Gold World News Flash |

- The Dallas Massacre: This Is The Kind Of Civil Unrest That I Have Been Warning Is Coming To America

- Outside Reversal For Gold and Silver – “We’re Likely to See MUCH Higher Prices…”

- Peter Schiff: Massive Quantitative Easing Is Coming, Warns Bubble Will Implode

- Alan “Bubbles” Greenspan Returns to Gold

- Eric Sprott Weekly Wrap Up – July 8, 2016

- Is Another 9/11 Necessary To Re-Direct American Anger?

- GATA Chairman Murphy discusses metals' astounding upward reversal Friday

- Top Gold Miners Burned Record Amount Of Fuel To Produce Gold In 2015

- Silver Prices: Turning of the Tide? – Ted Buter

- Charting The Epic Collapse Of The World's Most Systemically Dangerous Bank

- GSR interviews BILL MURPHY – July 8, 2016 Nugget

- Hillary Clinton Email Hacker found Dead in Jail Cell

- Corruption Climax: CLINTON, CARTEL, COLLAPSE. -- Rob Kirby

- We Will Make America Safe Again -- TRUMP on The Dallas Shooting

- HOT JULY 2016 Why The Next Major Economic Collapse Is Rapidly Approaching -- Martin Armstrong

- Signs of the End Times - Part 13 World Events July, 2016

- Governments Change, the Corporatocracy Endures

- The Chartology of a Generational Gold and Silver Miners Move

- Jason Zweig: Still Wrong on Gold

- Physical Gold and Silver vs Failing European Banks

- Brexit Vote and Gold

- ‘We've been through two revolutions’: Centamin boss Andrew Pardey on mining gold in Egypt

- Gold Bull Confirmed: What's Next?

- Breaking News And Best Of The Web

| The Dallas Massacre: This Is The Kind Of Civil Unrest That I Have Been Warning Is Coming To America Posted: 09 Jul 2016 11:00 PM PDT by Michael Snyder, The Economic Collapse Blog:

–Trump Rallies Reveal Increased Tensions Among Americans As This Nation Plunges Toward Civil Unrest –Civil Unrest Has Begun In Baltimore And This Is Only Just The Start Of Something MUCH Bigger –Prepare Your Homes And Neighborhoods For The Violence That Is Going To Sweep America Earlier this week, I warned that "the thin veneer of civilization that we all take for granted is evaporating", but this is one instance when I am definitely not happy to have been proven right. Shooter Micah X. Johnson was a 25-year-old former Army reservist with no criminal history. He was deployed to Afghanistan from November 2013 to July 2014, and what he experienced over there may have deeply scarred him mentally and emotionally. According to the police, the motivation for the shooting was because he "wanted to kill white people, especially white officers"…

What is truly frightening is that it looks like he was potentially planning even more violence in the future. When police searched his home, they found bomb-making materials, rifles, ammunition, and a personal journal of combat tactics. This attack in Dallas comes on the heels of two separate incidents in which young black men were gunned down by white police officers. The following comes from TruNews…

Racial tensions have soared to frightening levels in this country, and what is needed right now are calls for love and healing. But instead, many continue to stoke the flames of hatred and division. Here is just one example…

And as I mentioned above, social media websites such as Facebook and Twitter are being absolutely flooded with hate-filled messages toward police officers, white people, black people and those that would seek to bring Americans together in peace and love. It is a very disgusting thing to see, but this is where we are at as a nation. Sadly, what just happened in Dallas is not just an isolated incident. In fact, there was another very similar incident which just took place in Tennessee…

| ||

| Outside Reversal For Gold and Silver – “We’re Likely to See MUCH Higher Prices…” Posted: 09 Jul 2016 10:30 PM PDT from Silver Doctors: Gold and Silver Shrug Off Cartel Raid, Power Out a BIG Finish to a HUGE Week With A Big Outside Reversal, Closing Above Crucial Technical Levels. When We Record This Show Next Week, We’re Likely to See Much Higher Prices… Doc and Dubin Break it All Down… | ||

| Peter Schiff: Massive Quantitative Easing Is Coming, Warns Bubble Will Implode Posted: 09 Jul 2016 09:00 PM PDT from The Alex Jones Channel: Economic expert Peter Schiff has dire predictions for the American dollar and tells you how to survive the crash. | ||

| Alan “Bubbles” Greenspan Returns to Gold Posted: 09 Jul 2016 08:30 PM PDT by Bill Bonner, Wolf Street:

Under a gold standard, the amount of credit that an economy can support is determined by the economy's tangible assets, since every credit instrument is ultimately a claim on some tangible asset. […] The abandonment of the gold standard made it possible for the welfare statists to use the banking system as a means to an unlimited expansion of credit. — Alan Greenspan, 1966 That old rascal! Before joining the feds, former Fed chief Alan "Bubbles" Greenspan was a strong proponent of gold and the gold standard. He wrote clearly and forcefully about how it was necessary to restrain the Deep State and protect individual freedom. Then he went to Washington and faced a fork in the tongue. In one direction, lay honesty and integrity. In the other, lay power and glory. Faking It Under the Bretton Woods monetary system, the U.S. promised foreign central banks that it would convert their dollars to gold at a fixed price of $35 an ounce. This constrained the amount of dollars the U.S. could print to the amount of gold it had in its reserves. A smart man, Greenspan quickly realized he could not advocate for this old, tried-and-true gold standard and run the Deep State's new credit money system. In 1987, he made his choice. He took over the top job at the Fed and faked it for the next 19 years. Since 1978, we have had four different Fed chiefs. Some were smart. Some were honest. Only Paul Volcker was smart and honest. Bernanke was honest… we believe. As near as we can tell, so is Janet Yellen. Both may mean well, but both are careful not to think out of the Deep State box. Alan Greenspan was smart. But he is a scalawag. He knew all along that the system was corrupt and self-serving. He had explained it in essays he'd written prior to joining the Fed. But he also knew he would never get his picture on the cover of TIME magazine if he told the truth. (In 1999, Greenspan eventually got his mug on the cover. The magazine pictured him alongside then Treasury secretary Robert Rubin and his deputy, Larry Summers, under the headline "The Committee to Save the World" for their handling of the Asian financial crisis.) It was power Greenspan wanted; he knew he would have to play the Deep State's game to get it. Golden Period Now, Mr. Greenspan is 90 years old. Either he feels the cold downdraft of the beckoning grave… or he is simply forgetting to mumble. In an interview in the wake of Britain's decision to end its membership of the European Union, he had this to say:

The former Fed chairman says he believes another debt crisis is inevitable. He believes it will lead to high levels of inflation. His solution? Gold:

The Fed's minutes from its last meeting reveal no intention to return to the gold standard. Instead, the Fed's central planners want their photos on TIME, too. They can't give up their control of the nation's money or risk a correction. It would be "prudent to wait for additional data" before raising rates, they say. Mr. Greenspan might have said so, too… perhaps with a hidden, sly smile on his face. | ||

| Eric Sprott Weekly Wrap Up – July 8, 2016 Posted: 09 Jul 2016 08:00 PM PDT by Craig Hemke, Sprott Money:

Our Ask The Expert interviewer Craig Hemke began his career in financial services in 1990 but retired in 2008 to focus on family and entrepreneurial opportunities. Since 2010, he has been the editor and publisher of the TF Metals Report found at TFMetalsReport.com, an online community for precious metal investors. Click HERE to Listen | ||

| Is Another 9/11 Necessary To Re-Direct American Anger? Posted: 09 Jul 2016 07:00 PM PDT

As we can see from the above statement, Jeff Kluger has in mind another convulsive episode like Pearl Harbor or 9/11 that will unify the “anger” that Americans feel. Kluger seems to imply that this anger is stemming from current elections. His concern is that it is spilling over into other areas of life.

Kluger seems to be saying that anger has become fashionable and applying anger liberally trivializes it. Also, if Americans are angry about many things, that makes for a dysfunctional society rather than a unified one. Kluger obviously wants a unified America. In order for rage to be unifying it needs to be a “purple American fury.” This is actually a somewhat cynical assessment of how to manipulate anger in our view. Why do we need another Pearl Harbor or 9/11 just so Americans can feel unified? Why should “Americans” feel unified anyway? And, really, what is an “American?” Because the “anger in America” meme is ubiquitous in the mainstream media at the moment, there are many other commentaries on it. Here’s one from CNN by Michael Smerconish:

CNN is asking us to “close our windows” and not listen to people who are “angry” about the state of America’s politics and economy. TIME is hopeful that this anger can be channeled into some horrible, outsized event that will unify the current emotional anarchy. Both of these editorials seem frightened by anger. But the description trivializes what is going on. People aren’t just “angry.” Many are extraordinarily upset about certain events taking place in the USA. It’s not simply an inchoate emotion. Millions upon millions are angry over the reduction in freedoms and the rise of the fedgov political class. They are worried and anxious about police shootings, gun confiscation and a general trend toward increased authoritarianism all around them. They don’t recognize America anymore. It feels like a fascist or socialist country. Like Kluger’s article, Smerconish’s CNN piece suggests ways that the electorate’s anger can be reduced. His solution to American anger is to change voting laws so that “silent ones” have more impact and are more noticeable. That would make the anger less visible. Eventually, people would calm down. We don’t believe in either of these solutions. It is not a good idea to root for another major national tragedy in order to resolve American anger. And changing voter laws to empower people who are not angry surely does not address the causes of the anger. Conclusion: What will make people less angry in this case is more freedom. But freedom is rarely given and mostly manipulated. If you want to be free, you will have to do it yourself. Get out of debt. Store gold and silver. Find alternative living arrangements in case of an emergency. Don’t leave it up to mainstream punditry to determine how to deal with what you feel. Inevitably, their solutions will not lessen problems but increase them. | ||

| GATA Chairman Murphy discusses metals' astounding upward reversal Friday Posted: 09 Jul 2016 06:58 PM PDT 9:57p ET Saturday, July 9, 2016 Dear Friend of GATA and Gold: In an interview with GoldSeek Radio's Chris Waltzek, GATA Chairman Bill Murphy discusses the astounding upward reversal of gold and silver Friday following the usual smashdown upon release of the U.S jobs report. The interview is nine minutes long and begin at the 35:05 mark at GoldSeek Radio here: CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||

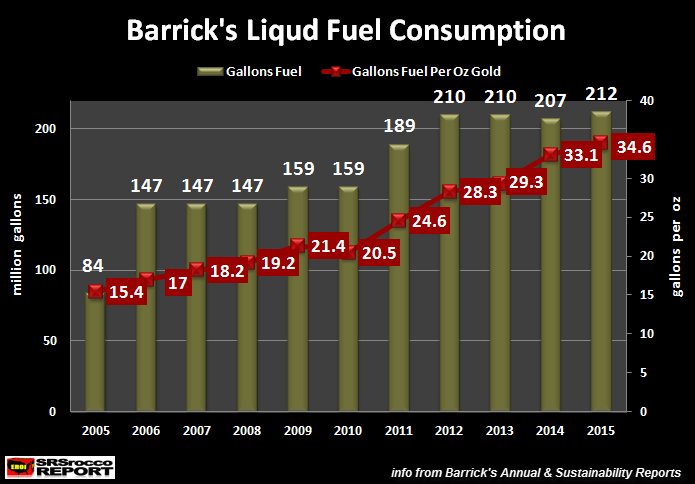

| Top Gold Miners Burned Record Amount Of Fuel To Produce Gold In 2015 Posted: 09 Jul 2016 06:00 PM PDT by Steve St. Angelo, SRSRocco Report:

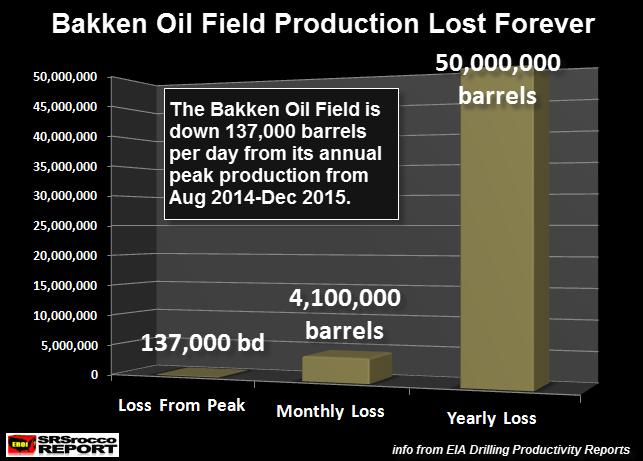

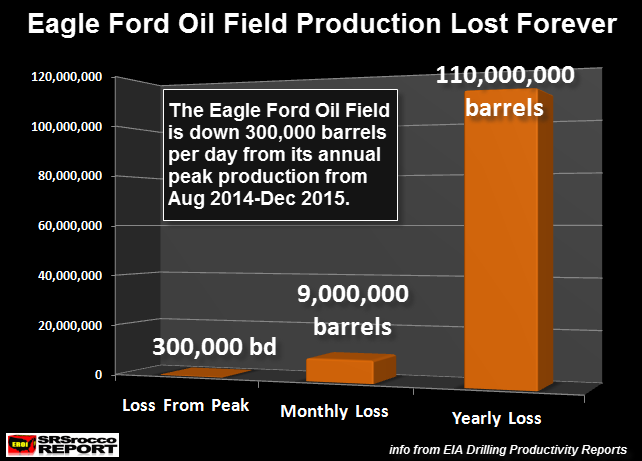

This is not good news for the gold mining industry as the world has peaked in cheap oil production. While total global liquid energy production continues to be at record levels, the high-value cheap light sweet crude oil peaked several years ago. Furthermore, we are now witnessing the rapid decline of U.S. oil production as many of the shale oil fields go into terminal decline. As shown in these next two charts, the Bakken and Eagle Ford are forecasted to be down 437,000 barrels per day (bd) from their minimum production between August 2014 and December 2015:

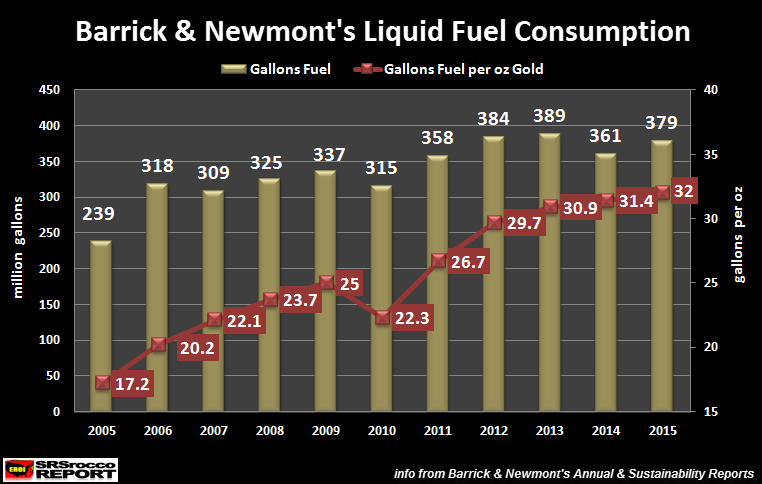

The production loss from these two fields will equal 160 million barrels in a year… and that's if their production doesn't continue to decline. Don't worry… it will. As I have stated in several interviews, I forecast U.S. oil production to decline 30-40% by 2020 from its peak in 2015, and be down 70-75% by 2025. We will also start to see declines in other oil-producing countries throughout the world. Top Two Miners Burned The Most Fuel Ever In 2015 To Produce Gold That's correct, Barrick and Newmont used more liquid fuel than ever to produce an ounce of gold in 2015:

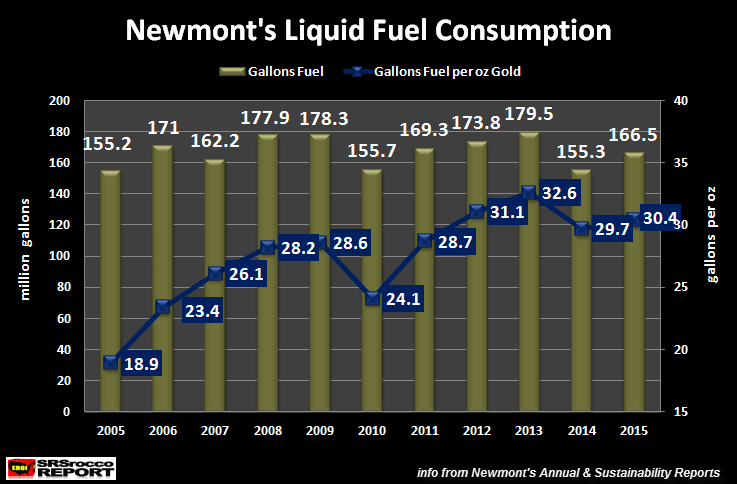

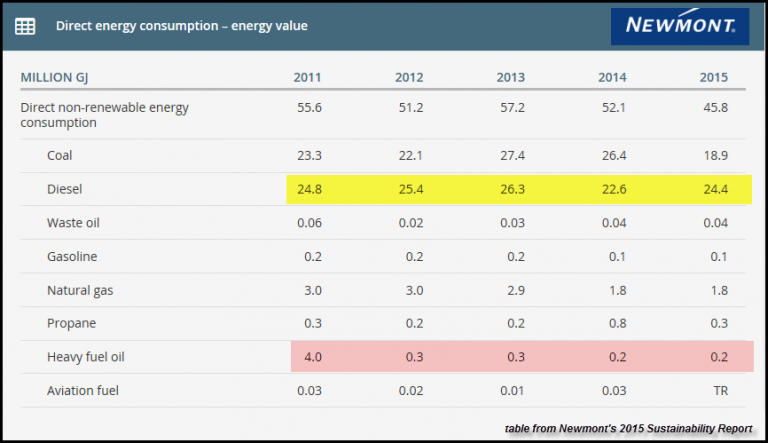

Between the two companies, they burned a total of 379 million gallons of fuel at an average 32 gallons per gold oz produced. Even though Barrick and Newmont burned more fuel in 2013 (389 million gallons), their consumption per gold ounce was less at 30.9 gallons. Here is the breakdown of the two individual companies fuel consumption:

While Newmont's fuel consumption fell to 30.4 gallons per oz gold (gal/oz), from its peak of 32.6 gal/oz in 2013, Barrick's increased to a new record of 34.6 gal/oz. The combination of the two in 2015 still reached a new record of 32 gal/oz in 2015. I have to say, acquiring the information for these fuel consumption figures has become quite difficult and frustrating to say the least. The data for fuel consumption is reported in the companies Sustainability Reports. The information used to be easier to access a few years ago. However, several companies are no longer reporting a breakdown in the different energy sources, but rather list it as "Indirect" or "Direct" energy consumption. I tried to get Goldcorp's liquid fuel consumption for 2015, but they no longer report that in their materials part of their Sustainability Report. Instead, they list it as total indirect or direct energy consumption. Indirect energy is purchased grid electric power, while direct energy would be the diesel to run the massive earth moving machines or other energy sources for generators that provide power for their mining operations. Furthermore, the companies report their figures in all different metrics. Some use Gigajoules, while others use Kiloliters or metric tons for example. So, everything has to be converted to gallons. To show my readers where I get this data and how I convert it so there are no questions…. look at the images below:

| ||

| Silver Prices: Turning of the Tide? – Ted Buter Posted: 09 Jul 2016 05:30 PM PDT by Ted Butler, Silver Doctors:

It's also hard to believe that it was only six months ago that gold and silver were locked in nearly the opposite situation. I continue to believe that the main price driver for gold and silver was the historic positioning changes in COMEX futures over the past six months. Year to date, the now $300+ rally in gold and $6+ rally in silver, were driven by more than 30 million oz of paper gold and 325 million oz of paper silver on the COMEX, bought principally by managed money technical funds and sold by commercials (mostly banks). In addition, the price rally in gold, in particular, set off significant buying in ETFs and other investment vehicles in which massive amounts of physical gold were purchased and deposited. In six months, nearly 20 million oz of physical gold were deposited into ETFs and COMEX warehouses (11 million oz in GLD alone), further cementing the gold rally. In dollar terms, that comes to $25 billion. The physical flows into silver have been much smaller in dollar terms as less than $1 billion worth of silver (40 million oz) has been deposited in silver ETFs, although there are recent signs that may be changing. The purchase of so much physical gold has apparently thwarted the usual outcome of an extremely bearish COT market structure causing a big price selloff, or at least so far. Physical metal demand is understandable because it is near impossible to construct a fundamental bear case for gold or silver. I don't think many would disagree over what occurred these past six months, namely, historic COMEX positioning, coupled with massive physical buying in gold ETFs. Now what? In contemplating what occurs next, it comes down to will the commercial traders succeed in turning price lower and triggering off technical fund selling on the COMEX and, at the same time, cool off ETF demand for physical metal? Up until very recently, history favored the commercials succeeding for the simple reason that they had never lost. Stated differently, the commercials as a whole and particularly the largest commercial traders had never been forced to buy back short contracts in COMEX gold and silver on rising prices. I've tried to characterize the circumstance in black and white terms in that either the commercials would prevail as usual and drive prices lower or would fail for the very first time. The chance for failure was predicated on the unusually large financial risk the commercials had found themselves in as a result of historically large and concentrated short positions in COMEX gold and silver. Further, the possibility of commercial failure was augmented by a potential double cross by JPMorgan, which has accumulated half a billion ounces of physical silver and perhaps a large physical gold position as well. To be fair, either outcome, a price selloff or surge, must be considered possible, but recent developments have raised the odds of a commercial failure in which prices surge, especially for silver. I'm still of the mind that we will go straight up or jiggle down one more time before then moving straight up, but it's more important to focus on the facts and figures and the reasoning behind the increased odds of something that has never happened before. It has to do with the money game on the COMEX. Through yesterday (July 5), the commercials had never been this deep ($2.1 billion) in the hole before in combined gold and silver losses; so in the truest sense of the word, these losses are unprecedented. Since futures trading is a zero sum game, meaning that what the shorts lose, the longs gain (and vice versa), the open profits for the managed money technical funds longs have also never been larger. These large open losses to the commercial shorts makes them both more vulnerable to further losses and more desperate to turn prices down. Make no mistake – whether the commercials succeed or not is what will determine which way gold and silver prices move in the immediate future. Even if the commercials prevail yet again, and that is far from certain, the tide seems to be turning on the whole COMEX game that has existed for decades. I believe there are a number of factors pointing to changes in the usual business of setting gold and silver prices. For one thing, it's hard to characterize the current extreme set up in COMEX market structure as being deliberately constructed by the commercials in its current form. After all, who would knowingly dig themselves into the deep hole the commercials find themselves in? What's most unprecedented about current circumstances is that never in the past have gold and silver prices rallied strongly after historic commercial short positions had been established. Yet, for the very first time, prices have so rallied. It's not possible the commercials intended to be billions of dollars in the hole and the most plausible explanation for why they are so deep in the red is simple miscalculation. And if the commercials have miscalculated to this point, that would seem to increase the odds of continued miscalculation, leading to a total failure which I would define as aggressive short covering on escalating prices. I don't think anyone could conclude that the commercials have the technical funds exactly where the commercials want them to be. At this point, given the positions and overall price levels, the best the commercials could hope for would be to rig prices low enough to recoup their sizable open losses and get out of this jam without being decimated. It's almost impossible to imagine that the commercials deliberately put themselves in a $2 billion hole in order to score billions of dollars of profits in the end. Along those same lines, it doesn't seem plausible that the phenomenal demand for physical gold in world ETFs was fully anticipated by the commercials. There was no evidence, for example, at the start of the year that the commercials held vast amounts of physical gold that they were seeking to unload. To the contrary, commercial net short positions in COMEX gold (and silver) were at extreme lows. If the commercials were expecting big physical buying in gold, they wouldn't have rushed onto the short side so early and aggressively. I believe the massive and, largely, unanticipated demand for physical gold this year not only adds to the premise of commercial miscalculation, but holds special potential significance for silver. As I indicated earlier, surging physical ETF investment demand has largely been confined to gold, but could and may be developing in silver, based upon price and volume patterns in silver ETFs, including the largest, SLV. It's kind of remarkable that $25 billion worth of gold has come into world ETFs over the past six months, while less than a billion dollars' worth of physical silver has come into the world's silver ETFs. Not that gold isn't the larger market, but there are other instances where the dollar demand for silver comes close and sometimes exceeds the dollar demand for gold, like in sales of Eagles from the US Mint. While gold did outperform silver pricewise earlier in the year, more recently silver has outpaced gold in the performance department. I can't help but think that if silver is doing so well despite the lack of physical demand compared to gold this year, what the heck will silver do when physical investment demand kicks in, as is almost certain at some point. In fact, that's always been the prime component for my investment case in silver – the likelihood of a physical shortage. Now, more than ever, does the potential for a physical silver shortage exist. And while I have been amazed at the quantity of physical gold that has flowed into the ETFs this year, to this point the lack of big deposits in SLV and other silver ETFs leaves intact the possibility that no big quantities of physical silver are available to the market near current prices. Since it has been a while, let me outline the silver shortage premise. First off, I am referring to a coming shortage in the form of silver that matters most – 1000 oz bars. Shortages in supplies of Silver Eagles or smaller bars of silver have gotten to be somewhat of a regular affair over the past few years, but do not directly impact the wholesale price of silver. The wholesale price of silver is determined by 1000 oz bars, because they are the industry and investment standard. Apparently overlooked by many, is the tiny quantity of 1000 oz bars of silver in existence. The entire world supply of verifiable 1000 oz bars in existence (including ETF and COMEX inventories) is just under 900 million oz, to which I would add 500 or 600 million oz in unrecorded 1000 oz bars (of which I believe JPMorgan holds the majority). Let's call it 1.5 billion oz, worth around $30 billion, compared to known gold in all forms of 5.5 billion oz, worth $7.5 trillion. In dollar terms, there is more than 250 times more gold than silver in the world. Common sense would suggest if there is going to be a shortage, it would likely occur in a commodity where inventories are small to begin with. But like most investment assets, including gold, very little of what exists is truly available for sale at any point in time. That's because relatively few sellers exist at any time in any asset or investment, usually amounting to no more than 5% or 10% of the total of any asset and sometimes much less. In silver, the 1.5 billion oz in the form of 1000 oz bars, probably has an actual availability of no more than 100 million oz. In other words, no more than $2 billion worth of silver could be bought at any time (say over a month or so). I noted earlier that less than $1 billion of silver in 1000 oz bar form had been bought by ETFs over the past six months. But we live in an investment era when many billions of dollars could flow or change direction at any time, almost instantly. Should the smallest amount of money get directed towards silver, say 10% of what flowed into gold ETFs over the past six months or $2 billion, it would likely absorb and exceed the amount of metal available. In addition to sending prices higher, sudden investment demand would disrupt the entire silver supply chain and lead to the "doomsday" effect in silver – an industrial user inventory buying panic. It would work like this. Investment demand for 1000 oz bars of silver, either through ETF demand or COMEX deliveries, triggered by higher prices (silver is up more than any other commodity or asset this year), triggers further investment buying until the supply of available 1000 oz bars are temporarily exhausted. But because 90% of silver demand is earmarked to industrial or total fabrication demand, the investment buying surge will result in growing delays in delivery of 1000 oz bars to users. This will cause those users denied timely delivery to behave like any industrial consumer when faced with the shortage of any vital commodity, namely, to not only buy, but buy more than usual, adding to the physical shortage. Certainly, regular readers know I have held this industrial user buying panic premise from the beginning and while we came close to physical shortage in early 2011, my premise has yet to fully blossom. Not only do I see my premise playing out, I believe the first stage, investment buying, may have begun or, at a minimum, is set to begin, based upon recent buying in SLV. The recurring image in my mind is that the coming silver user buying panic is like the great white shark lurking just off the beach. It doesn't matter until you cross its path, but when, not if, investment buying depletes the available supply of 1000 oz bars, industrial users will bite the silver market like never seen. In fact, this is the main difference between gold and silver. Gold is not an industrial commodity. Because silver is an industrial commodity, both world inventories and current production have been and are reduced by industrial demand. Very few recognize just how much this has depleted world silver inventories and available current production. World silver inventories are down more than 90% from 75 years ago and only 10% (100 million oz) are available from current production for investment in 1000 oz bars. It will take much higher prices to balance supply once investment and user demand kicks in. This is the case for $100 and higher silver. Not the end of the world as we know it, just the ignition of investment demand and user inventory buying. That's what makes the current set up so intriguing and dramatic. At precisely the same time 8 commercials have never been short so much silver on the COMEX (nearly 500 million oz), higher prices have put those traders more deeply underwater (in combination with gold) than ever, while those same rising prices threaten to ignite an investment stampede. It's as if one were deliberately chumming the waters off shore to excite the great white shark of user inventory buying. Even more stunning is the quickness in which the commercial losses developed. Only five weeks ago, the commercials were net-net ahead for the year by around $1.5 billion, meaning there has been a turnaround in the collective commercial position in COMEX gold and silver of close to $4 billion. These are big numbers in any event, but when you distribute the turnaround and assign losses by the actual number of commercial traders holding short positions, the numbers become quite dramatic. COT data indicates only 8 traders hold the entire commercial net short position in silver (nearly 500 million oz) and 8 traders in COMEX gold hold 86% (28 million oz) of the 33 million oz total commercial record net short position. The $4 billion turnaround in commercial financial results over the past 5 weeks comes to many hundreds of millions of dollars per trader. Not all of the $4 billion collective commercial negative turnaround needed to be deposited as additional margin, but at least half did. | ||

| Charting The Epic Collapse Of The World's Most Systemically Dangerous Bank Posted: 09 Jul 2016 05:15 PM PDT It’s been almost 10 years in the making, but the fate of one of Europe’s most important financial institutions appears to be sealed. After a hard-hitting sequence of scandals, poor decisions, and unfortunate events,Visual Capitalist's Jeff Desjardins notes that Frankfurt-based Deutsche Bank shares are now down -48% on the year to $12.60, which is a record-setting low. Even more stunning is the long-term view of the German institution’s downward spiral. With a modest $15.8 billion in market capitalization, shares of the 147-year-old company now trade for a paltry 8% of its peak price in May 2007.

Courtesy of: Visual Capitalist

THE BEGINNING OF THE ENDIf the deaths of Lehman Brothers and Bear Stearns were quick and painless, the coming demise of Deutsche Bank has been long, drawn out, and painful. In recent times, Deutsche Bank’s investment banking division has been among the largest in the world, comparable in size to Goldman Sachs, JP Morgan, Bank of America, and Citigroup. However, unlike those other names, Deutsche Bank has been walking wounded since the Financial Crisis, and the German bank has never been able to fully recover. It’s ironic, because in 2009, the company’s CEO Josef Ackermann boldly proclaimed that Deutsche Bank had plenty of capital, and that it was weathering the crisis better than its competitors. It turned out, however, that the bank was actually hiding $12 billion in losses to avoid a government bailout. Meanwhile, much of the money the bank did make during this turbulent time in the markets stemmed from the manipulation of Libor rates. Those “wins” were short-lived, since the eventual fine to end the Libor probe would be a record-setting $2.5 billion. The bank finally had to admit that it actually needed more capital. In 2013, it raised €3 billion with a rights issue, claiming that no additional funds would be needed. Then in 2014 the bank head-scratchingly proceeded to raise €1.5 billion, and after that, another €8 billion. A SERIES OF UNFORTUNATE EVENTSIn recent years, Deutsche Bank has desperately been trying to reinvent itself. Having gone through multiple CEOs since the Financial Crisis, the latest attempt at reinvention involves a massive overhaul of operations and staff announced by co-CEO John Cryan in October 2015. The bank is now in the process of cutting 9,000 employees and ceasing operations in 10 countries. This is where our timeline of Deutsche Bank’s most recent woes begins – and the last six months, in particular, have been fast and furious. Deutsche Bank started the year by announcing a record-setting loss in 2015 of €6.8 billion. Cryan went on an immediate PR binge, proclaiming that the bank was “rock solid”. German Finance Minister Wolfgang Schäuble even went out of his way to say he had “no concerns” about Deutsche Bank. Translation: things are in full-on crisis mode. In the following weeks, here’s what happened:

Doesn’t sound “rock solid”, does it? Now the real question: what happens to Deutsche Bank’s derivative book, which has a notional value of €52 trillion, if the bank is insolvent? Source: Visual Capitalist | ||

| GSR interviews BILL MURPHY – July 8, 2016 Nugget Posted: 09 Jul 2016 03:00 PM PDT from GoldSeek Radio: GoldSeek Radio’s Chris Waltzek talks to Bill Murphy of the Gold Anti-Trust Action Committee and La Metropole Cafe. | ||

| Hillary Clinton Email Hacker found Dead in Jail Cell Posted: 09 Jul 2016 12:48 PM PDT Hillary E MAIL Hacker Dies in VA Prison HILLARY CLINTONS...EMAIL HACKER FOUND DEAD...2016 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||

| Corruption Climax: CLINTON, CARTEL, COLLAPSE. -- Rob Kirby Posted: 09 Jul 2016 11:00 AM PDT The one and only Rob Kirby from Kirbyanalytics.com joins me to discuss the very latest news as we continue to document the collapse of the former 'Republic' of the United States: Clinton, Cartel, Collapse. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||

| We Will Make America Safe Again -- TRUMP on The Dallas Shooting Posted: 09 Jul 2016 10:24 AM PDT TRUMP on The Dallas Shooting : This is an Attack on America DONALD TRUMP...THE MAN THAT WILL MAKE A DIFFERENCE...2016 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||

| HOT JULY 2016 Why The Next Major Economic Collapse Is Rapidly Approaching -- Martin Armstrong Posted: 09 Jul 2016 09:57 AM PDT Economic March Madness is Coming says Martin Armstrong -"HOT JULY 2016 Why The Next Major Economic Collapse Is Rapidly Approaching Alex Jones talks with Martin Armstrong of Armstrong Economics about what he sees for the future and the coming collapse. The Financial Armageddon... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||

| Signs of the End Times - Part 13 World Events July, 2016 Posted: 09 Jul 2016 08:57 AM PDT Something Weird Happening Worldwide. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||

| Governments Change, the Corporatocracy Endures Posted: 09 Jul 2016 08:00 AM PDT This post Governments Change, the Corporatocracy Endures appeared first on Daily Reckoning. Ultimately, the dominance of global capital (the Corporatocracy) is not financial — it’s political. One little-remarked consequence of the central banks’ policies of near-zero interest rates and quantitative easing is the unrivaled dominance of mobile global capital, i.e. the Corporatocracy. The source of corporate political power is the ability to borrow essentially unlimited sums for next to nothing: what I have long termed free money for financiers. Armed with central-bank supplied unlimited credit, global capital can outbid local residents and businesses. Over time, profitable enterprises and assets end up in corporate hands. Consider the typical family farm, not just in America but in Germany, Australia, etc. It’s hard work squeezing a livelihood from the land in a market dominated by a handful of global corporate giants and their state handmaidens, and so unsurprisingly many in the next generation have opted for corporate-state jobs in urban areas rather than shoulder the financial risks of continuing the family farm. A neighboring farmer might be interested in buying, be he/she will have to borrow the money at (say) 4%. The global corporation can sell bonds (i.e. borrow money) at less than 1%. The lower cost of capital enables the corporation to outbid local farmers for the land, and this low cost of borrowing also enables the corporation to fund capital-intensive economies of scale that are beyond the reach of family farms. The net result is the nation’s farmland, its core productive asset, slides inevitably into corporate ownership. Anyone who resists selling out is crushed by low prices (corporate farms can over-produce and survive low prices, family farms cannot). Or they are crushed by the disadvantages of being an “outsider” selling to the corporate supply chain, which favors in-house suppliers or large corporate producers. The same dynamic — the unparalleled power of cheap credit — leads to corporate ownership which then funds corporate dominance of the political process. Consider building a house for your family. You’ll need construction financing, and since that’s riskier than a conventional mortgage to buy an existing home, that will cost you between 4% and 5%, and requires thousands of dollars in fees. The corporate homebuilder can borrow at 1%. Guess who’s construction costs are cheaper? As corporations buy up productive assets, they consolidate these assets into cartels and quasi-monopolies that can be protected from competition by lobbying and campaign contributions. Once you can buy up productive assets with cheap borrowed money, the profits start piling up, and you can use a thin sliver of these profits to hire lobbyists and buy political favors/protection from politicos desperate to cling onto their power. The net result of unlimited credit for corporations is a Corporatocracy that constantly expands its financial and political power. And the net result of this corporate control of governance is: governments come and go, candidates come and go, and political movements come and go, but the Corporatocracy remains in charge.

If interest rates were 10% for everyone and every entity, individuals and small enterprises that had saved up cash could outbid corporations, which habitually get crushed in downturns by high interest payments. At zero interest rates, corporations can outbid savers, households and small businesses, who don’t get to borrow billions of dollars at near-zero rates from central banks. Loan me $10 billion at 0.25% annual interest and I’ll assemble some profitable assets, too. Any of us can get obscenely wealthy if we have an unlimited credit line at .25% annual interest (i.e. essentially free money). Ultimately, the dominance of global capital (the Corporatocracy) is not financial — it’s political. The populace and their elected leadership either allow corporations to dominate (via central bank policies) or they strip the central banks of the power to create a dominant Corporatocracy. The choice is ours — or it used to be. No wonder voting fraud is the tool-du-jour of the Corporatocracy’s political toadies in the U.S. It’s far too dangerous to actually let the Great Unwashed taxpayers make political decisions. They might oust the central bankers, and if they did that, the Corporatocracy and their political toadies would suffer an inevitable decline as their free-money spigots were turned off. If you collapse these extractive, debt-dependent crony-capitalist cartels, you collapse the entire status quo. No matter how you interpret Brexit — a Kabuki play by Deep State insiders, a political ploy that went off the rails, an ugly outburst of xenophobia, a rebellion of the Forgotten Class that lost out in the Great Financialization boom, a resurgence of nationalism — whatever interpretation or combination of factors you favor, the net result is the same: Brexit reflects a precarious state of shifting political tectonics that threatens the status quo.

Brexit is a symptom of the Crisis of Modern Capitalism. The current global version of Capitalism is characterized by these overlapping dynamics:

The global “recovery” narrative is crumbling like weathered sandstone on the edge of a cliff. No wonder institutional money managers, hedge funds and punters are all either fleeing to safe havens or entering trades with their thumbs twitching nervously on the “sell” button. If the global banking sector isn’t precarious, then why are bank stocks tanking? If these banks are minting profits and accumulating well-collateralized capital, why are investors selling them? If everything’s so solid, why is hot money chasing the bubble du jour? From copper to rebar to bitcoin to iron ore to silver, hot money is sloshing from one casino-sector to another on a daily or weekly basis — what’s next? Bat guano? Disney collectibles? Is this a sign of a healthy, sustainable market? If you think so, I have a container load of hot bat guano to sell you. I guarantee it will be the next bubble du jour, you’ll get rich overnight… If the U.S. economy isn’t precarious, why has the growth rate of new businesses collapsed to Depression-type lows? If everything is going great, why aren’t entrepreneurs jumping in to mint all those easy profits? The global political/economic state feels precarious for a good reason: it is precarious. Being told everything’s rock-solid while the ground beneath us is rumbling isn’t terribly persuasive, and some talking head reassuring us that the economy is still “growing” won’t stop the tremors. Regards, Charles Hugh Smith Ed. note: "A charmingly mordant take on the stock news of the day, accentuated by philosophical maunderings…" That's how one leading financial magazine described the free daily email edition of The Daily Reckoning. You'll find cutting-edge analysis from the complex worlds of finance, politics and culture. Presented in an entertaining style few can match. Click here now to sign up for FREE. The post Governments Change, the Corporatocracy Endures appeared first on Daily Reckoning. | ||

| The Chartology of a Generational Gold and Silver Miners Move Posted: 09 Jul 2016 06:56 AM PDT This first chart for tonight is the GOLD:XAU ratio combo chart we’ve been following very closely. I just want to make it perfectly clear what this ratio chart is telling us. The ratio chart on top is telling us that gold is in a parabolic collapse vs the XAU after 20 years of out performance. Even though they can both go up together the XAU stocks are going up parabolic to gold as shown by the vertical move down in the ratio and the vertical move up in the XAU. | ||

| Jason Zweig: Still Wrong on Gold Posted: 09 Jul 2016 06:16 AM PDT Jason Zweig, who a year ago called Gold a “pet rock” is doubling down. He reiterates his belief, albeit a misguided one that Gold is a pet rock and justifies it with the usual anti gold bug propaganda. Unfortunately, Zweig along with many gold-bashers and ironically some gold bugs continue to either neglect Gold’s major fundamental driver or have no clue about it. | ||

| Physical Gold and Silver vs Failing European Banks Posted: 09 Jul 2016 06:15 AM PDT Physical Gold and Silver vs Failing European Banks | ||

| Posted: 09 Jul 2016 06:11 AM PDT In a historic referendum, Britain voted to leave the European Union. We covered this topic in our Gold News Monitors a few times, however it is worth analyzing in more detail, as the Brexit vote entails important implications for the global economy and the gold market. Initially, the Brexit vote led to short financial shock with a plunging pound and equities. However, the markets soon recovered, and the shock was not as bad as many had feared. Similarly, there was a knee-jerk reaction in gold, which boosted its price up to the $1,350 level immediately after the vote’s results were announced. As the chart below shows, the gold prices spiked in the U.S. dollar, in the Euro and, to a great extent, in the British pound. | ||

| ‘We've been through two revolutions’: Centamin boss Andrew Pardey on mining gold in Egypt Posted: 09 Jul 2016 04:35 AM PDT This posting includes an audio/video/photo media file: Download Now | ||

| Gold Bull Confirmed: What's Next? Posted: 09 Jul 2016 01:00 AM PDT Technical analyst Jack Chan confirms a bull market for gold and lays out his investment strategy. | ||

| Breaking News And Best Of The Web Posted: 08 Jul 2016 06:44 PM PDT Stocks recover on huge (but largely fictitious) US payrolls beat. Gold stabilizes and interest rates continue to fall, with Japanese 20-year bond yields going negative and US yield curve flattening to 2007 levels. Civil unrest in the US, as sniper kills five police in Dallas. UK in turmoil post-Brexit as Labour votes to oust leader, […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Today is a day to mourn and pray for America. In Dallas, Texas last night, a hate-filled gunman ruthlessly started gunning down police officers. A total of 12 officers were shot, and five of them are now dead. If we do not learn to love one another, there is no hope for us as a nation. Unfortunately, the love of most people has grown cold, and today messages of hate and division from people on all sides of the debate are being posted all over social media. The massacre in Dallas represented the deadliest day for law enforcement officers in the United States since 9/11, and this is the kind of civil unrest that I have been repeatedly warning is coming to America. I have warned about this in my books, on radio and on television. But of course I am best known for my articles, and the following are just a handful where I warned about what we would soon see…

Today is a day to mourn and pray for America. In Dallas, Texas last night, a hate-filled gunman ruthlessly started gunning down police officers. A total of 12 officers were shot, and five of them are now dead. If we do not learn to love one another, there is no hope for us as a nation. Unfortunately, the love of most people has grown cold, and today messages of hate and division from people on all sides of the debate are being posted all over social media. The massacre in Dallas represented the deadliest day for law enforcement officers in the United States since 9/11, and this is the kind of civil unrest that I have been repeatedly warning is coming to America. I have warned about this in my books, on radio and on television. But of course I am best known for my articles, and the following are just a handful where I warned about what we would soon see… After a misbegotten credit bubble and $60 trillion more of debt.

After a misbegotten credit bubble and $60 trillion more of debt. On Today’s Weekly Wrap Up, the historic Brexit decision has come down. Eric Sprott discusses how the British vote to exit the EU adds another compelling reason for owning physical gold and silver in your portfolio.

On Today’s Weekly Wrap Up, the historic Brexit decision has come down. Eric Sprott discusses how the British vote to exit the EU adds another compelling reason for owning physical gold and silver in your portfolio.

The top two gold miners burned a record amount of fuel to produce gold in 2015. Even though Barrick and Newmont burned less overall fuel than their operations did in 2013, their consumption per ounce of gold produced was the highest ever.

The top two gold miners burned a record amount of fuel to produce gold in 2015. Even though Barrick and Newmont burned less overall fuel than their operations did in 2013, their consumption per ounce of gold produced was the highest ever.

The price fireworks over the July 4 holiday, particularly in silver, were met with an outpouring of commentary and renewed interest. Not only have precious metals prices soared to levels not seen in a couple of years, it's hard for me to recall a time with more input from different voices.

The price fireworks over the July 4 holiday, particularly in silver, were met with an outpouring of commentary and renewed interest. Not only have precious metals prices soared to levels not seen in a couple of years, it's hard for me to recall a time with more input from different voices.

No comments:

Post a Comment