Gold World News Flash |

- Endgame for Corporation USA without Trump

- John Williams — Dollar Decline with Monetary Easing

- Deutsche Bank is Broke, DERIVATIVES COLLAPSE COMING — Jim Rogers

- Gold Price Will Move Higher, Soon - Won't Stop Till it Touches $1,450.00

- WARNING! DAY OF RAGE EVENT COULD OCCUR THIS FRIDAY!

- Shocking ! Government Declassified suppressed Document on Weather Control HAARP

- Central Bank Wonderland is Complete and Now Open for Business — The Epocalypse Has Fully Begun

- Jim’s Mailbox

- Bill Maher Says He Understands The Motivation Behind The Dallas Cop Killer!

- Imperial Elite Work Behind the Scenes as Japanese Emperor Prepares to Abdicate

- KING OBAMA DOING WHATEVER HE WANTS 2016

- New British PM Appoints Brexit Proponent Boris Johnson to Foreign Secretary ROKU

- BLM Leader Meets Obama In Secret, Plans Next Phase

- Jim Rogers - Deutsche Bank is Broke, Derivatives Collapse Coming

- Everybody wants Out of the EU

- The Golden Chameleon Has Changed Colors

- The IRS Wants A Piece Of Your Gold And Silver Profits: Here’s What You Need To Tell Them… And What You Don’t

- Gold Daily and Silver Weekly Charts - Stock Option Expiry Shenanigans

- Silver shares forecast explosion in metal's price, Embry tells KWN

- Stock Market Hits ALL-TIME HIGH! Japan New QE Will Send Stocks HIGHER!

- END TIMES SIGNS: LATEST EVENTS (JULY 13TH, 2016)

- The EU Meltdown and The Truth about Brexit

- ALERT -- Police Are Being Shot At Around The Country

- The Hottest Sector in the Stock Market (Hint: Not Gold)

- You’ll Never Guess Which Forgotten Metal is Outperforming Gold…

- Silver Appears Overbought, But Long-Term Outlook Good

- Breaking News And Best Of The Web

| Endgame for Corporation USA without Trump Posted: 13 Jul 2016 11:00 PM PDT Money doesn't exist - as we explain in Splitting Pennies. Money is an idea, an abstraction - a belief system. A dogma. So is a country. In fact, a country IS a currency. EU nations have given up their sovereignty to join the Euro (and we see how well that's working out for them). Brexit made a lot of money for FX traders, but planted a seed in the masses that change is possible (we'll see, if the British government actually goes through with Brexit..) Countries are born, and die. As far as countries go, the United States of America (USA) is actually one of the world's oldest countries. Actually there's only a small handful of older countries, such as San Marino (1600), Vatican City (1274), and the United Kingdom (1707). USA changed the global political landscape in many ways, especially during the 20th century - not only directly (through invasive foreign policy) but by example. USA was one of the first 'superstates' - now such superstates are common (the EU being one). USA was the first country to detach from cultural or ethnic identity, Americans were a mix of Europeans and others. So, what has USA become - does Television define what USA is? No, it's just a powerful control mechanism. Millions of Americans don't watch TV. In fact, for the majority of residents in USA, they are completely oblivious to how the other 99% live. Not everyone lives in Midtown and works for a prop shop. Not everyone lives in the burbs. But if you do - it seems that - this is America! We define the outside world by what we see inside our own. Which is a big mistake, but at least we have freedom to do it (so they tell us). Through the evolution of the global system, USA became a big business, a big corporation. America, Inc. is the largest employer in the world. What the US government actually does is a mystery to many analysts in the world, but one thing is for sure - they create employment. US Citizens who can't find reasonable jobs, and can't teach, usually end up working for the government. According to government data (here's the need for a governemnt job, compiling data on how many jobs), about 4.1 Million work for the government, down from it's 1970 peak of 6 Million +. Jimmy Buffet has a song "Everyone has a cousin in Miami" which is basically true for 99% of Americans - also everyone has a cousin that works for the government. This business runs very well. It greases all the right palms. That's why it exists. Not because of voters. Corporation America is a global octopus of trade. It's a form of uber Facism - words can't describe the system we have now in America because frankly, 90% of it is 'secret' and so it hasn't been studied. So what can make this machine break? Several social factors, domestic issues. But the machine can't break - it's too big, it's too involved in every aspect of global empire management. But it can change. Looking at America as a closed system, inside the walls that have been built by DHS, SEC, CFTC, FBI, CIA, IRS the social fabric of America is polarized. At the end of the day, all these riots, shootings, what everything comes down to is economics. People who are employed, don't take time off work to protest for their rights. They are happy for their jobs. Rich people, don't insinuate riots or shoot people, generally. Most of the time, your life determines your political views. If you have a nice life, a good job (about 95 Million Americans) you want the system to continue as it is, you don't want to lose what you have. If you have no job, no money, life sucks - you want change. But at some point, such as we are in now, social factors can become extreme, and a critical mass or 'tipping point' is reached, where a sufficient amount of angry people congregate into a mass of really angry people, which can choose to leave and create their own state, their own government- like America did when it was a part of Britain. Texas, just voted NOT to seced. These violent elements whether they be racial or other, make all this more extreme. The Establishment in America, for at least 30 years, has thrashed the Constituion, violated their own laws they create, and created a real Oligarchy, banana republic style. It coincides in parallel with other signficant social trends, such as the demise of the Mafia, and the rise of the robots. To someone like a Clinton, it's not what you know - but who you know. Well, that works in College or maybe to get into a Golf Club but it's no way to run a country. Like with any Oligarchy, it is the job of the Oligarchs to allow the system to flourish, and not to take too much bribes for themselves, because it becomes like a cancer, and finally the host dies. The masses who are unemployed have a strong argument to the Establishment - you're not doing a good job running our economy because there are unemployed people (i.e. ME). But you have your fancy haircuts and private jets and so on, so let's get rid of all of you! That's the idea of voting for Trump. True or not, he's seen as the anti-Establishment candidate. The Elite have created such a mess this year, whether by purpose or not it's irrelevant; the only thing that can save Corporation USA is a Trump Presidency. It's not as if Trump will save us from anything, and certainly he is self-serving. But he's a businessman, and really the only thing that can keep Corporation America ticking is a businessman. Probably, he doesn't even know the good he'll do in the White House until he gets there. Simple things can go a long way - such as a trade deal with Russia. Developing Thorium nuclear reactors. And most importantly, de-polarizing the population to pre-crisis levels, when we are 'all Americans.' Trump can do all this and more without even knowing it. We need a self-serving Hitler like dictator to run America's facist enterprise. It's just good for business. The stock market can double. QE will become QEEEEEE. Because the alternative is disaster (and no businessman wants to file bankruptcy). When Trump realizes that Corporation America can actually turn a profit, he'll cut taxes and at the same time double the size of entitlements, all paid for with a massive budgetary surplus, coupled with a strong dollar and finally 10% interest rates. Whoa! There's just so much opportunity out there, when you look from this perspective, economically speaking. This was one of Bush talents (and, as a national comedian). Bush made a business out of his office, and although he made a hefty empire for his family, he also made many other people, many Oligarchs, rich beyond their dreams. If a politician like Clinton is elected, based on Cybernetic systemic analysis, that USA will collapse. Business will move on, but the political system will collapse. States like Texas and the South will secede first. California will follow. Washington will struggle to maintain control. If you want to see what a new USA might look like, forget 'futurists' and just look the Federal Reserve map, they've already carved it out:

But, the Fed drew these according to state lines, so more likely, the lines will shift a little, based on demographic trends, and infrastructure geography. It will probably look more like this:

Probably, Trump will get in and this will be a non-issue. But if not, we will be faced with a real 'clash of civilizations' in America. This was best described by Noam Chomsky in his book "Hegemony or Survival:"

Chomsky noted that, during times of economic crisis like the post 9/11 world, the Elite (Oligarchs) decided to invest in weapons and security as opposed to social programs and businesses, such as the CCC. Meaning that, instead of growing a garden, they decided to build a bunker, and protect themselves from hungry people (or rioters) whether they be the black power movement, or just nomadic flash mobs of brainless teens being told what to do via phone app. Ironically, Rand corporation doesn't have scenarios gamed out for collapse USA, maybe DOD does and it's just private. If you haven't read Civil War 2 - it's a bit dated but will be chilling to any current reader, as it explains how the fabric of society will melt down as it has in last weeks and months. It's a great read about the strategem of a collapse scenario, written by a military man. The breakup of USA isn't a new idea, it's just easily laughed off as content for science fiction. It's not a reality, it can't happen - not in America! That's what Briton's thought before the Brexit vote. In fact if you look at any new country, it's always a surprise. I'm sure looking back, it was a big surprise to King George when the American ruffians decided to be defiant against their home country - England. All of a sudden, America was a country. Remember, during this time, Europe's colonial powers ruled the world, bit by bit. Revolution is always a surprise:

This time though, it really IS different. With electronic markets, the system is so robust, America could splinter and life would barely change. So while the idea of USA collapse seems earth-shattering, as a practical matter, things could very much continue as it were. It's an exciting idea for Forex traders, the ability to trade regional currencies in North America, I'd immediately go long the New England Dollar and short the Cali-peso (sorry, birthplace). But most people don't know, there's already many US Dollar alternatives that are used right now, today, in America (not just Bitcoin):

| |||||||||||||||||||||||||||||||||||||||||||||||||

| Deutsche Bank is Broke, DERIVATIVES COLLAPSE COMING — Jim Rogers Posted: 13 Jul 2016 09:15 PM PDT from CrushTheStreet: Often featured on mainstream television networks for economic analysis, Jim Rogers is graciously with us once again to discuss the macro picture of where the world is during this economic crisis. Jim reiterates the great value and preservation of wealth tool that Gold is especially with China most likely hoarding massive tons of it. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Will Move Higher, Soon - Won't Stop Till it Touches $1,450.00 Posted: 13 Jul 2016 08:35 PM PDT

On Thursday night, 14 July 2016 at 6:30 p.m. I'll be speaking at the Huntsville Tea Party meeting at Whitesburg Baptist Church, 3911 Pulaski Pike NW, Huntsville 35810. I'll be talking about the bank credit(debt) boom bust cycle, springing off Tilden Freeman's 1935 book, A World in Debt. I will be showcasing my one and only natural gift, Stating the Obvious, but in an age of Liars, Spin-Doctors, & Reality-Deniers, that ain't no gift to sneeze at. I heard the celebratin' has waxed so jinral in New York that they done run out of champagne. Having to fly it in from France & New Jersey. Might ought to slow down on that celebratin'. Stocks cooled markedly today. Dow rose 24.45 (0.13%) to 18,372.12 and the S&P500 got out its electron microscope and rose 0.29 (0.1%) to 2,152.43. That leaves me remarkably underrated. US dollar index fell 28 basis points (0.29%) to 96.21. Same old stalling action, dirty carburetor or clogged fuel filter. Ain't got no get up & go. Looks very outlandish, considering the rest of the world's shape. Gold bounced right back after two days' tribulation to close up $8.30 (0.6%) at $1,342.40. Silver gained 24¢ to 2037¢. Garlicky. Gold closed just below the upper channel boundary, but that don't concern me none a-tall. Gold Price will move higher, soon. Tomorrow's my guess. Won't stop till it touches $1,450.00 Silver Price also is dancing upon its upper boundary line. Expect higher prices tomorrow. Today silver reached a new high close for the year. On the five day charts both silver & gold posted credible lows yesterday, little double bottom affairs. That points both up tomorrow. New York draft riots began on 13 July 1863, resulting in more than 1,000 casualties. They were only stopped byre-assigning yankee army units from killing Southerners to killing New Yorkers. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | |||||||||||||||||||||||||||||||||||||||||||||||||

| WARNING! DAY OF RAGE EVENT COULD OCCUR THIS FRIDAY! Posted: 13 Jul 2016 08:00 PM PDT WARNING! DAY OF RAGE EVENT COULD OCCUR THIS FRIDAY! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||

| Shocking ! Government Declassified suppressed Document on Weather Control HAARP Posted: 13 Jul 2016 07:11 PM PDT Shocking ! Government Declassified suppressed Document on Weather Control HAARP The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||

| Central Bank Wonderland is Complete and Now Open for Business — The Epocalypse Has Fully Begun Posted: 13 Jul 2016 07:10 PM PDT The following article by David Haggith was first published on the Great Recession Blog.  Summer vacation is here, and the whole global family has arrived at Central-Bank Wonderland, the upside-down, inside-out world that banksters and their puppet politicians call "recovery." Everyone is talking about it as wizened traders puzzle over how stocks and bonds soared, hand-in-hand, in face of the following list of economic thrills:

Yet, the S&P 500 and Dow have soared to all-time record highs! Whoohoo! Hold onto your safety harness and try not to choke on your popcorn for the fun never ends in Bankster Wonderland!

What's up with stocks and down with bond yields?

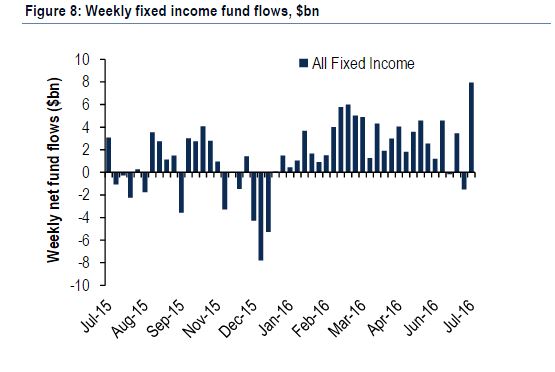

US Stocks are flying high at the same time demand for sovereign bonds is soaring and precious metals are experiencing a bull market. That says to me that money is fleeing to safety, and the apparent irrational exuberance in the stock market, considering all the flights to safety, is partially fueled by foreign investors fleeing to US investments now that Europe's cracks are showing like Frankensteins body seams. This chart from David Stockman's Contra Corner shows how people are piling into bonds right now:

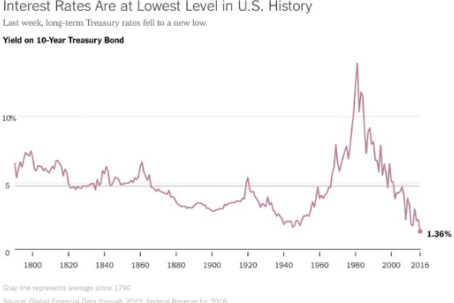

As a result, US bond interest rates are the lowest they have been in the history of this nation! Here's another chart from Contra Corner:

Whoohoo! Two massive records in one week. Highest stock market prices and lowest bond rates in the history of the United States! Does it get any better than this? Geez, I love this place!

We have never seen anything like this

Stocks are setting all-time record highs, and interest on US bonds is hitting all-time record lows. Money is running to gold and silver. Money is running to long-term sovereign bonds. And money is running to the US stock market all at the same time. Heck, money is running all over the place! What is there not to be happy about? However, before you think, Whoo! the stock market is going up; there's no crash happening, ask yourself what the heck is happening. We've never before seen either of these two extremes where stocks are free of all bondage and all bonds are free of their stocks. Only during the years of quantitative easing and zero-interest-rate policy have we seen bonds and stocks play together, but never to this extreme. So, when all the gauges on the instrument panel are pegging their needles past the red zone, including the one that says "We're going super fast now," you might want to say, "Whoa! What's going on?" Maybe the engineer on this train has fallen dead over the throttle. As Jesse Felder said on Contra Corner, "We're witnessing the greatest dichotomy in the history of financial markets." Interest rates on bonds have now gone below any low of any recession … ever. Far, far below. We're digging out the sub basement to find where the money is buried. If you were to gauge the economy's future based on where bonds have gone, you'd have to say, "This must be the scariest future ever because there has never been such a flight to presumably safe vehicles at any cost." At the same time, stocks have never been more overpriced than they are today. They hit their highest price ever during a period in which earnings have been flagging for many months. So, they're not rising because, "Woohoo! Businesses are making bank!" No, they're making new heights in spite of the fact that sales are down, profits are down, and wholesale inventories have remained locked in a highly backed-up position that is comparable only to the Great Recession and the dot-com crash … and while things are not looking generally good in the world economically. So, there is not a lot of reason to think sales will grow to fit the high stock values. In other words, median price-to-sales ratio (price of stocks compared to sales of the businesses) has also hit an all-time record high. Three all-time records in one week! This is the funnest place in the universe! Is this irrational euphoria among investors? Is it even people who are buying the bonds? Is it people who are buying the stocks? Or is it entities like central banks and their proxies — not buying them as investments, but buying them in mass to shore up the entire global economy and stop the crash that started right after Brexit … or that started right after December 16, 2015? (It's just one crash right after another here at Wonderland's National Demolition Derby.) Are central banks firing up all engines to stop a crash in its tracks with a massive coordinated salvo of purchases?

So, what is happening as central bankers watch each other in mutual admiration?

Says Jeff Cox of CNBC,

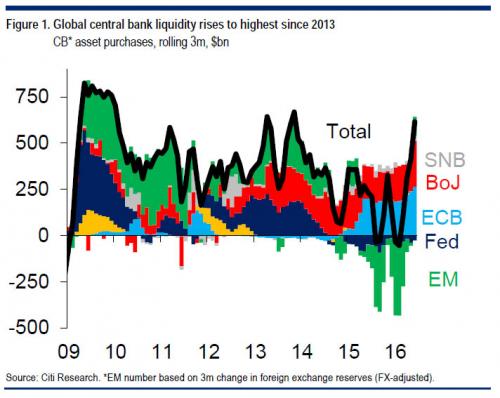

Gee, there are a lot of things breaking historic world records this week. That must mean it's a great week! Cox thinks the big buyers of bonds are central banks, pushing down interest rates to stimulate the economy. No surprise there. Central banks have been going pedal-to-the-metal to hold interest rates to the floor for almost a decade, so why not continue? The record highs in bond sales (with corresponding lows in interest) and high in stock sales most likely are due to rapid pressure being applied to the accelerator as a counter-measure to the concerns governments and bankers have had about Brexit. Central banks could do that directly, or they could do it invisibly (since they operate under a cloak most of the time anyway) by offering enticements or pressure to their proxies. ("You want this mega-conglomerating merger to happen: buy ten billion dollars worth of US bonds, and then I'm sure we can get it approved." If not that, there's a thousand other ways for central banks to push money into markets now that they are accustomed to doing so in an unbridled fashion. It's the new norm.) That the stock markets are being driven up by central bank purchases can be seen in the following graph:

Emerging markets (EM) that were crashing at the start of 2016 offloaded assets to raise funds to keep the home front running at the start of the year. That contributed to January becoming the worst January in the history of the US stock market — worse than any start of a year in the Great Depression or the Great Recession. The central Bank of Japan and the European Central Bank increased their buying of those assets to offset that fall, and both recently announced they are going to apply a lot more stimulus. Cox goes on to write,

Even central banksters who create money out of nothing cannot create a free lunch. Somebody pays, but probably you, not them. It's an ominous feeling really — a sense that there is no underlying reality anymore — that the sands are shifting under your feet.

We're seven years on since stimulus responses to the Great Recession began. These have also been the greatest stimulus measures in the history of the world. (No wonder these rides are so thrilling as they reach new world records multiple times a week.) However, outside of flying stocks, we still have a global economy that seems endlessly stuck in the dog days of summer. Or, to change to my old winter metaphor (now that summer has turned abnormally cold here where I write), the longer and harder the snow plows push the snow straight ahead, the more it piles up as an impossible obstacle ahead of them. The louder they get with chained tires clawing and engines roaring and smoking, the less snow they push. The plows are now grinding away at full throttle in the lowest gear they have, and it is looking like they are going to remain stuck in that gear for a very long time — maybe another decade … unless they simply give up the battle. The world is buried under the highest mountains of the cheapest debt ever imaginable, and nothing is moving in the overall economy (except financial instruments that are trading places). And that is where I said we would wind up when I wrote my very first articles in my Downtime series on government bailouts and stimulus back at the start of the Great Recession. I said they were pushing all the snow straight ahead, instead of off to the side, so (quite a ways down the road) they would have a mountain of snow so high in front of them that all the plows in the world could push it no further. We are now quite a ways down the road. The European banks that are screaming for bailouts are buried in bad debt they pushed forward from the Great Recession. They never wrote it off then because the damage to their balance sheets would have been so severe. As I said back then, such policies only meant the damage to their balance sheets in the future would be even more severe. The problem of bad debt owned by banks in Italy is now four times worse than it was at the bottom of the Great Recession. Why did I know that would happen? Because nothing about this "recovery" is recovery. It has all been a forestalling of problems, "kicking the can further down the road," with the inevitable pay-back time becoming worse the longer we forestall the inevitable write-off of bad debt. My Downtime articles years ago sounded many warnings that everything governments and central banks were doing was making a very bad situation worse just so we could avoid the pain at the time. Such actions resolved none of the true underlying problems that are built right into the foundation of our debt-based economy. Until we stop thinking we can build true monuments of wealth over ever-growing chasms of debt, we will solve nothing at all. < | |||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 13 Jul 2016 06:05 PM PDT Jim/Bill, For the uninformed, the desirability of gold hinges upon the return on investment as compared to bond yields. More clearly, if bonds yield 2% and inflation is reported at 1%, then you are making 1% per year on your money. However, if bonds yield only 1% and inflation is pegged at 2%, then you... Read more » The post Jim’s Mailbox appeared first on Jim Sinclair's Mineset. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Bill Maher Says He Understands The Motivation Behind The Dallas Cop Killer! Posted: 13 Jul 2016 06:00 PM PDT It's called low level mind control induced by media networks like this one. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||

| Imperial Elite Work Behind the Scenes as Japanese Emperor Prepares to Abdicate Posted: 13 Jul 2016 05:40 PM PDT Japanese Prime Minister Shinzo Abe is a member of elite Nippon Kaigi by Kurt Nimmo, Infowars:

Following the defeat of his father during the Second World War and serving under a constitution imposed by the United States, Akihito's reign has been described as the Heisei era, which is translated as "achieving peace." Akihito reigned during Japan's economic rise and subsequent collapse after its bubble economy crumbled, resulting in decades of economic decline. The collapse is a classic example of how an inflated money supply and unchecked credit expansion produce overheated economic activity that ultimately implode national economies. While popular with the Japanese people, the archaic monarchy has faced increased criticism since the end of the Second World War. The second largest party in the country, the Japanese Communist Party, advocated revolution to overthrow Imperial Japan's monarchy and create a socialist state. In the 1980s, leftist radicals were suspected of attacking the graves of two former emperors and setting off bombs near the Imperial Palace. Rightwing extremists, on the other hand, have used violence to defend the name of the Emperor. In 1961, a fanatic attacked the family of the editor of the monthly magazine Chuo-koron because the periodical published a novel considered irreverent to the throne. Extremists were responsible for the assassination of socialist leader Asanuma Inejiro in 1960 and an attempt on the life of former prime minister Ohira Masayoshi in 1978. Despite the fact the monarchy is ceremonial and wields no power, it continues to influence the political landscape in Japan. | |||||||||||||||||||||||||||||||||||||||||||||||||

| KING OBAMA DOING WHATEVER HE WANTS 2016 Posted: 13 Jul 2016 04:18 PM PDT OBAMA...( KING )...DOING WHAT EVER HE WANTS...2016 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||

| New British PM Appoints Brexit Proponent Boris Johnson to Foreign Secretary ROKU Posted: 13 Jul 2016 04:03 PM PDT Bill Black says Boris Johnson's demonization of the EU and virtually all of its leaders in his role as an alleged journalist makes him the worst conceivable person to put in a top diplomatic post The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||

| BLM Leader Meets Obama In Secret, Plans Next Phase Posted: 13 Jul 2016 02:47 PM PDT BLM Leader Meets Obama In Secret, Plans Next Phase Obama and Soros want civil unrest and chaos in America , the racial war is starting now The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||

| Jim Rogers - Deutsche Bank is Broke, Derivatives Collapse Coming Posted: 13 Jul 2016 02:40 PM PDT Deutsche Bank is Broke, Derivatives Collapse Coming - Jim Rogers Interview Often featured on mainstream television networks for economic analysis, Jim Rogers is graciously with us once again to discuss the macro picture of where the world is during this economic crisis. Jim reiterates the... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 13 Jul 2016 01:59 PM PDT BNP Chairman Adam Walker takes time out of his Out of the EU campaign to find out what regular people think on Brexit. Will you be voting IN or OUT? The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||

| The Golden Chameleon Has Changed Colors Posted: 13 Jul 2016 01:37 PM PDT This post The Golden Chameleon Has Changed Colors appeared first on Daily Reckoning. Is gold a commodity, an investment, or money? The answer is… Gold is a chameleon. It changes in response to the environment. And as I've said before, gold is making an important change right now. At times, gold behaves like a commodity. The gold price tracks the ups and downs of commodity indices. At other times, gold is viewed as a safe haven investment. It competes with stocks and bonds for investor attention. And on occasion, gold assumes its role as the most stable long-term form of money the world has ever known. A real chameleon changes color based on the background on which it rests. When sitting on a dark green leaf, the chameleon appears dark green to hide from predators. When the chameleon hops from the leaf to a tree trunk, it will change from green to brown to maintain its defenses. Gold also changes its nature depending on the background. And right now, gold is behaving more like money than a commodity or even an investment. It's important to take off your dollar blinders to see that the dollar is just one form of money. And not necessarily the best for all investors in all circumstances. Gold is emerging again as a strong competitor in the horse race among various forms of money. This is great news for those with price exposure to gold. The price of gold in many currencies is going up as confidence in those other currencies goes down. Gold is competing with central bank fiat money for asset allocations by global investors. That's a big deal because it shows that citizens around the world are starting to lose confidence in other forms of money such as dollars, yuan, yen, euros and sterling. For the first time since 2008, it truly looks like central banks are losing control of the global financial system. When you understand that gold is money, and competes with other forms of money in a jumble of cross-rates with no anchor, you'll know why the monetary system is going wobbly. Gold does not have a central bank. Gold always inspires confidence because it is scarce, tested by time and has no credit risk. Gold's role as money is difficult for investors to grasp. One criticism of gold is that is has no yield. Gold has no yield because money has no yield. In order to get yield, you have to take risk. And with trillions of dollars of government bonds around the world trading at negative yields right now, gold is certainly more attractive than many "safe" sovereign bonds. An asset with zero yield beats one offering negative yields. So in light of the fact that investors are buying bonds offering negative yields, the argument that gold doesn't offer any yield makes no sense right now. Also, bank deposits, and so-called money market funds have yield, but they are not money. A bank deposit is subject to default by the bank as happened in Greece and Cyprus. And a money market fund is subject to collapse of the fund itself, as we saw in 2008. Gold does not have these risks. What signs do we see that gold is now behaving like money? For one thing, gold price action has diverged from the price action of other commodities. This divergence first appeared in late 2014, but then became more pronounced. COMEX gold peaked at $1,876 per ounce on Sept. 2, 2011. And recently traded as low as $1,056 per ounce on Nov. 27, 2015. That's a 44% decline in just over four years. Yet in the same time period, broad-based commodities indices fell even more. One major commodities index fell 53%. The contrast between the behavior of gold and commodities is even more extreme when we narrow the time period. From June 20, 2014 to Jan. 15, 2016, the broad-based commodity index fell 63%, while gold fell only 17%. The collapse in commodity prices was almost four times greater than the decline in gold prices. From mid-January to mid-February 2016, gold rallied 14% while commodities still languished near five-year lows. All told, gold is now up 20% on the year, including its post-Brexit spike. Commodities overall have shown some recent strength recently, but gold continues to lead the way. It's also true that the dollar has rallied, especially after the Brexit shock, but the shock has worn off and the dollar should weaken. Lost confidence in fiat money starts slowly then builds rapidly to a crescendo. The end result is panic buying of gold and a price super-spike. We saw this behavior in the late 1970s. Gold moved from $35 per ounce in August 1971 to $800 per ounce in January 1980. That's a 2,200% gain in less than nine years. I think we're in the early stages of a similar super-spike that could take gold to $10,000 per ounce or higher. It won't happen tomorrow. And there will of course be setbacks along the way. But it's the big picture we're concerned with. And when that massive gold super-spike does happen, there will be one important difference between the new super-spike and what happened in 1980. Back then, you could buy gold at $100, $200, or $500 per ounce and enjoy the ride. In the new super-spike, you may not be able to get any gold at all. You'll be watching the price go up on TV, but unable to buy any for yourself. Gold will be in such short supply that only the central banks, giant hedge funds and billionaires will be able to get their hands on any. The mint and your local dealer will be sold out. That physical scarcity will make the price super-spike even more extreme than in 1980. The time to buy gold is now, before the price spikes and before supplies dry up. Normally I recommend a 10% allocation of investible assets to physical gold for your permanent portfolio. But I also recommend select gold and mining stocks that can leverage higher gold prices into potentially staggering profits. It happened in the 1970s and it happened again in the early 2000s. And now it's happening again as gold begins its march to $10,000. This chameleon has changed color recently. And the new color is gold. Regards, Jim Rickards Ed. note: "A charmingly mordant take on the stock news of the day, accentuated by philosophical maunderings…" That's how one leading financial magazine described the free daily email edition of The Daily Reckoning. You'll find cutting-edge analysis from the complex worlds of finance, politics and culture. Presented in an entertaining style few can match. Click here now to sign up for FREE. The post The Golden Chameleon Has Changed Colors appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 13 Jul 2016 01:13 PM PDT ShtfPlan | |||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Stock Option Expiry Shenanigans Posted: 13 Jul 2016 01:11 PM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||

| Silver shares forecast explosion in metal's price, Embry tells KWN Posted: 13 Jul 2016 01:04 PM PDT 4p ET Wednesday, June 13, 2016 Dear Friend of GATA and Gold: In an interview today with King World News, Sprott Asset Management's John Embry notes the recent "spectacular" performance of silver mining company stocks and suspects that this forecasts an explosion in the silver price, and possibly hyperinflation. An excerpt from the interview is posted at KWN here: http://kingworldnews.com/50-year-veteran-says-silver-to-hit-new-all-time... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||

| Stock Market Hits ALL-TIME HIGH! Japan New QE Will Send Stocks HIGHER! Posted: 13 Jul 2016 10:27 AM PDT Dow, S&P close at record high as Brexit fears ease; energy jumps 2 pct U.S. stocks closed higher Tuesday as fears eased over Brexit and Japan signaled more economic stimulus. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||

| END TIMES SIGNS: LATEST EVENTS (JULY 13TH, 2016) Posted: 13 Jul 2016 10:05 AM PDT end times, end times signs, end times news, end times events, bible prophecy, prophecy in the news, tornado, earthquake, strange weather, strange events, apocalyptic signs, apocalyptic events, strange weather phenomenon The Financial Armageddon Economic Collapse Blog tracks trends and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||

| The EU Meltdown and The Truth about Brexit Posted: 13 Jul 2016 09:44 AM PDT John Michael Greer - The Truth About Brexit John Michael Greer discusses the origins and potential outcome of the European Union's ongoing meltdown. The recent Brexit referendum in the UK was never meant to happen. The result of a miscalculated attempt by former British Prime Minister David... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||

| ALERT -- Police Are Being Shot At Around The Country Posted: 13 Jul 2016 09:09 AM PDT Violence across the country continues to bring more attacks on police nation wide The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||

| The Hottest Sector in the Stock Market (Hint: Not Gold) Posted: 13 Jul 2016 09:05 AM PDT This post The Hottest Sector in the Stock Market (Hint: Not Gold) appeared first on Daily Reckoning. The S&P 500 just hit a new high on Tuesday, closing at 2,152.14. Like Clinton shrugging off a criminal prosecution, this bull market keeps beating back uncertainty and bad news… Stagnant global economic growth and an historic debt bubble? No worries. Negative interest rates causing a meltdown in European banks? Nothing to see here. Brexit leading to a potential crack-up of the EU? It's just a flesh wound! This may be the most resilient bull market ever. It just keeps moving higher. And that's just fine with us. We don't try to predict what the market should be doing. We just follow the trend wherever it takes us to be on the right side of the trade. And today we're following a trend in a sector that's performing better than the rest… Central Bank "Safe Spaces"Skeptics without a solid trading plan have been worried about stocks plummeting ever since the global financial crisis of 2008-09. But the lesson investors have taken away over the last seven years is that there's no market problem central banks won't remedy. We saw this most recently with Brexit… Just days after the Brits voted to leave the European Union, markets were in a tailspin… $2 trillion of stock market value was erased in the Friday following the vote. But the Bank of England, the European Central Bank and the Federal Reserve let us know that further stimulus was available and that positive interest rates are essentially extinct in modern finance. Not surprisingly, that made investors feel warm and fuzzy. The monetary nannies made global markets "safe spaces" once again. So the masses piled back in. And frankly, what other options do most people have? Interest rates have been at zero for more than seven years in the U.S.… and they are negative in Europe and Japan. Investors remain in a desperate search to find yield somewhere, anywhere. And it's this quest that's been driving the hottest performing sector in the stock market… Ride This Wave Now for Profits…If you look back to the bear market lows in the midst of the financial crisis in 2009, you'll see that one sector has obliterated others by a huge margin… and that's real estate investment trusts (REITs). To see how much REITs have outperformed U.S. bonds and stocks, look at the chart below. It compares the total return of the Vanguard REIT ETF (NYSE:VNQ) to the S&P 500 and the Barclays U.S. Aggregate Bond Index ETF (NYSE:AGG) since March 2009:

As you can see, REIT returns have crushed stocks and annihilated bonds since the financial crisis lows. It's not hard to understand why. Non-existent interest rates for the past seven years have created incredibly strong demand for income investments tied to a so-called "safe-haven" like real estate. Yield demand intensified even more this year when bond yields collapsed as the effects of negative interest rates in Europe and Japan took hold. And there are no signs that the yield-seeking momentum in REITs is slowing down… My proprietary trend following system shows that REITs are still in an uptrend. Remember, trends always go farther than we can imagine or know. A good way to take advantage of this uptrend in REITs is the Vanguard REIT ETF (NYSE:VNQ), an ETF that invests in stocks issued by a broad range of real estate investment trusts. Just use a stop-loss to protect your downside. Keep in mind, my Trend Following subscribers are able to see my proprietary system's strongest "buy" signals in each month's issue. While VNQ isn't the highest-ranked signal produced by my proprietary system, it is a solid option if you're looking to ride another trend that's currently moving higher. Please send me your comments to coveluncensored@agorafinancial.com. Let me know what you think of today's issue. Regards, Michael Covel The post The Hottest Sector in the Stock Market (Hint: Not Gold) appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||

| You’ll Never Guess Which Forgotten Metal is Outperforming Gold… Posted: 13 Jul 2016 06:41 AM PDT This post You’ll Never Guess Which Forgotten Metal is Outperforming Gold… appeared first on Daily Reckoning. No one's watching the stock market right now… Everyone's checked out for the summer. They're either hanging out at the beach or playing Pokemon Go. Working stiffs aren't doing much better. They're tucked away in tiny cubicles, Googling Brexit facts while neglecting their actual jobs… So what's the real reason no one's paying attention to the market melt-up? Simple: Everyone cashed out months ago. "Investors have yanked $64 billion from domestic equity funds this year through May, nearly double the withdrawal from the same period a year ago," The Wall Street Journal reports. It looks like most folks missed the market's rally to new highs. And since they refused to pay attention to the major averages, I have no doubt they'll miss out on this next lucrative trade that's hiding in plain sight. That's right—base metal bonanza is back! And these industrial metals are setting up to outperform even our red-hot gold trades. Here's the scoop… Earlier this year, analysts were concerned that prices were detaching from fundamentals as prices of industrial metals heated up in the East. Turns out Chinese speculators were at it again. The same folks who were burned by Chinese stocks were throwing their money into the commodities market. They sent aluminum to 10-month highs back in April, while steel prices rose 20% in just four days. That gave us the opportunity to book some of our fastest gains of the year as we hitched a ride on the base metals rocket ship. For several months we've noted that some of the best trading opportunities we've seen have popped up in commodities. And just like the stock market, it seems as if no one's paying attention to the commodity space despite numerous breakouts in copper, steel and aluminum this year. Why? Most folks aren't interested in a commodity market that's produced nothing but losses over the past several years… Now that the major averages are taking a breather, it's time for these forgotten industrial metals to shine once again. "China's commodities market went ballistic on Tuesday, seemingly out of nowhere," Business Insider reports. "The spot price for benchmark 62% iron ore fines ripped 6.65% higher to $59.38 a tonne, according to Metal Bulletin, the largest one-day percentage increase since April 21. So far this year the price has surged 36.3%." In case you aren't keeping track, iron ore's 36% gain this year easily tops gold's rise of more than 25%. Bet you didn't see that coming… Iron ore isn't the only industrial metal ripping higher. Copper is quietly ripping to two-month highs this morning. If the move holds, Dr. Copper will have a nice higher low in place that could spark a massive run higher. Check it out:

Copper has endured a painful downtrend for years. But if it can build a solid base here, we could be treated to explosive gains. Don't take your eyes off this one over the next few weeks. The next leg of the base metals rally starts now. You won't want to miss it… Sincerely, The post You’ll Never Guess Which Forgotten Metal is Outperforming Gold… appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Appears Overbought, But Long-Term Outlook Good Posted: 13 Jul 2016 03:02 AM PDT The long-term outlook for silver is very positive indeed, but over the short to medium term it looks set to react, says technical analyst Clive Maund. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 12 Jul 2016 06:44 PM PDT Stocks recover on Abe’s promise of massive new stimulus. Gold stabilizes, oil drops and interest rates rise. Civil unrest in the US, as sniper kills five police in Dallas and protests spread. UK Conservative party appears to have chosen a leader. Sanders endorses Clinton. Best Of The Web Bernanke’s black helicopters – David Stockman […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Emperor Akihito, suffering from heart surgery and prostate cancer, will be the first Japanese monarch to abdicate in 200 years. He became monarch of the 2,600-year-old Chrysanthemum throne after his father, Emperor Hirohito, died in 1989. Akihito will handover the strictly ceremonial title to his 56-year old son, Naruhito.

Emperor Akihito, suffering from heart surgery and prostate cancer, will be the first Japanese monarch to abdicate in 200 years. He became monarch of the 2,600-year-old Chrysanthemum throne after his father, Emperor Hirohito, died in 1989. Akihito will handover the strictly ceremonial title to his 56-year old son, Naruhito.

No comments:

Post a Comment