Gold World News Flash |

- Gold & Silver: Why Current Prices DON’T Matter

- Guest Post: How The Blockchain And Gold Can Work Together

- USA Watchdog's Greg Hunter interviews Hugo Salinas Price on gold revaluation

- Meet The World Leader Who Stole His Citizens' Gold

- PBOC Strengthens Yuan By Most In 2 Months As Golden Week Looms

- NY Fed prez hints it's one-and-done for interest rate hikes

- Gold figures heavily in Lars Schall's tremendous interview with Ronnie Stoeferle

- SIGNS OF THE END PART 143 - LATEST EVENTS FEBRUARY 2016

- Silver and Gold Price Break Out

- Gold and Silver More 'Flight To Safety' Active February

- Gold Daily and Silver Weekly Charts - Non-Farm Payrolls on Friday

- The Age of Instability

- Is Silver Really a Weak Link

- How to Revive Good Ol’ American Know-How

- Gold to Beat Stocks 2016?

- Silver Price Fix – “Future Of The Fix Is Fraughtâ€

- ZIKA Virus is another Fake Psyop

- Ronald Stoeferle – The Matterhorn Interview Jan 2016

- Our Government Has Gone Insane -- John Mcafee

- Rand Paul Ends 2016 Presidential Campaign

- Armageddon Scenario : What if Putin invaded Latvia & nuked UK?

- This Is Really Bad For Banks

- Japan Cancels Auction On Ten-Year JGB’s

- Japanese central banker claims omnipotence for devaluing currency

- China's gold production falls as demand rises

- Gold to Beat Stocks?

| Gold & Silver: Why Current Prices DON’T Matter Posted: 03 Feb 2016 07:20 PM PST Current gold and silver prices don't matter. Period. by ETP, Silver Doctors:

It is no secret that the US has been covertly responsible for much of the destruction and strife in that area. Where not covertly involved, the US has provided arms and logistics to Saudi Arabia as the Saudis are destroying helpless Yemenis in the proxy war against Iran. None of the bought-and-paid-for Western press is questioning how and why, all of a sudden, Middle Eastern refugees have the money and means to escape to various parts of Greece and Europe, en masse. How is it that black Africans were never able to be in a position to migrate from far worse war atrocities? Unseen forces are behind this.

Problem, refugees, Reaction, growing antagonism of Europeans justifiably against the rabble rousing, sexual assaulting of women, robbing trucks on highways, etc, etc, etc, creating instability in an already weakened EU. The Solution is yet to come, but you know it will entail further weakening of individual freedom and eroding of the ability of individual countries to protect against this politically motivated destabilization of Europe where the elites will strengthen their stranglehold over Europeans via the artificially created European Union. Banks, and now select individual countries, are increasing the call for getting rid of cash altogether, ostensibly to fight terrorists who use cash, the prevention money laundering, and a few other nefarious reasons. The terrorists also use cell phones, but there are no plans to ban cell phones, and perhaps the biggest money launderers, by far, are large banks dealing with drug money to keep their banks afloat. However will the CIA launder all of its drug money from Afghanistan being funneled to support groups like al Qaeda and ISIS? Guess what happens when cash disappears and all so-called "money" becomes digital? "Now that we track and control your money, it would be better if we just deduct all taxes directly from your account," say the bankers. "Is there some reason why you are spending your money on gold and silver? Did you not know these are transactions not favorably looked upon?" Control. It is all about control. Get rid of cash. Get rid of all means of hiding anything from the Orwellian elite governments. Should your spending activities raise questions, or if you hold any kind of dissenting political views, you may find there was an inexplicable computer glitch, and your account has been frozen, or simply disappeared. Try feeding and providing for your family under those conditions. If you do not have, and literally hold gold and silver, or you are waiting for the "right" or a "better" price, how relevant is your reasoning "stacked" up against the increasing odds of what is yet to come? Privacy? You will have none. Right now, governments cannot track whatever gold/silver people hold, and that is unacceptable and it will change. If anyone thinks China and the BRICS nations are going to be a counter move to the Western globalists, think twice. China will become to the elite's East to what the US has been to the elite's West. Now that the elite's controlling bankers have sucked the wealth out of the US and Europe, China becomes their agenda for the next 100 years, or more. Rinse and repeat. China has had a relationship with the Rockefellers for decades. Many Fortune 500 companies have been doing business with China since the late 1980s, early 1990s, and to date. China has been vying to become a member of the IMF for over a decade. What more China has developed a social behavior card for each and every Chinese citizen to monitor their citizen's behavior, much like a report card. Citizens will be graded and/or held accountable for the contents of their behavior code, ensuring each good little citizen is conforming to the Chinese model of what constitutes acceptable behavior and attitudes. China and the BRICS will not be a part of the solution. They will become a greater part of the problem. Anyone who thinks China's massive purchases of thousands upon thousands of tons of gold is for an eventual gold-backed Yuan is not keeping in touch with reality. In addition to a social behavior card, China is also developing its own digital currency. The People's Bank attaches great importance from 2014 to set up This effort is being conducted in concert with the international agencies, foreign financial institutions, and traditional credit card entities. Christine LaGarde, head of the globalist's IMF, has embraced this means of virtual currencies. Welcome to our world, China. Rule or be ruled. That choice was made long ago. What possible relevance can there be to the current artificially suppressed price for gold and silver, in light of all that is going on around the world in full view, with no attempts to hide either motive or intent? If you do not have, or are planning to purchase gold and/or silver, price is not the issue. The US military might and Federal Reserve continue to keep the fiat FRN propped up. The sharp decline, week of 30 Nov '15 noted on the chart, shows greater EDM [Ease of Downward Movement], particularly compared to the labored rally over the next eight weeks. In a strong up trend, ease of movement should be up, and reactions down more labored, so while nearing recent highs, the market is not internally strong. If a new high is to be had, it could be short-lived, but this is not an interpretation for picking a top, just seeking context in this fiat. Beyond gold and silver, the next keen interest, maybe even greater than gold and silver, is oil. The highest monthly volume occurred at an area of support. More than once, we say that increased volume comes about from what we call smart money, controlling market interests. Smart money buys low and sell high, trite but accurate. There is a growing likelihood that this could be the start of a base or rapid turnaround rally in oil. If a base, Viewing these PM charts in a vacuum, ignoring many of the existing factors evolving around the world, a few of which we covered above, absent a surprise sustained rally, gold is not indicating a turn around in its current down trend. It is at an area where some basing can be expected, but there is not sufficient positive activity to say it is happening. As with the analysis of the fiat FRN, there was a shape EDM at the end of October going into November, and the ensuing rally off the November low has been labored with bars overlapping, indicative of a lack of buyer control. The last volume can be troublesome. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Guest Post: How The Blockchain And Gold Can Work Together Posted: 03 Feb 2016 06:30 PM PST Submitted by Thorsten Polleit via The Mises Institute, A look into monetary history shows that people, when given freedom of choice, opted for precious metals as money. This doesn’t come as a surprise. Precious metals have the physical properties a medium must have to serve as legal tender: They are scarce, homogenous, durable, divisible, mintable, and transportable. They are held in high esteem and represent considerable value per unit of weight. Gold fulfills these requirements par excellence, and this is why it has always been peoples’ first choice in terms of money. Gold has proven its merits as money for millennia; it is the ultimate means of payment. More recently, gold has been replaced by the state’s unredeemable fiat money — for reasons rather more political than economic. The state prefers money whose value can be altered at will — say, to influence overall demand, redistribute income, and to benefit some at the expense of the many. Gold money stands in the way of such machinations. Fiat money doesn’t. On the contrary, fiat money can simply be printed up; can be created out of thin air. Fiat money has serious economic and ethical drawbacks, though. It is chronically inflationary, widens the gap between poor and rich, triggers boom-and-bust cycles, and compounds the economy’s debt burden. Most important, a fiat money regime allows the state to expand actually without limit, over time potentially transforming even a minimum state into a maximum state at the expense of individual liberty and freedom. In the wake of the most recent financial and economic crisis of 2007–2008, many people have become concerned that their savings, mostly invested in fiat-denominated bank accounts and bonds, could be devaluated. This has prompted a search for “good” money. Somewhat new to the mix are the digital currencies, most famous of which is the virtual unit “bitcoin.” It is a digital currency generated by decentralized, internet-based computers rather than a central authority. Transactions through digital currencies such as bitcoin are confirmed, or validated, by a decentralized consensus system that uses a “blockchain.” The latter is essentially a public digital ledger, an account statement for transactions among computers. The blockchain is saved on many computers so that it is practically impossible to manipulate. In the case of bitcoin specifically, the blockchain ensures that only the bitcoin’s owner can make a transaction with his bitcoin, that the same bitcoin cannot be created manifold. In this article, I’ll use bitcoin as my main example, although this technology can be applied to any number of similar digital currencies. However, this technology has now been used to provide a new means of transferring assets among people: the “colored bitcoin.” A colored bitcoin — or something comparable using blockchain technology — represents a certain asset. For instance, physical gold can be made available for day-to-day transactions — for purchases and sales in supermarkets and on the internet — simply by transferring a gold-backed colored bitcoin from the bitcoin wallet of the buyer to the bitcoin wallet of the seller. How could one obtain such a gold-backed bitcoin? You would buy, say, physical gold at a gold shop. The latter then issues a colored bitcoin, which represents the ownership of physical gold. The colored bitcoin is, economically speaking, a gold substitute (a money substitute, fully backed by physical gold). It can be used for making purchases and, upon the wish of its owner, it can be redeemed into physical gold at the gold shop at any time. A colored bitcoin represents a physical thing or asset that exists outside the bitcoin network. It therefore carries with it a risk that the issuer will not live up to his promise. However, there are market solutions to this problem. For instance, the gold can be stored with a particularly trustworthy third party. Or, people hold colored bitcoins issued by various issuers. If the latter are seen to be of the same riskiness, they would trade at par to each other (after making allowance for possible storage and handling costs). That said, the gold-on-the-blockchain technology appears to hold great potential when it comes to making possible a world of digital gold money transactions. So far, governments use regulation and taxation to inhibit and even prevent unencumbered competition among monies. However, the evolution of the blockchain largely circumvents many of the obstacles governments put in the way of a free market in money. Where it will lead is, of course, is impossible to predict with certainty. In any case, when we’re comparing to government fiat money, digital currencies can offer attractive alternatives. The same goes for gold lovers, who may see blockchain technology as the means of conveying physical gold; and in the end digitized gold money could become a practical option. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| USA Watchdog's Greg Hunter interviews Hugo Salinas Price on gold revaluation Posted: 03 Feb 2016 05:55 PM PST 8:54p ET Wednesday, February 3, 2016 Dear Friend of GATA and Gold: Monetary metals advocate Hugo Salinas Price, president of the Mexican Civic Association for Silver, explains today in an interview with USA Watchdog's Greg Hunter why he expects a worldwide depression caused by excessive debt and then an official revaluation of gold to devalue debt. The interview, 24 minutes long, is especially nice because it's a video interview and you can see the two participants. It's posted at USA Watchdog's Internet site here: http://usawatchdog.com/world-going-into-nasty-depression-hugo-salinas-pr... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Meet The World Leader Who Stole His Citizens' Gold Posted: 03 Feb 2016 05:30 PM PST Submitted by Simon Black via SovereignMan.com, Even before his coronation in 1626, King Charles I of England was almost bankrupt. His predecessors King James and Queen Elizabeth had run the royal treasury down to almost nothing. Costly war and military folly had taken its toll. The crown had simply wasted far too much money, and brought in too little. To make matters worse, King Charles was constantly at odds with parliament. The English government was completely dysfunctional, with constant bickering, personal attacks, and very little sound decision-making. Parliament refused to pass the taxes that Charles needed to make ends meet. But at the same time, the King was legally unable to levy his own taxes without parliamentary approval. So, faced with financial desperation, he began to look for alternative ways to raise revenue. One way was relying on practically ancient, obscure laws to penalize his subjects. The Distraint of Knighthood, for example, was based on an act from 1278, roughly three and a half centuries before Charles’ coronation. The Act gave him the legal authority to fine all men with a minimum level of income who did not present themselves in person at his coronation. Charles also commandeered vast amounts of land, restoring the boundaries of the royal forests to where they had been during the time of King Edward I in the 13th century. He then fined anyone who encroached on the land, and resold much of it to industries that were supportive of his reign. King Charles even resorted to begging; in July 1626, he requested that his subjects “lovingly, freely, and voluntarily” give him money. When that didn’t work, the King levied a Forced Loan, effectively confiscating people’s funds under the guise of ‘borrowing’ it. He raised about £250,000, the equivalent of about $7.5 billion today. Emboldened by his success, Charles eventually seized assets directly, including all the gold on deposit being held at the Royal Mint– money that belonged to the merchants and goldsmiths of England. At one point Charles even forced the East India Company to ‘loan’ him their pepper and spice inventory. He subsequently sold the products at a steep loss. If any of this sounds familiar, it should. Today there is no shortage of nations facing fiscal desperation. Most of Europe. Japan. The United States. In the Land of the Free, the government has spent years… decades… engaged in the most wasteful folly, from multi-trillion dollar wars to a multi-billion dollar website. US debt just hit $19 trillion a few days ago. And it’s only going higher. We can already see the government’s financial desperation. Over the years, the government has effectively levied a ‘forced loan’ totaling more than $2.6 trillion on the Social Security Trust Fund, whose ultimate beneficiaries are the taxpayers of the United States. Bottom line, they’re ‘borrowing’ YOUR money. Last year the government stole more from Americans through ‘Civil Asset Forfeiture’ than all the thieves in the United States combined. In December, the US government confiscated $19.3 billion from the Federal Reserve, which, by the way, was already very thinly capitalized. Even if you want to believe the propaganda, it’s clear that these are not the actions of a healthy, solvent government that embraces liberty. In fact, the government published over 80,000 pages of laws, bills, regulations, and executive orders last year. Just this morning they published another 308 pages. It’s impossible for anyone to keep up with all of these rules. And yet each can carry civil and criminal penalties, including a fine now for not having health insurance. As Mark Twain used to say, history may not repeat, but it certainly rhymes. Financially insolvent governments of major superpowers do not simply go gentle into that good night. They don’t suddenly turn over a new leaf and start embracing economic freedom. Instead, they get worse. More desperate. More destructive. Should we honestly believe that they can continue racking up more debt than has ever existed in the history of the world without any consequences? This is madness. At some point, fiscal reality always catches up. Maybe not at $19 trillion. Maybe not even at $20 trillion. Maybe it takes 3 months. Or 3 years. But somewhere out there is a straw that can break the camel’s back. And that has serious consequences. Never forget that if something is predictable, then it’s also preventable. And facing such obvious trends, it makes all the sense in the world to take some simple, rational steps to put together your own Plan B. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PBOC Strengthens Yuan By Most In 2 Months As Golden Week Looms Posted: 03 Feb 2016 05:27 PM PST With just one more day of trading before China's lunar new year and Sping Festival Golden Week holiday, it appears The PBOC wants to flex its intervention muscles. By strengthening the Yuan fix by 0.16% (the most in 2 months) to 1-month highs, it seems China is trying to send a message before it practically closes for a week... Of course today's USD collapse is not going to help their 'devaluation' case...

China will be practically closed from Feb 7th until re-opening on Monday Feb 15th and so one wonders if this is a last ditch attempt to dissipate speculators before they are left somewhat to their own devices for a week? | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| NY Fed prez hints it's one-and-done for interest rate hikes Posted: 03 Feb 2016 04:57 PM PST Dudley Flags Tight Conditions Ahead of Fed Meeting Sam Fleming and Robin Wigglesworth Global financial conditions have tightened markedly since the Federal Reserve lifted interest rates in December and the central bank will have to take that into account if the situation persists into March, the president of the New York Fed has said. The words from Bill Dudley came as financial markets ratcheted back expectations of rate rises further, with traders now expecting no move at all in 2016 -- in sharp contrast to Fed policymakers' last forecasts in December. Mr Dudley said that the recent turmoil in financial markets could alter the outlook for growth and risks to the economy, adding that if the global economy were to hit a roadblock, triggering a further surge in the dollar, "it could have significant consequences back to the US." His comments in an interview with MNI are an acknowledgment of how sharply the backdrop has changed since the Fed boosted rates by a quarter point in December. ... ... For the remainder of the report: http://www.ft.com/intl/cms/s/0/5966a182-ca92-11e5-a8ef-ea66e967dd44.html ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold figures heavily in Lars Schall's tremendous interview with Ronnie Stoeferle Posted: 03 Feb 2016 04:51 PM PST 7:50p ET Wednesday, February 3, 2016 Dear Friend of GATA and Gold: Writing for Matterhorn Asset Management's Gold Switzerland Internet site, financial journalist Lars Schall has done a tremendous interview with fund manager Ronnie Stoeferle of Incrementum AG in Liechtenstein, covering, among other things, the increasingly positive prospects for gold, intervention by central banks against the gold price, gold's continuing centrality in the world financial system, the importance of the gold-silver price ratio, China's purposes for gold, the likelihood of more monetary debasement by central banks, and the perspective brought to the markets by the Austrian school of economics. The interview is 31 minutes long but there's a transcript as well and both are posted at GoldSwitzerland here: https://goldswitzerland.com/ronald-stoeferle-the-matterhorn-interview-ja... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SIGNS OF THE END PART 143 - LATEST EVENTS FEBRUARY 2016 Posted: 03 Feb 2016 04:44 PM PST End time events will continue and increase in strength. Be witness of how the earth is crumbling into pieces by devastating tornadoes, erupting volcanoes, massive earthquakes and never ending floods. Stay tuned for more upcoming and devastating events The Financial Armageddon Economic Collapse... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver and Gold Price Break Out Posted: 03 Feb 2016 04:38 PM PST

These breakouts smash my breakout requirements, $14.65 and $1,128-$1,132. Strong and vigorous, they confirm each other. More, platinum rose 2.9% and palladium 5.4%. The GOLD PRICE has risen through its 200 DMA for the first time since October, and on rising volume. Silver's volume EXPLODED, from 30,250 contracts yesterday to 62,071 today.

Here are the charts, and they are stunning: For a metals rally the GOLD/SILVER RATIO needs to fall as well. Today it hit the bottom boundary of the rising trading channel that has entrapped it since October. Closed today below its 20 AND 50 DMA. Appears ready to drop out of the channel. A close below 76.50 tomorrow will clinch that. This is exactly the sort of breakout move in metals that I've been looking for. BIG doin's. Gotta buy breakouts. MEDITATION: If all the world's central banks take interest rates negative, how could the Fed possibly stand against that tide? Leaving US rates positive would suck in all the capital in the world into the dollar. Why did Bloomberg report yesterday that the Fed announced it will assess the resilience of big banks to, among other conditions, negative interest rates (rate on 3 mo. Treasury bill below zero for a prolonged period). Are they merely satisfying their idle curiosity? Remember, negative rates remove the great objection to holding silver and gold, namely, they pay no interest. Under negative rates investors would have to PAY to hold bank deposits or government bonds, while holding metals would cost nothing and offer potential price rise.

Dollar's drop set off a universal re-pricing for commodities and bonds. West Texas Intermediate crude rose $4.15 (14%) to $33.86, not quite enough for a reversal but way above the 20 DMA. Close above $34.82 confirms at least a short term rally. 10 year treasury note yield dipped to new low territory, hitting the uptrend line from the July 2012 low, and reversed to close at 1.881, up 0.91% and first half of a key reversal upwards. Copper jumped 2.39% to $2.10. Not the least of the re-pricing happened in currencies. Euro vaulted 1.76% to $1.1110, above the $1.1052 200 day moving average for the first time since October. Now has painted a believable breakout from even-sided triangle. Oh, and the yen! Japanese Nice Government Men must be throwing hissy fits. After they thought they fixed the Yen/$ exchange rate last week, it gapped up today and closed up 1.83% at 84.91, not far from the January intraday high at 86.06. Saved its rally. Stocks wavered, scratched their heads, and then decided to rise. Dow climbed 183.12 (1.13%) to 16,336.66, back above the 20 DMA. But performance across indices oddly contradicted itself. S&P500 rose not 1.13% but only 0.5% or 9.5 to 1,912.53. Small cap Russell 2000 rose 0.14%, and the Nasdaq and Nasdaq 100 fell, 0.28% and 0.5%. That don't smell good, but at day's end the Big Two closed higher. Dear Friends, my wife Susan is suffering a lot of pain from her eye. Doctor today had to cut a stitch from her eye and scratched the eye doing it. She is clean worn out fighting pain. Would y'all please continue to pray for her? Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold and Silver More 'Flight To Safety' Active February Posted: 03 Feb 2016 01:55 PM PST Gold showed some strength today in an add on to the flight to safety trade, even though there was a midday hit on price that was pure antics. The dollar moved lower and silver wallowed. I posted an update to the NAV of Precious Metals Funds and Trusts today. Sprott has successfully absorbed the Central Gold Trust. It raised some cash and added substantially to their bullion and shares under management, so its a good deal for them. Let's see if time shows if it is a good deal for the trust unit holders. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Non-Farm Payrolls on Friday Posted: 03 Feb 2016 01:52 PM PST | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 03 Feb 2016 01:21 PM PST This post The Age of Instability appeared first on Daily Reckoning. Unprecedented policies always bring unintended consequences. Weidentify these hidden fractures. There are many at the moment, and we'll be writing to you about those in the months ahead. The ongoing currency war is not new. In fact, the war has been raging since 2010. That's when President Obama announced the National Export Initiative (NEI) in his Jan. 27, 2010, State of the Union. The president declared that it was the goal of the United States to double exports in five years. Of course, the U.S. could not become twice as productive or twice as populous in five years. The only way to double exports was to trash the currency, and that's exactly what happened.

Although it was not widely noticed at the time, the NEI was the start of a new currency war. This was the most momentous development in international economics since Nixon abandoned the gold standard on Aug. 15, 1971. The repercussions are still being felt, and the potential impact on your portfolio has never been greater. To understand the importance of this raging currency war, some history is needed. From the Bretton Woods conference in 1944 until Nixon abandoned gold in 1971, the international monetary system operated on a gold standard. All major currencies in the world were pegged to the dollar at fixed exchange rates, and the dollar was pegged to gold at $35 per ounce. Because of these pegs, non-dollar currencies were indirectly pegged to gold, and to each other. The International Monetary Fund could allow the currency pegs to be adjusted, but it was a laborious and protracted process. (But some countries had already broken their pegs prior to 1971.) Still, on the whole, it was a fixed-rate system with the dollar and gold as its anchors. This system cracked up in 1971. It was not immediately replaced with a new system. From 1971–79, the world muddled through first with a new gold peg (at $42.22 per ounce), then with floating exchange rates and then with the first efforts at a European monetary system (called "the snake"). None of this was stable. The world experienced multiple recessions and borderline hyperinflation, which reached a crescendo in January 1980. At that point, annual dollar inflation reached 15%, interest rates hit 20% and gold spiked to $800 per ounce — a 2,200% increase from the old $35 level. The international monetary system was collapsing. The world was spinning out of control. Then, on the brink of total collapse, two individuals stepped in to save the system. One was Paul Volcker, chairman of the Federal Reserve. The other was President Ronald Reagan. Volcker took interest rates as high as needed to kill inflation. Reagan cut taxes and regulation to encourage growth in the U.S. economy. It worked. Inflation came down, growth went up and soon the U.S. became a magnet for savings and investment from around the world. The Age of King Dollar had begun. From 1980–2010, the world was not on a gold standard, but it was on a de facto dollar standard. Under the leadership of Treasury secretaries James Baker (Republican) and Robert Rubin (Democrat), the U.S. told the world that the dollar was a stable store of value. Trading partners could not anchor to gold, but they could anchor to the dollar. This new "dollar standard" prevailed through the Plaza Accord (1985), the Louvre Accord (1987), the Mexican Peso Crisis (1994) and the Asian-Russian Crisis (1998). U.S. leadership under Presidents Reagan, Bush 41 and Clinton was resolute. The strong dollar was the new gold standard, and it was here to stay. Yet nothing lasts forever, especially in international economics. The Global Financial Crisis of 2008 put an end to the Age of King Dollar and gave rise to a new currency war. Wars have an official start date (when someone fires the first shot), but they are usually years in the making. The new currency war is no different. The war process started with the G-20 leaders' summit in Pittsburg in September 2009. It was at that meeting that Mike Froman (a key economic adviser to President Obama and now U.S. trade representative) devised a global "rebalancing" plan. Froman got Obama to convince world leaders of the need for rebalancing inside the major economic zones. He did this to jump-start the global recovery from the worst recession since the Great Depression. China and Japan would rebalance from exports to consumption. Europe would rebalance from exports to investment. The U.S. would rebalance from consumption to exports. In effect, the U.S. would export more to the rest of the world. This would grow the U.S. economy. Since the U.S. economy is the largest in the world, U.S. growth would act as an engine that would pull the rest of the world along with it. The key to this global rebalancing was U.S. exports. And the key to U.S. exports was a cheaper dollar. In effect, the world was being asked to suffer with strong currencies and a cheaper dollar as the price of getting the global economy moving again. Big ideas such as Froman's rebalancing plan are fine in theory, but they have to be put into practice. Between September 2009 and January 2010, Froman worked inside the White House to devise the National Export Initiative. This is what was rolled out in the January 2010 State of the Union address. The entire world recovery rested on a cheap dollar. The effects (orchestrated by the Fed with QE1 and QE2) were immediate. The dollar plunged over the next 18 months to an all-time low in August 2011. (Not coincidentally, gold hit an all-time high of $1,900 per ounce the same month the dollar hit its all-time low.) The world noticed the new currency war long before the summer of 2011. In September 2010, Brazilian Finance Minister Guido Mantega cried foul and publicly declared that a "currency war" had begun. (Brazil's exports and tourism were being crushed at the time by a strong currency. Brazil later trashed its own currency and now has recession and inflation at the same time, called "stagflation.") The classic problem with currency wars is that the losers eventually fight back by trashing their own currencies. That's exactly what happened this time. In December 2012, Japan announced "Abenomics," with an explicit goal of cheapening the Japanese yen. In June 2014, the European Central Bank announced negative interest rates, and in January 2015 "Euro QE" began, both with the purpose of weakening the euro. In August 2015, China shocked the world with a surprise devaluation of the yuan. China continued this policy in less dramatic form with stealth devaluations in November and December 2015. During this prolonged counterattack by China, Japan and Europe, the dollar went from weakness to strength. The dilemma of currency wars is that every currency cannot devalue against every other currency at the same time. It's a mathematical impossibility. Currency wars are like two kids on a playground seesaw. If one is up, the other must be down. As China, Japan and Europe counterattacked in the currency wars, the dollar got stronger and stronger. By early 2016, the U.S. dollar was back to a 10-year high on major indexes. Where are we now? The dollar is extremely strong, but it's not a new Age of King Dollar; it's the Age of Instability. One policy surprise follows another, and investors are being whiplashed in the process. In time, the dollar will weaken. That's how the currency wars seesaw works. But for now, the Fed is still tightening and the dollar will remain strong for most of 2016. The fallout from the strong dollar is still being felt in the hidden corners of U.S. corporate earnings. The biggest hidden impact at the moment is the damage to U.S. exporters and manufacturers. A strong dollar makes U.S. exports unaffordable to foreign buyers, who have to convert their local currencies to dollars to buy our goods. The impact is not limited to big-name exporters like Boeing and Caterpillar. The effects are felt up and down the U.S. manufacturing supply chain. This story is not new, but it is getting worse, and the bad news is far from over. Regards, Jim Rickards The post The Age of Instability appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 03 Feb 2016 01:13 PM PST Robert Alexander writes: I am not what many consider to be a Perma Gold Bull, but I do expect a 3rd phase of the 2000 Gold run to take place and end in a spectacular blow off top phase. That being the case, I also watch intently when we get these bear market lows for signs of a bigger picture change. Lately I am hearing that “Silver is weak”. “Silver cant get out of its own way. It is setting up to plunge now.” I’ve been discussing these lows and successfully trading them for weeks now. Is that the way I see current conditions? Is Silver really the weak link? Not the way I look at things. To the charts… | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| How to Revive Good Ol’ American Know-How Posted: 03 Feb 2016 12:59 PM PST This post How to Revive Good Ol' American Know-How appeared first on Daily Reckoning. It's come to this: Great Britain has more economic freedom than the United States. So says the conservative Heritage Foundation, which is out this week with its annual Index of Economic Freedom. The index is a composite of four categories — rule of law, limited government, "regulatory efficiency" and open markets. The index for the United States has slipped eight of the last nine years. Out of all the world's countries, Uncle Sam ranked fourth as recently as 2007. Now it's No. 11… and the mother country just vaulted over us. Heritage says you don't have to look far for an explanation: "Substantial expansion in the size and scope of government under the Obama administration, including through new and costly regulations in areas like finance, health care and the environment, has hit wide swaths of the economy, affecting almost every American in some way and reducing opportunities for nongovernmental production and investment." Well, yeah. But that's hardly the whole story… The United States does make the top 10 — barely — in another new survey that looks through the prism from through the angle of innovation. The Information Technology and Innovation Foundation assessed 56 nations accounting for 90% of global economic output. "The indicators examined include such factors as research and development, technology, human capital, tax policy, trade barriers and intellectual property protections," says study co-author Stephen Ezell. "Countries are scored for their contributions, their detractions and their overall impact on global innovation." Two Nordic countries come out on top — Finland and Sweden. Britain once again outshines the United States, clocking in at No. 3. The Land of the Free? Only No. 10. "This is due to the U.S. government's relative underinvestment in R&D as a share of the country's GDP, weak innovation-incenting tax policies as well as a middling performance in human capital," writes Mr. Ezell. The word "innovation" brings to mind a theme we've touched on here in The 5 from time to time — the urgent, pressing need for more startups. “Without startups, net job creation for the American economy would be negative in all but a handful of years” since 1980, according to a 2011 study by the Kauffman Foundation. You want new jobs? The chatter about small businesses as the "job creators" is only partly true. It's not small businesses that create jobs as much as new businesses — businesses less than five years old. Unfortunately, the number of new businesses has been declining steadily since the late 1970s… and for a while during the "Great Recession," more firms were going defunct than were coming into existence… Which brings us to one more survey. This one isn't new, but it's perhaps the most enlightening. Each fall, the World Bank does a ranking of all the countries in the world based on how easy it is to start a business. The United States clocks in at No. 49! New Zealand is No. 1, followed by Macedonia (who knew?) and Canada. Great Britain, you ask? No. 17. Hell, it's marginally easier to start a business in Russia, which is No. 41, than in the U.S. "In New Zealand," says the study, "an entrepreneur can complete the entire process of company formation in just a few hours through a single online procedure." We suspect, however, there's an even bigger impediment to starting a business in the United States than red tape. It clicked suddenly when your editor read a book review over the holidays. The title and the author don't matter for our purposes today. (It has "Runaway Capitalism" in the subtitle — oy.) What matters is that the author was laid off from a full-time job and went freelance. Suddenly, he was paying massive health care premiums and payroll taxes. Boom. The people who are still lucky enough to have jobs that issue them a W2 form every January are clinging to those jobs for dear life. They might want to launch a business of their own… but they're petrified to make the leap because of health care costs and the self-employment tax. Even before Obamacare, buying health insurance was an expensive nightmare if you weren't a W2 employee. Research by the Commonwealth Fund finds on average, premiums in the individual market grew 9.9% in 2008… 10.8% in 2009… and 11.7% in 2010. And what did you get for those premiums? Insurers would rescind policies for beneficiaries who got sick. Insurers would refuse to pay for services beneficiaries assumed were covered. And without a human-resource person at their employer to go to bat for them, they were SOL. Obamacare merely took something that was "problematic" and made it "nigh impossible." You might remember in late 2013 when millions of Americans received cancellation notices for their individual health plans. Those lucky enough to retain their policies saw average increases of 39%, according to eHealth — with deductibles going through the roof. And then there's the self-employment tax — which skyrocketed during the 1980s just as the number of new businesses began its decline. During most of the 1970s, total Social Security and Medicare taxes for the self-employed held steady around 8.0%. By 1990, they swelled to 15.3%, where they remain today. If you have to meet a payroll, you know the 6.2% "employer portion" of Social Security is an accounting fiction. When drawing up a budget, you include that as part of your W2 employees' overall compensation. Naturally, the employee doesn't see it that way… which leads to a rude surprise when that employee starts thinking about striking out on his own. Suddenly, he's responsible for the "employer portion" and realizes he needs to generate another 6.2% of gross income the first year… just to stay even! We humbly submit: You solve these two problems — payroll taxes and health care costs — and you solve the problem of innovation, startups and new jobs. Solve those two problems… remove the two biggest barriers to self-employment and entrepreneurship… and you unleash an era of unprecedented wealth creation and improved standards of living. We might get the flying car we've been promised all this time. We daresay this new era of prosperity would come about even if income tax rates were untouched, current financial and environmental regulations stayed on the books, the Keystone XL pipeline remained unbuilt and litigation reform didn't pass Congress — you know, the usual Heritage Foundation/Chamber of Commerce talking points. Unfortunately, there are entrenched interests whose oxen would be gored if these two problems were solved. As we learned from the "zombie budget" passed last fall, Congress and the White House are already resorting to chewing gum and baling wire to hold Social Security's finances together. And health care? The insurance companies and Big Pharma are among Obamacare's biggest beneficiaries — as intended. The Senate aide who wrote most of the bill was previously a VP at the insurer WellPoint. After her work was done, she went through the revolving door to Johnson & Johnson. Grim as it sounds, there are no solutions in sight to either problem — short of systemic collapse. Who knows, maybe that's in store. David Stockman, the former White House budget director and one of our newest editors, says Social Security will start paying out more than it takes in by 2026 — years earlier than the official projections. And even if Social Security can be "fixed," we explained last summer how something is bound to break in the health care system during the next 20 years; otherwise, health care will consume half the federal budget. Regards, Dave Gonigam P.S. Be sure to sign up for The Daily Reckoning — a free and entertaining look at the world of finance and politics. The articles you find here on our website are only a snippet of what you receive in The Daily Reckoning email edition. Click here now to sign up for FREE to see what you're missing. The post How to Revive Good Ol' American Know-How appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 03 Feb 2016 12:48 PM PST "Stocks beat gold in the long run!" is a 'rallying cry' to buy stocks we have heard lately that gets me riled up. It’s upsetting to me for two reasons: first, an out of context comparison, in my opinion, misguides investors. It might be the wrong assertion in the short to medium term. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Price Fix – “Future Of The Fix Is Fraught†Posted: 03 Feb 2016 12:39 PM PST The silver price fix debacle from last week and the new London silver price fix has received a litany of severe criticism in recent days. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ZIKA Virus is another Fake Psyop Posted: 03 Feb 2016 12:19 PM PST Zika Virus: Dirty Elite scumbag projects, Mosquito's and TDAP Vaccine Why on earth vaccines are especially recommended for pregnant women is total insanity! It only goes to show the vaccine makers want death The Financial Armageddon Economic Collapse Blog tracks trends and forecasts ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ronald Stoeferle – The Matterhorn Interview Jan 2016 Posted: 03 Feb 2016 12:05 PM PST “The Matterhorn Interview – Jan 2016: Ronald Stoeferle”This late January interview that Lars Schall did with Incrementum Investment manager Ronald Stoeferle comes shortly after the December launch of Ronald’s book ‘Austrian School for Investors’ co-authored with Mark Valek and Rahim Taghizadegan. The podcast interview deals with this year's prospects for gold, silver and mining shares, the ever increasing … Read the rest | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Our Government Has Gone Insane -- John Mcafee Posted: 03 Feb 2016 11:39 AM PST With every 3-letter agency under the sun sticking their noses in our business and spying on The People, it has become clear that the government has turned paranoid and insane. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Rand Paul Ends 2016 Presidential Campaign Posted: 03 Feb 2016 10:36 AM PST Senator Rand Paul has officially ended his 2016 Presidential bid, and will focus on getting reelected to the US Senate. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Armageddon Scenario : What if Putin invaded Latvia & nuked UK? Posted: 03 Feb 2016 10:13 AM PST What if Putin invaded Latvia & nuked UK? New BBC show fantasies will tell Russia invading Latvia - and then launching a nuclear strike on the British military. That's the fictitious vision of the future, in a new show from the BBC. The Financial Armageddon Economic Collapse Blog tracks... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

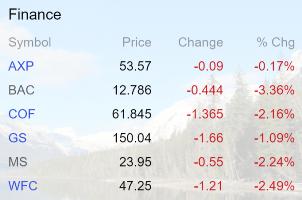

| Posted: 03 Feb 2016 10:07 AM PST Once upon a time, falling interest rates were great for banks. A lower cost of capital gave lenders access to cheap raw material while causing borrowers to clamber for what banks were selling. Large profits usually ensued. But not now. Rates have fallen past the banks’ sweet spot to levels that just don’t work. Borrowers appear to be spooked rather than energized and trading desks are imploding amid “catastrophic volatility“. See German bond yields collapse below 50bps for first time ever and UBS’s investment bank earnings decline 63% on equities trading. And now yield curves are inverting — that is, long rates are falling below short rates, which means banks’ borrowing costs (the short end of the yield curve) are starting exceed their lending revenue (the long end of the curve). See Japan’s yield curve faces further pounding amid BoJ aftershock and US Treasury yield curve inverts. To add a little spice to the toxic stew, capital controls are coming back into style:

Not surprisingly, US bank stocks are getting whacked. As of 9am on Wednesday Feb 3: Bank of America (BAC) stands out as especially cringe-worthy, having fallen from north of $18 per share to below $13 in just a few weeks: What does all this mean? The broad-strokes answer is that these huge, nearly-omnipotent entities that have dominated and defined the world’s economic and political landscape may finally be receding towards a more reasonable level of power. One way to gauge this is by the rhetoric coming out of the current presidential candidates, all of whom have decided that it’s not just safe, but profitable to bash Wall Street. Dimon, Blankfein, et al are clearly not the bullies they once were. More immediately it means there’s a new black swan in the sky. As a group the world’s biggest banks are leveraged to an extent that probably has the authors of the Glass-Steagall Act spinning in their graves. The notional value of their over-the-counter derivatives books dwarfs the global economy, while their exposure to now-moribund sections of the oil and gas industry guarantees massive write-offs in the year ahead. The question isn’t whether the big banks will report huge losses, but whether one of them will be destroyed in the process, giving us another Lehman Moment. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Japan Cancels Auction On Ten-Year JGB’s Posted: 03 Feb 2016 08:20 AM PST This post Japan Cancels Auction On Ten-Year JGB’s appeared first on Daily Reckoning. And now… today's Pfennig for your thoughts… Good day, and a wonderful Wednesday to you! Well, nothing BIG happened overnight, the markets were moving, but not getting out of hand, the news was quiet, and well things were as they should be! The dollar was getting sold, for the most part, and fundamentals seemed to rule the roost. So, let’s go through the roster of currencies we normally talk about and see where it takes us this morning, eh? Front and center, the New Zealand dollar/kiwi is the best performer overnight, after getting pushed around yesterday morning, kiwi began to recover, and that recovery kept going, especially after Reserve Bank of New Zealand (RBNZ) Gov. Wheeler chastised the markets about getting too locked in and focusing too much on the headline inflation rate, and then suggested that the RBNZ would not be cutting rates any time soon. And that sent kiwi soaring! The Aussie dollar (A$) has joined kiwi, but not to the degree of kiwi’s rally. There was some disturbing data overnight in Australia, and I’m wondering as I see this all unfolding, how the A$ is able to rally in the face of the Aussie Trade Deficit hitting an all-time high level in 2015 of A$ 32.7 billion, easily surpassing the previous record level of A$ 26.4 billion in 2007. I think that this soaring Trade Deficit illustrates just how important exports of metals and mineral are to Australia, and with them slumping 16% last year, you can see why the Trade Deficit is so large. The euro has a small gain this morning, and it’s getting smaller as I write! There will be a general election in Ireland next week, but I doubt this has any bearing on what the euro is doing. The BREXIT stuff is weighing on the euro, but not like the GREXIT stuff did. As there are a couple of BIG Differences between the two scenarios. Like, Britain never joined the euro, and Britain isn’t about ready to default on their debt. Britain does have a mountain of debt, but so far they haven’t been challenged with the question as to how they will pay it back, like Greece was back in 2011. The Chinese renminbi was marked down at the fixing again last night. A few days up, the next few days down for the renminbi. I’m really growing tired of these shenanigans, aren’t you? Pick a direction, I just want to see a direction! Sort of like when I’m driving and a driver of another car can’t stay in their lane. I always have a smart alec comment to say, like: Pick a lane, any lane, come on you can do it! So, I wish the Chinese would pick a direction! The Russian ruble stopped the bleeding of two days getting whacked. I was doing some reading regarding Russia’s problems with the drop in the price of oil, and the sanctions. There could be some light at the end of the tunnel for Russia, given that the Europeans are not so strong in their holding to the sanctions they implemented a couple of years ago, to be in step with the sanctions that the U.S. placed on Russia. So, if Europe goes ahead and drops the sanctions or loosens them, that could help the Russian economy, and then think about this one folks: after the current administration leaves office at the end of this year, the U.S. sanctions could be dropped. So, the light, is very small and faint right now, but there is a light in my opinion, which could be wrong! Well, it didn’t take long for the Japanese yen to gain back its losses from Friday and Monday. After the three-tiered negative rates policy was announced last Friday yen lost nearly three whole figures, but has gained two of those back since Monday. And I sit here scratching my balding head, wondering why. And especially after Japan announced that they had to cancel their bond auction for ten-year JGB’s because of lack of interest. Imagine that, no one wanted to buy ten-year bonds in Japan with little interest to pay you? Ooh, sign me up for some of that, yes sir may I have another? NOT! No way, take the highway on that thought! I cracked up a bit when I saw something yesterday. Swiss National Bank (SNB) Gov. Jordan was talking to reporters, and told them this juicy bit of information that I had never thought about, and was amazed that he had figured this out. Jordan told reporters that the euro’s problems stem from The ECB’s QE. Really? Thanks for that bit of “inside information” Mr. Jordan! I would have never figured that one out! Okay, back to the currencies… the British pound sterling is neck and neck with kiwi for the crown of best performing currency overnight. The latest British PMI – Services report beat expectations decidedly and put before the markets, the question of whether they were being too pessimistic about the direction of interest rates in Britain. Well, if they would allow me to throw my two cents into the ring here, I say that NO the markets were NOT being too pessimistic, and should be getting themselves prepared to deal with no rate hike in 2017, and if anything, they should probably have a backup plan that would deal with a rate cut instead! I know, I know, I’ve been a little difficult on the Beaver here, but think about the mountain of debt that exists here, and then look at Japan, and the U.S. and imagine that Britain will experience the same problems as these two debt generating countries have experienced and will still experience in the future! Oh, sure rub it in my face that here in the U.S. we did see a rate hike. So, even a blind squirrel can find an acorn, right? Well, I’m here to tell you, so you can hear me now and listen to me later, but could the Fed be already admitting they made a mistake hiking rates in December? Well, I know one thing for sure, they aren’t feeling so good about their call for four more rate hikes in 2016. Fed Vice-Chairman Stanley Fischer had this to say on Monday:

Oh, you think the market could turn out to be right do you? Hmmm… that’s quite interesting don’t you think? I think in the end, that the Fed’s attempt to hike rates in the face of 95% of countries in the world cutting rates even into negative territory, is going to end up much like when Sweden tried to hike rates a couple of years ago, and when the Eurozone hiked rates, and Australia and New Zealand. All had attempted to hike rates and start a rate hike cycle, only to have to come back to the rate table months later, and cut rates, thus reversing their rate hike, and then some! Well, we will see two peeks into the Jobs Jamboree on Friday today. First up is the ADP Employment Report for January, which is showing a forecast of 193,000 jobs created in January, which is good, but far below that blowout number that printed in December of 257,000. And then the other peek will come from the ISM Non-Manufacturing Index, which is the Services Index, and the Services index has an employment component to it that is usually very good at indicating the direction of jobs in the U.S. especially in this day and age when most of the jobs come in the Services area, bartenders, waiters, etc. Yesterday’s U.S. Data Cupboard was pretty empty, but did manage to spit out the vehicle sales in the U.S. for January, which showed that here in the U.S. we still love our new cars. the total didn’t reach the twice reached level in 2015, of 18 million units in a month, but it came close. Crazy stuff, eh? Retail Sales are negative, personal spending is non-existent but car sales are through the roof. Oh, and I know that most of those car sales were done on credit, but still, it’s pretty crazy. To me, that is! I took a look at the Treasury screen this morning to see the 10-year Treasury yield had fallen to 1.85%… that’s right, I said 1.85%! Is that not crazy? Who’s buying ten-year Treasuries at 1.85%? Well, just as I’m sure that stocks don’t grow to the moon, I’m sure that bond yields don’t fall forever. When this bond market bubble pops it’s going to be the biggest mess we’ve ever seen in financial markets, folks. But, I’ve given up trying to figure out when that bubble finds the pin in the room. When I used to travel and give presentations, I had a Power Point picture of a guy sitting at a desk and he has the signs they use in the cartoons to illustrate a head that has been hit hard, so the idea is that the guy is banging his head on the desk, and I would tell people that it was a picture of me, watching Treasury yields continue to drop, after telling people that the Treasury Bubble was about to pop! HA! I do have an “out” that I like to play whenever someone gives me grief for calling the Treasury Bubble, I simply say, yes, that was before anyone knew that the Fed was going to become a major buyer of Treasuries through QE1, QE2, and QE3. So there! Gold is flat this morning, and in the end only gained $1 yesterday, after going back and forth between gains and losses. There were no new market fears yesterday, no new developments in geopolitical risks, and so on, so it was a nothing day for gold. And today seems to be starting out much like yesterday finished for the shiny metal. With all those vehicle sales going on here in the U.S. one would think that platinum would be being bought up by the truck loads. But platinum, palladium and even silver have had a tough row to hoe so far this year, with gold getting all the attention. I did see a bank of charts yesterday from the St. Louis Fed (FRED) and they included graphs on Student Loans, Food Stamps, Federal Debt, Money Printing, Health Insurance Costs, Labor Force Participation, Worker’s Share of the Economy, Median Family Income, and Home Ownership. They are not a bunch of pretty pictures to look at, folks. They are all not only heading in the wrong direction, they’ve headed there long ago, and there’s nothing that indicates they’ll turn around! And all the time I was looking at these graphs/charts, I just kept shaking my head in disgust that the Fed, knowing all this, as these are their graphs, still hiked rates in December! I had a dear reader send me a note and give me a thought that I hadn’t crossed before regarding the rate hike. His thought was that the Fed hike rates because of pressure put on them by the Pensions… interesting. And with that, It’s time. I hope you have a Wonderful Wednesday! Regards, Chuck Butler P.S. Be sure to sign up for The Daily Reckoning — a free and entertaining look at the world of finance and politics. The articles you find here on our website are only a snippet of what you receive in The Daily Reckoning email edition. Click here now to sign up for FREE to see what you're missing. The post Japan Cancels Auction On Ten-Year JGB’s appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Japanese central banker claims omnipotence for devaluing currency Posted: 03 Feb 2016 07:15 AM PST Go, Haruhiko, go! * * * 'No Limit' to Japan Easing, Says Kuroda By Robin Harding TOYKO -- Haruhiko Kuroda said there was "no limit" to monetary easing as he vowed to slash Japanese interest rates deeper into negative territory if necessary. In his first speech since last week's surprise cut in interest rates to minus 0.1 per cent, the Bank of Japan governor said there was more room to ease and that he would invent new tools rather than give up his goal of 2 per cent inflation. "Going forward, if judged necessary, it is possible to cut the interest rate further from the current level of minus 0.1 per cent," said Mr Kuroda, pointing to the Swiss National Bank at minus 0.75 per cent and the Riksbank at minus 1.1 per cent, as examples of what the BoJ could do. ... Dispatch continues below ... ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. The speech raises the chances of future monetary easing in Japan, signalling that Mr Kuroda is fully committed to negative interest rates despite ruling them out for months before a sudden change of heart. In a paean to the magnificence of central banks -- delivered despite the global weakness of inflation -- he declared they were close to conquering the problem that interest rates cannot go below zero. "The constraint of the 'zero lower bound' on a nominal interest rate, which was believed to be impossible to conquer, has been almost overcome by the wisdom and practice of central banks, including those of the Bank of Japan," said Mr Kuroda. "It is no exaggeration that [ours] is the most powerful monetary policy framework in the history of modern central banking," he said. ... ... For the remainder of the report: http://www.ft.com/intl/cms/s/0/189c944a-ca38-11e5-be0b-b7ece4e953a0.html Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China's gold production falls as demand rises Posted: 03 Feb 2016 05:37 AM PST China 2015 Gold Output Dips 0.4%, Consumption Rises By David Stanway China, the world's top gold miner and consumer, produced 450.05 tonnes of the precious metal in 2015, down 0.4 percent from a year earlier, the country's gold industry body said today. Consumption rose 3.7 percent to 985.9 tonnes, driven by a recovery in jewellery manufacturing and consumption, the China Gold Association said. ... ... For the remainder of the report: http://www.reuters.com/article/china-gold-output-idUSL3N15I1VD ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers: To invest or learn more, please visit: Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 02 Feb 2016 04:00 PM PST |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Truth be known, short of an uprising or revolution by the masses, which is highly unlikely, the elites have won over the masses, hands down, and the end game is in the final and irreversible stages. Time and again, we have reiterated the elites formulaic strategy of Problem, Reaction, Solution. The most current is the outrageous Mid East refugee situation where European countries are being forced to accept hundreds of thousands of displaced refugees from the war-torn Middle East.

Truth be known, short of an uprising or revolution by the masses, which is highly unlikely, the elites have won over the masses, hands down, and the end game is in the final and irreversible stages. Time and again, we have reiterated the elites formulaic strategy of Problem, Reaction, Solution. The most current is the outrageous Mid East refugee situation where European countries are being forced to accept hundreds of thousands of displaced refugees from the war-torn Middle East.

No comments:

Post a Comment