Gold World News Flash |

- Computers Replace Wall Street, $8000 Gold Predicted?

- U.S. Dollar Index - Is Rising Inflation The Fed`s Nightmare Scenario (Video)

- Gold and Paper 1951 – 2016

- Silver Soars Post-Fed As Gold Ratio Tumbles Most In 5 Months

- Death of U.S. Dollar as Governments Dump U.S. Debt at RECORD RATE!

- Hillary Emails, Gold Dinars and Arab Springs

- Impaled On Its Own Petard——The Fed’s Folly Festers Further

- U.S. FAKES a “manufacturing rebound”

- Asian stocks, oil jump as dollar sags after Fed

- Your Money In The Bank Will Be Gone

- Can Trump Prevent Bankruptcy of Our Nation? – Jerry Robinson (part 1/3)

- Swiss Resist EU Domination in the Name of Liberty and Self-Determination

- Silver Soars Post-Fed As Gold Ratio Tumbles Most In 5 Months

- Gold Price Rose 2.86% and the Silver Price Rose 5.31%

- Alasdair Macleod: The European Central Bank and John Law

- BREAKING: DANGER: N. Korea Fires Ballistic Missile Again

- US Economy Is Tumbling Into An Economic Collapse That Will Shock The World

- The Government Has A "Zombie Apocalypse" Plan

- ive Reasons A Trump Presidency Would Be Good For Gold

- From Syria to Fukushima -- Charles R. Smith

- Donald Trump is LITERALLY Hitler

- The Fed’s Folly Festers Further

- Is it Gold that’s Up or the US Dollar that’s Down

- Gold Daily and Silver Weekly Charts - Stock Option Expiry - US Douleur du Monde

- Death of U.S. Dollar as Governments Dump U.S. Debt at RECORD RATE!

- Gold and Silver March Madness

- US Finally Acknowledges ISIS Genocide

- Gerald Celente and Eric Sprott Economics, Finance, and Geopolitics March 17th 2016

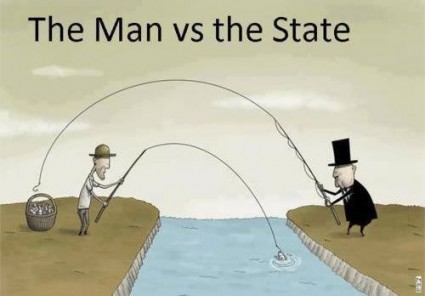

- Stefan Molyneux Men Are Scared Of The Government Not women (MGTOW)

- The REAL Story You Missed Yesterday

- Fractal Analysis Shows Coming 70s Style Gold Stocks Rally From Even Cheaper Levels

- FOMC Bring on the Clowns, Dollar, Gold and Bonds

- US Dollar Important Chart

- Gold: Trumped?

| Computers Replace Wall Street, $8000 Gold Predicted? Posted: 18 Mar 2016 01:00 AM PDT from Junius Maltby: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. Dollar Index - Is Rising Inflation The Fed`s Nightmare Scenario (Video) Posted: 17 Mar 2016 11:23 PM PDT By EconMatters Is a rising inflation problem going to force the Fed`s hand into raising interest rates faster than the financial markets currently have priced in with many asset classes from bonds, the U.S. Dollar, and equities. © EconMatters All Rights Reserved | Facebook | Twitter | YouTube | Email Digest | Kindle | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 17 Mar 2016 11:01 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Soars Post-Fed As Gold Ratio Tumbles Most In 5 Months Posted: 17 Mar 2016 10:38 PM PDT from Zero Hedge:

Two weeks ago we hinted at the flashing red warning coming from ‘a 4,000 year old’ financial indicator. The Gold/Silver ratio had reached extremely high levels, which at the time we explained… This isn't normal. In modern history, the gold/silver ratio has only been this high three other times, all periods of extreme turmoil—the 2008 crisis, Gulf War, and World War II.

This suggests that something is seriously wrong. Or at least that people perceive something is seriously wrong. And as we concluded at the time…

And, that appears to have happened… As Silver has soared post-Fed… | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Death of U.S. Dollar as Governments Dump U.S. Debt at RECORD RATE! Posted: 17 Mar 2016 10:30 PM PDT from The Money GPS: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hillary Emails, Gold Dinars and Arab Springs Posted: 17 Mar 2016 10:25 PM PDT by F. William Engdahl, Journal-neo:

Two paragraphs in a recently declassified email from the illegal private server used by then-Secretary of State Hillary Clinton during the US-orchestrated war to destroy Libya's Qaddafi in 2011 reveal a tightly-held secret agenda behind the Obama Administration's war against Qaddafi, cynically named "Responsibility to Protect."

Barack Obama, an indecisive and weak President, delegated all presidential responsibility for the Libya war to his Secretary of State, Hillary Clinton. Clinton, who was an early backer of an Arab "regime change," using the secret Muslim Brotherhood, invoked the new, bizarre principle of "responsibility to protect" (R2P) to justify the Libyan war, which she quickly turned into a NATO-led war. Under R2P, a silly notion promoted by the networks of George Soros' Open Society Foundations, Clinton claimed, with no verifiable proof, that Qaddafi was bombing innocent Libyan civilians in the Benghazi region. According to a New York Times report at the time, citing Obama Administration senior sources, it was Hillary Clinton, backed by Samantha Power, then a senior aide at the National Security Council and today Obama's UN Ambassador; and Susan Rice, then Obama's ambassador to the United Nations, and now National Security Adviser. That triad pushed Obama into military action against Libya's Qaddafi. Clinton, flanked by Powers and Rice, was so powerful that Clinton managed to overrule Defense Secretary Robert Gates, Tom Donilon, Obama's national security adviser, and John Brennan, Obama's counterterrorism chief, today CIA head. Secretary of State Clinton was also knee-deep in the conspiracy to unleash what came to be dubbed the "Arab Spring," the wave of US-financed regime changes across the Arab Middle East, part of the Greater Middle East project unveiled in 2003 by the Bush Administration after occupation of Iraq. The first three target countries of that 2011 US "Arab Spring"–an action in which Washington used its "human rights" NGOs such as Freedom House and National Endowment for Democracy, in cahoots as usual, with the Open Society Foundations of billionaire speculator, George Soros, along with US State Department and CIA operatives–were Ben Ali's Tunisia, Mubarak's Egypt and Qaddafi's Libya. Now the timing and targeting of Washington's 2011 "Arab Spring" destabilizations of select Middle East states assume a new light in relation to just-released declassified Clinton emails to her private Libya "adviser" and friend, Sid Blumenthal. Blumenthal is the slick lawyer who defended then-President Bill Clinton in the Monika Lewinsky and other sex scandal affairs when Bill was President and facing impeachment. Qaddafi's gold dinar For many it remains a mystery just why Washington decided that Qaddafi personally must be destroyed, murdered, not just sent into exile like Mubarak. Clinton, when informed of Qaddafi's brutal murder by US-financed Al Qaeda "democratic opposition" terrorists, told CBS news, in a sick, joking paraphrase of Julius Caesar, "We came, we saw, he died," words spoken by her with a hearty, macabre laugh. Little is known in the West about what Muammar Qaddafi did in Libya or, for that matter, in Africa and in the Arab world. Now, release of a new portion of Hillary Clinton's emails as Secretary of State, at the time she was running Obama Administration war on Qaddafi, sheds dramatic new light on the background. It was not a personal decision of Hillary Clinton to eliminate Qaddafi and destroy his entire state infrastructure. The decision, it's now clear, came from circles very high in the US money oligarchy. She was merely another Washington political tool implementing the mandate of those oligarchs. The intervention was about killing Qaddafi's well-laid plans to create a gold-based African and Arabic currency to replace the dollar in oil trades. Since the US dollar abandoned gold exchange for dollars in 1971 the dollar in terms of gold has dramatically lost value. Arab and African OPEC oil states have long objected to the vanishing purchasing power of their oil sales, mandated since the 1970's by Washington to be solely in US dollars, as dollar inflation soared more than 2000% to 2001. In a newly declassified Clinton email from Sid Blumenthal to Secretary of State Hillary Clinton dated April 2, 2011, Blumenthal reveals the reason that Qaddafi must be eliminated. Using the pretext of citing an unidentified "high source" Blumenthal writes to Clinton, "According to sensitive information available to this source, Qaddafi's government holds 143 tons of gold, and a similar amount in silver… This gold was accumulated prior to the current rebellion and was intended to be used to establish a pan-African currency based on the Libyan golden Dinar. This plan was designed to provide the Francophone African Countries with an alternative to the French franc (CFA)." That French aspect was only the tip of the Qaddafi gold dinar iceberg. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Impaled On Its Own Petard——The Fed’s Folly Festers Further Posted: 17 Mar 2016 10:01 PM PDT by David Stockman, DavidStockmansContraCorner:

Maybe that's what they have been doing all along—–that is, waiting for their slow match monetary fuse to finally ignite the next financial conflagration. After all, the Fed is now 87 months into its grand experiment with the lunacy of zero interest rates. If our monetary central planners still can't see their way clear to more than 38 bps of normalization, then, apparently, they intend to keep the casino gamblers in free carry trade money until they finally blow themselves up——just like they have already done twice this century. In fact, by Yellen's own bumbling admission the inhabitants of the Keynesian puzzle palace—-into which the Eccles Building has long since morphed—–can't see their way to much of anything. They couldn't even decide if the risks to the outlook are balanced to the upside or downside. And that roundhouse kind of judgment isn't even remotely measureable or exacting; it requires nothing more than a binary grunt. As a practical matter, the joint has lapsed into a state of mental entropy——apparently under the risible assumption that they have abolished the business cycle and have limitless time to normalize. Yet we are already at month 81 of this so-called expansion, and the signs of approaching recession are cropping up daily. This week, for example, we got another month of declining industrial production, which is now down nearly 2% from its recent peak and falling business sales, which are 5.1% lower than they were in mid-2014. Somehow Yellen deduced from the chart below that the US economy has been "very resilient in recent months". Since the commerce department's report on total business sales includes manufacturing, wholesale and retail, and despite the current slump still clocked in at a $15.5 trillion annualized run rate in January, it might be wondered just exactly what hidden crevice of the US economy is exhibiting all that "resilience". At the same time, CapEx orders are down by 7% from September 2014 levels and the inventory to sales ratio is at its highest level since April 2009. The Fed has never seen a recession coming, of course. It apparently doesn't even believe that business cycles die of old age, too much credit expansion and malinvestment or even of its own inept handiwork. The cause is always an "external shock" or even an extraterrestrial "contagion", as per Bernanke's specious history of the September 2008 market meltdown. Still, you might think that a posse of economists, which purportedly is laser-focussed on the "incoming" data, might have noticed the deteriorating trends so starkly evident in the chart below. Why do they think all of this is just "transient" and that they have until 2018 by their own latest "dot plot" to get money market rates out of what will have been a decade long sojourn in negative real rate land? In other words, if a recession has not already commenced, they are using up the recovery phase runaway real fast. But never mind the very real risk that the entire global economy is sliding into a deflationary contraction, and that normalization would then be put off indefinitely. By her own assertion Yellen espies no such danger, and even asserted during the presser that there are "upside risks to global growth". Let's see. In the most recent months, the three bellwether economies of Asia reported plunging exports. Japan was down 13% from last year, South Korea was off by 20% and China's exports tumbled by 25%. Beyond that, there is a veritable CapEx depression underway throughout the global energy, mining, shipbuilding, steel, aluminum and most other heavy industrial sectors; China is drifting ever closer to a spectacular credit collapse and violent labor unrest; and its satellite economies like Brazil are rapidly becoming economic basket cases. Yet Simple Janet could not explain why the Fed has lapsed again to a "hold" position or when global economic conditions would actually permit it to resume its path toward normalization. The unstated effect of the Fed's perpetual "hold" policy, therefore, would seem to be free gambling chips for the Wall Street casino, world without end. And we do know how that ends. We also now have an absolutely clear idea of why the Fed is impaled on its own petard. Yellen explained to her ever credulous audience of financial journalists that all of its shilly-shallying is due to the fact that the "neutral value" of federal funds is currently very "low" by historic standards, and that, accordingly, an exceptional degree of "accommodation" is warranted. Here's a newsflash for the passel of shills who attended the post-meeting press conference. First, as a technical matter there is no Federal funds market. It has been killed deader-than-a-doornail by the Fed's massive money printing campaign since September 2009. The resulting $2.4 trillion of excess bank reserves parked at the New York Fed simply suffocated the Federal funds market in its crib. More broadly, there ain't no such thing as the "neutral value" for federal funds or any of the related money market instruments. It's an entirely imaginary construct conjured up by Keynesian academic scribblers, and ultimately rests on purely religious belief. Indeed, Yellen might as well have been reciting the rosary and fingering her beads. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. FAKES a “manufacturing rebound” Posted: 17 Mar 2016 09:20 PM PDT by Jeff Nielson, Bullion Bulls:

For roughly six months; numbers from the U.S.’s (dubious) “manufacturing indices” have shown the U.S. economy sinking further into its Greater Depression — which dates back to at least 2007. Now, suddenly, these indices have “catapulted” higher (lol), supposedly indicating a manufacturing rebound into the U.S. How? We’re told by all the charlatan economists and government mouthpieces that “exchange rates” are all-important in terms of exports, and thus manufacturing activity. But the exchange rate of the USD is currently sky-high. Of course, strong domestic activity can also stimulate manufacturing. But with 45 million people on FOOD STAMPS, and more than 50 MILLION who are permanently unemployed, where is the buying-power to boost manufacturing?

A supposed “rebound” in U.S. manufacturing defies rationality. The U.S. dollar is still perched at an ultra-absurd exchange rate versus nearly every other currency in the world, making U.S. exports punitively expensive throughout the Rest of the World. Simultaneously, we’re told that the bankers have succeeded in sending the whole global economy into recession (again), so there is no DEMAND STRENGTH, even if U.S. exports were priced at rational levels. This is a Phantom Rebound, much like the Phantom Recovery, and all the Phantom Jobs which the government (and the Federal Reserve) claim have been created. Supposedly, there are now more than 11 million NEW JOBS created since the start of the Phantom Recovery. In the real world, the percentage of Americans with jobs hovers at a 40-year low. This translates into 3 million less Americans with jobs, since the start of the Phantom Recovery. The “11 million new jobs” never existed — just like this “manufacturing rebound”. The Wonderland Matrix is a wonderful place. Inside, the U.S. economy is once again “the growth engine of the world”. Everyone has jobs (except for the “lazy” people!), and the entire U.S. manufacturing industry can (suddenly) be propped up by nothing more than hope (and doctored numbers). The real world isn’t nearly as nice a place. In the real world, there never was a “U.S. recovery”, just ever-larger economic lies by corrupt politicians and bankers. The Middle Class has been destroyed, replaced by the Working Poor — those lucky enough to have any work at all. Fifty million permanently unemployed people are totally ignored (millions of them Homeless). Tens of millions more have seen their paycheques shrivel. Sometimes this is simply due to “cut-backs” by their current employer, pay-cuts which hit everyone — except the Fat Cats in management. Most often, however, these paycheques have shrunk as Americans lose their good-paying jobs, and then can find nothing but minimum wage “McJobs”, with esteemed employers such as the Golden Arches. In such an economic devolution, it isn’t even possible to produce economic growth, just an endless, self-cannibalizing contraction, as the Fat Cats hoard $trillions, while the anemic economy is literally starved for capital, as shown below. Fed money-printing has pumped 500% more of its funny-money into the “U.S. economy” (meaning into the hoards of Wall Street), but NONE OF THIS MONEY IS CIRCULATING IN THE ECONOMY. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Asian stocks, oil jump as dollar sags after Fed Posted: 17 Mar 2016 09:01 PM PDT The Hindu Business Line | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Your Money In The Bank Will Be Gone Posted: 17 Mar 2016 07:40 PM PDT by Egon Von Greyerz, Gold Switzerland:

Governments and Central Banks are now supreme experts in the total destruction of your money. They are constantly adding new methods so let's just look at a few of them: 1) Zero or Negative interest rates – Over time, together with bank charges, your money will slowly be confiscated. 2) Bail-ins – No one will bail you out. Instead the insolvent banks will take your money to save the bank. 3) Ban cash – Within a few years, cash will be virtually banned in many countries. So you will not see your money again and the bank and the government will tell you what you can do with it. 4) Forced savings in government bonds – Bankrupt governments will force you to invest in bonds for 30 years or longer. The bonds will be worthless at maturity. 5) Money Printing – Finally if the money isn't already gone, governments will totally destroy it by printing so much that it will become worthless.The world is now starting the final phase of the failed experiment in creating wealth and prosperity for a select few and massive debt and misery for the masses. It all started with the creation of the Fed in 1913. This led to a global credit creation and money printing extravaganza of a magnitude that the world has never seen before. We have now reached the point when it makes no difference who becomes US president or what the Fed or the IMF will do. No, now we are at the point that von Mises so succinctly defined:

The latter is guaranteed – Only Gold will protect you. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Can Trump Prevent Bankruptcy of Our Nation? – Jerry Robinson (part 1/3) Posted: 17 Mar 2016 07:20 PM PDT from Reluctant Preppers: Can ANY president we elect solve the looming problems that are hurtling us towards financial disaster and martial law? If the powers that be have been propping up markets and the US dollar, if the Washington party power brokers will stop at nothing, and if Trump becomes president, would the system be allowed to collapse on top of him, or is there a true longer game at play? Click HERE to Listen to Iran Retaliation for US 911 Lawsuit – Jerry Robinson (part 2/3) Click HERE to Listen to Bitcoin vs. the Banks’ RSCoin – Jerry Robinson (part 3/3) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Swiss Resist EU Domination in the Name of Liberty and Self-Determination Posted: 17 Mar 2016 07:00 PM PDT by Claudio Grass, GlobalWeathProtection:

Recently, the motion to withdraw that unwelcome piece of paper was finally submitted by the Swiss Peoples' Party (SVP). SVP won a majority in the parliamentary elections held last October. 116 out of 200 MPs supported this motion. It is also worth noting that last year, Iceland withdrew its application to join the EU. Not many people know or remember that back in 1992, the Swiss Federal Council held a secret meeting where 4 out of 7 members approved to officially apply to join the EU. In what I consider a cloak-and-dagger operation, the members of the Federal Council approved the membership application without informing either their political parties or the people of Switzerland. This isolated act, which was considered an act of treason by a large number of Swiss citizens, has finally and officially been eliminated this week. Some politicians argue that the motion to repeal the application was 'unnecessary' to begin with, because the Swiss people made it very clear in the past that joining the EU was not an option. Nevertheless, it is fair to say that this motion to dismiss the application officially constitutes a symbolic act. Over the past few years, we have witnessed a noticeable shift in the Swiss political sentiment regarding the EU. The Swiss public has repeatedly refused anything that could compromise Swiss sovereignty and independent decision-making. It refuses to adhere to another entity's rules, the EU included. On several occasions, the Swiss people voted against the recommendation of the Federal Council. Right-wing, pro-freedom parties like the SVP are gaining more and more ground in this regard. The Swiss citizens understand that the long legacy of Swiss independence and neutrality could be at jeopardy should it fall under the EU's umbrella. The SVP message is clear: the more centralization and the more federal government influence, the more the confederate system of Switzerland will be dismantled and infringements on personal freedoms will increase. What this stance underlines is the deep-rooted understanding that the people of Switzerland remain the ultimate sovereign and not their elected government representatives and professional bureaucrats. Politicians should serve one purpose only, and that is to serve the people, not to rule them. The last parliamentary elections in November of 2015 showed that more and more people have come to understand that a more conservative and freedom-oriented policy is in their best interests. The logical conclusion, therefore, is to support the call for less state intervention and more individual freedom. Historically, it is worth going back to the last world war when Europe was struggling in its fight against the emerging – and later prevailing – fascist movement. Switzerland was geographically positioned in the center of that war, making it rather vulnerable to any possible military attack if it did not act prudently. Here, the Swiss leadership, at the time headed up by Marcel Pilet-Golaz, who was affiliated with the dominant Free Democratic Party, struggled to balance the demands of the Germans National Socialist Regime (Nazi) with the political will of the Swiss public; his decisions were often disputed and criticized. Like the Federal Council today, he ignored the people and ruled according to what he thought was best for them. But it was the Swiss public that took a remarkable stance during these difficult times with the emergence of what was known as "Geistige Landesverteidigung" (Spiritual Defense of the Nation). This movement was significant in that it helped shape the Swiss sense of social cohesion and strong political will in its defense of the country's independence from both military takeover and the socio-political influence from the Nazi era. From my research on the matter, I have come to the conclusion that a successful resistance movement can only occur with natural leaders who can win the hearts and minds of their fellow citizens. One of these leaders was Federal Council member Rudolf Minger, who was a founding member of the Party of Farmers, Traders and Independents (BGB), which evolved into today's SVP, and at the same time, the first farmer elected into the Federal Council. He served as head of the department of defense from 1930 – 1940. Without him and our great General Henri Guisan, a true Swiss patriot and a clear and determined opponent of the Nazis, I'm sure the history of Switzerland would have been quite different. That brings us back to the situation at hand. Switzerland has certainly benefited from the free trade arrangements with the EU. But the dispute over immigration that emerged a few years ago has intensified. Ultimately, the Swiss felt this social cohesion that developed among the members of its population was at risk. Now the EU has escalated its position towards Switzerland: they only want to allow free trade if Switzerland does not limit immigration. On the one hand, the Swiss public is well aware of the costs of opening its borders and is not willing to compromise its security and interests. On the other hand, the Swiss are concerned about the potential implications if the EU actually carries out its threat and restricts future trade with Switzerland. However the EU and Germany, in particular, benefit considerably from free trade with Switzerland as well. In the end, I am confident that the Swiss will find a solution that will allow for both free trade and self-determined immigration controls. Members of the Federal Council as well as of the Federal Court are ignoring the peoples' will, fully convinced that they have the power and the wisdom to overrule those they have sworn to serve. On Friday, the Federal Council submitted its own draft law to parliament to limit immigration. Even though the Swiss had expressed their will to limit immigration in a referendum two years ago, the Federal Council wants to salvage ties with the EU. It appears that the government's wishes are taking precedence over the will of the people. This is a critical moment for Switzerland, for the question is: who is the true sovereign here? The Swiss constitution states it clearly, but the authorities openly disregard it. However, the battle is not over yet; the trend towards increasingly centralized power over the past 20 years has been broken – the public is well aware that this does not fit the Swiss mentality and culture. In fact, I find that the destructive way the EU elite is ruling can be seen as the best accelerator for the Swiss to uphold their constitutional right and claim sovereignty. Swiss Property Rights: A Model for All Free People This brings us to the core element of Switzerland: the respect for private property. The country's political system that embraces direct democracy, decentralization and that upholds personal liberties extends into the financial/economic sphere. The state may not simply expropriate or confiscate people's assets. It is therefore that Switzerland has built a strong reputation for its private banks, offshore investment, and the creation of independent storage facilities for gold and precious metals that operate outside the traditional banking system, which in turn offer even more security. Swiss private banking stands above its counterparts in the traditional banking realm for a number of reasons. First and foremost, real private banks operating under Swiss law in most cases have a general partner who has unlimited liability for misconduct. This serves as an indirect protection of wealth as it ensures that private bankers do not make overly risky investment decisions for their clients. Beyond that, lending in private banks, which are not involved in credit creation and fractional banking, is collateralized and therefore less exposed to systemic risks, which are extremely high in today's market. Despite potential threats, the Swiss are notorious in asserting their sovereignty over state institutions. Property rights are safeguarded against confiscation without due cause of action and process of law. Therefore it is no wonder, that the Swiss are stockpiling privately held cash and lead to the ranking on a global scale, despite regulations barring financial institutions from such actions. Beyond that, the Swiss have resisted the cashless society movement as is experienced with the relative disdain to card payments among the retail sector. The Swiss democratic system has truly empowered its citizens with the tools to resist outsider control. Resistance against the Establishment: A Global Movement We can see that tension is growing in other regions worldwide. Now all eyes are set on June 23rd when Britain will hold its Brexit referendum, strongly advocated by the UK Independence Party (UKIP). In this respect, SVP MP Lukas Reimann, made an interesting statement: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Soars Post-Fed As Gold Ratio Tumbles Most In 5 Months Posted: 17 Mar 2016 07:00 PM PDT Two weeks ago we hinted at the flashing red warning coming from 'a 4,000 year old' financial indicator. The Gold/Silver ratio had reached extremely high levels, which at the time we explained... This isn’t normal. In modern history, the gold/silver ratio has only been this high three other times, all periods of extreme turmoil—the 2008 crisis, Gulf War, and World War II. This suggests that something is seriously wrong. Or at least that people perceive something is seriously wrong. And as we concluded at the time...

And, that appears to have happened... As Silver has soared post-Fed...

Crushing the Gold/Silver ratio back to one-month lows (withthe biggest 2-day drop since October 5th 2015)...

But do not forget - even at 79x - this is an extreme level of fear - nothing has been 'fixed' as governments escalate their repression of financial freedom. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Rose 2.86% and the Silver Price Rose 5.31% Posted: 17 Mar 2016 06:51 PM PDT

I find myself in the lunatic position of fighting a silver & gold rally. I think I've slipped through the looking glass or down the rabbit hole. It's nutty. Prime mover today was the US dollar index that fell over a cliff: down 112 basis points or 1.17% -- 2.05% in the last two days. I offer the chart in evidence, http://schrts.co/smGchO I have marked with blue arrows the cascades since December. 2 - 3 December, -2.4%; 29 January- 3 Feb, -3.2%; 9-10 March, -1.07%, and now, 16-17 March, - 2.05%. Of course, currencies are always treacherous because central banks manipulate currencies for political reasons you can't see, and they often co-ordinate their manipulations. Wherefore, looking at a currency chart is, well, only worth what it's worth. That said, the dollar is painting a picture of weakness. It peaked in March 2015, corrected after an 8 month rally, then in October 2015 broke out of the downtrend. Great, but it reached the March high (100.02) & fainted -- first cascade. Caught & got enough traction for another little rise, but failed again near 100 -- second cascade. Third cascade was the ECB debacle last week, then the Fed's bumbling this week brought the fourth. Dollar has now sunk below 95.30 support, and if it falls lower will pierce that internal support from the old triangle (blue line). That will make the dollar look even weaker. If it breaks support at 92.50, the dollar will be through rallying for a long, long time and steering back to 81 where it broke out in July 2014. Y'all have already figured out that the euro, which is 57% of the US dollar index, jumped way higher today, up 0.84% to $1.1315. Yen leapt even more, +1.23% to 89.79¢/¥100. Don't miss this: dollar is the bottom part of a fraction of which the top part is all commodities & stocks. Wherefore it is a mathematical certainty that when the dollar shrinks, commodities & stocks bloat, & that includes silver & gold. We know we are watching might in metals when they gain against a RISING dollar. When they gain against a falling dollar, it may be metals strength but is more likely dollar puniness. Not the same thing at all. Dow Industrials bumped up 155.73 (0.9%) to 17,481.49. S&P500 lifted 13.37 (0.66%) to 2040.59. Thanks to aftermarket gold weakness, Dow in gold rose 1.26% to 13.89 oz. Thanks to wild silver strength today (up 5.3%), Dow in Silver fell 11.09 oz (1%) to 1,097.05 oz. Metals went wild as a razorback hog today. Comex gold bounded $35.20 (2.9%) to $1,264.50. Silver pole-vaulted 80.8¢ (5.3%) to 1602.2¢. Platinum gained $20.15 (3.1%) to $988.60, and palladium sprang $20.15 (3.5%) to $597.35. Gold/Silver ratio -- look at this, now -- has dropped below 80 to 78.923. And it's treading water underneath the 20 (81.24) and 50 (79.45) day moving averages. In other words, doing just what it ought to do in a gold-silver rally, dropping. Probably time still to swap gold for silver, but you won't realize quite as many silver ounces as you would have a few days ago. So far in this rally that began in December, gold's high close struck $1,273.10. Today's Comex close reached only to $1,264.50, then aftermarket gold fell $7.40 to $1,257.10. Yes, yes, it is thrilling when gold runs wild, gains $35.20, but on a chart it just don't look that impressive, and it ain't a breakout. http://schrts.co/pI1ZgR However, that retreat on 14, 15, & 16 March is beginning to look like a false breakdown. My mind's wondering, How will gold finish the week tomorrow? Will it hold on up here, or fall back? On the End of Day chart, MACD & RSI still point down, and Commitments of Traders reports remain grisly bearish. Nevertheless, the proverbs say, "Bull markets always climb a wall of worry," and "In bull markets, surprises come to the Upside." Yes, silver poked through 1600¢ today, but barely. Only reached 1608¢. Close, but this ain't hand grenades. One more day of higher closes and I will break & throw in the correction towel, but till silver SUBSTANTIALLY beats 1600¢, I'm standing back. I'm taking a whipping with a weedeater on my bare back, but I'm standing back. On this day in 432 a.d. Patrick was captured by Irish pirates in a raid on his home in Great Britain and taken to Ireland & sold as a slave. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alasdair Macleod: The European Central Bank and John Law Posted: 17 Mar 2016 06:33 PM PDT By Alasdair Macleod Last week the European Central Bank extended its monetary madness, pushing deposit rates further into negative figures. It is extending quantitative easing from sovereign debt into non-financial investment grade bonds, while increasing the pace of acquisition to E80 billion per month. The ECB also promised to pay the banks to take credit from it in "targeted longer-term refinancing operations." Any Frenchman with a knowledge of his country's history should hear alarm bells ringing. The ECB is running the Eurozone's money and assets in a similar fashion to that of John Law's Banque Generale Privee (renamed Banque Royale in 1719), which ran those of France in 1716-20. The scheme at its heart was simple: Use the money-issuing monopoly granted to the bank by the state to drive up the value of the Mississippi Company's shares using paper money created for the purpose. The Duc d'Orleans, regent of France for the young Louis XV, agreed to the scheme because it would provide the Bourbons with much-needed funds. This is pretty much what the ECB is doing today, except on a far larger eurozone-wide basis. The need for government funds is of primary importance today, as it was then. ... ... For the remainder of the report: https://www.goldmoney.com/the-ecb-and-john-law?gmrefcode=gata ADVERTISEMENT Free Storage with BullionStar in Singapore Until 2016 Bullion Star is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. Bullion Star's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in Bullion Star's bullion vault, which is integrated with Bullion Star's shop and showroom, making it a convenient one-stop-shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage is FREE until 2016 and will have the most competitive rates in the industry thereafter. For more information, please visit Bullion Star here: Join GATA here: Mines and Money Asia http://asia.minesandmoney.com/ Mining Investment Asia http://www.mininginvestmentasia.com/ Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| BREAKING: DANGER: N. Korea Fires Ballistic Missile Again Posted: 17 Mar 2016 05:06 PM PDT Kim Jong Un has just fired another Ballistic Missile into the sea The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| US Economy Is Tumbling Into An Economic Collapse That Will Shock The World Posted: 17 Mar 2016 04:53 PM PDT Gold slammed down and now pushing back up. Initial jobless claims at 42 year lows even though more retail stores are closing and corporations are laying off. Real income is going to decline this year. Baltic Dry index declines again, the dead count bounce is over. All the signs are pointing to a... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Government Has A "Zombie Apocalypse" Plan Posted: 17 Mar 2016 04:35 PM PDT The Center for Disease Control and the United States Strategic Command both have a plan for the "Zombie The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ive Reasons A Trump Presidency Would Be Good For Gold Posted: 17 Mar 2016 03:00 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| From Syria to Fukushima -- Charles R. Smith Posted: 17 Mar 2016 02:28 PM PDT Jeff Rense & Charles R. Smith - From Syria to Fukushima Clip from March 16, 2016 - guest Charles R. Smith on the Jeff Rense Program. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Donald Trump is LITERALLY Hitler Posted: 17 Mar 2016 01:51 PM PDT OMG like Donald Trump is LITERALLY Adolf Hitler! progressives are the ones who are most like fascists, they only like diversity of skin color not ideas... The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Fed’s Folly Festers Further Posted: 17 Mar 2016 01:36 PM PDT This post The Fed’s Folly Festers Further appeared first on Daily Reckoning. Listening to even a small portion of Simple Janet's incoherent babble makes very clear that the nation's central bank is well and truly impaled on its own petard. According to the dictionary, the latter term refers to….. …….. a small bomb used for blowing up gates and walls when breaching fortifications. It is of French origin and dates back to the 16th century. A typical petard was a conical or rectangular metal device containing 2–3 kg (5 or 6 pounds) of gunpowder, with a slow match for a fuse. Maybe that's what they have been doing all along—–that is, waiting for their slow match monetary fuse to finally ignite the next financial conflagration. After all, the Fed is now 87 months into its grand experiment with the lunacy of zero interest rates. If our monetary central planners still can't see their way clear to more than 38 bps of normalization, then, apparently, they intend to keep the casino gamblers in free carry trade money until they finally blow themselves up——just like they have already done twice this century. In fact, by Yellen's own bumbling admission the inhabitants of the Keynesian puzzle palace—-into which the Eccles Building has long since morphed—–can't see their way to much of anything. They couldn't even decide if the risks to the outlook are balanced to the upside or downside. And that roundhouse kind of judgment isn't even remotely measureable or exacting; it requires nothing more than a binary grunt. As a practical matter, the joint has lapsed into a state of mental entropy——apparently under the risible assumption that they have abolished the business cycle and have limitless time to normalize. Yet we are already at month 81 of this so-called expansion, and the signs of approaching recession are cropping up daily. This week, for example, we got another month of declining industrial production, which is now down nearly 2% from its recent peak and falling business sales, which are 5.1% lower than they were in mid-2014. Somehow Yellen deduced from the chart below that the US economy has been "very resilient in recent months". Since the commerce department's report on total business sales includes manufacturing, wholesale and retail, and despite the current slump still clocked in at a $15.5 trillion annualized run rate in January, it might be wondered just exactly what hidden crevice of the US economy is exhibiting all that "resilience". At the same time, CapEx orders are down by 7% from September 2014 levels and the inventory to sales ratio is at its highest level since April 2009. The Fed has never seen a recession coming, of course. It apparently doesn't even believe that business cycles die of old age, too much credit expansion and malinvestment or even of its own inept handiwork. The cause is always an "external shock" or even an extraterrestrial "contagion", as per Bernanke's specious history of the September 2008 market meltdown. Still, you might think that a posse of economists, which purportedly is laser-focussed on the "incoming" data, might have noticed the deteriorating trends so starkly evident in the chart below. Why do they think all of this is just "transient" and that they have until 2018 by their own latest "dot plot" to get money market rates out of what will have been a decade long sojourn in negative real rate land?

In other words, if a recession has not already commenced, they are using up the recovery phase runaway real fast. But never mind the very real risk that the entire global economy is sliding into a deflationary contraction, and that normalization would then be put off indefinitely. By her own assertion Yellen espies no such danger, and even asserted during the presser that there are "upside risks to global growth". Let's see. In the most recent months, the three bellwether economies of Asia reported plunging exports. Japan was down 13% from last year, South Korea was off by 20% and China's exports tumbled by 25%. Beyond that, there is a veritable CapEx depression underway throughout the global energy, mining, shipbuilding, steel, aluminum and most other heavy industrial sectors; China is drifting ever closer to a spectacular credit collapse and violent labor unrest; and its satellite economies like Brazil are rapidly becoming economic basket cases. Yet Simple Janet could not explain why the Fed has lapsed again to a "hold" position or when global economic conditions would actually permit it to resume its path toward normalization. The unstated effect of the Fed's perpetual "hold" policy, therefore, would seem to be free gambling chips for the Wall Street casino, world without end. And we do know how that ends. We also now have an absolutely clear idea of why the Fed is impaled on its own petard. Yellen explained to her ever credulous audience of financial journalists that all of its shilly-shallying is due to the fact that the "neutral value" of federal funds is currently very "low" by historic standards, and that, accordingly, an exceptional degree of "accommodation" is warranted. Here's a newsflash for the passel of shills who attended the post-meeting press conference. First, as a technical matter there is no Federal funds market. It has been killed deader-than-a-doornail by the Fed's massive money printing campaign since September 2009. The resulting $2.4 trillion of excess bank reserves parked at the New York Fed simply suffocated the Federal funds market in its crib. More broadly, there ain't no such thing as the "neutral value" for federal funds or any of the related money market instruments. It's an entirely imaginary construct conjured up by Keynesian academic scribblers, and ultimately rests on purely religious belief. Indeed, Yellen might as well have been reciting the rosary and fingering her beads. The only valid price of money is that set by the interaction of supply and demand in an honest free market. But that was quashed decades ago when Greenspan inaugurated the present regime of bubble finance. What we have in this age of monetary central planning, instead, is pegged rates arising from abstract theory and the blundering pretensions of the bubble-blind apparatchiks ensconced on the FOMC. At the end of the day, pegged rates will prove to be the ultimate destroyer of capitalism. They transform financial markets from organizers and allocators of real capital and the savings of producers and workers into gambling casinos which fuel massive speculative bubbles. Until the blow. Someone should tell Janet to let go of the petard. Regards, David Stockman P.S. Be sure to sign up for The Daily Reckoning — a free and entertaining look at the world of finance and politics. The articles you find here on our website are only a snippet of what you receive in The Daily Reckoning email edition. Click here now to sign up for FREE to see what you're missing. The post The Fed’s Folly Festers Further appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Is it Gold that’s Up or the US Dollar that’s Down Posted: 17 Mar 2016 01:33 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Stock Option Expiry - US Douleur du Monde Posted: 17 Mar 2016 01:23 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Death of U.S. Dollar as Governments Dump U.S. Debt at RECORD RATE! Posted: 17 Mar 2016 01:00 PM PDT The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 17 Mar 2016 12:59 PM PDT "The main thing is that the debt is in dollars. So we can't run out of cash--we print the stuff. Suppose that foreigners decide we're not reliable. How does that drive up interest rates? The Fed controls short-term interest rates, and long-term interest rates reflect expected short rates. How's that supposed to happen?" Paul Krugman, Interview on CNNMoney Well, at least now we know why gold was knocked down lower in the paper trading earlier this week. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| US Finally Acknowledges ISIS Genocide Posted: 17 Mar 2016 12:30 PM PDT Though the Secretary of State now acknowledges ISIS genocide, top brass in government refuse to admit that foreign policy has aided the group. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gerald Celente and Eric Sprott Economics, Finance, and Geopolitics March 17th 2016 Posted: 17 Mar 2016 11:29 AM PDT March 17 th 2016 Gerald Celente and Eric Sprott Economics, Finance, and Geopolitics The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stefan Molyneux Men Are Scared Of The Government Not women (MGTOW) Posted: 17 Mar 2016 10:26 AM PDT This lady is talking about things that pertain to only her views. She can't see the big picture without herself being in it and that's what women fear the most. (self accountability) The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The REAL Story You Missed Yesterday Posted: 17 Mar 2016 06:44 AM PDT This post The REAL Story You Missed Yesterday appeared first on Daily Reckoning. The financial noise machine has drowned out the real story behind this week's biggest market moves… The Fed decided to keep rates unchanged. Shocking! But while everyone else was parsing Fed statement language, a critical bounce in one commodity went largely unnoticed. More on this in just a second… I told you yesterday that the market has remained in flux this week thanks to the Fed. Trading dried up just before 2 p.m. yesterday as everyone waited for the announcement. Of course, there was speculation floating around at to how Janet & Co. would react since the markets have been so weak. "But ultimately, no one knows what will happen—or how the market will react," I wrote. "We'll just have to wait and see." Now we know the Fed's getting a bit dovish and just two rate hikes are on the table in 2016. Frankly, my dear Janet, I don't give a damn. I have bigger things to worry about. Like, ya know, major market trends. Take oil for instance… Crude gained nearly 6% when all was said and done on Wednesday. That's a pretty big one-day rip for black gold, especially when you consider how sluggish oil has been this week. More importantly, crude looks like it's carving out a higher low. After wandering around just below $38 for the better part of the past two weeks, oil quickly blasted over $40 this morning. The last time was saw $40 was December, by the way…

Here's something else no one is talking about for some reason: Energy stocks aren't looking half bad right now. While the S&P 500 is down about 1% year-to-date, the Energy Select SPDR (NYSE:XLE) is actually up nearly 4%. If this new oil "floor" is the real deal, we could see these beaten-down energy names take on a bigger leadership role in the markets. Pipeline stocks were up big yesterday. So were refiners. Even independent oil & gas names were getting jiggy with higher prices. This is one group of stocks we'll want to watch closely heading into the end of the week…

Will this move mark the long-term end of the oil rout? I'm not sure. But it does set us up for higher prices in the days ahead… Oil wasn't the only big mover that triggered yesterday. The U.S. Dollar Index was slammed to new 2016 lows, while gold got up off the mat and jumped above $1,270. Gold's resurgence and the dollar's weakness shouldn't surprise you. This is a trend that's been in place since early January. Gold's spot price is up more than 20% year-to-date as of this morning, while the Dollar Index is down nearly 3% over the same timeframe.

Don't get bogged down in the Fed hysteria. By tuning out the noise, we've been able to generate some amazing trades over the past several weeks. Now, your gold miners are breaking out to new 2016 highs. Keep your head on straight and you'll continue to book gains this year—no matter what happens at the Fed… Sincerely, Greg Guenthner P.S. Make money in a falling market–sign up for my Rude Awakening e-letter, for FREE, right here. Stop missing out. Click here now to sign up for FREE. The post The REAL Story You Missed Yesterday appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fractal Analysis Shows Coming 70s Style Gold Stocks Rally From Even Cheaper Levels Posted: 17 Mar 2016 04:21 AM PDT In terms of the gold price, gold stocks are currently at better value than at the beginning of the bull market in 2001. In 2001, at the bottom of the gold bull market, the XAU to Gold ratio was around 0.2 compared to 0.05 today. In other words, gold stocks are cheaper than they were in 2001. In fact, they are cheaper than they have been the last 78 years at least. If you are confident that the gold bull market is about to continue, and trust gold stocks as the best “vehicle” to take advantage of the gold bull market, then it is probably an ideal time to get into these gold stocks. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| FOMC Bring on the Clowns, Dollar, Gold and Bonds Posted: 17 Mar 2016 04:14 AM PDT Honestly, more and more that seems to be the best phrase to describe when waiting for these FOMC statements to be revealed. If we are not seeing a case of deliberate attempts to break the back of their own currencies among these Central Bankers, then "Scotty, beam me up!" With the Fed Fund futures showing sharp increases AHEAD of the FOMC statement of rate hike probabilities, today's ultra dovish statement had everyone positioned on the wrong side of the currency markets yet once again. The result was yet another unleashed chaos courtesy of our Central Bankers. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 17 Mar 2016 04:08 AM PDT Last week I showed you this potential H&S top forming on the USDU which is a more evenly balanced index for the US dollar which actually trades as an ETF. http://www.wisdomtree.com/etfs/fund-details-currency.aspx?etfid=91 I built this chart using a line chart and then leaving the trendlines in place I converted to a bar chart. As you can see it has been backtesting the neckline for the last week or so along with the 200 dma. This chart shows a reversal pattern which sets up a downtrend of some kind. This is an important development. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 16 Mar 2016 09:43 PM PDT SafeHaven |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Buried amid tens of thousands of pages of former US Secretary of State Hillary Clinton's secret emails, now being made public by the US Government, is a devastating email exchange between Clinton and her confidential adviser, Sid Blumenthal. It's about Qaddafi and the US-coordinated intervention in 2011 to topple the Libyan ruler. It's about gold and a potentially existential threat to the future of the US dollar as world reserve currency. It's about Qaddafi's plans then for the gold-based Dinar for Africa and the Arab oil world.

Buried amid tens of thousands of pages of former US Secretary of State Hillary Clinton's secret emails, now being made public by the US Government, is a devastating email exchange between Clinton and her confidential adviser, Sid Blumenthal. It's about Qaddafi and the US-coordinated intervention in 2011 to topple the Libyan ruler. It's about gold and a potentially existential threat to the future of the US dollar as world reserve currency. It's about Qaddafi's plans then for the gold-based Dinar for Africa and the Arab oil world.

For anyone who has money in the bank today, it is virtually guaranteed that in the next 5-7 years either the bank will be gone or the money will be worthless, or probably both.

For anyone who has money in the bank today, it is virtually guaranteed that in the next 5-7 years either the bank will be gone or the money will be worthless, or probably both. Last Wednesday, the Swiss National Council voted to withdraw the country's dormant application to join the European Union (EU). A clear majority of Swiss voters are not interested in joining the EU. And no democratically sanctioned application was ever submitted. However, it has been "in the drawer" for some time.

Last Wednesday, the Swiss National Council voted to withdraw the country's dormant application to join the European Union (EU). A clear majority of Swiss voters are not interested in joining the EU. And no democratically sanctioned application was ever submitted. However, it has been "in the drawer" for some time.

No comments:

Post a Comment