saveyourassetsfirst3 |

- The BIG Silver Long – What Gives?

- Silver Price Analysis: This Confirms The Continuation Of Silver’s Rally

- Silver Prices – The Rise and Fall of Specs With No Clothes

- Secessions and Breakup Movements Occurring Everywhere

- Things Could Get Desperate: “Americans Are Not Prepared For A Full Blown, Prolonged, Nightmarish Depression”

- JUBILEE JOLT: PRE-PLANNED AND LEAKED ‘SUMMER OF CHAOS’ BEGINS IN DALLAS

- Commercial Delinquency Rates and Gold

- They Know It’s Coming: Insurance Company Risk Experts Have Started Hoarding Physical Gold and Cash Ahead Of Crisis

- Elite Are Preparing for Financial ARMAGEDDON!

- JUBILEE DISASTERS ARE SINKING EUROPE FAST AS ITALY UNRAVELS AND DEUTSCHE BANK COLLAPSES

- Silver Going to $26 Quite Quickly? – Stewart Thomson

- Yin and Yang

- The Dow And The S&P 500 Soar To Brand New All-Time Record Highs – How Is This Possible?

- Italian Banking Crisis Escalates! – Harvey Organ

- Breaking News And Best Of The Web

- Video: Gold & Gold Stocks Starting Correction…?

- Gold Price Failing at 2011-2012 Trendline

- Theresa May and Gold

- Greg Weldon Analyzes Gold, Silver, US$ & Fed Policy

- Breakouts Galore in Gold & Silver

- Gold Quiets after Brexit Spike

- Gold price Forecast: Gold’s Final Warning of Impending Monetary Collapse

- Marc Faber: Holding Gold Is a 'No Brainer'

| The BIG Silver Long – What Gives? Posted: 13 Jul 2016 01:00 PM PDT Is JPM planning to utilize its physical long to quell silver prices on THE big rally? Buy 1 oz Gold Buffalo Coins at SD Bullion By Dr. Jeff Lewis: As Chris Powell of GATA made famous: “Price action makes market commentary”. Control the price of anything and you get control of the story. The U.S. […] The post The BIG Silver Long – What Gives? appeared first on Silver Doctors. |

| Silver Price Analysis: This Confirms The Continuation Of Silver’s Rally Posted: 13 Jul 2016 12:46 PM PDT The existence of this pattern, and its recent breakout confirm that the December 2015 bottom in silver is actually the bottom for the correction since 2011. |

| Silver Prices – The Rise and Fall of Specs With No Clothes Posted: 13 Jul 2016 12:00 PM PDT Are we close to the point where COMEX doesn’t matter as far as price discovery of silver is concerned? Buy 1 oz Gold Buffalo Coins at SD Bullion By Dr. Jeff Lewis: The mainstream financial media, as well as some retail investors, have awakened to the surge in the price of silver, relative to just […] The post Silver Prices – The Rise and Fall of Specs With No Clothes appeared first on Silver Doctors. |

| Secessions and Breakup Movements Occurring Everywhere Posted: 13 Jul 2016 11:00 AM PDT The globalist elites are clearly worried… Buy 90% Junk Silver Coins at SD Bullion As Low As $1.99/oz Over Spot! LIVE and Historical Market Data, Charts, and PM Prices: > Related: Kiss The EU Goodbye Post Brexit, Anti-EU Political Parties Across Europe Plan 34 Referendums TND/SD Guest Contributor: Wayne Madsen The globalist elites are clearly […] The post Secessions and Breakup Movements Occurring Everywhere appeared first on Silver Doctors. |

| Posted: 13 Jul 2016 10:00 AM PDT The global powder keg is rapidly approaching a detonation point… From SHTFPlan: The global powder keg is rapidly approaching a detonation point. The signs are everywhere. Confidence in the economy is deteriorating. Anger is boiling over. Panic is taking hold. Wealth Research Group says we may be on the cusp of another Great Depression and Americans […] The post Things Could Get Desperate: "Americans Are Not Prepared For A Full Blown, Prolonged, Nightmarish Depression" appeared first on Silver Doctors. |

| JUBILEE JOLT: PRE-PLANNED AND LEAKED ‘SUMMER OF CHAOS’ BEGINS IN DALLAS Posted: 13 Jul 2016 09:00 AM PDT Welcome to the Summer of Chaos… From Jeff Berwick, The Dollar Vigilante: It was only two days ago that we focused on the Black Lives Matter (BLM) leaked documents showing they were planning, in concert with the Obama Regime, a "Summer of Chaos." We wrote: Black Lives Matter leader Deray McKesson had two of his […] The post JUBILEE JOLT: PRE-PLANNED AND LEAKED 'SUMMER OF CHAOS' BEGINS IN DALLAS appeared first on Silver Doctors. |

| Commercial Delinquency Rates and Gold Posted: 13 Jul 2016 08:20 AM PDT SunshineProfits |

| Posted: 13 Jul 2016 08:00 AM PDT When re-insurance companies, whose sole purpose is to insure other insurance companies, start to panic into gold… From Mac Slavo, SHTFPlan: How do you know when the world's economic, financial and monetary systems are in trouble? Answer: When re-insurance companies, whose sole purpose is to insure other insurance companies, start to panic into […] The post They Know It's Coming: Insurance Company Risk Experts Have Started Hoarding Physical Gold and Cash Ahead Of Crisis appeared first on Silver Doctors. |

| Elite Are Preparing for Financial ARMAGEDDON! Posted: 13 Jul 2016 07:00 AM PDT Are the global elite preparing RIGHT NOW for financial Armageddon? James Corbett makes the case… Buy 90% Junk Silver Coins at SD Bullion As Low As $1.99/oz Over Spot! LIVE and Historical Market Data, Charts, and PM Prices: The post Elite Are Preparing for Financial ARMAGEDDON! appeared first on Silver Doctors. |

| JUBILEE DISASTERS ARE SINKING EUROPE FAST AS ITALY UNRAVELS AND DEUTSCHE BANK COLLAPSES Posted: 13 Jul 2016 06:50 AM PDT What we will see in Europe will just be a rolling series of crises that could leave the entire EU in ruins. And it's not just the EU. It's not just America or China. It's the whole word that is headed over the edge of the precipice. That's one reason gold and silver are up so sharply […] The post JUBILEE DISASTERS ARE SINKING EUROPE FAST AS ITALY UNRAVELS AND DEUTSCHE BANK COLLAPSES appeared first on Silver Doctors. |

| Silver Going to $26 Quite Quickly? – Stewart Thomson Posted: 13 Jul 2016 02:00 AM PDT For the first time in history, all US central bank actions are bullish for the entire precious metals sector. Gold stocks continue to take out key highs, but in the big picture, the upside action has barely started. Silver now has what appears to be a bull flag pattern in play. A pullback within the […] The post Silver Going to $26 Quite Quickly? – Stewart Thomson appeared first on Silver Doctors. |

| Posted: 12 Jul 2016 11:02 PM PDT During gold's bear market from 2011, the flow of gold out of ETFs drove the popularity of the West to East narrative not just among goldbugs but also bullion market professionals. It was a life raft I suppose that many clung to, to find hope as the price relentlessly fell, notwithstanding how much gold was flowing into "the East". Today, investors have abandoned the raft as they step out on to the terra firma of $1050 and stagger about basking in the lush tropical greenery of a rising gold price. Read more here. |

| The Dow And The S&P 500 Soar To Brand New All-Time Record Highs – How Is This Possible? Posted: 12 Jul 2016 09:04 PM PDT

Of course I never imagined we would be talking about new record highs for the stock market in mid-July 2016. We have seen some crazy ups and downs for the financial markets over the last 12 months, and the downs were pretty severe. Last August, we witnessed the greatest financial shaking since the historic financial crisis of 2008, and that was followed by an even worse shaking in January and February. Then in June everyone was concerned that the surprising result of the Brexit vote would cause global markets to tank, and that did happen briefly, but since then we have seen an unprecedented rally. So what is causing this sudden surge? We’ll get to that in a moment, but first let’s review some of the numbers from Tuesday. The following comes from USA Today…

Overall, we have seen stocks shoot up more than eight percent over the last two weeks. Normally, a rise of 10 percent for an entire year is considered to be quite healthy…

What makes all of this even stranger is the fact that investors have been pulling money out of stocks as if it was 2008 all over again. In fact, Zero Hedge tells us that on balance investors have been taking money out of equity funds for 17 weeks in a row. So why are stocks still going up? If your guess is “central bank intervention”, you are right on the nose. Across the Pacific, the Bank of Japan has been voraciously gobbling up assets, and the architect of “Abenomics” just won a major electoral victory which has fueled a huge market rally over there…

In Europe, the ECB has feverishly been pumping money into the financial system, and the result of the Brexit vote seems to have lit a renewed fire under the central bankers in Europe. Collectively, intervention by the Japanese and the Europeans has created “a surge in net global central bank asset purchases to their highest since 2013″…

So now you know the rest of the story. The economic fundamentals have not changed. China is still slowing down. Japan is still mired in a multi-year economic crisis. Much of Europe is still dealing with a full-blown banking crisis. Much of South America is still experiencing a full-blown depression. Here in the United States, just about every indicator that you can think of says that the economy is slowing down. If you doubt this, please see my previous article entitled “15 Facts About The Imploding U.S. Economy That The Mainstream Media Doesn't Want You To See“. The artificially-induced rally that we are witnessing right now can be compared to a “last gasp” of a dying patient. But my hope is that this “last gasp” can last for as long as possible. Because as much as I warn people about it, I am not actually eager to see what comes next. The economic and financial suffering that are coming are inevitable, but they are not going to be pleasant for any of us. So let us all hope that we still have a little bit more time before the party is over and it is time to turn out the lights. |

| Italian Banking Crisis Escalates! – Harvey Organ Posted: 12 Jul 2016 08:52 PM PDT BANKING PROBLEMS INSIDE ITALY ARE ESCALATING! ANOTHER RAID ON GOLD AND SILVER/CHINA'S STATE OWNED OPERATIONS BURNING CASH AS THEY ARE ALL UNPROFITABLE/THE HAGUE'S DECISION ON THE SOUTH CHINA SEA'S GOVES AGAINST CHINA: THEY DECIDE TO IGNORE RULING/BANKING PROBLEMS INSIDE ITALY ESCALATING! Buy 90% Junk Silver Coins at SD Bullion As Low As $1.99/oz Over […] The post Italian Banking Crisis Escalates! – Harvey Organ appeared first on Silver Doctors. |

| Breaking News And Best Of The Web Posted: 12 Jul 2016 06:44 PM PDT Stocks recover on Abe’s promise of massive new stimulus. Gold stabilizes, oil drops and interest rates rise. Civil unrest in the US, as sniper kills five police in Dallas and protests spread. UK Conservative party appears to have chosen a leader. Sanders endorses Clinton. Best Of The Web Bernanke’s black helicopters – David Stockman […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| Video: Gold & Gold Stocks Starting Correction…? Posted: 12 Jul 2016 05:53 PM PDT Are gold and gold stocks starting a correction? We discuss that probability and highlight support targets in Gold, GDX and GDXJ.

|

| Gold Price Failing at 2011-2012 Trendline Posted: 12 Jul 2016 12:51 PM PDT |

| Posted: 12 Jul 2016 06:20 AM PDT SunshineProfits |

| Greg Weldon Analyzes Gold, Silver, US$ & Fed Policy Posted: 02 Jul 2016 12:33 AM PDT Greg Weldon, CEO of WeldonFinancial (weldononline.com) one of the leading macro analysts covers the markets and Fed policy for Gold investors. Visit WeldonOnline.com to get a free trial to Greg’s fantastic research and analysis.

|

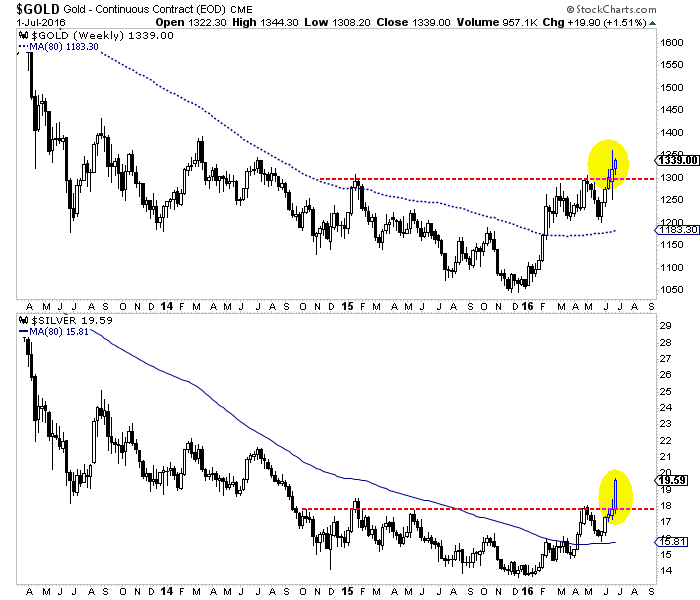

| Breakouts Galore in Gold & Silver Posted: 01 Jul 2016 02:10 PM PDT Gold broke-out last week on Brexit while Silver waited a week to join the party. The miners, meanwhile cleared 2014 resistance today. There are breakouts across the board in the precious metals space. The weekly candle charts of Gold and Silver are plotted in the image below. Gold appears to have digested the Brexit pop well as it gained another 1.5% on the week to $1339. If it holds above monthly and quarterly resistance ($1330s) then it should be on its way to $1380-$1400. Meanwhile, Silver surged 9.9% on the week to $19.59. It has broken out from an inverse head and shoulders pattern to nearly a 2-year high. The pattern projects to a target of $22.  Gold, Silver

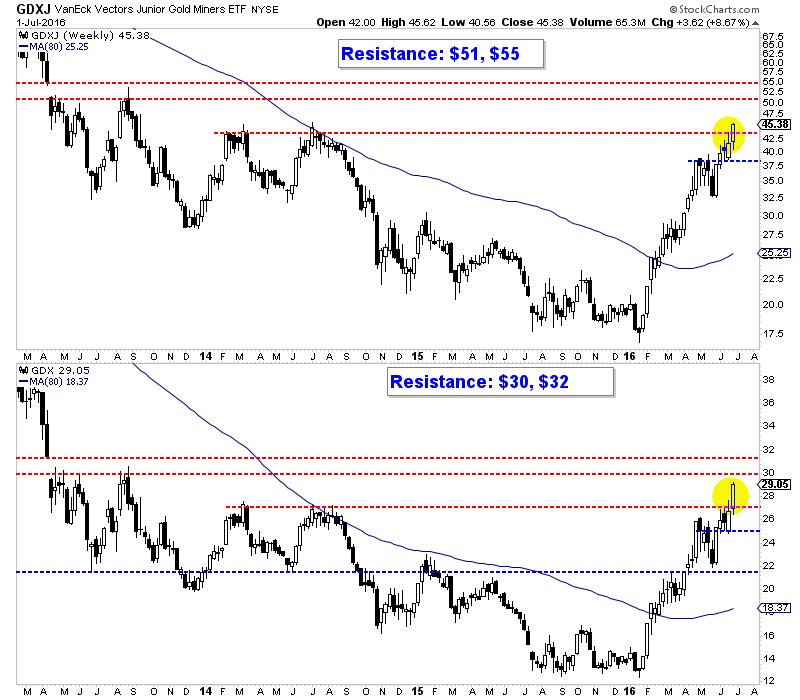

The breakouts in Gold and Silver were foretold by the strength and leadership from the mining stocks which closed the week with gusto. GDX surged 4.8% Friday and GDXJ surged 6.5%. Both closed near the highs of the day and broke 2014 resistance in clean fashion. GDX has upside to resistance at $30 and $32. GDXJ, which has more upside has resistance at $51 and $55.  GDXJ, GDX

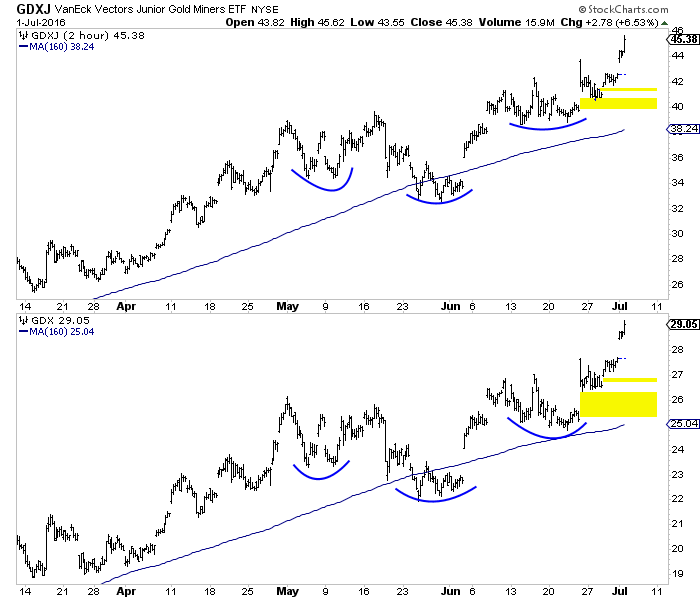

We had been looking for weakness or at least some consolidation but yesterday realized that was becoming unlikely. The chart below is one we sent to premium subscribers in a flash update. The 2-hour bar chart shows that miners had formed a reverse head and shoulders continuation pattern which because of its upward slant indicated more strength than the typical pattern. The pattern projects to a target of ~$51 for GDXJ and $32 for GDX. Those targets are inline with the resistance targets above.  2-Hour Bar Charts

I am one of the biggest precious metals bulls but even I at times have underestimated the strength of this bull market (particularly in the miners). The miners correct less than I expect or do not correct at all. While it is tough to chase strength and stay bullish after a huge rebound we maintain our posture as we expect Gold to test $1400 and perhaps $1550 before a significant counter trend move. Buy weakness and hold. That is how to make money in a bull market. Consider learning more about our premium service including our favorite junior miners which we expect to outperform in the second half of 2016.

Jordan Roy-Byrne, CMT, MFTA |

| Gold Quiets after Brexit Spike Posted: 30 Jun 2016 01:28 PM PDT |

| Gold price Forecast: Gold’s Final Warning of Impending Monetary Collapse Posted: 30 Jun 2016 04:06 AM PDT Gold Price Forecast 2017/2016 Gold is currently trading in excess of $1300 an ounce. This is well above the 1980 all-time high. However, this is an incomplete representation of what gold is trading at relative to US dollars. When you look at the gold price relative to US currency in existence (US Monetary Base), then… |

| Marc Faber: Holding Gold Is a 'No Brainer' Posted: 30 Jun 2016 01:00 AM PDT |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment