saveyourassetsfirst3 |

- Gold - Eerie Pattern Repetition Revisited

- The COT Report Is Still Bearish For Gold Investors, But There Was Something Important In It For The Bulls

- Oil And The U.S. Dollar: What's Wagging What?

- Dollar Rallies With Stocks And Bonds

- Harvey Organ: MASSIVE UPSIDE- OUTSIDE REVERSAL DAY IN GOLD & SILVER!!

- ‘We've been through two revolutions’: Centamin boss Andrew Pardey on mining gold in Egypt

- Gold Bull Confirmed: What Next?

- Jason Zweig: Still Wrong on Gold

- Outside Reversal For Gold and Silver – “We’re Likely to See MUCH Higher Prices…”

- Breaking News And Best Of The Web

- Jason Zweig: Still Wrong on Gold

- “Real Hell For the Shorts” Eric Sprott On HUGE Move in Gold and Silver Prices

- Silver & Gold : Trade of the Year? – Mike Maloney

- Financial Analyst Warns: “Millions Will Die” When Financial System Collapses

- BTFD! Gold and Silver Smashed On NFP, Scream Right Back On Dip Buying

- Sweden’s Largest Gold and Silver Dealer’s Bank Accounts Closed, Shut Out of Banking System!

- The CATALYST For Economic Collapse

- STUNNING Chart Shows Silver Prices Could Be Headed to $700/oz!!

- If Silver Breaks Through This Threshold This Week, WATCH OUT!

| Gold - Eerie Pattern Repetition Revisited Posted: 09 Jul 2016 01:46 PM PDT |

| Posted: 09 Jul 2016 01:43 PM PDT |

| Oil And The U.S. Dollar: What's Wagging What? Posted: 09 Jul 2016 08:01 AM PDT |

| Dollar Rallies With Stocks And Bonds Posted: 09 Jul 2016 07:49 AM PDT |

| Harvey Organ: MASSIVE UPSIDE- OUTSIDE REVERSAL DAY IN GOLD & SILVER!! Posted: 09 Jul 2016 05:00 AM PDT MASSIVE UPSIDE-OUTSIDE DAY REVERSALS IN BOTH GOLD AND SILVER AND THUS EXTREMELY BULLISH JULY GOLD STANDING RISES TO OVER 16 TONNES/HUGE BANK IN GERMAN : BREMEN LANDESBANK ABOUT TO FAIL/GOLD FINISHES AT $1366 IN ACCESS AND SILVER AT $20.27 Buy 90% Silver Coins at SD Bullion As Low As $1.99/oz Over Spot! LIVE and […] The post Harvey Organ: MASSIVE UPSIDE- OUTSIDE REVERSAL DAY IN GOLD & SILVER!! appeared first on Silver Doctors. |

| ‘We've been through two revolutions’: Centamin boss Andrew Pardey on mining gold in Egypt Posted: 09 Jul 2016 04:35 AM PDT This posting includes an audio/video/photo media file: Download Now |

| Gold Bull Confirmed: What Next? Posted: 09 Jul 2016 01:00 AM PDT |

| Jason Zweig: Still Wrong on Gold Posted: 08 Jul 2016 09:19 PM PDT The Daily Gold |

| Outside Reversal For Gold and Silver – “We’re Likely to See MUCH Higher Prices…” Posted: 08 Jul 2016 08:30 PM PDT Gold and Silver Shrug Off Cartel Raid, Power Out a BIG Finish to a HUGE Week With A Big Outside Reversal, Closing Above Crucial Technical Levels. When We Record This Show Next Week, We’re Likely to See Much Higher Prices… Doc and Dubin Break it All Down… Lowest Priced Silver Eagles Buy 90% Junk […] The post Outside Reversal For Gold and Silver – “We’re Likely to See MUCH Higher Prices…” appeared first on Silver Doctors. This posting includes an audio/video/photo media file: Download Now |

| Breaking News And Best Of The Web Posted: 08 Jul 2016 06:44 PM PDT Stocks recover on huge (but largely fictitious) US payrolls beat. Gold stabilizes and interest rates continue to fall, with Japanese 20-year bond yields going negative and US yield curve flattening to 2007 levels. Civil unrest in the US, as sniper kills five police in Dallas. UK in turmoil post-Brexit as Labour votes to oust leader, […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

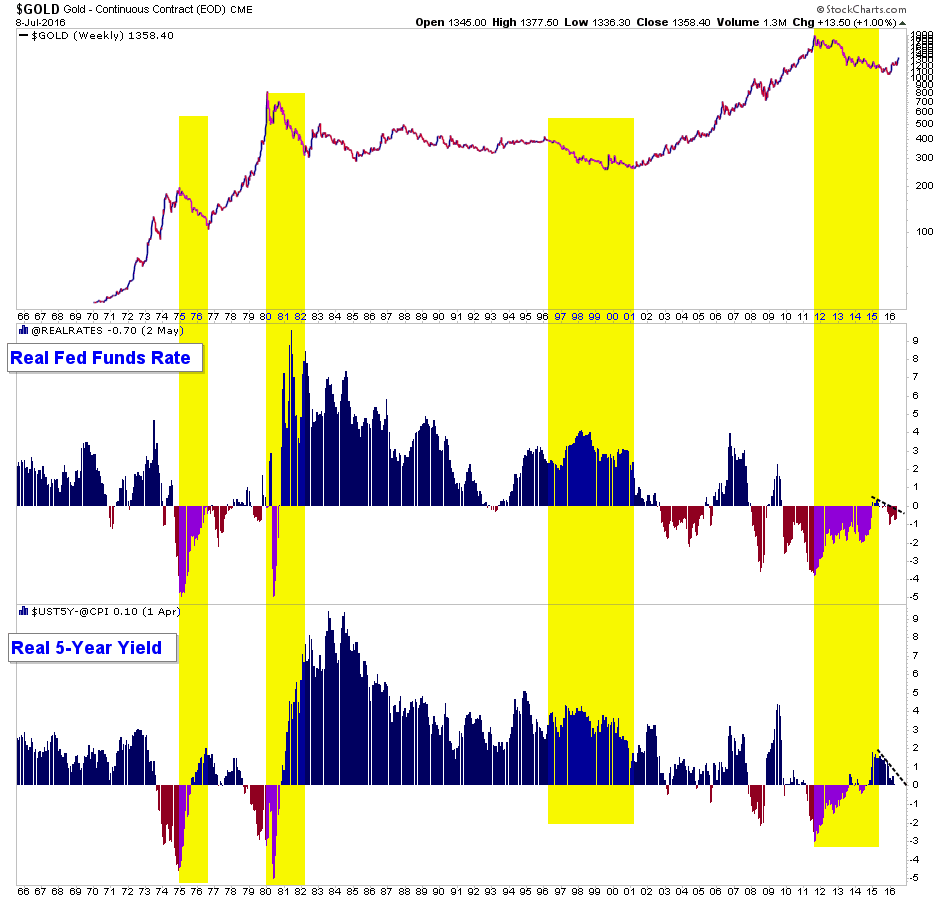

| Jason Zweig: Still Wrong on Gold Posted: 08 Jul 2016 02:24 PM PDT Jason Zweig, who a year ago called Gold a "pet rock" is doubling down. He reiterates his belief, albeit a misguided one that Gold is a pet rock and justifies it with the usual anti gold bug propaganda. Unfortunately, Zweig along with many gold-bashers and ironically some gold bugs continue to either neglect Gold's major fundamental driver or have no clue about it. Roughly year ago, I wrote my first book, The Coming Renewal of Gold's Secular Bull Market. Numerous readers and subscribers praised the book for being the best book ever written on the subject of Gold and gold investing. Unlike other present books on the subject my book is not typical gold-bug fluff with $10,000 price targets and such. Readers loved the book because it was based on objective facts that could be verified by real historical data and not opinion and ideology. It is a fact that the trend is Gold is inversely correlated to real interest. In other words, negative real rates or declining real rates is what drives Gold higher. Conversely, when real interest rates rise (as they did from 2011 to 2015) Gold declines. Take a look at the chart below in which we plot the real fed funds rate and real 5-year yield. Over the past year both have declined and gone negative. That explains the fundamental change driving the new bull market. (We also highlight the four bad bear markets in Gold during which real rates and real yields increased strongly and/or were strongly positive).

It makes perfect sense. Gold is money and an alternative currency. When short-term bonds, CD's and savings accounts can earn a positive real return there is no need for Gold and alternative currencies. However, when real rates of return are negative or declining, Gold outperforms as it is now. Zweig fails to mention anything about the importance of real rates and instead resorts to the typical anti-gold arguments. It is a poor inflation hedge. It is down 35% adjusted for inflation since 1980 (its absolute peak). It didn't do well for part of 2008. Yada yada yada. While he correctly notes that Gold is not an inflation hedge, his other arguments and facts are extremely disingenuous. Every gold hater typically picks 1980 as the start of every comparison (just as every gold bug picks 2000 as the start of their comparison). While I think 40-50 year comparisons aren't that important, isn't it interesting that Gold has actually outperformed the S&P 500 over the past 45 years! Did you know that Zweig? Furthermore, he notes that Gold did not perform well during September 2008 and October 2008. Dude, from 2001 to 2011 that is literally the only time Gold had a major decline. That would be akin to a gold-bug pointing out the 20% decline in stocks during 1998. Zweig concludes by arguing that investors are rushing into Gold because the chaos will only worsen and if Gold shoots higher from here it will only violate the precedents of the past. By now, you know this is bullshit. Investors are rushing into Gold because the global trend in real rates and real yields is favorable for Gold. They can't earn a positive real return on cash, CD's and bonds. Moreover, these investors realize that the only palatable short term and long term solutions to the global debt crisis (which is constricting growth) are super bullish for Gold. The bottom line is Gold is going much higher because the macro fundamentals are bullish and because historical valuation markers (which can be found in my book) easily justify Gold going to $3000-$5000/oz. Zweig and his ilk would be best advised to better educate themselves on Gold before writing another column. Ultimately, Gold's secular bull market will end early next decade and stocks will outperform for many years. But we are far, far away from that point. For professional guidance in riding the uptrend in Gold, consider learning more about our premium service including our favorite junior miners which we expect to outperform in the second half of 2016.

Jordan Roy-Byrne CMT, MFTA Jordan@TheDailyGold.com

|

| “Real Hell For the Shorts” Eric Sprott On HUGE Move in Gold and Silver Prices Posted: 08 Jul 2016 02:21 PM PDT Eric Sprott breaks down this week’s HUGE move in gold and silver, and explains what will be “real hell for the shorts”… Lowest Priced Silver Eagles From Sprott: Buy 90% Silver Coins at SD Bullion As Low As $1.99/oz Over Spot! LIVE and Historical Market Data, Charts, and PM Prices: The post “Real Hell For the Shorts” Eric Sprott On HUGE Move in Gold and Silver Prices appeared first on Silver Doctors. |

| Silver & Gold : Trade of the Year? – Mike Maloney Posted: 08 Jul 2016 02:20 PM PDT Pound sterling for gold and silver – is this the TRADE OF THE YEAR? Mike Maloney makes the case… 2 oz Silver Queen's Beasts Just $2.89 Over Spot, ANY QTY At SD Bullion! Buy 90% Junk Silver Coins at SD Bullion As Low As $1.99/oz Over Spot! LIVE and Historical Market Data, Charts, and PM Prices: The post Silver & Gold : Trade of the Year? – Mike Maloney appeared first on Silver Doctors. |

| Financial Analyst Warns: “Millions Will Die” When Financial System Collapses Posted: 08 Jul 2016 02:15 PM PDT Trillions of dollars of currency are being moved or rushing towards the debt market that is squeezing bond yields to historic lows. We are making history in the United States for the second week in a row, and I am talking about the bond market. Both gold and silver, since the beginning of this year, […] The post Financial Analyst Warns: “Millions Will Die” When Financial System Collapses appeared first on Silver Doctors. |

| BTFD! Gold and Silver Smashed On NFP, Scream Right Back On Dip Buying Posted: 08 Jul 2016 02:10 PM PDT The cartel just attempted a huge raid on gold and silver coinciding with today’s ridiculously bogus NFP numbers, but an extraordinary thing just happened… The cartel’s target was clearly to trigger the stops just below $1350 in gold, and trigger they did, sending gold plunging to $1340. A funny thing happened next however: […] The post BTFD! Gold and Silver Smashed On NFP, Scream Right Back On Dip Buying appeared first on Silver Doctors. |

| Sweden’s Largest Gold and Silver Dealer’s Bank Accounts Closed, Shut Out of Banking System! Posted: 08 Jul 2016 02:09 PM PDT With European capital scrambling into gold following BREXIT, the cartel just played their hand. The plan this time is NOT door-to-door confiscation, but simply to SHUT DOWN the best gold and silver dealers the moment the public begins to wake up… 2 oz Silver Queen's Beasts Just $2.89 Over Spot, ANY QTY At SD Bullion! The cartel […] The post Sweden’s Largest Gold and Silver Dealer’s Bank Accounts Closed, Shut Out of Banking System! appeared first on Silver Doctors. |

| The CATALYST For Economic Collapse Posted: 08 Jul 2016 02:09 PM PDT Precious Metals Fund Manager Dave Kranzler warns the elites may have LOST CONTROL of the financial system due to this catalyst: 2 oz Silver Queen's Beasts Just $2.89 Over Spot, ANY QTY At SD Bullion! Buy 90% Junk Silver Coins at SD Bullion As Low As $1.99/oz Over Spot! LIVE and Historical Market Data, Charts, […] The post The CATALYST For Economic Collapse appeared first on Silver Doctors. |

| STUNNING Chart Shows Silver Prices Could Be Headed to $700/oz!! Posted: 08 Jul 2016 02:01 PM PDT If you think silver’s Short Squeeze to $21 is exciting, you had better see the Greatest Silver Chart of All Time… 2 oz Silver Queen's Beasts Just $2.89 Over Spot, ANY QTY At SD Bullion! We have previously published a chart depicting silver’s 30 year cup and handle pattern, a pattern described as The […] The post STUNNING Chart Shows Silver Prices Could Be Headed to $700/oz!! appeared first on Silver Doctors. |

| If Silver Breaks Through This Threshold This Week, WATCH OUT! Posted: 08 Jul 2016 01:55 PM PDT Watch Out If Silver Breaks This Threshold Line This Week… 2 oz Silver Queen's Beasts Just $2.89 Over Spot, ANY QTY At SD Bullion! From SRSRocco: The huge Silver Rally this week took a lot of precious metals investors by surprise. The silver price surged 22% since the BREXIT vote results last Friday. Silver began […] The post If Silver Breaks Through This Threshold This Week, WATCH OUT! appeared first on Silver Doctors. |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment