Gold World News Flash |

- Current Economic Collapse News Brief – Episode 726

- Chinese Stocks Extend Friday’s Losses Following Drop In Corporate Profits

- Gold Bear Market Phase III

- Silver Bull Hammer Buy Signal

- Gold Cracks Support and Plunges to New Lows - How Low Will Price Go?

- The DHS & FEMA Plan To Round Up ‘Extremists’ – Sponsored By The US Congress

- Does Jewelry or Central Bank Demand Drive the Gold Price?

- Gold’s Two Stories: Paper Markets Collapse… While The Retail Public Buys At A Record Pace

- Meet The Kagans: Seeking War To The End Of The World

- Can You Hear the Fat Lady Singing? - Part III

- Clinton Favorability Plunges, Sanders Surges Amid Classified Emails Scandal

- Chinese Stocks Extend Friday's Losses Following Drop In Corporate Profits

- Gold's Two Stories: Paper Markets Collapse... While The Retail Public Buys At A Record Pace

- FDR: The Great Gold Confiscator Speaks *audio*

- In These 13 US Cities, Rents Are Skyrocketing

- Raoul Pal: GroupThink Is Almost Ubiquitous (& The 1 Chart That Matters)

- Gold Market Update

- Look to Q4 2015 for a Trading Rally in Gold

- Will Keynesians or Keynesian Economics Take the Hit?

- Bible Code Predicts Economic Collapse in 2015 -- Jonathan Cahn

- Gold Price at a Five-Year Low: Here’s What to Do

| Current Economic Collapse News Brief – Episode 726 Posted: 27 Jul 2015 12:30 AM PDT from X22Report: |

| Chinese Stocks Extend Friday’s Losses Following Drop In Corporate Profits Posted: 27 Jul 2015 12:15 AM PDT from Zero Hedge:

Following the weakness in Friday’s afternoon (China) session, tonight’s open is decidedly shaky as Shanghai Composite open down over 2% and CSI-300 (China’s S&P 500) is now down over 5%. This follows a year-over-year drop in China Industrial profits (-0.3%), the first since March as the small bounce in April and May is now done. Commodities are lower and silver saw a minor flash-crash shortlty after China opened. |

| Posted: 26 Jul 2015 10:40 PM PDT Plunger writes: Over 2 years ago I presented my first analysis of this precious metals bear market. After extensive study of the characteristics of past bear markets, I forecast a brutal bear market that would undergo three psychological stages. The third stage would be a wrenching decline that would ultimately reach levels so shocking that it would cause the destruction of the gold investment class. My analysis, which was dubbed Plunger's Flush, was met not just with skepticism but outright derision. I believe I know how Galileo felt. |

| Posted: 26 Jul 2015 10:20 PM PDT During gold's takedown over a week ago, silver rather surprisingly escaped relatively unscathed, a resilience that we can put down to this market already being very depressed, with its COTs showing little speculative interest even before the latest drop. On its 6-month chart we can see that, like gold, silver put in a fine bull hammer on Friday on good volume, and this, along with evidence elsewhere across the sector, suggests that a short-term rally is in the offing, even if the outlook remains bleak over the longer-term. Silver is a trading buy here with a stop beneath Friday's intraday low. |

| Gold Cracks Support and Plunges to New Lows - How Low Will Price Go? Posted: 26 Jul 2015 10:15 PM PDT Gold cracked support and plunged to new lows since the last update, which came as no surprise to us. So what now? We are seeing signs that a recovery rally is about to begin, but it probably won't get all that far before a new downleg gets underway that sees gold make new lows again. It's not just gold prices that are suffering - the entire commodity complex is in ragged retreat, with steep falls also in copper and oil. Why is this? The reason is that the gathering forces of deflation are starting to wreak havoc, and they are not going to be stopped by more QE - even if they print another $10 trillion to throw at the problem. The reason is that the debt mountain dwarfs whatever QE can be generated, and the deflation will continue until this debt is purged. Governments are like greedy short-sighted children - they are not interested in doing what is right and behaving with restraint and propriety, if they were they would have taken control of the debt crisis long ago. |

| The DHS & FEMA Plan To Round Up ‘Extremists’ – Sponsored By The US Congress Posted: 26 Jul 2015 10:14 PM PDT by SGT, SGT Report.com:

My friend Waldemar from Intercept Media e-mailed me with yet another troubling development about which I was unaware. The criminals in Washington have introduced a new Bill which WHEN passed will allow the US government to round up “radicalized” Americans – or those who are becoming radicalized – and put them in FEMA camps. The Bill is H.R. 2899 The Countering Violent Extremism Act Of 2015, and hardcore red-white-and-blue, Boogey man is under your bed, Pentagon Kool-Aid drinking “Representatives” like Congressman Michael McCaul can’t wait to pass it in order to “protect” the “homeland” in this “generation long fight against terror,” as he puts it. And guess which agencies will do the dirty work of rounding up these “pre-crime” extremists? The DHS and FEMA. As Waldemar writes, “I feel like taking the first plane ticket out of here. Don’t know how much longer we are going to have free speech and blogs like yours. Unfortunately I don’t see a clear plan to counter this, but I do what we can to help even if does not make much difference. Heart breaking.”

Friends, as most of you know, everything we are experiencing today is part of the orchestrated pre-9/11 plan, which is being carried out on the back of that horrific, traumatic day. And no one has explained the big picture of the Orwellian, world government, police state plan any better than the late Hollywood Producer Aaron Russo, a personal friend of Nick Rockefeller. Waldemar has it right. The smart money is getting out – or has already gotten out of dodge. For those of us who know the truth about the creation and funding of ISIS, which has been recounted time and time again at SGT Report which you can read about here, here, and here, we rapidly find ourselves at a crossroads. We can stay, speak out and continue to try to educate our friends, neighbors and colleagues about the realities of false flag terrorism and the Big Brother Orwellian policies being made “law” as a result of such operations – all of which are leading to the complete collapse of our Republic. Or we can leave the country. Here’s more from Before It’s News, and from Congressman McCaul himself:

Congressman McCaul Heritage Foundation Speech on “Terror Gone Viral” Barack Hussein Obama would use this legislation to round up the tea party, christian conservatives, constitutionalists, military veterans, gun owners, libertarians and all freedom loving Americans and put them in FEMA concentration camps and be executed by all of the U.N. Forces that are here on american soil. This bill was introduced and sponsored by Rep. McCaul, Michael T. [R-TX-10] on June 25, 2015. Homeland Security latest Action on this bill was:07/15/2015 Ordered to be Reported (Amended) by Voice Vote. For those who are still in doubt about what is happening in the US, here's the text to this bill. Text available as:

Introduced in House (06/25/2015) |

| Does Jewelry or Central Bank Demand Drive the Gold Price? Posted: 26 Jul 2015 10:00 PM PDT SunshineProfits |

| Gold’s Two Stories: Paper Markets Collapse… While The Retail Public Buys At A Record Pace Posted: 26 Jul 2015 09:30 PM PDT by Mac Slavo, SHTFPlan:

With China recently revealing that they have added some 600 tons of gold to their stockpiles and the U.S. mint having suspended sales of Silver Eagles due to extremely high demand in early July, how is it possible that prices are crashing? As noted in Mike Gleason's Weekly Market Wrap at Money Metals Exchange, while it appears that gold is currently one of the world's most hated assets, the retail public continues to buy at a record pace: |

| Meet The Kagans: Seeking War To The End Of The World Posted: 26 Jul 2015 07:15 PM PDT Submitted by Robert Parry, via The Ron Paul Institute for Peace & Prosperity,

If the neoconservatives have their way again, US ground troops will reoccupy Iraq, the US military will take out Syria’s secular government (likely helping Al Qaeda and the Islamic State take over), and the US Congress will not only kill the Iran nuclear deal but follow that with a massive increase in military spending. Like spraying lighter fluid on a roaring barbecue, the neocons also want a military escalation in Ukraine to burn the ethnic Russians out of the east, and the neocons dream of spreading the blaze to Moscow with the goal of forcing Russian President Vladimir Putin from the Kremlin. In other words, more and more fires of Imperial “regime change” abroad even as the last embers of the American Republic die at home. Much of this “strategy” is personified by a single Washington power couple: arch-neocon Robert Kagan, a co-founder of the Project for the New American Century and an early advocate of the Iraq War, and his wife, Assistant Secretary of State for European Affairs Victoria Nuland, who engineered last year’s coup in Ukraine that started a nasty civil war and created a confrontation between nuclear-armed United States and Russia. Kagan, who cut his teeth as a propaganda specialist in support of the Reagan administration’s brutal Central American policies in the 1980s, is now a senior fellow at the Brookings Institution and a contributing columnist to The Washington Post’s neocon-dominated opinion pages. On Friday, Kagan’s column baited the Republican Party to do more than just object to President Barack Obama’s Iranian nuclear deal. Kagan called for an all-out commitment to neoconservative goals, including military escalations in the Middle East, belligerence toward Russia and casting aside fiscal discipline in favor of funneling tens of billions of new dollars to the Pentagon. Kagan also showed how the neocons’ world view remains the conventional wisdom of Official Washington despite their disastrous Iraq War. The neocon narrative gets repeated over and over in the mainstream media no matter how delusional it is. For instance, a sane person might trace the origins of the bloodthirsty Islamic State back to President George W. Bush’s neocon-inspired Iraq War when this hyper-violent Sunni movement began as “Al Qaeda in Iraq” blowing up Shiite mosques and instigating sectarian bloodshed. It later expanded into Syria where Sunni militants were seeking the ouster of a secular regime led by Alawites, a Shiite offshoot. Though changing its name to the Islamic State, the movement continued with its trademark brutality. But Kagan doesn’t acknowledge that he and his fellow neocons bear any responsibility for this head-chopping phenomenon. In his neocon narrative, the Islamic State gets blamed on Iran and Syria, even though those governments are leading much of the resistance to the Islamic State and its former colleagues in Al Qaeda, which in Syria backs a separate terrorist organization, the Nusra Front. But here is how Kagan explains the situation to the Smart People of Official Washington:

The Real Hegemon While ranting about “Iranian hegemony,” Kagan called for direct military intervention by the world’s true hegemonic power, the United States. He wants the US military to weigh in against Iran on the side of two far more militarily advanced regional powers, Israel and Saudi Arabia, whose combined weapons spending dwarfs Iran’s and includes – with Israel – a sophisticated nuclear arsenal. Yet reality has never had much relationship to neocon ideology. Kagan continued:

In Kagan’s call for war and more war, we’re seeing, again, the consequence of failing to hold neocons accountable after they pushed the country into the illegal and catastrophic Iraq War by selling lies about weapons of mass destruction and telling tales about how easy it would be. Instead of facing a purge that should have followed the Iraq calamity, the neocons consolidated their power, holding onto key jobs in US foreign policy, ensconcing themselves in influential think tanks, and remaining the go-to experts for mainstream media coverage. Being wrong about Iraq has almost become a badge of honor in the upside-down world of Official Washington. But we need to unpack the truckload of sophistry that Kagan is peddling. First, it is simply crazy to talk about “Iranian hegemony.” That was part of Israeli Prime Minister Benjamin Netanyahu’s rhetoric before the US Congress on March 3 about Iran “gobbling up” nations – and it has now become a neocon-driven litany, but it is no more real just because it gets repeated endlessly. For instance, take the Iraq case. It has a Shiite-led government not because Iran invaded Iraq, but because the United States did. After the US military ousted Sunni dictator Saddam Hussein, the United States stood up a new government dominated by Shiites who, in turn, sought friendly relations with their co-religionists in Iran, which is entirely understandable and represents no aggression by Iran. Then, after the Islamic State’s dramatic military gains across Iraq last summer, the Iraqi government turned to Iran for military assistance, also no surprise. Back to Iraq However, leaving aside Kagan’s delusional hyperbole about Iran, look at what he’s proposing. He wants to return a sizable US occupation force to Iraq, apparently caring little about the US soldiers who were rotated multiple times into the war zone where almost 4,500 died (along with hundreds of thousands of Iraqis). Having promoted Iraq War I and having paid no price, Kagan now wants to give us Iraq War II. But that’s not enough. Kagan wants the US military to intervene to make sure the secular government of Syria is overthrown, even though the almost certain winners would be Sunni extremists from the Islamic State or Al Qaeda’s Nusra Front. Such a victory could lead to genocides against Syria’s Christians, Alawites, Shiites and other minorities. At that point, there would be tremendous pressure for a full-scale US invasion and occupation of Syria, too. That may be why Kagan wants to throw tens of billions of dollar more into the military-industrial complex, although the true price tag for Kagan’s new wars would likely run into the trillions of dollars. Yet, Kagan still isn’t satisfied. He wants even more military spending to confront “growing Chinese power, an aggressive Russia and an increasingly hegemonic Iran.” In his conclusion, Kagan mocks the Republicans for not backing up their tough talk: “So, yes, by all means, rail about the [Iran] deal. We all look forward to the hours of floor speeches and campaign speeches that lie ahead. But it will be hard to take Republican criticisms seriously unless they start doing the things that are in their power to do to begin to address the challenge.” While it’s true that Kagan is now “just” a neocon ideologue – albeit one with important platforms to present his views – his wife Assistant Secretary of State Nuland shares his foreign policy views and even edits many of his articles. As she told The New York Times last year, “nothing goes out of the house that I don’t think is worthy of his talents. Let’s put it that way.” [See “Obama’s True Foreign Policy ‘Weakness.’”] But Nuland is a foreign policy force of her own, considered by some in Washington to be the up-and-coming “star” at the State Department. By organizing the “regime change” in Ukraine – with the violent overthrow of democratically elected President Viktor Yanukovych in February 2014 – Nuland also earned her spurs as an accomplished neocon. Nuland has even outdone her husband, who may get “credit” for the Iraq War and the resulting chaos, but Nuland did him one better, instigating Cold War II and reviving hostilities between nuclear-armed Russia and the United States. After all, that’s where the really big money will go – toward modernizing nuclear arsenals and ordering top-of-the-line strategic weaponry. A Family Business There’s also a family-business aspect to these wars and confrontations, since the Kagans collectively serve not just to start conflicts but to profit from grateful military contractors who kick back a share of the money to the think tanks that employ the Kagans. For instance, Robert’s brother Frederick works at the American Enterprise Institute, which has long benefited from the largesse of the Military-Industrial Complex, and his wife Kimberly runs her own think tank called the Institute for the Study of War (ISW). According to ISW’s annual reports, its original supporters were mostly right-wing foundations, such as the Smith-Richardson Foundation and the Lynde and Harry Bradley Foundation, but it was later backed by a host of national security contractors, including major ones like General Dynamics, Northrop Grumman and CACI, as well as lesser-known firms such as DynCorp International, which provided training for Afghan police, and Palantir, a technology company founded with the backing of the CIA’s venture-capital arm, In-Q-Tel. Palantir supplied software to US military intelligence in Afghanistan. Since its founding in 2007, ISW has focused mostly on wars in the Middle East, especially Iraq and Afghanistan, including closely cooperating with Gen. David Petraeus when he commanded US forces in those countries. However, more recently, ISW has begun reporting extensively on the civil war in Ukraine. [See “Neocons Guided Petraeus on Afghan War.”] So, to understand the enduring influence of the neocons – and the Kagan clan, in particular – you have to appreciate the money connections between the business of war and the business of selling war. When the military contractors do well, the think tanks that advocate for heightened global tensions do well, too. And, it doesn’t hurt to have friends and family inside the government making sure that policymakers do their part to give war a chance — and to give peace the old heave-ho. |

| Can You Hear the Fat Lady Singing? - Part III Posted: 26 Jul 2015 07:08 PM PDT By Chris at www.CapitalistExploits.at I love what I do! A recent get together filled with blonde stick insects and cologne covered chinos found me subjected to talk about "work at the office":

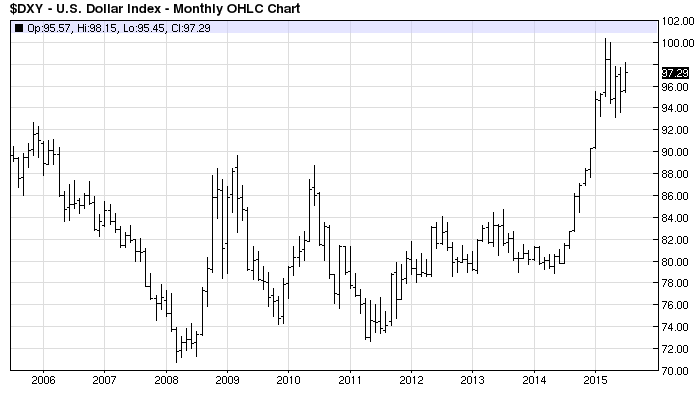

After only 10 minutes I was ready to leave. I then received a call from a friend which snapped me back into my world and cemented my decision to leave. This friend has been extremely successful trading Asian credit and I was eager to get his perspective on emerging market debt and in particular China. This brings me to my thoughts on emerging market currencies and debt, which I'd like to share with you today. It all starts with the dollar bull market which we've discussed previously at length. As Brad mentioned earlier this year:

After a brief breather, the dollar looks set to take out new highs:

This time around the dollar looks set to take out 100 on the Dollar Index. My thoughts today lie in what this may mean for various emerging market asset classes. Take a look at the MSCI Emerging Markets ETF:

Support sits at 36 and we're getting close! This is a function of a stronger dollar. The larger question lies in where the leverage in emerging markets may lie, remembering that the unwinding of the carry trade will be particularly severely felt where leverage is highest. Taking a step back for a minute and thinking about the events in Europe recently and the events we've just witnessed in China, it's clear to me that central banks are out of control. Risk lies in with the fact central banks believe themselves omnipotent. This is only half of the problem. The majority of investors believe the central banks are actually omnipotentand that is the other half of the problem. Central bank omnipotence is at an all time high... or is it? If we look back in history, it's littered, not with successful central bank intervention, but with central bank failures. For every action there is a reaction. Everything is connected. You can't throw a stone into a pond and not get ripples. Similarly you can't have central banks buying assets, or slashing interest rates or any other such action, without consequences for those actions. Last week I looked back at how the Asian crisis unfolded. That particular crisis was only 18 years ago, yet market participants seem to have forgotten the lessons. We know that central bank intervention in the face of a levered market which is unwinding can often be the precursor to an outright rout. I then spoke about China earlier this week and how easily and quickly the Chinese central bank stepped in to attempt to stabilise the stock market. That they acted so aggressively is far more concerning to me than the actions themselves. The consequences of this are ultimately a weaker remnimbi, and a weaker remnimbi threatens to exacerbate losses for investors that have been participating in the USD carry trade. Furthermore, as Chinese growth slows the temptation to slash interest rates and devalue the remnimbi, should it happen, puts additional pressure on competitive emerging market currencies. Countries such as Korea, Malaysia, Thailand, even India. Once again, a stronger dollar vis-à-vis these respective currencies threatens any levered capital invested in the bond markets to seek first to reduce exposures. This means selling the respective currencies and buying back dollars. This self-reinforcing cycle can quickly force margin calls and the global carry trade unwind threatens to get particularly "exciting". It's not difficult to imagine a scenario where as the dollar bull run gathers steam we may well see more and more emerging markets looking like Greece. Right now a number of emerging market currencies are looking like they're getting ready to roll over. The repercussions could well be an emerging market bond rout. As such, we've been dipping our toes into shorting the iShares JP Morgan Emerging market bond ETF (EMB) with some long dated options. If nothing else, it's a heck more interesting than boring cocktail parties... - Chris

"It amazed her how much people wanted to talk at parties. And about nothing in particular."- J.D. Robb, Holiday in Death |

| Clinton Favorability Plunges, Sanders Surges Amid Classified Emails Scandal Posted: 26 Jul 2015 06:40 PM PDT Despite all her proclamations of new fairness doctrines, false promises of her truthfulness, and exclamations of 'everyday Americanism' Hillary Rodham Clinton is seeing her favorability ratings collapse. As populist as she dares to be, in the face of her donating captors, it appears the everyday American just isn't buying it as Gallup reports just 43% Americans view her favorably (down from 66% just a few years ago) while none other than Bernie Sanders is bounding up the popularity ladder, rising from 12% to 24% favorability in recent weeks. Vermont Sen. Bernie Sanders' favorable rating among Americans has doubled since Gallup's initial reading in March, rising to 24% from 12% as he has become better known. Hillary Clinton's rating has slipped to 43% from 48% in April. At the same time, Clinton's unfavorable rating increased to 46%, tilting her image negative and producing her worst net favorable score since December 2007. Clinton, Clint-off...

Clinton maintains a higher absolute favorable rating from Americans than any of her official rivals for the 2016 Democratic nomination. In contrast to the relative prominence of numerous candidates on the Republican side, she remains the only Democratic candidate known well enough by a majority of Americans for them to rate her, which helps Clinton maintain a higher overall favorable score. Sanders is still an unknown to a majority of Americans, with just 44% able to rate him compared with Clinton's 89%. Clinton's favorable rating has slipped slightly among Democrats and Democratic-leaning independents since April, falling to 74% from 79%. This partly accounts for her overall decline in favorability among the public. The other factor is a drop among non-leaning independents, from 44% to 36%, while her image among Republicans and Republican leaners is essentially unchanged at 14%. Among Democrats and Democratic leaners, Clinton is currently viewed more favorably by older than younger adults, by nonwhites than whites and by liberals than moderates or conservatives. However, she retains solid majority favorable scores from all of these groups. And she enjoys equally high ratings from men and women as well as in each of the four major regions of the country. However, as Gallup concludes,

* * *

* * * And it is not surprising Hillary remains the front-runner as Liberty Blitzkrieg's Mike Krieger reports yet another group of lobbyists are raising funds for her campaign... Earlier this week, we learned that lobbyists for Monsanto, Exxon Mobil, Microsoft and the Telecom industry are actively raising funds for the pantsuit revolutionary, Hillary Clinton. Today, we can add private prison companies to the list. Because private prisons are sooooooo progressive. From the Intercept:

You ready?

|

| Chinese Stocks Extend Friday's Losses Following Drop In Corporate Profits Posted: 26 Jul 2015 06:38 PM PDT Following the weakness in Friday's afternoon (China) session, tonight's open is decidedly shaky as Shanghai Composite open down over 2% and CSI-300 (China's S&P 500) is now down over 5%. This follows a year-over-year drop in China Industrial profits (-0.3%), the first since March as the small bounce in April and May is now done. Commodities are lower and silver saw a minor flash-crash shortlty after China opened.

Silver saw a mini flash crash...

But PMs are bouncing back now...

Charts: Bloomberg |

| Gold's Two Stories: Paper Markets Collapse... While The Retail Public Buys At A Record Pace Posted: 26 Jul 2015 05:10 PM PDT Submitted by Mac Slavo via SHTFPlan.com, We’ve seen some significant swings in precious metals over the last several years and if we are to believe the paper spot prices and recent value of mining shares, one would think that gold and silver are on their last leg. Last weekend precious metals took a massive hit to the downside, sending shock waves throughout the industry. But was the move really representative of what’s happening in precious metals markets around the world? Or, is there an effort by large financial institutions to keep prices suppressed? In an open letter to the Commodity Futures Trading Commission First Mining Finance CEO Keith Neumeyer argues that real producers and consumers don’t appear to be represented by the purported billion dollar moves on paper trading exchanges. With China recently revealing that they have added some 600 tons of gold to their stockpiles and the U.S. mint having suspended sales of Silver Eagles due to extremely high demand in early July, how is it possible that prices are crashing? As noted in Mike Gleason’s Weekly Market Wrap at Money Metals Exchange, while it appears that gold is currently one of the world’s most hated assets, the retail public continues to buy at a record pace:

It’s not clear exactly who is suppressing precious metals or why, but it is quite apparent that prices on paper exchanges are completely disconnected from reality, as retail buyers are taking this opportunity to scoop up gold and silver at prices that are 50% or more off their highs. But what happens next? That, of course, is anybody’s guess, but considering current prices and movements within the context of a broader economic crisis, there is a precedent for what we have seen in recent years. We need only look back to the recession of the 1970’s.

You’ll notice that gold saw some significant price movements, not dissimilar to what we’re experiencing today. There were several down swings of 25% or more within the broader gold bull market. Most notably, take a look at what happened from 1975 to 1976. Gold shot up to nearly $200 an ounce, only to be pounded just twelve months later by 50% to a price of just over $100 an ounce. As the crisis accelerated in severity into the late 1970’s, complete with gas shortages, job losses and geopolitical tensions, we saw gold explode in value to a high of $850 by January of 1980. We’re not necessarily suggesting that gold will follow the exact same pattern. But history does rhyme, and the world again finds itself in serious financial, economic, and monetary crisis. As we’ve noted before, gold is and always has been the historical asset of last resort for preserving wealth. Should the current crisis accelerate as we saw in the 1970’s, the value of gold will likely rise accordingly. We may not be looking at a 700% increase in price like we did from 1976 to 1980, but there is a distinct possibility that we will witness serious gains in real value as crisis and panic unfold. You can’t eat gold and silver, of course. If crisis is coming we have always urged our readers to prepare themselves for disruption to credit-dependent commerce systems with reserves of food, emergency cash and other supplies. But having a physical asset with real monetary and barterable value in your possession is certainly an important strategic consideration going forward. It’s been said that an ounce of gold could buy 350 loaves of bread in Biblical times. Today, an ounce of gold still buys about 350 loaves of bread. However you slice it, whether the system falls into a deflationary depression like the 1930’s or an inflationary recession like the 1970’s, gold will maintain its purchasing power. Though past performance is not necessarily an indicator of future results, we have over 6,000 years of history backing gold’s legitimacy as a true mechanism of exchange. |

| FDR: The Great Gold Confiscator Speaks *audio* Posted: 26 Jul 2015 05:00 PM PDT Charleston Voice |

| In These 13 US Cities, Rents Are Skyrocketing Posted: 26 Jul 2015 04:55 PM PDT Seven years ago, the American homeownership "dream" was shattered when a housing bubble built on a decisively shaky foundation burst in spectacular fashion, bringing Wall Street and Main Street to their knees. In the blink of an eye, the seemingly inexorable rise in the American homeownership rate abruptly reversed course, and by 2014, two decades of gains had disappeared and the ashes of Bill Clinton's National Homeownership Strategy lay smoldering in the aftermath of the greatest financial collapse since the Great Depression. In short, decades of speculative excess driven by imprudence, greed, and financial engineering and financed by the world's demand for GSE debt had come crashing down and in relatively short order, a nation of homeowners was transformed into a nation of renters. It wasn't difficult to predict what would happen next. As demand for rentals increased and PE snapped up foreclosures, rents rose, just as a subpar jobs market, a meteoric rise in student debt, tougher lending standards, and critically important demographic shifts put further pressure on homeownership rates. Now, America faces a rather dire housing predicament: buying and renting are both unaffordable. Or, as WSJ put it last month, "households are stuck between homes they can't qualify for and rents they can't afford." We've seen evidence of this across the country with perhaps the most telling statistic coming courtesy of The National Low Income Housing Coalition who recently noted that in no state can a minimum wage worker afford a one bedroom apartment. In this context, Bloomberg is out with a list of 13 cities where single-family rents have risen by double-digits in just the last 12 months. Note that in Iowa, rents have risen more than 20% over the past year alone. More color from Bloomberg:

And for those with short memories, we thought this would be an opportune time to remind you of who became America's landlord in the wake of the crisis... |

| Raoul Pal: GroupThink Is Almost Ubiquitous (& The 1 Chart That Matters) Posted: 26 Jul 2015 03:50 PM PDT Exceprted from Raoul Pal's exclusive Global Macro Investor letter, All together now From a very top-down perspective, I find it interesting that most macro funds tend to align themselves in groups that share ideas, however I find the uniformity of views amongst these groups somewhat troubling. That is not to say that everyone is wrong but that too many firms have the same views and same positions. The three groups tend to be:

All three tend to be somewhat distinct from each other but the views held within each group are similar. This is the groupthink effect. However, it is not totally ubiquitous as there are many who hold very different views. The very macro-orientated tend to be broader in their opinions than those who are crossing over into macro from credit, multi-strat or event driven. Summary of views The first group (and the majority with whom I met in NYC) have extremely similar views generally. These are as follows:

Positioning In terms of positions, people were very light on dollar positioning, had zero bond exposure at best or were short, were long Chinese equities, long oil names, long German equities, long Japanese equities and generally long US equities. Many had on specific EM trades such as Argentina or Venezuela, Puerto Rico or Greece (yeah, it’s an EM now). I’m a tad different... Just to be clear, my views are startlingly out of consensus. My view is that shorting the Euro is the best risk reward trade in macro, US bonds are setting up to be a stunning opportunity on the long side, oil carries significant downside risk, the US and elsewhere are potentially heading into recession, equity volatility is highly likely, EM is a major risk and Germany is at the risk of leading Europe into a recession. Pure macro heaven (or hell) My overarching belief is that this is the most “pure macro” environment we have been in for over a decade, probably since the Asian Crisis in the late 1990s, and I just don’t think people understand what is going on. My entire thesis rests neatly on the US Dollar. Nothing else matters and if my view is wrong on that, then it is likely wrong on many things. What is really weird to me is that most people agree with my views on the dollar but don’t have the trade on, and were less versed on the macro knock-on effects of a strong dollar. Groupthink has tended to isolate particular parts of the US or global economy and ignore the bigger picture. ... My views I think that the dollar is the only thing that matters. My view remains that we are in the early stages of what will prove to be one of the biggest dollar bull markets in history, and it is going to reap devastation on the global economy... The Chart Of Truth

If this wedge breaks then I think the dollar will finish the year around 110 to 115, which would be consistent with the pattern of other dollar bull markets with an annual gain of over 20%. In a nutshell Clearly I can be wrong, and for me to be proven wrong is pretty simple: if the dollar does not rally further then the status quo can be maintained and we can continue with this lacklustre global expansion for a while longer. If the dollar rallies again from here then it is game over and the exit doors are small. * * * While mostly cost-prohibitive for the average investor, here is Raoul Pal's exclusive Global Macro Investor July letter... |

| Posted: 26 Jul 2015 03:21 PM PDT Clive Maund |

| Look to Q4 2015 for a Trading Rally in Gold Posted: 26 Jul 2015 01:00 PM PDT This post Look to Q4 2015 for a Trading Rally in Gold appeared first on Daily Reckoning. Editor’s Note: Rick Rule, CEO of Sprott U.S. Holdings, joined CNBC on Tuesday to give his opinion on when you might see a trading rally in gold, and why. It’s good context for the theme of this week’s email edition of the Daily Reckoning. Our humble correspondents are en route to Vancouver this week to report on and present at the 2015 Sprott Natural Resources Symposium. You can listen to the whole conference live, right here. In the meantime, click the play button below to watch Rick’s interview…

The post Look to Q4 2015 for a Trading Rally in Gold appeared first on Daily Reckoning. |

| Will Keynesians or Keynesian Economics Take the Hit? Posted: 26 Jul 2015 12:36 PM PDT It's rare that I take issue with Gary North in matters of economics or history, but his article of July 25 — "'The Bucks Stop Here': Keynesian Economics Will Get Blamed for the Crash" — is one I wish to discuss. He begins: For as long as the present economic system lumbers along, Keynesians will control the levers of power and influence. But when at last the system goes down in a heap, and central banks cannot restore the system, there will be a quest for answers. . . . When people's retirement plans are smashed, they are going to look for somebody to blame. That means Keynesians. The Keynesians will not be able to transfer this responsibility to somebody else. . . I can see people blaming specific Keynesians, such as Yellen or Bernanke, but not Keynesianism itself. They will not blame "Keynesian Economics" — unless it's to update it. Voters will demand reforms. They'll want heads to roll. Those at the top of the food chain will find a way to exploit their outrage, even if it means starting a major war. But as long as the government hasn't become a failed state Keynesianism itself will still be enthroned. When the Federal Reserve finally is not in a position to restore economic growth by means of inflating the currency, Keynesians are going to get blamed. Austrian economists will blame them, as they've done since 2007-2008. But who will listen, especially now that economic growth has returned according to the Fed's Beige Book collection of anecdotal reports that reveal increased consumer spending? Keynesians tell us the crisis was a result of lax lending standards, limited regulation of non-depository financial institutions, and a glut of savings. Wikipedia: The temptation offered by such readily available savings overwhelmed the policy and regulatory control mechanisms in country after country, as lenders and borrowers put these savings to use, generating bubble after bubble across the globe. From this, laymen could easily conclude the crisis was beyond anyone's control, or at least not the fault of any economic theory. When the next crash arrives we will be reminded once again that economics is hard, something mere mortals shouldn't practice at home. In 2008 Queen Elizabeth II asked Professor Luis Garicano of the London School of Economics how something as big as the financial crisis could strike without warning. His insipid answer: 'At every stage, someone was relying on somebody else and everyone thought they were doing the right thing.' Four years later an economist at the Bank of England elaborated: We got complacent. Regulation wasn't necessary. You know how it is, Your Majesty. Of course she does. This was the Great Moderation: Central bankers had solved the business cycle volatility problem. No wonder they were complacent. Austrians could have told the Queen that only by closing shop could central bankers begin to solve the business cycle problem. Austrians could have told her sound economics requires unfettered markets. But for most people Austrians are the devil they don't know. Austrians are a devil they've never heard of or care to hear about. The Great Depression and free markets The myth still lingers that adherence to the gold standard was a major reason for the Great Depression. Gold was the free market's money. Only after governments abandoned gold did recovery begin, Keynesians tell us. A casual viewing of some charts suggests they might have a point. Never mind that the world was running on a government-rigged gold standard, the free market was holding back recovery. We can't trust the free market ever again. During the Depression, one of the few defenders of the Austrian viewpoint in the English-speaking world was Lionel Robbins, who published The Great Depression in 1934. Yet he eventually repudiated his position. A biographical note informs us that after the war Robbins published another book in support of "Keynes's policies of full employment through control of aggregate demand." To laymen his apostasy could've been well-founded or expedient. In either case it didn't help the cause for free markets. I certainly hope North is right, that Keynesians will get hammered. Logically, the buck stops with them. But if this means Keynesianism will be tried and convicted, who will do it? Keynesians will write another Wikipedia article that eases any doubts about who or what is to blame. They'll go on cable shows and point fingers. The Queen will be fed another lame excuse. Though I wish it were otherwise, the working public will not spend their evenings studying Austrian economics or watching Austrian economists on YouTube. They'll vent on Facebook instead. They'll be as likely to champion a Bernie Sanders as a Ron Paul. They'll want redress, not understanding. For understanding they'll defer to the experts, and the experts will still be Keynesians. The situation reminds me of government's checks and balances. It's government that does the checking and balancing. No matter what atrocities it commits it never seriously finds fault with itself. Somehow it always finds a way to increase its power. Yet I'm probably at least as optimistic as Dr. North. And there's no question he's optimistic. See here for details. I think the future will be some combination of Rothbard and Kurzweil. Keynesianism will still be around intellectually because it is far too useful to the ruling elite to be abandoned. Yet the institutions that put it in play will be on the ropes. Broke governments will leave us with nearly free markets, while the law of accelerating returns will continue to open up radically new economic opportunities. |

| Bible Code Predicts Economic Collapse in 2015 -- Jonathan Cahn Posted: 26 Jul 2015 09:58 AM PDT - Spiritual Warfare - 2015 - Blood moons and eclipses are sensational, but have you heard about the 'Super Shemitah'? Best-selling author Jonathan Cahn explains The Mystery of the Shemitah, The Biblical Pattern Which Indicates That A Financial Collapse May Be Coming In 2015. Does a mystery that is... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Gold Price at a Five-Year Low: Here’s What to Do Posted: 26 Jul 2015 09:49 AM PDT Keith Fitz-Gerald writes: Gold prices crashed Monday as panicked sellers drove the yellow metal to its lowest level since 2002 before recovering to a five-year low. More significantly, they broke the $1,130/oz “floor” which had previously been regarded as a solid support level – a key indicator to me that the downdraft wasn’t over. So I wasn’t surprised to see gold prices finish yesterday’s U.S. trading session modestly lower – but that doesn’t mean I was any less excited, either. |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Friends, as I have long lamented, the fascist overreach of the US Federal Government and our “Representatives” is moving faster than any one of us can possibly document. “It takes a village” as Hillary once famously quipped, to keep an eye on the Orwellian tyranny.

Friends, as I have long lamented, the fascist overreach of the US Federal Government and our “Representatives” is moving faster than any one of us can possibly document. “It takes a village” as Hillary once famously quipped, to keep an eye on the Orwellian tyranny. We've seen some significant swings in precious metals over the last several years and if we are to believe the paper spot prices and recent value of mining shares, one would think that gold and silver are on their last leg. Last weekend precious metals took a massive hit to the downside, sending shock waves throughout the industry. But was the move really representative of what's happening in precious metals markets around the world? Or, is there an effort by large financial institutions to keep prices suppressed? In an open letter to the Commodity Futures Trading Commission First Mining Finance

We've seen some significant swings in precious metals over the last several years and if we are to believe the paper spot prices and recent value of mining shares, one would think that gold and silver are on their last leg. Last weekend precious metals took a massive hit to the downside, sending shock waves throughout the industry. But was the move really representative of what's happening in precious metals markets around the world? Or, is there an effort by large financial institutions to keep prices suppressed? In an open letter to the Commodity Futures Trading Commission First Mining Finance

No comments:

Post a Comment