Gold World News Flash |

- Protected: Gold – What Next?

- SOMEONE IS LOADING UP ON PHYSICAL SILVER PRIOR TO SEPTEMBER

- Gold Stocks Bear Market Bottom Buying Opportunity? - Video

- What Blows Up Next? Part 1: Resource-Based Economies

- An open letter to investors who are bullish on gold

- Andrew Hoffman – It Has All Come Undone

- Will financial journalism's bear hunt lead to a dingy basement or to the BIS?

- The 'Fallout' From Fukushima Summed Up In 1 Disturbing Image

- Gold Price Rose $2.60 Closing on the Comex at $1,094.00

- Central Banks And Our Dysfunctional Gold Markets

- Hoisington On Bond Market Misperceptions: "Secular Low In Treasury Yields Still To Come"

- 15 Years After Land-Grabs, Mugabe Invites White Farmers Back To Zimbabwe

- Commodity Carnage Contagion Crushes Stocks & Bond Yields

- The Corrupt Origins of Central Banking in America | Thomas J. DiLorenzo

- Central Bankers Have Shot Their Wad (Part I)

- The West is Collapsing , Humanity is in Danger -- Harley Schlanger

- What Blows Up Next? Part 1: Resource-Based Economies

- Gold Daily and Silver Weekly Charts - Though the Heavens May Fall

- Obama just made a SHOCKING Admission!

- Mish Shedlock -- The Economy Is Declining Which Will Ultimately Lead To A Collapse

- What’s Really Killing Capitalism

- Interest Rates Collapsing Globally -- Central Bankers Panicking

- Dave Kranzler: Anti-gold propaganda reaches bubble proportions

- Don’t Vote for Trump -- Wayne Allyn Root

- Alasdair Macleod: Gold and Gibson's paradox

- Gold rout could turn into stampede out of commodity investment

- Jim’s Mailbox

- In The News Today

- Gold Will Take Off Once Market Comes to Terms With Reality

- John Stossel -- Science Wars

- Now even Reuters acknowledges gold market rigging ....

- Did Gold Stocks Just Bottom?

- Gold and Silver Falling, Coiling - The Slow Blues

- WW3 ALERT -- Iran's Spiritual Leader "Threatens Israel" Of Missile Launches

- Marcia Christoff-Kurapovna: Central banks and our dysfunctional gold markets

- Prophetic Money: China Capital Exodus Of $800 Bn

- The Echo Housing Bubble Could Be About to Burst

- Commodity Prices, Gold and Silver Stocks Next Leg Down

- Gold and Gibson's Paradox

- Gold Price Smash Leads to Surge in Demand For Coins, Bars Around World

- Luisa Moreno Explains Why Metallurgy Is So Important in Critical Metals Projects

- Gold: Identity Theft

- Free Markets At Work - Gold and Silver 'Owners Per Ounce'

| Posted: 24 Jul 2015 12:27 AM PDT There is no excerpt because this is a protected post. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SOMEONE IS LOADING UP ON PHYSICAL SILVER PRIOR TO SEPTEMBER Posted: 23 Jul 2015 11:30 PM PDT by Jeff Berwick, Dollar Vigilante:

We won't get into the fine details of what he reported here as it gets very technical… but if you are interested you can see his article. But, to summarize, an unknown party is unexpectedly taking delivery of an unprecedented amount of physical silver this month at the Comex. According to Hemke, "… the Comex is on pace to deliver an additional 700+ over the course of the month? At 5,000 ounces/contract, that means someone or something has ponied up about $50,000,000 in order to "jump the queue" and take immediate delivery of 3,500,000 ounces of silver this month." | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Stocks Bear Market Bottom Buying Opportunity? - Video Posted: 23 Jul 2015 10:52 PM PDT The early year gold price rally soon peaked in mid January 2015 at $1307 that had fooled many gold bugs into assuming that the preceding multi-year bear market was finally over and that 2015 would see a strong price rally to possibly even new all time highs! However, so far 2015 has seen a series of failed rally's rolling over into downtrends to new lows, punctuated by flash crash days such as that which took place on the 19th of July that saw a series of flash crashes that lasted no more than a couple of seconds that took the gold price to well under $1,100, to a new five year low of $1080 before recovering a little to $1,100. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| What Blows Up Next? Part 1: Resource-Based Economies Posted: 23 Jul 2015 10:30 PM PDT by John Rubino, Dollar Collapse:

The result was robust demand and high prices for raw materials like copper, oil and iron ore, and a tsunami of cash pouring into Brazil, Canada, Australia and the other resource producers. Conventional wisdom deemed these countries to be well-run and destined for ever-greater things, which led locals to borrow US dollars at cheap rates and invest in mines, factories and/or domestic government bonds with much higher yields. Good times and fat margins all around. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| An open letter to investors who are bullish on gold Posted: 23 Jul 2015 10:01 PM PDT [Ed. Note: Well, there you have it from Howard and his MSM buddies: Gold totally sucks, and you probably want to get rid of any you own and buy up all the stocks and bonds you can get your hands on] by Howard Gold, Market Watch:

For some years, I have watched with puzzlement as you held on to gold out of deep affection and conviction. Gold clearly peaked above $1,900 an ounce back in 2011. Since then, its trend has been down, with a few rallies you must have found reassuring. But on Monday, gold tumbled to around $1,100 an ounce, its lowest price in five years. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Andrew Hoffman – It Has All Come Undone Posted: 23 Jul 2015 09:20 PM PDT from FinancialSurvivalNetwork.com:

Greece Click Here to Listen | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Will financial journalism's bear hunt lead to a dingy basement or to the BIS? Posted: 23 Jul 2015 06:47 PM PDT 10:14p ET Thursday, July 23, 2015 Dear Friend of GATA and Gold: Zero Hedge tonight mocks the purported search by mainstream financial news organizations for the instigator of Sunday night's nuclear assault on the gold market, and concludes that the trail will lead either to some Indian guy trading out of the dingy basement of his parents' home in a London suburb or to the luxurious offices of the Bank for International Settlements in Basel, Switzerland, the central bank of the central banks. Of course mainstream financial news organizations would sooner interview Kim Kardashian about the gold market than ever have to direct a critical question about gold to the BIS or any other central bank. Zero Hedge's commentary is headlined "The Hunt for the 'Mystery' Gold 'Bear Raid' Leader Begins" and it's posted here: http://www.zerohedge.com/news/2015-07-23/hunt-mystery-gold-bear-raid-lea... But anyone who wants to know about the BIS doesn't really have to question it much at all, as the documentation of its involvement in the gold market are on the public record already. ... Dispatch continues below ... ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. For at a BIS conference in Basel in June 2005, the director of the bank's monetary and economic department, William R. White, declared that among the major objectives of central bank cooperation is "the provision of international credits and joint efforts to influence asset prices (especially gold and foreign exchange) in circumstances where this might be thought useful": Every year, in its footnotes, the annual report of the BIS acknowledges that it functions largely as the gold broker for its member central banks and on their behalf deals in gold, gold futures, and gold swaps: http://www.gata.org/node/12717 Its gold brokerage services for central banks, the BIS told a seminar for prospective central bank members in June 2008, include surreptitious interventions in the gold market: http://www.gata.org/node/11012 In 1983 top officials of the BIS told the financial journalist Edward Jay Epstein, writing for Harper's magazine, that secret interventions in the gold market were a major part of the bank's work: And in recent years CME Group, operator of the major futures exchanges in the United States, has offered discounts to central banks for their secret trading in all major futures contracts and has acknowledged that central banks and governments are among the exchange operator's customers: http://www.gata.org/node/14385 http://www.gata.org/node/14411 For journalistic purposes, all the basic research has been done and there is nothing left to do but call the BIS and its member central banks and routinely collect their refusals to comment about their secret trading in the futures markets. No one will have to call the Banque de France, for its director of market operations already has confirmed that the bank is trading gold secretly for its own account and for the accounts of other central banks and never explains what it's doing: http://www.gata.org/node/13373 http://www.gata.org/node/14716 http://www.gata.org/node/14954 This is why all analysis of the gold market is simply disinformation if it does not begin with four questions: -- Are central banks in the gold market surreptitiously or not? -- If central banks are in the gold market surreptitiously, is it just for fun -- for example, to see which central bank's trading desk can make the most money by cheating the most investors -- or is it for policy purposes? -- If central banks are in the gold market for policy purposes, are these the traditional purposes of defeating a potentially competitive world reserve currency, or have these purposes expanded? -- If central banks, creators of infinite money, are surreptitiously trading a market, how can it be considered a market at all, and how can any country or the world ever enjoy a market economy again? Once again tonight this documentation will be sent to many major financial news organizations around the world. Of course it has been sent to them many times already and they have ignored it studiously. But if you are not yet completely demoralized about living on a planet that is quickly succumbing to totalitarianism, send this dispatch to some of them yourself and ask cordially why the documentation cited is not worthy of their inquiry. You just might shame somebody for the aspirations he had when he got into journalism. If you receive a response from anyone, please forward it to me. Maybe we can shame him some more. Don't be discouraged. This is the only planet we have; we have nowhere else to go. You can make a difference. Take it from James Russell Lowell: We see dimly in the present what is small and what is great, We'll press on in the morning. CHRIS POWELL, Secretary/Treasurer Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The 'Fallout' From Fukushima Summed Up In 1 Disturbing Image Posted: 23 Jul 2015 05:45 PM PDT If this is what is happening to a daisy now... good luck to the Olympic athletes in 5 years...

Four years after the disastrous 2011 earthquake, subsequent tsunami, and Fukushima nuclear meltdown, this small patch of deformed daisies suggests all is not well no matter what Abe tells the world...

We are sure everything is fine.. apart from

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Rose $2.60 Closing on the Comex at $1,094.00 Posted: 23 Jul 2015 05:39 PM PDT

Not even a nat'ral born durned fool running his loose jawed mouth at top speed could find anything to say about that. Silver and GOLD PRICES are trading sideways, in a downward trend. Until they either break down further, or signal an undeniable reversal up, 'tain't nothing to say. Silver and gold prices need to post some sort of reversal day: a spike down with a higher close, or a big one-day jump. I doubt they'll sneak up off these lows. True, the gold/silver ratio did rise today, but yesterday it nearly touched the 50 day moving average below (73.45). Today it cut into the 20 DMA above (75.15), but closed well below it. So far it doesn't threaten to rise significantly. Stocks took a big hit and have now erased all the gains of the last eight days. (I am manfully resisting the temptation to say those hateful words, "I told y'all so.") Dow Industrials lost 119.12 (0.67%) to close at 17,731.92. S&P500 stumbled 12 points (0.57%) to stop at 2,102.15. Dow has ducked under its 200 DMA (17,744) again, although the S&P 500 has only today closed below its 50 DMA (2,102) and remains way above its 2,063 200 DMA. Momentum indicators have rolled over away from heaven and toward the dirt.

West Texas Intermediate Crude broke down out of a flat bottomed triangle, but only 0.73% so far, to $48.85. Copper dropped 2.10% to a new low for the year at $2.36. Bloomberg Commodity Index dropped out of a falling right triangle, too, by about 1%. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2015, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Central Banks And Our Dysfunctional Gold Markets Posted: 23 Jul 2015 05:15 PM PDT Submitted by Marcia Christoff-Kurapova via The Mises Institute, Many investors still view gold as a safe-haven investment, but there remains much confusion regarding the extent to which the gold market is vulnerable to manipulation through short-term rigged market trades, and long-arm central bank interventions. First, much of the gold that is being sold as shares, in certificates, or for physical hoarding in dubious "vaults" just isn't there. Second, paper gold can be printed into infinity just like regular currency. Third, new electronic gold pricing — replacing, as of this past February, the traditional five-bank phone-call of the London Gold Fix in place since 1919 — has not necessarily proved a more trustworthy model. Fourth, there looms the specter of the central bank, particularly in the form of volume trading discounts that commodity exchanges offer them. The Complex World of Gold InvestmentsThe question of rigging has been brought to media attention in the past few months when ten banks came under investigation by the US Commodity Futures Trading Commission (CFTC) and the US Department of Justice in price-manipulation probes. Also around that time, the Swiss regulator FINMA settled a currency manipulation case in which UBS was accused of trading ahead of silver-fix orders. Then, the UK Financial Conduct Authority, which regulates derivatives, ordered Barclays to pay close to $45 million in fines against a trader who artificially suppressed the price of gold in 2012 to avoid payouts to clients. Such manipulations are not limited to the precious-metals market: in November of last year, major banks had to pay several billion dollars in fines related to the rigging of foreign-exchange benchmarks, including LIBOR and other interest-rate benchmarks. These cases followed on the heels of a set of lawsuits in May 2014 filed in New York City in which twenty-five plaintiffs consisting of hedge funds, private citizens, and public investors (such as pension funds) sued HSBC, Barclays, Deutsche Bank, Bank Scotia, and Société Génerale (the five traditional banks of the former London Gold Fix) on charges of rigging the precious-metals and foreign-exchange markets. "A lot of conspiracy theories have turned out to be conspiracy fact," said Kevin Maher, a former gold trader in New York who filed one of the lawsuits that May, told The New York Times. Central Banks at the Center of Gold MarketsThe lawsuits were given more prominence with the introduction of the London Bullion Market Association (LBMA) on February 20, 2015. The new price-fixing body was established with seven banks: Goldman Sachs, J.P. Morgan, UBS, HSBC, Barclays, Bank Scotia and Société Génerale. (On June 16, the Bank of China announced, after months of speculation, that it would join.) While some economists have deemed the new electronic fix a good move in contrast to behind-closed-door, phoned-in price-fixing, others beg to differ. Last year, the commodities exchange CME Group came under scrutiny for allowing volume trading discounts to central banks, raising the question of how "open" electronic pricing really is. Then, too, the LBMA is itself not a commodities exchange but an Over-The-Counter (OTC) market, and does not publish — does not have to publish — comprehensive data as to the amount of metal that is traded in the London market. According to Ms. Ruth Crowell, the chairman of LBMA, writing in a report to that group: "Post-trade reporting is the material barrier preventing greater transparency on the bullion market." In the same report, Crowell states: "It is worth noting that the role of the central banks in the bullion market may preclude 'total' transparency, at least at the public level." To its credit, the secretive London Gold Fix (1919–2015) featured on its website tracking data of the daily net volume of bars traded and the history of gold trades, unlike current available information from the LBMA as one may see here (please scroll down for charts). The Problem with Paper GoldThere is further the problem of what is being sold as "paper" gold. At first glance, that option seems a good one. Gold exchange-traded funds (ETFs), registered with The New York Stock Exchange, have done very well over the past decade and many cite this as proof that paper gold, rather than bars in hand, is just as sure an investment. The dollar price of gold rose more than 15.4 percent a year between 1999 and December 2012 and during that time, gold ETFs generated an annual return of 14 percent (while equities registered a loss). As paper claims on trusts that hold gold in bank vaults, ETFs are for many, preferable to physical gold. Gold coins, for instance, can be easily faked, will lose value when scratched, and dealers take high premiums on their sale. The assaying of gold bars, meanwhile, with transport and delivery costs, is easy for banking institutions to handle, but less so for individuals. Many see them as trustworthy: ETF Securities, for example, one of the largest operators of commodity ETFs with $21 billion in assets, stores their gold in Zurich, rather than in London or Toronto. These last two cities, according to one official from that company, "could not be trusted not to go along with a confiscation order like that by Roosevelt in 1933." Furthermore, shares in these entities represent only an indirect claim on a pile of gold. "Unless you are a big brokerage firm," writes economist William Baldwin, "you cannot take shares to a teller and get metal in exchange." ETF custodians usually consist of the likes of J.P. Morgan and UBS who are players on the wholesale market, says Baldwin, thus implying a possible conflict of interest. Government and Gold After 1944: A Love-Hate RelationshipStill more complicated is the love-hate relationship between governments and gold. As independent gold analyst Christopher Powell put it in an address to a symposium on that metal in Sydney, October 2013: "It is because gold is a competitive national currency that, if allowed to function in a free market, will determine the value of other currencies, the level of interest rates and the value of government bonds." He continued: "Hence, central banks fight gold to defend their currencies and their bonds." It is a relationship that has had a turbulent history since the foundation of the Bretton Woods system in 1944 and up through August 1971, when President Nixon declared the convertibility of the dollar to gold suspended. During those intervening decades, gold lived a kind of strange dual existence as a half state-controlled, half free market-driven money-commodity, a situation that Nobel Prize economist Milton Friedman called a "real versus pseudo gold standard." The origin of this cumbersome duality was the post-war two-tiered system of gold pricing. On the one hand, there was a new monetary system that fixed gold at $35 an ounce. On the other, there was still a free market for gold. The $35 official price was ridiculously low compared to its free market variant, resulting in a situation in which IMF rules against dealing in gold at "free" prices were circumvented by banks that surreptitiously purchased gold from the London market. The artificial gold price held steady until the end of the sixties, when the metal's price started to "deny compliance" with the dollar. Still, monetary doctrine sought to keep the price fixed and, at the same time, to influence pricing on the free market. These attempts were failures. Finally, in March 1968, the US lost more than half its reserves, falling from 25,000 to 8,100 tons. The price of other precious metals was allowed to move freely. Gold Retreats Into the ShadowsMeawhile, private hoarding of gold was underway. According to The Financial Times of May 21, 1966, gold production was rising, but it was not going to official gold stocks. This situation, in turn, fundamentally affected the gold clauses of the IMF concerning repayments in currency only in equal value to the gold value of such at the time of borrowing. This led to a rise in "paper gold planning" as a substitution for further increases in IMF quotas. (Please see "The Paper Gold Planners — Alchemists or Conjurers?" in The Financial Analysts Journal, Nov–Dec 1966.) By the late 1960s, Vietnam, poverty, the rise in crime and inflation were piling high atop one another. The Fed got to work doing what it does best: "Since April [1969]," wrote lawyer and economist C. Austin Barker in a January 1969 article, "The US Money Crisis," "the Fed has continually created new money at an unusually rapid rate." Economists implored the IMF to allow for a free market for gold but also to set the official price to at least $70 an ounce. What was the upshot of this silly system? That by 1969 Americans were paying for both higher taxes and inflation. The rest, as they might say, is the history of the present. Today, there is no “official” price for gold, nor any “gold-exchange standard” competing with a semi-underground free gold market. There is, however, a material legacy of “real versus pseudo” gold that remains a terrible menace. Buyer beware of the pivotal difference between the two.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hoisington On Bond Market Misperceptions: "Secular Low In Treasury Yields Still To Come" Posted: 23 Jul 2015 04:15 PM PDT Submitted by Hoisington Investment Management's Lacy Hunt via MauldinEconomics.com, Misperceptions Create Significant Bond Market ValueFrom the cyclical monthly high in interest rates in the 1990-91 recession through June of this year, the 30-year Treasury bond yield has dropped from 9% to 3%. This massive decline in long rates was hardly smooth with nine significant backups. In these nine cases yields rose an average of 127 basis points, with the range from about 200 basis points to 60 basis points (Chart 1). The recent move from the monthly low in February has been modest by comparison. Importantly, this powerful 6 percentage point downward move in long-term Treasury rates was nearly identical to the decline in the rate of inflation as measured by the monthly year-over-year change in the Consumer Price Index which moved from just over 6% in 1990 to 0% today. Therefore, it was the backdrop of shifting inflationary circumstances that once again determined the trend in long-term Treasury bond yields. In almost all cases, including the most recent rise, the intermittent change in psychology that drove interest rates higher in the short run, occurred despite weakening inflation. There was, however, always a strong sentiment that the rise marked the end of the bull market, and a major trend reversal was taking place. This is also the case today. Presently, four misperceptions have pushed Treasury bond yields to levels that represent significant value for long-term investors. These are:

Rebounding Economy and Higher YieldsThe most widely held view of these four misperceptions is that the poor performance of the U.S. economy thus far in 2015 is due to transitory factors. As those conditions fade, the economy will strengthen, sparking inflation and causing bond yields to move even higher. The premise is not compelling, as there is solid evidence of a persistent shift towards lower growth. Industrial output is expected to decline more in the second quarter than the first. This will be the only back-to-back decrease in industrial production since the recession ended in 2009 (Chart 2). Any significant economic acceleration is doubtful without participation from the economy’s highest value-added sector. To be sure, the economy recorded higher growth in the second quarter, but that was an easy comparison after nominal and real GDP both contracted in the first quarter. Adding to a weak manufacturing sector, other fundamentals continue to indicate that top- line growth will not accelerate further this year, and inflation will be contained. M2 year-over-year growth has slipped below the growth rates that prevailed at year-end. The turnover of that stock of money, or velocity, is showing a sharp deceleration. Presently M2 velocity is declining at a 3.5% annual rate, and there are signs that it may decline even faster. If growth in M2 or velocity subsides much further, then nominal GDP growth is unlikely to reach the Fed’s recently revised forecast of 2.6% this year (M*V=Nominal GDP). At year-end 2014 the Fed was forecasting nominal GDP growth to accelerate to 4.1% this year, compared with 3.7% and 4.6% actual increases in 2014 and 2013, respectively. In six months the Fed has once again been forced to admit it's error and has massively lowered its forecast of nominal growth to 2.6%. Additionally, the Fed formerly expected a 2.8% increase in real GDP and now anticipates only a 1.9% increase in 2015, down from 2.4% and 3.1% in 2014 and 2013, respectively. The inflation rate forecast was also lowered by 60 basis points. Transitory increases in long Treasury bond yields are not likely to be sustained in an environment of a pronounced downward trend in growth in both real and nominal GDP. However the expectation of lower long rates is also bolstered by the well-vetted economic theory of “the Wicksell effect” (Knut Wicksell 1851-1926). Wicksell suggested that when the market rate of interest exceeds the natural rate of interest funds are drained from income and spending to pay the financial obligations of debtors. Contrarily, these same monetary conditions support economic growth when the market rate of interest is below the natural rate of interest as funds flow from financial obligations into spending and income. The market rate of interest and the natural rate of interest must be very broad in order to capture the activities of all market participants. The Baa corporate bond yield, which is a proxy for a middle range borrowing risk, serves the purpose of reflecting the overall market rate of interest. The natural rate of interest can be captured by the broadest of all economic indicators, the growth rate of nominal GDP. In comparing these key rates it is evident that the Wicksell effect has become more of a constraint on growth this year. For instance, the Baa corporate bond yield averaged about 4.9% in the second quarter. This is a full 230 basis points greater than the gain in nominal GDP expected by the Fed for 2015. By comparison, the Baa yield was only 70 basis points above the year-over-year percent increase in nominal GDP in the first quarter. To explain the adverse impact on the economy today of a 4.8% Baa rate verses a nominal GDP growth rate of 2.6% consider a $1 million investment financed by an equal amount of debt. The investment provides income of $26,000 a year (growth rate of nominal GDP), but the debt servicing (i.e. the interest on Baa credit) is $48,000. This amounts to a drain of $22,000 per million. Historically the $1 million investment would, on average, add $2,500 to the annual income spending stream. Over the past eight decades, the Wicksell spread averaged a negative 25 basis points (Chart 3). Since 2007 however, the market rate of interest has been persistently above the natural rate, and we have experienced an extended period of subpar economic performance. Also, during these eight years the economy has been overloaded with debt as a percent of GDP and, unfortunately, too much of the wrong type of debt. The ratio of public and private debt moved even higher over the past six months suggesting that the Wicksell effect is likely to continue enfeebling monetary policy and restraining economic growth and inflation. Cost Push Inflation Means Higher YieldsThe second misperception is more subtle. The suggestion is that higher health care and/or wage costs will force inflation higher. It follows, therefore, that Treasury bond yields will rise as they are heavily influenced by inflationary expectations and conditions. Further, this higher inflation will cause the Fed to boost the federal funds rate. Some argue that health care insurance costs are projected to rise very sharply, with some companies indicating that premiums will need to rise more than 50% due to the Affordable Care Act. Even excluding the extreme increases in medical insurance costs, many major carriers have announced increases of 20% or more. Others argue that the six-year low in the unemployment rate will cause wage rates to accelerate. Four considerations cast doubt on these cost- push arguments. First, increases in costs for medical care, which has inelastic demand, force consumers to cut expenditures on discretionary goods with price elastic demand. Goods with inelastic demand do not have many substitutes while those with elastic demand have many substitutes. When an economy is experiencing limited top-line growth, as it is currently, the need to make substitute-spending preferences is particularly acute. Thus, discretionary consumer prices are likely to be forced lower to accommodate higher non-discretionary costs, leaving overall inflation largely unchanged. Second, alternative labor market measures indicate substantial slack remains and evidence is unconvincing that wage rates are currently rising to any significant degree. The U.S. Government Accountability Office (GAO) released a report that looks at the “contingent workforce” (Wall Street Journal, May 28, 2015). These are workers who are not full-time permanent employees. In the broadest sense, the GAO found these workers accounted for 40.4% of the workforce in 2010, up from 35.3% in 2006. The GAO found that this growth mainly results from an increase in permanent part-timers, a category that grew as employers reduced hours and hired fewer full-time workers. The GAO also said that the actual pay earned was nearly 50% less for a contingent worker than a person with a steady full time job. The process portrayed in the study undermines the validity of the unemployment rate as an indicator because a person is counted as employed if they work as little as one hour a month. Additionally there is an upward bias on average hourly earnings due to the difference in hours worked between full-time and contingent workers. Third, corporate profits and closely aligned productivity measures are more consistent with declining, rather than strengthening, wage increases. After peaking in the third quarter of 2013, profits after tax and adjusted for inventory gains/losses and over/under depreciation have fallen by 16% (Chart 4). Over the past four years, nonfarm business productivity increased at a mere 0.6% annual rate, the slowest pace since the early 1980s. A significant wage increase would cut substantially into already thin profits as top-line growth is decelerating, and the dollar hovers close to a 12.5 year high. Together the profits and productivity suggest that firms need to streamline operations, which would entail reducing, rather than expanding, employment costs. Fourth, experience indicates inflationary cycles do not start with rising cost pressures. Historically, inflationary cycles are characterized by “a money, price and wage spiral” and in that order. In other words, money growth must accelerate without an offsetting decline in the velocity of money. When this happens, aggregate demand pulls prices higher, which, in turn, leads to faster wage gains. The upturn leads to a spiral when the higher prices and wages are reinforced by another even faster growth in money not thwarted by velocity. Current trends in money and velocity are not consistent with this pattern and neither are prices and wages. Normalizing the Federal Funds RateA third argument is that the Fed needs to normalize rates, and as they do this, yields will also rise along the curve. It is argued the Fed has held the federal funds rate at the zero bound for a long time with results that are questionable, if not detrimental, to economic growth. Proponents for this argue that the zero bound may have resulted in excessive speculation in stocks and other assets. This excess liquidity undoubtedly boosted returns in the stock market, but the impact on economic activity was not meaningful. At the same time, the zero bound and the three rounds of quantitative easing reduced income to middle and lower range households who hold the bulk of their investments in the fixed income markets. Thus, to reverse the Fed’s inadvertent widening of the income and wealth divide, the economy will function better with the federal funds rate in a more normal range. Also, by raising short-term rates now, the Fed will have room to lower them later if t he economy worsens. Normalization of the federal funds rate is widely accepted as a worthwhile objective. However, achieving normalization is not without its costs. In order to increase the federal funds rate, the Fed will raise the interest rate on excess reserves of the depository institutions (IOER). Also, the Fed will have to shrink the $2.5 trillion of excess reserves owned by the depository institutions by conducting reverse repurchase agreements. This is in addition to operations needed to accommodate shifts in excess reserves caused by fluctuations in operating factors, such as currency needs of the non- bank public, U.S. Treasury deposits at the Fed and Federal Reserve float. If increases in the IOER do not work effectively, the Fed will then need to sell outright from its portfolio of government securities, causing an even more significant impact out the yield curve. The Fed’s portfolio has close to a seven-year average maturity. A higher federal funds rate and reduced monetary base would place additional downward pressure on both money growth and velocity, serving to slow economic activity. Productivity of debt has a far more important influence on money velocity than interest rates. Nevertheless, higher interest rates would cause households and businesses to save more and spend less, which, in turn, would work to lower money velocity. Such a policy consequence is highly unwelcome since velocity fell to a six decade low in the first quarter and another drop clearly appears to have occurred in the second quarter. These various aspects of the Fed’s actions would, all other things being equal, serve to reduce liquidity to the commodity, stock and foreign exchange markets while either placing upward pressure on interest rates or making them higher than otherwise would be the case. Stock prices and commodity prices would be lower than they otherwise. In addition the dollar would be higher than otherwise would be the case deepening the deficit between imports and exports of goods and services. Increases in the federal funds rate would be negative for economic activity. As the Fed’s restraining actions become apparent, however, the Fed could easily be forced to lower the federal funds rate, making increases in market interest rates temporary. The predicament the Fed is in is one that could be anticipated based on the work of the late Robert K. Merton (1910-2003). Considered by many to be the father of modern day sociology, he was awarded the National Medal of Science in 1994 and authored many outstanding books and articles. He is best known for popularizing, if not coining, the term “unanticipated consequences” in a 1936 article. He also developed the “theory of the middle range”, which says undertaking a completely new policy should proceed in small steps in case significant unintended problems arise. As the Fed’s grand scale experimental policies illustrate, anticipating unintended consequences of untested policies is an impossible task. For that reason policy should be limited to conventional methods with known outcomes or by untested operations only when taken in small and easily reversible increments. Bond Market BubbleThe final argument contends that the Treasury bond market is in a bubble, and like all manias, it will burst at some point. In The New Palgrave, Charles Kindleberger defined a bubble up as ..." a sharp rise in the price of an asset or a range of assets in a continuous process, with the initial rise generating expectations of further rises and attracting new buyers". The aforementioned new buyers are more interested in profits from “trading the asset than its use or earnings capacity”. For Kindleberger the high and growing price is unjustified by fundamental considerations. In addition Kindelberger felt that the price gains were fed by ‘momentum’ investors who buy, usually with borrowed funds, for the sole purpose of selling to others at a higher price. For Kindleberger, a large discrepancy between the fundamental price and the market price reflected excessive debt increases. This condition is referred to as “overtrading”. At some point, perhaps after a prolonged period of time, astute investors will begin to recognize the gap between market and fundamental value. They will begin to sell assets financed by debt, or their creditors may see this gap and deny the speculators credit. Charles Kindleberger called this process “discredit”. For Kindleberger, the word discredit was designed to capture the process of removing some of the excess debt creation. The phase leads into the popping of the bubble and is called “revulsion”. The issue in determining whether or not a bubble exists is to determine what constitutes fundamental value. For stocks this is generally considered to be after-tax earnings, cash flow or some combination of the two and the discount rate to put these flows in present value terms. Most experts who have addressed this issue of economic fundamentals have confined their analysis to assets like stocks or real estate. In the Palgrave article Kindelberger did not specifically cover the case of bonds. We could not find discussions by well- recognized scholars that explicitly defined a Treasury bond value or a market bubble. The reason is that there is no need. To be consistent with well-established and thoroughly vetted theory, the economic value of long-term Treasury bonds is determined by the relationship between the nominal yield and inflationary expectations, or the real yield. To assess the existence of a Treasury bond bubble one must evaluate the existing real yield in relation to the historic pattern of real yields. If the current real yield is well above the long-term historic mean then the Treasury bond market is not in a bubble. However, if the current real yield is significantly below this mean, then the market is in a bubble. By this standard, the thirty-year Treasury bond is far from a bubble. In the past 145 years, the real long bond yield averaged 2.1%. At a recent nominal yield of 3.1% with a year over year increase in inflation of 0.1%, the real yield stands at 3%, 50% greater value than investors have, on average, earned over the past 145 years. Indeed, the real yield is virtually the same as in 1990 when the nominal bond yield was 9%. Contrary to the Treasury bond market being in a bubble, errant concerns about inflation or other matters have created significant value for this asset class. ConclusionIn summary, economic theory and history do not suggest the secular low in inflation, or that its alter ego, Treasury bond yields, is at hand. The excessive debt burden, slow money growth, declining money velocity, the Wicksell effect and the high real rate of interest indicate that the fundamental elements are exerting downward, rather than upward, pressure on inflation. Inflation will not trough as long as the US economy continues to become even more indebted. While Treasury bond yields have repeatedly shown the ability to rise in response to a multitude of short-run concerns that fade in and out of the bond market on a regular basis, the secular low in Treasury bond yields is not likely to occur until inflation troughs and real yields are well below long-run mean values. We therefore continue to comfortably hold our long-held position in long-term Treasury securities. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 15 Years After Land-Grabs, Mugabe Invites White Farmers Back To Zimbabwe Posted: 23 Jul 2015 03:45 PM PDT File this one away in the "when populism backfires" folder. A little over a month after announcing that the Zimbabwean dollar - which, you're reminded, was phased out in 2009 after inflation rose modestly to 500 billion percent - would be demonetized and exchanged at a generous rate of $5 for every 175 quadrillion, Zimbabwe will for the first time rethink the sweeping land grabs which began in 2000 and subsequently crippled the country's economy. Many Zimbabwean farmers who have stopped growing food in favor of "green gold" (tobacco) fear they will starve this winter after a severe drought and a generalized "lack of knowledge" left them with a subpar crop that fetched little at auction. Here's more from Rueters:

Against this rather dreary backdrop, the government is beginning to reconsider its stance towards white farmers and will, according to The Telegraph, "give official permission for some whites to stay on their land." Via The Telegraph:

And so once again we see that necessity (a food shortage) breeds invention (rethinking populist land grabs), but lest anyone should believe that Mugabe has done a complete 180, we'll close with the following advice given to supporters at a recent Patriotic Front rally:

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commodity Carnage Contagion Crushes Stocks & Bond Yields Posted: 23 Jul 2015 03:30 PM PDT Summing up Mainstream media today...

Where to start... Bonds - Good!

Stocks - Bad!

Commodities - Ugly! * * * Everything was red in equity index land today... Trannies worst day since January

Stocks are all red for the week... Dow is down over 400 points from Monday's highs back below its 200DMA; S&P 500 cash is back below its 50DMA; and Russell 2000 broke below its 50 & 100DMA

Financials have given up their earlier week gains (as rates flatten) and only builders remain green on the week...

Leaving The Dow red for 2015...

52-Week Lows are at their highest since 2014...

On the week, the Treasury complex is seeing major flattening as the long-end collapses while short-end lifts on rate hike expectations...

With 30Y retracing all "Greece is fixed" weakness...

With 2s30s near 3 month flats...

Maybe all that NIM hope is overprices after all...

The US Dollar leaked lower on the day as EUR strengthened and cable weakened...

Summing up th edetails across the FX space (courtesy of ForexLive)

But that did nothing to support commodities...

Copper now at 6 year lows

And front-month crude getting close to cycle lows...

* * * Scotiabank's Guy Haselmann provides some more ominous color...

* * * Charts: Bloomberg Bonus Chart: Protection costs are dramatically diverging between credit and stocks... As Bloomberg notes, the last time the VIX diverged from high-yield CDS this much was in August 2013, when investors were anticipating the Federal Reserve would start reducing its quantitative easing program. The equity volatility gauge jumped more than 70 percent in the next two months as the S&P 500 lost as much as 4.6 percent.

Bonus Bonus Chart: The real fear index is the most complacent since before Lehman... (details on Implied Correlation here) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Corrupt Origins of Central Banking in America | Thomas J. DiLorenzo Posted: 23 Jul 2015 03:30 PM PDT Mises University is the world's leading instructional program in the Austrian School of economics, and is the essential training ground for economists who are looking beyond the mainstream. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

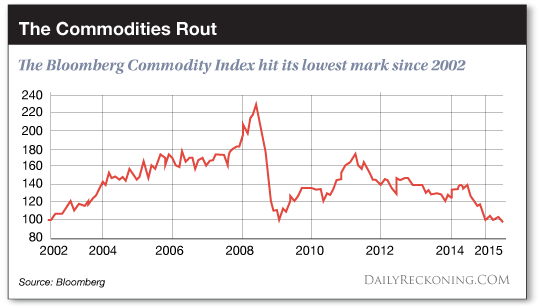

| Central Bankers Have Shot Their Wad (Part I) Posted: 23 Jul 2015 03:11 PM PDT This post Central Bankers Have Shot Their Wad (Part I) appeared first on Daily Reckoning. There has been a lot of chatter in recent days about the plunge in commodity prices. It was capped off by this week's slide of the Bloomberg commodity index to levels not seen since 2002. That epochal development is captured in the chart below. But most of the media gumming about the rapidly accelerating "commodity crunch" misses the essential point: The central banks of the world have shot their wad. The 12-year round trip depicted in the chart is not about the end of some nebulous "commodity supercycle" that arrived from out of the blue after the turn of the century. Nor is it evidence of the Keynesians' purported global shortage of "aggregate demand" that can be remedied by even more central bank monetary stimulus. No, the Bloomberg Commodity Index is a slow motion screen shot depicting the massive intrusion of worldwide central bankers into the global economic and financial system. Their unprecedented spree of money printing took the aggregate global central bank balance sheet from $3 trillion to $22 trillion over the last 15 years. The consequence was a deep and systematic falsification of financial prices on a planet-wide scale. This unprecedented monetary shock generated a double-pumped economic boom. First it took the form of an artificial debt-fueled consumption spree and then a sequel of massive malinvestment. Now comes the deflationary aftermath. Soon there will follow a plunge in corporate profits and collapsing prices among the vastly inflated risk asset classes which surfed these phony booms. It's worth recounting how we got here. In the first phase, central banks engineered a massive wave of household borrowing, consumption and housing spending in the developed market (DM) economies. That, in turn, ignited an export manufacturing boom in China and in its caravan of Emerging Market (EM) suppliers. This China and EM export boom eventually over-taxed the world's existing capacity to supply the raw materials required by a booming industrial economy. These included hydrocarbons, iron ore, met coal, aluminum, copper, nickel etc. The resulting commodity price boom peaked on the eve of the Great Financial crisis. It was crystallized when oil hit $150 per barrel in July 2008. During the 2007-2008 initial peak period, the spread between cash costs of production and soaring commodity and materials prices was inflated to unprecedented size. That generated vast economic rents that accrued to owners of existing production assets and reserves. Even though developed market consumption spending and demand for global exports was not sustainable, the pre-crisis windfalls generated a surge of capital investment in search of supra-normal returns. Then the central bankers doubled down in the face of collapsing global trade and the liquidation of DM domestic economic excesses in the fall and winter of 2008-2009. The desperate scramble by governments and their central banking branches to dig out from under the plunge in consumer spending and the subsequent liquidation of dodgy mortgages, excess inventories of manufactured goods and overstocked labor in the DM economies triggered the second artificial economic boom. This time it was manifested in a renewed frenzy of CapEx and public infrastructure spending in China and the EM economies. The push of dirt cheap central bank enabled credit was added to the pull of windfall profits in global mining, energy, materials, shipping and manufacturing. In the case of China, for example, public and private credit outstanding at the end of 2007 amounted to just $7 trillion. That was about 150% of its GDP.

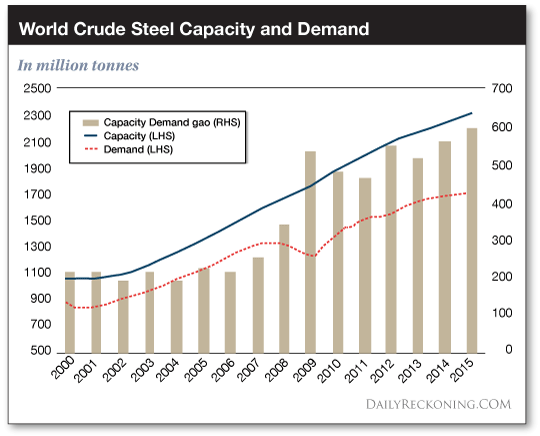

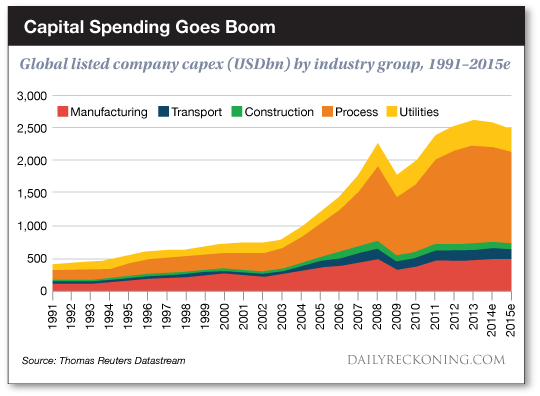

During the next seven years — owing principally to Beijing's maniacal stimulus of domestic infrastructure investment designed to replace waning exports — China's credit machine generated new debt equal to triple the 2007 amount. That brought credit outstanding to $28 trillion or nearly 300% of GDP at present. Adding fuel to the fire, DM central bankers drove interest rates to the zero bound in a foolish quest to jump-start spending by debt-saturated households. But this did not cause consumers to spend more in the US, England, Spain, Italy, Greece or France because the vast middle classes of these DM economies were already at "peak debt." Instead, it generated a madcap scramble for yield among money managers and an eventual capital outflow of $4-5 trillion into EM debt markets. The combination of unprecedented financial repression in DM capital markets and the prodigious expansion of domestic business credit in China and the EM elicited a tidal wave of capital investment. It was unlike the world has ever witnessed. It also put a renewed round of pressure on commodities that caused a second surge of prices which peaked in 2011-2013. The torrid demand for commodities during this second wave resulted in part from the need to feed cement, steel, copper, aluminum and hydrocarbons into the maw of China's massive infrastructure, high rise apartment and commercial building projects as well as similar construction booms in other EM economies. On top of that was another whole layer of demand for the raw materials needed to build the ships, earthmovers, mining machinery, refineries, power plants and steel furnaces and mills that were directly embodied in the capital spending spree. The torrid demand for construction steel in China indirectly led to demand for more iron ore bulk carriers, which, in turn, required more plate steel to supply China's shipyards which were given the contracts to build them. In short, a capital spending boom creates a self-feeding chain of materials demand. Especially when it’s fueled by cheap capital costs and the economically false rates of return embedded in long-lived capital assets funded by it. Therein lies the origins of the deflationary wave now rocking the global commodity markets. Neither the DM consumer borrowing binge nor the China and EM infrastructure and industrial investment spree arose from sustainable real world economics. They were artifacts of what history will show to be a hideous monetary expansion that left the DM world stranded at peak household debt and the EM world drowning in excess capacity to produce commodities and industrial goods. The reason that the Bloomberg Commodities Index will now knife through the 100 index level tagged on both the right- and left-hand side of the chart above is the law of supply and demand. Variable cost pricing and zombie finance will contribute too. The latter is what becomes of central bank driven bubble finance when the cycle turns, as it is now doing, from asset accumulation and inflation to asset liquidation and deflation. But to understand the potentially devastating extent of the coming asset deflation cycle, it is important to reprise the extent of the just completed and historically unprecedented global capital investment boom. In the case of the global mining industries, capital expenditures (capex) by the top 40 miners amounted to $18 billion in 2001. During the original boom cycle it soared to $42 billion by 2008. Then, after a temporary pause during the financial crisis, it re-accelerated once again, reaching a peak of $130 billion in 2013. Owing to the collapse of commodity prices, new projects and greenfield investments have pretty much ground to a halt in iron ore, met coal, copper and the other principal industrial materials. But there is a catch… Big projects which were in the pipeline when commodity prices and profit margins began to roll over in 2012 are being carried to completion. Available, on-line capacity continues to soar. The poster child for that is the world's largest iron ore complex at Port Hedland, Australia. It set another shipment record in June. That was owed to still rising output in the vast network of iron mines it services, notwithstanding the plunge of iron ore prices by $143 per ton since 2011. The ramp-up in exploration and production (E&P) investment for oil and gas was similar. Global spending was $100 billion in the year 2000, but had risen to $400 billion by 2008 and peaked at $700 billion in 2014. In the case of hydrocarbon E&P investment, however ,the law of variable cost pricing works with a vengeance because "lifting costs" even for shale and tar sands are modest compared to the front-end capital investment. Accordingly, the response of production to plunging prices has been initially limited and will be substantially prolonged. Similar cycles occurred in utilities, shipping, manufacturing, ports and warehousing and other process industries like chemical production. In the case of the steel industry, for instance, global capacity doubled from 1.1 billion tons to more than 2.3 billion tons during the past 15 years. That far outstrips current demand. In fact, the 600 million tons of excess capacity shown in the chart below will grow considerably larger. The demand for steel will wind down as the global capex boom rapidly cools. In the steel industry alone, excess capacity could easily reach 35%. Most of that is in China, Brazil, Mexico and elsewhere in the Emerging Markets. It amounts to more than the combined steel industry of the US, Europe and Japan.

As you can see in the chart below, in fact, the global capital spending total for all listed companies on a worldwide basis went nearly parabolic after the turn of the century. During the preceding decade (1991-2001), and notwithstanding the technology boom of that period, global capital expenditures for manufacturing, transport, construction, process industries and utilities rose from $450 billion to $700 billion. That's an annual rate of 4.5%. By contrast, during the capital spending boom which peaked in 2013, outlays accelerated to $2.6 trillion annually. This means that capital spending nearly quadrupled, rising at a 12% annual rate over the course of 12 consecutive years.

Since 2013 that staggering total has begun to roll-over. But the lagged effect of the project completion cycle has temporarily broken the fall. Excess capacity continues to build, meaning that the massive drop in commodity and industrial prices and profit margins has just begun. That's where central bank enabled zombie finance comes in. Production cuts and capacity liquidations in virtually every materials sector are being drastically delayed by the continuing availability of cheap finance. What "extend and pretend" really means is that prices and margins will be driven even lower than would otherwise be the case. Zombie finance means flattened profits for an unusually prolonged period of time. During the central bankers' doubled-pumped boom, profits margins rose to historically unprecedented levels because high prices were being captured by producers during most of the past 15 years. Now comes the era of gluts and lower prices. And as will be shown in part 2, the casino is most definitely priced as if high prices were a permanent fixture of economic life. In reality though, they were freakish consequences of the central bankers' reign of bubble finance. Yes, the central bankers may try a while longer to stimulate GDP. It's part of their futile quest to enable the monumental debts they have fueled to be serviced and the massive excess capacity to be absorbed. But they have only one tool: financial repression and the systematic falsification of financial market prices, especially the carry costs of debt. That will only feed the zombies, inflate the bubble in financial asset prices further and insure that when the day of reckoning finally comes the casino will be in for a rude awakening. More to come… Regards, David Stockman This article was originally posted on my ContraCorner website, right here. Editor’s Note: Be sure to sign up for The Daily Reckoning — a free and entertaining look at the world of finance and politics. The articles you find here on our website are only a snippet of what you receive in The Daily Reckoning email edition. Click here now to sign up for FREE to see what you're missing. The post Central Bankers Have Shot Their Wad (Part I) appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The West is Collapsing , Humanity is in Danger -- Harley Schlanger Posted: 23 Jul 2015 03:00 PM PDT Harley Schlanger from LaRouche PAC and Helga Zepp-Larouche, Founder and President of The Schiller Institute, join us for an insider's look at the Bankster domination and enslavement of Greece and Europe. Zepp-Larouche warns that a collapse of the western banking system would cause "a plunge into... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| What Blows Up Next? Part 1: Resource-Based Economies Posted: 23 Jul 2015 02:51 PM PDT The Great Recession and its aftermath was actually the best of times for countries with natural resources to sell. The US, Europe and Japan ran record deficits and cut interest rates to zero or thereabouts, sending hot money pouring into mining and energy projects around the world, while China borrowed (as it turned out) $15 trillion for an epic infrastructure build-out. The result was robust demand and high prices for raw materials like copper, oil and iron ore, and a tsunami of cash pouring into Brazil, Canada, Australia and the other resource producers. Conventional wisdom deemed these countries to be well-run and destined for ever-greater things, which led locals to borrow US dollars at cheap rates and invest in mines, factories and/or domestic government bonds with much higher yields. Good times and fat margins all around. Then it turned out that the debts accumulated by the resource-consuming economies had created a headwind that they couldn’t overcome. The Chinese build-out abruptly ended and the developed world failed to achieve escape velocity, causing the US dollar to soar and commodity prices to plunge. Oil, for instance, is down 21% just the last in last six weeks. while the Bloomberg Commodity Index is 42% below its recent high. For a sense of what this means, pretend you’re Brazil. During headier times your oil, iron ore and soybean exports created a generation of new millionaires and allowed your government to balance its budget. This in turn led your leaders to ratchet up spending and your entrepreneurs to borrow what now looks like an insane amount of US dollars. Now your currency, the real, is plunging… …while your interest rates are surging: Among other things, this gives you: a ton of dollar-denominated loans that are deeply under water and will be defaulted upon soon; plunging tax revenues necessitating huge cuts in government spending and/or much higher taxes — at exactly the wrong time; and hundreds mines and factories that aren’t generating enough cash flow to cover their cost of capital and will soon fail. Variations on this theme are playing out across the resource economy world, so depending on the country, it’s crisis now (Argentina and Venezuela) or crisis in 2016 (nearly everyone else). And that’s if everything stabilizes around these levels. Let resource prices keep falling and/or the dollar rise further and we can replace “crisis” with “chaos.” For more, see: Brazil slashes fiscal savings goals for 2015 and 2016 on plunging tax revenue The Australian dollar is smashed and poised to fall below US70 cents, analysts warn | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Though the Heavens May Fall Posted: 23 Jul 2015 02:34 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Obama just made a SHOCKING Admission! Posted: 23 Jul 2015 12:00 PM PDT At a Pentagon press conference today President Obama made a SHOCKING admission. Was it a slip of the tongue or a Freudian Slip? The White House was quick to correct him, but we've heard that before. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mish Shedlock -- The Economy Is Declining Which Will Ultimately Lead To A Collapse Posted: 23 Jul 2015 11:39 AM PDT with Mike "Mish" Shedloc The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| What’s Really Killing Capitalism Posted: 23 Jul 2015 11:18 AM PDT This post What’s Really Killing Capitalism appeared first on Daily Reckoning. Somewhere in British Columbia – "Do Not Hump" says the sign on the side of the boxcar. We had no idea why the Canadian Pacific Railway is putting its nose into our private lives. But the authorities are always trying to tell us what to do. As you know, we're making our way from Toronto to Vancouver by train. A quick summary of Canadian geography: The vast Eastern Forest gives way to the vast Western Prairie. And then you're in the vast mountains. The train chuffs along… hour after hour… day after day. Night after night. The scenery is majestic. It is fascinating. It is endless. We'll return to our travel update in just a moment… But first, let us check in with the markets… and continue telling you what we learned from George Gilder's latest book. The Dow lost 68 points yesterday. Gold gained $11 – to settle at $1,102 an ounce – after sliding for 10 straight sessions. It is up from its five-year low… but not by much. We remind ourselves that we hold gold as a financial reserve, not an investment. Still, it doesn't make us feel very good when it falls hard. Gilder doesn't make us feel very good either. First, he makes us work. He stretches from one dot to another. It can be hard to keep up with him. And he sometimes reaches too far. The key insight in his latest book, Knowledge and Power: The Information Theory of Capitalism and How It Is Revolutionizing Our World, is that an economy is fundamentally a learning system, not a way for distributing wealth. So far, so good. But Gilder has a sour side. He attacks our friends Nassim Taleb and David Stockman for reasons that seem trivial. He believes that neither fully appreciates his point. Friedrich Hayek and Murray Rothbard – two leading Austrian School economists – also get a beating. Rothbard was sure that any government control over the economy would be a bad thing. Hayek was willing to imagine that a minimal state might help hold things together. Both counted on a "spontaneous order" – without government – to create a free, prosperous society. They're wrong, says Gilder. But his dots don't connect. A paradoxical "spontaneous order" troubles him. You can't have both, he says – order and spontaneity. Then he makes the extravagant claim that "order requires political guidance." That is, of course, the point of Hayek's paradox: Order doesn't need guidance. And especially not from politicians. When politics guides an economy, the results are always bad. Gilder says so himself. Economies are built on information, not money, he says. Money – even gold – has no real value except what the economy gives it. Imagine you are alone at the North Pole. You have no food. And no shelter. But you have an ounce of gold. What is that gold worth? Zilch. This explains why adding to the money supply does nothing for the economy. It's the economy that gives money value, not the other way around. This explains why zombies and cronies stifle the process of growth and wealth creation. To add wealth, you have to add knowledge. That is, you have to learn to do things better. The trouble with zombies is that they don't want to learn. Learning is hard. And costly. Zombies just want to take the fruits of someone else's learning. Likewise, cronies try to freeze the process of accumulating knowledge. New knowledge – accumulated by others – is threatening. It is what causes disruption. And what economist Joseph Schumpeter called "creative destruction." Cronies fear this new knowledge and try to block it from ever happening – with subsidies, licensing requirements, and other regulatory impediments. Gilder believes that this obstructionism is a bigger threat to prosperity than debt. Information, says Gilder, is always surprising. It tells us things we didn't know. In an economy, the person who is the source of most important new information is the entrepreneur. He is the fellow who takes risks, builds a new business, and then – surprise, surprise – it works! The cronies want to stop him, before he undermines the value of their old assets and old business models with new information. The zombies want to drag him down, leeching on him so greedily that he runs out of energy. But without the entrepreneur, capitalism fails. Capitalism also fails when the information the entrepreneur relies upon is distorted. When the feds fiddle with interest rates, for example, they turn the most important signal in capitalism into misleading noise. Gilder: [I]nterest rates are noise, rather than signal. Interest rates near zero cause finance to hypertrophy, as privileged borrowers reinvest government funds in government securities. Only a small portion of these funds goes to useful "infrastructure," while the rest is burned off in consumption beyond our means. Gilder believes the signals must move through channels – secured, but not corrupted – by government! Yes, government exists. It is going to provide "channels" – laws, property protection, speed limits, and so forth – whether we like it or not. And it will be better for us all if it just keeps the channels open and free from twists and tolls. But that is very different from providing "guidance." Politicians don't have the information or experience to provide guidance. They are zombies. They don't want to learn the nitty-gritty details of real wealth building. They should just make sure basic laws – against murder, theft, and fraud – are enforced. And otherwise butt out. Meanwhile, back on the TransCanada… The cities here are rich. An influx of immigrants, mostly from Asia, has boosted the energy and wealth of Toronto, Vancouver, and other large metropolises. Property prices – especially in Vancouver – are among the highest in the world. The restaurants are among the best too. But outside the cities, you might just as well be in West Virginia or Alabama. There is little evidence of wealth or style. Along the tracks of the TransCanada, which is our only reference, houses are modest – or even shabby. Neither agriculture nor forestry appear to be especially rich industries. Particularly disappointing is the domestic architecture. Whether you are in the outer suburbs of Toronto… or out on the plains of Alberta… the style is the same: boxy, boring, and cheap. In Ontario, stone and wood are abundant and almost free. But people still put up their houses with two-by-fours and vinyl siding – just like they do in West Virginia. These places must be as cold in the winter as they are charmless in the summer. No attempt has been made to create a vernacular architecture appropriate to either the climate or the scenery. We expected the landscape to be barren, with stunted pines growing on windswept tundra. But most of the land we see is almost lush – either with fields planted in wheat or rye… or thick timber. Some places – especially the open country of Alberta – are particularly pretty. This time of year it looks like summertime in central France, with large fields of yellow or blue, depending on whether they were planted in canola or flax. Everywhere you look is a stunning vista – either mountains, plains, or woods. But the local builders don't seem to notice. The house goes up, wherever it is, as if it were in a New Jersey suburb. "We have a friend whose brother moved to Saskatchewan to farm," Elizabeth reminded us. "Do you remember?" We did not. "Yes you do. He was Dutch. He and his wife left the Netherlands. They lived in Winnipeg. And he farmed some large fields outside the city. "But we heard that they gave up. It was just too isolated and boring." Like the heartland of the U.S., there is little to do in these small prairie towns. Few restaurants. Few good liquor stores. No theater. No cultural attractions. They wouldn't appeal to everyone. We are now winding our way through the mountains of British Columbia. As usual, the scenery is superb. We sit in the dining car and our mouths drop open. The Thompson River… the Rainbow Canyon – Canada has some of the most spectacular natural beauty we have ever seen. Regards, Bill Bonner P.S. I originally posted this article at The Dairy of a Rogue Economist, right here. The post What’s Really Killing Capitalism appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest Rates Collapsing Globally -- Central Bankers Panicking Posted: 23 Jul 2015 11:00 AM PDT Central Banks Panic as Interest Rates Hit Record Low to Prevent COLLAPSE! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dave Kranzler: Anti-gold propaganda reaches bubble proportions Posted: 23 Jul 2015 10:03 AM PDT 1:02p ET Thursday, July 23, 2015 Dear Friend of GATA and Gold: In his new commentary, "Anti-Gold Propaganda Reaches Bubble Proportions," Dave Kranzler of Investment Research Dynamics argues that there really isn't any gold "market" now that central banks and governments are rigging it so much. Kranzler's commentary is posted at the IRD Internet site here: http://investmentresearchdynamics.com/anti-gold-propaganda-reaches-bubbl... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Don’t Vote for Trump -- Wayne Allyn Root Posted: 23 Jul 2015 10:00 AM PDT Trump's done it again. He's all the media can talk about. The media thinks his comments about John McCain have ruined his presidential campaign. I have news for them: "No way Jose!" Trump is just getting started. The Financial Armageddon Economic Collapse Blog tracks trends and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alasdair Macleod: Gold and Gibson's paradox Posted: 23 Jul 2015 09:59 AM PDT 1p ET Thursday, July 23, 2015 Dear Friend of GATA and Gold: Rising interest rates don't necessarily mean falling gold prices, GoldMoney research chief Alasdair Macleod writes today, noting the gold and interest rates rose together in the 1970s. Macleod's commentary is headlined "Gold and Gibson's Paradox" and it's posted at GoldMoney here: https://www.goldmoney.com/research/analysis/gold-gibson-paradox?gmrefcod... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold rout could turn into stampede out of commodity investment Posted: 23 Jul 2015 09:54 AM PDT World's largest mining companies are running out of options as commodities slump tipped to deepen This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||