saveyourassetsfirst3 |

- Chinese stocks just crashed… here’s the latest

- Shock of Slow Decline: “Economic Conditions Substantially Worse Than During Last Crisis”

- Gold Bullion Rallies Near $1100 But Specs Turn Bearish, Big ETF Shrinks, China Imports Fall

- Is deflation ‘winning’?

- Copper-Bottomed Cycles

- China: Major Devaluation Coming

- Gold and Gibson’s Paradox- Alasdair Macleod

- Day of Reckoning for American Pensions Is Fast Approaching

- Meet the Newest Enemy of your Financial Privacy: George Clooney

- Absurd Gold-Stock Levels

- How much gold does China really have?

- Wish You’d Jumped on the China Boom 20 Years Ago? Here’s Your Second Chance in Vietnam

- How much gold does the Chinese Government really have?

- Gold Bullion “Extremely Rare” – All World’s Gold Fits In Average Four Bedroom House

- Just a Minting Shortage? “There IS A WHOLESALE Shortage!” -Sprott’s John Embry

- Veteran technical analyst Robin Griffiths says Nasdaq bull dead

- Six Miners Dundee's Joseph Fazzini Believes Will Weather the Storm

- Shanghai stocks plummet 8.5% and gold price rallies 1.7%

- Mike Swanson: Fed rally this week and August bear market to follow

- The Stock Market Will Start To Fall In July? The Dow Plummeted More Than 500 Points Last Week

- 3% of Global Production Dumped in 90 Seconds!

- Two Week Shanghai Gold Exchange Withdrawals Exceed All 2014 Comex Deliveries

| Chinese stocks just crashed… here’s the latest Posted: 27 Jul 2015 12:15 PM PDT From Bloomberg: It’s days like Monday that reassure Tony Hann he was right to avoid stocks in mainland China… The severity of an 8.5 percent drop in the Shanghai Composite Index is bad enough, but what irks him the most is not knowing why it tumbled so much. In a market where unprecedented intervention has made government money one of the biggest drivers of share prices, authorities aren’t transparent enough for investors to make informed decisions, said Hann, the head of emerging markets at Blackfriars Asset Management Ltd. Foreign investors have unloaded about $7.6 billion of Shanghai shares through the city’s Hong Kong exchange link since July 6 Monday’s plunge was all the more surprising because it followed a government rescue package that had helped drive a 16 percent rally since July 8. That support appeared to vanish without warning, leaving analysts guessing whether authorities shifted their policy stance or just got overwhelmed by a flood of sell orders. After the close of trading, the securities regulator denied speculation that the government has exited the stock market. Investors “are concerned and lost,” said Alex Wong, a Hong Kong-based asset-management director at Ample Capital Ltd., which oversees about $155 million. “China’s market is distorted, so you can’t sell short very confidently and you can’t buy up very confidently either.” State SupportSigns of government purchases that were prevalent in recent weeks went missing in Monday’s rout. PetroChina Co., long considered a favorite holding of state-linked rescue funds, sank 9.6 percent. The government-run oil producer had been one of the biggest sources of support for the Shanghai Composite on big down days in late June and early July. China Securities Finance Corp., a state-backed agency that provides margin financing and liquidity, hasn’t withdrawn support for equities, China Securities Regulatory Commission spokesman Zhang Xiaojun said in a statement Monday. The commission will “continue efforts to stabilize market and investor sentiment, and prevent systemic risk,” he said. The China 50 ETF, another target of government funds, dropped 9.1 percent Monday. The Shanghai Composite’s one-day selloff was the broadest since at least 1997, with 959 more shares in the index falling than those that gained. Selloff RisksIf state-run funds withdrew support to test whether shares could stabilize at current levels on their own, the resulting retreat may prompt the government to step back in immediately to prop up prices, said Hann, who oversees about $350 million. On the other hand, if policy makers are starting to unwind support measures to let the market play a bigger role, shares may have further to fall, he said. “It is impossible to say at this stage,” said Hann, who has exposure to China through businesses listed on Hong Kong’s exchange instead of mainland bourses. Foreign investors have unloaded about $7.6 billion of Shanghai shares through the city’s Hong Kong exchange link since July 6, selling stock holdings for the 13th time in 16 days. Chinese policy makers have surprised investors before. In 2014, they jolted currency traders who regarded the yuan as a one-way bet by selling the currency and widening its trading band, spurring a record quarterly decline. The year before that, authorities tackled speculative lending by restricting the supply of funds to the banking system. The result was the country’s worst modern-day cash squeeze. The International Monetary Fund has urged China to eventually unwind its support measures, saying share prices should be allowed to settle through market forces, according to a person familiar with the matter, who asked not to be identified because the talks are private. Government Operations“The markets in China now are not really markets,” Donald Straszheim, head of China research at New York-based Evercore ISI, said on Bloomberg Television last week. “They are government operations.” Policy makers still have firepower to support equities and state-linked firms will probably start buying when the Shanghai Composite falls below 3,800, said Yang Delong, chief strategist at China Southern Fund Management. The gauge closed at 3,725.56 on Monday. Officials have already banned major shareholders from selling stakes, encouraged government-owned companies to boost holdings in listed units and armed China Securities Finance with more than $480 billion to support equities. “China won’t tolerate a worsening stock market, so those state-backed financial institutions may start buying,” Yang said. For Ken Chen, a Shanghai-based analyst at KGI Securities, the more likely explanation for Monday’s tumble is that the government is struggling to prop up overvalued shares. At 66, the median trailing price-to-earnings ratio on mainland bourses is higher than in any of the world’s 10 largest markets. It was 68 at the peak of China’s equity bubble in 2007. “It’s hard to start a new up move after a bubble bursts,” said Chen. “I don’t think they are able to prevent it falling.” |

| Shock of Slow Decline: “Economic Conditions Substantially Worse Than During Last Crisis” Posted: 27 Jul 2015 12:00 PM PDT Unfortunately, in our 48 hour news cycle world, a slow and steady decline does not produce many "sexy headlines". From The Economic Collapse Blog: Did you know that the percentage of children in the United States that are living in poverty is actually significantly higher than it was back in 2008? When I write […] The post Shock of Slow Decline: "Economic Conditions Substantially Worse Than During Last Crisis" appeared first on Silver Doctors. |

| Gold Bullion Rallies Near $1100 But Specs Turn Bearish, Big ETF Shrinks, China Imports Fall Posted: 27 Jul 2015 12:00 PM PDT Bullion Vault |

| Posted: 27 Jul 2015 11:47 AM PDT From Chris Martenson at Peak Prosperity: Deflation is back on the front burner… and it’s going to destroy all of the careful central planning and related market manipulation of the past six years. Clear signs from the periphery indicate that a destructive deflationary pulse has been unleashed. Tanking commodity prices are confirming that idea. Whole groups of enterprises involved in mining and energy are about to be destroyed. And the commodity-heavy nations of Canada, Australia and Brazil are in for a very rough ride. Whether the central banks can keep all of their carefully-propped equity and bond markets elevated throughout the next part of the cycle remains to be seen. We know they will try very hard. They certainly are increasingly willing to use any all tools at their disposal to keep the status quo going for as long as possible. Whether it’s the People’s Bank of China stepping in to the market to buy 10% stakes in major Chinese corporations in a matter of weeks, the Bank of Japan becoming the majority owner of key ETFs in the Japanese markets, or the Swiss National Bank purchasing $100 billion of various global equities, we see the same desperation. Equity prices are being propped, jammed and extended higher and higher without regard to risk or repercussions. It makes us wonder: Why haven’t humans ever thought to print their way to prosperity before? Well, that’s the problem. They have. And it has always ended up disastrously. History shows that the closest thing that economics has to an inviolable law is: There’s no such thing as a free lunch. Sadly, all of our decision-makers are trying their hardest to ignore that truth. First, The Fall…So how will all of this progress from here? We’ve always liked the Ka-Poom! theory by Erik Janzen which we explained previously like this: One of the models of the future that I favor is the Ka-Poom theory put out by Erik Janszen of iTulip.com back in 1999. Basically it states that the end of a bubble era begins with a sharp deflationary event (the ‘Ka’ part of the title), but ends in a highly inflationary blow-off, (the ‘Poom’). It’s a one-two punch. Down then up. The reason you get the deflationary portion is simply because bubbles always burst. They are seeking a pin from the moment they are born. The logic for the inflationary secondary reaction is that the central banks always respond to deflation with more money printing. Ironically, this is a doomed attempt to stem the damage caused by their prior money printing efforts. They never learn. So that’s what we’re looking for here at Peak Prosperity: a deflationary crunch savage enough to scare the central banks into opening the monetary spigots even wider. But this next time, we think they’ll seek to goose economic growth by giving money directly to the people as well as non-bank corporations. And we think that deflationary bust has already begun. Our record-high stock markets simply somehow haven’t gotten the memo yet. So that’s it: prices first go down (Ka!) and then they rocket back up (Poom!). When it’s all over some years down the line, many of the world’s fiat currencies (Yen, Euro, Bolivar, Real, and maybe a few Pesos and the Rupee, too) will be damaged or dead. Dreams are dashed. And those who are mentally unprepared and emotionally unequipped will have a very hard time adjusting. This predicted implosion has to happen. It’s a mathematical result of the grave errors made by central banks and government busybodies, who mistook the low volatility and easy gains of the virtuous portion of the money printing cycle for actual success. Goaded on by their great fortune, they simply doubled down over and over again; seeking the same bang for those freshly-printed dollars (or yen, euros, and yuan). Of course, their efforts progressively resulted in diminishing returns. Yet they completely ignored charts like the one below, which explains much if you just stop and think about it for a couple of seconds:

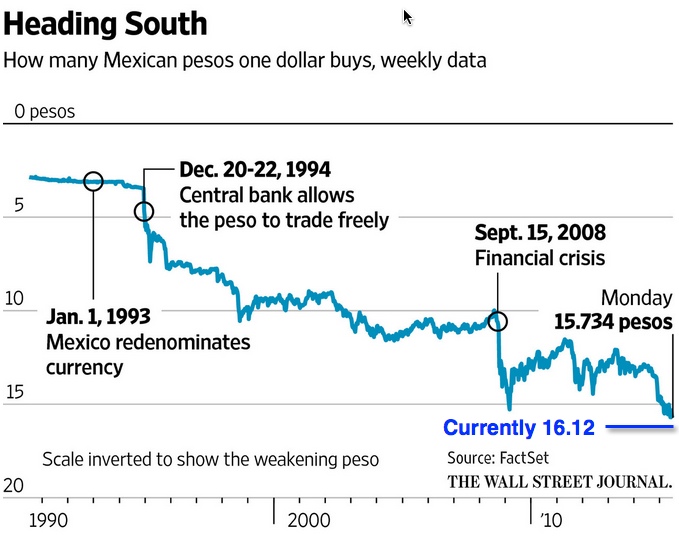

(Source) This chart says that between 1947 and 1952, when the middle class was expanding like crazy, each new dollar of debt increased the GDP by $4.61. Today, that number is $0.08(!). We can flip this, to say that it takes $12.50 of new debt to boost GDP by $1. Clearly this is an unsustainable trend. What’s been the response from the central banks? Why to encourage more debt, of course! We need more GDP, they say, and new credit formation is critical to that process! Well, what else would you expect a banker to say? Note that the central banks are deadly mute on topics like the role of cheap debt in fostering mal-investment, to say nothing of the importance of net energy and functional ecology to the human experience. Central planners may have a lot of power because of their access to and use of the magic printing press. But their knowledge of the real world is horribly immature, if not entirely wrong. From The Outside InThe way things tend to work is that trouble begins on the outside and works its way towards the center. The weaker periphery elements get clobbered first, the strongest last. So it’s Greece before Spain, and Spain before France. It’s the poor before the middle class, and the middle class before the rich. We can already see the signs of this process in play, but it’s now accelerating. MexicoIn January 2015 the Mexican peso, stung by falling oil export revenues, breached the 15-to 1-level against the US dollar for the first time since the 2009 crisis. Today, it’s 16.12-to-1:

(Source) BrazilMeanwhile, the Brazilian real has declined by a stomach-churning 45% in the past 12 months versus the dollar:

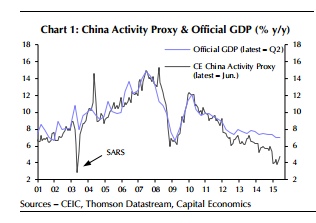

(Source) Where one Brazilian real used to be worth 45 cents a year ago, it’s now worth just 30 cents. All of the hedge funds that tried to get rich off of the fat 12.5% yield that Brazilian 10-year debt offers just got their heads handed to them as a result of the plummeting currency exchange ratio. Why is Brazil tanking so hard? It’s due to a combination of challenges: corruption scandals, poor trade prospects (as commodities collapse) and growing political risk. But the big one is that it’s ‘miracle’ economic growth has crashed into a brick wall. Puerto RicoSimilarly, Puerto Rico is in dire financial straits. There are huge haircuts coming for investors in Puerto Rican bonds and — like Greece — many years of economic hardship for the island’s populace: More than half of all muni bond funds have investments in Puerto Rican tax-exempt bonds, even though the sunny Caribbean island is an economic basket case. Its outstanding municipal debt of $72 billion amounts to $30,000 for each of the commonwealth’s residents, almost three times average annual per capita income. Puerto Rico’s ratio of debt to gross domestic product is more than triple that of any other U.S. state or territory, and the island’s economy has been mired in recession for nine years. (Source) How does a small island nation even borrow 3x average annual income per capita? It turns out it’s remarkably easy in the free-money liquidity fest offered up by the Fed. It was only a year ago that yield starved “investors” (more properly called speculators) placed $16 billion in bids for $3.5 billion of newly issued Puerto Rican junk muni bonds. VenezuelaIn even worse shape is Venezuela. It’s so far down the road to financial ruin that it’s almost certainly gong to be the next victim of hyperinflation. Inflation in Venezuela signals default impendingJul 16, 2015 Venezuela is about to earn another ignominious distinction. Long home to the world’s highest inflation rate, the country now is set to become the site of the 57th hyperinflation event in modern recorded history, says Steve Hanke, professor of applied economics at Johns Hopkins University. While the feat may be little more than a formality in a country where Hanke calculates annual cost-of-living increases already run at 772 percent, it’s the latest sign a debt default may be closer than previously thought. With Venezuela’s currency losing 32 percent of its value in the past month in the black market, according to dolartoday.com, and falling oil prices throttling the cash-starved nation’s biggest revenue source, the government may run out of money to pay its debts by year-end, according to Societe Generale. Derivatives traders have ratcheted up the probability of a default within one year to 63 percent, compared with 33 percent just two months ago. (Source) Things are about to get even more dire for the people of Venezuela. Already suffering acute shortages of consumer staples, they’re about to experience the same type of horrific monetary devaluation that Zimbabwe did. ChinaChina is anything but a peripheral country, but the import/export numbers suggest that China is slowing down hard and ripe for a crash. Instead of trying to gracefully manage its transition from an industrial economy to a consumer economy, China is simply plowing ahead following the same script that fostered its growth in the first place. Loans are being hurriedly pushed out the door to support everything from the stock market to real estate. Despite these efforts, lots is going wrong, as evidenced by the vicious bursting of China’s stock bubble and the heavy-handed government rescue efforts that have followed: Half the shares traded in Shanghai and Shenzhen were suspended. New floats were halted. Some 300 corporate bosses were strong-armed into buying back their own shares. Police state tactics were used hunt down short sellers. We know from a vivid account in Caixin magazine that China’s top brokers were shut in a room and ordered to hand over money for an orchestrated buying blitz. A target of 4,500 was set for the Shanghai Composite by Communist Party officials. Caixin says the China Securities Finance Corporation – a branch of the regulator – now owns an estimated $200bn of Chinese stocks and has authority to buy a further $500bn if necessary to prop up the market. This use of “brute force” – in the words of Peking University professor Michael Pettis – has done the trick. Equities have recovered. How could they not do so, since selling was illegal, and not to buy was also illegal? (Source – AEP Telegraph) We get the following interesting chart, from this same article which supports the idea that China’s rate of economic growth has slowed sharply and is well below the officially-stated rate of 7%:

Throwing lots and lots of new money at the problem of slowing growth and collapsing equity prices is exactly backwards from what should be done… The problem is not that equity prices are falling, it’s that they are too high compared to earnings (70x trailing earnings!).The problem is not that real estate building and sales are slowing down, it’s that too much was built and prices are already far too high (20x median income or higher!). Assume The Crash PositionIn Part 2: Assume The Crash Position, analyzes how if deflation does indeed take over and swamp the official efforts at damage control, quite a lot of fantasy wealth in today’s stock, bond and real estate markets will be destroyed. This means you want to be positioned away from risk-based financial assets right now — with stocks and low & junk grade bonds are right at the top of that list. Cash and short maturity sovereign debt of good countries will be much better places to hang out while the storm rages. Like it or not, things are getting interesting again. The prudent move here is to watch developments very closely, position yourself defensively, and be ready to react nimbly, if necessary. After years of suppression, the forces of reality are threatening to overwhelm our managed global “markets.” And it’s about damn time. |

| Posted: 27 Jul 2015 10:34 AM PDT Bullion Vault |

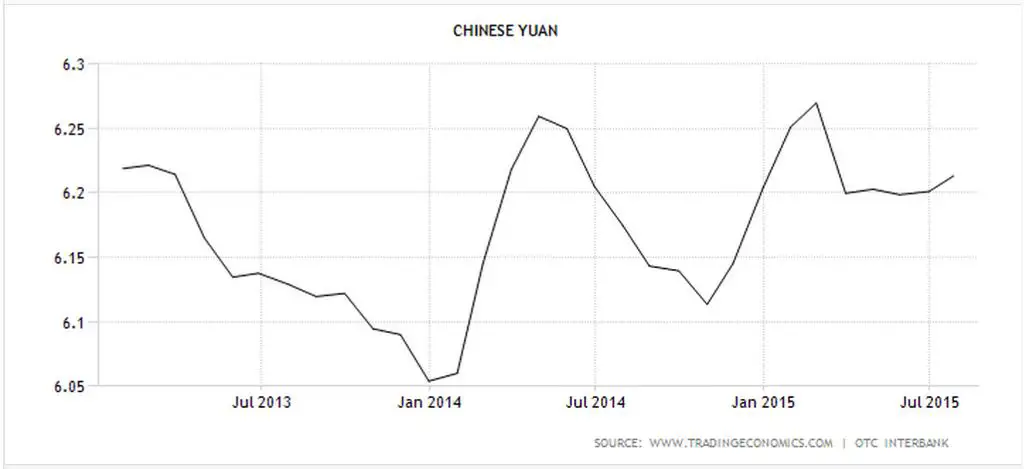

| China: Major Devaluation Coming Posted: 27 Jul 2015 10:13 AM PDT The whole “market economy” thing is turning out to be a little trickier than China’s dictators expected. To set up the story: After the 2008 crash the country borrowed about $15 trillion (an amount that dwarfs the US Fed’s quantitative easing programs) and spent the proceeds on history’s biggest infrastructure program. This pushed up the prices of iron ore, oil, copper, etc., igniting a global commodities boom. Then China liberalized its stock trading rules, setting off a stampede into local equities that doubled prices in less than a year. The result is a classically unbalanced economy, with massive physical malinvestment, overpriced financial assets and way too much debt. The inevitable crash began in June. Beijing responded by tossing about 10% of GDP into equities to stop the bleeding. This worked, as such interventions tend to do, for a while. But last night it failed:

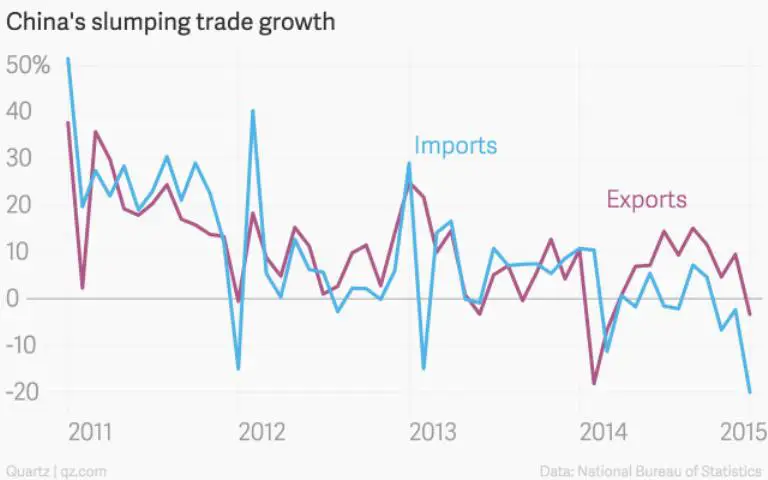

Devaluation time? But because the dollar is way up against virtually every other currency, so is the yuan, which is a major cause of today’s crisis. Economics 101 says that a stronger currency makes exports more expensive and slows growth, and in 2015 China’s trade has responded exactly as predicted: So here’s the dilemma: A too-strong currency is making it impossible for China to service excessive debts, which is contributing to a bear market in equities, which further slows the economy and makes it even harder to service debts, and so on. This probably seems like uncharted territory to the central planners, but is actually a pretty standard problem — for which the traditional solution is to devalue and stiff your creditors by repaying debts with cheaper currency. The US did it in the 1970s, Europe is in the process of doing it now with the euro’s recent steep decline, and much of Latin America is in various, mostly disorderly, stages of the process. Put another way, the world is following the standard currency war script, in which countries take turns devaluing, reap modest temporary benefits, and then give up those gains when their trading partners respond in kind. China’s devaluation, however, will be a much bigger deal than most. |

| Gold and Gibson’s Paradox- Alasdair Macleod Posted: 27 Jul 2015 10:00 AM PDT There is a myth prevalent today that the gold price always falls when interest rates rise. Submitted by Alasdair Macleod, GoldMoney: The logic is that when interest rates rise it is more expensive to hold gold, which just sits there not earning anything. And since markets discount future expectations, gold will even fall when a […] The post Gold and Gibson's Paradox- Alasdair Macleod appeared first on Silver Doctors. |

| Day of Reckoning for American Pensions Is Fast Approaching Posted: 27 Jul 2015 09:00 AM PDT The 25 largest public pension funds in the US have a $2 trillion budget shortfall. By Joshua Krause, The Daily Sheople: For decades, local and state governments in the United States have made promises to their employees that they cannot keep. They guaranteed a certain level of income to retirees at a time when […] The post Day of Reckoning for American Pensions Is Fast Approaching appeared first on Silver Doctors. |

| Meet the Newest Enemy of your Financial Privacy: George Clooney Posted: 27 Jul 2015 08:00 AM PDT This war on privacy is a war on freedom. And it's getting totally out of control. Submitted by Simon Black, Sovereign Man: I'm at a complete loss for words. I keep waiting for the deep baritone of that guy who voices all the action movie trailers to chime in. But it doesn't come. Because […] The post Meet the Newest Enemy of your Financial Privacy: George Clooney appeared first on Silver Doctors. |

| Posted: 27 Jul 2015 07:30 AM PDT Gold stocks suffered a full-blown panic this past week! This exceedingly-rare magnitude of selloff was triggered by extreme futures shorting intentionally executed to force a flash crash in gold. After gold's major multi-year support failed in this Machiavellian onslaught, gold stocks plummeted. The levels of fear were so epic that this entire sector was slammed […] The post Absurd Gold-Stock Levels appeared first on Silver Doctors. |

| How much gold does China really have? Posted: 27 Jul 2015 07:01 AM PDT Perth Mint |

| Wish You’d Jumped on the China Boom 20 Years Ago? Here’s Your Second Chance in Vietnam Posted: 27 Jul 2015 07:00 AM PDT If you missed the China boom, don't let Vietnam pass you by. Submitted by Simon Black, Sovereign Man: As Europe burns, Puerto Rico sinks, and China violently gyrates, it's nice to know there are still some exciting bright spots of growth in the world. Vietnam is certainly one of them. The first thing you […] The post Wish You'd Jumped on the China Boom 20 Years Ago? Here's Your Second Chance in Vietnam appeared first on Silver Doctors. |

| How much gold does the Chinese Government really have? Posted: 27 Jul 2015 06:15 AM PDT On Friday I posted on the messaging China may have been sending with its central bank gold reserves announcement. Today I will update this analysis from 2012 to estimate how much gold the Chinese government unofficially holds and how much the population holds. I estimate that the total amount of gold in China is approximately 10,950 tonnes, with the population holding 6,490t, commercial banks holding 2,060t and the government, officially and unofficially, holding 2,400t. [read more] |

| Gold Bullion “Extremely Rare” – All World’s Gold Fits In Average Four Bedroom House Posted: 27 Jul 2015 05:01 AM PDT gold.ie |

| Just a Minting Shortage? “There IS A WHOLESALE Shortage!” -Sprott’s John Embry Posted: 27 Jul 2015 03:00 AM PDT In the wake of historic movements in the gold and silver markets this week, Sprott’s John Embry joined us for a power-packed show, discussing: Metals Drive-By Shooting As $2.7 Billion Notional in Gold Dumped in Nanoseconds: “This is financial repression at its finest!“ CAPITULATION Bottom In Progress– Absolute OBLITERATION in Mining Sector! Manipulation & MOPE […] The post Just a Minting Shortage? “There IS A WHOLESALE Shortage!” -Sprott’s John Embry appeared first on Silver Doctors. This posting includes an audio/video/photo media file: Download Now |

| Veteran technical analyst Robin Griffiths says Nasdaq bull dead Posted: 27 Jul 2015 01:03 AM PDT ArabianMoney recalls how accurate Robin Griffiths was in calling the gold bull market of the 2000s and so considers his bearish views on the Nasdaq now highly significant. Now chief technical analyst for The ECU Group, he explains why he thinks the Nasdaq has entered a bear market like in 2000… |

| Six Miners Dundee's Joseph Fazzini Believes Will Weather the Storm Posted: 27 Jul 2015 01:00 AM PDT |

| Shanghai stocks plummet 8.5% and gold price rallies 1.7% Posted: 26 Jul 2015 11:50 PM PDT The Shanghai Composite Index plummeted 8.5 per cent on Monday, heading for its biggest sell-off in eight years, while the gold price advanced by 1.7 per cent as Chinese investors dumped stocks and bought precious metals. Is this a new paradigm starting? Medha Samant of Fidelity offers her timely thoughts on why the rout in Chinese stocks will continue… |

| Mike Swanson: Fed rally this week and August bear market to follow Posted: 26 Jul 2015 11:16 PM PDT The concentration of the stock market’s optimism into just a few companies leaves it hugely vulnerable to a crash, argues market maven Mike Swanson in an emergency Sunday stock market mastermind session with David Skarica ahead of what will likely be one of the most important stock market weeks of all our entire lives. They are looking for some sort of bounce this week around Fed meeting, but a big drop in August to start the next bear market. That makes this week one of the most important in our investment lifetimes. Gold is the asset class to be accumulating they argue… |

| The Stock Market Will Start To Fall In July? The Dow Plummeted More Than 500 Points Last Week Posted: 26 Jul 2015 05:37 PM PDT

Last week took a lot of investors by surprise. The following is how Zero Hedge summarized the carnage…

The talking heads on television were not quite sure what to make of this sudden downturn. On CNBC, analysts mainly blamed the usual suspects…

And without a doubt, there are some new numbers that are deeply troubling for Wall Street. For example, it is being projected that S&P 500 companies will collectively report a 2.2 percent decline in earnings for the second quarter of 2015. If this comes to pass, it will be the first drop that we have seen since the third quarter of 2012. The biggest reason for this decline in earnings is the implosion of U.S. energy companies due to the crash in oil prices. The following comes from CNBC…

Hmm – unlike what so many others were saying initially, it turns out that the oil crash is bad for the U.S. economy after all. But just like at this time of the year in 2008, most people fully expect that everything is going to be just fine. So many of the exact same patterns that we witnessed the last time around are playing out once again, and yet most of the “experts” refuse to see what is happening right in front of their eyes. When things crash this time, it won’t just be stocks that collapse. As I have been writing about so frequently, we are also headed for an implosion of the bond markets as well. The following comes from Dr. David Eifrig…

There is that word “liquidity” again. This is something that I have repeatedly been taking about. Just check out this article from a little over a month ago. A bond is only worth what someone else is willing to pay for it, and if the market runs out of buyers that can cause seismic shifts in price very rapidly. Here is more from Eifrig…

There has been a lot of speculation about what will happen in the second half of 2015. We only have a little over five months to go in the year, so it won’t be too long before we see who was right and who was wrong. Our perceptions of the future are very much shaped by our worldviews. All the time, I get “Obamabots” that come to my website and leave comments on my articles telling me how Barack Obama has “turned the economy around” and has set the stage for a new era of prosperity in America. Despite all the evidence to the contrary, they choose to believe that things are in great shape because that is what they want to believe. Just check out the results from one recent survey…

To me, those numbers are quite striking. Many Democrats very much want to believe that things are getting better because Barack Obama is in the White House. Many Republicans very much want to believe that things are totally falling apart because Barack Obama is in the White House. So who is right and who is wrong? Please feel free to share what you think by posting a comment below… |

| 3% of Global Production Dumped in 90 Seconds! Posted: 26 Jul 2015 03:00 PM PDT This past Sunday night and Monday’s action in gold needs to be discussed of what I believe is now a rapidly moving big picture. $2.7 billion worth of gold futures were sold in just 2 minutes Sunday night. As I have asked before, “who” could possibly “own” this much gold other than an official source? The answer of […] The post 3% of Global Production Dumped in 90 Seconds! appeared first on Silver Doctors. |

| Two Week Shanghai Gold Exchange Withdrawals Exceed All 2014 Comex Deliveries Posted: 26 Jul 2015 01:26 PM PDT USA Gold |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment