Gold World News Flash |

- China Finally Says How Much Gold it Has, but Nobody Believes It

- The Gold Price Dropped 2.2 Percent this Week Ending at $1,131.80

- Elite Fund Manager Tom Conrad Warns of 50% Market Crash

- A Ratio Worth Respecting

- Market Report: Extremes Become More Extreme

- The Bankruptcy Of The Planet Accelerates - 24 Nations Are Currently Facing A Debt Crisis

- Blankfein Joins The Billionaire Bankers' Club

- Bron Suchecki: Where did 110 tonnes of CME Hong Kong gold go?

- Shanghai Gold Exchange Sees 61.8 Tonnes Withdrawn In Eighth Largest Week Ever

- New York Sun: The Hubris of the Fed

- China finally says how much gold it has, but nobody believes it

- China's official gold reserves total is still phony -- and so is most everybody else's

- Martin Armstrong: "Those In Power Will Risk War And Civil Unrest To Preserve It"

- China Dumps Record $143 Billion In US Treasurys In Three Months Via Belgium

- What will happen if the "Dollar Collapses" In 13 September 2015

- Gold Daily and Silver Weekly Charts - Hidden Dragon, Crouching Dollar

- ISIS attack America. Starts to get dangerous. Then Martial Law

- Why Pensions Are A (Big) Black Swan

- China’s Master Gold Plan, Restated

- Gold and Silver Extremes Become More Extreme Weekly

- Compelling Reasons Why the Next Move Down in Global Markets is Just Around the Corner

- Global Precious Metal Roundtable - Greece, China, Manipulation, Interest Rates and Outlook

- Dr. Jerome Corsi: Trump Is The Real Deal

- Brace Yourself for Obamacare “Sticker Shock”

- Why Most Gold Bugs and Bloggers are Dead Wrong About China’s Gold

- Where is Support for Precious Metals Markets?

- GOLD and SP500 Intraday - Elliott Wave Analysis

- Jim Rogers Likes Rubles

- China gold reserves top Russia in first disclosure since 2009

- Credit Deflation and Gold

- Retail Silver Premiums - The Candle Blowing in the Wind

- Friday Morning Links

- In GoldSilver.com interview, Steer cites gradual acceptance of GATA's work

| China Finally Says How Much Gold it Has, but Nobody Believes It Posted: 18 Jul 2015 01:00 AM PDT by Myra P. Saefong, Market Watch:

The last time China reported official figures was in April 2009. Back then, the figure stood at 1,054 metric tons, according to Ross Norman, chief executive officer at Sharps Pixley. The latest total is about half what the market thought it was. The market was generally expecting a total of well over 3,000 metric tons, according to Brien Lundin, editor of Gold Newsletter. "There is much evidence that [China's] holdings are actually at those higher levels, which makes one wonder why they would feel compelled to understate the total now," he said. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Gold Price Dropped 2.2 Percent this Week Ending at $1,131.80 Posted: 17 Jul 2015 10:22 PM PDT

Nothing points to a turnaround in silver except its nearness to the recent low at $14.62 and last December's low at $14.165. I reckon I may get my head handed to me on a platter, but I have to stick with it: we're seeing a seasonal low that will mark the bottom of the long bear phase. We'll know next week. After a four year bear phase has beaten up the silver and gold price and left stock investors preening themselves and sticking out their tongues at us, it might be helpful to recall a bit of history. Gold's 1982-1999 bear market against stocks topped on 25 August 1999 with gold at $266. Silver's 1982-2001 bear market topped 7 June 2001 with silver at 432.3 cents. How have they done since then, as of 16 July 2015? Here are the numbers: Results for Gold against stocks from 25 August 1999: - Nasdaq 100, up 87% - Nasdaq Composite, up 80.5% - S&P500 up 54% - Wilshire 5000, up 75.6% - Dow Industrials, up 60% - Gold, up 330% Results for Silver against stocks from 7 June 2001: - Nasdaq 100, up 82% - Nasdaq Composite, up 85% - S&P500 up 44% - Wilshire 5000, up 65% - Dow Industrials, up 40% - Silver, up 347% Rough week for silver and gold prices, down 4.2% and 2.2%, but a good week for stocks, up about two percent. Last hurrah, I reckon. US dollar index removed all doubt about which way it would break: UP. Platinum and palladium are sinking out of sight, and the world is abuzz with a deflation scare. Well, that's only a boogeyman, but an effective one. Why a boogeyman? Because "inflation" is "an increase in the money supply" while "deflation" is a decrease in the money supply, and you can search the wide world over and you won't find any country whose money supply is decreasing. Every central bank in the world has responded to the chronic economic crisis since 2008 by creating money in amounts vaster than history knows. What ought to deflate is all the bad debt and bad investment in the world, but that is precisely what the central banks are preventing Rest assured, tuck this into your heart, swing across the vastest chasm safely using this for a rope: if real deflation threatens central banks will create new money until the electrons pop out of their eyeballs. It won't "jump start" the economy, but it will melt the monetary and financial jumper cables. What the world needs is a debt jubilee, a simple write-off and walk away from all the unpayable debt, and the destruction of the machine that made it possible, central banks and government deficit spending. Whoo! That feels better. Now, let's look at markets.

But a risin' dollar's sure pizen to the euro, as if it took much pizen to kill anything that sick. Today the euro lost 0.31% to $1.0846. This Greece mess makes it plain that the swoll up bureaucrats runnin' Europe have finally lost their minds. They think they're about to gobble Greece whole, but they are likely to choke on a bone no Heimlich will dislodge. Japanese ain't about to choke on a bone, cause they chop everything up and eat it raw. Yen gained 0.5% to 80.60, while its chefs in Tokyo just keep chopping it up into little bitty sushi.

Dow in silver closed the week at S$1,578.96 silver dollars (1,221.23 troy oz). Does that wreck the pattern and foretell stocks rising against silver (and gold) forever? Well, wait a little. This is just about when silver and gold ought to be making lows, and nothing's happened to make the US economy or stock market any more attractive than it looked six weeks ago. Just wait till next week and see. Dow in Silver chart's on the left. Y'all enjoy your weekend. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2015, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Elite Fund Manager Tom Conrad Warns of 50% Market Crash Posted: 17 Jul 2015 09:00 PM PDT by Jeff Berwick, Dollar Vigilante:

TDV: Hello, Tom, thanks for sitting down with us. Before we ask you about the markets, we heard you went to the FreedomFest conference in Las Vegas recently. I normally go but have decided to stay out of the US for now. But, tell us about that. Tom Conrad: I just got back and it was quite an experience. So many interesting people were there – Doug Casey, Peter Schiff, George Gilder, Steve Forbes – and people in the news like Donald Trump. I would say about 2,200 people attended and filled the hotel. Many were, of course, libertarians and Tea Party types. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

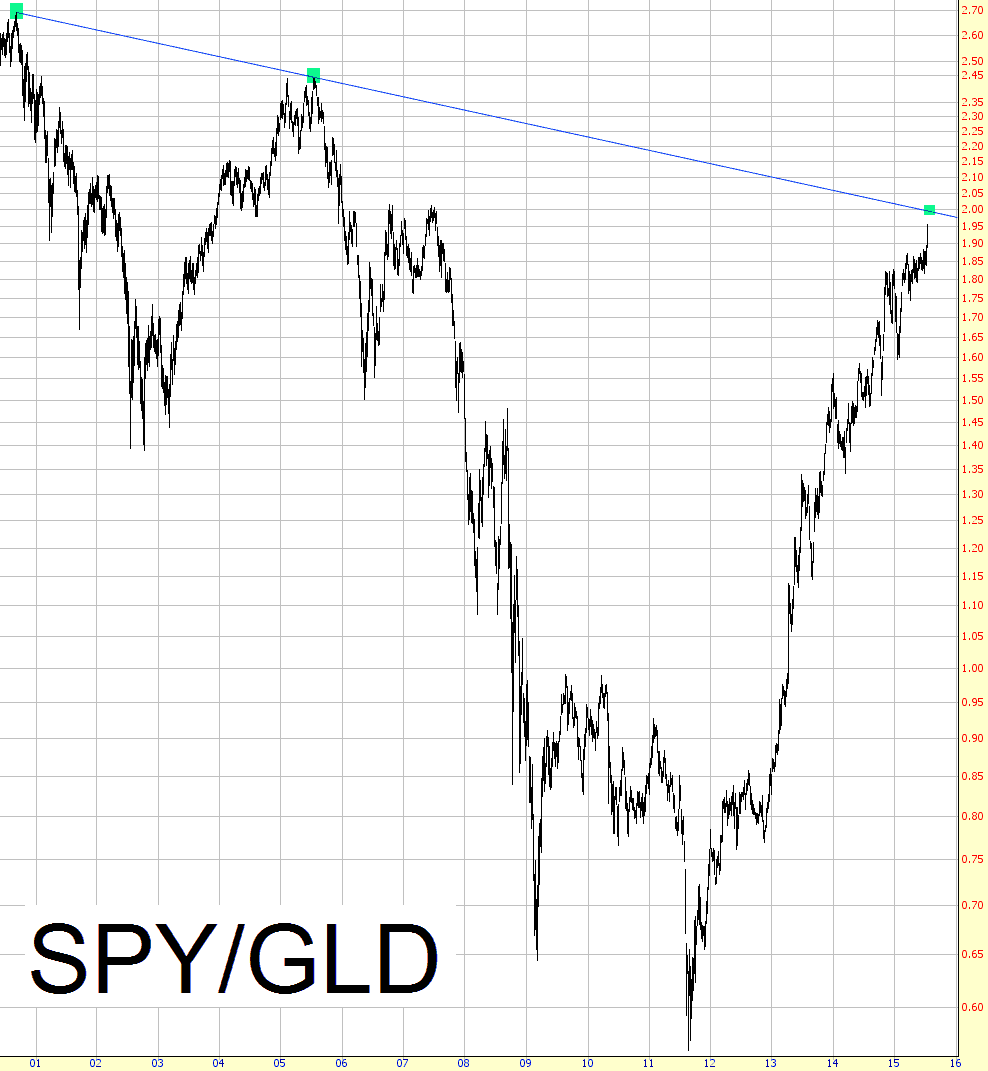

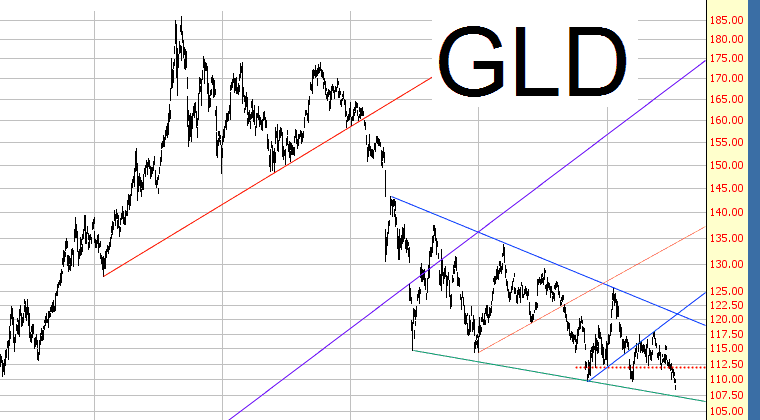

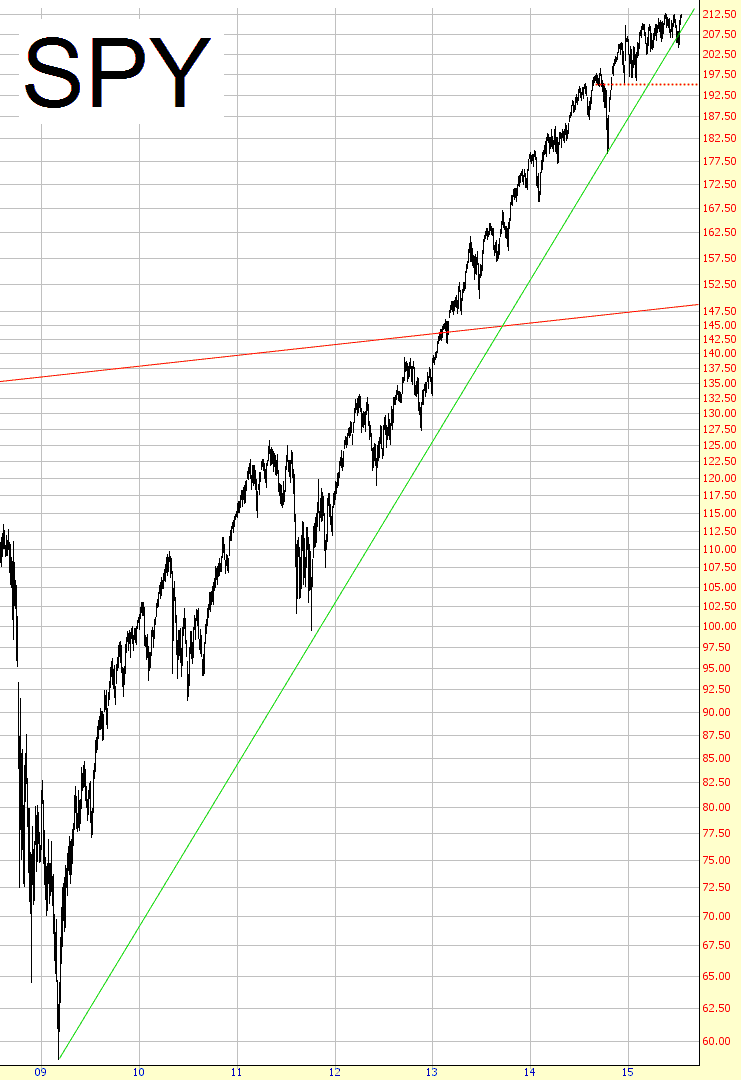

| Posted: 17 Jul 2015 08:49 PM PDT From the Slope of Hope: Two months ago, I did a piece called A Fascinating Ratio, which suggested that a major reversal was coming once the ratio reached about 2.0. At the time I did the post in mid-May, the ratio was a little under 1.8, but thanks to the unflagging strength of equities, as well as the unwavering suckiness of precious metals, this ratio is up to 1.95. We're getting very, very close to what I think will be a major pivot point, and perhaps the pairs trade opportunity of the decade:

Looking at the individual components, it's obvious that gold has been a piece of trash for almost four solid years now, but we might be reaching an important support point, which is at about 107.50 defined by GLD, shown below: At the same time, the S&P 500 ETF, symbol SPY, has already fractured its long-term ascending trendline. This violation, which took place on June 29, is something I don't take lightly. In my experience, once a financial instrument starts "chipping away" at a trendline, its days are numbered. In sum, the closer we get to a 2:1 relationship between SPY and GLD, the more powerful an opportunity is made available to go short the S&P and go long gold. Believe me, I realize what garbage gold looks like right now, and how powerful equities (think NFLX, GOOGL, AMZN, EBAY, etc.) appear to be. In spite of this, this contrarian play could be one of the most potent and profitable strategies in years.  | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Market Report: Extremes Become More Extreme Posted: 17 Jul 2015 08:20 PM PDT by Alasdair Macleod, Gold Money:

This is close to the lowest prices we have seen since 2010. At the same time equities have rallied strongly and the S&P 500 Index is within a whisker of its all-time high. It is a crazy world. On the New York Stock Exchange margin debt has hit all-time records at $500bn, roughly double that at the top of the dot-com bubble in 2000 when valuations rose to the highest ever recorded. This is at a time when China’s stock markets have begun at the very least a serious bear market; at worst embarking on a 1929-style market crash. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Bankruptcy Of The Planet Accelerates - 24 Nations Are Currently Facing A Debt Crisis Posted: 17 Jul 2015 07:30 PM PDT Submitted by Michael Snyder via The Economic Collapse blog, There has been so much attention on Greece in recent weeks, but the truth is that Greece represents only a very tiny fraction of an unprecedented global debt bomb which threatens to explode at any moment. As you are about to see, there are 24 nations that are currently facing a full-blown debt crisis, and there are 14 more that are rapidly heading toward one. Right now, the debt to GDP ratio for the entire planet is up to an all-time record high of 286 percent, and globally there is approximately 200 TRILLION dollars of debt on the books. That breaks down to about $28,000 of debt for every man, woman and child on the entire planet. And since close to half of the population of the world lives on less than 10 dollars a day, there is no way that all of this debt can ever be repaid. The only “solution” under our current system is to kick the can down the road for as long as we can until this colossal debt pyramid finally collapses in upon itself. As we are seeing in Greece, you can eventually accumulate so much debt that there is literally no way out. The other European nations are attempting to find a way to give Greece a third bailout, but that is like paying one credit card with another credit card because virtually everyone in Europe is absolutely drowning in debt. Even if some “permanent solution” could be crafted for Greece, that would only solve a very small fraction of the overall problem that we are facing. The nations of the world have never been in this much debt before, and it gets worse with each passing day. According to a new report from the Jubilee Debt Campaign, there are currently 24 countries in the world that are facing a full-blown debt crisis…

And there are another 14 nations that are right on the verge of one…

So what should be done about this? Should we have the “wealthy” countries bail all of them out? Well, the truth is that the “wealthy” countries are some of the biggest debt offenders of all. Just consider the United States. Our national debt has more than doubled since 2007, and at this point it has gotten so large that it is mathematically impossible to pay it off. Europe is in similar shape. Members of the eurozone are trying to cobble together a “bailout package” for Greece, but the truth is that most of them will soon need bailouts too…

In addition to Spain, Italy and France, let us not forget Belgium (106 percent debt to GDP), Ireland (109 debt to GDP) and Portugal (130 debt to GDP). Once all of these dominoes start falling, the consequences for our massively overleveraged global financial system will be absolutely catastrophic…

Things in Asia look quite ominous as well. According to Bloomberg, debt levels in China have risen to levels never recorded before…

And remember, that doesn’t even include government debt. When you throw all forms of debt into the mix, the overall debt to GDP number for China is rapidly approaching 300 percent. In Japan, things are even worse. The government debt to GDP ratio in Japan is now up to an astounding 230 percent. That number has gotten so high that it is hard to believe that it could possibly be true. At some point an implosion is coming in Japan which is going to shock the world. Of course the same thing could be said about the entire planet. Yes, national governments and central banks have been attempting to kick the can down the road for as long as possible, but everyone knows that this is not going to end well. And when things do really start falling apart, it will be unlike anything that we have ever seen before. Just consider what Egon von Greyerz recently told King World News…

So what do you think is coming, and how bad will things ultimately get once this global debt crisis finally spins totally out of control? | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Blankfein Joins The Billionaire Bankers' Club Posted: 17 Jul 2015 06:50 PM PDT One thing that has become abundantly clear after seven years of global QE is that the trickle-down "wealth effect" is a myth. At the macro level, lackluster global demand betrays the failure of central bank policy to engineer a robust recovery. At the micro level, the growing wealth divide is proof of what should have been self evident even to a PhD economist: policies explicitly designed to inflate the assets most likely to be held by the wealthy will likely serve to exacerbate the disparity been the haves and the have nots. Of course, post-crisis monetary policy has not only served to restore the fortunes of wealthy individuals - it's also been tremendously helpful in nursing the world's largest financial institutions back to health after they were nearly destroyed by their own greed and malfeasance. These two happy (if you understand how important it is to have assets) byproducts of post-crisis money printing coalesce into what is perhaps the greatest betrayal of the public trust in modern history when one looks at how things have turned out for the very people whose decisions brought about the collapse of the system and effectively sowed the seeds for the very policies which have since served to make them even richer than they were before the meltdown. In short, Wall Street executives have done quite well since 2009 as was made abundantly clear last month when Bloomberg reported that Jamie Dimon had become a billionaire. Well, just a little over a month later we learn that yet another TBTF CEO has joined the billionaire banker club and honestly, we're surprised it took this long because after all, when you're the CEO of the blood-sucking cephalopod that holds the political and financial fate of the world in its tentacles, it seems only right that you would have been a billionaire long before any other banker on the Street. Whatever the case, Lloyd Blankfein is now a billionaire. Bloomberg has more:

And frankly, that's pretty much all you need to know. The Bloomberg article has more on Blankfein's homes, background, and charity work, but the bottom line is that it pays (literally) to have friends (and former colleagues) in high government and regulatory places and if you're still having trouble understanding how it's possible that the same people who Plaxico'd themselves in 2008 and plunged the world into the worst recession since 1930 could possibly be allowed to not only remain out of jail but accumulate obscene fortunes on the back of the humble taxpayer well, "that's why [Lloyd Blankfein] is richer than you."

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bron Suchecki: Where did 110 tonnes of CME Hong Kong gold go? Posted: 17 Jul 2015 05:33 PM PDT 8:35p ET Friday, July 17, 2015 Dear Friend of GATA and Gold: Somebody trading gold on CME Group's exchange in Hong Kong seems to have taken special pains to avoid the advent of a little transparency, Perth Mint research director Bron Suchecki writes today, with an acknowledgment of gold researcher and GATA consultant Ronan Manly. Suchecki's commentary is headlined "Where Did 110 Tonnes of CME Hong Kong Gold Go?" and it's posted at the Perth Mint's Internet site here: http://research.perthmint.com.au/2015/07/17/where-did-110-tonnes-of-cme-... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shanghai Gold Exchange Sees 61.8 Tonnes Withdrawn In Eighth Largest Week Ever Posted: 17 Jul 2015 05:32 PM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New York Sun: The Hubris of the Fed Posted: 17 Jul 2015 05:20 PM PDT From The New York Sun A director of the New York Federal Reserve Bank has jumped into the fray against efforts by Congress increase its oversight of the central bank it created. The director, Glenn Hutchins, asserts in an op-ed piece in the London Financial Times, that the chairman of the Fed's governors, Janet Yellen, "is right" to have warned this week against measures that could subject policymakers "to short-term political pressure, in the name of transparency." He insists that in the past six years "monetary policy has been the only consistently functional economic policy tool." ... It's not our purpose to suggest that the scandal of the Fed's handling of the AIG crisis is the be-all-or-end-all of this debate. No damages were awarded the AIG shareholders who brought suit, and it may yet be that the Fed will be vindicated on appeal. But one would think that if the directors of the New York Fed are going to start mocking the standing of the Congress of the United States, they would have the judgment to acknowledge the latest verdict in respect of their own institution. The New York Fed was found to have, with the Treasury and certain lawyers, "orchestrated" the AIG takeover in a way to exclude AIG's shareholders. Isn't this a moment when it would be more logical for the directors of the New York Fed to look to the governance of their own institution? ... ... For the complete commentary: http://www.nysun.com/editorials/hubris-of-the-fed/89225/ ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China finally says how much gold it has, but nobody believes it Posted: 17 Jul 2015 05:02 PM PDT By Myra P. Saefong China released data on its gold holdings for the first time in about six years, but investors say the guessing game about the country's actual inventory continues. The People's Bank of China on Friday published figures on its gold reserves for the first time since 2009. Its official gold reserves stood at 53.3 million ounces, or 1,658 metric tons, in June. The last time China reported official figures was in April 2009. Back then the figure stood at 1,054 metric tons, according to Ross Norman, chief executive officer at Sharps Pixley. The latest total is about half what the market thought it was. The market was generally expecting a total of well over 3,000 metric tons, according to Brien Lundin, editor of Gold Newsletter. "There is much evidence that [China's] holdings are actually at those higher levels, which makes one wonder why they would feel compelled to understate the total now," he said. ... China has undertaken economic reforms aimed at persuading the IMF to include the yuan in the basket, which would accelerate its acceptance as a reserve currency. Or China could be "lowballing" their reserves to maintain confidence in its substantial U.S. dollar holdings, according to Mark O'Byrne, research director at GoldCore in Dublin. ... ... For the remainder of the report: http://www.marketwatch.com/story/china-finally-says-how-much-gold-it-has... ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China's official gold reserves total is still phony -- and so is most everybody else's Posted: 17 Jul 2015 03:58 PM PDT 7:41p ET Friday, July 17, 2015 Dear Friend of GATA and Gold: Most people in the gold business seems disappointed with China's announcement today of its gold reserve total, which, as Sharps Pixley CEO Ross Norman told The Wall Street Journal, was only about half of what the market expected, since it was the first updating of gold reserves by the People's Bank of China in six years: http://www.wsj.com/articles/china-discloses-its-gold-holdings-1437144149 But this expectation was probably always unrealistic, for as Zero Hedge writes -- http://www.zerohedge.com/news/2015-07-17/china-increases-gold-holdings-5... -- China's announcement today was also an admission that its gold reserve figures have been misleading. Indeed, the announcement was almost certainly hugely misleading, China's true gold reserves likely being far larger. That is, for six years, right through yesterday, China asserted that its official gold reserves were 1.054 tonnes, but today China reported its official reserves as 1,658 tonnes, an increase of 604 tonnes or 57 percent -- http://www.reuters.com/article/2015/07/17/china-gold-reserves-idUSL4N0ZX... -- and of course that much additional metal was not obtained in the last 24 hours. Zero Hedge writes: "China has finally admitted that its official gold numbers were fabricated (alongside all other official data released from the communist country), as it is impossible that the People's Bank of China could have bought 600 tons of gold in the open market in June when the price of the yellow metal actually dropped by 2 percent." But China has not "finally" admitted anything, as these are the same circumstances that prevailed when China updated its reserve report in 2009. For from 2003 to 2009 China maintained that its gold reserves were just 454 tonnes. Then one day in April 2009 the reserves report jumped 146 tonnes to 600 tonnes: China didn't get that additional gold overnight either. ... Dispatch continues below ... ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. Even so, China's gold reserves reporting may be no more dishonest than the reporting of Western central banks, which long have demanded that the International Monetary Fund allow them to conceal leased and swapped gold from their reserve reports -- allow them to count as reserves gold that has left their vaults or has multiple claims to ownership, lest truthful reserve data reveal and undermine their surreptitious interventions in the currency and gold markets. The secret March 1999 report of the IMF's staff disclosed that the IMF complied with these demands to facilitate the dishonesty: http://www.gata.org/node/12016 China's reporting also may be no less dishonest than the reporting of gold reserves by countries that think they're being honest. For any country that vaults its gold, as many do, at the Federal Reserve Bank of New York or the Bank of England, the nerve centers of gold price suppression, may not really have what it thinks it has on any particular day. Saudi Arabia, the oil-exporting superpower, pulled a similar trick in 2010. In June that year the World Gold Council reported that Saudi Arabia's gold reserves had increased by 126 percent, from 143 to 323 tonnes, since 2008. That Saudi Arabia, the oil-exporting superpower, seemed to be turning oil into gold for its foreign-exchange reserves caused a bit of a sensation. But a few weeks later the governor of the Saudi Arabia Monetary Authority, Muhammad al Jasser, insisted to news reporters that Saudi Arabia had not purchased the gold cited in that report by the World Gold Council but rather had possessed that additional gold all along, holding it in what he called "other accounts" but not reporting it: Ah, yes, good old "other accounts" -- the true accounts of gold reserves, which for all great powers are state secrets. For as your secretary/treasurer long has noted, for any great power the true amount, location, and disposition of gold reserves are secrets far more sensitive than the amount, location, and disposition of nuclear weapons. For nuclear weapons are not likely ever to be used, and nations can defend themselves well enough with just a few of them, since a nation that can deliver just a few is close to immune from attack from another nation. No nation is prepared to lose even a few cities by starting a nuclear exchange. In military strategy this is called "minimum deterrence." But gold, the ultimate national weapon in financial markets, can be effective against a national enemy only in bulk. For as Assistant Undersecretary of State Thomas O. Enders told Secretary of State Henry Kissinger in a private meeting at the State Department in April 1974, gold is the great "reserve-creating instrument" and whoever has the most gold controls its price and makes the rules of the international financial system: http://www.gata.org/node/13310 That is, the nuclear "missile gap" of old is survivable; the "gold gap" of today may not be. So where does this leave ordinary gold investors? Judging from today's market action, giving up. And though central banks probably are buying whatever ordinary gold investors are selling, that doesn't necessarily make those ordinary investors stupid for selling, since the central bank timetable for revaluing gold upward to a level more sustainable for the long-term price suppression scheme has not yet been ferreted out by GATA, Wikileaks, or the Financial Times (just kidding about the FT, which would never tell the truth about the gold market) and since it's a pretty good bet that gold could sink to $4 per pound, becoming cheaper than hamburger, and monetary mining company shares could go to zero without prompting the slightest curiosity from gold mining executives and the World Gold Council. But then the big issue here has never been merely gold but rather the destruction of free markets by unlimited government -- that is, totalitarianism. Fighting that tends to incur capital losses. CHRIS POWELL, Secretary/Treasurer Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Martin Armstrong: "Those In Power Will Risk War And Civil Unrest To Preserve It" Posted: 17 Jul 2015 03:55 PM PDT Submitted by Martin Armstrong via ArmstrongEconomics.com, Nigel Farage may be the only practical politician these days because he came from the trading sector. He explains the Euro-Project and its failures. He makes it clear that the Greek people never voted to enter the euro, and explains that it was forced upon them by Goldman Sachs and their politicians.

Nigel also explains that the Euro project idea that a trade and economic union would then magically produce a political union – the United States of Europe and eliminate war.

He has warned that the idea of a political union would end European wars has actually filled Europe with rising resentment in where there is now a new Berlin Wall emerging between Northern and Southern Europe.

The Euro project was a delusional dream for it was never designed to succeed but to cut corners all in hope of creating the United States of Europe to challenge the USA and dethrone the dollar. That dream has turned into a nightmare and will never raise Europe to that lofty goal of the financial capitol of the world.

The IMF acts as a member of the Troika, yet has no elected position whatsoever. The second unelected member is Mario Draghi of the ECB. Then the head of Europe is also unelected by the people. The entire government design is totally un-Democratic and therein lies the crisis. Not a single member of the Troika ever needs to worry about polls since they do not have to worry about elections. This is authoritarian government if we have ever seen one.

The ECB attempts by sheer force to manipulate the economy with zero chance of success employing negative interest rates and defending banks as the (former?) Goldman Sachs man Mario Draghi dictates.

Now, far too many political jobs have been created in Brussels. This is no longer about what is best for Europe, it is what is necessary to retain government jobs. The Invisible Hand of Adam Smith works even in this instance – those in power are only interested in their self-interest and will risk war and civil unrest to maintain their failed dreams of power.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China Dumps Record $143 Billion In US Treasurys In Three Months Via Belgium Posted: 17 Jul 2015 03:19 PM PDT When the latest Treasury International Capital data was released yesterday, many were quick to conclude that not only had China's selling of US Treasury ceased, but that with the addition of $7 billion in US government paper, China's latest total holdings of $1270.3 billion were the highest since May of 2014. And if one was merely looking at the "China" line item in the major foreign holders table, that would be correct.

However, as we have shown before, when looking at China's Treasury holdings, one also has to add the "Belgian" Treasuries, which is where China had been anonymously engaging in a record buying spree via the local Euroclear, starting in late 2013, which however concluded with a bang in early 2015. This is what we said last month:

It wasn't precisely clear just why China, which had historically used So with the benefit of the TIC data, we know that China's Treasury liquidation has not only not stopped, but has continued. Enter, once again, Belgium, only this time it is not a "mystery" buyer behind the small central European country's holdings, but a seller. As the chart below shows, after a record $92.5 billion drop in March, "Belgium" sold another $24 billion in April, and another $26 billion last month, bringing the total liquidation to a whopping $142.5 billion for the months of March, April and May.

This means that after adding mainland China's token increase of $7 billion in May after a $40 billion increase the two months prior, net of Belgium's liquidation, China has sold a record $96 billion in Treasurys in the last three months.

Just to confirm that one should add the dramatic changes in "Belgium" holdings to mainland China Treasury, here is a chart overlaying China's Forex reserves, which as we learned today had dramatically increased by 600 tons of gold, but more importantly forex reserves declined to $3.693 trillion, a drop of $17 billion from $3.711 trillion the month before, and the lowest since September 2013! Putting all of this together, it reveals that China has already dumped a record total $107 billion in US Treasurys in 2015 to offset what is now quite clear capital flight from the mainland, and the most aggressive attempt to keep the Renminbi stable. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| What will happen if the "Dollar Collapses" In 13 September 2015 Posted: 17 Jul 2015 02:30 PM PDT What will happen if the "Dollar Collapses" In 13 September 2015Maxwell PayneWhy a complete economic collapse in the U.S. is unlikely even if the dollar loses 100% of its value.Disclaimer: This article is opinion based with likely scenarios derived from logic based situations.Discussion includes... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Hidden Dragon, Crouching Dollar Posted: 17 Jul 2015 02:00 PM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ISIS attack America. Starts to get dangerous. Then Martial Law Posted: 17 Jul 2015 12:56 PM PDT ISIS was tweeting about Chattanooga the same time the attack took place The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why Pensions Are A (Big) Black Swan Posted: 17 Jul 2015 12:52 PM PDT When talk turns to what might derail today’s debt-driven “recovery,” the big names and easy stories get most of the attention: China with its soaring debt, volatile equities and heavy-handed intervention; Japan with its stratospheric debt and science fictiony demographics; Greece, which needs no explanation; the developing countries with their weak currencies and mountain of dollar-denominated debt. And of course America’s triple bubble of stocks, bonds and derivatives. Underfunded pension plans, to the extent they come up at all, tend to be mentioned in passing largely because most of them are 1) too small to matter on their own and 2) too hard to understand for most people to form a strong opinion. But they deserve a closer look. In the US there are dozens of state and local pension plans that in the aggregate are underfunded by several trillion dollars (meaning they’ve promised this much to beneficiaries but don’t have it). When one plan blows up it will impact lots of others, so the aggregate number is a pretty good indicator of the real risk. The generally-accepted poster child for pension mismanagement is Chicago. As the Wharton business school recently noted:

For a more detailed account of the mess that is Chicago see Emanuel fiddles while Chicago burns by enraged Illinois resident Mike Shedlock. But, you might reasonably say, pension funds have big investment portfolios so they must be making fortunes in today’s bull markets. You’d be right in some cases. But apparently it’s still not enough to offset rising liabilities as baby boomer teachers, cops and fire fighters retire. And now, as financial markets peak and start to roll over, it’s getting harder to make any money at all. Consider the plight of huge California pension plan CalPERS:

And this is during a year when stocks and bonds did okay. What happens when — after one of the longest bull markets ever — the inevitable bear market occurs? A diversified stock portfolio will fall by 20% (the definition of a bear market), real estate will tank as it always does in hard financial times, and bonds, which would normally outperform in such an environment, might only be stable since they’re already yielding next to nothing. The net result: A loss of 10% – 15% at a time when the fund needs at least +8% just to keep up with soaring obligations. The funding gap becomes a chasm, leading to calls for benefit cuts (which lower the incomes of current and prospective retirees and send them en masse to the polls to vote out the ruling party), big tax increases to rebuild pension portfolios (sending taxpayers not covered by these plans to the polls to vote out the incumbents), or massive spending cuts to free up money to rebuild pensions (which sends the local economy into a deep recession, sending newly-poor residents to the polls…you get the picture). If this sounds a little Greece-like, that’s because states and localities are in a very similar bind: they’re small economic units that have accumulated unpayable debts. Lacking the ability to print and/or devalue their own currency, they have no choice but to (at some point) live within their means. But this inflicts extraordinary pain inflicted on a populous that isn’t used to suffering and sees no point in starting. The ensuing crisis will be “solved” in one of two ways: 1) A default by, let’s say Chicago, which sends its municipal bonds down to pennies on the dollar and, much more important, panics everyone who owns munis, tanking the whole sector. States and localities around the country find themselves unable to borrow, and they start defaulting on their outstanding bonds and/or laying off tens of thousands of workers, turning a narrow little muni crisis into a full-blown recession. This in turn lowers the returns generated by stocks and real estate, further widening the pension gap. 2) Washington (DC) steps in and bails Chicago out before it can default. But — same as if the eurozone forgave Greece’s debt — all the other badly run pension plans decide they’re Italy and demand the same sweet deal. The cost spirals into the trillions, the financial markets realize that government debt and money creation are now on a one-way train to infinity, and everyone freaks out. Pretty big black swan, wouldn’t you say? So in the year ahead keep an eye on pension fund returns in general and Chicago’s in particular. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China’s Master Gold Plan, Restated Posted: 17 Jul 2015 12:34 PM PDT This post China's Master Gold Plan, Restated appeared first on Daily Reckoning. Query: How much gold does it take to get international prestige while not ticking off the powers that be? 1,658 tons, apparently. At least officially… But before we explain further, a look at the yellow metal. Gold's down $11, at $1,132, near its November 2009 lows. Inflation numbers, as measured by CPI, printed this morning and met surveyed economists' expectations. Maybe that's why. It could also be because of the gravitas Janet Yellen's showed yesterday while telling Congress rates would increase this year. Or it could be something entirely else… Either way, "there's a difference," as Addison explained in a NPR interview years ago, when gold was still rallying, "between being a gold bug and understanding the impact of Federal Reserve policy on the U.S. dollar. Gold bugs are overjoyed to be riding the gold price all the way to $2,000, and they should be. But you can count on it they'll ride the price all the way back down to $1,000." Take your pick of the reason gold's down today and then grumble or shrug depending on which characterization fits you best. "Gold is the only real money," Addison wrote on a different occasion, in one of The Daily Reckoning's free reports, The 5 Best Ways to Invest in Gold, "and it's value cannot be changed or controlled by government fiat." That's why "the ultimate dollar hedge investment will always be gold." "I find it funny that central bankers are always disparaging gold," Jim Rickards told me separately, but in the same vein, on the Eurostar train from London to Paris last week, "yet they all hold gold." As he finished that thought, we daydreamed back to July 13, 2011. We were sitting in room 2128 of the Rayburn House Office Building, in Washington, D.C. Congressman Ron Paul was questioning then-Fed chairman Ben Bernanke during a House Financial Services Committee hearing … Dr. Paul: Do you think gold is money? Ben Bernanke: No. It is a precious metal. Dr. Paul: It's not money? Ben Bernanke: It's a precious metal. Dr. Paul: Even if it has been money for 6,000 years, somebody reversed that and eliminated that economic law? Ben Bernanke: It's an asset. Would you say Treasury bills are money? I don't think they're money either, but they're a financial asset… Dr. Paul: Why do central banks hold it? Ben Bernanke: It's… it's is a form of reserves… Dr. Paul: Why don't they hold diamonds? Ben Bernanke: It is tradition… a long-term tradition… Dr. Paul: Some people still think it is money. I yield back. My time is up. A moment for reflection… "China increased its gold reserves 57%," reports Bloomberg this morning, "overtaking Russia to become the country with the fifth-largest hoard in its first disclosure in six years." To bring you up to speed, since 2009, the People's Bank of China has been mum on the country's official gold reserves. That year it revealed its gold reserves as 1,054 tons, having risen 454 tons since its prior update in 2003. Since 2009, speculation and sleuthing have led to a range of predictions about China's real gold hoard. Meanwhile, on page 229 of The Death of Money, published in 2013, Mr. Rickards says, "the next update to the gold reserve figures can be expected in 2015" — a call made good this morning. According to the report, China's official statement of reserves is now 1,658 tons. "While the metal is no longer used to back paper money," Bloomberg explains, "it's a large part of central bank reserves in the U.S. and Europe. China may have stockpiled gold as part of its plan to diversify its foreign-exchange reserves. Another explanation comes from a reader commenting on our website this morning, "The Golden Rule: Whoever has the gold makes the rules." Mr. Rickards has diligently laid out the case for as much… "Before I started talking about special drawing rights," Jim told us recently, "people thought SDR stood for strawberry daiquiri on the rocks." Since then, the ideas of the International Monetary Fund as proto world central bank… special drawing rights as the accepted world reserve currency… and currency wars seem to have become ubiquitous themes throughout the newsletter industry. Stay on top of other analysts' forecasts, by all means, but remember you heard it from Jim first. "The IMF officially demonetized gold in 1975," Rickards wrote on April 14. "The U.S. ended the convertibility of gold in 1971. Gold disappeared 'officially' in stages in the mid-1970s. But the physical gold never went away." He continued to explain: "Gold serves as political chips on the world's financial stage. It doesn't mean that you automatically have a gold standard, but that the gold you have will give you a voice among major national players sitting at the table. "Here's the problem: If you took the lid off of gold, ended the price manipulation and let gold find its level, China would be left in the dust. It wouldn't have enough gold relative to the other countries, and because their economy's growing faster and because the price of gold would be skyrocketing, they could never acquire it fast enough. They could never catch up. All the other countries would be on the bus, while the Chinese would be off. "When you have this reset, and when everyone sits down around the table, China's the second largest economy in the world. They have to be on the bus. That's why the global effort has been to keep the lid on the price of gold through manipulation… "The price is being suppressed until China gets the gold that they need. Once China gets the right amount of gold, then the cap on gold's price can come off." While tapping this reckoning out, Jim called from the road. "China's is feigning transparency with a 'don't rock the gold boat' strategy," he said. "It's a misrepresentation of the facts. They absolutely have more gold than they're reporting. "This behavior is consistent with the case we made in May," he continued. "China is doing what it needs to do to join the SDR club, but nothing more. The gold reserves they reported are less than the IMF's," which, for reference, holds about 2,814 tons, "but enough to get noticed. The report today was also not enough to send the gold price higher, which suits China fine, since they're still a buyer." Opinions and conjecture are bound to circulate in the coming hours. Now more than ever, it's important to understand why Jim believes most gold bugs and bloggers are dead wrong about China's gold reserves. That said, we've decided to republish Jim's piece from May 18. Click here to read it in it’s entirety. Regards, Peter Coyne P.S. Be sure to sign up for The Daily Reckoning — a free and entertaining look at the world of finance and politics. The articles you find here on our website are only a snippet of what you receive in The Daily Reckoning email edition. Click here now to sign up for FREE to see what you're missing. The post China's Master Gold Plan, Restated appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold and Silver Extremes Become More Extreme Weekly Posted: 17 Jul 2015 12:21 PM PDT Gold and silver continued to drift lower over the course of the week, with gold trading at $1,145 and silver at $15.02 in early European trade this morning. This is close to the lowest prices we have seen since 2010. At the same time equities have rallied strongly and the S&P 500 Index is within a whisker of its all-time high. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Compelling Reasons Why the Next Move Down in Global Markets is Just Around the Corner Posted: 17 Jul 2015 12:11 PM PDT There are some compelling reasons to believe that the next move down in risk assets across the globe is about to begin: First and foremost the Euro a good proxy for global risk appetite has completely broken down despite the perceived resolution to the crisis in Greece. The strong dollar could eventually cause the liquidation of carry trades (Source marketwatch.com): | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Global Precious Metal Roundtable - Greece, China, Manipulation, Interest Rates and Outlook Posted: 17 Jul 2015 12:00 PM PDT - Recent events in Greece have undermined trust in the EU - Sentiment towards gold cannot get much worse - Increase in interest and demand for gold recently - Elephant in room is manipulated gold and silver market - Will sharp slowdown in China see fall or rise in gold demand? - Gold served its function as safe haven in recent months - History shows that gold prices rise with interest rates - Gold has performed well in most currencies this year | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dr. Jerome Corsi: Trump Is The Real Deal Posted: 17 Jul 2015 12:00 PM PDT Dr. Jerome Corsi joins the show to discuss the political persecution of Obama critic Donald Trump and former Reagan policy advisor Dinesh D'Souza and more. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Brace Yourself for Obamacare “Sticker Shock” Posted: 17 Jul 2015 11:05 AM PDT This post Brace Yourself for Obamacare “Sticker Shock” appeared first on Daily Reckoning. It is cool here in Toronto. A welcome change from Athens, Madrid and Paris. The markets were cool yesterday too. The Dow rose 70 points. Nothing to get excited about, one way or another. We are sitting in the bar at the Hazelton Hotel. We always thought of Canadians as being a bit more reserved and conservative (socially, not necessarily politically) than their neighbors to the south. Well, not in this hotel! It is more like Dallas than what we recall from our summers in Nova Scotia. People dressed in the latest gaudy fashions, loud hip-ish music, trendy design, women who appear to have had extensive body work done… and on the TV screen above the bar is a recurring ad from a zombie law firm advertising for personal injury cases! We floated our way through Europe's wine country, foggily trying to keep track of what we what we were seeing. We surveyed the Greek front with a pitcher of red wine on a blue, paper tablecloth. Greek wine is as mysterious to us as Greek finance — both can make you a little light-headed. The wine served in the street restaurants of Athens is cheap and plentiful. In Madrid, our host insisted on a classic Rioja — a rich, complex vintage. Madrid is a cleaner, more modern, and more sophisticated city than Athens. The wine is similarly more advanced and reliable. And in France, a Bordeaux — a St. Emilion or a St. Estephe — usually anchors our red-checkered tablecloth. After the Rioja, and months of drinking Malbec in Argentina, the French wines seem to lack character. They are like the French themselves – subtle and clever. In Greece, we were there for a financial system meltdown. It didn't oblige us. The scheduled breakdown didn't happen when it supposed to; the can got booted down the road. Even after 2 weeks of closed banks and widespread expectation of a financial crack-up, we saw no sign of panic. Instead, the Greeks were prepared. Bloomberg explained how: ‘My son is a fisherman. Today I took two kilograms of my son's fish to the butcher. He gave me two kilograms of meat in return,’ [said a restauranteur]. ‘We don't take money to the bank. The money we earn is spent on supplies and expenses to eat and drink.’ Meanwhile, our sources in Madrid explained… There is a big movement to throw out the baby and the bath water. There's a whole new political party, called "Podemos" (We can!). It came out of nowhere. It was organized on the social media. I've never seen anything like it. And I don't know what these people want…but I don't think they're going to as predictable and as flexible as the traditional parties. Our guess is that Podemos wants to slip Spain's debts. Most people will be zombies – if they can get away with it. Everyone wants wealth, power and status, and they want to get it in the easiest way possible. So, it really only makes sense for them to support a political party if it promises to give them more than they can get on their own. Or, to put it differently, in a modern democracy, the politicians must promise to give them back more than they take from them in taxes. If a party only gives back what it takes in from taxes, the zombies get no net gain. And when the politicians promise to run a surplus(!) in order to pay down debts from past spending, the zombie math no longer works. The voters must pay more in taxes than they get in redistributions. That's when the logic of modern popular democracy breaks down. And when that happens, watch out! Now, back in the New World, we turn our lips to a California wine and our attention to the North America front. From the New York Times comes news of a big zombie push in the health insurance area. You'll recall the lay of the land. Crony lobbyists for insurance companies, pharmaceuticals and the medical industry got together with the Obama team and created "Obamacare." The law was so complex and so long that politicians voting for it admitted they didn't know what was in it. Only the cronies knew what was in this pudding; they had put the sugar plums in themselves. The rest of us would just have to wait until we choke on the seeds. The New York Times: Health Insurance Companies Seek Big Rate Increases for 2016 WASHINGTON — Health insurance companies around the country are seeking rate increases of 20 percent to 40 percent or more, saying their new customers under the Affordable Care Act turned out to be sicker than expected. Federal officials say they are determined to see that the requests are scaled back. "As a result, millions of people will face Obamacare sticker shock," said Senator John Barrasso, Republican of Wyoming. Yes, the medical industry is a battleground too. The zombies are fighting hard – by hook, crook, regulation and legislation – to get even more of your money. Stay tuned for the next dispatches from the front lines. Until then, Bill Bonner P.S. I originally posted this essay, right here, at the Diary of a Rogue Economist. The post Brace Yourself for Obamacare “Sticker Shock” appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why Most Gold Bugs and Bloggers are Dead Wrong About China’s Gold Posted: 17 Jul 2015 09:21 AM PDT This post Why Most Gold Bugs and Bloggers are Dead Wrong About China's Gold appeared first on Daily Reckoning. Editors’ Note: The following essay was published on May 18th. Given China’s official update of it’s gold reserves this morning, however, we felt it’s necessary re-reading for investors. Read on…

One of the most persistent story lines among gold bugs and market participants who foresee the collapse of the dollar goes something like this: China and many emerging markets including the other BRICS are looking for a way out of the global fiat currency system. That system is dominated today by the U.S. dollar. This dollar dominance allows the U.S. to force certain kinds of behavior in foreign policy and energy markets. Countries that don't comply with U.S. wishes find themselves frozen out of global payments systems and find their banks unable to transact in dollars for needed imports or to get paid for their exports. Russia, Iran and Syria have all been subjected to this treatment recently. China does not like this system any more than Russia or Iran but is unwilling to confront the U.S. head-on. Instead, China is quietly accumulating massive amounts of gold and building alternative financial institutions such as the Asia Infrastructure Investment Bank, AIIB, and the BRICS-sponsored New Development Bank, NDB. When the time is right, China will suddenly announce its actual gold holdings to the world and simultaneously turn its back on the Bretton Woods institutions such as the IMF and World Bank. China will back its currency with its own gold and use the AIIB and NDB and other institutions to lead a new global financial order. Russia and others will be invited to join the Chinese in this new international monetary system. As a result, the dollar will collapse, the price of gold will skyrocket and China will be the new global financial hegemon. The gold bugs will live happily ever after. The only problem with this story is that the most important parts of it are wrong. As usual, the truth is much more intriguing than the popular version. Here's what's really going on. As with most myths, parts of the story are true. China is secretly acquiring thousands of tons of gold. China is creating new multilateral lending institutions. No doubt, China will announce an upward revision in its official gold holdings sometime in the next year or so. In fact, Bloomberg News reported on April 20, 2015, under the headline "The Mystery of China's Gold Stash May Soon Be Solved," that "China may be preparing to update its disclosed holdings…" But the reasons for the acquisition of gold and the updated disclosures, if they happen, are not the ones the blogosphere believes. China is not trying to destroy the old boy's club — they are trying to join it. China understands that despite the strong growth and huge size of its economy, the yuan is not ready to be a true reserve currency and will not be ready for years to come. It is true that usage of the yuan is increasing in international transactions. But it is still used for less than 2% of global payments, compared with over 40% for the U.S. dollar. Usage in payments is only one indicium of a true reserve currency, and not the most important one. The key to being a reserve currency is not payments, but investments. There needs to be a deep, liquid bond market denominated in the reserve currency. That way, when countries earn the target currency in trade, they have someplace to invest their surplus. Right now, if you earn yuan trading with China, all you can do with the money is leave it in a bank deposit or spend it in China. There is no large yuan-denominated bond market to invest in. In addition to a bond market, you need the "plumbing" of a bond market. This includes a network of primary dealers; hedging tools such as futures and options; financing tools such as repurchase agreements, derivatives, clearance and settlement channels; and a good rule of law to settle disputes, secure creditors and deal with bankruptcies. China has none of these things on the needed scale or level of maturity. When it comes to true reserve currency status, the yuan is not ready for prime time. China is also not ready to launch a gold-backed currency. Even if it has 10,000 tons of gold — far more than it currently admits, the market value of that gold is only about $385 billion. China's M1 money supply as of April 2015 is about $5.4 trillion. In other words, even on assumptions highly favorable to China, their gold is only worth about 7% of their money supply. Historically, countries that want to run a successful gold standard need 20-40% of the money supply in gold in order to stand up to bank runs in the market. China could reduce its money supply to get to the 20% level, but this would be extremely deflationary and throw the Chinese economy into a depression that would trigger political instability. So that won't happen. In short, China can't have a reserve currency because it does not have a bond market, and it can't have a gold-backed currency because it has nowhere near enough gold. So what is China's plan? China wants to do what the U.S. has done, which is to remain on a paper currency standard but make that currency important enough in world finance and trade to give China leverage over the behavior of other countries. The best way to do that is to increase its voting power at the IMF and have the yuan included in the IMF basket for determining the value of the special drawing right. Getting those two things requires the approval of the United States because the U.S. has veto power over important changes at the IMF. The U.S. can stand in the way of Chinese ambitions. The result is a kind of grand bargain in which China will get the IMF status it wants, but the U.S. will force China to be on its best behavior in return. This means that China must keep the yuan pegged to the dollar at or near the current level. It also means that China can have gold but can't talk about it. In order to "join the club," China must play by club rules. The rules of the game say you need a lot of gold to play, but you don't recognize the gold or discuss it publicly. Above all, you do not treat gold as money, even though gold has always been money. The members of the club keep their gold handy just in case, but otherwise, they publicly disparage it and pretend it has no role in the international monetary system. China will be expected to do the same. It's important to note that China will not act in the best interests of gold investors; it will act in the best interests of China. Moreover, just because the grand bargain is in sight does not mean it will be easy to realize. Both sides are jockeying for leverage. Beijing launched its own development bank to put pressure on the IMF. The U.S. Treasury blames the tea party for delays in approving China's new votes at the IMF. Meanwhile, the White House does nothing to break the logjam in Congress. The White House is happy to let China twist in the wind while the game goes on behind closed doors. Meanwhile, China will probably announce its increased gold holdings later this year. But don't expect fireworks. China has three accounts where they keep gold — the People's Bank of China, PBOC; the State Administration of Foreign Exchange, SAFE; and the China Investment Corp., CIC. China can move enough gold to PBOC when they are ready and report that to the IMF for purposes of allowing the yuan in the SDR. Meanwhile, they can still hide gold in SAFE and CIC until they need it in the future. China will also probably be admitted into the SDR basket later this year. Far from launching its own gold-backed currency, China will be acknowledging that the SDR is the true world money as far as the major powers are concerned. Why would China want to give up on fiat money any more than the Fed or the European Central Bank? All central banks prefer paper money to gold because they can print the paper kind. Why give up on that monopoly of power? Gold is still the safest asset, and every investor should have some in their portfolio. The price of gold will go significantly higher in the years ahead. But contrary to what you read in the blogs, gold won't go higher because China is confronting the U.S. or launching a gold-backed currency. It will go higher when all central banks, China's and the U.S.' included, confront the next global liquidity crisis, worse than the one in 2008, and individual citizens stampede into gold to preserve wealth in a world that has lost confidence in all central banks. When that happens, physical gold may not be available at all. The time to build your personal gold reserve is now. Regards, Jim Rickards P.S. If you haven't heard, I've just released a new book called The Big Drop. It wasn't a book I was intending to write. But it warns of a few critical dangers that every American should begin preparing for right now. Here's the catch — this book is not available for sale. Not anywhere in the world. Not online through Amazon. And not in any brick-and-mortar bookstore. Instead, I'm on a nationwide campaign to spread the book far and wide… for FREE. Because every American deserves to know the truth about the imminent dangers facing their wealth. That's why I've gone ahead and reserved a free copy of my new book in your name. It's on hold, waiting for your response. I just need your permission (and a valid U.S. postal address) to drop it in the mail. Click here to fill out your address and contact info. If you accept the terms, the book will arrive at your doorstep in the next few weeks. The post Why Most Gold Bugs and Bloggers are Dead Wrong About China's Gold appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Where is Support for Precious Metals Markets? Posted: 17 Jul 2015 09:16 AM PDT The gold miners have broken below their 2008 to 2014 support while Silver is essentially trading at a six year low. Gold looks set to make a new monthly low and weekly low but has yet to break its daily low at $1140/oz. Barring a sudden short squeeze Gold could be hours or days away from cracking in the way Silver and the miners have in recent weeks. The trend for the sector is obviously down and sentiment is following. However, the more important issue for long term bulls is where is the strong support for these markets. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GOLD and SP500 Intraday - Elliott Wave Analysis Posted: 17 Jul 2015 09:09 AM PDT S&P futures did not go far in the last 24 hours, so our view did not change; looking for a reversal down into a three wave retracement for wave B) soon. Notice that we can count five waves up from 2037 while current price is already outside of upward channel so momentum is decreasing, signaling for a turn. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||