Gold World News Flash |

- Chinese Market Meltdown and the Secret Greek Plan B

- Open Letter to Alexis Tsipras

- China’s Stock Market Crash, QE4, Central Planner Moves And The War In Gold

- The Only Difference Between Now and Late 2008

- Global Financial Meltdown — Something Horrible is Coming

- Gold & Silver Money Has Devolved Into Debt and Plastic

- Truth, Justice, And (No Longer) The American Way!

- Money & Metals with David Morgan – PRECIOUS Gold Struggles to Recover

- Municipal Madness

- Dave Kranzler: GLD is being looted by bullion banks shorting gold

- The Irony Of Market Manipulation

- Gold Price Closed Up $10.90 at $1,096.50

- Coast To Coast AM - July 26, 2015 Fukushima & Solar Power

- China Stock Market CRASHING as Central Bank Buying Shares to Prevent COLLAPSE!

- Gold Daily and Silver Weekly Charts - Miner Miner

- In The News Today

- Focusing On The Wrong Thing

- Stop Iran Deal -- Former Congressman and US army veteran Allen West Speech

- Guerrilla Economist -- The DAY OF RECKONING Approaches

- No, Bob Moriarty, we don't want to live with market rigging

- Blame the Fed for the Commodities Slump

- China: Major Devaluation Coming

- How to Know When the Gold Bear Market is Over

- India's Rajesh Exports acquires Swiss gold refiner Valcambi

- Bron Suchecki: How much gold does China really have?

- Ron Paul's Texas Straight Talk 7/27/15: Do We Need to Bring Back Internment Camps?

- Agenda 21: We're Being Conquered By Banks, Not Tanks

- Jon Stewart and Donald Trump

- Monday Morning Links

- Six Miners Dundee's Joseph Fazzini Believes Will Weather the Storm

- Gold Update: Sentiment, Seasonality, and Price Patterns Look Favorable

| Chinese Market Meltdown and the Secret Greek Plan B Posted: 28 Jul 2015 01:30 AM PDT from Boom Bust: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 28 Jul 2015 01:17 AM PDT Dear Prime Minister Tsipras, First, congratulations for mustering the popular support to say "no" to the troika. The euro has long offered Greece a perverse incentive to borrow, and now your country is trapped in debt. By any conventional means, Greece cannot repay (I propose an unconventional way, below). The sooner everyone acknowledges this simple fact the better. While I don't claim to know why you agreed to a bailout deal this weekend, I can guess. The troika threatened to maximize the costs of leaving the euro. They can shut off access to further credit; including the Emergency Liquidity Assistance, European Stability Mechanism loans, liability transfers via TARGET2, and bond buying programs. They could do more, such as refuse to clear payments to and from Greece. That would utterly destroy the Greek banking system. In turn, that will wipe out all Greek savers and employers who haven't already transferred their bank balances out of the country. Defaults of all euro denominated liabilities will cascade throughout Greece, including insurance, annuities, corporate bonds, business credit lines, personal loans, and mortgages. Every liability is someone else's asset, and few creditors would survive. The government will collapse when no one can pay taxes. Greece will end, a failed state. The troika wants you to accept another bailout deal, to service Greek debts a while longer. Since bailouts mean borrowing more, you cannot avoid default in the end. Going deeper into debt is no good for anyone. Should you choose to default instead, you will not be able to continue using the euro. Even if the troika doesn't immediately act, the threat is real. No one would lend to the Greek government, or even businesses, with that Sword of Damocles hanging over you. However, you need outside capital to restart production and trade. Otherwise, your industries will be shuttered, even including exports. Some economists advise you to create a currency board. This is a new monetary authority that maintains a fixed exchange rate, by holding euros and issuing Greek currency. It's nothing more than using the euro, though indirectly. It has all of the flaws and risks I just described. Greece has no future, so long as it clings to the euro. Adopting the dollar might seem less bad. At least, the Federal Reserve isn't likely to stop you. Greek businesses and banks could even attract some dollar-based credit. Once you leave the euro, Greeks will probably end up using the dollar, with or without legal tender law. What a wasted opportunity. You could create a new drachma and redenominate all debts in the currency. Lamentably, even Nigel Farage offered you this advice at the European Parliament. It's tempting to think that Greece can just print its way out of debt, but it's a trap. Don't do it. It's obvious that the purpose of a new drachma is to fall. No one outside Greece will hold it. Few Greeks will hold it either, so the drachma will not find a bid. It may get you out of debt, but at the cost of the further destruction of businesses and jobs. Greece will become the next Zimbabwe. You can't stay with the euro. Switching to the dollar isn't much of a move forward. Imposing a new drachma will only harm the long-suffering Greek people. By the logic of Aristotle, that leaves one other option. Adopt gold as money. You have an historic opportunity to create another golden age for Greece. Begin by allowing the Greek people to use gold, free from legal tender laws and taxes on gold. Your people will begin accumulating savings again, which they desperately need to rebuild businesses. And speaking of building businesses, if you want to attract capital from the rest of the world, gold will do it like nothing else. Dollar denominated bonds will attract tepid investment, at best. With gold bonds, Greece can raise unlimited amounts. At least it can get as much honest credit as it needs. Honest means that the borrower has the means and intent to repay. It means credit is financing productive enterprise that generates income to amortize the debt. I said that no conventional approach will let Greece get out of debt. Let me briefly outline an approach to use gold to get out of debt without default or hyperinflation (I refer you to my paper, an entry to the 2012 Wolfson Prize, for the full explanation). Greece should issue gold bonds. These are not conventional bonds backed or collateralized with gold, but bonds that have the principal and interest denominated and paid in gold. There is one twist. Buyers don't pay in euros, or any paper currency. Instead, they pay by redeeming outstanding Greek bonds. For example, to buy a 1000oz gold bond, a bidder might be willing to bring you €500,000 worth of existing Greek government bonds. This is the only mechanism that lets Greece get out of debt cleanly. Greece will exploit a rising euro to gold exchange rate (i.e. gold price). With each new tranche issued, the price of gold will be higher. It will take less gold to retire more debt. And believe me, the gold price will begin rising once the markets realize that gold is being remonetized. Greece will be the first country, the leader, in using gold bonds to avert financial Armageddon. Many others will follow. With each new tranche, the paper bond to gold bond exchange rate will also be rising. As buyers realize that the value of gold does not erode, they will prefer a future gold payment to one in a paper currency. Gold bonds will sell for a premium over the gold price, compared to paper bonds. This premium will rise. You will find that the market will happily buy long term bonds, giving you the opportunity to pay off your debt without having to constantly roll short-term liabilities. If you can buy the time to let this strategy play out, you will get out of debt completely, avoid default, and end with the best credit rating. You will immediately attract capital, and then industry, and jobs to Greece. At this point, Mr. Tsipras, you have nothing to lose. Why not win the future?

Sincerely,

This article is from Keith Weiner's weekly column, called The Gold Standard, at the Swiss National Bank and Swiss Franc Blog SNBCHF.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China’s Stock Market Crash, QE4, Central Planner Moves And The War In Gold Posted: 28 Jul 2015 12:00 AM PDT from KingWorldNews:

The 2008 Finanial Crisis It’s a bit like when the government here was changing all kinds of rules and putting program after program in place to try and undo the 2008 financial crisis, which only worked after stocks got low enough and the Fed printed enough money. Perhaps the Chinese authorities can push the market up after it cracks further and they have to throw even more props at it, but they have to be quite concerned about this latest hit. Europe was weaker by a couple of percent, most likely as a consequence of what happened in China, and the early going here saw the indices drop about 0.75% to 1%. Then the dip buyers showed up, however, and went after scattered and sundry tech stocks, along with a couple of the big recent winners like Google and Amazon, which cut the losses to about 0.5%. From there the market leaked again, and by day’s end was back to the day’s lows. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Only Difference Between Now and Late 2008 Posted: 27 Jul 2015 11:32 PM PDT by Andrew Hoffman, Miles Franklin:

And by the "big one," I truly mean BIG, per what I have been anticipating since 2011's "global meltdown II" – i.e., the "point of no return" when the world's "leading" Central banks realized their post 2008 money printing orgy wasn't working; and consequently, went all-in with unprecedented, 24/7 money printing, market manipulation, and propaganda in a desperate "Hail Mary" attempt to stave off a violently angry "Economic Mother Nature," and her "unstoppable tsunami of reality." | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Global Financial Meltdown — Something Horrible is Coming Posted: 27 Jul 2015 11:30 PM PDT from GregoryMannarino: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold & Silver Money Has Devolved Into Debt and Plastic Posted: 27 Jul 2015 11:01 PM PDT Central banks will disagree; Keynesian economists probably disagree; Too-Big-To-Fail banks don't care; But I think the following is generally accurate regarding the devolution of gold and silver... {This is a content summary only. Click on the blog title to continue reading this post, share your comments, browse the website, and more!} | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Truth, Justice, And (No Longer) The American Way! Posted: 27 Jul 2015 10:11 PM PDT Dear CIGAs, While taking a short vacation last week, this article was intended to be my first one upon returning. That plan was squashed a week ago with the brutal "interventions" upon gold and silver during the illiquid overnight hours early Sunday morning. Let me add to what I wrote last Friday by saying the... Read more » The post Truth, Justice, And (No Longer) The American Way! appeared first on Jim Sinclair's Mineset. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Money & Metals with David Morgan – PRECIOUS Gold Struggles to Recover Posted: 27 Jul 2015 09:15 PM PDT from silver investor.com: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 27 Jul 2015 08:57 PM PDT From the Slope of Hope: Only a government employee could point to a 99.5% failure rate and declare it a success. Look no farther than my local newspaper this morning: the city of Menlo Park (which is an affluent superb like Palo Alto, but even whiter and more sheltered) spent hundreds of thousands of dollars on equipment to read the license plates of all the cars passing by certain intersections. (We'll set aside the creepiness of the surveillance and just focus on the economics here.) The latest quarterly report came out, and out of 198,286 license plates read, 204 of them were brought to the attention of authorities as "wanted" vehicles. OK, cool. Looks like we're getting some hits here and and go grab some criminals, right, boys? The problem is that 203 of the 204 weren't "wanted" at all. The plates were all misread. There was one - count 'em, one - license plate out of the 198,286 which was indeed a plate from a stolen car, and the police captain (which, around here, is a quarter-million dollar year salary) assures the public that the license plate readers are "working properly" since, after all, they did button down one vehicle (which, if I may speculate, was probably worth, oh, about ten thousand bucks or so). Suffice it to say that the hundreds of thousands spent on the equipment - - to say nothing of the time and effort involved from the police force (each member of which enjoys a six-figure salary) probably is a substantially greater sum than the value of the single vehicle retrieved. Here ya go: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dave Kranzler: GLD is being looted by bullion banks shorting gold Posted: 27 Jul 2015 06:59 PM PDT 9:58p ET Monday, July 27, 2015 Dear Friend of GATA and Gold: Dave Kranzler of Investment Research Dynamics tonight reviews evidence that the exchange-traded fund GLD is being used as a source of metal for the bullion banks shorting gold, an essential part of the Western central bank gold price suppression scheme. His commentary is headlined "GLD Continues to Be Looted While the Public Loads Up with Physical" and it's posted at the IRD Internet site here: http://investmentresearchdynamics.com/gld-continues-to-be-looted-while-t... And in commentary written with former Assistant U.S. Treasury Secretary Paul Craig Roberts, Kranzler explains how futures trading has pre-empted exchange of actual metal in setting gold and silver prices. Their commentary is headlined "Supply and Demand in the Gold and Silver Futures Markets" and it's posted at Roberts' Internet site here: http://www.paulcraigroberts.org/2015/07/27/supply-demand-gold-silver-fut... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT We Are Amid the Biggest Financial Bubble in History; With GoldCore you can own allocated -- and most importantly -- segregated coins and bars in Switzerland, Singapore, and Hong Kong. Switzerland, Singapore, and Hong Kong remain extremely safe jurisdictions for storing bullion. Avoid exchange-traded funds and digital gold providers where you are a price taker. Ensure that you are outright legal owner of your bullion. If you do not own segregated bullion that you can visit, inspect, and take delivery of, you are exposed. Crucial guides to storage in Singapore and Switzerland can be read here: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland GoldCore does not report transactions to any authority. Safety, privacy, and confidentiality are paramount when we are entrusted with storage of our clients' precious metals. Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44(0)203-086-9200. U.S.: +1-302-635-1160. International: +353(0)1-632-5010. Visit us at: http://www.goldcore.com Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Irony Of Market Manipulation Posted: 27 Jul 2015 06:45 PM PDT Having gazed ominously at the extreme monetary policy smoke-and-mirrors intervention in bond markets, and previously explained that "the stock market is to important to leave to the vagaries of an actual market." While the rest of the world's central banks' direct (BoJ) and indirect (Fed, ECB) manipulation of equity markets, nobody bats an eyelid; but when PBOC steps on market volatility's throat (like a bull in a China bear store), people start complaining... finally. There is no difference - none! And no lesser Asian expert than Stephen Roach warns that we should be afraid, very afraid as he states, the great irony of manipulation, he explains, is that "the more we depend on markets, the less we trust them."

BoJ is directly buying Japanese Stocks and the rest of the world's central banks are buying bonds with both hands and feet... for the first time ever, central banks are set to monetize all global government debt, something we showed previously...

But with China's heavy handed "measures" seemed to save the world (until the last 2 days)... 9-Jul-15 Thurs CSRC: 8-Jul-15 Weds PBOC: vowed to maintain market stability and avoid systematic financial risk. It will provide ample liquidity to CSFC via interbank lending, financial bond, pledge financing, and relending facilities. 7-Jul-15 Tues CIRC: to allow insurers to invest more in blue chips stocks: 1) investment in a single blue chip will be capped at 10% of the insurers’ total assets as of last quarter, vs. the previous 5%; 2) equity investment will be capped at 40%, vs. 30%, but the 10% difference must be invested in blue chips. CSFC said it will buy more smid-cap stocks Several joint stock banks resumed funding to umbrella trust; but have lowered leverage to 1x vs previous 3x. 6-Jul-15 Mon CFFEX took more measures to restrict index future trading by 1) capping the number of withdrawal of a single contract to 500/account/day; 2) raising margin for selling index futures of CSI500 from Jul 8 to 20% of contract price from 10% and up to 30% from Jul 9. CSFC to use Rmb120bn funds contributed by various brokers to buy ETFs. Social Securities Fund (SSF) vowed not to reduce existing equity positions in its portfolio. 3 to 5-Jul-15 Fri-Sun Huijin purchased Rmb12bn ETFs

2-Jul-15 Thurs CSRC said to investigate and “strictly” punish manipulations; Bloomberg reported CSRC has conducted examination on recent stock index future short selling activities. Brokers: some brokers loosened margin financing requirements eg cut margin ratio; extend margin financing duration period; raise collaterals discount ratio etc. Insurers have been buying blue chips stocks and ETFs since last Friday; though pace has moderated somewhat on Jul 2. Media reported that many mutual funds and privately raised funds also increased equity holdings. 1-Jul-15 Weds Shanghai Stock Exchange (SHEX), Shenzhen Stock Exchange (SZEX) & CSDC will cut transaction fees by 30% effective on Aug 1. CSRC granted brokers new financing channels, including: 1) All brokers, not limited to the trial 20 ones, can issue short-term bonds; 2) brokers can securitize their beneficiary rights of margin financing. Margin trading: loosened requirement that a margin account will be liquidated if the leverage ratio drops below 130%; brokers will have more liberty in such cases. CFFEX checked index futures trading by 38 QFII investors and 25 RQFII investors and it didn’t find “large scale” short selling activities in the market. 30-Jun-15 Tues Asset Management Association of China (AMAC): 1) requested investors and fund managers to stay rational & not to panic; 2) quoted 13 leading private funds' heads to advocate A-share investment. Bloomberg first reported CSRC may suspend IPO to stabilize the market. 29-Jun-15 Mon SSF: MOHRSS and MOF circulated a draft policy to allow basic pension fund to invest up to 30% into the A-share market; the consultation will end on 13 Jul 2015. People’s Daily said pension fund’s stock investment will be no more than Rmb150bn. CSFC said risks of margin financing & margin calls are relatively small. 27-Jun-15 Sat PBOC cut interests rate by 25bps and cut targeted RRR for selected FIs, effective on 28 June.

To July 7th... when selling was made "illegal"

and since...

So why did we not see this?

Simple, because China just exposed the rest of the world's manipulation is not omnipotent. As Stephen Roach, writing at Project Syndicate, notes, market manipulation has become standard operating procedure in policy circles around the world. All eyes are now on China’s attempts to cope with the collapse of a major equity bubble. But the efforts of Chinese authorities are hardly unique. The leading economies of the West are doing pretty much the same thing – just dressing up their manipulation in different clothes.

* * * As we concluded previously,

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed Up $10.90 at $1,096.50 Posted: 27 Jul 2015 05:40 PM PDT

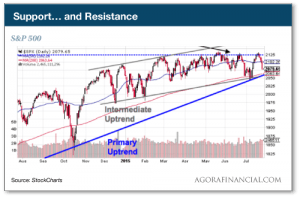

Remember Friday I was watching the first half of a key reversal in the End of Day chart, but the GOLD PRICE did not close the EOD higher today, so that reversal was not completed and verified. But look at this. Gold's new commitment of traders reports shows large speculators (the dumb money) with historically low long positions and commercials (the smart money) with barely any shorts. Silver's CoTs look bullish, too. Commercials have few shorts and large speculators few longs. Also bullish. On the 5 day chart the gold price shows a rounded bottom with a surge up through $1,090 on Friday, a rise to $1,105 today, then a plunge to test $1,090 support -- a test that gold passed, and rose to end the day about $1,095. Unless the price of gold breaks $1,090, Friday was the bottom. The SILVER PRICE chart also shows a low Friday, but a V-bottom, a higher high early today with a test of $14.55 -- also passed. Silver must hold $14.40. (Remember it's much more volatile than gold). None of reading markets is metrically precise, it's an art. That's why I try to give you a band of prices that both confirms and explodes any forecast. As long as we don't break $1,090 and $14.40, Friday was the low. I already bought on Friday, so I'm set. What about y'all? Bear in mind that when markets turn around, those universally scorned rise all the faster. Ever wake up like Rip Van Winkle wiping the cobwebs from you eyes and wondering what on earth got hold of you? I feel that way today, looking at markets. What on earth have I been thinking about? Stocks have rolled over. That May high was most likely the high for the entire bull phase (spawned by the Fed's QE). The present deflationary scare will pass, the dollar will fail and resume its downward progress toward zero, and central banks will surely shoot their only weapon: the inflation gun. And one more thing: the goofs in central banks and governments who believe they are Masters of the Universe, ain't. Gravity still works, truth will avenge itself economically on corrupt politics, and chickens still come home to roost. (What was that stuff those little men gave me to drink while we were bowling?)

Ponder stocks. No longer can the damage be hidden. The Dow lost another 127.94 (0.73%) today to 17,440.59 and has traced out a gigantic rounding top. Today's close was lower than July's earlier low close (17,466). It is trading way below its 200 day moving average (DMA, 17,750). There's another little internal broadening top traced out since March, and the Dow is about to break down out of that. Owch! I forgot to mention that the Dow is now 384.5 points below its 2014 close, and 871.4 points below its 19 May high. S&P500 today lost 12.01 (0.58%) to 2,067.64. Skidded to a halt today three points from its 200 DMA (2,064.13). Still 9 points above its 2014 close. After it breaks that 2,039 March low, the fleas will begin jumping off the rats and the rats will be jumping ship.

Dow in gold has retraced nearly all its "throwover" final top. That took it to 16.504 oz but today it closed at 15.91 oz. Working off an oversold RSI, falling Rate of Change, overbought stochastics, and a downturning MACD. Chart on the right. What about the Dow in silver? The throwover there was less than gold's, but it, too, has plunged, from 1,236.37 oz to 1,201.97 today. US dollar index tumbled again today, right badly, down 73 basis points (0.75%) to 96.61, cutting through its 20 DMA (96.89). Will drop further. Maybe by mid-August its tank will have finally run dry. Not that the euro offers any more solace or safety. If the US dollar's sorry as a three-legged mule, what about the euro? It's a three-legged twenty-eight-pede! Gained today 1.06% to $1.1090. That is above its 20 DMA, at least, but until the euro crosses $1.1150, it hasn't even begun to rally. Yen gapped up on dollar weakness, too, plus 0.38% to 81.11 cents/Y100 (Y123=US$1). Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2015, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Coast To Coast AM - July 26, 2015 Fukushima & Solar Power Posted: 27 Jul 2015 04:00 PM PDT In the first half of the program, George Knapp welcomed nuclear power expert, Arnie Gundersen, who discussed how, more than four years after the triple meltdown at Fukushima, nuclear waste inside the reactors continues to bleed into the Pacific Ocean creating low concentrations of... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China Stock Market CRASHING as Central Bank Buying Shares to Prevent COLLAPSE! Posted: 27 Jul 2015 02:00 PM PDT China's central bank is buying up shares of the stock market in order to keep it afloat as real investors are quickly fleeing the scene before they lose too much of their wealth. They're now admitting what Japan, Switzerland, and others have been doing for some time. A collapse is inevitable... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Miner Miner Posted: 27 Jul 2015 01:24 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 27 Jul 2015 12:42 PM PDT Jim Sinclair’s Commentary FT article "Gold a Flight to Safety" was in the main a review of gold’s fall over the past years, as is most reporting. It is however impressive that that Henry Sanderson of the prestigious Financial Times reached out to provide needed balance to the subject by interviewing gold and PM expert... Read more » The post In The News Today appeared first on Jim Sinclair's Mineset. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

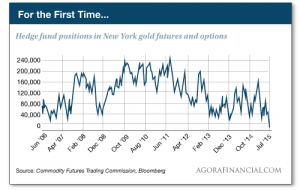

| Posted: 27 Jul 2015 12:40 PM PDT This post Focusing On The Wrong Thing appeared first on Daily Reckoning. The major U.S. stock indexes got slammed hard at the start of trading this morning — but as we write, the damage looks less severe. Small caps are taking it the hardest, the Russell 2000 down three quarters of a percent. But the S&P 500 is down only a quarter-percent, at 2,075. The proximate cause of the early-morning panic was an 8.5% sell-off overnight in China. There was no obvious trigger for the sell-off: Figures showed profits at Chinese industrial firms during June fell 0.3% from a year ago. Big whoop. Chalk it up, perhaps, to a collective loss of confidence in the Chinese government's measures to arrest a 30% drop in the Shanghai Composite Index going back to mid-June. Those measures included a ban on short selling. Today's drop was all but inevitable. Earlier this month, we cited a well-founded rant by money manager Barry Ritholtz. It's worth revisiting this morning. “Short sellers are typically the first to buy during a crash. Why? They have no risk in making the buy, as they are closing out an existing position. Thus, they act as a floor under a falling market. "The strongest collapse in U.S. equities took place after the SEC banned short selling in September 2008.” Back to the U.S. market: The S&P 500 bounced off support in the first hour of trading. So the primary uptrend going back nearly four years remains in place — that's the solid blue line on this chart going back the last 12 months. Of more significance to Jonas Elmerraji at our trading desk is the dashed blue line near the top. For the fifth time in five months, the index hit a ceiling at 2,125 a week ago today. Could a sixth try mark a breakout? "Things start to get interesting if the S&P can move materially above 2,125," says Jonas. "Expect earnings to remain a major market-moving factor in the next month or so. At this point, 185 S&P 500 components have reported their numbers to Wall Street for the second quarter — and 75% of those reporting companies have bested analysts' best-guess numbers. That's a pretty solid beat rate, and it could help take out some of that selling pressure up at 2,125." Gold raced past $1,100 again late Friday afternoon but can't hold it this morning. At last check, the bid was $1,097. The bargain gold price has breathed life into moribund sales of U.S. Gold Eagles. So far in July, 266,500 ounces of gold coins have exited the U.S. Mint's doors. That's already the highest monthly total since April 2013. Not coincidentally, that's the month when gold tumbled $200 in a week. Silver Eagles, you wonder? As we mentioned on July 8, sales to the Mint's dealer network have been suspended thanks to high demand. It was supposed to be for only two weeks, but two stretched into three and three is about to become four. To be continued… Here's a contrarian indicator gold bugs might like: Hedge funds have collectively gone bearish on gold for the first time on record. Figures from the Commodity Futures Trading Commission show hedge funds and other speculators are net short 11,345 contracts in futures and options for the week ended last Tuesday. That's never happened before… although we caution the records go back to only 2006. Regards, Dave Gonigam P.S. Be sure to sign up for The Daily Reckoning — a free and entertaining look at the world of finance and politics. The articles you find here on our website are only a snippet of what you receive in The Daily Reckoning email edition. Click here now to sign up for FREE to see what you're missing.

The post Focusing On The Wrong Thing appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stop Iran Deal -- Former Congressman and US army veteran Allen West Speech Posted: 27 Jul 2015 11:30 AM PDT Former Congressman and US army veteran Allen West making a passionate and emotional speech to over 12,000 people in Times Square at the 'Stop Iran Deal Rally' tonight... The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Guerrilla Economist -- The DAY OF RECKONING Approaches Posted: 27 Jul 2015 11:00 AM PDT SGT Report welcomes V, the guerrilla economist from Rogue Money.net to the show to discuss the end of the western banking and precious metals price suppression paradigm. On Sunday night the banking cartel struck again by flooding the world market with paper gold, slicing $50 off the price within... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| No, Bob Moriarty, we don't want to live with market rigging Posted: 27 Jul 2015 10:52 AM PDT 2:02p ET Monday, July 27, 2015 To hear 321Gold.com's Bob Moriarty tell it, GATA has conquered the world and now has more influence on the markets than the central banks we long have been clamoring against. For in his commentary today, "Capitulation in Gold" -- http://321gold.com/editorials/moriarty/moriarty072715.html -- Moriarty writes: "Speaking of GATA, they have done billions of dollars of damage to investors. Somehow they convinced tens of thousands of people that when gold went from $252 to $1,923 it was being suppressed, and like the gold derivatives time bomb, gold was going to explode one day soon. If someone was manipulating gold from $252 to $1,923, it wasn't down. Actually if you bought lumber or soybeans and they made the same percentage move as gold did from 1999 to 2011 and you didn't sell, it's because you are too stupid to recognize the difference between an investment and a religion." ... Dispatch continues below ... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Yet throughout gold's price rise, the gold market was subject to frequent interventions, most instigated by central banks, that panicked retail longs and allowed the bullion banks, agents of the central banks, to cover their short positions and begin the market-rigging cycle all over again, slowing gold's restoration as a competitive currency. That's not so hard to understand. As for the investment and religion businesses, Moriarty is in the former but GATA is in neither. Moriarty continues: "On Sunday night a week ago someone slammed gold when it was at $1,130 and dropped it to $1,080 in seconds. Billions of dollars that nervous investors had put in stop-loss orders on their long positions were wiped out in that time frame. It was deliberate and designed to steal from investors. It is called 'running the stops' and every guy who was ever a commodity broker or stockbroker understands what happened. It's perfectly legal. All those guys who claim to believe that manipulation is the most important issue in investing should have had buy orders well below the November low in gold because that was really predictable." But if it was "really predictable," where was Moriarty's commentary predicting it? Indeed, where was the commentary of other experienced market analysts predicting it? To the contrary, much commentary following the attack on gold actually found it extraordinary because of the sheer volume and suddenness of short sales, which implied central bank involvement. Such involvement was quickly suspected even by analysts who have never shown any interest in the possibility of surreptitious central bank intervention in the gold market. As for "perfectly legal," British authorities have arrested a guy who trades S&P futures from the basement of his parents' home outside London, accusing him of causing the May 2010 "flash crash" in the equity markets. The trader has been charged with one count of wire fraud, 10 counts of commodities fraud, 10 counts of commodities manipulation, and one count of "spoofing," and the "perfectly legal" defense does not seem to have worked for him. But it does work for governments, which have fully authorized themselves to trade all markets in secret. That's what the U.S. Exchange Stabilization Fund is about -- http://www.treasury.gov/resource-center/international/ESF/Pages/esf-inde... -- and presumably that is why CME Group, operator of the major futures exchanges in the United States, provides discounts to central banks and governments for their surreptitious trading on CME Group exchanges: http://www.gata.org/node/14385 http://www.gata.org/node/14411 Of course "perfectly legal" does not mean perfectly fair. For should investors in countries purporting to have free markets have to be trading in ignorance against government agencies that are authorized to create infinite money? Moriarty continues: "I doubt if any of the 'manipulation-conspiracy' people actually care about making money." That's a good point, though at least in regard to GATA it is not the accusation Moriarty intends. In fact GATA is a nonprofit, federally tax-exempt civil rights and educational organization based in the United States that seeks to expose market manipulation and restore free markets, particularly in the monetary metals. Of course as individuals we'd all like to make money but you can't do that as a nonprofit, federally tax-exempt organization. You do that as an individual or as a business. Moriarty continues: "Gold shares have been on the block for the last six months. If you were smart enough to buy them, you will be just fine. Sure, some are going to disappear, but while the 'manipulation-conspiracy' people are whining about how terrible it is for a financial product to be manipulated, you are going to own a lot of 10-20-baggers from here." So there's Moriarty's real grievance with GATA: By warning investors about the rigging of the monetary metals markets and the challenges they face, GATA is getting in the way of his touting the stocks in which he has invested, like the touting contained in the paragraphs immediately preceding his criticism of GATA today. Moriarty concludes: "All financial markets are manipulated. Live with it." This observation by Moriarty is actually progress, since, when GATA began, he and others like him denied any manipulation of the monetary metals markets at all. Now that market manipulation is so obvious that anyone who denies it risks losing all credibility, the former deniers can only try to minimize it. As for "living with" market manipulation, Moriarty is welcome to do so, and maybe he'll grant others the right not to. In the meantime, no analysis of the gold market is worth anything if it fails to address four questions: -- Are central banks in the gold market surreptitiously or not? -- If central banks are in the gold market surreptitiously, is it just for fun -- for example, to see which central bank's trading desk can make the most money by cheating the most investors -- or is it for policy purposes? -- If central banks are in the gold market for policy purposes, are these the traditional purposes of defeating a potentially competitive world reserve currency, or have these purposes expanded? -- If central banks, creators of infinite money, are surreptitiously trading a market, how can it be considered a market at all, and how can any country or the world ever enjoy a market economy again? GATA urges Moriarty and all others who claim to analyze the gold market to answer these questions. Documentation responsive to those questions is available here: http://www.gata.org/node/14839 CHRIS POWELL, Secretary/Treasurer Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Blame the Fed for the Commodities Slump Posted: 27 Jul 2015 10:35 AM PDT This post Blame the Fed for the Commodities Slump appeared first on Daily Reckoning. VANCOUVER, Canada – When we left you at the end of last week the world was falling apart. As you know, the economy functions on electronic credit… not cold, hard cash. Without the banks pumping more credit into the system – by way of loans – it sags. The Dow fell 163 points – or about 1% – on Friday. More significant is the action in the gold market. At this morning's price of $1,103 an ounce, gold is now trading $100 below what we thought was the "floor" under the price. Why? It could be that gold is signaling a global recession/depression. People tend to buy gold when they fear inflation. All they see today is a global deflationary slump. The People's Daily newspaper – the official organ of the Communist Party – tells us that Chinese electricity consumption is accelerating at the slowest rate in 30 years. We all know China's GDP figures are untrustworthy, but electrons don't lie. They flow with the economy. And they're now only increasing at a sluggish 1.3% a year – suggesting a big slowdown in the Chinese economy. According to economists' estimates compiled by Bloomberg – as opposed to the official spin from Beijing – China's economy is growing at the slowest pace in 25 years. Meanwhile, on the commodities highway, there's a huge pileup. The crash in the oil market – which has taken the price per barrel of U.S. crude down 53% over the last 12 months – has left a massive slick. A barrel of U.S. crude oil sold for just $48.14 at Friday's close – just 42 cents above its 52-week low. Overall, commodities are at a 13-year low. And the coal miners have slid on the cheap oil and gas. In the March issue of our monthly publication, The Bill Bonner Letter, we explained why energy was so cheap. The Fed dropped the price of capital so low that it cost almost nothing to borrow. When the cheap money came to an end, so would the cheap oil, we guessed. But it hasn't happened – yet… So far, the Fed's cheap credit has exaggerated and prolonged the bear market in oil. Producers who should have shut down months ago are still pumping – kept in business by ultra-cheap financing. Coal, cheap when we wrote about it back in March, is now even cheaper. Today, the price of coal is down 70% from four years ago. This is pushing coal producers to the edge of solvency… For example, Alpha Natural Resources, a big producer of metallurgical coal – or "met" coal, which is used for steelmaking –was delisted from the New York Stock Exchange because its share price was "abnormally low." Bankruptcy is now in the cards. And this from OilPrice.com on the fate of another big met coal producer, Walter Energy: Walter Energy, an Alabama coal miner, announced on July 15 that it is filing for bankruptcy. Senior lenders will see their debt turned into equity, and if the company cannot turn the ship around, it will more or less sell off all of its assets. "In the face of ongoing depressed conditions in the market for met coal, we must do what is necessary to adapt to the new reality in our industry," Walter Energy's CEO Walt Scheller said in a press release. Dr. Copper, too, says it's going to be a rough second half of the year for the global economy. Copper has earned the "Dr." title; the old-timers say it is "the only metal with a PhD in economics." Copper goes into everything – houses, offices, electronics, autos, you name it. Although it's not a perfect correlation by any means, when the price of copper falls, it indicates that the world economy is going down too. From Bloomberg: Goldman said prices will probably drop another 16% by the end of next year and expects Chinese demand to grow at the slowest pace in almost two decades. Goldman on Wednesday lowered its copper price outlook by as much as 44% through 2018. Why the big slowdown? Why is the world falling apart? Because you can't fake an economic recovery… Instead of "stimulating" a recovery, the feds have "simulated" one. They dropped the price of capital to near zero. Commodity producers took the bait. They borrowed money and increased production. But global demand couldn't keep up. You can't get real demand from empty credit. Real demand comes from Main Street, not Wall Street. And for that, you need a real recovery, not a phony one. Tomorrow: Hillary saves capitalism! Regards, Regards, Bill Bonner Originally posted at the Diary of a Rogue Economist, right here. Editor's Note: Be sure to sign up for The Daily Reckoning — a free and entertaining look at the world of finance and politics. The articles you find here on our website are only a snippet of what you receive in The Daily Reckoning email edition. Click here now to sign up for FREE to see what you're missing. The post Blame the Fed for the Commodities Slump appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

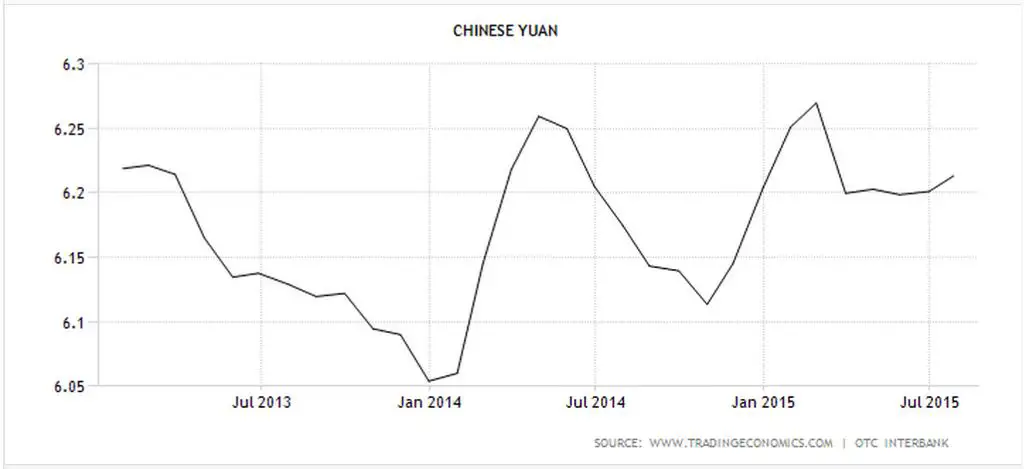

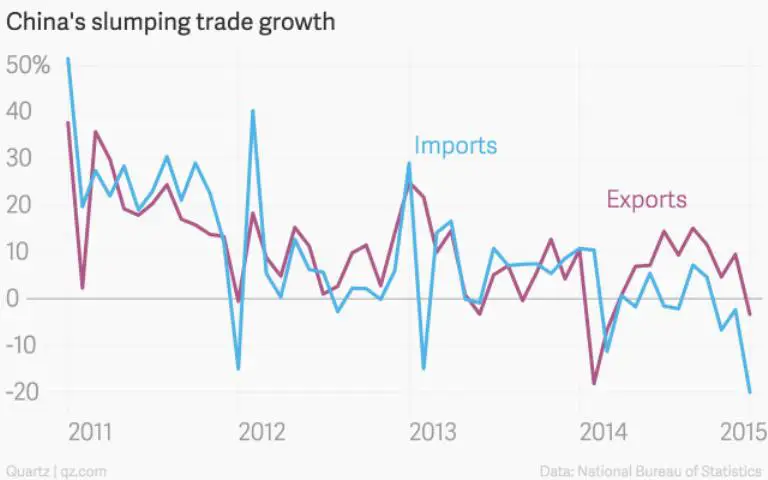

| China: Major Devaluation Coming Posted: 27 Jul 2015 10:13 AM PDT The whole “market economy” thing is turning out to be a little trickier than China’s dictators expected. To set up the story: After the 2008 crash the country borrowed about $15 trillion (an amount that dwarfs the US Fed’s quantitative easing programs) and spent the proceeds on history’s biggest infrastructure program. This pushed up the prices of iron ore, oil, copper, etc., igniting a global commodities boom. Then China liberalized its stock trading rules, setting off a stampede into local equities that doubled prices in less than a year. The result is a classically unbalanced economy, with massive physical malinvestment, overpriced financial assets and way too much debt. The inevitable crash began in June. Beijing responded by tossing about 10% of GDP into equities to stop the bleeding. This worked, as such interventions tend to do, for a while. But last night it failed:

Devaluation time? But because the dollar is way up against virtually every other currency, so is the yuan, which is a major cause of today’s crisis. Economics 101 says that a stronger currency makes exports more expensive and slows growth, and in 2015 China’s trade has responded exactly as predicted: So here’s the dilemma: A too-strong currency is making it impossible for China to service excessive debts, which is contributing to a bear market in equities, which further slows the economy and makes it even harder to service debts, and so on. This probably seems like uncharted territory to the central planners, but is actually a pretty standard problem — for which the traditional solution is to devalue and stiff your creditors by repaying debts with cheaper currency. The US did it in the 1970s, Europe is in the process of doing it now with the euro’s recent steep decline, and much of Latin America is in various, mostly disorderly, stages of the process. Put another way, the world is following the standard currency war script, in which countries take turns devaluing, reap modest temporary benefits, and then give up those gains when their trading partners respond in kind. China’s devaluation, however, will be a much bigger deal than most. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| How to Know When the Gold Bear Market is Over Posted: 27 Jul 2015 10:01 AM PDT D.R. Barton, Jr writes: Gold’s hard-and-fast tumble below $1,100 an ounce last week means some investors may be tuning out the yellow metal or suffering from gold “burnout.” But ignoring it is a huge mistake. It has been and always will be one of the best stores of value, and it's a crucial hedge against economic upheaval. It's a must-have holding. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| India's Rajesh Exports acquires Swiss gold refiner Valcambi Posted: 27 Jul 2015 09:52 AM PDT By Swansy Afonso Rajesh Exports Ltd., India's biggest maker and exporter of gold jewelry, said it bought Swiss gold refiner Valcambi SA for $400 million. The cash purchase of Valcambi from Newmont Mining Corp. helps ensure gold supplies to India, the world's largest consumer of the metal after China, Bangalore-based Rajesh Exports said in an exchange filing on Monday. Its shares rallied to close at the highest level since at least July 2000. "On a theoretical basis Valcambi is capable of supplying the entire gold requirement of India," said Chairman Rajesh Mehta. Credit Suisse Group AG has agreed to fund 30 percent to 35 percent of the acquisition through long-term debt, which Rajesh Exports plans to repay through Valcambi's future earnings, Mehta said at a news conference in Mumbai. ... ... For the remainder of the report: http://www.bloomberg.com/news/articles/2015-07-27/india-rajesh-exports-p... ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bron Suchecki: How much gold does China really have? Posted: 27 Jul 2015 09:41 AM PDT 12:40p ET Monday, July 27, 2015 Dear Friend of GATA and Gold: Hypothesizing painstakingly from Chinese gold market data, Perth Mint research director Bron Suchecki estimates that the Chinese government's gold reserves, including metal held by government-owned banks, total about 4,500 tonnes, or about 2,800 tonnes more than the People's Bank of China this month reported as its own gold reserves. Suchecki attributes to Chinese policy a steady accumulation of gold that divides it between the government and China's population at a ratio of 55 to 45 in favor of the population. Suchecki's analysis is headlined "How Much Gold Does China Really Have?" and it's posted at the Perth Mint's Internet site here: http://research.perthmint.com.au/2015/07/27/how-much-gold-does-china-rea... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ron Paul's Texas Straight Talk 7/27/15: Do We Need to Bring Back Internment Camps? Posted: 27 Jul 2015 09:00 AM PDT To think at 1st quarter of the 21st century, that humanity, particularly Murica with its past concentration camp hisitory, would even need to mull whether the regime may or may not intern its own populace, AGAIN, is deathly troubling... The Financial Armageddon Economic Collapse Blog tracks... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Agenda 21: We're Being Conquered By Banks, Not Tanks Posted: 27 Jul 2015 06:59 AM PDT Alex Jones special report on Agenda 21 and how we're being conquered by banks, not tanks. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 27 Jul 2015 05:25 AM PDT In his last two months as host of Comedy Central’s The Daily Show, Jon Stewart has found comedy gold in real estate mogul Donald Trump’s bid for the White House next year. The clip above is from last Monday, as the crew came back from a two-week break, during which they must have been chomping at [...] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 27 Jul 2015 04:56 AM PDT MUST READS China shares fall more than 8% – BBC There’s no need to panic about China’s falling stock markets – Telegraph The true cost of China's multibillion-dollar market intervention – MarketWatch EU/IMF mission chiefs to start bailout talks in Athens this week – Reuters Tsipras's Paradox Is Six Months of Pain and Enduring Popularity – Bloomberg Varoufakis reveals cloak and [...] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Six Miners Dundee's Joseph Fazzini Believes Will Weather the Storm Posted: 27 Jul 2015 01:00 AM PDT With ongoing volatility expected in the gold space, mostly owing to global economic weakness, investors should focus on quality gold names with three key attributes to weather the current metal price environment, explains Joseph Fazzini, vice president and senior analyst with Toronto-based Dundee Capital Markets. Fazzini says those attributes are low-cost, long-life assets; defensive balance sheets; and responsible management teams. In this interview with The Gold Report, Fazzini lists six Buy-rated names with those key attributes and more. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Update: Sentiment, Seasonality, and Price Patterns Look Favorable Posted: 26 Jul 2015 05:00 PM PDT |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Last night there were some pretty ugly fireworks in China, as that market declined about 8.5%, which is essentially one of the biggest breaks that country has ever seen, this after all kinds of support measures were put in place. Thus, the Chinese authorities have shot off a bunch of bullets and they haven’t really worked.

Last night there were some pretty ugly fireworks in China, as that market declined about 8.5%, which is essentially one of the biggest breaks that country has ever seen, this after all kinds of support measures were put in place. Thus, the Chinese authorities have shot off a bunch of bullets and they haven’t really worked.  The top thought on my mind is the question posed by Saturday's must hear Audioblog, "

The top thought on my mind is the question posed by Saturday's must hear Audioblog, "

No comments:

Post a Comment