Gold World News Flash |

- Meditation May Be the Key to Becoming a Better Investor

- One World Currency introduced by The Cartel Settlement Coin

- A Bit More Downside Potential in Gold Stocks

- ANOTHER DEAD CLINTON CRIMES TRUTH TELLER: WikiLeaks Julian Assange Lawyer FOUND DEAD, After Being Struck by Train

- NWO Panics Over The Broken Chessboard: Brzezinski Gives Up on Empire

- Yellen Basically Admits The U.S. Is A Banana Republic

- The Broken Chessboard: Brzezinski Gives Up On Empire

- Japanese Government Squanders Pension Funds On Failed Stocks As Losses Reach $130 Billion In Past Year

- China's Great Divide: A New Cultural Revolution?

- Prophecy Update End Time Headlines 8/26/16

- WAKE UP CALL: Our Entire World is Going To Change -- BILL HOLTER

- Gold: Divided We Stand

- The Market’s Being Set Up For A Hard Fall

- Gold Junior Stocks Q2 2016 Fundamentals

- What The Federal Reserve Really Is

- Hillary’s health: Clinton emails obsessed with sleep,“exotic drugs”

- EUR-USD pattern still on track

- Buy Gold’s August Dip? Gold’s Monthly Sweet Spot In September

- The Impact of Brexit on the U.S. Economy and Gold Market

- John Stossel On The Insanity Of Today's Democrats

- Jim’s Mailbox

- The New Power Elite Part II: The U.S. and China Escalate Energy War

- Julian Assange - Hillary's October Surprise

- The GLD vs GOLD

- Former Fed Governor Warsh admits that the central bank manipulates markets

- Ronan Manly: Is any gold still stored at U.S. Mint in Denver?

- Precious Metals Pullback To Uptrend Provides Buying Opportunities in New Bull Market

- Double Digit Inflation And The Rise of Gold

- Gold Futures See Massive $1.5 Billion “Non Profit†Liquidation In “One Minuteâ€

- The Precious Metals Sector and the Fed. . .

- Will China Lead The New World Order ?

- Alex Jones' Message To Hillary Clinton

- U.S-Russia Relations: Entering A New Thaw

| Meditation May Be the Key to Becoming a Better Investor Posted: 27 Aug 2016 12:53 AM PDT Every once in a while I write about topics that seemingly have nothing to do with investing, but for those that are able to connect the dots, they will actually find great value in these seemingly unrelated topics to wealth building and preservation strategies. As it is the weekend, I'm releasing an article that we originally posted on our website about the topic of meditation and investing on 19 August 2016. Again, to first read our articles when we release them, subscribe to our article feed here. Here is the entire article below.

Recently, I wrote about a behavioral phenomenon called the "It Won't Happen to Me" syndrome that prevents many of us from separating perceived reality from actual reality, and I discussed how acceptance of false precepts about investing and self-preservation can lead us to make wildly irresponsible decisions that are dangerous to our self-preservation, including decisions to do nothing when one should act. One of the easiest things we can do on a daily basis that won't cost us a penny, yet can help us achieve a tremendous level of clarity that allows us to separate the false paradigms and precepts that we have often already embraced from the staggeringly different reality that often exists, is the simple practice of meditation.

There are many different forms of mediation, including Zazen, Mindfulness Based Stress Reduction (MBSR), Kundalini Yoga, Vipassana meditation, and Transcendental Meditation (TM), just to name a few. I recommend TM or MBSR because it has been scientifically proven, in peer reviewed studies published in accredited medical journals, that one does not even need to believe in the beneficial effects of TM and MBSR to reap the beneficial rewards of practicing these forms of meditation. Though I've read a few articles and books about TM over the course of my lifetime, I personally believe that there are sufficient resources online to at least start practicing now. The important part of the equation is to start today, and to stop procrastinating. If you feel you need an instructor down the road, then you can seek out a local instructor down the road, but it certainly is not necessary, in my opinion, to spend thousands of dollars to receive a personal mantra from a maharishi, as is sometimes recommended, or to even spend hundreds of dollars taking an intensive course, whether online or in person, to receive the benefits of a daily meditative practice.

When I was younger and intensely training in martial arts as well as sparring regularly, my sensei would begin every class with a brief 5 minute period of Zazen meditation in which he would ask all of us to release all the work stresses that may have accumulated in our body from work conflicts experienced earlier in the day, to empty our mind to allow it to be receptive to learning whatever techniques we were focusing on that day, and to calm our mind to increase our focus during our training and sparring sessions. No matter how stressful any work matters I had dealt with earlier in the day had been, I always felt much better even after such a brief period of meditation. In fact, my Sensei encouraged all of us to meditate daily, so also supplemented this brief 5-minute period of meditation with a longer 15 to 20 minute daily session before I went to sleep each day.

However, back then, because I was unaware of the scientific research regarding meditation, I never connected the dots even though I had some remarkable experiences that I now attribute to my daily meditative practice. I can clearly recall one sparring session with a Muay Thai boxer during which everything seemed to be moving in slow motion, whereby I could sense every kick and every knee a fraction of a second before my sparring partner delivered them. However, each time, I easily moved out of the way or blocked his strikes. I literally felt as if my sparring fighter could not hit me. Another time, when engaged in a training session, I informed my Sensei before class that I had a fever, so I asked him to forgive me that day if I was a little slow in reacting to my training partners. In fact, just the opposite happened, and I was so sharp that day with my techniques that my Sensei sarcastically commented, "You should be sick every day!"

Later that evening, when I was trying to fathom the reason for my exceptional training session, I deduced that my better-than-normal display of skill that day was attributable to the fact that my sickness stopped me from thinking and put my muscle memory entirely in charge. In other words, my primordial instincts took over, allowing my "flow", my "chi", or whatever you want to call it, to be particularly strong that day. I felt a certain stillness that day when training that seemed to heighten all my senses, including my intuition, whereby I could predict my opponent's strikes before he even threw them, very similar to my sparring session with the Muay Thai boxer. It's odd that many people view people that practice daily meditation as "soft", as I discovered that not only did daily meditation make me a much better fighter, but it also served to calm any fears and anxiety I had prior to, and during, my sparring sessions.

In fact athletes often call this state of mind as "being in the zone". I'm sure fans of basketball can recall the 1997 NBA finals game between the Chicago Bulls and the Utah Jazz, when Michael Jordan had the flu and was so sick that he couldn't even stay upright on the bench. Despite his weakened physical condition, Jordan still dropped 38 points on the Jazz, in a virtuoso performance in which every point he scored was critical in an eventual 2-point win for the Bulls. Again, with Jordan that day, I think his physical disadvantage that day forced him to rely more on the mental aspects of the game, and this allowed him to more easily enter the "zone."

And this zone is something that meditation replicates. Many people mistakenly assume that great ideas come from relentless work habits and an indomitable work discipline, but just the opposite is true. When someone is so tired from relentless work, there is no energy from which creativity and great ideas can be born. Great ideas are born during those moments when the mind is still and the clarity exists to formulate new and creative ideas. If the concept that ideas are born out of nothingness and spaces of calmness and clarity seems foreign to you, then allow me to use an analogy of physical fitness. There is a concept in professional sports called overtraining. This is when someone, whether a sprinter, a UFC fighter, a football player, or a soccer player, trains so relentlessly for such a long period of time that he does not allow his muscles to adequately heal and recover from his training sessions. When an athlete overtrains, this inevitably leads to sub-optimal performance during a fight or a game.

If you are a workaholic, and the days blend into weeks, weeks into months, and months into years, and you never giver your mind adequate time to rest, chances are that you are going to have a mental breakdown. Furthermore, chances are that even though you give your mind time to rest during sleep, because you never refresh your mind with a period of calm and clarity during the day, that you may even suffer from frequent periods of insomnia. Can you imagine exercising every day for all hours you are awake, except meals, without every stopping? Most everyone would agree that this type of extreme unrelenting physical exertion is dangerous as it will lead to an eventual breakdown of the body and collapse. However, most people fail to take care of their mind in the same way they would their physical body. If you don't give your mind ample opportunity to reset every day with a sustained period of calm, then eventually you are going to damage your mind.

Fortunately, just two 20-minute daily meditation sessions a day can cure this damage and even reverse the damage that has already been done. In fact, if you are one of those people that toss and turn all night and can't shut off your mind, then you are an ideal candidate to start a daily meditation practice. According to Dr. Rebecca Robbins, a post-doctoral fellow at the NYU School of Medicine, meditation calms the mind to such a degree that its restorative effects can be greater than even deep stages of sleep. Robbins states that daily mediation offers some of the same benefits, cognitively and physically, from a recovery and a regeneration standpoint as stage-IV deep sleep. In fact, Robbins herself stated that she never was able to reach restful stages of sleep at night until she started meditating.

There are many peer-reviewed scientific studies that validate the following findings, but UCLA and Harvard studies are just two of many conducted studies that have proven the following. A daily meditation practice increases the grey matter volume in the brain, increases cortical thickness in the hippocampus, the region of the brain that governs learning and memory, and decreases the volume of the brain in the amygdala, the region of the brain responsible for producing fear, anxiety and stress. Many moons ago, when I was preparing to enter business school, I recall only having 2 weeks to study for the GREs (the graduate business school entrance exam) during a holiday break as I was already enrolled in another graduate program. Though many may believe 2 weeks to be an inadequate period of time to study for any scholastic exam, whether it is the GREs or another graduate level program exam, my daily meditation sessions provided me with great focus and memory retention for those two weeks and I felt surprisingly more than adequately prepared by the time the exam day arrived.

I credit my meditation sessions for my ability to respectively score in the very top percentiles of everyone that took the GRE exam in the entire United States that year, with only two weeks of preparation. And this is the power of meditation. I have seen it work in my own life with great success in my martial arts training, my scholastic endeavors and my current business of SmartKnowledgeU. I only wish that I had understood the benefits more fully back when I was mentoring at-risk youth in Philly and when I was mentoring gang members in Los Angeles. Had I more fully understood the benefits of meditation back then, I would have started every one of my mentoring sessions with them with a period of meditation, as I truly believe that meditation would have allowed me to break through to many more of them.

If all the above data does not provide enough compelling evidence to convince you that meditation will provide much more heightened levels of clarity that lead to better and more profitable investment decisions, and thus compel you to start meditating, then perhaps this last reason will do so. Dr. Elizabeth Blackburn, who won the 2009 Nobel Prize in medicine for her discovery of protective caps on chromosomes called telomeres, studied the effects of meditation on the length of telomeres. Blackburn reported that there was scientifically significant increases in the length of telomeres among those that meditated on a regular basis versus those that never meditated. Why is this important? Scientific studies have reported that people with longer telomeres have also demonstrated better cognitive ability, improved overall health, higher levels of satisfaction with life, and have had longer lives, than those with shorter telomeres.

At the very least, if everyone were to meditate twice a day for just 20 minutes per session, even if you have no desire to gain the inevitable clarity that will transform you into a better investor, the other extraordinary benefits of meditation are sufficient reason to do so, as they will benefit every other aspect of your life. As a result of more people practicing meditation, the world would transform into a kinder, more compassionate world with less angry people, and that is a development that none of us should ever oppose.

Fun fact of the day: According to Victor Hugo Criado Berbert, production manager of the 2016 Rio Olympic medals, the gold medals, though they each weighed 500 grams, only contained about 5.84 grams of gold. However, the "gold" medals each contained 494.16g of silver, making them by weight, by value, and by price, a gold-plated silver medal in reality. At today's respective prices for a 1-troy ounce American Gold and Silver Eagle coin, the gold and silver contained in each gold medal would be priced at $266.07 of gold and $364.63 of silver for a total price of $630.70, assuming that the gold and silver used in the fabrication of the medals are 99.99% fine, which I haven't been able to confirm. That's a lot of training for a "gold" medal that doesn't even contain 1/5 of a single troy ounce of gold and that, by every possible measurement metric, should truly be called a silver metal. That's also a lot of deception to cheat the "gold" medal winners out of a metal, that according to Warren Buffet and Bill Gates, is just a barbarous relic.

About the author: JS Kim is the Founder and Managing Director of SmartKnowledgeU, a fiercely independent wealth management consulting, research and education firm that focuses on building unique strategies centered around gold and silver assets to build a better tomorrow for everyone. We are excited to announce that we will be launching our SmartKnowledge Wealth Academy very soon. To receive two sample issues of our flagship Crisis Investment Opportunities newsletter, just send a request to ciotrial(at)smartknowledgeu(dot)com. |

| One World Currency introduced by The Cartel Settlement Coin Posted: 26 Aug 2016 10:12 PM PDT Well, it finally happened. Mark your calendars for the year 2016 as 'the year' a real One World Currency has been announced. But don't worry - as we explain in Splitting Pennies - Understanding Forex - MONEY DOESN'T EXIST. How is it possible, you say - when we haven't heard about it in the news? Let's start with the 'lead' story on this breaking event: Big banks buckle down to build better bitcoin — RT Business

Why is this different than any other Bitcoin startup - there sure have been many. Because these are the banks that control the global currency market, also known as AKA 'the cartel' according to court documents. Checkout some of the stories leading up into this climatic moment: Big Banks Band Together to Launch 'Settlement Coin' - CoinDesk UBS Sheds New Light on Blockchain Experimentation Settlement Coin Creators Seek to 'Liberalize' Central Banks With Blockchain - CoinDesk 8 Banking Giants Embracing Bitcoin and Blockchain Tech 'Central banks looking at Bitcoin as real threat to dominance' — RT Op-Edge So why does any of this matter? Central Banking policy has run the global economy into the ground. Central Banks OWN $25 Trillion of Financial Assets. $13 Trillion worth of Government Bonds in the world have NEGATIVE YIELDS. The financial system as it is now, is on the path for implosion. Settlement Coin apparently is targeting 'back office settlement' to reduce costs which are about $80 Billion per year. But why then does RT compare it with SDRs:

Has the world gone mad, and people don't understand the difference between "Blockchain" and "Bitcoin" and "Cryptocurrency" and "US Dollars" ? We have to note here, RT needs to hire some "Forex Experts" to consult with their authors on this topic. To clarify, the big banks are working on multiple blockchain projects, as well - most of them have filed patents for their own crypto currencies, most notably, Citi: Citi: Bitcoin is an Opportunity for Banks, Not a Threat - CoinDesk Citibank Is Working On Its Own Digital Currency, Citicoin | TechCrunch

Once implemented, these banks have the means to quickly connect this new cryptocurrency "Settlement Coin" to their existing global network, as well as adding their own proprietary currencies such as "CitiCoin." It will take some time before the cryptocurrency is even released, and still probably years before it's widely accepted. What makes this week's announcement unique is that, for the first time the banks publicly announced they are making a new digital 'crypto currency' that isn't issued by a central bank, that can be implemented by them across and without borders, which is a perfect fit for a replacement of the US Dollar and other fiat currencies when they completely run out of QE steam. But here's the real clincher, exposing this as a real One World Currency:

For those who understand that it's monetary policy driving the value of currencies down, not supply and demand, there's no need to read between the lines - they spell it all out real simple. For a quick primer for those who don't know, the Federal Reserve is the sole issuer of US Currency (not the US Mint, who prints notes and coins.) The Federal Reserve is a private institution, owned by the banks. It was previously thought that, the idea of a one world currency was preposterous, because, how would all countries agree on having a single central bank? But here's the workaround - the Forex banks have a monopoly on the global monetary system. So by forcing their central bank partners to use "Settlement Coin" in order to save on hefty settlement fees (and it will solve the problem of the recent SWIFT hacks as well - part of the plan??? ) A few scenarios here - one, the banks knew that if they didn't do it, some new players might do it. Two, this plan was hatched long ago by some clandestine CIA op, starting with the release of Bitcoin, leading into the global one world cryptocurrency, all sponsored by Illuminati. Three, central banks have legitimate concerns about security (such as because of recent hacks) and have no real way out of QE, they can't stop it and they can't continue it. This is a parallel financial system in which assets can be transferred over to. To learn more about Forex, checkout Splitting Pennies - the pocket guide to make you an instant Forex genius! If you're a non-US citizen or Pension Fund looking for a real Forex investment with a proven track record, checkout Magic FX Strategy.  |

| A Bit More Downside Potential in Gold Stocks Posted: 26 Aug 2016 09:10 PM PDT Last week we projected 5% to 10% downside in the gold stocks. Well, not to butter my own bread but GDX and GDXJ both lost 9% on the week. That being said, I believed that the weakness would be limited and miners could rebound to new highs in September. While that possibility remains, there is a chance this correction could go a bit deeper and perhaps last longer. |

| Posted: 26 Aug 2016 09:05 PM PDT [Ed. Note: John Jones was a successful, highly respected attorney at the top of his game who lived in a million dollar home. Jones had no reason to kill himself. Yet, the death is being called a suicide. Another convenient death of a man who crossed the Clintons and the NWO.] by Jennifer Johnson, Truth Uncensored:

British Transport Police were called to the West Hampstead train station in North London at 7:07 AM on Monday April 18, 2016 after a man was struck by a train. He was reportedly pronounced dead at the scene and his death is not being treated as suspicious. The event occurred almost one month to the day that the first batch of Clinton emails were released by his client from WikiLeaks.

Jones worked on the same team as actor, George Clooney's wife Amal. He specialized in extradition, war crimes and counter-terrorism; taking cases from the former Yugoslavia, Rwanda, Sierra Leone, Lebanon and Cambodia. Jones lived in an expensive home in North London, with wife Misa Zgonec-Rozej, 40 a director of an international law consultancy, and his two children. The news is particularly disturbing, as Democratic Strategist and CNN host, Bob Beckel appeared in a FOXTV interview and called for the assassination of Julian Assange (or more accurately, "Just kill the sonofabitch!") Assange is believed to be planning a strategic "October Surprise" leak of a Hillary Clinton email, just prior the US Presidential Election. It purportedly contains information that will definitively put her behind bars. Read More @ Truthuncensored.net Julian Assange’s LAWYER FOUND DEAD after being Struck by Train. Coincidence? John Pilger on Julian Assange, WikiLeaks the Swedish Extradition Nukes to ROMANIA ??? |

| NWO Panics Over The Broken Chessboard: Brzezinski Gives Up on Empire Posted: 26 Aug 2016 08:41 PM PDT The US is "no longer the globally imperial power." by Mike Whitney, CounterPunch:

The main architect of Washington's plan to rule the world has abandoned the scheme and called for the forging of ties with Russia and China. While Zbigniew Brzezinski's article in The American Interest titled "Towards a Global Realignment" has largely been ignored by the media, it shows that powerful members of the policymaking establishment no longer believe that Washington will prevail in its quest to extent US hegemony across the Middle East and Asia. Brzezinski, who was the main proponent of this idea and who drew up the blueprint for imperial expansion in his 1997 book The Grand Chessboard: American Primacy and Its Geostrategic Imperatives, has done an about-face and called for a dramatic revising of the strategy. Here's an excerpt from the article in the AI:

Repeat: The US is "no longer the globally imperial power." Compare this assessment to a statement Brzezinski made years earlier in Chessboard when he claimed the US was " the world's paramount power."

Here's more from the article in the AI:

But why is "that era is now ending"? What's changed since 1997 when Brzezinski referred to the US as the "world's paramount power"? Brzezinski points to the rise of Russia and China, the weakness of Europe and the "violent political awakening among post-colonial Muslims" as the proximate causes of this sudden reversal. His comments on Islam are particularly instructive in that he provides a rational explanation for terrorism rather than the typical government boilerplate about "hating our freedoms." To his credit, Brzezinski sees the outbreak of terror as the "welling up of historical grievances" (from "deeply felt sense of injustice") not as the mindless violence of fanatical psychopaths. Naturally, in a short 1,500-word article, Brzezniski can't cover all the challenges (or threats) the US might face in the future. But it's clear that what he's most worried about is the strengthening of economic, political and military ties between Russia, China, Iran, Turkey and the other Central Asian states. This is his main area of concern, in fact, he even anticipated this problem in 1997 when he wrote Chessboard. |

| Yellen Basically Admits The U.S. Is A Banana Republic Posted: 26 Aug 2016 07:34 PM PDT The Peter Schiff Show Podcast - Episode 189 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| The Broken Chessboard: Brzezinski Gives Up On Empire Posted: 26 Aug 2016 06:30 PM PDT Submitted by Mike Whitney via Counterpunch.org, The main architect of Washington’s plan to rule the world has abandoned the scheme and called for the forging of ties with Russia and China. While Zbigniew Brzezinski’s article in The American Interest titled “Towards a Global Realignment” has largely been ignored by the media, it shows that powerful members of the policymaking establishment no longer believe that Washington will prevail in its quest to extent US hegemony across the Middle East and Asia. Brzezinski, who was the main proponent of this idea and who drew up the blueprint for imperial expansion in his 1997 book The Grand Chessboard: American Primacy and Its Geostrategic Imperatives, has done an about-face and called for a dramatic revising of the strategy. Here’s an excerpt from the article in the AI:

Repeat: The US is “no longer the globally imperial power.” Compare this assessment to a statement Brzezinski made years earlier in Chessboard when he claimed the US was ” the world’s paramount power.”

Here’s more from the article in the AI:

But why is “that era is now ending”? What’s changed since 1997 when Brzezinski referred to the US as the “world’s paramount power”? Brzezinski points to the rise of Russia and China, the weakness of Europe and the “violent political awakening among post-colonial Muslims” as the proximate causes of this sudden reversal. His comments on Islam are particularly instructive in that he provides a rational explanation for terrorism rather than the typical government boilerplate about “hating our freedoms.” To his credit, Brzezinski sees the outbreak of terror as the “welling up of historical grievances” (from “deeply felt sense of injustice”) not as the mindless violence of fanatical psychopaths. Naturally, in a short 1,500-word article, Brzezniski can’t cover all the challenges (or threats) the US might face in the future. But it’s clear that what he’s most worried about is the strengthening of economic, political and military ties between Russia, China, Iran, Turkey and the other Central Asian states. This is his main area of concern, in fact, he even anticipated this problem in 1997 when he wrote Chessboard. Here’s what he said:

“…prevent collusion…among the vassals.” That says it all, doesn’t it? The Obama administration’s reckless foreign policy, particularly the toppling of governments in Libya and Ukraine, has greatly accelerated the rate at which these anti-American coalitions have formed. In other words, Washington’s enemies have emerged in response to Washington’s behavior. Obama can only blame himself. Russian Federation President Vladimir Putin has responded to the growing threat of regional instability and the placing of NATO forces on Russia’s borders by strengthening alliances with countries on Russia’s perimeter and across the Middle East. At the same time, Putin and his colleagues in the BRICS (Brazil, Russia, India, China and South Africa) countries have established an alternate banking system (BRICS Bank and AIIB) that will eventually challenge the dollar-dominated system that is the source of US global power. This is why Brzezinski has done a quick 180 and abandoned the plan for US hegemony; it is because he is concerned about the dangers of a non-dollar-based system arising among the developing and unaligned countries that would replace the western Central Bank oligopoly. If that happens, then the US will lose its stranglehold on the global economy and the extortionist system whereby fishwrap greenbacks are exchanged for valuable goods and services will come to an end. Unfortunately, Brzezinski’s more cautious approach is not likely to be followed by presidential-favorite Hillary Clinton who is a firm believer in imperial expansion through force of arms. It was Clinton who first introduced “pivot” to the strategic lexicon in a speech she gave in 2010 titled “America’s Pacific Century”. Here’s an excerpt from the speech that appeared in Foreign Policy magazine:

Compare Clinton’s speech to comments Brzezinski made in Chessboard 14 years earlier:

The strategic objectives are identical, the only difference is that Brzezinski has made a course correction based on changing circumstances and the growing resistance to US bullying, domination and sanctions. We have not yet reached the tipping point for US primacy, but that day is fast approaching and Brzezinski knows it. In contrast, Clinton is still fully-committed to expanding US hegemony across Asia. She doesn’t understand the risks this poses for the country or the world. She’s going to persist with the interventions until the US war-making juggernaut is stopped dead-in-its-tracks which, judging by her hyperbolic rhetoric, will probably happen some time in her first term. Brzezinski presents a rational but self-serving plan to climb-down, minimize future conflicts, avoid a nuclear conflagration and preserve the global order. (aka–The “dollar system”) But will bloodthirsty Hillary follow his advice? |

| Posted: 26 Aug 2016 06:00 PM PDT Nearly two years ago we wrote about how the largest pension fund in the world had been hijacked by political hacks in what would be a futile effort to prop up stocks in the "first failed Keynesian state, Japan." The post came in response to Japan's Government Pension Investment Fund announcing that it would slash its fixed income portfolio to double its target allocation to domestic and foreign equities, in essence, going outright long Central Banks.

Then, last month after the GPIF reported it's biggest fiscal year loss since the "great recession", a mere 5.3 trillion yen ($53 billion), we asked whether the pension fund had finally learned it's lesson. Would fund managers finally resort back to their original goal or preserving retiree wealth or continue in their failed efforts to prop up Japanese stocks. Alas, we concluded that maintaining the status quo was the most likely path forward.

Which brings us to today and the announcement of further staggering losses on the $1.3 trillion portfolio of the GPIF. Today the pension announced it lost 5.2 trillion yen ($52 billion) in 2Q 2016, or roughly 4% of their 129.7 trillion yen ($1.3 trillion) in assets. Not to rub it in too much, but that brings the rolling 4Q losses to an aggregate of nearly 13 trillion yen or $130 billion.

As Bloomberg points out, GPIF held 21 percent of investments in local stocks at the end of June, and 39 percent in domestic bonds. Overseas equities made up 21 percent of assets, while foreign debt accounted for 13 percent. Alternative investments were 0.05 percent of holdings, down from 0.06 percent at the end of March. GPIF targets allocations of 25 percent each for Japanese and overseas stocks, 35 percent for local bonds and 15 percent for foreign debt. Therefore, GPIF returns are not terribly surprising given that ~21% of assets, or $275BN, are allocated to Japanese equities which haven't performed all that well over the past year. In fact, Japanese stocks are down about 22% in the past 12 months which represents about $60BN of losses or 4.5% of GPIF assets.

In case you're the "hopelessly optimistic" type, the Wall Street Journal points out the GPIF has no intentions of admitting failure and reverting back to a reasonable asset allocation model that might have some hope in preserving pensions for Japan's retirees. No, as deputy director-general of investment strategy, Shinichiro Mori, points out, the GPIF will maintain the status quo as "stock markets are on a recovery trend."

Well, if at first you don't succeed... |

| China's Great Divide: A New Cultural Revolution? Posted: 26 Aug 2016 05:30 PM PDT Submitted by Charles Hugh-Smith via OfTwoMinds blog, The only question left for China (and every other debt/bubble-dependent nation) is what socio-political consequences will manifest when the credit bubble finally bursts? In Asia, it's generally seen as unpatriotic to criticize one's country in public, even if you disagree with its direction and leadership. The cultural norm is to maintain the "face" of one's country by hiding its ills from outsiders. This reticence is especially evident in China, which suffers from the memory of being subjugated by the Western imperialist powers in the late 19th century and early 20th century. As a general rule, you will rarely hear any profound criticism of China unless you are considered a trusted friend; giving China a black eye in public is frowned upon, even by its domestic critics. For this reason, the majority of the Western media has very little grasp of what worries Chinese people. Recently, I have heard fears of a Second Cultural Revolution being expressed in private. There is a Great Divide between generations in China: on the one side is the older generation that remembers the Maoist era with some nostalgia and the terrible adversities of the Cultural Revolution (1966 - 1976). On the other side is the young educated, prosperous generation which has only known consumerist prosperity and personal advancement. The ideals of the old communes are an abstraction to the young generation, as are the terrible costs of the Cultural Revolution. A resurgence of devotion to Mao has caught authorities off-guard; they can't very well suppress public displays of secular worship of the Party's founder, but raising Mao's revolutionary ideals from the dustbin of history implicitly challenges the Party's current leadership. The older generation resents the young consumer-obsessed generation, and some would like to purge China of the excesses of wealth and consumerism. It's not too difficult to see how rising unemployment (China's Hidden Unemployment Rate) and China's enormous wealth inequality could spark a new Cultural Revolution that would target Party leaders who have benefited from the state-managed neoliberal capitalism that has greatly enriched the leaders and their family dynasties. In effect, a return to the party's Maoist roots would open divisive fissures in the Party and the nation. Farfetched? Perhaps not as much as the conventional sugar-coated media representation would suggest. The status quo solution (in China, the U.S., Japan, the E.U., etc. etc.) to a weakening bubble-dependent economy is to inflate another even bigger bubble. If debt reached extremes that imploded, the solution is to expand debt far beyond the levels that triggered the implosion. If fudging the numbers triggered a loss of confidence, the solution is to fudge the numbers even more, so they no longer reflect reality at all. If the masses protest their powerlessness, the solution is to push them further from the centers of power. And so on. This blowing new bubbles to replace the ones that popped works for a while, but at the expense of systemic stability. Each new bubble requires pushing the system to new extremes that increase the risk of instability and collapse. In other words, the stability of the new bubble is temporary and thus illusory. The processes used to inflate the new bubble suffer from diminishing returns. The nature of stimulus-response is that overuse of the stimulus leads to diminishing responses. This is a structural feature that cannot be massaged away. Goosing public confidence in the status quo with phony statistics and rigged markets works splendidly the first time, less so the second time, and barely at all the third time. Why is this so? The distance between reality and the bubble construct is now so great that the disconnection from reality is self-evident to anyone not marveling at the finery of the Emperor's non-existent clothing. The system habituates to the higher stimulus. If the drug/debt has lost its effectiveness, a higher dose is needed. This is the progression of serial bubbles. Then the system habituates to the higher dose/debt, and the next expansion of debt must be even greater. This dynamic can be visualized as The Rising Wedge Model of Breakdown, which builds on the well-known Ratchet Effect: the system is greased for easy expansion of debt, leverage, employees, etc., but it has no mechanism to allow contraction. Any contraction triggers systemic collapse.

The only question left for China (and every other debt/bubble-dependent nation) is what socio-political consequences will manifest when the credit bubble finally bursts? The answer will arise from the unique interplay of history, social norms and central-state actions in each nation-state as the crisis deepens. In China, the two revolutions--the Communist victory of 1949 and the now-suppressed Cultural Revolution of 1966 - 1976-- will both loom large--perhaps far larger than the current regime would like. This essay was drawn from Musings Report 28. The Musings Reports are emailed weekly to subscribers ($5/month) and major contributors ($50+ annually). If you'd like to support this blog, please consider subscribing. My new book is #9 on Kindle short reads -> politics and social science: Why Our Status Quo Failed and Is Beyond Reform ($3.95 Kindle ebook, $8.95 print edition) For more, please visit the book's website. |

| Prophecy Update End Time Headlines 8/26/16 Posted: 26 Aug 2016 03:30 PM PDT A fast paced highlight and review of the major news stories and headlines that relate to Bible Prophecy and the End Times… The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| WAKE UP CALL: Our Entire World is Going To Change -- BILL HOLTER Posted: 26 Aug 2016 03:01 PM PDT The cartel hit gold hard again on Wednesday selling $1.5 BILLION is paper gold into the market in ONE MINUTE and as JS Mineset's Bill Holter notes, "$1.5 Billion of gold is close to 2% of global production and to see that sold in one minute is laughable. Who has that amount of gold to sell? And the... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Posted: 26 Aug 2016 02:52 PM PDT SafeHaven |

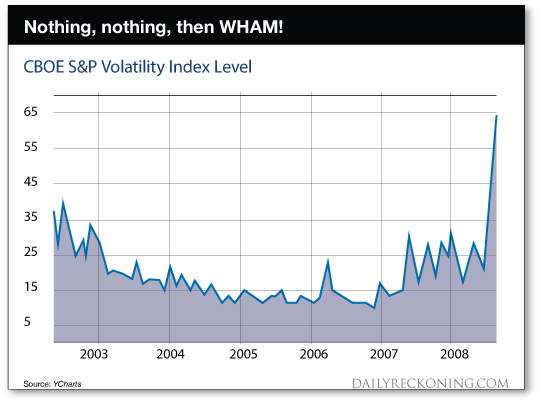

| The Market’s Being Set Up For A Hard Fall Posted: 26 Aug 2016 02:38 PM PDT This post The Market's Being Set Up For A Hard Fall appeared first on Daily Reckoning. The market's melt-up since the Feb. 11 interim low has been positively surreal. It has gone up 19% since that February low of 1,829 on the S&P 500. But there's nothing sustainable about it. This latest rebound was the work of eyes-wide-shut day traders and robo-machines surfing on a thinner and thinner cushion of momentum. What comes next, in fact, is exactly what happens when you stop pedaling your bicycle. Momentum gets exhausted, gravity takes over and the illusion of stability is painfully shattered. The simple truth is, the Fed's long-running interest rate repression policies have caused systematic, persistent and massive falsification of prices all along the yield curve and throughout all sectors of the financial market. The Fed is just systematically juicing the gamblers, and thereby fueling ever greater mispricing of financial assets and ever more dangerous and explosive financial bubbles. What we're seeing now is the illusion of stability. During this year's final pulse of the great stock market bubble of 2009–2016, the illusion of stability was reflected in the complete collapse of the VIX Index or, as it is often called, the fear gauge. Take a look at a chart from the last cycle, culminating in the crash of 2008. The Greenspan housing, credit and stock market bubbles were inflating. At the same time, volatility was steadily drained out of the market by increasingly more bullish and complacent traders. Accordingly, between the stock market's bottom in September 2002 and the first hints of the subprime crisis in February 2007, the VIX Index dropped relentlessly. In fact, it was then down by 75% to a bottom index value of 10.2 on the eve of the mortgage crisis. When the financial bubbles began to implode, however, the VIX exploded. By Oct. 28, 2008 it had risen by 550%. Traders who saw it coming and got long volatility, or "vol," made a fortune.

It just so happens that during the last few weeks, the VIX came close to its early 2007 low, touching 10.8 on an intraday basis. That meant that it had declined by 62% from its Feb. 11 level — and it had declined by 58% from its dramatic late-June spike at the time of the Brexit surprise. In a word, by mid-August, the casino had become so complacent and fearless that you needed a motion detector to identify signs of life. At approximately noon on Aug. 16, in fact, the VIX Index literally did not move for upward of an hour. Things are almost laughably quiet right now. Fed funds futures are now showing a 32% chance of a September rate hike, despite the latest "good" jobs report and other supposedly good economic news. That's up substantially from where it was just a few weeks ago, but it's still just one in three. But the larger question is why a tiny bump in interest rates should even matter at all. After seven years of zero or next to zero interest rates, it must be truly wondered how supposedly rational adults can obsess over whether the another tiny smidgeon of a rate increase should be permitted this year or next, or whether the economy can tolerate a rise in the funds rate from 38 bps to 63 bps when it finally does move. The difference is just irrelevant noise to the main street economy. It can't possibly impact the economic calculus of a single household or business! But then, again, the Fed doesn't serve the main street economy. It lives to pleasure Wall Street. Having pinned the money market rate at the zero bound for so long and with such an unending stream of ever-changing and silly excuses, the occupants of the Eccles Building are truly lost. They do not even fathom that they are engaging in a word-splitting exercise no more meaningful to the main street economy than counting angels on the head of a pin. Indeed, if they weren't mesmerized by their own ritual incantation they would not presume for a moment that fractional changes of the money market rate away from ZIRP would have any impact on main street borrowing, spending, investing and growth. So why does the Fed persist in this farcical minuet around ZIRP? The principal reasons are not at all hard to discern. In the first instance, the Fed is caught in a time warp and fails to comprehend that the game of bicycling interest rates to heat and cool the macro-economy is over and done. The credit channel of monetary transmission has fallen victim to "Peak Debt." This means that the main street economy no longer gets a temporary pick-me-up from cheap interest rates because with tapped out balance sheets they have no further ability to borrow. The only actual increases in household debt since the financial crisis has been for student loans, which are guaranteed by Uncle Sam's balance sheet, and auto loans which are collateralized by over-valued vehicles. Stated differently, home equity was tapped out last time and wage and salary incomes have been fully leveraged for years. So households have nothing else left to hock. Accordingly, they now only spend what they earn, meaning that the Fed's interest rate manipulations — which had potency 40 years ago — have no impact at all today. Keynesian monetary policy through the crude tool of money market rate pegging was always a one-time parlor trick. Then why on earth do our monetary central planners cling so desperately to ZIRP? The answer is they appear to believe that cheap money might still do a smidgeon of good. Besides, it hasn't caused any consumer price inflation, or at least that's what they contend — so where is the harm? Well, yes. Doing a rain dance neither causes harm nor rain. Yet there is a huge difference. Zero interest rates are not even remotely harmless. They amount to a colossal economic battering ram because they transform capital markets into gambling casinos. And the complacent casino is being set up for a fall when the battering ram hits. The Fed is out of dry powder and out of time. And it could easily spook the market at its upcoming meeting on Sept. 20–21. After what will be 93 months crouched on the zero bound, it will have no excuse not to raise rates by 25 basis points. Especially if it continues to be deluded by the false and lagging indicators of the BLS jobs report. But the market has most definitely not "priced in" a rate hike. It will sell off violently if the Fed goes ahead and raises rates. This has been recently suggested by its key rate strategist and Goldman man on the case, Bill Dudley, president of the New York Fed. On the other hand, if it punts until another time, that decision will come with new concerns. Concerns that continuing head winds from China, Europe and the rest of the world have the potential to seriously harm the struggling domestic recovery. Even the day traders and robo-machines must know that the Fed is out of dry powder. It cannot go to subzero interest rates without triggering a Donald Trump-led domestic political conflagration. Nor can it abruptly shift to a huge new round of QE without confessing that $3.5 trillion of the same has been for naught. In short, if it fails to raise rates and even hints at the risk of domestic recession, there will be pandemonium in the casino. The gamblers recognize that there will be no monetary fire brigade waiting at the exits. Either way, Sept. 21 will be a day of reckoning. This time, I believe that the Fed's desperate last resort to verbal intervention will fail, causing a market now living off the fumes of momentum to hit the skids. Another September event could trigger volatility as well. On Sept. 26, Trump and Hillary will have their first presidential debate. The results of this debate could also blindside the market because at the moment Hillary Clinton is considered to be a shoo-in. I beg to differ and have some personal experience with respect to what might be an October surprise. Back in 1980 I was actually Ronald Reagan's sparring partner in his Jimmy Carter debate rehearsals. I saw what can happen when a candidate finally gets the pulse of the country and scores big in the Presidential debates. Reagan did that and came from way behind to win. There is no telling what Donald Trump will do, but at this stage of the game there is absolutely no reason to think that the market has it right and that Hillary has it in the bag. Regards, David Stockman Ed. Note: Sign up for your FREE subscription to The Daily Reckoning, and you'll start receiving regular offers for specific profit opportunities. By taking advantage now, your ensuring that you'll be financially secure later. Best to start right away. The post The Market's Being Set Up For A Hard Fall appeared first on Daily Reckoning. |

| Gold Junior Stocks Q2 2016 Fundamentals Posted: 26 Aug 2016 01:14 PM PDT The junior gold miners and explorers have soared dramatically in an amazing year, before falling hard this week. This sharp correction is doing its job in rebalancing bull-market sentiment, crushing greed and leaving traders wary of this sector. But gold juniors’ recently-released second-quarter financial and operational results prove their fundamentals are strengthening dramatically, a very bullish omen for stock prices. The junior gold stocks are rightfully considered the Wild West of the gold sector. Most of the hundreds and hundreds of these small companies won’t prove successful. They won’t be able to secure funding to explore sufficiently, won’t be fortunate enough to find an economic deposit of gold to mine, or won’t be able to make the herculean leap from explorer to miner. The odds are stacked heavily against the gold juniors. |

| What The Federal Reserve Really Is Posted: 26 Aug 2016 01:00 PM PDT This post What The Federal Reserve Really Is appeared first on Daily Reckoning. Investors and analysts throw around the term "Fed" without much reflection on what the Federal Reserve actually is and is not. It's important to understand the Fed's structure as a prelude to understanding its policy process. Knowing how the central bank is organized and who's in charge can position you to preserve wealth and even profit from the coming Fed-induced turmoil. The Federal Reserve is not a single central bank, but a system of twelve regional reserve banks under the supervision of a board of governors in Washington DC. This central body is called The Board of Governors of the Federal Reserve System. It has a chairperson, currently Janet Yellen, and a vice chairperson, currently Stanley Fischer.  Janet Yellen Swearing In In addition, there are five other governors for a total of seven people on the board. Right now, there are two vacancies (and no pending nominees to fill the vacancies), so the entire board consists of five individuals: Yellen, Fischer, Lael Brainard, Daniel Tarullo, and Jerome Powell. The chair, vice chair, and governors are nominated by the president of the United States subject to Senate confirmation. Governors serve fourteen-year terms (although many resign from the board before those terms expire). The chair and vice chair have four-year terms, and concurrently serve fourteen-year terms as governors. It's unusual for a chair to remain as a governor if not reappointed for a new term as chair, but it has happened. While the board of governors oversees the "system," they are not in charge of any particular bank. The banking is left to the twelve regional reserve banks located in major cities such as Boston, New York, Philadelphia, Chicago, and San Francisco. The reserve banks are privately owned by the commercial banks in each district. For example, Citibank and JPMorgan are shareholders in the Federal Reserve Bank of New York because those banks have their headquarters in the Fed's Second District, which includes New York. Since the regional reserve banks are privately owned, they elect their own boards of directors based on voting by the private member banks. In turn, these boards hire the president of each bank. This has sometimes given rise to charges of conflict of interest because shareholders are, in effect, hiring their own regulator. It's Just Business As Usual At The Fed.This conflict came to a head with the hiring of William Dudley as President of the Federal Reserve Bank of New York. Dudley is a former partner with Goldman Sachs. The New York Fed has direct supervisory authority over Goldman. Stephen Friedman, another former Goldman partner, was Chairman of the Board of Directors of the New York Fed at the time Dudley was hired. The conflict is obvious, yet little was said or done about it.  Federal Reserve Member Plaque The set-up of twelve regional reserve banks is a throwback to a time when business conditions varied widely in the United States, and news traveled slowly. In 1915, a few years after the Fed was created, it was entirely possible to have tight money in Kansas City if drought conditions prevailed and farmers were failing to meet mortgage commitments. At the same time, there could be easy money in Boston if exports of manufactured goods were producing gold inflows. The president of the Federal Reserve Bank of San Francisco might bring news of immigration patterns that affected labor market conditions. Each regional reserve bank could set its own discount rate to reflect local conditions and implement monetary tightness or ease as needed. Today, This History Seems Quaint.News on business conditions travels instantaneously. Technically regional reserve banks can vary their discount rates, but this never happens in practice. Banks borrow in the Fed funds market, and if slight differences in rates emerge, they are arbitraged away immediately by computer driven trading. Nevertheless, the structure of twelve regional reserve banks continues. This means that twelve regional reserve bank presidents dutifully descend on Washington for each Fed meeting even though they have little to offer except their own opinions based on obsolete models. There is one exception to this description of the regional reserve bank presidents. That exception is the president of the Federal Reserve Bank of New York. While interest rate policy decisions are made in Washington, they are carried out by the open-market trading desk in New York. This gives the New York Fed unique power to affect money markets that the other regional reserve banks do not have.  Federal Reserve Board Building That's the basic arrangement. You have a Board of Governors in Washington who have power, but no bank. You have eleven regional reserve banks around the country who are privately owned, but have little power. Finally you have one regional reserve bank in New York that is controlled by the largest private banks, has considerable market power, but carries out the wishes of the Board. If you think this sounds convoluted, you're right. Rube Goldberg could not have done a better job of designing a system that makes no sense. Yet, much of this convoluted design is intentional, and is intended to obscure the real workings of monetary policy from everyday Americans. When conspiracy theorists and bloggers get carried away, they point to the big bank cronyism that emerges from this system. Elites like that just fine because the conspiracy mongers are easy to dismiss. Truth is always stranger than fiction. Regards, Jim Rickards Ed. Note: Sign up for your FREE subscription to The Daily Reckoning, and you'll start receiving regular offers for specific profit opportunities. By taking advantage now, you’re ensuring that you'll be financially secure later. Start right away.

The post What The Federal Reserve Really Is appeared first on Daily Reckoning. |

| Hillary’s health: Clinton emails obsessed with sleep,“exotic drugs” Posted: 26 Aug 2016 12:36 PM PDT Ezra Levant of TheRebel.media typed "sleep" into a searchable archive of Hillary Clinton's emails and uncovered disturbing medical info about the would-be president. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| EUR-USD pattern still on track Posted: 26 Aug 2016 12:26 PM PDT The Euro has spent the last year consolidating against the US Dollar, however it appears as though this long consolidation was just a breather in a longer term down trend. Our updated daily forecast pattern below, shows how we think this consolidation will end during the next few months. |

| Buy Gold’s August Dip? Gold’s Monthly Sweet Spot In September Posted: 26 Aug 2016 12:22 PM PDT Gold bullion has had its biggest gains in September over the past 20 years. Seasonally gold is entering the sweet spot with the Autumn being gold’s best season and with September being gold’s best month in the last 20 years. |

| The Impact of Brexit on the U.S. Economy and Gold Market Posted: 26 Aug 2016 12:17 PM PDT In the previous edition of the Market Overview, we analyzed briefly the consequences of Brexit vote. We stated that “the most important economic effect of the Brexit vote is so far a significant rise in uncertainty”. It applies particularly to the political future of Great Britain (Will the UK disintegrate? Will the UK really exit from the EU? When and how will it happen?) and the European Union (Will the EU break apart?). However, Brexit could also hurt the U.S. economy. This is why we would like to focus on the impact of Brexit on the U.S. economy and the gold market. |

| John Stossel On The Insanity Of Today's Democrats Posted: 26 Aug 2016 11:40 AM PDT Stossel on Fox Business 7/29/2016 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Posted: 26 Aug 2016 10:31 AM PDT Jim/Bill, In days like today, where gold is trashed on the paper Comex, I keep my wits about me by always relying on my definition of gold: It functions as a mirror for 2 things- -a guage of fear in the marketplace. -a measure of confidence in all things finance, including but not limited to... Read more » The post Jim’s Mailbox appeared first on Jim Sinclair's Mineset. |

| The New Power Elite Part II: The U.S. and China Escalate Energy War Posted: 26 Aug 2016 10:30 AM PDT This post The New Power Elite Part II: The U.S. and China Escalate Energy War appeared first on Daily Reckoning. [Editor's Note: If you haven't read part I, please click here now…] Most of the New Power Elite in the U.S. hails from Silicon Valley. The first person to talk about is the omnipresent Elon Musk. He is Rockefeller, Morgan and Ford all in one — he has melded together currency, transportation and energy in a 21st-century way. Musk made his first fortune as a cofounder of PayPal, which processes the exchange of money. He chairs and co-founded Tesla, which is innovatively the Ford Model T. He is also the chairman of SolarCity, the publicly traded solar panel designer and installer run by his cousin, Lyndon Rive. His pending merger announcement of Tesla and SolarCity will join clean transportation and energy. Not coincidentally, SolarCity's Executive Vice President of Global Capital Markets, J. Radford Small, was at Goldman Sachs for 17 years. And the underwriters Elon Musk is using on the Tesla/SolarCity deal? Goldman Sachs and Morgan Stanley. Musk is the modern version of the original robber barons. Expansion of his power is a fresh take on an old play. There's also the "Breakthrough Energy Coalition," which includes Microsoft co-founder Bill Gates, Facebook co-founder and chief executive Mark Zuckerberg, and Jeff Bezos, founder of Amazon. During the UN economic conference in Paris last winter, this group announced they would mainly invest in early-stage sustainable energy companies. The New Power Elite need energy to run their businesses. If they can harness new forms of energy, they don't have to compete with the fossil fuel crowd or their legacies. And like their past counterparts, the New Power Elite can influence governments and policy without holding public office. They don't need to be in the inner beltway to call the shots — they create the systems that monitor and share the information behind the scenes. They are investing in sustainability not only because it's profitable, but because it's a path to greater influence in general. China's Next Two Moves Against the U.S.China is challenging the U.S. for world influence right now. First, China is leading the way in wind, solar and associated investments, domestically and abroad. While being environmentally conscious and providing sustainable energy is good for PR and air quality, there is more to it than that. Geopolitics is strategically important and always at work — now more than ever. The competition between China and the U.S. can break depending on who has power over "dirty" energy and who can find alternatives to diffuse that power. It is all a power play, and that's how you should be reading U.S. and China economic and energy headlines. China has a long-term view of the global dominance offered by the shifting power paradigm. Central banking is the second key to this shift. China is undermining U.S. dominance by making the yuan a viable option to replace the dollar as the world currency. The 2008 financial crisis destabilized global finance and accelerated China's moves toward power and autonomy in the world. They want to get away from the fragile U.S. and European banking system and its central bank enablers. China was able to use the fallout to further jockey for its position as a global super power with respect to currency and energy. From my recent travels, I know that China has two target dates for certain global displays of their new power: the fast approaching G20 meetings and the 2022 Olympics. G20 Game ChangerThe G20 is the most urgent. China is hosting the G20 leaders on Sept. 4 and 5, 2016 in Hangzhou, Zhejiang. This will be the first official G20 summit hosted in China. According to one of my sources, China is spending around 100 billion yuan to make Hangzhou look and feel amazing for the G20 meetings. They want the G20 leaders (and the rest of the world) to see China at its best.

One main topic on the docket for the G20 meetings in September will be the fallout of Brexit and ensuring stability in the currency and financial markets. Hand in hand will be the inclusion of the yuan in the IMF's Special Drawing Right (SDR) basket. This is a huge move for China to gain power over the dollar. In addition to the yuan joining the SDR, the second focus, at China's insistence, will be sustainable energy. Chinese Minister of Foreign Affairs, Wang Yi, recently said at a press conference, "China will promote the G20 to take the lead in pursuing cooperation for sustainable development throughout the world in a bid to bridge the development gap." He wants to "accelerate the process of consolidation and the ratifying procedures of the Paris Agreement on climate change." In an ironic twist, given its former bad rap on clean air, China's superpower aspirations are paving the way for them to insert sustainable development into the G20 agenda by bringing the UN's 2030 Agenda to the table. While playing host to the G20, China will spearhead discussion on green bonds. Before the Hangzhou event regarding green bonds, China will hold a meeting with the NDB, based in Shanghai. Eastern countries picture Shanghai as an emerging financial hub and it appears to be quickly over-taking Hong Kong in terms of international attention and national growth — and buzz. I met with Mr. Paulo Nogueira Batista, Vice-President of the NDB, at its headquarters. Mr. Batista was the executive director at the IMF, representing Brazil and 10 other countries for eight years. He was also a key architect of the NDB after the financial crisis of 2008. The NDB was created to "support public or private projects through loans, guarantees, equity participation and other financial instruments." We met opposite the Shanghai Tower, the second-tallest building in the word, and one that promotes itself as the greenest. There, we discussed China's dedication to leading the way in sustainable energy. Regarding sustainable projects and investments, Mr. Batista told me:

Paulo Nogueira Batista, VP of the New Development Bank, previously the executive director of the IMF together with Nomi Prins The NDB isn't just financing green projects for its members. It's also the first major development bank putting its money where its mouth is — which spells demand for green bonds. "Our own assets," he said, "will be invested in green bonds — two-thirds of our proceeds will be in sustainable infrastructure." On July 18 2016, the NDB issued its first green bond, as Mr. Batista noted— a $449 million yuan-denominated green bond — into China's interbank market. It is the first green bond from a development agency with a lead underwriter that is not a U.S. or European bank, but instead, the Bank of China. China currently leads the world in the sale of green debt and has helped push global green issuance in the first part of 2016 to equal the full-year total of 2015, according to my sources at the Asian Development Bank. On July 6 2016, the Bank of China sold $3.03 billion in new green bonds, the largest international issuance of its kind. The issuance was the first to be made in three currencies — a $2.25 billion tranche, a €500 million tranche and one issued in New York totaling 1.5 billion in offshore renminbi. It was also the first green bond offering from Asia to be made in Europe. Green bonds have benefits beyond their greenness — they have tax advantages and take advantage of longer term investment strategies, in a similar way to gold. Beijing's Olympic MakeoverHaving walked around Beijing, I can tell you that pollution is troubling. Combatting it is something the Chinese government has aspired to since the 2008 Beijing Olympics.  Nomi Prins in Tiananmen Square in July 2016 In my talks with city locals, I learned that the government planted trees and grass around the city with a vengeance before those Games. Beijing will host the 2022 Winter Olympics. If trees and air quality were of concern before, the Chinese government is even more focused on the future Games. It will be the first city to host both the Summer and Winter Olympics. It will be the largest city ever to host the Winter Olympics. After the Paris climate change conference in 2015, China has stated its goal to reduce emissions of major pollutants in the power sector by 60% by 2020. Sustainability, clean energy and green bonds are matters of national pride and power. With these factors, the Olympics will provide a vantage point for the world to revisit how China has progressed on sustainable energy. China, in its renaissance as a new global power, will increasingly rely on renewable and sustainable energy to drive its economy and those of its key allies and trading partners. Currently China is "the world leader in wind power, accounting for about one in every three turbines currently installed," according to the Global Wind Energy Council. Solar power generation capacity was up 74% in China last year compared with 2014 levels. There are major implications in all of these changes, and opportunities to understand the energy wars. Regards, Nomi Prins Ed. note: "A charmingly mordant take on the stock news of the day, accentuated by philosophical maunderings…" That's how one leading financial magazine described the free daily email edition of The Daily Reckoning. You'll find cutting-edge analysis from the complex worlds of finance, politics and culture. Presented in an entertaining style few can match. Click here now to sign up for FREE. The post The New Power Elite Part II: The U.S. and China Escalate Energy War appeared first on Daily Reckoning. |

| Julian Assange - Hillary's October Surprise Posted: 26 Aug 2016 09:12 AM PDT Julian Assange is preparing to release new information from hacked Hillary emails. Megyn Kelly. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Posted: 26 Aug 2016 08:41 AM PDT The case for owning precious metals has already been made. We live in a world of unprecedented and ever expanding debt, devaluing fiat currencies and negative interest rates. Even Wall Street’s heralded “Bond King”, Bill Gross, now admits the world will continue to have difficulty paying its debts without further price inflations. Investors wisely seeking exposure to precious metals must deliberate between the convenience of buying shares of an electronically traded fund (ETF) and the ultimate security of owning physical gold and silver bullion. We tasked ourselves to take a closer look at each to understand their important distinctions. |

| Former Fed Governor Warsh admits that the central bank manipulates markets Posted: 26 Aug 2016 08:39 AM PDT Adjudicating GATA's freedom-of-information claim against the Federal Reserve when he was a member of the Fed's Borad of Governors in 2009, the author revealed that the Fed has secret gold swap arrangements with foreign banks -- -- a business about which New York Fed President William Dudley refused to answer questions five months ago: http://www.gata.org/node/16341 * * * The Federal Reserve Needs New Thinking By Kevin Warsh http://www.wsj.com/articles/the-federal-reserve-needs-new-thinking-14720... The conduct of monetary policy in recent years has been deeply flawed. U.S. economic growth lags prior recoveries, falling short of forecasts and deteriorating in the most recent quarters. This week in Jackson Hole, Wyoming, the Federal Reserve Bank of Kansas City hosts the world's leading central bankers and academics to consider monetary reform. The task is timely and consequential, but the Fed needs a broader reform agenda. Policy makers around the world neither predicted nor can adequately explain the reasons for current inflation readings below their targets. So it is puzzling that so many academics are pushing to raise the current 2% inflation target to a higher target of 3% or 4%. In the telling of the economics guild, the Fed's leaders should descend from the Grand Tetons with supreme assurance that their latest monetary policy invention will remedy the economy's ills. ... Dispatch continues below ... ADVERTISEMENT The Gold Mine Barrick Might Regret Having Sold K92 Mining is poised for production at its Papua New Guinea gold project and has just listed on the Toronto Venture exchange under the symbol KNT.V. The gold mining startup came together during one of the toughest periods in mining history. K92's main asset is the Kainantu project, a large high-grade gold resource with extensive infrastructure including underground mine development, a mill processing facility, a fully permitted tailings pond, and paved roads. The infrastructure means K92 can aim to restart mining in the near term with minimal capital costs and seek to grow through cash-flow funded exploration on the roughly 405-square kilometer property, considered prospective for additional discoveries. For more information, please visit: https://ceo.ca/@tommy/the-gold-mine-barrick-might-regret-selling The Fed's leaders should not take the bait. Raising the inflation target is a bad idea being considered at the wrong time for the wrong reasons. A new inflation target would undermine the Fed's commitment to any policy framework. It would please the denizens of Wall Street who pine for still-looser Fed policy. And households would be understandably miffed to receive a new lecture on unconventional monetary policy -- this one on the benefits of higher prices. A change in inflation targets would also add to the growing list of excuses that rationalize the economic malaise: the persistent headwinds from the crisis of the prior decade, the high-sounding slogan of "secular stagnation," and the convenient recent alibi of Brexit. A numeric change in the inflation target isn't real reform. It serves more as subterfuge to distract from monetary, regulatory, and fiscal errors. A robust reform agenda requires more rigorous review of recent policy choices and significant changes in the Fed's tools, strategies, communications, and governance. Two major obstacles must be overcome: groupthink within the academic economics guild, and the reluctance of central bankers to cede their new power. First, the economics guild pushed ill-considered new dogmas into the mainstream of monetary policy. The Fed's mantra of data-dependence causes erratic policy lurches in response to noisy data. Its medium-term policy objectives are at odds with its compulsion to keep asset prices elevated. Its inflation objectives are far more precise than the residual measurement error. Its output-gap economic models are troublingly unreliable. The Fed seeks to fix interest rates and control foreign-exchange rates simultaneously -- an impossible task with the free flow of capital. Its "forward guidance," promising low interest rates well into the future, offers ambiguity in the name of clarity. It licenses a cacophony of communications in the name of transparency. And it expresses grave concern about income inequality while refusing to acknowledge that its policies unfairly increased asset inequality. The Fed often treats financial markets as a beast to be tamed, a cub to be coddled, or a market to be manipulated. It appears in thrall to financial markets, and financial markets are in thrall to the Fed, but only one will get the last word. A simple, troubling fact: From the beginning of 2008 to the present, more than half of the increase in the value of the S&P 500 occurred on the day of Federal Open Market Committee decisions. The groupthink gathers adherents even as its successes become harder to find. The guild tightens its grip when it should open its mind to new data sources, new analytics, new economic models, new communication strategies, and a new paradigm for policy. The second obstacle to real reform is no less challenging. Real reform should reverse the trend that makes the Fed a general purpose agency of government. Many guild members believe that central bankers -- nonpartisan, high-minded experts -- are particularly well-suited to expand their policy remit. They fail to recognize that central bank power is permissible in a democracy only when its scope is limited, its track record strong, and its accountability assured. The Fed is suffering from a marked downturn in public support. Citizens are rightly concerned about the concentration of economic power at the central bank. Long after the financial crisis, the Fed holds trillions of dollars of assets that would otherwise be in private hands. And it appears to make monetary policy with the purpose of managing financial asset prices, including bolstering the share prices of public companies. With the enactment of the Dodd-Frank Act, the Fed claims the mantle of reform. It now micromanages big banks and effectively caps their rate of return. The biggest banks' growth in market share corresponds to that of their principal regulator. They are joint-venture partners with the Fed, serving as quasi-public utilities. As the dispenser of fault and favor, the Fed is contributing to the public perception of an unfair, inequitable economic system. Real reform this is not. Most gathered in Jackson Hole will judge that the Fed's aggressive actions are necessary and wise. Even if that were true, the Fed finds itself in an increasingly untenable position. Congress will tag the Fed for its failures, and the public will assail the Fed for favoritism for its ostensible successes. In the best of circumstances, the U.S. economy will accelerate to "escape velocity." In that event the Fed might get the benefit of the public doubt. If, as is more likely, the economy is closer to recession than resurgence, the Fed is poorly positioned to respond with force, efficacy, and credibility. The Fed is vulnerable. Its recent centennial as our nation's central bank should not be confused with its permanent acceptance in the American political system. ----- Mr. Warsh, a former member of the Federal Reserve board, is a distinguished visiting fellow in economics at Stanford University's Hoover Institution. Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Ronan Manly: Is any gold still stored at U.S. Mint in Denver? Posted: 26 Aug 2016 08:17 AM PDT 11:15a ET Friday, August 26, 2016 Dear Friend of GATA and Gold: Gold researcher Ronan Manly reports today that the U.S. Mint has made a subtle change in its monthly reports, which now indicate that no gold is being stored at the Denver mint. Manly infers from this that all U.S. government gold now is being held at the Army installations at Fort Knox in Kentucky and West Point in New York and that, as fund manager and geopolitical analyst James G. Rickards contends, all the gold is essentially under the Army's control. Manly's report is headlined "Is There Any Gold Bullion Stored at the U.S. Mint in Denver?" and it's posted at Bullion Star here: https://www.bullionstar.com/blogs/ronan-manly/gold-bullion-stored-us-min... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: New Orleans Investment Conference Help GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |