saveyourassetsfirst3 |

- So Yeah, Hillary Clinton Did Send Classified Emails From Her Private Account After All

- Gold & Silver Hit New Multi-Year Lows as ETF Trusts Dishoard Ahead of Looming Fed Rate Hike

- Federal Reserve: Largest Drug Money Laundering Organization In The World

- “Central Bank Warfare Model Wearing Thin”: Nations Desperate for Way Out of Crunch

- The message behind the Chinese gold reserves announcement

- The President Of France Wants Eurozone Members To Transfer Their Sovereignty To A United States Of Europe

- Guest Post: " The Collapse Of The U.S. Retirement Market & Epic Rise In The Price Of Gold", by Steve St. Angelo

- Greece has disappeared from the headlines, but its not out of the water yet

- Fund Manager: Anti-Gold Propaganda Reaches Bubble Proportions

- Central Banks Ready To Panic — Again

- Shock Report: China Dumps Half a Trillion Dollars: “Something Is Very, Very Wrong”

- Global economic termites are eating away gold price foundations

- Why the Iron-Fisted Tactics of the EU Will Help Bring Its Downfall

- The message behind the Chinese gold reserves announcement

- India further cuts import tariff value on Gold to $354 per gram

- The Misinterpretation of Money

- Bail-Ins Of “Big Deposits” In Greece Would Be “Extraordinarily Counter-Productive”

- Gold Miners Nearing Rebound

- Bail-Ins Of “Big Deposits” In Greece Would Be “Extraordinarily Counter-Productive”

- The Second Coming Of Gold

- GOLD Trades Lower As Exptectd, Support At 1060-1050 Area

- Gold Spot Intraday: The Downside Prevails.

- Gold-To-SPX Ratio Boom-Bust

- Here’s Why Silver Prices Have 110% Upside in 2016

- Gold Poised For Fifth Weekly Loss

- Gold and Silver Falling, Coiling - The Slow Blues

- Gold at a Long Term Trendline

- Gold Prices July 24, 2015, Technical Analysis

- Gold ... floats like a butterf.... no wait .... drops like a rock again

- Gold Miners Nearing Rebound

- Copper, China And World Trade Are All Screaming That The Next Economic Crisis Is Here

- What Blows Up Next? Part 1: Resource-Based Economies

- Free Markets At Work - Gold and Silver Owners Per Ounce

| So Yeah, Hillary Clinton Did Send Classified Emails From Her Private Account After All Posted: 24 Jul 2015 12:45 PM PDT I did not email any classified material to anyone on my email. There is no classified material. So I'm certainly well aware of the classification requirements and did not send classified material. – Hillary Clinton's public comments on the EmailGate scandal back in March Submitted by Michael Krieger, Liberty Blitzkrieg: Two inspectors general have asked the […] The post So Yeah, Hillary Clinton Did Send Classified Emails From Her Private Account After All appeared first on Silver Doctors. |

| Gold & Silver Hit New Multi-Year Lows as ETF Trusts Dishoard Ahead of Looming Fed Rate Hike Posted: 24 Jul 2015 12:44 PM PDT Bullion Vault |

| Federal Reserve: Largest Drug Money Laundering Organization In The World Posted: 24 Jul 2015 12:00 PM PDT What’s the largest money laundering institution in the world? Robert Mazur, the Former Undercover DEA agent Robert Mazur who famously infiltrated Pablo Escobar’s Medellin Cartel, asserts it’s the Federal Reserve! TND Podcast Spotlight: Operation Freedom | Topics discussed on this show: Cyber-security, Benghazi, Drug Cartels, Manipulation of financial markets, New World Order Syndicate, Putin, The Ukraine, […] The post Federal Reserve: Largest Drug Money Laundering Organization In The World appeared first on Silver Doctors. |

| “Central Bank Warfare Model Wearing Thin”: Nations Desperate for Way Out of Crunch Posted: 24 Jul 2015 11:00 AM PDT Until or unless central banks change their policies to spur this positive economic behavior, they are basically funding war, depopulation and death and destruction. Submitted by Mac Slavo, SHTFPlan: A financial expert has warned that allowing predatory economics to continue misleading the world can only result in three things: war, depopulation… or, maybe, change. […] The post "Central Bank Warfare Model Wearing Thin": Nations Desperate for Way Out of Crunch appeared first on Silver Doctors. |

| The message behind the Chinese gold reserves announcement Posted: 24 Jul 2015 10:44 AM PDT Perth Mint |

| Posted: 24 Jul 2015 10:00 AM PDT The President of France has come up with a very creative way of solving the European debt crisis. On Sunday, a piece authored by French President Francois Hollande suggested that the ultimate solution to the problems currently plaguing Europe would be for every member of the eurozone to transfer all of their sovereignty to a […] The post The President Of France Wants Eurozone Members To Transfer Their Sovereignty To A United States Of Europe appeared first on Silver Doctors. |

| Posted: 24 Jul 2015 09:35 AM PDT |

| Greece has disappeared from the headlines, but its not out of the water yet Posted: 24 Jul 2015 09:07 AM PDT From Bill Bonner, Chairman, Bonner & Partners: Onboard the TransCanada – “Have you people ever run a train before?” Sarcasm seemed appropriate. It wasn’t plainly crass or vulgar. Just mildly insulting. The book we were later given on the train explained that the VIA Rail Canada – Canada’s passenger rail system – was inspired by Amtrak in the U.S. This is a little like getting on a cruise line that said it drew inspiration from the Titanic. O CanadaBy then we hardly needed any explanation. Our tickets said we were to be in Prestige Class for the journey from Toronto to Vancouver. But there was nothing prestigious about the way we were handled. After waiting 10 hours to board, we were invited to drag our bags along a quarter mile of platform to get to the prestige car. By the time we got there, we expected to be asked to bend over so the staff could whack us with a board. The train – scheduled to leave at 10 p.m. on Saturday night – did not push off until 9 a.m. the following day. We had gotten a call advising us get to the station “no later than 6 p.m.” so we wouldn’t miss it! We fulfilled our part of the deal. Alas, the Canuck Amtrak failed. Rescheduled for7 a.m., it was then rescheduled again for 7:30 a.m… and then 8 a.m… “The train got in late to the station. Then we had to wait to find a new engineer,” was the word we got when we asked about it. “People have been running trains for a long time,” we began a lecture. “There is nothing unpredictable about it. A train is a big object. You should know where it is. Then it’s a simple matter to compute when it will arrive. You know – distance divided by speed… ” We felt an elbow. It was Elizabeth telling us to knock it off. Tempted to feel sorry for ourselves, instead we said a prayer for the poor economy-class travelers. They would probably be chained to their seats and whipped with barbed wire. But now we are rolling along. Too bad about the Wi-Fi – it doesn’t work. Nor does the mini-fridge. And the train has been backing up as much as it has been going forward. But, heck, the staff are friendly… and the scenery is magnificent. Beaten Down and DespisedWord comes this morning that Greek banks have reopened. Bank customers have been separated from their money for three weeks. Even now, they are allowed only brief conjugal visits. They may take out only up to €420 ($456) a week. The Greek stock market has reopened, too. But without Wi-Fi, we have not been able to get an update. Greek stocks, as you might imagine, have gotten beaten harder than a traveler on the Canadian train system. They are down as much as 95% from their 2007 high. The average stock listed in Athens sells for a little more than two times earnings. Many sell for barely a single year’s cash flow. It’s not for us to know at what price Greek stocks should trade. But the Greeks have been around a long time. They’re probably not going away. And neither are the companies headquartered there. And some of the biggest payoffs in the investment world have come from putting money into places no one else wanted to go. It’s the beaten down, despised, sad sack of a market that has the greatest potential: It has nowhere to go but up. If you had invested in the Turkish stock market in 1988, for example, today your investment would show a 1,188,047% gain. Every dollar invested, in other words, would be worth more than $11,000. Back in 1988, Argentina was a mess, too. If you had put your money there, you’d have a 39,297,300% gain. Had you invested $10,000, you’d now have $392,973,000. More Drama to Come But the drama isn’t over in Greece. Poor Alexis Tsipras is stuck. On the one side is the hard place: Many in his coalition government are refusing to go along with the deal he just made. Heads are rolling as a result. On the other side are the rocks of Northern Europe – especially Germany. And they are proving treacherous, too. Tsipras’s Syriza government could be history in a few weeks. There’ll be new elections… more negotiations… more cans… more kicks… and more absurdities. It is amazing how much nonsense is published on the subject. The mainstream press has turned it into a simpleton’s version of the kids’ movie A Bug’s Life – a struggle between Greek grasshoppers and German ants. Readers are expected to take sides – either for the poor Greeks or against them. Most economists – most prominently Paul Krugman and Thomas Piketty – weigh in on the side of the Greeks. They urge Germany to give the grasshoppers a break – more time… more money… and more rope. They believe Northern European “austerity” has doomed the Greek economy to and endless depression. But the whole show is silly. The Greeks aren’t going to start acting like ants. They aren’t going to pay back old loans… or new ones. And lending more money to people who already owe more than they can ever hope to repay is never going to help an ailing economy. Regards, Bill Crux note: What’s happening in Greece will be trifling compared to the U.S monetary catastrophe Bill sees coming. It’s all detailed in the new presentation he’s put together. As you’ll learn, this upheaval could leave you locked out of your bank account… unable to use your credit card… or even cash a check. To find out what has Bill so worried, go here now. |

| Fund Manager: Anti-Gold Propaganda Reaches Bubble Proportions Posted: 24 Jul 2015 08:57 AM PDT There's a new bubble in town. It's anti-gold propaganda. The anti-gold propaganda spewing forth from all corners of the media is greater and more intense than I've ever seen any investment propaganda. Every time I turn on Bloomberg, FoxBiz or CNBC there's a discussion of how useless gold is. It's beyond surreal – it's criminal. […] The post Fund Manager: Anti-Gold Propaganda Reaches Bubble Proportions appeared first on Silver Doctors. |

| Central Banks Ready To Panic — Again Posted: 24 Jul 2015 08:45 AM PDT Less than a decade after a housing/derivatives bubble nearly wiped out the global financial system, a new and much bigger commodities/derivatives bubble is threatening to finish the job. Raw materials are tanking as capital pours out of the most heavily-impacted countries and into anything that looks like a reasonable hiding place. So the dollar is up, Swiss and German bond yields are negative, and fine art is through the roof. Now emerging market turmoil is spreading to the developed world and the conventional wisdom is shifting from a future of gradual interest rate normalization amid a return to steady growth, to zero or negative rates as far as the eye can see. Here’s a representative take from Bloomberg:

This is not how the Fed, ECB or Bank of Japan envisioned the year playing out. They see ultra-low rates as an emergency measure, temporary in nature and to be dispensed with asap. From MarketWatch:

That “unforeseen event” has arrived, leaving most central banks with a stark choice: Let the deflationary crash run its course at the risk of blowing up the quadrillion or so dollars of interest rate, credit, and currency derivatives hidden on bank and hedge fund balance sheets. Or push interest rates into negative territory pretty much across the developed world. Since option number one carries a statistically-significant chance of ending the modern financial era it is absolutely unacceptable to Goldman et al, and is thus a non-starter. Which leaves only option two: more of the same but bigger and badder. So…the central banks will panic. Countries that retain some control over their monetary systems will see their interest rates fall to zero and beyond, while those that don’t will be thrown into some kind of new age hyperinflationary depression. Not 2008 all over again; this is something much stranger. |

| Shock Report: China Dumps Half a Trillion Dollars: “Something Is Very, Very Wrong” Posted: 24 Jul 2015 08:30 AM PDT Forget about what stock markets are doing because that is just a diversion… Submitted by Mac Slavo, SHTFPlan: We've recently reported that China is preparing for something very big in currency markets this October. We then learned that economic models from two very well known financial forecasters are predicting that governments around the world will run into […] The post Shock Report: China Dumps Half a Trillion Dollars: "Something Is Very, Very Wrong" appeared first on Silver Doctors. |

| Global economic termites are eating away gold price foundations Posted: 24 Jul 2015 08:15 AM PDT Even an arch-traditionalist like the late Sheikh Sakhbut learnt that there were alternatives to gold. Today's investors are finding ever-fewer reasons to hold the precious metal This posting includes an audio/video/photo media file: Download Now |

| Why the Iron-Fisted Tactics of the EU Will Help Bring Its Downfall Posted: 24 Jul 2015 08:00 AM PDT When secret bankster plans, in preparation for decades, are on the line….those banksters can hardly allow pesky things like "consent of the governed" to obstruct the consolidation of power into the hands of the very few, can they? They were bound and determined to ensure that this slow-moving steamroller called the EU, continued on, without veering, […] The post Why the Iron-Fisted Tactics of the EU Will Help Bring Its Downfall appeared first on Silver Doctors. |

| The message behind the Chinese gold reserves announcement Posted: 24 Jul 2015 07:25 AM PDT I don't want to pick on Societe Generale analyst Robin Bhar, as this was representative of most of the commentary around China's gold reserves announcement, but the statement that the 1,658 tonne figure "was not unexpected. If anything, it was slightly surprising that it wasn't more, the market was looking at a figure north of 2,000 tonnes" makes the mistake of assuming that Central Bank announcements are about communicating facts. So what is the WHY driving China's gold reserves announcement? [read more] |

| India further cuts import tariff value on Gold to $354 per gram Posted: 24 Jul 2015 07:08 AM PDT The government fixed import tariff value on gold at 354 per 10 grams, down from 376 per 10 grams earlier. |

| The Misinterpretation of Money Posted: 24 Jul 2015 07:00 AM PDT The 1729 quote from Voltaire "Paper money eventually returns to its intrinsic value — zero" is as true today as ever. One of the most absurd contradictions in the 21st century is that people actually believe that fiat money has a value… Submitted by Ronan Manly, Bullionstar: In its simplest form, money is a substitution for […] The post The Misinterpretation of Money appeared first on Silver Doctors. |

| Bail-Ins Of “Big Deposits” In Greece Would Be “Extraordinarily Counter-Productive” Posted: 24 Jul 2015 06:23 AM PDT There has been little or no debate by commentators or in the media about the risks posed by bail-ins. The cosy consensus is that bail-ins are good as they allegedly protect the taxpayers from bailing out banks. As if it is a fait accompli that banks should be bailed out by anybody – taxpayers or […] The post Bail-Ins Of "Big Deposits" In Greece Would Be "Extraordinarily Counter-Productive" appeared first on Silver Doctors. |

| Posted: 24 Jul 2015 06:10 AM PDT The Daily Gold |

| Bail-Ins Of “Big Deposits” In Greece Would Be “Extraordinarily Counter-Productive” Posted: 24 Jul 2015 06:10 AM PDT gold.ie |

| Posted: 24 Jul 2015 06:00 AM PDT Simply put, gold rises when the dollar falls…and not until then. So long as the community of faithful remain captured by the dollar religion and continue to believe in the church leadership, gold will remain to them little more than a shiny relic from antiquity, and the price will reflect this sentiment. If however peoples […] The post The Second Coming Of Gold appeared first on Silver Doctors. |

| GOLD Trades Lower As Exptectd, Support At 1060-1050 Area Posted: 24 Jul 2015 02:10 AM PDT insidefutures |

| Gold Spot Intraday: The Downside Prevails. Posted: 24 Jul 2015 02:05 AM PDT forexyard |

| Posted: 24 Jul 2015 01:30 AM PDT smarteranalyst |

| Here’s Why Silver Prices Have 110% Upside in 2016 Posted: 24 Jul 2015 01:30 AM PDT profitconfidential |

| Gold Poised For Fifth Weekly Loss Posted: 24 Jul 2015 01:30 AM PDT dailyforex |

| Gold and Silver Falling, Coiling - The Slow Blues Posted: 24 Jul 2015 01:30 AM PDT marketoracle |

| Posted: 24 Jul 2015 01:30 AM PDT dailyfx |

| Gold Prices July 24, 2015, Technical Analysis Posted: 24 Jul 2015 01:05 AM PDT fxempire |

| Gold ... floats like a butterf.... no wait .... drops like a rock again Posted: 24 Jul 2015 12:55 AM PDT forexlive |

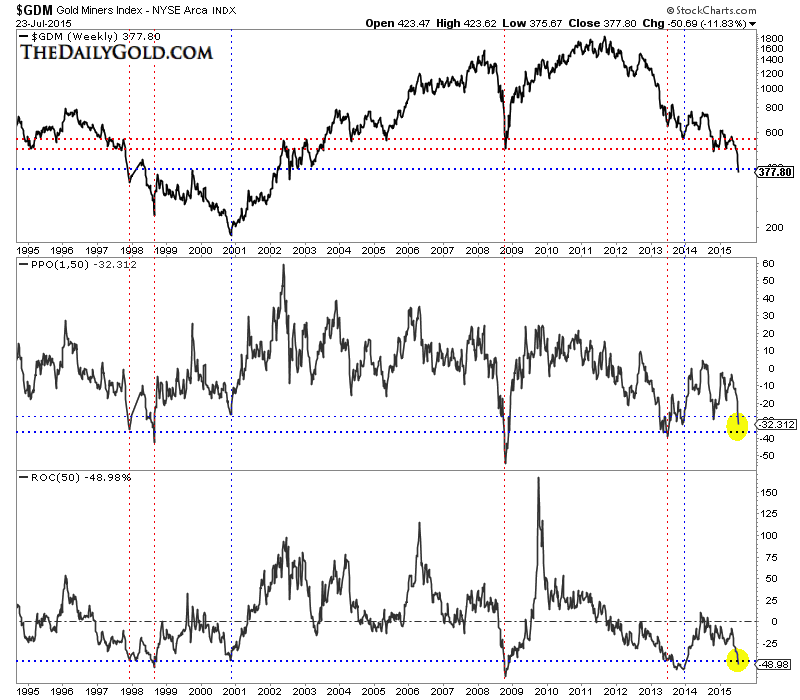

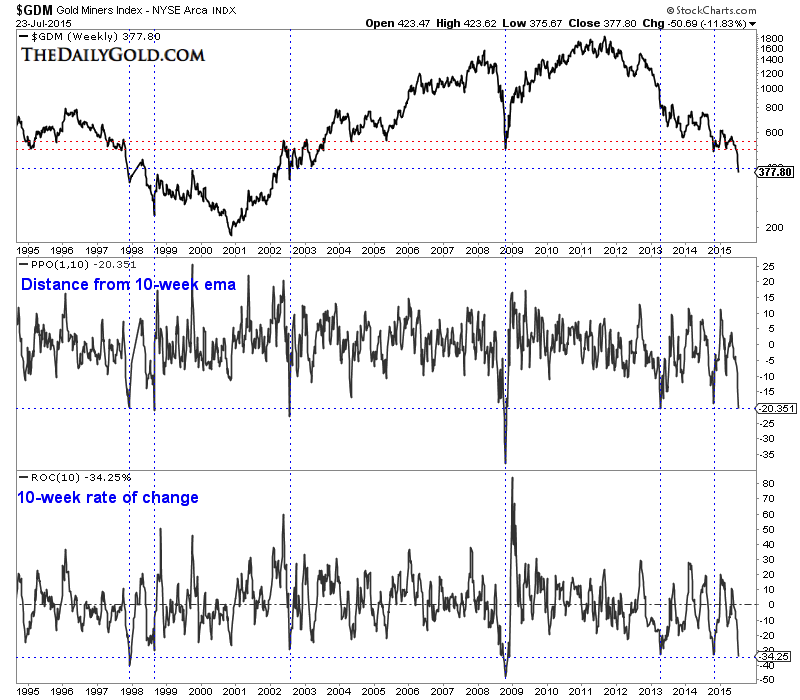

| Posted: 24 Jul 2015 12:43 AM PDT Recently we've been writing about the downside potential in precious metals and the danger for precious metals bulls. The gold miners and Silver have led the rout while Gold finally cracked support ($1140-$1150/oz) last week. That led to a severe selloff across the complex. As we pen this on Thursday evening it appears Friday could be a nasty day if Gold breaks below $1080/oz. Nevertheless, the odds now favor a rebound in the weeks ahead and especially in the gold miners. Though GDM (GDX) has closed below support at 400, it has done so in an extremely oversold state. In the first chart we plot GDM with its distance from its 50-week exponential moving average and its 50-week rate of change. If we count the two oversold instances in both 1998 and 2013 as only one then GDM is at one of its five most oversold points in the past 20 years. With a down day on Friday GDM would be at its third most oversold point in the past 17 years.

In the next chart we use the same indicators but use 10 weeks instead of 50 weeks. It gives us a medium term look. The oversold dates are nearly identical to those based on 50 weeks. If GDM has a down day on Friday to close the week then it could reach its 2nd most oversold point in the past 17 years.

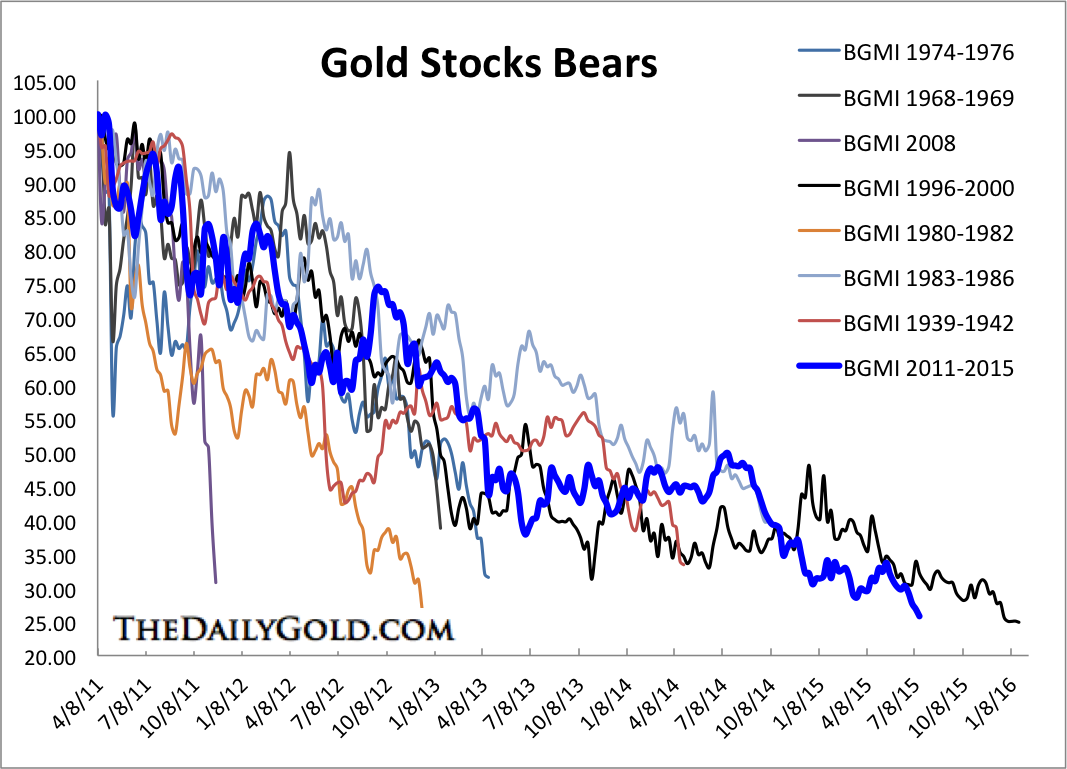

On a cyclical basis, gold mining stocks are arguably the most oversold ever. GDM and XAU have already surpassed their 1996-2000 bear markets. The next data point in the Barron's Gold Mining Index (whose bear market analog is shown below) will show the current bear surpassing that of 1996-2000. The HUI needs to close at 100 to equal its 1996-2000 bear. Any low in the gold miners weather it occurs in the coming days or next few months has a chance to mark the end of the bear market.

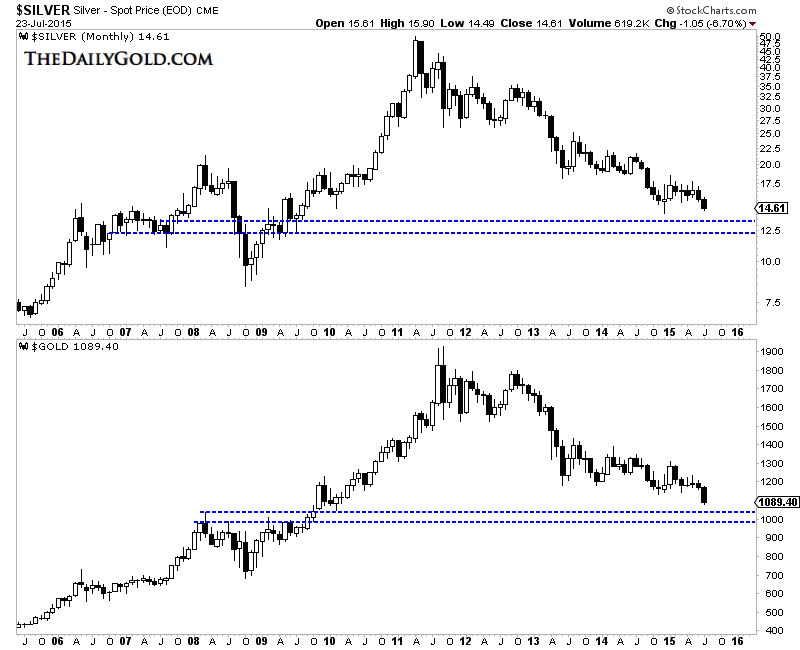

Another reason the miners are close to a rebound is Gold is (unlike in recent weeks) closer to important support. We've frequently mentioned targets of $1080/oz (50% retracement) and $1000 to $1040/oz. Below we plot the monthly candles for Silver and Gold. As we pen this article Thursday evening Gold is struggling to hold support at $1080/oz. A breakdown would create more selling but could quickly lead to a rebound from stronger support around $1040/oz.

The miners are now extremely oversold across all time frames and in position for a good rebound. Gold and Silver are not as oversold as the miners but that can certainly change within a few days. While we are unsure if the next low will mark the end of the bear market we can say that regardless, odds favor a big rebound. Consider learning more about our premium service including our favorite junior miners which we expect to outperform in the second half of 2015.

Jordan Roy-Byrne, CMT The post Gold Miners Nearing Rebound appeared first on The Daily Gold. |

| Copper, China And World Trade Are All Screaming That The Next Economic Crisis Is Here Posted: 23 Jul 2015 05:09 PM PDT

Copper is referred to as “Dr. Copper” because it does such an excellent job of indicating where economic conditions are heading next. We saw this in 2008, when the price of copper started crashing big time in the months leading up to the stock market implosion. Well, now copper is crashing again. Just check out this chart. The price of copper plunged again on Wednesday, and it is now the lowest that it has been since the last financial crisis. Unfortunately, the forecast for the months ahead is not good. The following is what Goldman Sachs is saying about copper…

It is funny that Goldman mentioned China so prominently. Even though China’s fake GDP figures say that everything is fine over there, other numbers are painting a very dismal picture. For instance, Chinese electrical consumption in June grew at the slowest pace that we have seen in 30 years, and capital outflows from China have reached a level that is “frightening”…

Just last month, the Chinese stock market started to crash, but the crash was interrupted when the Chinese government essentially declared a form of financial martial law. And I don’t think that “financial martial law” is too strong of a term to use in this case. Just consider the following excerpt from a recent article in the Telegraph…

So a stock market crash was halted, but in doing so Chinese officials have essentially destroyed the second largest stock market in the world. China’s financial markets have lost all legitimacy, and foreigners are going to be extremely hesitant to put any money into Chinese stocks from now on. Meanwhile, there is no hiding the fact that trade activity in China and in most of the rest of the planet is slowing down. In fact, world trade volume has now dropped by the most that we have seen since the last global recession. The following comes from Zero Hedge…

As you probably noted in the chart above, a decline in world trade is almost always associated with a recession. That was certainly the case back in 2008 and 2009. Another similarity between the last crisis and what is happening now is a crash in the price of oil. According to Business Insider, we have just officially entered a brand new bear market for oil…

So what does all of this mean? All of these signs are indicating that another great economic crisis is here, and that a global financial implosion is just around the corner. At this point, even many of the “bulls” are sounding the alarm. For example, just consider what Henry Blodget of Business Insider is saying…

For those that don’t know, Henry Blodget is definitely not a bear. In fact, he is one of Wall Street’s biggest cheerleaders. So for Blodget to suggest that we could see the stock market drop by half is a really big deal. The closer that we get to this next crisis, the clearer that everything is becoming. Where are things going to go from here? Please feel free to add to the discussion by posting a comment below… |

| What Blows Up Next? Part 1: Resource-Based Economies Posted: 23 Jul 2015 02:51 PM PDT The Great Recession and its aftermath was actually the best of times for countries with natural resources to sell. The US, Europe and Japan ran record deficits and cut interest rates to zero or thereabouts, sending hot money pouring into mining and energy projects around the world, while China borrowed (as it turned out) $15 trillion for an epic infrastructure build-out. The result was robust demand and high prices for raw materials like copper, oil and iron ore, and a tsunami of cash pouring into Brazil, Canada, Australia and the other resource producers. Conventional wisdom deemed these countries to be well-run and destined for ever-greater things, which led locals to borrow US dollars at cheap rates and invest in mines, factories and/or domestic government bonds with much higher yields. Good times and fat margins all around. Then it turned out that the debts accumulated by the resource-consuming economies had created a headwind that they couldn’t overcome. The Chinese build-out abruptly ended and the developed world failed to achieve escape velocity, causing the US dollar to soar and commodity prices to plunge. Oil, for instance, is down 21% just the last in last six weeks. while the Bloomberg Commodity Index is 42% below its recent high. For a sense of what this means, pretend you’re Brazil. During headier times your oil, iron ore and soybean exports created a generation of new millionaires and allowed your government to balance its budget. This in turn led your leaders to ratchet up spending and your entrepreneurs to borrow what now looks like an insane amount of US dollars. Now your currency, the real, is plunging… …while your interest rates are surging: Among other things, this gives you: a ton of dollar-denominated loans that are deeply under water and will be defaulted upon soon; plunging tax revenues necessitating huge cuts in government spending and/or much higher taxes — at exactly the wrong time; and hundreds mines and factories that aren’t generating enough cash flow to cover their cost of capital and will soon fail. Variations on this theme are playing out across the resource economy world, so depending on the country, it’s crisis now (Argentina and Venezuela) or crisis in 2016 (nearly everyone else). And that’s if everything stabilizes around these levels. Let resource prices keep falling and/or the dollar rise further and we can replace “crisis” with “chaos.” For more, see: Brazil slashes fiscal savings goals for 2015 and 2016 on plunging tax revenue The Australian dollar is smashed and poised to fall below US70 cents, analysts warn |

| Free Markets At Work - Gold and Silver Owners Per Ounce Posted: 23 Jul 2015 10:03 AM PDT Le Cafe Américain |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment