Gold World News Flash |

- QE Ends, Silver Price & Quotes of History

- “The Renminbi Hub”: Chinese Banks Acquire Stakes in US and Canadian Banks. Is There a Hidden Agenda?

- Bill Murphy on Gold and Silver — “This Cannot Last”

- Save Your Swiss Gold “ Peter Schiff™s Message to Switzerland

- Worried About Gold / Silver Smash - This Is Truly Terrifying

- “A Complex System About to Collapse” — Insider Jim Rickards’ Shares Frightening Facts In This Ad For ‘Money Morning’

- Marching In The Wrong Direction

- Swiss Gold Initiative establishes new mechanism for donations

- Koos Jansen: Europe and China are contemplating a new financial system

- Politicians and 'financial platforms' are pushing oil prices down, Putin says

- Ritual Incantation - The Economic Gibberish Of The Keynesian Apparatchiks

- Chinese gold buying means price floor to Standard Chartered

- If the London gold fix may have harmed you, contact Berger & Montague soon

- Lassonde says he doesn't suspect BIS in gold market manipulation

- Silver and Gold Prices are Severely Oversold

- Ron Paul: Watch Out When People Start To Distrust Our Money

- Gold Daily and Silver Weekly Charts - Pity the Swiss

- Chinese Wealth Management Products Will Cause the Next Financial Crisis

- This Will Trigger Collapse & Shockwaves In Global Markets

- Gold market rigging drives mines out of business -- but without complaint

- U.S. Mint Sells Out of Silver Eagle Coins as Buying Surges

- Panic Gold & Silver Selling Surprises Largest Dealer In U.S.

- A Signal of Coming Collapse

- Miners facing 'bloodbath' if gold sinks to $1,000

- Greenspan: "You Should Thank Central Banks"

- Early or Wrong? Still Stopped Out of Gold Miner Stocks

- Gold Down, Biotech Stocks Up

- No Commerce without Government Sanction? “AirBnb” Law Sets Ugly Precedent

- No Commerce Without Government Sanction? “AirBnb” Law Sets Ugly Precedent

- The Swiss Gold Initiative and Why it May Affect Gold Prices

- Crude Oil, Gold, Are Commodity Price at a Major Turning Point?

- Gold, Economic Theory and Reality: A Conversation with Alan Greenspan

- Gold and Oil. Into the Abyss?

- Rick Rule: No Capitulation In Gold Stocks Yet, Only A Nasty Sell-off

| QE Ends, Silver Price & Quotes of History Posted: 07 Nov 2014 01:00 AM PST from VisionVictory: Wealth & Purpose Show 023 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| “The Renminbi Hub”: Chinese Banks Acquire Stakes in US and Canadian Banks. Is There a Hidden Agenda? Posted: 07 Nov 2014 12:00 AM PST by Bill Holter, Global Research:

Why would this be happening? Why would it be happening now? First, why is China setting up shop all over the world? This is an easy one, for business, for trade, for relations. China knows exactly where the U.S. and the dollar stand, they also know fairly well where and how the U.S. and her dollar will fall. China is merely preparing the groundwork to trade with Western entities in either local currency or the yuan. In the case of Canada, China sees a very large energy source along with the mining of many necessary resources they will need in the future. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bill Murphy on Gold and Silver — “This Cannot Last” Posted: 06 Nov 2014 11:00 PM PST from DayTradeShow: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Save Your Swiss Gold “ Peter Schiff™s Message to Switzerland Posted: 06 Nov 2014 10:30 PM PST Euro Pacific Capital | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Worried About Gold / Silver Smash - This Is Truly Terrifying Posted: 06 Nov 2014 09:01 PM PST  Today King World News is featuring a piece by a man whose recently released masterpiece has been praised around the world, and also recognized as some of the most unique work in the gold market. Below is the latest exclusive KWN piece by Ronald-Peter Stoferle of Incrementum AG out of Liechtenstein. Today King World News is featuring a piece by a man whose recently released masterpiece has been praised around the world, and also recognized as some of the most unique work in the gold market. Below is the latest exclusive KWN piece by Ronald-Peter Stoferle of Incrementum AG out of Liechtenstein.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 06 Nov 2014 09:00 PM PST [Ed. Note: Despite lots of truth being shared in this video, our disclaimer: Jim Rickards Visits Keiser Report & Exposes Himself as an Establishment Shill Covering Up CIA Involvement in 9/11 Insider Trading, Calling It "IRRELEVANT."] from Money Morning: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Marching In The Wrong Direction Posted: 06 Nov 2014 07:15 PM PST Excerpted from Paul Singer's letter to investors, MARCHING IN THE WRONG DIRECTION ZIRP and QE have levitated a number of asset classes without generating sustainable, powerful economic and employment growth in the developed world. The asset price appreciation has delighted investors, and even those who are queasy and concerned about the unsoundness of the post-crisis policy landscape have been coaxed into believing that the low volatility and high asset prices actually have predictive power in suggesting positive economic and financial outcomes for the global economy and financial system. After all, the thinking goes, if ZIRP and QE were going to cause serious generalized consumer price inflation, then it certainly would have appeared by now. The very "discrediting" of the "serious inflation" crowd gives most investors comfort that policymakers are correct and the skeptics are just dyspeptics or partisans. We cannot possibly make the following statement any more clearly or strongly: Policymakers and pundits, with rare and courageous exceptions, are marching (and looking) in precisely the wrong direction. After the 2008 financial crisis, the developed world has barely experienced positive growth despite six years of zero-percent short-term interest rates and multiple bouts of money-printing that have taken a variety of forms and that have been announced with a plethora of rhetoric and obfuscation. At the start of the crisis, there was also a massive amount of government spending, but it was dominated by political payback and an attempt to maintain the kinds of jobs that had made sense only during the distortionary boom. Of course, the government spending had a supportive effect on the economy (as all spending programs do), but as designed it did not and could not create lasting and catalytic effects on growth. Over the entire post-crisis period, there have been effectively no significant structural improvements in the basic ability of the developed world to grow faster. We have described pro-growth policies at length and in depth, but sadly they are nowhere to be found. Thus six years of QE and ZIRP and a few rounds of make-work and benefit payments have failed. At present, only the U.S. can claim something that looks like decent growth, but that is only in comparison with its "peers." We have argued above that the appearance of growth is fake and delusionary. But globally, it should be beyond debate that the policy mix has failed. Many (if not most) politicians and "experts" refuse to acknowledge this, and en masse seem to believe that the failure of inflation to reach its "targets" is the problem – as if it is inflation, and not growth, that societies need. The mantra they repeat incessantly is that money-printing, ZIRP and stimulus spending have succeeded, and that things would be much worse without those policies, and that the real problem is that governments have not done enough radical monetary easing and deficit spending! Historically, as monetary debasement gets underway, its superficially-positive effects erode over time. Investors and citizens learn the game and front-run the debasement, bidding up asset prices. The distortions caused by debasement erode the citizenry's motivation to engage in real sustainable business and consuming activity. The difference between winners and losers gets exacerbated, as speculators increasingly take the prize at the expense of savers and salaried people. Monetary manipulations lead to bad investment decisions, which in turn causes hidden shortfalls in the standard of living, which in turn engenders public resentment, especially because the reported statistics on jobs and income paint too rosy a picture. At present, the situation in developed countries can be characterized as follows: Asset inflation is roaring, but it is sectoral and skewed. Consumer inflation is understated, and thus growth is overstated. Employment data is misleading. This combination of factors means that ordinary citizens are not doing well, but the owners of high-end everything are doing just fine, with few concerns for the middle-class people who know things are not "all right," but cannot put their finger on why. At or near this stage, either because of citizen resentment and distrust or (in the case of Europe) a pronounced weakening of economic activity despite all their efforts and experimentation, monetary authorities may decide that the real problem is that they just haven't done enough. Historically, this is the point at which the risk rises that central bankers will take monetary actions that destroy their societies. Once the "tiger by the tail" phase of monetary debasement has gotten started, there has never been a good exit. Past that point of no return, the collapse of money and/or asset prices becomes the inevitable denouement, with the only questions being the timing and the severity of the collapse. Our views are formed by an examination of historical episodes of societal monetary collapse. The script is not "baked," but the common elements are clear and present. Given that the authorities are so far behind the curve in their understanding of the modern financial system, we have little hope that they can revert in time to the correct mix of policies, preserve the fiat money regime and also get the developed world growing again while whipping into shape the long-term entitlement obligations which are obviously unpayable in their present form. We wish we could report that a counter-movement is afoot, with some cadre of truth-tellers who are making the case for marching in a different direction, but sadly we cannot. The argument for "doing more" or "doing more of the same" is universal. The "risk" case is only being made circumspectly by people who are being ridiculed as clueless Cassandras. Cassandra was proven right, of course, but we have no need or desire to be right about these views. Societal stability is a good thing for all, including skeptics and pessimists. Societal breakdown and uncontrollable inflation or financial crises are massively destructive, and typically accompanied by very bad policies. No disciplined investment approach can "work" in such an environment, in which preserving the real value of capital becomes difficult if not impossible. In extremis, political governance drifts toward totalitarianism, scapegoating and violence. Let us hope that leaders emerge who understand these realities and have the courage and political skills to reorient their societies toward growth, stability and soundness. Our belief is that the global economy and financial system are in a kind of artificial stupor in which nobody (including ourselves) has a good picture of what the next environment will look like. The difference between "them" and "us" is that they mostly think that policymakers will muddle through, but we assume that a very surprising and scary environment lies in wait. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Swiss Gold Initiative establishes new mechanism for donations Posted: 06 Nov 2014 06:53 PM PST 9:50p ET Thursday, November 6, 2014 Dear Friend of GATA and Gold: Interviewed by King World News, Swiss gold fund operator Egon von Greyerz, one of the managers of the Swiss Gold Initiative, reports that the initiative has established a mechanism for accepting contributions through Swiss Post, after the Pay Pal payments service refused to process donations for the initiative, apparently responding to government pressure. An excerpt from von Greyerz's interview is posted at the KWN blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/11/6_Th... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sinclair's Next Market Seminar Is Nov. 15 in San Francisco Mining entrepreneur and gold advocate Jim Sinclair will hold his next market seminar from 10 a.m. to 3 p.m. on Saturday, November 15, at the Holiday Inn at San Francisco International Airport in South San Francisco, California. Admission will be $100. For more information and to register, please visit: http://www.jsmineset.com/2014/10/10/san-francisco-qa-session-announced/ Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Koos Jansen: Europe and China are contemplating a new financial system Posted: 06 Nov 2014 06:46 PM PST 9:45p ET Thursday, November 6, 2014 Dear Friend of GATA and Gold: Bullion Star's market analyst and GATA consultant Koos Jansen today itemizes some European and Chinese government statements signifying that a new world financial system is in the works. Jansen's commentary is headlined "Beijing Forum: New Global Financial Order Is Essential" and it's posted at Bullion Star's Internet site here: https://www.bullionstar.com/blog/koos-jansen/beijing-financial-forum-new... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal in 2014, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Politicians and 'financial platforms' are pushing oil prices down, Putin says Posted: 06 Nov 2014 06:41 PM PST Gold too, Mister President? * * * Vladimir Putin: Oil Price Decline Has Been Engineered by Political Forces By Peter Spence Recent tumbles in the value of oil on global markets have been the creation of politicians, Vladimir Putin, president of Russia, suggested today. The Russian state has been heavily exposed to slumping oil values, widely viewed to be the result of a supply glut. "The obvious reason for the decline in global oil prices is the slowdown in the rate of [global] economic growth, which means consumption is being reduced in a whole range of countries," Mr Putin said. In addition to this, "a political component is always present in oil prices. Furthermore, at some moments of crisis it starts to feel like it is the politics that prevails in the pricing of energy resources," he added. Mr Putin also referred to a "distinct direct link" between physical oil markets and "the financial platforms where the trade is conducted," in explaining part of oil price changes. ... ... For the remainder of the report: http://www.telegraph.co.uk/finance/newsbysector/energy/oilandgas/1121506... ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit USAGold.com. USAGold: Great prices, quick delivery -- all the time. Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

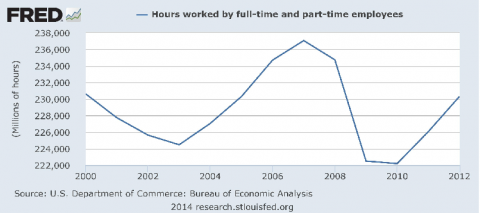

| Ritual Incantation - The Economic Gibberish Of The Keynesian Apparatchiks Posted: 06 Nov 2014 06:23 PM PST Submitted by David Stockman via Contra Corner blog, If you want an illustration of the utter intellectual bankruptcy of our Keynesian policy overlords just review the attached Wall Street Journal piece on yet another downgrade by the EC of its official economic growth forecast. What’s illuminating is not that the savants of Brussels were wrong by a country-mile yet again, but that they persist in a mechanistic numbers game that resembles nothing so much as ritual incantation. Yep, the Keynesian priesthood is operating from sacred texts and magic numbers. One of these revelations says that 2% inflation was decreed by the great god of GDP and that any shortfall will precipitate his wrathful extractions from growth and jobs. But there is not a shed of empirical evidence for 2% versus 1% or 3% annual change in consumer inflation—–even if it were honestly measured. Its just revealed word as transmitted by the Keynesian priesthood. Another sacred tenent avers that in handing down the laws of proper economic life, the Keynesian creator ordained that governments everywhere and always must strive to bring GDP growth to its full employment “potential” rate. No exceptions. World without end. While the texts are not clear on the precise numeric value of this divinely ordained rate of potential GDP growth, today’s congregants claim that it’s about 3%, reflecting the historic trend growth of the labor supply plus productivity gains. In fact, however, we have achieved only about half of that—about 1.8% per annum—-in the US during the last 14 years, and even a lesser fraction in Europe. Accordingly, this imaginary trend line of “potential GDP” is now far above actual output levels. This yawning gap between the real economy and its revealed potential, in turn, enables the Keynesian priesthood to demand an endless crusade by the fiscal and central banking agencies of the state to close it. This essentially means that the state’s economic apparatus is now all about stimulus, all of the time. In fact, the state’s central banking branch has gotten so deep into ritualized Keynesian governance that it’s essentially attempting to micro-manage vast accumulations of GDP—-about $17 trillion each in the US and Europe—-on a monthly basis.That’s entirely what the meeting statements and post-meeting press conferences are all about. Yet this is absurd. The information flow in a $17 trillion economy is far too vast to be digested and assessed by the 12 mortal members of the FOMC, and their policy control instrument—-the bludgeon of interest rate manipulations—- could not possibly shape its short-run course in any event. That’s especially true since the macro-economy is not a closed system, but one open to every manner of complicating and countervailing influence from trade, capital flows and financial impulses in a $80 trillion global economy. Still, the Keynesian policy apparatchiks have not even an inkling that they are attempting the impossible or that their patter about objectives, forecasts and policy actions have gotten downright moronic. And here’s where the EC’s latest retreat on its official forecast is so ludicrously illustrative. Given the massive complexity of the global economy—plus the tidal forces being unleashed by Japan’s yen destruction campaign, the cooling of China’s monumental construction binge, the dead-in-the-water bankruptcy of most of Europe and the massive shift of income and wealth to the top 1% in America— no one in their right mind should attempt to predict GDP growth to the exact decimal point three years into the future or even one year for that matter. There are imponderables, uncertainties and aberrations everywhere, and none of them are in the Keynesians’ primitive DSGE models. Yet like the Keynesian apparatus everywhere in the modern world, the EC bureaucrats are pleased to try, and feel compelled to make hairline adjustments twice a year—-mainly to cover their chronic back-pedaling on the near-term picture which, in any event, reveals itself soon enough. Thus, not too long ago the EC projected that real output gains averaged across 18 hugely divergent eurozone economies would average 2.5% during 2015. By the time of this year’s spring forecast revision, the projection was down to 1.7%; and now its fall update downgrades it further to 1.1%. Yes, and while they were splitting economic hairs, the EC prognosticators decided to embrace nine months of “disappointing” reality that has already occurred and lower the 2014 forecast to 0.8% from the spring level of 1.2%. While it was at it, the EC also resurrected its 1.7% GDP forecast—-which was projected for 2014 awhile back before it was lowered in semi-annual nicks to its current 0.8% level. It seems that this magical 1.7% growth number for the third year forward is never really abandoned; its just rolled forward year after year. Indeed, it had earlier been shuffled forward to 2015, but since that now seems out of reach, the Brussels prognosticators had no trouble seeing it coming clearly into view for 2016. This paint-by-the-numbers ritual is ridiculous because it makes not a wit of difference whether the outlook for GDP three years into the future is 0.8%, 1.2%, 1.7% or any other number in that range. Its just noise and foolishness. Why then do they persist in this pointless forecast ritual? Well, because it is written in the sacred texts that policy action to close the GDP gap is imperative, and that the size of the gap and the requisite policy interventions depend upon a macro forecast. The latter is, in effect, their policy intervention map. However, now that the output gap has become massive and the central bankers believe that there is vast “slack” in the labor force—- which is partly reflected in Europe’s official unemployment rates and largely obfuscated by the BLS’ dummied up U-3 numbers here—the Keynesian project faces a rude reality. Namely, that it is virtually impossible to believe that the “gap” and the “slack” are due to cyclical factors. Two simple time series prove the case. First, there has been virtually no increase in non-farm labor hours actually consumed by the US economy over the past 15 years. That’s not cyclical—–its a disastrous fundamental condition or trend.

Secondly, real median household incomes have been trending down for the past 15 years, as well. That too is not about temporary “cyclical” slack; it is a measure of a failing, decaying national economy.

So today’s perpetual stimulus policy is utterly unsuited to the real problems at hand because these deep challenges dwell on the supply side of the economy. The latter has become freighted down with debt, taxes, regulatory barriers, crony capitalist inefficiencies and welfare state inducements to dependency. They have nothing to do with “aggregate demand”, and couldn’t be solved with even more household and business borrowing on top of the mountains of debt already on their balance sheets. The Fed’s lunatic ZIRP policy has already proven that it can’t actually stimulate credit fueled spending for consumer and capital goods owing to the roadblock of “peak debt”. Yet the Keynesian apparatchiks continue to demand counter-cyclical “stimulus” because they are intoxicated in ritual incantation based on an earlier, more primitive Keynesian catechism. Those original texts called for episodic action at the bottom of the business cycle to prime the pump and overcome recessions. Stimulus was the exceptional condition, not the norm; it embodied the notion that after the state’s kick start——market capitalism could largely take care of itself. The corollary was that fiscal and monetary policy would rapidly normalize once the recovery commenced. Indeed, the “business Keynesians” of the early 1960’s promised that there would be an off-setting fiscal surplus during the top half of the cycle. Therefore “counter-cyclical deficits” were not a form of monetization of the state’s debts because the borrowing involved was held to be only temporary (i.e. would be repaid from recovery period surpluses). And central bankers like the great William McChesney Martin, who was no Keynesian at all, actually did endeavor to “lean against the wind” during the up-cycle and even take away the punch bowel just when the party got started. But somewhere during the last two decades the Keynesian stimulus project migrated from the fiscal authorities to the central banks. This had far-reaching consequences because it shifted the locus of policy making from the unruly, paralysis prone machinery of legislative budgets and taxes to unelected bureaucrats and academics endowed with virtually plenary powers and 13 year terms. What is worse, it put them in the full-time business of fiddling with the money and capital markets in the false belief that they could control the evolution of the macro-economy through its financial nerve center and deftly guide GDP back to the ordained path of full employment. Consequently, all hell has broken loss. These interventions have not levitated the real economy, nor have they closed the imaginary output gap. Instead, massive central bank stimulus has destroyed honest capital markets and enabled a giant casino of speculators to feast on the free money and market props, puts and bailouts offered by the central banks. Yet the true danger is not simply that the Keynesians are caught in a time warp. That is, that the fiscal Keynesianism taught by James Tobin in the 1960’s was OK because it was counter-cyclical help from the state to the private economy, but the 24/7 central banker Keynesianism practiced by his PhD student, Janet Yellen, has gone too far and is now obsolete. No, Keynesianism was always wrong. It is predicated on the alleged inherent cyclical instability of market capitalism, and a purported tendency to chronically tumble into recession, depression and an economic black hole absent the ministrations of the state. But the evidence for that is the founding event of the Keynesian gospel—–the Great Depression of the 1930s. Yet tragic as it was for mankind everywhere, the disaster of the 1930’s was not due to the inherent instabilities of capitalism or an unregulated free market. Instead, the Great Depression was born in the financial mayhem of World War I, which destroyed the monetary system and engulfed the world in debt and inflation; and in the 1920s manipulations of the Fed, Bank of England and other central banks as they attempted to restore the pre-1914 status quo ante without the fiscal and financial discipline that was part and parcel of the prosperity and stability that flowed from the liberal international order based on the gold standard and free trade in goods, capital and labor. All the milder business cycles since then have been generated by the state. These include the excesses of war finance and an overheated economy, as in the case the Korean and Vietnam wars; and the peacetime spells of excessive credit creation enabled by central banks, which had to then correct their own excesses through monetary stringency and recession. In open economies and a global trading system the only thing which counts is prices, not aggregates. America’s problem is that its production costs and labor prices are too high and its subsidies for inefficient production and non-production are too great. That is the reason why there is so much labor “slack” and why the growth of output and wealth has been so tepid since the late 1990s when the “china price” became the driving force in the global economy. Stated differently, the Keynesian notions of “potential GDP” and “aggregate demand” have no basis in the real world. They are revealed doctrine. They are the religion of the state’s economic policy apparatus. Its bad enough that this destructive economic religion leads to the farcical forecasting games evident in the EC’s chronic updates and slow-walks of the GDP numbers down. The evil, however, is that the Keynesian apparatchiks will not desist in their destructive money printing and borrowing until they have suffocated free market capitalism entirely, and have monetized so much public debt that the financial system simply implodes. * * * By Gabriele Steinhauser at The Wall Street Journal

* * * | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Chinese gold buying means price floor to Standard Chartered Posted: 06 Nov 2014 06:23 PM PST By Debarati Roy and Nicholas Larkin The cheapest gold in four years is proving irresistible for shoppers in China and India, where rebounding demand may signal an end to the longest price slump in more than a decade. Purchases in Asia will help support prices that are headed for the first two-year decline since 2000, Standard Chartered Plc said. While surging equities and tame inflation have eroded gold's appeal as a hedge, sending bullion tumbling to $1,137.94 an ounce this week, prices are nearing the lows forecast by banks from Citigroup Inc. to Goldman Sachs Group Inc. China supplanted India as the world's largest buyer last year, when the metal plunged 28 percent. Jewelry and bullion are viewed in both countries as a store of value and are popular as gifts. China's gold imports from Hong Kong in September were the highest in five months. Indian jewelers are forecasting a surge in fourth-quarter sales. "There is a floor around $1,100 set by Chinese retail demand," Paul Horsnell, head of commodities research at Standard Chartered in London, said by e-mail on Nov. 5. "Physical demand indicators out of China and India are firming." ... ... For the remainder of the report: http://www.bloomberg.com/news/2014-11-07/china-gold-buying-means-price-f... ADVERTISEMENT Anglo Far-East is a global market leader and innovator that for more than two decades has provided private purchase, vaulting, security logistics, transport, and liquidation of allocated gold and silver bullion outside of the banking system. AFE clients include individuals, family offices, and institutions like banks and regulated funds. Anglo Far-East: Think Outside the Bank Here's what one of our generationally wealthy clients has to say about AFE: http://www.afeallocatedcustody.com/research/teleconferences/download-inf... To get started, please visit: https://secure.anglofareast.com/ Anglo Far-East: Think Outside the Bank Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| If the London gold fix may have harmed you, contact Berger & Montague soon Posted: 06 Nov 2014 05:51 PM PST 8:53p Thursday, November 6, 2014 Dear Friend of GATA and Gold: If you traded gold or gold futures or options in the last decade and feel that you were injured by the manipulation of the London gold fix, you may have some recourse. In July a judge in U.S. District Court in New York appointed Berger & Montague of Philadelphia and Quinn Emanuel Urquhart & Sullivan of New York, two major law firms, to lead an anti-trust lawsuit against the London gold-fixing banks. Berger & Montague was of counsel to GATA some years ago and a press release about the firm's appointment is posted at the law firm's Internet site here: http://www.bergermontague.com/news?t=berger--montague-to-helm-gold-fix-c... More information about the case, including the text of the lawsuit, is posted at the law firm's Internet site here: http://bergermontague.com/cases?t=in-re-commodity-exchange-inc-gold-futu... ... Dispatch continues below ... ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers. (http://www.gata.org/node/173) To invest or learn more, please visit: In March GATA invited gold traders and investors to contact Berger & Montague to learn about the firm's investigation of the London gold price fixing: http://www.gata.org/node/13731 Now that the case has become more active, GATA again encourages anyone who believes he may have been harmed by the London gold fix -- gold traders and investors, gold mining companies, and others -- to contact Berger & Montague to learn about the case. Since the court has set a major deadline in December, it will be good to make contact with Berger & Montague soon. The lawyers handling the case may be reached by e-mail at: CHRIS POWELL, Secretary/Treasurer Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Lassonde says he doesn't suspect BIS in gold market manipulation Posted: 06 Nov 2014 04:58 PM PST 8:07p ET Thursday, November 6, 2014 Dear Friend of GATA and Gold: Franco-Nevada Chairman Pierre Lassonde, former chairman of the World Gold Council, told GATA today that, contrary to GATA's interpretation of his interview yesterday with King World News about manipulation of the gold market -- http://www.gata.org/node/14670 -- he did not mean to acknowledge the possibility that the Bank for International Settlements might be among the entities doing the manipulating. In that interview Eric King of King World News said to Lassonde: "Earlier today I spoke with a former board member of Paine Webber who also worked for Goldman Sachs 25 years ago, the very highly respected William Kaye out of Hong Kong. Kaye said the following about today's smash in gold: "'This is something that you see in precious metals when there is clear evidence of manipulation. We saw 30 tons of gold sold at 2 p.m. Hong Kong time. That is a time in which no one does any real trading. What Asian trading is going to take place is already done by that time of the day. At that time of day people are simply waiting to hand things over to London in a few hours. Regardless, an awful lot of paper gold was intentionally dumped in a programmed algorithm. This was most likely done by the Bank for International Settlements. This was designed to condition the paper market by forcing the price lower. It was also designed to set the market up in London to open up at lower levels.' ... Dispatch continues below ... ADVERTISEMENT Own Allocated -- and Most Importantly -- Zurich, Switzerland, remains an extremely safe location for storing coins and bars of the monetary metals. If you do not own segregated physical coins and bars that you can visit, inspect, and take delivery of, you are vulnerable. International diversification remains vital to investors. GoldCore can accomplish this for you. Read GoldCore's "Essential Guide to Gold Storage In Switzerland" here: http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44 (0)203 086 9200 -- U.S.: +1-302-635-1160 -- International: +353 (0)1 632 5010 King continued: "He [Kaye] is saying that somebody is in there manipulating the price of gold and they are doing it at a very high level -- the BIS. I'm just wondering if you are pissed off enough to talk about this." KWN quoted Lassonde as replying: "It would not be the first time that we've seen this and it won't be the last time either. There is obviously an entity or trading house who must have a short position and they are using the paper gold market to move the price. And if it's a fragile market they are going to get their way for a while." Lassonde told GATA today: "I did not comment on the BIS but strictly on the fact that yes, someone -- institution, private group, hedge fund, we don't know -- were throwing their weight around. ... I don't believe for one second that the BIS has anything to do with this." In any case, a summary of the documentation GATA has compiled about the gold trading long conducted, largely surreptitiously, by the Bank for International Settlements is appended. CHRIS POWELL, Secretary/Treasurer * * * Documentation of the Largely Surreptitious Involvement -- William R. White, the director of the monetary and economic department of the Bank for International Settlements, told a BIS conference in Basel, Switzerland, in June 2005 that a primary purpose of international central bank cooperation is "the provision of international credits and joint efforts to influence asset prices (especially gold and foreign exchange) in circumstances where this might be thought useful": -- The BIS actually advertises to potential central bank members that its services include secret interventions in the gold market: http://www.gata.org/node/11012 http://www.gata.org/files/BISAdvertisesGoldInterventions.pdf -- According to its 2013 annual report, the BIS functions largely as a gold banking and gold market intervention service for its member central banks. On Page 110 of the report the BIS says: "The bank transacts foreign exchange and gold on behalf of its customers, thereby providing access to a large liquidity base in the context of, for example, regular rebalancing of reserve portfolios or major changes in reserve currency allocations. The foreign exchange services of the bank encompass spot transactions in major currencies and Special Drawing Rights (SDR) as well as swaps, outright forwards, options, and dual currency deposits (DCDs). In addition, the bank provides gold services such as buying and selling, sight accounts, fixed-term deposits, earmarked accounts, upgrading and refining, and location exchanges." Of course the only point of central banks trading in gold derivatives is to affect the price. See: http://www.gata.org/node/12717 -- Secret gold market interventions by the BIS have a long history. A report in Harper's magazine in 1983, based on a seemingly unprecedented interview with BIS officials, disclosed that the BIS was constantly intervening in the gold market in secret: -- While the BIS' involvement in the gold market is undertaken primarily on behalf of its member central banks, the bank own gold itself, according to a statement on Page 183 of its 2013 annual report: http://www.bis.org/publ/arpdf/ar2013e.pdf The report says: "A. Gold price risk "Gold price risk is the exposure of the Bank's financial condition to adverse movements in the price of gold. "The Bank is exposed to gold price risk principally through its holdings of gold investment assets, which amount to 115 tonnes (2012: 116 tonnes). These gold investment assets are held in custody or placed on deposit with commercial banks. At 31 March 2013 the Bank's net gold investment assets amounted to SDR 3,944.9 million (2012: SDR 4,018.2 million), approximately 21% of its equity (2012: 22%). The Bank sometimes also has small exposures to gold price risk arising from its banking activities with central and commercial banks. Gold price risk is measured within the Bank's VaR methodology, including its economic capital framework and stress tests." -- The BIS isn't alone in trading in the gold market surreptitiously on behalf of its central bank members. An official of one of those members, the Banque de France, told the London Bullion Market Association conference in Rome last year that his bank is trading gold for its own account and the accounts of other central banks "nearly on a daily basis": http://www.gata.org/node/13373 Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver and Gold Prices are Severely Oversold Posted: 06 Nov 2014 03:45 PM PST

On Comex the GOLD PRICE lost another $3.10 to close at $1,142.30. The SILVER PRICE flatlined, down 2.6 cents to 1539.2c. Relative Strength Index for silver and GOLD PRICES has returned to severely oversold level. Versus "oversold" at 30, silver's RSI stands at 19.88, gold's at 21.38. Full stochastics are at lows and are trying to turn up. No sign of a reversal yet, although the speed of the fall has slowed. I read an article last night by Paul Craig Roberts and Dave Kranzler at bit.ly/1tNjnwe entitled "American Financial Markets Have No Relationship To Reality." They point out that recent falls in gold and silver have been accelerated by massive paper gold sales on the futures market, 47 tonnes' worth within a few minutes, or sales of 25 tonnes on the Comex Globex system at 3:00 a.m. Eastern time, about as thin a market as a manipulator might wish. Another 38 tonnes were sold the same day shortly before Comex opened. Remember these are tonnes of paper gold. Naked shorts. While I will admit that profit-maximizing sellers don't do such things, practically it doesn't matter whether this is a government/central bank conspiracy or simply trading sharks attracted by blood in the water. The outcome is the same. And ultimately, since all the manipulation in the world couldn't keep silver and gold from rising 2001 - 2011, the present weakness lies with silver and gold. By that I mean that confidence in scabrous fiat currencies and criminal central banks is so high that nobody's interested in gold. After all, isn't quantitative easing working? Ain't stocks rising? Well, when it stops working, and it will, abruptly, things will turn. Something near every day a reader writes to inform me how markets are rigged and it's pointless to attempt technical analysis because the gummint and Fed control everything. If that were true, only thing we could do is give up hope and take a job working for the gummint, because it would be god. If I don't accomplish a blessed thing except to remind y'all every day that, in spite of what folks around you may believe, gummint and central banks are not god, do not have godlike powers, and for the most part couldn't pour pea soup out of a boot with instructions written on the heel, well, durn, I'd be as contented as a skinny flea on a fat cat. Don't y'all understand that they WANT you to believe the myth of their invincibility? The entire monetary and financial system is a CONFIDENCE GAME, and it blows apart into instantaneous smithereens if confidence ever wanes. They're not invincible, they're hyenas and vultures. They do a great job on something weak and for the moment powerless. Against the strong and living they're not so successful, or so brave. Do central banks and government try to manipulate gold and silver? I don't doubt they do, but manipulations only work for a while, and when markets are weak. Against the rising tide of a primary trend, eventually they fail. This time, too. I think the power of Mario Draghi's tongue is fading. He said about the same thing that's been working for him so long -- "We're gonna do something" -- but it just didn't have much bang today. By the way, y'all look at a picture of him and tell me if somebody hasn't twisted his whole face to the right? Or maybe he caught it in a door? Anyway, he threatened to stimulate if folks and the economy don't straighten up. Draghi's threat and better than expected US jobless claims are the nearest causes for stocks rising today. Hush! Never mind that the jobless claims will be revised in the opposite direction in a week. They won't publish that. So stocks rose, the Dow up 69.2 (0.4%) to a new high close at 17,553.73. S&P500 also hit a new all time high at 2,029.73, up 6.16 (0.3%). Dow closed plumb up on that overhead megaphone pattern boundary I mentioned yesterday, and the S&P500 just a mouse-ear below it. I am just watching the magic of fiat money at work, with my mouth open like a fool at a tennis match. US dollar index passed that 3%-above-breakout test today by closing at 88.21, up 67 basis points or 0.77%). Indicators are overbought and toppy, but that topping process can last a while longer. Euro finally broke today, down 0.88% to $1.2375, signaling much lower prices to come. No curb before it hits $1.2042, the 2012 low. And the yen crumbled 0.42% to 86.85 cents/Y100. Yen has passed its 2008 low and hasn't been this low since 2007. No safety net before 80.55 cents/Y100, the 2007 low. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ron Paul: Watch Out When People Start To Distrust Our Money Posted: 06 Nov 2014 02:33 PM PST Last month, Global Gold's Claudio Grass met with Dr. Ron Paul in Lake Jackson, Texas at the Ron Paul Institute for Peace and Prosperity. Here we show you how their discussion unfolded. This interview is part of the latest Outlook Report by Global Gold, which is available for download. To get these issues in the future sent by email, subscribe for free to Global Gold’s newsletter service. Global Gold: Dr. Paul, thank you very much for taking the time to speak with us. It is a pleasure to meet with you and learn your perspective on political and economic developments. But first, how would you describe your days since you've retired from Congress? Dr. Paul: I'm staying busy! I've been involved in several things in my life. One was practicing medicine. That was very important, but I don't do that anymore. Even when I got started into politics, I did both for a long time. When I left Congress and went back home I practiced medicine for twelve years. The other activity was promoting the cause of liberty, believing that it's the lack of liberty that causes war and causes poverty and suffering and that if people were to understand the importance of personal liberty that the world would be a much better place. So the organization that I created was called "Campaign for Liberty" but all those years whether I was in Congress or out of Congress, I have been campaigning for liberty in different ways. When I ran for office, it gave me a chance to speak about the issues. It actually all started with the breakdown of Bretton Woods in 1971. That was a big monetary event for me because I've been observing the developments and had studied Austrian economics. Even though it was anticipated, it was still very dramatic when it happened. So, a couple of years later I decided to run for office. I did not expect to win any election because, as you know, my philosophy was different. It didn't seem to fit the pragmatism that everybody wanted. When I got elected in '76, I started an organization called "The Foundation for Rational Economics and Education", the F.R.E.E. foundation, which is also the parent of the new organization now, the Institute for Peace and Prosperity. Since leaving Congress, I went in different ways, including Internet broadcasting, programming and interviews; I do a bit of that. I also have a speaking activity, where I go as frequently as I can. College campuses have received me pretty well. I enjoy that and do a lot of it. I also started a Ron Paul curriculum for homeschoolers, believing once again in the importance of education. I don't believe that everyone should be homeschooled or that some are more inclined than others but there is a certain group that can handle it – parents and students. I think that is very important. I stay pretty active and though I am retired from Congress, I am not retired from promoting the cause I am talking about. Global Gold: Fantastic! What has changed since you left Congress? Are you freer in the way you can speak and address people? Dr. Paul: My schedule is more under my control and I only go where I want to go. And if I don't want to fly every single week, I don't. When you're in Washington, government is on autopilot, it just goes. The old saying used to be "boy you're lucky the legislature is out of session, liberty is safe". This isn't true anymore, because right now the President uses executive orders to go to war, issues statements, violates civil liberties and gets involved in the economy through the central bank, his central economic planner. Even the judicial system rules against us and violates our liberties. The whole thing is so out of control. I feel I am much better off now because I can still do what I think is important, as far as writing and speaking out is concerned. At the same time, I don't have to spend a lot of time with those politicians in Washington. Global Gold: When you look at the United States, or let's say the western world in general, what do you think of the shape we're in? The stock market is skyrocketing and the real estate market seems to be recovering or even spiking in certain areas. Dr. Paul: If you look at things from the surface, it looks like things are great. I am convinced, however, that we are probably in the worst shape the world has ever been financially. There've been bubbles and distortions and currency breakdowns for thousands of years, but I don't think that the world has ever had a universal acceptance of a fiat currency like we have with the paper dollar, US Dollar, today. It is being used endlessly as the reserve currency. Debt and investments have been pyramided. Even now, stock markets are doing well and people think that bonds are lovely. It's all a deception and even if people claim there's no consumer price inflation, I think there is plenty but not as much as we are still going to see in the future. A lot of people forget that the distortions created by the inflation of the money supply will and does lead to higher prices and these may arise in different areas. In stocks and bonds, prices are very high, so the distortions are great. Somebody might say the housing market is back and doing well again. However interest rates are distorted. Interest rates tell you the right thing to do, they give you a hint. Business people aren't perfect, half of them might do a good job, the other half might do it badly, but it's all ironed out and taken care of. But when governments fix the rate of interest, everybody, in a way, makes a mistake. Some are lucky and make more money than the rest, but this is still based on bad information. That is why debt is out of control, and the bubbles keep building. If you look at the malinvestment and the amount of debt as a consequence of the dollar being the reserve currency, I think that the problem is gigantic. Despite the power of the central banks, especially our Federal Reserve and the power of politicians to spend money, ornamentally, markets are more powerful than governments. The market always reigns. I was watching and waiting for 1971 and the breakdown of Bretton Woods after we dumped almost 500 million ounces of gold, trying to prove that the government is smarter than the market. I even remember Lyndon B. Johnson in the 1960s saying "I am going to mint so many Kennedy half dollars that the people will never be able to hoard them". But it didn't work. Silver reached USD 1.23 and people started hording them, because the silver value was higher than the nominal value of the coins. Markets are very powerful. The markets overwhelmed Bretton Woods! We printed money and pretended it didn't matter. And that's why we had that breakdown. Now we have that strange phenomenon of this unbelievable trust in the US Dollar. This could only happen because our country is (still) wealthy, but a lot of the wealth is superficial because it's based on debt. So, the people are going to be really shocked when the hit finally comes because this system has existed for so long and longer than any paper currency before it. The other thing that gives some confidence is the size of the economy and the perceptions of its health, but there is also the size of its military. If you have a very solid currency, even if you have the strongest currency, but people anticipate you will be defeated in a war next week, then all of a sudden that particular currency loses value even though common sense says it's a strong currency. Military power puts some support behind the currency. That is why I don't think the US is vulnerable economically, but I think it's vulnerable militarily. We cannot sustain what we do, even though it seems like we can. We go everywhere and "solve" everybody's problems. Just recently we've been talking in the news about what we should do in Syria and Iraq. Should we continue an 11-year war in Iraq and go back? Some politicians have come up with this astute idea that it's our moral obligation. But somebody has to pay for it! We did get a couple of dollars back when we went in to fight Saddam Hussein when he invaded Kuwait, for example. The question wasn't whether it was morally correct for us to get involved in the war, or overthrow governments and that we should do it without following the constitution. The only point being made was "we can do it and we will but we won't pay for it". In a way, that statement made by politicians was translated to "we are the mercenaries of the world". Well, that's not going to work for very long. When it's realized what kind of a problem we have with the currency and the debt, the military is going to continue to shrink. I believe that, right now, the military is on the defensive. It took a long time for Obama to really work the war propaganda to be able to enter Syria. The day will come when the dollar will weaken and we won't be able to afford our welfare state. The debt will be a big burden and we won't be able to maintain our military presence around the world. And then, believe me, the world is going to change. Global Gold: When you look at the Japanese economy, they're printing money like there's no tomorrow. And now we have a lot of countries in Europe back in a recession and inflation in the Eurozone is non-existent. So, Mario Draghi is trying everything to depreciate the Euro and at the same time put more money into the system. The ECB even recently introduced a negative interest rate for deposits at the central bank. Dr. Paul: When interest rates are zero or even negative, everyone wants to buy more. Back in 1979-1980, you could buy a US government bond and earn 15%. Nobody wanted it. Right now, of course, what people don't quite realize is interest rates are lower because the dollar is strong, but the average person who wants to educate their kids in 10-15 years is not actually investing in government bonds. It's all being bought by people who are playing this big game. Sometimes we even give money to another country just so they end up buying our treasury bills. It is amazing that this gimmick keeps working. What I believe is that one day we will wake up and the system will dissipate just as fast as it has grown, maybe even faster. It has taken lots of years to build up. It keeps getting knocked down; things have been rocky and I've see this quite a few times in my lifetime: in the 70s with high interest rates, asset bubble in 2000 and then the housing bubble. And we had this horrendous bailout and people still came back to rebuild the bubbles. They will not concede that it is better to use a hard asset as money than pieces of paper that a couple of people in a secret room decide how many of them there will be, and that whatever they decide they execute it with a click on the computer. The foreign nations are all at fault. America's not at fault, because they keep taking our money. We're not going to go back to work! In fact, Americans would never have to work again, because we can just print more money and buy everything that we need. Almost everybody knows that something will happen at some point along the way. But that's not going to happen anytime soon. Right now there's a lot of trust by foreign takers of our dollars, they keep taking them. And as long as they do that, I guess, we're going to limp along and the bubble keeps getting bigger and bigger. Global Gold: We believe we are witnessing a geopolitical power shift like we had right before the First World War where the British Empire was fighting against the rising Kaiserreich. We have a power shift where China, other Asian countries and the BRICs, are taking over. Also the US contribution to world GDP has been shrinking in the past ten years. How would you interpret this? Dr. Paul: The market is anticipating the vacuum that is building up and will come eventually. With the Russian situation and the sanctions, we're deliberately almost pushing them out of the dollar. There's a vacuum out there and the BRICs or somebody else is going to come along and create a substitute. Right now it's not clear what's going to evolve, there are still some questions. Something's got to fill the vacuum, but right now the vacuum isn't big enough. The dollar still does function, but there will be a day when it won't. I think it's a shift, as you say to the East, because we will keep selling gold and China is going to keep buying gold. I think it is so ironic that our policy is to deliberately keep the gold price down. This might be really building the case for China. But the people who are doing this don't believe gold is money anymore, so they pretend at least they don't care, because then they would have a different monetary policy. They actually convinced themselves that they're smart enough to manage money and not to have gold. One time I asked Alan Greenspan, because he had been pro-gold standard in the past and said: "What about this? You know, when we have a balance of payments problem we shift back and forth and make these adjustments". He said: "Well, it is different now, because we have learned to manage paper money as if it were gold". He said that very sincerely. And probably they do believe that they are smart enough to substitute the market. They have to be arrogant, because why should one person, like our Federal Reserve Chairman know how to fix the price of every transaction. One half of every transaction depends on the fixing of the interest rates and at the same time they decide on the level of the money supply. And yes, they have the Federal Reserve Board, but it is one person that makes the decision. They can fool a lot of people for a long time but markets will eventually catch on. Global Gold: You mentioned Greenspan. Usually when I have a presentation I always quote Greenspan about the article he wrote about gold and economic liberty in 1966 when he was still a supporter of Ayn Rand. You asked him a while back if he would like to repeal the article. What happened exactly when you asked him? Dr. Paul: I had him sign that particular article and I said "Would you write a disclaimer on it?". He said: "I still support everything I wrote". To me it was like "What is going on here? Who are you kidding?" He sounded serious. Maybe he believed in what he said but felt that the world wasn't quite ready for him. Ronald Reagan, for example, he was a loved president and he said all the right things, but deficits exploded and lots of financial problems developed over time. To Greenspan it was: "We're not ready to do it, the conditions aren't right. I'll be a good manager, you know. If someone has to manage the money, I'll do it." Of course history is going to show he didn't do a good job managing it. Global Gold: I think he really created the biggest bubble. Dr. Paul: History will show Bernanke didn't do a good job either. When low interest rates are the cause of the problem, what would you do? Lower them even more to make them negative? Global Gold: You're a fan of the Austrian School of Economic. We recently published a report on ABCT, the Austrian Business Cycle Theory, because we believe that economies operate in cycles and that the main drivers behind the cycles are the central banks by reducing the interest rates and printing large amounts of money. We also believe that we have the short-term debt cycles and the long-term debt cycles. When we go back in history, we see that the long-term debt cycle bursts every 50 to 70 years. What do you think about this cycle theory? Do you also believe we will see a big bust? Dr. Paul: Well, I think there is some truth to the big cycles. I don't think they're absolute, but the cycle is there. What if you're off ten years or so? I don't think we need cycle theories; I think that basic fundamental laws are sufficient to understand what is coming: The longer you print money and distort the market, the bigger the bubble and the bigger the bust. I wanted to study all the details of the cycles, I just know a bit about them. I know there are a lot of variables involved, because if the charts worked perfectly, that would mean that cycles would be predictable and the theories would be objective. However this conflicts with the subjective theory of value. People place value on certain things for other reasons, maybe because there've been no wars for a while, or maybe war breaks out and maybe somebody just dropped a bomb – this changes things all at once. I think cycles theories are interesting, but I wouldn't depend on them. Global Gold: In the United States, you now have almost 50 million Americans living off food stamps. In Europe, we have a high unemployment rate, especially among the young, 30-60%. So what we are witnessing is that the real economy is basically not growing in the western world, we only have this unlimited amount of money which is going into certain asset prices and spiking up the prices there. But it's not going into circulation. Do you believe that this world is going to recover? Is it getting better in the next few years or do you think the opposite is likely? Dr. Paul: It is not going to recover soon, because we haven't allowed the correction to come. The market wants it to correct. Right now, the market is saying that the conditions aren't right and confidence hasn't been restored and they're not going to build new businesses for various monetary as well as regulatory reasons. People aren't ready and I think the old saying about 'pushing on the string' is pretty true. When you don't have confidence, you can push that money in it and it doesn't go in the desired direction. The fact is that the correction has never been permitted. A correction means that when you have malinvestment, a lot of debt and the market quits functioning because of this imbalance, that you have to allow a correction. You have to liquidate the debt and have to get rid of the mistakes that were made and people have to go bankrupt. Instead, in our so-called recovery, we printed a lot of money and we bought the debt. We just transferred the debt from the rich over to the taxpayer who is ultimately behind the currency and the Federal Reserve. Just this past week, I was surprised to see this USD25 billion purchase of more mortgage debt by the Fed. We thought this was all over! How is that we are doing well? But evidently there wasn't enough money to keep those interest rates down at 2 and 3%, so the Fed ends up buying even more debt. This is the exact opposite of a correction. We have to liquidate the debt and that's what happened traditionally, even biblically, it was known as the jubilee. Debt getting too big seems to be human nature. When we compound this human factor with a currency that encourages debt, we find ourselves in a very problematic situation. I think a little more jubilee is what we need. But the debt is still out there and people have trouble understanding it. When people think of Detroit they recall it is bankrupt. They can't tax them, everybody left town. Well, how are we going to pay the retirees? The money is gone. That is a true bankruptcy but they're even going to say: "You can't let Detroit crumble, go to the federal government print some more money" and delay the inevitable. But on the federal level, nobody gets denied a cheque. More food stamps and more retirement benefits encourage people not to produce. Again, it's trust in our monetary system. As long as they trust the money, it is going to go on for a while, the bubble gets bigger and the inevitable bust gets worse. Global Gold: When we look back in history, economically unstable times are associated with a lot of debt, which is often followed by war. We just wrote an article comparing 1914 to 2014, because we see some parallels like massive centralization of the system, a lost generation due to massive unemployment and many more. This created the foundation for the extremism we saw at the time. Now when we look at what is happening on the borders of Europe, in Eastern Ukraine, and what's happening in the Middle East, Central Asia and North Africa. What is your take on that? Do you think that the situation will deescalate or is that just the beginning? Dr. Paul: No, I think it'll continue but I think it will calm down just as the confrontation with the Soviets did when they were spreading their empire and going into Afghanistan. That situation calmed down because they went bankrupt and had to go home. If people don't trust us or our money anymore, we will have to tighten our belts. Once the trust is lost, the more money you print, the less the trust is going to be. Right now, they have no other place to go. They could go and beg Europe to print Euros, but they trust the dollar more. As long as they keep doing that, these insane policies will continue. I think that governments need to fold, they need to be blamed for what they are doing. Central b | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Pity the Swiss Posted: 06 Nov 2014 01:33 PM PST | ||||||||||||||||||||||||||||||||||||||||||||||||||||