Gold World News Flash |

- Gold Daily and Silver Weekly Charts – Short Squeeze

- GLD to Gold – We have a Problem!

- Russell - Friday’s Gold Action Is Big Money Anticipating QE4

- Louise Yamada On The War In The Silver Market

- Gold Sector Analysis: Gold Jumps on Sluggish Jobs Report, Increased Ukraine Tensions

- Chinese and Canadian central banks agree to $30 billion currency swap

- Harvey Organ Weekend Update: Banksters Cannot Cover Silver Shortfall!

- RX For Modern Monetary Madness: Mises Explained Sound Money 80 Years Ago

- US Economy Shudders: East Coast Set To Freeze As Polar Vortex 2 Arrives

- Majorities In Several States Vote To Punish Low-Skill Workers

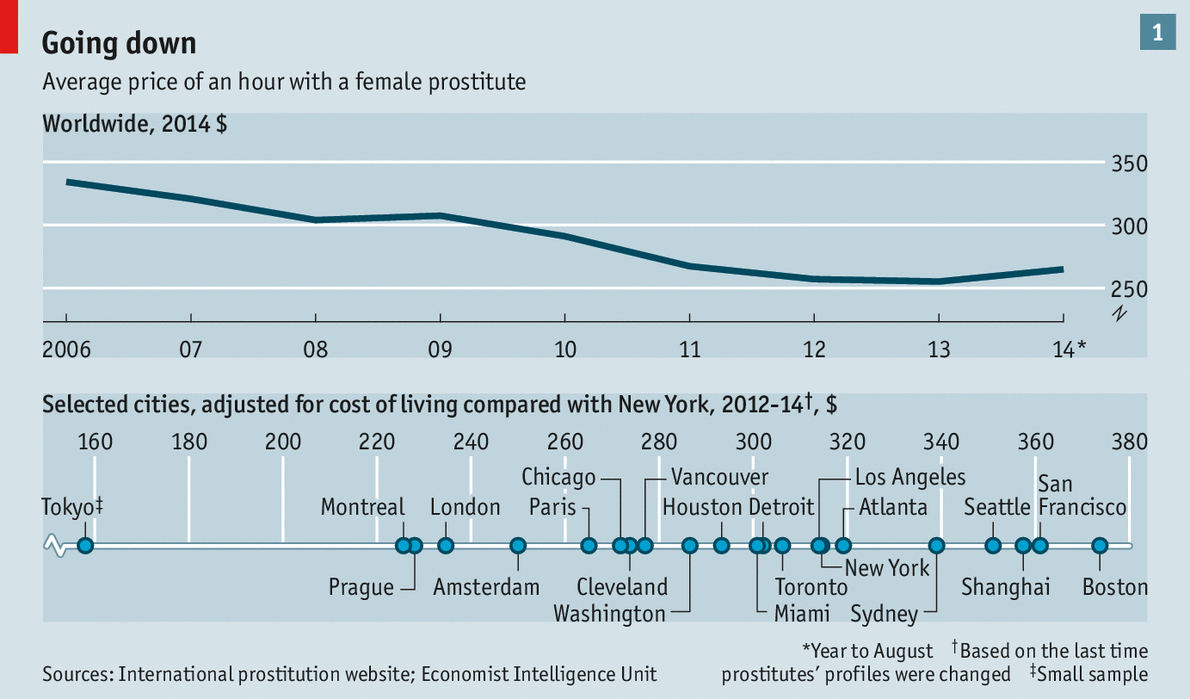

- The Silver Lining Of Stagnant US Incomes: Half-Price Hookers

- BREAKING: North Korea Releases 2 Detained Americans

- 3 Charts PROVE Global Economic COLLAPSE Caused by Central Bank Policies!

- One Chart, One Question

- Hambro's battle to bring miner back to land of the living

- In The News Today

- Speculators Have Never Been More Long The Dollar

- Gold and Silver Short Squeeze

- Gold And Silver - Charts Show Power Of Elite's Central Bankers

- Are The Russians Coming?

- Gold Investors Weekly Review – November 7th

- Coast To Coast AM - November 7, 2014 Visionary Tech & Open Lines

- The 1,100-year-old Royal Mint is moving in a modern direction

- Charts Of Gold And Silver Reveal Power Of Elite’s Central Bankers

- Ronan Manly: Why doesn't the World Gold Council care about Switzerland anymore?

- GATA secretary to speak in London and Munich in December

- The Silver Mining Cartel

- Samsung Smart TV Is BIG BROTHER!

- IMF and FED at secret Paris meeting 'unconventional policies needed"

- Squatting in America becomes Easier

- Did Gold and Silver Just Get Their Greenspan Put?

- When Deflation Comes Knocking at the Door

- Tesco Empire Strikes Back, £5 off £40 Discount Voucher Spend Explained, Exclusions Warning!

| Gold Daily and Silver Weekly Charts – Short Squeeze Posted: 08 Nov 2014 11:00 PM PST from Jesse's Café Américain:

Walter Scott, Marmion, Canto vi, Stanza 17 Watching the trade in gold and silver last night was interesting. Around midnight gold was smacked down seven dollars to about $1132 in the matter of a few seconds. That is customary since traders have to reset their stops after midnight, and there was a bit of the usual inexplicable ‘gamesmanship’ one sees in bucket shops, rigged card games, and for some reason the Comex. But about an hour later the price rebounded back up sharply to the 1144 area and seemed to stick there for most of the trade, with a slight upward bias, until the US announced its Non-Farm Payrolls Report for October, which sucked out loud. |

| GLD to Gold – We have a Problem! Posted: 08 Nov 2014 10:00 PM PST from Dan Norcini:

Instead of a nice climb in the holdings, what did we get instead? _ a fall of some 5.7 tons! Quite honestly, that came as a very big surprise to me. Given the action in the mining shares, I had expected to see some increase in the holdings. ‘Twas not to be apparently. This confirms my concerns about the rally – namely that while it was indeed powerful, it was due primarily to short covering and not so much due to an abundance of new buying. It is obvious that some used the rally in gold to close out some longs in the GLD. |

| Russell - Friday’s Gold Action Is Big Money Anticipating QE4 Posted: 08 Nov 2014 09:05 PM PST  Below is an extremely important note about Friday's trading in the gold market from legendary Richard Russell. Below is an extremely important note about Friday's trading in the gold market from legendary Richard Russell.This posting includes an audio/video/photo media file: Download Now |

| Louise Yamada On The War In The Silver Market Posted: 08 Nov 2014 09:01 PM PST  With the ongoing war in the gold and silver markets continuing to rage, today King World News is pleased to share a piece of legendary technical analyst Louise Yamada's "Technical Perspectives" report. Yamada is without question one of the greatest technical analysts Wall Street has ever seen. This information is not available to the public and we are grateful to Louise for sharing her incredible work with KWN readers globally. With the ongoing war in the gold and silver markets continuing to rage, today King World News is pleased to share a piece of legendary technical analyst Louise Yamada's "Technical Perspectives" report. Yamada is without question one of the greatest technical analysts Wall Street has ever seen. This information is not available to the public and we are grateful to Louise for sharing her incredible work with KWN readers globally. This posting includes an audio/video/photo media file: Download Now |

| Gold Sector Analysis: Gold Jumps on Sluggish Jobs Report, Increased Ukraine Tensions Posted: 08 Nov 2014 09:00 PM PST from The Daily Bell:

This Week’s Monetary and Industrial Trends Marketpulse tells us “Gold Rises After Lower than Expected Jobs Report.” Gold futures jumped after a US employment report showed that the “recovery” had slowed, at least temporarily. More from Marketpulse: Payrolls climbed by 214,000, the Labor Department said … That compares with an estimate for 235,000, the median forecast in a Bloomberg survey. After the report, the dollar fell as much as 0.3 percent against a basket of 10 currencies, erasing earlier gains. |

| Chinese and Canadian central banks agree to $30 billion currency swap Posted: 08 Nov 2014 07:13 PM PST By Andrea Hopkins BEIJING -- The central banks of China and Canada have agreed to a currency swap worth 200 billion yuan ($32.67 billion) or C$30 billion, according to a Canadian government statement issued at a meeting of Asia Pacific nations on Saturday. The swap will be effective for three years, according to a separate statement from China's central bank. The agreement was announced after Canadian Prime Minister Stephen Harper met Chinese Premier Li Keqiang. China's central bank, the People's Bank of China, will also appoint a clearing bank in Canada for yuan -- or renminbi, as the currency is also called -- as part of a memorandum of understanding, the statement said. It did not say which bank would be appointed as the clearing bank, but it is likely to be one of China's four largest banks. ... ... For the remainder of the report: http://www.reuters.com/article/2014/11/08/china-canada-yuan-idUSL4N0SY0B... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Harvey Organ Weekend Update: Banksters Cannot Cover Silver Shortfall! Posted: 08 Nov 2014 07:00 PM PST from Silver Doctors:

Something big is frightening our bankers. Monday is a critical day. Rarely do they ever let gold rise in a follow through. If we do have a good day Monday, we are off to the races… The gold comex today had a poor delivery day, registering 1 notice served for 100 oz. Silver registered 0 notices for nil oz. |

| RX For Modern Monetary Madness: Mises Explained Sound Money 80 Years Ago Posted: 08 Nov 2014 03:50 PM PST Authored by Richard Ebeling of The Ludwig von Mises Institute (via Contra Corner blog), Eighty years ago, in the autumn of 1934, Ludwig von Mises’s The Theory of Money and Credit first appeared in English. It remains one of the most important books on money and inflation penned in the twentieth century, and even eight decades later, it still offers the clearest analysis and understanding of booms and busts, inflations, and depressions. Mises insisted that the economic rollercoaster of the business cycle was not caused by any inherent weaknesses or contradictions within the free market capitalist system. Rather, inflationary booms followed by the bust of economic depression or recession had its origin in the control and mismanagement by governments of the monetary and banking system. Money Emerges from Markets, Not Government Building on Carl Menger's earlier work, Mises demonstrated that money is not the creature or the creation of the State. Money is a market-based and market-generated social institution that spontaneously emerges out of the interactions of people attempting to overcome the hindrances and difficulties of direct barter exchange. People discover that certain commodities possess combinations of useful qualities and characteristics that make them more marketable than others, and therefore more easily traded away for various goods that someone might wish to acquire in exchange with potential trading partners. Historically, gold and silver were found through time to have those attributes most desirable for use as a medium of exchange to facilitate the ever-growing network of complex market transactions that enabled the development of an ever-more productive system of division of labor. Money and the Savings-Investment Process Money not only facilitates the exchange of goods and services in the present — currently-available apples for currently-available bananas — but also makes easier and possible the exchange and transfer of goods and their uses over and across time. Willing investors can borrow from willing savers sums of money set aside out of earned income to then use to purchase and hire various quantities of productive resources — including capital equipment, workers for hire, and useful resources and raw materials — to employ them in production activities that will finally result in potentially marketable and profitable finished consumer goods at some point in the future. Out of earned revenues from such sales, the investor pays back the borrowed savings with any agreed-upon interest payment, which reflects the time preference of the savers for having been willing to defer the use of a part of their own income for the period of time covered by the loan. Under a commodity monetary system such as a market-based gold standard, there is a fairly close and closed connection between income earned and consumer spending, and savings set aside and savings borrowed for investment purposes. Suppose that $1,000 represents the money income earned by people during a given period of time. And suppose that these income earners decide to spend $750 on desired consumer goods and to save the remaining $250 of their earned income. That $250 of saved income can be lent out at interest to those wishing to undertake future-oriented investment projects. The real resources — capital, labor services, raw materials — that the $250 of purchasing power represents are transferred from the savers to the investors. The remaining real resources of the society represented by the $750 of buying power that income earners choose to spend in the present are directed to the manufacture and marketing of more immediately available consumer goods. Thus, the scarce and valuable resources of the society are effectively coordinated between their two general uses — producing goods closer to the present (such as a currently existing oven being combined with labor and raw materials to bake the daily bread that people wish to consume), or being used to manufacture goods that will be available and of use at some point later in time (such as the production of new ovens to replace the existing ones that eventually wear out or to add to the number of existing ovens so bread production can be increased in the future). Like all other prices on the market, the rates of interest on loans coordinate the choices of savers with the decisions of borrowers so to keep supplies in balance with demands for either consumer goods or future-oriented investment goods. In principle, there is nothing to suggest that within the free market economy itself, there are forces likely to bring about imbalance or discoordination between the choices and decisions of those trading in the marketplace. This remains true either for consumer goods in the present, or for savings in the present in exchange for more and better goods in the future through informed and successful investment by profit-oriented entrepreneurs. Central Banks as the Cause of the Business Cycle But what Ludwig von Mises showed in The Theory of Money and Credit and then in even greater detail in his master work, Human Action, was how the harmony and coordination of the competitive, free market can be thrown out of balance through the monetary central planning of governments and central banks. First under a weakened gold standard and then under systems of purely government-controlled paper monies, central banks have the ability to create the illusion that there is more savings available in the economy to sustain investment-oriented uses of scarce resources in the society than is actually the case. For example, in the United States, the Federal Reserve has the authority and power to buy up government securities and other “assets” such as mortgaged-backed securities, and pay for them by creating money “out of thin air” that then adds to the loanable funds available to the banking system for lending purposes. People may be still consuming and saving in the same proportions out of their earned income as they have in the past, but now financial institutions have artificially created bank credit to offer to potential borrowers, and at below what would otherwise be market-generated rates of interest to make investment borrowing more attractive to undertake. To use our previous example, suppose that people are still spending $750 of their $1,000 of earn income on desired consumer goods and saving the remaining $250. But suppose that the central bank has increased available loanable funds in the banking system by an additional $250. Investment borrowers, attracted by the lower rates of interest, borrow a total of $500 from banks — $250 of “real savings” and $250 of artificially created credit. They attempt to draw $500 worth of the society’s scarce and real resources into future-oriented investment activities that would not increase output in the economy until sometime later. But income earners are still spending $750 of their originally earned income on desired consumer goods. This results in the limited and scarce capital, labor and raw materials in the society being “pulled” in two incompatible directions at once — into the manufacture of $750 worth of consumer goods and $500 worth of investment goods, when to begin with there were only $1,000 worth of such real and scarce means of production. Price Inflation and Misdirection of Resources This will inevitably tend to push up prices in general in the economy above where they would otherwise have been if not for the central bank’s expansion of the money supply in the initial form of new bank credit, as consumers and investors bid against each other to attract into their direction the goods and services they, respectively, are attempting to buy. Thus, such monetary manipulation always carries the seed of future price inflation within it. At the same time, Mises argued, the fact that the newly created money first enters the economy through the banking system through investment loans brings about a malinvestment of capital and misallocation of labor and other resources as investment borrowers attempt to employ (as in our example) the equivalent of 50 percent of the society’s resources into future-oriented investment activities ($500), while income earners wish only to save the equivalent of 25 percent of their income ($250). Even though price inflation will push up the dollar amount of money income earned, the unsustainable imbalance between savings and investment brought about by central bank monetary policy will be reflected in any discoordination between the percentage amount of income (and the real resources they represent) that people wish to set aside for purposes of savings and the amount of money investment borrowers attempt to undertake as a percentage of the real resources available in the society, due to central bank money creation. Recession Correction Follows the Inflationary Misdirection This misdirection of capital, labor and raw materials away from that allocation and use consistent with people’s actual decisions to consume and to save, means that every monetary-induced inflationary boom carries within it the seeds of an eventual and inescapable economic downturn. Why? Because once the monetary expansion either slows down or is ended, interest rates will begin to more correctly reflect real available savings to sustain investments in the economy. At which point, it will start to be discovered that capital and labor have been drawn into investment uses and employments that cannot be completed or maintained in a, now, non-monetary inflationary environment. An economic recession, therefore, is the discovery period of misallocations of scarce resources in the economy that requires a rebalancing and a recoordination of supplies and demands for a return to market- and competitively-determined harmony in the society’s economic activities for long-run growth, employment, and improved standards of living. The current boom-bust cycle through which the U.S. and the world economy has been passing for over a decade now, has shown the real world application and logic of what Mises demonstrated in The Theory of Money and Credit decades ago, and why reading and learning from this true classic of monetary theory and policy still offers an invaluable guide for ending the business cycles of our own time. |

| US Economy Shudders: East Coast Set To Freeze As Polar Vortex 2 Arrives Posted: 08 Nov 2014 03:05 PM PST Remember when last December, a bout of cold weather crushed the US economy for the next 3 months, and subtracted about $100 billion from trendline growth, and when one after another economist (who were then predicting the yield on the 10 Year would "greatly rotate" to 4% by right about now, and who expected the US economy to have reached escape velocity in the second half only to see a 2014 GDP trendline as follows Q2: 4.6%, Q3: 3.5% (soon to be reviser lower), and Q4 now estimated just about 2.0%) blamed the then -3.0% GDP print on snow in the winter? Well here comes round two, because as CBS reports, "prepare for an invasion from the north. A blast of polar air is about to send temperatures plunging in the heart of America." The polar vortex is back, and this time it means even less business: A mass of whirling cold air will dip southward this weekend, sending the mercury plunging. As the cold air moves south and east, it has the potential to affect as many as 243 million people with wind chills in the single digits in some places and snow. Of course, the implication is that Q4 GDP is about to have its lights out moment. Either that, or if Q4 GDP mysteriously does not collapse, then scapegoating the weather for what was a fundamental flaw with the economy (and subsequent definitional revisions to GDP were the primary source of "economic growth" in 2014), will be just that. According to CBS, the cause of the latest and greatest bout of abnormally cold winter weather is not "global warming" but a Supertyphoon named Nuri, currently located above the North Pacific. Suomi NPP VIIRS Infrared image of the eye of Super Typhoon Nuri in the West Pacific Ocean on November 2, 2014 However, as CBS explains, "it would be wrong to think that it will affect only Alaska's far-flung Aleutian Islands or those famous fishermen who work in the North Pacific."

So how does a typhoon over the North Pacific lead to what may be a several percentage points drop in US GDP? The following sequence of events from EarthSky explains: On November 2, forecasters thought Super Typhoon Nuri might strengthen further into a 195 mph storm with gusts near 235 mph. Fortunately, it peaked at 180 and started to gradually weaken on Monday. Nuri becomes the sixth Super Typhoon of the Western Pacific season, largely due to the unusually warm waters and favorable atmospheric conditions across the Western Pacific basin. The storm will gradually weaken over the next couple of days into a tropical storm. It will stay east of Japan and move out into the Northern Pacific Ocean. GFS model showing Typhoon Nuri on November 6, 2014. Image Credit: Weatherbell As it gains latitude, the storm will transition from a warm-core low to a cold-core low, also known as an extratropical cyclone.The Northern Pacific jet stream will enhance the storm's intensity. It will begin to "bomb out", meaning the barometric pressure will drop drastically. Bombogenesis is a meteorological term used to define mid-latitude cyclones that drops at least 24 millibars within 24 hours. Typhoon Nuri becomes extratropical as it gains energy from the Northern Pacific jet stream. Image Credit: GFS via Weatherbell It'll become a super strong storm with a pressure around 915 to 922 millibars. Imagine a "Superstorm Sandy" over the North Pacific instead of the east coast of the United States. The storm will affect the Bering Strait, and extreme winds and surf is expected. A mega storm forms near the Bering Strait Friday evening into Saturday morning via GFS model. Image Credit: Weatherbell The storm will affect parts of the Alaska coast by Friday into Saturday. Some areas will likely experience hurricane force winds, high seas of 30 feet or greater, and minor coastal flooding/erosion in parts of southwest Alaska coastal areas. Some of our weather models are even projecting waves as high as 50 feet! Further color comes from Andrew Freedman of Mashable:

Back to EearthSky: The storm will influence the jet stream and atmospheric patterns across the Northern Hemisphere. It will likely trigger a ridge of high pressure across the Eastern Pacific and into Western North America. Meanwhile, it'll likely contribute to a large trough that will dig down into parts of Central/Eastern Canada and the United States. As the jet stream digs south, it will likely bring the year's first round of arctic air into the regions. Some of the weather models are indicating the potential for single digits in the Northern Plains by late next week (November 13-15). It is still uncertain if it will produce a big storm for the eastern United States. However, both the GFS and ECMWF models indicate a significant surge of cold air into the area. The Climate Prediction Center is in agreement with a significantly colder weather pattern setting up for next week. They are forecasting temperatures well below average for Central and Eastern United States with above average temperatures likely along the west coast of Canada and the United States. To summarize: Nuri will likely cause hurricane-like conditions along the Bering Strait as it becomes extratropical (no longer a tropical cyclone). It will help amplify the jet stream and likely produce a surge of very cold air that will reach parts of central/eastern Canada and the United States by November 12-15, 2014. There remains uncertainty regarding how cold the pattern will be, but as soon as models get within three to five days of the forecast, we will truly get a better idea of the overall setup and if a storm will develop. Now, the only question is how the resultant tumble in Q4 GDP will be used by the Fed and econo-pundit talking heads to justify a further delay in rate hikes, which consensus expects to take place in Q2 2015 at the latest as a result of recent seasonally massaged "strong data", or better yet, force the Fed to resume liquidity injections once it is revealed that the ECB's intervention is limited to verbal jawboning, while Japan's runaway import cost inflation and plunging real wages lead to a revulsion against Abenomics and Abe in 2015, and a premature end to Japan's epic hyper-reflation experiment and the best laid plans of Goldman Sachs to boost "risk assets" and Goldman year end bonuses. |

| Majorities In Several States Vote To Punish Low-Skill Workers Posted: 08 Nov 2014 02:29 PM PST Submitted by Ryan McMaken via The Mises Economic Blog, My anti-democracy critics will shake their heads in dismay at me, but I’ve been forced to come to the conclusion that there’s no reason to believe that plebiscitary democracy is any worse than the usual kind. Indeed, in American states that must hold plebiscites to authorize tax increases, one hears regular howls from the pro-tax crowd about how “direct democracy” is awful and that “representative democracy” is so much better. There’s even this federal lawsuit by pro-tax groups claiming that Colorado’s requirement that voters approve tax increases is unconstitutional. In other words, those who favor tax increases hate voter referendums and initiatives. Internationally, of course, there are the secession votes and the upcoming vote on gold in Switzerland. I have a hard time coming up with a reason why such things are comparatively bad (compared to an alternative in which everything is up to the elected elites). That said, the news isn’t always good with such voter-approved measures. A majority of voters in four states voted to raise the minimum wage:

What these voters said with their votes was “I’m in favor of making it illegal for people with low productivity to get a job. Teenagers, people who were poorly educated by failing public schools, people who have never had a job, and people who are not very intelligent, should all just stay home and do nothing because we want to make sure that no one can afford to hire those people.” Wages are a reflection of the worker’s productivity. When wages increase (assuming a relatively-free market) it is because the worker’s productivity has increased, either because of improved capital (such as better equipment) or because the worker himself has improved (e.g., through more experience). An employer simply cannot afford to pay an employee something above and beyond what the worker produces for the company. If he does, then the wage is generally being subsidized by the other workers who must now earn less than their level of productivity indicates, because some of that must go to pay the employees who are money-losers. In practice, the overwhelming effect is this: employers don’t hire low-productivity workers whose productivity is below the minimum wage, and in many cases will simply replace workers with capital (i.e., automated cashiers, etc.) which have been made relatively economical by the increase in the price floor. The federal government itself admits this employment effect, since it has included a loophole in the minimum wage in its own regulations for disabled workers. Early progressives also assumed it would cause unemployment, which they thought was a good thing. Increasing a minimum wage is a death sentence for the careers of the most “at-risk” members of the population (to use a phrase favored by the left). They will have to earn money under the table (i.e., illegally), work in an unpaid-internship, or simply go on welfare. Meanwhile, detractors of free markets will say “gee, look, the employment rate looks just fine in NE, SD, etc.” Ken Zahringer explains. * * * Still not convinced? Numerous Mises Daily writers have covered this topic, of course. For more, see: How Minimum Wage Laws Increase Poverty – George Reisman The Crippling Nature of Minimum-Wage Laws – Murray N. Rothbard Welfare, Minimum Wages, and Unemployment – Greg Morin Even the Feds Admit Minimum Wages Cause Unemployment by Nioholas Freiling How Special-Interest Groups Benefit from Minimum Wage Laws by Gary Galles Mythology of the Minimum Wage - D.W. MacKenzie The Unseen Costs of the Minimum Wage - Josh Grossman The Minimum Wage Forces Low-Skill Workers to Compete with Higher-Skill Workers – George Reisman |

| The Silver Lining Of Stagnant US Incomes: Half-Price Hookers Posted: 08 Nov 2014 01:49 PM PST This week's 'shellacking' of the administration suggests all is not well among the people of the Land of the Free. While headlines crow of plunging unemployment rates and record high stock prices, middle-class incomes remain stagnant at best (and sliding in most cases) and job quality continues to tumble. There is, however, a silver lining... as Bloomberg reports, "in a sign of lower income and middle income consumer stress, some prostitutes are dropping prices." Of course, this is terrible news for GDP (now what happens if the price of 'blow' also drops). This confirms our previous note on the deflation of prices in the oldest profession in the world... question is, will Yellen abhor this price drop too?

* * * As we noted previously, prices are going down...  |

| BREAKING: North Korea Releases 2 Detained Americans Posted: 08 Nov 2014 01:43 PM PST Kenneth Bae and Matthew Miller, the two remaining Americans who had been held in North Korea, have been released and are on their way home, US officials said Saturday. (Nov. 8) The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| 3 Charts PROVE Global Economic COLLAPSE Caused by Central Bank Policies! Posted: 08 Nov 2014 12:10 PM PST We are facing disaster as the economic conditions get worse, in a global plan to dominate the middle class. Poverty has been increasing which is a direct correlation to the misdeeds of the central bankers and technocrats. We will see more civil unrest as QE ignites a flame in the individual... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Posted: 08 Nov 2014 12:08 PM PST Submitted by Charles Hugh-Smith of OfTwoMinds blog, Just for fun, let's look at one chart and ask one question: is this stock continuing its downtrend or is it in the process of reversing? To avoid any bias, I've removed any clues to its identity.

Glancing at three common indicators, MACD, stochastic and RSI (relative strength), we note they have all turned up or are starting to turn up. We also notice that what looks like a key line of support/resistance was broken sharply to the downside, and price has reverted equally sharply back up to that line. So far, this could be interpreted as a bounce back to resistance, a move that will be followed by a resumption of the downtrend, or it could be interpreted as a classic Bear Trap, a sharp move below support that sucks in all the Bears who are anticipating a further collapse in price. Which interpretation is most likely to be correct? It's too early to say, but the possibility that price has traced out a falling wedge suggests that the Bear Trap/reversal scenario might well be in play, as falling wedges are classic reversal patterns. Now that we've conducted an unbiased overview, I can reveal the mystery stock: it's actually not a stock, it's a commodity: bat guano, a highly valued natural product. Like many of the commodities, bat guano has been in a free-fall, and the majority of financial pundits have been calling for further declines. Even bat guano Bulls have reluctantly conceded the inevitability of further large declines. Very few bat guano analysts are calling for a reversal here. The sentiment, in other words, is uniformly negative--everybody's on one side the boat in the bat guano trade. Add the overwhelmingly negative sentiment to the falling wedge/Bear-Trap spike down/recovery, and it seems the majority (Bears) might be surprised by a major reversal here. OK, the chart isn't actually bat guano. That was another way of maintaining an unbiased view. As far as I know, there is no bat guano index. So what's this chart of? Everybody's favorite emotional trade: Gold. |

| Hambro's battle to bring miner back to land of the living Posted: 08 Nov 2014 12:00 PM PST There is a recent addition to the ranks of the corporate undead: Petropavlovsk, a gold mining company that was once the darling of the City This posting includes an audio/video/photo media file: Download Now |

| Posted: 08 Nov 2014 11:32 AM PST Jim Sinclair’s Commentary The fix was manipulated to support a bear market. Not to hard to determine if you were hurt. If the London gold fix may have harmed you, contact Berger & Montague soon Submitted by cpowell on 05:51PM ET Thursday, November 6, 2014. Section: Daily Dispatches 8:53p Thursday, November 6, 2014 Dear... Read more » The post In The News Today appeared first on Jim Sinclair's Mineset. |

| Speculators Have Never Been More Long The Dollar Posted: 08 Nov 2014 11:29 AM PST After a brief hiatus the previous week, speculators have piled back into the most-over-crowded trade in the world - Long The US Dollar. As Goldman Sachs notes, overall USD speculative net long positioning increased $2.0bn to $45.7bn - a new record high.

King Dollar, however, is not all sunshine and rainbows, as SocGen's Michala Marcussen warns, beware the strong dollar paradox.... Recent currency movements have triggered nostalgia of the pre-crisis world when dollar strength was synonymous with a prosperous global economy. Hope today is that a strong dollar will cap US inflation, delay Fed tightening and boost exports to the US. To make an impact on US inflation significant enough to slow the Fed, we estimate, however, that EUR/USD would drop to 1.10, USD/JPY to 120 and USD/CNY to 6.50 to significantly shift Fed expectations. To our minds, moreover, such a scenario would only materialise if the growth gap between the US and the other major economies were to widen further. Should recent dollar appreciation, moreover, breed complacency amongst policymakers elsewhere, this risk scenario could become a very painful reality. The paradox is thus that a strong dollar tantrum could be a more worrying scenario than a Fed tightening tantrum. ... Several EM economies set to growth at a slower pace than the US: While the consensus growth outlook for the US has improved further in recent months, the opposite has been true for several other major economies, including the euro area, Japan and China. Moreover, our own forecasts remain generally below consensus with the exception of the US, where we are above. This view underpins our expectation of further dollar appreciation. Today, moreover, several EM economies are growing at a slower pace than the US. This is a notable difference from the pre-crisis era and has several implications. First, this lower global growth configuration is one reason why we believe that elasticities linking currency depreciation to growth may now be lower. The correlation between commodity prices and the dollar has also shifted. Finally, we note that capital flows are now moving in a very different pattern. Dollar and commodities: The link between the dollar and commodity prices has seen several shifts over time. Already prior to the latest moves in currency markets, commodity prices were trending lower in parallel with Chinese growth forecasts. More recently, it seems that dollar depreciation may have been an additional factor driving prices lower. For commodity importers, this is helpful; for exporters, this marks yet a headwind. Fed tightening may be a better scenario than a very strong dollar: Pre-crisis, in a simplified summary, the strong dollar can be described as having been driven by a global savings glut (mainly from the official sector in emerging economies) seeking a home in US Treasuries and, at the same time, US investors seeking risky capital abroad to profit from strong EM growth. It is also worth recalling that QE1 drove the dollar stronger and supported risky US assets as Treasuries rallied. QE2, on the other hand, saw dollar depreciation as US investors sought return in higher yielding asset abroad, and notably in emerging economies. As discussed above, we believe that a significant appreciation of the dollar relative to our baseline would be consistent with much weaker growth elsewhere. In such a scenario, dollar would equate to further capital outflows, placing further pressure on already vulnerable economies. Indeed, a “dollar tantrum” scenario could well prove more painful than a “Fed tightening tantrum”, assuming the later comes with better growth in the rest of the world. * * * The Long USD Trade...

If you are a trend follower, the trend is your friend. If you are a contrarian, you might want to go short the USD ... |

| Posted: 08 Nov 2014 11:27 AM PST "Oh what a tangled web we weave, When first we practise to deceive!" Walter Scott, Marmion, Canto vi, Stanza 17 Watching the trade in gold and silver last night was interesting. |

| Gold And Silver - Charts Show Power Of Elite's Central Bankers Posted: 08 Nov 2014 11:20 AM PST When considering Precious Metals fundamentals do not apply, and that is key to understanding how to relate your holdings of physical and/or interest in gold and silver. Nothing else matters. There are many sites that give minute details of the depletion of gold and silver stocks on the COMEX and LBMA; many that report on the demand for and scarcity of both metals; just last week, the news flash heard around the PM community on how silver American Eagles were sold out...shades of 2013-type news that dominated for several weeks. [Yawn]. Consider this: everything you have heard, including information of which you have not heard but others have is already priced into the market! Compile every sort of bullish news available, and almost all of it is true, yet gold and silver hit recent 4 year lows. How are all those news events working out, and not just for fundamentalists? So far, none of this information has mattered, at least with respect to current price levels. Ultimately, all of these known factors will have an impact on price. For now, all anyone can conclude is that legitimate demand is not a market-driver. |

| Posted: 08 Nov 2014 09:50 AM PST Submitted by Erico Tavares of Sinclair & Co. Are The Russians Coming?

In a recent speech at the Valdai conference in Sochi, laced with geopolitical and historical references, he stated that "changes in the world order – and what we are seeing today are events on this scale – have usually been accompanied by if not global war and conflict, then by chains of intensive local-level conflicts." What type of conflict is he referring to? In the nuclear age, a head on collision between the major world powers is unthinkable. The devastation that would ensue would likely end civilization, if not all life on this planet. It would take a real act of desperation for anyone to use that card. Russia remains a nuclear powerhouse for sure. However, when it comes to conventional warfare their capabilities have significantly fallen behind in recent decades. And it turns out that this has real geopolitical consequences. Russia's Asymmetrical Disadvantage in Conventional Warfare The following picture, widely circulated in the Western media some days ago, depicts a Russian strategic bomber being intercepted by a Portuguese fighter jet on a NATO mission [Note: so far this is perhaps the most salient feat in Portuguese military achievements in an otherwise terrible year].

More than yet another alleged incursion into NATO airspace, what is striking in this picture is the obvious difference in technologies of the two aircraft: the Russian bomber, the Tupolev Tu-95 or the "Bear" as it is known in Western circles, still runs on propeller engines. First introduced back in 1952, it is an icon of the Cold War - and one of the noisiest military aircraft around. Russia is the only country in the world which still uses propeller-powered bombers. For sure the "Bear" can still get the job done, but compare that to its US rival, the B-52 Stratofortress, introduced at around the same time. Having been continuously upgraded over the years, it now features subsonic, jet-powered engines and advanced technological capabilities. It is so modern and effective that the US Air Force is considering extending its use beyond 2040. And the B-2 stealth bomber, a (very expensive) marvel of modern US technology, is so far apart that it is not even comparable. Unlike its Western counterparts, in order to project force the Kremlin can only rely on its dated Cold War arsenal. Looking at military spending in recent decades clearly shows why. Military Expenditure in Selected Countries (constant 2011 US$ billion): 1988-2013 After the collapse of Russia's economy in the early 1990s, the country's military spending pretty much went down with it. It has started recuperating only recently. On the other hand, the US has been outspending everyone else by a wide margin since the end of the Cold War, and is clearly on a league of its own. Even "pacifist" Japan and Germany together spend more than Russia today, as part of their international commitments. Saudi Arabia, Russia's oil rival and fierce opponent of its allies in the Middle East, is not too far behind. Putin is keenly aware of this asymmetry in conventional terms. Going back to the speech referenced earlier, he stated that "in the event of full renunciation of nuclear weapons or radical reduction of nuclear potential, nations that are leaders in creating and producing high-precision systems will have a clear military advantage. Strategic parity will be disrupted, and this is likely to bring destabilization." Western military leaders are of course emboldened by this situation and may just keep on pressing their advantage. But Russia is not out. While it may be out-gunned for now, its military is still world class, featuring impressive capabilities – including various types of advanced nuclear weapons. And it is not alone either. The world's emerging superpower, China, is increasingly on its side, which had not been the case during the Cold War. Moreover, it has diplomatic and economic arguments which can augment its military capabilities. Just ask any European using Russian gas to keep warm this coming winter. Perhaps this is why Forbes magazine just ranked Putin as the world's most powerful man for the second year running. The question is, how will he use that power? A New Cold War? While the world's superpowers could not risk fighting each other directly during the Cold War (although they came close a few times), they were actively engaged in a warfare of another kind: supporting proxy wars, with one side trying to entangle the other in messy and expensive regional conflicts, while overtly and covertly undermining the support for its ideology. The Iron Curtain, the Vietnam War, the Soviets in Afghanistan, the regime overthrows across Latin America, the nuclear arms race... We should all be thankful that those days are behind us. Or are they? Today the US can entangle itself with no help from others, given all that has been going on in the Middle East. The bills keep piling up, and there could be a scenario where the US might run out of dollars before the world runs out of terrorists. Still, renewed intervention is a real prospect should things start spinning out of control in the region – nobody else has the capability to step in and preserve energy flows to the West. Senator John McCain, which clearly favors a more muscular approach, will have a very busy time as the new head of the Senate Armed Services. Russia is also gradually being dragged into regional conflicts of its own. With the situation raging in Ukraine, one wonders how much longer it can stay on the sidelines, particularly if pro-Russia forces start losing considerable ground there. And things are not looking too great for the besieged Assad regime in Syria, which hosts the Russian fleet at the Mediterranean port of Tartus. The bills are starting to add up for the Russians too. But confrontation can extend beyond military means alone. Globalization and greater economic integration in the post-Cold War world facilitated the creation of another "weapon" that can be used as a retaliatory measure: economic sanctions. For all of Russia's bravado in the face of Western imposed sanctions pursuant to its role in Ukraine, there is no doubt that they have a real bite to them. The collapse of the rubble has accelerated in recent weeks and ordinary Russians are now paying dearly for essential foreign goods, even those that originate in the countries that stepped in to replace European food and other imports. Furthermore, the coincidental (or not) sharp decline in oil prices undermines Russia's staying power in this situation, as well as its ability to use its own energy supplies as a retaliatory measure given the dwindling of foreign reserves. So far the West seems to be prevailing here, but there could be serious blowback consequences on Russia's main trading partners.

Composition of Russia's Imports by Country: 2012 est. The graph above shows that many Western companies – and crucially banks, many of which are heavily exposed to emerging markets – might share the pain as well. Let's not forget that the disruption of international trade pursuant to the introduction of the Smoot-Hawley Tariff Act in 1930 in the US and the subsequent retaliatory measures largely contributed to the length and depth of the severe global depression that followed. Not even China, which so far has emerged as a beneficiary of these East-West spats by securing long-term imports of cheap Russian gas and increasing its global influence while everyone else gets bogged down in regional conflicts, might escape unscathed. Therefore, as each side escalates its retaliation and seeks to inflict greater damage on the other, both in terms of economic loss and human suffering, we might be getting close to a point of no return. A dynamic can be set in motion where nobody will want to "lose face" and yield to the demands of the other side. And the world might once again be inexorably slipping into another Cold War, just as Putin warned. We will all be worse off as a result. It seems that international diplomacy is becoming as dated as those Russian bombers. Hopefully cooler heads will prevail. |

| Gold Investors Weekly Review – November 7th Posted: 08 Nov 2014 09:03 AM PST In his weekly market review, Frank Holmes of the USFunds.com summarizes this week's strengths, weaknesses, opportunities and threats in the gold market for gold investors. Gold closed the week at $1,177.98 up $4.50 per ounce (0.38%). Gold stocks, as measured by the NYSE Arca Gold Miners Index, rose 5.94%. The U.S. Trade-Weighted Dollar Index climbed 0.73% for the week. Gold Market StrengthsOne-month gold lease rates in London, the cost to borrow bullion, soared to 0.3405 percent on Thursday vs. 0.001 percent in September, reaching a high not seen since December 2008. Reasons cited for the rate upswing ranged from supply/demand imbalances to borrowing by traders in order to short the metal. Gold futures headed for the biggest gain since June after the U.S. September jobs report came in lighter than expected on Friday, 214,000 vs. 230,000 forecasts. The jobs report supported ongoing speculation that the Federal Reserve will continue to hold interest rates low amid tepid global growth. The U.S. Mint has temporarily run out of American Eagle Silver coins after October sales jumped 40 percent to 5.79 million ounces from a month earlier. Gold Market WeaknessesHoldings in the SPDR Gold Trust slid 0.3 percent to 738.8 metric tons on Tuesday to the lowest amount since September 2008. A confluence of factors has influenced the flight from the metal held my some investors as a safe haven. First, there is a mistakenly held notion in the markets that gold is one of the most volatile asset classes. In actuality, the return on equities as measured by the S&P 500 is typically twice as volatile as the return on gold bullion. Second, low gold prices have prompted some investment advisors to recommend a zero allocation to gold. Third, new highs in the equity market continue to increase investor appetite for risk assets. Lower oil prices create a headwind for gold as inflation expectations are pushed down. This reduces the inflation hedge demand for the metal. There was a selloff in gold stocks amid a broad based de-rating in the gold sector. The selloff brought a slew of gold miners near to, or below, decade lows. Among them were Barrick, Goldcorp, Newmont, Kinross and Yamana.

Gold Market OpportunitiesCanaccord Genuity came out with a study looking at the four major S&P/TSX Venture Composite Index corrections in the last three decades. The TSX Venture index is considered a good proxy for small cap gold stocks. The study found the current correction, at 43 months, the second longest as compared to the 45-month correction between April 1987 and January 1991. The study also showed the best three months to gain exposure to gold has historically been December, January, and February. With the authors believing the end to the correction could be nearing, the next couple of months could provide an attractive entry point into gold equities.

The World Gold Council forecast in September that gold demand in China will rise 20 percent in three years. Additionally, Standard Chartered called for a $1,100 price floor, citing firming physical demand indicators out of China and India.

Gold Market ThreatsA slew of negative forecasts have cast a cloud over the direction of gold prices. ABN Amro NV forecast a year-end price of $1,100 an ounce, sliding to $800 by year-end 2015. An analyst at Oversea-Chinese Banking Corp. called for a further drop of at least 13 percent and a price that could go lower than $1,000. The UBS Economics team released its global economic forecast for 2015 and 2016 and the outlook for gold was also negative. Reasons cited included weaker China growth, a faster than expected rate hike by the Fed, and a strong U.S. dollar fueled by a capital expenditure led boom. Looming gold reserve cuts threatens write-downs for gold miners. If gold prices stay low, gold miners will be forced to lower their reserve price assumptions, leading to write-downs. B2Gold is especially vulnerable as its 2013 reserve assumption stands at $1,350 an ounce.

Clean Diesel Technologies announced a new proprietary technology to replace costly use of platinum group and rare earth metals in catalytic converters. The company has been granted the first two of a family of patents for Spinel, a proprietary clean emissions exhaust technology. With original equipment manufacturers (OEMs) currently spending over $6 billion a year on platinum group metals, the technology could create major disruption in the commodities' demand if the patents take off.

|

| Coast To Coast AM - November 7, 2014 Visionary Tech & Open Lines Posted: 08 Nov 2014 08:46 AM PST Coast To Coast AM - November 7, 2014 Visionary Tech & Open Lines The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| The 1,100-year-old Royal Mint is moving in a modern direction Posted: 08 Nov 2014 07:37 AM PST Adam Lawrence is taking on big players by selling a new gold sovereign online This posting includes an audio/video/photo media file: Download Now |

| Charts Of Gold And Silver Reveal Power Of Elite’s Central Bankers Posted: 08 Nov 2014 07:35 AM PST When considering Precious Metals fundamentals do not apply, and that is key to understanding how to relate your holdings of physical and/or interest in gold and silver. Nothing else matters. There are many sites that give minute details of the depletion of gold and silver stocks on the COMEX and LBMA; many that report on the demand for and scarcity of both metals; just last week, the news flash heard around the PM community on how silver American Eagles were sold out…shades of 2013-type news that dominated for several weeks. [Yawn]. Consider this: everything you have heard, including information of which you have not heard but others have is already priced into the market! Compile every sort of bullish news available, and almost all of it is true, yet gold and silver hit recent 4 year lows. How are all those news events working out, and not just for fundamentalists? So far, none of this information has mattered, at least with respect to current price levels. Ultimately, all of these known factors will have an impact on price. For now, all anyone can conclude is that legitimate demand is not a market-driver. Precious metals are being driven by one thing only: survival of the elite's world-wide fiat system, aka paper debt foisted on the public and called "money." Debt is the opposite of money, but the Rothschild fiat system has successfully been sold to the American public since the financial coup d'état by the Federal Reserve Act, when one of the world's most important and prophetic sentences ever uttered, by Mayer Amschel Rothschild, went into effect: "Give me control of a nation's money and I care not who makes its laws" Specie-backed United States Notes were destroyed and replaced by circulating Federal Reserve Notes, which are not Federal, for the fiat is issued by a privately owned banking cartel; there are no reserves, for as fiat they are backed only by people's imagination, which for the American public apparently has no limits; and they are not Notes, for there is no stipulation for payment of anything, to anyone, at any time. The fact that almost all people do not grasp the importance of the content of this paragraph goes far to explain why most fail to understand the power of the moneychangers to maintain total control over those living in the Western world. The Euro Dollar is as phony as the fiat Federal Reserve Note, yet Europeans are as willing as Americans to subvert their common sense for fiat nonsense that ruins their economic lives, yet sill gives life to the unelected bureaucrats unreasonably in charge. So much for Europeans thinking Americans are not the brightest of people. The most important piece of news for PMs last week was not the "Sold Out" sign by the US Mint, rather it was the selling of about $1.5 billion in gold at the market. There are only two practical answers as to the "who" [or what] was selling, and both are from the same family of central bankers: either the New York Federal Reserve, acting though "other" agents to disguise direct involvement, or the BIS, [Bank of International Settlements], the central bankers bank. No other entity has that kind of financial wherewithal or carelessness to execute in a market with no other intent than to do harm. It should also be your biggest clue why gold and silver reached recent lows. No one can fight the fiat financial might of the central bankers. Russia and China can, and are doing so in a different way. Plus, both are willing to accept the opportunity to accumulate more PMs at current levels. In fact, it is not out of question that lower prices are a required accommodation to China in return for China not trashing the toxic Treasury bond market and exposing the US fiat scam. The best answer as to when will gold and silver rise to values that are reflective of the perverse distortion of their role as a known and accepted store of value, except for the elites running their fiat currency Ponzi scheme on the rest of a compliant world, is: not a day before the end of the moneychangers control over the existing fiat system so deeply entrenched and accepted for its existence. Once you recognize this factor as being in dominant control over gold and silver, you will better realize and accept it as sad reality, but it is what it is. Consider how much information you have read and digested about gold and silver over the past few years [since the highs]. What has been the impact on the market? Zero, in fact negative. What has been the impact on your thinking? False, actually more misleading, beliefs about expectations. If some of the strongest known fundamental demand for gold and silver has had no effect on price, the question has to be, why not? The simple and only answer is the elite's protecting its Ponzi fiat scheme, for they can never allow gold and silver to be considered as an alternative to their fiat paper issue. All they can do is what they have been doing for over 100 years, manipulate gold and silver, crushing them as viable alternatives to the "dollar" [more accurately, Federal Reserve Note], and the Euro dollar. It serves no purpose to bemoan or regret all purchases of physical gold and silver, especially since the high, and we are on record as buying and recommending buying physical all the way down, even buying more physical silver just last week. The purpose has not been to make money but to preserve purchasing power via the most reliable form over time. How has that been working? Not very well over the past few years, but keep in mind the time frame, just the past few years. It is a certainty, a certainty based on history that all known fiat systems fail, and the existing system is no exception. Likely within the next few years, all purchases made, including those made at the highs, will look prescient. Did the precious metals community get suckered in? Absolutely! There are probably only a relative handful who anticipated the power of the moneychangers over the PMs market to suppress price to levels not thought possible. This is hindsight for investors in gold and silver. We shall see who eventually gets the last laugh, as it were, and it will not be the moneychangers. There is one thing and one thing only that buyers of physical gold and silver can do, and that is to bide time until this failing power struggle by the moneychangers comes to its inevitable demise. Common sense tells you that a country that has increased its money supply to ethereal levels cannot be sustained. We said back in the earlier half of 2014 that it could well be a repeat of 2013, in terms of unrealized expectations for much higher PM price levels. While true in terms of time, we were not on target as to how low price would go. To our credit, we did continue to advise to stay out of the long side of the paper futures market for as long as the trend was down. That came from an obvious read of the charts. The silver chart has not improved on its lack of ability to show some kind of bottom being formed. The recent break of support has squelched those efforts, for now. 15.04 was last week's low, forming a potential double bottom. It is not important that 15.04 hold as an absolute low. What is more important is how market activity develops for whatever the eventual low price becomes, whether it is last week's price, 14.65, or any other number, 14.50, 14.32, etc. [Maybe even lower?] There will be evidence, through price and volume, that is low is in place. It may take several weeks to confirm that a low is in, so it will not pay to try to be "first in." Let the market prove its intent, and then one can be in a more informed and comfortable position to make better decisions from the long side, should one want to trade paper futures, if there is even a viable futures market in which to trade, and there may not be. Continue to monitor the way in which price responds or reacts to these lower levels. If there is no strong rally higher, on increased volume and upper range closes, then it will indicate that the bottoming process will take much more time. Be patient and allow your thinking to let the market develop as it will, for the controlling forces remain in place. The daily chart shows another layer of bearish spacing as silver continues to weaken relative to gold. At some point, either once a low has been established or once a trend higher begins, silver is likely to outperform gold over the next several years. When silver was in the low 20 area, we said prices are likely at generational lows. While now lower, the sentiment remains equally true. This artificial manipulation may go on beyond what most expect or want, but it will come to an end, and then even $50 silver will look like a great buy. Keep a level head in the face of recognized artificial adversity. Compare the difference in how gold is developing around its barely broken support, with that of silver to get an idea of what to look for when one market more successfully holds an area versus one that fails to hold in similar circumstances. All that can be said of gold, while stronger than silver, is that the trend remains down, and that is the most important piece of information to know, for now. Here is more of the same, just observing how price responds to this critical support area. If there is more deterioration to come, how strongly does it impact price to the down side? There are so many ways in which market activity can develop that it does not pay to try and outguess how price reacts. Let it react, and then you are in a better position to react to what is known without having to guess. Keep it simple. |

| Ronan Manly: Why doesn't the World Gold Council care about Switzerland anymore? Posted: 08 Nov 2014 07:01 AM PST By Ronan Manly GATA's dispatch of a Bloomberg News story November 5, "World Gold Council Has Nothing to Say about Swiss Gold Referendum" -- http://www.gata.org/node/14664 -- reminded me that there was a time when the council would publish detailed analysis on topics relevant to Switzerland's gold reserves. This time covered at least from May 1997 to May 2000, prior to Switzerland's infamous gold sales. These World Gold Council publications were frequent and often questioned the motives and purposes of the Swiss National Bank and Switzerland's federal government, while taking an independent stance representing the global gold industry. Here are five examples: ... Dispatch continues below ... ADVERTISEMENT Sinclair's Next Market Seminar Is Nov. 15 in San Francisco Mining entrepreneur and gold advocate Jim Sinclair will hold his next market seminar from 10 a.m. to 3 p.m. on Saturday, November 15, at the Holiday Inn at San Francisco International Airport in South San Francisco, California. Admission will be $100. For more information and to register, please visit: http://www.jsmineset.com/2014/10/10/san-francisco-qa-session-announced/ 1. In-depth analysis on potential Swiss gold sales, published by the World Gold Council in May 1997 as part of its quarterly Gold Demand Trends letter. Two pages of analysis titled "What Swiss Gold Rush?" can be found on Pages 16 and 17. http://www.gold.org/download/file/2917/GDT_19_Q1_1997.pdf 2. Analysis titled "Swiss Gold Policy" issued by the World Gold Council's "Centre for Public Policy Studies" on May 28, 1998, in reaction to statements made the previous day by the Swiss Finance Ministry about plans for constitutional changes involving the Swiss National Bank and their impact on Switzerland's gold reserves, including sections on the independence of the bank, the bank's mandate, and analysis of gold reserves. http://www.gold.org/download/file/2795/280598.pdf 3. "The Swiss National Bank and Proposed Gold Sales," Research Study No. 21, published by the World Gold Council in October 1998. This provided detailed analysis of everything concerning the Swiss National Bank's and the Swiss federal government's proposed gold sales. The report was written by an academic, Mark Duckenfield, on behalf of the World Gold Council's Centre for Public Policy Studies and was introduced by Robert Pringle, who was head of the Centre for Public Policy Studies. Pringle is the founder and chairman of Central Banking Publications and is well known in the world of central bank gold. http://www.ibrarian.net/navon/paper/THE_SWISS_NATIONAL_BANK_AND_PROPOSED... 4. A review by the World Gold Council titled "The Washington Central Banks Agreement on Gold," published September 26, 1999, immediately after announcement of the Washington agreement. This review includes analysis of the agreement's impact on Switzerland's gold reserves. http://www.gold.org/download/file/2775/Wr991006.pdf 5. An extensive question-and-answer brochure titled "20 Questions About Switzerland's Gold (with Answers by the World Gold Council)" written by the council in June 2000 pursuant to the October 1998 report "The Swiss National Bank and Proposed Gold Sales" and released soon after the Swiss National Bank had started its gold sales in May 2000. Access requires free registration. https://www.gold.org/download/file/2884/swissgold.pdf The World Gold Council was born in Switzerland and has its roots there. Its headquarters was in Geneva until it moved to London in 1999. The council was established as a verein in Switzerland and is still registered with the Swiss Registre Du Commerce. Notably, the council is registered in England and Wales as an "overseas company." So not so long ago the World Gold Council did care about Switzerland and the Swiss people's gold reserves. But with the council's continued silence on the Swiss Gold Initiative, unfortunately that caring seems to have passed. Whether this change results from the council's move to London and its alignment with the London gold market or from the council's opening offices worldwide, only the council itself can answer. The late Swiss gold advocate and banker Ferdinand Lips seems to have been prophetic about what was to become of the World Gold Council when in an interview in 2004 he rebuked it while incidentally complimenting GATA. Lips said: "GATA is accomplishing outstanding work by daily informing the investment public about the manipulation of all markets, especially the gold and silver markets. More, they are bringing out many interesting articles and information. To inform about the gold market actually would be the job of the World Gold Council . But this organization fails completely. ... GATA should be institutionalized and take over the work of the World Gold Council. My opinion is that the World Gold Council is worthless and even works against the interests of the gold-mining industry." In 2005, shortly before Lips died, his business partner J.P. Schumacher delivered a speech for him, saying: "It can only be in the interest of mining people to support GATA. Actually the defense of the mining industry was the job of the World Gold Council. But they failed. That is one of the strangest organizations I ever met. In any case the World Gold Council is not the friend of the gold-mining industry." With just three weeks until the potentially historic Swiss Gold Initiative referendum on November 30, it remains to be seen whether the World Gold Council in London or the gold-mining companies that it claims to represent will stir from their stupor and even comment in any way on an issue that a mere 15 years ago would have had the council devoting significant resources for analysis, comment, and shaping the debate. Without such commentary from the World Gold Council, it is becoming increasingly difficult to accept its claims that it provides "research and thought leadership" and "communication" on the gold market and that it would "inform and shape future gold markets." ----- Ronan Manly is a market analyst for GoldCore and a consultant to GATA. Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| GATA secretary to speak in London and Munich in December Posted: 08 Nov 2014 06:30 AM PST 9:31a ET Saturday, November 8, 2014 Dear Friend of GATA and Gold: Your secretary/treasurer is scheduled to speak in London and Munich in December. The appearance in London will come during the Mines and Money London conference, to be held Monday through Friday, December 1-5, at the Business Design Centre. The conference is expected to gather mining company executives, brokers, and investors, and scores of mining companies will be exhibiting. The conference program includes a few speakers who have indicated that they find GATA somewhat less radioactive than Chernobyl, including Matterhorn Asset Management's Egon von Greyerz, Ned Naylor-Leyland of Quilter Cheviot Investment Management, and Rod Whyte of Whyte and Associates. Information about the Mines and Money London conference can be found at its Internet site here: http://www.minesandmoney.com/london/ The appearance in Munich will be Tuesday, December 9, at a dinner at the Hotel Bayerischer Hof sponsored by the German Precious Metal Association and the Foundation for Liberty and Ratio. Attendance is by invitation only but GATA supporters can request an invitation by e-mailing Peter Boehringer of the German Precious Metal Association at pb@pbvv.de. CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal in 2014, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Posted: 08 Nov 2014 06:18 AM PST Jeffrey Lewis |

| Samsung Smart TV Is BIG BROTHER! Posted: 08 Nov 2014 04:59 AM PST Bet you didn't know your Smart TV could do this! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| IMF and FED at secret Paris meeting 'unconventional policies needed" Posted: 08 Nov 2014 04:01 AM PST U.S. Federal Reserve Chair Janet Yellen and IMF President Christine Lagarde attend a conference of central bankers hosted by the Bank of France in Paris The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Squatting in America becomes Easier Posted: 08 Nov 2014 03:53 AM PST "Squatting" is essentially trespassing on property. This report explores the loopholes that help squatters stay put. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Did Gold and Silver Just Get Their Greenspan Put? Posted: 08 Nov 2014 03:09 AM PST The world's central banks and derivatives traders have been having their usual fun with gold and silver lately, dumping huge volumes of futures contracts into thin markets to produce massive declines -- just when precious metals SHOULD have been soaring in response to near-global debt monetization. But something interesting happened as this latest smack-down really got going. Physical buyers -- who goldbugs have for years been expecting to ride to the rescue, finally did. Chinese and Indian gold imports, which had trailed off earlier in the year, soared in response to the recent price declines. There's some debate about exactly how much these guys are buying, but it certainly looks like they're talking all that's being produced by the world's mines, and then some. |

| When Deflation Comes Knocking at the Door Posted: 08 Nov 2014 03:06 AM PST There is little doubt that deflationary risks have increased in recent weeks, if only because the dollar has risen sharply against other currencies. Understanding what this risk actually is, as opposed to what the talking heads say it is, will be central to financial survival, particularly for those with an interest in precious metals. The economic establishment associates deflation, or falling prices, with lack of demand. From this it follows that if it is allowed to continue, deflation will lead to business failures and ultimately bank insolvencies due to contraction of bank credit. Therefore, the reasoning goes, demand and consumer confidence must be stimulated to ensure this doesn't happen. |

| Tesco Empire Strikes Back, £5 off £40 Discount Voucher Spend Explained, Exclusions Warning! Posted: 07 Nov 2014 10:18 AM PST Tesco, Britain's super market giant that continuous to implode as a consequence of a soaring debt mountain against a collapse in profits, a crisis further compounded by multiple investigations into financial irregularities by the regulator and SFO - Serious Fraud Office, appears to be going for broke by launching back to back £5 off vouchers for £40 spend on your next £40 shop offers in an attempt to reclaim its lost customers from the discount retailers. |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Once again we have another one of those proverbial flies in the ointment when it comes to one of these frequent rallies we have seen in gold during the ongoing bear market of the last two+ years. We get a great rally and a lot of powerful chart action over at the Comex only to wait upon the reported holdings update from GLD and then find disappointment.

Once again we have another one of those proverbial flies in the ointment when it comes to one of these frequent rallies we have seen in gold during the ongoing bear market of the last two+ years. We get a great rally and a lot of powerful chart action over at the Comex only to wait upon the reported holdings update from GLD and then find disappointment. Gold reversed its course on Friday, posting strong gains relative to the dollar. The big story was related to reports of a sluggish job market. Did Ukraine tensions play a role as well? We’d make the case, though Ukraine received scant attention from mainstream analysts.

Gold reversed its course on Friday, posting strong gains relative to the dollar. The big story was related to reports of a sluggish job market. Did Ukraine tensions play a role as well? We’d make the case, though Ukraine received scant attention from mainstream analysts. GLD loses 5.68 tonnes of gold inventory/Silver inventory remains constant/huge rise in gold and silver today. Gold $1177.00 wow!! something big is going on behind the scenes!! It looks like our banker friends are timid with respect to silver. The bankers just cannot cover their shortfall. Let's head immediately to see the major data points for today.

GLD loses 5.68 tonnes of gold inventory/Silver inventory remains constant/huge rise in gold and silver today. Gold $1177.00 wow!! something big is going on behind the scenes!! It looks like our banker friends are timid with respect to silver. The bankers just cannot cover their shortfall. Let's head immediately to see the major data points for today.

No comments:

Post a Comment