saveyourassetsfirst3 |

- A Zombie Financial System, Black Swans, & a Gold Stocks Correction

- What Are The Takeaways From Janet Yellen's Speech For Gold Investors?

- A Bit More Downside Potential in Gold Stocks

- Gold Bullion Sees Biggest Seasonal Gains in September Over Past 20 Years

- Ignore Yellen and Buy the Dip in Precious Metals

- Breaking News And Best Of The Web

- Jackson Hole Cartel Raid – An Inflection Point for Silver

- A Bit More Downside Potential in Gold Stocks

- “They Wanted Silver at $18.50” Eric Sprott Breaks Down Horrific Week For Gold, Silver & Mining Shares

- Top Ten Videos — August 27

| A Zombie Financial System, Black Swans, & a Gold Stocks Correction Posted: 27 Aug 2016 02:00 PM PDT The counterparties to your S&P short and gold long can’t pay up. Your money goes to money heaven and your wife runs off with the tennis instructor. Even your dog hates you. You forgot about the real risk of ETFs and derivatives… Submitted by The AU Report: Bob Moriarty of 321Gold says that since the […] The post A Zombie Financial System, Black Swans, & a Gold Stocks Correction appeared first on Silver Doctors. |

| What Are The Takeaways From Janet Yellen's Speech For Gold Investors? Posted: 27 Aug 2016 11:01 AM PDT |

| A Bit More Downside Potential in Gold Stocks Posted: 27 Aug 2016 10:11 AM PDT The Daily Gold |

| Gold Bullion Sees Biggest Seasonal Gains in September Over Past 20 Years Posted: 27 Aug 2016 07:00 AM PDT Seasonally, gold is entering the sweet spot… Submitted by Mark Obyrne: Gold bullion has had its biggest gains in September over the past 20 years. Seasonally gold is entering the sweet spot with the Autumn being gold's best season and with September being gold's best month in the last 20 years. Gold's Monthly Performance […] The post Gold Bullion Sees Biggest Seasonal Gains in September Over Past 20 Years appeared first on Silver Doctors. |

| Ignore Yellen and Buy the Dip in Precious Metals Posted: 27 Aug 2016 06:30 AM PDT  Investors worldwide have been on pins and needles in eager anticipation of a speech from our economic overlords. Friday morning FED chair Yellen finally opened her mouth and said a whole lot of nothing. Markets didn’t know exactly how to react to her nothingness. Stocks were up and then down. Gold was down and then up. […] Investors worldwide have been on pins and needles in eager anticipation of a speech from our economic overlords. Friday morning FED chair Yellen finally opened her mouth and said a whole lot of nothing. Markets didn’t know exactly how to react to her nothingness. Stocks were up and then down. Gold was down and then up. […] |

| Breaking News And Best Of The Web Posted: 26 Aug 2016 05:37 PM PDT Odds of rate hike go up after Yellen speech. US GDP Q2 lowered, expected to rise in Q3. World trade continues to contract. Gold and US stocks down last week. US manufacturing, home sales disappoint. Negative interest rates getting a lot of attention, mostly critical. Europe doesn’t seem fixable. Trump hires new people, keeps falling […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| Jackson Hole Cartel Raid – An Inflection Point for Silver Posted: 26 Aug 2016 02:50 PM PDT Whiplash in the Gold and Silver Markets As Yellen Yaps At Jackson Hole: Good Cop, Bad Cop: Fed Gooses, Then SMASHES Gold & Silver Flying By the Seat of Their Pants – How Much Longer Can The Fed Keep the Markets in the Air? After 6 Months of Falling Premiums, This Silver Indicator Just Experienced An […] The post Jackson Hole Cartel Raid – An Inflection Point for Silver appeared first on Silver Doctors. This posting includes an audio/video/photo media file: Download Now |

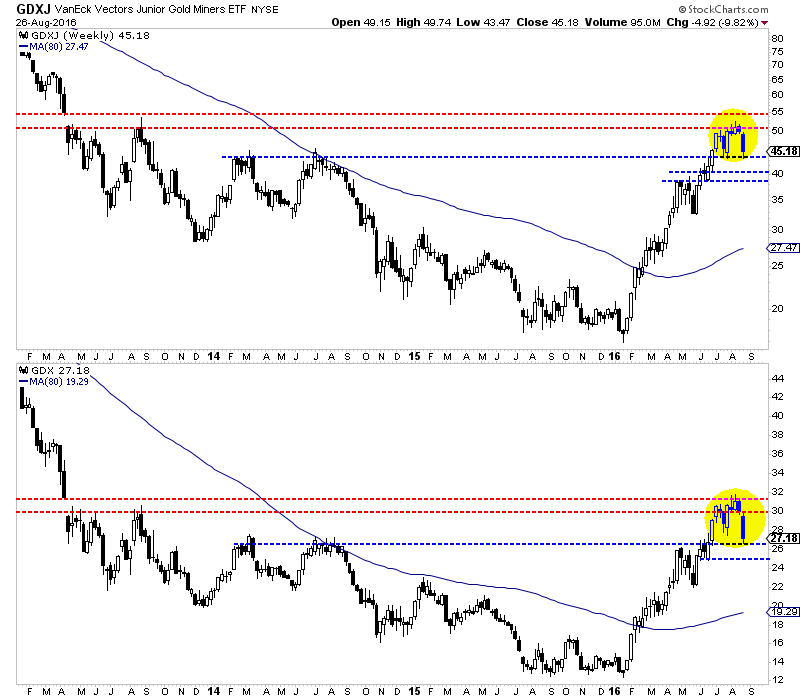

| A Bit More Downside Potential in Gold Stocks Posted: 26 Aug 2016 02:39 PM PDT Last week we projected 5% to 10% downside in the gold stocks. Well, not to butter my own bread but GDX and GDXJ both lost 9% on the week. That being said, I believed that the weakness would be limited and miners could rebound to new highs in September. While that possibility remains, there is a chance this correction could go a bit deeper and perhaps last longer. The weekly candle charts below show that the miners are correcting after failing to break into a "thin zone" of resistance. GDX has broken below its July lows and corrected as much as 16%. It has support at $25-$26 and that includes the Brexit gap. Also, the 38% retracement of its entire rebound is just below $25. Meanwhile, GDXJ has yet to break its July low in the $43s. It has corrected as much as 17% but could end up testing $39-$41. The 38% retracement of its entire rebound is a hair below $39.

GDXJ, GDX Weekly Candles

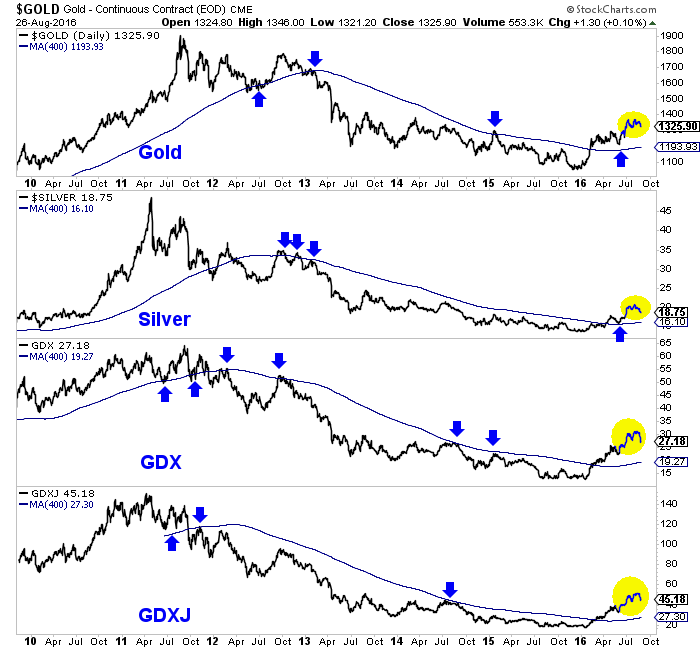

Whether the correction lasts longer or evolves into a long consolidation, precious metals will remain in a bull market. It is hard to argue against the chart below. We plot Gold, Silver, GDX and GDXJ along with the 400-day moving average which is an excellent indicator of the primary trend. The sector sits comfortably above the 400-day moving averages which are sloping upward for the first time in years.

While we expected this correction, we did not anticipate there would be a chance for a larger correction. If you believe we are in a new bull market, as I do, then the path to financial success is buying and holding and buying weakness. (Our guidance for selling, we'll get to another time). If I were holding too much cash or missed the epic rebound, I would be taking advantage of further weakness. Buying 20% to 25% weakness in a bull market (especially one that is only months old) will likely payoff in the long run. For professional guidance in riding the uptrend in Gold, consider learning more about our premium service including our favorite junior miners which we expect to outperform in the second half of 2016.

Jordan Roy-Byrne, CMT, MFTA

|

| Posted: 26 Aug 2016 01:47 PM PDT “That big decline we just experienced is probably the intern bottom here for another rally which will extend for quite a long time.” In this week’s critical Market Update, Eric Sprott assesses the recent pullback in the metals and miners, and discusses the context and reaction to Chair Yellen’s speech at Jackson Hole, and WHIPSAW in gold […] The post “They Wanted Silver at $18.50” Eric Sprott Breaks Down Horrific Week For Gold, Silver & Mining Shares appeared first on Silver Doctors. |

| Posted: 25 Aug 2016 05:01 PM PDT Jim Rickards, Dmitry Orlov, Julian Assange, Steve Keen on gold, silver, inflation, the debt jubilee, and political turmoil. The post Top Ten Videos — August 27 appeared first on DollarCollapse.com. |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment