Gold World News Flash |

- A Tale of Two Empires: the Old and the New

- UK Fund Managers Start Dumping Properties, Admit "Real Estate Needed Re-Pricing"

- NATO: Lying All the Way to Barbarossa

- Louis Cammarosano Silver Update

- Did Citi Just Confiscate $1 Billion In Venezuela Gold

- Groundbreaking Study Finds Turmeric Extract Superior To Prozac For Depression

- WTD- 24: No Way Around European Banking System Bailout

- The Big Picture Hasn’t Changed: Don’t Get Sucked Back Into the Stock Market

- Is There Such A Thing As Having Enough Food Storage?

- Did Citi Just Confiscate $1 Billion In Venezuela Gold

- Gold Price Closed at $1334.10 Down $20.90 or -1.54%

- Prophecy Update End Time Headlines 7/12/16

- The Wisdom of a Former Marine

- Gold Daily and Silver Weekly Charts - Stock Option Expiration - Risk On!

- Mass Shootings Boost Demand For Video Surveillance Provider

- BREAKING -- Sanders endorses Clinton

- Economic Collapse -- Food Shortages all over Venezuela

- Mark Carney: no silver bullet to address Brexit woes as policymakers warn of buy-to-let slowdown

- END TIMES SIGNS: LATEST EVENTS (JULY 12TH, 2016)

- As central banks buy nearly everything, technical analysis is a fraud

- Libertarians for Trump

- GLOBAL EXIT: After Brexit, SECESSIONS & BREAKUPS OCCURRING EVERYWHERE

- How Dangerous Is The Vatican?

- Here’s How to Trade New All-Time Highs…

- Crude Oil - Precious Metals Link

- Gold miners expand hedge book by another 50 tonnes in first quarter

- Gold Bull Confirmed: What's Next?

- Breaking News And Best Of The Web

| A Tale of Two Empires: the Old and the New Posted: 13 Jul 2016 01:30 AM PDT by Jeff Nielson, Bullion Bulls Canada:

Then we have China's empire. China's empire is a builder's empire. China's empire-building has elevated its own population, not enslaved-and-impoverished the people, as is being constantly done in the West. China builds relationships with other nations. The Corrupt West simply imposes its will on neighbouring nations, usually via some form of political, economic, or military coercion. China is an empire of the "carrot." The Corrupt West is an empire of the "stick." We can attach numbers, to illustrate this distinction between the two empires. Over the past two decades, China has engineered an unprecedented economic expansion, as illustrated by its robust GDP numbers. Yes, we've all read the propaganda: "China fakes its GDP numbers." This comes from the Western media, reporting from nations whose governments always claim their economies are "growing", when virtually all of these nations have been mired in a Greater Depression – going back to at least 2008. Yes, China exaggerates its GDP numbers. But even if we assumed it lies about its GDP as much as Western nations (highly unlikely), it is still a growing economy – not a steadily shrinking economy, like almost all Western nations. How do we know that the West lies about GDP more than China? Because faking GDP is a direct function of lying about inflation. The bigger the inflation-lie, the more imaginary "GDP" that can be padded on to its reports. Compared to the West, China's inflation numbers are credible and accurate. Thus compared to the West, China's GDP numbers are (relatively) credible and accurate. China's government builds; China's economy grows. Western nations destroy; Western economies shrink. The dynamics are elementary. We can also illustrate this Tale of Two Empires (vividly) by examining infrastructure spending.

As with its GDP-growth, what we see with China is an extraordinary rate of economic development. Again, we see the numbers of a "builder". Then we have the anemic numbers of the Corrupt West. Here we see infrastructure spending which not only lags the Rest of the World, it also lags what we used to see in the West – decades ago, when these economies were still also Builder Nations. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| UK Fund Managers Start Dumping Properties, Admit "Real Estate Needed Re-Pricing" Posted: 13 Jul 2016 01:00 AM PDT The uncomfortable moment of truth has arrived for property funds in the UK (and their investors). Following the initial tumble of the post-Brexit dominoes - eight major funds so far either gating redemptions or forcing massive haircuts on to investors who want out - contagion concerns even woke up Britain's regulators (and central bank) as fears of Bear-Stearns-esque forced liquidations spread; and now, as The FT reports, that is what has just started. With every UK property fund knowing every other UK property fund needs to sell assets (real physical illiquid property) to meet cash calls (in their unreal faux-liquidity funds), the game-theoretical first-mover advantage has begun with Henderson Global Investors, which has begun offloading prime assets to provide liquidity to investors... (as The FT details)

But given the following chart as an example of the 'liquidity gap' between fund-level liquidations and the exuberant UK real estate market, things could get ugly very quickly...

Perhaps even more troubling is the reality that you sell what you can, not what you want to...

Which suggests the lower-quality assets could be severely impaired, just as Richard Divall, head of cross-border capital markets at the property advisers Colliers, admitted:

And with managers forced to liquidate some of their best holdings to raise cash, the potential for fire-sale prices is very real (once again that chart above suggests the mark-to-market impact on real UK property alone could be significant), and that is why, as we previously noted, the Bank of England has been mulling a bailout... The Bank of England's 'strawman' here is likely the first step down the road of a full-blown bailout - a slush-fund to promise to buy UK property from the funds... with the hope that once they even mention it, investors will stop their selling and pile back in. Of course, we have seen and heard all of this before (about 9 years ago) when any number of government backstops, bailouts, partnerships, and direct buying did nothing to stop the contagious collateral chain collapse following the gating and liquidation of two Bear Stearns funds. We will never learn and this time is no different for as one major fund manager warned...

But all the time investors believe a central bank has their back, this is not a problem... until it is THE problem, and the walls come thundering down. It would seem monitoring the price-discussions of 440 Strand (£175m in 2014 shooting up staggeringly quickly to £220m pre-Brexit) is as good an indicator of crisis as any... and perhaps the least manipulated (for now). | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| NATO: Lying All the Way to Barbarossa Posted: 13 Jul 2016 12:30 AM PDT by Tony Cartalucci, New Eastern Outlook:

From the ongoing refugee crisis triggered by NATO's own global-spanning and ongoing military interventions, invasions, and occupations, to its continued expansion along Russia's borders – violating every convention and "norm" that existed during the Cold War to keep it "cold," NATO has proven that it is to the populations it poses as protector over, in fact, their greatest threat. In particular, the summit in Warsaw, Poland centered on NATO's expanding military presence along Russia's borders, particularly in the Baltic nations of Estonia, Latvia, and Lithuania, as well as in Poland itself. The summit also covered ongoing NATO involvement in Afghanistan and Iraq, two nations so far beyond the Atlantic states the alliance allegedly was founded to protect, it would be comical if the consequences of their far-reaching meddling weren't so serious. Belligerence Vs Balance Global peace and stability is tenuously maintained through a careful balancing act between conflicting centers of power. The story of human history is that of this balancing act being performed. World War II, which gave way to the current international order we live in, came about because of a fundamental failure to maintain this balancing act. Perhaps the most troublesome aspect of World War II's genesis, was the German military build-up along the then Soviet Union's borders characterized by Berlin at the time as a means of collective defense for Europe, when in fact it was the lead up to a full-scale invasion known now as "Operation Barbarossa." It is troublesome particularly because NATO is currently building up its forces in almost precisely the same areas and in almost precisely the same manner Nazi Germany did in the 1930s. When German forces crossed into Russia on June 22, 1941, a potential balance of power meant to preserve Germany and the rest of Europe against perceived Soviet menace turned into a war that devastated both Europe and Russia. The subsequent Cold War is an example of a balancing act of power being performed mostly with success. However, despite many common misconceptions regarding the Cold War, the mere existence of opposing nuclear arsenals and the concept of mutually assured destruction was not why balance was maintained. Instead, balance was maintained by an immense framework, painstakingly constructed by both American and Soviet leaders, at the cost of both nations' egos, pride, and interests and involved everything from agreements about the weaponization of space, to the composition and deployment of their nuclear arsenals, and even regarding defense systems designed to protect against nuclear first strikes. There were also specific and complex agreements arranged over the deployment of troops along each respective center of powers' borders, including the borders of nations that existed within their spheres of influence. It was clear during the Cold War that both Washington and Moscow vied to expand their respective reach over the rest of the world, resulting in proxy wars everywhere from the Middle East to South America, and from Africa to Asia in a "low-intensity" bid – relative to all-out nuclear war – to gain the upper-hand. Preceding and in the wake of the Soviet Union's collapse, tentacles of Western influence had finally prevailed, and reached deep within Russia itself, eroding not only Russia's own institutions and national sovereignty, but unsettling the global balance of power that had existed for decades after World War II. It was only during the rise of Russian President Vladimir Putin that this trend was reversed and something resembling global balance reemerged. It was clear that during the early 2000's, whatever progress the US had made in dismantling the remnants of Soviet checks to its otherwise unlimited desire for global hegemony, would need to come to an end, and a new framework mirroring that of the Cold War, established to accommodate emerging global powers including the Russian Federation But this is not what happened. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Louis Cammarosano Silver Update Posted: 13 Jul 2016 12:00 AM PDT from The Daily Coin: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Did Citi Just Confiscate $1 Billion In Venezuela Gold Posted: 12 Jul 2016 10:44 PM PDT from Zero Hedge:

Just over a year ago, cash-strapped Venezuela quietly conducted a little-noticed gold-for-cash swap with Citigroup as part of which Maduro converted part of his nation’s gold reserves into at least $1 billion in cash through a swap with Citibank. As Reuters reported then, the deal would make more foreign currency available to President Nicolas Maduro’s socialist government as the OPEC nation struggles with soaring consumer prices, chronic shortages and a shrinking economy worsened by low oil prices. Needless to say, the socialist country’s economic situation is orders of magnitude worse now. According to El Nacional, “the deal was for $1 billion and was struck with Citibank, which is owned by Citigroup.” As Reuters further added:

On paper yes – very much as any comparable gold leasing operation conducted by sovereign nations with central banks – but the actual physical gold would be transferred to an unknown vault of Citi’s choosing where it would become an asset controlled by the bailed out US bank. Just over a year ago, cash-strapped Venezuela quietly conducted a little-noticed gold-for-cash swap with Citigroup as part of which Maduro converted part of his nation’s gold reserves into at least $1 billion in cash through a swap with Citibank. As Reuters reported then, the deal would make more foreign currency available to President Nicolas Maduro’s socialist government as the OPEC nation struggles with soaring consumer prices, chronic shortages and a shrinking economy worsened by low oil prices. Needless to say, the socialist country’s economic situation is orders of magnitude worse now. According to El Nacional, “the deal was for $1 billion and was struck with Citibank, which is owned by Citigroup.” As Reuters further added:

On paper yes – very much as any comparable gold leasing operation conducted by sovereign nations with central banks – but the actual physical gold would be transferred to an unknown vault of Citi’s choosing where it would become an asset controlled by the bailed out US bank. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Groundbreaking Study Finds Turmeric Extract Superior To Prozac For Depression Posted: 12 Jul 2016 10:30 PM PDT by Sayer Ji, The Sleuth Journal:

The research was performed at the Department of Pharmacology, Government Medical College, Bhavnagar, Gujarat, India, and involved patients diagnosed with major depressive disorder (MDD). The objective of the trial was to compare the efficacy and safety of curcumin with fluoxetine (Prozac) in 60 patients diagnosed with MDD. Subjects were randomized to receive either a six week treatment with fluoxetine (20 mg) and curcumin (1000 mg) individually or their combination. Success of the treatment was evaluated using the 17-item Hamilton Depression Rating Scale (HAM-D17). The results were reported as follows:

Discussion If the results of this relatively small trial are applicable to a wider population, this is truly groundbreaking news. There was already a rather sizable body of preclinical research indicating that curcumin is an effective antidepressant in the animal model,[2] but this was not enough to sway most physicians who practice so-called "evidence based medicine" into actually suggesting it to patients as a Prozac or antidepressant alternative. And this is understandable, as the lack of solid human clinical evidence supporting the use of a natural substance is no small matter from a legal-regulatory perspective. Unless a substance has passed through the approximately 800 million dollar financial gauntlet of phase I, II, and III clinical trials required to apply for FDA drug approval, and has actually received that approval, there is scant legal protection for those who use natural medicines to prevent or treat disease and who might face a lawsuit, frivolous or genuine, as a result of a claim of injury. Curcumin, of course, is extremely safe, with a 2010 phase I safety study finding that oral doses as high as 8 grams a day were well tolerated.[3] Fluoxetine, on the other hand, is highly controversial due to its well-known toxicity, and its laundry list of side effects, which include suicidal ideation (not a good side effect for someone already depressed!). Also, even though it would appear the study found that curcumin and Prozac were equivalent in effectiveness, the fact that curcumin comes "…without concurrent suicidal ideation or other psychotic disorders," clearly proves its superiority over Prozac. There are also a wide range of additional side benefits that come with using curcumin, including its powerful neuroprotective properties. You will find no less than 109 studies on our database documenting curcumin's ability to protect, and in some cases restore brain function. [see research here: curcumin's neuroprotective properties] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| WTD- 24: No Way Around European Banking System Bailout Posted: 12 Jul 2016 10:01 PM PDT from WallStForMainSt: Jason Burack and Eric Dubin are back for Episode #24 of Welcome to Dystopia! During this episode, Jason and Eric start off by discussing Brexit and how gold and silver markets reacted to Brexit. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Big Picture Hasn’t Changed: Don’t Get Sucked Back Into the Stock Market Posted: 12 Jul 2016 09:20 PM PDT by Doug Casey, Casey Research:

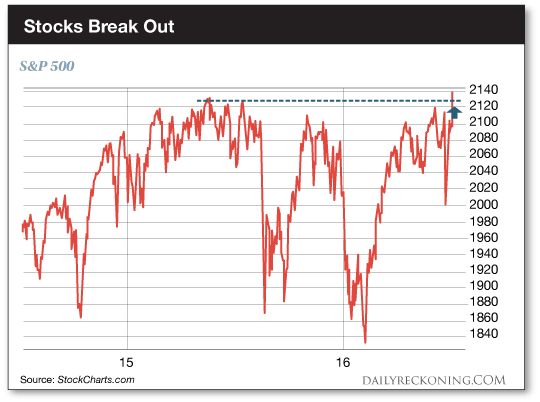

Today, the S&P 500 hit a new all-time high. It topped 2,130 for the first time since May 2015. The benchmark index is now up 6.9% over the past two weeks. All good, right? It might seem that way…if we were only analyzing U.S. stocks. The thing is, in nearly every other market, stocks are still headed lower:

The Japanese Nikkei 225 is down 15% this year. It’s down 28% since last June. The STOXX Europe 600, which tracks 600 large European stocks, is down 9% this year. It’s fallen 20% since April 2015. The FTSE 100, Great Britain's version of the S&P 500, is down 6% since last April. And that's not all. If you've been reading the Dispatch, you know the global economy is not in good shape. Corporate earnings are falling. Stocks are expensive. GDP growth is stalling. So why are U.S. stocks making new highs? Today, we take a look at the big picture to help you make sense of the market’s mixed signals. As you’ll see, right now is a dangerous time to get back into stocks… • First the good news… The Labor Department released a strong jobs report on Friday. The U.S. economy created 287,000 jobs last month. That's the most in eight months. Stocks rallied on the news. The S&P 500 jumped 1.5%. The Dow rose 1.4%. And the NASDAQ rose 1.64%. Many investors saw the strong jobs report as proof that the economy is doing OK. But the jobs report is a "noisy" indicator. It fluctuates a lot from one month to the next. This makes it unreliable. As you may remember, U.S. companies hired just 38,000 workers in May. That was the fewest workers added in one month since 2010. That's why you often need to "take a step back" to understand how an economy is really doing. Over the weekend, Barron's explained that U.S. companies are still hiring at one of the slowest rates in two years:

But that's not the only reason to be skeptical of this rally… • The world is now racing toward a full-blown banking crisis… If you've been reading the Dispatch, you know the recent "Brexit" triggered a crash in European banks. Many of these banks are now down more than 50% over the past year. Swiss banking giant Credit Suisse (CS) has plunged 57% since last July. Deutsche Bank (DB), Germany's biggest lender, is down 54%. The Royal Bank of Scotland (RBS) is down 52%. But it's not just European banks that are struggling. Major banks across the world are now trading like a major crisis is on the way. Mitsubishi UFJ Financial Group, Inc. (MTU), Japan's biggest bank is down 38% over the past year. U.S. banking giant Citigroup (C) is down 24%. The weak global economy is a major reason why banks are struggling to make money. It's hurt demand for loans, which is how many banks make most of their money. Low interest rates are also starving banks of income. Regular readers know low rates have "taken over the world." According to MarketWatch, global interest rates are at the lowest level in 5,000 years. With rates near all-time lows, banks are making less money on every loan they make. • Some investors see the recent selloff as an opportunity to buy the world's biggest banks… That's because many of these stocks are trading at the lowest prices in years. Some have never been cheaper. But that doesn't mean they can't get even cheaper still. According to The Wall Street Journal, the recent selloff could trigger another leg down in bank stocks:

• Italy's banking system looks like it's about to collapse… Italian banks have more than €360 billion worth of “bad” loans (ones trading for less than their book value). That's equal to about one-fifth of the country's annual economic output. Italian banks are in worse shape than U.S. banks were before the 2008 financial crisis. The Wall Street Journal reported last week:

The situation at Banca Monte dei Paschi di Siena SpA, the country's third biggest bank, is so bad that the company assigned a team of 700 people to deal with its bad loans. Last Tuesday, Bloomberg Business warned that the company is at high risk of default.

Monte Paschi's stock has plunged 83% over the past year. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Is There Such A Thing As Having Enough Food Storage? Posted: 12 Jul 2016 08:40 PM PDT by Ken Jorgustin, Modern Survival Blog:

A household that may have normally only kept enough food on hand to last about a week (probably the typical scenario for most Americans) may have decided to boost their food storage to several or three weeks of food to feed everyone there. This amount of food storage will certainly be plenty enough for nearly all 'typical' emergency scenarios that may tend to occur in our lives. So, is that enough food storage? Sure, if you believe that the probability of something worse than a 3-week disaster is so low – that's it's irrelevant… However, consider this, even if the likelihood of a long-term food shortage scenario is very low, 'what if' it actually happened? Sometimes that 'outlier' event does happen. If it does, how will your household survive it? It's interesting (and dangerous) how the vast, vast majority of people will completely ignore the value of having 'food insurance'. They (we) are so accustomed to a never ending supply of food at the grocery store that it is very difficult to adjust one's normalcy bias to accept that 'it could' be disrupted (or worse). Our modern systems of infrastructure (including modern agriculture, distribution channels, and retail grocery stores) have been working for so long, that it seems impossible that it could break down. It is absolutely remarkable to really think about it and consider how today's urban areas where nearly 90% of people live – would cease to exist without this working infrastructure! And add to that thought process the fact that all of it is functioning on a 'just in time' system of delivery – finely tuned for optimal profits. Millions upon millions upon millions of people NEVER think about the 'what if' scenarios whereby their food may no longer be available at their grocery store, their restaurants, or their local deli or corner store. The hard cold fact is that they, along with millions of their neighbors, will simply die if and when a terrible break down occurs. It may be an 'outlier' event, but 'if' it happens, is it worth your life? Don't you want insurance for this? Food insurance? Okay, lets get back to the question at hand… "Is there such a thing as having enough food storage?" How far does one take the outlier SHTF scenario? Here are my own current recommendations for 'food insurance' goals along the way: 3 Weeks Three weeks of food storage is ridiculously easy to acquire. Even the so called 'poor' should be able to manage this acquisition is relatively short order. This will cover nearly every 'typical' emergency / disruption that may occur. Three months of food storage is still not that difficult to acquire when you put your mind to it. This amount of food will ensure that you can feed your household for a greater disruption – albeit less likely to occur. One year of food storage is a tremendous insurance value. A very small percentage of people will reach this level of 'deep pantry' – mostly because they don't think they'll ever need it. The thing is though, if you truly rotate your food (which means actually consuming it – oldest first), it essentially becomes your own grocery store – your own food bank. The price of food rarely goes down, so it also has saved you money over the long run. A three year supply of food storage is an amount of food that will 'buy' you time from a self-sufficiency point of view. This is an amount of food that presumes a major collapse to the extent that only the self-sufficient will survive (mostly) and three years provides time for your garden (gardens) to establish and produce. A garden can be wiped out by a number of natural factors, and if during your first year you lose it – then you will run out of food. Again, this amount of food storage is tremendous and very few of even the most avid preppers will have acquired this much. But it truly is the ultimate insurance package if you are considering an 'end of the world' collapse… | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Did Citi Just Confiscate $1 Billion In Venezuela Gold Posted: 12 Jul 2016 05:40 PM PDT Just over a year ago, cash-strapped Venezuela quietly conducted a little-noticed gold-for-cash swap with Citigroup as part of which Maduro converted part of his nation's gold reserves into at least $1 billion in cash through a swap with Citibank. As Reuters reported then, the deal would make more foreign currency available to President Nicolas Maduro's socialist government as the OPEC nation struggles with soaring consumer prices, chronic shortages and a shrinking economy worsened by low oil prices. Needless to say, the socialist country's economic situation is orders of magnitude worse now. According to El Nacional, "the deal was for $1 billion and was struck with Citibank, which is owned by Citigroup." As Reuters further added:

On paper yes - very much as any comparable gold leasing operation conducted by sovereign nations with central banks - but the actual physical gold would be transferred to an unknown vault of Citi's choosing where it would become an asset controlled by the bailed out US bank. We note this peculiar gold swap case because something curious took place overnight. On the same day that Venezuela announced it would seize a local Kimberly-Clark factory after the US consumer-products giant announced it would shutter its Venezuela operations after years of "grappling with soaring inflation and a shortage of hard currency and raw materials", Venezuela's President Nicolas Maduro said on Monday that Citibank planned to shut his government's foreign currency accounts within a month, denouncing the move by one of its main foreign financial intermediaries as part of a "blockade." Among the many reasons why the sudden departure is surprising is that due to strict currency controls in place since 2003, the government relies on Citibank for foreign currency transactions, meaning that suddenly Venezuela's financial "blockade" is indeed about to get worse. "With no warning, Citibank says that in 30 days it will close the Central Bank and the Bank of Venezuela's accounts," Maduro said in a speech, adding that the government used the U.S. bank for transactions in the United States and globally. In typical bluster, Maduro added: "Do you think they're going to stop us with a financial blockade? No, gentlemen. Noone stops Venezuela." What Maduro did not mention is that among the central bank accounts closed by Citi will be at least one, rather prominent, gold swap launched just over a year earlier. Reuters adds that Citibank, could not immediately be reached for comment about the purported measure against Venezuela's monetary authority and the Bank of Venezuela which is the biggest state retail bank. With the OPEC nation's economy immersed in crisis, various foreign companies have been pulling out or reducing operations. However, few of them held over $1 billion in Venezuela gold as hostage. So during his next address, perhaps someone inquire Maduro if as part of its "blockade" Citi also absconded with a substantial portion of the country's gold reserves, and if so, which other banks have comparable "swap" arranagements with the insolvent nation? Meanwhile, Hugo Chavez, who spent the last years of his life repatriating Venezuela's gold is spinning in his grave. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1334.10 Down $20.90 or -1.54% Posted: 12 Jul 2016 05:30 PM PDT

Lawsie, the jubilatin' became general & there's a run on New York gin stores in the rush to celebrate. Dow closed at a new all time high today, 18,347.67 (vs. 2015's 18,312.39), up 120.74 or 0.66%. S&P500 made another new all-time high today, second in two days, at 2,152.04, up 14.98 (0.7%). Listening to the Wall Street shills, you'd think the millennium had arrived & the paving trucks were even now backing up to pave Wall Street with gold. That might be a mite previous, as we say. Looks to me like a textbook double top. This one is fed by the re-election of Abe in Japan, and is feeding on the assumption that the Bank of Japan and other criminal central banks will open wide the floodgates of new money stimulus again. Nothing has changed, & this game can just roll on forever, world without end. I knew a man once who thought he could repeal the law of gravity at will. Jumped off a 15 story building to prove his point. On the way down, somebody on the 12th floor heard him yell, "So far, so good!" What he said at ground zero is not recorded. It's risk-on trades all over the globe as the speculators dive in again. Scared to miss the train, they shucked bonds today so hard that the 10 year treasury yield gapped up. US dollar index sank again beneath its 200 day moving average, closing at 96.49, down 0.1 (0.11%). Not inspiring, but see for yourself, http://schrts.co/OkJ5UT Yen gapped down today 1.81% to 95.5¢/Y100. Looks broke. Gold plunged $20.9 (1.5%) to $1,334.10 as money was sucked away into the stock market. Silver backed off 13.4¢ (0.7%) to 2013¢. Yes, gold dropped, but remains in the grip of a fiercely strong upwave. Could correct back to the 20 DMA ($1,317.70) but should not fall as far as the last low about $1,310. Market is handing y'all a low-priced GIFT. View the chart at http://schrts.co/Vbp2I8 Gold/silver ratio keeps dropping as silver continues to outpace gold. Silver is stumbling over its top channel line. Might fall to 1950¢, but buyers throng in droves around 2000¢. Correction will be shallow again. http://schrts.co/Hg7S2A Y'all ought to pay attention: market is handing y'all free money with these lower gold & silver prices. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Prophecy Update End Time Headlines 7/12/16 Posted: 12 Jul 2016 04:30 PM PDT A fast paced highlight and review of the major news stories and headlines that relate to Bible Prophecy and the End Times… The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 12 Jul 2016 01:49 PM PDT This post The Wisdom of a Former Marine appeared first on Daily Reckoning. My father lived through the Great Depression and saw action with the Marines during World War II (that's his picture above). So he had a view of life shaped by those experiences that few can relate to today. After fighting on Okinawa, he was sent to northern China as part of a U.S. occupation force at the end of the war. Not many Americans realize it, but U.S. Marines occupied parts of northern China from 1945–49. There my father witnessed the effects of the Great Chinese Inflation that helped lead to the victory of Mao Zedong and the Communists over the Nationalist forces of Chiang Kai-shek. The Nationalist government printed vast amounts of paper money to fight World War II against the Japanese. And the civil war years afterward saw runaway inflation. It destroyed much of the Chinese middle class and drove a large portion of China's rural population into grinding poverty. That breakdown of society contributed to the victory of the Communists. So my father saw what paper money, unbacked by anything of real value, could do to a nation. And I'll never forget an important lesson in money my father taught me when I was a young child. This was in the late 1950s and I was about 9 years old. My father sat at the kitchen table and pulled out two $20 bills from his wallet and put them on the table. One was a standard Federal Reserve note like we have today. But the other was a silver certificate. He always carried a $20 silver certificate in his wallet. He pointed to the silver certificate and asked, "What does that say?" It said, "This Certifies That There Is on Deposit in the Treasury of the United States of America Twenty Dollars in Silver Payable to the Bearer on Demand" and "This Certificate Is Legal Tender for All Debts, Public and Private." Then he showed me the other bill and asked, "What does that say?" It simply said, "Federal Reserve Note" and "This Note Is Legal Tender for All Debts, Public and Private." Nothing about paying silver or anything else on demand. He then held up the silver certificate again and said, "You used to be able to walk into a bank, put this one on the counter and they'd give you 20 silver dollars," because a silver dollar was backed by real silver. He pointed at the Federal Reserve note and said, "This isn't backed by anything." And he left it at that. Not surprisingly, I guess, my father also believed that all politicians were crooks. My father never let go of that silver certificate. I was more interested in buying candy with silver at the time than anything else, but I never forgot that lesson. Up until the early '60s, a quarter also used to be a silver round. Then they started replacing silver with copper and nickel in 1965. I remember taking a quarter and holding it sideways. You could see the little copper on the inside if it was worn. I remember thinking that was really shabby. I'm sure I got that idea from my father. The point is silver once served an important monetary function. It no longer does. That's just another symptom of how monetary elites have driven precious metals from the monetary system. Now money is mostly digital and can be deleted at a single keystroke. You can't delete silver or gold. Below, my colleague Byron King shows you just how much silver and gold have preserved wealth over long periods of time — unlike paper and digital money. Read on. Regards, Jim Rickards

The Overlooked Value of SilverBy Byron KingHave you ever seen 100 ounces of pure silver, .999 fine? The typical bar is about the size of a small brick. Here's a photo.  100 Ounces .999 Fine Silver (Johnson-Matthey Refinery… only the best.) According to a recent listing on eBay, this 100 ounce, Johnson-Matthey bar is worth about $1,900.00. There's nothing fancy here. The value of this brick is all about silver content, with a slight premium for the name Johnson-Matthey, among the best refiners in the world. Now, let's look at another "100-ounce" version of silver. Here's a U.S. Treasury "silver certificate," Series 1891. It's a beautiful piece of paper, in my opinion, and quite rare. U.S. $100 Silver Certificate, Series 1891  What is this worth today? How rare? Every year, perhaps a few dozen $100 silver certificates trade, world-wide. Not long ago, I saw one priced at $10,000 on an antiquarian-oriented web-site; an amount that represents the extreme scarcity of certificates like this. Here's how these instruments worked: Long ago, the U.S. government issued silver certificates (gold, too) as a matter of convenience to citizens, banks and others who traded in dollars. The certificate states: "This certifies that there have been deposited in the Treasury of the United States One Hundred Silver Dollars, Payable to the Bearer on Demand." In other words, the certificate represents 100 ounces of silver coin, on deposit at the U.S. Treasury. The document bears a unique serial number, and has the "old" seal of the U.S. Treasury on it, shown in red ink. Indeed, that seal bears an old Latin inscription, "Thesaur. Amer. Septent. Sigil." (abbreviation for Thesauri Americae Septentrionalis Sigillum), which translates as "Seal of the Treasury of North America." It's very, very official. Indeed, back then, the U.S. government — and citizens, and certainly banks — were quite serious about the value of their money. Silver and gold were money; and merely for convenience, the Treasury (NOT a so-called "Federal Reserve") issued certificates backed by silver and gold. None of this "Federal Reserve Note" nonsense, with which we live today. Thing is, however, you'll never trade this piece of paper into the U.S. government for real silver. Not anymore. The certificate is valuable only because it's old and rare; not because it's backed by any silver, or anything else of true, long-lasting value. The silver certificate may as well be valued as art, as opposed to money. I'm mentioning this monetary history because it's inconvenient history. It's inconvenient to "money people" today, because U.S. currency is no longer backed by silver or gold; just the government "promise" that somehow or another, U.S. dollars represent things of value. It "is" because we say it is. The counter-argument is that U.S. currency is just paper with greenish ink printed on it. "One dollar" paper is the same as "five dollar" paper, or "ten dollar" paper, etc. The only difference is the imagery printed on that paper. There's no silver or gold on deposit anywhere, backing anything. All of this gets to a point that Jim Rickards made to me the other day, in an exchange of emails. He wrote: The environment for gold is the best it has been in years. This is because the international monetary elites have embarked on a path to weaken the U.S. dollar against other currencies. This is designed to push inflation in the U.S. toward the Fed’s target level of 2%. Inflation hasn’t come close to the target in five years and now the Fed is getting desperate. Currency wars are the last resort when all else fails. Helicopter money is not far behind. Whatever makes the dollar cheaper makes the dollar price of gold higher. History bears this out. The all-time low for the dollar was August 2011. That was also the all-time high for gold at $1,900 per ounce. No coincidence there. It’s that simple. Now those forces are in play again. Indeed they are "in play again." Think about what Jim just said. At 2% inflation, money loses about half its value in 35 years. It loses another half in the next 35 years. Then a further half of what remains in 35 more years. And so on. Let's say your great grandmother had $100, back in 1891. At 2% inflation, 35 years later, in 1924, that sum was worth only $50. By 1959, another 35 years, that $50 was worth $25. By 1994, a third 35-year period, that $25 was worth $12.50. By now — about 22 years on — that $12.50 is worth $8.00 or so. Do the math… it's a loss of 11/12ths of original value in 125 years. Then again, if great-grandmother had stashed her money as 100 ounces of silver back then, at the very least the metal would be worth about $1,900 today, per that bar I showed you above, based on the eBay valuation. So with "real" precious metal, you can preserve value over time, compared to losing almost all value over time. That's the idea. Jim Rickards had more words of wisdom as well, when we emailed. He pointed out: When it comes to gold miners, we all know that when gold goes up, the price of mining stocks goes up faster. That has to do with the role of fixed costs versus variable costs in mining company income statements. Once fixed costs are covered (a difficult challenge) mining profits can drop to the bottom line directly because variable costs are low in relation to fixed costs. Since stocks are priced on a multiple of earnings, the stock price goes up faster than earnings. That’s the environment we’re in today. A third factor moving the market in addition to higher gold prices, and higher gold company earnings. Big mining companies are looking at the same math. A big mining company can buy a small mining company and add to its own bottom line without lifting a finger. The stock multiplier effect kicks in for the large miner and increases its stock price too. That increase in valuation can “pay for” the acquisition. It’s almost like getting free gold! That’s how gold and stock markets interact. Great points by Jim. I call it the "mining slingshot." That is, when gold-silver prices rise, cash flow increased for mining companies. As long as companies keep their costs under control, most of that extra cash hits the bottom line. Then we see share values accelerate upwards. Not all companies are created equal. The idea is to screen, screen and screen some more. That's what Jim and I are doing in our service, Gold Speculator. Regards, Byron King The post The Wisdom of a Former Marine appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Stock Option Expiration - Risk On! Posted: 12 Jul 2016 01:18 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

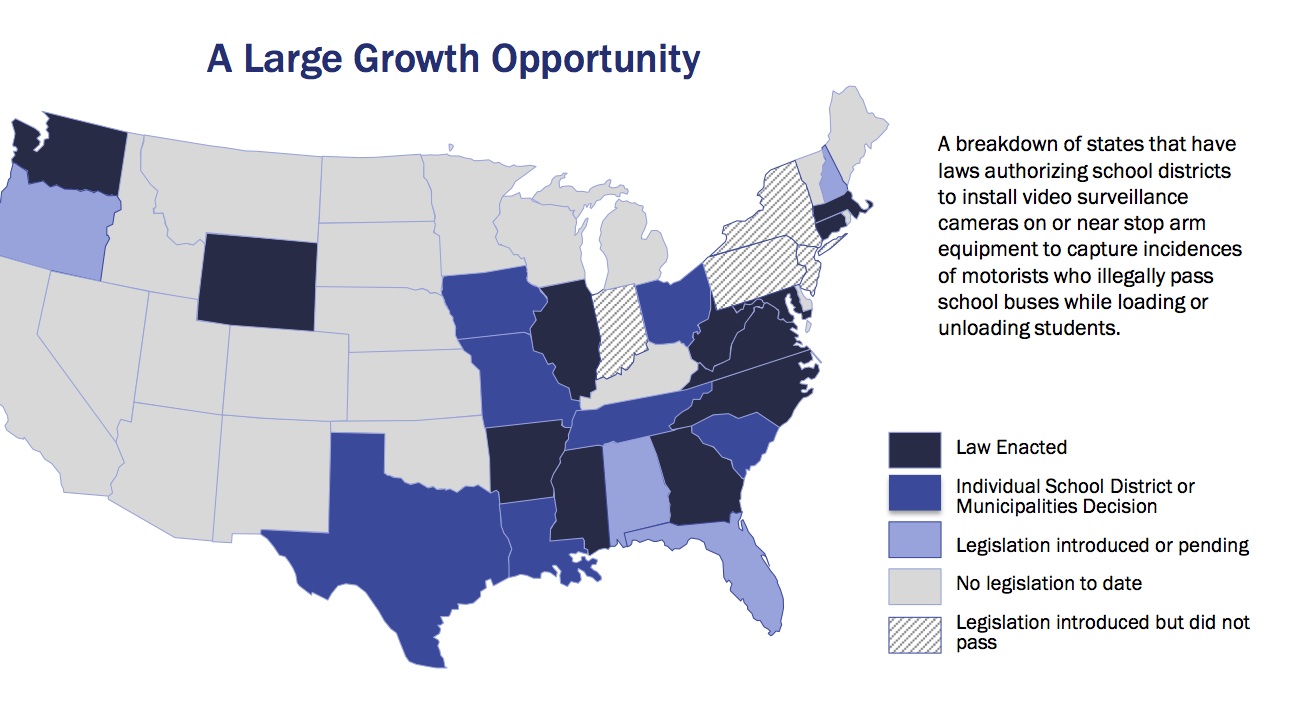

| Mass Shootings Boost Demand For Video Surveillance Provider Posted: 12 Jul 2016 12:33 PM PDT In late February I wrote an article entitled, “Increase in Terrorism and Violent Crime Boosts Demand for Video Surveillance Provider”. One of the most emotional issues facing the United States now is homegrown terrorism and rampant violence. Recently we witnessed mass shootings in Chaleston, San Bernardino, Orlando and Dallas along with increased violence between civilians and law enforcement. Although its sad to see the state of affairs and unrest, astute investors should realize the growth of video surveillance which has doubled in size over the past five years is now reaching $30 billion in 2015. There is a company I highlighted in that February article Gatekeeper Systems (GSI.V or GKPRF) which I believed would see great demand for their video products. Today they announced news that they saw a huge boost in profit and revenue in the 3rd Quarter. Their stop arm camera business is beginning with its first five year revenue sharing contract with the Jones County School District in Georgia. The first citation was already issued “Gatekeeper will receive 50% of the revenue from each citation issued with 25% shared with the school district and 25% shared with Jones County. Stop-arm violation fines in Georgia are $300 USD for first time offence, $750 USD for second time offence and $1,000 USD for each subsequent offence. The Company anticipates receiving proceeds from ticket citations prior to the end of the current fiscal year.” This could be a huge growth area as there are around 14 million stop arm violations annually and 13 states have already passed legislation that allows video enforcement.

Doug Dyment, President and CEO commented, "The third quarter revenue increase and profitability are indicators that we are successfully executing on our business strategy. During the third quarter we continued to allocate more resources to our base business in an effort to achieve profitability while at the same time we continued to move forward finalizing software features for our Jones County revenue sharing contract in Georgia. The Jones County project is our first five-year revenue project. We executed on our plan to begin issuing citations before the summer break. We currently have 20 additional stop-arm camera projects in the evaluation phase, and are in the process of negotiating several revenue sharing contracts." Dyment also added, "During the third quarter we were successful at executing delivery of products caused from the large backorder, which is directly attributed to the efforts of all Gatekeeper employees who have showed a strong commitment to the Company for many years. On behalf of management and our shareholders we thank them for their efforts and look forward to growing the Company together." See the full news release on Gatekeeper’s (GSI.V or GKPRF) by clicking here… Disclosure: I own securities in Gatekeeper Systems. This means I could benefit off of an increase in price and volume. Gatekeeper is an advertising sponsor of my website which should be considered paid compensation. This means I have a conflict of interest and you must do your own due diligence. See full disclaimer and current advertising rates by clicking on the following link: http://goldstocktrades.com/blog/featured-companies-on-gold-stock-trades/ Section 17(b) provides that: "It shall be unlawful for any person, by the use of any means or instruments of transportation or communication in interstate commerce or by the use of the mails, to publish, give publicity to, or circulate any notice, circular, advertisement, newspaper, article, letter, investment service, or communication, which, though not purporting to offer a security for sale, describes such security for a consideration received or to be received, directly or indirectly, from an issuer, underwriter, or dealer, without fully disclosing the receipt, whether past or prospective, of such consideration and the amount thereof." _______________________________________________________ Sign up for my free newsletter by clicking here… Order premium service by clicking here… Please see my disclaimer and full list of sponsor companies by clicking here… To send feedback or to contact me click here… Tell your friends! Please forward this article to a friend or share the link on Facebook, Twitter or Linkedin. For informational purposes only. This is not investment advice. May contain forward looking statements.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| BREAKING -- Sanders endorses Clinton Posted: 12 Jul 2016 12:30 PM PDT Sanders endorses Clinton at New Hampshire rally US Senator Bernie Sanders joins Hillary Clinton for their first joint rally in Portsmouth, New Hampshire The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Economic Collapse -- Food Shortages all over Venezuela Posted: 12 Jul 2016 11:30 AM PDT Venezuela grappling with food scarcity Food scarcity has turned into a serious problem in Venezuela. People have to wait in long lines for hours to get what they need for their daily lives. The issue has also worsened the political tug of war between government officials and opposition... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mark Carney: no silver bullet to address Brexit woes as policymakers warn of buy-to-let slowdown Posted: 12 Jul 2016 11:24 AM PDT This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| END TIMES SIGNS: LATEST EVENTS (JULY 12TH, 2016) Posted: 12 Jul 2016 10:30 AM PDT end times, end times signs, end times news, end times events, bible prophecy, prophecy in the news, tornado, earthquake, strange weather, strange events, apocalyptic signs, apocalyptic events, strange weather phenomenon The Financial Armageddon Economic Collapse Blog tracks trends and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| As central banks buy nearly everything, technical analysis is a fraud Posted: 12 Jul 2016 10:10 AM PDT 1:07p Tuesday, July 12, 2016 Dear Friend of GATA and Gold: Zero Hedge today reports the latest findings by Citigroup market analyst Matt King, who has determined that stock markets keep going up because selling in emerging markets has been more than offset by "a surge in net global central bank asset purchases to their highest since 2013." Soon, perhaps, central banks will have purchased nearly everything to maintain asset prices and prevent markets from functioning, thereby enveloping the world in "financial repression." Or, as a high school graduate remarked at GATA's Washington conference in 2008, "There are no markets anymore, just interventions": So what are the "technical analysts" among the financial letter writers really analyzing? Not markets but their own gullibility or that of their subscribers. Zero Hedge's report on King's findings is headlined "The 'Mystery' of Who Is Pushing Stocks to All-Time Highs Has Been Solved" and it's posted here: http://www.zerohedge.com/news/2016-07-12/mystery-who-pushing-stocks-all-... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT We Are Amid the Biggest Financial Bubble in History; With GoldCore you can own allocated -- and most importantly -- segregated coins and bars in Switzerland, Singapore, and Hong Kong. Switzerland, Singapore, and Hong Kong remain extremely safe jurisdictions for storing bullion. Avoid exchange-traded funds and digital gold providers where you are a price taker. Ensure that you are outright legal owner of your bullion. If you do not own segregated bullion that you can visit, inspect, and take delivery of, you are exposed. Crucial guides to storage in Singapore and Switzerland can be read here: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland GoldCore does not report transactions to any authority. Safety, privacy, and confidentiality are paramount when we are entrusted with storage of our clients' precious metals. Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44(0)203-086-9200. U.S.: +1-302-635-1160. International: +353(0)1-632-5010. Visit us at: http://www.goldcore.com Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 12 Jul 2016 10:00 AM PDT John Stossel - A Libertarian for Trump NY Observer columnist Michael Malice argues that libertarians are better served by Trump than by Gary Johnson. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| GLOBAL EXIT: After Brexit, SECESSIONS & BREAKUPS OCCURRING EVERYWHERE Posted: 12 Jul 2016 09:30 AM PDT GLOBAL EXIT: After Brexit, SECESSIONS & BREAKUPS OCCURRING EVERYWHERE The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 12 Jul 2016 08:24 AM PDT Author Dan Brown's novel 'The Da Vinci Code' popularised the notion that the Vatican was most definitely an organization to be feared. But is this really true? The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Here’s How to Trade New All-Time Highs… Posted: 12 Jul 2016 06:25 AM PDT This post Here’s How to Trade New All-Time Highs… appeared first on Daily Reckoning. Pop the champagne, baby! The bulls are back in town! You thought the world was ending two weeks ago? Wrong! Yesterday, the S&P 500 posted a new all-time high for the first time in 13 months, the longest stretch without a new high outside an "official" bear market since 1985, Bloomberg says. You should know by now that price leads the news. So it's no surprise that the financial media have abruptly canceled the world economy's funeral. The wake has been moved to a nightclub with an open bar. Everyone's invited to party until dawn and share whatever bullish data they can get their hands on… The economy? Strong! Earnings season? Due for a rebound! All that talk about another financial meltdown? Just forget anyone mentioned it…

"This is extraordinary, if you believe in the linear connection between headline news and markets," Josh Brown writes at his Reformed Broker blog. "All the same old fears serve as the hideous tableau against which this new all-time high has been printed. But there's nothing new to say – stocks have been talking over the naysayers for almost 8 years…" Fortunately, you can ignore all the hubbub. From a purely technical standpoint, the bull is back in action. That's all you need to know. What does this mean? For starters, overhead resistance has vanished. Remember how the S&P 500 would turn back every time it crossed 2,100 over the past several months? Each time these levels were rejected, this area became more important. And now that the S&P has crossed the threshold, we should expect a wild move higher—especially since most folks have been caught off guard…

This also means we should have plenty of new breakouts on our hands over the next few weeks. For most of 2016, the market has forced us to be incredibly selective with our trading dollars. Dangerous whipsaw action threatened countless potential trades. But now, we will have even more opportunities to book consistent, double-digit gains. Look no further than the market-leading stocks for proof… Another milestone occurred yesterday that you probably didn't notice: Amazon's market cap topped Warren Buffett's Berkshire Hathaway. Amazon is also at new highs—and it's now one of the five largest companies in the world by market value, Bloomberg reports. Today is also Prime Day. Amazon is offering special promotions all day for Prime members—and those who don't pay for Prime can sign up for a free trial. "This will be the Seattle retailer's second Prime Day," Yahoo Finance reports. "Last year the company reported 34.4 million items sold, which translates to 398 items per second." Of course, Amazon wasn't completely immune to the market turmoil we experienced earlier this year. The stock took a 30% hit to begin 2016. But it has rallied sharply since it bottomed out in February. While other retail names have struggled, the king of E-tail has staged an impressive comeback rally. Now that it's back on its highs, we can expect more gains in the coming weeks and months. You're already up more than 25% on our Amazon trade that we initiated back in April. Now's the perfect time to add to this winning position. More gains are on the way… Sincerely, Greg Guenthner P.S. Make money as the markets rebound — sign up for my Rude Awakening e-letter, for FREE, right here. Stop missing out on the next big trend. Click here now to sign up for FREE. The post Here’s How to Trade New All-Time Highs… appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Crude Oil - Precious Metals Link Posted: 12 Jul 2016 06:08 AM PDT In the recent few weeks oil bulls and bears fought battles between the barrier of $50 (the key resistance) and the green support zone based on the Apr and early May highs. After several unsuccessful attempts to move higher oil bears took control and crude oil closed Thursday's and Friday's sessions under its first important support zone. How did this drop affect the oil-to gold and oil-to-silver ratios? Let's jump right into charts (chart courtesy of http://stockcharts.com) and find out. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold miners expand hedge book by another 50 tonnes in first quarter Posted: 12 Jul 2016 04:30 AM PDT By Jan Harvey Gold miners expanded the global hedge book by another 50 tonnes in the first quarter after hedging on a net basis for a second straight year in 2015, an industry report showed on Monday. Miners use hedging, usually by selling future production forward, to guarantee returns for their output. In their quarterly Global Hedge Book Analysis, Societe Generale and GFMS analysts at Thomson Reuters said the global hedge book total stood at 270 tonnes at the end of March. ... ... For the remainder of the report: http://www.reuters.com/article/us-gold-hedging-idUSKCN0ZS02B ADVERTISEMENT Free Storage with BullionStar in Singapore Until 2016 Bullion Star is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. Bullion Star's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in Bullion Star's bullion vault, which is integrated with Bullion Star's shop and showroom, making it a convenient one-stop-shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage is FREE until 2016 and will have the most competitive rates in the industry thereafter. For more information, please visit Bullion Star here: Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Bull Confirmed: What's Next? Posted: 12 Jul 2016 03:24 AM PDT Technical analyst Jack Chan confirms a bull market for gold and lays out his investment strategy. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 11 Jul 2016 06:44 PM PDT Stocks recover on Abe’s promise of massive new stimulus. Gold falls and interest rates rise. Civil unrest in the US, as sniper kills five police in Dallas and protests spread. UK Conservative party appears to have chosen a leader. Sanders endorses Clinton. Best Of The Web Bernanke’s black helicopters – David Stockman Wall Street […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

One empire

One empire

Despite claims made during NATO Summit Warsaw 2016, that "NATO remains a fundamental source of security for our people, and stability for the wider world," it is clear that the threats and challenges NATO poses as existing to confront are in fact threats of its own, intentional creation and continued perpetuation.

Despite claims made during NATO Summit Warsaw 2016, that "NATO remains a fundamental source of security for our people, and stability for the wider world," it is clear that the threats and challenges NATO poses as existing to confront are in fact threats of its own, intentional creation and continued perpetuation. Venezuela’s President Nicolas Maduro said on Monday that Citibank planned to shut his government’s foreign currency accounts within a month, denouncing the move by one of its main foreign financial intermediaries as part of a “blockade.” What Maduro did not mention is that among the central bank accounts closed by Citi will be at least one, rather prominent, gold swap launched just over a year earlier, which saw some 1.4 million ounces in gold swapped over to Citi in exchange for cash… gold which now appears to be confiscated.

Venezuela’s President Nicolas Maduro said on Monday that Citibank planned to shut his government’s foreign currency accounts within a month, denouncing the move by one of its main foreign financial intermediaries as part of a “blockade.” What Maduro did not mention is that among the central bank accounts closed by Citi will be at least one, rather prominent, gold swap launched just over a year earlier, which saw some 1.4 million ounces in gold swapped over to Citi in exchange for cash… gold which now appears to be confiscated. A new study published in the journal Phytotherapy Research has confirmed for the first time in a randomized, controlled clinical trial that the primary polyphenol in turmeric known as curcumin is both safe and effective in treating serious states of depression.[1]

A new study published in the journal Phytotherapy Research has confirmed for the first time in a randomized, controlled clinical trial that the primary polyphenol in turmeric known as curcumin is both safe and effective in treating serious states of depression.[1] Stocks are on a tear right now…

Stocks are on a tear right now… When it comes to prepping and preparedness, the first steps that most people take are to acquire extra food (a variety thereof) to store or to deepen their pantry for a time of emergency (or worse).

When it comes to prepping and preparedness, the first steps that most people take are to acquire extra food (a variety thereof) to store or to deepen their pantry for a time of emergency (or worse).

No comments:

Post a Comment