Gold World News Flash |

- Gold Leasing Explained

- How El Chapo Used Gold To Move Money Out Of The U.S.

- How to Profit in this Gold/Silver/Mining Bull Market – Biggest Expert Rick Rule of Sprott

- Buy Gold, ‘Get Out Of The Stock Market’ Warns Druckenmiller

- Centennial Gold Mercury Dime: Up Close & Personal in 4K

- The Historic Dow Jones/Silver Ratio Points To $300 Silver

- How El Chapo Used Gold To Move Money Out Of The U.S.

- Incrementum Advisory Board Meeting, Q2 2016

- Gold Price Closed at $1292.90 up $21.50 or 1.69%

- Election 2016 - The Next "Advance Auction On Stolen Goods"

- GOLD, SILVER & OTHER TRUTHS in a Sea of Lies — Andy Hoffman

- Worst.Month.Ever... Hong Kong Retail Sales Collapse In March

- Silver for SHTF

- Proof That Donald Trump IS THE REAL DEAL!

- Economic Collapse in Puerto Rico -- Escalating Debt Crisis

- Trumped! Why It Happened And What Comes Next, Part 2 (The Peace Deal)

- Gold Daily and Silver Weekly Charts - De Nile

- Donald Trump Is Right On US Debt -- Peter Schiff

- Economic Collapse -- Greeks Suffering from crippling Economic Measures

- Gold Stocks Rise Too Far Too Fast?

- The Fall of Sweden | Ingrid Carlqvist and Stefan Molyneux

- Gold Leasing Explained

- Buy Gold, ‘Get Out Of The Stock Market’ Warns Druckenmiller

- Gold and Silver Companies with the Potential to Move the Needle

- Markets At Crossroads: Huge Moves Brewing In Stocks And Gold

- When Gold Confiscation Is a Personal Choice

- Monetary Liquifaction, Gold and The Time Of The Vulture

- Breaking News And Best Of The Web — May 7

- Top Ten Videos — May 6

- Bianco: Gold a ‘High Yield’ Asset in a Negative Rate World

| Posted: 07 May 2016 12:00 AM PDT SunshineProfits | ||||||||||||||||||||||||||||||||||||||||||||||||

| How El Chapo Used Gold To Move Money Out Of The U.S. Posted: 06 May 2016 10:15 PM PDT from Zero Hedge:

That’s a first hand account of how gold was delivered to a Miami jewelry store by drug cartels, to later be melted down and sold for cash. As Bloomberg reports, court documents from a federal court case in Chicago allege that El Chapo’s Sinaloa drug cartel laundered tens of millions out of the U.S. not through secret shell companies wiring funds from bank to bank, but by simply buying gold and selling it.

Here’s how the money laundering process allegedly worked. When the Sinaloa cartel needed to get the proceeds from its drug activities in the U.S. back to Mexico, it would first go buy up gold bars and other scrap gold pieces (sometimes silver as well) from jewelry stores and other businesses in the Chicago area. Then, the gold would be put into boxes, and under the name “Chicago Gold”, or on occasion “Shopping Silver”, would ship the boxes via FedEx to a company near Miami called Natalie Jewelry. Once the gold arrived at Natalie Jewelry, the second leg of the operation was set in motion. The gold would then be sold to companies referred to as refineries, who melted down the gold. The refinery would take a commission, and send the rest of the proceeds back to Natalie Jewelry. Now came the difficult part, which was getting the cash out of the country and into Mexico. This part of the operation called for a little bit more creativity, so the cartel set up a company in Mexico called De Mexico British Metal. De Mexico British Metal would invoice Natalie Jewelry, making it appear that it had sold the gold to them. Natalie Jewelry would in turn take their commission, and send the final proceeds to De Mexico British Metal. | ||||||||||||||||||||||||||||||||||||||||||||||||

| How to Profit in this Gold/Silver/Mining Bull Market – Biggest Expert Rick Rule of Sprott Posted: 06 May 2016 10:00 PM PDT from FutureMoneyTrends: | ||||||||||||||||||||||||||||||||||||||||||||||||

| Buy Gold, ‘Get Out Of The Stock Market’ Warns Druckenmiller Posted: 06 May 2016 07:40 PM PDT by Mark O'Byrne, GoldCore:

Druckenmiller, who has one of the best long-term track records in money management, said the stock market bull market has "exhausted itself" and that gold "remains our largest currency allocation." He told the Sohn Investment Conference attendees to sell their equity holdings: "The conference wants a specific recommendation from me. I guess 'Get out of the stock market' isn't clear enough …"

He has been very critical of Federal Reserve and central bank monetary policies in recent years while correctly anticipating at that time that it would lead to higher asset prices. "I now feel the weight of the evidence has shifted the other way; higher valuations, three more years of unproductive corporate behavior, limits to further easing and excessive borrowing from the future suggest that the bull market is exhausting itself," said Druckenmiller, who averaged annual returns of 30 percent from 1986 through 2010 at his Duquesne Capital Management. He's up 8 percent this year, according to a person familiar with the matter. As bankers experiment with "the absurd notion of negative interest rates," Druckenmiller said, he is investing in gold. "Some regard it as a metal, we regard it as a currency and it remains our largest currency allocation," he said. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Centennial Gold Mercury Dime: Up Close & Personal in 4K Posted: 06 May 2016 07:20 PM PDT from SalivateMetal: | ||||||||||||||||||||||||||||||||||||||||||||||||

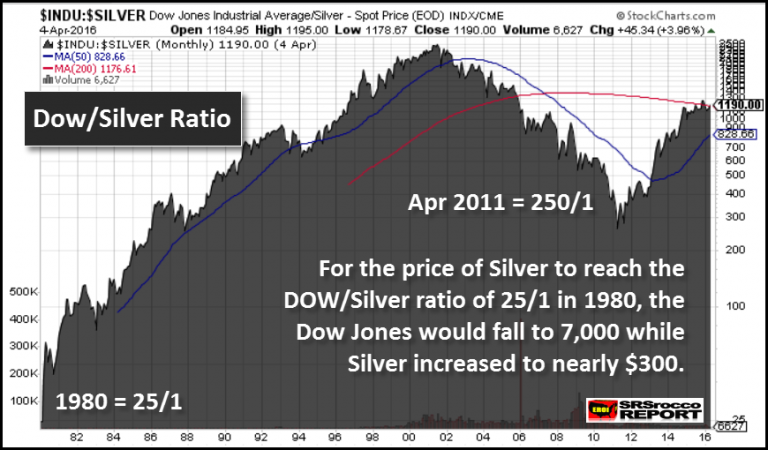

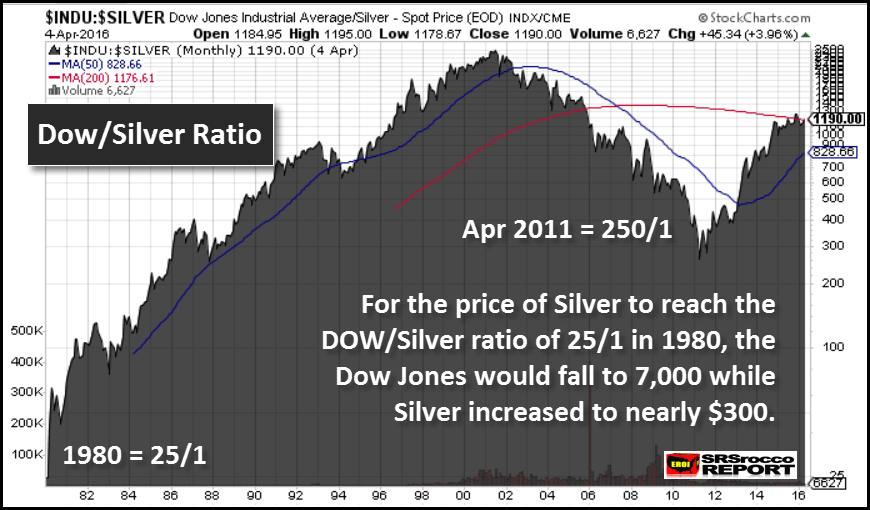

| The Historic Dow Jones/Silver Ratio Points To $300 Silver Posted: 06 May 2016 07:15 PM PDT by Steven St. Angelo, SRS Rocco:

That's correct. Going by the historic Dow Jones-Silver ratio, it points to $300 silver. This may seem outlandish or a play on hype, but it isn't. While many precious metals analysts have forecasted high three-digit silver prices, I didn't pay much attention to them. However, after I looked over all the data, $300 silver is not a crazy figure at all. Let me explain. The U.S. economy suffered a fatal blow in the 1970's as its domestic oil production peaked and inflation soared. To protect against the ravages of inflation, investors moved into gold and silver in a big way. Yes, it's true that the Hunts bought a lot of silver during the 1970's, but who was buying gold to push its price to $850 in 1980 versus $35 in 1970. Furthermore, who was buying oil to push its price up to $36 in 1980 from $1.80 in 1970?? As U.S. oil production and the EROI- Energy Returned On Invested continued to decline in the following decades, the American economy transitioned away from a high-paying manufacturing economy to what I call a LEECH & SPEND SERVICE ECONOMY. Thus, each new decade brought about a new bubble to keep the facade of a growing economy alive. We had the Department of Defense Military spending Bubble in the 1980's, the Tech Bubble of the 1990's, the Housing Bubble of the 2000's and now we have the Auto, Housing, College, HealthCare, Stock Market, Retirement and U.S. Treasury Bubble. The present highly-leveraged bubble will end all bubbles. Short Term Silver Market Analysts Can't See The Forest For The TreesI wrote about this in my recent article, Precious Metals Investor: Must See Important Charts & Data,

Mr Keith Weiner and Dan Norcini both view the precious metals with blinders on. I would imagine both of these trading analysts have no idea of the future negative impacts of the energy market or the ramifications of the Falling EROI – Energy Returned On Invested. Thus, they continue to make short-term forecasts as if the world will continue to grow for the next century. Unfortunately, most Americans have their wealth tied into financial products that have no future. Furthermore, the Auto & Real Estate Market will crash to a level that will take the breath away from even the most bearish analysts. Thus, there will be very few worthy physical assets to own at this time. The two physical assets I value the most are gold and silver. The Historic Dow Jones-Silver Ratio Points To $300 SilverIf we look at the the Dow Jones-Silver chart, we can see we are no where close to the 25/1 ratio of 1980:

You really can't see the 25/1 Dow Jones-Silver ratio in 1980 as it is a small blip on the bottom left-hand portion of the chart. In Feb 1980, the Dow Jones traded at 865 points while silver traded at $35. Can you imagine that??? The Dow Jones Industrials trading at 865 points? Then when silver reached a high of $49 in April 2011, the Dow Jones-Silver ratio fell to 250/1 from a high of 2,500/1 in June 2001. Note: I am using round numbers here showing the Dow Jones-Silver ratio. So, from 1980 to 2001, the Dow Jones-Silver ratio increased 100 times from 25/1 to 2,500/1. Then it fell 10 times to 250/1 in 2011. Currently, the Dow Jones-Silver ratio is 1,015/1. We all know the broader markets are being propped up by the Fed and U.S. Government Plunge Protection Team. However, at some point the markets will finally resume their crash lower. If we assume that Dow Jones falls to 7,000 points, a 25/1 Dow Jones-Silver ratio would suggest a $300 silver price (rounded figure). | ||||||||||||||||||||||||||||||||||||||||||||||||

| How El Chapo Used Gold To Move Money Out Of The U.S. Posted: 06 May 2016 07:05 PM PDT With blue lights flashing and a SWAT team in front of the warehouse, a black sedan pulled up. A man got out, popped the trunk, grabbed a briefcase and headed for Natalie Jewelry. Once there, the man was heard to say "I just need to drop off this gold and get a receipt. I need a receipt." That's a first hand account of how gold was delivered to a Miami jewelry store by drug cartels, to later be melted down and sold for cash. As Bloomberg reports, court documents from a federal court case in Chicago allege that El Chapo's Sinaloa drug cartel laundered tens of millions out of the U.S. not through secret shell companies wiring funds from bank to bank, but by simply buying gold and selling it. Here's how the money laundering process allegedly worked. When the Sinaloa cartel needed to get the proceeds from its drug activities in the U.S. back to Mexico, it would first go buy up gold bars and other scrap gold pieces (sometimes silver as well) from jewelry stores and other businesses in the Chicago area. Then, the gold would be put into boxes, and under the name "Chicago Gold", or on occasion "Shopping Silver", would ship the boxes via FedEx to a company near Miami called Natalie Jewelry. Once the gold arrived at Natalie Jewelry, the second leg of the operation was set in motion. The gold would then be sold to companies referred to as refineries, who melted down the gold. The refinery would take a commission, and send the rest of the proceeds back to Natalie Jewelry. Now came the difficult part, which was getting the cash out of the country and into Mexico. This part of the operation called for a little bit more creativity, so the cartel set up a company in Mexico called De Mexico British Metal. De Mexico British Metal would invoice Natalie Jewelry, making it appear that it had sold the gold to them. Natalie Jewelry would in turn take their commission, and send the final proceeds to De Mexico British Metal. The invoices made the entire transaction appear legitimate, and it worked for a period of time, as the cartel was able to launder an estimated $98 million using this process. However, the Department of Homeland Security eventually caught on to the scheme. "There was just way too much gold going through Miami" said retired DHS agent Lou Bock. The fact that U.S. customs records showed a large volume of gold being processed by a company in Miami, coupled with the fact that virtually no jewelry is made in Miami, made the agency very suspicious. In January 2014, based on Customs reports showing discrepancies between the volume and value of gold processed by Natalie Jewelry, federal agents converged on the office located in an industrial park just north of Miami. They seized cash and hundreds of kilograms of gold and silver, along with documents linking the company to the Sinaloa cartel. * * * This incredible scheme has us wondering, with the move to banish cash from the system in order to "make it harder for the bad guys", how long until gold is also banned? What an incredibly convenient excuse to get gold out of circulation and under the direct control of the central planners. “If I had a lot of money to launder, I would choose gold,” says John Cassara, a former U.S. Treasury special agent and author of books on money laundering. “There really isn’t anything else like it out there.” Once it’s melted down, the commodity’s origins are difficult to trace. It can quickly be converted to cash. Many of the companies that deal in gold aren’t held to the same compliance standards as banks. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Incrementum Advisory Board Meeting, Q2 2016 Posted: 06 May 2016 07:00 PM PDT by Pater Tenebrarum, Acting-Man.com:

On April 10, the Incrementum Fund's advisory board held its quarterly meeting. Two of the regulars (Zac Bharucha and Rahim Taghizadegan) were unable to attend this time, but we were joined by special guest Brent Johnson, the CEO of Santiago Capital. The transcript of the meeting with all charts can be downloaded further below. As indicated above, the main (but not the only) topic of the discussion was gold. This was an obvious choice in light of the strong rebound in gold and silver and the scorching performance of gold mining stocks in Q1. In the Q1 meeting on January 10, a fairly strong consensus had developed that it was still a good idea to go long gold and gold mining stocks – in spite of the drawn-out bottoming process trying everybody's patience. As is often the case, the fact that this process had created a lot of uncertainty and bearish sentiment in the market turned out to be a good sign. The question was now whether or not the recent move was just another flash in the pan or something more serious. When reading the transcript, keep in mind that the meeting took place on April 10, so any comments focused on the very short term obviously don't incorporate the most recent developments yet. A wide variety of factors influencing the gold price and pertinent to the recent rally were discussed – ranging from measures of inflation expectations and how the gold price tends to interact with them, to gold's usefulness as a hedge against counterparty risk, to the commitments of traders report which has recently received so much attention by numerous market observers. It should also be noted that the proprietary Incrementum inflation signal has actually turned up, giving the fund the green light to invest in inflation-sensitive assets. It is noteworthy that this has been the signal's strongest upturn since a long period of strong volatility and mostly negative readings began in 2012: | ||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1292.90 up $21.50 or 1.69% Posted: 06 May 2016 06:56 PM PDT Friday, May 6, 2016

Franklin Sanders will not be publishing commentary today and will return again on Monday. Y'all enjoy your weekend. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Election 2016 - The Next "Advance Auction On Stolen Goods" Posted: 06 May 2016 06:00 PM PDT Authored by Doug Casey via InternationalMan.com, (Doug Casey updates readers about his take on the current crop of would-be presidents… and why he believes most Americans will vote for Trump. It was originally published on April 14th.)

It appears there are two candidates running from the left wing of the Demopublican Party (Hillary and Bernie), and two and a half from the right wing (Trump, Cruz, and Kasich). Note: The media identifies the Lefties by their first names, a friendly and personal thing, unlike the Righties. I find it distasteful discussing current political figures. But since somebody new is going to be president come November, it makes sense to figure out who that might be, in order to insulate yourself as much as possible from the damage they’ll do. Let me start by saying that this is not just the most entertaining election I’ve ever witnessed. But after the 1860 election, which Lincoln won with 40% of the popular vote (the remainder split between Stephen Douglas and two other candidates), I suspect it will also be the most divisive, hostile, and critical to the future of the country. Ever. Why do I say that? Because the U.S. hasn’t been this unstable since the unpleasantness of 1861–1865. The figures show that the average American’s standard of living has been dropping since about 1971. This is manifestly true relative to the rest of the world. But it’s also true in absolute terms, especially after you back out extraneous factors. For instance, today’s families usually need two breadwinners just to make ends meet. Huge amounts of debt have also helped disguise the decay. The situation is becoming critical with real unemployment closer to 20% than the official 5%. Interest rates are being held at zero to maintain unsupportable levels of debt. But this isn’t the place for a full economic analysis of the Greater Depression. Let’s just say times are going to get very tough. When times are tough, people vote for something new. That’s why, at the height of the 2008 crisis, the electorate chose Obama over John McCain. Aside from being old, hostile, and mildly demented, McCain was sure to continue on the then current and unsustainable economic path. Obama’s re-election in 2012 is explained by the fact things improved during his first term. That, and the Republican, Romney, was widely (and correctly) perceived as a politically wired beneficiary of the Deep State. As you know, I believe we’re now leaving the eye of the great financial hurricane we entered in 2007. Even with (or in many ways because of) the trillions of dollars created over the last eight years, the average guy’s standard of living has continued falling. People are now widely aware that the rich have been getting radically richer because of QE and ZIRP, and they resent it. Any further hardship occasioned as we go into the hurricane’s trailing edge will likely cause that resentment to become violent. That accounts for the popularity of Trump and Sanders, but especially Trump. Let’s take a look at the candidates. But first, let’s look at the two dysfunctional wings of America’s Warfare/Welfare Party The Two-Party CharadeI find there’s actually little to distinguish the Democrats and the Republicans, besides their rhetoric and the type of people who join them. In terms of what they do and the direction they steer the country, the differences are surprisingly marginal. The ethos of 300 million people has a life of its own; changing it is like turning a super tanker. But I suspect there’s a huge change afoot. The country itself is fragmenting. There’s a good chance that, at a minimum, this election will destroy the Republican Party, no matter who they nominate. And will take the Democrats even further to the left. Remember, there are essentially two types of freedom. Economic freedom (mainly how you can produce and own things) and social freedom (mainly what you can say and do regarding other people). The principal difference between the parties is that the Reps say they believe in economic freedom—which is a lie—while they definitely, and overtly, don’t believe in social freedom. The Dems, on the other hand, say they believe in social freedom—which is a lie—while they definitely, and overtly, don’t believe in economic freedom. Pretty much the difference between Hitler and Stalin. And in the popular mind, Hitler was the devil incarnate, while Uncle Joe was only good bad, not evil. The Dems, therefore, come off as morally superior. They claim to care about people, while the Reps appear to care mostly about things. The Dems are “progressive,” believing we should move toward collectivism and more State control, which they posit as good and fair and moral. In contrast, the Reps don’t really believe in anything. In fact, they completely accept the Dems underlying premises. Their only real objection is the lefties are going too far too fast. So, of course they never have the moral and philosophical high ground and always come off looking like selfish hypocrites. The Republicans are the Stupid Party, and the Democrats are, in fact, the Evil Party. At this point, the Republican Party is religious fundamentalists, social conservatives, and those who feel the government should spend even more on the bloated military congregate. Those who oppose foreign intervention and those who are friendly to free markets hang around its edges because there’s nowhere else for them to go; the Libertarian Party is laughably ineffectual, a non-starter. But the Republican party is not a natural or comfortable fit for them. The party should splinter. In fact, it will likely self-destruct if it doesn’t accept the nomination of Trump if he wins the popular vote. Which I believe he will. The popularity of Sanders, who’s got the youth totally on his side and has won eight out of nine of the last caucuses and primaries, shows where the Democratic Party’s heart, and future, lies. But the Party machine won’t give him the nomination, which will increasingly reveal the Democratic Party as being very non-democratic. With a little luck, this election will expose both parties as the corrupt machines that they are and destroy them both. But will the evil two party system be replaced by something even worse? The CandidatesLet’s review them in decreasing order of disastrousness. Sanders is a lifelong government employee (like Hillary, Cruz, and Kasich). The self-declared socialist is an economically ignorant, hostile, mildly demented old man—the Democrats answer to John McCain. He gets traction by pushing the envy button effectively. This works in a world where many are not only ignorant of economics but have a distorted set of moral principles and no respect for property rights, while some others are cynically exploiting the system to become super wealthy. The machine approves of his basic principles, which are like Obama’s. But he’s probably just a bit too rabid to win a general election in 2016. Obama got in because, unlike Bernie, he seems so reasonable and nice. I know the pundits believe Hillary will win the Dem nomination and then the election, but I don’t buy it. For one thing, she’s (correctly) seen as the Establishment personified. And in a time of widespread resentment—especially if we’re in the middle of a meltdown by November—that’s the kiss of death. Assuming she’s not already indicted for any of a number of crimes. I’m not just talking about Benghazi and the email brouhaha, although some think that alone will sink her ship of state. Additionally, there are the persistent rumors of health issues. So, if neither Hillary nor Bernie gets the nod, who will it be? I expect the Dems will find a left wing general. Americans do love their military at the moment. Which is especially scary. If Trump is the Republican nominee, he’ll draw attention to a long string of corruption that surrounds Hillary like a miasma, starting in 1978 with the $100,000 bribe disguised as cattle-trading profits. And her numerous friends and associates that have died suspicious deaths in years past, not the least of them Vince Foster and Ron Brown. And her abetting Bill’s sleazy rape episodes with lower-middle-class bimbos. And persistent rumors (which I tend to credit) that she’s an aggressive lesbian. These things aren’t going to help her. Nor will the fact she’s a woman automatically help her with other women. To believe that is to believe that women are less perceptive than men. In fact, they tend to be shrewder at reading personalities. And Hillary’s personality traits scream “liar,” fraud,” and “dishonest.” What about Cruz? His shifty, beady, squinty little eyes speak of duplicity. He seems to be a genuinely dislikable person, which itself is the kiss of death in an election. Elections, after all, have very little to do with ideology; they’re really just popularity/personality contests among the hoi polloi. He’s a borderline religious fanatic, a Christian version of the type of Muslim imams that really scare people. He’s a genuine warmonger. And his wife, an ex-Goldman partner, an ex-Condi Rice counselor, and a member of the Council on Foreign Relations, is exactly the kind of Deep State person that voters are rejecting and despise. He may have beaten Trump in a few Heartland states with big fundamentalist populations, but even the tone deaf management of the Republican Party will see that he’s a complete non-starter in a general election. Kasich? A lifelong politician, with nine terms as a congress critter, a stint as a governor, and one as a managing director of Lehman Brothers when it failed. These are the opposite of qualifiers in today’s world. He’s on the conventional statist side of almost every important issue—guns, global warming, drugs, medical care, and civil liberties. He’s about as dangerous as Hillary or Cruz when it comes to involving the U.S. in foreign adventures. He’s getting traction only because he seems low-key and “reasonable”—a Republican Obama. My guess is that the Deep State will try to give him the Rep nomination. After all, anyone but Trump… So let’s look at Trump. I’m not a fan, per se, and I explained why at length here. But in October, I said I thought he was going to go all the way. I’ll explain why below. It’s not because I believe polls, or pundits, or keep my finger on the pulse of the capita censi (i.e., those who inhabit the ghettos, barrios, and trailer parks of the U.S.). Why is Trump as popular as he is? Two reasons. First, he’s outspoken and politically incorrect. He doesn’t read from a script, like all the others. He says what his supporters are thinking, things that no other public figure is willing to say. Second, he’s not part of the Establishment, the Deep State. He’s the only candidate that’s not a professional politician. These are simple things but extremely important characteristics for this election, which is going to take place during a social and economic hurricane. By the time November rolls around, however, three other qualities will come to the fore, and they’ll be even more important. First, he’s a businessman, and therefore presumed to know how to make things work. People, at least those who aren’t Democrats, don’t want a politico. They know politicos are just about lies and self-dealing. What most people will want in the face of a collapsing economy is somebody who has credentials saying they’re competent to kiss things and make them better. A truth teller who says that the U.S. is in trouble and thinks markets are overpriced. Someone whose slogan is “Make America Great Again!” Second, he projects certainty. In times of fear and confusion, which is what I expect in six months, certainty trumps everything in a public figure. No other candidate even comes close. A man who exudes certainty gets the confidence of voters. Third, the Establishment hates him. Despite all the free press he gets, practically all pundits and public figures loathe him. They label him as an unqualified, irresponsible, dangerous clown and a reality show star. But since the general public now despises the Establishment in general and the media, in particular, this will help him, not hurt him. P.S. Here’s Some Full DisclosureYou may be wondering, having said all this, if I will vote for Trump. The answer is: no. He’s an authoritarian, not a libertarian. He’s got only a marginal grip on either economic freedom or social freedom, and he says lots of stupid things that he may actually believe. That said, I still signed up for my friend Walter Block’s Libertarians for Trump movement. Why? Partly because he’s vastly less scary than any other candidate. And he’s certainly the least likely to start World War 3—which is actually the biggest risk with any president. So why won’t I vote for him? Longtime subscribers are aware that I don’t choose to be complicit in crimes, including national elections. I give five reasons why you, too, should consider opting out. But I hope Trump wins. Not just because he’s actually the least warlike but because he’s the only candidate who’s not a puppet on a string. He stands a chance of upturning the Deep State’s apple cart and spilling all the rotten apples it carries. A small chance, perhaps, but probably the only chance. Could he succeed in doing it? Unlikely, but it’s important someone try. He’d be no more likely to succeed than Ron Paul, if he’d won the last election. As I pointed out then, anyone who steps out of line would first get a sit-down with the heads of the praetorian agencies and a bunch of generals. They’d politely, but firmly, explain the way things work. Failing that, Congress would impeach him. Failing that, I expect he’d meet with an unfortunate accident. In conclusion, you can put the Rolling Stone’s “Street Fighting Man” on continuous loop to replace the audio whenever you watch the news. I expect a long, hot, violent summer. That’s somewhat counterintuitive, in view of the fact that the American public is more apathetic than ever. Apathy and ignorance. How else to explain their complacence at getting 0% on their savings? How better to explain that they’re more driven by fear than ever, evidenced by so many things, from the acceptance of “helicopter parenting,” to the bizarre hysteria over practically non-existent terrorism. Americans seem like zombies in many ways. Maybe that’s because something like 25% of the population are on medically prescribed psychoactives, like Ritalin, Prozac, Ambien, and scores of others. And even more are addicted to sugar, alcohol, overeating, recreational drugs, and Kardashian-style TV. Even so, as Ferguson, Missouri, proved last year, they’re still capable of rioting. America, which was much more a concept than a place, is long gone. What’s left of the white middle class correctly feel they’re losing what’s left of the U.S. Their children are being both bankrupted and corrupted by politically correct schooling. To them, the society appears to have been captured by gender feminism, LGBT preferences, and racial quotas. And I’d say they’re basically right. That’s why, even if they won’t admit it out loud, most Americans (hard-core Democrats excepted, of course), will vote for Trump. Hold on to your hat. | ||||||||||||||||||||||||||||||||||||||||||||||||

| GOLD, SILVER & OTHER TRUTHS in a Sea of Lies — Andy Hoffman Posted: 06 May 2016 05:52 PM PDT by SGT, SGT Report.com: Andy Hoffman from Miles Franklin joins me to discuss the sorry and worsening state of the US economy, the expectedly bad but still bogus non-farms payroll report – and the fact that precious metals in physical form will be among the few tangible assets still left standing as the US and Japan race toward hyperinfaltion and total economic breakdown. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Worst.Month.Ever... Hong Kong Retail Sales Collapse In March Posted: 06 May 2016 05:30 PM PDT A spending survey done by MasterCard shows that March retail sales in Hong Kong declined at the worst rate in the history of the survey. According to the latest MasterCard SpendingPulse Hong Kong Report, "Overall retail sales in Hong Kong contracted 18.5% year-on-year, reflecting the deepest decline since 2014." Only grocery outperformed overall retail sales in March, while clothing and jewellery sales dropped by more than total retail sales. After the dismal March, Q1 retail sales declined 11.7% when compared to the same period in 2015. "The early Easter holiday did nothing to stimulate spending as consumer confidence remains subdued." said Sarah Quinlan, Senior VP of market insights for MasterCard advisors. "Overall our outlook for Hong Kong retail sales remains weak as the slowdown in spending from Mainland China continues to negatively impact the Hong Kong retail economy." Quinlan added. A slowdown in tourist spending from Mainland China is certainly no surprise, as it was only a matter of time before the massive amount of job losses made its way through the economy, something which should get worse in the future as China addresses the economic slowdown and its massive overcapacity issue. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 06 May 2016 05:20 PM PDT from SensiblePrepper: | ||||||||||||||||||||||||||||||||||||||||||||||||

| Proof That Donald Trump IS THE REAL DEAL! Posted: 06 May 2016 04:31 PM PDT A collection of Donald Trump interviews from 1980 to 2015. Join us on camp Trump! Go Daddy! Trump 2016! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||

| Economic Collapse in Puerto Rico -- Escalating Debt Crisis Posted: 06 May 2016 03:51 PM PDT For years, the Puerto Rican economy has been in decline, and the U.S. territory is now on the brink of disaster, with $72 billion of overall debt and an unemployment rate twice that of the mainland. As the island's government is forced to suspend funding for vital services, hundreds of Puerto... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||

| Trumped! Why It Happened And What Comes Next, Part 2 (The Peace Deal) Posted: 06 May 2016 01:52 PM PDT This post Trumped! Why It Happened And What Comes Next, Part 2 (The Peace Deal) appeared first on Daily Reckoning. When it comes to the economic future, a Trump presidency could bring either a shitstorm or salvation. Regrettably, the odds of the former are immensely the higher. That's because Trump is a welcome, but extremely unguided missile. On the one hand, his great virtue is that he is a superb salesman and showman who has captured the GOP nomination and has a serious shot at the White House with absolutely no help whatsoever from the Washington/Wall Street establishment. So unlike any other candidate in recent memory, he owns his own talking points; is not saddled with a stable of credentialed advisors schooled in three decades of policy error and failure; and has the hutzpah to trust his own instincts——many of which, especially on foreign policy, are exactly the rebuke that Imperial Washington and its legions of parasites and racketeers so richly deserve. On the other hand, the Donald's policy thinking, if you can call it that, is thoroughly inchoate. His policy pronouncements amount to little more than spontaneous eruptions of sentiment, prejudice, hearsay, bile, applause lines, wishful thinking and disconnected non sequiturs. That's where thoughtlets like Muslim bans, mass deportations, a Trump Wall on the Rio Grande, paying off the national debt, 40% tariff barriers, obliteration of ISIS and numerous other stray verbal hand grenades come from. Yet occasional wild pitches are not really the problem, and the cynics are surely correct in predicting that Trump will excise most of them from his patter even before the GOP convention. The real problem is that Trump has no detectable economic philosophy or policy framework, and it is in that arena that he could go careening off into a cacophony of misfires, mistakes and statist mayhem. To wit, Trump has already said that he likes the Fed's low interest rates, is considering a minimum wage hike, thinks social security and medicare should remain untouched, will rebuild the military, intends to drastically increase spending for veterans, wants to slash income taxes on corporations and individuals, thinks a big infrastructure program is warranted, plans to spend tens of billions on border security and the Wall and will drastically hammer $2.2 trillion of imports in order to bring jobs back home. Not only is most of that unaffordable, counter-productive and wrong. More importantly, Trump's mish mash of economic policy utterances thus far fails to address why the Washington/Wall Street/Bicoastal/Bubble Finance status quo is failing main street so badly and causing 90% of Americans to realize that they are not winning economically anymore. The heart of what went wrong is the lethal combination of free money and free trade that has been practiced ever since Greenspan panicked after Black Monday in October 1987. That is what has gutted the fly-over economy while gifting casino prosperity to Wall Street, Washington and the bicoastal elites, as I documented in Part 1. (click here for Part 1) But as I indicated yesterday, there is a sliver of hope if Donald Trump does not capitulate to mainstream policies and is willing to set aside his potpourri of shibboleths and panaceas in favor of a disciplined and coherent game plan that builds on his bedrock political insight that American families are losing the economic battle. To repeat, there is a way forward for the self-proclaimed world class deal maker to move the whole mess out of the hopeless paralysis of governance that now afflicts the nation. A President Trump would need to make Six Great Deals. A Peace Deal with Putin for cooperation in the middle east, defeat of ISIS, withdrawal from NATO and a comprehensive worldwide disarmament agreement. A Jobs Deal based on slashing taxes on business and workers and replacing them with taxes on consumption and imports. A Federalist Deal to turn back much of Washington's domestic programs and meddling to the states and localities in return for a 4-year freeze on every single pending regulation and statue. A Health Care Deal based on the repeal of Obamacare and tax preferences for employer insurance plans and their replacement with wide-open provider competition, consumer choice and individual health tax credits. A Fiscal Deal to slash post-disarmament spending for defense, devolve education and other domestic programs to the states and cities and to clawback unearned social security/medicare entitlement benefits from the affluent elderly. And a Sound Money Deal to end the Fed's war on savers and retirees, repeal Humphrey-Hawkins and limit the central bank's remit to providing last resort liquidity at a penalty spread over market interest rates based on good commercial collateral. Under what would in effect be a restoration of the original vision of Carter Glass, who was a storied financial statesman and author of the 1913 enabling legislation, the Fed's authority to conduct open market operations and unlimited money printing would be eliminated. And its liquidity backstop would be limited to "narrow banks" which just take deposits and make loans, and have nothing to do with Wall Street trading, underwriting, hedging, derivatives and other forms of financial gambling. Needless to say, this all sounds like radicalism relative to the prevailing system of Casino Capitalism and the Big Government status quo. But all of that is in for a rude awakening, and soon. That's because the Bubble Finance status quo as we know it is on its last legs. With each driblet of "incoming data" it is evident that a new recession is just around the corner. With each limpid trading session on Wall Street it is also evident that most carbon units have vacated the casino and that the robo-machines are running out of chart points to chase. That means a big market dive is coming soon. In fact, a recession, a market crash, an explosion of deficit projections and, for good measure, double digit increases in next year's health insurance premiums and copays will be hitting the headlines before the final Hillary/Donald debate duals of the fall campaign. It is this impending perfect storm that offers Trump the chance to hang 30-years of failed policy on Hillary Clinton as the insider totem, and to bombastically demand in the patented Trumpster style a clean sweep of the Washington/Wall Street/Federal Reserve policy mess. I know from personal experience and long observation that it has to start with a Peace Deal. That's the secret to unlocking the entire Washington policy gridlock and the resulting drift toward national bankruptcy, which otherwise will prove unstoppable. Indeed, nothing can change until at least $200 billion is whacked out of the defense budget, and under the circumstances ahead that could easily be done. That propitious opportunity for peace is the emerging worldwide Great Deflation. It is taking down the Red Ponzi in China already and is administering the coup de grace to Russia's third rate, New York SMSA-sized oil, mineral and wheat based economy. At the same time, the next US administration will be grappling with recessionary trillion dollar annual deficits while the socialist enclaves of European NATO will face fiscal burial in a renewed eruption of public debts that already average nearly 100% of GDP. The key to a global Peace Deal is renunciation of Washington's encroachment on Russia's backyard in Ukraine and the former Warsaw Pact nations; and a Russian/Washington/Shiite alliance to encircle the Islamic state and enable Muslim fighters from Syria, Iran, Iraq and Hezbollah to finish off the butchers of the mutant Sunni Caliphate. The NATO renunciation part of the deal is already in Trump's wheelhouse because he thinks he can make a deal with Putin anyway, and has had the common sense to see that NATO is obsolete. What he needs to further understand is that Russia is incapable of threatening Europe and has no designs to do so. Moreover, it is Washington, not the Europeans, who insisted on the pointless expansion of NATO. And it was Washington which betrayed George HW Bush's sensible promise to Gorbachev in 1989 that in return for his acquiescence to the reunification of Germany NATO would "not be expanded by a single inch". There is even a bonus presidential debate point for the Donald on the latter matter. The betrayal of the elder Bush's pledge was initiated by none other than Bill Clinton in the midst of his political crisis during the blue dress affair. Do not doubt the Donald's capacity to put that one straight to Hillary. Likewise, Trump is already half way there on the ISIS threat. Unlike the neocon adventurists of Washington, he has welcomed Putin's bombing campaign against the jihadist radicals in Syria and recognizes that the enemy is headquartered in Raqqa, not Damascus. God willing, it is to be hoped that he somehow comes to understand that the Iranians have a justified grudge against Washington for its historic support of the Shah's plunder and savage repression; for CIA aid to Saddam's brutal chemical warfare against Iran during the 1980s war; and for Washington's subsequent demonization of the regime and false claims that it is hell-bent on nuclear weapons—–a charge that even the nation's top 16 intelligence agencies debunked more than a decade ago. To wit, the way out of the bloody mess in Iraq, Syria, Yemen and Libya—-all of which are projects bearing Hillary's support and even inspiration—–is a rapprochement with Iran's able and moderate statesman, President Hassan Rouhani, who has just received another wave of political reinforcement in the recent elections. Someone needs to tutor the Donald on the great General Eisenhower's pledge to go to Korea and make peace immediately after the election in 1952, which is exactly what he did. Likewise, the presumptive GOP candidate should pledge to go to Tehran to "improve the deal", and this time Trump even has the plane! Yes, "improving" the deal might be positioned as somehow strengthening Obama's "bad deal" on the nuclear accord, but that would be the diplomatic fig leaf for domestic political consumption. The far broader purpose would be to bury the hatchet on the general bilateral relationship between the US and Iran, and to secure Rouhani's agreement to a leadership role in the above referenced Muslin-led ground campaign to extinguish ISIS and liberate the territories now controlled by the Islamic State. An "I will go to Tehran" pledge by Trump could electrify the entire mideast policy morass and pave the way for early US extraction from its is counter-productive and wholly unaffordable military and political intrusion. The fact is, the Islamic State is on its last leg because of US and Russian bombings, $30s oil and its own barbaric brutality. These forces are rapidly drying up its financial resources, and without paychecks its "fighters" rapidly vanish. Indeed, ISIS is now so financially desperate that its fighters are literally disappearing. That is, it is shooting its wounded and selling their organs on the black market. Needless to say, no army of fighters has ever prevailed or even survived by harvesting its own flesh. And especially not when confronted by an opposing force of better trained, better equipped, air-power supported fighters motivated by an equal and opposite religious fanaticism. Accordingly, a Trump-Putin-Rouhani alliance could very readily celebrate the liberation of Raqqa and Mosul by July 4th next year, along with an history-reversing partition agreement to cancel the destructive Sikes-Picot boundaries of 1916. The latter would be superseded by Shiite, Sunni and Kurdish states, respectively in their historic areas of Iraq and a shrunken state of Alawites, Christians and other non-Sunni minorities in Syria , with protectorates in the north and east for Kurds and Sunnis. At that point, Trump could put on his own "mission accomplished" pageant by bringing home every last American military personnel now stationed in the middle east, either overtly or covertly and wearing boots on the ground or not. And he could do so from the deck of an aircraft carrier that had been withdrawn from the Persian Gulf as part of the comprehensive Peace Deal with Putin and Rouhani. The Persian Gulf would be an American Lake no more. The Donald might even be positioned to collect his Nobel Peace Prize on the way home. Before then, however, he would also be in a position to collect some giant domestic political plaudits that could be married with the defeat of ISIS and peace in the middle east and Europe. To wit, Trump should promise to sign legislation day one permitting families of the victims of 9/11 to suit the Saudis for their losses. Nothing could better bring closure to the vastly exaggerated domestic terrorist threat than the simultaneous eradication of the Islamic State and mutli-hundred billion lawsuits against the alleged 9/11 puppeteers hitting the headlines day after day. Also, nothing would do more to provide political cover and impetus for the balance of the Peace Deal. That's because the indigenous terrorist threat in Europe is not sponsored, supported or funded in any manner by the nations of the Shiite Crescent. Instead, it is an extension of the mutant jihadism of radical Sunni and Wahhabi clerics. Needless to say, even the unspeakably corrupt and arrogant princes of the House of Saud would get the message when the 5th Fleet leaves the Persian Gulf and the Trump/Putin/Rouhani alliance takes out its proxies in Syria and the Islamic State itself. In short, the financial lifeblood of terrorism would dry up—-whether the Saudi royals remained in Riyadh or decamped to Switzerland. The essence of the great Peace Deal required to save the American economy is an end to procurement and R&D spending by the Pentagon and a drastic demobilization of the 2.3 million troops in the regular armed forces and national guards. And that can happen under the auspices of a global military "build-down" agreement and freeze on all further weapons exports. Bankrupt governments in a world where NATO has been decommissioned, the Jihadi terrorist threat quelled and the middle east stabilized will absolutely be interested in a defense "builddown" and global arms reduction agreement. And there is no one better qualified to lead a sweeping military cost "restructuring" deal among bankrupt nations than the well experienced Donald Trump. Regards, David Stockman P.S. "A charmingly mordant take on the stock news of the day, accentuated by philosophical maunderings…" That's how one leading financial magazine described the free daily email edition of The Daily Reckoning. You'll find cutting-edge analysis from the complex worlds of finance, politics and culture. Presented in an entertaining style few can match. Click here now to sign up for FREE. The post Trumped! Why It Happened And What Comes Next, Part 2 (The Peace Deal) appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - De Nile Posted: 06 May 2016 12:48 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||

| Donald Trump Is Right On US Debt -- Peter Schiff Posted: 06 May 2016 10:30 AM PDT Peter Schiff on CNBC.com Futures Now 5/5/2016 Peter Schiff is a well-known commentator appearing regularly on CNBC, TechTicker and FoxNews. He is often referred to as "Doctor Doom" because of his bearish outlook on the economy and the U.S. Dollar in particular. Peter was one of the first... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||

| Economic Collapse -- Greeks Suffering from crippling Economic Measures Posted: 06 May 2016 09:30 AM PDT Greece austerity: More people are losing hope The austerity measures are having a profound effect on the Greek people. Each day, more people are losing hope and some are even taking their own lives. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Stocks Rise Too Far Too Fast? Posted: 06 May 2016 08:46 AM PDT The gold-mining stocks have skyrocketed this year, radically outperforming every other sector. Smart contrarians who bought them low late last year and in January have seen their capital doubled, tripled, and even quadrupled! But such blistering gains raise the ominous specter of crippling overboughtness, conditions preceding major toppings. Have gold stocks come too far too fast to continue their epic run? The magnitude of recent months’ gold-stock surge is simply stunning. Between mid-January and the end of April, this sector’s flagship HUI NYSE Arca Gold BUGS Index blasted 131.8% higher in merely 3.3 months! This was largely mirrored by the leading gold-stock ETF, the GDX VanEck Vectors Gold Miners ETF. GDX saw stupendous gains of 107.1% over this same span. Gold stocks have been on fire! | ||||||||||||||||||||||||||||||||||||||||||||||||

| The Fall of Sweden | Ingrid Carlqvist and Stefan Molyneux Posted: 06 May 2016 08:32 AM PDT In the midst of the European Migrant Crisis, Sweden has been said to be on the verge of economic collapse under the weight of mass Muslim immigration. Ingrid Carlqvist joins Stefan Molyneux to discuss the state of Sweden, the impact of multiculturalism, Islam as a totalitarian political... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 06 May 2016 06:16 AM PDT According to popular opinion, gold does not bear interest. Although that is true for retail investors, gold lending is an integral part of the gold wholesale market. What is gold leasing and how does it affect gold prices? A lease is a contract where an asset is rent to someone else. As odd as it sounds, gold is also leased. Why? Well, on the one hand, some entities own gold they need to put to work, e.g. the bullion banks that hold a metal as a debt to their customers, so they can lease it out to earn money. On the other hand, there are companies in the gold industry who, for some reasons, prefer to borrow the metal instead of buying it outright. For example, there might be a gold mining company which expects to have one thousand ounces of gold from its production. However, the metal will be ready to sell in the market not earlier than before one month, since it must be refined etc. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Buy Gold, ‘Get Out Of The Stock Market’ Warns Druckenmiller Posted: 06 May 2016 06:10 AM PDT Buy gold and ‘get out of the stock market,’ legendary billionaire investor Stanley Druckenmiller, advised investors this week at an investment conference in New York. Druckenmiller, who has one of the best long-term track records in money management, said the stock market bull market has “exhausted itself” and that gold “remains our largest currency allocation.” | ||||||||||||||||||||||||||||||||||||||||||||||||

| Gold and Silver Companies with the Potential to Move the Needle Posted: 06 May 2016 06:05 AM PDT The two times mining companies add the most value are upon first discovery and when they are nearing development and production. Joe Reagor of ROTH Capital Partners focuses on the latter group, and in this interview with The Gold Report, he discusses a handful of gold and silver companies poised to move up the value curve even if gold and silver don't go up. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Markets At Crossroads: Huge Moves Brewing In Stocks And Gold Posted: 06 May 2016 02:29 AM PDT Markets arrived at crossroads, and big moves are around the corner. Seldom have we seen so many assets and indicators at decision points simultaneously! We see stocks, gold, and the U.S. dollar trading at extremely important levels, all in conjunction. Note that this is not according to technical analysis, but our intermarket analysis and chart patterns. | ||||||||||||||||||||||||||||||||||||||||||||||||

| When Gold Confiscation Is a Personal Choice Posted: 06 May 2016 02:00 AM PDT The specter of government forcefully confiscating gold is still roaming around out there. That nagging prospect dampens many buying decisions, unfortunate at a time when gold, and especially silver, are near historically bargain basement prices when measured in fiat currency. Buy low, sell high only works for those who buy low. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Monetary Liquifaction, Gold and The Time Of The Vulture Posted: 06 May 2016 01:00 AM PDT Survive the Crisis | ||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web — May 7 Posted: 05 May 2016 07:34 PM PDT Central banks are clueless. Auto and truck sales are rolling over. More bad news from China — except for its takeover of the gold market, which is both impressive and smart. The global economy is “at stall speed.” The US labor market takes a turn for the worse. Money is pouring out of hedge funds […] | ||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 05 May 2016 06:00 PM PDT Shadowstats’ John William explains why most economic reports are fictitious. The McAlvany Report discusses gold and why its time has come. Doug Casey tells Schiff Gold about offshore investing and why geographic diversification is more important than ever. Plus Mike Maloney, Alesdair Macleod and David Stockman on bad things going on in the world and […] | ||||||||||||||||||||||||||||||||||||||||||||||||

| Bianco: Gold a ‘High Yield’ Asset in a Negative Rate World Posted: 05 May 2016 05:00 PM PDT |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

With blue lights flashing and a SWAT team in front of the warehouse, a black sedan pulled up. A man got out, popped the trunk, grabbed a briefcase and headed for Natalie Jewelry. Once there, the man was heard to say “I just need to drop off this gold and get a receipt. I need a receipt.”

With blue lights flashing and a SWAT team in front of the warehouse, a black sedan pulled up. A man got out, popped the trunk, grabbed a briefcase and headed for Natalie Jewelry. Once there, the man was heard to say “I just need to drop off this gold and get a receipt. I need a receipt.”

Buy gold and 'get out of the stock market,' legendary billionaire investor Stanley Druckenmiller, advised investors this week at an investment conference in New York.

Buy gold and 'get out of the stock market,' legendary billionaire investor Stanley Druckenmiller, advised investors this week at an investment conference in New York.

A New Bull Market in Gold?

A New Bull Market in Gold?

No comments:

Post a Comment