saveyourassetsfirst3 |

- Gold Daily and Silver Weekly Charts - Gold Resists, Silver Holds, Northeast Braces For Snow

- Fund Manager Warns Energy Sector Debt Implosion the Trigger Point for Systemic Collapse

- Gold Could Lose Safe-Haven Bid as Equities Rebound

- The Last Time THIS Happened, the Global Financial System Went Into Freefall!

- Fund Manager Warns: The Oil And Gas Credit Collapse Is Going To Be CATASTROPHIC

- Chronicle Of A Debt Foretold

- Middle East a Cauldron of Horror

- Retail Investor Meets 2016 Market Plunge

- Five Companies Swiss Asset Manager Florian Siegfried Is Watching

- Snowpocalypse 2016: Panic Hoarding Of Basic Supplies Leaves Store Shelves Empty

- Fund Manager: Financial Markets Are One Big Cartoon Network

- Gold Prices Slip as Oil Jumps 17%, Equities Rise, Commodities Slump Forces Supply Cuts

- Sage Investment Advice From Mike Tyson

- The Powers That Be Have Lost Control: “Everything Is Falling Apart Everywhere”

- Investing in Silver – 3 Must See Charts

- The Failure of the Iraqi Army: America’s $25 Billion Paper Tiger

- Jan 22, 1980 : The day the Gold Bull market stopped

- What is Money?

- 2016 Market Meltdown: We Have Never Seen A Year Start Quite Like This…

- Gold Daily and Silver Weekly Charts - Gold Resists a Raid, Silver Holds Place

- Gold Short Term Bullish Channel Forms

| Gold Daily and Silver Weekly Charts - Gold Resists, Silver Holds, Northeast Braces For Snow Posted: 22 Jan 2016 01:01 PM PST Le Cafe Américain |

| Fund Manager Warns Energy Sector Debt Implosion the Trigger Point for Systemic Collapse Posted: 22 Jan 2016 01:00 PM PST I would suggest that the massive debt implosion about to happen in the energy sector will be the trigger point for a collapse that can't be prevented this time. Submitted by PM Fund Manager Dave Kranzler, Investment Research Dynamics: Well, in truth, we had a de facto collapse in 2008 which was addressed with […] The post Fund Manager Warns Energy Sector Debt Implosion the Trigger Point for Systemic Collapse appeared first on Silver Doctors. |

| Gold Could Lose Safe-Haven Bid as Equities Rebound Posted: 22 Jan 2016 12:13 PM PST Gold and Silver have held up well during the recent selloff in equities. From December 28 through Wednesday the broad NYSE lost 10.4% while the S&P 500 lost 9.6%. Precious Metals gained strength during that period. Gold advanced 3.0% while Silver gained 1.7%. Gold relative to the NYSE broke its downtrend and touched an 11-month high. Gold relative to global equities (excluding the US market) reached a 2-year high. Precious metals have clearly benefitted from the equity selloff but therefore figure to lose strength as the equity market begins a relief rally. Equities have become very oversold and are forming a bullish reversal. The weekly candle chart of the S&P 500 is shown below. The market is forming a bullish hammer (reversal candle) right at important support. The week is not over but we expect volume to be sizeable. The last two hammers on big volume came at the October 2014 and August 2014 lows. The market became extremely oversold this week as only 15% of stocks within the NYSE were trading above their 200-day moving average. That is the lowest figure in more than four years. Furthermore, various sentiment indicators are showing extreme pessimism. The AAII survey for example is showing the lowest amount of bulls since 1987.

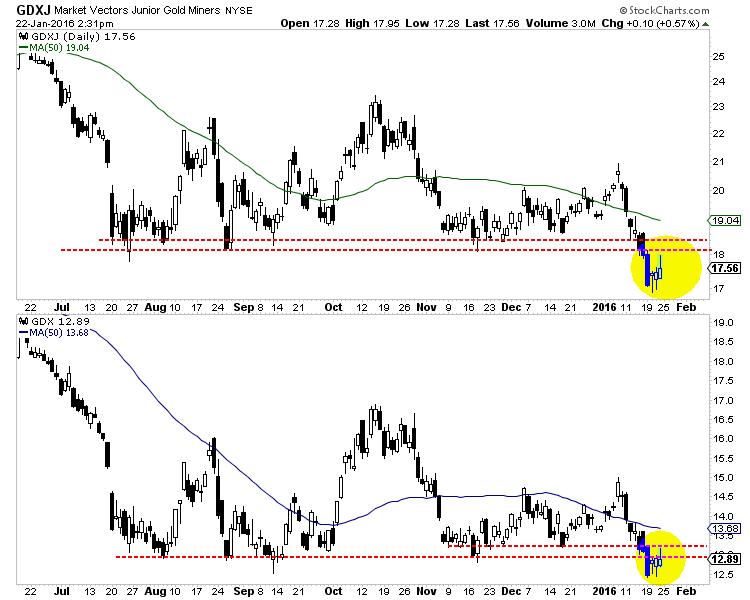

The S&P 500 could rally as high as 1990 where there is major resistance. Wednesday's low should hold for at least a few months. The recent poor performance of the gold miners is another signal that the metals (Gold and Silver) are at risk of making lower lows. During the aforementioned period when the metals were positive the miners (GDX and GDXJ) lost 9.6% and 12.0%. That relative and nominal weakness is a strong signal that the recent strength in the metals is unlikely to last. GDX and GDXJ are charted below. The miners are recovering in part due to the recovery in the stock market. They are also retesting Tuesday's breakdown to new lows. The rally has been weak as there is strong resistance overhead in the form of recent support ($18 for GDXJ and $13 for GDX) and the 50-day moving averages.

Recent relative weakness in the gold miners along with the bullish reversal in the equity market is a bearish development for precious metals. Gold and surprisingly Silver have held up well amid the decline in equities. They enjoyed a safe-haven bid yet are likely to lose that bid as the equity market begins a relief rally. The gold stocks, while initially following the stock market could resume their decline once metals have resumed their downtrends. Precious metals bulls should wait for an extreme oversold condition amid extreme bearish sentiment before turning bullish. As we navigate the end of this bear market, consider learning more about our premium service including our favorite junior miners which we expect to outperform in 2016.

Jordan Roy-Byrne, CMT |

| The Last Time THIS Happened, the Global Financial System Went Into Freefall! Posted: 22 Jan 2016 12:00 PM PST Things aren't Looking Good… Submitted by The Wealth Watchman: Holy smokes, 2016 is intense! The world economy is literally seizing up, and vaporizing vast amounts of wealth from investors. In just 2 weeks, over $3 trillion in wealth has been wiped out. I've been watching markets tank all over the entire world, and it's starting to […] The post The Last Time THIS Happened, the Global Financial System Went Into Freefall! appeared first on Silver Doctors. |

| Fund Manager Warns: The Oil And Gas Credit Collapse Is Going To Be CATASTROPHIC Posted: 22 Jan 2016 11:30 AM PST Remember 2007, when Bernanke stated that the problems developing in the mortgage market were "contained"??? Submitted by PM Fund Manager Dave Kranzler, IRD: We're headed toward another big credit explosion and I think what's happened in the oil market is will trigger that. The perfect poster-child of what's going to happen to the stock market […] The post Fund Manager Warns: The Oil And Gas Credit Collapse Is Going To Be CATASTROPHIC appeared first on Silver Doctors. |

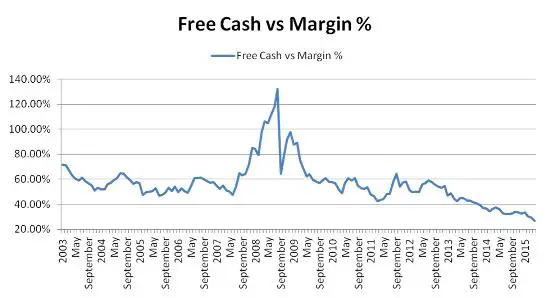

| Posted: 22 Jan 2016 11:09 AM PST Critics of today’s fiat currency/fractional reserve banking world have (for what seems like forever) made the common sense point that when debt rises faster than cash flow, bad things are bound to happen. In every cycle since 1980 this has been dismissed by the vast majority who benefit from inflating bubbles — until the bubble bursts. And here we go again. The following chart from Stock Traders Daily shows the relationship between margin debt (money borrowed by investors against existing stock positions in order to buy more stock) and cash on hand in brokerage accounts. The idea is that when investors hold lots of cash they’re pessimistic, and when they borrow a lot they’re optimisitc. Extremes of either tend to signal changes in market direction. At the end of 2015 investors were even more excited than at the peak of the housing bubble, indicating that there’s not much retail money left to be tossed at US stocks. China, being a little more bubbly than the US, is a good indicator of where US margin debt might be headed: Another red flag is being waved by corporate debt, much of which is being taken on to fund share repurchase programs. These tend to benefit shareholders in the moment but at the cost of higher leverage and less flexibility in the future. Where in the past net debt has tended to track EBITDA (a broad measure of earnings). starting in 2014 the former has soared beyond the latter. Just as a spike in margin debt implies a lack of retail stock buying in the future, soaring corporate debt implies limited borrowing power and a scale-back of share repurchases going forward. Based on both history and common sense, we should expect not just a slowdown, but a cratering of equity demand from both individuals and corporations in the year ahead. What happens then? Either the market crashes and prices go back to levels that attract wiser capital, or a new source of dumb money emerges. And that would be government. Already, the Bank of Japan owns more than half of the Japanese stock market. And now China — displaying its customary cluelessness about what markets are and how they work — is countering the recent bear market with public (which is to say borrowed) funds:

Companies exchanging long term bonds for equities and individuals using equities as collateral to buy more tend to distort equity valuations, but only temporarily, as the players’ finite borrowing capacity is eventually maxed out and the buying has to stop. Governments are a different story, since they can create trillions of dollars with a mouse click. Their ignorance is thus a lot more dangerous because it short-circuits price disclosure on a vast, potentially open-ended scale. When a central bank buys equities, it doesn’t have teams of analysts running valuation studies and creating model portfolios. Presumably it just makes across-the-board purchases, which tends to float all boats. So the wheat doesn’t get separated from the chaff and capital has no idea where to flow. Malinvestment becomes rampant and the result is, well, what we have today: Chinese ghost cities, Japanese zombie companies and US tech unicorns worth billions before generating their first dollar of earnings. And that’s before the Fed and European Central Bank really get going. |

| Middle East a Cauldron of Horror Posted: 22 Jan 2016 11:00 AM PST Up to this point in the age of atom splitting annihilation, the apprehension of obliteration kept sounder minds and self-control from pushing the button. But what restraint exists when Islamic suicide bombers or Zionist zealots who are prepared to use the "Samson Option" are in control of the weapons of mass destruction? Submitted by […] The post Middle East a Cauldron of Horror appeared first on Silver Doctors. |

| Retail Investor Meets 2016 Market Plunge Posted: 22 Jan 2016 10:00 AM PST Perhaps the best summary of the early trading action in 2016… The post Retail Investor Meets 2016 Market Plunge appeared first on Silver Doctors. |

| Five Companies Swiss Asset Manager Florian Siegfried Is Watching Posted: 22 Jan 2016 09:00 AM PST When a leading Swiss bank recommended its clients sell all their gold, AgaNola Asset Manager Florian Siegfried knew the precious metal was preparing for an upswing. In this interview with The Gold Report, he shares five junior mining names that have made smart moves during the down time and are well positioned for an upswing. […] The post Five Companies Swiss Asset Manager Florian Siegfried Is Watching appeared first on Silver Doctors. |

| Snowpocalypse 2016: Panic Hoarding Of Basic Supplies Leaves Store Shelves Empty Posted: 22 Jan 2016 08:20 AM PST Washington D.C. is about to be SLAMMED by one of the worst blizzards that it has ever experienced this weekend (models are predicting 3 ft+ 60mph winds), and people are already beginning to panic. If this is how crazy people are going to become when a big snowstorm arrives, what do you think they are going […] The post Snowpocalypse 2016: Panic Hoarding Of Basic Supplies Leaves Store Shelves Empty appeared first on Silver Doctors. |

| Fund Manager: Financial Markets Are One Big Cartoon Network Posted: 22 Jan 2016 08:00 AM PST If what you knew to be true turned out not to be true; when would you like to know about it? Submitted by Dave Kranzler, IRD: It seems to never end. The markets do the opposite of what would be expected based on common sense and on undeniable evidence about the fundamentals. Just this […] The post Fund Manager: Financial Markets Are One Big Cartoon Network appeared first on Silver Doctors. |

| Gold Prices Slip as Oil Jumps 17%, Equities Rise, Commodities Slump Forces Supply Cuts Posted: 22 Jan 2016 07:01 AM PST Bullion Vault |

| Sage Investment Advice From Mike Tyson Posted: 22 Jan 2016 07:00 AM PST Everyone has a plan 'til they get punched in the mouth… Submitted by Tim Price, Sovereign Man: In a crisis, it helps to have good counsel. Consider the following sage advice from investment strategist Mike Tyson: "Everyone has a plan 'til they get punched in the mouth." Or as German military strategist Helmuth von […] The post Sage Investment Advice From Mike Tyson appeared first on Silver Doctors. |

| The Powers That Be Have Lost Control: “Everything Is Falling Apart Everywhere” Posted: 22 Jan 2016 06:49 AM PST People don't realize that the global economy now is ground to a halt… We're talking about the worst economy of our lifetimes… Submitted by Mac Slavo, SHTFPlan: The entire system has been revealed for the sham it really is since the start of the New Year. Stock markets are crashing, the global economy has […] The post The Powers That Be Have Lost Control: "Everything Is Falling Apart Everywhere" appeared first on Silver Doctors. |

| Investing in Silver – 3 Must See Charts Posted: 22 Jan 2016 05:01 AM PST gold.ie |

| The Failure of the Iraqi Army: America’s $25 Billion Paper Tiger Posted: 22 Jan 2016 12:00 AM PST |

| Jan 22, 1980 : The day the Gold Bull market stopped Posted: 21 Jan 2016 04:00 PM PST Time Magazine |

| Posted: 21 Jan 2016 04:00 PM PST Dollar Daze |

| 2016 Market Meltdown: We Have Never Seen A Year Start Quite Like This… Posted: 21 Jan 2016 03:13 PM PST

The Dow was up just a little bit on Thursday thankfully, but even with that gain we are still in unprecedented territory. According to CNBC, we have never seen a tougher start to the year for the Dow than we have in 2016…

But even with the carnage that we have seen so far, stocks are still wildly overpriced compared to historical averages. In order for stocks to no longer be in a “bubble”, they will still need to decline by about another one-third. The following comes from MarketWatch…

Of course the mainstream media doesn’t seem to understand any of this. They seem to be under the impression that the bubble should have lasted forever, and this latest meltdown has taken them totally by surprise. Ultimately, what is happening should not be a surprise to any of us. The financial markets always catch up with economic reality eventually, and right now evidence continues to mount that economic activity is significantly slowing down. Here is some analysis from Brandon Smith…

In addition, another very troubling sign is the fact that initial jobless claims are starting to surge once again…

Since the last recession, the primary engine for the creation of good jobs in this country has been the energy industry. Unfortunately, the “oil boomtowns” are now going bust, and workers are being laid off in droves. As I mentioned the other day, 42 North American oil companies have filed for bankruptcy and 130,000 good paying energy jobs have been lost in this country since the start of 2015. And as long as the price of oil stays in this neighborhood, the worse things are going to get. A lot of people out there still seem to think that this is just going to be a temporary downturn. Many are convinced that we will just go through another tough recession and then we will come out okay on the other side. What they don’t realize is that a number of long-term trends are now reaching a crescendo. For decades, we have been living wildly beyond our means. The federal government, state and local governments, corporations and consumers have all been going into debt far faster than our economy has been growing. Of course this was never going to be sustainable in the long run, but we had been doing it for so long that many of us had come to believe that our exceedingly reckless debt-fueled prosperity was somehow “normal”. Unfortunately, the truth is that you can’t consume far more than you produce forever. Eventually reality catches up with you. This is a point that Simon Black made extremely well in one of his recent articles…

Sadly, the time for avoiding the consequences of our actions is now past. We are now starting to pay the price for decades of incredibly bone-headed decisions, and anyone that is looking to Barack Obama, the Federal Reserve or anyone else in Washington D.C. to be our savior is going to be bitterly disappointed. And as bad as things have been so far, just wait until you see what happens next. 2016 is the year when everything changes. |

| Gold Daily and Silver Weekly Charts - Gold Resists a Raid, Silver Holds Place Posted: 21 Jan 2016 03:02 PM PST Le Cafe Américain |

| Gold Short Term Bullish Channel Forms Posted: 21 Jan 2016 01:25 PM PST |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment