Gold World News Flash |

- NEW WORLD ORDER POWER BROKER GEORGE SOROS PREDICTS THE COLLAPSE OF THE EU

- Which Precious Metals are a Good Investment for 2016?

- Gold Being Gold; ‘It’s Doing a Good Job Right Now’ – Axel Merk

- Bank Debt Worries Overhang Markets: FDIC’s Hoenig Speaks Out

- When Will the Canadian Economy Crash? The Canadian Financial Meltdown

- No End to Oil Rout as Saudi Arabia Plays Tough

- The Government Will Never Let It Happen!

- End Times Saudi Arabia using Cluster&Tactical Nuclear Bombs in Yemen Breaking News January 2016

- The World’s Most Famous Case Of Hyperinflation (Part 2)

- Red Alert! Martial Law 2016

- Silver and Gold Prices Closed Up for the Week with the Gold Price Ending at $1,097.20

- Gold in a Non-Zero Interest Rate World

- Ron Paul Calls for End to Petrodollar System

- Gold Stocks Absurd Price Levels

- Gold Daily and Silver Weekly Charts - Hearts of Darkness

- How to Use a Bear Market to Increase Your Income

- Democracy Is No Better Than a Monarchy… or a Dictatorship

- What Is Cultural Marxism?

- BREAKING THE COMEX: First The Collapse Of Registered Gold Stocks, Now Silver??

- Stock Market Swing Baby, Swing!

- 9*11 EXPOSED AS A FALSE FLAG

- Chronicle Of A Debt Foretold

- Ron Paul Says to Watch the Petrodollar

- Silver Undervalued Versus Stocks, Bonds, Property and Gold

- LME said to be in talks with banks to list London gold contracts

- Peak Gold and Silver - It’s Here!

- "Sell Everything" Royal Bank Of Scotland Recommends

- Stock Market Crash! Sell everything & protect your 401k before it's too late!

- Draghi Throws The Euro Under The Bus, Again!

- Harry Dent: Why The Stock Market will Crash in 2016?

- Elite Collapsing America By Design

- Saudi Arabia's secret holdings of U.S. debt are suddenly a big deal

- Indian gold paperization scheme is failing so govt. boosts subsidy to banks

- 50 YEAR OLD CARTOON PREDICTS THE FUTURE !!! NWO !!!

- The Economic Collapse Is Here! Ships Have Halted Their Sails -- First Time In History !

- Gold Resists a Raid, Silver Holds Place, Northeast Prepares For Snow

- Stock Markets Waiting on U.S. Dollar

- Gold Maintains Value Despite Oil and Stock Market Crash

- Gold Has Passed the Lows

- Gold Daily and Silver Weekly Charts - Gold Resists, Silver Holds, Northeast Braces For Snow

| NEW WORLD ORDER POWER BROKER GEORGE SOROS PREDICTS THE COLLAPSE OF THE EU Posted: 23 Jan 2016 12:00 AM PST by Geoffrey Grider, Now The End Begins:

George Soros, for those of you who don't know him, is the "money man" behind the coming New World Order. Starting from his early days as a young Jewish teenage who betrayed his own people to work with the Nazis, to his rise as a multibillionaire financier, George Soros is the man who 'get it done'. In 1992, he single-handedly broke the Bank of England, and in 2015 spent 33 million dollars on financing the Ferguson race riots in St. Louis. Anywhere you find Liberals working to overthrow the rule of law and order, you will invariably find Soros there as well.

In an interview with the New York Review of Books, George Soros warned of the coming collapse of the European Union, and puts the responsibility squarely on the shoulders of German chancellor Angela Merkel. Merkel led Europe's response to the Muslim migrant crisis, opening Germany to the refugees that had travelled from the Middle East, in particular Syria, to try and find a new home in Europe. The decision by the German leader marked a sea-change in her policy. In the interview, Soros said he welcomed Merkel's move. "THERE IS PLENTY TO BE NERVOUS ABOUT," SOROS CRYPTICALLY REMARKED."As she (Merkel) correctly predicted, the EU is on the verge of collapse. The Greek crisis taught the European authorities the art of muddling through one crisis after another. This practice is popularly known as kicking the can down the road, although it would be more accurate to describe it as kicking a ball uphill so that it keeps rolling back down." "Merkel correctly foresaw the potential of the migration crisis to destroy the European Union. What was a prediction has become the reality. The European Union badly needs fixing. This is a fact but it is not irreversible. And the people who can stop Merkel's dire prediction from coming true are actually the German people. " "Now it's time for Germans to decide: Do they want to accept the responsibilities and the liabilities involved in being the dominant power in Europe?" | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Which Precious Metals are a Good Investment for 2016? Posted: 22 Jan 2016 11:01 PM PST By Ravinder Sahu Investors are interested in buying bullion to help diversify their risks. As the world economy weakens an investment in precious metals compensates for stock price declines. Although... {This is a content summary only. Click on the blog title to continue reading this post, share your comments, browse the website, and more!} | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Being Gold; ‘It’s Doing a Good Job Right Now’ – Axel Merk Posted: 22 Jan 2016 10:30 PM PST from Kitco News: Gold has been doing exactly what it should be doing, says Axel Merk of San Francisco-based Merk Investments. 'Gold has done a good job right now. It is a diversifier and the correction in the equity markets is far from over, so gold will do well,' he says in an interview with Kitco News Friday. The recent choppy, sideways trading and Thursday's rally suggest the gold market has put in at least a near-term low. Gold bulls' next upside near-term price breakout objective is to produce a close above solid technical resistance at $1,130. Merk explains, 'I like gold because I don't think we can have positive real interest rates – which ultimately is a competitor to gold.' | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bank Debt Worries Overhang Markets: FDIC’s Hoenig Speaks Out Posted: 22 Jan 2016 09:00 PM PST by Pam Martens and Russ Martens, Wall Street on Parade:

We are in the midst of an unprecedented collapse in commodity and oil markets, fueling fears about every kind of debt from emerging markets to junk bonds held in U.S. listed Exchange Traded Funds (ETFs). In this midst of this raging fear, what has the U.S. Federal Reserve proposed? It's proposed a plan to make banks "safer" by making them issue more debt and become more highly leveraged. We're not kidding folks. Back in October, Fed Chair Janet Yellen had this to say about the plan: "The long-term debt requirement we are proposing today, combined with our other work to improve the resolvability of systemic banking firms, would substantially reduce the risk to taxpayers and the threat to financial stability stemming from the failure of these firms. This is an important step toward ending the market perception that any banking firm is 'too big to fail.' " The plan is called TLAC, short for Total Loss-Absorbing Capacity, which boils down to having the systemically dangerous banks that might put taxpayers on the hook again for another bailout in a crisis, to hold more long-term debt that would absorb losses after stock equity is wiped out (think Citigroup in 2008). This would, in theory, allow recapitalization of subsidiaries so that they could continue operating. In other words, the bank holding company would file for bankruptcy while, ideally, the retail brokerage firm and the insured depository bank would remain solvent and continue operating. Good luck with that. Where did this idea originate? At the Financial Stability Board, a pack of foreign central bankers and regulators, including U.S. representation, who are desperately attempting to reassure their respective constituents that they've cured the need for future taxpayer bailouts of the global banking behemoths. This plan ignores the total history of Wall Street panics. What happened at E.F. Hutton after the crash in 1987 and following its 1985 guilty pleas to 2,000 fraud counts related to check kiting; what happened at Shearson in 1990; what happened at Bear Stearns and Lehman Brothers and Citigroup in 2008. In the midst of a financial panic, depositors and investors take their money and head for the door and the more highly leveraged the bank, the faster they exit. Here's how we reported Citigroup's evaporation during November 2008: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| When Will the Canadian Economy Crash? The Canadian Financial Meltdown Posted: 22 Jan 2016 07:33 PM PST While no one can be sure that the Canadian market will crash or that you should sell your Canadian stocks, the warning bells are loudening. I predict the Canadian financial meltdown to hit in 2016. History will repeat the market collapse of 2008, but this time in Canada:... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| No End to Oil Rout as Saudi Arabia Plays Tough Posted: 22 Jan 2016 06:30 PM PST Kingdom’s oil chief says Saudis can withstand the price collapse, vowing to keep production at record levels by Ambrose Evans-Pritchard, The Telegraph:

“We can take whatever the market serves us. If prices stay low, we will be able to withstand it for a long time. We have the lowest cost of production on the planet by a big margin, and Saudi Aramco has zero debt on its balance sheet,” he said. “The key issue is that liquidity could drop dramatically, and that scares everyone,” he told a panel at the World Economic Forum in Davos. “If everybody is moving together we don’t have any liquidity at all. We have to be ready to act very fast,” he said. Zhu Min said the worry is that policy-makers still do not understand the complex interactions in the global financial system, where vast sums of money can move across borders at lightning speed. What the IMF has observed is that market correlations are near an historic peak, with aligned positions in the US equity markets four times higher than the average since 1932. This is a recipe for trouble when the Fed is tightening. “When rates go up, market valuations have to adjust,” he said. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Government Will Never Let It Happen! Posted: 22 Jan 2016 06:05 PM PST by Bill Holter, SGT Report:

Can you imagine the outrage were Russia to accuse president Obama or the Prime Minister Cameron of Britain for ordering the murder of someone who called them a pedophile? Before going any further, I believe nearly ALL of what we are seeing is centered by and on the “petrodollar”. Will it survive or be replaced? In my opinion it is no longer “if”, but “when” and by “what” will it be replaced with? Just over the last two weeks we have seen three very important yet interrelated events. First, the sanctions against Iran in place over the last 35 years were lifted. Along with this comes the ability for Iran to sell oil and they will now have access to up to $150 billion worth of assets and accounts previously frozen as reported by many credible non government sources. The day after, we saw 10 U.S. captured sailors on their knees as they were said to have “strayed” into Iranian water. The official U.S. account has changed at least twice. We heard “mechanical failure” at first, this is unlikely as there were reportedly two separate vessels. If one had mechanical problems, the other could have tied off and either towed it or held it steady until help could arrive. Then the story changed to “navigational” problems. This one I believe …but not the official story they “strayed” into Iranian water. Again, if it was just one boat, maybe their navigation system malfunctioned …at the same time their communications failed …MAYBE? But both boats …at the same time lost their comm and navigation systems? Probably a better chance one of these sailors winning the Powerball lottery two weeks in a row! Speculation on my part, I believe the electronics were somehow hacked or blocked just as happened with the Donald Cook in the Black Sea in late 2014. Just a couple of days ago, President Xi of China met with Iranian leaders one day and then the Saudis the following day. We can only speculate what was discussed but surely oil was the centerpiece. Naturally China wants to make and diversify oil supply deals from them both. We have no proof but I believe it is a very good bet President Xi told the Saudis they would be expected to accept yuan for settlement instead of dollars. There is no denying, the Chinese have done everything in their power to prepare for the dollar being dumped as the world’s reserve currency. You can argue about timing, you cannot argue about “intent” as China/Russia have set up non Western clearing facilities similar to SWIFT but without any Western interference, trade deals, currency hubs, trading banks, and even gold and oil exchanges where the dollar will not be welcome. This is not tough to tie all of this together. I ask you this, what would the world look like the day following a “truth bomb” dropped by Mr. Putin and the Chinese. Would Americans even notice if he documented several false flags or frauds embedded in U.S. finance such as outright monetization of U.S Treasuries? No, most certainly not. Americans would however notice if financial markets collapsed or were shut down. Russia and China know full well the situation in the West. It is a bankruptcy waiting to happen as everything is fractional reserve and running on maximum margin while the underlying system is shrinking and no longer supplying enough liquidity. The way I see it, the stage is truly set for a financial attack on anything and everything American. Is it implausible for the Saudis to announce they will sell oil in yuan to China? Or Iran to withdraw their funds from U.S. institutions and then bid for gold with these funds? If the East does in fact have jamming or hacking capability of Western technology, is it far fetched for them to show it very publicly in one or several situations? How would the “bookies” react if they saw a prize fighter enter one of the later rounds with his hands tied behind his back? You can laugh at the above speculation if you choose but it is all quite plausible and actually probable if you look at where things are and what posturing has already been done leading up to this. Western markets, ALL markets are a fraud. Our Treasury market is one where the biggest buyer is “our self” …the Fed and the ESF. We have already seen $1 trillion of foreign reserves offloaded with no effect on yield nor the dollar itself and NO ACCOUNTING ANYWHERE as to “who” bought these offloaded central bank reserves. Accounting fraud and no rule of law here, nothing to see …please move along! You can laugh if you want and say Saudi Arabia will never move toward the East … Saudi Arabia is now in very dire straits financially, who do you think they will side with when Western markets melt down? Do you really believe they will go down trying to support our dollar? The stage has already been set. The East knows the West has bankrupted. They know we have no gold left because they have it! They can see the finances of the various cities, states and federal government. They know the situation in derivatives is one giant mountain of dynamite waiting for a spark. They know our rule of law is gone and bail ins of depositor funds is next. We are monetizing their sales of Treasury securities. “We” are fooling no one except ourselves. And by “ourselves” I am talking about the vast majority of the population who have grown to rely on the government for everything. Everyone knows we are broke, yet ask anyone and the odds highly favor you will hear “the government will never let it happen”. Even if you are silly enough to believe this you must ask yourself, what are the ramifications when markets become “make believe”? Standing watch, | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| End Times Saudi Arabia using Cluster&Tactical Nuclear Bombs in Yemen Breaking News January 2016 Posted: 22 Jan 2016 05:55 PM PST End Times News Update Saudi Arabia using USA supplied cluster bombs & Tactical Nuclear Bombing in Yemen Breaking News January 2016 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The World’s Most Famous Case Of Hyperinflation (Part 2) Posted: 22 Jan 2016 05:30 PM PST For the first infographic in this series, which summarizes the circumstances leading up to hyperinflation in Germany in 1921-1924, it can be found here: Hyperinflation (Part 1 of 2)

Courtesy of: The Money Project

Slippery Slope

In the two years past World War I, the German government added to the monetary base of the Papiermark by printing money. Economic historian Carl-Ludwig Holtfrerich said that the “lubricant of inflation” helped breathe new life into the private sector. The mark was trading for a low value against the dollar, sterling and the French franc and this helped to boost exports. Industrial output increased by 20% a year, unemployment fell to below 1 percent in 1922, and real wages rose significantly. Then, suddenly this “lubricant” turned into a slippery slope: at its most severe, the monthly rate of inflation reached 3.25 billion percent, equivalent to prices doubling every 49 hours. When did the “lubricant” of inflation turn into a toxic hyperinflationary spiral? The ultimate trigger for German hyperinflation was the loss of trust in the government’s policy and debt. Foreign markets refused to buy German debt or Papiermarks, the exchange rate depreciated, and the rate of inflation accelerated. The EffectsHyperinflation in Germany left millions of hard-working savers with nothing left. Over the course of months, what was enough money to start a stable retirement fund was no longer enough to buy even a loaf of bread. Who was affected?

Stories of HyperinflationDuring the peak of hyperinflation, workers were often paid twice a day. Workers would shop at midday to make sure their money didn’t lose more value. People burned paper bills in the stove, as they were cheaper than wood or other fuel. Here some of the stories of ordinary Germans during the world’s most famous case of hyperinflation.

Even Worse Cases of HyperinflationWhile the German hyperinflation from 1921-1924 is the most known – it was not the worst episode in history. In mid-1946, prices in Hungary doubled every fifteen hours, giving an inflation rate of 41.9 quintillion percent. By July 1946, the 1931 gold pengõ was worth 130 trillion paper pengõs. Peak Inflation Rates:

Hyperinflation has been surprisingly common in the 20th century, happening many dozens of times throughout the world. It continues to happen even today in countries such as Venezuela. What would become of Germany after its bout of hyperinflation? A young man named Adolf Hitler began to grow angry that innocent Germans were starving…

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 22 Jan 2016 05:25 PM PST Alex Jones breaks down how a possible economic crash in 2016 could easily lead to martial law. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver and Gold Prices Closed Up for the Week with the Gold Price Ending at $1,097.20 Posted: 22 Jan 2016 04:59 PM PST

The GOLD PRICE lost $1.90 to $1,097.20 and the SILVER PRICE backed off 4¢ to $14.043. Sigh. Silver keeps on pushing higher every day, today to $14.36, slugging toward that $14.40 hurdle. Something strange happened at High Noon: silver dropped in 5 minutes from $14.16 to $14.08. Demoralized it for the rest of the day. It's all right. Stage is set for more progress next week. The GOLD PRICE made its peak on Wednesday and has since backed off in a normal correction -- so saith the five day chart. Remains above $1,090 support, but still must conquer $1,113. Silver and gold prices continue to throw themselves against overhead barriers, are slapped down, but snap right back. One of these days they will bust through the ceiling, and not too long. Stocks barely managed to close the week up by rising today. US dollar index is swaying from side to side like a dog watching a tennis match. What! Platinum and Palladium rose! Stocks continue the pattern of driving higher during the day, but slipping grip on most of the gain by day's end. Today the Dow lost about 40 points from the high, not counting the 40 points slipped in at the very close. Dow gained 206.55 (1.3%) to barely throw a leg over 16,000 at 16,089.23. S&P500 jumped up 37.90 (2.03) to 1,906.89. Reaction rallies could carry as high at 16,600 and 1,950, but heed not the sirens who sing that stocks are coming back. They won't be, not in any time material to you and me. As one scarred old bull who has been through several bull/bear cycles, let me remind y'all how the herd mentality works. People made money as stock rose, so in their minds sticks the belief they will ALWAYS make money buying stocks. As stocks decline, they listen ot the sirens saying, Buy more and double down. This continues until they run out of money and morale. The market slides further and further, until at last they sell. Precisely THERE will be the bottom. Thus passeth the life of an old bull. After yesterday's humiliation, the US dollar index missed its chance to post a key reversal today. Instead, it rose 52 basis points to 99.65. That does not really atone for yesterday's sins. Yesterday the dollar index tried to enter new high territory and failed. Today it rose, but not nearly as high. None of this bears witness to underlying strength. Rather, it warns of spotty support and the possibility of large gaps down. How do those people in Europe stand it? Their currency, I mean (y'all thought I meant something else.) Euro dropped 0.72% today to $1.0796. Below its 20 and 50 DMAs, its resting on the bottom boundary of an even-sided triangle where it can get an easy push off into the abyss. Sorry as gully dirt. Yen dropped 0.89% to 84.15, back below its 20 DMA. Sorry, but not as sorry as the euro, and trying to rally, fueled by scared money in Asia. I have a favor to ask of y'all. My bionic wife, Susan, is scheduled for minor eye surgery on Tuesday, 26 January 2016. I would appreciate your prayers for her and for a successful surgery. She is, after all, the apple of my eye. Thank you. Y'all enjoy your weekend. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold in a Non-Zero Interest Rate World Posted: 22 Jan 2016 04:00 PM PST SunshineProfits | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ron Paul Calls for End to Petrodollar System Posted: 22 Jan 2016 03:00 PM PST The chaos that one day will ensue from our 35-year experiment with worldwide fiat money will require a return to money of real value. We will know that day is approaching when oil-producing countries demand gold, or its equivalent, for their oil rather than dollars or euros. The sooner the... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Stocks Absurd Price Levels Posted: 22 Jan 2016 02:29 PM PST Gold stocks remain the pariah of the investment world. Despite gold’s strong early-year gains, the stocks of its miners have slumped to new secular lows. This whole forsaken sector continues to languish at fundamentally-absurd price levels, an extreme anomaly that is long overdue to start unwinding. The gold miners will be bid massively higher to reflect their impressive profitability even at today’s dismal gold prices. Just this week, the flagship HUI gold-stock index plunged to a major new secular low. On Tuesday as gold merely slid 0.3%, the HUI plunged 5.6% to 100.7. This was an astounding new 13.5-year secular low, reeking of capitulation since gold’s price action certainly didn’t justify such a disastrous reaction in its miners’ stocks. That left already epically-bearish gold-stock sentiment even worse, which is hard to believe. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Hearts of Darkness Posted: 22 Jan 2016 01:36 PM PST | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| How to Use a Bear Market to Increase Your Income Posted: 22 Jan 2016 01:32 PM PST This post How to Use a Bear Market to Increase Your Income appeared first on Daily Reckoning. I’m sure you’ve read all about how the year has gotten off to the worst start in history. The media love a good bear market because falling stock prices give them something sensational to write about. But is a bear market really such a bad thing for your income investments? I know it sounds like crazy talk. No one likes it when their stocks trade lower. But what they may not realize is that when their dividend stocks temporarily lose value, it actually sets up an opportunity for them to grow their income — sometimes by a very large amount. That’s why I'm excited when the market trades lower. These are the times when levelheaded income investors can dramatically increase the amount of income they receive. There are two practical ways you can boost your income, thanks to the market’s downturn. But first, let me explain how lower stock prices can lead to more income… Suppose you’re watching a stock that pays a $0.50 quarterly dividend. The underlying company operates a solid business selling consumer products around the world. This business generates reliable profits in good times and bad because its products are needed by consumers — regardless of whether the economy is growing. When you started watching the stock, it was trading at $80 per share. Over a full year, investors could expect to receive $2.00 per share in income. (Four quarterly dividend payments of $0.50 add up to $2.00 of income each year.) So based on the stock price of $80, investors were able to collect income of 2.5%. (Income of $2.00 divided by the $80 stock price adds up to a 2.5% yield.) A yield of 2.5% is certainly attractive. It’s a lot more than you could expect to receive from a savings account at the bank. And it’s a bit more than the 2.4% yield you could get from investing in the S&P 500. But 2.5% isn’t an exciting amount of income. It just barely keeps up with the pace of inflation. Now suppose a bear market hits and your stock loses more than a third of its value, trading down to $50 per share. Nothing has changed with the business. The company still sells products that customers around the world need. Your dividend checks still show up punctually. The only difference is that the stock price is now $50 instead of $80. If you buy the stock at $50, you’ll still receive $2.00 per share in dividend payments. Only now your yield has moved from 2.5% to 4.0%. That’s a big jump! The point is as long as your stocks continue to pay you regular dividend checks, it really doesn’t matter what the market says you should pay for them. And if you're in a position to be able to buy even more shares at a lower price, you can actually purchase more income with your investment money. So today, instead of panicking about the falling market or checking the value of your account on a day-by-day basis, I want to show you two practical ways to take advantage of the lower stock prices and to increase the amount of income you receive. One of the best ways to juice your income payments is by participating in a dividend reinvestment plan (DRIP). A DRIP simply takes the income paid to you from your dividend stocks and automatically reinvests the income in new shares of stock. When you enroll in a DRIP, the size of your position automatically grows over time. And since you own more shares of stock each quarter, your dividend payments get larger and larger. Larger payments means more shares of stock are bought — and the cycle continues… If you’re enrolled in a DRIP program and the stock price moves lower, your DRIP plan will be able to buy more shares each quarter. This is not something you have to monitor or keep track of each quarter. The shares will automatically be bought in your account, and your next dividend payment will automatically increase. Today, as stock prices are trading lower, I encourage you to take a look at the stocks in your portfolio. If any of them offer a DRIP program, please take the time to enroll in that program if you haven't already. You can find out which of your stocks offer a DRIP program by calling the 800-number listed on your company’s investor relations website. Just Google your company’s name along with the words “investor relations.” Now let’s look at a second practical way to boost your income… You may have a 401(k) plan or another retirement plan that you regularly contribute to throughout the year. These retirement accounts give you an excellent opportunity to regularly invest new capital in dividend stocks. And this way, your income continues to grow as you add more shares. So if you have a 401(k) or IRA account (or any other brokerage account) that has available cash you don’t need immediately, I encourage you to regularly invest this additional cash into dividend stocks. If you do this on a monthly basis, you’ll automatically buy more shares when stocks are trading lower. And once again, that means you’ll receive more income for every dollar you spend on buying shares at a discount price. I hope by now you can see that lower stock prices can help you boost your income over time. But what about the total value of your account? Should you worry about your stocks trading lower? Of course, you don’t want to see the value of your account decline for an extended period. But if you're buying shares of strong companies with solid businesses that are able to grow their dividends, the stock prices won’t stay low forever. Here’s the thing… In the short run, stock prices trade up and down based on human emotions. If investors are afraid, they sell shares. And if investors feel euphoric, they buy shares. Selling sends stock prices lower, and buying sends stock prices higher. That’s why we have short-term fluctuations in the market that sometimes don’t really make sense. These short-term fluctuations are based on unpredictable human buy and sell orders. But in the long run, stock prices eventually line up with the profits our companies generate. So if you buy shares of well-run companies that pay great dividends and are growing their businesses, your stocks will eventually trade higher and your income will continually increase. So the next time you read a newspaper article about the Dow dropping 400 points, just realize that this decline likely sets up an opportunity for you to capture more income using these two practical income boosters. Here’s to growing your income! Zach Scheidt The post How to Use a Bear Market to Increase Your Income appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Democracy Is No Better Than a Monarchy… or a Dictatorship Posted: 22 Jan 2016 12:53 PM PST This post Democracy Is No Better Than a Monarchy… or a Dictatorship appeared first on Daily Reckoning. MUMBAI, India – The Dow managed a small bounce yesterday. The bounce came as crude oil gushed 4% higher… And back above $30 a barrel. What next? We wait to find out… "Flaming Lunatic"We had dinner in London last night, before boarding a plane for India. "A large part of the U.S. population must feel threatened by any kind of intelligence," said a voice at a nearby table. A group of Englishmen were discussing U.S. politics. We eavesdropped. "Can you imagine? That Trump… he seems like a flaming lunatic. His campaign is nothing but telling voters that he's a good negotiator. He thinks it's all just making deals with people. All that matters is getting a good deal. "Now he thinks people will vote for him because he got an endorsement from that total idiot Palin. What is the matter with Americans? How did they get to be so stupid?" We almost got up from our chair. It was time to straighten these Brits out. But what would we say? Besides, it is a fair question: How did Americans come to be so stupid? Of course, the same question could be asked of almost any nation. And it being Friday, and we being laid low by an epizootic and airline travel, we dug into our archives for an answer… The American BrainOriginally published on November 5, 2004 "There is no point in asking why Americans get caught up in the presidential election ritual, even when the campaigns are obviously manipulative and the candidates are far from the best the country has to offer. […] All rituals rest upon faith, not logic; all involve suspension of disbelief; and all seem as reasonable to the faithful as they seem absurd to unbelievers." – Forrest McDonald, The American Presidency "I guess you found me out," said a companion at lunch yesterday. "Yes, I am a monarchist. I don't really believe in all these elections." The man speaking was tall, fine-featured, very British, with the sort of hair your editor envies. (But then, he envies almost all hair.) "Look, it all boils down to what the people will accept. They went along with monarchies for hundreds of years and were perfectly happy with them. When they didn't like their king, they chopped off his head. That's the way it ought to work." That is the way is does work. People go along with whatever hooey is popular. Not only do they go along with it – they go out of their way to take part in it. The front page of almost all the newspapers in Europe this week [in November 2004] carried photos of long lines of Americans eager to stand in solemn fraud to keep it going. Would it make any difference how the contest was decided? Would it be better if Bush and Kerry had just flipped a coin or fought it out with broken-off bottles in their hands? We don't know. Muddled MassesAs near as we can tell, democracy offers no particular improvement over monarchy, theocracy, or even dictatorship. Every system separates citizens from their money, bosses them around to some degree, keeps delinquents in line and generates its own statues, myths, and public holidays. But democracy is a la mode now. Our crusaders in the Middle East do not risk their lives to force others to kneel down before the true cross; we judge our success in Iraq not on how many people convert to Christianity… but on how many turn into democrats! Not for the first time, we have reached what Francis Fukayama calls "the end of history." We can imagine no better system, no finer people, no higher authority than the wisdom of the muddled masses… and no more glorious end than that which our fat plumbers, skinny scholars, and sly insurance salesmen have voted for us in the last election. And so, the public spectacle of 2004: More people than ever before cast their ballots in the U.S. presidential election. But Americans have never been less free. There is a snoop behind nearly every door, a permission form to be filled out in nearly every day's mail, a government regulator for practically every known activity, and a large mortgage attached to almost every house. Nor have they ever been more timorous: A few fanatics with towels on their heads and murder on their minds have thrown the entire nation into hysterics. Nor have they ever been more in debt and more beholden to foreign creditors. Nonetheless, never before have they gurgled so triumphantly about America's freedom, courage, and democracy. Basic InstinctOur beat is markets. But markets are moved by people and people are moved by their own beating hearts… and the curious programming of their own brains. We take a look at them… Before mankind even existed, the pre-man primate lived on his instincts, like the rest of the animals. He had no language – no words. Which was probably a good thing. Often, he had no time for conversation. He had to react quickly. Whether he was hunting or being hunted, an animal responds according to a sophisticated, but a completely unspoken and unthought logic. In nanoseconds, he made life or death decisions, without reference to any formal reason, elections, or newspaper headlines. He relied on what German philosopher Immanuel Kant called the "categorical imperative." The approach of a lion, for example, must have given rise to the same emotions as a registered letter from the IRS today. It also triggered another immediate categorical response: flight. Our ape ancestor might never have seen a lion before. For all he knew, the big cat was a vegetarian. Or it was merely another monkey dressed in a cat suit. He could not know everything. So, he acted as modern humans do – on basic instinct, intuition, and the categorical imperative. He evolved categorical rules. Or, it is probably more correct to say, they evolved him. See a big cat-looking animal approaching? Get the heck out of there as soon as possible! Those without the quick categorical response became lunch, not parents. Hungry Cat!The development of words and language made a big difference because it introduced a new kind of thinking. Words had meaning. Words became categories – awkward, not nearly as subtle and fluid as intuitive categories, but versatile in their own way. Because they allowed humans to pass along more complex thoughts and sentiments. "Cat! Big cat! Hungry cat!" Unlike sounds that conveyed only emotions – fear, opportunity, danger, sorrow, and the like – words contained ideas… and large, super-charged metaphorical categories. "Home," for example. The single syllable is rarely emitted without a charge of emotion. In some circumstances, it brings tears to one's eyes. It has a specific meaning – one may imagine his own ivy-covered cottage among the rolling hills of the Cotswolds… or his rustic cabin on the slopes of the Appalachians. It has a general, categorical meaning, too. "Home" is where people live. It is also a financial asset for millions of people and a cost center for millions more. It is even a political term. Leftists, reformers, Bolsheviks, nationalists, Communists, and progressives of various social and political bents generally hate the word. It represents a traditional, bourgeois civilization – with its emphasis on private family life. Given the opportunity, the reformers abolish the home and replace it with state nurseries and boarding schools for the children, along with drab worker housing for the adults – often sharing small apartments with other households. People will put up with almost anything, no matter how absurd, if it is for a "good cause." That is the disadvantage of man over animal. The animal will follow his instincts. Man will convince himself that his instincts are wrong… outmoded… retrograde. Then he will do the most remarkably asinine things – such as substitute state-run reformatories for family-run homes. Often, the "smarter" the man, the more absurd and idiotic he can be. His "intelligence" helps him use words to persuade himself, and others, to do the most preposterous things! That is also George W. Bush's great advantage: He does not appear smart enough to be an idiot. His words didn't make much sense. But voters sensed he had an intuitive understanding of the world similar to their own. Bush may be a fool, they reasoned, but when the average voter looked at him, he saw his own honest face… and he liked it. "Let Freedom Reign"Today, we humans are smothered with words. Words tumble out of newspapers, books, reports, TV, radio, the Internet. Some of the words are precise and useful – how to avoid taxes… a recipe for sponge cake… the instruction manual for a new computer. But many words are nothing more than invitation to rumble. For example, when President Bush learned that sovereignty had been passed back to the Iraqis, the Commander-in-Chief sent a little note to Condoleezza Rice. With no speech writers or spinmeisters present to help, "Let freedom reign," wrote the president. We have no idea what Bush meant to say – if anything. If he meant that now we should back off and "let freedom reign," it is a strange thought for a president who sent 150,000 troops… killed 10,000 to 20,000 foreigners (who, as far as we know, never did anything to us)… and destroyed Iraq's government. Maybe he meant that the Iraqis were now free… a situation he is merely applauding. But was it true? In what sense? Left to their own devices – that is to say free of foreign meddlers – Iraqis seemed quite content with a dictatorship. If getting rid of Saddam were so important to them, why would they not have done so themselves? The English cut off Charles I's head in 1649. Surely, the Iraqis had their own Cromwell somewhere… ready to do the "cruel necessity." Of course, the president's apologists will have dozens of good reasons why the Iraqis needed us to intervene. We do not argue with them. We bring it up only to show how remarkably malleable and convenient words can be; it is a strange "freedom" that is only available at the whim of foreign invaders. Prisoner of ThoughtsIs a democracy – or whatever it is that America has set up in Iraq – freer than a dictatorship? We don't know. It depends. Citizens may not be free to vote in a dictatorship, but they could still be much freer. Given the choice between a dictator who left us alone and a democracy where everything we did required state approval, we would choose the dictator! One could ask a million questions about "freedom" or "democracy" and still know nothing. It is like an argument between a madman and a U.S. Senator – half incomprehensible… the other half, soothing lies. The words do not confront each other; instead, they pass like busloads of tourists in front of a philosopher's grave. Who was he? What did he say? What does it mean? No one knows… or cares. You can deconstruct the word "freedom" into a thousand different syllables. Indian independence leader Mahatma Gandhi once remarked that he was freer in his prison cell in New Delhi than most people walking around outside. He meant he was a free thinker; others were imprisoned by their own traditions, instincts, and intuitions. He was right… but also wrong at the same time. He was free of the traditional thinking of the average Indian, but he had merely become a prisoner of different thoughts – his own – and was now trapped in two cells at once. But now, in the name of "freedom" and "democracy," Americans leap to their own suicide. They are so sure their system is foolproof, they rush to test it – with unnecessary wars, unnecessary deficits, unnecessary conceits and pretentions… and political leaders that make your jaw drop. Even President Wilson would have been shocked; Eisenhower would have been appalled. But that is the charm of the American frontal lobe. It sets up thoughts like drinks at an Irish wedding. Before long, the guests can barely find their car keys, let alone their way home. Regards, Bill Bonner Originally posted at Bill Bonner's Diary, right here. P.S. Bill expects a violent monetary shock, in which the dollar — the physical, paper dollar — disappears. And he believes it will be foreshadowed by something even rarer and more unexpected — the disappearance of cash dollars. Many Americans don't see this coming because of what psychologists call "willful blindness." But Bill has taken the extraordinary step of assembling the full shocking details in a special report. To get full details on what Bill calls the "Great American Credit Collapse", click here right now. The post Democracy Is No Better Than a Monarchy… or a Dictatorship appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 22 Jan 2016 12:00 PM PST To understand the emergence of political correctness, social justice, modern feminism, etc., one must first understand the history of critical theory/Cultural Marxism. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BREAKING THE COMEX: First The Collapse Of Registered Gold Stocks, Now Silver?? Posted: 22 Jan 2016 11:46 AM PST SRSRocco Report | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stock Market Swing Baby, Swing! Posted: 22 Jan 2016 11:13 AM PST This article assumes one is trading the up and down swings in the stock market. Swing traders are just one segment of a market population that includes those sitting in cash (and/or risk ‘off’ vehicles like Treasury Bonds), maintaining longer-term short positions, our always bullish friends, the “stocks for the long-term” contingent and of course, the indomitable Gold Bug “community”, focusing as ever on one asset class while a world full of other assets is in motion. “Let’s go let’s go, he’s no batter, he’s no batter… (pitch comes to the plate) SWING BATTER!!!” | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 22 Jan 2016 11:09 AM PST U.S. government is a giant Mafia they shut people up that know the truth they bring in the drugs in dead bodies of U.S. soldiers! the elite is the Cancer of our country!!! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

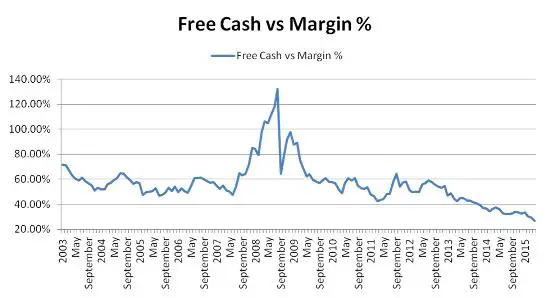

| Posted: 22 Jan 2016 11:09 AM PST Critics of today’s fiat currency/fractional reserve banking world have (for what seems like forever) made the common sense point that when debt rises faster than cash flow, bad things are bound to happen. In every cycle since 1980 this has been dismissed by the vast majority who benefit from inflating bubbles — until the bubble bursts. And here we go again. The following chart from Stock Traders Daily shows the relationship between margin debt (money borrowed by investors against existing stock positions in order to buy more stock) and cash on hand in brokerage accounts. The idea is that when investors hold lots of cash they’re pessimistic, and when they borrow a lot they’re optimisitc. Extremes of either tend to signal changes in market direction. At the end of 2015 investors were even more excited than at the peak of the housing bubble, indicating that there’s not much retail money left to be tossed at US stocks. China, being a little more bubbly than the US, is a good indicator of where US margin debt might be headed: Another red flag is being waved by corporate debt, much of which is being taken on to fund share repurchase programs. These tend to benefit shareholders in the moment but at the cost of higher leverage and less flexibility in the future. Where in the past net debt has tended to track EBITDA (a broad measure of earnings). starting in 2014 the former has soared beyond the latter. Just as a spike in margin debt implies a lack of retail stock buying in the future, soaring corporate debt implies limited borrowing power and a scale-back of share repurchases going forward. Based on both history and common sense, we should expect not just a slowdown, but a cratering of equity demand from both individuals and corporations in the year ahead. What happens then? Either the market crashes and prices go back to levels that attract wiser capital, or a new source of dumb money emerges. And that would be government. Already, the Bank of Japan owns more than half of the Japanese stock market. And now China — displaying its customary cluelessness about what markets are and how they work — is countering the recent bear market with public (which is to say borrowed) funds:

Companies exchanging long term bonds for equities and individuals using equities as collateral to buy more tend to distort equity valuations, but only temporarily, as the players’ finite borrowing capacity is eventually maxed out and the buying has to stop. Governments are a different story, since they can create trillions of dollars with a mouse click. Their ignorance is thus a lot more dangerous because it short-circuits price disclosure on a vast, potentially open-ended scale. When a central bank buys equities, it doesn’t have teams of analysts running valuation studies and creating model portfolios. Presumably it just makes across-the-board purchases, which tends to float all boats. So the wheat doesn’t get separated from the chaff and capital has no idea where to flow. Malinvestment becomes rampant and the result is, well, what we have today: Chinese ghost cities, Japanese zombie companies and US tech unicorns worth billions before generating their first dollar of earnings. And that’s before the Fed and European Central Bank really get going. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ron Paul Says to Watch the Petrodollar Posted: 22 Jan 2016 11:08 AM PST By Nick Giambruno The chaos that one day will ensue from our 35-year experiment with worldwide fiat money will require a return to money of real value. We will know that day is approaching when oil-producing countries demand gold, or its equivalent, for their oil rather than dollars or euros. The sooner the better. - Ron Paul Ron Paul is calling for the end of the petrodollar system. This system is one of the main reasons the U.S. dollar is the world’s premier reserve currency. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Undervalued Versus Stocks, Bonds, Property and Gold Posted: 22 Jan 2016 11:01 AM PST Precious metals continue to look very undervalued vis a vis most asset classes – particularly stocks and bonds. This is especially the case with silver which has fallen by more than 70% from what we believe was an intermediate price high of $49 in 2011 – despite surging demand for silver bullion coins and bars from canny buyers investing in silver. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| LME said to be in talks with banks to list London gold contracts Posted: 22 Jan 2016 10:57 AM PST By Eddie van der Walt and Agnieszka De Sousa The London Metal Exchange is in talks with the World Gold Council and five banks about the possibility of introducing futures contracts on gold and standardized central clearing, according to two people familiar with the matter. The talks are exploratory and there's no time frame for a decision on the contract, which would be for delivery in London, said the people, who asked not to be identified because the matter has not been made public. The banks are ICBC Standard Bank Plc, Citigroup Inc., Morgan Stanley, Goldman Sachs Group Inc., and Societe Generale SA, they said. The banks and World Gold Council asked for proposals last year from a group of exchanges, including London Stock Exchange, Intercontinental Exchange Inc., and CME Group Inc., on how to start clearing and listed derivatives on gold, the people said. The LME was chosen from that group for more detailed talks, they said. ... ... For the remainder of the report: http://www.bloomberg.com/news/articles/2016-01-22/lme-said-in-talks-with... ADVERTISEMENT Free Storage with BullionStar in Singapore Until 2016 Bullion Star is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. Bullion Star's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in Bullion Star's bullion vault, which is integrated with Bullion Star's shop and showroom, making it a convenient one-stop-shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage is FREE until 2016 and will have the most competitive rates in the industry thereafter. For more information, please visit Bullion Star here: Join GATA here: Vancouver Resource Investment Conference http://cambridgehouse.com/event/49/vancouver-resource-investment-confere... Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Peak Gold and Silver - It’s Here! Posted: 22 Jan 2016 10:56 AM PST Have we reached peak precious metals? Many analysts think so. Just to be clear, however, the idea of peak gold and peak silver doesn’t refer to a peak prices. The precious metals put in a cyclical price high in 2011. But annual mining production levels may have peaked in 2014-2015. This is what is meant by “peak precious metals.” | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| "Sell Everything" Royal Bank Of Scotland Recommends Posted: 22 Jan 2016 10:48 AM PST According to economist of the Royal Bank of Scotland "Sell Everything" as 2016 could be a "Cataclysmic Year" The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stock Market Crash! Sell everything & protect your 401k before it's too late! Posted: 22 Jan 2016 10:37 AM PST The economic collapse will start in 2016, as stock market expert Harry Dent predicts in his new book "The Demographic Cliff," which he's offering for free (just pay shipping.) http://harrydent.com/ The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Draghi Throws The Euro Under The Bus, Again! Posted: 22 Jan 2016 07:48 AM PST This post Draghi Throws The Euro Under The Bus, Again! appeared first on Daily Reckoning. And now… today's Pfennig for your thoughts…Good day, and a happy Friday to one and all! Front and center this morning, the price of oil is surging higher. What the heck is going on here? Ok, no animals were hurt here, but in the markets there’s a saying, it’s called a “dead cat bounce”, and it’s applied when some asset that otherwise has looked dead, bounces higher and surprises the markets. Well, oil sure exhibited the attributes of a dead cat bounce yesterday. As I left you, I had told you how the price of oil had dropped to $26.75, but as I said at the time, the price of oil had bounced to $28.11, but it didn’t stop there, and by the end of the day, the price of oil had jumped 4.25% to $29.53! I have to admit that I spent a better part of the morning watching this rise, and then looking at the Petrol Currencies, especially the Russian ruble, for their positive reaction to this dead cat bounce in the price of oil. And brother, did they have a positive reaction! But the price of oil didn’t stop at $29.53, and the rally continued throughout the overnight sessions, to bring the price of oil to a $31 handle. The supply numbers being weaker started all this yesterday, and then we just had to have a short squeeze to fuel this kind of rally. Yesterday, the Russian ruble was teetering and ready to fall off a cliff, but this morning the ruble is back in the saddle, still weak, but back in the saddle and away from the cliff. Yesterday, Mario Draghi threw the euro under the bus again. What ever happened to “Mr. I’ll do anything and everything to protect the euro”? This has to be at least 6 of one or 1/2-dozen of another times that Draghi has done this to the euro. You know, I just can’t seem to get these Central Bankers right these days. I used to be in tune with them, knew what they were thinking, and going to do, probably before they did! But lately, I just keep thinking they will go right and they go left, thinking they’ll stop and they go, and thinking they will act responsibly, and they don’t! I think I’ll blame it on the chemo brain. That’s what this generation does, right? Blame someone else, for they, themselves couldn’t be responsible for the mess up! It all started with the Fed decision to hike rates last month. That really knocked me for a loop and I haven’t recovered. Yesterday, I said that I didn’t think the European Central Bank (ECB) would do anything radical to upset the applecart. Well, I missed the boat on that one too… ECB president, Mario Draghi, decided that the 0.2% inflation report wasn’t good enough for him, and he opted to begin to grease the tracks for more stimulation. Crazy, eh? Well, I guess we could use that word to describe most Central Bankers, but in Draghi’s case, I think he’s just disillusioned! Furthermore. Draghi decided to tell the markets that the ECB “may” revisit its policy stance when the ECB meets again in March. Geez Louise… was that necessary, Mario? Really? Was it necessary? I don’t think so! The euro wasn’t getting stronger, to fight your wish for higher inflation. The Eurozone economy is in the middle of a really nascent recovery, but still a recovery nonetheless. I just don’t get these Central Bankers any longer. Oh, and notice Draghi didn’t say the ECB “WILL” revisit their monetary stance, he said they “may”! But, the markets just don’t get it either any longer, folks! So that was yesterday. Today is starting out much like yesterday with the currencies, for the most part on the rally tracks vs. the dollar. There’s only a handful of currencies not participating in the rally, and they include euros, which I just told what happened, New Zealand dollars/kiwi, which saw 4th QTR CPI (consumer inflation) inch higher from 1.5% to 1.6% (but the markets saw this as weak, and the calls for a rate cut came out of the walls), the Danish Kroner, which is pegged to the euro, so that explains that, and the Swiss franc, which for no other reason but it just is, can’t find a bid this morning. And the Czech Koruna seems to have run into a buzz saw this morning. And Japanese yen has lost that lovin’ feeling. That’s it! All the other currencies are rallying, led by the Russian ruble. Even the Chinese renminbi, and the Indian rupee, which have been beaten and left for dead on the side of the road lately, are rallying this morning. I want to point out that once again, the markets just don’t make sense any longer, now that they aren’t “fundamentals driven”. Take for instance these goings on in New Zealand with kiwi getting sold this morning. So, what is it that every country (save for Brazil and Russia who have more than they need) is looking for? Inflation. So, Inflation ticks higher in New Zealand but “it’s not enough” and kiwi gets smacked. What on earth do these guys want? Well, the calls for a rate cut from the Reserve Bank of New Zealand (RBNZ) might be coming out of the walls this morning, but I’m here to tell you that I just don’t see it happening that way! Hopefully by Monday, calmer heads will prevail, and kiwi will be allowed to rally alongside its kissin’ cousin across the Tasman, the Aussie dollar (A$), as is usually the case. In the U.K. inflation was weaker, and Bank of England (BOE) Gov. Mark Carney, delayed his rate hike once again. But that didn’t cause pound traders to run for the hills, instead they dug in and rallied the pound. See what I mean that they don’t use “fundamentals” any longer? Why would the pound rally, when the promised rate hike doesn’t materialize and probably won’t for some time? Craziness rules! Sanity Now! Gold is down $3 as I write, after spending the day yesterday above $1,100. For a brief time yesterday I had thoughts of sugar plums dancing in my head, no wait! I had thoughts of gold using $1,100 as a new base and moving higher from there, finally! But the road blocks were put up by the price manipulators and gold was not allowed to move higher. The GATA folks were busy yesterday putting out one article about gold after another. That was an indication to me that people, pundits, analysts, etc. are starting to talk about gold more, the way they used to, when gold shined and every other asset bowed down in gold’s presence. Is this a sign? Well if it is, it’s not a very reliable one, so let’s keep an eye out for any additional ones. I would have to say that five months in a row is what they call a “run rate”. So the “run rate” for the Philly Fed Index is “negative”! Yesterday’s print for the month of January was a negative -3.5. That was not as bad as the expectations of -5.9, but December’s number was revised downward by a HUGE margin, going from -5.9 to -10.2! And don’t look know but the jobless claims shot higher to 293,000 last week. Hmmm… Things to be really adding up for the train to pull from the station and head to Recessionville! The U.S. Data Cupboard could give us more fuel for the train to Recessionville this morning, as the Leading Index for December prints. Remember this is one of the few “forward looking” pieces of data that we see, even though it’s a month behind. I expect this data to fall in line with the other disappointing and negative prints we’ve had this week. We’ll also see Existing Home Sales for December. Recall that November’s data here showed a drop of 10.5% for the month. Maybe Existing Home Sales rebounded in December, you have to recall that mortgage rates were falling in the month, and continued through into this month. Speaking of Mortgage Rates. The yield on the 10-year Treasury has moved back above 2% after spending two days this week below that figure. If you were lucky enough to lock in this week while the 10-year was below 2%, I’m sure you came away with a very low Mortgage Rate. I found this in couple of places so it must be worth the read, eh? You can find it here. I found it first on Ed Steer’s letter, and then that led me to the article on Bloomberg, of which here are the snippets:

Chuck again. Looks like Big Ben has been reading the Pfennig! HA! Wouldn’t you know it. Just like his predecessor Big Al Greenspan, who came out talking about the merits of owning gold after leaving the Fed, and now Big Ben comes out talking about how the dollar may have peaked, after he leaves the Fed. Go Figure! That’s it for today. Thank you for reading the Pfennig. Now, I’m going to attempt to make this a fantastico Friday, I hope I meet you there! Regards, Chuck Butler P.S. Be sure to sign up for The Daily Reckoning — a free and entertaining look at the world of finance and politics. The articles you find here on our website are only a snippet of what you receive in The Daily Reckoning email edition. Click here now to sign up for FREE to see what you're missing. The post Draghi Throws The Euro Under The Bus, Again! appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Harry Dent: Why The Stock Market will Crash in 2016? Posted: 22 Jan 2016 07:45 AM PST The Great Depression 2016!The collapse of the stock market in 2016Alex Jones talks with economic expert Harry Dent about why he thinks the collapse is coming in 2016. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Elite Collapsing America By Design Posted: 22 Jan 2016 06:00 AM PST On this Thursday, January 21 edition of the Alex Jones Show, we break down the ongoing collapse of both the economy and the Hillary Clinton campaign. Clinton is now actually doing something very foreign to her: work! She's having to work for every vote as her supporters begin to abandon her... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Saudi Arabia's secret holdings of U.S. debt are suddenly a big deal Posted: 22 Jan 2016 05:37 AM PST By Andrea Wong and Liz McCormick It's a secret of the vast U.S. Treasury market, a holdover from an age of oil shortages and mighty petrodollars: Just how much of America's debt does Saudi Arabia own? But now that question -- unanswered since the 1970s, under an unusual blackout by the U.S. Treasury Department -- has come to the fore as Saudi Arabia is pressured by plunging oil prices and costly wars in the Middle East. In the past year alone Saudi Arabia burned through about $100 billion of foreign-exchange reserves to plug its biggest budget shortfall in a quarter-century. For the first time, it's also considering selling a piece of its crown jewel -- state oil company Saudi Aramco. The signs of strain are prompting concern over Saudi Arabia's outsize position in the world's largest and most important bond market. ... ... For the remainder of the report: http://www.bloomberg.com/news/articles/2016-01-22/u-s-is-hiding-treasury... ADVERTISEMENT We Are Amid the Biggest Financial Bubble in History; With GoldCore you can own allocated -- and most importantly -- segregated coins and bars in Switzerland, Singapore, and Hong Kong. Switzerland, Singapore, and Hong Kong remain extremely safe jurisdictions for storing bullion. Avoid exchange-traded funds and digital gold providers where you are a price taker. Ensure that you are outright legal owner of your bullion. If you do not own segregated bullion that you can visit, inspect, and take delivery of, you are exposed. Crucial guides to storage in Singapore and Switzerland can be read here: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland GoldCore does not report transactions to any authority. Safety, privacy, and confidentiality are paramount when we are entrusted with storage of our clients' precious metals. Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44(0)203-086-9200. U.S.: +1-302-635-1160. International: +353(0)1-632-5010. Visit us at: http://www.goldcore.com Join GATA here: Vancouver Resource Investment Conference http://cambridgehouse.com/event/49/vancouver-resource-investment-confere... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Indian gold paperization scheme is failing so govt. boosts subsidy to banks Posted: 22 Jan 2016 05:29 AM PST Banks to Get Commission for Unlocking Household Gold, RBI Says By Rajendra Jadhav MUMBAI -- The government will pay banks a 2.5 percent commission to unlock the country's massive stash of gold under a new monetization scheme, the Reserve Bank of India said, as the ambitious plan received a poor response from banks and customers. Prime Minister Narendra Modi launched the Gold Monetization Scheme on Nov. 5 to lure an estimated 20,000 tonnes of gold hoarded in households and temples into the banking system and trim the import bill of the world's second biggest gold consumer after China. ... Dispatch continues below ... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata But only a few kilograms trickled in over the last two months as banks showed little interest in popularizing the scheme because of negligible returns for them. Now the government has decided to pay the participating banks a total commission of 2.5 percent, including 1.5 percent handling charges, for the first year, the RBI said in a statement late Thursday. Support from banks is crucial to the success of the scheme. Similar programmes in the past have failed as they were not profitable for the banks. Under the current scheme, citizens are encouraged to deposit jewellery, bars, or coins with banks so it can be refined to meet fresh demand and cut the need for imports. The consumer would earn interest and, at the end of the deposit term, get the gold back in the form of bars. But the public response has been lacklustre. Indians' penchant for bullion spans centuries and they would not part with their gold, which is seen as providing financial security, unless they were offered incentives such as higher interest rates. Banks were saying they could not offer attractive rates unless the government compensated them for the loss from higher rates. ... For the remainder of the report: http://in.reuters.com/article/india-gold-idINKCN0UZ2O2 Join GATA here: Vancouver Resource Investment Conference http://cambridgehouse.com/event/49/vancouver-resource-investment-confere... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 50 YEAR OLD CARTOON PREDICTS THE FUTURE !!! NWO !!! Posted: 22 Jan 2016 05:05 AM PST 50 years ago a cartoon predicted how Liberals would screw up America All leaders are silver-tongued smooth-talking snake-oil peddlers. They perform no work, only work others with their mouths. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Economic Collapse Is Here! Ships Have Halted Their Sails -- First Time In History ! Posted: 22 Jan 2016 02:49 AM PST Now is the Time to Stock Up! Food, water, toiletries, everything!!!For the first time in history, North Atlantic cargo ships are no longer moving. There are no cargo ships traveling in these waters, all ships are anchored, and many are empty. Not to mention the Baltic Dry Index (BDIY), which... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Resists a Raid, Silver Holds Place, Northeast Prepares For Snow Posted: 22 Jan 2016 02:12 AM PST Gold was hit early on in a general 'stocks are good, gold is bad' move that fizzled into the late afternoon. Despite all the misinformation to the contrary, gold is still a safe haven asset. Silver held its ground. There was intraday commentary on the increasingly 'insubstantial' nature of the NY gold trade, and the relative robust purchasing of physical gold in Asia. You may scroll down to see it. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stock Markets Waiting on U.S. Dollar Posted: 22 Jan 2016 02:06 AM PST It appears that the outcome of the world markets may depend on the behavior of the USD. The pattern is now clear, after a long consolidation. The rising domestic markets have been dependent on the rising dollar. This has made especially so by the emerging markets as they have to buy back dollars to repay dollar-denominated debts which they so eagerly took over the past several years. This has caused a terrible squeeze on their economies and the Emerging Markets stocks and bonds. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Maintains Value Despite Oil and Stock Market Crash Posted: 22 Jan 2016 01:51 AM PST Investors should analyze 2016 year to date action as it is generally a good predictor of how the year will look. Major capitulation in oil and global market rout sends investors to the sidelines seeking out capital preservation. Volatility is soaring and precious metals are holding their values in January. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 21 Jan 2016 11:00 PM PST Sk Options Trading | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Gold Resists, Silver Holds, Northeast Braces For Snow Posted: 21 Jan 2016 01:04 PM PST |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

George Soros is a firm backer of transnational bodies such as the European Union, and his Open Society Foundation (OSF) provides assistance for pro-migration activists. He is well-known for his support for "progressive" causes such as the Centre for American Progress, Hillary Clinton and Barack Obama.

George Soros is a firm backer of transnational bodies such as the European Union, and his Open Society Foundation (OSF) provides assistance for pro-migration activists. He is well-known for his support for "progressive" causes such as the Centre for American Progress, Hillary Clinton and Barack Obama.

Saudi Arabia has vowed to continue flooding the global market with oil despite the collapse in Brent prices to a 12-year low, insisting that it will not cut output until Russia and other non-Opec countries agree to share the burden. “We’re not going to withdraw our production to make way for others,” said Khalid Al-Falih, the president of the giant Saudi oil producer Aramco. “If other producers are willing to collaborate, Saudi Arabia is willing to collaborate. But Saudi Arabia will not accept the role, by itself, of balancing a structural imbalance,” he told the World Economic Forum in Davos.