Gold World News Flash |

- Paul Craig Roberts Shocking Interview On Criminality By US Fed

- Metals Insider Shares Alarming News About Demand & Mine Supply

- Paul Craig Roberts Shocking Interview On Criminality By US Fed

- FASCIST INSANITY: Florida Law CRIMINALIZES Feeding the Homeless

- The Government's Manipulated Job Numbers Will Not Stop The Economic Collapse

- Could This Nightmare Scenario Unfold For The Gold Shorts?

- In Defense Of Peter Schiff

- Silver and Powerful Forces

- No bear market in monetary metals, Roberts tells KWN, just a rigged one

- Death Of The Working Class In 12 Charts

- This was the Week that the Gold Price Bottomed, at Least for Now

- Michael Savage - Bill O'Reilly and Glenn Beck Mention ' Civil War ' All of a Sudden on Fox News

- Russia Nears Completion Of Second "Holy Grail" Gas Deal With China

- Did Gold and Silver Just Get Their “Greenspan Put”?

- Tesco Empire Strikes Back, £5 off £40 Discount Voucher Spend Explained, Exclusions Warning!

- Gold Daily and Silver Weekly Charts - Short Squeeze

- NAV Premiums of Certain Precious Metal Trusts and Funds - More Sprott Gold Goes Walkabout

- Gold and Silver Hit By Strong U.S. Dollar

- Gold's Fundamental Supply Picture

- Silver Price and Powerful Forces

- This Will Trigger A Wipeout Of Markets & Economies Worldwide

- A Tale of Two Markets: Gold Market Manipulation in NY and London

- Jim’s Mailbox

- At KWN, Bill Kaye outlines the likely course of a short squeeze in gold

- Gold Bug Psychology Must be Neutered

- Marc Faber Warns Not to Hold Any Gold in the U.S.

- More QE for a Zombified Electorate

- The Silver Mining CartelÂ

- Gold and Silver Bear Markets Close to the Bottom but Not There Yet

- Silver Price Extremes!

- Could This Nightmare Scenario Unfold For The Gold Shorts?

- Silver Price Extremes!

- John Crudele: U.S. economic growth is all illusion

- Alasdair Macleod: Deflation comes knocking at the door

- TF Metals Report: Are we getting close?

- Was the Great Pyramid of Giza a Factory for Mono-Atomic Gold

- UK prepares forex fines for six big banks, sources tell Reuters

- ICE to run replacement for century-old London gold fixing

- Could Gold Stocks Bottom at 2008 Credit Crisis Low Prices?

- America Future - The Worst Economic Collapse Ever - Prepare 2014

- Save Your Swiss Gold “ Peter Schiff™s Message to Switzerland

- Silver and Powerful Forces

- Druglord, Genius, or Saint? What Kind of Man, Really, Is Silk Road’s Dread Pirate Roberts?

| Paul Craig Roberts Shocking Interview On Criminality By US Fed Posted: 07 Nov 2014 11:30 PM PST from KingWorldNews:

But when the fiat currencies in the West get in trouble, there is nothing to back them with because all the gold is in Asia. So the Fed, trying to save four big banks, it increased its balance sheet $4 trillion, and national debt in the United States increased 7 or 8 trillion dollars. This puts pressure on the dollar. The pressure shows up in the gold price and so they suppress the gold price. That's the story. I'm convinced there is no other explanation. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Metals Insider Shares Alarming News About Demand & Mine Supply Posted: 07 Nov 2014 09:30 PM PST from silver investor.com: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Paul Craig Roberts Shocking Interview On Criminality By US Fed Posted: 07 Nov 2014 09:01 PM PST  Today former US Treasury official, Dr. Paul Craig Roberts, gave a shocking interview to King World News covering criminal activity by the U.S. Federal Reserve. He also discussed the outrageous action in the gold and silver markets, and why the West is so desperate. Below is what Dr. Roberts had to say in this stunning interview. Today former US Treasury official, Dr. Paul Craig Roberts, gave a shocking interview to King World News covering criminal activity by the U.S. Federal Reserve. He also discussed the outrageous action in the gold and silver markets, and why the West is so desperate. Below is what Dr. Roberts had to say in this stunning interview.This posting includes an audio/video/photo media file: Download Now | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FASCIST INSANITY: Florida Law CRIMINALIZES Feeding the Homeless Posted: 07 Nov 2014 09:00 PM PST by Jeff Nielson, Bullion Bulls Canada:

In Florida (specifically the city of Fort Lauderdale); it is a crime to provide food for another hungry human being. There can be no possible legitimate reason or justification for a law of this nature. Here is the official pretext for this abusive, fascist law: Mayor Jack Seiler doubled down, arguing that homeless people should be forced to have "interaction with government" and cannot be taken care of by fellow citizens, adding that Abbott's activities represented a "public safety" and a "public health" issue. Read More @ BullionBullsCanada.com image credit: wikimedia.org | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Government's Manipulated Job Numbers Will Not Stop The Economic Collapse Posted: 07 Nov 2014 07:42 PM PST The Federal Reserve is now blaming the government for the economic collapse. Unemployment drops to 5.8% with one in five jobs added in October was a waiter or a bartender. Major corporations are laying off more employees. Obama bails out the credit card companies with an executive order. Obama will... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Could This Nightmare Scenario Unfold For The Gold Shorts? Posted: 07 Nov 2014 07:20 PM PST from KingWorldNews:

And this is the type of thing that, because of the construction of the system as we know it, could lead to outcomes to the upside that currently seem unimaginable to most people. By that I mean we have what I call an awful lot of synthetic shorts in the market — unallocated bank accounts in the system, which is basically fractional reserve in nature, that amount to shorts on gold. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 07 Nov 2014 07:12 PM PST Submitted by James E. Miller via Mises Canada, The financial television channel CNBC has hit hard times. Nielsen ratings show the network’s viewership is at a 21 year low. This is a far cry from two decades ago. The dot-com bubble of the late 90s and early aughts gave the channel its highest ratings in history. The Federal Reserve’s easy money flooded the market, hitting blue chip stocks like a tidal wave. All of a sudden laypeople fancied themselves market gurus, playing the market and investing for a big pay day some time in the future. Trader and commentator Barry Ritholz described the environment as one where “CNBC was everywhere.” “Gyms, bars, restaurants, any public place you went into that had a TV — even sports bars! — had the ticker strewn channel running in the background.” One bubble burst and a financial crisis later, the home of hothead Jim Cramer has cooled off significantly. There are a few reasons for this. As Lehman Brothers cratered into bankruptcy, the middle class saw its 401(k)s lose a significant portion of value. Such a loss begged for an explanation. Yet economists and financial experts were caught off-guard by the crisis. No popular orator of the dismal science could explain why the banking system devolved into chaos. CNBC’s most popular hosts and guests could only offer guesses. One person was the exception: Peter Schiff. The internet video “Peter Schiff was right” collaged all of Euro Pacific Capital founder’s dire warnings about the housing bubble. At the time, he was ridiculed on air. Schiff was a cassandra, spouting crank theories long disproven by economic orthodoxy. But by September of 2008, he had the last laugh. The financial world was in turmoil, and Schiff’s explanation – based on the Austrian school’s theory of boom and bust cycles – was at last seen as legitimate. But memories can sometimes be short. Half a decade later, and Schiff remains the Rodney Dangerfield of finances. Thanks to a flawed call on consumer price inflation and the price of gold, he still finds himself the joke of many a CNBC broadcasts. His continued warnings about the Fed’s reckless inflation binge and coming dollar crisis provide plenty of excuses for the channel’s on-air personalities to pick on him. On a recent edition of “Futures Now,” Schiff was challenged on his inaccurate assessments of macro-economic trends. Scott Nations of NationsShares called him out on his dour Fed assessment. Nations piled on the contempt, practically questioning how Schiff has a career in investment at all. Exasperbated, Schiff proclaimed, “I am wrong a lot less often than most people on this program… and all you do is hassle me.” Schiff’s rant doesn’t immediately come off as exonerating; let alone mature. He sounds childishly bitter – entitled to respect for his prescient forecasting. This behavior is not admirable in any setting. Anyone who demands praise for his achievements is treading on shaky ground. Pride before the fall, and all that. Still, Schiff has a point. He went on national television and endured a deluge of mockery for challenging established opinion. His forecasts, while not always correct, were far more accurate than those of his contemporaries. No one likes an ideologue wedded to a philosophy to the point of redundancy; yet there comes a point when facts are facts. When it mattered, Schiff had both an accurate assessment of the economy and a solid explanation to justify his findings. His advice might have saved the livelihood of millions, had it been taken. To this day, his call was seen as heroically prophetic, even while his philosophical underpinnings are still held in suspicion. He hasn’t earned the benefit of the doubt in the eyes of his Keynesian-minded contemporaries. The lack of respect – and even off-putting attitude – showed toward Schiff can be blamed on outright bias. Like any thought-sport, there is accepted doctrine and kooky theories. The winning team is naturally suspicious of anyone who challenges their earned position. When it comes to mainstream economics, Keynesianism reigns supreme. Central banking is widely viewed as a benefit to the economy; not a meddling danger. The orthodoxy is enforced by believers of what James Grant calls the “PhD standard.” The financial press loves the idea of a few select men guiding the economy toward peak employment. Reporters and commentators need to stay in the good graces of decision-makers to boost their own career. No one would know who Jon Hilsenrath of the Wall Street Journal is if it weren’t for his close contacts to Federal Reserve officials. Schiff’s Austrian-minded approach to markets is a challenge to acceptable opinion, and he pays the price by burning at the stake on television. The Keynesian revolution didn’t just bring the idea that economies can be fine-tuned with the help of central planners; it brought a high-minded smugness to economic science. It taught aspiring dictators that with enough math formulas and aggressive authority, they could be gods among men. Such conceit is paid for in economic depressions, prolonged unemployment, broken family life, and general societal malaise. The misery wrought by the Keynesians consensus is paramount. Yet it’s practitioners seem immune to considering the simple proposition that their worldview could, in any way, be flawed. Presumption, though attractive, leads to folly. Lives and fortunes have been lost in the gamble known as the stock market because of the hubris built into economic assumptions. You might think that being caught off guard by the biggest banking crisis in 80 years would force observers to show more respect toward an outsider like Peter Schiff. But then you might think that the Keynesianism belief in turning one dollar into several by spending it at the local department store is the stuff of fantasy. Economic forecasting is a dangerous job. As Mark Twain put it in his novel Pudd’nhead Wilson, “October. This is one of the peculiarly dangerous months to speculate in stocks. The others are July, January, September, April, November, May, March, June, December, August, and February.” Every wrong prediction could doom a career, or a bank account. Prudence and humility are the only sound tools for building one’s reputation. The talking heads on CNBC appear to know neither. They pledge allegiance to the flag of the tinkering bureaucracy. It explains the loss of ratings, and loss of confidence in the ability of “experts” to see what’s coming down the tracks. Refusing to learn from mistakes will lead to future blunders. Pundits that don’t heed this message are doomed to fail. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 07 Nov 2014 06:40 PM PST by Gary Christenson, Deviant Investor:

Example 2: A mother demands that her teenage son clean his room. Instead he responds to powerful forces, such as testosterone surges, cute girls, and teenage rebellion. Example 3: Silver prices surged higher in early 2011 and have collapsed since then in spite of increasing investment demand. The silver market was responding to powerful forces. What forces?

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| No bear market in monetary metals, Roberts tells KWN, just a rigged one Posted: 07 Nov 2014 06:40 PM PST 9:40p ET Friday, November 7, 2014 Dear Friend of GATA and Gold: Former Assistant U.S. Treasury Secretary Paul Craig Roberts tells King World News tonight that there can't be a bear market in gold and silver when real metal is so scarce. Instead, Roberts says, agents of the U.S. Federal Reserve are suppressing prices with futures contracts. An excerpt from the interview is posted at the KWN blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/11/8_Pa... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit USAGold.com. USAGold: Great prices, quick delivery -- all the time. Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Death Of The Working Class In 12 Charts Posted: 07 Nov 2014 06:00 PM PST Submitted by Thad Beversdorf via First Rebuttal blog, They say a picture is worth one thousand words. And so here’s a twelve thousand word equivalent essay that quite clearly depicts how the policies of the new millennium are shaping the new world order. The powers that be have looked at these same charts, understand their implications and yet continue on the current path. The objective then is clear. The death of the working class. With almost 100% of ‘savings’ having been forced into the stock market we are getting ever closer to what will be described as an epic collapse of wealth. However, the more fitting description will be an epic and final transfer of wealth from the working class to the burgeoning aristocracy as assets are picked up for pennies on the dollar. Pay particular attention to data from the end of the 1990′s through the new millennium.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This was the Week that the Gold Price Bottomed, at Least for Now Posted: 07 Nov 2014 05:45 PM PST

Another sign of a bottom is that old bulls throw in the towel. That is, they did well on the way up, and have held on a long time in anticipation of another ride, but at last they give up. I have been witnessing old bulls selling out. Another sign is that new buyers enter the market. I've been seeing those, too. The GOLD PRICE today rose $27.30 (2.39%) to $1,169.60. The SILVER PRICE rode right alongside, rising 30.7 cents (2%) to $15.699. Both metals posted the first day of a key reversal up with a break to new low ground and a higher close. After a five day waterfall, that surely marks the end of the plunge and beginning of some rally. But what kind of rally? Can we say that this week's lows were THE lows of the 2011-2014 bear move? Not yet. The gold price needs to climb above $1,255.60, the last high, before I would venture that. Silver needs to rise above $17.82. In any event, we ought to see a sharp rally from here, especially if stocks fall next week, as they may. Meanwhile all the indicators I watch are turning up, so next week ought to float metals higher. GOLD/SILVER RATIO today closed at 74.502, highest close yet. That also suggests a bottom. It also suggests it's high time to swap gold for silver and wait for the ratio to drop to 30. Funny how you think you'll never live through a week, but when Friday arrives it doesn't seem so bad after all. This was the week silver and gold bottomed, at least for a while. This may have been the week stocks reached their ultimate high -- we'll see next week. And it may be the week the US dollar index, for all its strength, turned equatorward. Dow and S&P500 are both bumping up against an overhead resistance line in place for the last few months. And both have formed broadening tops. Step back from the Dow or S&P chart, way back, about 20 years and you'll see since 1998 a Megaphone or Broadening Top formation. Right now the Dow is knocking on that line (S&P500 is already through it), so technically, after a 5 year bull run, stocks ought to be meeting impenetrable resistance. I know, I know, with the central bank tag team rolling Quantitative easing around the world, it might go further (newly created Japanese money only funds a carry trade that sends money back to the US to buy more stocks). But technically, I wouldn't bet on it. Today the Dow hit its third new high in a week, up 19.46 (0.11%) to 17,573.93. Likewise, the S&P500 made a new high at 2,031.92, but I can't tell how much that's up because the numbers on the NASDAQ site don't tally with yesterday's close. No matter, both indices moved up very thinly today, in spite of good news from the official liars at the Labor Department about increasing jobs. After three weeks of unbroken rise, the Dow in Gold finally fell sharply today. High this week was 15.38 oz or G$317.93 gold dollars, but today it fell 3.07% to 14.91 oz or G$308.22. Ditto for the Dow in silver, which peaked this week at 1,143.15 oz or S$1,478.01 silver dollars. Bothe are excruciatingly overbought, and it catches my eye that the rate of change and full stochastics have turned down. Next move points down. It would exaggerate some but not too much to state that the source of all sorrow in the last 100 years has been fiat money and central banking. Think about it: without central banks, world wars would be impossible. More, fiat money controls us and everything else. So when I rave and stomp about scabrous, scrofulous, scurvy fiat currencies, I am at least sincere. The scurvy US dollar index showed forth the first half of a key reversal down today, reaching a new high intraday but closing lower for the day. That must be followed through Monday by another lower close. Preferably, a two day lower close is needed to cinch it. High came at 88.32, close at 87.63, down 58 basis points (0.66%) from yesterday. Both the euro and Yen closed higher today, but one day maketh not a trendchange. Euro rose 0.65% to $1.2458, not enough to climb above the last low at $1.2501. Sorry as gully dirt. Yen rose 0.54% to 87.26 cents/Y100. Looks sorrIER than gully dirt. Y'all enjoy your weekend! Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Michael Savage - Bill O'Reilly and Glenn Beck Mention ' Civil War ' All of a Sudden on Fox News Posted: 07 Nov 2014 04:40 PM PST Aired on November 7, 2014 --- Michael Savage - Bill O'Reilly and Glenn Beck Mention ' Civil War ' All of a Sudden on Fox News The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Russia Nears Completion Of Second "Holy Grail" Gas Deal With China Posted: 07 Nov 2014 03:29 PM PST Six months ago, something few had expected would take place in 2014, or even in the coming years, happened: under Western pressure and out of a desire to diversify away from an increasingly hostile European market, Russia signed the so-called "Holy Grail" gas deal with China, pivoting away from the west and toward with Beijing. As part of the deal, the two nations reached a $400 billion agreement to construct the Power of Siberia pipeline, which will deliver 38 billion cubic meters (bcm) of gas to China. The compromise was a lower price than Gazprom would have otherwise hoped for, however in taking a cue right out of Amazon, "Russia would make up in volume what it lost in price." This eastern route will connect Russia's Kovykta and Chaynda fields with China, where recoverable resources are estimated at about 3 trillion cubic meters. And then today, with little fanfare, Russia's president Putin - whose economy is said to be reeling as a result of a plunging currency, paradoxically something Japan would love to be able to achieve on such short notice - told the media ahead of his visit to the Asia Pacific Economic Conference on November 9-11, that Moscow and Beijing have agreed many of the aspects of a second gas pipeline to China, the so-called western route, or as some already are calling it, the "second holy grail." "We have reached an understanding in principle concerning the opening of the western route," Putin said. "We have already agreed on many technical and commercial aspects of this project laying a good basis for reaching final arrangements," the Russian President added. As RT reports, the opening of the western route, the Altai, would link Western China and Russia and supply an additional 30 bcm of gas, nearly doubling the gas deal reached in May. Once the Altai route is completed, China will become Russia's biggest gas customer, able to receive up to 68 bcm of gas annually, surpassing the 40 bcm Russia supplies Germany each year.

Furthermore, now that the western embargo against Russia has made any ongoing cooperation between the western majors and Russia, especially in the Arctic region, virtually impossible if only for the time being, Russia has no choice but to entice China to accept the part of the provider of capital investment and technical know how (arguably reverse engineered from the best western firms). Which is why Russia has already offered Chinese companies a stake in large energy fields. In September, Russia's largest oil company, Rosneft, offered China a share in its second-largest oil field, Vankor in the Krasnoyarsk region in Eastern Siberia. The area is estimated to have reserves of 520 million metric tons of oil and 95 billion cubic meters of natural gas.

And while Putin will be planning how to further expand the Russia-China energy symbiosis without losing too much of his own leverage, he will be joined by Russia's Foreign Minister Sergey Lavrov, who will reportedly meet with his US counterpart John Kerry. Judging by the recent escalation in Ukraine, the two will have much to discuss. And yet, it is increasingly the case that Russia is happy to leave the west and its petrodollars behind (something Obama is hardly excited about), instead chosing to be paid in Gas-o-yuans or rubles. "Strengthening ties with China is a foreign policy priority of Russia. Today, our relations have reached the highest level of comprehensive equitable trust-based partnership and strategic interaction in their entire history. We are well aware that such collaboration is extremely important both for Russia and China," Putin President said. And as Europe slowly slides into depression having lost a major trade partner, China's trade with Russia, and obviously vice versa, is surging: overall trade between Russia and China increased by 3.4% in the first half of 2014, reaching $59.1 billion, and the two neighbors expect annual trade to reach $200 billion by 2020. China is Russia's second-biggest trading partner after the EU. And just in case the two host central banks opt out of wiring or reciving USD-denominated payments, or are prohibited to do so should SWIFT escalate and expel Russia from the organization, recall that the central banks of the two countries recently signed a three-year ruble-yuan currency swap deal worth up to $25 billion, in order to boost trade using national currencies and lessen dependence on the dollar and euro. Said otherwise, front page coverage of Russia, and its Chinese pivot, may have slowed down in recent weeks, but the motions behind the scenes are anything but over. And while the developed world is increasingly withdrawing from trade with itself and the BRICs, instead relying increasingly more on outright currency devaluation to boost "wealth", it is the two superpowers of China and Russia that are approaching the future the right way. The "exorbitant privilege" of having their own reserve currency will arrive in due course. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

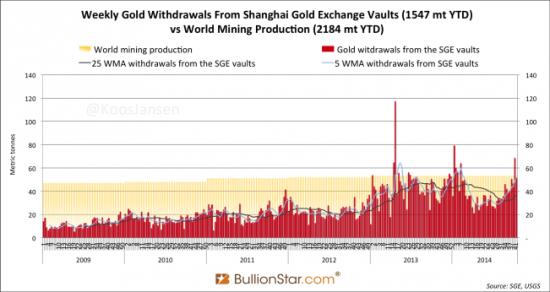

| Did Gold and Silver Just Get Their “Greenspan Put”? Posted: 07 Nov 2014 02:23 PM PST The world’s central banks and derivatives traders have been having their usual fun with gold and silver lately, dumping huge volumes of futures contracts into thin markets to produce massive declines — just when precious metals SHOULD have been soaring in response to near-global debt monetization. But something interesting happened as this latest smack-down really got going. Physical buyers — who goldbugs have for years been expecting to ride to the rescue, finally did. Chinese and Indian gold imports, which had trailed off earlier in the year, soared in response to the recent price declines. There’s some debate about exactly how much these guys are buying, but it certainly looks like they’re talking all that’s being produced by the world’s mines, and then some. Here’s a chart from gold analyst Koos Jansen showing Chinese imports spiking lately: In silver, the response of individual coin buyers has been even more dramatic. The US Mint, which in a good month sells 5 million one-ounce silver eagles, sold 2 million of them in two hours on November 5, ran out of inventory, and suspended sales until further notice. For more on the recent tsunami of precious metals buying, see: Physical gold shortage worst in over a decade as GOFO rate tumbles to negative China gold buying means price floor to Standard Chartered US Mint temporarily sold out of silver Eagles amid huge demand So it looks like physical buyers at long last have decided to tell the precious metals market what the US government and Federal Reserve have been telling the stock, bond and real estate markets markets since the 1990s heyday of Fed chair Alan Greenspan: Relax, we’ve got your back. We’ll short-circuit small declines before they can turn into big ones, and failing that we’ll ramp up a new bubble so quickly that you’ll hardly notice the blip. There is of course no way to know what the manipulators will do in response, and whether they’ll succeed. They do, after all, have trillions of dollars of fiat currency at their disposal. But at least there’s now a real fight going on in which physical buyers are landing some punches. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Tesco Empire Strikes Back, £5 off £40 Discount Voucher Spend Explained, Exclusions Warning! Posted: 07 Nov 2014 02:18 PM PST Tesco, Britain's super market giant that continuous to implode as a consequence of a soaring debt mountain against a collapse in profits, a crisis further compounded by multiple investigations into financial irregularities by the regulator and SFO - Serious Fraud Office, appears to be going for broke by launching back to back £5 off vouchers for £40 spend on your next £40 shop offers in an attempt to reclaim its lost customers from the discount retailers. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Short Squeeze Posted: 07 Nov 2014 01:45 PM PST | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| NAV Premiums of Certain Precious Metal Trusts and Funds - More Sprott Gold Goes Walkabout Posted: 07 Nov 2014 12:56 PM PST | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold and Silver Hit By Strong U.S. Dollar Posted: 07 Nov 2014 12:52 PM PST The dollar continued its upward path against the major currencies this week, and gold and silver prices suffered accordingly. The bears have maintained the upper hand, as shown in the following charts of Comex prices and Open Interest. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold's Fundamental Supply Picture Posted: 07 Nov 2014 12:31 PM PST Demand Global gold demand was 964t in Q2 2014, significantly reduced from the record high in Q2 2013. ETF outflows slowed sharply. Central Banks continued to buy gold for the 14th consecutive quarter in Q2 2014. CB's purchased 118t in Q2 2014 up 28% over Q2 2013. The announcement of a fourth CBGA in the second quarter also reiterated that sales will not be forthcoming from some of the largest holders. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Price and Powerful Forces Posted: 07 Nov 2014 12:16 PM PST Example 1: When a golfer hits a shot to the green he often yells “sit” as he orders the ball to slow or stop near the flag. Even professionals indulge in this bit of satisfying self-delusion. However, the ball responds to powerful forces, such as wind, the undulations of the green, its own momentum, and gravity. Example 2: A mother demands that her teenage son clean his room. Instead he responds to powerful forces, such as testosterone surges, cute girls, and teenage rebellion. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This Will Trigger A Wipeout Of Markets & Economies Worldwide Posted: 07 Nov 2014 12:15 PM PST  On the heels of a weaker than expected jobs report in the U.S. that sent the gold market surging nearly $30, today Michael Pento warned King World News that the world is about to fall into a terrifying deflationary crater. Pento also discussed what he is doing with his firm's money ahead of the coming chaos. On the heels of a weaker than expected jobs report in the U.S. that sent the gold market surging nearly $30, today Michael Pento warned King World News that the world is about to fall into a terrifying deflationary crater. Pento also discussed what he is doing with his firm's money ahead of the coming chaos.This posting includes an audio/video/photo media file: Download Now | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| A Tale of Two Markets: Gold Market Manipulation in NY and London Posted: 07 Nov 2014 11:41 AM PST | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 07 Nov 2014 11:13 AM PST Jim Sinclair’s Commentary The real facts of the Swiss referendum concerning gold. Dear Jim, I hope you are keeping well. No, they are wrong. If there is a majority Yes vote for the country as a whole the Initiative, as it stands, becomes part of the constitution on Nov 30. There is one additional condition,... Read more » The post Jim’s Mailbox appeared first on Jim Sinclair's Mineset. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| At KWN, Bill Kaye outlines the likely course of a short squeeze in gold Posted: 07 Nov 2014 11:02 AM PST 2p ET Friday, November 7, 2014 Dear Friend of GATA and Gold: Interviewed by King World News, Hong Kong fund manager William Kaye describes what might happen with a short squeeze in the gold market if supplies of metal got tight enough. It makes sense provided that the U.S. Federal Reserve or Treasury Department would not avert the squeeze by lending or swapping into the market whatever is left of the foreign custodial gold vaulted at the Federal Reserve Bank of New York. There's a reason the New York Fed does not charge rent to foreign governments that vault their gold there -- it's so that the U.S. government might control the disposition of their gold and apply it wherever U.S. interests might best be served. Kaye's interview is posted at the KWN blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/11/7_Co... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Anglo Far-East is a global market leader and innovator that for more than two decades has provided private purchase, vaulting, security logistics, transport, and liquidation of allocated gold and silver bullion outside of the banking system. AFE clients include individuals, family offices, and institutions like banks and regulated funds. Anglo Far-East: Think Outside the Bank Here's what one of our generationally wealthy clients has to say about AFE: http://www.afeallocatedcustody.com/research/teleconferences/download-inf... To get started, please visit: https://secure.anglofareast.com/ Anglo Far-East: Think Outside the Bank Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Bug Psychology Must be Neutered Posted: 07 Nov 2014 09:51 AM PST The precious metals bear market, beginning with silver’s blow out in early 2011 and the general top in the commodity and ‘inflation trade’ along with gold’s lesser blow out later that summer amidst Euro crisis hysterics, has been all about psychology. Well, every bear or bull market is about psychology, but the intensity of this dynamic has been something to behold in the gold sector over these last few years. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Marc Faber Warns Not to Hold Any Gold in the U.S. Posted: 07 Nov 2014 09:46 AM PST Dr Marc Faber has again urged people in the world to be diversified, own physical gold and to be their own central bank. In another fascinating interview with Bloomberg, Dr. Marc Faber covered Japan's massive QE experiment, the slump in oil prices and the importance of diversification and owning physical gold. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| More QE for a Zombified Electorate Posted: 07 Nov 2014 09:41 AM PST This post More QE for a Zombified Electorate appeared first on Daily Reckoning. [N]othing is more essential than that permanent, inveterate antipathies against particular nations and passionate attachments for others should be excluded, and that in place of them just and amicable feelings toward all should be cultivated. The nation which indulges toward another an habitual hatred or an habitual fondness is in some degree a slave. – George Washington's farewell address QE is dead. Long live QE! This time it was the European Central Bank that bought the drinks. US investors bellied up to the bar and helped themselves; the Dow rose 69 points. Gold kept slipping. Since the Fed ended its QE program, the Bank of Japan and the ECB have come forward promising more money for stock markets. Draghi has faced increased pressure to do more to support a slowing euro-zone economy after the Bank of Japan last week unexpectedly announced it would add the equivalent of another $730 billion to its balance sheet. The US has not and cannot decouple from the rest of the world. The US is struggling too. And at the end of its two-day policy meeting yesterday, the ECB announced a plan to buy another €1 trillion in asset-backed securities. This will bring the ECB's balance sheet back to 2012 levels. According to the standard narrative, the US is on the road to recovery, as Japan and Europe struggle. Globalization? Forget it. The US has apparently "decoupled" from the rest of the world. And now Japan and the euro zone need more QE. The story is appealing. But untrue. The US has not and cannot decouple from the rest of the world. The US is struggling too. That was the real message from the midterm elections. The Democrats had promised a lot. They hadn't delivered. The voters — whose real incomes have been going down since the turn of the century — knew the truth. Now it's the Republicans' turn to make promises they can't keep. They can't keep them because it will take major changes to turn the economy around. Voters don't really want any major changes. And the Republicans don't plan to make them anyway. Giveaways and special privileges have zombified the electorate. It doesn't want anything different. It just wants more. What would be different? Easy: a flat income tax rate, a neutral foreign policy, and a balanced budget. Any chance of those things? Did you hear Mitch McConnell promise them? Would a single member of Congress vote for them? Russia has a flat income tax rate of 13%. Simple. Easy. Cheap to administer. A flat tax would save billions of dollars and help businesses, investors and households. But Congress will never vote for a flat tax because it would mean giving up its power to hand out special favors. That is what makes a national election at least as uplifting as professional wrestling — and not just because the contestants can be gaudy and breathtakingly stupid. Sometimes there's something really at stake: the private interests of the elite against the public interest of everyone else. As for a neutral foreign policy, we could just butt out and watch the Sunnis and Shia kill each other without our help or our heavy artillery. That might be good for them and good for us, but it would be bad for the security industry. But wait… There is "a savage global terrorist threat that seeks to wage war on every American," said Mitch McConnell and John Boehner in yesterday's Wall Street Journal. The terrorists don't seem to be gunning for the Swiss. Why not? "Avoid foreign entanglements," said Washington, thinking ahead. But today, the city named after him — and especially its northern Virginia suburbs — never met a foreign affair it didn't want to get entangled in. A balanced budget? Oops… have we said something wrong? The professional economists in the room are covering their mouths and suppressing giggles. What a terrible mistake that would be, they will tell you. We have to encourage unbalanced budgets. We need to lure people to spend money — citizens, corporations and the government — not save it. Ordinary Americans are wisely dragging their feet on this; US household net debt has gone down since 2007. But corporations and the government are doing stout service in the name of increasing debt slavery. Why is it supposed to be a good idea to spend money you don't have? Well, there is something called the "paradox of thrift." The paradox is that saving may be good for an individual, but it is bad for an economy as a whole. Like so much of modern economics, the "paradox of thrift" is nonsense. When a single person saves, he improves his personal finances. But when many people save, consumer spending goes down. Then sales go down… profits go down… and the entire economy disappears down some uncharted rat hole. That's why Martin Wolf said Japan has "too much" savings in Wednesday's Financial Times. Like so much of modern economics, the "paradox of thrift" is nonsense. Savings gives families a cushion against disaster. It also gives them the capital they need to improve their standard of living. On our farm, for example, we have a woodpile about 50 yards from the kitchen door. In the winter, we spend a fair amount of time just bringing in firewood. So, we put aside some savings… and use the money to build a woodshed closer to the house. Time saved. We can live more comfortably (a higher standard of living) and we have time available to do other things (more household output). The same thing happens in an economy. Money spent is money gone forever. But money saved and invested is money that increases our standard of living, raises wages and adds to our wealth. The US, Japan and Europe are still stimulating consumption and discouraging saving. In Japan, this has been going on for more than 20 years — with little to show for it aside from the world's highest government debt-to-GDP ratio. These policies have failed everywhere. That is one of the reasons the American voter turned against the Democrats; he held them responsible. But they are extremely popular with Wall Street — the single biggest source of funding for Mitch McConnell's reelection campaign. Over the last five years, the Fed has added $3.6 trillion to the financial system, much of it passing through or coming to rest on Wall Street. Whatever campaign contributions it took to support the unlocking of the Fed's vault must have been the most successful investment ever. QE dead? With that kind of adrenaline pumping in Wall Street's veins, it will be amazing if we don't have more of it. Regards, Bill Bonner Ed. Note: There seems to be some confusion over the death of QE… Will it stay “dead” or will it rear its ugly head again sometime next year (or the year after that…)? It’s a story we’ve been following very closely in The Daily Reckoning email edition — a free e-letter that gives you the kind of entertaining and informative analysis you won’t find in the mainstream media. Don’t miss your chance to join the conversation. Click here now to sign up for FREE. This article originally appeared in Bill Bonner’s Diary of a Rogue Economist, here. The post More QE for a Zombified Electorate appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 07 Nov 2014 09:37 AM PST The silence of the precious metals producers in the face of blatant, ongoing, illegal, and seemingly never ending price suppression has been deafening. How could the primary gold and silver producers sit by and watch as the price of their product is fixed by an illegal pricing mechanism? But just when it seemed it couldn't be any darker, we got a glimpse of the dawn. Last month Keith Neumeyer, the celebrated CEO of First Majestic, changed the game. He made a shocking and graceful statement that should cause shock waves to reverberate across the sector. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold and Silver Bear Markets Close to the Bottom but Not There Yet Posted: 07 Nov 2014 09:32 AM PST The selloff in precious metals intensified over the past week. GDXJ declined 25% in seven days while Gold plunged below $1180 to $1140 and Silver plunged below $16 and to as low as $15.20. Precious metals are becoming extremely oversold and the bear market is clearly in the 9th inning. Be on alert for a snapback rally to repair the extreme oversold conditions. Although we are likely very close to the bottom in the miners, Gold’s current position continues to leave me skeptical. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 07 Nov 2014 09:26 AM PST To identify “buying opportunities” in “extreme” situations, we identify historical extreme situations and use them for a benchmark. Provided that a correction occurs in an active bull market, the insights from this kind of analysis can be very helpful. Most should agree that the credit crisis was a major economic event that pushed nearly all assets down to an extreme low. We have used this kind of extraordinary market action as a comparison for the current commodities correction. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Could This Nightmare Scenario Unfold For The Gold Shorts? Posted: 07 Nov 2014 09:15 AM PST  Today one of the top people in Hong Kong spoke with King World News about a nightmare scenario for the shorts in the gold market. Hedge fund manager William Kaye, who 25 years ago worked for Goldman Sachs in mergers and acquisitions, also discussed what it would mean for the gold shorts if this terrifying scenario started to unfold. Below is what Kaye had to say in this extraordinary interview. Today one of the top people in Hong Kong spoke with King World News about a nightmare scenario for the shorts in the gold market. Hedge fund manager William Kaye, who 25 years ago worked for Goldman Sachs in mergers and acquisitions, also discussed what it would mean for the gold shorts if this terrifying scenario started to unfold. Below is what Kaye had to say in this extraordinary interview.This posting includes an audio/video/photo media file: Download Now | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 07 Nov 2014 08:45 AM PST Investment Score | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| John Crudele: U.S. economic growth is all illusion Posted: 07 Nov 2014 08:43 AM PST By John Crudele As voters were coming out of the polls on Tuesday, pesky reporters were asking why they voted the way they did -- and what was going through their heads? The most popular response -- from 45 percent of the voters -- was the economy. Only 28 percent said their families were doing better financially. The economy is always the major issue in an election during times like these. So no one should have been shocked that voters took their anger out on the party that controls the White House, even though Republicans are just as much to blame for our economy's failures. John Harwood, a political reporter for CNBC, asked a very good question before the votes were counted: Why? As in, "Why did people appear so angry and unhappy when the stock market was at record levels, the unemployment rate is down sharply, inflation is subdued and the number of jobs is increasing?" Harwood's explanation was that the benefits of this economic growth weren't being evenly distributed and were being felt only by the blessed in the American economy -- the upper 1 percent, if you will. Harwood is only a little right. Yes, the economy is blessing the few and leaving the rest of us in limbo. What Harwood and the rest of the folks who rely solely on Washington's mainstream thinkers and Wall Street boosters for their information don't realize is this: The economy isn't really doing what the statistics say it is doing. ... ... For the full commentary: http://nypost.com/2014/11/06/us-economic-growth-is-all-an-illusion/ ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers. (http://www.gata.org/node/173) To invest or learn more, please visit: Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alasdair Macleod: Deflation comes knocking at the door Posted: 07 Nov 2014 08:31 AM PST 11:30a ET Friday, November 7, 2014 Dear Friend of GATA and Gold: In his new commentary, "Deflation Comes Knocking at the Door," GoldMoney research director Alasdair Macleod writes that "the apparent mispricing of gold, equities, bonds, and even currencies indicates they are all are ripe for a simultaneous correction, driven by what the economic establishment terms deflation but more correctly is termed a slump." Macleod's commentary is posted at GoldMoney's Internet site here: http://www.goldmoney.com/research/analysis/deflation-comes-knocking-at-t... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Own Allocated -- and Most Importantly -- Zurich, Switzerland, remains an extremely safe location for storing coins and bars of the monetary metals. If you do not own segregated physical coins and bars that you can visit, inspect, and take delivery of, you are vulnerable. International diversification remains vital to investors. GoldCore can accomplish this for you. Read GoldCore's "Essential Guide to Gold Storage In Switzerland" here: http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44 (0)203 086 9200 -- U.S.: +1-302-635-1160 -- International: +353 (0)1 632 5010 Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TF Metals Report: Are we getting close? Posted: 07 Nov 2014 08:10 AM PST 11:10a ET Friday, November 7, 2014 Dear Friend of GATA and Gold: Gold interest rates signify extreme tightness in the gold market, the TF Metals Report's Turd Ferguson writes today, arguing that the break between prices for physical and paper is coming soon. Ferguson's commentary is headlined "Are We Getting Close?" and it's posted at the TF Metals Report here: http://www.tfmetalsreport.com/blog/6300/are-we-getting-close CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Free Storage with BullionStar in Singapore Until 2016 BullionStar is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. BullionStar's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in BullionStar's bullion vault, which is integrated with BullionStar's shop and showroom, making it a convenient one-stop-shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage is FREE until 2016 and will have the most competitive rates in the industry thereafter. For more information, please visit Bullion Star here: Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Was the Great Pyramid of Giza a Factory for Mono-Atomic Gold Posted: 07 Nov 2014 07:33 AM PST How the Great Pyramid Made Monatomic Gold Was the Great Pyramid of Giza a Factory for Mono-Atomic Gold ? Spencer Cross identifies the purpose of the structure, what it was making, and the significance of this substance. Cross' theory that the Pyramid was a factory for mono-atomic gold (White... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| UK prepares forex fines for six big banks, sources tell Reuters Posted: 07 Nov 2014 07:29 AM PST By Steve Slater and Jamie McGeever LONDON -- British regulators investigating allegations of collusion and manipulation in the foreign exchange market could fine a group of six banks as early as next Wednesday, people familiar with the matter said. The six banks are Switzerland's UBS, U.S. banks JP Morgan and Citigroup, and Britain's HSBC, Barclays, and Royal Bank of Scotland, sources said. They are expected to be fined a total of about 1.5 billion pounds ($2.37 billion). It would be the first settlement in the year-long global probe into the $5.3 trillion-a-day foreign exchange market. Around 35 traders have been suspended or fired by their banks. No individual or institution has so far been accused of any wrongdoing. A group settlement could be appealing to the banks, after Barclays in 2012 was singled out as the first bank to settle with regulators over a global investigation into the rigging of benchmark interest rates. ... ... For the remainder of the report: http://www.reuters.com/article/2014/11/07/us-banks-forex-settlement-idUS... ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ICE to run replacement for century-old London gold fixing Posted: 07 Nov 2014 07:21 AM PST By Nicolas Larkin LONDON -- CE Benchmark Administration will run the replacement for the 95-year-old London gold fixing, as benchmarks for other precious metals were overhauled this year. Intercontinental Exchange Inc.'s IBA will provide a price platform and methodology and administer the procedure that now takes place by phone each day at 10:30 a.m. and 3 p.m., the London Bullion Market Association and ICE said today in statements. Societe Generale, Bank of Nova Scotia, HSBC Holdings,and Barclays currently conduct the fixings used by miners to central banks to trade and value metal. Silver became the first precious metal to ditch the daily fixing procedure in August after Deutsche Bank AG said it would stop taking part as it scales back its commodities business. A new mechanism will replace platinum and palladium fixes on Dec. 1. Scrutiny on how benchmarks are set increased after regulators uncovered price-rigging in everything from interbank-loan rates to currencies. IBA said it expects to start running the LBMA Gold Price in the first quarter of next year. ... ... For the remainder of the report: http://www.bloomberg.com/news/2014-11-07/ice-to-run-replacement-for-cent... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Could Gold Stocks Bottom at 2008 Credit Crisis Low Prices? Posted: 07 Nov 2014 05:20 AM PST The commodity equities are selling off as The Fed halts QE3. However, we are reaching oversold levels and support areas where short covering could soon begin. Commodities, metals and the junior miners are hitting multi year lows and falling below 2008 credit crisis levels. This crash is not based on fundamentals only on an artificially inflated dollar due to Yen and Euro weakness. This is not a time to panic but continue to accumulate as the bear market may be reaching the final capitulation stage. This decline may be a sign that the quantitative easing may have lifted stock market indices, but it did little to improve demand and growth in the economy reflected by demand for energy and metals. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| America Future - The Worst Economic Collapse Ever - Prepare 2014 Posted: 07 Nov 2014 04:37 AM PST Martial Laẉ 2014! Revolution And Economic Meltdown Prepare! ALAS, BABYLON / AMERICA - THE TIME OF YOUR DOOM HAS COME ! The USA we knew is gone - replaced by the Evil Empire - "Mystery Babylon". She rules over other nations from the UN. She spreads immorality worldwide in the media. She kills... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Save Your Swiss Gold “ Peter Schiff™s Message to Switzerland Posted: 07 Nov 2014 02:00 AM PST Euro Pacific Capital | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 06 Nov 2014 11:01 PM PST Example 1: When a golfer hits a shot to the green he often yells "sit" as he orders the ball to slow or stop near the flag. Even professionals indulge in this bit of satisfying self-delusion. ... {This is a content summary only. Click on the blog title to continue reading this post, share your comments, browse the website, and more!} | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Druglord, Genius, or Saint? What Kind of Man, Really, Is Silk Road’s Dread Pirate Roberts? Posted: 06 Nov 2014 10:34 PM PST Dear Reader, We all know that it’s silly to base our opinions on media reports, but very often we have nothing else to go on. So today I’m going to provide some information that big media hasn’t on a rather important legal case. You most likely heard the first media reports, but that was all, even though some highly relevant information followed. If we are to understand this case—and it’s an important one for the freedom of the Internet— we need to see the full picture. Then Doug French will explain how technology (including Silk Road) is making end-runs around politics to make our lives better. So let’s get to it. Druglord, Genius, or Saint? What Kind of Man, Really, Is Silk Road's Dread Pirate Roberts?Changing the World: Technology Versus PoliticsDoug French, Contributing Editor We were all supposed to go vote on Tuesday. It’s our civic duty, we’re told. If you want change, your vote is more important than anyone else’s. What a crock. Technology has replaced politics as the way toward a freer, more prosperous world. The easiest example is one everyone understands: once upon a time, communications were controlled by employees in blue suits. The post office had everyone over a barrel. There was a problem, and government wasn’t going to fix it because the postal service was the government. Then came FedEx and the like, along with fax machines. Now everyone gets their utility bills via email. Why send letters when you find out everything you wanted know—and lots of things you didn’t—about friends and family via Facebook? Government has continued to grow, mucking up commerce where it can. But did you ever think you’d see the post office delivering packages on Sunday? Thank you, Amazon. MoneyThe Federal Reserve’s stewardship of the dollar has been atrocious. The once-proud currency has fallen in value by 95% since the Fed opened for business 100 years ago… and Ben Bernanke—and now Janet Yellen—believe it should buy even less. When Nixon snipped the last remaining string between gold and the dollar, Ron Paul was inspired to run for office, thinking politics made a difference. He spent decades scrapping with Federal Reserve Chairmen Alan Greenspan and Ben Bernanke about central bank policies. These exchanges gained Paul millions of followers and helped him raise millions in campaign contributions. He was able to get an “Audit the Fed” bill passed in the House. However, politics—in the form of Harry Reid—stopped it in its tracks. Of course auditing the Fed would not make the dollar sounder. It wouldn’t give citizens a choice in what currency to transact business with or store wealth in. Auditing would only be a political charade, providing the appearance of something being done when in fact it would simply be the government checking on the government. As Paul tilted at windmills, the Fed’s money supply inflation continued. In 2008, a person or group of people decided to take matters into their own hands, brains, and keyboards, developing the cybercurrency Bitcoin under the pseudonym Satoshi Nakamoto. It was entrepreneurship to fix a problem instead of politics. He, she, or they designed and created the original Bitcoin software, currently known as Bitcoin-Qt. This brilliant and anonymous work is—after only a few years—providing a sound alternative to debauched government currencies, and has inspired dozens of competitors. No political grandstanding. No interviews from Capitol Hill. No ghost-written rants in the Wall Street Journal. No horse trading or sausage making. This is the simple creation of a product to satisfy human desires. A product people trade with voluntarily, not through the force of legal tender laws. Lending and BorrowingRegulators have had banks under their thumb. Rates are low, but just try to borrow the money. This is where the market steps in with wonderful innovations. Among the most impressive is a model of borrowing and lending much closer to what we might see in a real market economy. It is called peer-to-peer, or P2P, and it means that those who want to borrow work directly with those who want to lend, bypassing the intermediary role that banks have traditionally played. The market is providing solutions that permit all of us to participate in a system that’s effectively freer than the banking system of the past. For this reason, the peer-to-peer lending business is on the verge of disrupting the banking business in a big way. Through companies like Lending Club, customers can borrow directly from savers who wish to lend. There’s no army of bank vice presidents or their country club memberships to pay for in between them. The P2P model can work for lenders looking to earn a decent return on their money as well, while banks pay little or nothing for interest in this brave new Federal Reserve zero-interest-rate-policy world. P2P was all the buzz at a recent conference sponsored by American Banker. When asked about the conference, Prosper Marketplace President Ron Suber stated: Today’s event was proof that banking has collided with Silicon Valley. The combined size of Prosper and Lending Club has proven that borrowing and lending are now changed forever. Traditional banks are now forming relationships with us so they are not left behind. The proliferation of platform diversification is further evidence of the permanency of the industry. So how can investors earn high returns while borrowers pay competitive rates? “It is a more direct funding process between the investors and the borrowers,” Renaud Laplanche, the CEO of Lending Club, says. “There’s no branch network. Everything happens online and it is really powered by technology and the Internet. And we use technology to lower cost.” Catching a RideAlso lowering costs are ride-sharing apps like Uber and Lift. While taxicab companies are politically powerful, ride sharing is making inroads. “It’s been a great run for New York City’s taxi medallion speculators, but the party could be coming to an end,” Bloomberg Businessweek reported in July. “The average price fell by $5 in June.” The price of medallions (licenses) had rocketed upward for years to over $1 million apiece. The City of New York keeps medallions in short supply to keep the price up and cabdrivers happy. But Uber is operating in the Big Apple, and according to the Washington Post, “the median wage for an UberX driver working at least 40 hours a week in New York City is $90,766 a year.” The Washington Post also reports that in San Francisco, the median wage for an UberX driver working at least 40 hours a week is $74,191. In the tech-savvy Bay area, “Uber has pretty much destroyed regular taxis in San Francisco,” a headline for Time stated. After Uber began in 2012, regular cab rides fell 65%. But it’s not easy for Uber everywhere. Any city that depends upon tourist dollars kowtows to cabbies. The threat of a cabdrivers’ strike in Las Vegas will make a Nevada governor fold before any cards are dealt. Uber has set up shop in Las Vegas but is staying off the resort corridor, where about 95% of cab rides begin around the airport, convention center, or strip. I can attest that the residential neighborhoods are underserved. It’s a dicey proposition, for instance, to call a cab to take you to the airport. You never know if one will show up. Next City reports: “In Vegas, the industry is perhaps more impermeable. With only 16 companies employing around 9,000 drivers in Clark County, it’s both centralized and highly regulated; a state board oversees everything from fares to the number of vehicles authorized per company.” Last year taxis provided 26 million rides in Sin City alone. Vegas cab companies and their union drivers won’t go down without a fight, but serving the residential areas is a great start for ride sharing. Buying Drugs SafelyThe War on Drugs was declared in the 1970s and has been ongoing ever since, putting millions behind bars for victimless crimes and subjecting countless more to needless harm. Since 2006, more people have died in drug-related violence than have died in the Iraq or Afghanistan war. Why don’t the people just elect lawmakers who will call off the drug war? It will never happen. It’s not even a subject of debate. Besides, law enforcement is getting rich using asset forfeiture laws to steal large amounts of cash under the guise that all cash is used for drug transactions. With illegal drugs, there are no ways to settle disputes, and people risk their lives to buy and sell. Drug production isn’t going to stop, and neither is the demand. Enter Silk Road in 2011. “It was Amazon.com except for products and services that are frowned upon by political elites,” writes Jeffrey Tucker in his forthcoming book Bit by Bit: How P2P is Liberating the World. “It brought peace to the drug markets.” Tucker believes that Silk Road’s administrator “Dread Pirate Roberts” should get the Nobel Peace Prize for his work. The authorities think differently, shutting down Silk Road after three years of operation and jailing the alleged mastermind, Ross Ulbricht. But the market aided by technology is a game of whack-a-mole, frustrating government officials and bureaucrats. They took down one Silk Road, and another popped up. According to Tucker, “There are more products than ever before. The volume of trade is higher than before. There are safe measures for escrow and for encrypted contact between trading partners.” What Else Can Technology Fix?There are apps under development to do most everything. Imagine if you’re stopped by a cop: you touch an app on your phone and an available lawyer is hired instantly to speak on your behalf. Looking for a parking place? An app will direct you to one. The applications are endless. In a scathing article criticizing the sharing economy, Avi Asher-Schapiro writes, “The premise is seductive in its simplicity: people have skills, and customers want services. Silicon Valley plays matchmaker, churning out apps that pair workers with work.” Of course Asher-Schapiro is exactly right, but he hates this idea because he’s writing for Jacobin, “a leading voice of the American left, offering socialist perspectives on politics, economics, and culture.” He believes capitalists are evil and thinks all labor should be unionized. Asher-Schapiro hits the nail on the head with his conclusion: “There’s nothing innovative or new about this business model. Uber is just capitalism, in its most naked form.” Yes, exactly. And it is capitalism (the more naked, the better) that creates prosperity, not politics. Friday FunniesI’m dedicating this week’s funnies to one of my favorite comedic characters: Reverend Jim Ignatowski of Taxi. This clip is long (a full episode), but I think you’ll enjoy it.

That’s It for This WeekHave a great weekend, and remember that freedom doesn’t mean “people are free to do things I like.” It means that they can do anything, so long as they don’t intrude on others. Paul Rosenberg |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

The Federal Reserve protecting the value of the dollar from quantitative easing and the massive increase in the supply of dollars and dollar-denominated debt. Normally when a central bank creates 4 trillion new dollars the currency collapses. It's not worth anything in terms of rubles, euros, yen, or (even) pesos. This hasn't happened (yet). …But it's very obvious what they (the Fed) are doing. And the consequences of it are also very dangerous because essentially what it means is that gold is being driven out of the West, into the hands of the Chinese, Indians, and the Russians.

The Federal Reserve protecting the value of the dollar from quantitative easing and the massive increase in the supply of dollars and dollar-denominated debt. Normally when a central bank creates 4 trillion new dollars the currency collapses. It's not worth anything in terms of rubles, euros, yen, or (even) pesos. This hasn't happened (yet). …But it's very obvious what they (the Fed) are doing. And the consequences of it are also very dangerous because essentially what it means is that gold is being driven out of the West, into the hands of the Chinese, Indians, and the Russians. Let me reiterate this, for those readers who still (mistakenly) believe that we live in “democratic societies”, since such people will undoubtedly have difficulty processing the title of this post.

Let me reiterate this, for those readers who still (mistakenly) believe that we live in “democratic societies”, since such people will undoubtedly have difficulty processing the title of this post. The way I think this will unfold is when people least expect it — when sentiment readings, as they are now, are exceedingly negative. And we are at levels now from a valuation perspective, we've mentioned tightness of the metal in the system, in which we could get a tradable rally and possibly something much more.

The way I think this will unfold is when people least expect it — when sentiment readings, as they are now, are exceedingly negative. And we are at levels now from a valuation perspective, we've mentioned tightness of the metal in the system, in which we could get a tradable rally and possibly something much more.

Example 1: When a golfer hits a shot to the green he often yells "sit" as he orders the ball to slow or stop near the flag. Even professionals indulge in this bit of satisfying self-delusion. However, the ball responds to powerful forces, such as wind, the undulations of the green, its own momentum, and gravity.

Example 1: When a golfer hits a shot to the green he often yells "sit" as he orders the ball to slow or stop near the flag. Even professionals indulge in this bit of satisfying self-delusion. However, the ball responds to powerful forces, such as wind, the undulations of the green, its own momentum, and gravity.

No comments:

Post a Comment