saveyourassetsfirst3 |

- Venezuela Exported 12.5 Tonnes of Gold to Switzerland On 8 March 2016…Via Paris

- Well That Didn’t Work

- The New Zealand Dollar Will Weaken Considerably This Year

- One of the richest countries in the world now has one of the cheapest stock markets

- A Collision Is Coming In Securitized Auto Debt

- Self-Driving Cars Programmed to Sacrifice As They Hit the Road: “Someone Is Going to Die”

- Silver Soars 4%, Gold Consolidates On Dovish Fed

- The Midas Touch Consulting Report

- One Nation Under Surveillance – U.S. Government Pushed Tech Companies to Hand Over Source Code

- Crumbling U.S Empire Drives Russia & China To Move Into Gold

- Bank Desperation Continues

- Harvey Organ: The Next Bombshell Hits!

- Former Fed Employee Who Leaked Information to Goldman Sachs Avoids Jail, Fined a Whopping $2,000

- Why Our Financial System Is Like the Titanic

- The Year Of The Red Monkey: Volatility Reigns Supreme

- Comex Gold Rigging – Fact or Myth?

- Sparta - Gold prohibition in a collapsing economy

- Rickards: Why Gold Is Going To $10,000

- Gold Dip Holds Key 1230 Price

- Gold Daily and Silver Weekly Charts - Stock Option Expiry - US

| Venezuela Exported 12.5 Tonnes of Gold to Switzerland On 8 March 2016…Via Paris Posted: 18 Mar 2016 01:00 PM PDT On Tuesday 8 March, the Banco Central de Venezuela (BCV) sent another 12.5 tonnes of gold by air freight to Switzerland (via Paris), and fascinatingly in this instance, the exact details of the transfer are already available, including the cargo manifest… Submitted by Ronan Manly, Bullionstar: Following on from last month in which Koos Jansen broke […] The post Venezuela Exported 12.5 Tonnes of Gold to Switzerland On 8 March 2016…Via Paris appeared first on Silver Doctors. |

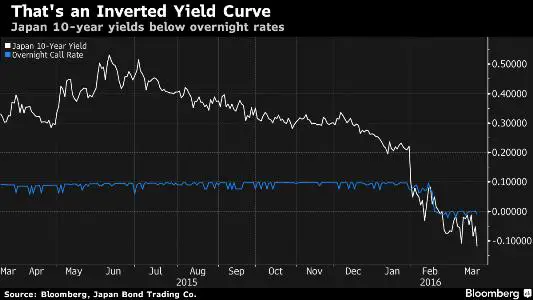

| Posted: 18 Mar 2016 12:39 PM PDT The Bank of Japan and European Central Bank eased recently, which is to say they stepped up their bond buying and/or pushed interest rates further into negative territory. These kinds of things are proxies for currency devaluation in the sense that money printing and lower interest rates generally cause the offending country’s currency to be seen as less valuable by traders and savers, sending its exchange rate down versus those of its trading partners. This was what the BoJ and ECB were hoping for — weaker currencies to boost their export industries and make their insanely-large debt burdens more manageable. Instead, they got this: Both the yen and the euro have popped versus the dollar, which means European and Japanese exports have gotten more rather than less expensive on world markets and both systems’ debt loads are now harder rather than easier to manage. And it gets worse: Japan’s yield curve has inverted, meaning that long-term interest rates are now lower than short-term rates, which is typically a harbinger of recession. From today’s Bloomberg: This sudden failure of easy money to produce the usual result is potentially huge, because the only thing standing in the way of a debt-driven implosion of the global economy (global because this time around emerging countries are as over-indebted as rich ones) is a belief that what worked in the past will keep working. If it doesn’t — that is, if negative interest rates start strengthening rather than weakening currencies — then this game is over. And a new one, with rules no one understands, has begun. |

| The New Zealand Dollar Will Weaken Considerably This Year Posted: 18 Mar 2016 12:04 PM PDT |

| One of the richest countries in the world now has one of the cheapest stock markets Posted: 18 Mar 2016 12:00 PM PDT One of the wealthiest countries in the world– the place where there are more millionaires per capita than anywhere else on the planet– now has a dirt cheap stock market: Submitted by Tim Staermose, Sovereign Man: It's Singapore. And right now, the total market value of all stocks traded in Singapore amounts to about […] The post One of the richest countries in the world now has one of the cheapest stock markets appeared first on Silver Doctors. |

| A Collision Is Coming In Securitized Auto Debt Posted: 18 Mar 2016 11:00 AM PDT The developing crash in subprime auto debt is just the tip of the iceberg and it will fuel anegative feedback loop that will include a collapse in general consumption spending other than for necessities and an eventual implosion in mortgages. Submitted by Dave Kranzler, IRD: Delinquencies on subprime auto debt packaged into securities reached […] The post A Collision Is Coming In Securitized Auto Debt appeared first on Silver Doctors. |

| Self-Driving Cars Programmed to Sacrifice As They Hit the Road: “Someone Is Going to Die” Posted: 18 Mar 2016 10:00 AM PDT With self-driving cars, the programming will make sometimes fatal choices in the mix of situations that may involve innocent by-standers and no-win situations. Submitted by Mac Slavo, SHTFPlan: Self-driving cars are poised to take over U.S. roads and destroy American jobs… and they will also kill people, even if by accident. Right now, their […] The post Self-Driving Cars Programmed to Sacrifice As They Hit the Road: "Someone Is Going to Die" appeared first on Silver Doctors. |

| Silver Soars 4%, Gold Consolidates On Dovish Fed Posted: 18 Mar 2016 09:50 AM PDT gold.ie |

| The Midas Touch Consulting Report Posted: 18 Mar 2016 09:47 AM PDT The Silver GoldSpot |

| One Nation Under Surveillance – U.S. Government Pushed Tech Companies to Hand Over Source Code Posted: 18 Mar 2016 09:30 AM PDT Freedom? Liberty? Don't be ridiculous. It's been a little while since I've updated readers on the shady, shameless surveillance practices of the U.S. government. As usual, it's worse than we thought… Submitted by Michael Krieger, Liberty Blitzkrieg: Our founding fathers studied power structures over the millennia and knew exactly what they were doing […] The post One Nation Under Surveillance – U.S. Government Pushed Tech Companies to Hand Over Source Code appeared first on Silver Doctors. |

| Crumbling U.S Empire Drives Russia & China To Move Into Gold Posted: 18 Mar 2016 09:00 AM PDT Central bankers have been on a massive Gold Buying Spree led by Russia and China. One must remember that not only is Putin ex-KGB, but he is also an economist and holds a black belt in judo. Judo teaches you to use your opponent's momentum to defeat him or her, and that appears to what […] The post Crumbling U.S Empire Drives Russia & China To Move Into Gold appeared first on Silver Doctors. |

| Posted: 18 Mar 2016 08:17 AM PDT Just like last week, fundamentally positive news for gold has been met with massive short issuance by the Comex Banks. That price is down instead of up should come as no surprise as these Banks are intent upon rigging price lower in the short term. |

| Harvey Organ: The Next Bombshell Hits! Posted: 18 Mar 2016 08:16 AM PDT The next bombshell to hit: A WHOPPING 11.89 TONNES "ADDED" TO GLD/JAPANESE EXPORTS COLLAPSE/CHINA'S SHADOW BANKING PEER TO PEER LENDING IS IMPLODING/SYRIAN KURDS TO SET UP THEIR OWN STATE ON THE BORDER WITH TURKEY AND THUS ERDOGAN'S WORST NIGHTMARE/CHAOS IN BRAZIL AS JUDGE RELEASES WIRETAPS INDICATING ROUSSEFF HIRED LULA AS CHIEF OF STAFF […] The post Harvey Organ: The Next Bombshell Hits! appeared first on Silver Doctors. |

| Former Fed Employee Who Leaked Information to Goldman Sachs Avoids Jail, Fined a Whopping $2,000 Posted: 18 Mar 2016 08:00 AM PDT A former Federal Reserve Bank of New York employee was spared prison on Wednesday, disappointing prosecutors who said his leaking of confidential documents to a friend at Goldman Sachs Group Inc justified time behind bars. Jason Gross, 37, was fined $2,000… Submitted by Michael Krieger, Liberty Blitzkrieg: "All animals are equal, but some animals are […] The post Former Fed Employee Who Leaked Information to Goldman Sachs Avoids Jail, Fined a Whopping $2,000 appeared first on Silver Doctors. |

| Why Our Financial System Is Like the Titanic Posted: 18 Mar 2016 08:00 AM PDT The “unsinkable” global financial system is rushing headlong toward its encounter with the iceberg… Submitted by Charles Hugh Smith, Of Two Minds: Why did the Titanic sink, despite being considered unsinkable? The conventional answer is the design of its watertight compartments was flawed: the watertight bulkheads were limited in height to a few feet […] The post Why Our Financial System Is Like the Titanic appeared first on Silver Doctors. |

| The Year Of The Red Monkey: Volatility Reigns Supreme Posted: 18 Mar 2016 07:00 AM PDT To preserve capital, you need to outsmart the monkey… Submitted by Charles Hugh Smith, Peak Prosperity: In the lunar calendar that started February 8, this is the Year of the Red Monkey. In other words, the financial world will be volatile. And few will have the agility and wile to outsmart the market-monkey. […] The post The Year Of The Red Monkey: Volatility Reigns Supreme appeared first on Silver Doctors. |

| Comex Gold Rigging – Fact or Myth? Posted: 18 Mar 2016 05:47 AM PDT SunshineProfits |

| Sparta - Gold prohibition in a collapsing economy Posted: 17 Mar 2016 05:00 PM PDT Galmarley.com |

| Rickards: Why Gold Is Going To $10,000 Posted: 17 Mar 2016 02:41 PM PDT Jim Rickards believes a cocktail of factors makes it more critical than ever for investors to protect their portfolios with gold. In the interview below, Rickards explains why the royal metal is going to $10,000/oz… Why own gold in a deflationary cycle? The longest period of sustained deflation in American history was during 1929 to 1933. […] |

| Posted: 17 Mar 2016 02:12 PM PDT |

| Gold Daily and Silver Weekly Charts - Stock Option Expiry - US Posted: 17 Mar 2016 02:02 PM PDT Le Cafe Américain |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment