publicized Monday by a few news organizations, including Business Insider (see below), observed that gold's price ordinarily correlates with central bank balance sheets but that lately it has not been keeping up with the vast expansion of those balance sheets. Unfortunately if predictably, the analysts don't inquire into the seeming breakdown of this correlation, perhaps because such inquiry might lead them to the largely surreptitious intervention in the gold market by central banks and particularly their underwriting the huge gold derivatives business, in which paper claims to gold that doesn't exist take the place of ownership of real metal. That central bank activity remains a highly prohibited subject among mainstream market analysts and mainstream financial news organizations alike. CHRIS POWELL, Secretary/Treasurer * * * Gold Is Doing Something It Has Done Only Twice in the Past Decade By Akin Oyedele Gold may be worth more than what traders have decided is the spot price. There's a correlation between gold price changes and the rate at which central banks bought assets to expand their balance sheets, according to Deutsche Bank's Michael Hsueh and Grant Sporre. And the pace of balance-sheet expansion — by 300% since 2005, according to the analysts — indicates that gold could be worth more. They wrote in a note on Friday: "Let us be clear; we are not saying that gold will trade up to $1,700/oz in the near term, but when viewed against the aggregated balance sheet of the 'big four' global central banks (the Fed, European Central Bank, Bank of Japan, and People's Bank of China), the argument can be made if we view gold as a currency, the metal is worth closer to $1,700/oz versus the spot price $1,326/oz." ... ... For the remainder of the report: http://www.businessinsider.com/gold-and-central-bank-balance-sheets-2016... ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Resolute Mining to pay dividends in gold bullion Posted: 30 Aug 2016 04:57 AM PDT By Tess Ingram Shareholders in Resolute Mining will have the option of collecting dividend payments in gold bullion, under a new policy believed to be the first of its kind in the world. The gold miner announced today that it would resume dividend payments, declaring a 1.7-cent per share final dividend for the 2016 financial year under a new gold sales-linked dividend policy. Resolute, which has not paid consistent dividends since the late 1990s, joined a group of local gold miners reinstating or raising dividends amid the best conditions the sector has enjoyed in recent years. But with a twist. Shareholders who hold 5,000 or more shares in the company can elect to receive dividends in gold bullion paid into a personal account held with The Perth Mint. It is a first for The Perth Mint and Resolute Managing Director John Welborn said he believes it is the first time a gold company has ever offered the option. ... ... For the remainder of the report: http://www.afr.com/business/mining/gold/resolute-mining-to-pay-dividends... ADVERTISEMENT The Gold Mine Barrick Might Regret Having Sold K92 Mining is poised for production at its Papua New Guinea gold project and has just listed on the Toronto Venture exchange under the symbol KNT.V. The gold mining startup came together during one of the toughest periods in mining history. K92's main asset is the Kainantu project, a large high-grade gold resource with extensive infrastructure including underground mine development, a mill processing facility, a fully permitted tailings pond, and paved roads. The infrastructure means K92 can aim to restart mining in the near term with minimal capital costs and seek to grow through cash-flow funded exploration on the roughly 405-square kilometer property, considered prospective for additional discoveries. For more information, please visit: https://ceo.ca/@tommy/the-gold-mine-barrick-might-regret-selling Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Central bankers get tired of gold as lower exports cut cash Posted: 30 Aug 2016 04:48 AM PDT By Camilla Naschert and Eddie Van Der Walt The biggest owners of gold are tiring of the metal. Central banks -- holders of about 32,900 metric tons of bullion -- cut their purchases by 40 percent during the three months through June, compared with the same period a year earlier, to the lowest since 2011, World Gold Council figures compiled by Bloomberg show. It was the third-straight quarterly drop, the longest such streak in at least five years. Buying declined in 2016 as prices were rallying for their biggest first-half gain in 40 years. Central banks in emerging-market nations have been adding less gold as the amount of cash they get from exports declined, said John Nugee, a manager of Bank of England reserves in the 1990s. "The flows have slowed dramatically," said Thorsten Proettel, a commodity analyst at Landesbank Baden-Wuerttemberg in Stuttgart. "This could be a very important factor for the market." ... ... For the remainder of the report: http://www.bloomberg.com/news/articles/2016-08-29/central-bankers-get-ti... ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stagflation to Force People into Gold Posted: 30 Aug 2016 03:27 AM PDT Mike Gleason: It is my privilege now to be joined by Michael Pento, president and founder of Pento Portfolio Strategies and author of the book The Coming Bond Market Collapse: How to Survive the Demise of the US Debt Market. Michael is a money manager who ascribes to the Austrian school of economics and has been a regular guest on CNBC, Bloomberg, and Fox Business News, among others. Michael, it's good to talk to you again. Thanks very much for joining us today and welcome back. Michael Pento: Thanks for having me back on. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Late-August Calm a Breeding Ground for Gold Bullion Bank Shenanigans Posted: 30 Aug 2016 03:19 AM PDT Precious metals specialist discusses the recent correction in the gold market and the moves by bullion banks behind them. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Correction in Gold and Silver Price Underway Posted: 30 Aug 2016 03:11 AM PDT Technical analyst Jack Chan charts a correction in the gold and silver markets and plots his investment strategy. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Big Gold Rally This Week, Stocks Down? Posted: 30 Aug 2016 03:07 AM PDT Last week, I wrote that I believed GDX would make one final blow-off top into or around September 1. I also wrote that the stock market looked too hard to trade at this point. When the SPX dropped to below 2161 on Friday we went long via SPXL and SVXY. Today (8/29) we sold for some nice profits (+2.8% and +5.5%). | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Bars Near 5-Week Dollar Low as Fed's 'Full Employment' Rate-Rise Hints Meet 'Falling Inflation' Posted: 29 Aug 2016 05:00 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Power of Price Spikes On Intraday Charts Posted: 29 Aug 2016 07:31 AM PDT Last week ended on a very positive note for those who follow and trade filtered price spikes. What is a filtered price spike? In short, I scan pre-market, and post-market trading hours’ price charts of SPY, QQQ, IWM, GLD, and GDX for a very special odd tick in the market which creates a spike on the chart. These spikes could be to the upside or downside, does not matter. What they tell me is the direction which the market (market makers) are going to try and move the market in then next 48 hours. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Right Lessons from Obamacare's Meltdown Posted: 29 Aug 2016 06:55 AM PDT The decision of several major insurance companies to cut their losses and withdraw from the Obamacare exchanges, combined with the failure of 70 percent of Obamacare's health insurance "co-ops," will leave one in six Obamacare enrollees with only one health insurance option. If Obamacare continues on its current track, most of America may resemble Pinal County, Arizona, where no one can obtain private health insurance. Those lucky enough to obtain insurance will face ever-increasing premiums and a declining choice of providers. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Canada Housing Market in Extreme Bubble Territory - Here’s How to Profit Posted: 29 Aug 2016 03:18 AM PDT There’s trouble brewing in the Great White North. Jared Dillian, former Lehman Brothers trader and noted financial writer, says that low oil prices have hurt the Canadian economy and the real estate market is near the peak of a massive bubble. In a video interview with Mauldin Economics, Dillian notes he shorted the Canadian dollar almost three years ago, and has profited a great deal since then. He also says the structure of the Canadian mortgage market means that when the bubble bursts, it will look quite different than the sharp and sudden 2008 crisis in the US. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Over the past week Rasmussen polls have captured the epic disgust of voters in the direction America is heading. Only

Over the past week Rasmussen polls have captured the epic disgust of voters in the direction America is heading. Only

One: Student Loans — The student loan debt bomb is exploding, with few remedies to address it. Student loans aren't dischargeable in bankruptcy, meaning there's no way to get rid of them for a clean, Donald Trumpesque slate. The financial industry lobbied to make sure of this when the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) was passed.

One: Student Loans — The student loan debt bomb is exploding, with few remedies to address it. Student loans aren't dischargeable in bankruptcy, meaning there's no way to get rid of them for a clean, Donald Trumpesque slate. The financial industry lobbied to make sure of this when the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) was passed. t Cards — U.S. credit card debit willsurpass $1 trillion this year, just shy of its 2008 peak… In 2008, Americans' personal savings rate was 4.4% amid a historically high $1.02 trillion in credit card debt. That rate reached 11% in December 2012, but has since dropped back down to 5.4%, while credit card debt has risen. That means the liquidity of Americans has dropped to last crisis levels. They have no liquidity to weather debt problems or bad times.

t Cards — U.S. credit card debit willsurpass $1 trillion this year, just shy of its 2008 peak… In 2008, Americans' personal savings rate was 4.4% amid a historically high $1.02 trillion in credit card debt. That rate reached 11% in December 2012, but has since dropped back down to 5.4%, while credit card debt has risen. That means the liquidity of Americans has dropped to last crisis levels. They have no liquidity to weather debt problems or bad times.

No comments:

Post a Comment