Gold World News Flash |

- Paul Craig Roberts Warns: US Is "A Dead Nation Walking"

- “I’ve Never Seen Anything Like This Before" - The Housing Markets In The Hamptons, Aspen And Miami Are All Crashing

- UNLOCKING GOLD'S TRUE VALUE: The Economic Code - Finally Revealed

- Fed Recommits to Propping Up Markets No Matter What – Michael Pento

- Jim Rogers Explains What He Is Doing Before "The Next Time The World Comes To An End"

- Anonymous - The SECRET strategy to create a new system: TPP, TTIP, TISA

- New Gold Discoveries are Still Hiding in America – Wade Hodges Interview

- Hope Fades As The Collapse Spreads Across The Country

- GOLD & DEBT: The 1929 Great Depression vs The Next Great Collapse

- Ignore Yellen and Buy the Dip in Precious Metals

- The US: A Dead Nation Walking — Paul Craig Roberts

- WW3 - The Nuclear Apocalypse : Anonymous

- Market Report: $1.4bn Gold Take-Down

- Pemex Collapse Threatens Biggest Banks in Mexico

- Koos Jansen: Netherlands central bank won't release gold bar list

- Dark Dynamics

- The Dark Dynamics of the Deep State

- Ignore Yellen and Buy the Dip in Precious Metals

- Renewed use of gold swaps by BIS indicates strain on price suppression

- Barrick signs on to Venezuela gold push as oil sinks economy

- Hillary Clinton pure evil

- Breaking News And Best Of The Web

| Paul Craig Roberts Warns: US Is "A Dead Nation Walking" Posted: 27 Aug 2016 07:00 PM PDT Authored by Paul Craig Roberts, Here is an excerpt from an informative article by Dmitry Orlov:

I use the writings of Orlov and The Saker as checks on my own conclusions. In his article Orlov concludes that the United States is a dead nation, still walking, but no longer a uni-power. I agree with Orlov that US weapon systems are more focused on profits than on effectiveness and that Russia has superior weapons and a superior cause based on protection rather than dominance. However, in his assessment of the possibility of nuclear war, I think that Orlov under-appreciates the commitment of Washington’s Neoconservatives to US world hegemony and the recklessness of the Neoconservatives and Hillary Clinton. Washington is incensed that Russia (and China) dare to stand up to Washington, and this anger crowds out judgment. Orlov, also, I think, under-estimates the weakness in the Russian government provided by the “Atlanticist Integrationists.” These are members of the Russian elite who believe that Russia’s future depends on being integrated with the West. To achieve this integration, they are willing to sacrifice some undetermined amount of Russian sovereignty. It is my conclusion that Washington is aware of the constraint that the desire for Western acceptance puts on the Russian government and that this is why Washington, in a direct thrust at Russia, was comfortable orchestrating the coup that overthrew the elected Ukrainian government. I believe that this constraint also explains the mistakes the Russian government made by refusing the requests of the Donetsk and Luhansk republics to be reincorporated as parts of Russia, where the territories formerly resided, and by the premature withdrawal from Syria that allowed Washington to resupply the jihadists and to insert US forces into the conflict, thus complicating the situation for Russia and Syria. Orlov sees Russian advantage in the ongoing conflict between Kiev and the breakaway republics as the conflict could be leading to the collapse of the US puppet government in Kiev. However, the disadvantage is that the ongoing conflict is blamed on Russia and feeds Western anti-Russian propaganda. It also makes Russia look weak and unsure of itself as if the Western criticism of Russia’s reincorporation of Crimea has struck home and Russia is afraid to repeat it by accepting the pleas of the break-away republics. Moreover, if the Russian government had accepted the requests of Donetsk and Luhansk to return to Russia from which they were artificailly separated, not only would the conflict have been ended, but also the Ukrainian people would have realized the disaster caused by Washington’s coup against their government, and Europe would have realized from decisive Russian action that it was not in Europe’s interest to provoke Russia in behalf of Washington. The correct Russian response was prevented by the Atlanticist Integrationist desire to appease Washington. In contrast to Orlov, The Saker underestimates Russian military strength, but he does understand the constraints placed on Russian decisiveness by the Atlanticist Integrationists, who seem to count in their ranks the economic establishment including the central bank and perhaps the prime minister himself. Putin does not seem to be overly concerned with what appears to me to be a fifth column of Washington’s agents as Putin himself has placed heavy bets on achieving accommodation with the West. However, Putin has cracked down on the US-financed NGOs that have tried to destabilize Russia. Western reporting and think tank and university reports on Russia are propaganda and are useless to understanding the situation. For example, in the current issue of The National Interest Thomas Graham, who had the Russian desk on the National Security Council during the George W. Bush regime, attributes the “destabilization of eastern Ukraine” to “Russia’s annexation of Crimea.” He avoids mentioning the US-orchestrated overthrow of an elected Ukrainian government and that Crimea voted overwhelmingly (97 percent) to rejoin Russia when faced with the Russophobic government Washington established in Kiev. According to Graham, the foul deed of Russia’s acceptance of a democratic outcome upset all of Washington’s very friendly, supportive, and hopeful attitudes toward Russia. With all of Washington’s “assumptions that had guided America’s Russia policy” irreversibly dashed, it is no longer possible to maintain that Russia “is a suitable partner for addressing global issues.” Graham goes on to define Russia as a problem because Russia favors a multi-polar world to a uni-polar world run by Washington. It is possible to read Graham’s repeat of the propaganda line as Graham genuflecting before the Neoconservatives before going on quietly in a low-key manner to attack their hegemonic attitude toward Russia. In his concluding paragraph Graham says that Washington must find a new approach to Russia, an approach of balance and limits that rejects “resort to force, which would be devastating given the destructive power of modern weaponry.” All in all, it is an artful argument that begins by blaming Russia’s response to Washington’s provocations for a dangerous situation and concludes with the argument that Washington must adjust to Russia’s defense of her own national interests. It is reassuring to see some realism creeping back into Washington attitudes toward Russia. However, realism is still a minority view, and it is highly unlikely that it would be the view of a Hillary regime. In my opinion, the chance of nuclear war from Neoconservative intention, miscalculation or false launch warning remains high. The provocations of US/NATO military forces and missile bases on Russia’s borders are reckless as they build tensions between nuclear powers. It is in times of tension that false warnings are believed and miscalculations occur. In the interest of life on earth, Washington should be de-escalating tensions with Russia, not building them. So far there is no sign that the Neoconservatives are willing to give up their hegemonic agenda for the sake of life on earth. |

| Posted: 27 Aug 2016 05:53 PM PDT One month ago, we said that "it is not looking good for the US housing market", when in the latest red flag for the US luxury real estate market, we reported that sales in the Hamptons plunged by half and home prices fell sharply in the second quarter in the ultra-wealthy enclave, New York's favorite weekend haunt for the 1%-ers. Reuters blamed this on "stock market jitters earlier in the year" which damped the appetite to buy, however one can also blame the halt of offshore money laundering, a slowing global economy, the collapse of the petrodollar, and the drastic drop in Wall Street bonuses. In short: a sudden loss of confidence that a greater fool may emerge just around the corner, which in turn has frozen buyer interest. A beachfront residence is seen in East Hampton, New York, March 16, 2016. We concluded this is just the beginning, and sure enough, several weeks later a similar collapse in the luxury housing segment was reported in a different part of the country. As the Denver Post reported recently, high-end sales that fuel Aspen's $2 billion-a-year real estate market are evaporating, pushing Pitkin County's sales volume down more than 42 percent to $546.45 million for the first half of the year from $939.91 million in the same period of 2015. The collapse in transactions means that Aspen's high-end real estate market "one of the most robust in the country, with dozens of options for buyers ready to spend more than $10 million" finds itself in its first-ever sustained nosedive, despite "dense summer crowds, soaring sales tax revenues and high lodging occupancy." Like in the Hamptons, the question everyone is asking is "why"? There are many answers:

"People are worried about all kinds of stuff these days," says longtime Aspen broker Bob Ritchie. "I've never seen anything like this before." The speed of the collapse has been stunning. Until just last year, the local market was beyond robust, with Pitkin County real estate sales hitting $2 billion in 2015, a 33% annual increase driven largely by sales of homes in Aspen, where prices average $7.7 million. This year, however, "a slowdown in January turned into a free fall." Sales volume in Pitkin County is down 42%, according to data compiled by Land Title Guarantee Co. Almost all of that decline is coming from Aspen, where the market is frozen. Sales in the Aspen-Snowmass market in the first half of the year were the bleakest since the first half of 2009, and inventory soared to levels not seen since the recession.

The statistics are stunning: single-family home sales in Aspen are down 62% in dollar volume through the first-half of the year. Sales of homes priced at $10 million or more — almost always paid for in cash — are down 60%. Last year, super-high-end transactions accounted for nearly a third of sales volume in Pitkin County. "The high-end buyer has disappeared," said Tim Estin, an Aspen broker whose Estin Report analyzes the Aspen-Snowmass real estate market. "Aspen has never experienced such a sudden and precipitous drop in real estate sales," according to the post. Worse, it's not just the collapse in the number of transaction: even more disconcerting for brokers who have always trumpeted Aspen as a safe and lucrative place to park a huge pile of money: Prices are dropping. In the first half of this year, the average price per square foot of Aspen homes dropped 22 percent to $1,095 from $1,338 in 2015. Recent Aspen sales also closed at more than 15 percent below listing price, a rare discount. Some brokers suspect that the frenzied sales and pricing pace of 2015 was not sustainable. The present decline is a correction, they say. "I think a lot of people thought we would go to the next level in 2016. Take the next step up and that step got resistance from buyers," said longtime Aspen broker Joshua Saslove, who just put an Aspen home for more than $10 million under contract. If it closes, it will be just the fourth sale above $10 million in Aspen this year, compared with more than a dozen by this point last year. "I think a lot of developers thought they would push their, say, $5 million properties to $6 million this year, but no one is buying," Saslove said. "I don't see that nonchalance or cavalier attitude any more." To be sure, Saslove is hoping that a rebound is coming; that however, may be overly optimistic and first far more pain is in store especially if one considers what is taking place in yet another formerly red-hot housing market, where suddenly things are just as bad, because as Mansion Global reports... Luxury condo sales in Miami have crashed 44%. According to the latest report by the Miami Association of Realtors, the local luxury housing market is just as bad, if not worse, than the Hamptons and Aspen. The latest figures out of Miami this week showed residential sales are down almost 21% from the same time last year. But as bad as this double-digit decline may seem, it pales in comparison to what's happening at the high end of the market. A closer look at transactions for properties of $1 million or more in July shows just 73 single-family home sales, representing an annual decline of 31.8%, according to a new report by the Miami Association of Realtors. In the case of condos in the same price range, the number of closed sales fell by an even wider margin: 44.4%, to 45 transactions. The Miami housing market, and its luxury segment in particular, has been softening for the past year with high-end condos sitting on the market for twice as long as they did a year ago and sellers offering bigger discounts amid an increased supply.

In July, townhouses and condos of $1 million or more waited, on average, 162 days for a buyer, a 1.9% increase over a year ago and the longest time of any other price range, according to the report. As in the previous two markets, the locals want something to blame, in this case the strong dollar, which has significantly increased the value of properties in other currencies, has been blamed, and perhaps rightfully so as sales to foreigners—an important client base, since international buyers acquire more homes in Florida than in any other state, according to the National Association of Realtors - have tumbled. Real estate appraiser and data expert Jonathan Miller said that Miami is behaving like most of the rest of the U.S. housing market, which is in fairly good shape overall "but soft at the top." As noted here over the years, In the case of Miami, like in other most other coastal markets such as New York and Los Angeles, the housing boom was heavily boosted by foreign buyers, who used US luxury real estate as their new form of anonymous "offshore bank accounts" courtesy of the NAR's exemption from Anti-Money Laundering Provisions. However, after the recent drops in commodity prices and the spike in the USD, they have scaled back their purchases. "The international component is not as intense," Mr. Miller said. Depsite the slowdown deals are still being done, with cash the preferred form of payment of foreign buyers in the U.S., - some 43% of all sales in Miami in July were closed in cash, however down from 48.1% the same month last year, according to the latest figures. Other potential buyers are also stepping back: cash sales for townhouses and condominiums, an indicator of investor activity, hit their lowest level in a year last month: 633 transactions, representing a 30.4% year-over-year decline, according to the report. As for the forecast for the coming months, sales activity doesn't look likely to surge. There were 1,272 pending sales of townhouses and condos in Miami in July, which means 25.4% fewer transactions waiting to close than in the same month in 2015 and the lowest number so far this year. Meanwhile, as a result of a building boom, luxury condo inventory is up 47.8% from last year, with 2,482 units worth $1 million or more waiting to change hands; this means that sellers of high-end condos will continue to face stiff competition, prompting even fewer transactions and/or lower prices. So far, the collapse at the luxury end has failed to transmit to the broader market, less impacted by lack of foreign demand, however as we documented two weeks ago, it is only a matter of time before the overall US housing market suffers as well. The only question is whether the NAR and the US Census Bureau, who tabulate the "goal-seeked", seasonally adjusted data, will admit it before or after the presidential elections. The likely answer: it depends on who the next president is. |

| UNLOCKING GOLD'S TRUE VALUE: The Economic Code - Finally Revealed Posted: 27 Aug 2016 05:28 PM PDT

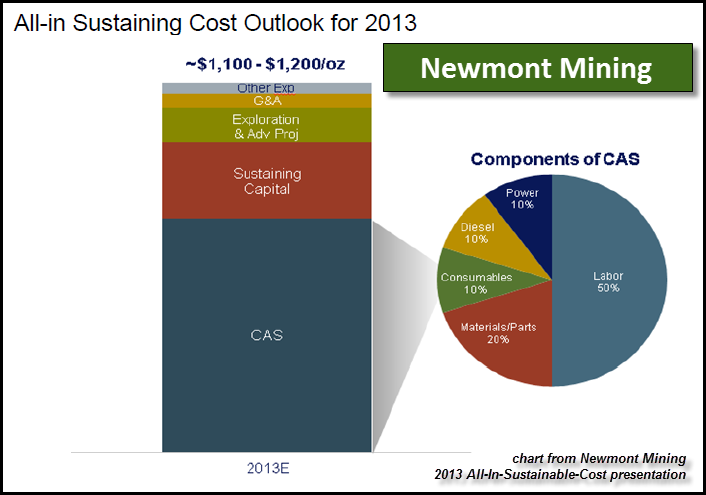

By the SRSrocco Report, The true value of gold is much higher than the spot price quoted in the market. This is due to several factors, but the most important reason is misunderstood by just about every economist and monetary scientist in the world today. Those who are able to understand the information in this article, will finally be able see the value of gold (money) in a totally different way. Unfortunately, the majority of economists and precious metal analysts look at gold in a very specialized way. While precious metals analysts see gold as real money versus the Keynesian view of a Fiat Dollar System, both fail to grasp gold's true value. Gold is more than a precious metal based on supply and demand. Furthermore, the Austrian School of Economics looks at gold as a foundation of money in the procurement of goods and services. However, gold's real value comes from energy in all forms and in all stages in its production. The Foundation Of Gold Money: ENERGY = GOLD = MONEY To understand this principle, I have decided to use one of the largest gold producers in the world as an example, Newmont Mining. According to Newmont's 2013 All-In-Sustaining-Cost for producing gold, they provided the following chart:

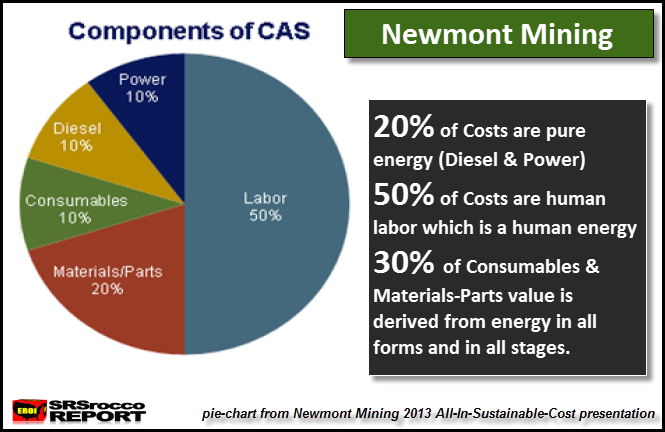

Now, this was a few years ago when the price of oil (energy) was higher, so with lower energy prices, costs have come down since then. Regardless, this still provides us with a list of costs. The main part of Newmont's sustaining costs are shown as CAS - Cost Of Sales. That's the blue part of the bar chart, which is broken down on the right, in the circle pie-chart. If we look at the pie-chart by itself, we see that energy comprises 20% of the total costs. Of course, the knee-jerk reaction from a typical precious metals analyst is that energy is only 20% of Newmont's cost to produce gold. The analyst only sees 20% energy cost because his mind has been trained to look in a superficial and specialized way. Here is a breakdown of the CAS -Cost Of Sales pie-chart:

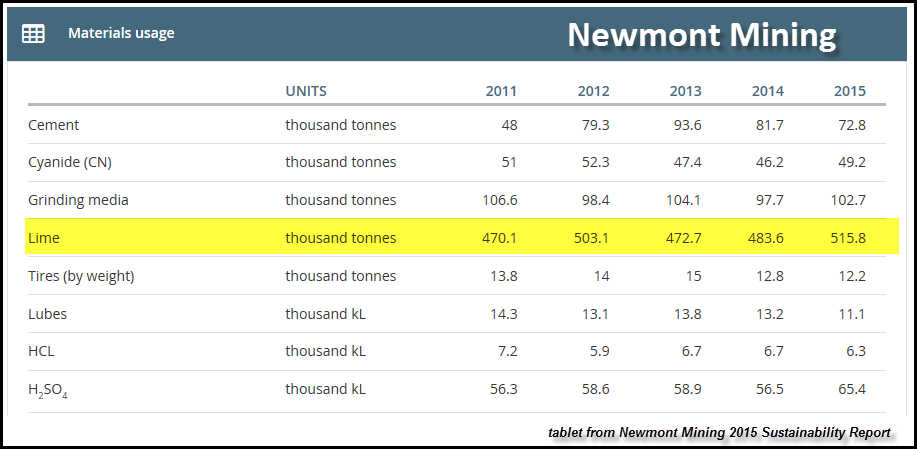

As we can see, diesel at 10% and power (electricity) at 10% comprises 20% of pure energy for Newmont's gold cost. However, we must realize that labor at 50%, is also a form of energy.... it's HUMAN ENERGY. People need to understand that science breaks down labor into work or energy. The term Horsepower was developed from the energy of horses performing work. Thus, human labor is a form of work, and is also a form of energy. Now, some of the labor force gets paid more because their labor contains more experience and specialization. For example, an experienced mechanic working on the huge earth moving machines gets paid more than another working doing regular manual labor because of the TIME & ENERGY invested in the mechanic's trade. The mechanic spent years doing work and education which consumed one hell of a lot of energy in different forms to have 20 years experience. Thus, the energy in labor for years of work has provided him that experience. Which means, the amount of work-energy the mechanic has done for 20 years allows him to be paid a higher rate. So, if we add human labor (work-energy) of 50% of the CAS cost with the 20% of diesel and power, the total is now 70%. So, if we were going by scientific terms of doing work-energy, pure energy and labor energy comprises 70% of Newmont's cost to produce gold in its CAS- Cost Of Sales breakdown. Okay, let's look at the remaining two categories: Consumables = 10% Newmont's uses a lot of consumables to produce gold. Here is a list of some of Newmont's consumables provided in their 2015 Sustainability Report:

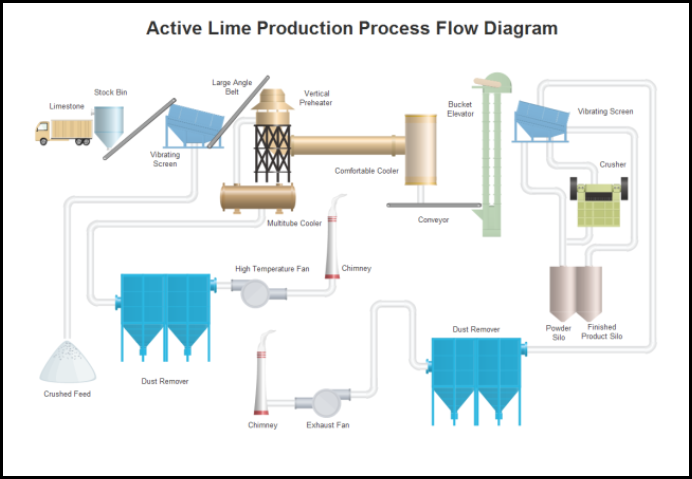

I decided to use lime as perfect example, because the production and transportation of lime is very energy intensive. Again, according to a typical gold mining analyst, he places lime as a "consumable cost" and not an energy cost. Once we look at the total process of producing and transporting lime, we will realize the overwhelming value or cost of lime is from the ENERGY in ALL FORMS and in ALL STAGES. Here is simple diagram of the production of lime, which Newmont consumed 515,800 tonnes in 2015 to produce gold:

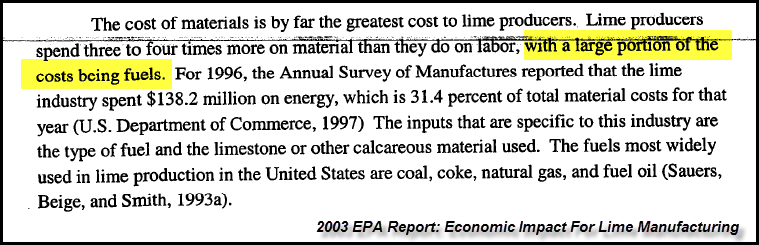

The lime is first mined from the ground and transported to the production plant. This costs a lot of energy from the diesel in the truck as well as the labor-energy of the truck driver. As the lime moves through the producing plant, it consumes a great deal of energy as electricity is needed to power the plant as well as the high-temperature Kilns that process the lime. Here is a small section of an EPA Report on the Economic Production of Lime in the United States:

As the report states, the cost of materials for producing lime is much greater than the labor... three to four times greater. If we go back to Newmont's CAS - Cost of Sales, labor was 50%, which is half the cost, while the other half was from energy, materials and consumables. Regardless, the largest percentage of materials used to produce lime is liquid fuels. Furthermore, the lime industry spent $138.2 million on energy in 1996, which was 31.4% of its material cost. I would imagine that energy cost is much higher now and accounts for an even higher percentage of total costs. In addition, we must add the percentage of human labor to the total energy cost in producing lime. Moreover, all the other materials used to make lime also must be viewed the same way in their production. Even though the lime industry purchased materials to produce lime, the overwhelming value of those materials came from the energy consumed in ALL FORMS and in ALL STAGES. Once the lime is produced, it has to be transported to Newmont's gold mines. Lime is very heavy, so it takes a lot of energy to transport lime via ship, railroad or by truck. Either way, the energy burned in the ship, locomotive and truck as well as the labor by the ship captain and crew, locomotive engineer or truck driver also must be added to the total cost as ENERGY. Using lime as an example, we can see that other consumables such as cyanide, grinding materials and cement also get their value from the energy in all forms and in all stages in their production. This is also true for the other category of "Materials & Parts." If Newmont has to replace a large part of a system in one of their ore processing facilities, the value of that part comes from all the energy consumed in all forms and in all stages along the way. Additional Newmont Mining Full Cycle Energy Costs Explained Let's take a look at Newmont's All-In-Sustaining-Cost chart once more:

Okay, I just explained the first category on the bottom of the bar chart in blue, the CAS - Cost Of Sales. Let's discuss the next category called "Sustaining Capital (in red)." Newmont Mining spends a lot of money on sustaining capital to be able to produce gold on a continual basis. According to their Q2 2016 financial report, they will spend between $650 and $700 million on sustaining capital in 2016. One part of sustaining capital is "stripping costs." This is a tremendously energy intensive activity of stripping (removing) overburden and poor quality ore. Many of you are aware of this huge cost if you watch the show, GOLD RUSH. If my memory serves me correctly, the team under Parker Schnabel spent something close to $500,000 to remove the overburden and move their wash plant on one of their biggest gold cuts last year in Alaska. The majority of that cost was the diesel to power the huge earth moving machines to remove that overburden. Basically, the stripping cost listed as "Sustainable Capital" is from the liquid energy burned and human labor. Another energy cost found in sustainable capital is the making of new haul roads to get to the new ore cut. This takes a huge amount of energy as loaders, haul trucks and other earth moving machines transport the rock and gravel to make these new haul roads. If I went down the entire list of sustaining capital, the overwhelming expenditure of the $650-$700 million Newmont will spend this year will be from all the energy in all forms and in all stages. Another category not included here is regular "Capital Expenditures." This would include purchasing a new one of these massive haul trucks below:

This is the Caterpillar 797F that costs $5 million. If we went on the same journey as we did when I explained the cost to produce lime, we would find out that the overwhelming value of that massive CAT 797F comes from all the ENERGY in ALL FORMS and in ALL STAGES. Hell, the huge tires for the CAT 797F, that cost $40,000 a piece, each contain nearly 2,000 pounds of steel, enough to build two small cars and enough rubber to make 600 tires to put on them. Again, according to the gold mining analysts, they list the Caterpillar 797F as a capital expenditure. However, if we look through the entire ENERGY MATRIX, we now see that what Newmont purchased as a CAT 797F haul truck, is again.... all the energy in all forms and in all stages in its production. If we consider the last few categories in Newmont's All-In-Sustaining-Cost bar chart of Exploration-Advanced Projects, General & Administration and Other, we can apply the same energy logic. It takes a lot of energy to explore for gold as well as advancing new gold mining projects. Not only does it take the burning of a lot of energy to explore and advance projects for gold mining, there is also a lot of human labor (manual & experienced), materials and parts to consider in the total process. Unfortunately, most people have been programmed to compartmentalize everything today. They see most things separately and are not able to understand how energy gives value to the majority of goods and services in the world today. They just see the end result and believe that it magically appeared on the storeroom shelf. I would assure you that the value of most goods sitting on the shelves in the thousands of Walmarts across the country were derived from ENERGY, in all forms and in all stages. While Newmont is showing on its balance sheet that it purchased, lime, materials or equipment, it really purchased a great deal of energy that was consumed in their production. There are several other items that Newmont has to dish out money to be in the business of producing gold, such as interest expense and taxes to name a few. I would imagine someone reading this article would be quick to blurt out that interest expenses and taxes are not energy. Well, that might be true if we look at them in a superficial way, but most taxes go to pay the governments to maintain roads, infrastructure, public buildings and government employees that function as a necessary part of our highly complex society. Thus, the government spends a lot of money on energy as well as human labor to maintain roads and infrastructure. So, if we really expand our ENERGY MATRIX horizons, we would see that ENERGY is the main driver that comprises the value of most goods and services in the world today... including GOLD. The Strategic Importance Of ENERGY = GOLD = MONEY Hundreds of years ago, the prize by empires was obtaining gold and silver. This was especially true for the Spanish Empire and its leading role in the world at the time due to its ability to acquire massive amounts of gold and silver from South America and Mexico. During the 1500's when the Spaniards were using Aztecs as slaves to loot gold and silver from their lands, the energy source at the time was mainly human and animal labor. To build the massive Spanish Armada that was destroyed or then sunk by a huge storm in 1588, it took a great deal of human and animal labor.

(courtesy of Wikipedia) Furthermore, according to this source, On May 28th 1588, the Armada, with around 130 ships, 8,000 sailors and 18,000 soldiers, 1,500 brass guns and 1,000 iron guns, set sail from Lisbon, Portugal, headed for the English Channel. The Spanish were able to amass such a large fleet of ships, crew and armaments due to massive amount of gold and (especially) silver they plundered from South America and Mexico. According to the Historical World Silver Production 1492-1927, the Spaniards produced over 90 million oz of silver from 1521-1600 in Mexico alone. They started mining silver in Zacatecas, Mexico in 1540, the region where the largest primary silver miner in the world, Fresnillo is currently producing silver. Furthermore, the Spanish opened large-scale mines in Peru, in the land of the Incas. From 1533 to 1600, over 94 million oz of silver were produced. As we can see, the Spanish became the leading empire on the globe due to their ability to amass the largest hoard of silver on the planet at the time. Well, this all changed in the early 1900's when the top oil barons realized the value of money would come from oil and no longer from just human and animal labor. This is why the top oil companies decided to carve up the globe in the early 1900's and work with each other to control, extract, and sell the most important energy source to world. Oil was also the main reason why Hitler decided to attack Russia in World War 2. He needed the oil to continue with his plans of Nazi expansion. Instead of using gold or silver, Hitler needed oil.. and badly.

According to this source on Germany & Oil:

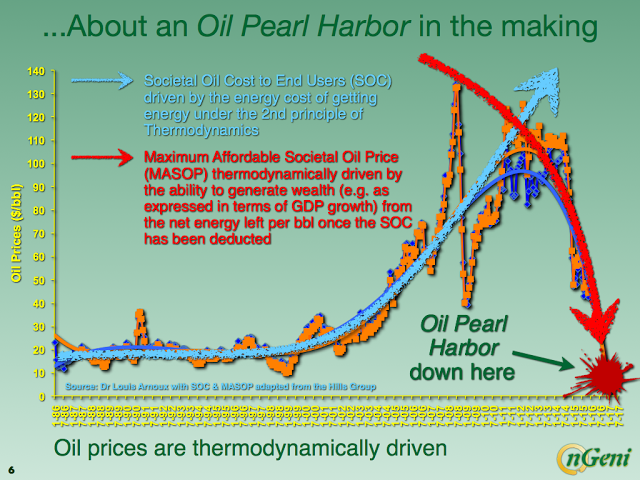

Here we can see that Hitler gained five million barrels of much-needed oil from Norway, Holland, Belgium and France to be able to attack Russia. I have read some accounts that Russia was the REAL PRIZE for Hitler and the Nazi's. Which is why they used their lightning-speed Blitzkrieg Warfare on the Western European countries to consume as little fuel as necessary while acquiring the necessary petrol to attack Russia. When the United States entered into World War 2, it was just a matter of time before the Germans were beaten. The U.S. was the Saudi Arabia at the time and was providing most of the oil to the allies. It was the huge reserves of oil and natural resources that propelled the United States to becoming the leading empire in the world. Unfortunately, the United States peaked in cheap oil production in 1970. One year later, Nixon dropped the Dollar-Gold peg. How ironic... aye? Then of course we had the Arab oil embargo in 1973 and Iranian oil crisis of 1978 which pushed the price of oil from $1.80 a barrel in 1970 to $31 by 1979. This had a profound impact on the price of gold and silver as they skyrocketed during that decade. However, over the next 45 years, clever bankers on Wall Street, London and etc, have hoodwinked investors into putting their surplus funds into paper assets which have become the GREATEST PONZI SCHEME in history. This paper ponzi scheme can only work on RISING OIL PRODUCTION. Again, the greatest ponzi scheme in history can only work on rising oil production. Furthermore, it can only work on rising CHEAP oil production. Unfortunately, the world has peaked in cheap oil production a decade ago. We are filling in the gaps with very expensive oil production that the world cannot afford without the massive increase of debt. According to the work by the Hills Group and Louis Arnoux, they believe an OIL PEARL HARBOR will take place by the end of the decade:

They don't see a rising oil price in the future, rather they believe it will fall as the available net energy to the market will continue to decline. They also believe the economic principle of supply and demand will no longer function as a "Thermodynamic Collapse" of oil will take place. With rapidly falling oil production, the $250 trillion in total world assets of Stocks, Bonds, Real Estate and Insurance Funds will be in big trouble. Thus, investor fleeing rapidly falling paper assets and Real Estate will move into gold (and silver) to protect wealth. Energy has been the key driver for the value of gold and silver for thousands of years. For the majority of our history, the energy has come from human and animal labor. However, as coal, then oil came in the picture, this changed the dynamics considerably. With the peak of inexpensive global oil production, the world is about to experience one hell of a FINANCIAL CALAMITY. Very few people are prepared for what is coming. With the understanding that most goods and services in the world are based upon all the ENERGY in ALL FORMS and in ALL STAGES, things are about to get very interesting. Some believe falling energy production will depress the price of gold. This is an incorrect assumption Due to the massive funneling of the world's funds into paper assets over the past 45 years, this has artificially lower |

| Fed Recommits to Propping Up Markets No Matter What – Michael Pento Posted: 27 Aug 2016 04:30 PM PDT by Mike Gleason, Money Metals:

Precious metals markets moved lower this week ahead of Janet Yellen's Jackson Hole speech. But metals popped after Yellen opened her mouth this morning, and gold prices are now only down 0.8% on the week to come in at $1,333 an ounce. Silver, also rallying today after falling farther than gold earlier in the week. With this morning's rebound, the white metal now shows a weekly decline of 2.5% to bring spot prices to $18.90. Click HERE to Listen |

| Jim Rogers Explains What He Is Doing Before "The Next Time The World Comes To An End" Posted: 27 Aug 2016 04:28 PM PDT One week after RealVision brought us the latest Jeff Gundlach interview, in which the DoubleLine bond king explained why he is now "100% net short", on Friday Grant Williams interviewed Jim Rogers, in which George Soros' former partner (the two co-founded the Quantum Fund in 1973), is about as gloomy, warning "the next time the world comes to an end, it's going to be a bigger shock than we expect." Nonetheless, since an interview talking about canned foods, radioactive fallout shelter and guns would be relatively brief, Rogers presents several non-traditional ideas, most notably as relates to various frontier markets he is looking at currently, as well as Russia, a market where he has notoriously been invested since the start of 2015 when he went long Russian stocks, and which recently - and very much under the radar - hit all time highs. So Rogers takes a well-deserved victory lap. The investing legend, who doesn't belong to any economic school of thought, also touches on China and reminds RealVision subscribers that "Beijing has said we're going to let people go bankrupt, which I hope they do." He then emphasized, "they don't do that in the West. The communist Chinese are going to let people go bankrupt, because they're good capitalists." China has amassed debt and will not be able to help countries as they did the last time the world fell apart in 2008. "The next time the world comes to an end it's going to be a bigger shock than we expect," says Rogers. Still, while China will face problems, Rogers assures it "will be the most important country in the 21st century." Throughout the interview, Rogers describes unconventional investments including government bonds in Russia, where he proclaims, "the yields are astonishing."

To be sure, Rogers' extreme investing is not for the faint hearted, as he predicts a bear market and bankruptcy for the US, waxes lyrical on the decline in Western Europe and forecasts more pains for China, which is still his greatest hope for global growth. For profitable investing, Rogers is advocating Russia and the astonishing yields he's getting there, while opening the debate on putting money to work in North Korea, which now has 15 free trade zones. With Rwanda, also up for discussion - which resources wise could be the Singapore of Africa in time - and even Zimbabwe considered, there are trading ideas here you won't see anywhere else. Some of the bigger picture highlights from the interview: First, on Rogers' current take on China, he does not see a simple solution to China's debt problem, as the country will have to let companies go bankrupt, and a shock will be the ultimate outcome.

While explaining his view on the fate of currencies, Rogers thinks "safe haven" FX such as the US dollar, the Japanese yen and the Swiss Franc, will continue rising as most other currencies fall:

On the dollar and gold rising together:

On which other investors he follows and what he thinks of others agreeing with him:

On how bear markets emerge:

Why very few are concerned about the approaching bear market:

On the Russian market, whose rebound he famously called nearly two years ago:

Some even more extreme frontier market

On trading versus investing, Rogers says he is a hopeless trader, is early at most things, and so he "holds":

Unlike Gundlach, Rogers does not seems to be a fan of Trump's proposed economic policies:

However, that does not mean he is a fan of Hillary either:

So "you have to be short"

On the lessons of investing and history:

Finally, on the cyclicality of history, how in 15 years everything we know has changed: The lessons of history are very, very, very clear. Pick any year in history, whatever we think is true, that year, 1900, 15 years later, it's a whole entirely different world. And we all know in 1900 how the world is, and we should be saying to ourselves, find me a weird guy. Find me a strange guy to tell me how this is going to change. 1950, 15 years later, everything we knew, everything we knew was totally wrong. So I, at least, have learned that, that lesson of history. And perhaps that's why I'm more-- not interested, more I'm excited when I start looking at the way the world is today and what we all know. Because I know what we all know is not going to be true in 15 years, no matter what it is. And my problem is how do I figure it out. How do I figure it out? Whatever we know today, no matter what it is is not going to be true in 15 years. * * * Selected excerpts from the interview: Watch the full 50 minute interview with Jim Rogers exclusively on Real Vision TV. |

| Anonymous - The SECRET strategy to create a new system: TPP, TTIP, TISA Posted: 27 Aug 2016 01:09 PM PDT Help stop our downward economic spiral and loss of national sovereignty by watching this video, then sharing with others.We are Anonymous.We are Legion.We do not forgive.We do not forget.Expect us. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| New Gold Discoveries are Still Hiding in America – Wade Hodges Interview Posted: 27 Aug 2016 12:55 PM PDT from Future Money Trends: |

| Hope Fades As The Collapse Spreads Across The Country Posted: 27 Aug 2016 12:00 PM PDT from X22Report: Episode 1059a. |

| GOLD & DEBT: The 1929 Great Depression vs The Next Great Collapse Posted: 27 Aug 2016 11:30 AM PDT by Steve St. Angelo, SRSRocco Report:

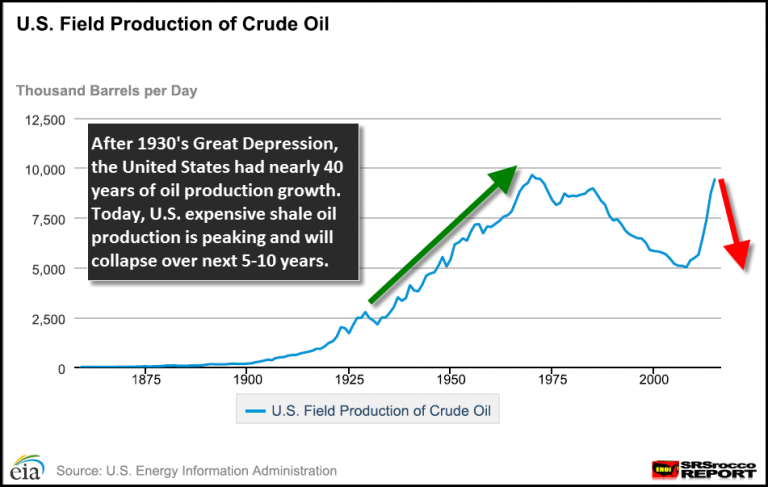

At the time, approximately 25% of American population were farmers. Thus, when things really got bad, folks in the cities could move out and stay with their relatives on the country farm. This is not an option for most Americans today as only 2% of the population are farmers and ranchers (source). After WWII, Americans left the farms in large numbers for the allure of the great life in the cities and suburbs. For decades, living in the city or suburb offered Americans a much easier way of life as the United States had plenty of cheap energy and resources to tap into. Matter-a-fact, after the 1930's Great Depression, U.S. oil production continue to increase for nearly 40 years:

Even though U.S. oil production declined some years (1930-1970), overall growth steadily increased in a linear fashion. However, the recent surge in U.S. oil production (2007-2015), mainly due to ramp up of expensive shale oil, moved up exponentially and will likely decline in the same fashion. This will have a profoundly negative impact on the U.S. economy and financial system. Furthermore, the U.S. was able to pull itself out of the Great Depression due to the fact it was just starting to tap into its huge reserves of cheap, high EROI (Energy Returned On Investment) oil supplies. For example, the massive Lakeview Gusher in California (1910) had an estimated EROI of 35,000/1:

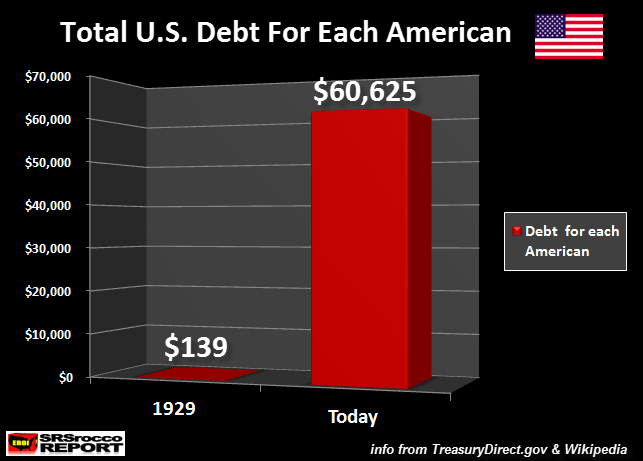

Basically, for the one barrel of energy equivalent burned to drill the Lakeview Gusher, it provided 35,000 barrels of oil. Today, Shale Oil comes in at 5/1 and Oil Sands in Canada is about 4-5/1. The EROI of U.S. Oil & Gas in the U.S. in 1930 was 100/1. This includes exploration and production. According to white paper, A New Long Term Assessment Of Energy Returned On Investment (EROI) For U.S. Oil & Gas Discovery and Production, the U.S. oil industry was finding 1,200 barrels of oil for each barrel of oil equivalent energy it burned in exploration. Today it has fallen to less than 5/1. As the U.S. oil and gas EROI continued to decline, especially after 1970, the United States continued to thrive due to the Petro Dollar system and the ability to import high EROI from the Middle East and other oil exporting countries. Unfortunately, this is not a situation that will continue for much longer as the debt in the system has exploded. Comparing U.S. Debt 1929 vs 2015 It's quite interesting to see how much of a change has occurred since the Great Depression. While things were very bad for Americans in the 1930's, the amount of U.S. public debt per person was very low versus today:

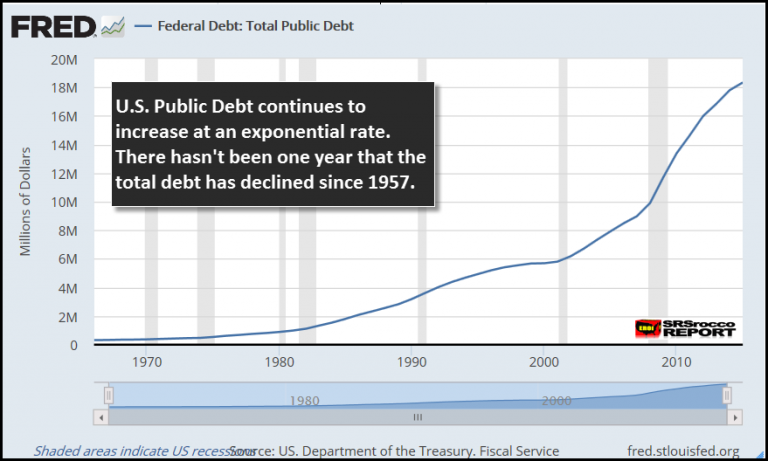

According to several sources, the U.S. population was 122 million in 1929 while total public debt was $16.9 billion. Thus, the average debt per American in 1929 was $139. Compare that to a population of 320 million and $19.4 trillion in debt at an average $60,625 per American today. Total U.S. debt per American is 436 times greater than 1929. What is interesting about total U.S. debt is that after each World War, the total level of debt declined for several years. For example, after the end of World War I, total U.S. debt fell from $27.4 billion in 1919 to $16.1 billion in 1930 (source). This was also true after World War II when total U.S. debt fell from a high of $269 billion in 1946 to a low of $252.7 billion in 1949. Over the next several, as total U.S. debt continued to increase, there were a few years that experienced declines (1951, 1956 & 1957). However, after 1957, there wasn't a single year that total U.S. debt declined. It has continue to increase for the past 58 years:

I believe the reason total U.S. debt was able to decline after each World War and during a few years in the 1950's, was due to the relatively high EROI of U.S. oil and gas. Moreover, as cheap domestic U.S. oil production peaked in 1970, oil imports had to increase to supply the ever-growing sprawl of the AMERICAN LEECH & SPEND SUBURBAN ECONOMY. |

| Ignore Yellen and Buy the Dip in Precious Metals Posted: 27 Aug 2016 11:23 AM PDT Investors worldwide have been on pins and needles in eager anticipation of a speech from our economic overlords. Friday morning FED chair Yellen finally opened her mouth and said a whole lot of nothing. Markets didn’t know exactly how to react to her nothingness. Stocks were up and then down. Gold was down and then up. The USD index plunged and then rallied nearly 1%. Will the FED raise rates in 2016 or not? The drama continues as Yellen of Oz pulls the levers behind the curtain. |

| The US: A Dead Nation Walking — Paul Craig Roberts Posted: 27 Aug 2016 10:30 AM PDT by Paul Craig Roberts, Paul Craig Roberts:

I use the writings of Orlov and The Saker as checks on my own conclusions. In his article Orlov concludes that the United States is a dead nation, still walking, but no longer a uni-power. I agree with Orlov that US weapon systems are more focused on profits than on effectiveness and that Russia has superior weapons and a superior cause based on protection rather than dominance. However, in his assessment of the possibility of nuclear war, I think that Orlov under-appreciates the commitment of Washington's Neoconservatives to US world hegemony and the recklessness of the Neoconservatives and Hillary Clinton. Washington is incensed that Russia (and China) dare to stand up to Washington, and this anger crowds out judgment. Orlov, also, I think, under-estimates the weakness in the Russian government provided by the "Atlanticist Integrationists." These are members of the Russian elite who believe that Russia's future depends on being integrated with the West. To achieve this integration, they are willing to sacrifice some undetermined amount of Russian sovereignty. It is my conclusion that Washington is aware of the constraint that the desire for Western acceptance puts on the Russian government and that this is why Washington, in a direct thrust at Russia, was comfortable orchestrating the coup that overthrew the elected Ukrainian government. I believe that this constraint also explains the mistakes the Russian government made by refusing the requests of the Donetsk and Luhansk republics to be reincorporated as parts of Russia, where the territories formerly resided, and by the premature withdrawal from Syria that allowed Washington to resupply the jihadists and to insert US forces into the conflict, thus complicating the situation for Russia and Syria. Orlov sees Russian advantage in the ongoing conflict between Kiev and the breakaway republics as the conflict could be leading to the collapse of the US puppet government in Kiev. However, the disadvantage is that the ongoing conflict is blamed on Russia and feeds Western anti-Russian propaganda. It also makes Russia look weak and unsure of itself as if the Western criticism of Russia's reincorporation of Crimea has struck home and Russia is afraid to repeat it by accepting the pleas of the break-away republics. Moreover, if the Russian government had accepted the requests of Donetsk and Luhansk to return to Russia from which they were artificailly separated, not only would the conflict have been ended, but also the Ukrainian people would have realized the disaster caused by Washington's coup against their government, and Europe would have realized from decisive Russian action that it was not in Europe's interest to provoke Russia in behalf of Washington. The correct Russian response was prevented by the Atlanticist Integrationist desire to appease Washington. In contrast to Orlov, The Saker underestimates Russian military strength, but he does understand the constraints placed on Russian decisiveness by the Atlanticist Integrationists, who seem to count in their ranks the economic establishment including the central bank and perhaps the prime minister himself. Putin does not seem to be overly concerned with what appears to me to be a fifth column of Washington's agents as Putin himself has placed heavy bets on achieving accommodation with the West. However, Putin has cracked down on the US-financed NGOs that have tried to destabilize Russia. Western reporting and think tank and university reports on Russia are propaganda and are useless to understanding the situation. For example, in the current issue of The National Interest Thomas Graham, who had the Russian desk on the National Security Council during the George W. Bush regime, attributes the "destabilization of eastern Ukraine" to "Russia's annexation of Crimea." He avoids mentioning the US-orchestrated overthrow of an elected Ukrainian government and that Crimea voted overwhelmingly (97 percent) to rejoin Russia when faced with the Russophobic government Washington established in Kiev. According to Graham, the foul deed of Russia's acceptance of a democratic outcome upset all of Washington's very friendly, supportive, and hopeful attitudes toward Russia. With all of Washington's "assumptions that had guided America's Russia policy" irreversibly dashed, it is no longer possible to maintain that Russia "is a suitable partner for addressing global issues." Graham goes on to define Russia as a problem because Russia favors a multi-polar world to a uni-polar world run by Washington. It is possible to read Graham's repeat of the propaganda line as Graham genuflecting before the Neoconservatives before going on quietly in a low-key manner to attack their hegemonic attitude toward Russia. In his concluding paragraph Graham says that Washington must find a new approach to Russia, an approach of balance and limits that rejects "resort to force, which would be devastating given the destructive power of modern weaponry." All in all, it is an artful argument that begins by blaming Russia's response to Washington's provocations for a dangerous situation and concludes with the argument that Washington must adjust to Russia's defense of her own national interests. It is reassuring to see some realism creeping back into Washington attitudes toward Russia. However, realism is still a minority view, and it is highly unlikely that it would be the view of a Hillary regime. In my opinion, the chance of nuclear war from Neoconservative intention, miscalculation or false launch warning remains high. The provocations of US/NATO military forces and missile bases on Russia's borders are reckless as they build tensions between nuclear powers. It is in times of tension that false warnings are believed and miscalculations occur. In the interest of life on earth, Washington should be de-escalating tensions with Russia, not building them. So far there is no sign that the Neoconservatives are willing to give up their hegemonic agenda for the sake of life on earth. |

| WW3 - The Nuclear Apocalypse : Anonymous Posted: 27 Aug 2016 10:07 AM PDT Anonymous Message 2016 - You have to watch this! This is the latest Anonymous message to the US public. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Market Report: $1.4bn Gold Take-Down Posted: 27 Aug 2016 10:00 AM PDT by Alasdair Macleod, Gold Seek:

Before that event, the silver price had been hit hard, though Open Interest remained stubbornly high. Gold fell $14 to $1324.5 over the week by early European trade this morning, and silver from $19.30 to $18.63. It is possible that the 10,000 gold contract sale and the price action in gold and silver was connected with option expirations on Thursday. In silver, the target would have been to make the $19 calls expire worthless, while in gold the target was probably as low as $1300. In gold's case, there were some 13,000 September call options with striking prices between $1300 and $1340. Last Friday, the gold price closed at $1342, so there is no doubt there was a huge incentive for the grantors to manage prices lower to a sub-$1300 target. As it was, they only managed to get the price down to $1320, so for the professional shorts the cost on about 8,000 option contracts was saved. Silver was a similar story, but the numbers were far smaller. Nonetheless, the price has fallen over $1.30 over the last ten days trading. However, there was another interesting development last night. An exceptionally high 20,966 Comex December contracts were exchanged for physical (EFP). EFP transactions happen all the time, but this was a jumbo deal. We don't know the reason, which is most probably technical, but it could be linked to the sale of 10,000 contracts the day before. Most exchanges would automatically initiate an enquiry to ensure that there is no market rigging involved in a $2.8bn deal. Dream on. Volumes, in common with contracts for other markets, have been seasonally low, which inevitably means that prices are easily moved, when not driven by technical issues such as option expirations. Later today (Friday) Janet Yellen will deliver her Jackson Hole speech, which has the effect of delivering pre-speech uncertainty into the market all week. The concern for precious metals, as always, is that she might hint more strongly of a rise in interest rates sooner rather than later. The Fed is committed to two statistical targets, unemployment and price inflation. With the CPI approaching its 2% target and official unemployment numbers also at or close to the Fed's target, official rates should be returning to normality. Perhaps we are seeing another target, the dollar exchange rate, actually being monitored, because a return to interest rate normality in the US at a time when the Bank of Japan and the European Central Bank are imposing negative rates, could have unexpected consequences. And here we need to remember that international business is highly dependent on dollar finance, but earnings are in other currencies. Here at Goldmoney, our economic research clearly indicates that the Fed must prioritise higher interest rates if future price inflation is to be contained. However, it is not as simple as that, because the end of the bond bull market on its own will create a backwash out of the financial sector into consumption, simply because there is nowhere else for income allocation to go. We do not expect the Fed to be fully aware of this effect, but there is no doubt it is acutely aware of the possible consequences of the bursting of a bond market bubble. It amounts to a wall of worry for gold bulls, which is at the same time the underlying reason why accelerating monetary inflation is guaranteed in the future. Meanwhile, the price chart of gold reflects a continuing bullish set-up, which overrides short-term worries. |

| Pemex Collapse Threatens Biggest Banks in Mexico Posted: 27 Aug 2016 09:00 AM PDT by Wolf Richter, Wolf Street:

These days, the trend is not Pemex's friend. Mexico's loss-leading, debt-swamped, state-owned oil giant company announced that in July it had imported 554,000 barrels of oil a day — its highest monthly volume of imports since public records began in 1990. In total, two-thirds of all the oil Mexico consumed in July was imported — a staggering statistic for a country that until not so long ago was home to one of the largest oil fields in the world, the Cantarell. Pemex also acknowledged that its crude production fell a further 5% in July while its natural gas production shrunk 9%. The export figures were just as ugly. In 2011, when the price of Brent crude averaged over $100, Pemex's export revenues hit a historic peak of $49 billion, a monthly average of $4.11 billion. In the first quarter of 2016 the monthly average was just $893 million. That's a plunge of 78%. As Pemex's exports dwindle, Mexico's imports of oil and gas continue to grow. Petroleum accounted for two-thirds of last year's $14.5 billion trade deficit, which was the widest since 2008. During the same year, Pemex managed to rack up $38.5 billion in losses, its biggest ever. If anything, the company's decline is accelerating. This could be bad news not only for Mexico's fiscally challenged government, which has grown comfortably dependent on the once bountiful proceeds from the oil business, but also for many of Mexico's biggest banks, which have lent vast sums to the oil major and its huge network of suppliers. As Moody's warns, if Pemex's financial health continues to deteriorate, it could be a major source of risk for the banking sector in the months and years ahead. This is all happening at a time that Mexico's economy is showing ominous signs of stagnation. In the second quarter, GDP fell 0.2%, on a drop in industrial output. At the beginning of the year its most important export sector, the automotive industry, began suffering the consequences of gradually softening demand, particularly in the U.S. On Tuesday, Standard & Poor downgraded the Mexican economy's outlook from stable to negative as the country's weak growth continues to disappoint. Hours later Moody's did the same. One of the biggest causes for concern is the recent explosion in public debt, which at close to 45% of GDP may seem tiny by comparison with other OECD economies. But it is more than double what it was in 2008. Serious questions are once again being asked about how much support the government will have to, and be able to, provide Pemex in its hour of need. According to Moody's sovereign debt analyst for Latin America, Jaime Reusche, over the next year and a half, Pemex will need to raise somewhere in the region of $20 billion from the markets just to roll over its maturing debt. But in light of current conditions, "it's unlikely to raise more than $10 billion." In other words, a very large taxpayer-funded bailout of Mexico's oil giant is in the cards, especially now that the financial sector is also at risk. The bailout is already underway. In early April, Pemex was given a $4.2 billion cash injection to help tide it over. But that's a tiny fraction of what will ultimately be required, especially if losses continue to pile up at anywhere near the rate experienced in 2015, by the end of which Pemex owed its creditors a staggering $86 billion. If you include the company's pension liabilities its debt already exceeds €100 billion. The more the fiscal capacity of the government weakens, the greater the risk for Mexico's banks, many of which are foreign owned. At Moody's Annual Seminar banking analyst David Olivares warned that if the government does end up bailing out Pemex, its capacity to put out fires in the financial sector in the event of contagion will be significantly diminished. Given the banks' acute level of exposure to Pemex and its suppliers, this could be a very serious problem. That, added to the fact that the same banks have increased their lending to consumers and businesses at a time of sluggish economic growth, was the main reason behind Moody's decision on Tuesday to downgrade its outlook for Mexico's banking sector from stable to negative. The agency also downgraded the credit ratings of seven Mexican banks — Bancomer, Santander, Banorte, Scotiabank, BanBajío, Banobras and Bancomext — as well as the Institute for the Protection of Bank Savings. Most at risk of exposure to a sudden deterioration in Pemex's financial health are Mexico's state-owned development banks, Banobras and Bancomext, which earlier this year were forced by the country's Treasury Secretary to take on part of the debt Pemex owes to its suppliers. |

| Koos Jansen: Netherlands central bank won't release gold bar list Posted: 27 Aug 2016 08:34 AM PDT 11:35a ET Saturday, August 27, 2016 Dear Friend of GATA and Gold: Gold researcher Koos Jansen reports today that the Netherlands central bank, which purports to believe in transparency, says it has a list of the bars in the nation's gold reserves but refuses to release it to him. Jansen's report is headlined "Dutch Central Bank Refuses to Publish Gold Bar List for Dubious Reasons" and it's posted at Bullion Star here: https://www.bullionstar.com/blogs/koos-jansen/dutch-central-bank-refuses... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver Coins and Rounds with Employee Pricing and Free Shipping Grab your Silver Starter Kit at cost from Money Metals Exchange, the company named "Precious Metals Dealer of the Year" by industry ratings group Bullion Directory. Simply go to MoneyMetals.com and type "GATA" in the radio box at the top of the page. This special silver offer contains 4 ounces of silver coins and rounds in the most popular 1-ounce, half-ounce, and 10th-ounce forms. Claim yours now, because GATA readers get employee pricing and free shipping. So go to -- -- and type "GATA" in the radio box at the top of the page. Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Posted: 27 Aug 2016 08:00 AM PDT This post Dark Dynamics appeared first on Daily Reckoning. What the world is witnessing, without actually paying much attention, is the death of our debt-based economy — that is, borrowing the means to thrive in the now from a future that can't really furnish it anymore. The illusion that the future would always provide was a legacy of the cheap energy era. That era ended in 2005. The basic promise is broken and with it the premise for living as we had been. The energy available today, especially oil, is no longer cheap enough to run the industrial economies designed to run on it. Any way that you look at the dynamic, Modernity loses. With oil under $50 a barrel, and gasoline under $3 a gallon (back east), the public apparently thinks that the Peak Oil story is dead and gone. But when it costs $75 a barrel to pull the stuff out of the ground, and the stuff only sells for $47 a barrel, the oil companies' business model doesn't really work. The shale oil companies especially have been gaming the system by issuing bonds that pay relatively high interest rates in an investment climate where almost nothing else offers enough yield to live on, especially for pension funds and insurance companies. Two little upward bumps this year in the price of oil toward the $50 range prompted a wish that the good old days of high-priced oil were coming back, that the oil business would be profitable again. The trouble is that high oil prices — say, over $100 a barrel, as it was in 2014 — crush advanced economies, so that demand for oil crashes, and with it productive activity. Without productivity, the debts issued by companies (and even governments) don't get repaid. There really is no "sweet spot" in this energy cost equation. A lot of wishful thinkers would like to believe that you can run contemporary life on something beside oil. But the usual "solutions," solar and wind energy, don't pencil out, especially when you consider that the hardware for running them — the photovoltaics, charge controllers, batteries, turbines, and blades, can't be mass-produced and distributed without the very fossil fuels they are supposed to replace. These matters add up to the essential quandary of our time. It has expressed itself in falling standards of living for what used to be the middle class, most particularly in the USA. European countries have tried to work around this problem with their rigid bureaucracies for keeping those already employed from losing their jobs. In France, Spain, and Italy, this has only made it much harder for people under 30 to get a job. The jobs picture for millennials in the USA is not much better, though there's no structural job-protection for their elders who are still working here. They live in abject fear of termination by the HR ghouls of the big corporations. Sooner or later the younger generation will explode in rage at the system and there is no telling what the result will be. We're already seeing it in the black ghettos, where decades of accrued social dysfunction make the anomie and purposelessness — of young men especially — much worse. The newer loser class of people who once had good jobs and now have poor prospects of ever getting them back gets swept up in the mania for their incoherent champion, Trump, who shows no sign of understanding the essential quandary of our time. The tragedy of Trumpism is that the man so poorly represents a large group of Americans with genuine woes and grievances. And the larger tragedy of our country these days is that events did not prompt better leaders to step forward. The explanation may be that people who actually understand the dark dynamics spinning out are rather pessimistic about our ability to carry on under the familiar disposition of things. Hillary represents the continuity of all the current rackets being used to prop up belief in the foundering business model of western civilization. These are the forces in our national life that want to pretend that nothing is wrong, that all the splendid rackets of the day — Federal Reserve interventions, corporate debt-fueled stock buybacks, military log-rolling, medical racketeering, the college loan Ponzi, pension fund levitation, primary dealer bank interest rate arbitrage, agribiz Frankenfood proliferation — can just grind along like some old riverboat banger engine keeping the garbage barge of American life afloat. Thus, Hillary is shaping up to be the patsy of the century, likely to preside, if elected, over the biggest blowup of established arrangements that world has ever seen. If she doesn't get into the White House there may be no backstopping of the insolvent banks and bankrupt governments and a TILT message will appear in the sky. That TILT message is likely to appear anyway because, remember, the authorities are only pretending that they can manage events. In fact, all of their "management" strategies and shenanigans only insure the further distortion of the basic operating system, which is already so far out of whack from twenty years of previous management efforts that nothing in banking and markets really works anymore. Companies don't make money, despite rising share prices. No one in his right mind buys bonds with negative yields — that promise to pay back less over time — so governments have to pretend to buy them. (In fact, they don't so much "buy" them as simply extinguish them by playing three-card-monte with national treasuries.) And, of course, the masses of people in all these nations — including the patsy USA — sink ever deeper into poverty every month. The release of tension is being felt in the ground game of politics where outsider candidates here and abroad are rising on a tide of rage and resentment. The fecklessness and stupidity of the elites has been epic, sacrificing everything to maintain the illusion of normality. Nothing is normal and "the people" are finally onto it. Sadly, it looks as if both politics and finance are veering toward crack-up simultaneously. The daisy-chained Too-Big-To-Fail banks are already choking on the suicide bolus of derivatives. The equity markets are one algo accident away from cratering. The bond markets are a sick joke. And Hillary may win the booby prize of presiding over the smoldering wreckage of it all. When it happens, she will have no idea what to do. The debt problem alone is absolutely certain to express itself in at least three major ways: the crash of equity markets, the collapse of the bond markets, and the loss of faith in the value and meaning of whatever money you're using. Any of those events would turn the economic life of the linked advanced economies upside down. Any of them could occur during the 2016 U.S. election season. Regards, James Howard Kunstler Ed. Note: Readers who subscribe to receive The Daily Reckoning by email will get exclusive, forward-leaning commentary sent straight to their inboxes every day. What you're reading here on our site is just a slice of the independent forecasts we issue each and every day.Simply click here to receive The Daily Reckoning. It costs you nothing — and promises to be the most informative and entertaining 15 minutes of your day. The post Dark Dynamics appeared first on Daily Reckoning. |

| The Dark Dynamics of the Deep State Posted: 27 Aug 2016 08:00 AM PDT This post The Dark Dynamics of the Deep State appeared first on Daily Reckoning. We live in an age of complete lack of accountability. Our institutions fail regularly. And there are no consequences. When American politicians used to violate the public trust by lying, they faced consequences, like being voted out of office or resigning in disgrace. But that's not the case anymore. Today, our ruling class lies about issues both big and small without consequence. It happens on both sides of the political aisle. The public does nothing about it. And the Deep State uses this apathy to further cement its control. What once happened only in banana republics and dictatorships is now happening regularly in the U.S. And unless free citizens start holding their elected representative accountable to the truth, we will never regain control of our country from the clutches of the Deep State. Hillary Clinton is an agent of the Deep State. And she was a big supporter of the Transatlantic Trade and Investment Partnership (TTIP) trade deal until Trump made it so unpopular. The Obama administration kept it shrouded in extreme secrecy. The text of the deal was kept in the basement of the U.S. Capitol, in a bombproof room, only accessible by U.S. Congress members. Transparent democracy at its finest. Well, as details of the deal started to leak out, we started to see why it was kept double-secret. The main goal of the deal is to protect global megabanks and U.S. bond rating agencies from claims by investors who were cheated during the debt crisis. That's just more evidence that the Deep State will eat your financial health alive. Will Hillary resurrect it if she's elected? But the Deep State's grand plans may be disintegrating before our eyes. June's Brexit vote was a critical battle in the long war against the Deep State. British citizens decided they're tired of surrendering their democratic rights to multinational corporations, unelected bureaucrats and feckless central bankers whose policy goals are at direct odds with regular people. It dealt a deathblow to the Eurocrats' one-world government dreams. And with the European Union teetering, France wants its own EU referendum. Now millions are clearly losing faith in the power of once godlike central bankers. QE, ZIRP and NIRP have failed. And the price of gold is rising as investors have begun realizing that the monetary overlords have run out of bullets. The Deep State has kept its vise grip on power through a rigged system. But what happens when the manipulated masses realize that system is finally breaking down? We may soon find out. Below, James Howard Kunstler shows you why our debt-based economy, which the Deep State depends upon, is collapsing around us. Will the Deep State collapse too? Read on. Regards, Michael Covel Ed. note: "A charmingly mordant take on the stock news of the day, accentuated by philosophical maunderings…" That's how one leading financial magazine described the free daily email edition of The Daily Reckoning. You'll find cutting-edge analysis from the complex worlds of finance, politics and culture. Presented in an entertaining style few can match. Click here now to sign up for FREE. The post The Dark Dynamics of the Deep State appeared first on Daily Reckoning. |

| Ignore Yellen and Buy the Dip in Precious Metals Posted: 27 Aug 2016 07:20 AM PDT Gold Stock Bull |

| Renewed use of gold swaps by BIS indicates strain on price suppression Posted: 27 Aug 2016 06:19 AM PDT By Robert Lambourne Recent disclosures in the monthly statement of accounts published by the Bank for International Settlements indicate the bank's renewed use of a substantial quantity of gold swaps. In the annual report of the BIS for its financial year ended March 31, 2010, it was disclosed that 346 tonnes of gold were acquired through gold swaps from commercial bullion banks. A review of the previous use of gold derivatives by the BIS reveled that the transactions in 2009/10 were far more substantial than anything done in the bank's recent history. ... Dispatch continues below ... ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers: To invest or learn more, please visit: Yet in an article published in the Financial Times on July 29, 2010, BIS General Manager Jaime Caruana said the gold swaps were "regular commercial activities" for the bank. Here is a link to the FT article, which requires a subscription to access: http://www.ft.com/cms/s/0/3e659ed0-9b39-11df-baaf-00144feab49a.html Here are excerpts from the article: "Some analysts speculated that the swap deals were a surreptitious bailout of the European banking system ahead of last week's publication of stress tests. But bankers and officials have described the transactions as 'mutually beneficial.' "'The client approached us with the idea of buying some gold with the option to sell it back,' said one European banker, referring to the BIS. "Another banker said: 'From time to time central banks or the BIS want to optimise the return on their currency holdings.'" It is notable that none of these comments in the FT article focused on the gold market but implicitly accepted that gold was being used as collateral to support dollar loans to commercial banks. An alternative explanation -- that the swap transactions were initiated by the BIS to place more unallocated gold into the hands of certain central banks -- seemed plausible, since the gold market was tight at the time. The use of gold swaps by the BIS increased in the financial year ended March 31, 2011, with 409 tonnes of gold swaps reported by the bank. This was the peak amount reported by the bank: 2011: 409 tonnes. As the table makes clear, the use of gold swaps by the BIS had reduced considerably in the period leading to March 2016, when the use of gold swaps stopped. It is an interesting coincidence that the BIS has renewed its use of gold swaps when gold market conditions again are considered tight, as in 2010 and 2011. This link accesses the July 2016 statement of account by the BIS: https://www.bis.org/banking/balsheet/statofacc160731.pdf From the published information it is not possible to calculate an exact amount of gold swapped, in part because the BIS has probably continued its recent policy of selling a few tonnes of its own gold each year. The bank's own gold holdings have fallen from 120 tonnes in 2010 to 104 tonnes in 2016. But it appears that the swapped by the BIS is in the range of 225 tonnes to 230 tonnes as of the end of July. No doubt the BIS will comment at some point on its renewed use of gold swaps. But to those who consider the suppression of gold prices by central banks to be obvious, this is another sign that strain on the suppression scheme is growing. ----- Robert Lambourne is a business executive in the United Kingdom and a consultant to GATA. Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Barrick signs on to Venezuela gold push as oil sinks economy Posted: 27 Aug 2016 05:56 AM PDT By Danielle Bochove Barrick Gold Corp. agreed to form a joint venture in Venezuela, according to state television, as President Nicolas Maduro turns to mining as a way to boost one of the fastest-shrinking economies in the world. The world's biggest producer of the precious metal was among several companies to sign letters of commitment for gold-mining ventures during a ceremony held at the presidential palace in Caracas on Friday. The government would take a 55 percent stake in the proposed Barrick venture, Maduro said. "At the invitation of the government, we intend to review information pertaining to mining opportunities in the country," Andy Lloyd, a spokesman for Toronto-based Barrick, wrote in an e-mailed response to questions. ... ... For the remainder of the report: http://www.bloomberg.com/news/articles/2016-08-26/barrick-signs-on-to-ve... ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Posted: 27 Aug 2016 05:50 AM PDT IF YOU WANT TO GET RID OF THE CLINTON CROOKED FAMILY VOTE FOR TRUMP BELIEVE ME YOU WON'T. BE SORRY....... The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Breaking News And Best Of The Web Posted: 26 Aug 2016 05:37 PM PDT Odds of rate hike go up after Yellen speech. US GDP Q2 lowered, expected to rise in Q3. World trade continues to contract. Gold and US stocks down last week. US manufacturing, home sales disappoint. Negative interest rates getting a lot of attention, mostly critical. Europe doesn’t seem fixable. Trump hires new people, keeps falling […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |