Gold World News Flash |

- Survival Communications After a Collapse: “Pringles Can And Broadband Routers Could Create a WiFi Network”

- Comex Gold Open Interest - Craig Hemke

- Top Silver Mining Companies and Countries

- Gerald Celente – “TREND ALERT: Global Equity Markets Sinking, Gold Rising. Trend Or Fad?”

- Mind Control as a method to support the US Dollar

- Don’t Trust Politics to Change Your Life, Trust Yourself

- Trumped! Why It Happened And What Comes Next, Part 3 - The Jobs Deal

- According To Deutsche Bank, The "Worst Kind Of Recession" May Have Already Started

- Rick Rule: Sprott’s Weekly Wrap Up

- Gold Doing What It Does Best

- Paul Mylchreest: The death of the gold market -- reforming the LBMA and the true price of physical gold

- 5 Reasons You Should Vote For Donald Trump

- Britain's Modern Slave Trade

- Gold Sector Checkup After the ‘Inflation Trade’ Bounce

- Gold And Silver ARE The Only Money [Hardly] In Existence

- Precious Metals Complex Combo Chart...

- Gerald Celente : Global Equity Markets Sinking, Gold Rising. Trend Or Fad?

- Economic Collapse -- Over 8 Million Britons struggling to get food

- Misreading Gold and Silver CoTs, Again

- Week In Review: Gold Bounces on Soft Jobs Report

- Breaking News And Best Of The Web — May 8

| Posted: 07 May 2016 11:00 PM PDT by Mac Slavo, SHTFPlan:

It could prove to be the darkest period yet for modern civilization and the age of technocracy. An EMP, a natural disaster, a nuclear attack, an economic collapse or a declaration of martial law rank among just some of the worst scenarios that could befall our society. And if you are not prepared, you will fall along with the masses. Not long ago, the London Guardian interviewed global crisis expert and author Nafeez Ahmed, extracting lots of great info to think about prepping for survival. Ahmed, who was involved with advising on a video game that included realistic portrayals of crisis aftermath, brought up lots of good points, including basics like: | ||||

| Comex Gold Open Interest - Craig Hemke Posted: 07 May 2016 10:00 PM PDT Sprott Money | ||||

| Top Silver Mining Companies and Countries Posted: 07 May 2016 09:38 PM PDT | ||||

| Gerald Celente – “TREND ALERT: Global Equity Markets Sinking, Gold Rising. Trend Or Fad?” Posted: 07 May 2016 09:00 PM PDT from TrendsJournal: | ||||

| Mind Control as a method to support the US Dollar Posted: 07 May 2016 08:29 PM PDT There is a paradox of capitalism, we've reached a point where those at the top, have an unlimited budget to maintain the status quo, increase their wealth, and develop an ever increasing sophistocated toolbox to manage empire and maintain their dominance. As we explain in Splitting Pennies - this is no where more obvious than Forex. The last 100 years we've seen capitalism evolve brightly. Industries that shouldn't be industries, now employ millions of workers. Paradigm shift, revolution, can now be artificially created by means of automated computer algorithm. The political process, has been hacked by this technology. And it's all controlled by a central banking Elite - it's all controlled by THEY (Them). At the top of the pyramid of society, groups such as the CIA, MI6, KGB, Mossad, and others - are responsible for maintaining safety and security, that is, from change. They cull the herd when necessary, whether it be a revolution in Libya, or bringing down the twin towers. But these are all physical ops, their most important missions are the ones least talked about - that is, PsyOps, and most significantly, PsyOps that support the financial system. I believe that if ZH readers can understand this matrix, it will help make better more objective investing decisions. Because although the market is a free entropic environment, it is controlled by humans, by institutions, and well - it's only free when it's allowed to be free. These PsyOps are what make such a state of hypocrisy possible - otherwise, people would 'wake up' and realize that we are programmed with oxi moron hypocrisy. "We had to bomb the village to save it." The tools they use to implement mind control are very simple and have been around for 50 years - the most successful one is Television (TV). According to testimony by CIA analyst who was involved in domestic PsyOps, he said when asked how can the average person avoid such programming, "Unplug your TV." In case you aren't aware of modern mind control techniques, checkout this well compiled article by Activist Post about 10 methods commonly used. The connection between the global social control paradigm and the US Dollar runs deep. In support of the US Dollar, it's important that people are blindly hypnotised into submission by using US Dollars. This is more important than any Fed operations to prop the markets. Because ultimately, the only real threat to the US Dollar is if people start THINKING. At the end of the day, the US Dollar, like any fiat currency, provides a basic accounting service for economic activity. Never before in history has a single currency enjoyed such widespread global use. And the marketing and propoganda campaigns in support of the USD support it more than the Petro Dollar system, more than CIA operations in Switzerland, and more than any financial algorithm employed by groups such as the Plunge Protection Team (PPT). Understanding something, isn't criticizing - maybe it's a good thing, maybe not - it's not for the teacher to make any conclusive opinion. It is however something that all investors should be aware of, especially those who are subject to daily Neuro Linguistic Programming (NLP) in support of this financial system. Why is Hollywood so successful? Because they make magic - they make the artificial, seem real... if only for a few moments, it is enough to rewire your brain, already filled with advertising, chemicals in the food, air, and water, and various radio and radiation pumped into populated areas. The Fed, controlled by a similar group of people like Hollywood is, also makes magic. They make people believe in this paper they print numbers on called "Federal Reserve Notes" - even though it's backed by nothing. US Dollars are only backed by BELIEF and FAITH in them - which is why Mind Control - or in more plain language, aggressive advertising; is necessary to support the US Dollar. Maybe watching some of these lunatics that have coined phrases such as "King Dollar" are enough for the average busy businessman to be lulled into a sense of semi-consciousness, where rational, objective thought is impossible. Buy buy buy.. drill drill drill.. Investors are whipped into a bullish frenzy easily with such programming. They meet the first criteria - they are open to it. Admitting you have a problem, is step number one. The mind is like a parachute, you must open to use. Not only that, they actually want to hear what TV personalities want to say, to help them make investing decisions! I remember when I learned Bill OReilly wrote a book - I was shocked. I didn't think that someone with his mental disability could even read - let alone write! (Still, I'm not sure he actually wrote any book, probably he hired someone to do it.) Anyway, this guy is a great example of someone who fits the role needed to be played perfectly - slightly mentally retarded, aggressive abrasive personality, with a lot of opinions about meaningless issues that will guarantee that it is impossible to receive any valuable information by watching such a program. So how does this all work? Clearly, the Elite have decided that financial services - it's not for the people. People should work hard, obey, consume, watch sports, and watch TV, and eat, and drink.. So they embed advertising in subtle ways, when discussing financial issues. For example, during the 911 commission reports and investigation, there's no mention of the post 911 US Dollar, or transactions that took place short USD just before 911. There's a little talk about PUT options on UAL but they've tried confusing the issue by releasing snopes reports that its a myth, even though you can see what really happened here:

No mention of Forex - no USD short. No reports about the missing Gold from the Fed depository, which was at Ground Zero. This type of subtle manipulation goes on today. It's not what they say, it's what they don't say. As long as the American population is fat, happy, and stupid - they will be happy to use US Dollars, which continually decline in value. Alternatives such as community currencies, gold, Bitcoin, and others - which are readily available for use - should be avoided at all costs. Most Americans aren't even aware that other currencies exist. As we explain in our book Splitting Pennies - this brainwashing of the domestic population is critical to the global advertising campaign that supports the US Dollar. The USD is the one world currency. The Euro, backed by USD and run by CIA agent "Super Mario" - is simply the other side of the same coin. The goal of this programming is simple - don't question the US Dollar. It's not about convincing people to buy USD in a Forex account. In fact, they're betting that by not questioning the value of the USD or questioning the USD as an accounting functional currency, people aren't going to want to trade Forex, where they can potentially hedge themselves from Forex exposure, or even make a fortune on Forex like Stan did. What's the point of this article? Turn off your TV, or just obey.

They are investing billions to control your mind. All they want is your time. Just a few moments of your time. It's all they need. Who cares, whatever, nevermind.  | ||||

| Don’t Trust Politics to Change Your Life, Trust Yourself Posted: 07 May 2016 07:30 PM PDT from The Daily Bell:

Glenn Reynolds is law professor and member of the USA Today editorial board. He makes good points in this just-published editorial, as you can see above. But the reality goes far deeper than that. The main idea Reynolds presents is that the more control voters give politicians, the more resources they have at hand to abuse.

In other words, politicians will invariably use the power they have to enrich themselves and their cronies at your expense. More:

But Reynolds never discusses modern, monopoly central banking. The entire US economy – the world's economy – is poisoned by it. | ||||

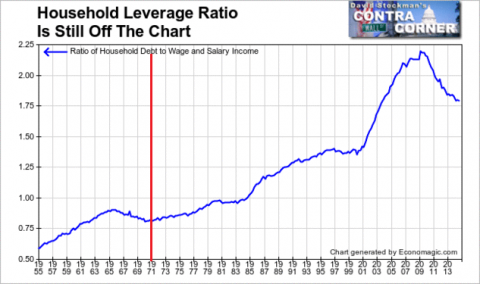

| Trumped! Why It Happened And What Comes Next, Part 3 - The Jobs Deal Posted: 07 May 2016 06:15 PM PDT Submitted by David Stockman via Contra Corner blog, Donald Trump’s patented phrase “we aren’t winning anymore” lies beneath the tidal wave of anti-establishment sentiment propelling his campaign and, to some considerable degree, that of Bernie Sanders, too. As we demonstrated in Part 1, and Part 2, what’s winning is Washington, Wall Street and the bicoastal elites. The latter prosper from finance, the LA and SF branches of entertainment ( movies/TV and social media, respectively) and the great rackets of the Imperial City - including the military/industrial/surveillance complex, the health and education cartels, the plaintiffs and patent bar, the tax loophole farmers and the endless lesser K-Street racketeers. But most of America’s vast flyover zone has been left behind. Thus, the bottom 90% of families have no more real net worth today than they had 30 years ago and earn lower real household incomes and wages than they did 25 years ago. Needless to say, the lack of good jobs lies at the bottom of the wealth and income drought on main street, and this week’s April jobs report provided still another reminder. During the last three months goods-producing jobs have been shrinking again, even as the next recession knocks on the door. These manufacturing, construction and energy/mining jobs are the highest paying in the US economy and average about $56,000 per year in cash wages. Yet it appears that the 30 year pattern shown in the graph below——lower lows and lower highs with each business cycle—-is playing out once again. So even as the broadest measure of the stock market—-the Wilshire 5000—–stands at 11X its 1989 level, there are actually 22% fewer goods producing jobs in the US than there were way back then. This begs the question, therefore, as to the rationale for the Jobs Deal we referenced in Part 1, and why Donald Trump should embrace a massive swap of the existing corporate and payroll taxes for new levies on consumption and imports. The short answer is that Greenspan made a giant policy mistake 25 years ago that has left main street households buried in debt and stranded with a simultaneous plague of stagnant real incomes and uncompetitively high nominal wages. It happened because at the time that Mr. Deng launched China’s great mercantilist export machine during the early 1990s, Alan Greenspan was more interested in being the toast of Washington than he was in adhering to his lifelong convictions about the requisites of sound money. Indeed, he apparently checked his gold standard monetary princples in the cloak room when he entered the Eccles Building in August 1987. Not only did he never reclaim the check, but, instead, embraced the self-serving institutional anti-deflationism of the central bank. This drastic betrayal and error resulted in a lethal cocktail of free trade and what amounted to free money. It resulted in the hollowing out of the American economy because it prevented American capitalism from adjusting to the tsunami of cheap manufactures coming out of China and its east Asian supply chain. So what would have happened in response to the so-called “china price” under a regime of sound money in the US? The Fed’s Keynesian economists and their Wall Street megaphones would never breath a word of it, of course, because they have a vested interest in perpetuating inflation. It gives inflation targeting central bankers the pretext for massive intrusion in the financial markets and Wall Street speculators endless bubble finance windfalls. But the truth is, sound money would have led to falling consumer prices, high interest rates and an upsurge of household savings in response to strong rewards for deferring current consumption. From that enhanced flow of honest domestic savings the supply side of the American economy could have been rebuilt with capital and technology designed to shrink costs and catalyze productivity. But instead of consumer price deflation and a savings-based era of supply side reinvestment, the Greenspan Fed opted for a comprehensive Inflation Regime. That is, sustained inflation of consumer prices and nominal wages, massive inflation of household debt and stupendous inflation of financial assets. To be sure, the double-talking Greenspan actually bragged about his prowess in generating something he called “disinflation”. But that’s a weasel word. What he meant, in fact, was that the purchasing power of increasingly uncompetitive nominal American wages was being reduced slightly less rapidly than it had been in the 1980s. Still, the consumer price level has more than doubled since 1987, meaning that prices of goods and services have risen at 2.5% per year on average. Notwithstanding all the Fed’s palaver about “low-flation” and undershooting its phony 2% target, American workers have had to push their nominal wages higher and higher just to keep up with the cost of living. But in a free trade economy the wage-price inflation treadmill of the Greenspan/Fed was catastrophic. It drove a wider and wider wedge between US wage rates and the marginal source of goods and services supply in the global economy. That is, US production was originally off-shored owing to the China Price with respect to manufactured goods. But with the passage of time and spread of the central bank driven global credit boom, goods and services were off-shored to places all over the EM. The high nominal price of US labor enabled the India Price, for example, to capture massive amounts of call center activity, engineering and architectural support services, financial company back office activity and much more. At the end of the day, it was the Greenspan Fed which hollowed out the American economy. Without the massive and continuous inflation it injected into the US economy, nominal wages would have been far lower, and on the margin far more competitive with the off-shore. That’s because there is a significant cost per labor hour premium for off-shoring in terms of a 12,000 mile pipeline of transportation charges, logistics control and complexity, increased inventory carry in the supply chain, quality control and reputation protection expenses, average productivity per worker, product delivery and interruption risk and much more. In a sound money economy of falling nominal wages and even more rapidly falling consumer prices, American workers would have had a fighting chance to remain competitive, given this significant off-shoring premium. But the demand-side Keynesians running policy at the Fed and US treasury didn’t even notice that their wage and price inflation policy functioned to override the off-shoring premium, and to thereby send American production and jobs fleeing abroad. Indeed, they actually managed to twist this heavy outflow of goods and services production into what they claimed to be an economic welfare gain in the form of higher corporate profits and lower consumer costs. Needless to say, the basic law of economics—-Say’s Law of Supply—-says societal welfare and wealth arise from production; spending and demand follow output and income. By contrast, our Keynesian central bankers claim prosperity flows from spending, and they had a ready solution for the gap in spending that initially resulted when jobs and incomes were sent off-shore. The de facto solution of the Greenspan Fed was to supplant the organic spending power of lost production and wages with a simulacrum of demand issuing from an immense and contiunuous run-up of household debt. Accordingly, what had been a steady 75-80% ratio of household debt to wage and salary income before 1980 erupted to 220% by the time of Peak Debt in 2007. The nexus between household debt inflation and the explosion of Chinese imports is hard to miss. Today monthly Chinese imports are 75X larger than the were when Greenspan took office in August 1987. At the same time, American households have buried themselves in debt, which has rising from $2.7 trillion or about 80% of wage and salary income to $14.2 trillion. Even after the financial crisis and supposed resulting deleveraging, the household leverage ratio is still in the nosebleed section of history at 180% of wage and salary earnings. Stated differently, had the household leverage ratio not been levitated in the nearly parabolic fashion shown below, total household debt at the time of the financial crisis would have been $6 trillion, not $14 trillion. In effect, the inflationary policies of the Greenspan Fed and its successors created a giant hole in the supply side of the US economy, and then filled it with $8 trillion of incremental debt which remains an albatross on the main street economy to this day. Then again, digging holes and refilling them is the essence of Keynesian economics. At the end of the day, the only policy compatible with Greenspan’s inflationary monetary regime was reversion to completely managed trade and a shift to historically high tariffs on imported goods and services. That would have dramatically slowed the off-shoring of production, and actually also would have remained faithful to the Great Thinker’s economics. After all, in 1931 Keynes turned into a vociferous protectionist and even wrote an ode to the virtues of “homespun goods”. Alas, inflation in one country behind protective trade barriers doesn’t work either, as was demonstrated during the inflationary spiral of the late 1960s and 1970s. That’s because easy money does lead to a spiral of rising domestic wages and prices owing to too much credit based spending; and this spiral eventually soars out of control in the absence of the discipline imposed by lower-priced foreign goods and services. In perverse fashion, therefore, the Greenspan Fed operated a bread and circuses economy. Unlimited imports massively displaced domestic production and incomes—even as they imposed an upper boundary on the rate of CPI gains. The China Price for goods and India Price for services, in effect, throttled domestic inflation and prevented a runaway inflationary spiral. In the face of ever increasing credit-funded US household demand, there was virtually unlimited labor and production supply available from the rice paddies and agricultural villages of the EM. Free trade also permitted many companies to fatten their profits by arbitraging the wedge between Greenspan’s inflated wages in the US and the rice paddy wages of the EM. Indeed, the alliance of the Business Roundtable and the Keynesian Fed in behalf of free money and free trade is one of history’s most destructive arrangements of convenience. In any event, the graph below nails the story. During the 29 years since Greenspan took office, the nominal wages of domestic production workers have soared, rising from $9.22 per hour in August 1987 to $21.26 per hour at present. It was this 2.3X leap in nominal wages, of course, that sent jobs packing for China, India and the EM. At the same time, the inflation-adjusted wages of domestic workers who did retain there jobs went nowhere at all. That’s right. There were tens of millions of jobs off-shored, but in constant dollars of purchasing power, the average production worker wage of $383 per week in mid-1987 has ended up at $380 per week 29 years later During the span of that 29 year period the Fed’s balance sheet grew from $200 billion to $4.5 trillion. That’s a 23X gain during less than an average working lifetime. Greenspan claimed he was the nation’s savior for getting the CPI inflation rate down to around 2% during his tenure; and Bernanke and Yellen have postured as would be saviors owing to their strenuous money pumping efforts to keep it from failing the target from below. But 2% inflation is a fundamental Keynesian fallacy, and the massive central bank balance sheet explosion which fueled it is the greatest monetary travesty in history. Dunderheads like Bernanke and Yellen say 2% inflation is just fine because under their benign monetary management everything comes out in the wash at the end——-wages, prices, rents, profits, living costs and indexed social benefits all march higher together with tolerable leads and lags. No they don’t. Jobs in their millions march away to the off-shore world when nominal wages double and the purchasing power of the dollar is cut in half over 29 years. These academic fools apparently believe they live in Keynes’ imaginary homespun economy of 1931! The evident economic distress in the flyover zone of America and the Trump voters now arising from it in their tens of millions are telling establishment policy makers that they are full of it; that they have had enough of free trade and free money. What can be done now? The solution lies in the contra-factual to the Greenspan/Fed Inflation Regime. Under sound money, the balance sheet of the Fed would still be $200 billion, household debt would be a fraction of its current level, the CPI would have shrunk 1-2% per year rather than the opposite and nominal wages would have shrunk by slightly less. But real wages would be far higher than the $380 per week shown above and good jobs in both goods and services would be far more plentiful than reported last Friday by the BLS. Needless to say, the clock cannot be turned back, and a resort to Keynes’ out-and-out protectionism in the context of an economy that suckles on nearly $3 trillion of annual goods and services imports is a non-starter. It would wreak havoc beyond imagination. But it is not too late to attempt the second best in the face of the giant historical detour from sound money that has soured the practice of free trade. To wit, public policy can undo some of the damage by sharply lowering the nominal price of domestic wages and salaries in order to reduce the cost wedge versus the rest of the world. It is currently estimated that during 2016 social insurance levies on employers and employees will add a staggering $1.8 trillion to the US wage bill. Most of that represents social security and medicare payroll taxes at the Federal level, along with state unemployment insurance taxes that are induced by Federal policy. The single greatest things that could be done to shrink the Greenspan/Fed nominal wage wedge, therefore, is to rapidly phase out all payroll taxes, and thereby dramatically improve the terms of US labor trade with China and the rest of the EM world. Given that the nation’s total wage bill (including benefit costs) is about $10 trillion, elimination of Federal payroll taxes would amount to a 11% cut in the cost of US labor. On the one hand, such a bold move would also dramatically elevate actual main street take-home pay owing to the fact that half of the payroll tax levy is extracted from worker pay packets in advance. Moreover, elimination of payroll taxes would be far more efficacious from a political point of view in Trump’s flyover zone constituencies. That’s because nearly 160 million Americans pay social insurance taxes compared to less than 50 million who actually pay any net Federal income taxes after deductions and credits. At the same time, elimination of Federal payroll taxes would reduce the direct cost of labor to domestic business by upwards of $575 billion per year. And as we have proposed in the Jobs Deal, the simultaneous elimination of the corporate income tax would reduce the burden on business by another $350 billion annually. Zeroing-out the corporate income tax happens to be completely appropriate and rational in today’s globalized economy in its own right. The corporate tax has always posed an insuperable challenge to match business income and expense during any arbitrary tax period, anyway. But in a globalized economy in which capital is infinitely mobile on paper as well as in fact, the attempt to collect corporate profits taxes in one country is pointless and impossible. It simply gives rise to massive accounting and legal maneuvers such as the headline grapping tax inversions of recent years. Yet notwithstanding 75,000 pages of IRS code and multiples more of that in tax rulings and litigation, corporate tax departments will always remain one step ahead of the IRS. That is, the corporate tax generates immense deadweight economic costs and dislocation—including a huge boost to off-shoring of production to low tax havens——while generating a meager harvest of actual revenues. Last year, for example, corporate tax collections amounted to just 1.8% of GDP compared to upwards of 9% during the heyday of the American industrial economy during the 1950s. Needless to say, you don’t have to be a believer in supply side miracles to agree that a nearly $1 trillion tax cut on American business from the elimination of payroll and corporate income taxes would amount to the mother of all jobs stimulus programs! Self-evidently, the approximate $1.5 trillion revenue loss at the Federal level from eliminating these taxes would need to be replaced. We are not advocating any Laffer Curve miracles here——although over time the re-shoring of jobs that would result from this 11% labor tax cut would surely generate a higher rate of growth than the anemic 1.3% annual GDP growth rate the nation has experienced since the turn of the century. In the next section we will delve deeper into the tax swap proposed here. But suffice it to say that with $3 trillion of imported goods and services and $10 trillion of total household consumption, the thing to tax would be exactly what we have too much of and which is the invalid fruit of inflationary monetary policy in the first place. To wit, foregone payroll and corporate tax revenue should be extracted from imports, consumption and foreign oil. An approximate 15% value added tax and a variable levy designed to peg landed crude prices at $75 per barrel would more than do the job. And revive the US shale patch, too. * * * As we began, there is a sliver of hope if Donald Trump does not capitulate to mainstream policies and is willing to set aside his potpourri of shibboleths and panaceas in favor of a disciplined and coherent game plan that builds on his bedrock pol | ||||

| According To Deutsche Bank, The "Worst Kind Of Recession" May Have Already Started Posted: 07 May 2016 06:07 PM PDT One week ago, Deutsche Bank's Dominic Konstam unveiled, whether he likes it or not, what the next all too likely step will be as central bankers scramble to preserve order in a world in which monetary policy has all but lost effectiveness: "It is becoming increasingly clear to us that the level of yields at which credit expansion in Europe and Japan will pick up in earnest is probably negative, and substantially so. Therefore, the ECB and BoJ should move more strongly toward penalizing savings via negative retail deposit rates or perhaps wealth taxes." Many were not happy, although in reality the only reason why the DB strategist proposed this disturbing idea is because this is precisely what the central banks will end up doing. Today, he follows up with an explanation just why the central bankers will engage in such lunatic measures: quite simply, he thinks that economic contraction is now practically assured - and may have already begun - for a simple reason: contrary to popular belief, this particular "expansion" will die of old age after all, and won't even need the Fed's intervention to unleash the next recession (if not depression).

However, this time it's different. As Konstam writes, "the current cycle is distinct in that pricing power is generally lower than in the past... This is likely because of the now well worn theme of global competition: production can be moved to lower wage centers, allowing constant or larger profits in an environment of steady or even lower prices. Lower pricing power reduces the ability of the corporate sector to pass along even mild wage increases to consumers and makes profits that much more vulnerable." Then there is the issue of plummeting productivity, something discussed here extensively in the past:

Konstam then flips the entire "old age" question on its head and asks the relevant question namely whether the Fed is still needed to create a recession given the characteristics of the current economic cycle.

So if Fed action (read tightening) is not needed to induce a recession, what could be the catalyst? According to DB, two things.

Maybe, although as we showed recently, as of March, the US savings rate following numerous revisions, was already at the highest in over three years and rising.

Which brings us to Konstam's worst case scenario, one which is quickly starting to smell like the credit analyst's "base-case" namely the "third avenue for recession" which Deutsche Bank believes is the worst of the three. "This is an endogenous slowdown in labor demand that results because corporations are not just tired of negative profit growth, but also because they are drawing a line in the sand from the perspective of defending margins. No one knows where that line is. But payroll reports like last week's suggest it could be around here. We have had the worst profit recession since 1971 but profit share is still in the low 20 percent range, having peaked around 24 pct. The worst level has been in the mid to low teens." And the punchline:

But why plow back profits into the economy when one can just buy back stock instead and make owners of capital wealthy beyond their wildest dreams when you have every central bank, and in the case of the ECB explicitly, backstopping bond purchases so that the use of proceeds can just to to fund buybacks. Or, god forbid that the "inherent contradiction" not in capitalism but in the neo-Keynesian model is revealed, exposing all those tenured economists and central bankers as clueless cranks, and finally vaulting Austrian economics to the pinnacle of economic thought. The irony, of course, is that once the global economy falls into the deepest economic depression the world has seen - perhaps ever - everyone will be shocked and confused hot it is that we go there when "markets" kept rising, and rising, and rising... Sarcasm aside, let's summarize: according to Deutsche Bank the worst kind of a recession, an "endogenous one" in which labor demand plunges as "corporations are not just tired of negative profit growth, but also because they are drawing a line in the sand from the perspective of defending margins" may be imminent... or is already here because based on "payroll reports like last week's suggest it could be around here." Surely, that alone should be enough to send the S&P to new all time highs. * * * And for those wondering: yes, according to DB things will get worse simply because they have to get worse to offer some hope for an actual mean reversion-based recovery. Sadly, as DB is all too correct, the only way that central banks have ahead of them now involves more negative rates, more wealth transfers, and of course, the infamous "wealth tax" DB touched upon last week.

Actually, make that a depression, because when central banks have really nothing left to lose, that's when the terminal step in fiat debasement can finally begin. | ||||

| Rick Rule: Sprott’s Weekly Wrap Up Posted: 07 May 2016 05:00 PM PDT from Sprott Money:

This week, Rick Rule sits in for Eric and discusses interest rates, the resumption of the bull market in gold and the rally in the mining shares. | ||||

| Posted: 07 May 2016 04:15 PM PDT | ||||

| Posted: 07 May 2016 04:04 PM PDT 7p ET Saturday, May 7, 2016 Dear Friemd of GATA and Gold: Market analyst Paul Mylchreest's new report, "The Death of the Gold Market -- Reforming the LBMA and the True Price of Physical Gold," argues that little if any metal remains available in the London gold market. With his kind permission it's posted at GATA's Internet site here: http://www.gata.org/files/MylchreestReport-05-2016.pdf CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT The Committee to Destroy the World: This new book by Michael E. Lewitt is a passionate and informed analysis of the struggling global economy. Lewitt, one of Wall Street's most respected market strategists and money managers, updates his groundbreaking examination of the causes of the 2008 crisis and argues that economic and geopolitical conditions are even more unstable today. Lewitt explains how debt has overrun the world's productive capacity, how government policies have created a downward vortex sapping growth and vitality from the American economy, and how greed and corruption are preventing reform. For more information: http://www.wiley.com/WileyCDA/WileyTitle/productCd-1119183545,subjectCd-... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit:

This posting includes an audio/video/photo media file: Download Now | ||||

| 5 Reasons You Should Vote For Donald Trump Posted: 07 May 2016 10:40 AM PDT (LANGUAGE WARNING:) If you're a Donald Trump supporter like Gavin McInnes, it can be hard dealing with anti-Trump fanatics. He presents great talking points for your next argument! MORE: The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||

| Posted: 07 May 2016 10:30 AM PDT Al Jazeera's Investigative Unit goes undercover to reveal the true scale of modern slavery in suburban Britain. We expose the slave masters and the people smugglers and talk to victims about their ordeals. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||

| Gold Sector Checkup After the ‘Inflation Trade’ Bounce Posted: 07 May 2016 10:08 AM PDT There has been a lot of talk about how gold is not a good inflation hedge. Indeed, with the recent bounce in inflation expectations, this was shown to be true over a short timeframe, at least in relation to silver and other commodities. Gold sagged while the more inflation-sensitive commodities bounced. | ||||

| Gold And Silver ARE The Only Money [Hardly] In Existence Posted: 07 May 2016 10:03 AM PDT Gold and silver ARE money. Neither is a "currency," although money is often cited as interchangeable with currency. Take the Federal Reserve Note, [please!], as an example. A Federal Reserve Note [FRN], is more commonly known as a "dollar." Even though the word "dollar" appears on every FRN, each and every FRN is a debt instrument issued by the Federal Reserve and not a true dollar. The Federal Reserve is a privately held corporation, owned mostly by certain european bankers, and may include the Rockefellers, from the US. "When a government is dependent upon bankers for money, they and not the leaders of the government control the situation, since the hand that gives is above the hand that takes... Money has no motherland; financiers are without patriotism and without decency; their sole object is gain." - Napoleon Bonaparte, Emperor of France, 1815 | ||||

| Precious Metals Complex Combo Chart... Posted: 07 May 2016 09:45 AM PDT Below is a long term weekly chart we've been following which shows the breakouts and backtesting that have been going on for several months with gld and slv, and just 5 weeks or so for the HUI. This big picture look from 35,000 feet shows how infant this new bull market is right now. It was basically born back in January of this year and is just opening its eyes. What we want to see now is a higher high in the coming days and weeks. | ||||

| Gerald Celente : Global Equity Markets Sinking, Gold Rising. Trend Or Fad? Posted: 07 May 2016 08:52 AM PDT Gerald Celente - "TREND ALERT: Global Equity Markets Sinking, Gold Rising. Trend Or Fad?" - (5/4/16) The latest Trend Alert is released, Shell Oil profits plunged 83% this quarter when compared with a year earlier & China's central bank continues to pump money into their failing... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||

| Economic Collapse -- Over 8 Million Britons struggling to get food Posted: 07 May 2016 08:33 AM PDT According to the study conducted by the Food Foundation, one in ten adults in the UK suffered moderate levels of food insecurity in 20-14. This places the country in the bottom half of European countries in terms of hunger measures, below Hungary, Estonia, Slovakia and Malta. The study also... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||

| Misreading Gold and Silver CoTs, Again Posted: 07 May 2016 06:46 AM PDT Nearly two months ago I published a video in which I discussed conventional CoT analysis and the mistake many investors might make assuming Gold and gold stocks would undergo a big correction. The fact is a bull market that follows a nasty bear usually stays very overbought throughout its first year and therefore sentiment indicators remain in bullish territory. As a result of the primary trend change, conventional CoT analysis fails and requires an adjustment. Today we look at the Gold and Silver CoT's while harping on a few of the mistakes people are making. | ||||

| Week In Review: Gold Bounces on Soft Jobs Report Posted: 07 May 2016 04:00 AM PDT Gold Stock Bull | ||||

| Breaking News And Best Of The Web — May 8 Posted: 05 May 2016 07:34 PM PDT Central banks are clueless. Auto and truck sales are rolling over. More bad news from China — except for its takeover of the gold market, which is both impressive and smart. The global economy is “at stall speed.” The US labor market takes a turn for the worse. Money is pouring out of hedge funds […] |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Are you truly prepared to survive what is coming?

Are you truly prepared to survive what is coming?

Glenn Reynolds: Don't let U.S. become next Rome … Entrenched political elites will sacrifice anything to retain power, including their own country…. As you vote, remember that the more resources you put under the control of the political class, the more likely it is that things will eventually go bad. Politicians seldom look past the next election, and they're willing to sacrifice pretty much anything to hang on. And that "pretty much anything" includes you. –USA Today

Glenn Reynolds: Don't let U.S. become next Rome … Entrenched political elites will sacrifice anything to retain power, including their own country…. As you vote, remember that the more resources you put under the control of the political class, the more likely it is that things will eventually go bad. Politicians seldom look past the next election, and they're willing to sacrifice pretty much anything to hang on. And that "pretty much anything" includes you. –USA Today

No comments:

Post a Comment