Gold World News Flash |

- The Gold & Silver Price Is Skyrocketing – A Historic Time For Sound Money

- A Precarious State

- Gold Daily and Silver Weekly Charts – Pause Ahead of the Non-Farm Payrolls – Winter Is Coming

- Massive One-Day Record Surge Of Mainstream Gold Investment Demand

- How George Soros Singlehandedly Created The European Refugee Crisis - And Why

- Jim Rickards and Egon von Greyerz Discuss $10,000 Gold

- Sign of the Times: Riot Control Gear Sales Are Soaring Globally

- 26 Million Americans Are Now "Too Poor To Shop" Study Finds

- The Disastrous Dollar Standard

- Peter Schiff: Massive Quantitative Easing Is Coming, Warns Bubble Will Implode

- Silver Price Rose 5.7% Off Today's Low, in One Day - Silver Price Will Rise Further Next Week

- The Blacks are Leaving The Democrats Plantation

- Gold Daily and Silver Weekly Charts - Le Bon Samaritain

- Crisis — The Inevitable Result of Modern Central Banking

- Jim Rickards and Egon von Greyerz discuss $10,000 gold

- BREAKING: Hillary Clinton Email Hacker found Dead in Jail Cell - Guccifer

- PROOF History Is Repeating Itself: DotCom Bubble. 2008 Crash. 2016 Meltdown?? By Gregory Mannarino

- WARNING -- I’m a Physicist At CERN We’ve Done Something We Shouldn’t Have Done

- Gold Stocks’ Record Summer Surge

- The Economy Is Going To Implode - Ann Barnhardt

- Robot Kills Dallas Suspect

- How to Double Your Gains on Silver…

- EU Citizens Living in UK BrExit Status Not Secure, Not Guaranteed

- Gold Stocks Record Summer Surge

- Breaking News And Best Of The Web

- Pound Replaces Oil As Leading Indicator

| The Gold & Silver Price Is Skyrocketing – A Historic Time For Sound Money Posted: 09 Jul 2016 12:30 AM PDT from World Alternative Media: Josh Sigurdson talks with author and economic analyst John Sneisen about the incredible rise in gold and silver prices. Of course for several years silver and gold have been in a corrective market due to manipulation by funds like the Exchange Stabilization Fund as well as major banks like Deutsche Bank and The Bank of Nova Scotia (Scotia Bank), however, even with the level of manipulation that has kept the price down, silver and gold have still been able to rise above the manipulation. The value of silver and gold may just be limitless considering scarcity, demand and the preservation of value which has held on strong for thousands of years. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 09 Jul 2016 12:00 AM PDT by Charles Hugh Smith, Of Two Minds:

That the global economy is in a precarious state seems self-evident. Take your pick of the systemic risks: debt bubble and slowdown in China, banking/political crisis in Europe, negative interest rates and stagnation in Japan, ongoing meltdown in emerging markets and currencies, oil prices that threaten mayhem if they go up and if they go down, and a downturn in global trade that is usually associated with recession. Other than that, everything’s great. How about those summer Olympics? Seriously, what isn’t in a precarious state? If the global financial sector isn’t precarious, then why is capital flooding into negative interest bonds? Why are money managers willing to accept a guaranteed loss of capital if things are going great and opportunities for low-risk profits are abundant? The political realm is also in a precarious state. No matter how you interpret Brexit–as a Kabuki play by Deep State insiders, as a political ploy that went off the rails, as an ugly outburst of xenophobia, as a rebellion of the Forgotten Class that lost out in the Great Financialization boom, as a resurgence of nationalism–whatever interpretation or combination of factors you favor, the net result is the same: Brexit reflects a precarious state of shifting political tectonics that threatens the status quo. It isn’t just political certainties that are giving way beneath our feet–the global “recovery” narrative is crumbling like weathered sandstone on the edge of a cliff. No wonder institutional money managers, hedge funds and punters are all either fleeing to safe havens or entering trades with their thumbs twitching nervously on the “sell” button. If the global banking sector isn’t precarious, then why are bank stocks tanking? If these banks are minting profits and accumulating well-collateralized capital, why are investors selling them? If everything’s so solid, why is hot money chasing the bubble du jour? From copper to rebar to bitcoin to iron ore to silver, hot money is sloshing from one casino-sector to another on a daily or weekly basis–what’s next? Bat guano? Disney dollectibles? Is this a sign of a healthy, sustainable market? If you think so, I have a containload of hot bat guano to sell you –I guarantee it will be the next bubble du jour, you’ll get rich overnight… If the U.S. economy isn’t precarious, why has the growth rate of new businesses collapsed to Depression-type lows? If everything is going great, why aren’t entrepreneurs jumping in to mint all those easy profits?

The global political/economic state feels precarious for a good reason: it is precarious. Being told everything’s rock-solid while the ground beneath us is rumbling isn’t terribly persuasive, and some talking head reassuring us that the economy is still “growing” won’t stop the tremors. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts – Pause Ahead of the Non-Farm Payrolls – Winter Is Coming Posted: 08 Jul 2016 09:30 PM PDT from Jesse's Café Américain:

It is in itself only power; and its value depends on its application.” Sydney Smith Let’s see if the Non-Farm Payrolls Report tomorrow gives the Fed enough of a recovery fig-leaf to start talking about rate increases, and sufficient nudge for the market takers to shove the price of the precious metals around to catch any of the over-leveraged specs leaning in the wrong direction. Except for the occasional exogenous news that moves markets, we are in the Summer doldrums where the market fakers and takers like to shove prices around to generate enough action to fuel the vig. It used to be ridiculously high commissions and the occasional frauds, but now it is pervasive insider trading and the soft corruption surrounding HFT and the exchanges that fuels the Jabba the Hutts of Wall Street and Washington. So I wisely chose to spend a pleasant afternoon doing a thorough overhaul on our old Troybilt Pony rototiller on the driveway in the shade, and rewarded myself with an ice cold beer after it was done. It has done us good service over the past twenty five years on both lawn and garden. It really needed some careful attention, a few parts, and a bit of elbow grease. Like most things in daily life really. You choose quality and take good care of it, and it serves you well in the long run, from kits to chickens to investments. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Massive One-Day Record Surge Of Mainstream Gold Investment Demand Posted: 08 Jul 2016 07:35 PM PDT by Steve St. Angelo, SRSRocco Report:

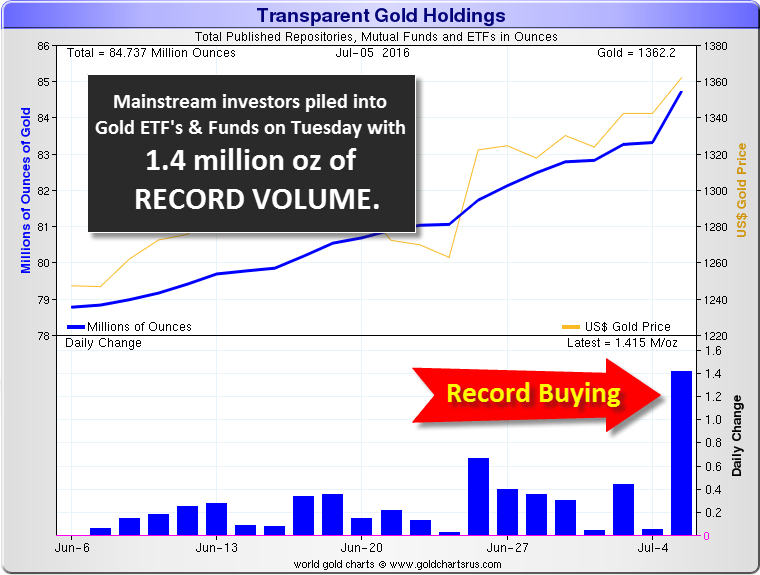

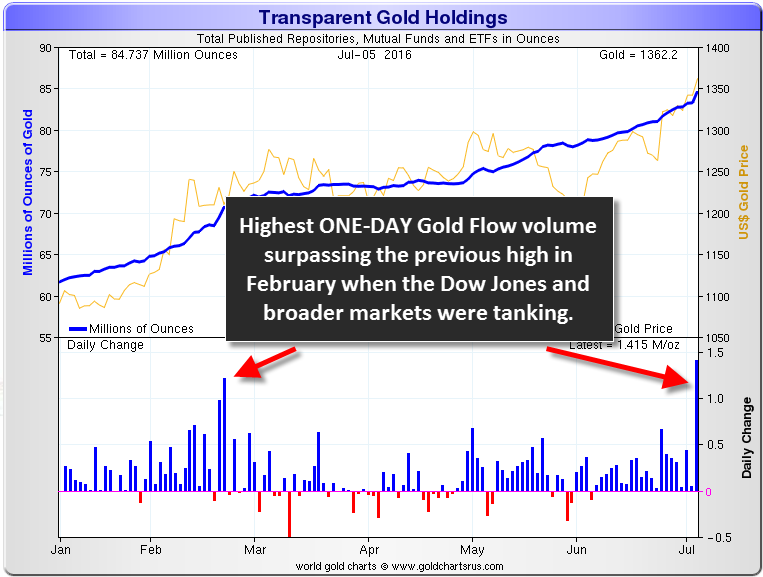

Mainstream investors who thought the gold price may come under pressure at Tuesday's market open, were caught by surprise as the yellow metal continued to rally even higher. This caused a massive one-day surge in mainstream investor Gold ETF's and Fund demand. How much gold flooded into Gold ETF's and Funds on July 5th? Take a look at the chart below: Mainstream investors piled into gold on Tuesday, July 5th, thus pushing the ONE-DAY flow into Gold ETF's & Funds to a record 1.4 million oz (Moz). Let me tell you… this is one hell of a lot of gold. Even if we go back and look at a six month chart from Sharelynx.com, the amount of gold that flowed into Gold ETF's & Funds surpassed the previous record in February when investors were fleeing stocks and moving into gold as the Dow Jones and broader markets were getting crushed. The Dow Jones fell 2,000 points in a matter of weeks:

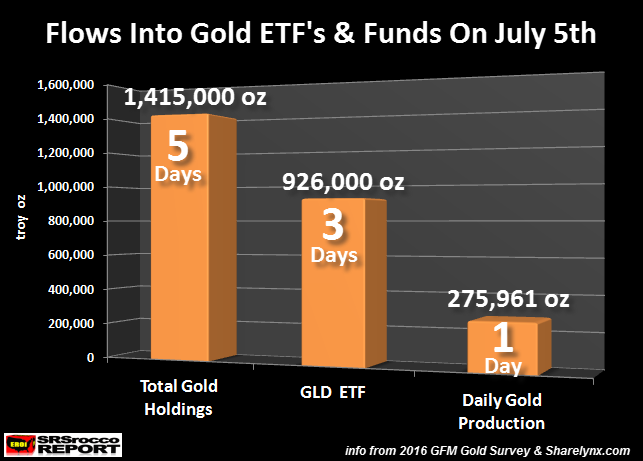

The one-day previous record set back in February was approximately 1.25 Moz. However, the 1.4 Moz of gold that flowed into Gold ETF's & Funds on July 5th was the result of the surging gold price, not the falling stock markets. What happens when the markets crack as the gold price spikes higher?? We could see double or triple that amount in just one day. To give you an idea of just how much gold supposedly moved into Global Gold ETF's & Funds on Tuesday, July 5th, take a look at this chart:

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| How George Soros Singlehandedly Created The European Refugee Crisis - And Why Posted: 08 Jul 2016 07:01 PM PDT By David Galland and Stephen McBride, Garret/Galland Research

How George Soros Singlehandedly Created the European Refugee Crisis - And Why George Soros is trading again. The 85-year-old political activist and philanthropist hit the headlines post-Brexit saying the event had “unleashed” a financial-market crisis. Well, the crisis hasn’t hit Soros just yet. He was once again on the right side of the trade, taking a short position in troubled Deutsche Bank and betting against the S&P via a 2.1-million-share put option on the SPDR S&P 500 ETF. More interestingly, Soros recently took out a $264 million position in Barrick Gold, whose share price has jumped over 14% since Brexit. Along with this trade, Soros has sold his positions in many of his traditional holdings.

Soros had recently announced he was coming out of retirement, again. First retiring in 2000, the only other time Soros has publicly re-entered the markets was in 2007, when he placed a number of bearish bets on US housing and ultimately made a profit of over $1 billion from the trades. Since the 1980s, Soros has actively been pursuing a globalist agenda; he advances this agenda through his Open Society Foundations (OSF). What is this globalist agenda, and where does it come from? The Humble BeginningsThe globalist seed was sowed for young George by his father, Tivadar, a Jewish lawyer who was a strong proponent of Esperanto. Esperanto is a language created in 1887 by L.L. Zamenhof, a Polish eye doctor, for the purpose of “transcending national borders” and “overcoming the natural indifference of mankind.” Tivadar taught young George Esperanto and forced him to speak it at home. In 1936, as Hitler was hosting the Olympics in Berlin, Tivadar changed the family name from Schwartz to Soros, an Esperanto word meaning “will soar.” George Soros, who was born and raised in Budapest, Hungary, benefited greatly from his father’s decision. Allegedly, in 1944, 14-year-old George Soros went to work for the invading Nazis. It is said that until the end of the war in 1945, he worked with a government official, helping him confiscate property from the local Jewish population. In an 1998 interview with 60 Minutes, Soros described the year of German occupation as “the happiest time in my life.” Soros’s Venture into FinanceWhen the war ended, Soros moved to London and in 1947 enrolled in the London School of Economics where he studied under Karl Popper, the Austrian-British philosopher who was one of the first proponents of an “Open Society.” Soros then worked at several merchant banks in London before moving to New York in 1963. In 1970, he founded Soros Fund Management and in 1973 created the Quantum Fund in partnership with investor Jim Rogers. The fund made annual returns of over 30%, cementing Soros’s reputation and putting him in a position of power—one he utilizes to this day to advance the agenda of his mentors. The Currency Speculations That Threw Britain and Asia into CrisisIn the 1990s, Soros began a string of large bets against national currencies. The first was in 1992, when he sold short the pound sterling and made a $1 billion profit in a single day. His next big currency speculation came in 1997. This time Soros singled out the Thai baht and, with heavy short-selling volume, destroyed the baht’s artificial peg to the US dollar, which started the Asian financial crisis. “Humanitarian” EffortsToday, Soros’s net worth stands at $23 billion. Since taking a back seat in his company, Soros Fund Management, in 2000, Soros has been focusing on his philanthropic efforts, which he carries out through the Open Society Foundations he founded in 1993. So who does he donate to, and what causes does he support? During the 1980s and 1990s, Soros used his extraordinary wealth to bankroll and fund revolutions in dozens of European nations, including Czechoslovakia, Croatia, and Yugoslavia. He achieved this by funneling money to political opposition parties, publishing houses, and independent media in these nations. If you wonder why Soros meddled in these nations’ affairs, part of the answer may lie in the fact that during and after the chaos, he invested heavily in assets in each of the respective countries. He then used Columbia University economist Jeffrey Sachs to advise the fledgling governments to privatize all public assets immediately, thus allowing Soros to sell the assets he had acquired during the turmoil into newly formed open markets. Having succeeded in advancing his agenda in Europe through regime change—and profiting in the process—he soon turned his attention to the big stage, the United States. The Big TimeIn 2004, Soros stated, “I deeply believe in the values of an open society. For the past 15 years I have been focusing my efforts abroad; now I am doing it in the United States.” Since then, Soros has been funding groups such as:

Soros also uses his Open Society Foundations to funnel money to the progressive media outlet, Media Matters. Soros funnels the money through a number of leftist groups, including the Tides Foundation, Center for American Progress, and the Democracy Alliance in order to circumvent the campaign finance laws he helped lobby for. Why has Soros donated so much capital and effort to these organizations? For one simple reason: to buy political power. Democratic politicians who go against the progressive narrative will see their funding cut and be attacked in media outlets such as Media Matters, which also directly contribute to mainstream sites such as NBC, Al Jazeera, and The New York Times. Apart from the $5 billion Soros’s foundation has donated to groups like those cited above, he has also made huge contributions to the Democratic Party and its most prominent members, like Joe Biden, Barack Obama, and of course Bill and Hillary Clinton. Best Friends with the ClintonsSoros’s relationship with the Clintons goes back to 1993, around the time when OSF was founded. They have become close friends, and their enduring relationship goes well beyond donor status. According to the book, The Shadow Party, by Horowitz and Poe, at a 2004 “Take Back America” conference where Soros was speaking, the former first lady introduced him saying, “[W]e need people like George Soros, who is fearless and willing to step up when it counts.” Soros began supporting Hillary Clinton’s current presidential run in 2013, taking a senior role in the “Ready for Hillary” group. Since then, Soros has donated over $15 million to pro-Clinton groups and Super PACs. More recently, Soros has given more than $33 million to the Black Lives Matter group, which has been involved in outbreaks of social unrest in Ferguson, Missouri, and Baltimore, Maryland, in 2015. Both of these incidents contributed to a worsening of race relations across America. The same group heavily criticized Democratic contender Bernie Sanders for his alleged track record of supporting racial inequality, helping to undercut him as a competitive threat with one of Hillary Clinton’s most ardent constituencies. This, of course, greatly enhances the clout Soros wields through the groups mentioned above. It is safe to assume that he is now able to drive Democratic policy, especially in an administration headed by Hillary Clinton. Simply, what Soros wants, he gets. And it’s clear from his history that he wants to smudge away national borders and create the sort of globalist nightmare represented by the European Union. In recent years, Soros has turned his attention back to Europe. Is it a coincidence that the continent is currently in economic and social disarray? Another Home Run: the Ukrainian ConflictThere’s no doubt about Soros’s great influence on US foreign policy. In an October 1995 PBS interview with Charlie Rose, he said, “I do now have access [to US Deputy Secretary of State Strobe Talbott]. There is no question. We actually work together [on Eastern European policy].” Soros’s meddling reared its ugly head again in the Russia-Ukraine conflict, which began in early 2014. In a May 2014 interview with CNN, Soros stated he was responsible for establishing a foundation in the Ukraine that ultimately led to the overthrow of the country’s elected leader and the installation of a junta handpicked by the US State Department, at the time headed by none other than Hillary Clinton: CNN Host: First on Ukraine, one of the things that many people recognized about you was that you during the revolutions of 1989 funded a lot of dissident activities, civil society groups in Eastern Europe and Poland, the Czech Republic. Are you doing similar things in Ukraine? Soros: Well, I set up a foundation in Ukraine before Ukraine became independent of Russia. And the foundation has been functioning ever since and played an important part in events now. The war that ripped through the Ukrainian region of Donbass resulted in the deaths of over 10,000 people and the displacement of over 1.4 million people. As collateral damage, a Malaysia Airlines passenger jet was shot down, killing all 298 on board. But once again Soros was there to profit from the chaos he helped create. His prize in Ukraine was the state-owned energy monopoly Naftogaz. Soros again had his US cronies, Secretary of the Treasury Jack Lew and US consulting company McKinsey, advise the puppet government of Ukraine to privatize Naftogaz. Although Soros’s exact stake in Naftogaz has not been disclosed, in a 2014 memo he pledged to invest up to $1 billion in Ukrainian businesses, but no other Ukrainian holdings have since been reported. His Latest Success: the European Refugee CrisisSoros’s agenda is fundamentally about the destruction of national borders. This has recently been shown very clearly with his funding of the European refugee crisis. The refugee crisis has been blamed on the civil war currently raging in Syria. But did you ever wonder how all these people suddenly knew Europe would open its gates and let them in? The refugee crisis is not a naturally occurring phenomenon. It coincided with OSF donating money to the US-based Migration Policy Institute and the Platform for International Cooperation on Undocumented Migrants, both Soros-sponsored organizations. Both groups advocate the resettlement of third-world Muslims into Europe. In 2015, a Sky News reporter found “Migrant Handbooks” on the Greek island of Lesbos. It was later revealed that the handbooks, which are written in Arabic, had been given to refugees before crossing the Mediterranean by a group called “Welcome to the EU.” Welcome to the EU is funded by—you guessed it—the Open Society Foundations. Soros has not only backed groups that advocate the resettlement of third-world migrants into Europe, he in fact is the architect of the “Merkel Plan.” The Merkel Plan was created by the European Stability Initiative whose chairman Gerald Knaus is a senior fellow at none other than the Open Society Foundations. The plan proposes that Germany should grant asylum to 500,000 Syrian refugees. It also states that Germany, along with other European nations, should agree to help Turkey, a country that’s 98% Muslim, gain visa-free travel within the EU starting in 2016. Political DiscourseThe refugee crisis has raised huge concern in European countries like Hungary. In response to 7,000 migrants entering Hungarian territory per day in 2015, the Hungarian government reestablished border control in order to keep the hordes of refugees from entering the country. Of course this did not go down well with Soros and his close allies, the Clintons. Bill Clinton has since come out and accused both Poland and Hungary of thinking “democracy is too much trouble” and wanting to have a “Putin-like authoritarian dictatorship.” Seeing through Clinton’s comments, Hungarian Prime Minister Viktor Orbán responded by saying, “The remarks made about Hungary and Poland … have a political dimension. These are not accidental slips of the tongue. And these slips or remarks have been multiplying since we are living in the era of the migrant crisis. And we all know that behind the leaders of the Democratic Party, we have to see George Soros.” He went on to say that “although the mouth belongs to Clinton, the voice belongs to Soros.” Soros has since said of Orbán’s policy toward the migrants: “His plan treats the protection of national borders as the objective and the refugees as an obstacle. Our plan treats the protection of refugees as the objective and national borders as the obstacle.” It’s hard to imagine that he could be any clearer in his globalist intentions. The Profit MotiveSo why is Soros going to such lengths to flood Europe with hordes of third-world Muslims? We can’t be sure, but it has recently come to light that Soros has taken a large series of “bearish derivative positions” against US stocks. Apparently, he thinks that causing chaos in Europe will spread the contagion to the United States, thus sending US markets spiraling downward. The destruction of Europe through flooding it with millions of unassimilated Muslims is a direct plan to cause economic and social chaos on the Continent. Another example of turmoil equaling profit for George Soros, who seems to have his tentacles in most geopolitical events. We all understand correlation is not causation. However, given Soros’s extraordinary wealth, political connections, and his long track record of seeing and profiting from chaos, he is almost certainly a catalyst for much of the geopolitical turmoil now occurring. He is intent on destroying national borders and creating a global governance structure with unlimited powers. From his comments directed toward Viktor Orbán, we can see he clearly views national leaders as his juniors, expecting them to become puppets that sell his narrative to the ignorant masses. Soros sees himself as a missionary carrying out the globalist agenda taught to him by his early mentors. He uses his vast political connections to influence government policy and create crises, both economic and social, to further this agenda. By all appearances, Soros is conspiring against humanity and is hell-bent on the destruction of Western democracies. To any rational thinker, some global events just don’t make sense. Why, for example, would Western democracies take in millions of people whose values are completely incompatible with their own? When we look closely at the agenda being actively promoted by the leading globalist puppet master, George Soros, things become a little clearer. Want to read more? If you haven’t done so already, sign-up for your free subscription to The Passing Parade from Garret/Galland Research. It’s a rousing weekly romp on economics and markets, with a dose of politics and other follies. It’s free and you can cancel at any time. Click here now to start subscription today! On Soros & GoldDavid, again. While I’m not a conspiracy theorist per se, I do believe there is a naturally occurring and constant collaboration about shared interests occurring amongst the heads of governments, corporations, investment managers and all of the bottom feeders that survive off their scraps. What I find most interesting about Soros is that he is so obvious in his intentions and persistent in their pursuit. Given the consequences of his actions, it is also clear he’s a believer in moral relativism and that the ends justify the means. That he turns a nice buck in his crusade for what certainly rhymes with a one-world government is a Soros hallmark. “It allows me the money needed to fund my philanthropies” he might answer to the charges he is profiting from blood in the streets he was instrumental in spilling. Going forward when something big is happening geopolitically, I am going to start my analysis by checking under rocks for signs of Soros. At the beginning of this article we noted that Soros has gone big into American Barrick (ABX), a leading gold producer. As of the end of March it was his single largest holding at 7.36% of his overall portfolio. As telling, he has dumped a lot of his more conventional stocks in recent months. Given the man’s inside track – and active manipulations – you might want to take the hint and pick up some physical gold as an insurance policy against a systematic shock. If you already own gold, I probably wouldn’t chase it here as it has had a good run of late. Ditto silver which is up 46% year to date. But if you don’t own some, adding precious metals to your portfolio as a long-term holding, even at today’s prices, makes sense. Per last week, I continue to believe the gold stocks have probably gotten ahead of themselves and could be in for a pretty significant correction. If so, I would be inclined to up my allocation to the sector to 20% of my total portfolio. That said, no one can predict the future and gold could continue to power ahead, with the gold shares a more leveraged way to play the sector. As always with gold shares, it is important to remember a few things:

Earlier this week I commented to a friend that if the EU was going to remain relevant, there had to be some major financial pain dished out post-Brexit. To let that seminal event pass with nothing more than the equivalent of a global shrug would entirely change how people view the European Union. The bottom line, I’m expecting some volatility, perhaps triggered by Soros taking a second run at crushing the British pound, the source of much of his fortune and fame. It’s promising to be a long, hot summer. Here Come the ClownsNothing comes close to the Get Out of Jail card handed by the clowns at the FBI to Hillary over her private email servers. This despite pretty much no one disputes she broke any number of federal laws of the sort which would have landed a lesser clown in jail | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jim Rickards and Egon von Greyerz Discuss $10,000 Gold Posted: 08 Jul 2016 07:00 PM PDT from GoldSwitzerland: In this 18 minutes video, recorded in a Swiss vault, Jim and Egon cover many vital factors that investors must be aware of to protect themselves against the major risks in the financial system. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sign of the Times: Riot Control Gear Sales Are Soaring Globally Posted: 08 Jul 2016 06:40 PM PDT by Joshua Krause, Ready Nutrition:

And all over the world, people are becoming sick and tired of the status quo. In nearly every single country, people are losing their faith in major institutions, and in increasing numbers, they are losing their trust in the financial and political elitists who run those institutions. Obviously, this state of affairs can't continue indefinitely. There is a flashpoint somewhere down the road, when the people of the world reach their breaking point, and the elitists who run their societies will do everything they can to hold onto their power. It's going to be ugly, and it's going to be global in scope. The governments of the world clearly know what's coming. That's why they're stocking up on riot gear at an unprecedented rate. We know this because globally, sales of riot gear are rapidly growing.

And that's not all. Wealthy Americans from Chicago to the Silicon Valley are buying rural compounds that they can escape to if civil unrest occurs. Companies that produce luxury bomb shelters are seeing widespread interest, and the wealthy who are still living in major cities are building panic rooms in their luxury apartments. Clearly, the people who are in the know are getting ready for something big. The elitists who run the governments of the world are hunkering down. They're preparing their police forces to deal with widespread civil unrest, and they preparing to protect themselves as well. The only question that remains is, are you ready? | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 26 Million Americans Are Now "Too Poor To Shop" Study Finds Posted: 08 Jul 2016 06:00 PM PDT A new study finds that roughly 26 million Americans remain "too poor to shop". The study, performed by America's Research Group, found that about 26 million Americans work on average two or three jobs at a time which, when added together, nets just shy of $30,000 in annual income. All while supporting anywhere from two to four children. The chairman of ARG, Mr. Britt Beemer, said in an interview with the NY Post that he first started looking into data when he was tracking a different indicator. Beemer first started tracking a group and surveying roughly 15,000 people to determine who had not finished Christmas shopping in 2014. During that year, the number was 21 percent but recently ran as high as 29%. From there Beemer decided to analyze the data further and learned American's are seeing increasing numbers of fellow citizens who are simply just too poor to shop. Beemer told the Post: "The poorest Americans have stopped shopping, except for necessities" and "It's scary when you start to see things that you've never seen before"..."People are so pessimistic about their future" Just this past April we wrote: "most Americans' savings continue to decline, and millions of US households not only don't have any money left over to save away, but are forced to resort to credit to fund day to day expenses." Recall from January the piece from the Atlantic that review that weak state of American's finances. The Atlantic learned that nearly 50% of Americans were not in a position to find $400 to pay of a doctor visit without reaching out to friends So not only are 26 million Americans too poor to shop, there are also 2/3 of Americans who have no savings.

As The NY Post details, retailers have blamed the weather, slow job growth and millennials for their poor results this past year, but a new study claims that more than 20 percent of Americans are simply too poor to shop.

The story of the increasing difficulty facing Americans in maintaining their standard of living continues... even after almost 10 years of Federal Reserve market-based intervention. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Disastrous Dollar Standard Posted: 08 Jul 2016 05:40 PM PDT by Richard Duncan, DailyReckoning:

When the Bretton Woods international monetary system broke down in 1973, the world's financial officials were unable to agree on a new set of rules to regulate international trade and monetary relations. Instead, a new system began to emerge without formal agreement or sanction. It also remained nameless. The current international monetary system which evolved out of the collapse of Bretton Woods will be referred to as the dollar standard — so named because U.S. dollars have become the world's core reserve currency in place of gold, which had comprised the world's reserve assets under the Bretton Woods system as well as under the classical gold standard of the 19th century. The primary characteristic of the dollar standard is that it allowed the Unites States to finance extraordinarily large current account deficits by selling debt instruments to its trading partners instead of paying for its imports with gold, as would have been required under the Bretton Woods system or the gold standard. In this manner, the dollar standard has ushered in the age of globalization by allowing the rest of the world to sell their products to the United States on credit. This arrangement has had the benefit of allowing much more rapid economic growth, particularly in large parts of the developing world, than could have occurred otherwise. It also has put downward pressure on consumer prices and therefore interest rates in the United States, as cheap manufactured goods made with very low-cost labor were imported into the United States in rapidly increasing amounts. However, it is now becoming increasingly apparent that the dollar standard has also resulted in a number of undesirable, and potentially disastrous, consequences. First, it is clear that the countries that built up large stockpiles of international reserves through current account of financial account surpluses experienced severe economic overheating and hyperinflation in asset prices that ultimately resulted in economic collapse. Japan and the Asian Crisis countries are the most obvious examples of countries that suffered from that process. Those countries were able to avoid complete economic depression only because their governments went deeply into debt to bail out the depositors of their bankrupt banks. Now China's facing a similar crisis. Second, flaws in the current international monetary system have also resulted in economic overheating and hyperinflation in asset prices in the United States, as the country's trading partners have reinvested their dollar surpluses in U.S. dollar-denominated assets. Their acquisitions of stocks, corporate bonds, and U.S. agency debt have helped fuel the stock market bubble, facilitated the extraordinary misallocation of corporate capital, and helped drive U.S. property prices to unsustainable levels. Third, the credit creation that the dollar standard made possible has resulted in over-investment on a grand scale across almost every industry. Over-investment has produced excess capacity and deflationary pressures that are now undermining corporate profitability around the world. The U.S. economy is faltering under the immense debt burden of its corporate and consumer sectors. The rest of the world has grown reliant on exporting to the United States and has allowed the United States to pay for much of its imports on credit. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Peter Schiff: Massive Quantitative Easing Is Coming, Warns Bubble Will Implode Posted: 08 Jul 2016 05:02 PM PDT Economic expert Peter Schiff has dire predictions for the American dollar and tells you how to survive the crash. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Price Rose 5.7% Off Today's Low, in One Day - Silver Price Will Rise Further Next Week Posted: 08 Jul 2016 04:44 PM PDT

Despite stocks' rally today, they failed to rise against silver or gold for the week. Silver knocked everybody silly today, and gold didn't slouch, either. Dollar index is pitiful. Platinum & palladium are raging. Should you listen to Wall Street's cheerleaders & pimps, you'd think the millennium had arrived sure enough. Dow burst upward 250.86 (1.4%) to 18,146.74 while the S&P500 added 1.53% or 32.00 to 2,106.97 -- as one headline shouted, it "brushed" its old high. Yes, but. Dow's all time high came on 19 May 2015 at 18,312.39. Dow's high today was 18,166.77. S&P's all time high hit two days later, 21 May 2015, at 2,130.82. Daddurn, that's sounds like stocks are goin' like a house afire, don't it? How've they done for 2016 so far? Whoops. Dow is up 4.1% & the S&P up 3.1%. Meanwhile gold has risen 27.9% and silver 45.6% (not a typo). But more important is that you compare stocks to gold & silver, so you can see that the trend has changed. Back at the 2015 stock highs, the Dow in Gold was 15.17 oz, today, 13.27 oz. Today, the Dow is worth 1.90 oz or 12.5% less in gold. At the May 2015 stock peak, the Dow in silver cost 1,063.51 oz, today only 891.73 oz. The Dow has lost 171.78 ounces or 16.2% against silver. Y'all beginning to understand why I watch these spreads, Dow in Gold & Dow in Silver? I am so puking sick of government reports of all kinds I don't even want to talk about that hogwash anymore. It means nothing anyway, because the numbers are imaginary estimates, and the next report they always revise the spine out of 'em anyway. So a "good" lying jobs report was published today. Stock markets, for reasons which comport not with logic, took that as a sign that the Fed was more likely to raise interest rates, and, as everybody knows, it's great for business when interest rates rise and you have to pay more to borrow. One might also conclude that if the Fed's more likely to raise interest rates, that might make for a stronger dollar, since the relative interest rate is a prime determinant of exchange rates. One would conclude against how the US dollar index behaved today. It shot up to 96.7, then slammed immediately down to 95.826. Some big sellers were waiting for a rise over 96.60. Then it leveled off and finished the day down 6 basis points (nothing, 0.06%) at 96.33. 'Tain't right, folks. Something smells like shrimp left out in the sun for four days. Either the Fed/yankee government are manipulating the dollar down, or the dollar is sick as cholera. It should not behave this way. There's something we're not seeing. Yen rose 0.3% to 99.54¢=Y100 (or US$1 = Y100.46). One wonders how long the Japanese Nice Government Men, committed as they are to destroying their currency, will stand for these yen gains. Euro sank 0.07% to $1.1055. Lawsie! It's been one long coon's age since I've seen silver behave like it did today! Here are the Comex closes, which hardly tell anything. Gold ended down $3.50 (0.3%) at $1,356.60. Silver gained 26¢ (1.3%) to 2005.8¢. Mercy! Where do I start? In the aftermarket gold rose to $1,366.50, 0.5% or $6.40 over yesterday's Comex close. But silver! Silver rose to 2030.5¢, up 2.5% over yesterday. That STILL don't tell the tale. Remember yesterday I was expecting silver to correct perhaps as far as 1920 but said "The rally will resume, & quickly"? I didn't know how quickly. By 9:45 today silver had fallen to 1923.5, fell like a meteor out of the sky, then rose like a July 4th skyrocket in 30 minutes to 1990¢, & kept on climbing till the bell rang. Mercy, silver didn't even stop then, but rose another 25¢ in the aftermarket! Now don't walk off yet. Think on that. Silver's low was 1922.5¢ & high was 2033¢, which I make to be a 110¢ difference, giving a half a cent to the enemy. Silver price rose 5.7% off today's low, in one day. Hold on there. Don't touch that delete key, I ain't near about finished. WHENEVER a market breaks to a new low, then fiercely turns around to close the day higher, that's strong action, at least the first half of a key reversal. But when it rises 5.7% off the low to close higher, well, it's just stronger than a garlic farmer's breath. Hear my words and mark 'em: silver price will rise further next week. This rally is aiming for 2300¢, and the gold for $1,450. I think it's the covered-up, hushed-up European banking crisis that's pushing them right now, but maybe it's just that Brexit suddenly pulled the wraps off more economic & financial messes than anybody imagined were there. When people get scared, their powers of observation improve substantially. Did I mention that the Gold/Silver ratio has fallen to 67.634? That's down 8.9% from 74.203 two Fridays ago. Sure, it's a red hot precious metals rally, sure it's dangerous as a rattlesnake on a liverish day, sure, sure, watch out. But it sure is fun while it runs. And later this year they will rise higher still. Y'all enjoy your weekend. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Blacks are Leaving The Democrats Plantation Posted: 08 Jul 2016 02:00 PM PDT A Black Man Opens Up To Me About the White Liberal Plantation The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Le Bon Samaritain Posted: 08 Jul 2016 01:26 PM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Crisis — The Inevitable Result of Modern Central Banking Posted: 08 Jul 2016 01:00 PM PDT This post Crisis — The Inevitable Result of Modern Central Banking appeared first on Daily Reckoning. The inevitable effect of contemporary central banking is serial financial booms and busts. With that comes increasing levels of systemic financial instability and a growing dissipation of real economic resources in misallocations and malinvestment. The world ultimately becomes poorer. Why? Because gains in real output and wealth depend upon efficient pricing of capital and savings. But the modus operandi of today's central banking is to deliberately distort and relentlessly falsify financial prices. After all, the essence of zero percent interest rates (ZIRP) and negative interest rates (NIRP) is to drive interest rates below their natural market clearing levels to induce more borrowing and spending by business and consumers. It's also the inherent result of massive quantitative buying (QE) bond-buying where central banks finance their purchases with credits conjured from thin air. The central banks' big fat thumb on the bond market's supply/demand scale results in far lower yields than real savers would accept in an honest free market. The middle class and retirees who rely on savings lose out. The same is true of the old doctrine of "wealth effects" stimulus. After being initiated by Alan Greenspan 15 years ago, it has been embraced ever more eagerly by his successors at the Fed and elsewhere ever since. Here, the monetary transmission channel is through the top 1% that own 40% of the financial assets and the top 10% that own upwards of 85%. Stock prices are intentionally driven to artificially high levels by means of "financial easing." That's a euphemism for cheap or even free finance for carry trade gamblers and fast money speculators. As the stock averages rise and their Fed-subsidized portfolios attain ever higher "marks," the wealth effects operators supposedly feel, well, wealthier. They are thereby motivated to spend and investment more than otherwise, and to actually double-down on these paper wealth gains by using them as collateral to obtain even more cheap funding for even more speculations. The trouble is, financial prices cannot be falsified indefinitely. At length, they become the subject of a pure confidence game and the risk of shocks and black swans that even the central banks are unable to offset. Then the day of reckoning arrives. Exactly that kind of Lehman-scale crisis is now descending on global markets. The end result of today's massive central bank intrusion in financial markets is, everywhere and always, crisis. Today central banks and their affiliates own about $21 trillion of government bonds and related securities. Most of that has been purchased in the last two decades and the preponderant share since the 2008 crisis. The effect of that giant central bank thumb on the scales at the very interior of the fixed income markets — that is, the benchmark government securities sector — has been to radically inflate sovereign bond prices. In turn, that drastic mispricing has spread to the balance of the fixed income spectrum, and from there into equities and other markets. Above all else, the QE driven falsification of bond prices means that central banks have displaced real money savers as the marginal source of demand in the government bond markets. But when you replace savers with central bankers at the very heart of the price discovery process in financial markets, the system eventually goes tilt. You go upside down. That condition was aptly described in a lengthy Wall Street Journal Wednesday about a recent development in sovereign debt markets which absolutely defies human nature and the fundamental dynamics of modern welfare state democracies. That is, modern governments can never stop issuing more debt due to massive entitlement constituencies, special interest racketeers of every stripe and the prevalence of Keynesian-style rationalizations for not extracting from taxpayers the full measure of what politicians are inclined to spend. Yet there is now a rapidly growing "scarcity" of government debt — the equivalent of a fiscal unicorn: A buying spree by central banks is reducing the availability of government debt for other buyers and intensifying the bidding wars that break out when investors get jittery, driving prices higher and yields lower. The yield on the benchmark 10-year Treasury note hit a record low Wednesday. "The scarcity factor is there but it really becomes palpable during periods of stress when yields immediately collapse,'' he said. "You may be shut out of the bond market just when you need it the most.'' On Wednesday, the yield on the 20-year Japanese government bond fell below zero for the first time, joining a pool of negative-yielding bonds around the world that has expanded rapidly over the past year. In Switzerland, government bonds through the longest maturity, a bond due in nearly half a century, are now yielding below zero. In Germany, government debt with maturities out as far as January 2031 is trading with negative yields. Owing to this utterly insensible "scarcity" central banks and speculators together have driven the yield on nearly $12 trillion of government debt — or nearly 26% of total outstandings on the planet — into the subzero zone. This includes more than $1 trillion each of German and French government debt and nearly $8 trillion of Japanese government debt. The systematic falsification of financial prices is the sum and substance of what contemporary central banking does. Forty years from now, for example, Japan's retirement colony will be bigger than its labor force, and its fiscal and monetary system will have crashed long before. But no matter. Before it self-destructs, the BOJ will buy all the Japanese government debt, anyway. It already owns 426 trillion yen worth — an amount that equals fully 85% of GDP. When it comes to government debt, therefore, it can be well and truly said that "price discovery" is dead and gone. Japan is only the leading edge, but the trend is absolutely clear. The price of sovereign debt is where central banks peg it, not where real money savers and investors will buy it. Yet that's only half the story, and not even the most destructive part. The truth of the matter is that the overwhelming share of government debt is no longer owned by real money savers at all. It is owned by central banks, sovereign wealth funds and leveraged speculators. Regarding the latter, do not mistake the funding deployed by speculators with genuine savings. To the contrary, it's pure credit extracted from the value of bond collateral being driven ever higher by central banks. What this means is that real money savings — which must have a positive nominal yield — are being driven to riskier investments in search of returns, most especially into the corporate credit risk zone. At the present moment, for example, there is nearly $3 trillion of junk bonds and loans outstanding in the U.S. alone. That's double the level existing on the eve of the great financial crisis. But double the money embodies far more than double the risk. That's because a very substantial portion of current junk credit outstandings went into speculations that even leveraged buyout shops wouldn't have entertained 15 years ago. That is, it was used to fund radical commodity price speculations in the shale patch, mining and other commodity plays, subprime auto lending schemes and financing for stock buybacks and dividend recaps by highly leveraged companies. Indeed, the scramble for yield generated by central bank action has systematically impregnated the global markets with FEDs (financial explosive devices). Approximately 100 principal central bankers have spent the last seven years pushing interest rates toward the zero bound or below. It may have been a blessing for the 1% who've won big in the gambling casino. But it's crushed middle-class savers and retirees. Regards, David Stockman Ed. note: "A charmingly mordant take on the stock news of the day, accentuated by philosophical maunderings…" That's how one leading financial magazine described the free daily email edition of The Daily Reckoning. You'll find cutting-edge analysis from the complex worlds of finance, politics and culture. Presented in an entertaining style few can match. Click here now to sign up for FREE. The post Crisis — The Inevitable Result of Modern Central Banking appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jim Rickards and Egon von Greyerz discuss $10,000 gold Posted: 08 Jul 2016 12:04 PM PDT Jim Rickards and Egon von Greyerz discuss $10,000 gold

I was very pleased to welcome Jim Rickards to Zurich very recently. In this important 16 minutes video, recorded in a Swiss vault, Jim and I cover many vital factors that investors must be aware of to protect themselves against the major risks in the financial system.

Among the topics … Read the rest | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BREAKING: Hillary Clinton Email Hacker found Dead in Jail Cell - Guccifer Posted: 08 Jul 2016 12:00 PM PDT BREAKING: Romanian hacker with access to Clinton emails found dead in jail cell. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PROOF History Is Repeating Itself: DotCom Bubble. 2008 Crash. 2016 Meltdown?? By Gregory Mannarino Posted: 08 Jul 2016 11:00 AM PDT It will go Down just before the Elections in US. It will take Trump Out, they want to let it go and then rebuild from the Chaos. Obama will stay on in Emergency capacity then hand over to Hilery. Problem is it will take Down the World, China will retaliate within 48 hours. It's China's Empire Now.... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| WARNING -- I’m a Physicist At CERN We’ve Done Something We Shouldn’t Have Done Posted: 08 Jul 2016 10:30 AM PDT what is really going on at Cern.... The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Stocks’ Record Summer Surge Posted: 08 Jul 2016 10:00 AM PDT Zealllc | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Economy Is Going To Implode - Ann Barnhardt Posted: 08 Jul 2016 10:00 AM PDT The Gold Standard is Not Necessary Continued WE Are the Gold The Morality and Economically Essential Nature of Interest The Real Problem in Banking System: Unbacked Unsecured Lending Bank Balance Sheet Exercise The Financial Armageddon Economic Collapse Blog tracks trends and forecasts ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 08 Jul 2016 09:30 AM PDT Police say suicide reports inaccurate. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| How to Double Your Gains on Silver… Posted: 08 Jul 2016 09:00 AM PDT This post How to Double Your Gains on Silver… appeared first on Daily Reckoning. Check out these headlines from the past few days… "Silver sets the pace as precious metals surge after Brexit" – Financial Times "Silver Outshines Gold in Brexit Precious Metals Rally" – Wall Street Journal "Silver Is Going Nuts" – Business Insider Sounds like you could have made a killing if you placed a bet on silver ahead of the Brexit vote. But what those headlines don't tell you is that you could have made twice as much money on silver with less risk if you were a trend follower… Sex SellsSilver has had a big rally since the Brits chose to leave the EU. The market reaction's been a traditional “risk off/safety on” move. Global stock markets dropped on the uncertainty of Brexit, while safe-havens like the U.S. dollar, gold and silver shot higher. This is the kind of story the financial media loves to blather about. A major global event spiking big market moves is ratings gold. The reality? Gamblers posing as investors made bets on either side… Some make a killing… Others get wiped out… It all sounds so sexy – the chance for instant lottery riches. That makes for a great narrative and hyperbolic headlines help bolster the fantasy. But this storyline tells you squat about getting rich as a smart investor. See, you can't make money just following the news cycle. Price is what creates the news, not the other way around. The media is talking about silver and gold because they've both rallied in recent weeks. If they'd tanked, the media would be talking about something else. So if you're just following the news, you'll always be late to the party. The Formula for Fat ProfitsLook, there's no doubt that Brexit is responsible for the recent silver rally. But silver's been trending up far longer than just a couple of weeks. I know steady gains over longer stretches of time don't make for riveting CNBC teleprompter copy. But those longer-term trends sure as hell make for fat profits. And if you weren't aboard the silver uptrend that formed months before Brexit, you left a lot of opportunity on the table. Take the iShares Silver Trust (NYSE:SLV) as an example. Had you bought SLV in anticipation of Brexit, you'd be up 12%. Congratulations to you, but try replicating that feat with consistency. Mathematics and history dictate that you will not. But if you are a trend follower, you know that SLV has been in an uptrend far longer than the recent headlines reveal. In fact, I recommended SLV as part of a trend following approach back in April. And if you bought then, you've seen nearly double the return compared to schizophrenic Brexit gamblers. Why were we able to nearly double up the lucky casino junkies? Well, trend following systems like mine are designed to identify already established trends that tend to get a big boost when unexpected market events happen. Trend trader Michael Rulle explains trend following's success during uncertain times: For markets to move in tandem, there has to be a common perception or consensus about economic conditions that drives it. When a major event occurs in the middle of such a consensus, such as the Russian debt default of August 1998, the terrorist attacks of September 11, 2001, or the corporate accounting scandals of 2002 [and the 2008 equity market crash], it will often accelerate existing trends already in place…events do not happen in a vacuum… This is the reason trend following rarely gets caught on the wrong side of an event. The bottom line is trend following puts you on the right side of the big trends, such as the current trends in gold and silver. Stay with the precious metals trend… until it changes. Nobody knows how high gold and silver could go. Our system may not be sexy, and it might not tell you "why" moves are happening, but it can make you rich. Please send me your comments to coveluncensored@agorafinancial.com. Regards, Michael Covel The post How to Double Your Gains on Silver… appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| EU Citizens Living in UK BrExit Status Not Secure, Not Guaranteed Posted: 08 Jul 2016 07:25 AM PDT Junker, Tusk, Hollande, Merkel and the whole of the heavily UK subsidised Eastern European states have been busy laying down threats of x,y,z happening of what Britain faces in its attempts to negotiate its way out of the European Union. Though it's not hard to see why the EU has adopted such a threatening stance because it's obvious Britain breaking away from the EU threatens a wider breakup and ultimately a collapse of the EU project, hence triggering such an aggressive response. Whilst Eastern Europe does not want it's UK gravy train to end that the region profits from to the tune of £75 billion a year! | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Stocks Record Summer Surge Posted: 08 Jul 2016 07:17 AM PDT The red-hot gold miners’ stocks have continued blasting higher this summer on heavy ETF buying by professional money managers. Funds’ ongoing big capital inflows into this market-leading sector have overcome its usual summer seasonal weakness. While gold stocks’ odds-defying record early-summer surge certainly ramps short-term downside risk, this year’s dazzling new gold-stock bull still remains young. Managing other people’s money is a hard and challenging job. Investors naturally expect and demand healthy returns after entrusting their hard-earned wealth to financial professionals. And if these fund managers fail to deliver, investors are quick to pull their capital and move it elsewhere. So the money-management industry faces staggering pressure to perform. The funds that don’t measure up risk extinction. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 07 Jul 2016 06:44 PM PDT Stocks recover on huge US payrolls beat. Gold corrects and interest rates continue to fall, with Japanese 20-year bond yields now negative. Lots of speculation about the end of the EU. UK in turmoil post-Brexit as Labour votes to oust leader, Boris Johnson drops out of PM race, and Nigel Farage leaves UKIP. Clinton gets […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pound Replaces Oil As Leading Indicator Posted: 07 Jul 2016 05:00 PM PDT |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

The global political/economic state feels precarious for a good reason: it is precarious.

The global political/economic state feels precarious for a good reason: it is precarious.

“Every increase of knowledge may possibly render depravity more depraved, as well as it may increase the strength of virtue.

“Every increase of knowledge may possibly render depravity more depraved, as well as it may increase the strength of virtue. The spike in the gold price during the holiday weekend triggered a record ONE-DAY surge in mainstream investor gold demand. Investors in the West watched over the fourth of July holiday weekend as the gold price continued higher on early morning trading on Monday. By the time gold opened on Tuesday, the price was already $15 higher.

The spike in the gold price during the holiday weekend triggered a record ONE-DAY surge in mainstream investor gold demand. Investors in the West watched over the fourth of July holiday weekend as the gold price continued higher on early morning trading on Monday. By the time gold opened on Tuesday, the price was already $15 higher.

If you pay attention to the news at all, it probably seems like the world has been fraying at the edges lately. In South America, Brazil's economy is crumbling and Venezuela is on the verge of collapse. In the United States, riots are expected at the Republican National Convention later this month. In Europe, the Brexit vote is threatening to tear apart the EU and the UK.

If you pay attention to the news at all, it probably seems like the world has been fraying at the edges lately. In South America, Brazil's economy is crumbling and Venezuela is on the verge of collapse. In the United States, riots are expected at the Republican National Convention later this month. In Europe, the Brexit vote is threatening to tear apart the EU and the UK.

Then the Gods of the Market tumbled, and their smooth-tongued wizards

Then the Gods of the Market tumbled, and their smooth-tongued wizards

No comments:

Post a Comment