saveyourassetsfirst3 |

- Fund Manager: New Bull Market For Mining Stocks May Be Underway

- Trade Balance, Oil, And China Present Worries For The Australian Economy And Dollar

- Perth Mint Silver Sales Explode!

- Has the Silver Market Turned?

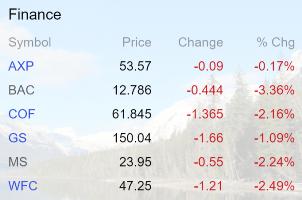

- This Is Really Bad For Banks

- Gold Deficits, Fort Knox, and a Reset

- Connecting The Comex Dots

- The Dark Side of Negative Interest Rates

- Fast Market

- Rob Kirby on DeutscheBank Meltdown & Paper Metals Derivatives

- Gold Stocks: Spectacular Charts In Play – Stewart Thomson

- Gold & Silver – Why Current Prices Don’t Matter

- The Time for REAL Insurance has NEVER Been this Great!

- Gold Bullion Slowly Higher on Oil, Equity Slump as Chinas Mine Output Falls 1st Time Since 1999

- Silver Price Fix – Go “To Jail To Fix The Fix”?

- LBMA 2016 Precious Metal Forecast

- Chinas Silver Demand and a couple of other charts

- Gold Daily and Silver Weekly Charts - More Flight To Safety - Active February

| Fund Manager: New Bull Market For Mining Stocks May Be Underway Posted: 03 Feb 2016 01:00 PM PST The key battles in the “war on gold” are now being won by gold bugs… Submitted by PM Fund Manager Dave Kranzler, IRD: Concerning gold and noting that this is Friday, "they"…and we've no idea who "they" are, but we do indeed know that "they" exist… are out there again making mischief as […] The post Fund Manager: New Bull Market For Mining Stocks May Be Underway appeared first on Silver Doctors. |

| Trade Balance, Oil, And China Present Worries For The Australian Economy And Dollar Posted: 03 Feb 2016 12:06 PM PST |

| Perth Mint Silver Sales Explode! Posted: 03 Feb 2016 12:00 PM PST Record demand for investment grade silver is no longer simply an American phenomenon… Submitted by Smaulgld: January Perth Mint silver sales of 1,473,408 ounces were up 151% year over year. Silver Kangaroo bullion coin continues to drive massive silver sales. January Perth Mint gold sales of 47,759 were up 106% year over year. Silver […] The post Perth Mint Silver Sales Explode! appeared first on Silver Doctors. |

| Posted: 03 Feb 2016 11:00 AM PST Is this a sign that silver’s 5 year bear market has finally TURNED?? Submitted by Keith Weiner, Monetary Metals: The price of the dollar was down 50mg gold, to 27.8mg, or if you prefer 0.04g silver to 2.18g. Why do we measure the volatile dollar in terms of gold and silver? There's nothing else […] The post Has the Silver Market Turned? appeared first on Silver Doctors. |

| Posted: 03 Feb 2016 10:07 AM PST Once upon a time, falling interest rates were great for banks. A lower cost of capital gave lenders access to cheap raw material while causing borrowers to clamber for what banks were selling. Large profits usually ensued. But not now. Rates have fallen past the banks’ sweet spot to levels that just don’t work. Borrowers appear to be spooked rather than energized and trading desks are imploding amid “catastrophic volatility“. See German bond yields collapse below 50bps for first time ever and UBS’s investment bank earnings decline 63% on equities trading. And now yield curves are inverting — that is, long rates are falling below short rates, which means banks’ borrowing costs (the short end of the yield curve) are starting exceed their lending revenue (the long end of the curve). See Japan’s yield curve faces further pounding amid BoJ aftershock and US Treasury yield curve inverts. To add a little spice to the toxic stew, capital controls are coming back into style:

Not surprisingly, US bank stocks are getting whacked. As of 9am on Wednesday Feb 3: Bank of America (BAC) stands out as especially cringe-worthy, having fallen from north of $18 per share to below $13 in just a few weeks: What does all this mean? The broad-strokes answer is that these huge, nearly-omnipotent entities that have dominated and defined the world’s economic and political landscape may finally be receding towards a more reasonable level of power. One way to gauge this is by the rhetoric coming out of the current presidential candidates, all of whom have decided that it’s not just safe, but profitable to bash Wall Street. Dimon, Blankfein, et al are clearly not the bullies they once were. More immediately it means there’s a new black swan in the sky. As a group the world’s biggest banks are leveraged to an extent that probably has the authors of the Glass-Steagall Act spinning in their graves. The notional value of their over-the-counter derivatives books dwarfs the global economy, while their exposure to now-moribund sections of the oil and gas industry guarantees massive write-offs in the year ahead. The question isn’t whether the big banks will report huge losses, but whether one of them will be destroyed in the process, giving us another Lehman Moment. |

| Gold Deficits, Fort Knox, and a Reset Posted: 03 Feb 2016 10:00 AM PST A reset is coming… Submitted by Gary Christenson, Deviant Investor: Everyone knows that government expenses and deficits are out of control. Think U.S., Europe, the U.K., Japan, and others. So what? Borrowing today supposedly brings spending forward from the future, so future spending should be curtailed. It hasn't happened so far. But no government […] The post Gold Deficits, Fort Knox, and a Reset appeared first on Silver Doctors. |

| Posted: 03 Feb 2016 09:30 AM PST Last week, there was a lot of hubbub regarding the record low Comex registered gold inventory. At the time, we suspected that the vault movements were due to December “deliveries”, and today we got our answer… Submitted by Craig Hemke, TFMetals Report: Before we start, please go back and review this article from one week […] The post Connecting The Comex Dots appeared first on Silver Doctors. |

| The Dark Side of Negative Interest Rates Posted: 03 Feb 2016 09:00 AM PST Prepare to be welcomed to the DARK SIDE… Submitted by Smaulgld: Fed Chair Janet Yellen Is A Supporter of Negative Interest Rates. When Janet Yellen was first appointed to the Chair of the Federal Reserve we noted that Janet Yellen was a supporter of negative interest rates. In "Janet Yellen and Negative Interest Rates" we […] The post The Dark Side of Negative Interest Rates appeared first on Silver Doctors. |

| Posted: 03 Feb 2016 08:38 AM PST Boy oh boy, things are moving really quickly this morning. With gold surging through it's 200-day MA and a collapsing USDJPY, there's a lot to cover and very little time to do it. |

| Rob Kirby on DeutscheBank Meltdown & Paper Metals Derivatives Posted: 03 Feb 2016 08:00 AM PST 2016 has begun with a bang and much of the volatility is due to global derivative exposure. With that in mind, what better time than now for an exclusive interview with bond trading and derivative expert, Rob Kirby: Over the course of this 48-minute presentation, Rob Kirby breaks down: The meltdown at DeutscheBank. What could be causing it […] The post Rob Kirby on DeutscheBank Meltdown & Paper Metals Derivatives appeared first on Silver Doctors. |

| Gold Stocks: Spectacular Charts In Play – Stewart Thomson Posted: 03 Feb 2016 07:45 AM PST The chart below is arguably the global financial markets' "chart of the year". The massive bullish wedge pattern in play on this daily bars GDX chart looks truly spectacular. Note how close GDX is to staging a significant upside breakout above the supply line of the wedge! Within GDX itself, many of the component stocks are […] The post Gold Stocks: Spectacular Charts In Play – Stewart Thomson appeared first on Silver Doctors. |

| Gold & Silver – Why Current Prices Don’t Matter Posted: 03 Feb 2016 07:00 AM PST Current gold and silver prices don’t matter. Period. Submitted by ETP: Truth be known, short of an uprising or revolution by the masses, which is highly unlikely, the elites have won over the masses, hands down, and the end game is in the final and irreversible stages. Time and again, we have reiterated the […] The post Gold & Silver – Why Current Prices Don’t Matter appeared first on Silver Doctors. |

| The Time for REAL Insurance has NEVER Been this Great! Posted: 03 Feb 2016 06:50 AM PST Central Banks have LOST CONTROL. The coming global financial crash will be greater than anything ever before seen in history. The time for REAL INSURANCE has never before been this great! Submitted by Bill Holter, JSMineset: Japan announced negative interest rates Friday which caused a bounce in Europe and then in the U.S.. It […] The post The Time for REAL Insurance has NEVER Been this Great! appeared first on Silver Doctors. |

| Gold Bullion Slowly Higher on Oil, Equity Slump as Chinas Mine Output Falls 1st Time Since 1999 Posted: 03 Feb 2016 06:21 AM PST Bullion Vault |

| Silver Price Fix – Go “To Jail To Fix The Fix”? Posted: 03 Feb 2016 04:01 AM PST gold.ie |

| LBMA 2016 Precious Metal Forecast Posted: 02 Feb 2016 11:40 PM PST At the beginning of each year the London Bullion Market Association (LBMA) polls a range of respected precious metals analysts in the large banks and independent consultancies for their forecasts for metal prices for the coming year. This year contributors are "predicting price increases across the board for all four metals". Their forecasts for the average price during 2016 are: Silver – $14.74, ranging from $12.63 to $16.78 Platinum – $911, ranging from $748 to $1,076 Palladium – $568, ranging from $413 to $674 Read more here |

| Chinas Silver Demand and a couple of other charts Posted: 02 Feb 2016 05:18 PM PST Commodity Trader |

| Gold Daily and Silver Weekly Charts - More Flight To Safety - Active February Posted: 02 Feb 2016 03:01 PM PST Le Cafe Américain |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment