saveyourassetsfirst3 |

- Big Reversal Day for Gold - But will it Last?

- The Business Secrets of the World’s Most Successful Gold Company: Franco-Nevada’s David Harquail

- Putin has signed a "secret pact" to crush NATO

- PM Fund Manager: US Will Start WW3 to Avoid Admitting Gold Reserves Are Gone

- No inflation Friday: How sport salaries reveal the true rate of inflation

- For Those Who Think Justice is Dead…

- Volcanic Eruption of Gold and Silver Demand: Shanghai’s Blast

- Europe closes lower on poor US jobs data and renewed crisis in Ukraine

- They’re Burning The Furniture Now

- Gold Bug Psychology Must be Neutered

- Gold and silver rally hard after very weak US jobs data

- Fans of Central Banking Have an Achilles Heel

- Eyes on gold as price plunges

- Why $1,100 could be the "floor" for gold

- LBMA Announces ICE gets the Gold Fix

- 50 Percent Of American Workers Make Less Than $28,031 A Year

- Metals market update for November 7

- India's leading financial enterprise exits gold loan business

- “I Wouldn’t Hold My Gold in the U.S. At All” - Faber

- Gold fights back

- Perpetual Debt Slavery

- More interesting ways to smuggle gold

- Payrolls Friday - Lots of Volatility

- Market Report: PMs hit by strong dollar

- “I Wouldn’t Hold My Gold in the U.S. At All” – Faber

- ICE wins race to run London gold fix

- Gold mining companies making losses - Phillips

- Midterms 2014: Paying the Gold Price, and the Iron Price

- Turkish gold imports seen recovering as prices slump

- Kinross continues talks on Tasiast mine financing

- Close to the Bottom but Not There Yet

- Wild Volume in Overnight Gold Trade

- Gold Firms Plan Drastic Cuts to Stay Afloat as Bullion Sinks

- Large Comex Gold Withdrawal As Paper Price Manipulated Lower

- Precious Metals are Oversold

- How investors can still make money in gold stocks with metal prices on the floor

- Dollar strength could raise European stocks next

- Stronger US dollar a threat to the rally on Wall Street

- Gold Daily and Silver Weekly Charts - Pity the Swiss

- Ron Paul: Watch Out When People Start To Distrust Our Money

- Gold Manipulation - For Adults Only

- Argonaut Gold Cash Flows $8.7M on $37.3M in Revenue in Q3

- Must-see: This is how the government hides inflation

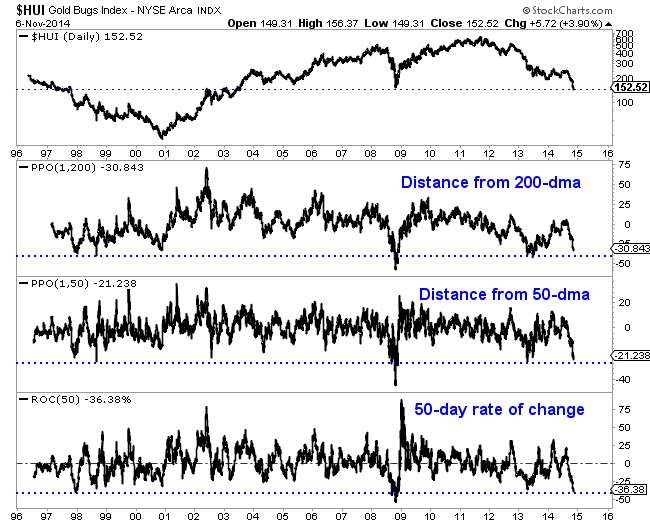

| Big Reversal Day for Gold - But will it Last? Posted: 07 Nov 2014 01:25 PM PST That's the question on a lot of minds as a result of the huge upside day in the gold market today. Gold essentially managed to erase nearly all of the losses on what was began as a big technical downside failure but ended up leaving both sides a bit unsure as to what to expect next. From my perspective, you had a combination of two things at work here. The first is the payrolls number which came in a bit on the low side of what the market was looking for. In and of itself, the number was not that bad but the market seemed to be looking for a reason to rally and that was as good as any. But what compounded the move higher was the reports of Russian tanks moving in Ukraine. That was just too much for the already nervous shorts and out they came in droves. I mentioned the other day about the psychology at work in what the gold perma bulls constantly harangue us about whenever gold experiences a sharp selloff, namely, their poorly dubbed, "Flash Crash". "GET ME OUT AND GET ME OUT NOW" at any price is the psychology at work on the longs when selloffs are the case. Once the computer selling kicks in, that attitude then takes over. Today it was the bears screaming the same thing, "GET ME OUT AND GET ME OUT NOW" as prices MELTED HIGHER. Of course, just as all it takes to get a move lower is a few big sell orders, all it takes to get things rolling on the upside like today is a few big buy orders. Computers on the way down and computers on the way up. It is that simple. Take a look at the daily chart first. That is most impressive! The price posted a huge outside reversal up day today. Coming after an extended decline like gold has experienced, it is therefore significant from a technical analysis perspective. It indicates that the market is SOLD OUT for now. Those who have been short should have covered most of their shorts during today's session so as not to lose the tremendous profits that they have accrued over the last couple of weeks. That is where a great deal of the buying originated from today. Here are some things that I am watching however which, while I respect the day's action, I am noting as obstacles the bulls have yet to overcome. First is the ten year moving average ( in BLUE). Note it is still declining and note that the rally has not made it back to even this initial of key technical levels. In spite of the tremendous rally today, that 10 day is still lurking overhead. I should also note that it is ABOVE the key downside breakout level of $1180. The test for the bulls comes early next week to see whether or not they can prove that the breakdown below $1180 was a bear trap or whether this is just another one of those violent short covering rallies that come so often in gold during its bear market and which only serve as higher selling levels from which new bears can enter the market or existing stronger hands can add to their short positions. The verdict remains out on this in my view but I am keeping an open mind. Previous experience with gold is that it tends to put in these violent upside rallies only to then disappoint with little in the way of additional upside follow through. Will this time be different? I honestly do not know so therefore I am observing. One thing that the gold bulls have working in their favor at this time however is the confirmation in the gold mining shares as evidenced by the strong chart action in the HUI. Here is its chart... Notice that it filled that overhead gap serving as resistance. That is impressive and needs to be respected. Was it an exhaustion gap signifying the end of the move and a final bottom in what has been an inexorably brutal bear market in the gold shares or is this merely the beginning of a new sideways pattern forming above the low of the week near the 146 level? Subsequent price action next week will go a long way towards clearing that up for us. However, if you take an intermediate term view of the gold chart, that casts a bit different light on the metal which urges some caution about getting too bulled up. Here is the weekly chart of gold. Some of you will recall this from some previous posts I made when the metal broke down below chart support at the triple bottom near $1180. Notice that you have what chartists will refer to as a "hammer" pattern, which derives its name from price action "hammering out a bottom". However, this is the key - the CLOSE remains below the former triple bottom of $1180. I would very much prefer to have seen the market recover that broken triple bottom before turning more strongly bullish. Right now I am ambivalent. Why? Because i am unsure whether this is merely a return to that level to test to see whether or not the same eager sellers are present or is this a move indicating a stronger move higher that can possible recapture a "12" handle? Again I do not know as we will have to wait to see what we get next week before saying with much certainty. Right now any guesses are just that, GUESSES, and successful traders do not become successful by trading guesses. If the bulls can take the price ABOVE $1180 and keep it there to end next week, then we have something. If not, I suspect we will see a new range trade develop at a lower level with the bottom near $1130 ( this week's low) and the top wherever the pattern develops. I will get some more up later on when I have a chance to go over the COT stuff. Suffice it to say it is an easy matter to expect significant short covering will not show up on this week's report. That all happened today! In the meantime I am worn out from trying to keep my sanity trading beans and cattle, which have both been all over the place as the computers have shoved them around relentlessly this week, especially the meal. Monday we get a major USDA grains report and perhaps we will see some semblance of normalcy come back to the grains and get rid of some of the volatility that is jerking traders all over the place. But then again, given the brave new world of electronic screen trade and computers incessantly firing off buy or sell orders in huge quantities, I tend to doubt it. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Business Secrets of the World’s Most Successful Gold Company: Franco-Nevada’s David Harquail Posted: 07 Nov 2014 12:45 PM PST Interested in learning the business secrets of the world's most successful gold company? Submitted by Henry Bonner, Sprott’s Thoughts: David Harquail joined well-known investors 'Lucky' Pierre Lassonde and Seymour Schulich in 1987, when Franco-Nevada was just getting its legs. He's been with the company ever since, currently serving as CEO. Franco-Nevada is now one of the largest […] The post The Business Secrets of the World’s Most Successful Gold Company: Franco-Nevada’s David Harquail appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Putin has signed a "secret pact" to crush NATO Posted: 07 Nov 2014 11:50 AM PST From Marin Katusa, Chief Energy Investment Strategist, Casey Research Back on September 11 and 12, there was a summit meeting in a city that involved an organization that most Americans have never heard of. Mainstream media coverage was all but nonexistent. The place was Dushanbe, the capital of Tajikistan, a country few Westerners could correctly place on a map. But you can bet your last ruble that Vladimir Putin knows exactly where Tajikistan is. Because the group that met there is the Russian president's baby. It's the Shanghai Cooperation Organization (SCO), consisting of six member states: Russia, China, Kazakhstan, Kyrgyzstan, Tajikistan, and Uzbekistan. The SCO was founded in 2001, ostensibly to collectively oppose extremism and enhance border security. But its real reason for being is larger. Putin sees it in a broad context, as a counterweight to NATO (a position that the SCO doesn't deny, by the way). Its official stance may be to pledge nonalignment, nonconfrontation, and noninterference in other countries' affairs, but − pointedly − the members do conduct joint military exercises. Why should we care about this meeting in the middle of nowhere? Well, obviously, anything that Russia and China propose to do together warrants our attention. But there's a whole lot more to the story. Since the SCO's inception, Russia has been treading somewhat softly, not wanting the group to become a possible stalking horse for Chinese expansion into what it considers its own strategic backyard, Central Asia. But at the same time, Putin has been making new friends around the world as fast as he can. If he is to challenge US global hegemony—a proposition that I examine in detail in my new book, The Colder War − he will need as many alliances as he can forge. Many observers had been predicting that the Dushanbe meeting would be historic. The expectation was that the organization would open up to new members. However, expansion was tabled in order to concentrate on the situation in Ukraine. Members predictably backed the Russian position and voiced support for continuing talks in the country. They hailed the Minsk cease-fire agreement and lauded the Russian president's achievement of a peace initiative. However, the idea of adding new members was hardly forgotten. There are other countries which have been actively seeking to join for years. Now, with the rotating chairmanship of the organization passing to Moscow − and with the next summit scheduled for July 2015 in Ufa, Russia − conditions could favor the organization's expansion process truly taking shape by next summer, says Putin. To that end, the participants in Dushanbe signed documents that addressed the relevant issues: a "Model Memorandum on the Obligations of Applicant States for Obtaining SCO Member State Status," and "On the Procedure for Granting the Status of the SCO Member States." This is extremely important, both to Russia and the West, because two of the nations clamoring for inclusion loom large in geopolitics: India and Pakistan. And waiting in the wings is yet another major player − Iran. In explaining the putting off of a vote on admittance for those countries, Putin's presidential aide Yuri Ushakov was candid. He told Russian media that expansion at this moment is still premature, due to potential difficulties stemming from the well-known acrimony between India and China, and India and Pakistan, as well as the Western sanctions against Iran. These conflicts could serve to weaken the alliance, and that's something Russia wants to avoid. Bringing longtime antagonists to the same table is going to require some delicate diplomatic maneuvering, but that's not something Putin has ever shied away from. (Who else has managed to maintain cordial relationships with both Iran and Israel?) As always, Putin is not thinking small or short term here. Among the priorities he's laid out for the Russian chairmanship are: beefing up the role of the SCO in providing regional security; launching major multilateral economic projects; enhancing cultural and humanitarian ties between member nations; and designing comprehensive approaches to current global problems. He is also preparing an SCO development strategy for the 2015-2025 period and believes it will be ready by the time of the next summit. We should care what's going on inside the SCO. Once India and Pakistan get in (and they will), and Iran follows shortly thereafter, it'll be a geopolitical game changer. Putin is taking a leadership role in the creation of an international alliance among four of the ten most populous countries on the planet − its combined population constitutes over 40% of the world's total, just short of 3 billion people. It encompasses the two fastest-growing global economies. Adding Iran means its members would control over half of all natural gas reserves. Development of Asian pipeline networks would boost the nations of the region economically and tie them more closely together. If Putin has his way, the SCO could not only rival NATO, it could fashion a new financial structure that directly competes with the IMF and World Bank. The New Development Bank (FKA the BRICS Bank), created this past summer in Brazil, was a first step in that direction. And that could lead to the dethroning of the U.S. dollar as the world's reserve currency, with dire consequences for the American economy. As I argue in The Colder War, I believe that this is Putin's ultimate aim: to stage an assault on the dollar that brings the US down to the level of just one ordinary nation among many… and in the process, to elevate his motherland to the most exalted status possible. What happened in Tajikistan this year and what will happen in Ufa next summer − these things matter. A lot. Perhaps no one knows how dangerous Vladimir Putin is − and how much he controls the flow of capital in the global energy trade − than author of The Colder War, Marin Katusa. Marin stakes millions on his deep knowledge of energy and politics. And as a result, his hedge funds have outperformed the TSXV index by 6-fold over the past 5 years. To discover everything Putin is planning and how it will directly affect you, click here to get a copy of Marin’s brand new book, The Colder War. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PM Fund Manager: US Will Start WW3 to Avoid Admitting Gold Reserves Are Gone Posted: 07 Nov 2014 11:30 AM PST Time is starting to run out for ability of the U.S. to keep kicking the can of collapse down the road. I really believe that the full-on intensity of the recent intervention in the precious metals market is the most obvious signal of time expiring. China has been accumulating physical gold at a stunning […] The post PM Fund Manager: US Will Start WW3 to Avoid Admitting Gold Reserves Are Gone appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| No inflation Friday: How sport salaries reveal the true rate of inflation Posted: 07 Nov 2014 11:00 AM PST The new NBA season started this week. And with it the new salary cap for 2014-15 entered into force. It increased by 7.5% and is now at a record high of $63 million. Yet another "all time high" in a world where everything but the Average Joe’s paycheck seems to be hitting the moon. […] The post No inflation Friday: How sport salaries reveal the true rate of inflation appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| For Those Who Think Justice is Dead… Posted: 07 Nov 2014 10:15 AM PST Justice is not a government concept, but a Cosmic one, and it most often comes as a thief in the night, from very unlooked-for places! Justice may be deferred for a lifetime, but it always appears in the end! Submitted by The Wealth Watchman: Not What It Seems I once heard a shield brother tell me an anecdote about […] The post For Those Who Think Justice is Dead… appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Volcanic Eruption of Gold and Silver Demand: Shanghai’s Blast Posted: 07 Nov 2014 10:04 AM PST In just half a decade, the Chinese nationals, through the bourse of Shanghai, have taken delivery of nearly 7,500 tonnes of gold! This has never happened before in the history of the world. China's citizens (and central bank) own at least twice as much gold, in reality, as Fort Knox and the NY Fed claim to own, […] The post Volcanic Eruption of Gold and Silver Demand: Shanghai's Blast appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Europe closes lower on poor US jobs data and renewed crisis in Ukraine Posted: 07 Nov 2014 09:30 AM PST European stock indexes closed lower on Friday, with the exception of the UK’s benchmark FTSE 100 after the US economy produced fewer than expected jobs in October and tensions in Ukraine unsettled investors once more. Gold and silver rebounded strongly as a safe haven trade confounding the bears… | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| They’re Burning The Furniture Now Posted: 07 Nov 2014 09:30 AM PST Last night around 12:30 a.m. EST, $1.5 billion of paper gold was dumped into the Comex Globex computer trading system during one of the least liquid periods of trading in any 24 hour period. It was done when there was almost no resistance from the physical market. The two largest physical buying markets in the world […] The post They're Burning The Furniture Now appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Bug Psychology Must be Neutered Posted: 07 Nov 2014 09:30 AM PST Biwii | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold and silver rally hard after very weak US jobs data Posted: 07 Nov 2014 09:14 AM PST Gold and silver rallied by around two per cent after lacklustre jobs data that confirmed stagnant US wages and underlined the need for further stimulus measures in the near future. Bloomberg's Betty Liu and Josh Wright discuss wage growth and the monthly jobs report. They speak on ‘Market Makers’… | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fans of Central Banking Have an Achilles Heel Posted: 07 Nov 2014 09:00 AM PST Our opponents, those who support central banking and irredeemable paper money, have to make two cases: One is to defend the theory and practice of central banking, that central bankers are wise and honest and that their debt-based paper money works. They have to argue that the dollar does everything you want money to do, […] The post Fans of Central Banking Have an Achilles Heel appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 07 Nov 2014 08:43 AM PST This year, the gold prices have fallen five percent. The Dollar Index went from strength to strength, rising 1.26% this week and around ten percent this year. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why $1,100 could be the "floor" for gold Posted: 07 Nov 2014 08:37 AM PST From Bloomberg: The cheapest gold in four years is proving irresistible for shoppers in China and India, where rebounding demand may signal an end to the longest price slump in more than a decade. Purchases in Asia will help support prices that are headed for the first two-year decline since 2000, Standard Chartered Plc said. While surging equities and tame inflation have eroded gold's appeal as a hedge, sending bullion tumbling to $1,132.16 an ounce today, prices are nearing the lows forecast by banks from Citigroup Inc. to Goldman Sachs Group Inc. China supplanted India as the world's largest buyer last year, when the metal plunged 28 percent. Jewelry and bullion are viewed in both countries as a store of value and are popular as gifts. China's gold imports from Hong Kong in September were the highest in five months. Indian jewelers are forecasting a surge in fourth-quarter sales. "There is a floor around $1,100 set by Chinese retail demand," Paul Horsnell, head of commodities research at Standard Chartered in London, said by e-mail on Nov. 5. "Physical demand indicators out of China and India are firming." Gold demand in China will rise 20 percent in three years, the World Gold Council forecast in September. The country's net imports from Hong Kong that month totaled 61.7 metric tons, the most since April, according to calculations by Bloomberg News based on data from the Hong Kong Census and Statistics Department on Oct. 27. Festival Buying The All India Gems & Jewellery Trade Federation has said fourth-quarter imports of the metal may jump 75 percent. Gold is often bought during the year-end festivals, and during the wedding season, it is part of many bridal trousseaus and as gifts in the form of jewelry. Gold for immediate delivery has lost 3.9 percent this year and traded at $1,155.26 at 10:04 a.m. in New York. The Bloomberg Commodity Index of 22 raw materials declined 6.8 percent in 2014, while the MSCI All-World Index of equities climbed 2.2 percent. The Bloomberg Treasury Bond Index advanced 4.7 percent. Coin collectors also are buying. The U.S. Mint has sold 30,500 ounces of gold coins this month, about half the average monthly total since August, after October sales reached 67,500 ounces, the most since January. The Mint ran out of American Eagle silver coins after selling 1.26 million ounces since the start of the month, a spokesman said in a Nov. 5 e-mail. Dollar Downer To other investors, the selloff in gold is far from over, with the rallying dollar curbing demand for the metal as a store of value. The greenback rose to a five-year high against a basket of 10 currencies. Gold will end the year at $1,100 and keep sliding to $800 by the end of 2015, Georgette Boele, an analyst at ABN Amro Group NV in Amsterdam, wrote in a Nov. 5 report. The chances are increasing that it will slip to $1,000 as oil prices tumble and the U.S. economy improves, Societe Generale SA's Michael Haigh, an analyst who correctly forecast gold's 2013 rout, said Oct. 30. "The reasons to hold gold are getting smaller and smaller," Sameer Samana, a senior international strategist at Wells Fargo Advisors LLC in St. Louis, which oversees $1.4 trillion, said in a Nov. 5 telephone interview. "The dollar will continue to trade strong since there is a divergence between the U.S. economy and other major economies in Asia and Europe." Reduced Holdings Investors have cut holdings in gold-backed exchange-traded products by 38 percent since they reached a record in December 2012, data compiled by Bloomberg show. The 1,634.8 metric tons now held is the least in more than five years and valued at $60.2 billion. Hedge funds and other money managers have reduced bullish bets on gold by 51 percent since early July, U.S. Commodity Futures Trading Commission data show. David Wilson, an analyst at Citigroup, said he expects gold to trade between $1,100 and $1,200 in the short term. Michael Widmer at Bank of America Corp. in London predicted a drop to as low as $1,100, and Barnabas Gan, an economist at Oversea-Chinese Banking Corp. in Singapore, forecast $1,150 by year-end. Goldman's Jeffrey Currie said he expects $1,050 by the end of December. Gold Production Some higher-cost mining companies are already losing money on production. Gold's drop this week took it below output costs for seven of 19 mining companies tracked by Bloomberg Intelligence. Two more were within $50 of the figure. Unprofitable mine output will cause producers to shelve plans and help limit gold supplies, according to Caroline Bain, a commodities economist at Capital Economics Ltd. in London. She said prices will probably rebound to $1,200. "We are building our gold position very gradually," Peter Sorrentino, senior vice president at Huntington Asset Advisors in Cincinnati, said in an interview Nov. 5. He helps oversee $1.8 billion. "We are still favorably disposed to accumulating. Gold has become a victim of dollar strength." | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| LBMA Announces ICE gets the Gold Fix Posted: 07 Nov 2014 08:28 AM PST In what will obviously make the Intercontinental Commodity Exchange crow to annoy the CME Group, the London Bullion Market Association announced that it has picked ICE to manage the Gold Fix. The new electronic fix will commence in early 2015 with 11 firms intending to participate. This will be interesting to watch as it ushers in a new age for the gold fix and brings it into the 21th century. One can only hope that is functions smoothly and efficiently and above all, with increased transparency. At this hour, gold is showing excellent chart performance as shorts are getting pushed out. Here is a quick chart. We now have some solid technical support levels that have formed as well as resistance levels that will make analyzing this market a bit easier. As you can see, it has pushed past the first zone of resistance noted on the chart. The market looks to be experiencing what I and some other long time traders refer to as a "melt up". It continues to work its way higher as one can see groups of shorts covering as the market refuses to give up much ground on the upside. That causes some who come in to sell into the rally to jump back out which then tends to feed the further upside progress. I am still most interested in how this thing will close today. Mining stocks are having a nice rally as well with their upside performance bettering that of the actual metal. That is a good sign if one is bullish. Also, that HUI/Gold ratio is correctly somewhat today after striking all time record lows this week. By the way, there are some reports circulating out of Ukraine that Russian tanks are moving. That is keeping some safe haven buying which can be seen in the upmove in the bonds and the unwillingness of the Yen to move lower. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 50 Percent Of American Workers Make Less Than $28,031 A Year Posted: 07 Nov 2014 08:00 AM PST The Social Security Administration has just released wage statistics for 2013, and the numbers are startling. Last year, 50 percent of all American workers made less than $28,031, and 39 percent of all American workers made less than $20,000. Every avenue of prosperity for the middle class is under assault, and there does not appear […] The post 50 Percent Of American Workers Make Less Than $28,031 A Year appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Metals market update for November 7 Posted: 07 Nov 2014 07:43 AM PST Gold rose $1.10 or 0.% to $1,143.50 per ounce yesterday and silver climbed $0.17 or 1.11% at $15.45 per ounce. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| India's leading financial enterprise exits gold loan business Posted: 07 Nov 2014 07:34 AM PST Magma Fincorp Limited has announced its decision to exit the gold loan business, as part of strategic business plans to focus on its core strengths. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| “I Wouldn’t Hold My Gold in the U.S. At All” - Faber Posted: 07 Nov 2014 07:30 AM PST gold.ie | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 07 Nov 2014 07:21 AM PST Gold futures headed for the biggest gain in two weeks after U.S. employers added fewer jobs than forecast last month, reviving demand for a haven. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 07 Nov 2014 07:00 AM PST The next collapse will come wrapped in some other fear-laden, false flag-riddled tragic disaster meant to distract and protect the elite. Submitted by Dr. Jeffrey Lewis, Silver Coin Investor: There is an unspoken difference between debt that is designed to be paid back and debt (disguised as perpetual flow) to finance pre-existing streams of debt […] The post Perpetual Debt Slavery appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| More interesting ways to smuggle gold Posted: 07 Nov 2014 06:34 AM PST The Air Intelligence Unit (AIU) under Mumbai Customs Department has detained two passengers for attempting to smuggle gold in the eyelets of belts and caps. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Payrolls Friday - Lots of Volatility Posted: 07 Nov 2014 05:50 AM PST Payrolls number disappoints Wall Street could be the headline for today's trading session. The always volatile number came in at +214K against expectations of a +233K. The rate of unemployment fell to 5.8% versus market expectations of 5.9%. The numbers for September were adjusted upwards to +256K from +248K. Also, the August numbers were kicked up as well going from +180K to +203K. As always, the data unleashed a round of furious price action across the currency markets, and by default, the gold market. Most are seeing the numbers as having a bit of something for all sides. Those reacting to the headline number registered their disappointment by selling the Dollar, especially in favor of the Euro. However, those who were looking at the monthly average since the beginning of the year, were doing the opposite. Analysts pointed out that the average number of jobs created this year has been +220K/month, something not seen since nearly a decade ago. A key data point inside the report was the fact that average hourly wages rose 3 cents to $24.57. A lot of traders, including yours truly here, are closely watching that important number. Remember, it is my view that the reason inflationary pressures have yet to show up in the economy is because wages have been flat/stagnant. If, and this is a HUGE "IF", we were to see a trend in rising hourly wages develop, that might be the catalyst that could shift the current deflationary psyche to one more of an inflationary bias. It is certainly not here now but we are all watching. The data did little to convince market players that the Fed is going to move on the interest rate sooner rather than later. Most still expect something to happen on the front mid year next year. Shortly after the data was released however, one of the Fed governor's, Mr. Mester was quoted as saying that the report was: " a pretty solid jobs report across the Board". He also noted that the "unemployment rate is a pretty good indicator of improvement in the Labor Markets". The Fed has been very vocal about stating its close scrutiny of the labor markets ahead of today's reports in their various statements coming out of the FOMC meetings. I am interested in seeing how the dust settles today before making too much of the early price action. As I said, there is a little of something for everyone in this report. The Dollar moved slightly lower as an initial reaction to the report but in the tmie it has taken me to type these comments, it has since stabilized and remains slightly higher. Gold is taking its cues directly from movements in the Forex markets. No telling where all this will end today so buckle your seat belts and stay tuned. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Market Report: PMs hit by strong dollar Posted: 07 Nov 2014 05:30 AM PST Finance and Eco. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| “I Wouldn’t Hold My Gold in the U.S. At All” – Faber Posted: 07 Nov 2014 05:05 AM PST "I Wouldn't Hold My Gold in the U.S. At All" – Faber Dr Marc Faber has again urged people in the world to be diversified, own physical gold and to be their own central bank. In another fascinating interview with Bloomberg, Dr. Marc Faber covered Japan’s massive QE experiment, the slump in oil prices and the importance of diversification and owning physical gold.

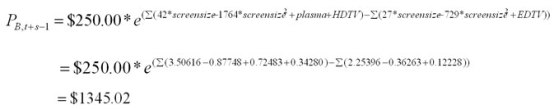

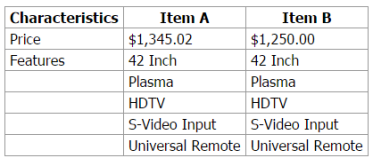

The interview was extensive and he covered a lot of ground which helped put the current major economic trends in perspective. The editor of the the Gloom, Boom and Doom Report, is always contrarian but always measured in his insightful analysis. Japan’s foray into QE as a “ponzi scheme” in that “all the government bonds that the Treasury issues are being bought by the Bank of Japan” according to Faber. He said that in the short term Japan may not have to face consequences because “most countries are engaged in a Ponzi scheme.” But he warned that “it will not end well.” When the interviewer put it to him that various economic indicators such as jobs numbers in the US were positive recently he countered that these statistics” are published by the Obama administration, and therefore I would be very careful to take every figure for granted.” He pointed to first-time home-buyers in the US, the number of which are at thirty year lows. “A lot of people are being squeezed very badly because the costs of living are rising more than their salaries and wages.” The low home-buying figures show that people simply cannot afford to buy houses anymore demonstrating that no amount of cherry-picked statistics can gloss over the fact the US economy is not in good shape. He also mentioned his long maintained view that inflation and deflation are not uniform phenomena but that “in some sectors of the economy you can have inflation and in some sectors deflation.” The implication of this is that, again, government statistics are not necessarily an accurate reflection of the state of the economy. He does not see long term weakness in the oil market. The current low prices, while they may be advantageous to western consumers are damaging those companies in the U.S. who took on large debts to develop oil drilling projects. And Saudi Arabia cannot run it’s social system, he reckons, if prices go below $70 for an extended period. The consumption of oil in the developing world is increasing from a very low base in comparison to the West. “So I think the long-term trend for demand is up, but obviously the decline of oil prices, some people blame it on Saudi Arabia and some other blame it on the US and who knows what, the fact is maybe the decline in oil prices tells you that the global economy is not recovering as all the bullish analysts think, but actually it's weakening. Yes, weakening.” To support this contention he argued that European economies are stagnant and China is in a slowdown. The knock on effect of this is that industrial countries are not buying commodities from resource-rich countries who in turn are not buying manufactured products from the West. This means that “you have the potential of a downside spiral.” With regards to gold being at four-year lows he said “it's been a miserable performance since 2011. However, from the late 1990 lows we're still up more than four times. So I just looked at performance tables over 10 years and 15 years. Gold hasn't done that badly, has done actually better than stocks.” When asked about Goldman Sachs negative outlook on gold, he mischievously said “I would say Goldman Sachs is very good at predicting lower prices when they want to buy something.” He added, “now I personally, I think that we may still go lower. It's possible. I'm not a prophet, but I'm telling you I want to own some gold because I don't trust the financial system anymore. I think the whole thing is going to collapse one day and then I'll be happy to have some assets. But of course the custody is important. I wouldn't hold my gold at the Federal Reserve because they will lend it out. I wouldn't hold my gold in the US at all.” In terms of custody, Dr. Faber has been a long time advocate of storing gold in Singapore. We concur and believe that along with Hong Kong and Zurich, Singapore is one of the safest places in the world to store bullion. In terms of government, Singapore is ranked 4th in the world and 1st in Asia for having the least corruption in its economy. Singapore is ranked the most transparent country in the world. In terms of economic performance, Singapore is ranked No. 2 worldwide as the city with the best investment potential for 15 consecutive years. Singapore is the world leader in foreign trade and investment. In terms of business competitiveness, legislation and efficiency, Singapore is ranked the most competitive country in the world. Singapore is ranked No. 1 for having the most open economy for international trade and investment. Singapore is one of the world’s easiest place to do business and may have the best business environment in Asia Pacific and worldwide. Singapore is Asia’s most “network ready” country. Dr. Faber prudently advises clients not only to diversify among asset classes but to also to diversify within asset classes. We share this view. We advise our clients to hold gold in various locations and in various forms but always in secure vaults and safe jurisdictions such as Singapore or Switzerland. Access Essential Guide to Storing Gold in Singapore Here MARKET UPDATE Gold rose $1.10 or 0.% to $1,143.50 per ounce yesterday and silver climbed $0.17 or 1.11% at $15.45 per ounce. Gold fell another 2.3% in dollar terms this week but its losses in euro and pound terms were more muted and it was down less than 0.8% in euro terms and by a similar amount in pounds.

Importantly, for European buyers, gold has remained quite robust in euro and indeed sterling terms (see charts) and seen only slight falls in recent days. Gold in euros remains up 5.5% for the year so far. Given the problems in the eurozone – it looks very well supported above the €900 level. Gold in Singapore ticked marginally lower until just before London opened prices popped about $10, on high volumes of about 1,000,000 ounces. By late morning in London, prices had eked out small gains but futures trading volumes were double the average for the past 100 days for this time of day. Most traders are on the sidelines ahead of the U.S. non farm payrolls number. U.S. employers are expected to add some 235,000 jobs in October. A weak number would trigger a strong rally in gold due to short covering and safe haven buying. Gold in Euros – Year to Date 2014 (Thomson Reuters) Gold is headed for another weekly drop, as the dollar headed for its biggest weekly gain in more than 16 months. The dollar index was little changed today but is set for a weekly advance of 1.5%, the most since the period ended June 21, 2013. Silver traded near the lowest since 2010. Silver for immediate delivery fell 0.6% to $15.43 an ounce and is down 4% this week. Bullion prices have fallen as the Federal Reserve threatens to increase interest rates and despite central banks in Europe and Japan easing monetary policy to boost growth. Gold has fallen despite the very uncertain geopolitical situation and the real threat of terrorism and war as tensions with Russia deepen. The Swiss gold initiative at the end of this month is also another bullish factor and it is surprising that gold has moved lower given the outcome will be close, and the yes side has a good chance of getting it passed. Gold in Pounds – 5 Days (Thomson Reuters) Physical investors in the US, Europe and Asia have taken advantage of lower prices this week. The US Mint sold 30,500 ounces of gold coins in November so far. This is half the average monthly total since August. October sales were the most since January. The Mint ran out of American Eagle silver coins after selling 1.26 million ounces since the start of the month. Holdings in the SPDR Gold Trust, the biggest gold ETP, contracted to 732.83 tons yesterday, shrinking for a third day to the lowest level since September 2008. Gold continues to flow from weak hands in the West to strong hands in the East. Goldman Sachs forecasts a drop to $1,050 by year-end. As ever, their predictions should be taken with a pinch of salt. Gold is very oversold and it's 14-day relative-strength index is at just 22.9 today. For six consecutive sessions it has held below 30, suggesting that it may be a bounce. Get Breaking News and Updates on the Gold Market Here | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ICE wins race to run London gold fix Posted: 07 Nov 2014 04:27 AM PST The new mechanism will be named the LBMA Gold Price. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold mining companies making losses - Phillips Posted: 07 Nov 2014 04:14 AM PST Around 50% of the world's gold mining companies are now making losses. Silver miners may be faring better. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Midterms 2014: Paying the Gold Price, and the Iron Price Posted: 07 Nov 2014 02:55 AM PST | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Turkish gold imports seen recovering as prices slump Posted: 07 Nov 2014 01:39 AM PST The country's gold trade hit record highs in 2012 and 2013 on booming business with Iran. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Kinross continues talks on Tasiast mine financing Posted: 07 Nov 2014 01:27 AM PST The gold miner is considering financing of $700 million to $750 million toward Tasiast. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

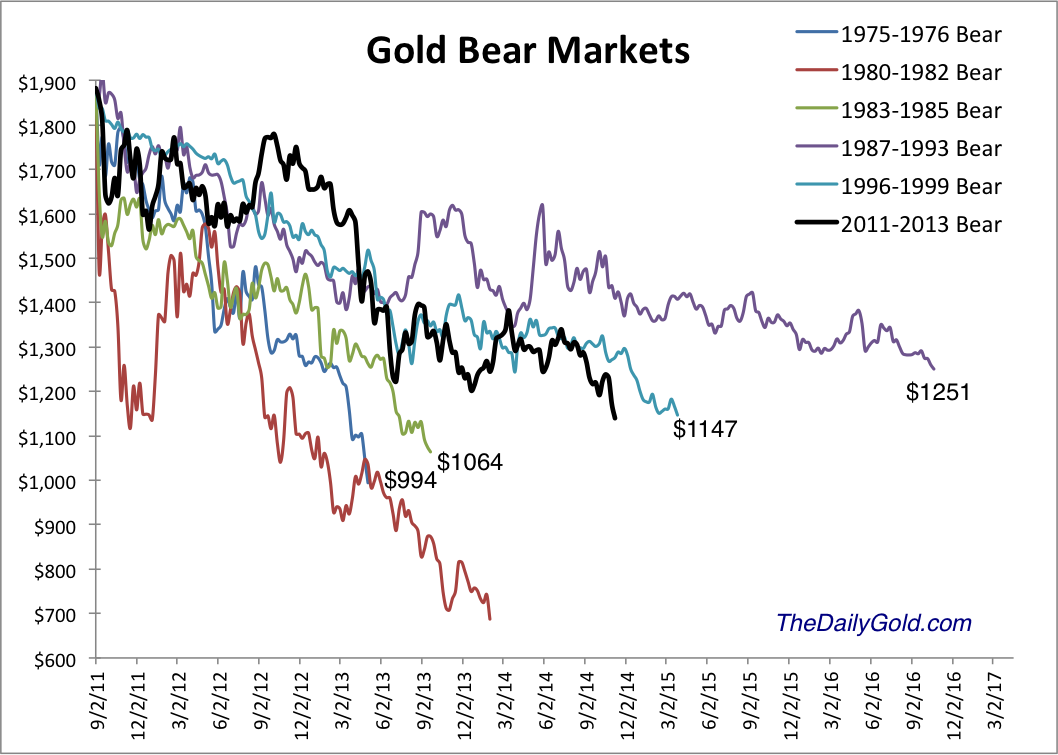

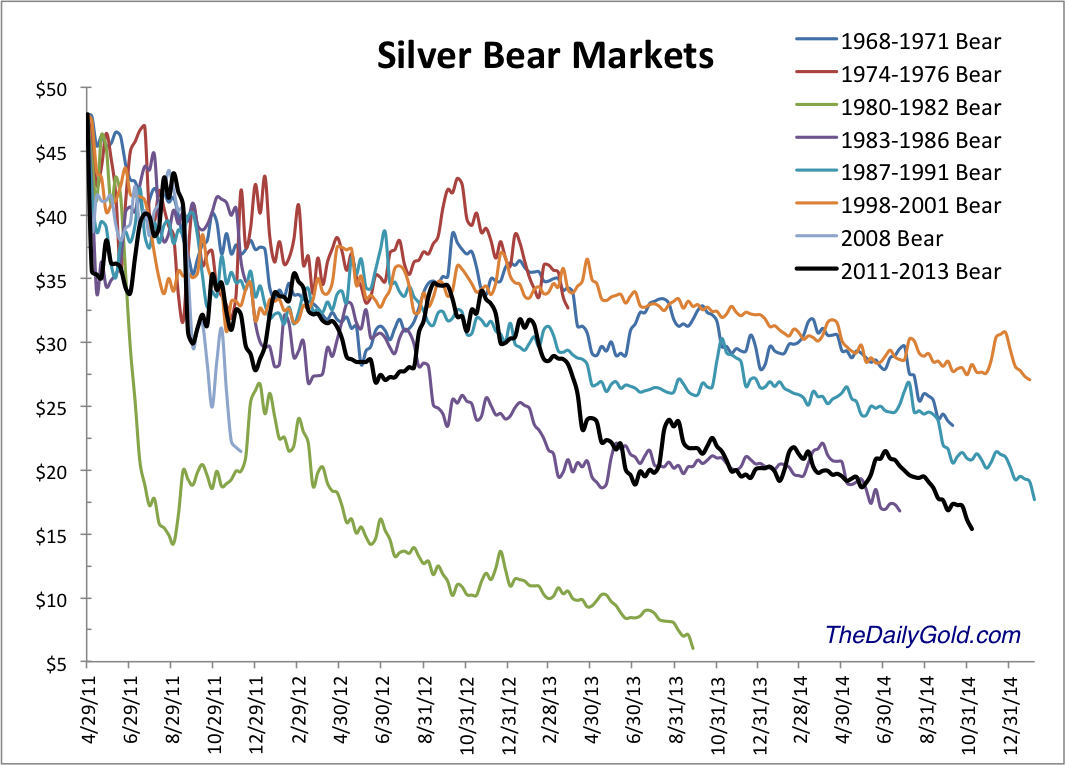

| Close to the Bottom but Not There Yet Posted: 06 Nov 2014 11:29 PM PST The selloff in precious metals intensified over the past week. GDXJ declined 25% in seven days while Gold plunged below $1180 to $1140 and Silver plunged below $16 and to as low as $15.20. Precious metals are becoming extremely oversold and the bear market is clearly in the 9th inning. Be on alert for a snapback rally to repair the extreme oversold conditions. Although we are likely very close to the bottom in the miners, Gold's current position continues to leave me skeptical. Below is the updated bear analog for Gold which uses weekly data. Gold has yet to suffer the extreme selling experienced by Silver and the mining stocks. It makes sense given that Gold peaked months after those assets. The chart illustrates how bear markets are a function of price and time. The most severe bears in price are the shortest in time while the longest bears in terms of time are the least severe in terms of price. This bear falls in between. Given that Gold went 10 years without a real bear market it makes sense that this bear could bottom very close to the 1983-1985 and 1975-1976 bears but will have lasted quite a bit longer. With respect to Gold, another point to consider is the strong supports at $1080/oz (50% retracement of the bull market) as well as $1000/oz. These downside targets continue to align well with the history depicted in the bear analog chart. Moreover, the fact that Gold currently sits well above these support levels is reason to expect more downside. Silver on the other hand figures not to have the same degree of downside. Silver's bear began five months before Gold's and the bear analog below makes a strong case that the current bear will end very soon. Other than the epic collapse from 1980-1982, the current bear is the worst ever for Silver in terms of price and is the third worst in terms of time. Similar to Silver, the mining stocks which led the bear market are moving from very oversold to extremely oversold. The HUI Gold Bugs Index, shown below closed Wednesday at an 11-year low. As far as the HUI's distance from its 50 and 200-day moving averages, it is inches from major extremes. Over the past 50 days the HUI has declined 36.4%. That is the second worst performance over the past 20 years. The picture is even worse for the junior mining sector. GDXJ has declined 43% over the past 50 days. It is trading at the lowest level relative to its 50-day moving average since the creation of the ETF. The worst bear market ever for the gold stocks was the more than four and a half year decline following the junior bubble in 1996. That bear did have a 14 month long respite where the indices rallied as much as much as 70% and 80%. That rally was longer and much larger than the one experienced recently. During the 1996-2000 bear, the GDM index (forerunner to GDX) declined 77.5%. Through Wednesday it was down 76%. The XAU declined 72.5%. Through Wednesday the XAU was off 74.2%. The Barron's Gold Mining Index declined 75% during the late 1990s bear. Through last week it was down 68%. The mining stocks and Silver are obviously extremely oversold and very close to the bottom. It could happen any day or any week. However, I'm skeptical because Gold is currently trading so far above its potential bottom. Sure, Gold figures to be the last to bottom but my view is the window for a bottom in the stocks could come when Gold declines below $1080. That being said, we could definitely see a snapback rally of some sort. The mining stocks and Silver are extremely oversold and could pop higher in the short-term. In any event, the bear market is very close to its end. The weeks and months ahead figure to be very enticing and exciting for precious metals traders and investors. Expect quite a bit of volatilty as we see some forced liquidation from longtime bulls and as the sector tries to carve out a major bottom. Opportunities are fast approaching so pay attention. Be patient but be disciplined. As winter beckons, we could be looking at a lifetime buying opportunity. I am working hard to prepare subscribers. Consider learning more about our premium service including a report on our top 5 stocks to buy at the coming bottom. Good Luck! Jordan Roy-Byrne, CMT Jordan@TheDailyGold.com

The post Close to the Bottom but Not There Yet appeared first on The Daily Gold. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Wild Volume in Overnight Gold Trade Posted: 06 Nov 2014 11:00 PM PST Lions and Tigers and Bears, Oh my! Flash Crashes and Reverse Flash Crashes and Swings, Oh my! That pretty much sums up what is happening at this hour as I watch the overnight trade. It is not only in gold, but I am seeing some very strange things occurring in the December meal contract as well. Keep in mind what I wrote the other day about those in the gold perma bull camp who are always crying up their "Flash Crash" crap as evidence of some sort of price fixing conspiracy. Also, note that they are deathly silent on what I have sarcastically countered as "Reverse Flash Crashes". Well, guess what? We got both in one evening, separated by 90 minutes! The first occurred on heavy volume of upwards near 6000 contract that dropped gold $10 in 15 minutes. The Reverse Flash Crash occurred on even HEAVIER VOLUME and completely erased the losses from the "Flash Crash" and then some. There is currently staggeringly huge volume in the December meal contract taking place at the 10:00 PM Pacific Time Zone hour. There has been more volume done than what occurred during the final 15 minutes of the pit session trade in the grains and that is one of the busiest times of the day. I have no idea what is taking place but I can say this with certainty, computers are going nuts this evening. I have said it many times before and will do so again - welcome to the new normal in our broken markets. When the exchanges voted to move to electronic trade, they opened a Pandora's box of idiocy. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Firms Plan Drastic Cuts to Stay Afloat as Bullion Sinks Posted: 06 Nov 2014 10:30 PM PST "All was quiet yesterday" ¤ Yesterday In Gold & SilverThere was no price activity worthy of the name in Far East trading on their Thursday---and not much in Comex trading either. But, having said that, the three tiny rallies that did occur---starting with the one at the Comex open---all got sold down before they could get anywhere. The high and low ticks aren't worth looking up. Gold closed on Thursday in New York at $1,14.30 spot, up $1.30 from Wednesday close. Net volume was pretty decent at 144,000 contracts. Here's the New York Spot Gold [Bid] chart on its own, so you can see the very subtle price capping that occurred during the New York trading session yesterday. It wasn't much, but it was there. Silver spent the entire Far East and early London trading session shedding 10 cents from its price. The rally that began at the 8:20 a.m. EST Comex open yesterday, got capped about 10:20 a.m.---and after that, the price traded sideways for the remainder of the day. The price traded within a 25 cent range yesterday and, like gold, the high and low aren't worth my effort to look up. Silver finished the Thursday trading session at $15.425 spot, up 11 cents on the day. Net volume was pretty chunky as well, at 40,000 contracts. Platinum and palladium both traded a few dollars higher until the Comex open---and then sold down quietly after that into the 5:15 p.m. EST close of electronic trading Platinum was closed down another 12 dollars---and palladium finished lower by 8 dollars. Here are the charts. The dollar index closed late on Wednesday afternoon in New York at 87.47. From there it traded flat until about 11 a.m. Hong Kong time on their Thursday morning---and then it fell down to 87.19 within an hour or so. It didn't do much until the 8:20 a.m. EST Comex open---and then it blasted up to around 87.90 within minutes. It rallied a bit more after than---and closed the Thursday session at 88.07---up another 60 basis points, at another new record high for this move. Here's the 6-month U.S. dollar index chart so you can get the longer-term view. I don't know if you'll agree or not, but it's my opinion that this rally is getting a little long in the tooth. The gold stocks gapped up about 2 percent at the open in New York yesterday---and hit their highs [up 6 percent at 3:30 p.m.---and in the following forty-minutes the stocks gave up a third of their gains as the HUI finished up only 3.90%. It was exactly the same chart pattern in the silver equities. At their highs, they were up more than 7 percent until a thoughtful soul sold them down in the last forty-five minutes of trading, just like the gold stocks. Nick Laird's Intraday Silver Sentiment Index closed up 4.82%. I received an e-mail from reader Johan Kuster yesterday---and he pointed out the following: "When I look at the chart of GDXJ for the last 5 days, I noticed that there is high volume trading at the end of the day and EXACTLY at 3:59 the volume rises to the extreme. Today GDXJ was pushed down close to 3% in 1 minute thanks to somebody selling the stock. This looks like a criminal activity to me. What idiot would sell that amount of shares in 1 minute?" It could be 'da boyz' or day traders. But whoever they were, they weren't selling for maximum profits. Nothing would surprise me, dear reader---and by now this sort of activity shouldn't surprise anyone. It looked like the HUI and Silver 7 index suffered from a similar disease yesterday---and it seems to be cropping up more and more. Here's the GDXJ chart from yesterday so you can see what he's referring to. The CME Daily Delivery Report showed that only 1 lonely gold contract was posted for delivery within the Comex-approved depositories on Monday. The CME Preliminary Report for the Thursday trading session showed that November open interest in gold increased by 5 contracts to 61 contracts---and November o.i. in silver is now at 102 contracts, down 33 contracts from yesterday because of delivery that was posted yesterday. Not surprisingly, there was another withdrawal from GLD. This time it was 96,113 troy ounces. And as of 9:52 p.m. EST yesterday evening, there were no reported withdrawals from SLV. Since yesterday was Thursday, Joshua Gibbons, the "Guru of the SLV Bar List," updated his website with the in/out movements over at iShares.com for the week ending at the close of business on Wednesday---and here is what he had to report. "Analysis of the 05 November 2014 bar list---and comparison to the previous week's list: 1,952,482.9 troy ounces were added. No bars were removed or had a serial number change." "The bars added were from Kazakhmys (0.5M oz), Shui Kou Shan (0.4M oz), Yunnan Copper (0.2M oz), and 8 others." "The overallocated cannot be calculated, as the monthly withdrawal is factored in the bar list, but was not factored in to the daily iShares reports. Missing from the bar list is the 2,073,283.6 withdrawal from Tuesday (which includes the approximately 150,000 troy ounce monthly expense withdrawal)." The link to Joshua's website is here. There was another sales report from the U.S. Mint yesterday. They sold 6,500 troy ounces of gold eagles---and 1,500 one-ounce 24K gold buffaloes. They didn't report selling any silver eagles, of course---and it remains to be seen if they produce any more this year, as the time to retool for the 2015 silver eagles is coming up hard. Just as an aside here, I've heard reports from readers that the premiums on silver eagles have already gone up at their local bullion stores in the U.S.---and our supplier confirmed that, as of yesterday, one U.S. bullion producer has already raised prices across the board for their entire product line. It was another busy day for in/out activity at the Comex-approved depositories on Wednesday. In gold, 47,104 troy ounces were reported received---and 50,244 troy ounces were shipped out. The 'in' activity was at Canada's Scotiabank---and the 'out' activity was at HSBC USA. The link to the action is here. In silver, nothing was reported received, but a very decent 937,957 troy ounces were shipped off to parts unknown---and the link to that activity is here. China officially released their September gold import data via Hong Kong through regular channels on their Friday morning---and that enabled Nick Laird to update his charts. I, along with other commentators, had given up using Hong Kong imports as a proxy for China's gold consumption. That still may be the case, but here's the chart anyway. It will be interesting to see how much gold they import through Hong Kong in October. I have a lot of stories today, and a very decent number of them fall into the must read category---and I hope you have the time for them. Of course---and as is always the case---the final edit is yours. ¤ Critical ReadsLawsuit: Chicago Futures Market Creates "Guaranteed Winners and Guaranteed Losers"Remember the Senate hearing on June 18 when Senator Elizabeth Warren talked about the high frequency trading firm, Virtu, reporting in its IPO prospectus that it had been trading for 1,238 days and made money on 1,237 of those days. Last week three futures traders told a Federal court in Chicago that it’s not just the high frequency trading firms that are reaping a windfall but the exchanges who are engaged in a conspiracy with them to create “guaranteed winners and guaranteed losers.” The original lawsuit was filed on April 11 against the CME Group and four of its officials in the U.S. District Court for the Northern District of Illinois. The CME Group owns the Chicago Mercantile Exchange (CME), the largest futures exchange in the world. Terrence (Terry) Duffy, the Executive Chairman and President of the CME Group, a man who has testified before Congress that his exchanges have nothing to do with the charges of rigged markets that are swirling about, is a named defendant in the suit. Last week lawyers for the plaintiff traders filed a Memorandum of Law to ward off efforts by CME Group’s attorneys to have the case dismissed for lack of specificity. Citing a case known as U.S. v. Snow, the plaintiffs respond that “conspiracy by its very nature is a secretive operation, and it is a rare case where all aspects of a conspiracy can be laid bare in court with … precision.”) Notwithstanding that, many of the charges laid before this court have been quite detailed and named names, such as the following: This very interesting article, which is certainly worth reading, appeared on the wallstreetonparade.com Internet site on Thursday sometime---and I thank David Caron for sharing it with us. Ron Paul Says: Watch the PetrodollarThe chaos that one day will ensue from our 35-year experiment with worldwide fiat money will require a return to money of real value. We will know that day is approaching when oil-producing countries demand gold, or its equivalent, for their oil rather than dollars or euros. The sooner the better.—Ron Paul Dr. Paul is referring to the petrodollar system, one of the main pillars that’s been holding up the US dollar’s status as the world’s premier reserve currency since the breakdown of Bretton Woods. Want to know when the fiat U.S. dollar will collapse? Watch the petrodollar system and the factors affecting it. This is critically important, because once the dollar loses its coveted reserve status, the consequences will be dire for Americans. At that moment, I believe Washington will become sufficiently desperate to enforce the radical measures that governments throughout world history have always implemented when their currencies were threatened—overt capital controls, wealth confiscation, people controls, price and wage controls, pension nationalizations, etc. This commentary by Nick Giambruno, the Senior Editor over at the InternationalMan.com Internet site, was posted over at Casey Research yesterday---and it, too, is definitely worth your time. I thank reader M.A. for pointing it out. F. William Engdahl: The U.S. Shale Oil Bubble is Ready to BurstBy now even The New York Times is openly talking about the secret Obama Administration strategy of trying to bankrupt Russia by using its oil-bloated Bedouin bosom buddy, Saudi Arabia, to collapse the world price of oil. However, it’s beginning to look like the neo-conservative Russia-haters and Cold war wanna-be hawks around Barack Obama may have just shot themselves in their oily foot. As I referred to it in an earlier article, their oil price strategy is basically stupid. Stupid, as all consequences have not been taken into account. Take now the impact on U.S. oil production as prices plummet. The collapse in U.S. oil prices since September may very soon collapse the U.S. shale oil bubble and tear away the illusion that the United States will surpass Saudi Arabia and Russia as the world’s largest oil producer. That illusion, fostered by faked resource estimates issued by the U.S. Department of Energy, has been a lynchpin of Obama geopolitical strategy. Now the financial Ponzi scheme behind the increase of U.S. domestic oil output the past several years is about to evaporate in a cloud of fictitious smoke. The basic economics of shale oil production are being ravaged by the 23% oil price drop since John Kerry and Saudi King Abdullah had their secret meeting near the Red Sea in early September to agree on the Saudi oil price war against Russia. This essay, which certainly falls into the absolute must read category, showed up on the russia-insider.com Internet site shortly before noon Moscow time on Thursday, which was shortly before 4 a.m. EST. My thanks go out to South African reader B.V. for bringing it to our attention. Job Cuts Surge 68%, Most in 3 Years; Worst October Since 2009Maybe this explains the election results? Challenger reports U.S. companies laid off over 51,000 people in October, the most since May (and 2nd most since Feb 2013). This is a 68% surge MoM (and 11.9% rise YoY) - the biggest monthly rise since September 2011. Retail, Computer, and the Pharmaceutical industries saw the biggest layoffs. Hiring also collapsed from the record 567,705 exuberance in September to just 147,935 in October. This was the worst October for layoffs since 2009. This tiny story, with two excellent charts, appeared on the Zero Hedge website at 8:12 a.m. EST yesterday morning---and it's the second contribution of the day from reader M.A. IPO Scandal in Denmark Is 'Poison' for Stock Market, NASDAQ Says“Surprises like this are poison to the stock market, and this is one of the big surprises,” Carsten Borring, head of listings and capital markets at Nasdaq OMX in Copenhagen, said in a phone interview. “This really isn’t good.” OW Bunker, which provides fuel to the marine industry, said on Wednesday shortly before midnight that it had lost $275 million through a combination of fraud committed by senior executives at its Singapore office and poor risk management. Its shares have been suspended since Nov. 5 and the company says its equity has been wiped out. Just eight months ago, investors drove OW Bunker’s shares up 21 percent in their first day of trading, following an initial public offering that valued it at almost $1 billion. “There’s no doubt this case is damaging to investors and the stock market,” Borring said. “The stock market depends deeply on the relationship of trust between investors and companies.” Wow! This Bloomberg story, filed from Copenhagen, showed up on their website at 4 p.m. MST yesterday afternoon---and I thank Harry Grant for sending it our way. Clashes, water cannon as 100,000+ march in Brussels against austerityViolent clashes broke out in Belgium as more than 100,000 protesters marched in Brussels against the government’s austerity measures. Police deployed water cannon as dockworkers, metalworkers and students took to the streets. The violence flared up at the end of an otherwise peaceful protest, with tear gas deployed as some radical demonstrators hurled objects at riot police and launched attacks with the barriers against the officials. Some set off colored smoke flares. At least 14 people were taken to hospital following the violence, according to national daily HLN.be. The Belgian government which assumed power just a month ago has caused unrest with promises to raise the retirement age, cancel a wage rise in line with inflation and cut health and social security benefits - moves that undermine the country's welfare state. This article put in an appearance on the Russia Today website at 2:48 p.m. Moscow time yesterday [EST+8]---and I thank Roy Stephens for finding it for us. Conditions for Mistral Delivery to Russia Not Met: French PMThe conditions for delivery of French-built Mistral-class helicopter carriers to Russia have not been met, AFP reported Thursday citing French Prime Minister Manuel Valls. "You know the French stand [on Mistral issue]. Today the conditions have not been met for their [warships] delivery to Russia," Valls said at a news conference in Belgrade. On October 30, media reported that French Finance Minister Michel Sapin also said the conditions have not been met for the handover of the Mistral to Russia. Later that day, an official from the Russian Federal Service for Military-Technical Cooperation said Moscow had not received any information from Paris in regard to why the helicopter carrier contract could not be fulfilled. This RIA Novosti news item. filed from Paris, showed up on their Internet site at 9:07 p.m. Moscow time on Thursday evening---and I thank reader B.V. for his second story in today's column. Mario Draghi's efforts to save EMU have hit the Berlin WallMario Draghi has finally overplayed his hand. He tried to bounce the European Central Bank into €1 trillion of stimulus without the acquiescence of Europe's creditor bloc or the political assent of Germany. The counter-attack is in full swing. The Frankfurter Allgemeine talks of a "palace coup", the German boulevard press of a "Putsch". I write before knowing the outcome of the ECB's pre-meeting dinner on W | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Large Comex Gold Withdrawal As Paper Price Manipulated Lower Posted: 06 Nov 2014 09:00 PM PST JP Morgan only has 577,937 oz of gold remaining in its vaults. A few weeks ago, JP Morgan experienced a ONE DAY removal of 321,500 oz from its warehouse stocks. This is not a trend JP Morgan can afford to continue. Furthermore, total Comex gold inventories fell nearly 2 million oz since its […] The post Large Comex Gold Withdrawal As Paper Price Manipulated Lower appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

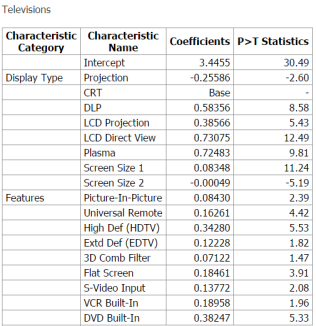

| Posted: 06 Nov 2014 08:25 PM PST I did an update on Precious Metals only a week ago and since then we've had a lot more of selling. While I remain fully hedged in Silver and also continue to hold my naked short positions in Gold, I believe that any further downside from the current levels will eventually see us reach extremely oversold conditions from which a major rally should occur. In coming weeks or months, depending on how long the selling exhaustion lasts, we could be approaching an all important buying opportunity. Please understand that during the last leg of the bear market (I believe that is where we are), liquidation can last for awhile. I happen to think that majority of the sector will be under pressure until Gold re-tests its phycological level of $1000 per ounce (give or take some dollars). However, this isn't necessary a prediction as I acknowledge that a low could now come at anytime as we are becoming very oversold. More and more indicators are flashing buy. Let us go through some of these extreme indicators: Chart 1: Gold miners are oversold & have fallen 41% the last 3 months Source: Short Side of Long

Prices of various assets within the Precious Metal sector have gone down a lot over the last rolling quarter or 3 month period. Consider the chart above, which shows an extremely oversold conditions in Gold Mining shares, which are currently down 41% over the last 90 days. This is an astoundingly large drawdown, only second to the Global Financial Crisis of 2008. In the same period Gold is down almost 13%, Silver is down almost 22%, Platinum is down over 17%, Silver Miners are also down over 41%, Gold Mining Juniors are down a whooping 46% and Silver Mining Juniors are down close to 45%. The carnage isn't over a year or two, it is all in just three months. As already stated, these are some insane losses in a very short period of time, especially considering the bear market is over 3 years old!

Chart 2: Silver price is more then 20% below its 200 day moving average Source: Short Side of Long

With prices so oversold, it shouldn't be a surprise that indicators such as the one in Chart 2 are once again entering extreme reading. Sure, they've been even more extreme at times, but when an asset is more then 20% below its 20 day moving average (like Silver is today) you should pay attention. Who knows… it might go down to 30% by next week, but my point here is that a rebound and a mean reversion is in the cards very soon indeed (obviously let the selling run its course first). Also consider the fact that Gold is trading 10% below its 200 day MA, which is quite a rare event. I think it has happened only 8 or so times over the last 25 years. Gold Miners find themselves more then 32% below its long term MAs. Finally, Gold Mining Juniors are in total wash out mode, as they trade almost 40% below the 200 day MA and over 27% below its shorter term 50 day MA. This is just getting ridiculously oversold now…

Chart 3: There are now 0% of Gold Miners trading above 50 & 200 MA Source: SentimenTrader

One thing is clear here. Gold Mining shares, whether they are large caps or small caps, have been beaten down… no, I think I should say they have been smashed and bashed like Rocky during his famous fights. And this is also reflected in breath readings. There are 0% of companies within the HUI Index that are currently trading above the 50 day or 200 day moving averages. But oversold breadth readings don't stop there. A handful of days ago we saw the 88% of the components within the index make 52 week lows, one of the highest readings ever and an indication of total liquidations and free fall declines. Also of note, Bullish Percent Index is at a reading of 0%. This occurred once during the 2008 crash and a cluster of three times during the 2013. All of them led to major rebounds.

Chart 4: Hedge funds and other speculators are now heavily short Silver Source: Short Side of Long As we wait for the this weeks release of the Commitment of Traders report, we can already assume that positioning is going from bad to worse. The bottom line is, a major shake out is in progress. Hedge funds have already been heavily short Silver and that is most likely going to intensify further. At the same time, sentiment surveys are showing an extremely negative picture, with hardly anyone believing Silver will rise from here. Sentiment readings aren't any better in Gold and Platinum, where prices have been dropping like a rock. Finally, speaking of prices… Gold is trading more then 3 standard deviations away from its 50 day mean yesterday. This is a very rare event, especially when Bollinger Bands are wide. It should be considered an extremely oversold condition, and judging by history it is from where powerful rebounds and mean reversions tend to occur.

Chart 5: Gold price is trading 3 standard deviations away from its mean Source: Bar Chart

Is this the bottom for Precious Metals like Gold and Silver? I do not think so, but I will say that we are getting quite close now. In other words, it should be matter of weeks or months instead of a matter of years. One thing is for certain, this is not a time to be entering new short positions on these beaten down assets. Precious Metals investors have watched as a bear market slaughtered just about all assets within the sector. Even Gold is now down 40% from its all time highs. Regular readers of the blog will know that I thought that buying Gold at $1185 in 2013 was a very good entry. I still hold that view today! Now the prices are sinking even lower towards $1100 per ounce, so buying Gold has gone from a very good entry towards a great entry. If it gets down to $1000 per ounce, it will be a magnificent entry. The lower it goes over the coming weeks and months, the better your return will be in coming years! The post Precious Metals are Oversold appeared first on The Daily Gold. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| How investors can still make money in gold stocks with metal prices on the floor Posted: 06 Nov 2014 07:40 PM PST Gold has fallen below the price of production at many gold producers turning their cash flow negative. However, this is not true for every gold producer. Are these now the stocks to be picking up at a discount for the longer term, assuming prices will be on the way back up soon as currency wars beat up other asset prices. Bloomberg's Ryan Chilcote reports on dropping gold prices and what that means for production. He speaks with Jonathan Ferro on Bloomberg Television's ‘On The Move’… | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dollar strength could raise European stocks next Posted: 06 Nov 2014 07:34 PM PST ECB president Mario Draghi is all talk and no action. But could one side-effect of the rising US dollar be higher prices for European stocks as this boosts the competitive advantage of the big eurozone exporters? OppenheimerFunds’ Jerry Webman and AllianceBernstein’s Vadim Zlotnikov discuss the outlook for the US dollar with Bloomberg’s Trish Regan and Matt Miller on ‘Street Smart’… | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||