Gold World News Flash |

- If This Weakest, Wobbly Link Snaps… Look Out!

- Chinese Stocks Face Derivatives-Driven Trigger Of Doom

- 1981 Movie ‘Rollover’ Predicted The Coming Collapse Almost Perfectly

- Front Loaded: China, Volatility, and Debt Deflation

- The Fragile Forty & How The World Lost $17 Trillion In 6 Months

- Silver and Gold Price Rally Had Begun with Metals Poised for a Great Leap Up

- Billionaire Blackstone CEO Trolls American Public – Doesn't Get Why People Are Angry

- Chinese Stocks Face Derivatives-Driven Trigger Of Doom

- The Next "Significant Risk For The S&P 500" - Kolanovic Reveals "The Macro Momentum Bubble"

- Money will be useless -- The Number One Threat to your Survival

- Gerald Celente: As Predicted The Panic Of 2016

- Wayne Madsen -- Mystery, Murder and Military Secrets

- Senator Elizabeth Warren Calls for Action to Root Out Influence of Money in Politics

- The NWO's Collapse Plan Laid Out by Fabian Calvo: Price Controls, NIRP, World Bailout

- Bubble Finance Trading: The Best Strategy for Profiting From a Crashing Market

- Will the Bursting of Auto Loan Bubble Affect Gold?

- What drives the Mines - Commodities or the Market

- Gold Daily and Silver Weekly Charts - Gold Resists a Raid, Silver Holds Place, Northeast Prepares For Snow

- Alex Jones Show (VIDEO Commercial Free) Thursday 1/21/2016: Larry Nichols

- Alasdair Macleod: Out of the mouths of babes. ...

- China vice president vows to 'look after' stock market investors

- Koos Jansen: In China everyone can buy gold at the Shanghai exchange

- Ronan Manly: As Deutsche Bank exits London gold, Chinese bank enters

- No end to oil rout as Saudi Arabia plays tough

- Miles Franklin bullion shop's Schectman, Hoffman hold seminar in Colo. on Jan. 28

- Benjamin Fulford: Jan 18, 2016: The revolution continues with shipping freeze, stock plunge, US dollar dumping, $20 oil, attacks on gold mines and more

- Video: These Stunning Charts Show Exactly Why You Need Gold Before The Next Wave Hits

- Another Year of Insubstantial Gold Trading in the New York Market

- Who is Really Ruling Saudi Arabia?

- 2016 Commodity Forecast: Follow This Sneaky Indicator

- The Rout Of The Russian Ruble Continues

- Gold Stock Set Up In 1 Chart Cartel~Buster® !, For You

- US Dollar Drop Gold Price Rally

- Investors "Think About How to Mitigate Your Losses"

- Rick Mills: How to Profit from the Demands of a Growing World Population

- Purchase Gold and Silver From Tom Cloud

- ISIS Revealed as an American Secret? | Jim Willie

- Hollywood Warning of Something Big in 2016? (Illuminati in America)

- Gold: The Road to Hell is Paved with Good...

- Gold Price Shot Up on Opening and Never Looked Back Closing up $17.20 to $1.107.10

- Gold Bugs Index (HUI) Drops through 100

- How Much Did Silver Miners Produce in 2015?

- RED ALERT! SATAN NOW CONTROLS AMERICA!

- Jim Sinclair's next seminar to be held in Tampa on Feb. 20

- The Hidden Reason Why Stocks Are Tumbling…

| If This Weakest, Wobbly Link Snaps… Look Out! Posted: 21 Jan 2016 09:01 PM PST The Global Rout Intensifies from The Wealth Watchman:

I intend to survey the damage, and focus on the weak link in the system here that I've been watching carefully. Firstly though, let's take a gander at a laundry list of absolutely horrifying data points around the world. Let's start with a very revealing chart, which should tell everyone with eyes to see, precisely what they need to know:

The Baltic Dry Index tracks the shipping industry in international trade. Greece factors heavily in this equation. This picture is unbelievable. I honestly keep thinking to myself: "Wow, we made another new low in the BDI, surely it's gotta find a bottom here somewhere," only to find there is no bottom! It just keeps falling! The 700 level, which was important due to the final bottom the shipping industry found during the Great Financial Crisis of 2008, was finally taken out with gusto in the last two business quarters. Something snapped and snapped hard! It has now dropped to nearly half the previous lowest level that global shipping had reached during the Great Financial Crisis of 2008/2009. Half of the worst level that we'd seen in the last century! Everywhere you turn, there is excess capacity in shipping. Shipping lanes are becoming backed up, and there is far too much product waiting to make its way through the "just in time" chain of command. Poor Greece! First they were gutted by globalist bankers, then their vote to reject the newest "bailout" was literally tossed in the trash by Brussels, and now their golden-child industry, international shipping, is literally dead in the water right now. Oh, and their pain is being shared and felt in spades throughout their continent. Just take a look at these charts(via zerohedge). Europe's Growing Financial Calamity The equity bloodbath that the world is feeling, is spreading quickly over Europe. Most major stock markets there have now either reached the December lows of last year or have made new lows! This is partially the result of cheap credit drying up all over the world(as we covered in my last article). If you look closely, the correlation between credit and their stocks is absolutely undeniable: Credit is tightening, taking the oxygen from the primary dealer banks and large corporate buy-backs, that have helped levitate their stock markets. Tens of millions of stock-owners, pensioners, and savers are getting hosed. Their savings, their 401ks, their retirement plans are taking a beating. If it's any consolation though, there is a silver lining to all of what's going on, and it should bring a smile to your face! For as ugly as global trade and global equities are right now, the banks are faring much worse! Italy, whose banks have been bobbing for air for months, have finally succumbed to the renewed selling pressure, which is being exacerbated by the withdrawal of liquidity and credit. Ouch, that's a wrecking ball to the face! What happens next though, should make you nervous. Things are getting so bad for Italian banks, that the CEO of Monte Paschi Bank said this: *MONTE PASCHI CEO CONFIRMS FINANCIAL STABILITY OF BANK *MONTE PASCHI CEO: STOCK DECLINE NOT JUSTIFIED BY FUNDAMENTALS Shield brothers, there is an old saying, which you should ALWAYS keep at the forefront of your mind: "Never believe anything until it has been officially denied". The fact that Monte Paschi's CEO is coming out to assure everyone that: 1)They're stronger than ever… 2)That the actions of investors selling their stocks, aren't "justified" by the big picture 3)That stability and calm reign supreme… Should have you hunkering down! Also their ridiculous assertions, do not match the actions of the Italian government,who just made this announcement: PRESS RELEASEConsob adopts a temporary ban on short selling on Banca MPS shares.The ban shall apply immediately and shall last until Tuesday 19 January 2016 end of day. Consob decided to temporary prohibit short sales of the share Banca MPS (ISIN code IT0005092165). The ban will apply immediately and will be enforce for the entire trading session of tomorrow, Tuesday 19 January 2016, on the MTA market of Borsa Italiana. Yes, brothers, the Italian government has begun the policy of banning short-selling again! Now, granted, it's only one bank, and it was only for one day, but that's how it starts, not how it ends. Look at the general picture of their CDS market(which is used to insure against risks on these banks): Uh oh! Folk, that's a huge spike, in fact the last time there was this little trust in their banking system, and this much hedging, was nearly 3 years ago, and this spike has occurred in just a few weeks' time. There's a lesson here: It doesn't take long to lose confidence in the entire system,when that system is built on the rock-solid foundation of unicorn tears and puppy dog tails! There is absolutely nothing to this financial system of ponzi/debt pyramids, and increasingly, everyone's putting their money in places which state that the emperor has no clothes! The banking carnage is not contained to Europe or to Italy either….it is spreading here, and fast! Just look at a few of the major US banks: 1) CitiBank Share price 6 weeks ago: $55 Share price today: $40.50 A decline of 28% in one month. 2) Goldman Sachs Share price 9 weeks ago: $199 Share price today: $153.78 A decline of nearly 28% in two months. 3) JP Morgan Share price 7 weeks ago: $67.89 Share price today: $55.51 Decline of roughly 19% in 7 weeks. 4) Bank of America Share price 6 weeks ago: $17.80 Share price today: $13.70 Decline of 33% in 6 weeks! Banking is bearing the worst of the brunt, because of tightening credit, and folks' concern over the liquidity and equity picture. However, there is another huge teetering pillar that I've been watching for weeks(along with oil, which just caved to $26 and change per barrel, by the way), and if this wobbly pillar goes….watch out! The Banking Cabal's Foot Soldiers

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Chinese Stocks Face Derivatives-Driven Trigger Of Doom Posted: 21 Jan 2016 09:00 PM PST from Zero Hedge:

And it appears that has already begun as not only did stocks accelerate through the “pin” level of 8,000 butChinese ‘VIX’ has surged as banks look for alternative ways to hedge their implied positions… When banks sell the structured products to investors, they take on an exposure that's similar to purchasing a put option on the index, Chan said. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1981 Movie ‘Rollover’ Predicted The Coming Collapse Almost Perfectly Posted: 21 Jan 2016 08:00 PM PST MUST WATCH: This is what WILL happen… soon. From the 1981 film ‘ROLLOVER‘. Our advice: PREPARE. from SilverShieldGrp: hat tip: The Truth | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Front Loaded: China, Volatility, and Debt Deflation Posted: 21 Jan 2016 07:00 PM PST Below are some excerpts from our latest macro note, "Front Loaded: China, Volatility, and Debt Deflation." The full report with the charts and footnotes is on www.kbra.com. The key question raised by the comment is this: Do Chair Yellen and the other members of the Federal Open Market Committee actually believe that there is a positive trade-off between the "benefits" of QE and zero rates and the carnage now unfolding in the global capital markets? The downside of the social engineering experiment by Ben Bernanke & Janet Yellen is measured in the trillions of dollars, but the benefits seem to be few. Indeed, the only segment of global society that seems to benefit from zero rates and "large scale asset purchases," to paraphrase Chairman Bernanke, are debtors. So was this whole exercise with zero rates and purchases of trillions of dollars worth of Treasury and agency securities simply a delaying tactic to avoid deflation and debt liquidation? The FOMC says that QE and ZIRP are all about restoring jobs and growth, but when you examine the situation carefully, it seems hard avoid the conclusion that the Fed's actions were really about managing a world that is drowning in a sea of uncollectible debt. Chris Front Loaded: China, Volatility, and Debt Deflation Kroll Bond Rating Agency January 21, 2016

Summary Kroll Bond Rating Agency (KBRA) believes that the secular shift of asset allocations away from high-yield and leveraged credit, and into more secure government and investment grade credits, will result in lower interest rates as the year progresses – even as the Federal Open Market Committee (FOMC) talks about raising interest rates in its policy guidance. Increased market volatility results from changes in expectations for global growth and come at the end of Fed bond market market intervention, euphmestically called "quantitative easing." The credit bubbles in sectors like energy and commodities created during the period of FOMC market intervention must now necesssarily be unwound. Watching the benchmark 10-year Treasury trade through 2% yield confirms KBRA's earlier judgement that the bias with respect to market interest rates will remain negative for some time to come – regardless of what the FOMC may say or attempt to do in terms of increasing the cost of short-term funding. Ironically, KBRA believes that short-term benchmark interest rates will remain under downward pressure even as credit spreads widen and the process of remediating distressed credits moves forward. Discussion When financial markets began the New Year 2016, comfortable assumptions about financial stability were dashed by strong selling pressure coming from the Chinese equity markets. This outflow by domestic Chinese investors somehow caused a cascade of selling throughout global equity markets. Many analysts have concluded that worries about forward growth prospects in China are the cause of the selling pressure, but we believe that rising debt levels and central bank manipulation of financial markets are also significant drivers of renewed market volatility. The Fed and other central banks have pursued a policy of purchasing hundreds of billions of dollars' worth of debt securities, action meant to change investor preferences and, indirectly, result in higher growth and employment. KBRA believes that the end of debt purchases by the FOMC, not only selling in China's equity markets, is now the chief source of instability in the global financial markets, especially given that most other central banks are easing policy as the Fed attempts to tighten. The conclusion of Fed securities purchases over a year ago essentially marked the start of a tightening process that has coincided with a sharp decline in demand for commodities and has seen an equally sharp selloff in the high yield debt sector. Former Dallas Fed President, Richard Fisher, describes how the FOMC "front loaded" a rally in financial markets starting in 2009, but now says that the global economy must go through a "digestive period" of lower growth. Fisher specifically opines that one should not blame the equity market selloff on China and that market distortions caused by the Fed are to blame for recent market volatility. Of note, the just-released 2010 minutes of the FOMC reveal that former Chairman Ben Bernanke unsuccessfully sought to get a consensus to accurately describe QE, namely as "large scale asset purchases." Mass purchases of assets, it should be recalled, are fiscal activities that traditionally required Congressional authorization. For example, the government purchase of gold in the 1930s was funded by the Reconstruction Finance Corporation, an executive branch agency created by President Herbert Hoover. The market intervention conducted by the Bernanke and Yellen Feds exceeds the scope of past practice by western central banks, which have become de facto fiscal agencies funded not via the debt markets but by investing moribund bank reserves on deposit with the central bank. Significantly, the real economy has not responded to the Fed's social engineering experiment. Indeed, since 2013 economic growth has gradually slowed so that as 2016 begins the world economy seems on the brink of entering a recession. Many economists, joined by the International Monetary Fund and Atlanta Fed, have lowered forward growth estimates for 2016 and beyond. To read the rest of the KBRA research note, go to: https://www.krollbondratings.com/show_report/3640 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Fragile Forty & How The World Lost $17 Trillion In 6 Months Posted: 21 Jan 2016 06:45 PM PST It's official. More than 50% of the "wealth" effect created from the 2011 lows to the 2015 highs has been destroyed (despite the world's central banks going into money-printing overdrive over that period). Almost $17 trillion of equity market capitalization has evaporated in just over 6 months with over 40 global stock indices in bear markets...

So just before you (Jim Cramer et al.) demand the central banks do more, just remember what reality looks like - will you use any centrally-planned rally to buy moar or sell into as the smoke and mirrors of yet another bubble is exposed with the business cycle inevitably beating the rigging... | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver and Gold Price Rally Had Begun with Metals Poised for a Great Leap Up Posted: 21 Jan 2016 06:17 PM PST

Both silver and gold prices are poised and coiling for a great leap up. Gold's daily chart seems to say that it has begun that rally and today was only a usual correction of yesterday's big ($17.20) rise. Keep watching $14.40 silver and $1,113 gold price. When they break through that fence, they will run for the woods. Here's a small request for y'all. On Tuesday, 26 January, my wife Susan will have eye surgery to remove the floaters in her vitreous humor. I would deeply appreciate your prayers on her behalf for a successful surgery, and I know she would, too. I see where Jamie Dimon, JPMorgan CEO, got a 35% pay raise in 2015, to $27 million from $20 million. Of course I risk being called a communist, although I am probably the only human being in North America who emphatically is not a communist or socialist, but given reality, I must question what sort of genius it would take to add $20 million, much less, $27 million, in value to an enterprise. After all, if JPM pays Jamie $27 million, business logic says they expect to leverage that $27 million into some larger income for JPM. Maybe he could boost their income that much, maybe he is such a business genius or maybe he has so many Washington contacts that he's worth that. But I doubt it, all the way from Tennessee. For some reason, the words "crony capitalism" keep popping to mind, and "well-positioned parasites." Don't bother writing me smoking emails about free markets and libertarianism, etc., because this has absolutely NOTHING to do with any of that. If you're that naïve, you ought to be investing in Perpetual Motion Machines, Ltd. Today was a reaction day. Stocks rose a bit, but before the first hour's trading passed had gone nose underwater again. Buyers came in and drove the Dow to a high of 16,039 about noon. But the Dow must have et somethin' didn't agree with it, cause it started puking up points and never stopped till 2:45, when it stopped falling and eased upward. Ended gaining 115.94 (0.74%) to 15,882.68. S&P500 gained 9.66 (0.52%). Stocks may be ready for a leetle countertrend rally, as they are right oversold, but today didn't convince me of that. If they do rally, it will be brief. MUCH more plunging lies in the future. Think of yourself looking into a deep well, trying to see your face in the water hundreds of feet below. Now think of yourself toppling over the top of the well wall and plummeting down the well shaft. Something like that. US dollar index blew up today. It rose to 99.95, a new high for the move, on sudden buying around the open. Must have looked around and wondered what it was doing that high up, because it fell sharply, then more, then more through the day to close down 11 basis points at 99.06. A break to a new high intraday with a lower close for the day is puking sick action, and the first half of a key reversal. Lower close next two days sinks the dollar. Euro took a notion to fall today, even though the dollar index fell. Euro fell 0.9% to $1.0879 and the bottom boundary of that even sided triangle -- also below its 20 and 50 day moving averages. Next step is a breach of that boundary and further fall. Nor did the yen rise, no, it fell 0.65% to 84.96 cents per 100 yen. Looks like folks generally were fleeing fiat currencies today, but into what? Washing machines? Wasn't gold. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Billionaire Blackstone CEO Trolls American Public – Doesn't Get Why People Are Angry Posted: 21 Jan 2016 05:30 PM PST Submitted by Mike Krieger via Liberty Blitzkrieg blog,

I’ve written several posts examining the dangerous cluelessness inherent throughout the ranks of the oligarch class over the past several years. One of my earliest and most viral pieces was published two years ago and titled, An Open Letter to Sam Zell: Why Your Statements are Delusional and Dangerous. That article was a response to the billionaire’s appearance of CNBC during which he instructed the less financially fortunate to “emulate the 1%,” as if their destitution was a result of personal shortcomings as opposed to egregious structural flaws inherent in the rigged, crony, oligarch-controlled Banana Republic economy billionaires such as himself helped mold. Here’s an excerpt:

In that article, I outlined many of the reasons people are angry and why they should be angry. In fact, I’ve published hundreds of articles every year since early 2012 detailing exactly why the country is in such dire straights. It’s not just me of course, tens of thousands of people across the globe have been doing it for far longer and to much larger audiences. The reason billionaires are incapable of comprehending what’s going on is because doing so would contradict the life-stories they tell themselves about themselves. Make no mistake about it, billionaires think of themselves as truly exceptional people. Privately, they likely muse that their mere presence on earth is nothing short of a glorious gift to humanity from the heavens. These people are deluded, secluded and emotionally stunted in more ways than you could possibly imagine. They have zero capacity for self-reflection. In our modern world, our culture has become convinced that extreme wealth and power are something to admire, when history shows us time and time again that “the people” must always remain vigilant against the centralization of precisely those two things. Naturally, the people who are centralizing the wealth and power for themselves don’t see the problem with wealth and power centralization. Neither does much of the fawning, inept, and soulless media. The latest example of oligarch disconnectedness comes, quite appropriately, from Davos. So here’s the quote from Steven Schwartzman, billionaire CEO of private equity giant Blackstone:

Forbes goes on to accurately note that:

David Sirota at the International Business Times adds:

Yes, you read that right. 62 people own more than 3.5 billion of the earth’s inhabitants. Nothing to see here, move along serfs. Of course, as I’ve maintained time and time again, this sort of aggregation of wealth only happens in rigged economies. It’s as if the entire Western world has become that Third World oil dictatorship where three guys have billions while the rest of the population eats dirt. I’m sure those dictators also see wonderful, admirable people when they fawn over themselves in the mirror, just as Steven Schwartzman undoubtably does. Which brings me to my final point: Blackstone. It’s not like Steven Schwartzman is Steve Jobs or Henry Ford, revolutionary entrepreneurs who made their fortunes changing the world and bringing innovative products to people. In fact, you could very easily make the argument that Schwartzman has made much of his fortune by bringing misery to people, or if we want to be generous, hyper rent-seeking from the destruction of the American middle class. Need some proof? Check out the following: Leaked Documents Show How Blackstone Fleeces Taxpayers via Public Pension Funds A Closer Look at the Decrepit World of Wall Street Rental Homes America Meet Your New Slumlord: Wall Street | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Chinese Stocks Face Derivatives-Driven Trigger Of Doom Posted: 21 Jan 2016 05:00 PM PST Despite the collapse in Chinese stocks, Bloomberg reports annual sales of Chinese equity-linked structured notes across AsiaPac rose to a record (prompting Korea's financial regulator to warn investors in August that their holdings had become too concentrated in notes tied to the China H-Shares index). When banks sell the structured products to investors, they take on an exposure that's similar to purchasing a put option on the index... which needs to be hedged via index futures; and if BofAML is right, Chinese stocks in Hong Kong are poised for a fresh wave of selling now that HSCEI has crossed 8,000 as banks are forced to hedge.

And it appears that has already begun as not only did stocks accelerate through the "pin" level of 8,000 but Chinese 'VIX' has surged as banks look for alternative ways to hedge their implied positions... When banks sell the structured products to investors, they take on an exposure that’s similar to purchasing a put option on the index, Chan said.

Still, if Chan’s scenario plays out, the market could soon come under pressure. A notional $13.6 billion of structured products linked to the H-share measure will get knocked in between levels of 7,000 and 8,000 on the index, and $16.8 billion between 6,000 and 7,000, he said.

It was clear that is what happened yesterday, but how many more are to follow? | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Next "Significant Risk For The S&P 500" - Kolanovic Reveals "The Macro Momentum Bubble" Posted: 21 Jan 2016 04:55 PM PST Yesterday when we presented Tom DeMark's latest technical forecast, which anticipates a 5-8% bounce in risk before the next leg lower in equities, we said to "look for the next few days to see if DeMark still has his magic" adding that "we, on the other hand, would rather wait for "Gandalf" Kolanovic' next take." We didn't have long to wait: moments ago JPM's head quant, whose uncanny track record of predicting every major market inflection point has been duly documented here, laid out his latest thoughts on the negative feedback loop that is "becoming a significant risk for the S&P 500" but also showed what he thinks is an odd divergence between various asset classes, to wit: "as some assets are near the top and others near the bottom of their historical ranges, we are obviously not experiencing an asset bubble of all risky assets, but rather a bubble in relative performance: we call it a Macro-Momentum bubble." His warning: beware the bursting of the macro-momentum bubble. Here is the latest warning from the man whose every single caution so far has played out virtually as predicted:

That was then, and played out just as Kolanovic predicted: here is the latest warning:

Why do we have this bubble?

So now we know that we have not one massive bubble, but a bubble of small asset-class divergences, all thanks to the Fed. What to do? As a reminder, here is how JPM's will trade this: use transitory bounces to liquidate risk positions, and stay in either cash or gold until better buying opportunities present themselves. Unless, of course, Yellen launches QE4, in which case all bets are off. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Money will be useless -- The Number One Threat to your Survival Posted: 21 Jan 2016 04:15 PM PST What An Economic Collapse Looks Like People have been Warned Repeatedly for years but you can't tell most people anything! When it hit their front door it will be way too late and you are right most of them will act like FOOLS and act like they had no idea! Problem is this is just a bit of... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gerald Celente: As Predicted The Panic Of 2016 Posted: 21 Jan 2016 03:47 PM PST Economic collapse and financial crisis is rising any moment. Getting informed about collapse and crisis may earn you, or prevent to lose money. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Wayne Madsen -- Mystery, Murder and Military Secrets Posted: 21 Jan 2016 03:16 PM PST Alex Jones talks with investigative journalist Wayne Madsen about the dark secrets of the American political system. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Senator Elizabeth Warren Calls for Action to Root Out Influence of Money in Politics Posted: 21 Jan 2016 02:57 PM PST In a Senate floor speech on the sixth anniversary of Citizens United, Senator Elizabeth Warren laid out steps that Congress and the Administration can take to root out the influence of money in politics. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The NWO's Collapse Plan Laid Out by Fabian Calvo: Price Controls, NIRP, World Bailout Posted: 21 Jan 2016 02:41 PM PST I found Fabian Calvo's opinions very interesting, and respect his professional knowledge – Fabian hosts a weekly Real Estate webinar The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bubble Finance Trading: The Best Strategy for Profiting From a Crashing Market Posted: 21 Jan 2016 02:33 PM PST This post Bubble Finance Trading: The Best Strategy for Profiting From a Crashing Market appeared first on Daily Reckoning. We’re at one of the greatest financial market inflection points since 1929. The market is down for the year… and headed much lower. But that doesn't mean you have to lose money. In fact, it's just the opposite. It's a basic truism that you can make a profit in a rising market if you "go long" and you can make a profit in a falling market if you "go short." The $64 million question, of course, is always how can you know the direction? There are all kinds of financial advisers and market seers and chart readers and fancy investment formulas to report to answer to answer that question. All of these assume some kind of world in which the future unfolds in a grand cyclical continuum that’s anchored in past history. They’ll tell you that with the right pattern recognition software or system like they advertise on financial TV and you'll make a killing. Don’t believe that for a second. We’re in uncharted waters after nearly 20 years of madcap money printing by the Federal Reserve and other central banks. Over that time, everything was wildly inflated: Stocks, bonds and real estate. Now the credit bubble has reached its apogee, its maximum extent. From now, on it's "look out below." That begs the questions: How do you profitably invest in a falling market? How do you profit the huge correction of this immense bubble that's popping? There are two ways… You can short stocks. Or, you can buy "put options." I recommend the latter. Put options are easy to use and an effective way to execute my bubble finance trading strategy. Here are the basics. There are two types of options: "Call options" and "put options". Both give you the right, but not the obligation to buy or sell a stock at a certain price. You buy a call option if you think the market is going up. A lot of people have been making a lot of money doing that during the entire expansion of this financial bubble. You buy a put option — which I'm recommending to you — if you think market is going to fall. That's our thesis. The market is going to fall further, faster, soon. Put options are a safe way to take a profitable position where the facts and analysis overwhelmingly suggest that a stock or exchange traded fund (ETF) is going to fall. I say they’re safe because you can never lose more than the money you pay for the put options. Your risk is limited. Meanwhile, if you bet correctly, you’ll earn your money back plus double or triple your original investment if the stock in question falls. The worst case scenario is that if your timing is wrong, or the market moves in the opposite direction you've bet you can lose all of the money you purchased the option for. This is the best strategy to use right now. Because the inflated market valuations of the past seven years have gotten so out of hand. With the Federal Reserve raising interest rates and signs of recession spooking investors, you can expect the selling momentum in many markets — especially those that were most inflated — to intensify. So far, I've helped readers of my Bubble Finance Trader readers close out two trade recommendations: 88% in 30 days, on Viacom put options. And 54% yesterday with put options on the company WisdomTree which is in the business of creating exchange trading funds. And there are many more opportunities. I've taken the time to outline the most urgent opportunity right here. This is not to say that bubble finance trading is automatic or guaranteed. Don't believe anyone who tells you their strategy is foolproof. But buying put options is the ideal way to profit in this new market environment. They can make you two, three and four times your money as the most overvalued stocks and ETFs take a big fall. The market is going down. That doesn’t mean it will go down every day (as I write this, for example, all three indexes are in the green), but there won’t be relief rallies. Rational investors in thought will drive the market, instead of robo-traders and machines. As 2016 unfolds and the recessionary forces become manifest in our economy, the markets will go even lower. There's a company in particular that you should focus on right now. It's one of four high-flying stocks essentially holding up the entire stock market. Think of it like the foundation of the stock market. When this stock starts to collapse in price it will take the bottom out of the whole stock market. Investors will hit the sell button on other stocks as the broad market starts to tank along with it. With a $267 billion market cap, a 70% drop in this company's share price would wipe out $200 billion in investors' wealth. Creating a tsunami of fear in the stock market… It'd be like dropping another A-bomb into the economy — since the rising stock market of the last seven years is one of the only signs of an "economic recovery." But using the strategy I just outlined, you could make 300% on the opportunity. Click here to see all of the details. There's no long video that you need to watch. Regards, David Stockman The post Bubble Finance Trading: The Best Strategy for Profiting From a Crashing Market appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Will the Bursting of Auto Loan Bubble Affect Gold? Posted: 21 Jan 2016 02:00 PM PST SunshineProfits | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| What drives the Mines - Commodities or the Market Posted: 21 Jan 2016 01:55 PM PST | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 21 Jan 2016 01:04 PM PST | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alex Jones Show (VIDEO Commercial Free) Thursday 1/21/2016: Larry Nichols Posted: 21 Jan 2016 01:03 PM PST -- Date: January 21, 2016 --Today on The Alex Jones ShowOn this Thursday, January 21 edition of the Alex Jones Show, we break down the ongoing collapse of both the economy and the Hillary Clinton campaign. Clinton is now actually doing something very foreign to her: work! She's having to work... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alasdair Macleod: Out of the mouths of babes. ... Posted: 21 Jan 2016 11:59 AM PST By Alasdair Macleod Parents will tell you the most difficult questions to answer sometimes come from their children. Here are some apparently innocent questions to ask of economists, journalists, financial commentators, and central bankers, questions designed to expose the contradictions in their economic beliefs. They are at their most effective using a combination of empirical evidence and simple, unarguable logic. References to economic theory are minimal, but in all cases the respondent is invited to present a valid theoretical justification for what invariably are little more than baseless assumptions. A pretense of economic ignorance by the questioner is best, because it is most disarming. Avoid asking questions couched in anything but the simplest logical terms. You will probably get only two or three questions in before the respondent sees you as a troublemaker and refuses to cooperate further. The nine questions that follow are best asked so that they are answered in front of witnesses, adding to the respondent's discomfort. Equally, journalists and financial commentators, who make a living from mindlessly recycling others' beliefs, can be great sport for an interrogator. The game is simple: We know that macroeconomics is a fiction from top to bottom; the challenge is to expose it as such. If appropriate, preface the question with an earlier statement by the respondent, which he cannot deny; i.e. "Last week you said that..." ... For the remainder of the commentary: https://www.goldmoney.com/out-of-the-mouths-of-babes?gmrefcode=gata ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Join GATA here: Vancouver Resource Investment Conference http://cambridgehouse.com/event/49/vancouver-resource-investment-confere... Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China vice president vows to 'look after' stock market investors Posted: 21 Jan 2016 11:42 AM PST By John Micklethwait and John Fraher China is willing to keep intervening in the stock market to make sure that a few speculators don't benefit at the expense of regular investors, China's vice president said in an interview. Calling the country's market "not yet mature," Vice President Li Yuanchao said the government would boost regulation in an effort to avoid too much volatility. "An excessively fluctuating market is a market of speculation where only the few will gain the most benefit when most people suffer," Li said in an interview with Bloomberg News after arriving at the World Economic Forum's annual meeting in Davos, Switzerland. "The Chinese government is going to look after the interests of most of the people, most of the investors." Li, 65, is the most senior Chinese official yet to underline the government's readiness to intervene should the market turmoil of last summer and the start of 2016 continue. ... ... For the remainder of the report: http://www.bloomberg.com/news/articles/2016-01-21/china-vice-president-v... ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: Vancouver Resource Investment Conference http://cambridgehouse.com/event/49/vancouver-resource-investment-confere... Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Koos Jansen: In China everyone can buy gold at the Shanghai exchange Posted: 21 Jan 2016 11:34 AM PST 2:34p ET Thursday, January 21, 2016 Dear Friend of GATA and Gold: Chinese gold market researcher Koos Jansen today attributes the World Gold Council's chronic underestimation of gold demand in China to the failure to recognize that ordinary people as well as big companies can purchase gold through the Shanghai Gold Exchange. Jansen's report is headlined "In China Everyone Can Buy Gold at the SGE" and it's posted at Bullion Star here: https://www.bullionstar.com/blogs/koos-jansen/in-china-everyone-can-buy-... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. Join GATA here: Vancouver Resource Investment Conference http://cambridgehouse.com/event/49/vancouver-resource-investment-confere... Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ronan Manly: As Deutsche Bank exits London gold, Chinese bank enters Posted: 21 Jan 2016 11:19 AM PST 2:18p ET Thursday, January 21, 2016 Dear Friend of GATA and Gold: Gold researcher Ronan Manly today examines Deutsche Bank's withdrawal from the London gold market, the potential sale of its spanking-new London gold vault to a Chinese government-controlled bank, and the possibility that the Chinese bank will be admitted to the secretive cabal that works with the Bank of England to manipulate the London market. Manly's report is posted at Bullion Star here: https://www.bullionstar.com/blogs/ronan-manly/g4s-london-gold-vault-2-0-... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers: To invest or learn more, please visit: Join GATA here: Vancouver Resource Investment Conference http://cambridgehouse.com/event/49/vancouver-resource-investment-confere... Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| No end to oil rout as Saudi Arabia plays tough Posted: 21 Jan 2016 11:12 AM PST Kingdom's oil chief says Saudis can withstand the price collapse, vowing to keep production at record levels This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Miles Franklin bullion shop's Schectman, Hoffman hold seminar in Colo. on Jan. 28 Posted: 21 Jan 2016 10:55 AM PST 1:52p ET Thursday, January 21, 2016 Dear Friend of GATA and Gold: Celebrating their 27th year in the monetary metals business, GATA's supporters at the Miles Franklin bullion shop in Minnesota are planning to travel around the United States making free presentations about the monetary functions of gold and silver. Doing the talking will be Miles Franklin's president and co-founder, Andy Schectman, and the company's market analyst and marketing director, Andy Hoffman. Attendees will be welcome to listen and ask questions and the company will not contact them afterward unless asked to do so. The first Miles Franklin presentation will be held from 6:30 to 11 p.m. Thursday, January 28, at the Broadlands Golf Course Clubhouse in on 144th Avenue in Broomfield, Colorado, just north of Denver. Hors d'oeuvres, water, coffee, tea, and iced tea will be complimentary. For the harder core of GATA supporters, there will be a cash bar as well. If you want to attend, please e-mail info@milesfranklin.com or telephone Miles Franklin's Yelena Peterson toll-free at 1-800-822-8080. CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver Coins and Rounds with Employee Pricing and Free Shipping Grab your Silver Starter Kit at cost from Money Metals Exchange, the company named "Precious Metals Dealer of the Year" by industry ratings group Bullion Directory. Simply go to MoneyMetals.com and type "GATA" in the radio box at the top of the page. This special silver offer contains 4 ounces of silver coins and rounds in the most popular 1-ounce, half-ounce, and 10th-ounce forms. Claim yours now, because GATA readers get employee pricing and free shipping. So go to -- -- and type "GATA" in the radio box at the top of the page. Join GATA here: Vancouver Resource Investment Conference http://cambridgehouse.com/event/49/vancouver-resource-investment-confere... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 21 Jan 2016 10:30 AM PST The revolution continues with shipping freeze, stock plunge, US dollar dumping, $20 oil, attacks on gold mines and moreBy: Ben Fulford http://benjaminfulford.net The revolution continues with shipping freeze, stock plunge, US dollar dumping, $20 oil, attacks on gold mines and more Posted... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Video: These Stunning Charts Show Exactly Why You Need Gold Before The Next Wave Hits Posted: 21 Jan 2016 10:30 AM PST ShtfPlan | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Another Year of Insubstantial Gold Trading in the New York Market Posted: 21 Jan 2016 08:42 AM PST | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Who is Really Ruling Saudi Arabia? Posted: 21 Jan 2016 08:19 AM PST Bilal Ahmed of Souciant.com says the rivalry results from the fact that the King's nephew Mohammad bin Nayef is currently the minister of interior and also the crown prince The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

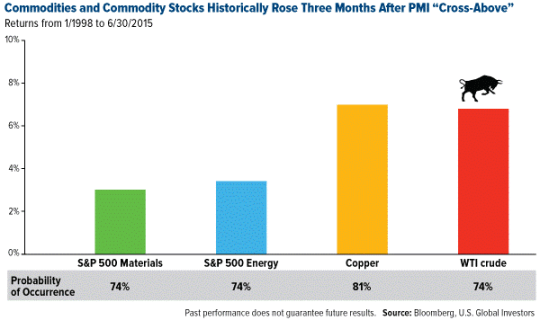

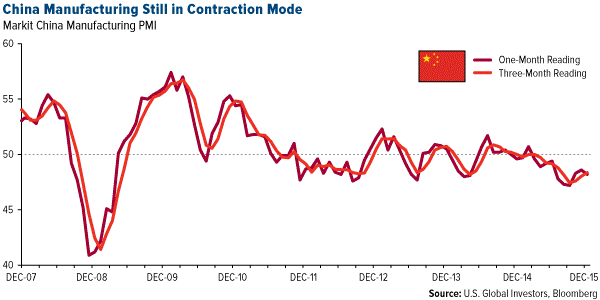

| 2016 Commodity Forecast: Follow This Sneaky Indicator Posted: 21 Jan 2016 08:00 AM PST This post 2016 Commodity Forecast: Follow This Sneaky Indicator appeared first on Daily Reckoning. If you want to know about the past, a good place to start is by looking at GDP. It tells you the dollar value of a country or region's goods and services over a specific time period. But GDP's like looking in the rearview mirror, in that it shows you where you've been and little more. It's "blind" to what's ahead of you. For that you need another indicator, and if you're a regular reader of the Investor Alert or Frank Talk, my CEO blog, you probably know which one I'm referring to: the purchasing managers' index (PMI). Unlike GDP, the PMI forecasts future manufacturing conditions and activity by assessing forward-looking factors such as production levels, new orders and supplier deliveries. PMI, then, is like the high beams that help guide you at night through the twists and turns of a mountain road. Several times in the past, we've shown that there's a high correlation between the global PMI reading and the performance of commodities and energy three months later. When a PMI "cross-above" occurs—that is, when the monthly reading crosses above the three-month moving average—it has historically signaled a possible uptrend in crude oil, copper and other commodities. Our research shows that between January 1998 and June 2015, copper had an 81 percent probability of rising 7 percent, while crude jumped the same amount three-quarters of the time.

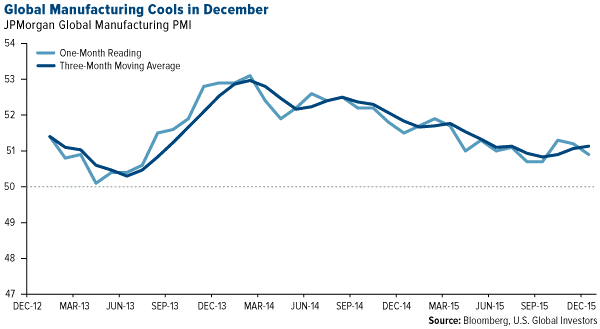

But the reverse is also true. When the monthly reading crosses below the three-month moving average, the same commodities and materials have in the past retreated three months later. And as I mentioned last week, the global PMI fell in December, from 51.2 in November to 50.9. The reading also crossed below the moving average.

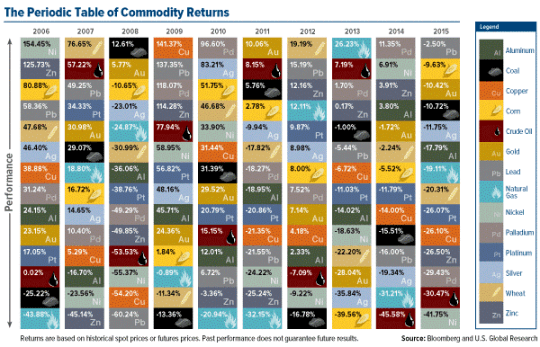

As you can see, the PMI has been in a relatively steady downtrend since midyear 2014, signaling the decline in commodities during the same period. Below is our newly-released Periodic Table of Commodity Returns, which has consistently been one of our most popular research pieces year after year. Precious metals ended 2015 as the best-performing group, with palladium, gold and silver ranking among some of the more resilient commodities. A high-resolution copy of the table is available for download.

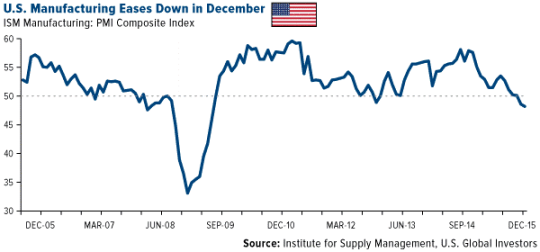

Time to Cut the Red Tape One of the main contributors to the lower global PMI reading in December was weak American manufacturing activity, according to a recent report from Cornerstone Macro. The research group had expected an improvement, but the one-month U.S. PMI reading landed "with a thud" at 48.2, its lowest point since June 2009.

China also contracted in December, dropping to 48.2. The reading also crossed below the three-month average.

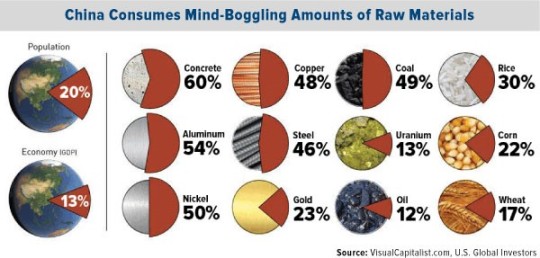

The Asian giant is responsible for consuming massive amounts of raw materials—60 percent of the world's concrete, 54 percent of aluminum. So when the PMI falls in both China and the U.S., the two largest economies in the world, it's not a good sign.

Cornerstone cites the strong U.S. dollar, weaker exports, rising manufacturing inventory and the plunge in oil prices as factors that led to the downturn last month. I agree that these factors played a huge role—oil slid below $30 per barrel this week—but I would also add more burdensome regulations to the list. Such rules have gunked up the gears of industry, and it's essential that they be cleaned out to ignite synchronized global growth.It's hard to overemphasize just how important the American manufacturing sector is to the national (and world) economy. According to the National Association of Manufacturers (NAM), manufacturing has the highest multiplier effect and drives more innovation than any other sector. For every $1 spent on manufacturing, $1.40 is created and pumped back into the U.S. economy. The sector employs more than 12 million Americans, or roughly 9 percent of the workforce, and supports more than 18 million additional jobs. If it were its own country, American manufacturing would be the ninth largest in the world. And yet the cost of federal regulations falls disproportionately on manufacturers, who pay an average $19,500 per worker in compliance costs—about $10,000 more than what other industries must pay on average. George Mason University's Mercatus Center, a free market think tank, studied the effects of federal regulations on the productivity of various industries between 1997 and 2010. Unsurprisingly, the group found that the most regulated industries experience the least amount of growth. Whereas output per person for lightly regulated companies grew 63 percent during the period, output grew only 33 percent for those that carry heavier regulatory burdens. More rules means less productivity and efficiency. As an analogy, imagine if professional basketball were played with more referees than players on the court, and with more rules than anyone can remember. No one would be able to score! This would have a huge multiplier effect: Viewers would drop off, ticket sales would plummet, advertising would dry up, and much more. We must ensure that this doesn't happen in manufacturing.

TPP to Unleash Global Trade To achieve synchronized global growth, policymakers from the G20 countries must commit themselves to cutting red tape. Look at how quickly energy and shipping companies shifted into gear after Congress lifted the 40-year-old oil export ban less than a month ago. Two tankers have already departed from Corpus Christi, Texas, to deliver crude to Europe. In anticipation of the policy change, infrastructure companies have poured billions into building new pipelines and oil storage facilities and expanding loading capacity at ports.

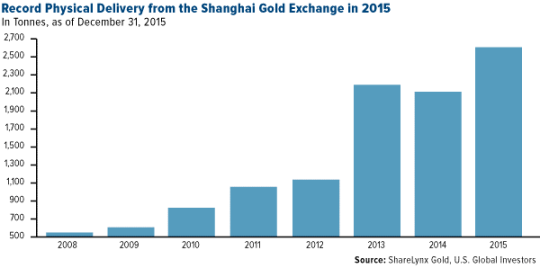

Once ratified, 18,000 tariffs are expected to be eliminated among the 12 TPP nations, which together account for 40 percent of global GDP and 20 percent of global trade. The World Bank estimates that individual GDPs will rise between 0.4 and 10 percent by 2030 as a direct result of the TPP. Could 2016 Be Gold's Turnaround Year? As the Periodic Table of Commodity Returns above indicates, gold has seen annual losses for the past three years. But there are already signs that 2016 could reverse the trend. With equities around the world weakening, more consumers have been turning to the precious metal as a safe haven. In China, physical delivery from the Shanghai Gold Exchange reached a record 2,596 tonnes, or a whopping 80 percent of total global output for 2015.

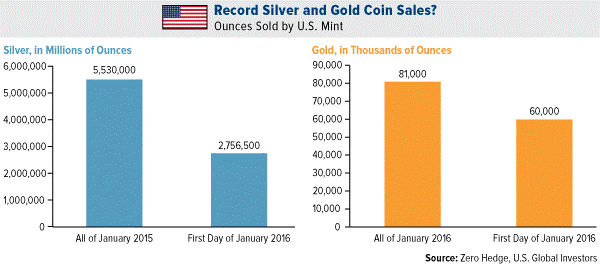

In addition, the People's Bank of China reported adding 19 more tonnes in December, bringing the total amount to over 1,762 tonnes. Meanwhile, here in the U.S., demand is just as electric. On January 1, Americans gobbled up unprecedented amounts of gold and silver coins from the U.S. Mint, purchasing in one day a sizable percentage of total sales in the entire month a year ago.

"Should the epic demand for precious metals from the first day of sales persist," writes Zero Hedge, "we are confident that the Mint will run out of gold and silver within a few days." We will continue to monitor the global PMI, and once the global, China and U.S. readings all cross above the 50 mark, it'll be time to lock and load. Later this week I'll be speaking at the Vancouver Resource Investor Conference, the world's largest investor conference for resource exploration. I hope to see you there, but if you can't make it, I'll be sure to share with you my thoughts and takeaways. Regards, Frank Holmes [U.S. Global Investors, Inc. is a boutique investment advisor specializing in emerging markets and natural resources. Their portfolio managers travel the earth researching opportunities and evaluating risk, all in the pursuit of exceptional performance for their funds. The company, headquartered in San Antonio, Texas, manages several no-load mutual funds in the U.S. Global Investors fund family, as well as funds for international clients.] The post 2016 Commodity Forecast: Follow This Sneaky Indicator appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Rout Of The Russian Ruble Continues Posted: 21 Jan 2016 07:39 AM PST This post The Rout Of The Russian Ruble Continues appeared first on Daily Reckoning. And now… today's Pfennig for your thoughts… Good day, and a tub thumpin’ Thursday to you! Front and center this morning, the Russian ruble is getting whacked badly, and right now is trading lower in value than it ever did during the 2014 rout on the currency. YIKES! This is getting really ugly folks, and one has to wonder where it ends, a short squeeze, Central Bank Intervention, or something like that to wrap a tourniquet around the bleeding. But absent any of that, the currency traders are making the ruble pay for being so tied to the price of oil, which actually fell to $26.75 yesterday, but has bounced back to $28.11 as I write. This rout on the ruble has gotten completely away from fundamentals, folks. So, some semblance of reality has to come into focus here at some point. Other than the ruble, the rest of the currencies are basically flat, or trading with a small bias to buy. The trading ranges are tiny, and it looks like a day when everyone is waiting for something to happen before they move. The Chinese announced that they were taking a firehose to their markets and spraying an injection of cash. And then the Chinese announced that the renminbi would be fixed at a lower level once again. That’s sending mixed messages folks, and I have to wonder if the Chinese meant to do that, or did they just have a “learning moment?” Wrong! BUZZZZ, thank you for playing, Chuck, there’s a nice parting gift for you at the door! The Bank of Canada (BOC) decided to leave rates unchanged yesterday, at 0.5%. Recall, I told you that it was a 50/50 call on whether they would cut rates or not, and I opted for the “will cut rates stance” only to be proved incorrect. UGH! But good for the BOC and its Gov. Stephen Poloz, who I had not given any credit to for maintaining price stability. But I have to add here that there’s no way that Poloz and the BOC can maintain their stance if the price of oil continues to fall. But really, having said that, I just realized that we’re talking about 50 Basis Points of interest to cut, unless the BOC opts for negative rates, which I wouldn’t put past any central bank at this point. I’ve long told you that once interest rates get so low, like 50 Basis Points, it really does no good to cut them further, for the effect on the economy will be nascent at best. Moving South into Mexico. The Mexican peso has really gotten whacked along with its fellow Petrol Currencies. The peso now trades with an 18 handle. That’s very weak folks, and I wouldn’t put it past the Mexican authorities to order up some currency intervention by the Bank of Mexico. I don’t know how deep the Central Bank’s pockets are, but if they are going to take on the markets who have become so “oil price-centric” they had better have really deep pockets. The European Central Bank (ECB) is meeting while I type away with my fat fingers this morning. I don’t expect anything radical from the ECB today, and I think the small gain the euro is carving out right now, is an indication that the markets feel that way too. The Central Bank of Brazil really pulled a fast one on the markets, as they had indicated that they were prepared to hike rates, and then at the last moment left them unchanged. And the real got whacked for this little game. In South Africa, where the rand is the best performing currency overnight, but has been one of the worst performing currencies in the last year. The rand lost 25% to the dollar in 2015, and had started this year down 8%, before the overnight bounce. The bounce is due to rhetoric from the Central Bank Gov. who told reporters that falling inflation in S. Africa, will be met with an adjustment to the monetary policy stance. Hmmm… shouldn’t the change in monetary policy stance be proactive and not reactive? Wouldn’t it behoove the S. African economy to be proactive here? You bet your sweet bippie it would, but this is S. Africa. Enough said, there. Oh, and our next Currency of the Month (COTM) is going to feature the S. African rand, so you’ll get your fill of how I feel toward the rand. After a yummy dinner at the Juno Beach Fish House last night, I came back to my home away from home, and began to read emails. And I saw one from friend, Jeff Opdyke, from the Sovereign Society, and formerly from the Wall Street Journal, where he wrote a semi-nice article about me and the Pfennig a few years ago, so I’m always drawn to what he writes. I’m not always in agreement with him, but in this case I was! His title was: China Isn’t in Trouble: We Are. He then went on to explain that China’s Retail Sales grew 11% in December, while the U.S. Retail Sales in December were negative -0.1%, and how China’s Industrial Production and Manufacturing Index are rising, while the same data prints in the U.S. are going in the opposite direction. Great stuff, and precisely what I’ve been focusing on. The problems here at home, and not in China. So, even if the Chinese data is inflated like some say it is even by 50%, Chinese Retail Sales for December at the 50% rate would be 5.5%, and it still blows the Retail Sales for December in the U.S. out of the water. Speaking of data… the U.S. Data Cupboard doesn’t have much for us today, other than the usual weekly Initial Jobless Claims, and there’s the latest Philly Fed Index, which is a check on the pulse of the Manufacturing sector in the Philadelphia region. this data has been negative lately, and I don’t expect anything else to print here, do you? Yesterday’s Data Cupboard had the stupid CPI on the docket, and since the markets get all worked up over CPI we might as well go through it. Consumer prices edged down -0.1% in December (you experienced that, right? ) and for the year on year data consumer inflation/prices rose to 0.7% from 0.5% in November. That’s funny math if you ask me, but that’s what the data said, and another reason it’s so stupid! It was reported on Tuesday that the 2016 deficit is forecast to rise to $544 billion (without off sheet debts of course!). Dave Gonigam over at the 5 Minute Forecast said it best, when he said the other day that with all the bad economic data, tax receipts are going to suffer, and that could mean a larger deficit for the Government. And I do believe he has nailed it! But, I would have to add, in addition to that, is the fact that there is no longer a debt limit. Remember, they suspended it? Pretty convenient timing on their part don’t you agree? The economy is screeching to a halt, tax receipts are riding off into the sunset, and of course, the government doesn’t have to worry about spending too much again. Sanity NOW! Gold has dropped back below the $1,100 figure it traded to yesterday. When I left you yesterday morning, I told you that gold was heading toward $1,100 again, and then a couple of hours later, it reached that level, but has given back $3 this morning, so once again the shiny metal couldn’t hold $1,100 (the second time this year so far). Longtime readers know that I put a lot of stock into the thought that an asset will test higher levels a few times, and if it can’t move past the higher level and remain there, then traders will give up and move on to some other asset, thus leaving the asset they were trading to fend for itself, which normally doesn’t work out too nicely. So, I guess what I’m saying here is that gold had better get on its horse and move past $1,100 once and for all, pretty soon, or else traders might well just move on to other assets that could use their attention. I don’t believe that will happen here, but it could. I prefer to believe that gold will eventually move past $1,100 for good, on its way to higher levels that are awaiting the shiny metal. Over a year ago, I talked to you about the Liquidity Crisis that I saw coming in the markets. A year passed, and there were signs of liquidity being a problem, but nothing to put fear into the markets. But in Davos, Switzerland, where annually, financial people meet to discuss the global economy and so on, there seems to be a reoccurring discussion about a possible Liquidity Crisis. Then I heard Marc Faber, talk about a liquidity crisis, as a reason to buy gold. And It got me thinking about something that James Rickards had said in one of his newsletters that I subscribe to. James Rickards had met an old friend for lunch, the old friend was an “insider” in Wall Street, a BIG TIME PLAYER, who told James that Liquidity was a problem, that the BIG Deals, Size Deals that used to be done in a couple of hours, now takes days and even a weeks to complete. So, I said all that to lead into this article in the U.K. Telegraph. that can be found here, and here’s a snippet:

Chuck again. I’ve said enough about this, above, it’s time to really keep an eye on the ball here folks. Because nothing is worse (in the markets that is) than calling someone that used to buy your stuff, and they no longer will make a market. Uh-Oh. That’s it for today. Have a tub thumpin’ Thursday! Regards, Chuck Butler P.S. Be sure to sign up for The Daily Reckoning — a free and entertaining look at the world of finance and politics. The articles you find here on our website are only a snippet of what you receive in The Daily Reckoning email edition. Click here now to sign up for FREE to see what you're missing. The post The Rout Of The Russian Ruble Continues appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Stock Set Up In 1 Chart Cartel~Buster® !, For You Posted: 21 Jan 2016 07:29 AM PST LAST time we got a very nice signal, say Nov 5-9th, we spent about 5 or 6 market sessions in limbo before the GDX (dashed gold line) price responded fully, although individual stocks responded, some faster (AEM), some slower (AUY). Today provisional signal is not really any different. Each panel on this chart of my proprietary measure “CARTEL~BUSTER® !, contains its own Tripwire Zones, for buying and selling. Either or both works well. Thus the bottom panel is a bit faster for shorter trades. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| US Dollar Drop Gold Price Rally Posted: 21 Jan 2016 04:46 AM PST Once the dollar starts to drop into its intermediate cycle low in earnest gold should produce an intermediate degree rally | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investors "Think About How to Mitigate Your Losses" Posted: 21 Jan 2016 12:23 AM PST FRA Co-Founder Gordon T. Long deliberates with Eric Sprott about the outlook for the global economy in 2016. Eric Sprott is a Canadian hedge fund manager and founder of Sprott Asset Management. He became a billionaire on paper with the initial public offering of Sprott Inc, the parent of his Sprott Asset Management firm. In August 2011, Sprott was acknowledged by Bloomberg as a 'hidden billionaire.' The publication estimated Sprott's worth at $1.3 billion, largely based on his publicly disclosed holdings in Sprott Inc. and Sprott Physical Gold Trust. Sprott started his career as an analyst at Merrill Lynch covering everything but commodities. He eventually became known as a natural-resources and energy investor. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Rick Mills: How to Profit from the Demands of a Growing World Population Posted: 21 Jan 2016 12:00 AM PST As the world prepares to house, feed and care for 9.7 billion people, Ahead of the Herd founder Rick Mills is looking for the companies that will profit from the silent tsunami of demand creeping up on resource and healthcare providers. In this interview with The Gold Report, Mills reveals the six companies he thinks are well positioned in their respective sectors to ride this population wave to profits. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Purchase Gold and Silver From Tom Cloud Posted: 20 Jan 2016 11:01 PM PST If you want to purchase gold and silver, consider buying from Tom Cloud. Gold and silver are insurance against devaluing fiat currencies, and financial disasters. That insurance is valuable now and... {This is a content summary only. Click on the blog title to continue reading this post, share your comments, browse the website, and more!} | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ISIS Revealed as an American Secret? | Jim Willie Posted: 20 Jan 2016 07:30 PM PST ISIS is a CIA construction. These constructions become real through the infusion of money and information. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hollywood Warning of Something Big in 2016? (Illuminati in America) Posted: 20 Jan 2016 06:25 PM PST WHAT IS GOING ON IN HOLLYWOOD 2016...Illuminati new world order martial law signs in movies end times prophecy The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold: The Road to Hell is Paved with Good... Posted: 20 Jan 2016 06:22 PM PST SafeHaven | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Shot Up on Opening and Never Looked Back Closing up $17.20 to $1.107.10 Posted: 20 Jan 2016 04:12 PM PST

Silver and GOLD PRICES are moving in the right direction, but must break through that crust of resistance at $1,113 and $14.40. Silver at last closed above its 20 ($14.02) and 50 ($14.10) day moving averages. $14.25 has several times blocked its progress, but stocks are stoking a powerful head of steam under both the silver and gold price. Today or tomorrow the price of gold should breach that resistance, and that will pull silver along. Did I mention it's probably time to buy silver and gold? Or you can wait for breakouts. Stock markets are getting ugly, so let's shoot straight: the only way to stay out of a bar fight is to leave the bar before the fight begins. Given the way things unfolded in Greece lately, if another crisis erupts you will likely have trouble getting any money larger than chicken feed out of your bank account. Everybody ought always have sufficient cash to cover three months' cash needs for your family. If you don't, get it. Ditto all those other supplies preppers wax loud about. If you don't have 'em, get 'em. I don't mention getting physical silver and gold or firearms, since that is already obvious to y'all. You can play the short side of stocks with bear ETFs or options. If you understand such things, I remind you that you always make more money short than long, because markets fall faster than they rise. As of today, since the first of the year the Dow has fallen 9.5%, the S&P500 9%, the Dow Transports 11.8%, Euro Stoxx600 11.9%, DJ World index 9%, Shanghai 15.9%, and the Nikkei 13.7%. For the year the Dow in silver is down 11.9% and the Dow in gold down 13.3% (meaning stocks have lost that much against metals.) Most eye catching is the $BKX bank stock index, down 15% on the year. The Gold/BKX spread has gained 22.7%, i.e., gold has gained that much on the BKX. This offers the most alarming view of the stock market rout, since people are piling out of bank stocks and into gold faster even than stocks are falling, and that flight has only barely begun. According to the New York Times, that prints all the news that fits, global stock markets have lost $3.6 trillion since 2016 dawned. By the way, in the New York Times today appeared another article, 6 Tips for Investors When the Stock Market Tumbles. Y'all will be surprised: Tip No. 1, stay in the market. Tip # 2, stay in the market. Tip #3, stay in the market. Tip # 4, stay in the market. Tip #5, stay in the market. Tip # 6, stay in the market. Y'all will hear this same siren song from every guru on every side, but like Ulysses, you'd better tie yourself to the mast and stop your ears with beeswax, because after 6-1/2 years of an money-creation-based rally and unspeakable overvaluation, the sirens on Stock Island do not have your best interests at heart. For them, you are what's for supper. But don't listen to me. I'm only a nat'ral born durn fool from Tennessee, and I can hardly spell duhrivvatuv. Stocks today had one of their worst days of 2016. At one point the Dow had peeled off 585 points (3.5%), against its worst previous loss on 7 January of 392.41. This selling set off with the opening bell, and persisted until the low about 1:00 scared the NGM out of their hiding places behind the baseboards and sent them scurrying to buy. Best they could do was trim the loss to 249.07 (down 1.56%) for the day, and a close at 15,766.95. S&P500 (but not the Dow) closed below its August low (1,867). Down 21.96 (1.17%) to 1,859.37. Oooooo. Breaking that August low is like your horse breaking a leg in the Sahara Desert -- when you're alone.