Gold World News Flash |

- MUST SEE VIDEO: The Moment Diver Discovers $1 Million In Gold From 300-Year-Old Spanish Shipwreck

- What Silver Chart Has The Bankers Worried??

- Gold: It’s Time to Buy

- GUEST POST: Truth, Justice, and (no longer) The American Way!

- Supply And Demand In The Gold And Silver Futures Markets

- The End Draws Near For Syria's Assad As Putin's Patience "Wears Thin"

- In The News Today

- Gold Price Lost 20 Cents to $1,096.30 on Comex

- David Morgan Confirms Market Crash in September 2015

- The Pleiadians 2015! Economic Collapse, Revolution and More!

- Caught On Tape: The Moment Diver Discovers $1 Million In Gold From 300-Year-Old Spanish Shipwreck

- The Globalists are Planning The Wars of The Future

- The Rise Of The Yuan Continues: LME To Accept Renminbi As Collateral

- Economic Collapse 2015 -- China Stocks COLLAPSING Despite MASSIVE Government Intervention!

- WARNINGS of Artificial Intelligence: Hawking, Musk, Wozniak and More!

- GLOBAL FEAR MEETS PEAK GOLD & SILVER

- Gold & Silver Money Has Devolved Into Debt and Plastic

- Gold Daily and Silver Weekly Charts - Option Expiry - Leverage 117:1 at The Bucket Shop

- Abortion: Destruction of Innocence

- Is gold manipulated? Clif Droke thinks he knows without looking

- Hillary Saves Capitalism!

- China Stock Market Crash Explained by Mike Maloney

- SOROS Behind CHINA STOCK MARKET COLLAPSE #NYSE ?

- Are Women Really Discriminated against ? -- John Stossel

- The King Of Gold

- Buy and "Own Gold Krugerrands" Says Money Expert Jim Grant, Very Bullish on Gold

- PROPHECY ALERT: Israel Prepares For War Massive 3 Day Drill

- Jim’s Mailbox

- Banks Tracking Physical Location of Customers

- TF Metals Report: Comex gold leverage widens to record

- Inflation Deniers Emboldened by Gold's Struggles

- Ronald Stoeferle – I Like Contrarian Investing

- Gold Mining Stocks to Weather the Storm

- How to Identify a Classic Market Bubble

- Markets Macrocosm

- Gerald Celente -- Banksters Rule Neo Feudal USA

- CERN Portal // Sept 2015 "Year of Light" EXPOSED (R$E)

- GATA Chairman Murphy interviewed on China's reserves, latest attack on gold

- Supply and Demand in the Gold and Silver Futures Markets

- Experts' Guide to Getting the Most Out of Company Presentations

- Is the Gold Price Manipulated?

| MUST SEE VIDEO: The Moment Diver Discovers $1 Million In Gold From 300-Year-Old Spanish Shipwreck Posted: 28 Jul 2015 11:49 PM PDT from Zero Hedge:

Which is precisely what happened. For several weeks the Schmitt family had a million-dollar secret on their hands. Last month, it recovered $1 million worth of sunken Spanish coins and jewels off the Florida coast. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| What Silver Chart Has The Bankers Worried?? Posted: 28 Jul 2015 11:15 PM PDT from SRS Rocco:

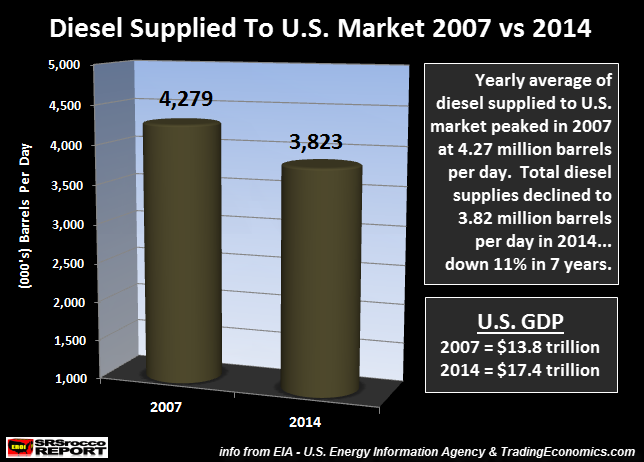

There is a rising trend in the silver market that has the bankers worried. This may seem like a play on hype, but I can assure you… the facts are clear. If we look at the data in the silver market, there was a distinct change that took place in 2008. Basically, the U.S. Banking system died in 2008 and more investors are finally catching on. Before I show you the silver chart, let's look at some of the nonsense taking place in U.S. published financial data. According to the EIA – U.S. Energy Information Agency, supplies of diesel product to the U.S. market peaked in 2007 at 4.27 million barrels per day (mbd) and declined 11% to 3.82 mbd in 2014. These figures represent the average annual amount of diesel supplied to the U.S. Market:

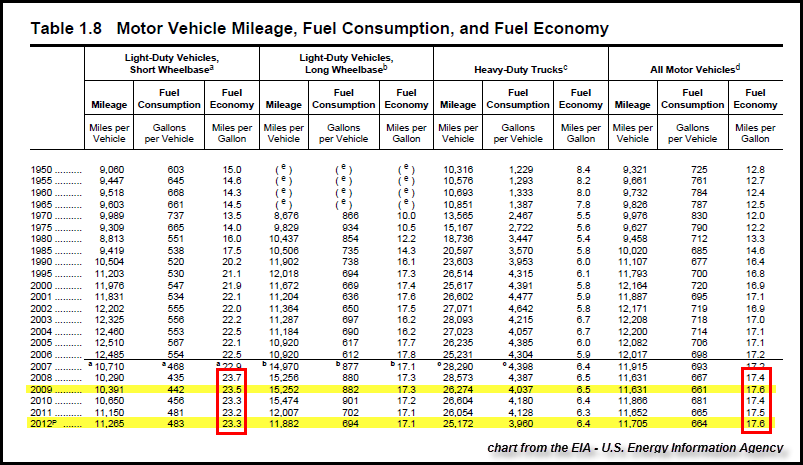

We must remember, the majority of diesel used in the U.S. is consumed by our huge trucking-transportation system. So, how did the U.S. GDP grow from $13.8 trillion in 2007 to $17.4 trillion in 2014, while the country's commercial trucking fuel consumption fell 11%?? It didn't…. the U.S. GDP figures are all smoke and mirrors. As I have stated many times, the Fed and U.S. Govt. manufactured financial and economic growth by propping up the market with trillions of Dollars of monetary liquidity. If total U.S. diesel and gasoline consumption declined since 2007, how is it possible to show a 26% increase in U.S. GDP ($13.8 trillion to $17.4 trillion)? Of course, some would have a knee-jerk reaction and say that "fuel efficiency" has increased in the United States, so that would account for the decline. Hardly. If we look at the table below, you will see that heavy-duty truck fuel consumption is the same at 6.4 mpg in 2012 as it was in 2007: You see, the Fed and U.S. Government can manufacture all the financial and economic data to their heart's desire. However, the facts show that the United States commercial transportation industry consumed 11% less diesel in 2014 than it did in 2007. Thus, the country's GDP should be lower, not higher. The Silver Chart The Bankers Are Worried AboutAnother fascinating piece of data that doesn't seem to jive with the current value of this asset is shown in the chart below: The figures in this chart are broken down in three-year time periods. I like to show data in this fashion as it removes annual volatility. As we can see, total global silver bar and coin demand from 2005-2007 was only 4,712 metric tons (mt). This translates to 151 million oz (Moz). So, before the Fed and Central Banks got caught with their pants down when the entire financial system nearly imploded in 2008, physical silver investment was relatively low. However, this all changed in 2008 when Bear Stearns and Lehman Brothers went belly up and AIG filed for bankruptcy. Investors who became quite worried about the sustainability of the financial system starting buying a great deal of physical gold and silver. This is shown by the massive increase of physical silver bar and coin demand in the 2008-2010 time period. Investors purchased 13,005 mt (418 Moz) of physical silver during this three-year time period, up 177% compared to the prior period. However, something quite interesting took place in the following period. As the price of silver skyrocketed to $49 in 2011, physical silver investment shot up to 6,550 mt (210 Moz) that year, up from 4,457 mt (143 Moz) in 2010. But, as the price of silver remained in a trend-bound fashion in 2012, physical silver investment declined to 4,292 mt (138 Moz). When the market is unsure of the direction in price of an asset or commodity, they tend to hold back on purchases. That being said, that all changed in 2013 when the price of silver fell from a high of $32 in the beginning of the year to $18… just six months later. Investors piled into the precious metal in record numbers pushing the total of physical silver investment to a staggering 7,577 mt (244 Moz). Thus, total physical silver bar and coin demand during the three-year period from 2011-2013 was a massive 18,419 mt or a hefty 592 Moz. During those three years, the total world net silver deficit was 220 Moz. (Silver Institute). Which means, the bankers or institutions had to fork over an additional 220 Moz to supplement the increased global silver demand. If it wasn't for this increased physical silver investment demand, the world would have enjoyed a 70 Moz surplus. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 28 Jul 2015 09:00 PM PDT from Nestmann:

And I make it a point to sell when the "man in the street" starts giving me investment tips. That happened most recently in 2011, when over a glass of Malbec at a local watering hole, I overheard two other patrons talking about the "killing" they were about to make buying gold at $1,800 an ounce. I sold all but my core position the next day. Since then, gold has had a tough time of it. It closed last week under $1,100 per ounce. The talking heads now predict $800 gold by the end of 2016. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GUEST POST: Truth, Justice, and (no longer) The American Way! Posted: 28 Jul 2015 08:40 PM PDT by Bill Holter, SGT Report:

This is not rocket science. It is not hocus pocus or even anything “special”. Time and sales have been around since the dawn of trading. Even prior to computers, handwritten records were taken to record who traded what, when and in what quantities. Should the SEC, NYSE, CFTC or anyone else want to know who is doing what, it takes five seconds or less to find out.. (This includes the Chinese who have outlawed selling under the penalty of firing squad!!! So who is doing all the selling?) In my opinion, the regulators should be strung up on lampposts for their lack of doing the jobs they are being paid public tax money to do. They have turned a blind eye, presumably because they are told or believe it is for “the greater good”? …the greater good… sounds like something out of Russia or China back in the day when I was a youngster in the 1960’s – or even something in the history books we read as kids in school regarding Nazi Germany. Do you remember this time period? I still remember this time frame very well and pine for it every day. Back in those days we couldn’t wait to get home from school so we could get to play baseball, football, basketball or even hike it to the nearest pond in winter time to play some pickup hockey. Back in those days our parents knew where we were by where our bicycle was.

We could sell (or even buy) lemonade without a health department license and had no fear of arrest – we even gave the police free samples. We walked a half mile or even a full mile to get to school (but not uphill both ways nor always in the snow). We did this with friends or if we were late we did it alone. Back then this was the norm. Today, parents are regularly being arrested for allowing a child to go two blocks away on their own… not to mention the nine-year-olds for selling lemonade!!!

After playing, we’d all head home for dinner and get to watch some TV. Remember? ” TV” where no cussing was allowed. Most shows had a “theme” or an underlying lesson that taught kids “good always triumphed over evil”. We watched Batman, Superman and others. Western’s were in vogue and there was always a lesson to be learned from watching The Rifleman or Gunsmoke. I have said several times over the years when writing on this subject, “Leave it to Beaver cannot even be found on syndicated reruns anymore”. My point is, the “wholesome” world we grew up in is so far gone, current history books don’t even mention it as a footnote! Think about where we are today. Where handshakes used to suffice, contracts are now drawn up to be purposely broken. More than half of our population “takes” while less than half the population supports this spending habit. Worse, it is the “supporters” who are vilified today because they don’t “give enough.” We used to have free speech as outlined in The Constitution, now there is only free speech for the “special” groups. Anyone who speaks against any of these very special groups is branded a racist, sexist, homophobe, or religious persecutor (except of course, unless you’re speaking against Christians – that’s OK… even seemingly encouraged). Or worst of all, you could be labeled a “CONSERVATIVE!” Today it is OK to burn the American flag, outlaw the quaint historical Confederate flag …while flying the flag of any other nation (here in Texas the favorite to fly is that of Mexico) on our own sovereign soil. I noticed yesterday while in a very long U.S. Customs line upon returning home, how much longer, formal and probably difficult it was rather than just swimming across the river! Many states no longer require a voter registration card to vote or even a driver’s license, so the motto “vote early and often” applies. Citizens who pay for “old” health insurance now get “charged” extra on their taxes, while those who can’t afford insurance get it for free… along with cellphones, housing, food, stipends for each child etc. …and anyone who speaks out about it is branded a “crazy.” Please let me remind you, this country was originally formed because of oppression and the practice of “taxation without representation.” Have we pretty much gone full circle? You could not have told me even 20 years ago we would be where we are today. We have a system where the president makes up laws as he goes along, the Supreme Court rubber stamps his illusions and Congress has been relegated to irrelevance. Speaking of Congress, didn’t “We the People” just throw the bums out? Didn’t the Republicans run on a ticket that said they would overturn all sorts of ridiculous (and if you ask me) tyrannical laws? Have they overturned anything? No, they just passed the fast track trade bill which will gut our economy even further …while the Democrats voted against it …? Forget about the giant sucking sound Ross Perot spoke of, we will soon hear the wheezing and gurgling last breaths of a nation, in my sad opinion. In the interest of not losing you as a reader, I could go on and on about subjects like guns, GMO’s, baby parts for sale or whatever but I think you get the point and I’ll stop here. From an economic and financial standpoint, it is funny that while away I read “The Scarlet Woman of Wall Street.” This was the story of Daniel Drew, Vanderbilt, Fisk, Gould and Erie railroad during the mid to late 1800’s. There were no financial laws back then that prevented anything with the exception of bribery which was impossible to prove unless the giver and receivers were both stupid beyond their years. Then all sorts of laws were written and the playing field was somewhat leveled (as much as it could have been). Now, there are so many laws on the books, it is impossible not to break one of them. The thing is, financial institutions do not care. Since no one goes to jail (except for a couple of hedge fund managers), it is more profitable to illegally and blatantly swipe $10 billion because you know your fine will only be $100 million. If you think about it, management in today’s world could probably be held accountable in today’s civil legal system for NOT BREAKING THE LAW and leaving money on the table. Why play fair when everything is rigged, while you can steal and pay only 1% or less of what you made? It is almost management’s “fiduciary duty” to lie, cheat and steal in order to not fall behind! To wrap this piece up I would like to say this, if you don’t believe or cannot see that all markets are rigged all of the time I’m sorry. If I offended anyone for any reason, again I’m sorry. If you believe today is “normal” in any way, I am sorry. Actually, let me clarify this: I am not sorry, but I am sorry you don’t understand the point I am trying to get across and sorry you cannot see it. Unfortunately, the American people have been slow boiled into believing our lives are normal and things are “just the way they are.” We have been lulled into believing we are an “exceptional” people and “deserve” the finer things in life. What we have forgotten is that hard work, hard money, and innovation is what made this country great to begin with. Many today don’t remember or never knew this very basic tenet…but ignorance does not change the fact. Truth and justice (and for the most part “business”) was what America was once all about. Please do not tell me I am naïve. I am not. Please do not tell me this is not being done according to a plan. It is. There is zero percent probability the policies in place today are by mistake. They are not by mistake and no one could be so stupid which leaves only one option …”purposeful” is the operative word. The United States was the shining light of the world in so many ways. We are no longer. We were built as a Republic that followed The Constitution which was written mainly by God fearing Christians. We have evolved into a perverted, apologetic, weak and slovenly society with little to no values regarding anything from our ethics, morals, constitutions, or anything else. We believe we deserve the best and should work the least (if at all). It’s the American WAY!!! Unfortunately, what I write here is now considered by the majority as either anti-government or unpatriotic. It is neither. In fact, all I advocate is following The Constitution. You know, that “thing” our politicians “swear to God to uphold” (did you catch that? They swear to God! Not to Walt Disney, Facebook or even the almighty Google!) while raising their right hand with their left hand on The Bible? I am a true patriot in a world where burning the flag, shredding The Constitution and spitting on The Bible is considered sane and normal. I am here to remind you it certainly is not! I am not writing this to convert the perverts, only to let those who are still sane know that yes, you are still sane. That said, in today’s ludicrous world, what I write here can be used as proof of my “insanity” and my lack of “patriotism.” You decide. I guess I would sum it all up by twisting the words of Superman, “Truth, Justice and (is no longer) The American Way! Standing watch (with tears in my eyes), Bill Holter | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Supply And Demand In The Gold And Silver Futures Markets Posted: 28 Jul 2015 08:15 PM PDT Authored by Paul Craig Roberts and Dave Kranzler, This article establishes that the price of gold and silver in the futures markets in which cash is the predominant means of settlement is inconsistent with the conditions of supply and demand in the actual physical or current market where physical bullion is bought and sold as opposed to transactions in uncovered paper claims to bullion in the futures markets. The supply of bullion in the futures markets is increased by printing uncovered contracts representing claims to gold. This artificial, indeed fraudulent, increase in the supply of paper bullion contracts drives down the price in the futures market despite high demand for bullion in the physical market and constrained supply. We will demonstrate with economic analysis and empirical evidence that the bear market in bullion is an artificial creation. The law of supply and demand is the basis of economics. Yet the price of gold and silver in the Comex futures market, where paper contracts representing 100 troy ounces of gold or 5,000 ounces of silver are traded, is inconsistent with the actual supply and demand conditions in the physical market for bullion. For four years the price of bullion has been falling in the futures market despite rising demand for possession of the physical metal and supply constraints. We begin with a review of basics. The vertical axis measures price. The horizontal axis measures quantity. Demand curves slope down to the right, the quantity demanded increasing as price falls. Supply curves slope upward to the right, the quantity supplied rising with price. The intersection of supply with demand determines price. (Graph 1)

A change in quantity demanded or in the quantity supplied refers to a movement along a given curve. A change in demand or a change in supply refers to a shift in the curves. For example, an increase in demand (a shift to the right of the demand curve) causes a movement along the supply curve (an increase in the quantity supplied). Changes in income and changes in tastes or preferences toward an item can cause the demand curve to shift. For example, if people expect that their fiat currency is going to lose value, the demand for gold and silver would increase (a shift to the right). Changes in technology and resources can cause the supply curve to shift. New gold discoveries and improvements in gold mining technology would cause the supply curve to shift to the right. Exhaustion of existing mines would cause a reduction in supply (a shift to the left). What can cause the price of gold to fall? Two things: The demand for gold can fall, that is, the demand curve could shift to the left, intersecting the supply curve at a lower price. The fall in demand results in a reduction in the quantity supplied. A fall in demand means that people want less gold at every price. (Graph 2)

Alternatively, supply could increase, that is, the supply curve could shift to the right, intersecting the demand curve at a lower price. The increase in supply results in an increase in the quantity demanded. An increase in supply means that more gold is available at every price. (Graph 3)

To summarize: a decline in the price of gold can be caused by a decline in the demand for gold or by an increase in the supply of gold. A decline in demand or an increase in supply is not what we are observing in the gold and silver physical markets. The price of bullion in the futures market has been falling as demand for physical bullion increases and supply experiences constraints. What we are seeing in the physical market indicates a rising price. Yet in the futures market in which almost all contracts are settled in cash and not with bullion deliveries, the price is falling. For example, on July 7, 2015, the U.S. Mint said that due to a “significant” increase in demand, it had sold out of Silver Eagles (one ounce silver coin) and was suspending sales until some time in August. The premiums on the coins (the price of the coin above the price of the silver) rose, but the spot price of silver fell 7 percent to its lowest level of the year (as of July 7). This is the second time in 9 months that the U.S. Mint could not keep up with market demand and had to suspend sales. During the first 5 months of 2015, the U.S. Mint had to ration sales of Silver Eagles. According to Reuters, since 2013 the U.S. Mint has had to ration silver coin sales for 18 months. In 2013 the Royal Canadian Mint announced the rationing of its Silver Maple Leaf coins: “We are carefully managing supply in the face of very high demand. . . . Coming off strong sales volumes in December 2012, demand to date remains very strong for our Silver Maple Leaf and Gold Maple Leaf bullion coins.” During this entire period when mints could not keep up with demand for coins, the price of silver consistently fell on the Comex futures market. On July 24, 2015 the price of gold in the futures market fell to its lowest level in 5 years despite an increase in the demand for gold in the physical market. On that day U.S. Mint sales of Gold Eagles (one ounce gold coin) were the highest in more than two years, yet the price of gold fell in the futures market. How can this be explained? The financial press says that the drop in precious metals prices unleashed a surge in global demand for coins. This explanation is nonsensical to an economist. Price is not a determinant of demand but of quantity demanded. A lower price does not shift the demand curve. Moreover, if demand increases, price goes up, not down. Perhaps what the financial press means is that the lower price resulted in an increase in the quantity demanded. If so, what caused the lower price? In economic analysis, the answer would have to be an increase in supply, either new supplies from new discoveries and new mines or mining technology advances that lower the cost of producing bullion. There are no reports of any such supply increasing developments. To the contrary, the lower prices of bullion have been causing reductions in mining output as falling prices make existing operations unprofitable. There are abundant other signs of high demand for bullion, yet the prices continue their four-year decline on the Comex. Even as massive uncovered shorts (sales of gold contracts that are not covered by physical bullion) on the bullion futures market are driving down price, strong demand for physical bullion has been depleting the holdings of GLD, the largest exchange traded gold fund. Since February 27, 2015, the authorized bullion banks (principally JPMorganChase, HSBC, and Scotia) have removed 10 percent of GLD’s gold holdings. Similarly, strong demand in China and India has resulted in a 19% increase of purchases from the Shanghai Gold Exchange, a physical bullion market, during the first quarter of 2015. Through the week ending July 10, 2015, purchases from the Shanghai Gold Exchange alone are occurring at an annualized rate approximately equal to the annual supply of global mining output. India’s silver imports for the first four months of 2015 are 30% higher than 2014. In the first quarter of 2015 Canadian Silver Maple Leaf sales increased 8.5% compared to sales for the same period of 2014. Sales of Gold Eagles in June, 2015, were more than triple the sales for May. During the first 10 days of July, Gold Eagles sales were 2.5 times greater than during the first 10 days of June. Clearly the demand for physical metal is very high, and the ability to meet this demand is constrained. Yet, the prices of bullion in the futures market have consistently fallen during this entire period. The only possible explanation is manipulation. Precious metal prices are determined in the futures market, where paper contracts representing bullion are settled in cash, not in markets where the actual metals are bought and sold. As the Comex is predominantly a cash settlement market, there is little risk in uncovered contracts (an uncovered contract is a promise to deliver gold that the seller of the contract does not possess). This means that it is easy to increase the supply of gold in the futures market where price is established simply by printing uncovered (naked) contracts. Selling naked shorts is a way to artificially increase the supply of bullion in the futures market where price is determined. The supply of paper contracts representing gold increases, but not the supply of physical bullion. As we have documented on a number of occasions, the prices of bullion are being systematically driven down by the sudden appearance and sale during thinly traded times of day and night of uncovered future contracts representing massive amounts of bullion. In the space of a few minutes or less massive amounts of gold and silver shorts are dumped into the Comex market, dramatically increasing the supply of paper claims to bullion. If purchasers of these shorts stood for delivery, the Comex would fail. Comex bullion futures are used for speculation and by hedge funds to manage the risk/return characteristics of metrics like the Sharpe Ratio. The hedge funds are concerned with indexing the price of gold and silver and not with the rate of return performance of their bullion contracts. A rational speculator faced with strong demand for bullion and constrained supply would not short the market. Moreover, no rational actor who wished to unwind a large gold position would dump the entirety of his position on the market all at once. What then explains the massive naked shorts that are hurled into the market during thinly traded times? The bullion banks are the primary market-makers in bullion futures. They are also clearing members of the Comex, which gives them access to data such as the positions of the hedge funds and the prices at which stop-loss orders are triggered. They time their sales of uncovered shorts to trigger stop-loss sales and then cover their short sales by purchasing contracts at the price that they have forced down, pocketing the profits from the manipulation The manipulation is obvious. The question is why do the authorities tolerate it? Perhaps the answer is that a free gold market serves both to protect against the loss of a fiat currency’s purchasing power from exchange rate decline and inflation and as a warning that destabilizing systemic events are on the horizon. The current round of on-going massive short sales compressed into a few minutes during thinly traded periods began after gold hit $1,900 per ounce in response to the build-up of troubled debt and the Federal Reserve’s policy of Quantitative Easing. Washington’s power is heavily dependent on the role of the dollar as world reserve currency. The rising dollar price of gold indicated rising discomfort with the dollar. Whereas the dollar’s exchange value is carefully managed with help from the Japanese and European central banks, the supply of such help is not unlimited. If gold kept moving up, exchange rate weakness was likely to show up in the dollar, thus forcing the Fed off its policy of using QE to rescue the “banks too big to fail.” The bullion banks’ attack on gold is being augmented with a spate of stories in the financial media denying any usefulness of gold. On July 17 the Wall Street Journal declared that honesty about gold requires recognition that gold is nothing but a pet rock. Other commentators declare gold to be in a bear market despite the strong demand for physical metal and supply constraints, and some influential party is determined that gold not be regarded as money. Why a sudden spate of claims that gold is not money? Gold is considered a part of the United States’ official monetary reserves, which is also the case for central banks and the IMF. The IMF accepts gold as repayment for credit extended. The US Treasury’s Office of the Comptroller of the Currency classifies gold as a currency, as can be seen in the OCC’s latest quarterly report on bank derivatives activities in which the OCC places gold futures in the foreign exchange derivatives classification. The manipulation of the gold price by injecting large quantities of freshly printed uncovered contracts into the Comex market is an empirical fact. The sudden debunking of gold in the financial press is circumstantial evidence that a full-scale attack on gold’s function as a systemic warning signal is underway. It is unlikely that regulatory authorities are unaware of the fraudulent manipulation of bullion prices. The fact that nothing is done about it is an indication of the lawlessness that prevails in US financial markets. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The End Draws Near For Syria's Assad As Putin's Patience "Wears Thin" Posted: 28 Jul 2015 07:30 PM PDT Early last month in, "The Noose Around Syria's Assad Tightens" we outlined the latest developments in the country's prolonged civil war. Here's what we said then:

In short, the US and its Middle Eastern allies are simply playing the waiting game; watching for the opportune time to charge in and "liberate" Syria from whatever army manages to take Damascus first, at which point a puppet government will be promptly installed. And make no mistake, the new, U.S.-backed regime will present itself as fiercely anti-militant and will be trotted out as Washington's newest "partner" in the global war on terror. Of course behind the scenes the situation will likely resemble what happened in Yemen (Obama's "model of success") where, according to one account, Abdullah Saleh and his lieutenants not only turned a blind eye to AQAP operations, but in fact played a direct role in facilitating al-Qaeda attacks even as the government accepted anti-terrorism financing from the US government. Of course no one in Washington will care to know the details, as long as the new regime in Syria is receptive to things like piping Qatari natural gas to Europe via a long-stalled pipeline, a project which will do wonders for breaking Gazprom's energy stranglehold and robbing Vladimir Putin of quite a bit of leverage in what is becoming an increasingly tense standoff with the EU over Ukraine. On Sunday, Assad gave a speech in which he attempted to address concerns about the recent setbacks his army has suffered at the hands of the various groups fighting for control of the country. Here's more from the LA Times' Special correspondent Nabih Bulos reporting from Beirut:

Maybe not yet, but that could change quickly, especially if Assad were to lose the support of his most important ally, Vladimir Putin. As we noted last month, the key outstanding question is this: what is the maximum pain level for Russia, which has the greatest vested interest in preserving the Assad regime? We could have an answer to that very soon, as slumping commodities prices, falling demand from China (which was recently cited as the reason for "indefinite" delays to the Altai pipeline joint venture which would have delivered 30 bcm/y of Siberian gas to China), and economic sanctions from the West are squeezing Moscow and may ultimately prompt Putin to "consider the acceptability of other candidates" for the Syrian Presidency. Here's WSJ with more:

So, as the Assad regime weakens in the face of dwindling manpower and is forced to resort to a military recrutiment drive complete with billboards designed to shame men into taking up arms against the various armies competing to conquer Damascus, Russia has not only seen the writing on the wall, but may be prepared to finally cut Assad loose. As for what happens next, see here. * * * Full Assad speech from Sunday | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 28 Jul 2015 07:24 PM PDT Jim Sinclair’s Commentary The Great Flushing ( Lehman Brothers) is to be followed by the Great Leveling (the end of the middle class), which is to be followed by the Great Reset ( In which gold assumes it rightful role as the ultimate valuator, not currency). US Middle Class Stays Dead: Homeownership Drops To... Read more » The post In The News Today appeared first on Jim Sinclair's Mineset. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Lost 20 Cents to $1,096.30 on Comex Posted: 28 Jul 2015 06:42 PM PDT

Good evenin', Mushrooms! It's gold and silver futures options expiry today, so you could expect that metals weren't going anywhere. No, they had to be kept down just one day so those barely out of the money options would expire worthless. They use the same playbook every month. I'm glad that's behind us. Ranges were very tight, $14.68 - $14.51 for silver and $1,098.20 to $1,090.70 for GOLD PRICE. I can't promise y'all metals will rise tomorrow, but that's what I expect. Same rules apply: the price of gold must not close below $1,090 nor silver below $14.40. Upside the gold price must o'erleap $1,140 and silver $15.50 to prove they have any muscle left. Dow Industrials rose 189.68 (1.09%) today to 17,630.27. S&P500 also rose, 25.61 (1.24%) to 2,093.24. I ain't impressed. In five days it lost 660.99. It'll take more than a single day gaining 189.68 to fix that. Likewise the US dollar index rose 26 basis points to 96.86. So what? Remains below its 20 day moving average. Delays in physical silver deliveries on one ounce rounds and now even 100 oz bars have stretched out to three weeks. US 90% premium has risen to $3.30 over spot at wholesale. Now gold coins have caught the infection with rising prices and delayed deliveries. What do y'all reckon that means? The door into silver and gold is an exceedingly low and narrow passage. When too many people rush it all at once, some don't get through. Y'all bear that in mind. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2015, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| David Morgan Confirms Market Crash in September 2015 Posted: 28 Jul 2015 06:00 PM PDT David Morgan of Silver-Investor.com says the world is loaded with debt that is going to explode. It's just a matter of time. When might the economy and the "debt bomb" explode? Morgan predicts this fall. Why? Morgan says, "Momentum is one indicator and the money supply. Also, when I... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Pleiadians 2015! Economic Collapse, Revolution and More! Posted: 28 Jul 2015 05:00 PM PDT The Pleiadians channeled by Barbara Marciniak 03/21/15. Topics include 2015 predictions, extraterrestrials, Anunnaki, chakras, advanced technology, psychedelic drugs, demons, space wars, fracking, Malaysia plane, CERN, the 6th trumpet, revelations and more. The Financial Armageddon... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Caught On Tape: The Moment Diver Discovers $1 Million In Gold From 300-Year-Old Spanish Shipwreck Posted: 28 Jul 2015 04:51 PM PDT Following the latest mass media assault on gold, capped with such trollbait pearls as "Gold is doomed" or the classic "Let's Be Honest About Gold: It's a Pet Rock" by the inimitable Jason Zweig (imitable perhaps only by the September 2011 version of Jason Zweig when, days after gold hit its all time high just shy of $2000, he famously said "Is Gold Cheap? Who Knows? But Gold-Mining Stocks Are"... since then gold-mining stocks are down 80%) we were more shocked that someone would actually bother to look for the worthless pet rocks (of which China allegedly just bought 600 tons) than actually finding them during a random dive in the sea. Which is precisely what happened. For several weeks the Schmitt family had a million-dollar secret on their hands. Last month, it recovered $1 million worth of sunken Spanish coins and jewels off the Florida coast. The Schmitts are subcontractors to 1715 Fleet-Queens Jewels LLC which since 2010 has the salvaging rights to a fleet of Spanish ships, aka the "1715 Fleet", that wrecked off the Florida coast some 300 years ago. While $50 million has been pulled in from the fleet's resting place so far, this is so far the biggest single haul. "One of the most amazing recoveries in 1715 Fleet History. Congratulations to the entire Schmitt family and the crew of the Aarrr Booty," said 1715 Fleet on its Facebook page Monday. Some more details from the Fleet Society's website: "Gold and silver in great quantity was homeward bound to Philip V when a hurricane destroyed his fleet along Florida's coast. Some recovery in the aftermath still left much to be recovered beginning in the 1960's and ongoing to this day." "The treasure was actually found a month ago," said Brent Brisben of 1715 Fleet-Queens Jewels LLC. Keeping the news under wraps was "particularly hard for the family that found it. They've been beside themselves." The timing of 1715 Fleet's announcement coincides with the 300th anniversary of the Spanish treasure fleet's shipwrecks off the coast of Florida. Among the precious items recovered:

Queens Jewels owner Brent Brisben told the Daily News this discovery is of the biggest single hauls taken from the ship. Or, as the WSJ would call it, a whole bunch of pet rocks. Brisben gives 20% of everything found to the state of Florida and then splits the remaining treasure equally with the contractor that finds it. Brisben said he and his family will keep everything they have and save it for a special collection for the public. It's believed there is still $400 million worth of treasure located below, he said. As the WSJ's sister publication, MarketWatch adds, "the discovery comes almost 300 years to the day that the fleet wrecked. As for the history, the ships were sent to America to fetch gold and silver and under pressure to get back quickly, as the Spanish crown needed to replenish its coffers to finance wars. Sailing from Havana, Cuba on July 24, 1715, the ships crashed during a hurricane a week later near present-day Vero Beach, Fla. The Spaniards returned a few times, salvaging a great chunk of that treasure." Three hundreds years later wars are financed by long strings of 1s and 0s, backed by the full faith of a government whose total unfunded obligations amount to over 5x the total amount of goods and services produced by said government. Back to the discovery, whose key components are shown below.

Fifty-one gold coins and 40 feet of gold chains were found from a Spanish ship of the 1715 Fleet

The total value of the haul is more than $1 million.

About $50 million worth of treasure has been discovered since the 1960s. * * * But the biggest drama was the actual moment when Schmitt discovered the gold, captured conveniently in the video below. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Globalists are Planning The Wars of The Future Posted: 28 Jul 2015 04:00 PM PDT They're Planning The Wars of the Future Now David Knight looks at a report that details just what the military is working on for the battlefield of the future and just how science fiction nightmare they plan on making the world. The Financial Armageddon Economic Collapse Blog tracks... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Rise Of The Yuan Continues: LME To Accept Renminbi As Collateral Posted: 28 Jul 2015 03:45 PM PDT As far-fetched as the notion may be to those who are wedded - by choice, by misguided beliefs, or by virtue of being completely beholden to the perpetuation of the status quo - to idea that the dollar will forever retain its status as the world's reserve currency, the yuan is set to play a critical role in global finance, investment, and trade going forward. We've long argued that the BRICS bank, the AIIB, and to an even greater extent, the Silk Road Fund, will help to usher in a new era of yuan hegemony in international investment and trade. A number of recent developments support this, including Beijing's push for the renminbi to play an outsized role in loans doled out through the AIIB, the denomination of loans from the BRICS bank in yuan, and China's aggressive investment in Pakistan and Brazil via the Silk Road initiative (here and here). As for financial markets, China recently confirmed the impending launch of a yuan denominated gold fix which conveniently dovetailed with the LBMA's acceptance of the first Chinese banks to participate in the twice-daily auction that determines London gold prices. Now, in the latest sign of yuan proliferation and penetration, the renminbi will be accepted as collateral by the LME along with the dollar, the euro, the pound, and the yen. Here's WSJ with more:

The takeaway: irrespective of any damage China's recent interventions into its domestic equity markets may have on the country's SDR push, and regardless of whether the PBoC cash injection into CSF spooks the market and serves to accelerate short-term capital outflows, the internationalization of the yuan isn't likely to be meaningfully derailed. We'll leave you with the following quote from Dan Marcus, CEO of London-based currency trading platform ParFX who spoke to WSJ:

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Economic Collapse 2015 -- China Stocks COLLAPSING Despite MASSIVE Government Intervention! Posted: 28 Jul 2015 03:17 PM PDT China has been aggressively dumping money into their stock markets in order to fill in the void for the MASS EXODUS which is taking place now. Despite this activity, the market continues to slide, drifting the truth about how much wealth is actually fleeing. This is a global program in which... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| WARNINGS of Artificial Intelligence: Hawking, Musk, Wozniak and More! Posted: 28 Jul 2015 03:00 PM PDT A Warning has been issued concerning Artificial Intelligence from a huge list of leaders in the tech community. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GLOBAL FEAR MEETS PEAK GOLD & SILVER Posted: 28 Jul 2015 02:00 PM PDT Andy Hoffman from Miles Franklin is back to document the global economic collapse for the final week of July, 2015.With September looming, a month in which many have predicted the great collapse will begin in earnest, Andy and I cover the current state of affairs as the global economic situation... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold & Silver Money Has Devolved Into Debt and Plastic Posted: 28 Jul 2015 01:49 PM PDT Central banks will disagree; Keynesian economists probably disagree; Too-Big-To-Fail banks don’t care; But I think the following is generally accurate regarding the devolution of gold and silver money. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Option Expiry - Leverage 117:1 at The Bucket Shop Posted: 28 Jul 2015 01:49 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Abortion: Destruction of Innocence Posted: 28 Jul 2015 01:00 PM PDT Planned Parenthood President Blames 'Militant Wing' Of Anti-Abortion Crowd For Videos The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Is gold manipulated? Clif Droke thinks he knows without looking Posted: 28 Jul 2015 12:47 PM PDT 4p ET Tuesday, July 28, 2015 Dear Friend of GATA and Gold: Echoing the commentary yesterday by 321Gold's Bob Moriarty -- http://www.gata.org/node/15595 -- gold market analyst and financial letter writer Clif Droke today marvels at what he sees as the growing pervasiveness of the belief that the gold market is manipulated. Can GATA really have been this successful? Is it because all those other participants in the gold market are so gullible? Or has the manipulation been documented enough and visible enough that people actually have been persuaded? In any case, in his commentary today, posted at GoldSeek, "Is the Gold Price Manipulated?" -- http://news.goldseek.com/ClifDroke/1438107705.php -- and at 24hGold -- http://www.24hgold.com/english/news-gold-silver-is-the-gold-price-manipu... -- Droke sets out to refute the complaint of manipulation, and a few of his assertions may deserve a reply. ... Dispatch continues below ... ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers: To invest or learn more, please visit: The market for gold is immensely huge and [it is] virtually impossible for any one entity to control its price swings. Beyond the very immediate term, any attempt at raising or depressing gold prices would almost certainly meet with failure. Even a coterie of interests devoted to pushing gold prices lower would meet with certain failure due to the enormous size and complexity of the market. As one well-known market analyst of the previous century commented, "... the market itself is bigger than all the 'pools' and 'insiders' put together. ... The great market movements are beyond the manipulation of the combined financial interests of the world." This is what even the ancients recognized as an "ipse dixit," an assertion made without authority -- "He said it himself." Besides, is the gold market or any market really bigger than institutions that are fully empowered to create infinite money -- central banks? Infinite is bigger than anything else. As for that "well-known market analyst of the previous century," he likely was not living in the age of modern central banking, the age when infinite money came within the reach of governments. One commonly shared belief among gold bugs who subscribe to the manipulation theory is belief in a global conspiracy. Probably the most famous example of this is the Illuminati concept. Illuminati theorists believe in a highly organized group of elite individuals within government, industry, and finance who share the common goal of undermining the sovereignty of nations and establishing a one-world government. Good grief! GATA wants to review the records of the Bank for International Settlements, the Federal Reserve, the Treasury Department, the Exchange Stabilization Fund, the European Central Bank, the Banque de France, and the G-10 Gold and Foreign Exchange Committee, among other government agencies, and Droke can cite only the Illuminati, a straw man for market analysts who won't examine the documents of government policy and won't put a single critical question to any central bank. GATA has peppered central banks with questions and has even sued a couple of them for critical information. Their objections have shown that they have plenty to hide. Droke should try attending them before he disparages complaints of conspiracy. While there's no denying that conspiracies and monopolies do exist, there's also no denying that for every attempt at controlling an industry or a commodity there is a counterbalance. Within any group of would-be monopolists there are those who can never agree on a common plan for gaining control; common experience teaches this (as anyone familiar with corporate politics knows). Further, there are always other parties who would also like to gain total control in opposition to other conspiracy groups. In other words, there is no one overriding "Illuminati" monopoly group, but multiple groups of would-be controllers competing amongst themselves. But what exactly is the "counterbalance" to institutions authorized to create and dispose infinite money? And with gold price suppression, we're talking less about "conspiracies" than about longstanding government policy, though "conspiracy" is a perfectly apt term for central banking, insofar as it involves regular secret meetings called to determine courses of action, like the meetings held every month by the BIS, ECB, and Federal Reserve. There are several questions which should be asked by those who subscribe to the gold manipulation theory. To begin with, why would manipulators actively seek to push prices lower when there is less to be gained by a lower gold price than a higher one? The manipulation crowd is presumably in favor of multinational businesses which comprise the global economy. It's well known that higher commodity prices reflect a healthy outlook for big business due to the increased demand for raw materials and industrial inputs. Gold being the strongest barometer for commodities demand, a falling gold price is more apt to reflect deflation, which is the bane and scourge of big business. If anything, manipulators would have more interest in raising gold prices, not crashing them. Still more mere "ipse dixits" when answers to Droke's questions can be found throughout the official documents of gold price suppression, which we'll cite below. Essentially governments have sought to suppress the gold price because gold is a potentially competitive currency whose value, if set in a free market, powerfully influences the value of government currencies and bonds and the level of interest rates. Secondly, what interest could gold manipulators have in lowering gold prices when it automatically presumes a stronger dollar? A stronger currency does no favors to the U.S. economy over the longer term. It results in lower export prices for U.S. manufacturers and strains profit margins. As the Wall Street Journal reported on April 24, the strong dollar has been "wreaking havoc" on the profit margins of American multinationals. A stronger dollar forces multinationals to raise prices in order to offset currency issues, yet as WSJ pointed out, this only tends to depress profits due to lower sales. Yes, there may be times when governments want gold to rise to devalue their currencies and debts generally. Yet as one of his undersecretaries told Secretary of State Henry Kissinger at the State Department in April 1974, gold is "the reserve-creating instrument" for central banks, whoever has the most gold can determine its value and the value of other currencies, and that value has to be suppressed and gold excluded from the world financial system to maintain the dominance of the U.S. dollar as the world reserve currency. In fact if a gold conspiracy did exist, the only conceivable reason for knocking down prices would be for the sole purpose of allowing the manipulators to buy the gold back at bargain levels. This in turn would allow them to profit from the inevitable bull market which always eventually follows a long-term bear market. To this end, I can't recall gold bugs discussing manipulation during the glory years between 2002 and 2011 when the gold price was rocketing to all-time highs. Indeed, it would seem that cries of "manipulation!" are selectively applied to only those times when gold's prospects have dwindled. Yes, some analysts lately have speculated that China has joined the Western central banks in suppressing the gold price precisely so China can obtain more metal inexpensively. But this is speculation, not fact, and it would be nice if we could stick to facts -- the documentation -- when examining this issue. Droke may not be able to recall "gold bugs discussing manipulation during the glory years between 2002 and 2001 when the price was rocketing to all-time highs, but he could find plenty of that in GATA's dispatch archive. We've been complaining about gold market manipulation since our founding in 1999. Droke purports to be refuting complaints of gold market manipulation, but his admission of ignorance of GATA's work shows that he is not the least familiar with those complaints. Finally, if the conspiracy theorists truly believe that the gold price is subject to manipulation, why do they advocate owning gold? This is probably the biggest inconsistency of their hypothesis. Why even touch gold if its price is subject entirely to the whims of an elite group of power brokers? Could it be that the ringleaders of the conspiracy theorists haven't bothered to smooth out this dissonance because so many of them have a vested interest in promoting gold coins? GATA can speak only for itself. But one reason for owning gold is a belief that enough publicity will help expose the manipulation, push investors out of imaginary gold underwritten by central banks and into real metal, and liberate gold into a free market, wherein its value relative to other currencies will rise. In any case GATA isn't telling people how to invest and is not an investment adviser. It's a nonprofit educational and civil rights organization aiming to advance free markets, especially in the monetary metals. If Droke is ever interested in reviewing and rebutting specifically the major documents of gold price suppression by central banks, he can find them here: http://www.gata.org/node/14839 In the meantime, no analysis of the gold market is worth anything if it fails to address these questions, which Droke has failed to address even as he pontificates about everything else: -- Are central banks in the gold market surreptitiously or not? -- If central banks are in the gold market surreptitiously, is it just for fun -- for example, to see which central bank's trading desk can make the most money by cheating the most investors -- or is it for policy purposes? -- If central banks are in the gold market for policy purposes, are these the traditional purposes of defeating a potentially competitive world reserve currency, or have these purposes expanded? -- If central banks, creators of infinite money, are surreptitiously trading a market, how can it be considered a market at all, and how can any country or the world ever enjoy a market economy again? Of course since he is selling subscriptions to a newsletter of technical analysis, Droke has a powerful interest in ignoring the documentation of central bank intervention in the gold market, for it would reveal that he has been analyzing mere holograms, and he'd be out of business. But if GATA ever succeeds, there will be plenty of actual markets for him to analyze again. CHRIS POWELL, Secretary/Treasurer Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 28 Jul 2015 12:36 PM PDT This post Hillary Saves Capitalism! appeared first on Daily Reckoning. VANCOUVER, Canada – What would the world do without well-intentioned, earnest, and intelligent public servants like Hillary Clinton? We don't know. But we'd like to find out! Before we get to that… a quick market update. Shanghai stocks took another big dive. They fell 8.5% for the session, the biggest one-day rout since 2007. Meanwhile, the Dow fell another 128 points. Gold fell below $1,100 an ounce. And oil his a new 52-week low of $46.68 a barrel. The world is still falling apart. What's going on? As we explained yesterday, the Fed's EZ money is creating hard times. It led to overconsumption… then overproduction… and now to a big bust. Just what you'd expect. And what you'd expect next is more crashing, sliding, and busting up in the world's markets… followed by more EZ money. Eventually, it will explode into consumer price inflation. But that could still be far in the future. Back to Hillary… We keep our political coverage balanced at the Diary. On the Republican's side, there is an unusually rich assortment of fools and knaves. And on the Democrat's side, there is the aforementioned Ms. Clinton. We don't know what we would do without her. How would we know, for example, how long we should hold an investment without her to tell us? She seems to believe that today's average holding period is too short. It causes an obsession with short-term results that she calls "quarterly capitalism." CNBC reports: To change the incentives, Clinton proposed raising capital gains taxes on investments held for only short periods of time. The tax on investment earnings would nearly double from their current rate of 20% for investments held less than two years. And the rate for those in the top tax bracket would be set on a sliding scale, with incentives for people who hold their investments longer. […] Some liberals were disappointed. "Working to end short-termism on Wall Street will definitely help working families in important ways," said Democracy for America executive director Charles Chamberlain. "But let's be really clear: The Democratic Party doesn't want, and the American people don't need, another Democratic president who tiptoes around Wall Street's insatiable greed." How will "working to end short-termism" help working families? How many months of holding an investment is acceptable to the Democratic Party's front-runner? Why would anyone even think that Ms. Clinton – who has never held an honest job in the private sector – could possibly have any idea about how to save capitalism… or how long an investment should be held? These questions leave us panting, sweating… and in need of a drink. All Ms. Clinton knows about capitalism is what the cronies tell her when they are slipping her cash. Wall Street is a major financial contributor to her campaign. They know she can be bought. She won't disappoint them. Hillary still has to grandstand for the benefit of the Democratic masses. But she's clearly on the side of the cronies and the zombies. And they both hate capitalism. Why? Because capitalism is a zombie killer. Capitalism is not a wealth distribution system, as supply-side economist and techno-utopian guru George Gilder makes clear in his latest book, Knowledge and Power. It's an information system… a knowledge system… in which entrepreneurs take risks and find out what works. They learn how to build better things… putting old zombie manufacturers out of business. They figure out how to cut costs and increase quality, too… squeezing out the cronies and forcing the zombies to get to work. They discover the knowledge that makes us wealthier. Naturally, the zombies and cronies try to put capitalism out of business. Typically, their candidates claim to be "improving" or "saving" capitalism from itself. What they are really doing is saving the crony lobbyists and zombie voters from real capitalism. Regards, Bill Bonner Originally posted at the Diary of a Rogue Economist, right here. Editor's Note: Be sure to sign up for The Daily Reckoning — a free and entertaining look at the world of finance and politics. The articles you find here on our website are only a snippet of what you receive in The Daily Reckoning email edition. Click here now to sign up for FREE to see what you're missing. The post Hillary Saves Capitalism! appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China Stock Market Crash Explained by Mike Maloney Posted: 28 Jul 2015 12:30 PM PDT China's Stock Bubble - The Breakdown With Mike Maloney The bigger the bubble, the bigger the implosion. This is deflationary. Learn what is coming by watching the video linked above. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SOROS Behind CHINA STOCK MARKET COLLAPSE #NYSE ? Posted: 28 Jul 2015 11:30 AM PDT Sinister forces are at work in China's stock market, according to at least one "non-biased" Hong Kong newspaper. To be sure, one might well be tempted to suspect that the inevitable unwind of a completely unsustainable (and by many measures, entirely insane) margin mania is to blame for the brutal... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Are Women Really Discriminated against ? -- John Stossel Posted: 28 Jul 2015 11:00 AM PDT John Stossel - Gender Gap Myths , Ariane Hegewisch, Institute for Women's Policy Research, joins John to discuss the perception of a gender gap. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 28 Jul 2015 10:36 AM PDT Graceland Update | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Buy and "Own Gold Krugerrands" Says Money Expert Jim Grant, Very Bullish on Gold Posted: 28 Jul 2015 10:33 AM PDT - “I own Krugerrands” says legendary Jim Grant - He is “very bullish indeed” on gold - Gold is “investment in financial and monetary disorder” – says Grant - It thrives in current environment – “uncertainty, turbulence and disorder” - “One of the most radical periods of monetary experimentation in the annals of money” - “Gold…is now the conjunction of price, value and sentiment” - Reminds owners of gold that the original reasons for buying gold have not gone away | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PROPHECY ALERT: Israel Prepares For War Massive 3 Day Drill Posted: 28 Jul 2015 10:30 AM PDT Israel has launched the largest 3 day military drill with hundreds of thousands of reservists The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 28 Jul 2015 09:36 AM PDT Jim, A man speaks his mind! CIGA Wolfgang R "I Own Krugerrands" Says Legendary Jim Grant Submitted by GoldCore on 07/28/2015 07:06 -0400 "I Own Krugerrands" Says Legendary Jim Grant - He is "very bullish indeed" on gold - Gold is "investment in financial and monetary disorder" – says Grant - It thrives in current... Read more » The post Jim’s Mailbox appeared first on Jim Sinclair's Mineset. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Banks Tracking Physical Location of Customers Posted: 28 Jul 2015 09:26 AM PDT Halifax Bank in the UK is collecting date time and location of customer ATM cash withdrawals and selling the information to 3rd party marketing companies. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TF Metals Report: Comex gold leverage widens to record Posted: 28 Jul 2015 09:14 AM PDT 12:13p ET Tuesday, July 28, 2015 Dear Friend of GATA and Gold: Leverage for the big bullion banks in the New York Commodities Exchange's gold futures contracts now has reached 116 times the metal available on the exchange, the TF Metals Report's Turd Ferguson reports today. Ferguson writes: "Is this fair and does this market discover an accurate representation of price when it uses a leverage of paper to physical at 116 times? And this is where this is all just one big scam. With no boundaries or limits placed on the bullion banks that issue these paper contracts, what's to stop them from extending the leverage to 200X? Maybe 300X? How about 500X?" Ferguson concludes: "All we can do is continue to force the banks' leverage even higher by removing physical metal from their system and placing it out of their collective reach." His analysis is headlined "Comex Leverage Widens to Record" and it's posted at the TF Metals Report here: http://www.tfmetalsreport.com/blog/7027/comex-leverage-widens-record CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver Coins and Rounds with Employee Pricing and Free Shipping Grab your Silver Starter Kit at cost from Money Metals Exchange, the company named "Precious Metals Dealer of the Year" by industry ratings group Bullion Directory. Simply go to MoneyMetals.com and type "GATA" in the radio box at the top of the page. This special silver offer contains 4 ounces of silver coins and rounds in the most popular 1-ounce, half-ounce, and 10th-ounce forms. Claim yours now, because GATA readers get employee pricing and free shipping. So go to -- -- and type "GATA" in the radio box at the top of the page. Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Inflation Deniers Emboldened by Gold's Struggles Posted: 28 Jul 2015 09:04 AM PDT The vultures are circling. Precious metals bulls, laid flat by gold and silver prices dropping for the 5th week in a row, are watching deflationists such as Harry Dent and the financial media squawk about the imminent demise of precious metals. We covered the superficial and condescending coverage of the metals markets in the financial press last week. Since then, the financial press has stepped it up even more. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ronald Stoeferle – I Like Contrarian Investing Posted: 28 Jul 2015 09:02 AM PDT “The Matterhorn Interview – July 2015: Ronald Stoeferle”"I Like Contrarian Investing"Short Video interview (15 minutes): | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Mining Stocks to Weather the Storm Posted: 28 Jul 2015 07:26 AM PDT With ongoing volatility expected in the gold space, mostly owing to global economic weakness, investors should focus on quality gold names with three key attributes to weather the current metal price environment, explains Joseph Fazzini, vice president and senior analyst with Toronto-based Dundee Capital Markets. Fazzini says those attributes are low-cost, long-life assets; defensive balance sheets; and responsible management teams. In this interview with The Gold Report, Fazzini lists six Buy-rated names with those key attributes and more. The Gold Report: Many of the people we interview have a theory about why gold is performing poorly this summer despite so much global uncertainty, especially in China and Greece. What's your theory? | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| How to Identify a Classic Market Bubble Posted: 28 Jul 2015 07:20 AM PDT One of the most ironic and fascinating characteristics about an asset bubble is that central banks claim they can't recognize one until after it bursts. And Wall Street apologists tend to ignore the manifestation of bubbles because the profit stream is just too difficult to surrender. The excuses for piling money into a particular asset class and sending prices several standard deviations above normal are made to seem rational at the time: Housing prices have never gone down on a national basis and people have to live somewhere, the internet will replace all brick and mortar stores, and perhaps the classic example is that variegated tulips are so rare they should be treated like gold. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 28 Jul 2015 07:18 AM PDT Below is the opening segment of this week's edition of Notes From the Rabbit Hole, NFTRH 353. After this theoretical exercise we got down to nuts and bolts analysis, which provided logical 'bounce' targets (provided a bounce is indeed what is in play) for Gold, Silver and HUI, a compelling trend in the Commitments of Traders data and more talk about the trends that will need to be in place before a favorable macrocosmic environment is in place for the gold sector. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gerald Celente -- Banksters Rule Neo Feudal USA Posted: 28 Jul 2015 07:10 AM PDT Gerald Celente - America Heading Towards a Economic Collapse 2014. Gerald Celente: Why An Economic Crash Is Coming & How To Survive The Coming . The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CERN Portal // Sept 2015 "Year of Light" EXPOSED (R$E) Posted: 28 Jul 2015 07:08 AM PDT Lucifer, the false light, key to the bottomless pit. CERN propaganda 'International Year of Light 2015' and the meaning of the occult symbolism shown. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GATA Chairman Murphy interviewed on China's reserves, latest attack on gold Posted: 28 Jul 2015 05:14 AM PDT 8:13a ET Tuesday, July 28, 2015 Dear Friend of GATA and Gold: GATA Chairman Bill Murphy, interviewed by Elijah Johnson of FinanceAndLiberty.com, discusses China's lowballing its gold reserves, the latest manipulative attack on the gold market, and gold's prospects generally. The interview is 12 minutes long and can be heard at YouTube here: https://www.youtube.com/watch?v=6a6vcMbfvRc CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Free Storage with BullionStar in Singapore Until 2016 Bullion Star is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. Bullion Star's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in Bullion Star's bullion vault, which is integrated with Bullion Star's shop and showroom, making it a convenient one-stop-shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage is FREE until 2016 and will have the most competitive rates in the industry thereafter. For more information, please visit Bullion Star here: Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Supply and Demand in the Gold and Silver Futures Markets Posted: 28 Jul 2015 02:54 AM PDT Counterpunch | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Experts' Guide to Getting the Most Out of Company Presentations Posted: 28 Jul 2015 01:00 AM PDT What can you really learn from the fuzzy project diagrams, site photos and columns of numbers often shown in dark rooms at conferences? A lot, if you know what you are looking for, according to the experts. Beyond the warnings about forward-looking statements, corporate presentations often contain the details that could make or break a project's economics. And many companies time the release of important information to coincide with events like the Sprott-Stansberry Natural Resource Symposium, going on now in Vancouver. For those who weren't able to make the trip or are doing their homework in a hotel room somewhere, The Gold Report asks veteran investors what they look for in a corporate presentation when evaluating a possible opportunity. As a bonus, we included links to several company presentations shown in Vancouver so you can practice your analyzing skills. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Is the Gold Price Manipulated? Posted: 27 Jul 2015 05:00 PM PDT |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Following the latest mass media assault on gold, capped with such trollbait pearls as “

Following the latest mass media assault on gold, capped with such trollbait pearls as “