saveyourassetsfirst3 |

- Gold Defies Stock-Market Bear Rally On Strong Investment Demand

- Credit Suisse On Gold And Gold Equities - Decidedly Bullish For A Bank

- Billion-Dollar Unicorns: ForeScout Does Not Want To Go Public Yet

- Avoid Putting Your Money in THESE Banks

- $900 Price Target For Gold: Still Bullish On Platinum

- Gold Stocks Breakout, Gold to Follow

- The Premier Of VAXXED In NYC and Full Review

- Gold Stocks Breakout, Gold to Follow

- Europe Heading Towards Civil War, Societal Collapse, & Currency Crisis

- Things We Cannot Say

- HUD Wants to Make Living in a Tiny House or RV Illegal

- Video of the Day – Producer of Vaccine Documentary Banned From Tribeca Film Festival Speaks Out

- Gold Sector: Macrocosm Updated

- The NWO Beast System EXPOSED

- What New Economic Recovery?

- Number One Reason To Buy Gold and Silver Is “Cyber Financial Warfare”

- The Gold Money Supply Correlation

- Harvey Organ: Investors Flock Into Silver!

- Video Update: Gold & Gold Stocks in Bullish Consolidation

- Gold: Something Is Melting Down In The Global Financial System

- The costs of a Gold Standard

- Gold is Testing Key Technical Support – Is There More Downside Ahead?

- Fight Over Future of London’s $5 Trillion, 300 Year-Old Gold Market

- Interview with Mike Swanson

- Top Global Gold Mining Companies

- Goldman Sach’s Dubious Advice “Short Gold!”

- Gold is Testing Key Technical Support – Is There More Downside Ahead?

| Gold Defies Stock-Market Bear Rally On Strong Investment Demand Posted: 08 Apr 2016 12:45 PM PDT |

| Credit Suisse On Gold And Gold Equities - Decidedly Bullish For A Bank Posted: 08 Apr 2016 12:21 PM PDT |

| Billion-Dollar Unicorns: ForeScout Does Not Want To Go Public Yet Posted: 08 Apr 2016 12:03 PM PDT |

| Avoid Putting Your Money in THESE Banks Posted: 08 Apr 2016 12:00 PM PDT Investors spend a lot of time analyzing bank stocks to see whether or not they should invest. Yet very few people analyze the banks themselves to see whether or not to deposit money there. This is totally backwards… Submitted by Simon Black, Sovereign Man: A friend of mine who's an equities analyst at a […] The post Avoid Putting Your Money in THESE Banks appeared first on Silver Doctors. |

| $900 Price Target For Gold: Still Bullish On Platinum Posted: 08 Apr 2016 11:40 AM PDT |

| Gold Stocks Breakout, Gold to Follow Posted: 08 Apr 2016 11:10 AM PDT The Daily Gold |

| The Premier Of VAXXED In NYC and Full Review Posted: 08 Apr 2016 11:00 AM PDT In this video Luke Rudkowski goes to the premier of Vaxxed in NYC and gives his full review of the film. We show you how many people showed up to the premier and what happened inside. The controversial film was pulled from the Tribeca film festival by Robert De Niro after a media backlash. […] The post The Premier Of VAXXED In NYC and Full Review appeared first on Silver Doctors. |

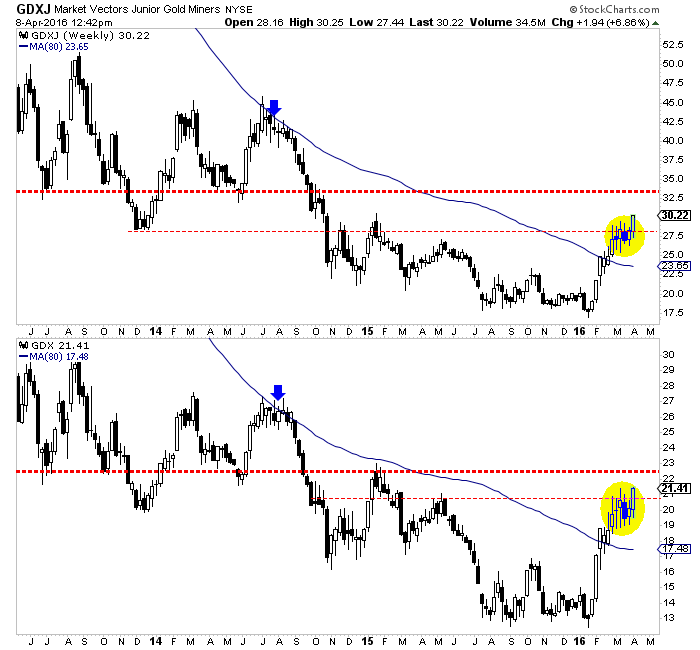

| Gold Stocks Breakout, Gold to Follow Posted: 08 Apr 2016 10:38 AM PDT Last week we concluded: As long as the gold stocks continue to hold support for another week or two then the near term outlook is bullish. A bull flag is a consolidation pattern that separates two strong moves. It could be developing in the miners. There is logical reason to be cautious if not bearish at this point. The metals look okay at best while the miners remain somewhat overbought. However, the action in the miners, if it continues for another few weeks is telling us what could be ahead. The strength in the miners continues to surprise as the majority of pundits look for any reason for a pullback in the face of very bullish price action. The gold miners are now breaking out and Gold is likely to follow. The weekly candle charts of GDXJ and GDX are shown below along with their 80-week moving averages. Note that the miners advanced for six weeks and their bullish consolidation began during that sixth week in late February. This week marks the fifth week since the previous advance. The miners are a little overbought here but not as much as they were five weeks ago. Moreover, we should note that overbought can become very overbought and extremely overbought. The immediate upside targets are GDXJ $33 and GDX $22.50 and it is possible this move has even greater upside.

GDXJ, GDX Weekly

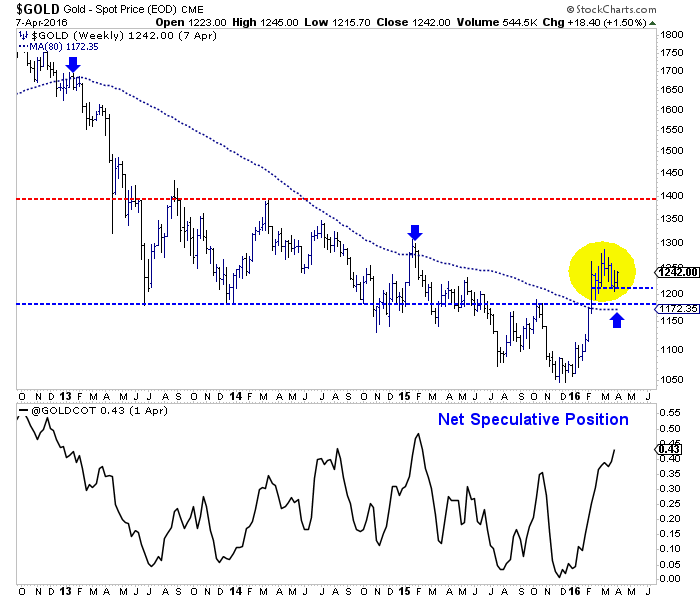

Turning to Gold, we see that it has stabilized in the mid $1200s within a larger range of $1210 to $1270/oz. With the miners breaking to the upside, Gold is very likely to follow to the upside. The current net speculative position of 43% is relatively high but we should note that from 2001 to 2012 it often peaked at 50% to 60%. Gold is weaker than the miners and may require a bit more consolidation. Nevertheless, weekly closes above $1262/oz and $1300/oz could send Gold on its way to $1400/oz.

Gold, Gold CoT

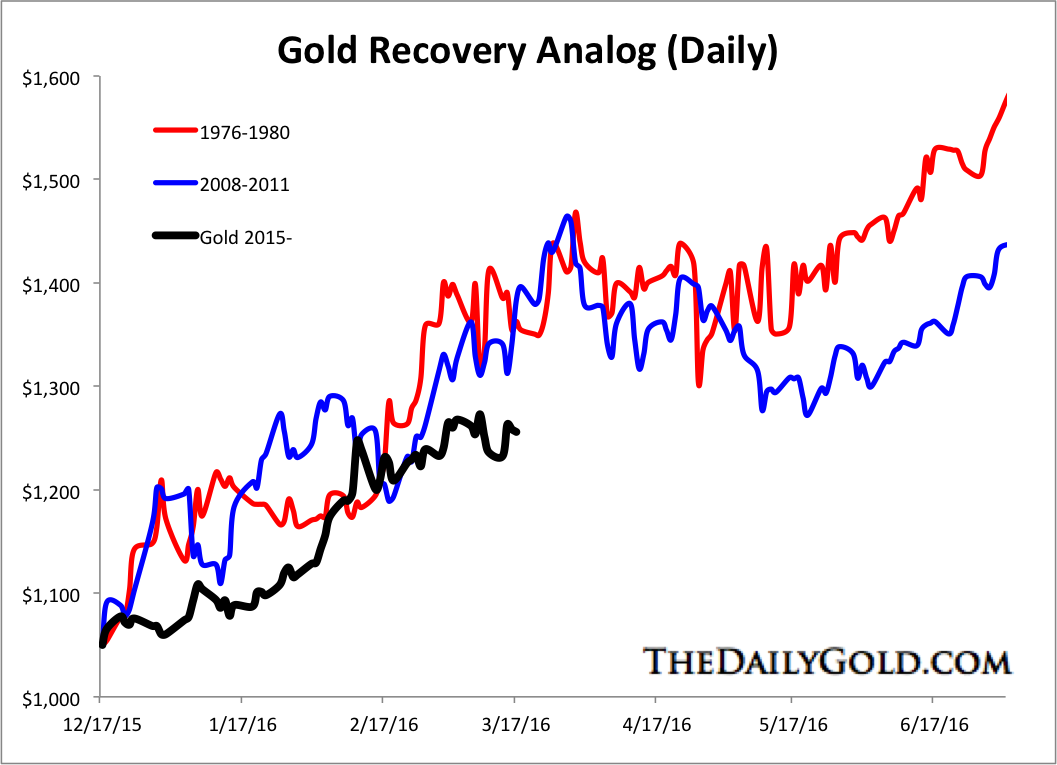

A move in Gold to $1400/oz would fall in line with history. In the chart below we compare the current rebound in Gold to its rebounds following major lows in 1976 and 2008. If Gold rallies to $1400/oz in the next few months then its recovery would be in line with those previous two recoveries.

Gold Recovery Analog

After consolidating in bullish fashion for a good five weeks the miners appear to be starting their next leg higher and this should eventually propel Gold higher. The toughest time to buy is after a market has already had a strong rebound, following a nasty bear market. Investors and pundits alike subconsciously refuse to believe a major change has taken place. Gold stocks endured the worst bear market in 90 years. Of course there will be fear that it could reassert itself at any time. However, the action of the market is clear. Gold stocks are breaking out and could be headed much higher in the near term. Consider learning more about our premium service including our favorite junior miners which we expect to outperform in 2016.

Jordan Roy-Byrne, CMT TheDailyGold.com

|

| Europe Heading Towards Civil War, Societal Collapse, & Currency Crisis Posted: 08 Apr 2016 10:00 AM PDT The US may not be the trigger for the global financial collapse… from Crush the Street: The post Europe Heading Towards Civil War, Societal Collapse, & Currency Crisis appeared first on Silver Doctors. |

| Posted: 08 Apr 2016 09:57 AM PDT This sounds like a belated April Fool’s joke, but it’s not. In Germany it’s apparently a crime to offend a foreign politician.

So Germany is “a country that strongly advocates freedom of the press,” but will imprison you for three years if you say mean things about a foreign dictator. Americans tend to think the 1st Amendment is just the way things work, but that’s obviously not the case. In much of Europe people are regularly arrested for, among other things, insulting a religion. For a longer treatment of this subject, see the Legal Project’s European Hate Speech Laws. Some related thoughts: The self-confidence of a society can be measured by its tolerance for dissent. Viewed that way, the 1989 US Supreme Court decision defining flag-burning as protected speech was a sign of a culture that’s not afraid of a little self-examination. Good for us. But the battle is ongoing, and lately our cultural self-confidence seems to be going the way of Europe’s. See The Atlantic’s recent Glaring Evidence That Free Speech Is Threatened on Campus. Meanwhile here and abroad, restrictions on honestly (if crudely) expressed opinion are boosting support for sharp-tounged politicians like Donald Trump, Marine Le Pen and Nigel Farage who display a willingness to offend. In the political marketplace, as in any other, unfulfilled needs are quickly met by creative entrepreneurs. So in the long run, extreme PC may be self defeating. Why bother with this subject in a finance blog? Because capital markets, more than perhaps any other part of the modern world, depend on confidence. If we’re too timid to exchange ideas and opinions, then we’re unlikely to be comfortable with long-term investment in factories and growth stocks. So restrictions on speech equal “risk off” in financial markets. All trends these days seem to point towards gold and away from equities and government bonds. Finally, in honor of what’s left of free speech, here are Liam Neeson threatening Vladimir Putin and Barack Obama’s press conference with China’s premier. |

| HUD Wants to Make Living in a Tiny House or RV Illegal Posted: 08 Apr 2016 09:00 AM PDT Yes, you read that correctly… Submitted by Daisy Luther, The Organic Prepper: Photo Credit: Tiny House, Giant Journey The tiny house movement has taken America by storm, in part because our economy is in the toilet. People are striving to reduce their expenses by embracing minimalism. They're breaking free from the corporate grind because, […] The post HUD Wants to Make Living in a Tiny House or RV Illegal appeared first on Silver Doctors. |

| Video of the Day – Producer of Vaccine Documentary Banned From Tribeca Film Festival Speaks Out Posted: 08 Apr 2016 08:30 AM PDT Vaccine Whistleblower Gave Congress Thousands of Documents, Claims CDC Destroyed Proof of MMR-Autism Link Submitted by Michael Krieger: Before getting into this post, I want to reiterate something I wrote in my last article on the topic, published last year: I want to start off this post by making it clear that I'm not remotely anti-vaccine. Personally, […] The post Video of the Day – Producer of Vaccine Documentary Banned From Tribeca Film Festival Speaks Out appeared first on Silver Doctors. |

| Gold Sector: Macrocosm Updated Posted: 08 Apr 2016 08:01 AM PDT Biwii |

| Posted: 08 Apr 2016 08:00 AM PDT Join SGTReport for this gripping expose into the NWO Beast system and the Satanic agenda of the global elite with best selling author James Perloff. James' latest book Truth is a Lonely Warrior: Unmasking the Forces Behind Global Destruction is an absolutely essential addition to your library. From elite Satanism and false flag terrorism to Rothschild Zionsim, […] The post The NWO Beast System EXPOSED appeared first on Silver Doctors. |

| Posted: 08 Apr 2016 07:00 AM PDT The average American is slowly earning less and becoming financially stressed about their future outlook. If you are one of these hard working individuals experiencing a decline in business/income, its best you do some research and change what you are doing because things will likely get MUCH worse before they get better… Submitted by Chris Vermeulen: The […] The post What New Economic Recovery? appeared first on Silver Doctors. |

| Number One Reason To Buy Gold and Silver Is “Cyber Financial Warfare” Posted: 08 Apr 2016 05:03 AM PDT gold.ie |

| The Gold Money Supply Correlation Posted: 08 Apr 2016 04:00 AM PDT Has the price of gold been correlating with the US Money supply? Submitted by Keith Weiner: There were some fireworks this week. Gold went up on Tuesday (it was a shortened week due to Easter Monday), from a low of $1,215 to $1,244 over the day, a move of over 2 percent. Silver moved […] The post The Gold Money Supply Correlation appeared first on Silver Doctors. |

| Harvey Organ: Investors Flock Into Silver! Posted: 07 Apr 2016 07:00 PM PDT Investors continue to flock into silver on the dovish Yellen speech where she indicated that she is reticent to raise rates. All global mints are recording record silver sales: TURMOIL ON GLOBAL MARKETS/GLD HAD 4.17 TONNES TO ITS INVENTORY/GOLD AND SILVER RISE BUT CONTAINED BY OUR BANKING MANIPULATORS/ UK PREM MINISTER EXPOSED AS HE […] The post Harvey Organ: Investors Flock Into Silver! appeared first on Silver Doctors. |

| Video Update: Gold & Gold Stocks in Bullish Consolidation Posted: 07 Apr 2016 06:34 PM PDT A quick look at the current consolidations in Gold & Gold Stocks. GDX, GDXJ.

|

| Gold: Something Is Melting Down In The Global Financial System Posted: 07 Apr 2016 05:05 PM PDT The only conclusion we can draw from this is that something has blown up in the global financial system which caused unpredictable instability in – and loss of control over – the Fed's manipulation mechanisms. I believe the likely culprit is… Submitted by Dave Kranzler: Deutsche Bank is the financial system's "Hurt Locker" – Investment […] The post Gold: Something Is Melting Down In The Global Financial System appeared first on Silver Doctors. |

| Posted: 07 Apr 2016 04:00 PM PDT Mises.org |

| Gold is Testing Key Technical Support – Is There More Downside Ahead? Posted: 07 Apr 2016 03:19 PM PDT Gold Stock Bull |

| Fight Over Future of London’s $5 Trillion, 300 Year-Old Gold Market Posted: 07 Apr 2016 03:02 PM PDT gold.ie |

| Posted: 07 Apr 2016 02:45 PM PDT Today, Mike Swanson of WallStWindow interviewed me to get my latest thoughts on Gold and gold stocks. Click Here to Listen to the Interview

|

| Top Global Gold Mining Companies Posted: 07 Apr 2016 11:02 AM PDT Le Cafe Américain |

| Goldman Sach’s Dubious Advice “Short Gold!” Posted: 07 Apr 2016 10:15 AM PDT Global Economic Analysis |

| Gold is Testing Key Technical Support – Is There More Downside Ahead? Posted: 06 Apr 2016 12:54 PM PDT The gold price advanced sharply during the first three months of 2016 (+16%), marking its best quarter in 30 years. However, it corrected from a high around $1,287 to $1,200 over the past few weeks. There was a nice bounce yesterday, but gold has once gain dropped today, back below $1,220. With this latest pullback in […] |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment