saveyourassetsfirst3 |

- Why Pensions Are A (Big) Black Swan

- Nothing Matters Until it Does – Bill Holter

- Harvey Organ: RIOTS In Athens!

- WARNING: The next leg down in gold is here…

- The ‘Greek Debt Deal’ Is Already Starting To Fall Apart

- Will September 11th, 2015 Be the “Shemitah” Global Economic Collapse?

- China Gold reserves at 53.31 mn oz as of June: Central Bank

- China Announces 57% Increase in Official Gold Reserves

- Marshall Swing: Global Economic Crash is COMING, and There is Nothing You Can Do To Stop It!

- Caption Contest Friday!

- Caption Contest, Bankster Edition

- Nuclear CDS Daisy Chain Averted With Greek Deal?

- Gold Eagle Sales Surge Due To Financial Turmoil

- The must-learn lesson from Chinese gold holdings

- Where is Support for Precious Metals Markets?

- Chinese Gold Reserves

- Global Precious Metal Roundtable – Greece, China, Manipulation, Interest Rates and Outlook

- Where did 110 tonnes of CME Hong Kong gold go?

- Where did 110 tonnes of CME Hong Kong gold go?

- How will gold prices move after the Fed raises interest rates?

- CHARTS : Gold Slides for Fourth Day

- Gold Spot Intraday: Under Pressure.

- Gold technical analysis for July 17, 2015

- Gold is on the cusp of a major breakdown: Technician

- Silver Forecast July 17, 2015, Technical Analysis

- Gold Prices July 17, 2015, Technical Analysis

- Gold and Hit Again - Pervasive Nonsense

- Where is Support for Precious Metals Markets?

- 12 astonishing things about gold

- The Bankruptcy Of The Planet Accelerates – 24 Nations Are Currently Facing A Debt Crisis

- Gold and Hit Again - Pervasive Nonsense

- Gold Price to Break or Not to Break? That is the Question

| Why Pensions Are A (Big) Black Swan Posted: 17 Jul 2015 12:52 PM PDT When talk turns to what might derail today’s debt-driven “recovery,” the big names and easy stories get most of the attention: China with its soaring debt, volatile equities and heavy-handed intervention; Japan with its stratospheric debt and science fictiony demographics; Greece, which needs no explanation; the developing countries with their weak currencies and mountain of dollar-denominated debt. And of course America’s triple bubble of stocks, bonds and derivatives. Underfunded pension plans, to the extent they come up at all, tend to be mentioned in passing largely because most of them are 1) too small to matter on their own and 2) too hard to understand for most people to form a strong opinion. But they deserve a closer look. In the US there are dozens of state and local pension plans that in the aggregate are underfunded by several trillion dollars (meaning they’ve promised this much to beneficiaries but don’t have it). When one plan blows up it will impact lots of others, so the aggregate number is a pretty good indicator of the real risk. The generally-accepted poster child for pension mismanagement is Chicago. As the Wharton business school recently noted:

For a more detailed account of the mess that is Chicago see Emanuel fiddles while Chicago burns by enraged Illinois resident Mike Shedlock. But, you might reasonably say, pension funds have big investment portfolios so they must be making fortunes in today’s bull markets. You’d be right in some cases. But apparently it’s still not enough to offset rising liabilities as baby boomer teachers, cops and fire fighters retire. And now, as financial markets peak and start to roll over, it’s getting harder to make any money at all. Consider the plight of huge California pension plan CalPERS:

And this is during a year when stocks and bonds did okay. What happens when — after one of the longest bull markets ever — the inevitable bear market occurs? A diversified stock portfolio will fall by 20% (the definition of a bear market), real estate will tank as it always does in hard financial times, and bonds, which would normally outperform in such an environment, might only be stable since they’re already yielding next to nothing. The net result: A loss of 10% – 15% at a time when the fund needs at least +8% just to keep up with soaring obligations. The funding gap becomes a chasm, leading to calls for benefit cuts (which lower the incomes of current and prospective retirees and send them en masse to the polls to vote out the ruling party), big tax increases to rebuild pension portfolios (sending taxpayers not covered by these plans to the polls to vote out the incumbents), or massive spending cuts to free up money to rebuild pensions (which sends the local economy into a deep recession, sending newly-poor residents to the polls…you get the picture). If this sounds a little Greece-like, that’s because states and localities are in a very similar bind: they’re small economic units that have accumulated unpayable debts. Lacking the ability to print and/or devalue their own currency, they have no choice but to (at some point) live within their means. But this inflicts extraordinary pain inflicted on a populous that isn’t used to suffering and sees no point in starting. The ensuing crisis will be “solved” in one of two ways: 1) A default by, let’s say Chicago, which sends its municipal bonds down to pennies on the dollar and, much more important, panics everyone who owns munis, tanking the whole sector. States and localities around the country find themselves unable to borrow, and they start defaulting on their outstanding bonds and/or laying off tens of thousands of workers, turning a narrow little muni crisis into a full-blown recession. This in turn lowers the returns generated by stocks and real estate, further widening the pension gap. 2) Washington (DC) steps in and bails Chicago out before it can default. But — same as if the eurozone forgave Greece’s debt — all the other badly run pension plans decide they’re Italy and demand the same sweet deal. The cost spirals into the trillions, the financial markets realize that government debt and money creation are now on a one-way train to infinity, and everyone freaks out. Pretty big black swan, wouldn’t you say? So in the year ahead keep an eye on pension fund returns in general and Chicago’s in particular. |

| Nothing Matters Until it Does – Bill Holter Posted: 17 Jul 2015 12:30 PM PDT The financial world almost ended in 2008. Nothing was fixed, nothing even changed. In fact, the only change has been the degree to which unsound monetary, fiscal and banking practices have been since then. It is as if we hit a brick wall in 2008 yet pressed the accelerator harder ever since! This article is […] The post Nothing Matters Until it Does – Bill Holter appeared first on Silver Doctors. |

| Harvey Organ: RIOTS In Athens! Posted: 17 Jul 2015 12:00 PM PDT RIOTS ON THE STREETS OF ATHENS… Submitted by Harvey Organ: Good evening Ladies and Gentlemen: Here are the following closes for gold and silver today: Gold: $1147.20 down $6.10 (comex closing time) Silver $15.03 down 16 cents. In the access market 5:15 pm Gold $1149.60 Silver: $15.12 First, here is an outline of […] The post Harvey Organ: RIOTS In Athens! appeared first on Silver Doctors. |

| WARNING: The next leg down in gold is here… Posted: 17 Jul 2015 11:45 AM PDT From Bloomberg: For six years, investors have been guessing how much gold China owns. On Friday, they found out and the results were underwhelming.

China said it boosted bullion assets to about 1,658 metric tons, less than brokers at GoldCore Ltd and Sharps Pixley Ltd. expected. Futures dropped to the lowest since 2010 on Friday as signs of improving U.S. economic growth further diminished the metal’s appeal as a haven. With investors in the U.S. scoffing at the precious metal, bulls were holding out hope that buying from China could help to buoy demand. The Asian country is the world’s biggest gold producer and vies with India as the top consumer. The price rout worsened the outlook for miners, with shares of Barrick Gold Corp. dropping to the lowest since 1991 on Friday. “I’m shocked by how small the figure is,” Ross Norman, chief executive officer of dealer Sharps Pixley, said by telephone from London, referring to China’s gold reserves. “I don’t think I was alone in thinking they have accumulated three times as much.” Gold futures for August delivery dropped 1.1 percent to $1,130.90 an ounce at 11:16 a.m. on the Comex in New York, after touching $1,129.60, the lowest since April 2010. The reserve figures “were disappointing in some aspects and reflected that China isn’t adding gold as much as people thought it was,” Bernard Dahdah, a precious-metals analyst at Natixis SA in London, said in a telephone interview. “It begs the question of what’s been happening to the gold produced that hasn’t been taken by the central bank.” Weekly Drop Prices extended losses after a government report showed new-home construction in the U.S. climbed in June to the second-highest level since 2007. The metal is heading for a fourth straight weekly decline as Federal Reserve Chair Janet Yellen has indicated that the central bank will increase interest rates this year amid the improving economy. Higher rates cut the appeal of precious metals because they don’t pay interest or give returns like other assets such as bonds and equities. Gold futures in New York fell for a seventh straight session, the longest streak since November. Shares of Barrick Gold, the world’s biggest producer of the metal, fell as much as 6.5 percent in Toronto. The Philadelphia Stock Exchange Gold and Silver Index, a gauge of miners, slumped as much as 4.2 percent, reaching the lowest since January 2002. “There is just no interest in the market to own gold,” Donald Selkin, the New York-based chief market strategist at National Securities Corp., which manages about $3 billion, said by telephone. “The Fed’s hawkish stance is the biggest culprit for the decline that we are seeing in the precious-metals market.”

|

| The ‘Greek Debt Deal’ Is Already Starting To Fall Apart Posted: 17 Jul 2015 11:00 AM PDT The "deal that was designed to fail" has already begun to unravel. From The Economic Collapse Blog: The IMF, which was expected to provide a big chunk of the financing, has indicated that it may walk away from the deal unless Greece is granted extensive debt relief. This is something that the Germans and their […] The post The 'Greek Debt Deal' Is Already Starting To Fall Apart appeared first on Silver Doctors. |

| Will September 11th, 2015 Be the “Shemitah” Global Economic Collapse? Posted: 17 Jul 2015 10:18 AM PDT In the article below, Marshall Swing refutes best-selling author Jonathan Cahn’s calculations for a coming Global Financial Collapse “Shemitah”, and States That the Date of the Global Financial Collapse May Be September 11, 2015! Submitted by Marshall Swing: By now, my readers and all the readers at SilverDoctors have heard of Jonathan Cahn and […] The post Will September 11th, 2015 Be the "Shemitah" Global Economic Collapse? appeared first on Silver Doctors. |

| China Gold reserves at 53.31 mn oz as of June: Central Bank Posted: 17 Jul 2015 10:05 AM PDT The central bank earlier adjusted its reserve figure in April 2009, when the level was at 33.89 million troy ounces (1054 metric tons). |

| China Announces 57% Increase in Official Gold Reserves Posted: 17 Jul 2015 10:05 AM PDT China has just dropped its long anticipated bombshell on the gold market… Perhaps now we know why the cartel has mercilessly hammered the gold market over the past 2-3 weeks, as this morning China officially announced a 57% increase in its Official Gold Reserves in May, revising their gold holdings upwards by 604 metric tonnes […] The post China Announces 57% Increase in Official Gold Reserves appeared first on Silver Doctors. |

| Marshall Swing: Global Economic Crash is COMING, and There is Nothing You Can Do To Stop It! Posted: 17 Jul 2015 10:00 AM PDT The Global Economic Crash is coming and there is absolutely nothing you can do to stop it… Submitted by Marshall Swing: So, here we are in the doldrums of Summer, might as well be floating along in the Sargasso Sea with no wind at our sails, our hands aching even bleeding from rowing the […] The post Marshall Swing: Global Economic Crash is COMING, and There is Nothing You Can Do To Stop It! appeared first on Silver Doctors. |

| Posted: 17 Jul 2015 09:30 AM PDT The post Caption Contest Friday! appeared first on Silver Doctors. |

| Caption Contest, Bankster Edition Posted: 17 Jul 2015 09:30 AM PDT The post Caption Contest, Bankster Edition appeared first on Silver Doctors. |

| Nuclear CDS Daisy Chain Averted With Greek Deal? Posted: 17 Jul 2015 09:00 AM PDT If Greece fell, it would have triggered the nuclear daisy chain of credit default swaps, of which Deutsche Band, Citigroup and JP Morgan are the largest bag-holders. Submitted by PM Fund Manager Dave Kranzler, Investment Research Dynamics: The Greece situation was "fixed" once the the United States IMF began to flex its muscles openly. […] The post Nuclear CDS Daisy Chain Averted With Greek Deal? appeared first on Silver Doctors. |

| Gold Eagle Sales Surge Due To Financial Turmoil Posted: 17 Jul 2015 08:45 AM PDT Something QUITE INTERESTING took place on Friday last week… From the SRSRocco Report: The U.S. Mint updated its figures showing sales of its Gold Eagles surged to a level not seen for more than a year. Sales of Gold Eagles have been strong ever since the financial turmoil in Europe increased significantly with the threat […] The post Gold Eagle Sales Surge Due To Financial Turmoil appeared first on Silver Doctors. |

| The must-learn lesson from Chinese gold holdings Posted: 17 Jul 2015 08:30 AM PDT forexlive |

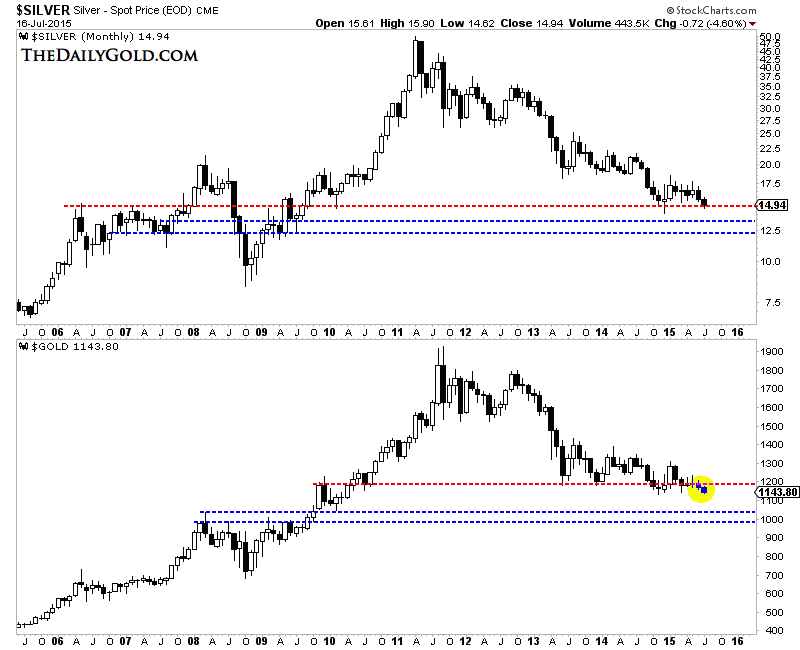

| Where is Support for Precious Metals Markets? Posted: 17 Jul 2015 08:10 AM PDT The Daily Gold |

| Posted: 17 Jul 2015 07:47 AM PDT A lot of interest today in the announcement of some Chinese gold reserve numbers. Before you get too worked up, let's try to think this through for a minute. |

| Global Precious Metal Roundtable – Greece, China, Manipulation, Interest Rates and Outlook Posted: 17 Jul 2015 06:02 AM PDT gold.ie |

| Where did 110 tonnes of CME Hong Kong gold go? Posted: 17 Jul 2015 05:06 AM PDT Thanks to Ronan Manly, we have found out that 110 tonnes left Hong Kong warehouses between Dec 2014 and mid-March 2015 http://research.perthmint.com.au/2015/07/17/where-did-110-tonnes-of-cme-hong-kong-gold-go/ |

| Where did 110 tonnes of CME Hong Kong gold go? Posted: 17 Jul 2015 03:15 AM PDT Perth Mint |

| How will gold prices move after the Fed raises interest rates? Posted: 17 Jul 2015 02:51 AM PDT The odds on a September rate hike are increasing after Fed chair Janet Yellen’s statement on Wednesday night. That’s depressing the gold price as higher rates on holding dollars make a non-interest bearing alternative less attractive. But what will happen when the Fed actually does raise interest rates? Many Wall Street veterans are seriously worried that this will tip an overvalued stock market into a crash after a five-year period without a correction of 10 per cent. Wall Street Crash New money created by liquidating stocks would first boost demand for the dollar. There would also be pressure from forced sellers of gold who would need it to pay down record margin debt in the US equity markets. That said, there is a contrary force to consider. Gold prices are being depressed to eight-month lows now by the anticipated rate hike. If it any less than anticipated then gold prices would see a relief rally, and how likely is the Fed to do anything that might really shock the market? Besides a couple of months is still a long time in global financial markets. We have not seen the fall-out from the Chinese equity crash yet, and this could be a considerable down pull on global demand and enough to kick the Fed’s rate rises into the long grass. Europe is also having to digest the Greece debt implosion. So far that has hit the euro and that’s not helped gold prices one iota. But again there may be a point where this is overdone and the pendulum swings back in the other direction, perhaps when the euro tests its previous $1.05 low. Another important wild card must be the central bank manipulators of the gold price. They lost control in the 2008 stock market crash. Then gold dropped like a stone so they seemingly left it to its own devices and failed to prevent the huge bounce back until the high of 2011. Market manipulation Absent manipulation any market that has been artificially held down will snap back. Then again what will the response of the central banks be if the US joins China in having a stock market crash? They will print money and slash interest rates. China has already cut interest rates. And what effect did this have on the gold price in 2009-11? It went through the roof. Bigger crisis this time? Higher gold prices! Certainly writing off gold as a lost cause right now is both short-termist and a call that could easily go horribly wrong. |

| CHARTS : Gold Slides for Fourth Day Posted: 17 Jul 2015 01:55 AM PDT dailyforex |

| Gold Spot Intraday: Under Pressure. Posted: 17 Jul 2015 01:40 AM PDT forexyard |

| Gold technical analysis for July 17, 2015 Posted: 17 Jul 2015 01:40 AM PDT mt5 |

| Gold is on the cusp of a major breakdown: Technician Posted: 17 Jul 2015 01:20 AM PDT cnbc |

| Silver Forecast July 17, 2015, Technical Analysis Posted: 17 Jul 2015 01:10 AM PDT fxempire |

| Gold Prices July 17, 2015, Technical Analysis Posted: 17 Jul 2015 01:05 AM PDT fxempire |

| Gold and Hit Again - Pervasive Nonsense Posted: 17 Jul 2015 01:00 AM PDT marketoracle |

| Where is Support for Precious Metals Markets? Posted: 17 Jul 2015 12:58 AM PDT The gold miners have broken below their 2008 to 2014 support while Silver is essentially trading at a six year low. Gold looks set to make a new monthly low and weekly low but has yet to break its daily low at $1140/oz. Barring a sudden short squeeze Gold could be hours or days away from cracking in the way Silver and the miners have in recent weeks. The trend for the sector is obviously down and sentiment is following. However, the more important issue for long term bulls is where is the strong support for these markets. The monthly candle charts of Silver and Gold are below. I'll start with Silver. It is losing key support at $15/oz. The next key support levels are in the low $13s and low $12s. Moving to Gold, note that Gold appears to have lost $1180/oz which has been a key support level for two years. The monthly chart shows that the next strong support levels are $1040 and $1000.

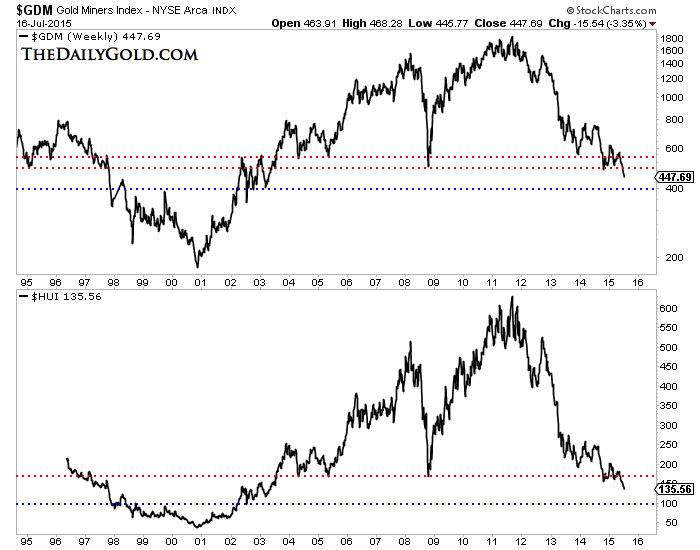

Moving on, let's look at the miners. We plot $GDM (essentially GDX) and the HUI Gold Bugs Index. This time we look at the weekly line charts. The picture remains clear. GDM has broken below key support (the 2008 and 2014 lows) of 500. It has about 11% downside to the next strong support at 400. The HUI is a much weaker index as unlike GDM it is comprised only of miners and not the stronger royalty companies. The HUI still has a whopping 25% downside to its next major support.

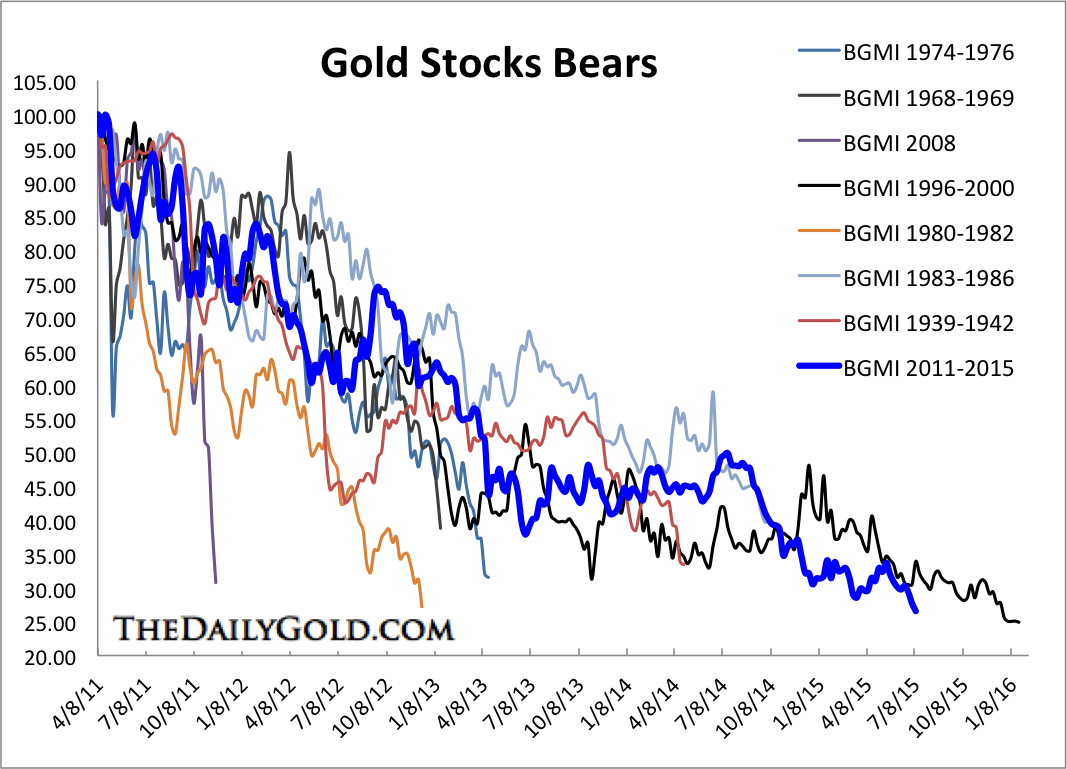

GDXJ (not shown) is not performing as poorly as GDX and HUI because junior companies don't have debt. In looking at the top five gold producers I found a combined market cap of roughly $40 Billion, $6.5 Billion in cash but $27 Billion in debt. Gold breaking below $1140 and $1100 could exacerbate the problems facing miners with significant debt. Hence, the GDXJ to GDX ratio should continue to rise. The bear market in the miners is on the cusp of matching the 1996-2000 bear market. If the Barron's Gold Mining Index drops another 10% then it will match the decline from 1996-2000. If the HUI drops to 100 it will match the decline from 1996-2000. If GDM, which closed Thursday at 448, drops 7% then it would match its decline from 1996-2000. You get the point. The gold stocks bear analog chart below puts this bear market into perspective.

Considering the support targets, it is too soon to be a buyer. We'd prefer to see Gold below $1100 and Silver below $14 before thinking about buying. We will also keep the targets for GDM and the HUI in mind. If Gold cracks $1140 and $1100 immediately thereafter it is possible a mini capitulation could develop and the sector could rally. In our view the bottom is likely to develop over a few months rather than a few days or weeks. Stay defensive and stay nimble with hedges and short positions. At somepoint within a few months, the switch will flip and we could have some epic buying opportunities in the precious metals complex. Consider learning more about our premium service including our favorite junior miners which we expect to outperform in the second half of 2015.

Jordan Roy-Byrne, CMT

The post Where is Support for Precious Metals Markets? appeared first on The Daily Gold. |

| 12 astonishing things about gold Posted: 16 Jul 2015 04:00 PM PDT Perth Mint Blog |

| The Bankruptcy Of The Planet Accelerates – 24 Nations Are Currently Facing A Debt Crisis Posted: 16 Jul 2015 02:51 PM PDT

As we are seeing in Greece, you can eventually accumulate so much debt that there is literally no way out. The other European nations are attempting to find a way to give Greece a third bailout, but that is like paying one credit card with another credit card because virtually everyone in Europe is absolutely drowning in debt. Even if some “permanent solution” could be crafted for Greece, that would only solve a very small fraction of the overall problem that we are facing. The nations of the world have never been in this much debt before, and it gets worse with each passing day. According to a new report from the Jubilee Debt Campaign, there are currently 24 countries in the world that are facing a full-blown debt crisis… ■ Armenia ■ Belize ■ Costa Rica ■ Croatia ■ Cyprus ■ Dominican Republic ■ El Salvador ■ The Gambia ■ Greece ■ Grenada ■ Ireland ■ Jamaica ■ Lebanon ■ Macedonia ■ Marshall Islands ■ Montenegro ■ Portugal ■ Spain ■ Sri Lanka ■ St Vincent and the Grenadines ■ Tunisia ■ Ukraine ■ Sudan ■ Zimbabwe And there are another 14 nations that are right on the verge of one… ■ Bhutan ■ Cape Verde ■ Dominica ■ Ethiopia ■ Ghana ■ Laos ■ Mauritania ■ Mongolia ■ Mozambique ■ Samoa ■ Sao Tome e Principe ■ Senegal ■ Tanzania ■ Uganda So what should be done about this? Should we have the “wealthy” countries bail all of them out? Well, the truth is that the “wealthy” countries are some of the biggest debt offenders of all. Just consider the United States. Our national debt has more than doubled since 2007, and at this point it has gotten so large that it is mathematically impossible to pay it off. Europe is in similar shape. Members of the eurozone are trying to cobble together a “bailout package” for Greece, but the truth is that most of them will soon need bailouts too…

In addition to Spain, Italy and France, let us not forget Belgium (106 percent debt to GDP), Ireland (109 debt to GDP) and Portugal (130 debt to GDP). Once all of these dominoes start falling, the consequences for our massively overleveraged global financial system will be absolutely catastrophic…

Things in Asia look quite ominous as well. According to Bloomberg, debt levels in China have risen to levels never recorded before…

And remember, that doesn’t even include government debt. When you throw all forms of debt into the mix, the overall debt to GDP number for China is rapidly approaching 300 percent. In Japan, things are even worse. The government debt to GDP ratio in Japan is now up to an astounding 230 percent. That number has gotten so high that it is hard to believe that it could possibly be true. At some point an implosion is coming in Japan which is going to shock the world. Of course the same thing could be said about the entire planet. Yes, national governments and central banks have been attempting to kick the can down the road for as long as possible, but everyone knows that this is not going to end well. And when things do really start falling apart, it will be unlike anything that we have ever seen before. Just consider what Egon von Greyerz recently told King World News…

So what do you think is coming, and how bad will things ultimately get once this global debt crisis finally spins totally out of control? Please feel free to add to the discussion by posting a comment below… The post The Bankruptcy Of The Planet Accelerates – 24 Nations Are Currently Facing A Debt Crisis appeared first on The Economic Collapse. |

| Gold and Hit Again - Pervasive Nonsense Posted: 16 Jul 2015 02:15 PM PDT marketoracle |

| Gold Price to Break or Not to Break? That is the Question Posted: 16 Jul 2015 12:38 PM PDT |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment