saveyourassetsfirst3 |

- 9 Signs That 2016 Looks Ominously Like 2008 Just Before the Crisis

- Speculative Traders Cut Gold Long And Short Positions - Is Gold Still Overbought?

- Precious Metals Ignore Correction Calls

- Valeant (VRX) Is Now Selling “Furniture” To Keep The Lights On

- End-of-week top gold stories

- Gold Daily and Silver Weekly Charts - Shenanigans for Option Expiration, Silver Cup and Handle

- Cartel Tries to Paint the Tape Right Off Huge Move in Gold!

- Precious Metals Ignore Correction Calls

- China’s 7,000 Year Old Strategy Hints That A Massive Move Is Coming : “Largest Gold Rally Of Our Lifetime… It Will Go Ballistic”

- Crumbling U.S Empire Drives Russia & China To Move Into Gold

- Jim Willie Issues Alert: “Systemic Lehman Event Is In Progress”

- Rickards: Why Gold Is Going To $10,000

- Harvey Organ: The Next Bombshell Hits!

- Bo Polny Releases: “THE FINAL COUNTDOWN”

- Trend Forecaster Gerald Celente Warns: Prepare For The Panic Of 2016: “History Will Remember This”

- Comex Gold Rigging – Fact or Myth?

| 9 Signs That 2016 Looks Ominously Like 2008 Just Before the Crisis Posted: 19 Mar 2016 01:00 PM PDT Simply put, the bubble is just as insane as in 2008, but much bigger. And the financial establishment has no ammunition to fight it. Submitted by Simon Black, Sovereign Man: If you haven't seen the 2015 Best Picture nominee, The Big Short, I strongly recommend it. The Big Short is based on Michael Lewis' […] The post 9 Signs That 2016 Looks Ominously Like 2008 Just Before the Crisis appeared first on Silver Doctors. |

| Speculative Traders Cut Gold Long And Short Positions - Is Gold Still Overbought? Posted: 19 Mar 2016 12:59 PM PDT |

| Precious Metals Ignore Correction Calls Posted: 19 Mar 2016 07:09 AM PDT The Daily Gold |

| Valeant (VRX) Is Now Selling “Furniture” To Keep The Lights On Posted: 19 Mar 2016 07:00 AM PDT VRX is entering the "IDS" stage of business failure – the "Irreversible Debt Spiral"… Buy Gold Eagle Coins and Bars at SD Bullion Submitted by PM Fund Manager Dave Kranzler, IRD: Valeant stock is down another 10% today. I'm wondering if some of the Wall Street Journal writers are reading this blog because the WSJ published […] The post Valeant (VRX) Is Now Selling "Furniture" To Keep The Lights On appeared first on Silver Doctors. |

| Posted: 19 Mar 2016 01:55 AM PDT USA Gold |

| Gold Daily and Silver Weekly Charts - Shenanigans for Option Expiration, Silver Cup and Handle Posted: 18 Mar 2016 02:50 PM PDT Le Cafe Américain |

| Cartel Tries to Paint the Tape Right Off Huge Move in Gold! Posted: 18 Mar 2016 02:18 PM PDT With Massive Movements In Gold & Silver This Week, Craig Hemke Joins the Show to Break Down All the Action, Discussing: Paper Gold Manipulation Play By Play: Hemke Walks Investors Through the Last 5 Sessions in the “Gold” Market The End Game? “Silver’s Gonna Be A Little Higher Than $16…“ This Game Is Moving Toward THE […] The post Cartel Tries to Paint the Tape Right Off Huge Move in Gold! appeared first on Silver Doctors. This posting includes an audio/video/photo media file: Download Now |

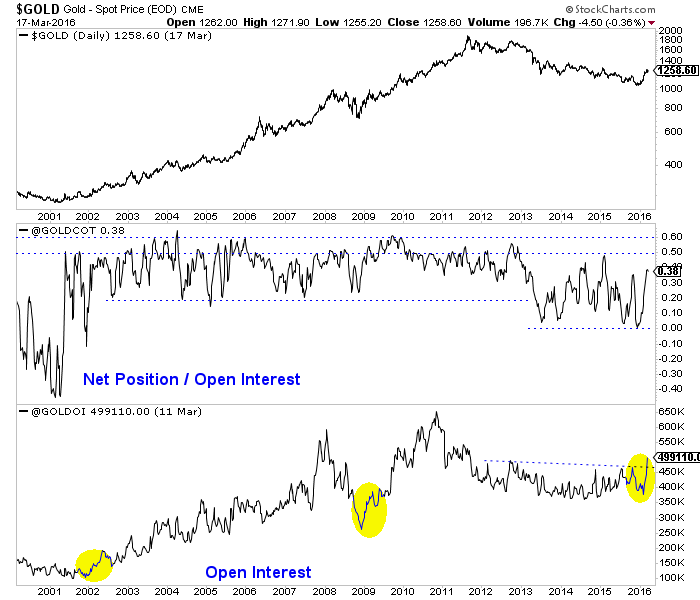

| Precious Metals Ignore Correction Calls Posted: 18 Mar 2016 02:17 PM PDT Gold and gold stocks have refused to correct for more than a few days at a time. Weakness is being bought and quickly. Gold has gained over $200/oz but not corrected by more than 6%. The miners (GDX) have endured three roughly 10% corrections in the past six weeks but nothing greater. A few weeks ago we noted a comparison to the 2008 rally which hinted that miners could correct 20% before moving higher. So far, no dice. Many gold bulls continue to expect a correction while losing sight of the bigger picture: precious metals are in a new bull market. Many have expected a correction due to the CoT, which shows a net speculative position of 37.6% of open interest. While this figure appears high, we should note that from 2001 through 2012 the net speculative position often peaked from 50% to 60%. Moreover, everyone has completely missed the rise in open interest, which reached a more than 4-year high! Open interest is not a leading indicator but a confirming indicator. Strong increases in open interest validate the strong increases in Gold. The recent increase in open interest mirrors the increases that followed the 2001 and 2008 lows in Gold.

Gold & Gold CoT

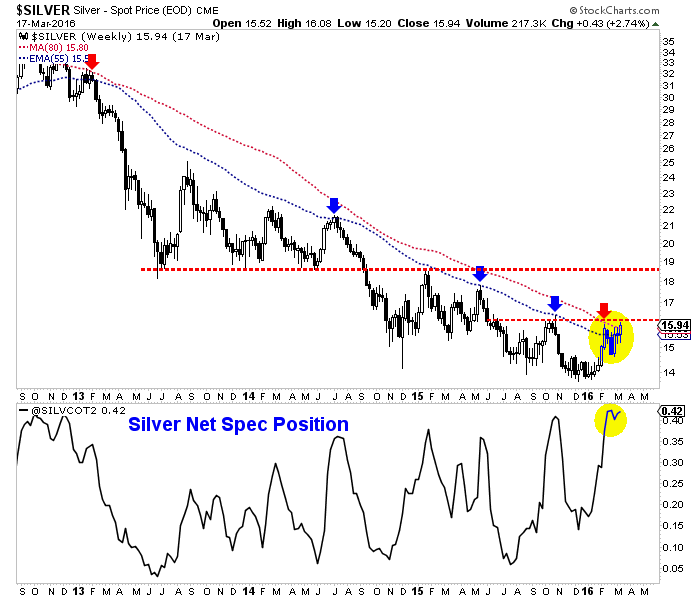

Silver is also defying "conventional" CoT analysis. In recent weeks, Silver's net speculative position of 43% actually was the highest in more than 5 years! That means Silver has to decline, right? While Silver hasn't broken above $16/oz yet, it closed above its 80-week moving average (by a penny) for the first time since 2012. Moreover, the recent strength in Silver stocks strongly argues that Silver will move higher. Look for an upside target in the mid to high $18s.

Silver & Silver CoT

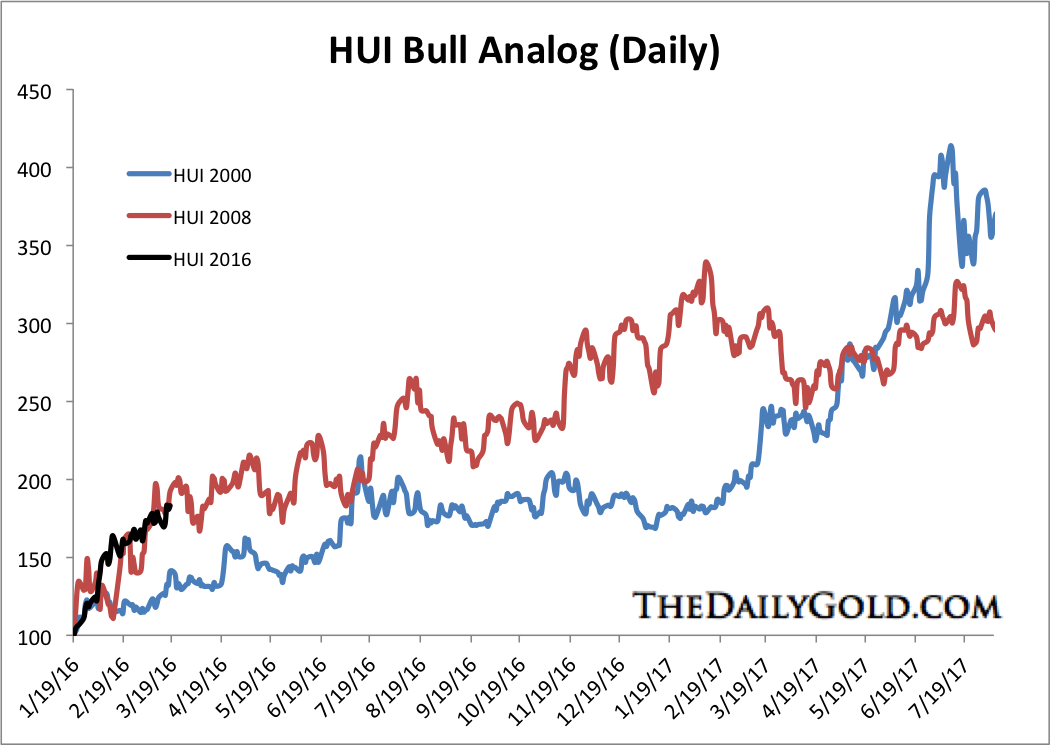

There are two problems with the recent, widespread conventional analysis of the CoT. (By the way you can't swing a dead cat without hitting a "bearish CoT" article or blog post in the past few weeks). First, bullish and bearish parameters have to adjust during a trend change. In a bear market sentiment usually reaches "extremely bearish" before that market can rebound. Also, even neutral or slightly bullish sentiment is enough to bring about more selling. In a bull market it is the opposite. Sentiment can get really bullish before that market corrects. The second point is sentiment analysis can be tricky and counterproductive when a market has just made a major trend change. An extreme sentiment reading during a brand new bull trend is often a false signal because the majority remain on the sidelines. This is why new bull markets recover quickly and remain overbought for months amid bullish sentiment. Here are some examples. Recall the huge moves equities made from the 2002 and 2009 lows. Following its 2002 low the Nasdaq rebounded 94% in 15 months and only endured one real correction (15%). Following its 2009 low the Nasdaq rebounded roughly 100% in 13 months and never corrected more than 9%! Gold, following its 1976 low rebounded roughly 62% over the next 15 months and its worst correction was 11%. Gold from its 2008 low rallied roughly 45% in five months and only endured one 10% correction. Where are we now? As we noted last week, if Gold follows the path of the 1976 and 2008 rebounds then it would soon reach $1400/oz and continue to reach higher levels in the months and quarters ahead. Meanwhile, the gold stocks are certainly overbought but history argues they could trend higher in the months ahead. Note the bull analog chart below. If the HUI follows its 2008 path then it would gain 46% over the next five months and 88% over the next 11 months. If the HUI follows its path after its 2000 bottom then it would rally 128% over the next 16 months.

HUI Bull Analog

While it is very difficult to buy into a market that has already gained substantially, history argues that the larger risk is staying out of that market especially if it only recently made a major bottom. The epic "forever" bear market of 2011-2015 lingers in the minds of many and that is why it is so difficult to believe the recent strength can continue. Hence, many continue to apply bear market thinking and bear market parameters without realizing the sector has made a major character change. That doesn't preclude the likelihood of pullbacks. We even made a solid case two weeks ago for GDX to correct 20%. It will come to pass soon or later. Going forward, look to accumulate select shares on weakness. Buy and hold. You don't make money in a bull market by trading. Consider learning more about our premium service including our favorite junior miners which we expect to outperform in 2016.

Jordan Roy-Byrne, CMT

|

| Posted: 18 Mar 2016 02:02 PM PDT THIS explains China's long-term strategy to liquidate their dollar holdings and implement a gold-backed currency: Submitted by Mac Slavo, SHTFPlan: Up until January, the majority of people assumed that governments and central banks had everything under control. Zero-Interest and Negative-Interest rate policies coupled with unprecedented monetary printing appeared to have stabilized the economy and financial markets. […] The post China's 7,000 Year Old Strategy Hints That A Massive Move Is Coming : "Largest Gold Rally Of Our Lifetime… It Will Go Ballistic" appeared first on Silver Doctors. |

| Crumbling U.S Empire Drives Russia & China To Move Into Gold Posted: 18 Mar 2016 02:00 PM PDT Central bankers have been on a massive Gold Buying Spree led by Russia and China. One must remember that not only is Putin ex-KGB, but he is also an economist and holds a black belt in judo. Judo teaches you to use your opponent's momentum to defeat him or her, and that appears to what […] The post Crumbling U.S Empire Drives Russia & China To Move Into Gold appeared first on Silver Doctors. |

| Jim Willie Issues Alert: “Systemic Lehman Event Is In Progress” Posted: 18 Mar 2016 01:45 PM PDT “A systemic Lehman event is in progress…” Submitted by Jim Willie, GoldenJackass: The current monetary policy is stuck in place. It is highly destructive to banking systems, working capital, and financial markets. Yet it continues ad infinitum, actually until the great collapse. A systemic Lehman event is in progress, as the global financial structure is […] The post Jim Willie Issues Alert: “Systemic Lehman Event Is In Progress” appeared first on Silver Doctors. |

| Rickards: Why Gold Is Going To $10,000 Posted: 18 Mar 2016 01:35 PM PDT Jim Rickards believes a cocktail of factors makes it more critical than ever for investors to protect their portfolios with gold, and in the interview below, explains why the royal metal is going to $10,000/oz… The post Rickards: Why Gold Is Going To $10,000 appeared first on Silver Doctors. |

| Harvey Organ: The Next Bombshell Hits! Posted: 18 Mar 2016 01:16 PM PDT The next bombshell to hit: A WHOPPING 11.89 TONNES "ADDED" TO GLD/JAPANESE EXPORTS COLLAPSE/CHINA'S SHADOW BANKING PEER TO PEER LENDING IS IMPLODING/SYRIAN KURDS TO SET UP THEIR OWN STATE ON THE BORDER WITH TURKEY AND THUS ERDOGAN'S WORST NIGHTMARE/CHAOS IN BRAZIL AS JUDGE RELEASES WIRETAPS INDICATING ROUSSEFF HIRED LULA AS CHIEF OF STAFF […] The post Harvey Organ: The Next Bombshell Hits! appeared first on Silver Doctors. |

| Bo Polny Releases: “THE FINAL COUNTDOWN” Posted: 18 Mar 2016 01:02 PM PDT Complete with Europe’s anthem to make things official, Bo Polny warns: “The Greatest Wealth Transfer in History is Set to Begin…“ The post Bo Polny Releases: “THE FINAL COUNTDOWN” appeared first on Silver Doctors. |

| Trend Forecaster Gerald Celente Warns: Prepare For The Panic Of 2016: “History Will Remember This” Posted: 18 Mar 2016 12:55 PM PDT There's not going to be anything to pump it back up because they've blown all their ammunition… Silverbug Island 2nd Release The Kraken Submitted by Mac Slavo, SHTFPlan: Earlier this week hedge fund manager Marin Katusa explained that up until the recent stock market hit all the easy money flowing into the energy sector was […] The post Trend Forecaster Gerald Celente Warns: Prepare For The Panic Of 2016: "History Will Remember This" appeared first on Silver Doctors. |

| Comex Gold Rigging – Fact or Myth? Posted: 18 Mar 2016 05:47 AM PDT SunshineProfits |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment