saveyourassetsfirst3 |

- Hambro's battle to bring miner back to land of the living

- Gold Price in November 2014

- Gold Investors Weekly Review – November 7th

- Pig-headed Ignorance or the Courage of Conviction? Why I'm Thrilled to Own Gold And Silver after a 3 year bear market

- The 1,100-year-old Royal Mint is moving in a modern direction

- Charts Of Gold And Silver Reveal Power Of Elite’s Central Bankers

- US Mint Caught Totally Off Guard By EPIC Wave of Silver Demand- Physical Market Screams No Mas!

- Harvey Organ Weekend Update: Banksters Cannot Cover Silver Shortfall!

- Russia’s ruble is only the first casualty of the renewed war in Ukraine

- Greenspan: “Gold is Currency. No Fiat Currency, Including the Dollar, Can Match It”

- Did Gold and Silver Just Get Their Greenspan Put?

- GLD to Gold - We have a Problem!

- Some Thoughts on Corn and the Commitment of Traders

- US Mint Caught Totally Off Guard By EPIC Wave of Silver Demand- Physical Market Screams No Mas!

- Did Gold and Silver Just Get Their “Greenspan Put”?

- China Likely Bought 10,000 tons of Gold…and if They Did, Here’s Why

- Reader Question on Greenspan and Gold: "No Fiat Currency Can Match It"

- May Day! May Day!! GOFO Rates Move into SEVERE Backwardation!

| Hambro's battle to bring miner back to land of the living Posted: 08 Nov 2014 12:00 PM PST There is a recent addition to the ranks of the corporate undead: Petropavlovsk, a gold mining company that was once the darling of the City This posting includes an audio/video/photo media file: Download Now |

| Posted: 08 Nov 2014 10:18 AM PST SunshineProfits |

| Gold Investors Weekly Review – November 7th Posted: 08 Nov 2014 09:03 AM PST In his weekly market review, Frank Holmes of the USFunds.com summarizes this week's strengths, weaknesses, opportunities and threats in the gold market for gold investors. Gold closed the week at $1,177.98 up $4.50 per ounce (0.38%). Gold stocks, as measured by the NYSE Arca Gold Miners Index, rose 5.94%. The U.S. Trade-Weighted Dollar Index climbed 0.73% for the week. Gold Market StrengthsOne-month gold lease rates in London, the cost to borrow bullion, soared to 0.3405 percent on Thursday vs. 0.001 percent in September, reaching a high not seen since December 2008. Reasons cited for the rate upswing ranged from supply/demand imbalances to borrowing by traders in order to short the metal. Gold futures headed for the biggest gain since June after the U.S. September jobs report came in lighter than expected on Friday, 214,000 vs. 230,000 forecasts. The jobs report supported ongoing speculation that the Federal Reserve will continue to hold interest rates low amid tepid global growth. The U.S. Mint has temporarily run out of American Eagle Silver coins after October sales jumped 40 percent to 5.79 million ounces from a month earlier. Gold Market WeaknessesHoldings in the SPDR Gold Trust slid 0.3 percent to 738.8 metric tons on Tuesday to the lowest amount since September 2008. A confluence of factors has influenced the flight from the metal held my some investors as a safe haven. First, there is a mistakenly held notion in the markets that gold is one of the most volatile asset classes. In actuality, the return on equities as measured by the S&P 500 is typically twice as volatile as the return on gold bullion. Second, low gold prices have prompted some investment advisors to recommend a zero allocation to gold. Third, new highs in the equity market continue to increase investor appetite for risk assets. Lower oil prices create a headwind for gold as inflation expectations are pushed down. This reduces the inflation hedge demand for the metal. There was a selloff in gold stocks amid a broad based de-rating in the gold sector. The selloff brought a slew of gold miners near to, or below, decade lows. Among them were Barrick, Goldcorp, Newmont, Kinross and Yamana.

Gold Market OpportunitiesCanaccord Genuity came out with a study looking at the four major S&P/TSX Venture Composite Index corrections in the last three decades. The TSX Venture index is considered a good proxy for small cap gold stocks. The study found the current correction, at 43 months, the second longest as compared to the 45-month correction between April 1987 and January 1991. The study also showed the best three months to gain exposure to gold has historically been December, January, and February. With the authors believing the end to the correction could be nearing, the next couple of months could provide an attractive entry point into gold equities.

The World Gold Council forecast in September that gold demand in China will rise 20 percent in three years. Additionally, Standard Chartered called for a $1,100 price floor, citing firming physical demand indicators out of China and India.

Gold Market ThreatsA slew of negative forecasts have cast a cloud over the direction of gold prices. ABN Amro NV forecast a year-end price of $1,100 an ounce, sliding to $800 by year-end 2015. An analyst at Oversea-Chinese Banking Corp. called for a further drop of at least 13 percent and a price that could go lower than $1,000. The UBS Economics team released its global economic forecast for 2015 and 2016 and the outlook for gold was also negative. Reasons cited included weaker China growth, a faster than expected rate hike by the Fed, and a strong U.S. dollar fueled by a capital expenditure led boom. Looming gold reserve cuts threatens write-downs for gold miners. If gold prices stay low, gold miners will be forced to lower their reserve price assumptions, leading to write-downs. B2Gold is especially vulnerable as its 2013 reserve assumption stands at $1,350 an ounce.

Clean Diesel Technologies announced a new proprietary technology to replace costly use of platinum group and rare earth metals in catalytic converters. The company has been granted the first two of a family of patents for Spinel, a proprietary clean emissions exhaust technology. With original equipment manufacturers (OEMs) currently spending over $6 billion a year on platinum group metals, the technology could create major disruption in the commodities' demand if the patents take off.

|

| Posted: 08 Nov 2014 08:41 AM PST Make no mistake, I read what they're saying. I see it virtually every day, from Bloomberg to independent investment blogs to Market Watch. I see the slings and arrows in the headlines and in the comments. Dogmatic. Zealot. Goldbug. Emotionally invested beyond rationality. Bleeding cash for three years straight. Unable to admit being wrong. |

| The 1,100-year-old Royal Mint is moving in a modern direction Posted: 08 Nov 2014 07:37 AM PST Adam Lawrence is taking on big players by selling a new gold sovereign online This posting includes an audio/video/photo media file: Download Now |

| Charts Of Gold And Silver Reveal Power Of Elite’s Central Bankers Posted: 08 Nov 2014 07:35 AM PST When considering Precious Metals fundamentals do not apply, and that is key to understanding how to relate your holdings of physical and/or interest in gold and silver. Nothing else matters. There are many sites that give minute details of the depletion of gold and silver stocks on the COMEX and LBMA; many that report on the demand for and scarcity of both metals; just last week, the news flash heard around the PM community on how silver American Eagles were sold out…shades of 2013-type news that dominated for several weeks. [Yawn]. Consider this: everything you have heard, including information of which you have not heard but others have is already priced into the market! Compile every sort of bullish news available, and almost all of it is true, yet gold and silver hit recent 4 year lows. How are all those news events working out, and not just for fundamentalists? So far, none of this information has mattered, at least with respect to current price levels. Ultimately, all of these known factors will have an impact on price. For now, all anyone can conclude is that legitimate demand is not a market-driver. Precious metals are being driven by one thing only: survival of the elite's world-wide fiat system, aka paper debt foisted on the public and called "money." Debt is the opposite of money, but the Rothschild fiat system has successfully been sold to the American public since the financial coup d'état by the Federal Reserve Act, when one of the world's most important and prophetic sentences ever uttered, by Mayer Amschel Rothschild, went into effect: "Give me control of a nation's money and I care not who makes its laws" Specie-backed United States Notes were destroyed and replaced by circulating Federal Reserve Notes, which are not Federal, for the fiat is issued by a privately owned banking cartel; there are no reserves, for as fiat they are backed only by people's imagination, which for the American public apparently has no limits; and they are not Notes, for there is no stipulation for payment of anything, to anyone, at any time. The fact that almost all people do not grasp the importance of the content of this paragraph goes far to explain why most fail to understand the power of the moneychangers to maintain total control over those living in the Western world. The Euro Dollar is as phony as the fiat Federal Reserve Note, yet Europeans are as willing as Americans to subvert their common sense for fiat nonsense that ruins their economic lives, yet sill gives life to the unelected bureaucrats unreasonably in charge. So much for Europeans thinking Americans are not the brightest of people. The most important piece of news for PMs last week was not the "Sold Out" sign by the US Mint, rather it was the selling of about $1.5 billion in gold at the market. There are only two practical answers as to the "who" [or what] was selling, and both are from the same family of central bankers: either the New York Federal Reserve, acting though "other" agents to disguise direct involvement, or the BIS, [Bank of International Settlements], the central bankers bank. No other entity has that kind of financial wherewithal or carelessness to execute in a market with no other intent than to do harm. It should also be your biggest clue why gold and silver reached recent lows. No one can fight the fiat financial might of the central bankers. Russia and China can, and are doing so in a different way. Plus, both are willing to accept the opportunity to accumulate more PMs at current levels. In fact, it is not out of question that lower prices are a required accommodation to China in return for China not trashing the toxic Treasury bond market and exposing the US fiat scam. The best answer as to when will gold and silver rise to values that are reflective of the perverse distortion of their role as a known and accepted store of value, except for the elites running their fiat currency Ponzi scheme on the rest of a compliant world, is: not a day before the end of the moneychangers control over the existing fiat system so deeply entrenched and accepted for its existence. Once you recognize this factor as being in dominant control over gold and silver, you will better realize and accept it as sad reality, but it is what it is. Consider how much information you have read and digested about gold and silver over the past few years [since the highs]. What has been the impact on the market? Zero, in fact negative. What has been the impact on your thinking? False, actually more misleading, beliefs about expectations. If some of the strongest known fundamental demand for gold and silver has had no effect on price, the question has to be, why not? The simple and only answer is the elite's protecting its Ponzi fiat scheme, for they can never allow gold and silver to be considered as an alternative to their fiat paper issue. All they can do is what they have been doing for over 100 years, manipulate gold and silver, crushing them as viable alternatives to the "dollar" [more accurately, Federal Reserve Note], and the Euro dollar. It serves no purpose to bemoan or regret all purchases of physical gold and silver, especially since the high, and we are on record as buying and recommending buying physical all the way down, even buying more physical silver just last week. The purpose has not been to make money but to preserve purchasing power via the most reliable form over time. How has that been working? Not very well over the past few years, but keep in mind the time frame, just the past few years. It is a certainty, a certainty based on history that all known fiat systems fail, and the existing system is no exception. Likely within the next few years, all purchases made, including those made at the highs, will look prescient. Did the precious metals community get suckered in? Absolutely! There are probably only a relative handful who anticipated the power of the moneychangers over the PMs market to suppress price to levels not thought possible. This is hindsight for investors in gold and silver. We shall see who eventually gets the last laugh, as it were, and it will not be the moneychangers. There is one thing and one thing only that buyers of physical gold and silver can do, and that is to bide time until this failing power struggle by the moneychangers comes to its inevitable demise. Common sense tells you that a country that has increased its money supply to ethereal levels cannot be sustained. We said back in the earlier half of 2014 that it could well be a repeat of 2013, in terms of unrealized expectations for much higher PM price levels. While true in terms of time, we were not on target as to how low price would go. To our credit, we did continue to advise to stay out of the long side of the paper futures market for as long as the trend was down. That came from an obvious read of the charts. The silver chart has not improved on its lack of ability to show some kind of bottom being formed. The recent break of support has squelched those efforts, for now. 15.04 was last week's low, forming a potential double bottom. It is not important that 15.04 hold as an absolute low. What is more important is how market activity develops for whatever the eventual low price becomes, whether it is last week's price, 14.65, or any other number, 14.50, 14.32, etc. [Maybe even lower?] There will be evidence, through price and volume, that is low is in place. It may take several weeks to confirm that a low is in, so it will not pay to try to be "first in." Let the market prove its intent, and then one can be in a more informed and comfortable position to make better decisions from the long side, should one want to trade paper futures, if there is even a viable futures market in which to trade, and there may not be. Continue to monitor the way in which price responds or reacts to these lower levels. If there is no strong rally higher, on increased volume and upper range closes, then it will indicate that the bottoming process will take much more time. Be patient and allow your thinking to let the market develop as it will, for the controlling forces remain in place. The daily chart shows another layer of bearish spacing as silver continues to weaken relative to gold. At some point, either once a low has been established or once a trend higher begins, silver is likely to outperform gold over the next several years. When silver was in the low 20 area, we said prices are likely at generational lows. While now lower, the sentiment remains equally true. This artificial manipulation may go on beyond what most expect or want, but it will come to an end, and then even $50 silver will look like a great buy. Keep a level head in the face of recognized artificial adversity. Compare the difference in how gold is developing around its barely broken support, with that of silver to get an idea of what to look for when one market more successfully holds an area versus one that fails to hold in similar circumstances. All that can be said of gold, while stronger than silver, is that the trend remains down, and that is the most important piece of information to know, for now. Here is more of the same, just observing how price responds to this critical support area. If there is more deterioration to come, how strongly does it impact price to the down side? There are so many ways in which market activity can develop that it does not pay to try and outguess how price reacts. Let it react, and then you are in a better position to react to what is known without having to guess. Keep it simple. |

| US Mint Caught Totally Off Guard By EPIC Wave of Silver Demand- Physical Market Screams No Mas! Posted: 08 Nov 2014 06:39 AM PST Podcast: Play in new window | Download

Click here for a MUST LISTEN Special Market Alert Edition of the SD Weekly Metals & Markets: |

| Harvey Organ Weekend Update: Banksters Cannot Cover Silver Shortfall! Posted: 08 Nov 2014 06:24 AM PST GLD loses 5.68 tonnes of gold inventory/Silver inventory remains constant/huge rise in gold and silver today. Gold $1177.00 wow!! something big is going on behind the scenes!! It looks like our banker friends are timid with respect to silver. The bankers just cannot cover their shortfall. Let's head immediately to see the major data points […] The post Harvey Organ Weekend Update: Banksters Cannot Cover Silver Shortfall! appeared first on Silver Doctors. |

| Russia’s ruble is only the first casualty of the renewed war in Ukraine Posted: 08 Nov 2014 02:21 AM PST Hostilities are on the rise again in Ukraine as the east lurches back towards open war. Bloomberg's Ryan Chilcote reports on the impact the tensions have on Russia's currency on ‘Countdown.’ But while the ruble may be the first casualty of the renewed war the impact on geopolitical instability could send the global financial markets into a tailspin and revive gold from its near death experience… |

| Greenspan: “Gold is Currency. No Fiat Currency, Including the Dollar, Can Match It” Posted: 08 Nov 2014 01:59 AM PST "JPMorgan et al painted key reversals to the upside in all of them" ¤ Yesterday In Gold & SilverThe gold price did zip in early Far East trading, but the HFT boyz set a new low tick minutes after 1 p.m. Hong Kong time. Then an hour or so later, the gold price rallied back to a few dollars back above unchanged shortly before the London open. From there it traded flat until ten or so minutes before the Comex open. Then a rally began that continued through the rest of the New York session---including electronic trading after the 1:30 p.m. EST Comex close. I was amazed to see that gold closed on its absolute high tick of the day. The low and high were reported by the CME Group as $1,130.40 and $1,179.00 in the December contract, an intraday move of 4.3%, which is huge for gold. Gold closed on Friday in New York at $1,178.50 spot, up $37.20 on the day. Net volume was enormous at 267,000 contracts, so it's obvious that this rally was not going unopposed. Silver was under selling pressure right from the open in New York at 6 p.m. EST on Thursday evening, culminating in the HFT-sponsored new low tick, which came around 2:30 p.m. in Hong Kong on their Friday afternoon. From there the price rallied until 9 a.m. in London---and then didn't do a lot until minutes before the 8:20 a.m. EST open. The spike at the 8:30 a.m. EST jobs report got spiked---and after that silver rallied in a choppy fashion for the remainder of the day. Like gold, silver also closed on its high tick of the day. The low and high were recorded as $15.04 and $15.88 in the December contract, an intraday move of 5.6%. Silver finished the Friday session at $15.83 spot, up 40.5 cents. Net volume was huge in this metal as well---61,000 contracts. Platinum and palladium had similarly engineered price declines at 2:30 p.m. Hong Kong time, but the ensuing rallies in both these metals appeared to get capped around 2 p.m. EST in New York. They both closed off their highs, with platinum up 22 dollars, and palladium 19 dollars. Here are the charts. The dollar index closed late on Thursday afternoon in New York at 88.07. The 88.17 high tick came minutes before 1 p.m. in Hong Kong on their Friday afternoon---and it headed quietly lower from there. But that decline accelerated shortly after the jobs report---and the index closed down 50 basis points, finishing the Friday session at 87.57. The gold stocks were up 5 percent within thirty minutes of the open in New York on Friday morning. By 1:45 p.m. EST, they were up 7 percent or so, before fading a hair until 3:30 p.m. Then, in the last thirty minutes of trading, the shares staged a mini rally into the close, as the HUI finished up a very impressive 7.88%. The trading pattern for the silver equities was very similar to their golden brethren, complete with the mini rally into the close. Nick Laird's Intraday Silver Sentiment Index closed up 8.34%. The CME Daily Delivery Report was a bust, as it showed that zero gold and zero silver contracts were posted for delivery within the Comex-approved depositories on Tuesday. The CME Preliminary Report for the Friday trading session showed that gold open interest for November dropped down to 43 contracts from 61 in Thursday's report---and silver's November o.i. is basically unchanged from Thursday, down 1 contract to 101 contracts. There was another withdrawal from GLD yesterday---and it was pretty big, as an authorized participant withdrew 182,612 troy ounces. And as unbelievable as it may sound, an authorized participant actually added 1,437,510 troy ounces to SLV yesterday. So not only are unknown entities buying up every share of the SLV that the panicked public has been selling for the last year or so, but they've also been depositing physical silver like mad as well. Whoever these 'buyers' are, they're obviously expecting silver to trade at a materially higher price somewhere in the [probably] not-too-distant future. There was a tiny sales report from the U.S. Mint yesterday. They only sold 2,000 troy ounces of gold eagles---and that was all. In the first week of November, the mint has sold 32,500 troy ounces of gold eagles---6,000 one-ounce 24K gold buffaloes---and 1,260,000 silver eagles. That works out to a silver/gold sales ratio of 33 to 1. But that ratio is probably far off the mark considering the fact that the mint stopped selling silver eagles until further notice a few days ago. It was another decent day for in/out activity in both gold and silver at the Comex-approved depositories on Thursday. In gold, there was 130,426 troy ounces shipped in, but only 225 troy ounces shipped out. All the 'in' activity was at Canada's Scotiabank---and the link to that is here. In silver, there was 336,892 troy ounces reported received---and 707,949 troy ounces shipped out the door. The link to that action is here. The Shanghai Gold Exchange reported their gold withdrawal for the week ending October 31, 2014---and the magic number was 47.449 tonnes. Here's Nick's most excellent chart showing that. The Commitment of Traders Report for positions held at the close of COMEX trading on Tuesday, showed a small improvement in silver---and a monster improvement in gold. In silver, considering the size of the price decline, the Commercial net short position only improved by a smallish 1,745 contracts, or 8.7 million troy ounces. The Commercial net short position is now down to 62.0 million troy ounces which, I believe, is a new record low, at least in 'modern' times. Ted will rap my knuckles in his weekly commentary later today if I guessed wrong about this. The small traders [holding less than 150 Comex contracts] were the big sellers during the reporting week, dumping 733 long contacts. and going short another 2,024 contracts. The short holders in the Managed Money category of the Commitment of Traders Report actually covered 1,894 short contracts, ringing the cash register on some very decent profits. I'm sure that JPMorgan et al weren't happy to see this 'leakage' as the silver price continued to get hammered to the downside. But the big surprise---and what I was most interested in---was the 'unblinking' non-technical longs in the same category, as they added another 2,361 contracts to what was already a record long position. Who are they---and what do they know that we don't? I would guess that they know that Substantially higher silver prices are in our future. Ted says that JPMorgan's short position in silver is down to the 8-9,000 contract range---and he speculated, correctly in my opinion, that JPMorgan is no longer the big silver short on the COMEX. I would be prepared to bet a fair chunk of change that the title has now passed over to Canada's very own Scotiabank. I estimate [based on the data in yesterday's Bank Participation Report] that they are short about 16,000 COMEX contracts, or 80 million troy ounces of silver. The big improvement was in gold---and I could hardly believe the numbers when I first saw them. The Commercial net short position in gold was almost cut in half, as it improved to the tune of 43,557 contracts, or 4.36 million troy ounces. Ted said that it was one of the biggest one-week improvements in COMEX history. The Commercial net short position is now down to 5.53 million troy ounces. That 43,557 contract improvement came from the small traders in the Nonreportable category going net short 6,043 contracts during the reporting week---and the traders in the Non-Commercial category selling 18,986 long contracts, plus they added 18,528 short contracts as well. The technical funds in the Managed Money category sold 15,096 long contracts and added 6,166 contracts to their short position. The 'Managed Money' category in the Disaggregated Commitment of Traders Report is a sub-set of the traders inside the Non-Commercial category in the legacy COT Report. The total numbers are the same in both reports, they're just broken down differently. After dumping 15,096 long positions, the remaining long holders in the Managed Money category are virtually all of the 'non-blinking' non-technical fund variety waiting for the day that gold sports a permanently higher price. As of yesterday's report, these 'traders' held 113,324 long contracts, or 11.33 million troy ounces. Armed with the new Bank Participation Report, Ted says that JPMorgan's long-side corner in the COMEX gold market is around 20,000 contracts, a 2,000 contract increase from the prior reporting week. Here's Nick Laird's "Days of World Production to Cover COMEX Short Positions" graph showing the short positions of the 4 and 8 largest traders in each physical commodity traded on the COMEX. In silver in the above chart, it's my opinion that the combined short positions of JPMorgan and Canada's Scotiabank represents about 58 days of world production. And now for the November Bank Participation Report, or BPR. These are the COMEX long and short positions that are all held by the world's banks. The report comes out once a month---and the data is extracted directly from the current COT Report discussed above. For this one day a month we get to see what the banks are up to in all four precious metals and, as I say every month, they're always up to quite a bit. Even thought there was an up/down movement in gold during the October trading month---and the metal finished lower by a decent amount, the world's banks actually increased their overall COMEX short positions in that precious metal. In a declining price environment, the banks are almost always buying longs and covering shorts but, for whatever reason, that didn't happen in gold in October. In gold, '3 or less' U.S. banks are net short 3,511 COMEX gold contracts, which is 878 contracts more short than these same three banks were short in the October BPR. Since Ted pegs JPMorgan's long position at 20,000 contracts, this means that the '2 or less' U.S. banks that are left must, in total, hold a COMEX short position of about 23,500 contracts to make the total 'net short' position work out. The '2 or less' U.S. bullion banks would be HSBC USA and Citigroup. Also in gold, '20 or more' non-U.S. banks are net short 54,811 COMEX contracts, an increase of 4,924 contracts from the October BPR. I'd bet serious money that just under half of this amount is held short by one foreign bank---and that would be Canada's Scotiabank. If you subtract about 25,000 contracts from the total net short number, that leaves about 30,000 COMEX contracts held net short by '19 or more' non-U.S. banks---and divided up more or less equally, the remaining short positions don't mean much. Below is Nick Laird's BPR chart for gold going back to 2000. Note the blow-out in the short position in gold in the U.S. banks [red bars on Charts 4 and 5] in August of 2008. This is when JPMorgan took over the COMEX short positions of Bear Stearns. Also note the blow-out in gold in the non-U.S. banks [the blue bars on Chart #4] when Scotiabank got 'outed' in October of 2012. The net COMEX short position there blew out by almost double. The net long position also increased. The 'click to enlarge' feature really helps here. In silver, '3 or less' U.S. banks were net short 6,159 COMEX contracts in the November BPR. That's down more than a third from the 9,867 COMEX contracts these same '3 or less' banks held short in the October BPR---and a big improvement. Ted feels that JPMorgan's short position is around 8,500 contracts, so the '2 or less' U.S. bullion banks have to be net long to the tune of 2,300 contracts or so to make the numbers work. These '2 or less' banks, if there are two---as it could just as easily be one, are also HSBC USA and Citigroup. Also in silver, '11 or more' non-U.S. banks are net short 19,225 COMEX contracts, which is down only 360 contracts from the short positions they held in the October BPR, only a 2 percent decline, which is barely a rounding error. I would bet serious money that Canada's Scotiabank is probably short 90 percent [if not more] of that amount. Look at the blue bars [the non-U.S. banks] on Chart #4 below---both before and after Scotiabank was 'outed' in October 2012. The foreign banks were basically market neutral before that date. That's why I have no trouble stating that Scotiabank is now the 'King Short' in the COMEX silver market. Below is the BPR chart for silver and, once again, cast your eyes on the events of August 2008 on charts #4 and #5---and October 2012 in chart #4---to see where JPMorgan took over the silver short position once held by Bear Stearns---and where Canada's Scotiabank was 'outed' by the CFTC. Both events stand out like the proverbial sore thumbs that they are. In platinum, '3 or less' U.S. bullion banks are net short 4,202 COMEX contracts in the November BPR, which is down sharply from the 6,196 COMEX contracts they were net short in the October BPR. Also in platinum, '12 or more' non-U.S. bullion banks are net short 3,268 COMEX contracts, which is down a bit more that 25 percent from the net short position they held in October's BPR. Divided up more or less equally, the short positions of the non-U.S. banks are irrelevant. In palladium, '3 or less' U.S. bullion banks are net short 8,231 COMEX contracts in the November BPR, down a bit more than 5 percent from the positions they held in the October report, which is not a big change. But these '3 or less' U.S. banks are net short more than 20 percent of the entire COMEX palladium market. Also in palladium, '12 or more' non-U.S. banks are net short 3,856 COMEX contracts in the November BPR, which is up 91 contracts from the collective short positions they held in the prior BPR. Unless all these foreign banks are acting in collusion with the U.S. banks, the individual short positions of these banks don't mean much, either. Although JPMorgan, HSBC USA and Citigroup are the key U.S. bullion banks that are active in the COMEX futures market in the precious metals, it's becoming more and more obvious that Scotiabank's monster short positions in both gold and silver---but particularly silver---may put the bank in jeopardy at some point That is, of course, unless they've got themselves covered in other markets like JPMorgan appears to have done in silver. We do live in interesting times. It's Saturday---and I have a lot of stories for you again today, including quite a number that I've been saving all week, so I hope you have the time to read all the ones that interest you in what's left of your weekend. ¤ Critical ReadsJohn Crudele: U.S. economic growth is all illusionAs voters were coming out of the polls on Tuesday, pesky reporters were asking why they voted the way they did -- and what was going through their heads? The most popular response -- from 45 percent of the voters -- was the economy, as only 28 percent said their families were doing better financially. The economy is always the major issue in an election during times like these. So no one should have been shocked that voters took their anger out on the party that controls the White House, even though Republicans are just as much to blame for our economy's failures. This commentary on the economy appeared on The New York Post website at 6:22 a.m. EST on Thursday morning---and I found it embedded in a GATA release. If You Really Think It Matters Which Party Controls the Senate, Answer These QuestionsPlease don't claim anything changes if one party or the other is in the majority. Anyone clinging to that fantasy is delusional. If you really think it matters which political party controls the U.S. Senate, please answer these questions. Don't worry, they're not that difficult: 1. Will U.S. foreign policy in the Mideast change from being an incoherent pastiche of endless war and Imperial meddling? Please answer with a straight face. We all know the answer is that it doesn't matter who controls the Senate, Presidency or House of Representatives, nothing will change. 2. Will basic civil liberties be returned to the citizenry? You know, like the cops are no longer allowed to steal your cash when they stop you for a broken tail light and claim the cash was going to be used for a drug deal. This 'questionnaire' by Charles Hugh-Smith was posted on the Zero Hedge website very late on Thursday evening EST---and I thank Harry Grant for sending it our way. Home Depot: Hackers Also Stole 53 Million E-mail AddressesThe nation's largest home improvement chain had disclosed the massive, months-long breach of 56 million debit a |

| Did Gold and Silver Just Get Their Greenspan Put? Posted: 07 Nov 2014 07:00 PM PST Dollar Collapse |

| GLD to Gold - We have a Problem! Posted: 07 Nov 2014 05:33 PM PST Once again we have another one of those proverbial flies in the ointment when it comes to one of these frequent rallies we have seen in gold during the ongoing bear market of the last two+ years. We get a great rally and a lot of powerful chart action over at the Comex only to wait upon the reported holdings update from GLD and then find disappointment. Instead of a nice climb in the holdings, what did we get instead? _ a fall of some 5.7 tons! Quite honestly, that came as a very big surprise to me. Given the action in the mining shares, I had expected to see some increase in the holdings. 'Twas not to be apparently. This confirms my concerns about the rally - namely that while it was indeed powerful, it was due primarily to short covering and not so much due to an abundance of new buying. It is obvious that some used the rally in gold to close out some longs in the GLD. Here is the chart. Gold holdings are now DOWN 71.07 tons from the first of the year ( and going in the wrong direction) while reaching back to levels last seen in late September 2008. I am going to keep a very close eye on this next week and can only hope that we get some regular numbers reported daily from the ETF. Those of you who tend to follow that thing as I do know that we can sometimes go days without any fresh numbers coming our way. |

| Some Thoughts on Corn and the Commitment of Traders Posted: 07 Nov 2014 05:10 PM PST Those of you who trade the grains as I do are well aware of the importance of this Monday's upcoming USDA grains report. We will get a fresh look at the yield numbers and the overall size of the crop based on the latest from USDA as well as what the expected changes in the final carryover will be for the 2014-2015 marketing year. It is no secret that we are expecting record corn and bean crops. The only question is what size? Traders such as myself are going to be especially interested in the carryover numbers expected. Heading into this report however, we have had a huge rally in the bean complex as well as generally higher prices in corn, after it made a low near $3.20 at the beginning of October. It has since rallied some $0.60 higher in the face of a record crop which has most traders confounded and left scratching their heads looking for a reason to justify a move of this extent. It did back down a bit this week as expectations began to circulate that we would get some higher numbers based on what the private firms were saying as well as some anecdotal type reports from long-time crop watchers/observers. I want to make an especial note that these USDA reports more often than not produce some violent moves. Many traders tend to move to the sidelines ahead of them therefore to avoid getting caught in the usual crossfire that erupts when the numbers hit the wires. I have noticed something however that I feel is worth mentioning. In going over the Commitment of Traders reports, I was struck by the size of the NET LONG positioning of the LARGE SPECS heading into this report. To put it bluntly, they are banking on a very bullish report. Take a look at the following COT chart and note the blue line. That is the combined NET position of the LARGE SPEC category. As of Tuesday this week, it is the largest it has been since May of this year. As a matter of fact, it is at levels commensurate with late May when they began to exit and move out from their heavy long side exposure in earnest, eventually reaching a net short position in the process. ( NOTE the price chart where this is detailed). Here is what should make any trader a bit nervous about this... If this report is not strongly bullish, given the fact that corn has rallied to the extent it has over the last 5 weeks, one has to be concerned that there is now a hefty contingent of these large specs sitting on the net long side of the market waiting for this report to essentially confirm their bullish bias. While the report may yet to prove bullish, it is going to take a much lower than expected yield, a lower ending carryover, or a lower planted/harvested acreage number than what the market has built in heading into this report to provide the additional fuel required to push this market much higher in my view. As I see this thing, the corn has essentially been pulled higher by the antics of the meal market, which as I have been commenting rather frequently of late, has been dragging the entire grain floor higher alongside of it. The strong fund buying in the meal then spilled into the beans, which then spilled into the corn. But here is the interesting thing - the number of OUTRIGHT LARGE SPEC LONGS has not seen near the volatility as has the number of OUTRIGHT SHORTS. Look at how relatively stable the long positions have been versus the sharp moves up and down in the number of outright short positions. To put it bluntly, the vast majority of this move in corn, both down from its peak in May and now HIGHER, from its valley in October, has been caused by sharp fluctuations in the number of short positions held by these large speculators which dominate our markets. It has been my experience that a market which moves higher due more to the fact of an overwhelmingly larger amount of short covering, than BRAND NEW LONG POSITIONS being added, lacks the necessary ingredients to support a bullish trend remaining intact. In other words, that move is suspect. Those of you who have been reading here for any length of time at the site, know quite well that I have often commented on the inability of gold to sustain rallies due to the fact that the largest component of the move higher during the current bear market has been based on short covering and not NEW LONG positions. I suspect the same thing with corn. When the shorts are finished being run out, who is left to buy up at these levels? Answer - not many, especially when they realize that a record crop is coming. For now, the bulls, aided by nervous shorts, have been able to push this market well off the low made in early October as the final size of the crop was becoming known. Harvest delays, meal rallies, etc, have been the fundamental justification to support that rally. Will the report we get this coming Monday turn out to be the swan song for the large specs or will they be proven to have been correct? We shall certainly see. |

| US Mint Caught Totally Off Guard By EPIC Wave of Silver Demand- Physical Market Screams No Mas! Posted: 07 Nov 2014 04:05 PM PST T. Ferguson joins The Doc & Eric Dubin for a Special Market Alert edition for this week’s Metals & Markets, discussing: US Mint caught completely off guard by EPIC physical demand, SOLD OUT of Silver Eagles after burning through over 2 million oz in less than 2 hours Wednesday morning! Primary Dealer of Silver Eagles […] The post US Mint Caught Totally Off Guard By EPIC Wave of Silver Demand- Physical Market Screams No Mas! appeared first on Silver Doctors. This posting includes an audio/video/photo media file: Download Now |

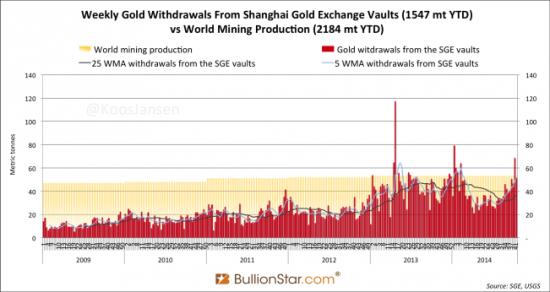

| Did Gold and Silver Just Get Their “Greenspan Put”? Posted: 07 Nov 2014 02:23 PM PST The world’s central banks and derivatives traders have been having their usual fun with gold and silver lately, dumping huge volumes of futures contracts into thin markets to produce massive declines — just when precious metals SHOULD have been soaring in response to near-global debt monetization. But something interesting happened as this latest smack-down really got going. Physical buyers — who goldbugs have for years been expecting to ride to the rescue, finally did. Chinese and Indian gold imports, which had trailed off earlier in the year, soared in response to the recent price declines. There’s some debate about exactly how much these guys are buying, but it certainly looks like they’re talking all that’s being produced by the world’s mines, and then some. Here’s a chart from gold analyst Koos Jansen showing Chinese imports spiking lately: In silver, the response of individual coin buyers has been even more dramatic. The US Mint, which in a good month sells 5 million one-ounce silver eagles, sold 2 million of them in two hours on November 5, ran out of inventory, and suspended sales until further notice. For more on the recent tsunami of precious metals buying, see: Physical gold shortage worst in over a decade as GOFO rate tumbles to negative China gold buying means price floor to Standard Chartered US Mint temporarily sold out of silver Eagles amid huge demand So it looks like physical buyers at long last have decided to tell the precious metals market what the US government and Federal Reserve have been telling the stock, bond and real estate markets markets since the 1990s heyday of Fed chair Alan Greenspan: Relax, we’ve got your back. We’ll short-circuit small declines before they can turn into big ones, and failing that we’ll ramp up a new bubble so quickly that you’ll hardly notice the blip. There is of course no way to know what the manipulators will do in response, and whether they’ll succeed. They do, after all, have trillions of dollars of fiat currency at their disposal. But at least there’s now a real fight going on in which physical buyers are landing some punches. |

| China Likely Bought 10,000 tons of Gold…and if They Did, Here’s Why Posted: 07 Nov 2014 02:00 PM PST My article "10,000 tons of gold…The math says China could have easily done it!" explains how it's possible or even likely China has amassed 10,000+ tons of gold. What it doesn't explain is the context as to why this is so important. I know some know this story well, but for most, this needs […] The post China Likely Bought 10,000 tons of Gold…and if They Did, Here's Why appeared first on Silver Doctors. |

| Reader Question on Greenspan and Gold: "No Fiat Currency Can Match It" Posted: 07 Nov 2014 01:31 PM PST Global Economic Analysis |

| May Day! May Day!! GOFO Rates Move into SEVERE Backwardation! Posted: 07 Nov 2014 12:25 PM PST GOFO Rates are plunging deeper into backwardation! Let’s head immediately to the important data points today: NOV 6.2014/ANOTHER 2.99 TONNES OF GOLD LEAVE THE GLD/INVENTORY RESTS AT 732.83 TONNES/NO CHANGE IN SILVER INVENTORY/GOLD DOWN A BIT/SILVER DOWN A BIT/GOLD/SILVER EQUITY SHARES RISE CONSIDERABLY. Gold: $1142.30 down $3.10 Silver: $15.39 down 3 cents In the access market 5:15 […] The post May Day! May Day!! GOFO Rates Move into SEVERE Backwardation! appeared first on Silver Doctors. |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment