Gold World News Flash |

- Gold should stay strong in 2016

- Precious Metals Ignore Correction CallsÂ

- The Coming Gold Mania - How to Make 10, 20, Even 50 Times Your Money

- Silver Eagle Sales To Jump 25% Due To Deteriorating Market Conditions

- CLINTON EMAILS REVEAL THE GOLDEN REASON SHE OUSTED GADDAFI AND IT EXPOSES THE TRUE MASTERS

- Gold Price Closed at 1,253.80 Down $10.70 or -0.85%

- Meet Two Of The Men Who Will Determine Whether Trump Becomes President

- The New New 'Deal' - "Markets Are Too Important To Be Left To Investors"

- Crude Oil Fractals & Funding Fears

- Jim Rickards – Cyber financial warfare, Fed balance sheet, gold price, windfall tax on gold

- Here's why surging gold miner stocks may still be bargains

- Gold Stocks Tiny Baby Bull Market

- Gold Daily and Silver Weekly Charts - Shenanigans for Option Expiration, Silver Cup and Handle

- Silver Price Soars 4%, Gold Consolidates On Federal Reserve

- Islam | Real Truth Behind islam - Full Documentary

- Well That Didn’t Work

- Government Debt Bubble About to Burst

- Silver Eagle Sales To Jump 25% Due To Deteriorating Market Conditions

- Why Interest Rates Are Never Going Back to Normal

- ECB's bazooka has not run out of ammunition, chief economist says

- The Mad World of Donald Trump 2016 - Leftist MSM Documentary

- India's gold paperizing scheme strains for its fourth tonne of metal

- Comex Gold Rigging – Fact or Myth?

- Financial letter writer, mining investor Ian McAvity dies

- Analysis on Peak Dollar

- Oil Prices Rally to 2016 Highs on Weaker Dollar

- Gold and Silver March Madness

| Gold should stay strong in 2016 Posted: 19 Mar 2016 12:00 AM PDT by Salma Tarikh, Northern Miner:

On March 16, the Fed estimated two quarter-point hikes this year, compared to the four expected in December, to offset the weaker global economy. This helped lift the spot gold price roughly 2.4% to US$1,262 per oz. and drive down the U.S. dollar to its lowest level since October. A day later, while spot gold lost momentum to finish at US$1,256.90 per oz., the DXY Dollar Index, which measures the strength of the greenback against a basket of foreign currencies, sank further to close at 94.75.

Year to date, the yellow metal is up 18%. The only other years since 2000 where gold registered similar gains during this point were 2014 and 2008, climbing a respective 14% and 19%, Raymond James analyst Phil Russo writes. Gold, however, exited 2014 down 2%, while gaining 6% in 2008, the year the financial crisis began. Meanwhile, the Philadelphia Gold and Silver Index, comprising 30 gold and silver mining companies, is off to its best start, up 58% year to date, Russo writes. The index's second best year was 2008, up about 19% at this time. The recovery for gold and gold equities this year to date can be partly attributed to the "depth and breadth" of the preceding five-year-long bear market. This will set 2016 apart from the other years, Russo opines. "The unprecedented run in 2016 follows an unprecedented bear market for the sector, and suggests to us the unrivalled performance can continue." What's good for gold? "For gold prices to rise in U.S. dollars, it would be extremely helpful if the U.S dollar rolled over," Martin Murenbeeld, Dundee Economics' chief economist, said in an early March presentation. The U.S. dollar, currently overvalued, is at a turning point, he adds. The greenback has retreated 4% year to date, making gold, priced in U.S. dollars, more attractive for foreign investors. A sluggish global economy, however, negatively affects the price of gold. Whenever the global annual growth rate is below 4%, prices of commodities tend to go negative year-over-year, due to weak inflation, Murenbeeld reveals. There's a positive correlation between the price of gold and reflationary measures, such as quantitative easing, and low or negative interest rates. "What gold needs is a hell of the policy stimulation to get the heck out of a recession," he said. For 2016, Murenbeeld expects gold to average US$1,190 per oz., before ending the year at US$1,234 per oz. In 2017, he forecasts the metal will average US$1,304 per oz. No longer an 'obscenity' Negative interest rates demonstrate economists have run out of ways to make the traditional policies to stimulate the economy work, Don Coxe, chairman of Coxe Advisors LLC, said at the 2016 PDAC convention. The policy spurs spending and economic growth, by discouraging cash hoarding and pushes banks to provide more loans. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Precious Metals Ignore Correction Calls Posted: 18 Mar 2016 09:28 PM PDT Gold and gold stocks have refused to correct for more than a few days at a time. Weakness is being bought and quickly. Gold has gained over $200/oz but not corrected by more than 6%. The miners (GDX) have endured three roughly 10% corrections in the past six weeks but nothing greater. A few weeks ago we noted a comparison to the 2008 rally which hinted that miners could correct 20% before moving higher. So far, no dice. Many gold bulls continue to expect a correction while losing sight of the bigger picture: precious metals are in a new bull market. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Coming Gold Mania - How to Make 10, 20, Even 50 Times Your Money Posted: 18 Mar 2016 09:23 PM PDT By Justin Spittler Regular readers know why I believe the gold price is poised to move from its current level of $1,250 per ounce to $1,500…$2,000…and eventually past $3,000. Right now, we are exiting the eye of the giant financial hurricane that we entered in 2007, and we’re going into its trailing edge. It’s going to be much more severe, different, and longer lasting than what we saw in 2008 and 2009. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Eagle Sales To Jump 25% Due To Deteriorating Market Conditions Posted: 18 Mar 2016 08:42 PM PDT by Steve St. Angelo, SRS Rocco:

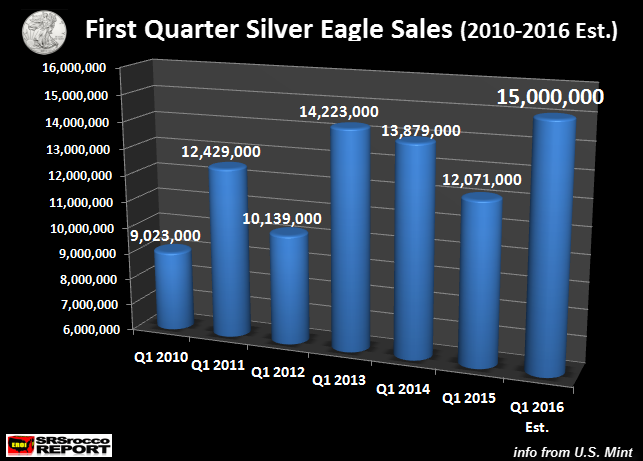

Silver Eagle sales will likely jump by 25% in the first quarter due to deteriorating market conditions. During the first three months last year the U.S. Mint sold 12 million Silver Eagles. Already, sales of Silver Eagles have reached 13 million. There are two weeks remaining in March and the U.S. Mint will likely sell another two million. This will put total Silver Eagle sales for the first quarter at 15 million….. the highest ever.

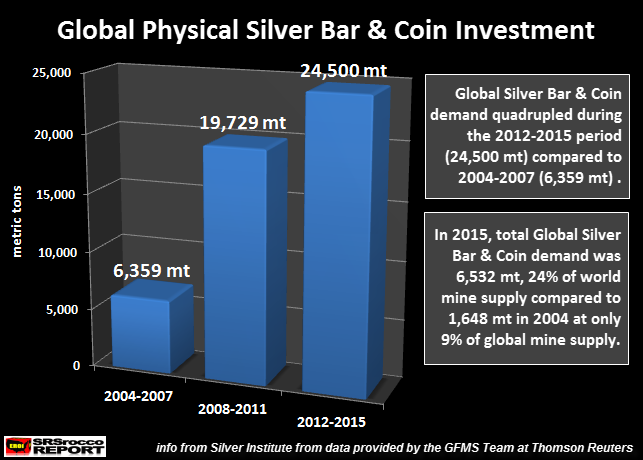

The last record was set in 2013 as the U.S. Mint sold 14.2 million Silver Eagles as the price of silver fell from $32 down to $25 in the first three months of the year. Regardless, the Authorized Purchasers have been on a one million week allocation for the past two months, so there was no way to acquire more Silver Eagles. Demand for Silver Eagles this year has hit a record due to deteriorated market conditions. Even though the Dow Jones Index has added 2,000 points from its low last month at 15,500, this is not a sustainable rally. Each day, there are more indicators pointing to a worsening economic fundamentals. Total Silver Eagle sales in 2016 could easily reach 50 million and possibly 55 million if demand remains strong for the remainder of the year. I believe a certain amount of investors understand that nothing has been fixed in the financial system since the collapse of U.S. Investment Banking and Housing Market in 2008. This is why we continue to see record buying of Silver Eagles. I published this chart in a prior article, but it's worth taking another look… especially if you haven't seen it yet. What is interesting about this chart is that cumulative physical Silver Bar & Coin demand is higher in the past four years even though the price has fallen in half:

As we can see, cumulative Silver Bar & Coin demand from 2012-2015 was 24,500 mt (788 Moz) versus 19,729 mt (634 Moz) from 2008-2011 (Moz = million oz). Again, a percentage of investors realize the system continues to get weaker even though the stock and bond markets look good on paper. This is why silver investment demand continues to be strong even though the price has declined 67% from its $49 high in 2011. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CLINTON EMAILS REVEAL THE GOLDEN REASON SHE OUSTED GADDAFI AND IT EXPOSES THE TRUE MASTERS Posted: 18 Mar 2016 06:40 PM PDT from The Next News Network: A declassified email exchange between former US Secretary of State Hillary Clinton and her adviser Sid Blumenthal shows that Clinton was up to her eyeballs in the Western conspiracy against Libyan leader Muammar Gaddafi and his Pan-African “Gold Dinar” currency, F. William Engdahl narrates. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at 1,253.80 Down $10.70 or -0.85% Posted: 18 Mar 2016 05:50 PM PDT

No matter how fiercely the socialist public believes there is such a thing as a free lunch, there isn't. Markets don't work that way, either. Everybody can't win ALL the time. In the last week commodities have won, stocks have won, & gold and silver have won. Ain't gonna last. Only the US dollar index lost big this week, thanks to the Fed "stabilizing" the economy. Jes' like me "stabilizing" your chickenhouse with dynamite. The US dollar added yet another waterfall & failure to its chart this week. Last week the ECB's announcement pounded the buck, this week the Fed's. What's a scrofulous currency to do? After cascades in December, February, and two in the last fortnight, dollar index is looking like high quality merchandise from the Soviet Union. It broke 95.30 support, but caught today at an internal downtrend line reaching back to the March 2015 top. Look here, http://schrts.co/Bjf68H Should the dollar break that trendline's support, next stop will be 92.50. That is the make-or-break dollar support. Fracture that & it freefalls to 81. However, it hasn't broken that level yet. Dollar bounced today 32 basis points (0.34%) to 95.12, &still looks firehose-pukin' sick. I take it as a measure of central banks' rapidly shrinking credibility, worldwide. Euro fell in a mirror image of the dollar's rise, down 0.39% to $1.1271. Is it rallying? Shucks, CAN the euro rally? Yen lost 0.15% to 89.64. Pushing on the ceiling. Can it break through to the attic? Lookit, lookit. Stocks have actually risen into positive territory for the year. Dow is up 177.27 (1%) over the 31 Dec 2015 close and the S&P500 is a massive 5.64 (0.3%) higher. My land a' Goshen! Anybody CAN become president! Today the Dow climbed 120.81 (0.69) to 17,602.30 & the S&P500 clambered up behind it 8.99 (0.44%) to 2,049.58. Let us now ponder the Volatility Index ($VIX). This measures complacency (low readings) & terror (high readings) in the stock market. Here's a chart, http://schrts.co/fBq0hr When investors waxed fat, dumb, & happy back in April - August 2015, the VIX was bumping along around 11.70. Observe, though, how it shot up WAAY over 30 (high side of the range) to 53.29 back in August when stocks hit the skids. Line it up with the plot of the S&P500 in the bottom window. Then stocks rallied & investors again forgot that stocks go both up AND down. First of November VIX hit 12.80, & thereafter began the S&P500 to slide. Smugness reached another extreme toward end-December, right as stocks began a terrible six week dive. BEHOLD! Complacency hath returned. VIX hit 14.02 today, lower than December's low. Yes, the VIX can drop more, but experience saith stocks' rally draweth soon to a close. Also, the Dow in Gold & Dow in Silver may have finished their upward corrections, which also points to stocks' rise ending. By the way, for the year the Dow in Gold has lost 14.6% and the Dow in Silver 12%, so take those new stock highs for the year with a shaker of salt. Stocks are NOT at new yearly highs againt metals. Recall that last fall I mentioned that sometime during 2016, probably first half, commodities would begin turning up after eight years' of falling. Something like that turn-up is unfolding, but may stumble before it finds permanent footing. West Texas Intermediate Crude has been climbing along with stocks since the February low at $26.05. Today it backed off a little but still closed 41.13, up 58% off the low. Copper has rallied from $1.937 to $2.286, up 18%. CRB commodity index gapped up this week, but that might be an exhaustion gap. Oil & Copper are both about to hit their 200 day moving average, a fit location for a fall & correction. The SILVER PRICE today lost 1.35% or 21.6¢ to close Comex at 1580.6¢. Gold backed down $10.70 (0.85%) ending at $1,253.80. Silver made a new intraday high for the move at 1617¢, but held not on. Never a good sign. Pause to ponder the gold/silver ratio. Silver often finds its juice toward the end of a rally. This week it has traded down toward the bottom boundary of its uptrending channel. Look here, http://schrts.co/kh9gOy The falling ratio (silver outperforming gold) is consistent with the latter stages of a rally. I feel goofy fighting a silver & gold rally, but can't help myself. From a longer term perspective I remain confident that both metals completed their post-2011 correction in December. The GOLD PRICE has broken out to the upside on both weekly & monthly charts. Silver has broken out on the weekly chart and is challenging the long term downtrend line on the monthly & daily. I don't question both have turned up for the next phase of their bull markets that began in 1999 and 2001. But right now they have reached levels where they need a rest. Gold has traced out a bear flag, http://schrts.co/pI1ZgR Volume is declining, RSI is falling, Rate of change is shrinking. In other words, its painting a picture of your car coughing & sputtering & bucking as it runs out of gas. Silver looks strong as a horseradish martini, but the 10 month chart is BEGGING for a right shoulder. Nonetheless, silver is knocking at the door of 1600¢ resistance, and its downtrend line from April 2011. Should it break down that gate, it will run, run, run. http://schrts.co/3XPPHS No, I am not blowing hot and cold out of both sides of my mouth, like the fellow who threw himself on the mercy of the court after he killed his parents -- because he was an orphan. I expect a correction to materialize soon in silver & gold. Y'all will know I'm wrong as a woman wearing white shoes after Labor Day IF gold closes above $1,287 and silver above 1624¢ -- together. I wonder if any of you Canadian readers would be kind enough to recommend a reliable silver & gold dealer in Canada? I am often asked, but know no one in particular I can trust. Once again, thanks for your prayers on my wife Susan's behalf. When I ask her now how her eye is faring, she shoots back, "Fabulous!" Y'all enjoy your weekend. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Meet Two Of The Men Who Will Determine Whether Trump Becomes President Posted: 18 Mar 2016 05:35 PM PDT One of the things that seems to have never sunk in for Donald Trump's GOP rivals (or at least until they were either sitting back at home on the couch reflecting on why they were beaten so badly or else talking sheepishly to reporters on Capitol Hill about their plans to retire from politics after being trounced in their home state) is that he feeds off of controversy and publicity. The more you talk about him - good or bad - the larger he looms in voters' minds. Although certainly adept at whipping crowds into a frenzy and clearly a much more savvy politician than probably even he suspected going into the campaign, the Trump juggernaut is to some extent a monster of the GOP field's own making. The more they focused on Trump, the more voters did too, and before you knew it, he was the frontrunner. At that point, it became self-fulfilling - they had to focus on him because he was at the top of the polls. But alas, they never learned. He was best left alone from the start to fizzle out or, more likely, to self-destruct of his own accord. Instead, by creating an "us versus him" dynamic, the other Republicans made an anti-establishment candidate out of a billionaire who probably didn't even know what "anti-establishment" meant when he entered the race. Before you knew it, Trump was Mr. Anti-Washington and from that point forward he could do no wrong. So oblivious to this are Republicans that they're about to make the very same mistake with the GOP convention. If you were to have gathered an arena full of Trump voters in January and asked them to raise their hands if they could explain what a "contested convention" was, our guess is that you would have come up with a stadium full of full pockets. But that's not the case now. The media, the Republicans, the Democrats, indeed damn near everyone is talking about what strategies the GOP can employ in Cleveland to steal the nomination away from Trump. Well guess what? Just like that, everyone has virtually guaranteed that they'll never be able to get away with it. Now, Trump will make absolutely sure that his millions of rabid supporters know there's a chance they may be effectively disenfranchised in July and thanks to the fact that America's political establishment still hasn't learned anything about why they're losing to Trump, those same supporters will be able to turn on the nightly news and hear all about how the Republican party plans to screw them. Indeed, CNN was gullible enough to actually ask Trump what he thought would happen if the nomination were stolen from him, effectively affording him an "inception" opportunity which he jumped on immediately by saying in as innocent a voice as he could muster, "I think there'd be riots." If there was any chance of pulling the wool over Trump's eyes and duping his followers with backroom, old school politics in Cleveland, there sure as hell isn't now. Just the same as if there was any chance of shutting down Trump's campaign in the first GOP debate by effectively ignoring him and treating him as though he didn't belong on stage, that chance was lost immediately when Fox's Megyn Kelly made him a political star by asking him if he thought it was befitting of a President to call women "disgusting animals." It's been a comedy of errors on everyone's part but Trump's and now, by alerting the billionaire to just how real the threat of a convention coup truly is, he may actually end up turning the tables on them and stealing their delegates. With that as the backdrop, we bring you the following excerpts from a Reuters piece out today entitled "Meet The Man Who Will Help Determine Trump's Fate In 2016 Race." * * * From Reuters Mark Strang spends his days delivering farm equipment, listening to politics on the radio during cross-country drives. But in July, the 63-year-old could have an outsized voice in choosing the Republican nominee for president of the United States. For the first time in 40 years, Republicans could arrive at their national convention in Cleveland without a nominee. If front-runner Donald Trump fails to lock up the nomination before then, as some pollsters are predicting, Strang will have a chance to make history. Strang, from Illinois, is one of 2,472 delegates to the convention who will ultimately determine the party's choice for the White House this November. In recent elections, the delegates have simply rubberstamped the presumptive nominee. But this year the convention could become a brutal fight in which every delegate vote will count. If the convention becomes a fight because no candidate has the needed 1,237 delegates on the first round of voting, most of the delegates would eventually be released. States are still sorting through some rules governing how long delegates are bound to candidates. Strang said if he found himself a free agent, he would be open to switching his vote. Interviews with Republican state party officials and some delegates who have already been selected reveal widespread soul-searching in anticipation of a potential fight. Officials and delegates described weighing their personal preference with the need to rally around a candidate going into the general election. Party faithful are steeling themselves for a battle, not just for the nomination, but also for the party's core values. A contested convention would pose a major test for Trump's campaign, which thus far has eschewed a traditional grassroots organization. His rivals, Cruz and Ohio Governor John Kasich, are already trying to lobby delegates who might be open to changing sides once they are allowed to become free agents in the convention. In every state, the party chair and two national committee members, a man and a woman, are automatically selected to be delegates. But from there, state parties use a wide variety of procedures to pick delegates, most of whom won't be named until late spring or summer. "These are the base of the party," said Michigan Republican Party chairwoman Ronna Romney McDaniel. "The delegates are not the establishment. They are the base. And I think that's a great misunderstanding." Often sporting outfits with homemade decorated hats or jackets weighed down with dozens of buttons, delegates who show up every four years include everyone from lawmakers to homemakers, and from those who write million dollar checks to retirees who make phone calls. Many states use small conventions to pick delegates, many of whom are long-time party activists and elected office holders. Not all of them personally back the candidate they are pledged to support in the first round of convention voting, said Virginia Republican Party chairman John Whitbeck. Jim Carns, a state representative from Alabama, where delegates are selected in the primaries, signed up to represent Trump last fall -- when many still viewed the rise of the New York real estate mogul as a temporary phenomenon. He sees no circumstance in which he would switch candidates. * * * Right. Jim Carns, who pledged himself to Trump last year wouldn't drop his support "under any circumstances." And how about Mark Strang, the Cruz delegate? Well, let's go to Mark himself for the answer: "I am going to be loyal to Ted Cruz, and I will stick with him until I see if there's no hope. And if there's no hope for Ted getting in, as I understand it I can pledge my votes to somebody else, and I would hope Ted would understand." We're sure he will Mark. We're sure he will.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The New New 'Deal' - "Markets Are Too Important To Be Left To Investors" Posted: 18 Mar 2016 05:10 PM PDT Submitted by Ben Hunt via Salient Partner's Epsilon Theory blog, Five Easy Pieces for the World-As-It-Is

Our story so far... In the second half of 2014, export volumes in every major economy on Earth began to decline, the result of divergent monetary policies that crystallized with the Fed’s announced tightening bias in the summer of 2014. This decline in trade activity – which is far more impactful than a decline in trade value, because it means that the global growth pie is structurally shrinking – accelerated in 2015 and 2016 as Europe and Japan intentionally devalued their currencies to protect their slices of the global trade pie. In game theoretic terms, Europe and Japan have been “free riders” on the global system, using currency devaluation to undercut the prices of competing US and Chinese products in a way that avoids domestic political pain. But if there’s an iron law of international politics, it’s this: once the strategic interaction between nations begins to shift from cooperation to competition, once a principal player decides to defect and go for free rider benefits, then the one and only equilibrium of the new game has ALL principal players abandoning cooperation and competing with each other. Moreover, once one principal player begins to compete with a new and terrible weapon (i.e., mustard gas in World War I or negative interest rates in monetary policy or Trump-esque debate tactics in a Republican primary), then all principal players must adopt those tactics or lose the game. Universal competition is a highly stable equilibrium, both on the international stage and the domestic stage, particularly in the way it plays out in domestic politics, where there is never a shortage of populist politicians ready and willing to blame global trade for a host of ills. And because universal competition is such a stable equilibrium, typically only a giant crisis – one that shakes the principal players to their domestic political cores – gets you back, maybe, to a Cooperative game. Hmm … here’s what the World Trade Organization (the gold standard in the field) says about seasonally-adjusted quarterly export volumes in the four economies that matter for international relations. The chart below starts with the low-water mark of all four geographies in Q1 2009, draws a line to the respective high-water marks hit in the second half of 2014, and then connects to the current index value. I find this sort of minimum-to-maximum-to-current data representation to be a very effective way of isolating inflection points in data series that should (if all is well with the world) grow at a pretty steady linear clip. And no, that’s not an error in the Japan and China graphs. Both countries' export volumes peaked more than 5 years ago, essentially flatlined (a dip and recovery around the European crisis of 2012 not shown), and rolled over in late 2014. It’s pretty stunning, right? This is the primary reason why I think Japan gets no respect with their monetary policy experiments, and why I think we are already past the event horizon for China to float or otherwise devalue their currency. China has been trying to jumpstart industrial production growth for years now, nothing has worked, and the downturn since Q3 2014 not only puts them embarrassingly behind both the US and Europe in export activity, but also gives the lie to the idea that they can stimulate their way out of this.

To paraphrase George Soros, I’m not expecting a shrinking of the global trade pie and an expansion of competitive, protectionist domestic policies; I’m observing it. Something derailed the global trade locomotive in the second half of 2014, and it doesn’t take a genius to figure out that this something was divergent monetary policy, with the Fed embarking on a public quest to tighten, and the rest of the world doubling down on monetary policy easing. This is Exhibit 1 to support the case that we've entered a new, more competitive international political environment, as all four major global economies suffer a simultaneous contraction in trade volumes. I'm often asked what would need to happen for me to change my structurally bearish views about the world. So here you go. If this chart changes, then my views will change. As you can see, the published WTO data currently goes through Q3 2015. Now maybe the Q4 2015 WTO data will come out and show a new high-water mark for these principal players in the global economy. But I don’t see how. First, I've looked at Q4 year-over-year trade values in local currency. Not a perfect measure of volumes, but indicative. The US, Japan, and China are all clearly down year-over-year in Q4; it’s hard to tell for the EU without including intra-EU trade. Second, I've looked at the raw data of container volume in the major ports in the world. 2015 data isn’t available for China and Japan, but partial data is available for the largest EU port (Rotterdam) and full data for the largest two US ports (Los Angeles and Long Beach). Rotterdam is down a little in 2015 total volumes; Los Angeles and Long Beach are down a lot in export volumes, with the declines accelerating in Q4 (partially labor issues, but still). Want more? Read this FT article on structural shifts in global trade. Read this WSJ article on the expanding January US trade deficit driven by disappointing exports, or this WSJ article on enormous new US tariffs on Chinese cold-rolled steel (while you're at it, look who the biggest direct beneficiary of these tariffs is: Indian mega-billionaire Lakshmi Mittal ... I swear to god, you can't make this stuff up ... and you wonder why Bernie Sanders strikes a chord with his message?). Take a look at Chinese electricity consumption data for 2015 (highly correlated with industrial production) and tell me that we're not seeing continued declines. How, then, do consensus sell-side analysts claim that global trade volumes are increasing? Two ways. First, they include countries that don’t matter, like Canada and Brazil. Sorry, my friends to the north and south, but you can increase your export volumes all you like and it matters not to the Great Game. Second – and this is the really egregious data interpretation mistake – they report global trade growth by including intra-EU trade! It’s a statistic that the WTO reports (as they should), and they include it in their aggregated global trade number (as they should). But if you can’t see that you need to back this number out if you’re trying to understand the strategic interaction between central banks … if you can’t see that intra-EU trade is as extraneous to this analysis as trade between Texas and California … well, I really don’t know what to say. Now even though I think it's totally disingenuous to claim that all is well with global trade volumes, I will be the first to admit that all is not lost. Yet. First, export volumes have rolled over since the second half of 2014, but they haven't collapsed, certainly not in the US, anyway. Export values, on the other hand, have taken a nose dive, particularly in the US (the total value of merchandise goods exported by the US is currently off more than 15% from its high-water mark). Keep in mind, though, that I don’t think that a decline in export values is as much of an emergency alarm as a decline in volumes. Why? Because a decline in export values impacts industrial sector earnings, while a decline in export volumes impacts actual industrial sector production. I think this is exactly why we’ve seen an earnings recession in the US, particularly in any sector with a connection to trade, but not a jobs recession. When export values decline, companies are missing their revenue targets. When export volumes decline, companies are shutting down factories. This is the big question I have for the US economy: will export volume declines start catching up to export value declines? If yes, then I think we’re going to have a “real” recession. If no, then I think we’re likely to muddle through in the real economy. Second, it’s not like you can hide the fact that this enormous barge called global trade has reversed course over the past year and a half, and it’s not like central bankers or the IMF are oblivious to what’s going on. They’re going to respond, and who knows, maybe they’ll be successful in turning this barge back around. I don’t think they have the proverbial snowball’s chance, for reasons I’ll talk about in a second, but they’re certainly going to try. Here’s a chart of the CDS spread (the premium you have to pay to insure your bond against default) for a senior credit index of the 33 largest European financial institutions as of February 8. I used this chart in the Epsilon Theory note “Snikt” to show what it looks like when the claws of systemic risk pop out.

But now here’s a chart of the same CDS spread as of March 11. We’ve retraced the entire move. What happened? Exactly what happened in August 2012, the last time Draghi built up huge expectations for a miracle cure, blew the press conference, and had to be bailed out by the Powers That Be. In short, I suspect that the allocation heads at one or two European mega-insurance firms were informed that they would be supporting risk assets, I can observe how the Narrative machine got into gear, and I am certain that real world investors do what they always do, they play the Common Knowledge Game. Hopefully, if you’ve seen this movie before, you traded around the spike in February, got out of the position entirely, and are looking for a reprise. Is there some reality to what the Narrative machine is pumping out? Sure, there always is. I think we have to take seriously the idea that the G-20 Shanghai meeting of the world’s central bankers and finance ministers in late February was more productive than anyone thought, and that maybe the joint communiqué calling for fewer beggar-thy-neighbor currency devaluations is a temporary truce of sorts. What would this truce look like? China agrees to give it the old college try one more time with domestic credit expansion and money printing, in an effort to replace feeble foreign demand for their products with goosed-up domestic demand and fiscal deficit spending. Europe agrees to lower its negative rates as little as humanly possible, and instead concentrate on good old-fashioned asset purchases. The US agrees to sit on its hands for a while with any more rate hikes, and Japan agrees to sit on its hands for a while with any more rate cuts. Sounds like a plan to me. So we’re in the early days of a perfectly investable rally, driven by a plausible Narrative of central bank cooperation on currencies. Reminds me for all the world of September 2007, right after every quant-oriented multi-strat fund in the world was gob-smacked in July and August (and if you’ve seen the returns for quant-oriented multi-strat funds this January and February you’ll get my point). We had a perfectly investable rally then, too, driven by the Bernanke Narrative that the sub-prime crisis was “contained” and that the real economy was just in a “mid-cycle slow-down”. All good, until Bear Stearns was taken out into the street and shot the following March. Which was itself followed by a perfectly investable rally from April to mid-summer 2008, under the pervasive Narrative that “systemic risk was off the table.” Until it wasn't. So forgive me if I call this a temporary truce, an investable rally before the next “shock” that no one sees coming. Forgive me if I note that yet another FT puff piece on the unappreciated genius of Mario Draghi is ultimately small comfort given that we are smack-dab in the middle of an endemic of political polarization and anti-liberal sentiment (that’s small-l liberalism, of course, the Adam Smith and John Locke sort), the sort of political plague that the world hasn’t seen since the 1930s.

We are now in a world where principled politicians are called fascists, and fascist politicians are called principled. In most Western countries, we are one Reichstag Fire away from a complete up-ending of the core liberal principles of limited government and individual rights. At least the ascendant candidates on the right have the guts, for the most part, to wear their authoritarianism on their sleeves. The other side of the political spectrum, equally ascendant, is no less anti-liberal, they’ve just adopted the façade of smiley-face authoritarianism. Politics always trumps economics, and until someone can show me that the structural advance in anti-liberal politics is any less pronounced than the structural decline in global trade volumes, I can’t get away from my structurally bearish views about this market. Or about this world, for that matter. So what do we do about it?

After all, as fictional gangster Hyman Roth, patterned after real-life gangster Meyer Lansky, would say, “This is the business we have chosen.” It’s all well and good to bemoan the thin gruel we are served in modern politics and markets, but it’s the only food we’ve got, and we have a responsibility to make the most of it. I've got some ideas, but to be useful, these ideas need to fit the reality of the investment world and the business we have chosen. Let's talk about that for a minute. I think that many investors, allocators, and financial advisors today find themselves in the position of Bobby Dupea, the character played brilliantly by a young Jack Nicholson in “Five Easy Pieces.” In that movie's iconic scene, Bobby just wants to get a side order of wheat toast with his breakfast at the local diner. But he is faced with what game theorists call a Hobson's Choice, which is part of a more general class of games that includes ultimatums and dilemmas. A Hobson's Choice is best understood as a strategic interaction where you are presented with what at first glance seem to be multiple opportunities for free will and free choice, but where in truth you only have a single option. Bobby has an entire menu to choose from, and the diner makes toast for sandwiches all day long, but it is impossible – despite a smart proposal of pair trades and long/short exposures that would isolate the wheat toast factor – for Bobby to get what he wants. He can have an omelet with a roll, or he can have nothing. Those are his true choices. A Hobson's Choice is Henry Ford telling you that you can have your Model-T in whatever color you like, so long as it's black. A Hobson's Choice is a Klingon telling you to surrender or die. A Hobson's Choice is Vito Corleone making you an offer that you can't refuse. Today we have what appears to be a wide-ranging menu of investment strategies and ideas to choose from. But like Bobby Dupea, our true range of choices turns out to be terribly limited if we show the least preference for something that goes against the grain of conventional wisdom. Specifically, the dominant conventions of modern investment are "stocks for the long haul", "you can't time markets", "focus on the fundamentals", and "buy quality". Everything you order from the investment menu has these conventional items embedded within them, and the more you question the conventional wisdom (not that it's all wrong or a big lie, but simply to inquire whether the conventional wisdom is perhaps less useful in unconventional times, and maybe – just maybe – you might want to have some wheat toast with your omelet) the more you risk getting kicked out of the diner. The Hobson's Choice that nearly every investor, allocator, or financial advisor faces today is always some variation of the famous quote from John Maynard Keynes: it's better for your reputation (i.e., your business) to fail conventionally than to succeed unconventionally. Every investment professional I've ever met – every. single. one. – wrestles with this dilemma. So do I. We've all seen examples in our portfolio results that the conventional tools aren't working. We know that the words we hear from our Dear Leaders and the articles we read from our Papers of Record are designed to manipulate and entertain us, not inform us. We want to succeed, and we feel in our gut that we should be trying something new and (maybe) better. But not if it means losing our clients or losing the support of our Board or losing the support of that little voice of convention inside each of our heads. It's that last bit that's probably the most powerful. As George Orwell so correctly observed about human psychology, the most terrifying part of hearing Big Brother say that two plus two equals five isn't that they might kill you for believing otherwise, but that you think they might be right! And make no mistake about it, our Hobson's Choice is getting worse. Investing according to conventional wisdom has always been the reputationally safe decision, but in the policy-controlled markets to come, investing according to conventional wisdom may well be the only legally safe decision. So here's what I'm not going to do. I'm not going to discuss "alternative strategies" that are always set off to the side in a little section of their own on an investment menu, intentionally organized and presented as if to say "Careful now! Here are some exotic side dishes that you might use to spice up your core portfolio a bit, but you'd be crazy to make a | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Crude Oil Fractals & Funding Fears Posted: 18 Mar 2016 04:55 PM PDT Submitted by Jeffrey Snider via Alhambra Investment Partners, From June 2014 until late January 2015, oil prices (WTI) fell about 60%. From June 2015 until late January 2016, oil prices (WTI) fell about 60%.

The exact track each annual trading history took to achieve those results is different (2014-15 much more straight ahead and persistent; 2015-16 jagged and irregular), but you can't deny the repetition in both the amount of time and the ultimate scale of the collapse. To my personal view, such self-similarity (fractal) is funding and "dollar." The rebound after the latest "dollar" run is so far more quick and intense, but it remains to be seen whether that will make any difference. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jim Rickards – Cyber financial warfare, Fed balance sheet, gold price, windfall tax on gold Posted: 18 Mar 2016 04:38 PM PDT Jim Rickards – Cyber financial warfare, Fed balance sheet, gold price, windfall tax on gold The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Here's why surging gold miner stocks may still be bargains Posted: 18 Mar 2016 02:41 PM PDT Luzi-Ann Javier Gold-mining companies that are seeing their shares surge the most in decades are still cheap, based on historic measures of their reserves. An index of large producers, including Barrick Gold Corp. and Goldcorp Inc., has gained a whopping 87 percent in the past three months, more than four times the gold-price rally. That's after three years of slumping prices made miners leaner, meaning more of the bullion gains flow through to their bottom lines. While the rally has made shares expensive by traditional valuation metrics such as future earnings, they are still 19 percent cheaper than at the same point last year based on the value of their gold reserves, according to data compiled by Bloomberg. "Despite the rally in gold and despite the increase in the value for the companies, they're still trading at a significant discount to where they've traded in the past," said Ken Hoffman, an analyst at Bloomberg Intelligence in Skillman, New Jersey, said. "Gold doesn't have to get to $1,800 for companies to revisit where they were at their peaks." ... ... For the remainder of the report: http://www.bloomberg.com/news/articles/2016-03-17/here-s-why-surging-gol... ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: Mines and Money Asia http://asia.minesandmoney.com/ Mining Investment Asia http://www.mininginvestmentasia.com/ Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Stocks Tiny Baby Bull Market Posted: 18 Mar 2016 01:51 PM PDT Gold stocks have radically outperformed every other sector in the stock markets this year, blasting higher as investors flock back to gold. This powerful surge is spawning worries that gold stocks’ new bull run is in danger of exhausting itself. But such fears are totally unfounded. A longer-term perspective reveals that gold stocks’ baby bull market in 2016 remains tiny in the grand scheme. This new bull has barely begun. Successfully buying low and selling high to multiply wealth in the markets demands traders overcome their own innate greed and fear. These ever-present emotions are constantly warring in traders’ minds, impairing their judgment. One consequence of heeding these dangerous emotions is the tyranny of the present. Traders naturally tend to overweight the present and forget the past, which leads to poor decisions. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Shenanigans for Option Expiration, Silver Cup and Handle Posted: 18 Mar 2016 01:40 PM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Price Soars 4%, Gold Consolidates On Federal Reserve Posted: 18 Mar 2016 01:30 PM PDT Silver rose 2% yesterday and has surged 4% this week to over $16 per ounce as the Federal Reserve flip flopped regarding interest rates and lowered its expectations for rate rises this year from four back to two or just one rate rise due to “global risks.” | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Islam | Real Truth Behind islam - Full Documentary Posted: 18 Mar 2016 12:59 PM PDT islam | real truth behind islam - Full Documentary The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

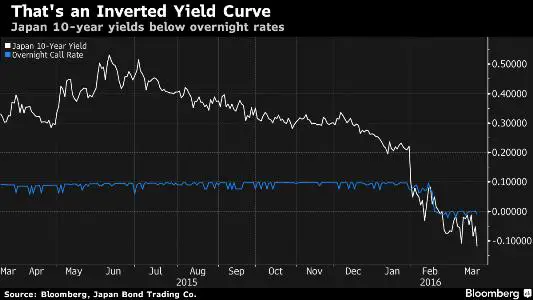

| Posted: 18 Mar 2016 12:39 PM PDT The Bank of Japan and European Central Bank eased recently, which is to say they stepped up their bond buying and/or pushed interest rates further into negative territory. These kinds of things are proxies for currency devaluation in the sense that money printing and lower interest rates generally cause the offending country’s currency to be seen as less valuable by traders and savers, sending its exchange rate down versus those of its trading partners. This was what the BoJ and ECB were hoping for — weaker currencies to boost their export industries and make their insanely-large debt burdens more manageable. Instead, they got this: Both the yen and the euro have popped versus the dollar, which means European and Japanese exports have gotten more rather than less expensive on world markets and both systems’ debt loads are now harder rather than easier to manage. And it gets worse: Japan’s yield curve has inverted, meaning that long-term interest rates are now lower than short-term rates, which is typically a harbinger of recession. From today’s Bloomberg: This sudden failure of easy money to produce the usual result is potentially huge, because the only thing standing in the way of a debt-driven implosion of the global economy (global because this time around emerging countries are as over-indebted as rich ones) is a belief that what worked in the past will keep working. If it doesn’t — that is, if negative interest rates start strengthening rather than weakening currencies — then this game is over. And a new one, with rules no one understands, has begun. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Government Debt Bubble About to Burst Posted: 18 Mar 2016 12:18 PM PDT Global Government Debt TRIPLE What We Thought in Financial System! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Eagle Sales To Jump 25% Due To Deteriorating Market Conditions Posted: 18 Mar 2016 12:00 PM PDT SRSRocco Report | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why Interest Rates Are Never Going Back to Normal Posted: 18 Mar 2016 10:07 AM PDT This post Why Interest Rates Are Never Going Back to Normal appeared first on Daily Reckoning. BALTIMORE – Let's see… U.S. corporate earnings have been going down for three quarters in a row. The median household income is lower than it was 10 years ago. And now JPMorgan Chase has increased its estimated risk of a recession to about one in three. These things might make sober investors wonder: Is this a good time to pay some of the highest prices in history for U.S. stocks? Apparently, they don't think about it… Grotesque MutantsYesterday, U.S. stocks rose again, after the Fed announced that it would go easy on "normalizing" interest rates. The Dow rose 156 points, putting it in positive territory for 2016. Hooray! Investors – at least those who passively track the index – are even for the year. And with more central bank fixes, maybe they'll be able to keep their heads above water for the rest of 2016. Good luck with that! You may recall our prediction: The Fed will NEVER return to a "normal" interest rate. Why not? Many Wall Street analysts say the Fed's move to bring interest rates to a more normal level – after seven years of ZIRP (zero-interest-rate policy) – was "too early." We think it was too late. The Fed has already distorted too much for too long. Its EZ money policies have created a hothouse of speculation, mistakes, and misallocation of resources. The financial plants that grew up in that environment – grotesque mutants that require huge doses of liquidity – cannot survive a change of seasons. But these plants are big. And powerful. Washington… the health care industry… housing… Wall Street… They control the U.S. government, the bureaucracy, and major economic sectors – notably the $1 trillion-a-year security industry. What they need – what the entire economy needs – is a correction. Excess debt must be purged. That's what credit cycles, bankruptcies, and depressions are for. "Normal" includes corrections. But the feds can't let it happen. They've staked their careers – and their fortunes – on the myth that they can tame the credit cycle… and prevent serious setbacks. They're not going to give up now and admit defeat. They're not going to let their major crony friends –or their campaign contributors – go broke. Freaky FinancesYes, the feds created this freakish financial world. They cannot fix it because they want it to stay broken. So what if it doesn't make the typical family better off? It makes THEM – the feds and their cronies in the Deep State – better off. And that's what really matters. In these Diary entries, we have shown how the system has become "extractive" rather than productive. In a normal, healthy economy, people work, save, invest, and build real wealth one dollar at a time. But today's dollar is different. And the economy is different, too. It runs on credit, not real savings, and builds debt – not wealth. Instead of encouraging savings – which is what you need to make progress – it penalizes thrift. Over the past 10 years, U.S. savers have lost nearly $8 trillion, extracted from them by the Fed's ZIRP. While savers were punished, borrowers were rewarded. Since 1980, the U.S. economy has added about $50 trillion in excess debt – above and beyond the real output that can comfortably sustain it. This $50 trillion came not from honest work and saving. Instead, it was conjured up by banks – out of thin air. And now, the productive Main Street economy must pay interest… and principle… on that debt – effectively extracting real wealth from the real economy and sending it to Wall Street and other favored industries. The scam is so elegant that not one person in 1,000 understands how it works. We've been studying it for years, and we're still in awe. But the result is obvious: Honest working people struggle to stay in the same place, as real wealth goes to the elite. Scammy PoliciesThe plain people may not understand it, but they don't like it. And they count on Donald J. Trump to do something about it. Alas, even the best swindle runs into trouble. The debt burden crushes the life out of the real economy. Productive sectors sink into the mud. Manufacturing disappears. Business slows. Trade slows. Borrowing slows. And soon, the feds are paying people to borrow! As Chris Lowe reported in Wednesday's Market Insight, about one-third of developed country government debt – worth roughly $7 trillion – is now trading at negative yields. And then, even more elegance… With the world economy slowing down, central banks adapt to the world they created. How? With more scammy policies. "Global risks bring Fed into line… ," reads a headline in yesterday's Financial Times… The Federal Reserve has scaled back its forecasts for lifting interest rates this year, coming closer into line with market expectations for two quarter-point rises as it flagged up risks to the U.S. outlook from global, financial, and economic developments. See how it works? Central banks destroy the real economy with cheap money and extractive policies. Then, as the economy slumps, they need to bring their policies in line with the slumping economy. They need to swear off raising rates back to normal. And since their policies can never produce real prosperity, they can never produce an economy that can support normal interest rates. Normal? Forget it. Eventually, normal will make a comeback. But not because the Fed wants it. Instead, the markets will normalize – brutally – over the Fed's dead body… … Which is just the way we'd like it. Regards, Bill Bonner P.S. Be sure to sign up for The Daily Reckoning — a free and entertaining look at the world of finance and politics. The articles you find here on our website are only a snippet of what you receive in The Daily Reckoning email edition. Click here now to sign up for FREE to see what you're missing. The post Why Interest Rates Are Never Going Back to Normal appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ECB's bazooka has not run out of ammunition, chief economist says Posted: 18 Mar 2016 08:23 AM PDT By Szu Ping Chan The European Central Bank is prepared to slash interest rates deeper into negative territory if the economic outlook deteriorates, according to its chief economist. The economist, Peter Praet, insisted that the central bank had not run out of ammunition as he left the door open to pumping cash directly into the real economy through so-called "helicopter drops." "If new negative shocks should worsen the outlook, or if financing conditions should not adjust in the direction and to the extent that is necessary to boost the economy and inflation, a rate reduction remains in our armory," he told Italian newspaper La Repubblica. "We have not reached the physical lower bound" on rates. Underscoring the ECB's determination to drive inflation back up to its target of just below 2 percent, Mr. Praet did not rule out printing money and giving it away to households. ... ... For the remainder of the report: http://www.telegraph.co.uk/business/2016/03/18/ecbs-bazooka-has-not-run-... ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. Join GATA here: Mines and Money Asia http://asia.minesandmoney.com/ Mining Investment Asia http://www.mininginvestmentasia.com/ Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Mad World of Donald Trump 2016 - Leftist MSM Documentary Posted: 18 Mar 2016 08:16 AM PDT The Mad World of Donald Trump in a new Channel 4 documentary that follows the campaign of the presidential hopeful around the country. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| India's gold paperizing scheme strains for its fourth tonne of metal Posted: 18 Mar 2016 08:13 AM PDT Mumbai's Siddhivinayak Temple to Mobilize Gold as India Scrambles to Cut Imports By Rajendra Jadhav, Sankalp Phartiyal, Neha Dasgupta, and Krishna N. Das The 200-year-old Shree Siddhivinayak temple in Mumbai has said it will deposit a portion of its gold hoard with a bank by the end of the month for recycling, responding to a government campaign to monetize some of the country's thousands of tonnes of privately owned stocks of gold and to cut costly imports. Officials from finance ministry and the Reserve Bank of India met today to discuss modifying the much-publicized scheme after managing to attract deposits of only three tonnes of gold in four months out of an estimated pool of 20,000 tonnes stacked away in family lockers and temple vaults. ... ... For the remainder of the report: http://in.reuters.com/article/india-gold-siddhihvinayak-temple-idINKCN0W... ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers: To invest or learn more, please visit: Join GATA here: Mines and Money Asia http://asia.minesandmoney.com/ Mining Investment Asia http://www.mininginvestmentasia.com/ Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Comex Gold Rigging – Fact or Myth? Posted: 18 Mar 2016 08:09 AM PDT The U.S. gold market is second, after the London gold market, as the most important center for gold trading. Although the U.S. has a well-developed OTC spot market for gold, it primarily trades paper gold, i.e. gold derivatives (futures and options) and ETFs. The first gold futures market was established in Winnipeg, Canada, at the Winnipeg Commodity Exchange in 1972, but when private gold trading again became legal in the U.S. a few years later, Americans jumped at the opportunity and opened their futures markets. In December, 1974, the Commodity Exchange Inc. (Comex), launched gold futures trading and quickly gained a dominant position. Although the volume built up slowly, the trading expanded and Comex launched gold option trading in 1982 (options are on gold futures, not on the bullion itself). In 1994, Comex merged with the New York Mercantile Exchange (Nymex), officially becoming its division responsible for metal trading. Since 2008, Nymex and Comex have been owned and operated by the CME Group, the largest derivatives marketplace in the world. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Financial letter writer, mining investor Ian McAvity dies Posted: 18 Mar 2016 05:54 AM PDT 8:53a ET Friday, March 18, 2016 Dear Friend of GATA and Gold: Toronto-based financial letter writer and mining industry investor and executive Ian McAvity died this week, according to an announcement by Duncan Park Holdings Corp., which he served as president and chief executive officer: http://www.marketwired.com/press-release/duncan-park-announces-the-passi... McAvity's letter, Deliberations on World Markets -- http://www.topline-charts.com/Deliberations.htm -- was well-read and he was a prominent figure in the industry for many years. CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver Coins and Rounds with Employee Pricing and Free Shipping Grab your Silver Starter Kit at cost from Money Metals Exchange, the company named "Precious Metals Dealer of the Year" by industry ratings group Bullion Directory. Simply go to MoneyMetals.com and type "GATA" in the radio box at the top of the page. This special silver offer contains 4 ounces of silver coins and rounds in the most popular 1-ounce, half-ounce, and 10th-ounce forms. Claim yours now, because GATA readers get employee pricing and free shipping. So go to -- -- and type "GATA" in the radio box at the top of the page. Join GATA here: Mines and Money Asia http://asia.minesandmoney.com/ Mining Investment Asia http://www.mininginvestmentasia.com/ Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 17 Mar 2016 05:00 PM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Oil Prices Rally to 2016 Highs on Weaker Dollar Posted: 17 Mar 2016 05:00 PM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 17 Mar 2016 08:59 AM PDT "The main thing is that the debt is in dollars. So we can't run out of cash--we print the stuff. Suppose that foreigners decide we're not reliable. How does that drive up interest rates? The Fed controls short-term interest rates, and long-term interest rates reflect expected short rates. How's that supposed to happen?" Paul Krugman, Interview on CNNMoney Well, at least now we know why gold was knocked down lower in the paper trading earlier this week. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Gold rallied on the back of the Federal Reserve's decision to lower interest rate expectations for 2016, with many economists and analysts forecasting the metal will register a year-over-year increase.

Gold rallied on the back of the Federal Reserve's decision to lower interest rate expectations for 2016, with many economists and analysts forecasting the metal will register a year-over-year increase.

No comments:

Post a Comment