saveyourassetsfirst3 |

- Osisko Gold Royalties' (OKSKF) CEO Sean Roosen on Q1 2016 Results - Earnings Call Transcript

- What It Really Costs To Mine Gold: The Agnico Eagle First-Quarter Edition

- After Yamana Gold Earnings, Take Some Off The Table

- Harvey Organ: Gold & Silver EXPLODE!!

- Key Dollar Developments Include Bottoming Against The Dollar Bloc

- Give me Facts or at Least Logical Opinions

- Week In Review: Gold Bounces on Soft Jobs Report

- Sprott’s Gold & Silver Market Wrap: A BIG Move!

- This Historic Ratio Points To $300 Silver

- Birth of New Bull Market in Silver Bullion

- Bill Holter Issues RED ALERT WARNING: THIS IS YOUR LAST CHANCE!

- Misreading the CoTs, Again

- If You Don’t Have Gold, You Have A Problem! – Alasdair Macleod

- A FLOOD of Capital Waiting For a Pullback in Gold & Silver

- Sprott’s Precious Metals Watch: Perfect Storm For Gold?

- Physical Silver “Once the Last Ounce Is Sold, Price Goes From $15 to $5,000”

- Was The Fed Just Given The Launch Codes?

- Breaking News And Best Of The Web — May 7

| Osisko Gold Royalties' (OKSKF) CEO Sean Roosen on Q1 2016 Results - Earnings Call Transcript Posted: 07 May 2016 11:51 AM PDT |

| What It Really Costs To Mine Gold: The Agnico Eagle First-Quarter Edition Posted: 07 May 2016 10:40 AM PDT |

| After Yamana Gold Earnings, Take Some Off The Table Posted: 07 May 2016 09:28 AM PDT |

| Harvey Organ: Gold & Silver EXPLODE!! Posted: 07 May 2016 09:00 AM PDT Gold and Silver EXPLODE on jobs report as COMEX OI rises to multi-year highs! COMEX GOLD AND SILVER COMEX OI RISE TO MULTI YEAR HIGHS: GOLD:569,492/SILVER AT 202,893/ GOLD AND SILVER EXPLODE HIGHER ON WEAKER JOBS REPORT/HILLARY TO FACE FBI INTERVIEW IN TWO WEEKS: CBS Good evening Ladies and Gentlemen: Gold: $1,292.90 up […] The post Harvey Organ: Gold & Silver EXPLODE!! appeared first on Silver Doctors. |

| Key Dollar Developments Include Bottoming Against The Dollar Bloc Posted: 07 May 2016 07:37 AM PDT |

| Give me Facts or at Least Logical Opinions Posted: 07 May 2016 02:00 AM PDT The Gold Report |

| Week In Review: Gold Bounces on Soft Jobs Report Posted: 06 May 2016 04:59 PM PDT  This week was a decisive time in the markets. It was the first big data month since the Fed’s ill-guided interest rate hike. Investors are now considering which way stocks will move next and whether or not the gold pullback is over. On the domestic data front, the nonfarm payroll jobs number missed horribly (posted 160,000; expected 200,000-215,000). […] This week was a decisive time in the markets. It was the first big data month since the Fed’s ill-guided interest rate hike. Investors are now considering which way stocks will move next and whether or not the gold pullback is over. On the domestic data front, the nonfarm payroll jobs number missed horribly (posted 160,000; expected 200,000-215,000). […] |

| Sprott’s Gold & Silver Market Wrap: A BIG Move! Posted: 06 May 2016 03:05 PM PDT A HUGE move for gold and silver ahead? Buy 2016 Silver Maples Lowest Price Ever! The post Sprott’s Gold & Silver Market Wrap: A BIG Move! appeared first on Silver Doctors. |

| This Historic Ratio Points To $300 Silver Posted: 06 May 2016 02:45 PM PDT That’s correct. $300 silver… Buy 2016 Silver Maples Lowest Price Ever! Submitted by SRSRocco: That's correct. Going by the historic Dow Jones-Silver ratio, it points to $300 silver. This may seem outlandish or a play on hype, but it isn't. While many precious metals analysts have forecasted high three-digit silver prices, I didn't pay […] The post This Historic Ratio Points To $300 Silver appeared first on Silver Doctors. |

| Birth of New Bull Market in Silver Bullion Posted: 06 May 2016 01:45 PM PDT Is the Silver Bull Run back? Submitted by Joe Russo: The prospect for the birth of a new Bull-Run in Silver speaks to a broader cyclical theme that relates to a dying dollar bull, and a corollary cyclical sentiment shift back toward a strong market preference for tangible vs. paper assets. From its current […] The post Birth of New Bull Market in Silver Bullion appeared first on Silver Doctors. |

| Bill Holter Issues RED ALERT WARNING: THIS IS YOUR LAST CHANCE! Posted: 06 May 2016 01:15 PM PDT "I think what we are looking at is an EVENT that you're not going to be able to recover from. If this market snaps and the markets close, and you're not in position, you're out. You're out for the rest of your life. This is going to be an EVENT that you can't recover from." […] The post Bill Holter Issues RED ALERT WARNING: THIS IS YOUR LAST CHANCE! appeared first on Silver Doctors. |

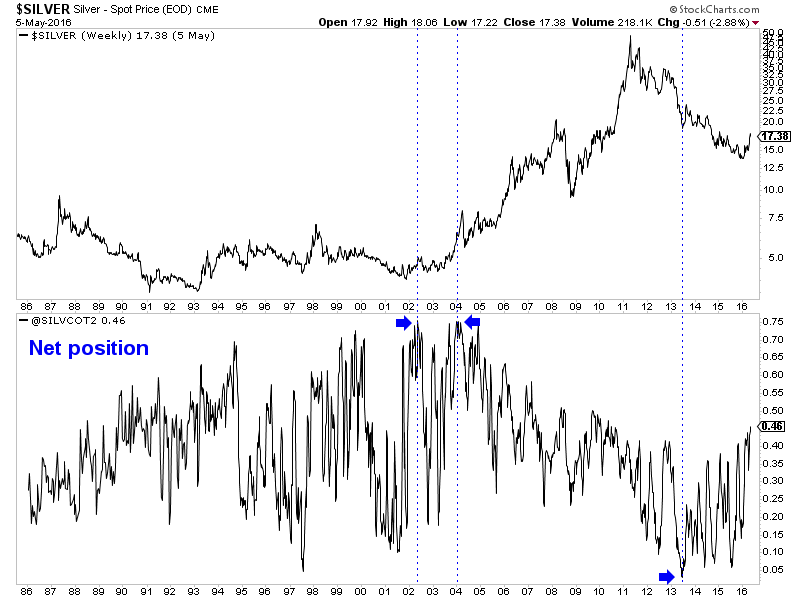

| Posted: 06 May 2016 01:00 PM PDT Nearly two months ago I published a video in which I discussed conventional CoT analysis and the mistake many investors might make assuming Gold and gold stocks would undergo a big correction. The fact is a bull market that follows a nasty bear usually stays very overbought throughout its first year and therefore sentiment indicators remain in bullish territory. As a result of the primary trend change, conventional CoT analysis fails and requires an adjustment. Today we look at the Gold and Silver CoT's while harping on a few of the mistakes people are making. The first mistake people are making (and I've seen this quite a bit recently) is painting the commercial traders as smart money. This completely mischaracterizes that group. Commercial hedgers are the users, producers or consumers of the commodity. They are using the futures market to hedge in some way. As Steve Saville writes in his explanation of the CoTs, the commercials usually do not bet on price direction. Generally speaking they tend to fade the trend while speculators drive or follow the trend. Risk certainly rises for bulls when speculators increase long positions aggressively and we should be aware of that. However, we should look beyond nominal figures to get a better reading of the degree of speculation. The second mistake is looking at the CoT's in only nominal terms and not as a percentage of open interest. The nominal net speculative position in Silver is at an all time high, which sounds scary. However, as a percentage of open interest the net speculative position is nowhere close to an all time high. In the chart below we plot Silver and its speculative position as a percentage of open interest. The current position is 45.7%, which is nowhere near the all-time highs seen in 2002 and 2004 of nearly 75%. Also note how the net speculative position does not tell us anything about the primary or long-term trend. Speculators were most bullish in 2002 and 2004 just after the start of a secular bull market. Speculators were least bullish in 2013. Silver bounced but continued to make new lows for a few more years!  Silver & Silver CoT

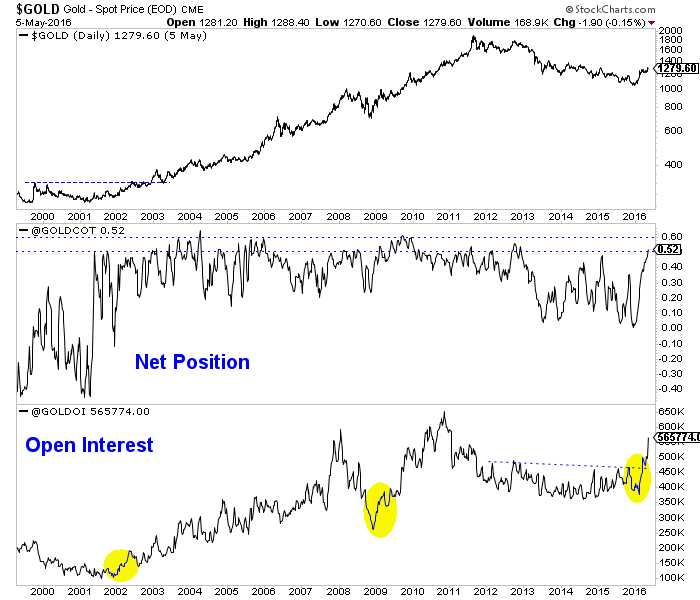

When considering open interest, Gold's primary trend change has been confirmed yet the net speculative position in Gold is much closer to extremes than Silver's. Take a look at the chart below and note the huge increases in open interest that immediately followed the lows in 2001, late 2008 and late 2015. A rise in open interest confirmed the trend change at those points. As of Tuesday, the net speculative position in Gold was 52.1%. Note that from 2003 to 2012 the net speculative position often peaked at 55% to 60%. Keep in mind, we do not know if Gold's next peak will be at 55% or even 70%.  Gold CoT

Overall, the CoT is one of a handful of tools we use and we learned how to interpret and analyze it the hard way. Remember, the speculators drive the trend and it's best to judge their position in terms of open interest. I do not see anything in the CoTs or price action of the metals or the miners that says they are about to endure a large correction. That will change at somepoint but for now weakness or consolidation is a buying opportunity. Consider learning more about our premium service including our favorite junior miners which we expect to outperform in 2016.

Jordan Roy-Byrne, CMT Jordan@TheDailyGold.com

|

| If You Don’t Have Gold, You Have A Problem! – Alasdair Macleod Posted: 06 May 2016 01:00 PM PDT This is how the inevitable geopolitical and financial "reset" might unfold: Buy 2016 Silver Maples Lowest Price Ever! Submitted by PM Fund Manager Dave Kranzler: Akin to ancient Rome, the United States has over-extended herself. She has created a climate that could easily be transformed into a war on a slight pretext. Wars, as it is […] The post If You Don’t Have Gold, You Have A Problem! – Alasdair Macleod appeared first on Silver Doctors. |

| A FLOOD of Capital Waiting For a Pullback in Gold & Silver Posted: 06 May 2016 01:00 PM PDT You might have just MISSED your chance… Submitted by PM Fund Manager Dave Kranzler: "Short gold on market overreaction" – Jeffrey Currie on CNBC on Feb 16, 2016; CNBC host: "Is there any commodity that you can recommend to help our viewers make money?" Jeffrey Currie: "Short gold" – CNBC on April 5, […] The post A FLOOD of Capital Waiting For a Pullback in Gold & Silver appeared first on Silver Doctors. |

| Sprott’s Precious Metals Watch: Perfect Storm For Gold? Posted: 06 May 2016 01:00 PM PDT Could a perfect storm for higher gold prices be in the process of unfolding? Buy 2016 Silver Maples Lowest Price Ever! Submitted by Sprott’s Thoughts: First quarter performance of precious metals and precious-metal equities caught many investors by surprise. After a four-year correction from September 2011 highs, spot gold posted its strongest quarterly performance in […] The post Sprott’s Precious Metals Watch: Perfect Storm For Gold? appeared first on Silver Doctors. |

| Physical Silver “Once the Last Ounce Is Sold, Price Goes From $15 to $5,000” Posted: 06 May 2016 01:00 PM PDT With silver looking like it may have finally shaken off the shackles of a brutal 5 year beat down by the cartel, Bix Weir joins ‘V’ The Gorilla Economist for an EXPLOSIVE interview: “Once the last ounce is sold that’s when the price goes from $15 to $5,000 because as the price rises – and […] The post Physical Silver “Once the Last Ounce Is Sold, Price Goes From $15 to $5,000” appeared first on Silver Doctors. |

| Was The Fed Just Given The Launch Codes? Posted: 06 May 2016 12:45 PM PDT Want to throw in a wildcard in this house-of-cards? The Saudi's have now (there's that timing thing again) openly, as well as, explicitly threatened to dump U.S. Treasury Notes. And not just a few, but ALL. Add too that an almost in-your-face cozy-ing up to China with oil for Yuan – and you have a […] The post Was The Fed Just Given The Launch Codes? appeared first on Silver Doctors. |

| Breaking News And Best Of The Web — May 7 Posted: 05 May 2016 07:34 PM PDT Central banks are clueless. Auto and truck sales are rolling over. More bad news from China — except for its takeover of the gold market, which is both impressive and smart. The global economy is “at stall speed.” The US labor market takes a turn for the worse. Money is pouring out of hedge funds […] |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment