Gold World News Flash |

- Gold is Near a ‘Technical Tipping Point’

- Greece Is Just The Beginning: The 21st Century 'Enclosures' Have Begun

- Balance Of Superpowers: Comparing The US And Chinese Armed Forces

- BofA Confused "Why People Would Wake Up One Morning And Decide To Panic"

- Alasdair Macleod: Credit deflation and gold

- Gold Price Lost Another $3.40 Today Closing at $1,143.80

- How Likely Is Hyperinflation In The U.S?

- In The News Today

- From Spain with Foreshadowing

- Invest with the Fed

- Gold Daily and Silver Weekly Charts - An Extreme In Sentiment Ahead of Key Month

- Gold and Hit Again - Pervasive Nonsense

- Credit Deflation and Gold

- ANONYMOUS - Leaked Illuminati Training Video

- Protesters Gathered In Syntagma Square Last Night

- ANONYMOUS JADE HELM 2015 URGENT UPDATE

- Greek Protests turn violent after Officials approve Bailout Plan

- Imbalances at the Heart of Greece’s Crisis

- John Stossel - Green Tyranny: The Propaganda Machine

- $85 Billion in Write-Offs May Fuel Small Gold Mining Stocks

- America Is Heading Toward Financial Ruin Economic Collapse -- Harry Dent

- Prediction On Global Meltdown: As Early As Fall

- Economic Confidence Management 101

- Another “IF” The Economy Evolves…

- 3 Ways World War III Might Start | Stuff They Don't Want You to Know

- Stefan Ioannou's Ways to Ride the Next Zinc and Nickel Waves

- US Dollar, Commodities and the Great Deflation Round 2

- The Multi-Trillion Dollar Oil Market Swindle

- Forces Driving the Dollar Higher

| Gold is Near a ‘Technical Tipping Point’ Posted: 16 Jul 2015 09:20 PM PDT by Myra P. Saefong, Market Watch:

Gold for August delivery GCQ5, -0.29% shed $3.50, or 0.3%, to settle at $1,143.90 an ounce on Comex, tallying a sixth straight session loss. Based on the most-active contracts, that was the lowest settlement since Nov. 6. September silver SIU5, -0.49% lost 6.4 cents, or 0.4%, to $14.984 an ounce. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Greece Is Just The Beginning: The 21st Century 'Enclosures' Have Begun Posted: 16 Jul 2015 07:30 PM PDT Submitted by Paul Craig Roberts, All of Europe, and insouciant Americans and Canadians as well, are put on notice by Syriza’s surrender to the agents of the One Percent. The message from the collapse of Syriza is that the social welfare system throughout the West will be dismantled. The Greek prime minister Alexis Tsipras has agreed to the One Percent’s looting of the Greek people of the advances in social welfare that the Greeks achieved in the post-World War II 20th century. Pensions and health care for the elderly are on the way out. The One Percent needs the money. The protected Greek islands, ports, water companies, airports, the entire panoply of national patrimony, is to be sold to the One Percent. At bargain prices, of course, but the subsequent water bills will not be bargains. This is the third round of austerity imposed on Greece, austerity that has required the complicity of the Greeks’ own governments. The austerity agreements serve as a cover for the looting of the Greek people literally of everything. The IMF is one member of the Troika that is imposing the austerity, despite the fact that the IMF’s economists have said that the austerity measures have proven to be a mistake. The Greek economy has been driven down by the austerity. Therefore, Greece’s indebtedness has increased as a burden. Each round of austerity makes the debt less payable. But when the One Percent is looting, facts are of no interest. The austerity, that is the looting, has gone forward despite the fact that the IMF’s economists cannot justify it. Greek democracy has proven itself to be impotent. The looting is going forward despite the vote one week ago by the Greek people rejecting it. So what we observe in Alexis Tsipras is an elected prime minister representing not the Greek people but the One Percent. The One Percent’s sigh of relief has been heard around the world. The last European leftist party, or what passes as leftist, has been brought to heel, just like Britain’s Labour Party, the French Socialist Party, and all the rest. Without an ideology to sustain it, the European left is dead, just as is the Democratic Party in the US. With the death of these political parties, the people no longer have any voice. A government in which the people have no voice is not a democracy. We can see this clearly in Greece. One week after the Greek people express themselves decisively in a referendum, their government ignores them and accommodates the One Percent. The American Democratic Party died with jobs offshoring, which destroyed the party’s financial base in the manufacturing unions. The European left died with the Soviet Union. The Soviet Union was a symbol that there existed a socialist alternative to capitalism. The Soviet collapse and “the end of history” deprived the left of an economic program and left the left-wing, at least in America, with “social issues” such as abortion, homosexual marriage, gender equality, and racism, which undermined the left-wing’s traditional support with the working class. Class warfare disappeared in the warfare between heterosexuals and homosexuals, blacks and whites, men and women. Today with the Western peoples facing re-enserfment and with the world facing nuclear war as a result of the American neoconservatives’ claim to be History’s chosen people entitled to world hegemony, the American left is busy hating the Confederate battle flag. The collapse of Europe’s last left-wing party, Syrzia, means that unless more determined parties arise in Portugal, Spain, and Italy, the baton passes to the right-wing parties - to Nigel Farage’s UK Independence Party, to Marine Le Pen’s National Front in France, and to other right-wing parties who stand for nationalism against national extermination in EU membership. Syriza could not succeed once it failed to nationalize the Greek banks in response to the EU’s determination to make them fail. The Greek One Percent have the banks and the media, and the Greek military shows no sign of standing with the people. What we see here is the impossibility of peaceful change, as Karl Marx and Lenin explained. Revolutions and fundamental reforms are frustrated or overturned by the One Percent who are left alive. Marx, frustrated by the defeat of the Revolutions of 1848 and instructed by his materialist conception of history, concluded, as did Lenin, Mao, and Pol Pot, that leaving the members of the old order alive meant counter-revolution and the return of the people to serfdom. In Latin America every reformist government is vulnerable to overthrow by US economic interests acting in conjunction with the Spanish elites. We see this process underway today in Venezuela and Ecuador. Duly instructed, Lenin and Mao eliminated the old order. The class holocaust was many times greater than anything the Jews experienced in the Nazi racial holocaust. But there is no memorial to it. To this day Westerners do not understand why Pol Pot emptied Cambodia’s urban areas. The West dismisses Pol Pot as a psychopath and mass murderer, a psychiatric case, but Pol Pot was simply acting on the supposition that if he permitted representatives of the old order to remain his revolution would be overthrown. To use a legal concept enshrined by the George W. Bush regime, Pol Pot pre-empted counter-revolution by striking in advance of the act and eliminating the class inclined to counter-revolution. The class genocide associated with Lenin, Mao, and Pol Pot are the collateral damage of revolution. The English conservative Edmund Burke said that the path of progress was reform, not revolution. The English elite, although they dragged their heels, accepted reform in place of revolution, thus vindicating Burke. But today with the left so totally defeated, the One Percent does not have to agree to reforms. Compliance with their power is the only alternative. Greece is only the beginning. Greeks driven out of their country by the collapsed economy, demise of the social welfare system, and extraordinary rate of unemployment will take their poverty to other EU countries. Members of the EU are not bound by national boundaries and can freely emigrate. Closing down the support system in Greece will drive Greeks into the support systems of other EU countries, which will be closed down in turn by the One Percent’s privatizations. The 21st century Enclosures have begun. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance Of Superpowers: Comparing The US And Chinese Armed Forces Posted: 16 Jul 2015 07:01 PM PDT Whether China is busy championing trade deals outside of the US dollar, buying up some of the world’s biggest companies, taking over foreign housing markets, or building massive networks of nuclear or wind power grids, it is clear that the country is a world power to be reckoned with. To be considered a true force, China also needs to be able to back up its economic and political might with a top notch military. Today’s infographic compares the armed forces of China with the United States. click image fir massive legible version In terms of military spending per capita, China is the new kid on the block. Although it has increased in recent years, China is still behind Russia, Turkey, South Korea, Japan, Germany, the United Kingdom, France, and the United States. However, the country does make up for it with in absolute terms by its sheer population. In terms of total military expenditures, China spends the second most worldwide with a total of approximately $216 billion per year, which is about one-third of the US. In GDP terms, China spends about 2.1% of its annual GDP on military, and the United States spends 3.8%. Perhaps the biggest difference between the two superpowers is influence in other parts of the world. The United States has 133 military bases outside of its territory, and China has zero. More specifically, the United States has bases in multiple jurisdictions that surround China: South Korea, Kyrgyzstan, Japan, Singapore, Guam, Afghanistan, and Diego Garcia, a set of small islands in Indian Ocean. Courtesy of: Visual Capitalist | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BofA Confused "Why People Would Wake Up One Morning And Decide To Panic" Posted: 16 Jul 2015 06:21 PM PDT Over the past twelve months, the decades-old economic infrastructure that supports global dollar dominance suffered irreparable damage to two of its load-bearing walls. First, the petrodollar system quietly began to die late last year. As crude prices plunged, the deluge of oil proceeds which had for years been recycled into USD-denominated assets dried up. Indeed, OPEC nations drained liquidity from financial markets for the first time in nearly two decades last year: As we noted last month, a new oil price "equilibrium" (i.e. a sustained downturn) could result in a net petrodollar drain of $24 billion per month on the way to nearly $900 billion in total by 2018, according to Goldman.The implications, BofAML observed in February, are far reaching: "...the end of the Petrodollar recycling chain is said to impact everything from Russian geopolitics, to global capital market liquidity, to safe-haven demand for Treasurys, to social tensions in developing nations, to the Fed's exit strategy." Second, the world's most influential emerging economies have lost faith in the US-dominated multilateral institutions that have dominated the post-war world. This has manifested itself in the creation of two new supranational lenders (the AIIB and the BRICS bank) and one major new infrastructure development fund (China's Silk Road fund). China plays an outsized role in the AIIB and the BRICS bank and both should serve to help Beijing embed the yuan further in global investment and trade. Meanwhile, Russia and China have begun settling crude imports in yuan amid the extension of Western economic sanctions on Moscow and Russia recently overtook Saudi Arabia as China's number one crude supplier. All of this marks a departure from the economic and political norms that have served to underwrite decades of dollar dominance and it goes without saying that printing trillions of dollars over the course of multiple QE iterations doesn't help king dollar's cause. In addition to the above, there's certainly an argument to be made that the US effectively surrendered its right to print the world's reserve currency long ago. That is, once the new economics succeeded in burying sound money once and for all, and when fine-tuning macroeconomic outcomes and "smoothing" out business cycles finally became so entrenched in modern economic thought that talk of balanced budgets and a gold standard was largely relegated to the annals of history, the dollar became nothing more than another example of fiat money, unworthy of the reserve currency title. Nevertheless, the status quo must be perpetuated, which is why Washington launched a Quixote-esque campaign against the AIIB complete with President Obama tilting against environmental and governance windmills and it is also why the likes of Bank of America must issue "research" with titles like "Econ 101: The reserve status of the dollar." Fortunately, that particular piece of crisply-worded dollar cheerleader propaganda has one footnote that makes the five minutes we spent reading it all worth while. We present it below and leave it to readers to respond. From BofAML:

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alasdair Macleod: Credit deflation and gold Posted: 16 Jul 2015 06:18 PM PDT 9:17p ET Thursday, July 16, 2015 Dear Friend of GATA and Gold: In his new commentary, "Credit Deflation and Gold," GoldMoney research chief Alasdair Macleod predicts that China will be compelled to devalue its currency against gold rather than directly against the U.S. dollar. Such a revaluation, Macleod writes, "would be presented to the world as bound up with China's domestic economic problems, instead of an act aimed at undermining the dollar's reserve status -- a solution that is less confrontational than outright disagreement with Western central banks over gold's role in the international monetary order." "Credit Deflation and Gold" is posted at GoldMoney's Internet site here: https://www.goldmoney.com/research/analysis/credit-deflation-and-gold?gm... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Free Storage with BullionStar in Singapore Until 2016 Bullion Star is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. Bullion Star's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in Bullion Star's bullion vault, which is integrated with Bullion Star's shop and showroom, making it a convenient one-stop-shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage is FREE until 2016 and will have the most competitive rates in the industry thereafter. For more information, please visit Bullion Star here: Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Lost Another $3.40 Today Closing at $1,143.80 Posted: 16 Jul 2015 06:12 PM PDT

The GOLD PRICE traded today to a lower low for the move ($1,140.60) by about $3.50. Looking at yesterday's V-bottom low and decline into today's slightly lower V-bottom, all those are places gold could turn around. More likely it will wait for $1,130, the low from November 2014. That's $13 from here. SILVER has followed gold's pattern the last two days, with a slightly lower V-bottom today ($14.85). Most obvious target from the chart is that 7 July intraday low at $14.62, maybe a dime lower. If it breaks that, 'twould be bad, but volume is not rising on this fall, with silver or gold, and that's a plus. I can testify that we are experiencing HUGE increase in physical demand at these prices. GOLD/SILVER RATIO refuses to rise as metal's fall -- odd, and might point to a turnaround. Ratio today closed Comex at 76.436, up a fraction from yesterday but not near the 7 July high. I remain unrepentantly clinging to my interpretation that we are seeing seasonal lows that mark the convergence of two very long cycles and the bottom of the long bear phase that began in 2011. Don't bother telling me it wracks your nerves. Mine are already shot, but I am buying in the teeth of 'em. Stocks rose again today. Dow added 70.08 (0.4%) to 18,120.25 and the S&P500 picked up 16.89 (0,8%) to 2,124.29. Now both indices have met the downtrend from their last two highs. What happens next? Stocks might turnaround tomorrow, or rise a few more days even to new nominal high, say, 2,140 and 18,400. Dow in gold rose to a new high today, 15.84, 1.7% above its March high at 15.581. Dow in silver Hit 1,209.31 oz. These new highs are what you would expect if metals are making seasonal lows, plus the whole carnival of propaganda about deflation, Greece solved, Chinese stock market stabilized, and the US economy a-boomin'. Hard to twist your head around that way to look at it from the contrary viewpoint, but that's the only way to penetrate to the truth. US dollar index rose 49 basis points (0.5%) to 97.77. That has passed the last high (97.45) and is working on the May high (97.88). This rising dollar also belongs to the deflation scare. Dollar is due for another cyclical high in August. Euro fell 0.66% to $1.0876 and the Yen lost 0.31% to 80.55 cents/Y100. Seems a naturalized Kuwaiti citizen working for ISIS today opened fire at a naval center in Chattanooga and killed four US Marines and wounded a police officer. It is loony to let all these immigrants flood into the country, and looks loonier still when you consider how much damage a few sleepers could do in the US. Makes a concealed carry permit look like the only sane path. Pray for the families of those victims. Jay Taylor interviewed me on 14 July about all the fun I had playing with the government 25 years ago. Its about 25 minutes long on YouTube, http://bit.ly/1KbiqXK Listen, I don't look nearly as bad as that picture makes me look. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2015, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| How Likely Is Hyperinflation In The U.S? Posted: 16 Jul 2015 05:05 PM PDT Authored by Seaborn Hall, originally posted at Advisor Perspectives, My previous article, “How likely is hyperinflation in the US? Part One,” covered hyperinflation's history, process, effects, definition, types and causes, as well as how to measure its emergence in nations using casual symptoms. Part Two answers the questions of how to gauge the likelihood of hyperinflation in the United States, what the emerging dangers are, how it might happen here and how to prepare if it does. As stated in Part One, because there are so many conflicting or just different views among analysts relative to hyperinflation, it is difficult for the average advisor or person investing for retirement – or just self-preservation – to know what to believe and how to act. Many of the warnings related to hyperinflation sound like Chicken Little's cry that the sky is falling. In the midst of the alarmism and confusion, these articles sift through the best resources available, including Bank for International Settlements (BIS), International Monetary Fund (IMF), Cato Institute and Fed papers to provide some clarity. Measuring hyperinflation in the U.S.A.The U.S. has come just short of hyperinflation twice before: once during the Revolutionary War and the second time, in March 1864, towards the end of the Civil War. The wars created high debt and supply disruptions within the continental states, congruent with fast acting hyperinflation, as explained in Part One. The U.S. has geographic advantages. It has natural supply routes made up of rivers, natural ports and inter-coastal waterways connected by a sophisticated rail and interstate system. It is protected by the natural boundaries of oceans, mountains and friendly bordering states. It is also not dependent on one export, like oil. These geographical and man-enhanced attributes temper any economic trend towards hyperinflation in the modern U.S. As previously noted, hyperinflation may be expected when there is persistent monetization and when the currency exchange premium – the premium the most-used foreign currency commands over the native currency – rises above 50%. This later sign typically occurs during a period of high inflation and up to three years before hyperinflation appears. This period may or may not include a currency crisis, which is distinct from, and can be an initial phase of, high inflation or hyperinflation. More broadly, the dangers of hyperinflation are measured by casual symptoms. These include fiscal, monetary and political causes and symptoms. As to fiscal symptoms in the U.S., according to a recent JP Morgan (JPM) presentation, net U.S. debt is presently around 75% of GDP, high, but non-critical. Foreign officials hold 35% of this debt; the Fed holds 16 percent. Both are significant, but not excessive. And, as Prasad and Ye note, debt cements the U.S. dollar role as global reserve; that is, as long as it is not unsustainable, and interest is a manageable piece of the total budget (chart, below). On this front, the U.S. does not have enough reserves to cover its short-term debt, but the Guidotti-Greenspan rule may not apply to Advanced Economies. And, as long as 10-year yields, currently about 2.35%, stay below 7% global bond investors tend not to panic, especially when the U.S. is the best of a bad lot.

Deficits-to-expenditures is marginal at about 18%. According to the Wall Street Journal, the deficit has decreased to only 3% of GDP in 2014. The deficit was $1.4 trillion six years ago and the Congressional Budget Office (CBO) projects it to be just $486 billion this year. But, it is expected to increase in 2016 and according to The Heritage Foundation could be worrisome again by 2021. Also on the down side, according to Heritage, net U.S. debt, above, will reach 100% of GDP, a dangerous level, around 2028. At $18.2 trillion, total federal debt is already 102.5% of GDP. But most analysts feel that net debt (total minus intra-governmental debt) is the more critical measure. By 2024, mandatory expenditures, or entitlements plus interest on the debt, will be 75% of revenues. By 2030 they will consume revenues (chart, below). As to monetary symptoms, Federal Reserve liabilities are also high, about $4.4 trillion. According to Guggenheim, the Federal Reserve's debt/equity ratio was 51:1 in July 2012, more than double 2008, and almost double commercial institutions that failed. And Fed Assets as a percentage of GDP have more than doubled since 2007. But central banks are judged differently, as Japan's experience implies, thus far at least. John Cochrane, a professor of finance at the University of Chicago, points out more specifically that Fed reserves do not lead to hyperinflation. It is also important to understand that printing money or QE is not necessarily the same as monetizing the debt.

In most cases, central banks control interest rates and reserves through government security and foreign currency purchases. To create money, a central bank purchases securities when it digitally credits the accounts of dealers with whom it does business. These dealer banks, like JP Morgan, are immediately richer. In some cases they park the money with the Fed, earning interest; in others, they invest it, some in riskier ways, like derivatives. For money velocity to increase they must actually loan it, which, according to Hanke, few currently do. This is partially due to increased federal regulations, like Dodd-Frank, instituted since the GFC, that place strict restrictions on lending activities.

Monetizing is when the central bank buys government securities directly from the Treasury to fund existing or, unplanned debt, as in the case of Zimbabwe or Japan at present (see Part One). An independent central bank firmly resists such pressure from the political power. The danger, of course, is that this distinction becomes unclear. And, as a 2008 IMF report on the Fed stated, "Compared with its posture during the Great Depression, the Fed today is taking considerably more risk and the scope for possible profit and loss outcomes is much greater." The report also points out that the Fed's ability to make a profit during every year of the Great Depression era was largely due to its accumulation of gold. This is a far cry from the make-up of the Fed's burgeoning balance sheet today. Another emerging hyperinflation danger is in the area of political management relative to economic health. The Obama administration has less business experience than previous administrations (chart above). Surveys also show that the American people see themselves as more divided than at any time in history (below), and other studies show that the political center is shrinking. Political mismanagement that suddenly increases the debt and social tensions could lead to a crisis that results in high inflation. Years ago, R. E. McMaster, author of No Time for Slaves, proposed a simple formula to facilitate understanding of the interplay between government and economics: government + religion = economics. According to Hanke, the problem with Venezuela and its hyperinflation is Hugo Chavez's successor, Maduro; the problem in Yugoslavia was Milosevic; the problem in Zimbabwe was and is Mugabe. They all adhered to the ten-point playbook of the Communist Manifesto, which wrecked their economies and the social order. According to McMaster government does not operate in a vacuum, but those who lead administer by their philosophy or religion.

This simple, but profound theorem plays out around the world today. It can lead to prosperity or economic crisis and hyperinflation. In America, this theorem has led to prosperity. The respect for individual rights and property rights are the pillars of the free market. The founders assured these rights through the founding documents, especially the U.S. Constitution.

According to Coltart (see Part One), the primary reason for Zimbabwe's hyperinflation was that the deficiencies of their constitution allowed a vast disparity of power between the executive office and the legislative and judicial branches. Most worrisome relative to the U.S. Constitution are a list of Supreme Court reversed Executive Orders that even liberal law scholars say blatantly violate the Constitution. It is the quality, not the quantity (above ) of these orders that is the issue. If Americans continue to allow this executive tendency to span administrations, as they have in the past, the dilution of their constitutional rights may eventually lead to hyperinflation in the U.S.A. For the present, inflation and money velocity remain low. Though there are various reasons high inflation may appear, typically, there need to be two elements: economic capacity, including low unemployment, and high money velocity. With even core inflation (PCE) currently under 1.2% (as of June 15th headline PCE is 0.2%), economic capacity and lower unemployment just emerging, and money velocity still quite low, high inflation does not appear to be on the horizon. This is not to say that other factors could not instigate high inflation or hyperinflation. Some of these "black swans" are dealt with below. But, while Reinhart and Rogoff are no doubt right about the rampant denial afflicting advanced nations relative to future sub-par growth, QE, debt restructuring and coming high inflation, a crisis appears years away. Greece is symbolic of that looming crisis; but it is not Bear Stearns or Lehman. This time is not different; but global reserve status, the trust and confidence of investors and deep and wide financial markets make the U.S. unique. There are still enough questions not to be dogmatic, but until the U.S. experiences an increase in causal symptoms or a black swan that fractures global confidence in its economy, hyperinflation is not a worry. Black swans that could lead to high inflation or hyperinflationThe above being noted, according to FT, the global system is in many ways more fragile today than before the GFC. And, considering its fragile nature, many incidents could come out of nowhere and lead to a crisis, or series of crises, that eventually results in a currency crisis and/or hyperinflation. One of the prominent possibilities is a successful cyber-attack on a major institution or the U.S. itself, especially the nation's power grids, its nuclear plants, its water supply or its major financial institutions. JPM's, NASDAQ's, and Sony's recent experience serve as examples, and with increasing tensions with Russia and China this area will continue to be a challenge. The director of the NSA recently warned that a cyber-attack will cause a major systems collapse within a decade unless the U.S. develops counter strategy immediately. According to Greg Medcraft, chairman of the board of the International Organization of Securities Commissions, the next black swan will be a cyber-attack.

Though the U.S. has largely avoided catastrophe in the past, there is also the possibility that it might experience more natural disasters in the future. Remember Zimbabwe? About 19% of the U.S. is presently in severe or extreme drought, 29% in moderate to extreme conditions and approximately 40% in abnormal dryness or greater. 100% of California is in extreme, severe or exceptional drought. Also alarming is that according to the Wall Street Journal U.S. beekeepers have been losing 30% of their bees for the last decade, above the 19% sustainable rate. The above issues may place strains on agriculture, lead to supply disruptions and drive up food prices in future years. As I covered more extensively in “Evaluating the Arguments for the Dollar's Demise,” in the last decade, globally, at least, there has been an, apparent, increase in natural disasters. According to a 2013 article in The New England Journal of Medicine, there were three times as many natural disasters from 2000 to 2009 as there were from 1980 to 1989. And, according to one account, it was the 1906 San Francisco earthquake and fire that led directly to the Financial Panic of 1907. In another critical area, both George W. Bush and Barack Obama have identified nuclear terrorism as the greatest threat to national security. According to a 2008 FBI study, any terrorist nuclear weapon is likely to have a yield of about 1-kiloton (chart, below ), large enough to destroy a city center and with the potential to contaminate surrounding area for up to 4 miles, depending on wind direction (chart, 2nd below ). According to Nukemap, a 1-kiloton detonation in lower Manhattan would kill about 30,000 people and cause three times as many injuries, some fatal. A smaller possibility is a 10-kiloton event with fallout reaching 20 miles.

Even before 911, the U.S. recognized that terrorist groups were attempting to acquire nuclear material. According to one recent joint report by Belfer Center at Harvard endorsed by military leaders, constructing a crude nuclear device is easier today than constructing a safe, reliable weapon. Tests indicate that intelligent operatives could defeat security systems holding weapons or materials and in the last five years several sites have been penetrated. As of 2014, at least four key core Al Qaeda nuclear operatives were still at large. And the difficulty of smuggling nuclear material into the U.S. is largely overstated. But the primary concern is that with one detonation terrorists could claim they had more bombs hidden, creating mass panic.

The nuclear scenario would be a global catastrophe, claiming thousands of lives, shutting down trade and exporting dire consequences to other nations. The cost in response and retaliation would also add enormously to U.S. debt, potentially accelerating the nation towards economic crisis. According to the above Belfer report, the risk of a nuclear terrorist attack on U.S. soil is greater than 1 in 100 every single year. In addition to all of the above possibilities there are ongo | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 16 Jul 2015 04:49 PM PDT Jim Sinclair's Commentary This will have a positive impact on gold. There's No Place to Hide as Bonds Move in Tandem With Equitiesby Lisa AbramowiczJune 8, 2015 — 10:57 AM MDT Investors who've tried to balance their holdings between stocks and bonds may be less protected from asset-price swings than they think. Here's why: bonds... Read more » The post In The News Today appeared first on Jim Sinclair's Mineset. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

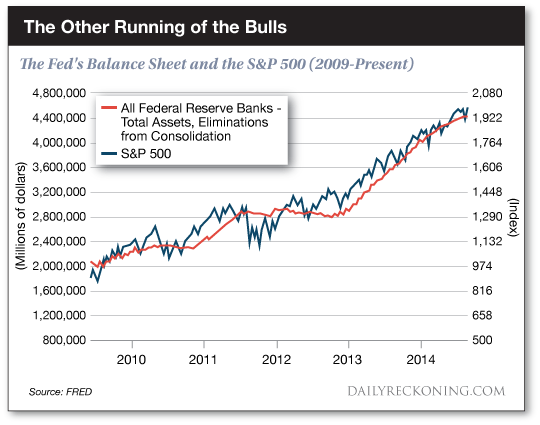

| Posted: 16 Jul 2015 02:42 PM PDT This post From Spain with Foreshadowing appeared first on Daily Reckoning. “To recognize bullsh*t, your nose is more useful than your ear." "It's a religious tradition," our colleague Sonja Lopez related this morning. She'd just returned from Pamplona, Spain, after running with the bulls. "The idea is if you believe in God, you will be protected. If you don't… you'll be gored." All three major U.S. stock indexes are up this morning. The foreshadowing isn't lost on us… "There's a strategy to it," Sonja continued. "You have to know when to enter and when to exit. "It's not a game. The Spanish will tell you as much. You actually have to know what you're doing. It's the people running around you that you should be afraid of, too — more than the animals themselves. And they supposedly had the biggest and fastest bulls in history this year. "Some Americans ended up getting gored." Nearly 4,000 miles west of that, Janet Yellen began her fool's footrace on Capitol Hill where Spain's ended: the two-day hearing formerly known as Humphrey-Hawkins. Much like the Pamplona spectacle, there's an old trader's tale that if you believe in the chair, you'll be spared. Doubt her and you'll get a horn in your ass, so to speak. Yellen spun her tale to Congress ex cathedra this morning for true believers who'd listen. We did, but only so you don't have to: "If the economy evolves as we expect, economic conditions likely would make it appropriate at some point this year to raise the federal funds rate target, thereby beginning to normalize the stance of monetary policy… "If we wait longer, it certainly could mean that when we begin to raise rates, we might have to do so more rapidly. An advantage to beginning a little bit earlier is that we might have a more gradual path of rate increases." Besides her word that rates will go up, we see mortgage, credit card and auto loan credit all became easier for consumers to get in June. Producer prices, a leading indicator of consumer inflation, went up too. Jobless claims improved last week as well, while homebuilders' confidence — however that's measured and interpreted — supposedly firmed. All signals that Yellen may indeed increase rates. And yet, like Bono said, "She moves in mysterious ways." Caveat emptor. "The Fed is flying blind with flawed forecasting tools and backward-looking data," colleague Jim Rickards wrote in these pages on April 28. "This leads to two possible outcomes… "Scenario A is that the Fed sees the weak economic signals before they raise rates. In that case, they will not raise rates in 2015 and may even go back to QE in early 2016. Stock markets might maintain momentum and even reach slightly higher levels as continued ease offsets the drag from deflation and weak growth. "Scenario B is that the Fed overestimates growth based on their flawed models and relies on the employment data while ignoring other danger signs. In that case, they might raise interest rates in September or December of this year. "Stock markets around the world could crash as liquidity dries up. Emerging markets would suffer the most because of a stronger U.S. dollar combined with a global dollar shortage. But U.S. markets would not be immune from this misguided and premature tightening." Jim recommends employing a "barbell strategy" including: gold, cash, bonds, select stocks, fine art, raw land and some alternatives in strategies like global macro hedge funds and venture capital. That advice's better taken sooner rather than later, too. By definition, the longer the bull market, the less time it has left. This one's 76 months old, the third longest in history. If not, at least put your money down aware that if you slap the bull on the ass, you deserve whatever comes to you. That said, a new acquaintance of ours, a Professor Robert Johnson, president of the American College of Financial Services, thinks you can use the market's odds in your portfolio’s favor. Johnson is the author of a new book called Invest with the Fed: Maximizing Portfolio Performance by Following Federal Reserve Policy, which landed on my desk in April. We recommend you grab a copy. "I was a finance academic," Johnson told me, explaining how the book came about. "I was also a money manager and a Fed watcher. I was convinced that the Fed has a tremendous influence on the financial markets. For context, this was in the late '80s. "It was before the fixation on Alan Greenspan uttering the term 'irrational exuberance' and having the markets collapse and so forth. This was before the Fed was front-page news. In fact, the Fed was barely in the financial news at that time. I was convinced that the Fed had a significant influence on capital market returns." As you'd expect a good academic to do, Johnson decided to study the Fed's impact on investment returns in a rigorous fashion. He's been doing that now for the last quarter of a century. Invest with the Fed, he explained, is a "culmination of all of that research updated. I think the astute individual investor will get some tremendous insights about what the Fed’s influence on their returns is and how they can monitor Fed actions to hopefully increase portfolio returns or reduce their risk." Click here to read a transcript of our conversation. Regards, Peter Coyne P.S. Be sure to sign up for The Daily Reckoning — a free and entertaining look at the world of finance and politics. The articles you find here on our website are only a snippet of what you receive in The Daily Reckoning email edition. Click here now to sign up for FREE to see what you're missing. The post From Spain with Foreshadowing appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

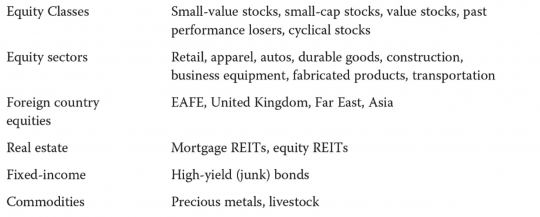

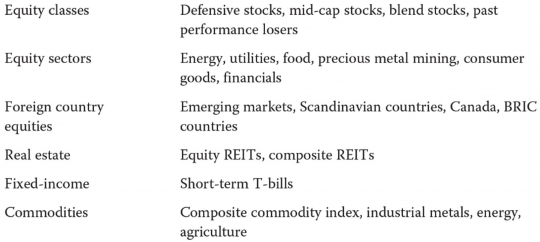

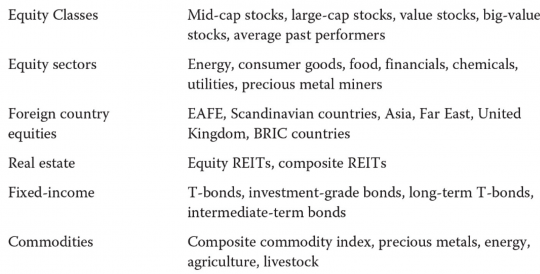

| Posted: 16 Jul 2015 02:38 PM PDT This post Invest with the Fed appeared first on Daily Reckoning. We recently spoke with Dr. Robert Johnson, co-author of Invest with the Fed: Maximizing Portfolio Performance by Following Federal Reserve Policy and president of the American College of Financial Services. "I was a finance academic," Johnson told me, explaining how the book came about. "I was also a money manager and a Fed watcher. I was convinced that the Fed has a tremendous influence on the financial markets. For context, this was in the late '80s. "It was before the fixation on Alan Greenspan uttering the term 'irrational exuberance' and having the markets collapse and so forth. This was before the Fed was front-page news. In fact, the Fed was barely in the financial news at that time. I was convinced that the Fed had a significant influence on capital market returns." As you'd expect a good academic to do, Johnson decided to study the Fed's impact on investment returns in a rigorous fashion. He's been doing that now for the last quarter of a century. Invest With the Fed, he explained, is a "culmination of all of that research updated. I think the astute individual investor will get some tremendous insights about what the Fed’s influence on their returns is and how they can monitor Fed actions to hopefully increase portfolio returns or reduce their risk." Read on for our conversation… Peter Coyne: Bob, welcome to The Daily Reckoning. Bob Johnson: Thanks for having me. Peter Coyne: Let's jump right in. To telescope the premise of your book, Invest with the Fed: You look at the correlations between Fed policy and returns by asset class from 1966-2013. Based on your findings, you recommend a set investment strategy based entirely on what the Fed does. To start, can you explain the three different periods of Fed policy that you say investors should focus on in order to use this strategy? Bob Johnson: Sure, you can think about Fed policy in three different periods. When interest rates are rising we call that a restrictive period. When interest rates are falling it's an expansive period. And when interest rates are going sideways is an indeterminate period. You know what period you're in by looking at two interest rates influenced by the Fed — the Federal Reserve discount rate, which largely signals a long-term, broad monetary policy stance. — and the federal funds rate. The Fed doesn’t change the discount rate very often. But if the last change in the discount rate was a decrease, you would say that the discount rate signals an expansive monetary policy. You should always look the last change the Fed made. The second rate we look at is what's called the monthly federal funds rate. Now the Fed sets a target fed funds rate, but what we look at is the actual fed funds rate in the market and we look at what the monthly average was. If the monthly average is declining, you would say that monetary policy is expansive. So we look at the direction of those two rates in the book. If both rates are going down, we say it’s an expansive monetary policy. If both those rates are going up, it’s a restrictive monetary policy. The Fed has been expansive, restrictive, and indeterminate about the same amount of time from 1966 to 2013… If they’re going in opposite directions, say the last change in the discount rate, for instance, was an increase and the last change in the fed funds rate was a decrease, we say that’s an indeterminate period. What we’ve found is interesting. The Fed has been expansive, restrictive, and indeterminate about the same amount of time from 1966 to 2013. In other words, the results that we look at aren’t driven by a small data sample, and that’s a really nice thing when you’re looking at statistics. If, for instance, they were only restrictive or expansive for, say, a sixth of the time, the findings wouldn’t be that robust. But when there’s equal sample sizes, a third, a third, and a third, we think that you can draw some conclusions from that. Peter Coyne: Let's get into those. What are the conclusions investors should draw from your research? Bob Johnson: I think the biggest conclusion that your readers can draw is, there are many pundits out there that are suggesting that if the Fed raises rates, it might signal good news to the markets because as the logic goes, that shows that the Fed has faith in the economic recovery. That’s not what the evidence shows in the past. What we find is that, on average, returns in the equity markets are much greater when the Fed is in an expansive monetary policy than in a restrictive monetary policy. Peter Coyne: Right. Here are the returns by asset classes in the different periods for readers to look at. In a few minutes we'll explore one way readers can invest in each sector. First, the top performing asset classes in expansive monetary conditions: Second, the top performing asset classes in restrictive monetary conditions:

And finally, the top performing asset classes in indeterminate monetary conditions: Bob Johnson: Exactly. Peter Coyne: Should investors be concerned with what the interest rate is in evaluating these? Bob Johnson: Our research shows is it’s not the level of interest rates that’s the most important factor, it’s the direction of interest rates. Right now interest rates are at unprecedented low levels. Some people would say, “Well, wait a minute. Is it really a big deal if the Fed increases interest rates from unprecedented low levels and just slightly increases them?” Well, what we find is that the relationship has to do with the direction of interest rates and not the levels. Peter Coyne: What's the causation there? Bob Johnson: Well, during an expansive monetary policy, interest rates are falling. If you think about it, cash flows are worth more when rates are declining. That’s one theoretical link, if you will. Another is the fact that if, for instance, in the recent time period, the Fed is infusing liquidity into the markets, people have more disposable income to spend. That should translate into higher corporate profits and so forth. I think it makes intuitive sense. People lose the forest for the trees listening to Fed language… You said causal effect, so I want to make the following point because I’m a little bit hesitant certainly to be quoted that the Fed causes these returns. The Fed is reacting to the economy and the Fed influences the economy. But you don’t know what the direction is. I always say it’s correlation, not causality. If I’m an investor, I really don’t care what the cause is. A strong case can be made that the Fed has a substantial influence on the economy and capital markets. I don’t think anybody’s going to argue with that. But it’s the direction that important. Is the Fed leading or are they lagging in some cases? Well, the Fed is both creating and reacting. That’s why the Fed’s afraid to raise interest rates, because they may forestall the economic recovery. Peter Coyne: Though you recommend investors react to the Fed's policy announcements it seems that today the Fed's "forward guidance" — Janet Yellen talking about what policy announcement the Fed might make in the future — is the new policy announcement. Does this dynamic change your advice? Bob Johnson: I’m glad you brought this up at this point in the interview. Of course we’re interested in short-term reactions to the Fed policy changes. But we're not as interested in them as we are in long-term returns. I grew up in Omaha, Nebraska. I’m highly influenced by Warren Buffett. I’m a long-term investor. We were concerned with what Fed policy means for the investor in the book, not for the speculator. People lose the forest for the trees listening to Fed language. I think that many people are focused on the timing of the Fed announcement and what that means for the markets in the near term. What our book looks at more is what it means for the markets long-term, and that’s what I think people need to focus on. Peter Coyne: Given the constant coverage of the Fed in the press, do you think we’re in a new era of Fed policymaking? Bob Johnson: Sir John Templeton once said the four most dangerous words in investing are, “This time it’s different.” I believe that. I am hesitant to say it’s a new paradigm. I think there have been very few new paradigms. I remember back in 1999 people would say, “Oh, you can’t value Internet stocks using discounted cash flow analysis.” Well, it turns out you could. So, no, I don’t believe we’re in a new time period. Now, could rates stay low for a long period? Could it be for an unusually long period of time? Sure. But do I believe that we are in an unprecedented era where rates are going to remain low for the foreseeable future? I don’t think so. Peter Coyne: Let’s bring it back to the findings of the book then. What are some more lessons readers can take away? Bob Johnson: It’s much easier to find really good-performing asset classes in expansive monetary conditions than it is in restrictive monetary conditions. Just across the board, it’s easier to find good performers. There are a lot of investors who have developed their own investment styles. One example is what's called "the small firm effect." That idea is that small firms over time do better than large firms. It’s much easier to find really good-performing asset classes in expansive monetary conditions… Other investors might operate on the premise that value stocks will perform better than growth stocks. What we found is the small firm effect is highly concentrated in expansive monetary policy periods, and the value effect is highly concentrated in expansive monetary policy periods. That is there isn’t much of a small firm effect or a value effect in indeterminate and restrictive conditions. So if you’re a value investor or you’re a small-stock investor, you get the bang for your buck in expansive monetary conditions, and that style doesn’t outperform in indeterminate or restrictive conditions. The interesting thing to me is you see which equity sectors perform. It makes sense in expansive periods, there’s a wealth effect that people feel. Retail, apparel, autos, durable goods, those kinds of firms outperform. If you look at restrictive conditions, the equity sectors that better perform are your traditional defensive sectors: energy, utility, food. So there is some intuition here, too. Peter Coyne: For the beginner investor who looks at the tables above, should they simply find exchange traded funds (ETFs) to invest in? Bob Johnson: Absolutely. In fact, we say in the book that the advent of ETFs — and investors can find an ETF that virtually follows any sector or any style — that if you want to utilize the information in the book and invest along with the Fed that one of the easiest ways to do that and cost-efficient ways to do that is to use ETFs. Peter Coyne: What's the one commonly held misconception among investors that your book dispels? Bob Johnson: One thing that people may glean from the book is that the asset class that moved exactly opposite to equities during different Fed monetary policy periods were commodities. Investing in a broad basket of commodities as rates are rising would have provided you with substantial returns over the equity markets. So the time to increase your commodity exposure is when interest rates are rising. As far as a surprising finding goes, I was surprised that physical gold — commonly thought of as a good hedge against inflation — didn’t provide you with that protection. Gold futures actually did worse in restrictive environments than they did in expansive environments. Inflation was much higher in restrictive monetary periods than expansive monetary periods… On that topic, inflation was much higher in restrictive monetary periods than expansive monetary periods. The S&P returned about 12.5% during expansive conditions. It roughly returned less than 7% during indeterminate periods. And it returned less a percent during restrictive conditions. So when you factor inflation in and look at real returns, there’s even a greater difference across the monetary environments. Yet, if you look at the return to gold futures, subtract out the inflation rate and the return to gold futures in restrictive monetary conditions is negative. By the way, people might look at the book as say “Well, this didn’t hold true in this period.” We get that. These findings are what happened on average. There are some expansive conditions that were poor for stocks. There are some restrictive conditions that were wonderful for stocks. It’s on average. Peter Coyne: Why then, given the returns you report, do you think many concerned investors still buy physical gold? Bob Johnson: I think it’s that people have confirmation bias. People look for news sources to confirm what they already think. It’s the old Anchorman line, where Will Ferrell says: “Why should we tell ’em the news? Why not just tell ’em what they want to hear?” I think that that’s what people look at with gold. There are time periods that you can point to that holding physical gold was a very good investment, and so people will anchor themselves in that time period. It’s behavioral finance. I think that’s a real danger for gold investors is that there is confirmation bias. They’re oftentimes listening to folks who are champions of investing in gold. I would invest in precious metal miners and mining companies rather than the physical precious metal… My bias has always been if you want to invest in precious metals, I would invest in precious metal miners and mining companies rather than the physical precious metal or precious metal futures. That's based on the evidence and based on the fact that there’s an equity market component to precious metals miners. Over the long run, that equity component doesn’t detract from results. Oh, by the way, what I would say to your readers is all three of us, the authors of this book, do not believe that you should make wholesale portfolio changes based on the evidence. That is, you shouldn’t sell your entire equity stake off when the Fed starts raising rates. We believe you can tilt your asset allocations instead. Within, for instance, equities, you can move from some equities that perform better in rising-interest rate environments. I’m a golfer, and there was a famous golf instructor named Harvey Penick. He was Ben Crenshaw’s golf pro, and he would tell people he gave golf lessons to, “Take an aspirin. Don’t take the whole bottle.” I would encourage your readers to glean some insights from the book. But I wouldn’t manage my entire portfolio that way. Peter Coyne: Great, thanks for your time today, Bob. The book is called Invest With the Fed: Maximizing Portfolio Performance by Following Federal Reserve Policy. There's a lot more inside it that we didn't cover here. You can grab a copy on Amazon, and we recommend you do. Even the beginner investor will find explanations of how the Fed operates and of basic financial terms helpful. Regards, Peter Coyne P.S. “Three takeaways” writes one reader who bought Invest with the Fed on Amazon and gave it five stars. “First, the authors show that monetary policies dramatically effect overall investment performance, as well as various strategies. Second they explain and show the empirical results across asset categories and many styles and strategies. Dozens of ideas are carefully compared. Finally, the book is designed for a normal investor, not a sophisticated and experienced expert. However, because the book is so well organized and thorough, both a novice and an expert will enjoy it. Great read!” We’ve also read through a copy. Beyond investment conclusions, it’s also good reference for how the Fed works and some easy to understand financial explanations. Click here to grab your copy now. The post Invest with the Fed appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - An Extreme In Sentiment Ahead of Key Month Posted: 16 Jul 2015 02:34 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold and Hit Again - Pervasive Nonsense Posted: 16 Jul 2015 11:56 AM PDT Gold and silver we hit again today, but silver managed to hang on to its 15 handle, and gold bounced back to 1050. I suspect that this was the usual sort of antics we see whenever some Fed head appears before the Congress for some 'confidence building.' Gold and silver are now both short term oversold, and at some key support areas. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 16 Jul 2015 11:05 AM PDT There is a common view in financial markets that credit deflation is bad for gold prices, because gold nowadays is regarded as an asset to be sold in the scramble for cash when people are forced to pay down their debts. When asked by Congressman Ron Paul his opinion on gold four years ago, Ben Bernanke replied it was not money, just another asset, appearing to confirm this view. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ANONYMOUS - Leaked Illuminati Training Video Posted: 16 Jul 2015 10:30 AM PDT I hope you folks have seen this before and learning their plans will help us to counteract this.DOWN WITH THE ILLUMINATI!!! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Protesters Gathered In Syntagma Square Last Night Posted: 16 Jul 2015 09:50 AM PDT This post Protesters Gathered In Syntagma Square Last Night appeared first on Daily Reckoning. PARIS – Protesters gathered in Syntagma Square in Athens last night… They were remonstrating against the cruelty of life in general and, more specifically, the deal their government made with its creditors. "Greek workers taken to the cleaners, as Tsipras forced to retreat on promises," reports the Financial Times. "Austerity," the papers call it. But that is just the public narrative. (More on this in Market Insight below…) Austerity is what Greece would have gotten without $220 billion in bailout funds from its neighbors and two debt restructurings. Without these, public sector wages… and pensions… would go unpaid. The banking system would collapse. And Greek savings would be obliterated. In reality, Greece is just cutting back on the extravagant bribes and payoffs to zombies; it's the price of keeping the whole game going. If the Greeks want more money, they have to pretend to use it prudently. If their crony lenders want to keep lending, they have to pretend that they will get their money back. Like the zombie wars in the Middle East, the important thing is not to win. Or to resolve problems. The important thing is to keep the money flowing. Despite the protests, the zombies in Athens were generally quiet and listless last night. They knew the new deal struck in Brussels over the weekend would keep the human flesh coming their way, though not as much as they wanted. What's the alternative? Default on their debt and live within their means? "We hope Syriza will look after us," said a janitor. "As long as I live, I hope." Meanwhile in Washington, Janet Yellen was pretending to look after janitors, too. "Looking forward, prospects are favorable for an improvement in the U.S. labor market and the economy more broadly," she said. As if she would know! Yellen went on to suggest that the Fed might move to "normalize" interest rates later this year – if things evolve as expected. "People need myths," said a colleague in Paris, Simone Wapler, over lunch yesterday. "They need a public narrative simple enough for them to understand." Good vs. evil, black vs. white, red states vs. blue states, evil Germans vs. put-upon Greeks – the narrative must be stripped of all nuance, subtlety, and contradiction. That is to say it must be stripped of anything resembling real life. The popular myth about the 2008 global financial crisis was that it was caused by greed and deregulation. Then the authorities stepped in to save the day. Since then, they have carefully nurtured a "recovery." When appropriate, Ms. Yellen will turn the economy back over to market forces. At the Diary we have a different narrative – still evolving, rough around the edges, and necessarily full of paradox and confusion. What is really going on is a Great Zombie War. The layabouts, manipulators, and grifters are fighting to maintain their hold on the productive economy's output. It's getting harder and harder for them to do so. First, because there are so many zombies. There's not enough human flesh to go around. Second, the zombies have imposed so many regulations and distortions that the economy has become less productive. Many of the battles you see in the news are really battles between different groups of zombies, each fighting for a larger share of the loot. Teachers want pay increases. The Pentagon wants more planes, or tanks, or pensions. Wall Street wants more cheap credit. Of course, zombies will always be with us. And they will always want more flesh. What makes the Great Zombie War unique is that never before have there been so many zombies… and never before have they depended so heavily on credit. Usually, the unproductive parts of a society are limited to the surplus production available to them. And when the surplus disappeared, so did the zombies. Apparently, when food was short, Eskimo tribes put the older members of the tribe out on the ice, where they would drift away and disappear. In almost all cultures – as far as we know – laziness and parasitism are discouraged. In Switzerland, for example, the work ethic used to be so strong that a young man sitting on a park bench in the middle of the day was likely to be approached by an old person waving a cane: "Young man, why aren't you at work?" Then along came the post-1971 money system – with its (theoretically at least) unlimited supply of credit. Suddenly, the sky was the limit for zombiedom… Firefighters want to retire at 45? No problem. Need a new sports stadium? Sure. More subsidies for sugar growers? Why not! Along with the easy money came a big relaxation in attitudes. Soon, people didn't seem to mind the zombies around them. And they didn't mind becoming zombies themselves. Taking welfare used to be a mark of failure and shame. "Disability" was reserved for people with genuine problems. Million-dollar paydays were regarded as unseemly, greedy, or vulgar. No more. Get it while you can! And why not? The new credit money was splashing out on the street like an open fire hydrant. Just put on your bathing suit and join in the summer fun. It appeared that society could support as many zombies as it wanted to – with no (current) loss to anyone else. But wait. What about the debt? In the mid-1980s, the Republican Party lost its traditional distaste for deficit spending. Conveniently, it discovered that deficits didn't matter to voters. There was plenty of credit. Voters were happy to have bigger Social Security payments. And they would put up with another federal agency to pretend to improve education… or health… or whatever – so long as taxes weren't raised to pay for it. The cost would be paid by someone somewhere someday. Who knew? Who cared? Households and businesses also discovered that deficits didn't matter. People came to think that a big mortgage was a good thing. House prices were rising. Stocks were going up. If you wanted to get rich, you just had to get "on the escalator." The bigger the mortgage, the bigger the house, the more stocks you owned – and the bigger the gain when you sold. So, total debt grew. From about 150% of GDP in the 1950s, 1960s, and 1970s, it rose to 350% of GDP after 2000. And the zombies ran wild from Wall Street to Syntagma Square – siphoning off trillions of dollars of capital from the productive economy. This is the world that the zombies and their crony allies are so desperate to protect. Regards, Bill Bonner P.S. I originally posted this essay, right here, at the Diary of a Rogue Economist. The post Protesters Gathered In Syntagma Square Last Night appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ANONYMOUS JADE HELM 2015 URGENT UPDATE Posted: 16 Jul 2015 09:44 AM PDT ANONYMOUS HAS DISCOVERED INFORMATION REGARDING THE TREASON OF OUR GOVERNMENT. YOU SHOULD BE STANDING FOR YOUR RIGHTS AGAINST THE TYRANNY OF THIS GOVERNMENT. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Greek Protests turn violent after Officials approve Bailout Plan Posted: 16 Jul 2015 09:30 AM PDT Greece riots on streets can't change the Greek future . Former German Minister of Economics Karl-Theodor zu Guttenberg and SkyBridge Capital Founder Anthony Scaramucci on the latest on the Greek debt crisis. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Imbalances at the Heart of Greece’s Crisis Posted: 16 Jul 2015 08:50 AM PDT This post Imbalances at the Heart of Greece’s Crisis appeared first on Daily Reckoning. In Greece and the End of the Euroland Fantasy, I suggested the trade imbalances at the heart of Greece’s debt crisis could only be resolved by Greece returning to its own national currency. Correspondent Michael Gorback observed that there are other mechanisms for correcting imbalances in trade and productivity: There is not one but 4 ways to address international productivity imbalances: currency revaluation, fiscal transfers, labor migration, and changes in local wages. If you peg one of those the others must adjust. In the case of the Eurozone and Greece, the adjustment was largely through fiscal transfers with a bit of migration. Wages are not so much sticky as fossilized. I submit that the reason the US does well under monetary union (ED NOTE: that is, all 50 states use the same currency, the U.S. dollar) is not so much its fiscal union as it is the strength of compensatory mechanisms that are far less developed in Europe. American states and localities still engage in their own fiscal policies and productivity is by no means homogeneous. The US enjoys excellent labor mobility – about 10x that of Europe. It has seen numerous population shifts based on economics: the early western migration, the Gold Rush, migration of freed slaves to the north, Okies leaving the midwest during the Dust Bowl, the population shift from New England to the Sun Belt, and more recently the oil-boom-related migrations, to name a few. Employers are also mobile. Furniture manufacturers moved from Western NY state to the South decades ago. GE once had 14,000 employees in the town of Pittsfield, MA. Now it’s gone. Boeing is moving ops to SC. Beretta moved to TN. If the wages don’t adjust, the employers migrate to the lower wages. The US, having a large and relatively less regulated private sector that’s also relatively unencumbered by unions, has greater wage flexibility than most developed countries. I think these compensation mechanisms in mobility and wages work better for the US and that’s why the US handles monetary union better than the Eurozone. The US still has to engage in interstate fiscal transfers but they’re mediated through the central government and few citizens give it a second thought. Is the State of NY frothing over the fact that it gets back less federal dollars than it pays, and that the difference is going to Kentucky? Why does Boeing open a plant in South Carolina and China open factories in Africa but BMW hasn’t opened a plant in Greece? If I were negotiating a bailout, those would be the reforms I’d demand – reforms that make business thrive. Easing the process of labor migration within Europe was one goal of the Eurozone, and in terms of making it relatively easy for someone to take a job in another Eurozone member nation, it was a successful reform. But this doesn’t really address imbalances in productivity due to differences in skills, education, cultural values and corruption. Low-skill labor is more easily recruited than high-skill labor, and in a global economy, the choice of where to site a new plant or call center depends on many factors, not just wage arbitrage, i.e. going to where the labor is currently cheaper. Many assume corporations have shifted production to China to take advantage of lower wages. But as wages rise in China, this is not necessarily the deciding factor: proximity to China’s growing market is often the over-riding factor. A new book, Thieves of State: Why Corruption Threatens Global Security, highlights the many systemic costs of corruption. The corruption that is endemic to Greece and China (among many others) imposes profound systemic costs on those economies, costs that may well loom much larger in the next global downturn than they did in the last Global Financial Meltdown. I think it is safe to say that piling on more debt is the worst possible way to correct structural trade and productivity imbalances, yet that is the Eurozone’s “solution” to Greece’s debt/ trade/ productivity/ corruption crisis. The discussion should be (as Michael pointed out) about creating conditions for business and real wealth creation to thrive, not jamming more debt down the throats of everyone on either side of the structural imbalances. Regards, Charles Hugh Smith P.S. Ever since my first summer job decades ago, I've been chasing financial security. Not win-the-lottery, Bill Gates riches (although it would be nice!), but simply a feeling of financial control. I want my financial worries to if not disappear at least be manageable and comprehensible. And like most of you, the way I've moved toward my goal has always hinged not just on having a job but a career. You don't have to be a financial blogger to know that "having a job" and "having a career" do not mean the same thing today as they did when I first started swinging a hammer for a paycheck. Even the basic concept "getting a job" has changed so radically that jobs–getting and keeping them, and the perceived lack of them–is the number one financial topic among friends, family and for that matter, complete strangers. So I sat down and wrote this book: Get a Job, Build a Real Career and Defy a Bewildering Economy. It details everything I've verified about employment and the economy, and lays out an action plan to get you employed. I am proud of this book. It is the culmination of both my practical work experiences and my financial analysis, and it is a useful, practical, and clarifying read. The post Imbalances at the Heart of Greece’s Crisis appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| John Stossel - Green Tyranny: The Propaganda Machine Posted: 16 Jul 2015 08:30 AM PDT For five decades now, fear mongering over climate change has been used as mechanism to grow government and reduce the control individuals have over their own lives. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $85 Billion in Write-Offs May Fuel Small Gold Mining Stocks Posted: 16 Jul 2015 08:00 AM PDT This post $85 Billion in Write-Offs May Fuel Small Gold Mining Stocks appeared first on Daily Reckoning. 'Dis-aggregation,' where mines become dispersed among more players, may lead to much greater efficiency in the mining sector. Miners' big endeavor in the boom years was to produce more and more tons. Commodity prices were rising, so their revenues grew as they ramped up production. The market rewarded the biggest players for taking over smaller counterparts, believing that it would mean even more production and lower overall costs. Mergers and acquisitions proliferated. Fast forward to today. Commodity prices have declined and big miners are paying for their excesses… A recent Citi report puts the total amount of write-offs at 90% of the value of projects that miners acquired after 2007. That's US$85 billion in shareholder value gone. Most of that destruction happened in the big industrial commodities like aluminum, coal, and iron ore. But gold mining also saw its share of losses among the major gold miners, including Goldcorp, Barrick Gold and Kinross. The Financial Post reports on one example: Cerro Negro was a [big] problem. Goldcorp spent $3.6 billion to buy the project in 2010, when gold prices were steadily going up. The company then ran into troubles with runaway inflation in Argentina, a permitting delay and government currency controls that limit the ability to convert Argentine pesos into U.S. dollars. All these factors drove up costs at Cerro Negro and meant a writedown was required to bring its carrying value down to reality. Goldcorp also took a $2 billion write-down on the Penasquito mine in Mexico. Big Miners Shedding Mines During a recent visit to Barrick Gold, one of the world's biggest gold producers, I learned that Barrick was planning to sell billions in assets within the year. The company has written off a lot of its projects. But the debt they incurred to run the business is still there. They need to pay it off to avoid disaster, so they're undoing the very thing that turned them into the behemoth gold producer they are today. They're selling off a number of their mines to other miners. For instance, they recently sold the Cowal mine to Evolution Mining for $US550 million. Smaller Players Stepping Up Klondex Mines, the second company to show me around their mines, was breathing new life thanks to the majors' difficulties. The company was able to acquire a new producing mine from major gold producer Newmont Mining. Newmont, once headed by Pierre Lassonde, wanted the cash without the hassle of running a small mine. Like Barrick, Newmont had too many small mines for its taste and was looking to shed assets like its Midas gold mine. As the Klondex team explained during my recent trip, they think there is a lot more that they can do with their new mine than Newmont had anticipated. The majors, meanwhile, are able to focus once again on their most important projects. As one senior manager at Barrick put it, the company "allowed themselves to become fat" with people and unnecessary expenses during the bull market. Now, they are cutting back heavily on those costs by reducing their staff and seeking ways to minimize costs. Both Klondex and Barrick Gold cited maximizing their efficiency and getting their operations to run smoothly – without negative surprises like cost overruns – as their top priorities. This includes dropping some of their smaller projects to raise some cash and pay off debt. We are seeing a reversal of the M&A frenzy that occurred from approximately 2007 to 2011. The sector is becoming less consolidated and allowing room for new players. The gold rout is showing why uncontrolled M&A was so bad for the mining sector. During the M&A boom, majors used their best projects to subsidize a disorderly expansion. This diverted attention from generating production as cost-effectively as possible and lessened their attention to operational performance. In the end, projects were heaped on the balance sheets of a few big players, who could not manage them appropriately. Now the trend may be reversing. Projects are being re-distributed among more players, and smaller companies are getting a chance to grow. Steve Todoruk has recently written about how some of these smaller groups are faring. Click here to read more. Henry Bonner P.S. Ever wonder how you can make a lot of money from oil without owning a well? Or whether or not you should buy gold and silver? Or is fracking just a flash in the pan? Get insight, insider scoops and actionable investment tips twice a week with Daily Resource Hunter? Just click here for a FREE subscription! The post $85 Billion in Write-Offs May Fuel Small Gold Mining Stocks appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| America Is Heading Toward Financial Ruin Economic Collapse -- Harry Dent Posted: 16 Jul 2015 08:00 AM PDT The governments' need to inflate its way out of the debt hole it's sinking deeper into every day is just another driver of the change to come. Harry S. Dent Harry S. Dent Jr. The Great Depression Ahead Harry S. Dent, Jr. is the Founder and President of the H. S. Dent... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Prediction On Global Meltdown: As Early As Fall Posted: 16 Jul 2015 07:34 AM PDT As the risk of a global economic downturn rises, the European Union's head of foreign affairs and security policy asserted that "political Islam" is a firm part of Europe's future. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||